39 minute read

Thermoforming

Machinery installations done remotely

As the pandemic Covid-19 hit worldwide and countries imposed travel lockdowns, machinery makers had to resort to innovative ways of installing and commissioning machinery.

Advertisement

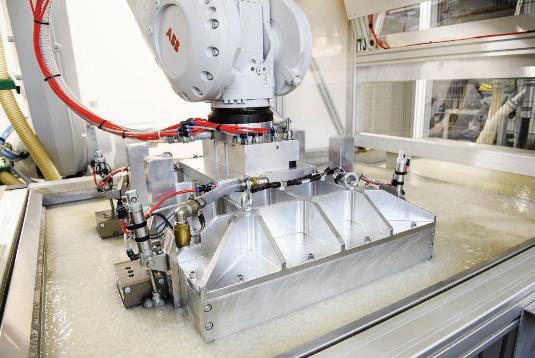

WM utilised remote commissioning in its installation of machinery

WM resorts to remote commissioning

In 2019, Russian firm UPAX-UNITY purchased three thermoforming machines from Swiss machine maker WM Thermoforming Machines, to enlarge their existing fleet of over ten units by a well-known German supplier. The equipment by WM was delivered to the facility in Perm just before the world faced the outbreak of the pandemic, making it impossible for WM to send their technicians to Russia for the standard procedures of supervision, installation and commissioning.

Wondering how to deal with this situation, WM came up with a solution. Since the machines supplied by WM are delivered fully assembled in a single frame, with all the electrical connections between electrical cabinet and machine components, UPAX-UNITY technicians were able to put the machines in place and connect all utilities (cooling water, power supply, pressed air) to the equipment just relying on the instruction manual.

All activities for the placement and installation of the two-steel rule cutting machines, model FC 780 E and FC 780 HP, as well as for the tilting machine model Twist 700 MSv7 took around one week, about 1 ½ day for each machine.

At this point the next step should have been the arrival of WM technicians for the startup, however due to the worsening of the situation with Covid-19 in EU, it was not possible to predict when this would happen.

Hence, the customer needed to start-up the thermoforming machines, and also in this case the only solution was to do it without waiting for the physical presence of WM technicians.

All of WM’s machines combine a PLC and control system from Austrian company B&R with WM’s software, and it was possible to establish an internet connection between WM’s service department in Stabio and the thermoforming machines in UPAX factory, for the commissioning of the machines, which took an hour or so each.

“The big advantage of WM machinery is the presence of a selfadjustment setting when using a new mould for the first time,” said Mikhail Tsirkulev, UPAX Senior Project Leader. “Thanks to that, we were able to produce many different thermoformed articles within some days. Thanks to the user-friendly graphic design and easy to understand PLC pages, we didn’t face any difficulties when putting the machines in production,” Tsirkulev adds. “

WM says this was the first time in its history that a customer did the start-up of a machine without the physical presence of a WM technician, with remote commissioning.

GN takes to whatsapp messaging

Meanwhile, Canada’s GN Thermoforming Equipment of Chester, Nova Scotia, a manufacturer of servodriven, roll-fed thermoforming machines, came up with a novel way to install new equipment and train operators at customer sites.

The company made extensive utilisation of the WhatsApp Messenger web platform to install new thermoforming machines for customers in Eastern Europe and the US.

GN says it faced a critical challenge at the beginning of the pandemic when Georg Polymer, the largest Russian producer of rigid meat trays, needed its new GN760 machine installed quickly so it could meet growing demand for meat trays in Eastern Europe.

“We had to think out-of-the-box and come up with a solution because our customer desperately needed the new capacity,” said Paul Phillips, GN Sales and Marketing Manager.

With the prospect of having to postpone the installation due to travel restrictions, one of GN’s qualified technicians remotely guided its Russian customer through the installation of the new GN760, an in-mould cut thermoforming machine.

The installation in April, which normally would take three to four days onsite, took about a week to complete using the WhatsApp platform.

GN says the installation was successful due to the customer’s broad mechanical experience with this type of machine and a high-speed internet connection, with the biggest challenge along the way being the language barrier.

Georg Polymer faced some minor problems with wiring, but a video call to the technician resolved the issue. The machine is up and running, producing 240,000 meat trays/day.

The company also has two other GN760s and three GN1914DM machines within its portfolio and produced more than 350 million meat trays last year. “It gives us great comfort and confidence knowing that we can accomplish this kind of installation remotely with a customer who has a high degree of mechanical ability,” said Phillips.

Previously, GN says it had used its broad remote capabilities to perform various support tasks including troubleshooting. Phillips noted that face-to-face machine installations are preferable so the company can personally provide its know-how and superior level of customer service and support. Remote installation through a messaging platform required a high level of preparation including enhanced labelling of componentry and extensive diagrams and collateral support.

Since April, two more machine installations have been successfully conducted using the WhatsApp platform - one in Central US and another for Pro-Form kft in Hungary. Both customers installed GN800s, adding to their existing GN machine line-up.

If travel restrictions continue, Phillips said GN would continue to install remotely through the WhatsApp platform so its customers wouldn’t face production delays.

As the Covid-19 crisis evolves, GN said it would adapt and adjust to its customers’ needs. “We will continue to review and examine our remote installations closely and optimise our solutions to ensure our customers get the support and training they require,” said Phillips.

Fibre thermoforming from Kiefel

In line with the current theme of recycling, German thermoforming machinery maker Kiefel says its systems can process recycled (eg rPET) or biobased materials (eg PLA). Now, the Freilassing-based company has introduced its Natureformer machine for thermoforming cellulosebased packaging for easier recyclability. The process of the new Natureformer machine is known as "Kiefel-FibreThermoforming" or KFT for short and the process is similar to Kiefel’s KMD steel rule machine.

Thermoforming

The new Natureformer machine for processing paper

Erwin Wabnig, Head of Fibre Thermoforming says, “Paper products can hardly be distinguished from those made of plastic in terms of appearance. For example, applications include inlays for high-quality electronic devices that look classy and fulfil their protective function. The advantage is obvious: all of the packaging - the outer packaging and inlay - consists of a single material; paper fibre, meaning no material separation is necessary before recycling.”

The raw paper pulp is processed in batches up to 1% fibre content. Flow simulations ensure that the fibres are evenly distributed over the basin volume. The metal mesh suction tool dips into the slurry, the vacuum sucks up liquid and leaves the fibres in the form of a filter cake in the tool. A spray bar cleans the edge of the tool and removes excess pulp. The suction tool then moves into a flexible counter tool of the pre-pressing station.

Alexander Huber, Fibre Product Manager, says: "The flexible pre-pressing tool ensures very even fibre distribution across the entire tool geometry."

After this step, the fibre content reaches approximately 40%. The suction tool then transfers the component to the hot press. Any remaining moisture is eliminated by temperatures up to 200°C in the upper and lower tools in combination with a clamping force of up to 600 kN. Huber explains: “Our technology allows us to achieve product heights up to 250 mm. We work with cavities which are direct heated by heating cartridges. The heating cartridges are integrated in the hot-press tool. This enables us to achieve optimal heat transfer, reduce energy consumption and achieve high product quality."

The suction tool is mounted on the handling robot and transfers the component from station to station. Defined tool positions for maintenance, cleaning and tool change can be reached in this way, with the tool change completed within 15 minutes, thanks to the automated quick-change system. Kiefel adapts machine automation - stacking, sleeving, packing in boxes - to customer requirements. Quality control and inspection measures can be integrated into the machine via additional modules.

A full scale pilot system is already running, producing sample cups with a cycle time of 15 seconds. Huber states, “We now have numerous systems in our order backlog. We will deliver the first to a customer in the middle of this year.” This makes Kiefel the first plastic thermoforming machine manufacturer to offer an automated system for fibre thermoforming.

Chemi al Industry

Chemical industry faces volatile backdrop on road to recovery

By Joseph Chang, Global Editor, ICIS Chemical Business T he coronavirus crisis may simply accelerate key Joe Biden is soft on China. “I do think we will head towards a macro trends already underway, creating a volatile more confrontational relationship with China,” said Bremmer. backdrop for chemical companies to navigate on the A cold war between the US and China would be another road to recovery. shift away from globalisation, ultimately leading to less

Four key macro trends are shaping global discontentment: efficiency, less growth and more volatility, he said. growing income inequality; the displacement of labour While there will continue to be competition between from automation, technology, immigration and free trade; the US and China, “long term, both are much stronger wars displacing investment in infrastructure, healthcare and when working together than when squandering education; and increasing polarisation via social media, said opportunities and working apart,” said Huntsman. Ian Bremmer, president of global political risk research and However, he sees a “good probability” that the phase consulting firm Eurasia Group. one US-China trade deal will be scrapped, or further

For example, technology can take away the ability of brick progress delayed, as the impact of the coronavirus makes and mortar stores to turn a profit, even more so during the it difficult for China to meet its commitments in terms of coronavirus crisis. And the clash between the US and China is substantially more imports from the US. progressing more rapidly because of the coronavirus. Huntsman Corp’s supply chains are already largely

In the US, the violent protests being sparked by the killing localised, with about 95% of sales in China from products of George Floyd by police come amid a backdrop of a hyperproduced in China or southeast Asia, with the percentage accelerated polarisation of political views, inequality, over 40 in the low-90% range for sales in Europe. It serves the US million unemployed Americans, and a major contraction in market from US production with some exports, he pointed GDP, with the economic impact being experienced more by out. “We don’t have large plants that export a lot. By and African Americans and other minorities, he pointed out. large we are close to the customer,” said Huntsman.

However, the impact of the widespread protests on the chemical industry is likely to be limited. “I don’t see a great Societal shift/ACC overhaul deal of economic impact [from the protests] on the chemical The chemical industry will also have to deal with changes industry,” said Peter Huntsman, CEO of Huntsman Corp, in in societal expectations, where the public and consumers an interview with ICIS amid the American Chemical Council have set a higher bar for corporate responsibility. (ACC) virtual annual meeting. In this vein, the ACC plans to renew and refresh its

The chemical industry has a unique opportunity to attract flagship Responsible Care programme, focusing on health, people from the high school level to the STEM (science, safety and environment (HSE) in a rapidly changing technology, engineering and mathematics) disciplines, where political and social landscape. they can have better job opportunities. In the US, many of its “Responsible Care is about continuous improvement facilities are on the Gulf Coast and coastal southeast, which - not just for ACC member companies, but to the program have more diverse populations, he said. itself,” said Chris Jahn, CEO of the ACC, in the trade

Some of the root causes of the civil unrest include group’s virtual annual meeting, noting that the last review people under quasi-house arrest from the coronavirus of the programme was done in 2010. lockdowns, and many people in service sectors losing their In the past two years, there has been an increase in high jobs, often after finding employment for the first time, he profile accidents amid a changing regulatory and social noted. Add to that the degree of frustration around racial landscape. Public expectations have set a higher bar, he noted. discrimination, and isolated cases of police brutality, and Mark Vergnano, CEO of Chemours and Chairman of we’re in today’s situation, said the CEO. the ACC Board of Directors, said the industry must have a forward-looking vision and do more than just commit to a US-China relationship renewed Responsible Care. There must be proven progress Should US President Trump’s approval ratings slip into the in HSE as a top priority. 30% range, there is a greater probability of Trump ramping Details of the ACC’s renewed Responsible Care initiative up the rhetoric against China and using it as a cudgel in have yet to be released, but it’s clear there will be a greater focus promoting the view that contender for presidential elections on sustainability and industry is acting in its best interests.

Automotive Sector

This is not a drill: the automotive sector is urged to be more adaptable and innovative in the post-pandemic global economy, according to Angelica Buan in this article.

Tough year for the sector

Historically, the automotive industry, although not entirely immune to market volatilities, has always rebounded from setbacks. But it seems to have run out of luck.

In a quandary even before the first cases of coronavirus were reported, the industry witnessed a major decline in revenue, akin to 2007 and the global financial crisis.

The global economic trade impact of the Covid-19 pandemic on the automotive industry in 2020 has resulted in a 15% drop in the market, according to a market analysis

In 2019, vehicle demand and sales were affected by the economic slowdown in China, the US and Europe. Looking back, it seems like the warnings from experts of a looming automotive downturn was a prediction of a major upheaval to come. Then the coronavirus pandemic happened.

In a matter of four months, the coronavirus pandemic has resulted in the contraction of the market, with disrupted supply chains, reduced capacities, production suspension, and shrunken workforce.

Stripped to its bare bones, the industry has also had to contend with delays in model launches, plant investments, and cash-strapped companies, especially during the first quarter of the year.

A Frost & Sullivan report on the global automotive industry, covering 2020 to 2025, vis-à-vis the pandemic, stated that this situation spilled over into the second quarter with unfulfilled orders due to ongoing production lockdowns.

Citing a latest report from Meticulous Research, the global economic trade impact of the Covid-19 pandemic on the automotive industry in 2020 is pegged at US$5.7 billion or a 12%-15% drop in the market.

Europe suffered a production shortfall of over 1.2 million units, due to lockdowns. New car registrations in five key European markets also tumbled. Germany, Italy, Spain, UK, and France dropped 11%, 9%, 6%, 3%, and 3%, respectively.

In India, according to the Society of India Automobile Manufacturers (SIAM), passenger vehicle sales declined 51% to 143,014 units in March 2020. Also, sales of commercial vehicles declined 88% to 13,027 units, while sales of two-wheelers fell 40% to 866,849 units.

There is no doubt that the Covid-19 outbreak has seriously dented the automotive industry, with the US anticipated to witness a decline of 27% in sales in 2020.

VynZ Research, in its report on the Covid-19 impact assessment of the automotive industry, echoed similar findings of major automotive makers, including Fiat, GM, Hyundai and Honda. It said these companies posted sharp declines in sales and production in the US.

Even with the contingency plans and financial reliefs that are being rustled up by governments, production in the region may not resume soon, according to Meticulous Research. But it expects recovery to take place as the pandemic starts to run its course.

Automotive Sector

Survival of the fittest: retooling manufacturing spaces

The post-pandemic, “new normal” era could play out differently for different sectors and for the automotive industry it will not be a breezy drive.

“The pandemic has exposed cracks and vulnerabilities across all areas – everything from supplies to justin-time production strategies, on-site operations and financial liquidity will need to be strengthened as the economy recovers and production starts back up again,” according to Nick Castellina, Senior Nick Castellina, Senior Director Director of Industry of Industry and Solution Strategy, and Solution Strategy Infor for the New Yorkheadquartered Infor. He infers that automotive players need to review and revise the automotive value chain for crisis-proof resiliency.

In other words, adapting to the changes may be key to dodging further contractions. One strategy for automotive makers to ride out the pandemic disruptions is to “re-purpose their factories”, which Castellina explained is a way for companies to approach this (crisis) through innovative ways “to stay afloat”.

Recently, a number of car makers have converted their manufacturing or assembly spaces, entirely or in part, into personal protective equipment (PPE) facilities to boost the supply of PPEs.

Car companies like Škoda Auto Volkswagen India Private Limited (ŠAVWIPL), Ford and Tesla Motors, General Motors, Seat, and others have produced a range of PPEs from face shields and masks to ventilators and respirators from their factories.

According to Castellina, a measure to redirect production and development facilities and capabilities of car makers to support the fight against the virus is a strategic move.

He also noted how the world’s biggest players in the automotive space have already made this shift, including the likes of Kia Motors, Ferrari, and Toyota, to cite a few that have repurposed their production lines to manufacture PPEs, which has helped ease the strain on manufacturers of medical supplies.

He also gave other examples: electrical products maker Dyson that has gone from manufacturing vacuums to ventilators, and Sharp from electronics to surgical masks as well as luxury house LVMH that has redirected its perfume and fragrance capacities to produce hand sanitisers instead.

“In addition to providing an alternative way to protect both people and profits, (this strategy) also strengthens brand reputation and recall amongst consumers, and can be a valuable addition to a company’s corporate social responsibility efforts,” he added.

Nevertheless, re-purposing is no easy feat, he said, and certain variables such as material sourcing, regulations, production cycles, and other considerations may pose challenges to the already complex process (of re-purposing).

“The key to successful repurposing, thus, lies in identifying where there are similar materials and production processes, matching them with a need, then plotting the roadmap to production. A digitally-enabled supply chain that provides end-to-end visibility is key. Manufacturers who have not started this process are likely to find it daunting, but it is an effort worth undertaking,” Castellina noted.

Energy security, opportunity for electric vehicles

Essential services, such as healthcare, transport, utility services, and other economic activities rely heavily on stable access to energy during the pandemic.

Energy services, according to a United Nations’ report on Covid-19 response, are a key to preventing disease and fighting pandemics – from powering healthcare facilities and supplying clean water for essential hygiene, to enabling communications and IT services that connect people while maintaining social distancing.

In the post-pandemic state, adequate energy is required to sustain economic recovery. In transitioning to a post-pandemic economy, the energy sector must revisit its clean energy efforts, since energy is a main contributor to climate change, accounting for 60% of greenhouse gases.

Medical Sector Automotive Sector

Increasing uptake of EVs and PHEVs worldwide can achieve a 50% reduction in CO2 by 2050

This awareness augurs for the long-term goals of the electric vehicle (EV) sector. The International Energy Agency (IEA) surmises the relevance of increasing uptake of EV and plug-in hybrid electric vehicles (PHEV) worldwide to achieve a 50% reduction in CO2 by 2050, against the 2005 levels. For transport, a 30% reduction of CO2 can be achieved through the introduction of new types of vehicles and fuels, according to the EV and PHEV technology roadmap report.

This could also help EV sales to pick up after a series of declines, specifically during the economic and health crises, it said.

However, the report titled “Long-Term Electric Vehicle Outlook” by research company BloombergNEF (BNEF) revealed that global EV sales could fall 18% to 1.7 million units this year, due to the coronavirus situation, interrupted by years of successive strong growth.

Nonetheless, the long-term electrification of transport is projected to accelerate in the years ahead and could buffer the setbacks from the pandemic.

According to the report, there are currently over 7 million passenger EVs, together with more than 500,000 e-buses, almost 400,000 electric delivery vans and

Colin McKerracher, Head of Advanced Transport for BNEF

trucks, and 184 million electric mopeds, scooters and motorcycles on the road globally. The majority of the e-buses and electric two-wheelers on the road today are in China.

In the nearer term, the report indicated EVs would be accounting for 58% of new passenger car sales

globally by 2040, and 31% of the whole car fleet. They will also make up 67% of all municipal buses on the road by that year, plus 47% of two-wheelers and 24% of light commercial vehicles.

Having more EVs of all types on the road translates to about a 5.2% increase in global electricity demand by 2040, BNEF said.

It also suggests that EVs will represent 3% of global car sales in 2020, rising to 7% in 2023, at some 5.4 million units.

The report sees fully autonomous vehicles or ‘robotaxis’ beginning to play a much larger role in the late 2030s, helped by the growing deployment of advanced driver assistance systems, or ADAS, and the build-out of sensor supply chains.

For the electric mobility sector, technological advancement continues and sales and production show indications of recouping but without more stumbling blocks along the way.

Colin McKerracher, Head of Advanced Transport for BNEF, said that the Covid-19 pandemic has raised difficult questions about car makers’ priorities and their ability to fund the transition. “The long-term trajectory has not changed, but the market will be bumpy for the next three years,” he forecast.

Keeping innovations on the radar

Despite speculations, a post-pandemic economy is a blind spot for the automotive sector. Hence, the importance of keeping operations flexible and resilient is highlighted by this pandemic, according to Infor’s Castellina. “Uncertainties will always plague the market — today it is a global pandemic, and tomorrow it could be a data breach, protests or natural calamities,” he said.

Thus, he said that companies must ensure business continuity and operational resiliency against unprecedented events. “Ensuring agility across the organisation such that operations, processes and practices can quickly adjust to changing demands and market conditions,” he added.

Is there a way out of the downturn trend from the pandemic? Definitely, but the road ahead will not be a smooth ride.

Castellina places emphasis on innovation. “Steady innovation will lead us out of this,” he said.

Adoption of key megatrends in the automotive sector, such as connected, autonomous, shared and electric driving, are likely to slow in the downturn, while innovation will continue to drive investment and growth, he said, adding that investing in technology will enable companies to manoeuvre their way into the post-pandemic world where agility, resiliency and adaptability could be winning virtues to thrive.

“Companies that take the opportunity to invest in technology now will certainly reap the rewards when the economy rebounds,” he concludes.

Industry News

Trinseo, a manufacturer of plastics, latex binders, and synthetic rubber, is looking at disposing its styrene monomer assets in Boehlen, Germany, and its polybutadiene rubber (nickel and neodymium-PBR) assets in Schkopau, Germany. The combined EBITDA of these operations in 2019 was a negative US$18 million. The styrene facility has capacity of 300 kilotonnes, and production over the past three years was 200 kilotonnes. The Schkopau PBR line has a capacity of 30 kilotonnes. Trinseo says it will continue its other operations in Schkopau, including polystyrene, SSBR, and ESBR.

• Japan’s Toyoda Gosei Co. has invested in Uhuru Corp, a venture business that provides services and solutions using huge amounts of data in cloud computing and edge devices. Uhuru, it says, has solid track record in the field of IoT services and solutions with experience in projects using cloud computing. Through collaboration with Uhuru, Toyoda Gosei says it aims to enhance value in products and services using various types of data gained through e-Rubber sensors.

Bridgestone Corporation is acquiring German tyre retail, wholesale and retreading company Reiff Reifen & Autotechnik from UK-based Fintyre Group. The latter acquired Reiff in 2017. However, Fintyre in Germany filed for bankruptcy in February and a number of tyre distribution companies that it controls in the country are now for sale. Financial terms were not disclosed.

Tokai Carbon and its subsidiary Tokai Cobex are to acquire Carbone Savoie International SAS, a French carbon and graphite manufacturer, for US$183 million. Carbon Savoie garners 95% of its sales revenue from exports and in 2018 had a sales revenue of EUR118 million. The shareholding will be 70% by Tokai Carbon and 30% by Tokai Cobex. The Japanese firm says this is in line with its midterm plan for growth by utilising strategic investment in existing and complementary businesses.

• German technology firm Continental Corp. has put on hold spinning off its powertrain unit Vitesco Technologies this year, due to the coronavirus pandemic and the resulting ongoing economic uncertainty. It says it will “complete this step as soon as the market environment has improved noticeably and is more stable”. Continental also adds that its Executive Board together with the management of Vitesco Technologies will discuss and decide about the transitional period up to this point in time. By doing so, Continental says it is “ensuring that the spinoff planned for later can be implemented with the shortest possible lead-in time and great flexibility once the market conditions change”.

• Swedish chemical firm Nynas says it is no longer being blocked pursuant to t he Venezuela Sanctions Regulations of the US Treasury Department’s Office of Foreign Asset Control (OFAC). As a result of a corporate restructuring of the ownership of Nynas AB, with a reduction in the ownership share and control by Venezuelan state-owned oil company PDVSA to 15%, the sanctions have been lifted. This also means that US persons and companies no longer require an authorisation from OFAC to engage in transactions or activities with Nynas. As a consequence, general license GL 13E is removed.

• Synthetic rubber maker Arlanxeo has moved its corporate headquarters from Maastricht to The Hague, Netherlands, to forge closer ties w ith its parent company, Saudi Aramco. Arlanxeo was established in April 2016 as a joint venture of German chemicals firm Lanxess and Saudi Aramco. In 2018, state-owned oil/gas firm Saudi Aramco became the sole owner of Arlanxeo.

• The rising demand of medical gloves due to the Covid-19 pandemic will see the Rubber Authority of Thailand (RAOT) setting up a medical glove factory soon with a production capacity of 1.8 billion units/ year. It will be located in Thailand’s Nakhon Si Thammarat province and estimated to cost about US$15.4 million. However, the state agency has yet to finalise the proportion of shareholding of partners in the joint venture. It is also conducting a feasibility study to set up a Rubber Valley in Nakhon Si Thammarat as a hub of integrated rubber production, as part of its yearly US$12. 4 million R&D plan.

Green Distillation

Technologies (GDT), an Australian tyre recycling company, has secured US backing for its world-first tyre recycling technology that produces oil, carbon and steel from end-of-life (EOL) tyres, in demand by world markets at promising market prices. GDT’s original agreement with a US tyre recycling company provided for ten tyre recycling facilities across the US, but will now be increased to 15 with construction of three plants to commence as soon as government approvals are obtained. GDT said that although the cost was around US$150 million, the company has yet to consider “different variables” in terms of the cost of obtaining key components for each of the plant locally, site selection and so on.

• Italian petchem company Saipem, which is leading a consortium with Egypt-based Petrojet, has been awarded a contract by Ethylene & Derivatives Co. (Ethydco) for the first polybutadiene (PBR) facility in Egypt, with an expected production capacity of 36,000 tonnes/ year. Saipem and Petrojet have a long history of partnership in Egypt and will be jointly responsible for detailed engineering design, procurement and supply of equipment and materials, construction, pre-commissioning, commissioning up to start-up and performance testing.

• By the end of 2020, Russian petchem company Sibur’s Krasnoyarsk site plans to start commercial production of synthetic nitrile butadiene rubber (NBR) latex with a capacity of 3,500 tonnes/year.

Industry News

The project aims to develop a feedstock base for import substitution of technical and diagnostic exam (including medical) gloves through localisation of production in Russia. The capacity of the new production site will make it possible to churn out some 230 million exam gloves/year.

• In what is said to be an ambitious new strategy to boost international membership and participation in its events, training and learning opportunities, the Rubber Division of the

American Chemical Society

(ACS) has appointed newly formed UK-based Rubber Heart as its representative in Europe. It will pave the way for a partnership that will spread awareness of the benefits and opportunities offered by Rubber Division, ACS to professionals working in the global rubber industry.

ASTM International, an international standard organisation based in the US, plans to start a new rubber sub-committee to focus on alternative sources of natural rubber and natural rubber latex and develop standards covering “agricultural growth operations, processing, colloidal and physical testing of raw material, as well as in-process and finished goods made from raw material.” The organisation is welcoming “polymer experts” and members of regulatory bodies to join the new subcommittee (D11.21), which is part of ASTM’s D11Committee on Rubber.

• In an ambitious project to transform the global rubber market, experts from the

Conservation Finance

Alliance (CFA), the Word Wildlife Organisation (WWF), and Halcyon Agri Corp, among others, will design a Rubber Trust Fund (RTF) to offer efficient financial solutions to rubber farmers, who seek to improve their productivity and livelihoods sustainably, by developing and implementing tools to make the rubber chain more sustainable. The new RTF project is expected to engage the multi-stakeholder GPSNR to leverage its technical and financial reach throughout the rubber supply chain through a financial mechanism, designed to engage the entire sector in addressing supply chain risks and impacts with i nvestments that may include the matching of bi-/multilateral developmental aid with mandatory or voluntary sustainability premiums collected through a GPSNRendorsed rubber e-trade platform.

• Tyre major JK Tyre & Industries has started the operations of Western Tires Inc, its new unit based in Houston, Texas. The Indian tyre manufacturer now has its own marketing arm in the US to cover sales, service and network expansion across multiple segments of the market while the after-sales service will be backed by a team of technical experts from India and Mexico. The formation of Western Tires comes after the acquisition of its JK Tornel subsidiary in Mexico and enhancement of capacity at JK Tyre in India. The firm has also been exporting to the US for nearly two decades through an extensive network of local partners. Now, with Western Tires, JK Tyre says it can better focus on direct sales in the truck/bus radial, passenger car and light truck tyre segments.

Rubber Market Analyses

Post-pandemic recovery for the Asian rubber market

The Covid-19 pandemic has triggered declines in rubber prices and overall gloomy sentiments in the rubber sector. While recouping of losses is in sight, it will be an uphill climb, says Angelica Buan in this article.

Ruthless effect on rubber market

The pandemic has spared no commodities. Rubber is among one of the casualties. In the first quarter of the year, from January-March, world production of natural rubber (NR) dropped 3.6%, year-on-year, according to the Association of Natural Rubber Producing Countries (ANRPC), an intergovernmental organisation comprising 13 countries that account for 91% of the global NR output.

Nevertheless, flexed by the surging demand for personal protective equipment (PPE) to manage Covid-19, consumption for gloves and other rubberbased healthcare products has partially offset the fall in demand for NR from the automotive/tyre manufacturing sector, especially in Malaysia and Thailand, the rubber group said.

Glove consumption has offset the downturn in the tyre sector

RB Premadasa, Secretary-General of ANRPC, noted in the report that Covid-19 has impacted the production, primary processing and local trading of NR in three ways. Firstly, a further slump in NR prices, caused by the alarming spread of the coronavirus, compelled a large number of farmers to abstain from maintaining rubber holdings and harvesting the trees. Secondly, the social distancing protocols, movement control measures, lockdowns and widespread closures implemented by governments in rubberproducing countries have disrupted the harvesting, primary processing and transportation.

Although some rubber-producing countries exempted the NR sector from the control measures, the production has still been affected by various other constraints R. B. Premadasa, Secretarythat are associated with General of ANRPC the epidemic.

Last but not the least, with the abrupt fall in the demand for NR, both from domestic end-users and overseas buyers, the factories producing block rubber and centrifuged latex reduced the purchase of cup lump and field latex, compelling farmers to reduce or stop harvesting.

However, the sector could see a reprieve by July, the report said, finding that until then, the monthly trends in world production show an indication of world production continuing along the current trend of falling prices/demand.

China: lockdown decreased demand; scaled down operations

In China, the epidemic caused a major threat during the period from mid-January to mid-March. As this period coincided with the wintering off-season of production in the country and the long vacation for the Spring Festival, the output loss was negligible. Most of the plantations and holdings in China give complete lay-offs to tapping from January-March every year. Therefore, the total production during these three months comes to only around 1% of the annual production.

Although the epidemic had no direct bearing on the production of NR in the country, the production sector was affected by unfavourable weather that prevailed from March-April this year. This hindered tapping in some of the regions, besides affecting the growth of rubber trees.

The movement controls and supply-chain disruptions also affected tapping during April to a limited extent.

China produced 4,500 tonnes of NR during the first quarter of 2020, against 9,000 tonnes during the same quarter a year ago. Obviously, the loss in production is too small in absolute terms. As per preliminary estimates, the country produced 25,100 tonnes in April this year compared to 39,300 tonnes in the same month a year ago.

Rubber Market Analyses

The pandemic affected tapping activities of Asian rubber producers

Furthermore, while the country started its recovery from the Covid-19 pandemic by March, and its manufacturing activities resumed by the end of March, the rest of the world was self-contained via movement controls, lockdowns and widespread closures. Thus, the decreased demand from overseas markets deterred China’s export-dependent manufacturing sector, including automotive/tyre manufacturing, from returning to normal capacity, ANRPC stated.

The reduced demand from overseas markets has deterred China’s export-dependent manufacturing sector

China’s return to normalcy is also challenged by the poor domestic demand for manufactured rubber products because cash-strapped households and businesses are reluctant to spend.

Due to poor demand for manufactured products and acute shortage of funds, businesses worldwide would also be under pressure to scale down their operations and reduce the workforce for at least a couple of months. While massive unemployment, lasting several months, can aggravate the debt load on households, paucity funds and poor demand can make many businesses bankrupt across the world unless supported by implementation of effective policies by the respective governments.

Southeast Asia: pandemic heightens tapping woes

The impact of the pandemic on NR production also varies between rubber producing countries in Asia, Jom Jacob, Senior Economist at ANRPC, told RJA in an email interview. Deducing from the report, he relayed that this impact depends on the seriousness of the spread, nature of control measures implemented, and socioeconomic profile of the farmers concerned.

In Thailand, the largest rubber producer, the pandemic coincided with the wintering off-season of NR production. This has helped in keeping output loss at a minimum. However, the pandemic disrupted harvesting during April. According to preliminary estimates, production in April this year is down 20%, or by 95,000 tonnes, from the same month a year ago.

The production in the country has also been affected by a set of indirect factors. The pandemic has resulted a 15-20% annualised fall in NR prices across the country, and thus, farmers lost interest in harvesting the trees.

Over in Indonesia, most of Jom Jacob, Senior Economist, the farmers either reduced or ANRPC stopped tapping due to the pandemic-related fall in NR prices. Local trading activities have been affected due to poor domestic demand, domestic supply chain disruptions and uncertainty in NR prices. Compounding the situation is the new fungal leaf disease, which affected more than 500,000 ha of mature trees in the country, and which is expected to have a negative bearing on the yield from the trees.

Vietnam has witnessed the same condition where the epidemic disrupted the tapping from March-April. Farmers either stopped or reduced tapping as they found harvesting of trees not economically viable following the sharp fall in rubber prices. The lack of raw rubber (cup-lump, field latex and sheet rubber) buyers also discouraged farmers from tapping. Local traders largely stopped operations due to poor demand, both from exporters and from domestic manufacturing factories, and to guard against the risk associated with the abnormal fluctuations in prices and market uncertainty. The control measures have also prevented local traders from continuing operations in pandemicstricken regions.

Rubber Market Analyses

In Malaysia, the harvesting, trading and processing of rubber have been exempted from the Movement Control Order (MCO) since mid-March. However, harvesting and trading have been affected since dealers located in the “red zone” areas found it difficult to operate due to the movement restrictions. Meanwhile, a section of smallholders abstained from harvesting and a few traders stopped their operations; tapping also declined because of the wintering-off season from February-May and some farmers found harvesting not economical as NR prices fell further.

Meanwhile, in the Philippines, tapping of rubber trees from March-April was disrupted due to government-enforced control measures. A section of local traders halted their operations due to supplychain disruptions, poor demand both from domestic manufacturers and exporters, and the risk associated with abnormal fall in prices. As a result, farmers faced difficulties in disposing of the cup lump and field latex.

India: loss in production may be offset by increased output

In India, the nationwide lockdown since March has hindered tapping. Nevertheless, harvesting continued in holdings located in interior villages of some of the rubber-growing states, as well as those being managed by the growers themselves. All operations in large rubber estates and the tapping undertaken by hired tappers in the smallholdings, as well as in the Collection Centres of field latex and the Group Processing Centres (GPC) have been barred.

Furthermore, local trading and transporting of rubber was immobilised; while trading in NR was stopped at the primary, secondary and terminal levels of the market.

In the southern state of Kerala, which accounts for about 80% of the country’s total production, its

government in mid-April gave the green light to resume tapping and permitted operation of latex facilities to cater to glove manufacturing, subject to observation of Covid-19 epidemic protocols, except in the regions classified as “red zones”. However, both tapping and production at the latex facilities has not normalised as yet due to unattractive prices, lack of buying interest from local traders, dislocation of migrant tappers, and other reasons

ANRPC pegged the loss in India’s production arising from the lockdown at 50,000 tonnes to 730,000 tonnes, showing a 4% increase from the previous year. India was actually expecting a higher production from March-May this year on account of the good summer rains received in the major rubber growing regions. In view of the expected 35,000 ha of expansion of the country’s area under tapping this year, the loss in production during the first half could be partly offset by increased output expected in the second half.

Slow, steady market rebound expected

The rubber sector will eventually come out of the pandemic onslaught and is anticipated to witness an improvement, according to the ANRPC report. The market improvement will be propelled forward by five factors:

a)

b)

c)

d) e) Manufacturing and other economic activities are expected to further improve in China, and this can help a marginal recovery of rubber contracts in the Shanghai Futures Exchange A number of NR consuming regions/countries have lately succeeded in their efforts to reduce the spread of Covid-19 epidemic. Further improvements expected in the near future are likely to contribute to business confidence and positive market sentiment The economic recovery policies being launched by various governments Improvement in crude oil prices Increase in consumption from now onwards

On the other hand, although the NR market is expected to recover marginally, returning to the preCovid-19 level may be hindered by constraints. These include the global economic slump, poor demand outlook for NR and low crude oil prices, expected to keep commodity indices low at least in the short-term.

Although the epidemic situation is improving in a few countries, other countries are still struggling to manage it, according to ANRPC. Even if the epidemic is over and the lockdowns are lifted, it may still take several months or longer to repair the financial damages caused by the pandemic, unless suitable strong policies are carefully designed and effectively implemented by respective countries, ANRPC concluded.

2020 16-17 JUNE EIHA HEMP Conference

Venue: Online Event Tel: +49 2233 48-1449 Email: dominik.vogt@nova-institut.de Internet: www.eiha-conference.org

2 - 4 JULY Complast Myanmar

Venue: Yangon, Myanmar Tel: +91 (44) 2250 1986 87 Email: office@smartexpos.in Internet: www.complastexpo.in

25 - 27 AUGUST Rosmould | Roplast

Venue: IEC "Crocus Expo", Moscow, Russia Tel: +7 495 649 8775 ext. 153 Fax: +7 495 649 8775 Email: alina.kudelina@russia.messefrankfurt.com Internet: www.rosmould.ru.messefrankfurt.com

2 - 5 SEPTEMBER INDOPLAS

Venue: Jakarta International Expo Kemayoran, Indonesia Tel: (65) 6332 9645 Email: rita_biswas@mda.com.sg Internet: www.indoprintpackplas.com

9 - 11 SEPTEMBER ProPak Vietnam

Venue: (SECC) Ho Chi Minh City, Vietnam Tel: +84 28 3622 2588 Fax:+84 28 3622 2527 Email: propakvietnam@informa.com Internet: www.propakvietnam.com

12 - 14 SEPTEMBER Plastic, Packaging & Print Asia

Venue: Karachi Expo Centre, Pakistan Tel: (+92-21) 3486 0830 Email: info@plastpackasia.com.pk Internet: www.plastpackasia.com.pk

17 - 19 SEPTEMBER ProPak Myanmar

Venue: Yangon, Myanmar Tel: +95 1 378 975 (Ext 104) Fax: +95 1 378 994 Email: nyeinnyein.aye@informa.com Internet: www.propakmyanmar.co

20 - 22 SEPTEMBER India Plastics Show

Venue: Gandhinagar, Gujarat Tel: +91 990-904 1613 / 18 Email: info@kdclglobal.com Internet: www.kdclglobal.com

23 - 26 SEPTEMBER VietnamPlas

Venue: SECC, Ho Chi Minh City, Vietnam Tel: +886-2-2659-6000 Fax: +886-2-2659-7000 Email: exfdp@chanchao.com.tw Internet: www.chanchao.com.tw/Vietnamplas

23 - 26 SEPTEMBER INTERMACH & MTA Asia

Venue: BITEC, Bangkok Tel: +662 036 0500 Fax: +662 036 0588 Email: Intermach-th@informa.com Internet: www.intermachshow.com

7 - 9 OCTOBER Plastics Expo Osaka

Venue: INTEX Osaka, Japan Tel: +81-3-3349-8568 Email: materialweek-e@reedexpo.co.jp Internet: www.plas.jp

8 - 10 OCTOBER ProPak India

Venue: Pragati Maidan, New Delhi, India Tel: +9196192 74838 Email: Monica.Rohra@informa.com Internet: www.propakindia.com

11 - 13 OCTOBER ProPak Mena

Venue: Cairo International Convention Center Tel: +44(0)20/7921-5000 Email: exhibit@informamarkets.com Internet: www.propakmena.com

12 - 15 OCTOBER Plastasia

Venue: BIEC, Bangalore, India Tel: +91 80 43307474 Email: info@plastasia.in Internet: www.plastasia.in

20 - 23 OCTOBER VietnamPrintPack

Venue: Ho Chi Minh City, Vietnam Tel: +886-2-2659-6000 Email: exfdp@chanchao.com.tw Internet: www.chanchao.com.tw/VietnamPrintPack

ADVERTISERS’ ENQUIRIES

Check out the Advertisers' page on our website.

Information is categorised by the YEAR & DATE of publication for easy reference.

For further details, email us at: news@plasticsandrubberasia.com

PRA Digital issue is available ONLINE! www.plasticsandrubberasia.com

INTERNATIONAL OFFICES

Publishing Office/Scandinavia, Benelux & France Postbus 130, 7470 AC Goor, The Netherlands Tel: +31 547 275005 Fax: +31 547 271831 Email: arthur@kenter.nl Contact: Arthur Schavemaker

Regional Office

SQ9, Block A, Menara Indah, Taman TAR, 68000 Ampang, Selangor, Malaysia Tel: +603 4260 4575 Fax: +603 4260 4576 Email: tej@plasticsandrubberasia.com Contact: Tej Fernandez

China & Hong Kong

Room 803, No.2, Lane 3518, Road Bao'An, District Jiading, Shanghai Tel: +86 13341690552 Mobile: +86 17751702720 Email: henry.xiao@matchexpo.com Contact: Henry Xiao/Zhu Wei

China

Bridge Media 亚桥传媒 Room 206, #1, 569 Shilong Rd, Shanghai, China 200237 Tel: +86 21 3368 7053 Mobile: +86 138 1643 7421 Email: lagopoah.yang@bridgemedia.cn Contact: Lago Poah Yang 杨旋凯

Southeast Germany, Switzerland & Austria

Verlagsbüro G. Fahr e.K Breitenbergstrasse 17 D-87629 Füssen, Germany Tel: +49 8362 5054990 Fax: +49 8362 5054992 Email: info@verlagsbuero-fahr.de Contact: Simon Fahr

North-West Germany

JRM Medien+Verlag Minkelsches Feld 39 D-46499 Hamminkeln, Germany Tel: +49 2852 94180 Fax: +49 2852 94181 E-mail: info@jwmedien.de Contact: Jürgen Wickenhöfer

Malaysia. India, Indonesia, Singapore, Thailand, Australia, New Zealand, Korea & Philippines

Tara Media & Communications SQ 9, Block A, Menara Indah Jalan 9, Taman TAR, 68000 Ampang, Selangor, Malaysia Tel: +603 4260 4575 Fax: +603 4260 4576 Email: winston@taramedia.com.my Contact: Winston Fernandez

Italy, Spain & Portugal

MediaPoint & Communications Srl Corte Lambruschini, Corso Buenos Aires, 8, Vo Piano - Interno 9, 16129 Genova, Italy Tel: +39 010 570 4948 Fax: +39 010 553 0088 Email: info@mediapointsrl.it Contact: Fabio Potesta Taiwan 宗久實業有限公司 Worldwide Services 11F-B, No.540 Sec.1, Wen Hsin Rd., Taichung, Taiwan Tel: +886 4 23251784 Fax: +886 4 23252967 Email: global@acw.com.tw Contact: Robert Yu 游宗敏

USA & Canada

Plastics Media International P. O. Box 44, Greenlawn, New York 117430, USA Tel/Fax: +1 631 673 0072 Email: charlotte@4m-media.com Contact: Charlotte Alexandra

www.plasticsandrubberasia.com www.rubberjournalasia.com www.injectionmouldingasia.com www.plasticsandrubberasia.cn