27 minute read

OUTLOOK

RECRUITING THE NEXTGENERATION WORKFORCE

By Brittany Willes, contributing writer, The American Mold Builder

Prior to the coronavirus pandemic, one of the key issues facing leadership across nearly every industry was that of recruiting and retaining the next generation of employees. For the mold- and toolbuilding industries, workforce development is especially crucial as the older generation – often with decades of specialized knowledge and skill sets – begins to retire. So, how do businesses find the right people to fill the necessary roles in their facilities? Marketing and communications expert Shelly Otenbaker, president and founder of WayPoint Marketing Communications, shared current human resources marketing trends and best practices for recruiting the next-generation workforce.

MARKETING FOR EMPLOYEES There is a common myth that marketing is solely for business development. In reality, a company’s marketing resources and strategies are incredible assets when it comes to attracting and retaining the best employees.

“Marketing plays an important role in the hiring process,” said Otenbaker. “It creates awareness of your company, as well as engaging the right people to move them through the different phases of the hiring process.” Consider the sales funnel – the process of attracting leads and moving them through the funnel to the intent to purchase. This is similar to how employers should consider their workforce. “Think about your workforces as an audience and the funnel is an employee acquisition funnel,” explained Otenbaker. In this acquisition funnel, employers should make use of their marketing resources to attract potential new hires. Similar to the sales funnel, the acquisition funnel begins with creating awareness, followed by consideration and interest. In this case, the intent to purchase becomes the application, selection and hiring process.

As Otenbaker noted, marketing is a key component in moving potential employees through the funnel by attracting just the right candidates. “If someone searches for your company online, what do they find?” she questioned. If the next-generation workforce is the audience, what message are they receiving about a given company?

“In 2020, 50% of the workforce is made up of millennials, who look at things very differently than previous generations,” said Otenbaker. “These folks know all about your company before they even submit an application or resume. They’re qualifying you and your company without a single conversation. Seventy-five percent have researched the company’s reputation before applying for the job. They’re using social media, job boards and other sources to determine what your company offers, how you operate and what your commitment is to

your team.” 30 the american MOLD BUILDER | Issue 3 2020

A company needs to look at all of its marketing and recruiting materials – read them, analyze them and see what they say. What picture is being created about the company? Is it easy for people to access the materials? Are they up to date? Do they reflect the company’s culture? Is the website inviting? “It’s time to really be

honest with yourself,” said Otenbaker. “Take a step back and look at what it is you’re sharing with the world.”

Which, again, begs the question: How are companies marketing themselves to this new audience? What messaging are they passing along to potential hires? Now, more than ever, it is just as important to sell the company to potential employees as it is to sell products and services to clients.

EVOLVING NEEDS AND PROCESSES “A lot has changed in the last two decades when it comes to talent acquisition,” said Otenbaker. “The process has evolved and so have the needs and wants of the next-generation workforce. This is the generation that grew up with smart technology, that is known to challenge hierarchical structures. They want the flexibility to work when and where they want. They are open to change, and they want to build relationships with managers that deliver constant feedback and recognition. They’re looking for a place where they can continue to advance, as well as someplace where they can have a social and enjoyable workplace.”

This is in stark contrast to previous generations for whom flexible schedules and work/life balance were rarely on leadership’s radar. As a result, a large portion of today’s leadership is resistant to the evolving needs of the current workforce, something Otenbaker has encountered all too often.

“Unfortunately, a lot of companies’ leadership are not open to some of these characteristics or changes in the workplace that are appealing to the younger generation of workers,” she stated. “There’s work to be done,” Otenbaker noted. “As the current workforce continues to age and more people are going to be retiring, leadership is going to have to embrace these younger generations. Adjustments will need to be made.” For companies to continue to grow and succeed in the current and future marketplace, it is vital that leadership support the needs of the next generation workforce.

TALENT MANAGEMENT According to Otenbaker, to effectively recruit a workforce, companies need to develop a talent management strategy. “Statistics show that people change jobs 12 times during their career,” she stated. “While it could be a little longer or shorter in the print industry, the average employee tenure is roughly 4.3 years. This means you will need to continuously replenish your workforce.”

A typical talent management strategy includes the establishment of a talent pipeline – a pool of candidates available before a position is even open. This, in turn, means a reduction in the amount of time required to hire candidates, access to better-qualified candidates and reduction in recruiting costs.

So, how do companies go about establishing a talent pipeline? There are several steps that can be taken, but first and foremost, Otenbaker said, companies need to identify their long-term needs. “What are the employee characteristics – the types of people – you need in the long run to continue to meet your business’ goals?” she asked. “Once you have that, you can work on attracting and engaging candidates.”

Candidates in the talent pool should be assessed to determine which of them are the right fit. Who are those candidates who will best align with the business’ goals? Those are the candidates to nurture.

“It’s not something that can be done overnight,” said Otenbaker. “It’s takes time, and there are a lot of resources that have to be put into place to get something like this up and going. However, once all of the strategy and work has been put into it, and it finally is up and going, it is a lot easier to maintain.”

page 33

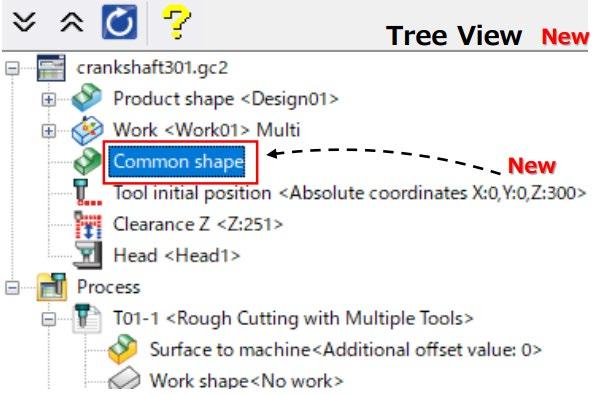

New Version 16

Easy to Use “Tree Format” + More Efficient Tool Paths with 60% Faster Calculation Time

Auto Simultaneous 5X Conversion

page 31

Additional steps for establishing a pipeline include conducting an audit of the business – i.e., going back to those marketing and recruiting materials. Once those have been reviewed, it is vital to secure the support of leadership. “Company leadership needs to agree that talent and the future workforce is important for the company’s success, and that building a pipeline will help the company perform better,” noted Otenbaker.

Next, connect with HR and/or marketing departments and make sure they are aligned and working in tandem, leveraging their tools and resources to build the talent pipeline. Once HR and marketing are aligned, focus should be turned to determining metrics for what success looks like for the company and establishing a budget for meeting those metrics. “What are you trying to accomplish and how will you measure the effectiveness of your strategy?” asked Otenbaker. “Some of your metrics might look at reduced time to replace an employee or filling all talent gaps within a certain time frame. Whatever those success metrics look like, they need to be in place so that you understand what you’re trying to accomplish and can plan accordingly. And, you need to understand what kind of budget you have to work with so you can prioritize tasks and determine what can be accomplished within that budget.”

Finally, companies must build an “employer brand toolbox” that will help in attracting talent. “The most important tool is your website,” said Otenbaker. “It is the foundation for all of your recruiting activities, not to mention business development activities. Whether it is a customer or a potential candidate, people are looking at your website every day and making decisions on whether or not to engage with you. If your desired brand identity doesn’t match with your website, you may lose potential candidates.”

RECRUITING DURING COVID-19 As COVID-19 continues to spread across the US and the world, many companies are experiencing a hiring freeze – or even layoffs. Depending on their individual situations, continuing to develop a talent pipeline may be the last thing they’re worried about. However, Otenbaker advised not to let efforts with the talent pipeline fall by the wayside.

“Continue working on your pipeline through the hiring freeze,” she stated. “If you stop now, it will put you behind when we get on the other side or are dealing with the new normal. You want to continue to work on it and make sure you are communicating what’s going on with your company to ensure you are appropriately staffed and ready to react throughout the crisis.” n

With nearly 20 years of marketing communications experience under her belt, Shelly Otenbaker has the experience, knowledge and determination to help companies develop and implement strategic communications strategies focused on improving their business’ bottom line. For more information, visit www.waypointmc.com.

You need to be sure, you can rely on your supplier.

HASCO as pioneer in development of standard components for moldmaking is working with qualified suppliers from Europe and North America, offering a secure supply chain to our customers.

Our Promise:

- More than 100,000 highest quality standard components - Fast and reliable delivery - Continuous product identification traceability - Certified quality management system to DIN EN ISO 9001

HASCO America Inc. 270 Rutledge Road, Unit B Fletcher, NC 28732 USA Toll Free 877-427-2662 www.hasco.com

1

2

4

5

[1] MOLDWORX CONSOLIDATES INTO NEW FACILITY Moldworx LLC, Gilbert, Arizona, a contract manufacturer specializing in custom design and build of injection molds, precision automation, assembly and laser marking equipment, as well as providing injection molding of engineering thermoplastic components, has announced its expansion to a new facility. The new 24,000-plus sq. ft. facility has allowed Moldworx to combine its mold and equipment manufacturing facility with its injection molding facility, affording greater efficiencies and collaboration among departments. For more information, visit www.moldworx.com.

PCS COMPANY LAUNCHES NEW WEBSITE PCS Company, Fraser, Michigan, a manufacturer and distributor of mold bases, mold components, molding supplies, hot runner systems and cutting tools, has launched a new website. The site features faster load times and a more user-friendly experience, including enhanced online account access to view order history and to easily reorder commonly ordered items. Also included are LIVE product order features to view product availability and product page promotional pricing, as well as convenient ordering options like quick CAD file delivery via zip files, mass product easy-order upload ability and custom product online order forms. For more information, visit www.pcs-company.com.

[2] COMAU AND TECNOMATIC JOIN FORCES Comau, an Italy-based developer of systems and products for the industrial automation sector, has signed a multi-year partnership with Tecnomatic, an Italian automation provider specializing in hairpin stator technologies, to provide a complete offering encompassing rotor, stator, inverter, transmission assembly and testing. This partnership confirms Comau’s commitment to help customers address emerging market needs through the complete lifecycle. Combining their respective strengths, the companies offer a single source for fully-integrated electrical motor and transmission 6

3

assembly solutions, as well as access to an engineering approach designed to meet current and future production needs. The jointlydeveloped systems are modular, scalable, cost effective and digitally enabled. For more information, visit www.comau.com.

[3] HEIDENHAIN ANNOUNCES OPENING OF EXPANDED WESTERN US HEADQUARTERS Motion control feedback solutions provider HEIDENHAIN Corporation, headquartered in Traunreut, Germany, has announced the opening of its newly completed West Coast headquarters. This includes the expansion of its executive, sales and technical support offices, as well as demo facilities in San Jose, California. The new development includes the consolidation of the company’s Fremont, California, technical support operation into its expanded San Jose business center offices. For more information, visit www.heidenhain.us.

[4-6] HARBOUR RESULTS EXPANDS TEAM WITH MANUFACTURING, RESEARCH EXPERTS Harbour Results, Inc., (HRI), Southfield, Michigan, a consulting firm for manufacturers, has expanded its team of experts, adding Jason Brewer [4] and Brian Gillespie [5] as directors in its consulting team, and research specialist Matt Trentacosta [6]. With more than 30 years of experience, Jason Brewer began his career as a product engineer at Ford Motor Company and also worked as a consulting manager at Plante & Moran and in global business development for Magna Powertrain. Brian Gillespie was vice president of AI applications at Data Prophet. He started his career at FANUC Robotics and also has held executive positions in sales and marketing at Imaginestics LLC, Slight Machine, Citrine Informatics and Plex System. Matt Trentacosta comes to HRI to further build the company’s Harbour IQ solution. He started his career at The Martec Group as a senior market analyst, and most recently was a senior consultant at IHS Markit. For more information, visit www.harbourresults.com. n

2020 ELECTIONS: CHINA AND THE US PRESIDENCY

By Omar Nashashibi, The Franklin Partnership, LLC

The nonpartisan Pew Research Center regularly conducts opinion polls of what Americans think of other countries. It should come as no surprise that China does not rank highly on the US popularity charts right now.

PERSPECTIVE: PUBLIC OPINION ON CHINA Around the time of the 2016 US election, 47% of surveyed American adults saw China unfavorably, with 44% being favorable. This represents the highest favorable percentage for China among US adults since its peak of 52% in 2006.

In a survey conducted in March 2020, these numbers shift dramatically. Sixty-six percent of American adults said they have an unfavorable opinion of China, while only 26% report having a favorable view. An even more recent Pew Research poll of Americans from June 16 to July 14 breaks it down further, showing that 83% of Republicans hold an unfavorable opinion of China – a marked number that is a full 15 points higher than Democrats (the largest spread since 2005). This is not to say Democrats are supportive of China; in the same survey, one in five Democrats describe China as an enemy, with 61% saying they are a competitor.

Certainly, based on the data above, the way Americans view China has trended negative since the election of Donald Trump to the White House – but how does this impact the 2020 campaign and the future of manufacturing in America?

Both President Trump and former Vice President Biden would be committing political malpractice were they to not make China a central focus of their campaigns – and indeed, they both have. One ad from the Biden campaign attacks the president, saying “15 times Trump praised China, as the coronavirus was spreading across the globe.” This ad came in response to the Trump campaign’s video mocking Biden as “China’s puppet.”

TARIFFS AND THE TRUMP ADMINISTRATION In 2016, Trump won Michigan, Pennsylvania and Wisconsin by being anti-trade and largely focusing the ire of Midwest manufacturers on China. The strategy clearly worked, and the Trump administration went on to impose tariffs on thousands of Chinese imports. The president included Chinese plastic injection molds on the list subject to 25% tariffs and, although he suspended them following pressure from US importers, he then reinstated them after a coordinated lobbying strategy between the AMBA and The Franklin Partnership, resulting in 150 filed formal comments with the Office of the US Trade Representative from US mold manufacturers.

Despite the efforts, manufacturers report continued trade violations by China. After two years of tariffs on Chinese goods, 39% of Americans remain supportive of the president’s action. Combine the facts on the ground with the polling of voters’ feelings toward China, the obvious approach to winning manufacturing-intense states in 2020 is a battle for who is best suited to take on China.

SETTING THE STAGE: THE 2020 PRESIDENTIAL ELECTION Prior to COVID-19, President Trump had the upper hand against the former vice president on manufacturing, having imposed tariffs and concluded a Phase I deal with China in January 2020. However, since the onset of the virus, we have seen voters’ growing disapproval of the president’s handling of the coronavirus. In July 2020, 11 polls averaged a 58.6% disapproval rating. page 38

page 37

These numbers pose a problem for the Trump campaign. The more he links China to the virus – and the more he is linked to the virus negatively – the likelier it is that voters may make the connection and agree with the Biden campaign. Regardless, each campaign is going to try and one-up the other when it comes to China.

One of the most difficult transitions a presidential candidate makes is from campaign promises to actual governing. Through an examination of past statements, current actions and candidate proposals, we can begin to piece together what a second Trump term may bring for US-China relations and how a Biden administration may govern.

A SECOND TRUMP TERM In January 2019, President Trump signed a Phase I trade deal with China, promising to increase by $200 billion purchases of US goods over 2017 levels, including ordering $77 billion in manufactured goods. Most were skeptical before COVID that China could hit those levels and, while the US deficit in goods with China widened over the summer, Beijing has reaffirmed its commitment to make the purchases.

However, all presidents immediately become a lame duck upon their reelection, giving China little incentive to concede. President Trump also is loathe to take on battles when a clear victory isn’t ensured. Because a Phase II agreement would require China to make significant and concrete changes (and not just purchase more US goods), it is unlikely that he would pursue this particular challenge.

As tariffs remain in place, President Trump will look at any China deal in the context of his legacy, but if he cannot secure a deal, tariffs likely will remain and could increase. This tariff action also would cover the 25% AMBA successfully lobbied to reinstate on plastic injection molds from China. Under this scenario, without a Phase II deal, many in Washington expect the tariffs to remain in place through 2021. Keep in mind, under President Trump’s trade strategy, there is no “carrot” approach in negotiations – only the “stick.” Expect littleto-no change, especially in the early months.

A JOE BIDEN ADMINISTRATION During his five decades of public service in Washington, former Vice President and past US Senator Joe Biden clearly established himself as a multilateralist and internationalist. Whereas President Trump largely has chosen a bilateral approach to trade, preferring one-onone country engagement, Biden likely will seek to build coalitions to confront China.

Let Us Quote Your Custom Components! Or shop our extensive selection of ready-to-order mold components.

PCS Company mold components are designed and manufactured to exceed our customer expectations for quality, reliability, and performance.

Shop our extensive selection of Mold Components in INCH, Metric DIN, and Metric JIS dimensions:

• Mold Action • Part Ejection • Mold Alignment • Mold Cooling • Mold Date & Recycling Inserts • General Mold Components

PCS Company is proud to be the Industry leader in Custom Components for over 50 years.

You can count on our dedicated Custom Component department to work with you to deliver:

Quick quote turnarounds • Industry best delivery • Most competitive prices around • Highest quality products • Customer-driven design capabilities

Shop Now or Get a Quote at www.pcs-company.com Phone: 1-800-521-0546

While his campaign strategically has chosen to not provide more details on its China tariff agenda, the campaign is focusing more on running against Trump’s current China approach. A Biden administration will elevate concerns over human rights, including China’s treatment of its Muslim population and addressing Hong Kong, while protecting Taiwan from a similar fate.

Sources in Washington and close to the Biden campaign indicate his administration likely would continue the Section 301 tariffs on Chinese products, including the 25% on plastic injection molds, at least into the spring and likely to summer 2021. Leaving the tariffs in place will provide a new Biden administration additional time to establish its trade policy and build coalitions with other countries.

More importantly, continuing the tariffs allows Biden to inherit a certain amount of leverage against China as Beijing – and many US importers – would like to see those tariffs lifted. However, just as it often is a fool’s errand to forecast the outcome of elections, predicting how Biden will act on trade in the summer of 2021 may be a similar undertaking.

Regardless of the election outcome, both a second Trump term and a Biden first will continue the focus on China, especially if the pathway to the White House runs through the Midwest as it did in 2016 and is expected to do again.

Like many political consultants, it is my job to undertake that fool’s errand each election season and predict outcomes to help businesses plan for the future. Irrespective of the White House occupant, we expect tariffs on China to continue into 2021, likely at least through the first quarter. President Trump will remain content to continue the status quo with tariffs in place throughout not just 2021, but the remainder of his second term without a comprehensive Phase II deal. Meanwhile, Biden will seek to expand the attack on China to include human rights, the environment and military encroachment, but take a more global approach with allies, while tariffs temporarily remain in place.

China is one of the few places where both candidates agree on the need for action and closely align on the preferred outcome, but strongly disagree on the approach. When it comes to presidential politics, for as long as manufacturers and Midwest voters remain among those who decide control of the White House, the candidates will have no choice but to listen to AMBA members and others calling for action on China. The one prediction I am certain to not get wrong in 2020 is that standing up to China will remain one of the few bipartisan issues left in Washington. n

Omar Nashashibi is a founding partner at The Franklin Partnership, LLC, a bipartisan government relations and lobbying firm retained by the American Mold Builders Association in Washington, DC.

SWT

SWA

LM-C

Exceptional laser systems, made in Italy and supplied by Gesswein. Our sales team will help find the best laser for your application. Visit gesswein.com/sisma-welding or call.

ECONOMIC SMOOTH SAILING OR HEADED FOR THE ROCKS?

By Chris Kuehl, managing director, Armada Corporate Intelligence

The business leaders of today resemble the captains of those old clipper ships. They know where they came from and they have an idea where they are going, but what happens in between is unknown and possibly disastrous. Thus far, the assumptions regarding the macroeconomy have ranged from glass half full to glass half empty, but all the while we have no knowledge of how big the glass is or what is in it. Is there anything to have confidence in as far as 2021 or the rest of 2020 is concerned? We would assert there are three very likely scenarios, all nearly the same in terms of probability.

Bear in mind that all three of these are based on a whole series of assumptions – and also bear in mind that many of the assumptions that were made earlier in the year proved to be desperately inaccurate. Remember when we all thought the virus would peak in April and that every state would be seeing steep declines by the end of that month? Now that we are registering record numbers of infections, hospitalizations and fatalities, that assumption has been rejected. Remember when there was to be a lifting of the lockdown and a quick May rebound, leading to a recovery and a “V” shaped recovery by the third quarter? The lockdowns were only partially lifted and, since then, many have been reimposed. In fact, there is serious talk of another national shutdown – and one that would last even longer than the first one. There were assumptions about how many people were “furloughed” as opposed to having been actually fired. There were assumptions regarding what would take place in other nations as they contended with the viral threat. All of these assumptions fell short. As we review the scenarios now developing, it will be important to remain skeptical. 1. SCENARIO ONE: CONTINUED DECLINE This is the most miserable of the three, as it assumes that the virus is not brought under control, that treatment options do not improve and that a vaccine is not developed before sometime in 2021. This will lead most nations back to the lockdown strategy as the only response, and the economic collapse experienced in March will be repeated. The decline will be even more intense, as businesses will have exhausted their reserves, consumers will have exhausted theirs and governments will have little ammunition left. This is the scenario that leads to a severe depression – but we hasten to point out that this outcome is anything but guaranteed, as it depends on both the progress of the virus and the willingness on the part of the government to shut down the business community. The first and most important is that the virus will not be contained in any real sense. This means social distancing will not be maintained, mask-wearing will be rejected by many people, testing will be inadequate, hospitals will be unable to keep pace and so on. With a more universal response to the threat, this assumption would be rendered inaccurate.

The second assumption is that dealing with the virus will mean some form of a renewed economic lockdown – an immensely difficult decision given the damage already done to the global economy. The probability of a lockdown in a political year is very low.

The third assumption is that solutions to either the viral outbreak or economic collapse will not be developed. That means that treatment options remain inadequate, and the vaccine still is many months away. It also means that governments cease efforts to insulate people and business from the impact, as there will no longer be the money to do so. 2. SCENARIO TWO: THE ARRIVAL OF THE SWOOSH This is the optimistic counterpoint to Scenario One. This assumes a substantial rebound by the end of 2020 and continued expansion into 2021. As is apparent as one looks over the latest numbers, there has been a lot of momentum developing in a variety of key sectors. Remember that the 2020 economy was growing at a respectable pace prior to the pandemic, and it has appeared that businesses and consumers are eager to get back in the groove. What has to happen for Scendario Two to develop is either a retreat by the virus to levels seen as “under control” or a willingness to move ahead with ending the lockdown even as the virus remains a threat. The discovery of a treatment would be critical to moving ahead with removing the lockdown, but the vaccine will be required to end the threat. If the lockdown is not imposed again, there is a modified “V” recovery yet this year – the swoosh (as it will look similar to the Nike symbol).

Again, there are three primary assumptions driving this scenario. The first is that the virus is either contained or its impact is accepted to some degree. The reality is that the world will never be rid of the COVID-19 virus altogether. It will behave as all the other viruses have (SARS, MERS, Avian flu, Swine flu, Marburg, Ebola, Zika, West Nile and so on). It will remain in the global population and will take a human toll, but the numbers will be deemed “acceptable.” Either the number of people affected declines dramatically or the public tolerance for the death toll grows.

The second assumption is that restarting the economy takes center stage, and lockdowns continue to lift in order to get people back to work and business back to normal functioning.

This leads to assumption three – that policy makers will have public support to focus on the resumption of normal activity, even as the threat of the virus continues. 3. SCENARIO THREE: SPLITTING THE DIFFERENCE As always, there is the middle ground – the swoosh is coming but not as quickly as had been originally anticipated. Rather than seeing a recovery under way in Q3 or Q4, the rebound starts in earnest in 2021 and likely not until the second quarter. The assumptions at work here involve a partial reimposition of the lockdown, but one that leaves major sectors relatively untouched. This scenario relies more on what is happening in the rest of the world, although all three scenarios will be profoundly affected by the pace of recovery in Asia, Europe and elsewhere.

There are reasons that middle ground scenarios often dominate. There will be limited appetite for either of the other positions – people will not want to see the virus become an even greater threat and will demand that authorities “do something.” On the other hand, that same public will reject the notion of crushing the economy again and plunging the nation into a depression that would destroy millions of lives. They will demand: “Do something else.” The result will be a bit of the worst of both worlds. The virus will continue to constitute a very real threat and the economy will be weakened, but there will be some perception of progress. If there is no expanded lockdown to deal with the virus and no lockdown lifting to boost the economy, all the hope will be placed on the development of an effective treatment and the development of an effective vaccine. The assumption is that neither of these are available until some point in 2021 and perhaps not until 2022.

This puts the business leader in the cabin of that ship. The course might be smooth all the way to the destination or there may be a hurricane developing dead ahead. It has been a long time since business in general has faced this much uncertainty. n

Chris Kuehl is managing director of Armada Corporate Intelligence. Founded by Keith Prather and Chris Kuehl in January 2001, Armada began as a competitive intelligence firm, grounded in the discipline of gathering, analyzing and disseminating intelligence. Today, Armada executives function as trusted strategic advisers to business executives, merging fundamental roots in corporate intelligence gathering, economic forecasting and strategy development. Armada focuses on the market forces bearing down on organizations. For more information, visit www.armada-intel.com.

• (800) 558-6040 • WWW.SUPERIORDIESET.COM •

SHOP NOW

WWW.SUPERCOMP.COM MOLD BASE COMPONENTS

SEPTEMBER Roundtable Discussion – Embracing the Challenges of the “Now,” September 9, 12:00 p.m. EDT, www.amba.org/events

Lead Generation and Marketing Strategy in a Virtual World: Tactical “To Dos,” September 23, 11:00 a.m. EDT, www.amba.org/events

OCTOBER 2020 Race for the White House: Politics, Outcomes and Trade, October 27, 12:00 p.m. EDT, www.amba.org/events NOVEMBER The Cultural Application of Continuous Improvement, November 4 to 5, www.amba.org/events

2020 EHS Summit – A Virtual Event, November 11 to 12, www.amba.org/events

Alliance Specialties and Laser Sales................................................................www.alliancelasersales.com...................................................................................................19 AMBA Benchmarking Publications................................................................www.amba.org............................................................................................................................28 AMBA Continuous Improvement Forum....................................................www.amba.org/events................................................................................................................ 3 CAM-TOOL............................................................................................................www.camtool.com......................................................................................................................31 Crystallume, a Division of RobbJack Corporation.....................................www.crystallume.com..............................................................................................................29 DME............................................................................................................................www.dme.net/estore..............................................................................................Back Cover Dynamic Surface Technologies........................................................................www.dynablue.com...................................................................................Inside Back Cover Erowa System Solutions......................................................................................www.erowa.com..........................................................................................................................12 Federated Insurance.............................................................................................www.federatedinsurance.com...............................................................................................35 Finkl Steel.................................................................................................................www.finkl.com............................................................................................................................18 Gesswein...................................................................................................................www.gesswein.com...................................................................................................................39 Grainger.....................................................................................................................www.grainger.com.....................................................................................................................32 HASCO America, Inc...........................................................................................www.hasco.com..........................................................................................................................33 HEIDENHAIN CORPORATION..................................................................www.heidenhain.us.....................................................................................................................7 INCOE Corporation............................................................................................www.incoe.com..........................................................................................................................25 Kruse Training.........................................................................................................www.krusetraining.com............................................................................................................13 Mold-Tech Midwest..............................................................................................www.mold-tech.com................................................................................................................27 MoldMaking Technology....................................................................................www.moldmakingtechnology.com.....................................................................................36 PartnerShip..............................................................................................................www.PartnerShip.com/12AMBA..........................................................................................23 PCS Company.........................................................................................................www.pcs-company.com..........................................................................................................38 Plastic Engineering & Technical Services, Inc............................................www.petsgroupintl.com...........................................................................................................21 Progressive Components....................................................................................www.procomps.com...............................................................................Inside Front Cover Superior Die Set Corporation...........................................................................www.superiordieset.com........................................................................................................ 41 Ultra Polishing, Inc................................................................................................www.ultrapolishing.com.........................................................................................................10 Vincent Tool............................................................................................................www.vincenttool.com..............................................................................................................10 Wisconsin Engraving Co. Inc./Unitex............................................................www.wi-engraving.com........................................................................................................... 41