8 minute read

WELCOME FROM THE CEO

The Word on the Ground

After weeks of lockdown there are some really concerning messages coming from the business community. We have focused most of our time on speaking to businesses about their experiences with the impact of coronavirus so that we can truly represent them to government.

Alongside these calls we have been running a survey which attracted 301 responses from all sizes, sectors and locations across Surrey. The results were quite stark showing 72% of organisations either laying off staff or using the furloughing scheme. 63% said they were at risk of closure within 3-6 months. The results of our first survey have helped us to inform government just how tough things are and has contributed to some of the measures which have been put in place.

For a summary of the first survey, go to https://www. gov.uk/business-coronavirus-support-finder

Obviously within that period of time a number of business support mechanisms have come into play so our second survey will be measuring the effectiveness of these schemes. To take the second survey, go to https://www.surveymonkey.co.uk/r/ SCCCOV19V2.

Grants from Councils

Following the delivery of grant funding to the Boroughs and Districts, they have been busily distributing it to their businesses. If a business believes they should be getting a grant and haven’t received it yet they should go to the appropriate page on their council’s website to find out what to do.

These are listed on our website at https:// www.surrey-chambers.co.uk/representation/ how-is-your-business-doing/#section3 to try and make it as easy as possible for people to get money into their businesses.

Falling through the cracks?

I am sad to say that I am still receiving many calls from businesses, which are falling between the schemes and are therefore fearful for their survival. These include start-ups, which have only been operational for less than a year, Directors who are paid in dividends, and businesses in serviced offices who pay rates within their rent but are not registered as rate payers, and therefore are exempt from grants.

These stories, as well as experiences of those trying to access loans, are being shared with the govern-

ment to try and secure further support. We also continue to work closely with Enterprise M3 and Coast to Capital Growth Hubs, Business South and the Local Authorities to identify additional support for our local economy. Continuing to hear individual stories is really powerful. We are happy to hear from anyone with feedback. Call us on 01483 735540.

Good news stories

We continue to pick up the great work being done locally supporting the NHS, including the SurreyDrive initiative to feed NHS workers, as they finish long arduous shifts and our local entertainment businesses coming up with novel ways to keep us amused. Check out Guildford Fringe and Guildford Shakespeare Company for some entertainment.

We have also been running a series of webinars via Zoom, giving people the opportunity to ask questions of specialist panels and although there are too many to mention, I wanted to thank the members who have given us so generously their time and expertise! The camaraderie within Chambers has never been so evident.

I would like to take this opportunity to say a massive thank you to the team at Surrey Chambers, who have adjusted to our new way of working in such a brilliant way. Their passion to help as many businesses as possible has been a pleasure to see and I believe we will come through this with even more insight into what businesses need from us so that we can support them.

It is recommended that ALL businesses use the official Business Support Finder from the UK government which can be found at https://www.gov. uk/business-coronavirus-support-finder

On behalf of the team, board and council of Surrey Chambers of Commerce, we wish you and your company the best possible outcome at this difficult time and hope that you and your families are staying healthy.

Very best wishes Louise and the team

CEO Surrey Chamber of Commerce Louise Punter

And while you’re here...

Platinum Publishing enjoys the largest circulation of any business magazines in the UK, reaching over 720,000 readers across the South East and this includes 468,000 online readers. If you can’t wait for the next issue then jump onto our social media platforms and join the conversation.

@platbusmag

Platinum Publishing Group

www.platinumpublishing.co.uk

national news Divorce Bonanza

Law firms are braced for a surge in divorce filings as couples struggle to live with each other during the coronavirus lockdown, Britain’s so-called Queen of Divorce today predicted. Ayesha Vardag, one of Britain’s best known lawyers, said clients had been contacting her and her team in droves even during the lockdown period, sneaking calls in to the law firm while on their daily exercise or food shopping breaks from the house. “It’s been amazing how the calls have still kept coming in – two dozen a day,” she said. “They are finding lockdown is forcing their hand, they just can’t stand it any more.” When the lockdown ends, she predicted an explosion in the numbers. “All those people who have not been able to get to law firms like us will go completely mad.”

Life is like a sewer – what you get out of it depends on what you put into it

BUSINESS WISDOM

Partner Appointment

HS2 Share Jump

UK travel restrictions remain tight due to the Covid-19 lockdown, but not everything has ground to a halt. The City is digesting the news that the Government is pressing further ahead with the mega HS2 project, which could provide a well-needed boost to construction businesses. Europe’s largest infrastructure scheme recently got the green-light, and the Government today issued a “notice to proceed”, marking the formal approval for construction to start. Contractor Costain welcomed the update. The company, led by Alex Vaughan, said a joint venture of which it is part has a £3.3 billion contract on the rail project, which includes creating tunnels in the approach to the London terminus at Euston station.

MHA Carpenter Box continues to invest in ‘home grown’ talent, with the promotion of Chris Reeves to Partner at the accountancy firm. Chris, 33, has been appointed Partner having joined the practice as a trainee in 2004. He qualified as a Chartered Accountant (ACCA) in 2010 and helped to set up the firm’s Gatwick office in 2015. Chris commented: “MHA Carpenter Box has been a significant part of my life for the last 16 years since joining as a trainee, and I’m delighted to be made a Partner. It’s a great place to work, with brilliant people and I look forward to advising and engaging with clients for many years to come." In his role as Partner, Chris will help to drive the AAG (Assurance and Advisory Group) department forward as significant changes in the world of audit are expected over the next 12 months.

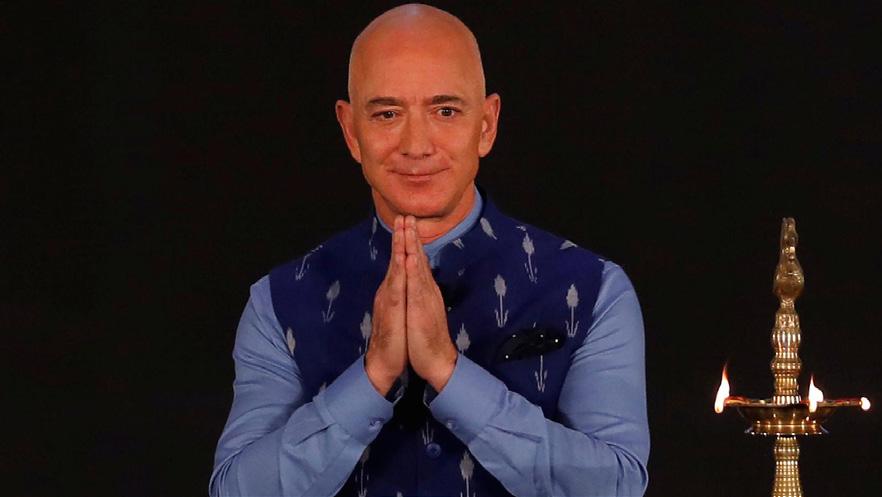

national news BUSINESS WISDOM The elevator to success is out of order.

You will have to use the stairs, one step at a time. C oronavirus has boosted the net worth of American billionaire Jeff Bezos by $24bn (£19bn) as the demand for online shopping sent Amazon’s stock price to an all-time high. The Amazon founder and CEO was already the world’s richest person, but now according to the Bloomberg Billionaires Index, his fortune is worth $138bn (£110bn). On Tuesday, Amazon’s share price climbed 5.3% as consumers have moved online during the coronavirus pandemic. Tesla founder Elon Musk added $10.4 bn (£8.3 bn) to his fortune this year, whilst the demand for teleconferencing has seen the fortune of Zoom founder, Eric Yuan more than double to $7.4 bn (£5.9bn). Walmart owners, the Walton family, also saw a 5% increase in their net worth as consumers have come to depend on the retailing giant for goods during the lockdown. Billions upon Billions M ore than 100 nightclubs, pubs and bars are planning coordinated legal action against the insurer Hiscox over its non-payment of business interruption insurance claims. Hiscox sold policies before coronavirus hit the headlines, stating it would pay out when a business was forced to shut owing to a notifiable disease. Business owners have filed claims to Hiscox and other commercial insurers only to be told their business interruption policies do not cover the pandemic. Michael Kill, the chief executive of the Night Time Industries Association (NTIA), which is coordinating the action, said: “Businesses are being denied legitimate insurance claims, many claims are being disputed by insurers based on contrived arguments to avoid sharing the financial burden during the Covid-19 crisis.” The group is calling on more businesses to join its move against the insurer. Hiscox said it had about 10,000 companies which had purchased cover for business interruption and had been directly impacted by the government-imposed closures. It said its core small commercial package policies did not provide cover for business interruption as a result of the “general measures” taken by the government in response to the pandemic. Interruption Insurance Woes Covid Kills Cash T he lockdown has led to a 60% fall in the number of withdrawals from cash machines, although people are taking out bigger sums. Payment card use has risen with online shopping, particularly for groceries. Experts say the long-term future of cash could be at risk, before the UK is ready to cope with the change. This could leave behind an estimated 20% of the population who rely on cash, they say. About 11 million cash withdrawals are still being made each week, with £1bn taken out, according to Link, which oversees the UK’s cash machine network. Yet, with many shops as well as bars, cafes and restaurants closed, there is less demand for regular cash withdrawals. People are going out less, but potentially hoarding more cash. The average ATM withdrawal has risen from £65 last year, to £82 now.