It shouldn’t take a six-by-six barn beam crashing through your customer’s bedroom wall to find out who you can trust.

It shouldn’t take a six-by-six barn beam crashing through your customer’s bedroom wall to find out who you can trust.

And that’s the Silver Lining®.

We are a community of independent agents and other dedicated insurance professionals, working to promote and improve the independent agency channel. Our mission is to support the advancement and excellence of all independent agencies.

We are the premier association for insurance education in Wisconsin. Grow your knowledge and your bottom line, at our education sessions. Whether you want to pursue a CIC, CPIA, CISR or CRM designation, or just meet your bi-annual Wisconsin CE requirement, you have come to the right place.

With lobbyists representing you in Madison and in Washington, D.C., PIA is looking out for your interests and promoting the independent agency channel within state and federal government. Our goal is a regulatory environment that allows your agency to grow and prosper.

PIA is a place for you to collaborate with, and learn from, other agents and many other professionals in the industry. Starting an agency? We’ve been there. Growing an agency? We’ve been there. Considering a new agency management system? PIA members have been there. Whether at our PIAW Winter Get-Away event in Minocqua, Annual Convention, Scholarship Golf Outing or dozens of other events, you can collaborate with other professionals who have “been there.”

As I think about the comments I received from readers of my last Wisconsin Professional Agent article, I’m led to believe that people might not mind if I simply told a bunch of flying stories in future columns. But as it turns out, PIA stands for Professional Insurance Agents and not Professionals In Aviation so I’ll do the responsible thing and stay focused on the task at hand.

In the concluding paragraphs of that January/February article, I made mention of a mantra that works just as well in an agency as it does in a cockpit: Stay calm, stay focused, and stay optimistic. I promised to spend some dedicated editorial space examining each of these components to help us understand why they are so important and how they can be practically applied to our professional (and personal) circumstances.

Stay Calm – When faced with adversity, the tendency of human beings is to panic or to simply freeze-up. In almost every case, such responses are unhelpful at best. One research firm found that among the traits shared by top performing leaders, an astonishing 90% of them possessed the ability to manage their emotions and stay calm and in-control during stressful times. The good news is that such reactions can be learned through practice and intentionality. In other words, as we consistently force ourselves to replace feelings of anger or panic with a calm and controlled demeanor (even if it feels fake), we will begin to experience an exponential increase in our ability to handle adverse circumstances critically and effectively. Over time, the very landscape of our initial reactions begins reshaping itself for the better.

Stay Focused – It’s so easy to take our eyes off of the big picture and fixate on the immediate issue in front of us. We just want the adversity to be over so we can move on in a more comfortable manner. But did you know that adversity has incredible refining effects? In nearly all cases, it makes us stronger, more resilient, and helps us develop skills and perspectives we didn’t previously have. In April of 1970, the Apollo 13 spacecraft, while en route to a moon landing, was severely crippled by a system malfunction while 200,000 miles away from home. The only possible way back was to travel the opposite direction to perform a “gravity assist” maneuver around the dark (back) side of the moon which would ultimately propel them toward earth. In our businesses (and in life) it is often these “dark side of the moon” occurrences that help attain better results in the long run. Keep focused on doing the “next best thing” and asking how the current circumstances can help us improve and innovate.

Stay Optimistic - In a grim but incredibly profound experiment on the power of hope, Dr. Curt Richter placed rats into a bucket of water to determine their ability to swim. The rats lasted an average of 15 minutes before drowning. In a second experiment, he rescued the rats just as they began to stop swimming and sink. After drying them off and giving them a short period to rest, he placed them back into the water. This time, they swam much longer than 15 minutes. They swam for nearly 60 hours. When we stay positive and believe that things will ultimately work out for the good, I firmly believe we can accomplish much more than we ever thought possible.

It is worth reiterating that not everything within the current insurance environment is functionally adverse.

Stay calm, stay focused, and stay optimistic – great things are happening...

STEVE CLEMENTS, CPIA President, PIA of Wisconsin

In many ways, quite the opposite is true. For example, the increasing costs for carriers and agents to run their businesses is being offset by increased premiums and higher revenues. As one might imagine, this rate volatility heightens consumer unrest– but also generates greater quoting activity – across all insurance buying channels. It is particularly in these instances that the independent agent channel is able to leverage the distinct advantage of accessing multiple carrier options to optimize rates and

capture an increasing percentage of the insurance market. Finally, the loss environment of the past year has revealed possible coverage gaps in policies, prompting some directwritten consumers to seek out an agent to help manage their insurable risks. All of this is good news for independent insurance agents and carriers. Stay calm, stay focused, and stay optimistic – great things are happening, and even better things are to come – even if the path to get there is a bit curvy at times.

Every agency should have a formal method for exposure identification. Every agency should have formal agency procedure standards. And every agency should have formal coverage standards! This program will introduce you to these concepts and offer some suggestions for your consideration.

April 25, 2023 / 9–10 a.m.

1 WI CE Credit

PIAW Member – FREE

Non-Member - $39

REGISTER ONLINE AT PIAW.ORG

Rockford Mutual provides superior value by supplying policyholders with the insurance products they need, paired with the outstanding claims service they deserve.

For over 125 years we have supported Independent Agents with competitive products, exciting incentive opportunities, exceptional claims service, and much more.

Did you know that the U.S. Capitol Building and congressional office buildings (where congresspersons and senators have their offices) just reopened to the public in January?

During the past three years of pandemic-shutdown in Washington, D.C., we were thankful for the ability to hold Zoom meetings with our federal elected officials. One benefit of the virtual meetings was that we got to include more PIA-member agents in those meetings, because no travel was required. We even had a number of successes, such as recruiting Representatives Tom Tiffany (R-Minocqua) and Glenn Grothman (R-Glenbeulah) to sign on to PIA’s bill to abolish the Federal Insurance Office.

Now that we have the option to visit our federal representatives in person again, it’s an easy choice to resume the PIA Advocacy Day conference and take a group of independent agents to Washington. If you’re a PIA-member agent, you’re invited to join us!

We will be advocating on issues critical to the success of our members and the industry as a whole, including:

• Stopping Proposed Cuts to Crop Insurance Commissions

• Making the 20% Tax Deduction for S-Corporations Permanent

• Allowing Legal Cannabis Businesses to Get Insurance

• Making the National Flood Insurance Program Permanent

• Repealing the Federal Insurance Office

• Removing Agents from the Definition of “Third-Party Marketing Organization” for Medicare Plans

PIA Advocacy Day will take place on May 9 & 10, 2023. On the afternoon of May 9th, we will meet in Old Town Alexandria to discuss the issues and messaging. On May 10th, we will go up to Capitol Hill for meetings with our elected representatives and senators. There will also be a reception, dinner and plenty of camaraderie with other agents from across the country. This is a very rewarding way to spend two days! If you’re interested, please give me a call for more information, at (608) 274-8188, or email me at phanson@piaw.org.

While it’s important to visit with our federal representatives, most insurance regulations happen right here in Wisconsin – whether in the Wisconsin Legislature or at the Office of the Commissioner of Insurance. That is why PIAW President Steve Clements, CPIA and our Board of Directors decided to hold an Advocacy Day for PIA members in Madison, as well.

Our first Advocacy Day in Madison in a generation, just took place in Madison on March 8th. We met with state lawmakers and their staff members to

advocate for these key objectives:

• Repealing the Personal Property Tax

• Stopping Unlicensed Clerks in Self-Storage Facilities from Selling Insurance

• Growing the Wisconsin Youth Apprenticeship Program and its Insurance Track

• Requiring One Semester of Financial Literacy Education in High School

Look for a recap of this event and photos on our Facebook and LinkedIn pages, and in the May/June edition of Wisconsin Professional Agent!

We will be advocating on issues critical to the success of our members and the industry…

PETE

CAE, CISR Executive Director, PIA of Wisconsin

During the 4th quarter and the beginning of each calendar year, agencies tend to look at potential profit-sharing bonuses and how to maximize them for the coming year. At the end of the year, most insurance agencies also take a close look at where they stand with each one of their partner carriers, when it comes to bonuses. Most insurance carriers have some type of bonus program for their appointed agencies. This bonus comes as a check and is almost always comprised of two major book components, evaluated at the end of each calendar year:

• Growth: Insurance carriers need to partner with growing agencies for both organizations to prosper. Each year, they will look at growth from a premium standpoint. Positive growth is a key factor. Many carriers will reward higher percentage growth with higher percentage bonuses.

• Profitability: It is the goal of both the insurance company and agency to have a profitable book of business, come December 31st of each year. Unfortunately, it does not always happen. There are a few factors of loss ratio, but the most basic is the one that applies when looking at bonuses: Total Losses vs. Written (or Earned) Premium = Loss Ratio %. Most carriers require an agency to fall under 55% to earn a bonus.

Once an agency has achieved these goals, the carrier awards a percentage of either written or earned premium as a bonus. Most carriers use a “grid” and/or matrix where the lower the loss ratio and the higher the growth, the greater the percentage bonus.

Carriers often require a minimumpremium threshold to participate in a profit-sharing bonus program. This process ensures the carriers are spending time and money with those agencies that want to build a long-term relationship and maintain a quality book of business. Usually, this premium number is somewhere between $250-$500k before an agency meets qualification requirements. Reaching this level of business can be a tall task for smaller agencies that don’t belong to an agency “group,” but it is certainly achievable.

Another factor that comes into play is the 9-month lock in opportunity. If an agency is at a certain level of premium and loss ratio, the company may offer them a guarantee lock in in the event the last quarter of the year the loss ratio is not favorable to them. There typically is a charge for this benefit of 15%+. Insurance companies may also offer a stop-loss option in their agreements to cap off large claims to help conserve an agencies loss ratio on a single claim exposure.

There are many ways an agency may increase their profit sharing potential, whether they are a small, medium or large agency, some of those ways are:

• Join an aggregator or cluster-type network.

• Acquire another agency or merge with another group.

• Perform loss ratio management. Take a look at your insurance book of business for efficiency.

• Hire a new producer(s) to grow the agency.

• Review your current marketing plan and strategy to strengthen your agency portfolio.

There are many ways an agency may increase their profitsharing potential…

I realize that a lot of the information I have outlined may seem elementary to experienced agencies, but the main point is: regardless the size of the agency, profit sharing time is an exciting time of the year. An agency principal once shared with me, “Commissions pay the bills, but profit sharing buys the toys.” Each agency has different philosophies and strategies they follow. It may be to pay down current debt, distribute to their staff, enhance their agency to grow to even better levels or buy more toys.

Whatever the reason, it can be an exciting time of the year. Be sure to channel some of that excitement into developing a business plan for profit sharing in the coming year. It can be critical to your agency’s future growth and relationship with each carrier.

May you and your agency have a prosperous and rewarding 2023!

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control measures

Responsive claims handling

Facilitation of quality medical care (when an accident does occur)

We’ve been successfully protecting our policyholders and their employees since 1983.

Browse all of our products at www.guard.com

taxing authorities for the lost revenue and links future reimbursement of the tax to inflation

• Allows municipalities with populations over 30,000 and all counties (other than Milwaukee) to enact an additional 0.5 percent sales tax

• Allows Milwaukee County to impose additional sales tax up to one percent

• Expands Medicaid eligibility for from 100 percent of the federal poverty line to 138 percent of the federal poverty line

• Adopts a paid family and medical leave program providing for twelve weeks of benefits for qualified individuals beginning in 2025, requiring employers with at least 50 employees to participate

• Sets various PFAS standards and requires the Department of Natural Resources to establish rules for the acceptable level of PFAS

• Gives DNR the authority to require as a condition for possessing PFAS, proof of financial responsibility for remediation and long-term care to address PFAS contamination

• Allocates $60 million for traffic calming grants to create traffic circles, pedestrian islands, and more infrastructure to slow vehicle traffic

• Creates a program to allow for undocumented immigrants to receive drivers licenses

Estimated Budget Surplus Hits $7.1 BILLION – a surplus not seen before in Wisconsin State History. The total of the anticipated budget surplus has continued to climb upwards over the last several months, prompting grand discussions of sweeping tax reform, tax breaks and ambitious new policy initiatives. What will be included in the final budget will be determined as it evolves over the next few months, but the ball is rolling and the process has finally begun once again.

Governor Evers revealed his budget and highlighted many of his key priorities on February 15th, during his official Budget Address in the Assembly Chambers of the Wisconsin State Capitol. In this address, he unveiled many new initiatives he is calling the Legislature to approve. With a surplus of $7.1 billion, there are numerous noteworthy programs and new initiatives he is proposing, but here are some standout points that are of interest. The Governor’s proposed budget:

• Repeals the personal property tax, providing revenue to reimburse local

• Establishes a state-based health insurance marketplace under the Affordable Care Act

• Increases Wisconsin’s minimum wage three times until 2026, to a final $10.25/hour, and begins a study of a $15 minimum wage

• Includes an appropriation of $5 million for talent attraction and retention efforts in Wisconsin

• Allocates $1 million of each year of the biennium to conduct a study for the development of a public option health insurance plan

• Creates a fiduciary responsibility for pharmacy benefit managers to insurers and other payers

• Requires insurance plans to cover substance use disorder counselors, infertility treatments and services provided by qualified treatment trainees.

• Creates the Office of Environmental Justice to perform climate risk assessments and determine resilience plans for state agencies

• Requires municipalities to create comprehensive plans, local hazard mitigation policies and community health assessments to address the

• Requires the use of an ignition interlock device for all offenses, including first time, involving operating a motor vehicle under the use of alcohol

• Increase fines for seatbelt violations from $10 to $25

• Creates new private cause of action for service denial for broadband service based on race or income and creates new private causes of action for employment discrimination, unfair honesty testing and unfair genetic testing

Though these proposals were included in the Governor’s budget, it is highly unlikely that many of them will be included in the final version that is ultimately enacted. The Joint Finance Committee will strip non-fiscal policy items from the budget during the next month or so and will begin voting on their own budget proposal agency by agency. The budget will likely be up for final consideration in early summer, unless unforeseen circumstances arise.

Continue to stay up to date with Wisconsin politics and PIA legislative activities in the Wisconsin Professional Agent and with updates on the PIAW Blog at piaw.org.

• Flexible partner agreements including the ability to continue to grow your equity

• Gain the ability to retain local ownership while at the same time reallocating some of your assets at a time when valuations are high

• A dedicated integrations team that supports your agency’s onboarding

• A leadership team that values results, employee engagement, & local community support

• Access to agency-shared services: information technology, accounting, licensing & contracting, reporting & data analytics, human resources including benefits administration, marketing, & more

• Access to resources such as safety & human resources consulting

• State-of-the-art technology platforms & data analytics such as Salesforce, Indio, & more

• A strong focus on financial strength, backed by JC Flowers, a robust private equity capital group with strong ties to investing & growing businesses in the Midwest, supports our future growth

growwithus@tricorinsurance.com Contact us for a confidential consultation

Should an agency contact a client to notify it that its policy is being cancelled for failure to pay the premium (direct billed by the carrier)? Risk managers and errors and omissions insurance providers almost always say that an agent should not intervene and contact the insured about a cancellation notice. They will say that you do not want to create a precedent whereby the insured starts to rely on you to notify it that its policy is being cancelled. This makes sense from a risk management viewpoint because once an agent voluntarily starts monitoring a client’s account, a client that suffers a loss may allege that the agent had a legal duty to continue to monitor the account. If the agent fails in the performance of a duty, an insured could assert a claim of negligence. The agent could then be responsible for a loss if the carrier cancelled the policy and does not provide coverage for a subsequent event.

The standard answer ignores customer service and human nature. If the insured is one of your best accounts, and you know that the account has the financial ability to pay the premium, then the cancellation for failure to pay may be due to an oversight. Moreover, you develop relationships with your clients. Many of them become your friends. How can you keep silent when you find that a notice of cancellation has been sent to a longtime client and a friend for failure to pay the premium?

If you are going to inform your client of the impending cancellation, you should take some steps to protect yourself. One thing you can do is pick up the phone and call the insured and have a conversation to the effect that you just discovered there was a cancellation of the policy for failure to pay. Obviously, you should show some empathy and understanding that the failure to pay was an oversight and that payment should be made promptly within the timeframe described in the notice of cancellation. You should clearly state that this is a one-time event or favor in terms of the agent calling to point this out because it’s not the common practice of the agent to do so. Most importantly, you should follow up the conversation with an email confirming the conversation, specifically stating that (i) you brought this

to his or her attention as a one-time favor, and (ii) that the insured cannot rely on you to inform him or her in the future of an impending cancellation. Make sure you save your email. We believe that the foregoing scenario creates a situation where legally, the agent should be able to establish that it has not assumed an ongoing duty to monitor a client’s payment of premiums.

Again, the standard answer to this question is, do not notify the client because it is not your responsibly and opens you up to a possible errors and omissions claim. This answer raises a possibly bigger question: What makes insurance agencies different from one another?

Agency A sells a particular carrier’s products, but so does Agency B. Why do many customers go to Agency A rather than Agency B? It is generally because of personal relationships and the services being offered by the agency. This is particularly true in the commercial area. In other words, the question presented to you is one that requires the exercise of your business judgment. You need to balance the risks you are willing to take when providing customer service and maintaining your relationships. There is no right answer. If you are going to notify your customer, then make sure you take simple steps to mitigate your risk.

If you have questions when this, or any, issue presents itself—call the PIA Legal Hotline.

Carriers’ online applications are convenient, but can lead to E&O exposures for your agency. Here are some scenarios and tips that can help you protect your agency:

SCENARIO #1: Your client completes the application online and digitally signs it.

• TIP: Ensure the signed application is stored in your records.

SCENARIO #2: Your client completes an application, and you enter it into the carrier’s online system.

• TIP: Save a signed copy of the application for your records, regardless of whether the carrier requires it. This will help if there’s a claim alleging the information provided to the carrier was not the information the client provided to you.

SCENARIO #3: You use a checklist to obtain information instead of an application.

• TIP: If you can print a copy of the application entered online, have the client review the application and sign it prior to binding coverage. Communicate to the client that they should review the entire application for accuracy before signing and bring any discrepancies to your attention.

• TIP: If you can’t print a copy of the application entered online, have the client review the information on the checklist and sign off on its accuracy. Indicate to the carrier that they are creating a potential E&O exposure for their agents by not providing access to the completed application.

• Carefully document guidance you provide to help the client fill out the application and coverage discussions. Comments in your agency management system are good, but an email to the client memorializing the conversation is better – and provides protection if there’s a claim.

• Get the client’s signed confirmation. Claims where a client indicates the information they provided to the agent differs from what was provided to the carrier are common. You have no way to defend yourself without signed confirmation from the client. You will lose in a “he said/ she said” scenario.

• Ask your client about information on the application you are unsure about before entering it into the carrier’s system. Never enter rough information to generate an estimate – it can be problematic if the application is not updated once accurate information is provided.

The insured procured an HO-3 policy for the claimant that was placed with a carrier. The contract was written with the following Coverage Limits:

• Dwelling: $155,000

• Other Structures: $15,500

• Contents: $77,500

• ALE: $31,000

The claimant’s single-family dwelling was a total fire loss. The claim against the insured arose from allegations that the insured made material misrepresentations on the carrier’s policy application regarding the claimant’s criminal history. The carrier investigated the claim and eventually rescinded the policy back to policy inception based on material misrepresentations made on the policy application. The carrier stated they would not have written the risk if they were aware of claimant’s prior criminal conduct.

The claimant noted she would pursue an E&O claim against the insured alleging that the agency answered the questions on the claimant’s policy application without any input from the claimant. The agency producer stated that he completed the application based on a phone interview with the claimant. The claimant indicated she stopped at the agent’s office, was simply advised to sign the form, and was never asked to answer or review any of the application’s questions. The dwelling loss totaled nearly $200,000.

This claim is ongoing with the creditability of the agent/claimant to be assessed.

LESSON: Be cautious in your communications if you fill out an application using information not supplied in writing by the client. Always get the completed application signed and communicate in writing to the insured that they should review the application for accuracy before signing. Use language such as: Please review the attached application and sign to warrant that all information is accurate. If there are any discrepancies, contact me prior to signing.

ADDITIONAL INFORMATION:

How are You Handling Completion of the App? »

Consider These Best Practices when Completing an Application »

Madison, WI—OCI has taken the following administrative actions. In many of these cases the respondent denied the allegations but consented to the action taken. Any forfeitures paid in these administrative actions are deposited in the Common School Fund which is administered by the Board of Commissioners of Public Lands. The earnings from this fund are distributed to all public K-12 schools in Wisconsin and are used by school libraries to purchase books. Copies of the administrative action orders may be viewed online at https://ociaccess. oci.wi.gov/OrderInfo/OrdInfo.oci.

Allegations & Actions Against Agents

Morgan Casey, 203 N San Dimas Canyon Rd, Apt C137, San Dimas, CA 91773, was ordered to pay a forfeiture of $500.00. This action was taken based on allegations of making misrepresentations in the sale of an insurance product and recommending an unsuitable insurance product.

Ira Johnson, 3436 Indiana Ave., St Louis, MO 63118, was ordered to pay a forfeiture of $500.00. This action was taken based on allegations of making misrepresentations in the sale of an insurance product and recommending an unsuitable insurance product.

Jessica Merten, 823 Quinlan Dr., Unit B, Pewaukee, WI 53072, had her application for an insurance license denied. This action was taken based on allegations of having criminal convictions that may be substantially related to insurance marketing type conduct and failing to disclose an alias name on a licensing application.

Marco A Ortega, 3217 S 25th St., Milwaukee, WI 53215, was ordered to pay a forfeiture of $500.00. This action was taken based on allegations of making misleading statements regarding a Medicare insurance plan.

Igor Shaykevich, 2307 W Club View Dr., Glendale, WI 53209, agreed to pay a forfeiture of $5,000.00, agreed to remain current on a payment plan with the Wisconsin Department of Financial Institutions (DFI), and agreed to a one-year suspension of his insurance license. These actions were taken based on allegations of selling unsuitable annuities and unregistered securities to insurance customers.

John Paul Anderson, c/o SelectQuote Insurance Services, 595 Market St., Fl. 10, San Francisco, CA 94105, had his application for an insurance license denied. This action was taken based on allegations of having administrative actions taken by Missouri and FINRA, failing to disclose all administrative actions on a licensing application, and having an employment contract terminated for misconduct.

Robert L. Anderson, 211 Phillips Blvd., Sauk City, WI 53583, had his application for an insurance license denied for 31 days. This

action was taken based on allegations of failing to disclose criminal convictions on licensing applications.

Latanya R. Beason, 916 W Hadley St., Milwaukee, WI 53206, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Alicia Bey, N114W16080 Sylvan Cir., Apt.104, Germantown, WI 53022, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

William L Bixby, N6258 County Rd. P, Delavan, WI 53115, was ordered to pay a forfeiture of $500.00. This action was taken based on allegations of conditioning assistance with obtaining a Wisconsin Insurance Plan (WIP) policy on purchasing separate insurance coverage.

Martin A. Cruz-Gonzalez, 9270 E Bay Harbor Dr., Apt. 6A, Bay Harbor Islands, FL 33154, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Aubrey K. Dodd, 602 S 9th St., Unit 4, Milwaukee, WI 53204, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Olivia B. Evans, 2322 E Euclid Ave., Milwaukee, WI 53207, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Rebekah R. Falk, 738 Red Hawk Dr., Milton, WI 53563, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Shoshannah Gomm, 9190 Stadt Rd., Marshfield, WI 54449, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Glenn E. Hahn, 111 Forest Ave., Riverside, IL 60546, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Courtney D. Hatcher, 4114 Meadow Pkwy., Apt. C, Hermantown, MN 55811, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

John M. Hayes, 926 W Stephenson St., Freeport, IL 61032, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Amy J. Hein, 114 W 10th St., Merrill, WI 54452, agreed to the revocation of her insurance license. This action was taken based on allegations of utilizing insurance premiums for her own use, failing to submit policy applications to an insurer, and having insurance employment terminated for cause.

Paula Houston, PO Box 250872, Milwaukee, WI 53225, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Jennifer M. Jones, 402 Water St., Lake Mills, WI 53551, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Pa Houa Kha, 9665 Glacial Valley Rd., Woodbury, MN 55129, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Anthony B Liddle, 232156 Little Brook Ct., Wausau, WI 54401, had his insurance license suspended pending the outcome of an administrative hearing. This action was taken based on allegations of borrowing funds from insurance and securities customers, making an unsuitable annuity sale, and falsifying documents.

Xa Lor, 2615 N Birchwood Ave., Appleton, WI 54914, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Steven Malone, 15629 Summit Place Cir., Naples, FL 34119, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Richard D. Melberg, 2021 Saratoga St., Wisconsin Rapids, WI 54494, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Jennifer J. Moore, 416 Racine Dr., Apt. 101, Wilmington, NC 28403, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Brenda A. Oft, 711 County Rd. FF, Dalton, WI 53926, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Kevin L. Parks, 517 Lakehurst Rd., Apt 1R, Waukegan, IL 60085, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Melissa Pierce, 2749 Packerland Dr., Green Bay, WI 54313, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Jeffrey Pollard, 4400 Applecrest Dr., Palm Beach Gardens, FL 33410, had his insurance license revoked. This action was taken based on allegations of failing to timely pay an ordered forfeiture.

Gabrielle D. Portis, 800 N Central Ave., Apt. 910, Phoenix, AZ 85004, had her insurance license revoked. This action was taken based on allegations of failing to timely pay an ordered forfeiture.

Stacey K. Renn, 4604 N John Paul Rd., Milton, WI 53563, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

John A. Richmond, 2740 Lyman Ln., Fitchburg, WI 53711, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Cynthia L Schweitzer, 31307 Hickory Hollow Rd., Waterford, WI 53185, had her insurance license suspended pending the outcome of an administrative hearing. This action was taken based on allegations of misappropriating funds from insurance customers.

Liam Sivanich, 332 S Main St., Apt. 3, Fountain City, WI 54629, had his insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

Ashley Wriedt, 829 15th Ave., Green Bay, WI 54304, had her insurance license revoked. This action was taken based on allegations of owing delinquent Wisconsin taxes.

OCI is responsible for overseeing the operations and marketing of insurance companies and agents in Wisconsin. OCI encourages anyone with a question or a complaint regarding an insurance company or agent to contact the office at this toll-free telephone number: 1-800-236-8517.

By Al Diamond, President, Agency Consulting Group, Inc.

By Al Diamond, President, Agency Consulting Group, Inc.

What a ludicrous statement! How can an insurance agency MAXIMIZE income if they stop “SELLING” insurance?

There are still almost 1,000 agencies in each state and most of them “sell” insurance to clients and prospects in the same way. They are introduced to prospects by others (or by marketing and advertising) and then they meet the prospect and collect policies and information in order to create a quote and proposal for insurance. They hope to “win” the prospect with a good price and by showing the prospect that the agent knows his or her business and products.

Most insurance buyers look at insurance as a necessary evil – one that wastes money when it is not needed during the policy year in the best scenario and causes stress and anguish if needed because the insurance company is expected to pay as little as legally possible to settle a claim. Clients, frankly, don’t know whether you, as their agent, are working for them or for the insurance company. We all represent ourselves correctly as agents of the companies, but we want the client to think that we’re looking out for their best interests, as well.

So, at best, the clients and prospects are confused and suspicious. Every time you come in the door, they expect you to try to pry more money out of them for insurance that, while it may be needed, takes discretionary income out of their pockets.

Unfortunately, most agents were trained to be exactly what the client suspects — salespeople trying to get them to change from their current insurance programs to other, similar programs – in order that the agent may earn commissions. Most agents will live out their entire careers exchanging clients with other agents as pricing changes in the companies they represent.

Yet, the best agents in the country don’t work that way. And most agents have at least a few clients for whom price is less a consideration because of the services provided and/or the relationship established between them and the agent.

We have been consulting to the agency industry for over 35 years. Pretty much every week we are in a different agency helping them with organizational development, compensation programs, Strategic Planning, valuation, marketing programs and all other phases of agency operations. We get to see every kind of agency in operation and we can easily differentiate the success stories from the

‘failures’. The three headings, above, define every successful agency in our experience.

Successful agents take the time to develop relationships with their clients before “selling” them anything. As a matter of fact, The Asset Protection Model of Selling (APM) was built on the principal that clients will come to you to become their insurance advisor IF they trust you and believe that you are looking out for their best interest. This attitude is impossible to create if you come into the prospect ‘shooting from the hip’ and seeking to quote his insurance. He then looks at you as just another agent – just like the others. Relationships are developed – over time – and are made outside of the selling philosophies. Relationships are based on building trust and the client’s realization that you are DIFFERENT from all of the other insurance agents he has encountered before. The APM actually disproves selling as a way to achieve long-term clients. Every client is interested in minimizing costs. No one disputes that. But you have no business taking that client if COST is the only thing that shifts his loyalty from his current agent to you. In order to build the quality relationship that defines gaining a Customer for Life, you must show him your value BEFORE you provide him his insurance program.

If the only ammunition in your arsenal is PRICE, then the only weapon you have is quoting. Sure – you know your products. Sure – you can create an insurance program that covers the clients’ risks. Sure – you have several companies to market each client’s insurance program. But how does that differentiate you from every other agent in the country?

Let’s face it: with the exception of very large or very specialized clients, insurance products have, in fact, become relatively commoditized. And, while you certainly know your products and insurance topics, so do your best competitors. Either you are drawing from an ever-increasing number of marginal clients, those with serious deficiencies or claims waiting to happen who are available to any insurance agent who would like to try to insure them – OR you are competing with other knowledgeable agents on good clients with decent insurance programs in decent companies. What makes you different than the agents around you?

In order to really grow your business, you must gain access to your competitor’s best clients, ones with whom they have strong relationships, but clients whose only tie to their current agent is product or price-driven.

If you can demonstrate a range of services that you can provide to which the current agent has no access and can do so proactively and progressively, the client will soon realize the intangible value of using your agency instead of his current agent. She or he will then come to you to take over his insurance program in order to avail himself of those services.

What kind of “services” are we talking about? Small and medium-sized companies have the same regulatory compliance

issues as large companies. Their problem is that they have no one trained or available to analyze their compliance shortfalls and resolve them. There are also ingredients of the Total Cost of Risk that are far beyond simple insurance products and cost in which you can be trained and create new levels of service for your clients. The services are out there for you. But you must be committed to adopting them as core services, not tangential services, available to your clients and prospects to prove to them that you are more valuable than any of your competitors. Their selection of you as their insurance counselor should be theirs (without sales or coercion from you) based on the services that you provide that the other agents cannot.

We don’t want to consult to agencies who don’t believe that the cost of our services, while not inexpensive, is more than worth the return they achieve from the changes we implement. Similarly, if you become a prospect’s agent because of the services you have provided him you want him to think that you are wellworth the cost because of the benefit you bring to his company on an on-going basis. This means that the service doesn’t end with his conversion as a client.

We offer a very successful marketing program to agents to take advantage of the non-appearance of their competitors to their best clientele. We also warn our client that they must become an integral part of the customer’s business in order to assure that they will not even consider shopping their insurance in the future. If your doctor has successfully worked with you on every illness and condition that you have on an on-going basis, would you consider changing doctors when one appears that may cost you a few dollars less? Of course not. Similarly, you must “indoctrinate” your agency into your client’s on-going operations through both insurance and other value-added services to assure that you are always considered more than cost and that it would be just as ludicrous as in the example above to consider changing insurance counselors.

We help agents form Contact Grids; this works best for those who have planned activities and have contact with each client several times each year. This provides the level of service promised, while you were establishing your relationships. Each client has an annual plan associated with that transcends renewal quoting and truly gets into the Total Cost of Risk while protecting all of the assets. Of course, each client is different, so it requires specific planning. Some may only need you once or twice a year while others may require your efforts as an agency, not just the efforts of a product, several times each year in different protection venues. All you need to do is to create and monitor a contact plan for each client, each year, that convinces them that you are providing more service than a) your cost to them, and b) than your competitors can provide.

If you implement these three key ingredients and STOP SELLING insurance, you will find that the clients eventually demand that you be their agent, keeping the income flow growing as you expand your products and services to more than just another insurance agent.

How are you and your agency or company helping your community? Community Corner showcases what individual members and agency/company members are doing to help make Wisconsin a great place to live and run a business. Share your volunteer story with us – shoot an email and photos of the action to nwhite@piaw.org!

As part of the Snowball Cancer Challenge 2023, Jeff Glass of Glass Insurance Center in Lake Geneva committed to traveling 500 miles by snowmobile in a single day for the Keller Family Community Foundation. The Foundation hosts events to raise awareness and funds to help cancer patients and their families, most notably the Snowball Challenge. For Jeff, this year’s challenge started on February 9th at 4:30 a.m. and ended at 9:55 p.m. with 504 miles ridden for a grand total of 17.5 hours riding around the open air of the Upper Peninsula in Michigan. Congratulations to Jeff for completing the challenge and for raising awareness for this great cause!

During the holiday season, you may have seen Rockford Mutual Insurance Company associates volunteering as official bell ringers for The Salvation Army. With their signature red kettles, various employees spent hours at grocery stores throughout the territory “Doing the Most Good” and collecting donations for the annual drive. The funds collected go towards critical community services like emergency shelters, housing programs, etc.

Forward Bank, Insurance, and Investment Services asked employees to select a non-profit that they volunteer with or personally support for Forward to make a $100 contribution to on their behalf. With this initiative, they recently celebrated the milestone of having donated over $12,000 to local causes on behalf of their employees. Some of the local causes include the YMCA of the Northwoods, All Saints Parish, Phillips Area Youth Football, and many many more!

Renee Hein from the Forward Insurance office in Athens selected Athens Area Fire & Ambulance to receive her contribution!

This winter, Wayne Dallman of Dallman Insurance Agency spent time with his daughter Allison volunteering at Feed My People Food Bank in Eau Claire, helping to prepare food items to be shipped to those dealing with food insecurity. Feed My People collects donated food that otherwise might have been thrown away from various manufacturers, wholesalers, and retailers, and then redistributes it to various hunger-relief programs throughout West-Central Wisconsin. Great work Wayne and Allison!

Associates from Vizance and Hanover Insurance presented The Women’s Center of Waukesha with a donation, and then spent the afternoon volunteering for the organization. Along with sorting donated items, the group helped to assemble various food boxes and worked to fulfill wish lists for clients’ families. The Women’s Center provides safety, shelter, and support to those impacted by domestic violence, sexual assault, abuse, and trafficking.

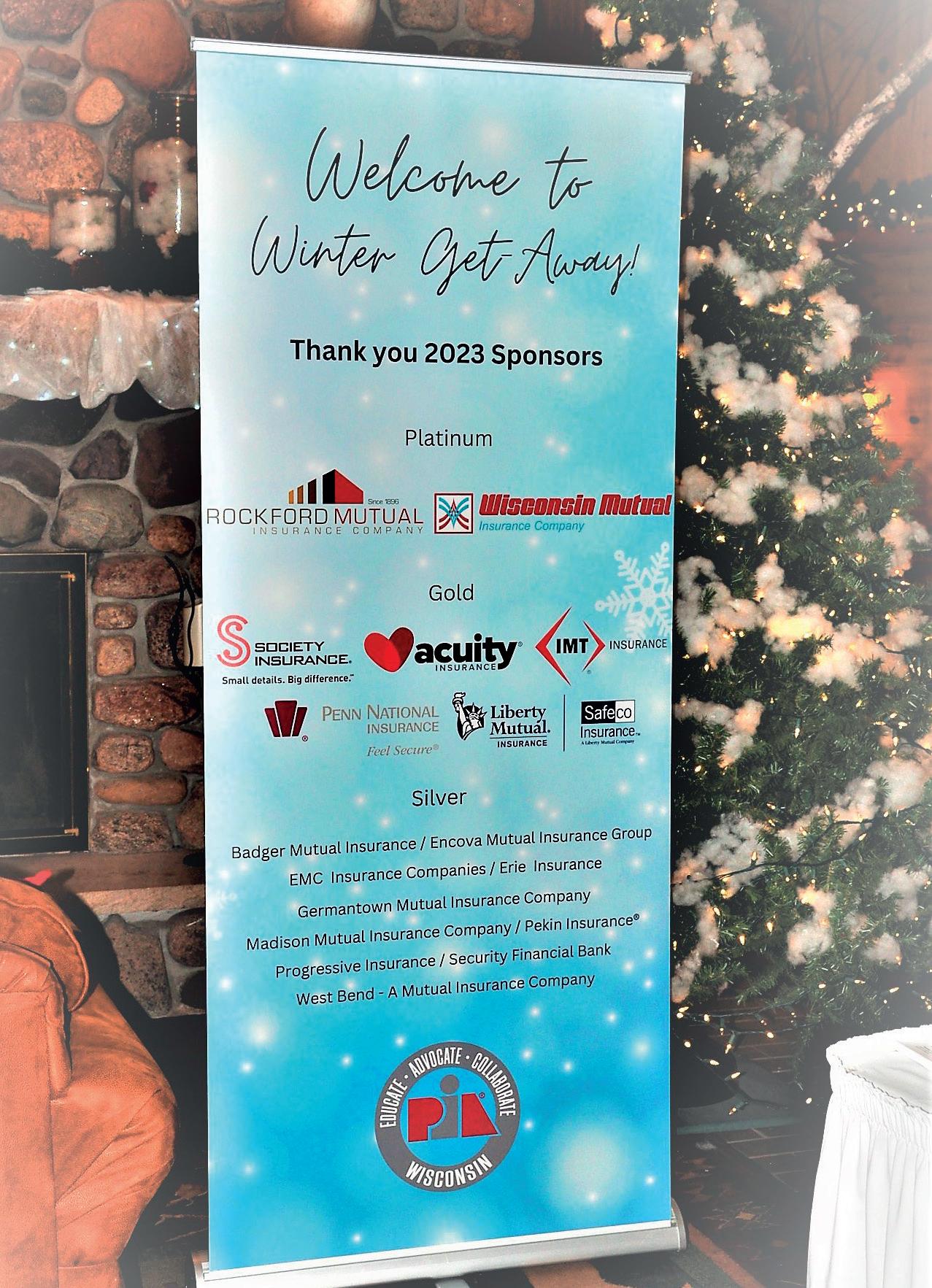

Winter Get-Away 2023 was another one for the books! Attendance was at an all time high in the Northwoods of Wisconsin for three days of networking, fun and 10 CE credits presented by the wonderful Todd Davis. Day one started with learning about different claim trends before moving to the Oakfire Pizzeria for a social and various collaborative games. Day two kicked off with a look in at the court process with E&O before lunch and then bowling at Island City Lanes. The day ended at the Whitetail Inn with a delicious dinner, followed by live music and dancing. The final day concluded with earning ethics credits, before saying goodbye to the Northwoods. We can’t wait for next year – dates coming soon!

WE HAVE DISCOVERED AN EMPLOYEE HAS BEEN SLEEPING DURING LUNCH BREAKS. CAN WE ASK EMPLOYEES NOT TO SLEEP IN THE OFFICE DURING THEIR LUNCH BREAK (OR ANY OTHER UNPAID BREAK)?

It depends. Generally, employees can use unpaid breaks as they see fit. However, if the employee sleeping is affecting their work, disrupting others, or otherwise negatively impacting the business, you could (and should) address those issues. For example, if the employee is sleeping at the front desk where customers can see them, you could tell them not to nap there. If they’re routinely late returning to work, you could discipline them for their tardiness. But if the naps aren’t affecting their work or disrupting the workplace, it may not be worth addressing at all. Research suggests that a “10- to 30-minute power nap” can improve a person’s mood, alertness, and focus.

If you raise the issue with the employee, we recommend that your first step be to ask why they are sleeping during the day. They may have a good reason. If it’s related to a disability, you are required to engage in the interactive process and will need to allow the employee to nap somewhere as a reasonable accommodation under the Americans with Disabilities Act, unless it creates an undue hardship or direct threat, or another effective accommodation is available.

WE’VE RECEIVED SUSPICIOUS EMAILS THAT APPEAR TO BE FROM EMPLOYEES ASKING TO CHANGE THEIR DIRECT DEPOSIT INFORMATION. WHAT SHOULD WE DO?

This is likely a phishing scam—a type of con in which scammers use emails, texts, or phone calls to trick someone into providing company or personal information that then allows the scammer to steal from them. These messages often appear to come from someone the recipient knows—in this instance, your employees.

A successful scam can be a costly data breach with legal consequences for employers. In this case, had you fallen for the direct deposit scam, your employees would not have been paid on time, and you’d be out the money you owed them.

To protect your organization from this and other phishing attempts, we recommend taking the following steps:

• Verify that the message is not legitimate. In this case, inspect the email addresses for validity and reach out to the employees to confirm they didn’t request to have their bank information changed.

• Notify your IT department of the potential phishing attempt.

• Inform your workforce that scammers are afoot and remind them not to respond to emails that are suspicious or to email sensitive information. Email is like a postcard, potentially visible to anyone, so employees shouldn’t email their banking or other sensitive information.

• Work with your IT department to train employees how to recognize phishing attempts and what to do if they notice or fall prey to one.

• Ensure employees update their security software, internet browser, and operating system regularly.

• Create processes and policies that staff should follow in case of a breach, including what notices need to be given.

I finally broke down and ordered a meal kit from Blue Apron, the pre-portioned, ready-to-cook meal delivery service. What a treat to have the meal already planned, purchased and ready to go. Not a bad way to expose the family to some new recipes either, with no extra work.

After tucking the Blue Apron ingredients away in the refrigerator, I then noticed the laundry detergent was getting low and the dog treats were almost gone. A quick visit to Amazon and I was able to check those items off my to-do list, knowing they’d be shipped to my doorstep the next day.

I haven’t changed my purchases — food, laundry detergent and dog treats — but the way they’re delivered has certainly kicked my brand loyalty up a notch. I’m becoming accustomed to the delivery perk, and that’s going to make it harder for other brands to lure me back to their products.

You sell insurance products and risk management services. But most customers view insurance as a necessary evil. How you deliver insurance coverage is what can set you apart. Digital access, 24/7 communication, quick response times, personalized service — these have become the norm for today’s consumers i.e. your customers. The challenge you must address is how you can deliver products and services in a new way that not only seals the deal, but reinforces long-term loyalty.

Take time out in the coming weeks to consider how you can become your client’s next Blue Apron or Amazon Prime service. Encourage your team to share their ideas, too. Delivering in a new way likely won’t require grand gestures, but only thoughtful consideration of what will make your client’s life easier when it comes to risk management and securing the appropriate insurance coverage. When you deliver an outstanding client experience, you create a competitive advantage that is tough to replace.

It’s

•

•

•

•

NEW TOPICS ADDED! 3 WI CE CREDITS. LIVE (NOT PRE-RECORDED). NO TEST. NO PROCTOR. Visit the Education tab at piaw.org for a complete list of topics, descriptions, webinar demo and registration. Several approved for Utica credit. Ethics is offered each month. Fee per Webinar: $55 PIAW Member, $70 Non-Member. Includes WI CE fees.

An Hour with Nicole: Everything You Need to Know About Insuring Work-From-Home Exposures 1 WI CE # 6000134133

Growing Good Insurance: Using Property & Liability Endorsements to Fortify Farm Risks

for in-house webinar opportunities. bsteinbach@piaw.org

NEW TOPICS ADDED! 3 WI CE CREDITS. LIVE (NOT PRE-RECORDED). NO TEST. NO PROCTOR. Visit the Education tab at piaw.org for a complete list of topics, descriptions, webinar demo and registration. Several approved for Utica credit. Ethics is offered each month. Fee per Webinar: $55 PIAW Member, $70 Non-Member. Includes WI CE fees.

“Wait…What the #^&* Just Happened?!” Fourteen Personal Lines Issues To Know Before It’s Too Late

Claims That Will Convince Your Insured to Enhance Their Homeowners Coverage

3 WI CE # 6000136609

Lurking: Surprises in the Contractor’s CGL Policy & Endorsements to Watch Out For

3 WI CE # 6000110926

Why Good People Do Bad Things: A Deep Dive into Agency Ethics

3 WI ETHICS, CE # 6000112615

An Hour with Dave: Fast Facts About Flood

1 WI CE # 6000123785

Bots, Crypto, Weed and Other Risks You Never Imagined Insuring (But Here We Are)

3 WI CE # 6000134132

Chris Amrhein’s “Adventures in Aging”: Social Security and Other Retirement Income Solutions

3 WI CE # 6000110967

CIC WEBINARS & CLASSROOM

Anyone Can Attend No Exam or Proctor Required for CE 16 WI CE Each (3 of 16 are Ethics in April)

APRIL 19-20

Agency Management West Bend

MAY 17-18

Commercial Casualty Neenah

JULY 11-12

Personal Lines Madison

CIC GRADUATE RUBLE WEBINARS & CLASSROOM

Exciting update option for CICs, CRMs, and CISRs!

16 WI CE Each / CISRs Can Attend One Day for 8 CE and Update Credit

JUNE 14-15

Sheboygan (Includes 3 Ethics)

AUGUST 29-30 Webinar

CISR WEBINARS

Anyone Can Attend. No Exam or Proctor Required for CE 7 WI CE Each

MARCH 17

Personal Residential

APRIL

MARCH 28 NEW - Other Personal Lines Solutions

DECEMBER 6-7 Webinar

APRIL 14 Commercial Property

CPIA WEBINAR

Anyone Can Attend. No Exam. 7 WI CE Each, 2 of 7 are Ethics

MAY 23

APRIL 27

Elements of Risk Management

SEPTEMBER 12

SAVE THE DATE SAVE the DATE!

Filling

You know as well as anyone that today’s cut corner can easily turn into tomorrow’s missing piece. With our forty years of experience in specialized coverage and policies developed alongside actual restaurant and bar owners, you can rest assured that your policyholders are protected against the unique risks they face every day.

BWO is here for you today and for all your tomorrows. Join BWO... the agency that remains small, not selling out to big entities or private equity firms that lose you in the shuffle. BWO continually invests in their independent agents giving you the freedom to do what you do best... SELL!!

DON’T CHASE THE COMPETITION... BECOME THE COMPETITION!!

THE PIA OF WISCONSIN IS KNOWN NATIONWIDE FOR ITS TOP-NOTCH EDUCATION AND NETWORKING EVENTS!

For a comprehensive list of all PIA education opportunities, including the 12-14 multiple topic 1-3 hour webinars, and pre-licensing, visit the Education tab at piaw.org.

16 Mandatory Annuity Webinars (4 WI CE a.m., 1 WI CE p.m.)

17 CISR Personal Lines Webinar (7 WI CE)

28 NEW CISR Other Personal Lines Solutions Webinar (7 WI CE)

11 CPIA 2 Webinar Webinar(7 WI CE, 2 of 7 Ethics)

14 CISR Commercial Property Webinar (7 WI CE)

19-20 CIC Agency Management, West Bend (16 WI CE, 3 of 16 Ethics)

25 Agency Coverage Standards Webinar (1 WI CE) FREE FOR PIA MEMBERS

27 CISR Elements of Risk Management (7 WI CE)

officers

Steve Clements, CPIA President Clements Insurance Agency 151577 King Fisher Ln. Wausau, WI 54401 (715) 842-1664 steve@clementsagency.com

Lacey Endres, CIC Vice President M3 Insurance, Inc. 828 John Nolan Dr. Madison, WI 53713 (608) 288-2874 lacey.endres@m3ins.com

Jon M. Strom Treasurer Image of Wisconsin PO Box 600 St. Germain, WI 54558 (920) 723-1209 jon@imageofwi.com

Mike Endres Secretary Endres Insurance Agency, Inc. 2201 Eulalia Street Cross Plains, WI 53528 (608) 798-3811 mendres@endresinsurance.net

Steve R. Albinger Couri Insurance Associates 379 W. Main St. Waukesha, WI 53186 (414) 916-9321 salbinger@couri.com

Ryan Butzke, CIC, CISR Immediate Past President Northbrook Insurance Associates, Inc. PO Box 520 Slinger, WI 53086 (262) 297-7101 ryanb@northbrook-ins.com

Matt Cranney, CIC, CRM Past President Liaison M3 Insurance, Inc 828 John Nolan Dr. Madison, WI 53713 (608)288-2810 matt.cranneym3ins.com

Tracy A. Oestreich, CIC, CPIA, AU, CPIW PIA National Director T4 Insurance Solutions, Inc. PO Box 408 Jackson, WI 53037 (262) 423-4949 tracyo@t4ins.com

Octavio Padilla

Nova Insurance LLC 4615 W. National Ave. West Milwaukee, WI 53214 (414)639-1650

octavia@novaagencies.com

Mitch Tarras Advantage Insurance Agency LLC PO Box 165 Plymouth, WI 53073 (920) 893-3252

mitch@bwoinsurance.com

Michael Winstanley

Winstanley Insurance Agency Inc. 3044 S. 92nd St. West Allis, WI 53227 (414) 425-6914

mdw@mdwinstanley.com

Bob Wolfgram

Wolfgram Insurance Agency PO Box 122 North Prairie, WI 53153 (262) 349-9605

bob@wolfgraminsurance.com

Staff Pete Hanson, CAE, CISR Executive Director phanson@piaw.org

Becca Bredeson Administrative Assistant bbredeson@piaw.org

Shirley Faherty Office Manager/Bookeeper sfaherty@piaw.org

Heidi Hodel-Faris, CPIA, CIC Insurance and Member Services Director hhodel@piaw.org

Brenda Steinbach Education & Convention Director bsteinbach@piaw.org

Natalie White Communications Director nwhite@piaw.org

Sporting clays is sometimes described as “golf with a shotgun.” Players move from station to station on an outdoor course, shooting at clay targets that are launched at different angles and trajectories to mimic the flight paths of game species.

Sponsorships go towards the costs of putting on the event and can be paid with corporate funds.

EVENT SPONSOR $500

• Signage for all Clay Shoot activities

• Recognition during the program

• Logo on course signage

STATION SPONSOR $250

• A dedicated sign at a shooting station

COST $125

Registration includes safety training, two rounds of sporting clays (multistation shooting), warm-up shooting at the five-stand, lunch, and social hour hors d’oeuvres.

Under Wisconsin law, donations to the Professional Insurance Agents PAC must come from individuals only, not from corporations or any other type of company owned by more than one person. Please use a personal credit card or send a personal check to register for this event. Donations from most businesses are not allowed by law.