4 minute read

AVANTIS WEALTH

All is Not Lost

Challenging. Unprecedented. Crash. Uncertainty. The new trending phrases of despair. The once dreaded ‘B’ word seems like sweet relief right now. Good news! Adding to the seemingly all-encompassing gloom is not my intention. By Aaron Phillips, Senior Investment Broker, Avantis Wealth

My message for investors is one of calculated optimism. Most investors, at this moment in time, will be going through a recalibration of objectives and strategy to take them forward. On the tip of many investors’ tongue could be something along the lines of ‘look for opportunities’; however, most will be trying to sit tight in their bunker until ‘something’ happens.

The current position of the property market and why we believe that UK developers can hold the key.

Avantis has spent the last ten years selecting investments from global providers to deliver diversification for investors. We look for exceptional value for investors while helping companies improve their cash flow and fulfil projects.

It has never been a better time to be involved in helping maintain UK businesses and UK jobs. But it is not all about being altruistic or a sense of national duty. There are considerable profits to be made.

We deal in corporate bonds and loan notes. If you are unfamiliar with these, please contact our office for a more in-depth understanding. They are a necessary means for micro and SME’s to raise capital to fulfil projects and increase cash flow. Without a second glance, these can be immediately flagged as high risk. But if you look at the security involved in a lot of these projects, it will surprise you. Unlike many assets, you can choose to invest for income or growth, and perhaps best of all, the rates are fixed negating any volatility. Investors invariably get the luxury of a first charge over assets to secure their investment.

The problem facing us is that traditional asset classes have failed investors over the last 20 years. Stocks and shares, for example, have failed many. Using the FTSE 100 index as a guide, the previous peak was at the turn of the millennium when it topped 7,000.

On April 1st, it stood at about 5,500, a fall of 1,500 or roughly 22% over the period. Investors generally assumed that the stock market would show an average annual return of 4%. If this had continued over the past 20 years, the FTSE 100 index would now stand at 15,000, almost three times the actual value.

The importance of the housing market to the FTSE100 has been evident recently as large developers pulled up the index by its bootstraps.

Government Gilts and Savings Ac

counts. This latest series of rate cuts, concluding (for now) at 0.1% have slashed any income that investors would have been counting on. Gold is far from stable, and it’s probably best to not even mention oil right now.

Diversification among these asset classes alone is not diverse enough.

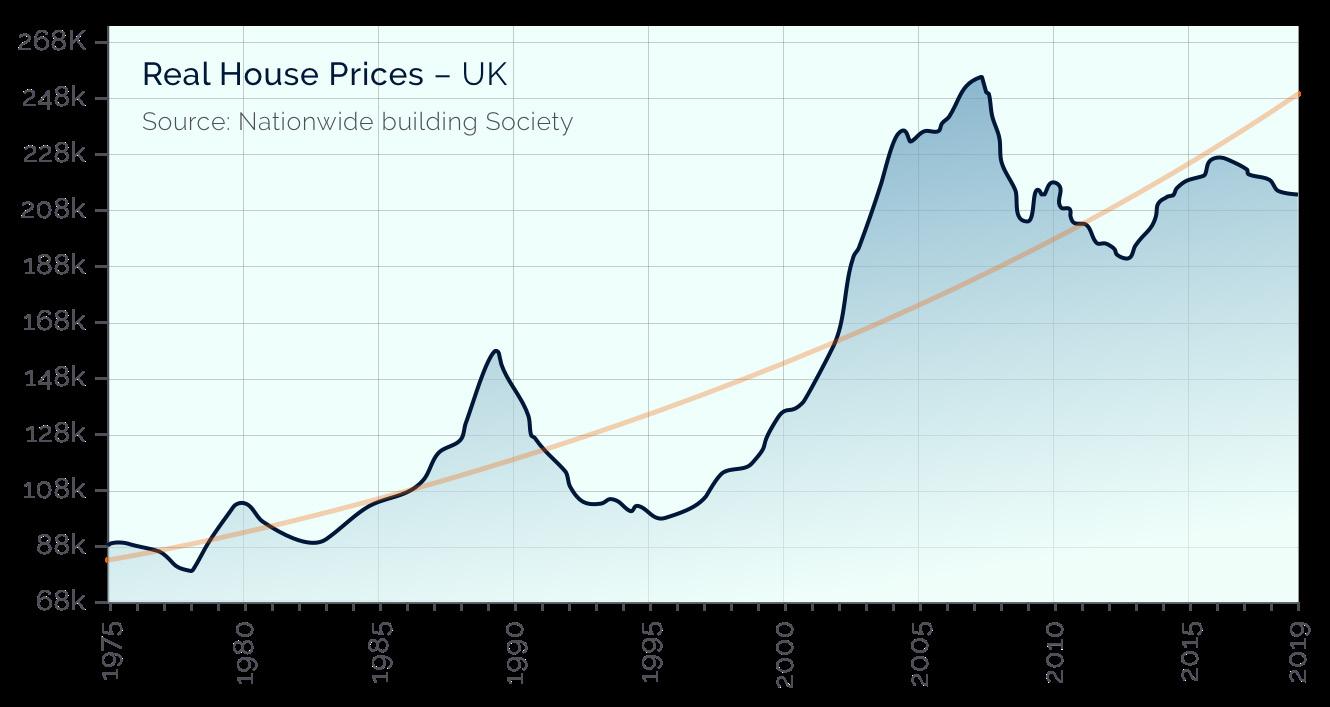

UK Property: From 1975 to 2018, a period of 43 years, the property market has delivered an average capital growth

from £100,000 to £220,000, leaving an unimpressive annualised rate of 1.85% a year. The data shows that timing is everything. However, it is essential to remember that these figures are far removed from the 20-30% profit benchmark for developers.

If you analyse the purchase price of UK property market over the last 40+ years, you will see that it has not all been plain sailing but investing into a contract with the developer negates the risk of lower resale values on the investors part. Your returns are secured against the asset.

The property market renaissance, February 2020

The UK property market released from the shackles of the ‘B’ word, experienced a period of sustained growth in

all but one region. Analysts believe we were in for a bumper year. Why? Because demand outstrips supply, and it continues to do so. If we remember the manifesto pledge of the Conservatives, 200k new homes a year for five years and the extension of the Help to Buy scheme, only 170k were built which is still a good number, but under what is required.

The good news keeps bouncing into the construction industry, with many of the UK’s biggest house builders re-opening sites whilst continuing with social distancing restrictions. Most smaller developers have managed to adapt and kept sites 60-80% operational, so there has been reduced disruption. Developers are willing to pay up to 18% pa for the top part of their funding stack to complete or to fund a project entirely. We are also noticing the draw of the UK property market combined with the weakened pound enticing a host of global investors into the marketplace.

If you feel that your once brightly shining goal is now fading into the distance, remember that there is hope. A realisation that there are opportunities out there and that lost profit can be regained.

Whatever your investment strategy, it has never been more important to look for diversity in a portfolio. That will mean veering off the well-trodden path, but that is where you can find the hidden gems.