18 minute read

AVANTIS WEALTH

Seven Principles of Investment in Uncertain Times

by Rod Thomas FCA, Chairman, Avantis Wealth Ltd

Seven Principles of Investment in

Whether you invest for income, savings or capital The impact of this incredible fall in bank base rate has been growth, the last 20 years have been dominated by uncertainty and dramatic changes to investUncertain Times calamitous. It has effectively wiped any income from millions of investor portfolios invested in Gilts or bank and savings ment markets. Rod Thomas FCA, accounts. Many investors have failed to generate decent returns on Chairman, Avantis Wealth Ltd Buy-To-Let (BTL) Property their money, and face even more difficulties in choosing what to do now. Many investors, in recent years, have chosen to invest in Whether you invest for income, savings or capital growth, the last 20 years have been dominated by uncertainty and dramatic changes to investment markets. property and receive rental income. Sadly, BTL property no Falling (and failing) investments for 20 years! longer offers the same profitability. Review the Nationwide index of house prices across 40 years; Many investors have failed to generate decent returns on their money, and face even more Investment in shares has been the mainstay of many investdifficulties in choosing what to do now. ment portfolios for around 100 years. But consider the perFalling (and failing) investments for 20 years! formance of the FTSE 100 index, which measured approx. 7,000 at the turn of the millennium. On April 1st 2020, it stood at 5,500, a loss of 22% over 20 years. Investment in shares has been the mainstay of many investment portfolios for around 100 years. But consider the performance of the FTSE 100 index, which measured approx. 7,000 at the This is a massive underperformance by anyone’s standards turn of the millennium. On April 1st 2020, it stood at 5,500, a loss of 22% over 20 years. and a serious blow to millions of investors! This is a massive underperformance by anyone’s standards and a serious blow to millions of investors! Government Gilts and Savings Accounts Government Gilts and Savings Accounts Most investors have also held income producing assets, parMost investors have also held income producing assets, particularly for retirement or to ticularly for retirement or to supplement other sources. supplement other sources. Investment income primarily depends on interest rates. We now have the lowest bank base rate ever (for more than 300 Investment income primarily depends on interest rates. We now have the lowest bank base years!) at just 0.10% pa. rate ever (for more than 300 years!) at just 0.10% pa.

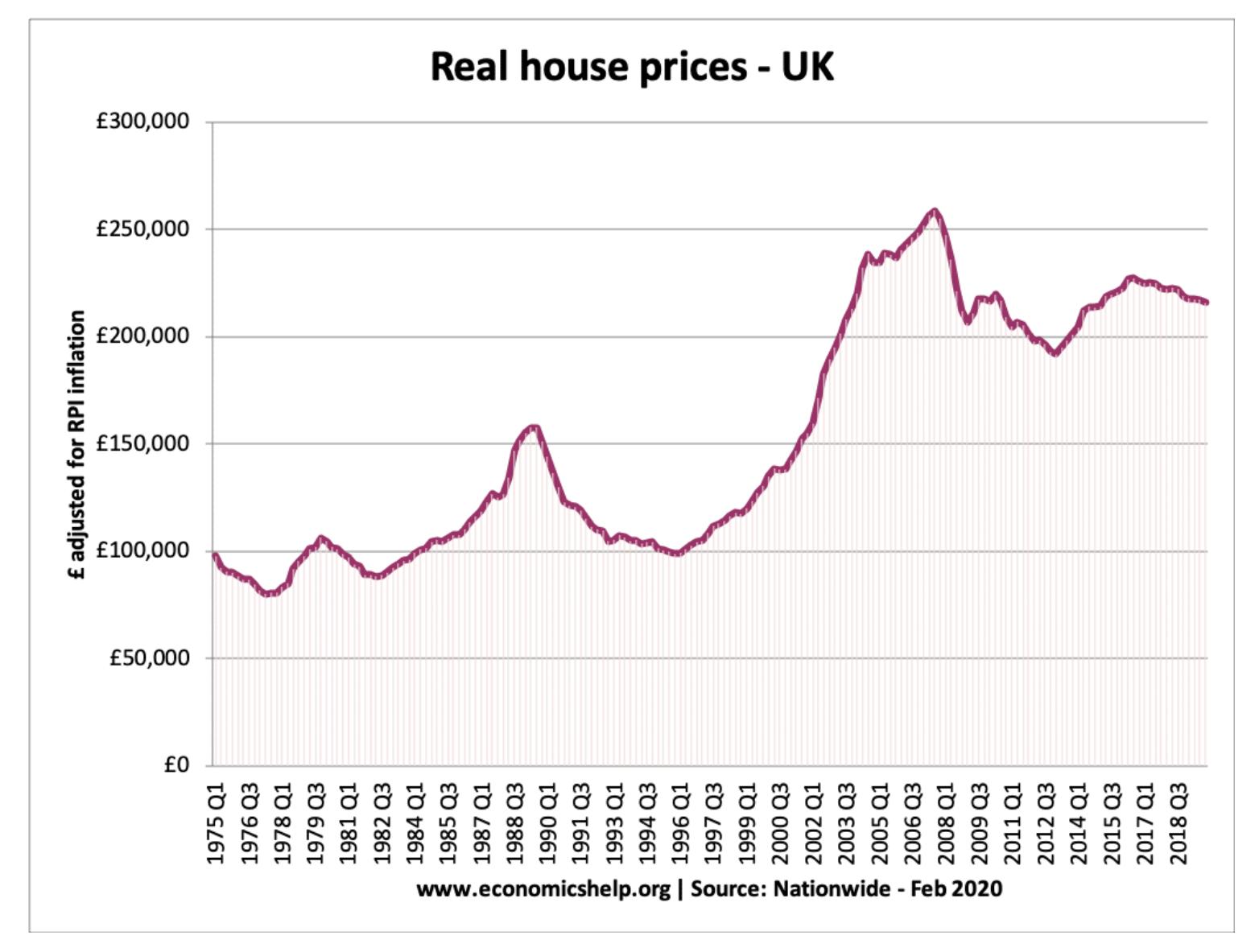

Over the period from 1975 to 2018, a period of 43 years, property has delivered an average Over the period from 1975 to 2018, a period of 43 years, propcapital growth from £100,000 to £220,000, a rate of 1.85% a year. Very disappointing. erty has delivered an average capital growth from £100,000 to £220,000, a rate of 1.85% a year. Very disappointing. Not only is capital growth questionable, the costs of owning and running buy-to-let property have also escalated, significantly reducing the net rental yield.

Not only is capital growth questionable, the costs of owning and running buy-to-let property have also escalated, significantly reducing the net rental yield.

The impact of this incredible fall in bank base rate has been calamitous. It has effectively wiped any income from millions of investor portfolio’s invested in Gilts or bank and savings accounts. 14 Buy-To-Let (BTL) Property Many investors, in recent years, have chosen to invest in property and receive rental income.

Over the period from 1975 to 2018, a period of 43 years, property has delivered an average capital growth from £100,000 to £220,000, a rate of 1.85% a year. Very disappointing.

Have you heard the saying; ‘If you keep doing what you’ve always done, you’ll keep getting what you’ve always got.’ What you have now needs real improvement!

Look outside the box and consider new investment options. Mainstream investments have mostly failed to deliver for twenty years! How long does something have to fail before you say ‘enough is enough’.

Principle No 2: Fixed is better than variable

In a time of uncertainty, fixed income beats variable income every time.

If you are seeking income to live on now, or to build up your savings for the future, then knowing – in advance – what you will receive and when you will receive it is crucial. At Avantis Wealth we are massive believers in investors being This chart shows a rise of 38% in private renting costs since 2005, which has impacted all This chart shows a rise of 38% in private renting costs since assured of what they will receive in return for investment – 2005, which has impacted all landlords. fixed income with a fixed payment schedule, whether monthThe Big Challenge ly, quarterly, six-monthly or annually. Principle No 3: Insist on Rewarding Returns The Big Challenge So what can you do to generate income where every major asset class has failed to deliver, So what can you do to generate income where every major broadly for 20 years? These Seven Principles may show the path. What do you consider to be a reasonable return on your inasset class has failed to deliver, broadly for 20 years? These Seven Principles may show the path. Principle No 1: Forget the “same old, same old” vestment money? Most investors anticipate a very low return in the range of 1% - 3% annually. Have you heard the saying; ‘If you keep doing what you’ve always done, you’ll keep getting Principle No 1: Forget the “same old, same old” what you’ve always got.’ What you have now needs real improvement! At Avantis Wealth our focus is on investments that offer from Look outside the box and consider new investment options. Mainstream investments have mostly failed to deliver for twenty years! How long does something have to fail before you say ‘enough is enough’.

7% to 15% annually. Investors are often surprised that this level of return can be achieved at modest risk.

We believe that rewarding returns are absolutely essential for everyone who invests.

Principle No 4: Short-term is better than long-term

The longer the term of investment, the greater the risk. Who knows what will happen in any sector or with any company over the next 5-10 years? It’s difficult enough to have any confidence in the next 12 months. So our focus is on short term investments typically over 12-36 months, but still providing rewarding returns. It’s a powerful combination!

Principle No 5: Diversification offers real benefits

In my opinion, the most important time to have a diversified portfolio is in uncertain times where the economic outlook is poor.

Diversification means holding a variety of assets in your portfolio. If you hold one investment and it fails, you could lose 100% of your money. But if you held more, the chance of them all going bust at the same time is small, assuming they are diversified. Therefore, the level of risk is much reduced.

Principle No 6: Underpin your investment with security

We are great believers in bringing security to all investments. Security is a positive addition but rarely offers perfect protection.

Here are key points about the provision of ‘security’. • Any security is better than no security • A first legal charge over property is the best available option. • There are many security options: First legal charge, second legal charge, personal guarantee, corporate guarantee, debenture, charge over other assets etc. • The lower the quality of security, the higher the investment return that is required. • For many investments, including the bulk of regulated investments like shares, there is no security at all!

Principle No 7: Waiting costs you money

When there are significant shifts in the marketplace, and shocks to the system, investors are naturally concerned, often choosing to ‘sit and wait’ before investing. Recent market uncertainty has been driven by the dot.com crash in 2000 and 2001, the housing crash followed by the financial crash in 2008-2009 and now the coronavirus pandemic of 2020.

Sitting and waiting appears to be a low risk strategy. However, being out of the market carries a significant cost, viz;

EXAMPLE

Suppose you invest in a fixed income investment offering 10% pa, for 10 years. You reinvest profits. For a £100,000 investment, your return would be £259,374 after 10 years. Now assume you wait for 2 years before investing. Your return on £100,000 is £214358. This delay has therefore cost you £45,000 in lost income!

I suggest you explore ways to protect yourself from the vagaries of the market. My recommendation is to consider fixed income, short-term investments with rewarding returns.

Bringing it all together

The Seven Principles offers a new approach to investment, intended to delivery better returns.

Think about the value of these Principles for your own investments and adopt the ones that you believe will add value to your strategy . Remember that nothing is certain in investing. Capital is almost always at risk and you may get back less than you invested, or in a worst case lose all the capital invested. I recommend that you take advice from a regulated advisor before changing your investment strategy.

If you would like to explore investment opportunities which match the Seven Principles, without cost or obligation, just email invest@avantiswealth.com , call +44 1273 447299 (UK office hours), or visit our website at www. avantiswealth.com.

Some cautious 17 June 2020 optimism

The new NatWest UK Small Business PMI® survey shows signs of optimism as downturn in business activity eases, but small firms are especially cautious about outlook NatWest UK Small Business PMI ®

The new NatWest UK Small Business PMI® survey has identified a clear improvement in the business environment since April, with the downturn in priHowever, small businesses are more cautious about the year ahead outlook than their peers in all three main sectors covered by the new survey, prompting NatWest to unveil a Small Key Findings • New survey on small businesses shows signs of optimism with slower downturn Slide in business activity eases, but small firms are especially cautious about the outlook vate sector output moderating from Business Taskforce to support its in business activity during May the record drop at the peak of the coronavirus disease (COVID-19) outbreak. customers through the next phase of recovery. • Widespread use of furlough scheme for small firms helps Signs of a turnaround were highlighted Key findings retain staff

UK Small Business Activity Index by a rise in the supporting Small Business Activity Index – which monitors output at private sector companies • Small firm’s expectations lag behind those reported by larger firms Signs of a turnaround as downturn in activity slows during May with 1-49 employees in the services, construction and manufacturing sec• NatWest unveils Small Business Taskforce to respond to findings Widespread use of furlough scheme helps retain staff tors – from 14.6 in April to 26.3 in May. and support customers with next May ‘20 Nonetheless, the index remained bephase of recovery Business expectations lag behind those reported by larger firms 26.3 low the 50.0 no-change value and signalled the second-fastest drop in business activity since the start of the Employment trends among small businesses have been more resilient This new NatWest UK Small Business PMI ® is a monthly index designed to monitor the progress and challenges faced by small enterprises in the manufacturing, services and construction Apr: 14.6 series in 1998. Small manufacturers than elsewhere in each of the main sectors as the UK economy begins to emerge from the public health emergency. recorded the slowest drop in output, followed by service providers, while those in the construction sector postcategories of activity monitored by the survey. However, survey respondents experiencing a slump in reveMay data from the NatWest UK Small Business PMI ® point to a clear improvement on the situation seen during April, with the downturn in private sector output moderating from the record pace ed the fastest pace of decline. nues overwhelmingly commented on reported at the peak of the coronavirus disease (COVID-19) outbreak. 50 60 Dec ‘19 - May ‘20 Small businesses continued to experience a severe shortfall of new work in May and reported widespread business closures across their supply chains, despite a boost as some parts use of the government’s job retention scheme to help keep on staff. Downturn in service sector business activity eases from Signs of a turnaround were highlighted by a rise in the All-Sector Small Business Activity Index – which monitors output at private sector companies with 1-49 employees – from 14.6 in April to 26.3 in May. Nonetheless, the index remained below the 50.0 no-change value and signalled the second-fastest drop in business activity since the start of the series in 1998. Small manufacturers 40 of the UK economy began to reopen with social distancing measures. April's record recorded the slowest drop in output, followed by service providers, while those in the construction sector posted the fastest pace of decline. 20 30 Difficulties sourcing materials, restricted transport capacity and the need to find alternative suppliers all May data highlighted that small service sector companies remained under severe strain, despite a boost in some areas as parts of the economy Small businesses continued to experience a severe shortfall of new work in May and reported widespread business closures across their supply chains, despite a boost as some parts of the UK economy began to reopen with social distancing measures. Difficulties sourcing materials, 10 UK overall placed a particularly strong burden on small business costs in May, especially in the manufacturing and construction sectors. began to reopen with social distancing measures. At 25.9, the Business Activity Index was well below the 50.0 no-change mark and the second low- restricted transport capacity and the need to find alternative suppliers all placed a strong burden on small business costs in May, especially in the manufacturing and construction sectors. Employment trends among small businesses have been more resilient than elsewhere in each of the main categories of activity monitored by the survey. However, survey respondents experiencing a slump in revenues overwhelmingly commented on use of the government’s job retention scheme to help keep on staff. Small businesses are much more cautious about the year 18 ahead outlook than their peers in all three main sectors covered by the survey. A dynamic small business sector is undoubtedly a pre-requisite for growth in the UK economy, and the latest PMI results illustrate the urgent need to help these firms adjust to the 'new normal'.

est since the start of the survey in 1996. Around 60% of small UK service providers reported a drop in business activity during May. The proportion recording a fall in output was down from 78% in April, but it exceeded the equivalent figure for large service sector companies in May (49%). On a more positive note, the percentage of small service sector firms signalling activity growth in May (11%) was up from just 6% in April.

Small manufacturers record softer output drop than in April

Latest data indicated that small manufacturers fared better than companies of the same size in the service and construction sectors during May. A number of firms commented on a phased return to work with production schedules adapted for social distancing measures. That said, the index measuring manufacturing output at small businesses remained well below the 50.0 no-change value, with the rate of decline but now exceeding that seen across the sector as a whole. Around 59% of small manufacturers reported lower production in May, while only 19% signalled an expansion. The proportion signalling a rise in output was up from just 12% in April.

Sharp construction sector downturn continues amid rapid drop in new work

May data pointed to sustained weakness across the construction sector, but a gradual restart of work on site with social distancing measures helped to moderate the overall rate of decline. However, material shortages held back smaller construction firms leading to them showing a faster drop in business activity than larger firms during May, which reversed the pattern seen in the previous month. Survey respondents often cited a lack of new opportunities to tender and project cancellations amid the COVID-19 pandemic.

COMMENT

Andrew Harrison, NatWest's Head of Banking

“This survey demonstrates the support that small businesses need as they adapt to a very different world. That’s why we’re establishing a Small Business Taskforce with a range of partners, including the British Chambers of Commerce to ensure that we can play our part in supporting our customers and by extension the UK economy. We know customer behaviour is going to change rapidly as a result of the crisis and we want to do everything we can to be here for our customers when they need us most.”

Stephen Blackman, Principal Economist, NatWest

“During crises, surveys signal mood as much as activity. And the slight uptick in May’s Small Business PMI tells us that, at least, the worst should be behind us. As the survey highlights, the furloughing schemes have been instrumental in limiting the scale of job losses across the UK. “The question is, what happens as these schemes unwind? And here the news is mixed. More than a third of small business in services expect a further reduction in activity this year. Yet, fewer firms now anticipate a reduced workforce than they did in April and there’s even tentative signs, via VAT reports, that new businesses are starting; though modestly, it must be stressed. It’s worth noting that most of what is captured in this survey occurred before further easing in lockdown measures. Directionally, this is just what we hoped to see. It now needs to accelerate.”

METHODOLOGY The NatWest South East PMI® is compiled by IHS Markit from responses to questionnaires sent to South East companies that participate in IHS Markit’s UK manufacturing and services PMI surveys.

Help for Social Enterprises

NatWest charity launches £1m grant fund to help social enterprises survive coronavirus crisis

• £1 million Coronavirus Response Fund launched by Social & Community Capital; an independent charity funded by NatWest • Grants worth between £5,000 and £50,000 available for social enterprises, charities and community business that employ people from vulnerable or disadvantaged groups • Funding will help bridge income gap so organisations can survive the current crisis

Social & Community Capital (S&CC),

an independent charity launched by survive the crisis and continue to have NatWest in 1999 to support social a positive impact in their communienterprises and community businessties. es, has today announced a £1 million Coronavirus Response Fund to help Alison Rose (pictured on the cover organisations that have suffered a of our sister title Dynamic), CEO at loss because of Covid-19 lockdown NatWest Group, said: “Many social enrestrictions. terprises, community businesses and charities that form an integral part of Grants between £5,000 and £50,000 our local communities have unfortuare being offered to organisations nately seen their incomes affected by across the UK that employ people the ongoing pandemic, and we want to from vulnerable or disadvantaged do what we can to offer our support. groups. This funding aims to bridge These grants will help champion the the income gap so that organisations vital work that these businesses and charities do, so that they can continue to make a difference to those that need it most.”

Megan Peat, CEO at Social & Community Capital, said: “We know that people and families rely on the great work of local charities and community businesses, but we know that no one has been left unaffected by this devastating pandemic. This is why we want to help those organisations that employ people from vulnerable or disadvantaged groups and who have suffered a loss of trading income with our grants so that they can continue to have a positive impact in their communities.”

Applications for the NatWest Social & Community Capital Coronavirus Grant Fund will open at 9am on Monday 22 June. Full information on the grants, including the application form and how to apply, are available online at www.natwest.com/scc

Join our ‘Looking ahead’ webinar series

Many businesses are focusing on their immediate issues, on doing what they can to survive this unprecedented period of mass uncertainty. However, it’s still important to remember to pause, breathe and look up from the current circumstances at the bigger picture. Where some see challenges, others see opportunity, adaptability and innovation.

The aim of our ‘Looking ahead’ series is to help your business achieve a brighter future with practical guidance and tips. Details of the webinars from this series are below:

Looking ahead... for the rest of this year 24 June 2020 | 10:00am - 11:00am • Sourcing funding • Cashflow management • Employee welfare/resilience

Looking ahead... to 2021 22 July 2020 | 11:00am - 12:00pm • Finding your entrepreneurial spirit and opportunities and innovation in chaos/crisis • Exploring routes to market

Looking ahead... to the next 3-5 years 26 August 2020 | 12:00pm - 13:00pm • Focusing on rebuilding, reviving and stabilising your finances • Funding • Corporate finance • Trading internationally Looking ahead... to the future with purpose 23 September 2020 | 9:00am - 10:00am • The importance of ‘purpose’ and reviewing your business’ purpose • Sustainability • Corporate Social Responsibility

Looking ahead... retaining agility - rain or shine 28 October 2020 | 10:00am - 11:00am • Funding reserves, resilience and contingency planning, crisis planning/management • Importance of looking for opportunities in crisis

For more information on our Looking ahead webinar series and to register to join: Visit: www.krestonreeves.com/webinars Email: events@krestonreeves.com 21