10 minute read

Balance Your Payroll Risks

Step-by-Step Instructions to Find Your Balance

Advertisement

We have published several articles on the problematic issue of independent contractor (IC) classification in the past. Now it is time to go where no grooming authors one have gone before. This study does not address classification errors. Instead this article is a wake-up call about the financial impact of both W-2 and IC forms of compensation for groomers, and employers. Is it true that

an IC groomer working the same hours, 42 Copyright © 2013 Find A Groomer Inc. All rights reserved

(Continued from page 42)

grooming the same pets, same services and same commission as an employee is likely to earn less net pay? Is it true that an IC groomer renting a work station, grooming the same pets at the same service fees and working the same hours actually makes nearly twice the personal net income as an IC groomer not renting a station? Yes. We have the numbers to open eyes wide.

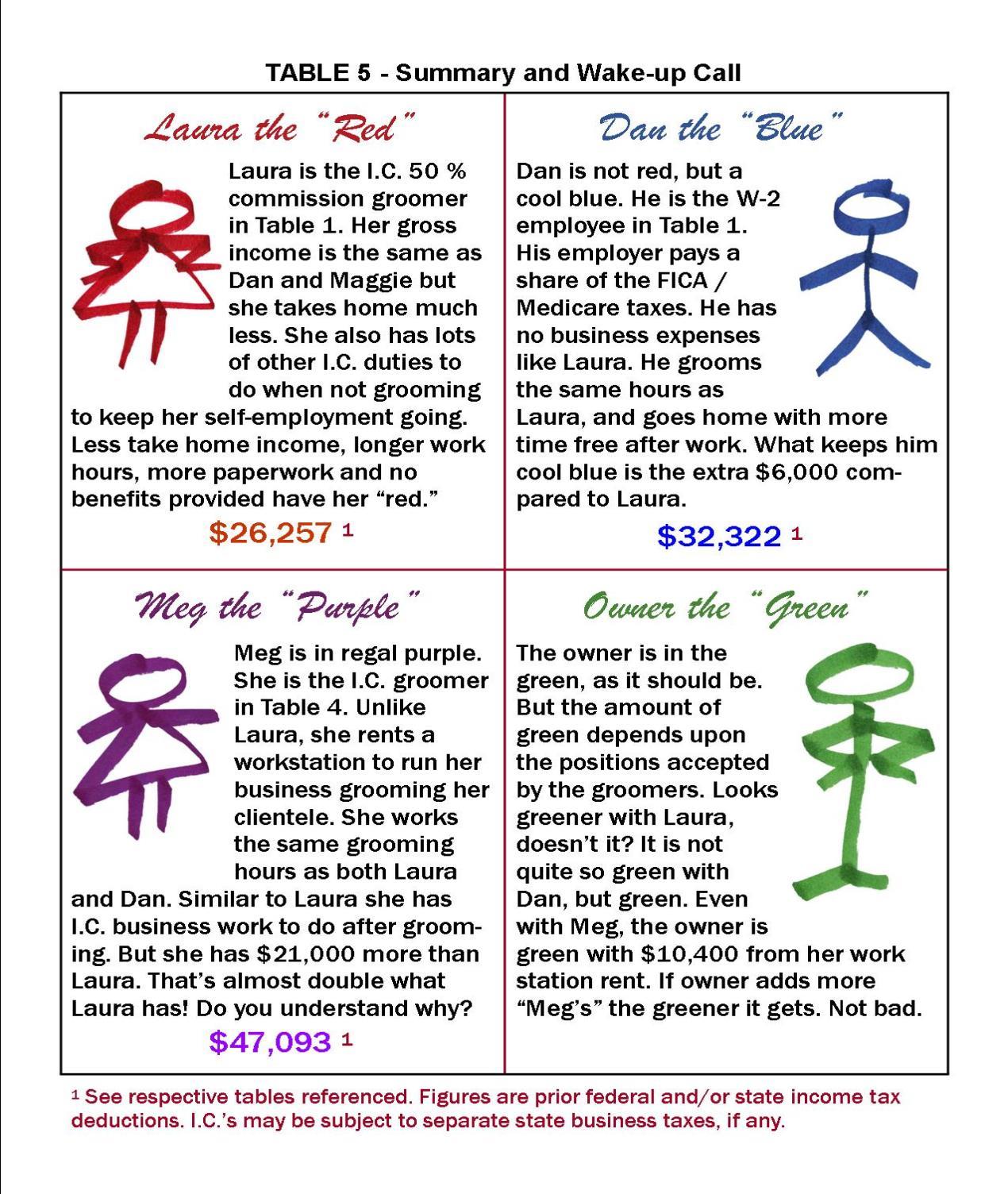

Introducing three groomers, Laura, Dan and Meg.

1. Laura is an IC groomer working on 50% commission from her employer.

Her grooming performance skills are the same as Dan and Meg. 2. Dan is an employed groomer (W-2), and again, his grooming performance skills are equal to Laura and Meg.

Dan grooms his employer’s clients.

3. Meg is an IC. She is only willing to rent work station in pet business in order to operate her business. Meg solely grooms her clientele, and not the clientele owned by an employer.

This difference is key to her being more accurately classified as an IC.

Laura primarily grooms clients of her employer who ask for her services. They are not legally her clientele. One final reminder, Meg’s grooming skills are equal to Dan and Laura.

Today there are thousands of Laura’s

and Dan’s in the United States. Hiring trends of the last 10 years have turned more and more Dan’s into Laura’s.

Large numbers of W-2 employed status groomers are now IC groomers like Laura, usually not by their choice. Few corporate stores hire IC’s bucking the trend. Independents created this trend. Does it make you wonder why the corporate world bucks it?

Is this state of employment for the grooming industry good or bad? Our answer would simply be an opinion, and your opinion is more important. Instead we prefer to let the numbers tell their story. Done fairly, numbers do not lie and avoid opinion. Refer to Table 1 on the following page.

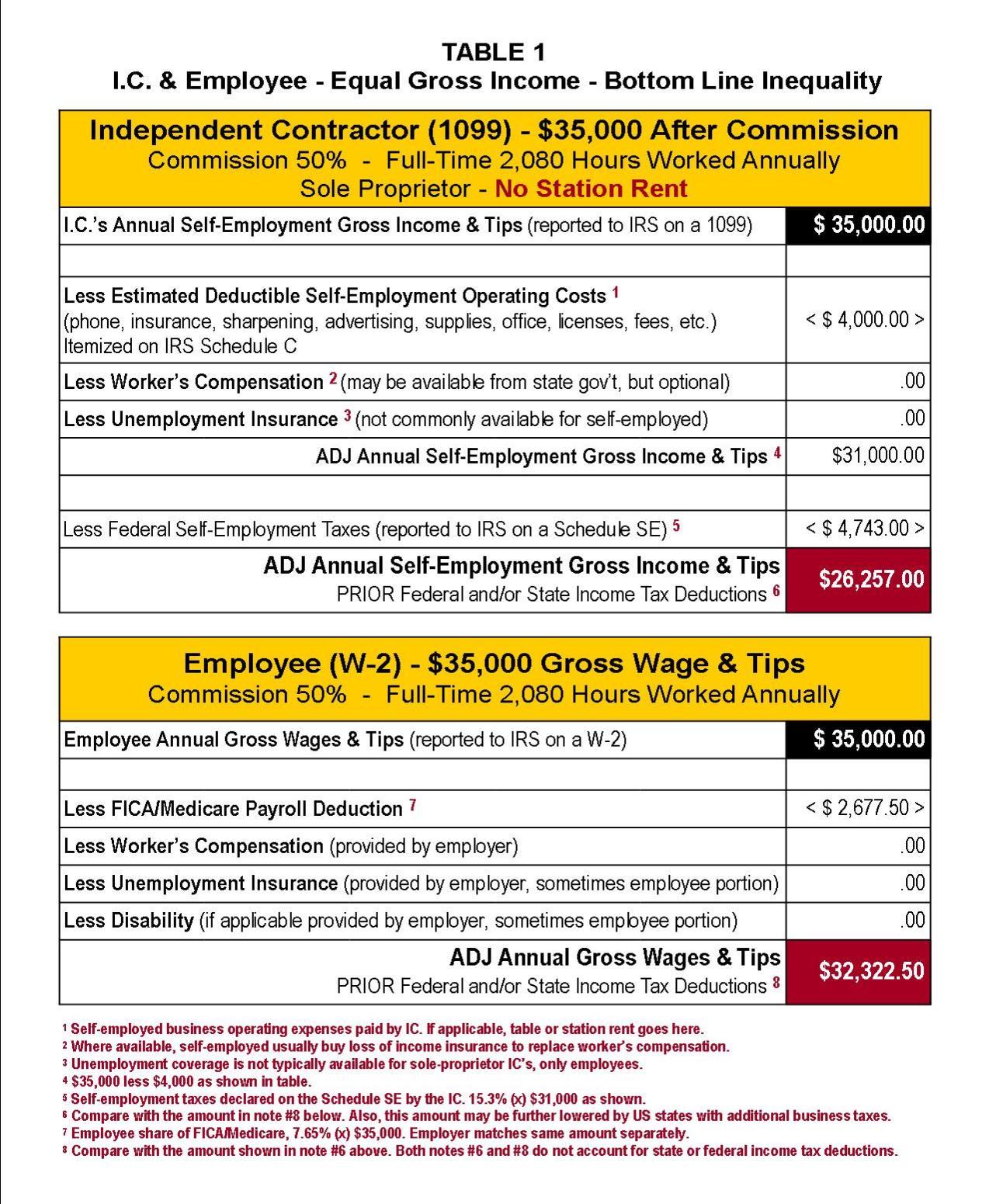

Laura’s (IC) numbers are shown in the top half of Table 1. She produces $70,000 annual gross sales of grooming services for her employer, and gets 50% or $35,000 a year. Annually her employer sends the Internal Revenue Service (IRS) a 1099-MISC reporting the

(Continued on page 47)

income paid to her. There are no payroll deductions. Laura reports the $35,000 on her Schedule C filed with the IRS. She deducts operating expenses of $4,000 lowering her taxable income to $31,000. On a Schedule SE (SE is an abbreviation for “self-employment”) Laura pays 15.3% FICA/Medicare taxes on the $31,000, or $4,743.

Why is her Federal SE nearly $4,800? Employees pay 7.65% of their gross wages for FICA/Medicare. Laura is not a W-2 employee, and IC’s pay two shares, their self-employment share (7.65%) and their share at 7.65%, total 15.3%. Laura is left with $26,257 from the $35,000. She must still pay federal and state income taxes. In some US states there are state and local taxes assessed on self-employed (IC). Those taxes would lower her bottom line even further.

There are thousands of Laura’s in the industry paying taxes as shown in Table 1. What if they were W-2 employees? The bottom half of Table 1 represents this scenario. Dan grooms the same pets earning the same 50% commission rate as Laura. Dan is a W-2 employee. What happens to Dan’s $35,000?

Unlike Laura, Dan is not a business (IC) and takes no deductions for business expenses. He receives a payroll check with payroll tax deductions. Table 1 shows his deduction of 7.65% for FICA / Medicare. His employer pays the other 7.65% share, not Dan. He is provided worker’s compensation at no charge, as well as unemployment coverage. To compare Dan fairly with Laura we have not deducted federal or state income taxes for Dan, as well as Laura. What is the result? Dan’s $35,000 is reduced by $2,677.50 for his share of FICA / Medicare. His adjusted total is $32,322.50 (prior federal and state income taxes). Compare that to Laura’s $26,257.

Grooming the same pets and the same work schedule Dan’s bottom line is $6,065.50 greater than Laura. She has no worker’s compensation coverage and no unemployment security. Why does Laura make so much less? The answer is simple. Laura is self-employed (IC) and pays self-employment taxes, and another $4,000 for business operating expenses.

There is more to Laura’s fate. She must

(Continued on page 49)

maintain daily records of income and expenses which may be audited. She needs business insurance, and must inventory and order supplies. Laura must maintain business licenses and advertising. Laura has daily client duties such as appointment scheduling and reminders. Do you know how many tax forms a business owner must file every year? Many. Laura manages a business checking account and reports financial activity on quarterly and annual basis. Dan grooms full-time (2,080 hours a year) the same as Laura. Unlike Laura, When Dan finishes grooming he is done for the day. The bottom line for Laura is this. All of her self-employment extra tasks and expenses doesn’t add up to a better financial bottom line. In fact, her personal net income is thousands less than Dan.

Not all, but most major and growing chain stores hire Dan’s, not Laura’s. Why do you think that is?

(Continued on page 51)

Table 1 has made clear the imbalance between the Dan’s and Laura’s of the grooming industry today. Next, Table 2 explores one reason for the tilted scale.

Financially there is a steep advantage for employers to hire “Laura’s.” Refer to Table 2. Laura’s numbers are in the middle of the table earning $35,000 from 50% commission. Her employer simply writes a check for the amount without payroll deductions since she is not a W-2 employee. Her employer pays no worker’s compensation or coverage for unemployment, and any other state and local payroll taxes.

At the bottom of Table 2 we examine the cost to her employer if Laura was classified a W-2 employee. Additional costs for her employer are $5,849.50 on top of her $35,000 gross wages.

Saving nearly $6,000 a year per “Laura” is a major financial advantage for any employer. The financial misfortune for Laura is serious. She does not have to pay the entire $5,849.50 saved by her IC employer. She is liable for a second share of $2,677.50 for FICA / Medicare normally paid by W-2 employers. Her $4,000 deduction for operating expenses reduces her two shares to $2,371.50 each, or a total of $4,743 (see Table 1). Dan the W-2 employee pays a fraction of that and did not spend $4,000 on operating expenses. For this reason alone

(Continued on page 53)

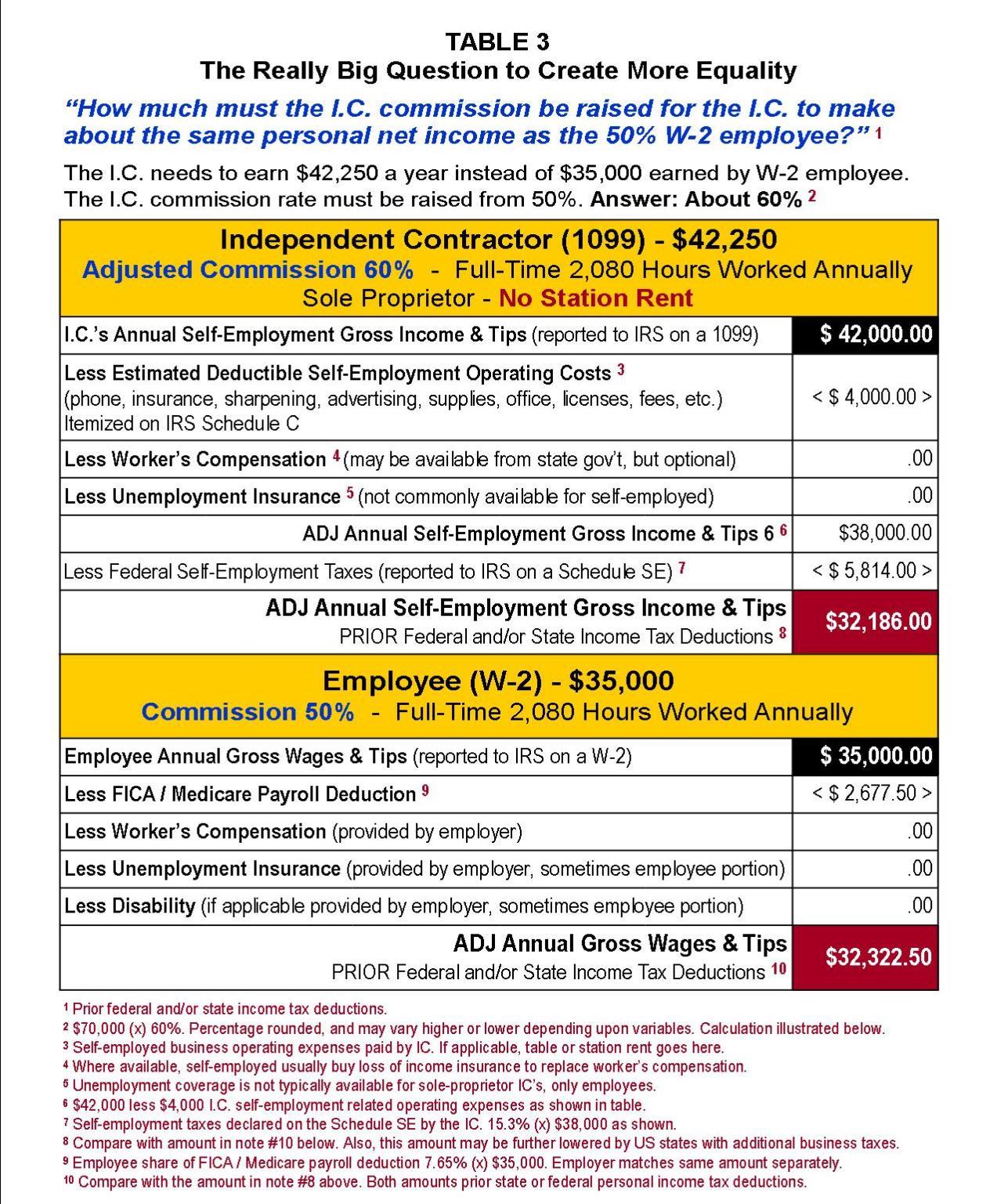

A 60% IC commission will generally compensate IC groomers for the extra tax burdens of selfemployment. It will not compensate them for having no coverage for unemployment or worker’s compensation provided by their employers.

the employers of Laura’s come out way ahead by hiring IC’s, and transferring their employer tax burdens to their Laura’s. The numbers make it clear. Hiring IC groomers is to the advantage of employers who find groomers willing to accept the burden and make less than The Really Big Question Hundreds of groomers have asked us what recourse they have if they do not The answer is simple. Negotiate your commission rate! Of course the next really big question is, “How much?” If this describes your predicament the financial method shown in Table 3 will reign supreme. We can better balance the scale between Laura and Dan by fairly increasing Laura’s IC commission rate above 50% yet retain some savings to help appease IC employers. The bottom half of Table 3 are figures for Dan from Table 1. The top of Table 3 is Laura earning 60% commission, not 50%. Look what happens. Her gross is $42,000, no longer $35,000. She still deducts $4,000 for her operating costs, if they were “Dan’s,” (W-2 employees). Federal SE taxes. The red-shaded fields compare adjusted incomes of Laura and Dan. Laura is no longer at $26,257 (see Table 1). Instead, she is now at $32,186 from 60% commission. Dan remains at $32,322.50 or nearly the same as Laura. Our compensation scale

want to be a Laura-type IC groomer when they cannot find a W-2 position.

is essentially balanced between the two. Our answer to the really big question is this. A 60% IC commission will generally compensate IC groomers for the extra tax burdens of self-employment. The continue to lack unemployment security and worker’s compensation coverage. Dan has it best. Laura’s employer retains financial advantages even at 60% commission. There is no unemployment and worker’s compensation coverage for them to pay.

IC’s offered 50% should target 60% and purchase self-employment insurance covering worker’s compensation (or an alternative), and loss of income should they not be able to work. IC employers and IC groomers should have business liability insurance covering both sides of

their working relationship.

(Continued on page 54)

What About Meg the Groomer $47,093.20 a year. Now wait a minute! Meg rocks. Very few groomers are Meg is grooming the same pets as aware why. We have the financial proof Laura and Dan. Meg is working the to explain why (see Table 4). same grooming hours as both, and all “Meg’s” are the most likely to hold up to commission deductions. In Table 1, scrutiny by the IRS determining if their Laura’s similar bottom line was independent contractor status is proper. $26,257 and Dan’s $32,322.50. Holy In our opinion, most Laura’s are not. ReBichon! Meg does indeed rock at fer to articles on IC classification in the $47,093.20. archives of PetGroomer.com Magazine to know why. Like Laura, Meg as an IC needs to pay Meg works the same hours grooming as worker’s compensation or alternative. both Laura and Dan. Grooming the Because Meg is about $21,000 ahead same pets we have assumed she generof Laura, Meg won’t blink. ates the same sales income of $70,000 a year as Laura, but Laura was paid Meg does not have a W-2 employer, she 50% commission of that amount, or is commercial renter. Pet business own$35,000. Meg stands out, she keeps ers advertise work station rentals in the the entire $70,000. Meg pays rent for a Classified Ads at PetGroomer.com but work station in a pet business, which there numbers are not large. We hope may be a grooming business, or day to see more. Perhaps there would be if care, boarding facility or veterinary clinmore groomers understood the state of ic. Where does her $70,000 go? compensation presented in this article. Table 4 is all about Meg and her selfmany thousands of work station rentals, employment finances. First, Meg pays why not grooming? $200 a week for a work station, or generate $70,000 gross sales before for insurance for loss of income and The hairstyling world for people has $10,400 a year. Second, Meg accounts Remember state laws can override IRS for $4,000 a year (same as Laura) for IC regulations, study both federal and other operating expenses. state laws before investing in IC selfemployment. We prepared Table 5 as a Once you deduct these expenses Meg summary of the conclusions of this artiadjusted self-employment gross income cle. We hope we are sending out a wake is $55,600. Because she is an IC she -up call to thousands of groomers to expays 2 shares of FICA / Medicare, same plore better compensation for the hard 54 Copyright © 2013 Find A Groomer Inc. All rights reserved Subscribe www.egroomer.com as Laura, or $8,506.80. Her bottom line prior federal and state income taxes is work they perform as pet groomers. ■