INDUSTRY AND TRADES

INDUSTRY IN OUR REGION

FEATURES

Northern BC gets boost with new gold mines

Heavy-duty trucks convert to hydrogen-diesel

Northern BC gets boost with new gold mines

Heavy-duty trucks convert to hydrogen-diesel

Prince George has been identified by the provincial government as the ideal location for a regional “hydrogen hub” to produce and distribute hydrogen fuel for northcentral B.C.

Prince George city council approved entering into an agreement with the province to develop a case study report, investor resources and support engagement opportunities over the next two years – along with a final summary of lessons learned and recommendations for the future. Under the agreement, the B.C. government provided $150,000 to the city from the BC Hydrogen Strategy Implementation budget.

“We’ll be working to help start and grow the hydrogen sector,” city economic development manager Deklan Corstanje said. “It aligns with our existing economic development strategy already. It’s a new sector, it’s exciting.”

Hydra Energy is already looking to develop a hydrogen production and fuelling station in the city to sell fuel to converted transport trucks. Prince George’s location makes it well suited to deliver fuel to 70 per cent of the province, and nationally and internationally via rail, air and the ports of Prince Rupert and Vancouver, Corstanje added in his report to council.

Under the deal the province provides the funding for the

project, while city staff will be responsible for managing it –with help and resources from the Minister of Energy, Mines and Low Carbon Innovation, Energy Decarbonization, he added.

Coun. Cori Ramsay said she was glad to hear in the report that the provincial government would be bringing their expertise to support the project and not just “dropping the money and running.”

“I think this is an incredible opportunity, and anytime we can take the on something like this, it’s great,” Coun. Brian Skakun said.

“ We’ll be working to help start and grow

It has been six years since the last new gold mine – Brucejack – went into production in B.C.

Now, as many as three could be pouring first gold next year: Premier, Blackwater and

Cariboo Gold.

While the Premier and Cariboo Gold mines are brownfield projects with historical mining, the new Artemis Gold Blackwater project south of Prince George is a large greenfield project that will generate a significant number

of jobs and economic activity in an area hard hit by sawmill and pulp mill closures.

Combined, the three new mines represent an initial capital investment of $1.5 billion over the next couple of years, and hundreds of new jobs.

Premier mine – low volume and high grade

The first of the three new gold mines to go into production will be the Premier underground gold mine near Stewart. Ascot Resources is aiming to pour first gold by the first quarter of 2024. The capital cost of the project is $300 million, and much of the new works are already built or nearing completion.

The mine is located within Nisga’a treaty lands. An agreement with the Nisga’a provides the First Nation with cash payments, training, employment and business opportunities. Sprott Streaming is helping to finance the mine with a US$110 million gold and silver streaming agreement.

The Premier gold mine has been mined since the early 1900s, most recently as an open-pit operation until the late 1990s, so a lot of the infrastructure needed to operate a mine is in place.

“We have a lot of strategic

infrastructure advantages that a greenfield site doesn’t have,” said Ascot CEO Derek White. “That’s why we’re able to go much quicker. We’re benefiting from all the historical infrastructure.”

Ascot has designed a huband-spoke approach, with one central mill near the historical Premier mine site, and four distinct deposits, all to be mined underground. The furthest deposit is 44 kilometres away by road. Since a lot of the infrastructure is already in place, most of the capital investment has been in refurbishing the mill and a tailings pond and water treatment system.

“In 2023, the big things for us are putting in a new state-ofthe-art water treatment plant,” White said.

Ascot expects the mine to produce 150,000 ounces a year, with average grades of 7.5 grams of gold per tonne. To put that in context, Blackwater’s average annual production would be just under 400,000 ounces per year with gold grades of 0.75 grams per tonne.

“These are high-grade underground deposits,” White said. “So small volume, high grade.”

Ascot will be ramping up

to about 200 workers this summer. Once in operation, the mine will employ 230 to 250 miners. While some of the miners may live in camp at the site, others may end up living in Stewart, B.C., White said.

Blackwater Gold – locally owned and low carbon With an initial capital cost of $645 million – and up to $1.4 billion total over a 22-year mine life – Artemis Gold’s Blackwater open-pit gold mine south of Vanderhoof will be largest new mine built in the region in more than a decade. Plus, it is largely locally owned, with 41 per cent of the owners being board members or management, including Vancouver developer Ryan Beedie, who is a director and major shareholder.

“We live here,” said Artemis Gold CEO Steven Dean. “This is our home and our decisions are made here in Vancouver, and not in Toronto or some other head office outside of

the province or even outside of the country.”

The Blackwater project was green-lit just last month with the issuance of a Mines Act permit. Early works construction has already started.

“We’re already well into construction,” Dean said.

The Blackwater project will create 500 jobs during an 18-month construction period, with production expected later in the second half of 2024. It will employ 300 miners in the first phase of operation and up to 450 in later phase expansions. The project will expand in phases, with the expansions focused on processing, starting at six million tonnes annually in Phase 1, 12 million tonnes in Phase 2 and 20 million tonnes in Phase 3.

The mine will be in a region that has been hard hit in

recent years by sawmill and pulp mill closures, so it will provide a welcome injection of jobs and tax revenue.

“British Columbians will benefit from hundreds of new jobs of this new mine, with both its construction and multiple decades of operation,” said Josie Osborne, minister of energy, mines and low carbon innovation.

“We’re hoping to be able to support employment and re-employment of some of those people in the forestry sector, maybe with a little bit of retraining into our sector,” Dean said. “Whether it be operators, truck drivers, maintenance people in the mill, there are some common skills between the two industries.”

Wheaton Precious Metals is staking the project with a US$141 million streaming agreement.

...continued on pg 6

This feasibility study demonstrates that the Cariboo Gold project will be a large-scale, long-life and profitable gold mine...

“We think it’s a robust asset that has some potential upside even beyond what they’ve identified so far,” Wheaton CEO Randy Smallwood said. “It looks like a really good asset that will deliver a lot of gold and silver to us. It’s a strong team that’s had great success building other operations and other mines around the world.”

An economic impact study by KPMG estimates the mine will contribute $13 billion to the B.C. economy over its 22-year life, including $2.3 billion in provincial revenue.

The Blackwater will have a lean carbon emissions profile. Its processing plant will be fully electric, and therefore zero emission, and the company has an agreement with Caterpillar in which the mine’s haul trucks can switch to fully electric in 2029.

“We have an agreement whereby we will be one of the first to receive these pieces of equipment,” Dean said.

Cariboo Gold – bringing

Barkerville back to life

Osisko Development has plans to bring the historic gold mining region of Barkerville back to life. The company had planned to have a new mine in operation last year, but it has been delayed, and the company is now aiming to pour first gold in 2024.

The project has a total capital cost of close to $600 million – $137 million for the first phase and $451 million for expansion. In January, Osisko published a new feasibility study that estimates the mine will produce an average 163,695 ounces of gold a year over a 12-year period, with gold grades of 3.72 to 4.43 grams per tonne.

“This feasibility study demonstrates that the Cariboo Gold project will be a largescale, long-life and profitable gold mine,” said Osisko Development CEO Sean Roosen. “It will also produce significant quantities of gold in its initial years at a capital cost below $140 million.”

TheCariboo economic region, which includes Prince George, is projected to have the lowest employment growth in B.C. over the next 10 years, according to the B.C. Labour Market Outlook report.

According to the provincial government forecast, the predicted employment growth rate from 2022 to 2032 is 0.2 per cent per year –well below the B.C. average of 1.3 per cent.

“In the next ten years, the Cariboo region is expected to have 18,500 job openings. About 93 per cent of these jobs will replace exiting workers and 7 per cent will come through economic growth,” the report says. “Employment demand is expected to grow at an average of 0.2 per cent annually during the next ten years.”

The Cariboo economic development region includes communities from 100 Mile House to Mackenzie, and the Robson Valley. As of 2022, 87,700 people were employed in the region. The region is expected to see 1,300 new jobs by 2032, with 17,200 job openings to replace workers retiring or otherwise leaving the workforce.

“The region’s largest industries are: other retail

trade (excluding cars, online shopping and personal care); hospitals; food services and drinking places; elementary and secondary schools; wood product manufacturing; ambulatory health care services; and forestry, logging and support activities,” the report says. “The region is the third largest in geographical size, but less than five per cent of B.C. residents live and work here.”

The top 10 industries in the region for job openings (new and replacement) over the next 10 years will be: hospitals (1,490 jobs); other retail trade (1,290 jobs); food service and drinking places (1,150 jobs); personal, nonautomotive repair and nonprofit services (850 jobs); universities (770 jobs); wholesale trade (770 jobs); business and building support services, excluding travel (730 jobs); social assistance (670 job); other manufacturing (600 jobs); and paper manufacturing (600 jobs).

The strongest job growth in B.C. over the next 10 years is predicted in the Vancouver Island/Coast region (1.5 per cent per year) and the Thompson-Okanagan region (1.4 per cent per year).

The Mainland/Southwest and North Coast/Nechako regions are expected to see average job growth (1.3 per cent per year), with below-average growth predicted in the

Northeast (0.5 per cent per year), Kootenay (0.4 per cent per year) and Cariboo (0.2 per cent per year) regions.

Throughout B.C., more than a million job openings are predicted by 2032. Of those, 37 per cent are expected to be new positions created by economic growth, and the other 63 per cent to replace retiring workers.

Nearly 80 per cent of those

job openings are expected to require some level of post-secondary education – 37 per cent will require a bachelor’s degree or higher, 29 per cent will require a diploma or certificate, 12 per cent will require a trades apprenticeship, and 22 per cent will be available to people with a high school diploma or less education.

Of the five liquefied natural gas projects in B.C. that are either under construction or

in the environmental review process, two will need to pass a new provincial sniff test for greenhouse gas intensity.

One of them is FortisBC’s

Tilbury Island LNG plant expansion in Delta, which is still working its way through the BC Environmental Assessment Office (EAO) review process. The other is the much larger Ksi Lisims project in Prince Rupert.

With a capital cost of $3 to $3.5 billion, the Tilbury Island expansion project is one of the largest capital projects on the major projects inventory for the Lower Mainland.

Should the project be approved, the expansion could bring the plant’s total production capacity up from 250,000 tonnes annually (current) to 3.4 million tonnes – a twelve-fold increase that would make it larger, in terms of production capacity, than the Woodfibre LNG project in Squamish (2.1 million tonnes) or Cedar LNG project in Kitimat (3 million tonnes).

The Tilbury Island LNG project is different from all others in B.C. in two respects. For one, it is an expansion of an existing LNG plant, not a greenfield project. Secondly, the LNG it would produce would not be solely, or even primarily, for export. Its main

market would be domestic, including marine fuel bunkering and fueling trucks that run on compressed natural gas or LNG.

“The export piece is interesting, but it’s really not the core part of our story,” said Andrew Hamilton, FortisBC’s senior project manager for Tilbury Island. “There’s no firm contract for export. It’s an opportunity – we’re interested in it. But we are very, very closely watching the marine fuelling, the marine bunkering market, because that demand continues to grow.”

FortisBC has tested the export market by selling some LNG to China, via ISO container, through third party sellers. But due to a container shortage that resulted from a supply chain snarl during the global pandemic, there have been few sales in the last couple of years by ISO container, and FortisBC does not, as yet, have any long-term purchase agreements with customers in Asia.

“We may find that we build less than the 2.5 million tonnes because the market demand’s different, or there’s

no export,” Hamilton said.

If an export market does develop for FortisBC, LNG would be exported by small LNG carriers that would dock at a proposed new marine jetty at the LNG plant site on Tilbury Island in Delta.

The existing Tilbury Island LNG plant would add additional tank, production capacity. |

FortisBC

FortisBC

FortisBC’s LNG plant on Tilbury Island has been in operation since 1971 and already has natural gas pipeline connections. The Tilbury Island plant includes LNG storage tanks and regasification equipment. Originally, it’s sole purpose was to provide backup natural gas for peak demand periods or supply disruptions.

Between 2014 and 2019, FortisBC spent roughly $425 million to expand the plant to add additional production, mainly to serve a growing domestic market for natural gas as an alterative to diesel in the marine sector and in trucking. The phase 1 expansion brought its production up to 250,000 tonnes per year, but also includes a further expansion potential of another 650,000 tonnes.

FortisBC is now planning a second phase expansion, to the tune of $3 to $3.5 billion, which would add an additional storage tank (142,400 cubic metres) and an additional 2.5 million tonnes of annual production capacity. That would bring the plant’s total potential production capacity to 3.4 million tonnes of LNG annually. The expansion would employ about 600 workers during peak construction.

As part of the plant expansion plans, FortisBC is also partner in a proposed new marine jetty, which would be used to fill LNG tankers for export and marine bunkering barges.

The Tilbury Island marine

jetty is a joint venture – the Tilbury Limited Partnership – between FortisBC and Seaspan. The marine jetty proposal – estimated to cost $160 million to $200 million to build -- has already moved through the BC EAO process separately and now just awaits a final decision from provincial and federal Environment ministers.

The Tilbury Island phase 2 expansion is a bit further back in the EAO process. FortisBC plans to file an application this summer, which typically takes six months to review, Hamilton said.

Vancouver, Richmond and New Westminster city councils have registered their opposition to the expansion, citing concerns about greenhouse gases from upstream natural gas production, safety and impacts on air quality. More than a dozen First Nations are being consulted as part of the environmental review process for the phase 2 expansion.

Realistically, the earliest FortisBC could hope to get a green light for phase 2 is the end of 2024. With a construction phase of four to six years, the expanded plant would not likely be in production until between 2028 and 2030.

By then, it would need to be “net zero” in emissions, as per the provincial government’s new Energy Action Framework announced earlier this month. Essentially, the new framework would make it difficult for new LNG projects to be approved without committing to using electric drive, as opposed to natural gas drive.

In a recent analysis, Richard McCandless, a former B.C. civil servant who blogs about B.C. public policy issues, estimated that electrifying all five LNG projects in B.C., including second phase for the LNG Canada project, would require 18,500 gigawatt hours (GW/h) of electricity annually, whereas

the new Site C dam will provide only 5,100 GW/h. He said it’s clear there will simply not be enough electricity in B.C. to power all these LNG projects.

“Either the new LNG projects are stillborn, or they use natural gas to condense the product (the practice of most LNG plants in the world) and compromise the government’s net zero emissions objective,” he recently wrote.

FortisBC’s Tilbury Island LNG plant has used electric drive from the beginning. Using it for the phase 2 expansion would produce 200,000 tonnes less CO2 annually than if natural gas drive were to be used, according to the company’s project description.

Because it was designed to use e-drive, Hamilton said he believes FortisBC’s Tilbury Island expansion plan will fit with the provincial government’s new Energy Action Framework, which

requires all new LNG projects to demonstrate they can be net zero by 2030.

“We’re proceeding under the assumption that all of that framework complies to the phase 2 assessment,” Hamilton said. “We’re very comfortable that we will be able to work within that net zero by 2030 framework.”

The phase 2 expansion would require 1,325 GW/h of electricity -- roughly one quarter of the annual generating capacity of Site C dam (5,100 GW/h).

Hamilton said FortisBC does not expect any problems in getting the electricity it will need.

“We do not believe we will be constrained by electricity,” he said. “Because we’ve been working with BC Hydro, we are comfortable that the electricity that we require for our development concept is available to us.”

A$62 million hydrogen production plant and fuelling station is one step closer to reality, following a decision by Prince George city council.

Following a public hearing, city council approved the first three readings to bylaws to amend the Official Community Plan and rezone Hydra Energy’s proposed site at 9048 Sintich Rd., located at the intersection of Sintich Road and Northern Crescent. Final approval will be considered at a future meeting.

Hydra Energy originally intended to build a hydrogen fuelling station at the site, and produce the flammable gas off-site at another location, David McWalter of McWalter Consulting Ltd. said.

“The applicants want to make Prince George into a hydrogen hub, similar to

what is being developed in Edmonton. And they hope to do the same two years from now out in Prince Rupert, 500 miles apart,” McWalter said. “…(Basically) we’re taking water, city water, and using the adjacent BC Hydro powerlines to produce hydrogen, and the waste product is oxygen, which is simply vented to the air.”

Producing the hydrogen on site will mean less traffic, but if through the design process it is a determined a deceleration lane is needed on Sintich Road, then Hydra Energy will build one, he added.

The hydrogen produced on site will be primarily sold to converted transport truck operators, McWalter said.

‘In the last few months, we’ve been pounding the pavements, speaking to local truck operators, truck fleets, and the response has been phenomenal in terms of converting existing diesel trucks to a combination of diesel and hydrogen,” he said. “Trucks that are converted, and it’s a fairly easy conversion – it’s basically three or four days in the shop and $60,000 later your truck can run on hydrogen or diesel, either or.”

Northern British Columbians are getting better highway coverage to help improve safety for travellers.

The province is investing $75 million through the Connecting British Columbia program, administered by Northern Development Initiative Trust, to help fund projects that will expand cellular to at least another 550 kilometres of highway by 2027.

The funding builds on a $15-million investment made by the province for highway cellular expansion in 2020, which is supporting 532 km of additional highway cellular coverage.

Projects underway include 252 km and two rest areas to complete continuous coverage along the stretch of Highway 16 between Prince George and Prince Rupert, known as the Highway of Tears.

“This $75-million infusion to the Connecting British Columbia program will result

in increased safety for all those who live and travel in remote and isolated areas of our province,” said Joel McKay, chief executive officer, Northern Development Initiative Trust.

“Improving connectivity in rural and Indigenous communities will strengthen community resiliency, providing timely access to information in case of emergency and encouraging entrepreneurial activities. Northern Development applauds the Province of B.C. for investing in cellular connectivity and we look forward to administering this new phase of the Connecting British Columbia program.”

The province supports the expansion of highway cellular in B.C. by contributing to the overall cost of the projects led by service providers.

More information regarding the program and funding eligibility will be available later in 2023.

Hydra Energy CEO Jessica Verhagen points to the nozzle where hydrogen fuel is pumped into a long-haul truck now in the hands of

Lodgewood Enterprises Hanna Petersen Hydra Energy achieved another significant milestone in its Prince George project

www.TDB.ca

rollout by signing with eight commercial truck fleets in the region.

This represents 82 Class 8 trucks to be retrofitted using Hydra’s proprietary hydrogen-diesel, co-combustion conversion technology

Once converted by Hydra installation partner, First Truck Centre, these trucks will refuel at the world’s largest hydrogen refuelling station Hydra is currently building in Prince George to be operational in 2024, which uses green hydrogen produced on site by two 5-megawatt electrolysers powered with hydroelectricity.

“Upon signing our first commercial fleet customer in Prince George and breaking ground on our local refuelling station last year, we had an initial goal to secure 65 heavyduty trucks to leverage the new station once operational next year. We’re pleased to surpass this target with the signing of these eight fleets highlighting the continued interest in hydrogen trucking and the benefits it delivers for fleets of all sizes, even with

heavy payloads in challenging weather and road conditions like those found in Northern B.C.,” explained Hydra Energy CEO Jessica Verhagen.

“We look forward to working with First Truck Centre to start converting these trucks about six months prior to our station’s opening and to continuing to work with the City of Prince George as the flagship stop in the Western Canadian Hydrogen Corridor we’re building between the B.C. Coast and Edmonton.”

Hydra Energy has signed memorandums of understanding with Arrow Transportation Systems, Excel Transportation, Edgewater Holdings, Wilson Bros. Enterprises, Burke Purdon Enterprises, Godsoe Contracting, Keis Trucking, and Peace Valley Industries, who all service the Prince George and Northern B.C. region.

“We also continue to have ongoing discussions with additional local fleets who are keen to explore how hydrogen can benefit them,” said Hydra’s service delivery lead Ilya Radetski.

The B.C. government approved a new $3 billion LNG project last month, but any further LNG developments that have not yet made it through the environmental review process will need to meet new emissions caps to get approved.

In announcing the approval of the Cedar LNG project, the B.C. government also announced a new “energy action framework” that will include a new cap on emissions for the oil and gas sector, as well as a plan to electrify the economy as a way of achieving greenhouse gas emission reduction targets..

“We will require all newly proposed LNG facilities in or entering the environmental assessment process to have a credible plan to reach net zero emissions by 2030,” said Premier David Eby. “Projects that are interested in reducing emissions can pass

this test with the right plan and innovation. We know that proponents are already moving in this direction because industry knows this is where we must go to deliver a low-carbon future.”

LNG projects that have yet to move through the environmental assessment process yet include the Ksi Lisims LNG project, which is backed by the Nisga’a First Nation.

As part of the new energy framework sketched out Tuesday, Eby also announced a new clean energy and major projects office will be established for “expediting approvals for clean major projects.”

Such projects could include critical minerals mines and hydrogen projects. Josie Osborne, minister of Energy, Mines and Low Carbon Innovation, noted that there are some 50 hydrogen projects proposed in B.C.

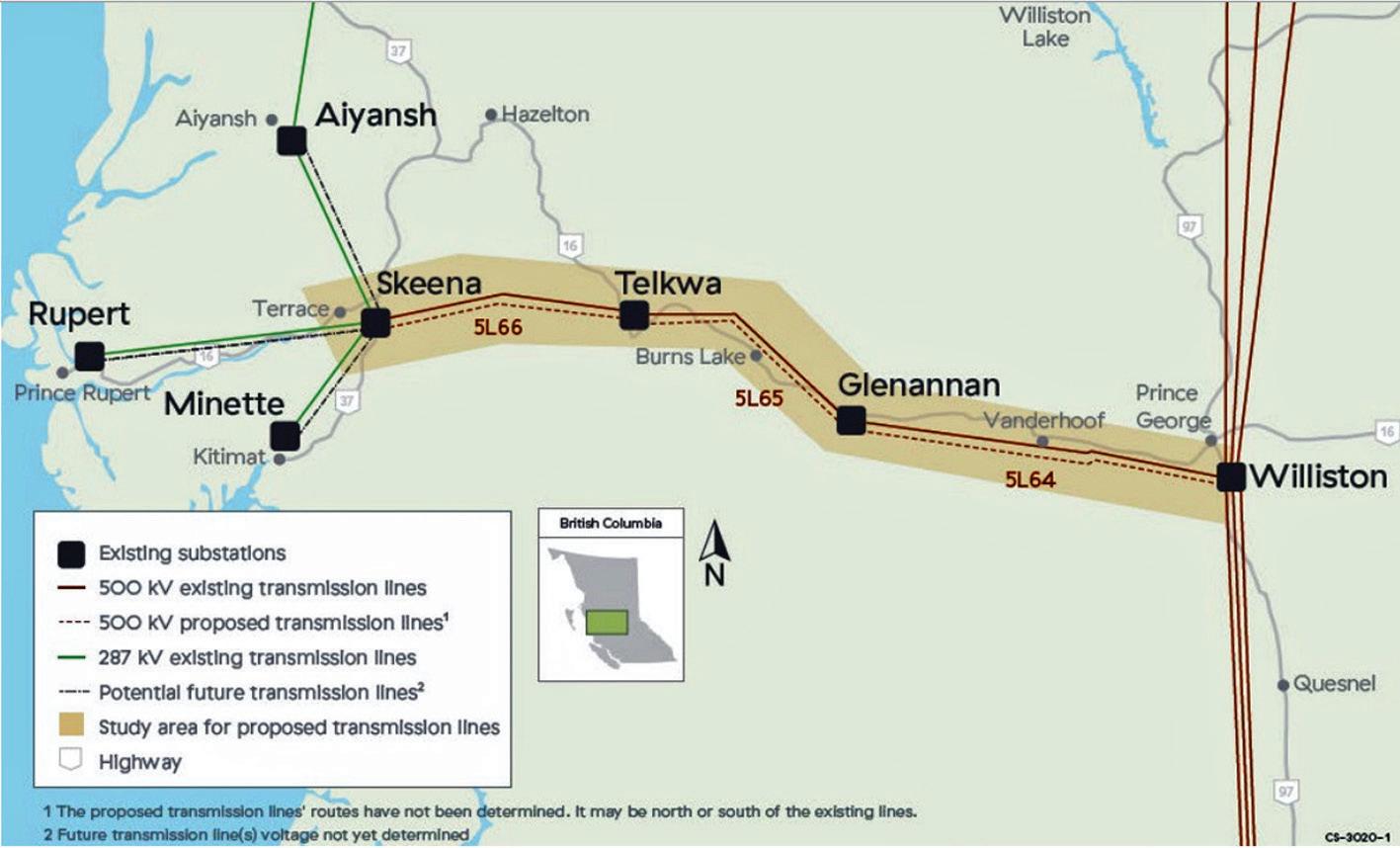

BC Hydro is looking to build approximately 440 km of new, 500 kilovolt (kV) transmission lines from Prince George to Terrace, according to information provided to the Regional District of FraserFort George.

BC Hydro stakeholder engagement advisor Debra Lamash said three sections of new 500 kV transmission line are planned, along with three new capacitor stations and expansion of existing substations along the route.

“As noted in my September 16, 2022 letter regarding electrification, industrial customers are increasingly seeking to electrify their operations to reduce greenhouse gas emissions,” Lamash wrote in a letter to the regional district. “Meeting the needs of potential large scale industrial developments in this region will require new 500 kilovolt (kV) transmission lines and associated infrastructure to be developed from Prince George to Terrace.”

The new lines are expected to follow generally the same route as BC Hydro’s current transmission lines along Highway 16, she wrote. The project would be divided into three sections: a 170-km section from the Williston Substation near Prince George to the Glenannan Substation near Fraser Lake, a 130-km section from Glenannan to Telkwa Substation near Telkwa, and a 140-km section from Telkwa to Skeena Substation near Terrace.

“We have been reviewing preliminary studies that were completed when these lines were previously considered to determine what additional work is needed,” Lamash wrote. “We expect the system additions will take around 8 to 10 years to plan, consult on, permit, design, and build. As noted in my earlier letter, other system expansion including new transmission lines beyond Terrace may also be required.”

BC Hydro plans to complete their studies and design work, and seek the necessary permits and approvals between this year and 2028, she added. Construction was slated to begin between 2026 and 2033.

No cost estimate was provided.

Eby also announced the creation of a new BC Hydro task force “to electrify the provincial economy.”

B.C. is blessed with abundant, low-emission hydro power, and electrifying the oil and gas and LNG sectors is one of the tools that could be used to reduce its emissions.

B.C.’s oil and gas sector produced about 12.8 million tonnes of CO2 equivalent in 2020 -- about one-fifth of B.C.’s total emissions according to the Canadian Energy Regulator.

In its CleanBC plan, the government had never fully explained how it would achieve all of its emission reductions targets, with the oil and gas sector’s carbon footprint being the biggest question mark. The plan was criticized for a 25 per cent emissions gap that had not been accounted for.

“The need to cut emissions from the oil and gas sector was a major gap in the B.C. climate plan, and the announcement today closes that gap,” said

Chris Severson-Baker of the Pembina Institute.

“Before this announcement, LNG production was simply incompatible with the B.C. climate plan, and now we have policies that ensure the target will be met.”

“We’re pleased to see B.C. signalling a shift in economic priorities, recognizing that the province’s prosperity can’t rely on climate-damaging fossil fuels,” said Tom Green, senior climate adviser for the David Suzuki Foundation.

“Successive B.C. governments have missed climate targets. This new framework can limit climate impacts and redirect investments to enable a fair energy transition in B.C. A regulated emissions cap signals this government’s intention to get the oil and gas sector’s emissions under control.”

Stand.earth, by contrast, slammed the government for supporting any further LNG development.

“The province can put together as many plans and targets as it wants, but if they’re still approving and building new gas megaprojects like Cedar LNG, these plans are meaningless,” said Sven Biggs, Canadian oil and gas program director for Stand.earth.

Asked how the oil and gas emissions cap will work, B.C. Environment Minister George Heyman said his government will be doing consultations this year on the cap’s design.

“The cap, in all likelihood, will be a declining cap that aligns with the sectoral targets on the way to 2030,” Heyman said. “It will neither be the level we’re at now, and it won’t be zero. But it will be in line with the announcement we made two years ago.”

CleanBC’s targets for the oil and gas sector were set at 33 to 38 per cent below 2007 levels by 2030.

We’re pleased to see B.C. signalling a shift in economic priorities, recognizing that the province’s prosperity can’t rely on climatedamaging fossil fuels