MYTHS CREATE BARRIERS

Misconceptions about what a career in accountancy actually entails may be creating unnecessary barriers for many young people, preventing them from seeing accountancy as an attainable career option.

New research from Grant Thornton shows these misconceptions could be limiting the potential talent pool of the profession.

Exploring Gen Z’s views of accountancy as a career, Grant Thornton discovered 62% of respondents believed you need high exam grades to become an accountant. Another 57% said you need to go to university, and the same percentage thought training for the qualification is expensive.

Over half also see accountancy as a sedentary profession – 53% think accountants sit at a desk all

day!

The worry is that two-thirds of young people surveyed have never received careers advice about accountancy. However, those attending private schools are 20% more likely to have been given careers advice about becoming an accountant than those from comprehensive schools. Private school students are also more likely

to know a real accountant than those going to a state school. Gender is also found to impact young people’s perception of accountancy as an attainable career. Men are 13% more likely to believe that they can become an accountant than women. Nonbinary people are less likely than both men or women to feel a career in accountancy is possible.

Grant Thornton’s head of inclusion, diversity and ESG, Jenn Barnett, said: “It is clear that the accountancy profession needs to work harder to bust historic misconceptions. There remain clear misunderstanding about not only routes to entry but also the scope of the career on offer, which may be preventing many from considering it as an option.”

Barnett stressed: “The school you attend, your background or gender should not dictate your access to information or the career path you follow, yet our research shows that these factors contribute to the level of exposure to and understanding that a young person may have of the profession.”

• Grant Thornton has launched a myth busting campaign ahead of its 2023 trainee recruitment window.

WHERE ARE THE WOMEN?

Why are women still underrepresented in the very top positions at the Big 4 accountancy firms, asks Dr Patrizia KokotBlamey (pictured) in her new book.

Women’s access to the professions has improved remarkably over the past 20 years, and professional service firms, such as the Big 4, have invested heavily in equality,

diversity and inclusion drives. She says some, such as Deloitte, regularly feature in ‘Best Workplaces for Women’ rankings, but the number of women at the very top has failed to budge significantly over the same period. It means women make up just over 20-23% of partners in larger firms.

In her new book, ‘Gendered Hierarchies of Dependency’, Kokot-Blamey analyses this stickiness at the top of the profession. She found that the price of making it to the top is still frequently motherhood, indicating that flexible working and equal opportunity initiatives continue to fail. “There is nothing wrong with prioritising one’s career, but for many women giving up family life and motherhood in this way will be a cost too high to pay,” says KokotBlamey.

She also queries whether a focus on performance, blind recruitment and data-driven HR interventions has done anything but alienate people from one another. KokotBlamey explains: “We all spend so much time at work and, at the same time, work for many of us is no longer a place where we develop friendships or relationships of trust. A shift away from relationshipbased hiring has succeeded in getting more women through the door, but when we look at it comparatively, we can see that they are not as secure in their positions.”

Incorporating NQ magazine www.pqmagazine.com/www.pqjobs.co.uk October 2023 o.uk ISSUE250th

Joinhundredsofbookkeepers foradayofinspirational speakers,learningand networking.Nottobemissed! BOOKNOW THE ICB BOOKKEEPERS SUMMIT 2023 6th Nov 23 Park Plaza Westminster London

IN THIS ISSUE

A note from the Editor

Welcome to the 250th issue of PQ magazine. I want to thank everyone who has helped us get to this amazing milestone, and I’m sorry that there are just too many people to thank individually.

Since 2003 we have been there by the side of PQs, shining a spotlight on the profession. You can check out what some people think of how we have done on page 21.

This month is no different – our job is never done. We have just received news that AAT is promising to deal with all platform-related student complaints within five days. It has also made the decision to issue estimated results for any student who meet the following requirements:

1. Sat MATS between 1 September 2022 – until further notice.

2. Received a zero-score for Task 5 and/or Task 6.

The AATs special consideration policy was updated from the week commencing 11 September 2023.

Our joint free in-person seminar series with Queen Mary University of London is also back. In October we will be looking at creating the ethical accountant. See page 11 for more.

And, last and by no means least, PQ magazine has joined forces with VIVA Financial Tuition to offer three lucky ACCA PQs free tuition for the whole of their studies. See page 9 for all the details. Graham Hambly, Editor and Publisher, PQ magazine

News

4 CIPFA/ICAEW Accountancy bodies launch joint qualification

5 PQ October semin ar Creating ethical accountants is the theme of our upcoming seminar

6 Student survey You want more ethics and sustainability training, research has found

8 AAT 2030 strategy Association re-jigs internal structure to facilitate new plans

9 Plea to ACCA

Students in Pakistan struggling to pay subscriptions and exam fees

10 CIPFA exam results

All the latest pass rates, including the first for the new exams

12 Tech news SVOD – it’s good to share! Features, etc

14 Have your say

We really need to see our exam papers, ACCA; and how AI is going to change the face of accountancy. Plus our social media round-up

16 CIMA spotlight Last-minute tips for case study exam success

18 ACCA exam feedba ck

We run the rule over the September exams – so what was hot and what was grot?

21 Celebratin g 250 issues

We take a look back at the past 20 years – and share some kind words from the great and the good

24 Thank you PQ!

Karen Groves of e-Careers explains how PQ helped her in her studies, and why it is still an important part of what she does today

26 CIPFA/ICAEW initiative Accelerated route to gain CPFA and ACA qualifications set to deliver better career opportunities

27 Advanced tax

Keeping it simple –simplified self-employed cash basis questions

28 ACCA spotlight

Three simple steps to take to help you pass your very first accountancy exam

29 Study advice

How to move seamlessly from one phase of your training to the next

31 AAT exams

Q2022 means students will need to know more about payroll

– and we’re here to help

32 Sustainability

Net Zero Now explains what Scope 3 emissions are, and why they matter

35 The triple bottom line

When it comes to social and environmental reporting, we need whole truths not halftruths, says Robert Sowerby

p22

37 Student accommodation Increasing rental costs are creating barriers to higher education, says PwC survey

38 Working lives

Rachel Spence describes her experience of working in the legal sector as an AAT accountant

39 Careers Happiness in the workplace; tackling work/life balance issues; and our Book Club review

40 Fun

The lighter side of life – and accountancy

The columnists Lisa Nelson Theory and practice go hand-in-hand

4 Robert Bruce Audit reform – it’s the same old story… 6

8

Ann a Kat e Phelan One cable to rule them all 10 David Rothera Your planet needs you – now! 12

Prem Sikka Water giants flush money down the drain

To subscribe for FREE go to www.pqmagazine.com Octobe

r 2023

contents p18

Take the next step in your career with the CGMA® Finance Leadership Program. CFOs CFOs FUTURE WANTED

p21

LISA NELSON Theory and practice working together

CIPFA and ICAEW to launch dual qualification

CIPFA has unveiled a new accelerated route to gain both the CPFA and ACA designation, and dual membership with the ICAEW.

CIPFA’s head of qualifications, Anna Howard (pictured), told PQ magazine the private and public sectors are becoming increasingly interdependent. She explained that CIPFA is also “dedicated to providing the best possible career options for our students”.

To achieve dual status newly qualified CPFA members will have to take an additional module, Corporate Reporting, and complete

a statement of intent. Newly qualified ACA members will also be able to gain the CPFA designation by completing the

Public Sector Financial Reporting module.

Howard said: “This will mean that choosing to study a CPFA qualification does not limit your career options to the public sector for the first five years.”

She also believes the new dual membership will make students much more attractive to potential employers.

The new accelerated route to gain CPFA and ACA designations and dual membership will be launched early in 2024. If you would like to register your interest or receive further information email hello@cipfa.org

CIPFA and the ICAEW have been working more closely since late 2021.

World’s fastest accountant

Accountant and sprinter Eugene Amo-Dadzie (pictured) had to take time out of the day job to compete for GB at the World Athletics Championships in Budapest.

The senior management accountant didn’t quite make the 100 metres final, but had the 10th fastest time, and was just 0.02 seconds from making the final. He ran 10.03 in his semi-final heat.

As he told a BBC interviewer: “I am incredibly proud. I am a fulltime chartered accountant. How

dare I stand here in front of you and start being negative… I am ambitious. Don’t get me wrong, it would have been great to be in

Free ACCA guides

For many studying for ACCA and working as an accountant is just the first part of their career journey.

VIVA Financial Training believes ACCA students are ambitious, and are always looking to the journey ahead. That is why it has produced a series of

ground-breaking guides, which it hopes will offer insights and support and help allay many common doubts.

The guides cover everything from how to get a practising certificate and a salary guide –and there’s even something for the oft-forgotten affiliates!

that final, in the mixer… for me I have got to take the learning. And yeh man, I had fun, that is the main thing.”

Check them out at:

ACCA Affiliate - Your Ticket to a Thriving Career in Finance

ACCA Practising CertificatesEverything You Need to Know

Unlocking Opportunities - ACCA

aduate Jobs

What is ACCA Part Qualified?

Are

students Canary Wharf bound?

As the banks move out of Canary Wharf it looks like university students will be moving in. Search engine StuRents said that demand for accommodation in east London (that’s where Canary Wharf is) is the same as that of Bloomsbury, the heart of London’s university district. There is one problem. Canary Wharf currently has no purposebuilt student housing. However, applications for two students

blocks have been submitted to the local authority.

Accidental exam

We loved a story we recently read on one Facebook group of the PQ who ‘accidentally’ took the wrong exam. The AAT student in question booked POBC rather than ITBK. They missed the pass mark by 2%, which they said they were pleased about! We weren’t told if this was the first time they had sat the assessment or one they had already passed.

Anyone out there got a better story? We would love to hear from you, just email graham@ pqmagazine.com

New Access to Accountancy chair

Social mobility charity Access Accountancy has confirmed ICAEW COO Sharron Gunn as its new chair. Gunn replaces Hazel Garvey, who left the ICAEW at the end of June. Access Accountancy works to ensure that everyone has an equal chance of accessing and

progressing within accountancy based on merit, not background. Since it was established in 2014, signatories of Access Accountancy have included 25 organisations, incorporating the biggest firms in the sector, to improve access and progression within the profession for those from low socio-economic backgrounds. More than 5,000 work experience places have been offered to students that meet Access Accountancy’s criteria since 2015.

PQ the PQ Magazine October 2023 4

In brief In Oppenheimer, the movie, General Groves asks Oppenheimer if he was confident that when they were testing the atom bomb, the explosion wouldn’t destroy the entire world. Oppenheimer says that the chances of that happening were “near zero”, to which Groves repeats “near zero”. Oppenheimer replies: “What do you want from theory alone?” “Zero would be nice,” says Groves. This is an excellent example of the need to have theory and practice; they work together both in the real world and the classroom. It can, however, be frustrating for some learners who are being taught a theory without any apparent practical application, or at least one they can see. And yet it’s often the theory that helps us navigate the complexity of the real world in order to come up with solutions. Theories are academic models or frameworks that explain or predict what should happen, while practice is the application of knowledge, including theories and skills in a given situation. Many exam questions follow a similar structure, asking the learner to explain a theory before applying it to a given situation. And while theories can be memorised, if you don’t understand them you won’t be able to apply them. But what of those learners who don’t like or appreciate theories? The best solution is to ask your tutor what the theory will help you do. After that learn it, because one day it might help you solve an important problem – in theory at least!

Lisa Nelson is Director of Learnin g at Kaplan

Gr

Benefits

Opportunities

An ACCA Qualified SalaryWhat To Expect

and Career

Explained

ACCA EXAM FEEDBACK

ACCA students looking for the perfect exam experience may need to book the Imparando venue. Apparently, it is “always great”. One student gave it five stars, explaining the staff are always nice and helpful. The exam rooms and equipment are also good and “they just don’t

disappoint you”.

While many praised the centre, the same could not be said for the AFM September exam! In the Open Tuition Instant Poll, one in three sitters said the exam was a disaster, and another 41% said it was hard.

In stark contrast APM sitters

Save the date

Queen Mary University of London’s award-winning seminar series is back. The PQ team and a whole list of guests will be descending on Queen Mary University of London on Wednesday 25 October to discuss how the professional bodies create the Ethical Accountant.

Over the coming weeks we will be assembling a panel of experts to see just how good a job is being done.

As always the event starts at 6pm sharp, but

left the exam halls feeling fairly confident, something that doesn’t happen too often. ATX sitters were also pretty happy, and there were not many complaints for the AAA examiners, either.

The new-look SBL exam seemed OK. However, some students felt the pre-seen was “largely redundant for the exam other than to give you the feel for the industry”.

September SBR exam was deemed a tough one, as was the PM exam this time around. PM was described by sitters as awkward, tricky and very tough! • For more feedback see page 18

AAT

assessment

problems are back!

AAT experienced core infrastructure problems at the end of August, with systems issues impacting assessments for several days.

The association told colleges it was working to establish the root cause and resolve the issues, and explained that its systems “are currently stable”.

AAT again apologised for any inconvenience this caused to sitters, and said students needed to submit an incident report so it can provide support and investigate the matter further.

As another academic year starts, one worried tutor said many students are not convinced that the ongoing software problems are going to be resolved any time soon.

AAT’s Claire Bennison told PQ magazine that while incident reports concerning the assessment platform remained low in August, it is continuing to prioritise dealing with emerging issues, fixing remaining problems, improving customer response and student experiences.

She also explained AAT recently experienced some tech issues caused by AAT’s firewall and its data centres. These were fixed in less than three hours.

PQ 5 PQ Magazine October 2023 PQ news

Sign

at https://tinyurl.com/3z4tvp5a

there is time for networking and a bite to eat before it all kicks off, so doors open around 5.30pm.

up

ROBERT BRUCE

More ethics please!

It is simply astonishing. Two events in the past month tell you everything you need to know about the importance of financial reporting. First up was the publication* of an account of the period in the 1990s when the government got behind efforts to make financial reporting rules thunderously effective. As Professor Geoff Meeks makes plain in the book, when the reform programme into its stride ‘inward portfolio investment in UK equities recorded a 20-fold increase’ and as his own research shows ‘London played a disproportionate role in international M&A’. This is exactly the sort of economic boost the UK needs at the moment. But politicians, only looking at the short term, fail to learn from history.

As became plain in August the government, for the umpteenth time, is kicking plans to reform audit and corporate governance into the long grass once more. It is the old story. And so the long-awaited replacement of the Financial Reporting Council with a much more powerful and influential Audit, Reporting and Governance Authority, vanishes into the mists of the future once again. Instead of, as the book makes clear, boosting the economy, the politicians have decided that things called audit will not boost their chances of being re-elected next year. Instead of doing something to benefit everyone they have chosen the route of simply benefiting themselves.

* ‘The UK Accounting Standards Board, 1990-2000: Restoring Honesty and Trust in Accounting’, by David Tweedie, Allan Cook, Geoffrey Whittington and Geoff Meeks.

Almost every accountancy student (97%) says their current curriculum does not sufficiently cover broader ethics, social or environmental sustainability issues.

Students also want to see more belief ethics, accountability and critical accounting in their studies.

The problem is that many students do not believe that they have any power to change the

accountancy curriculum themselves, and feel that the accreditation bodies have the most power to engender change.

A recent Rethinking Accountancy snapshot survey also found that only one-third of respondents believed their course prepared them for the world of work.

Money seems to be the big reason for studying accountancy.

Some 89% of respondents admitted that the prime motive to study for an accountancy degree was the high earning potential and not to have a social or environmental impact.

The number of exemptions that a student can get from a business school influenced 68% of students when choosing their degree.

Rethink Accountancy organiser

Mzwanele Ntshwanti said: “Ethics has never been more important in accountancy, since the profession has been embroiled in a series of recent scandals involving fraud, tax evasion and corruption, as well as environmental and socially unsustainable practices.”

• Read the full report at https:// tinyurl.com/3um8mj5n

What happened to the PQ of the Year 2020?

Bethany Duffy’s journey in her words:

“5 years, 2 months and 3 days ago, it was my last day at sixth form

4 years, 11 months and 28 days ago, I joined Grant Thornton on the school leaver programme.

3 years, 5 months and 1 day ago, something called a lockdown was announced!

3 years, 4 months and 3 days ago, I completed my AAT qualification.

Today (25 August 2023) I passed my final ACA exam to become a qualified chartered accountant

(with all first time passes and all study remote!).

It’s fair to say it has been a journey, but I’m proud to say I made

it! What will the next 5 years, 2 months and 3 days look like?”

Bethany Duffy was PQ magazine’s PQ of the Year in 2020.

From Mongolia to Montenegro

Almost 450 tax students were celebrating recently after passing Chartered Institute of Taxation ADIT (Advanced Diploma in International Taxation) exams, including the first-ever cohorts from Israel and Mongolia.

A total of 765 students sat 816 online exams in June across

68 different countries, with 442 of those passing at least one exam, and 144 successfully completing their third ADIT module and achieving the full qualification. Of the new ADIT holders, 11 also achieved the distinction grade for excellence in their exams.

The ADIT qualification is now held by 1,905 tax practitioners in 91 countries and territories around the world, including the first ADIT holders in Lesotho and Montenegro, and more than 350 have chosen to subscribe with the CIOT as International Tax Affiliates.

For a fourth year in a row

UK has honoured offers it made to students joining the firm as school and college leaver apprentices in September, regardless of their final A-level results. The firm said the 75 students joining the apprenticeship schemes are still feeling the

programmes have already passed a series of assessments as part of their

6 PQ the PQ Magazine October 2023 PQ course finder Looking for a top tutor for your AAT, ACCA or CIMA studies? Well, look no further – check out our PQ CourseFinder feature on www.pqmagazine.com. Just click on the ‘Coursefinder’ bar at the top of the home page and you can see all the top tutors in one place. We belied that if you choose one of these top colleges you will be able to get to where you want to be in double-quick time – you can now find a course that ticks your boxes in 60 seconds!

means we have rejigged the website a bit and you can now find our Testbank series in the Study Zone.

honours offers

It

PwC

PwC

process to PwC.

to

a faculty? Did you know that ICAEW students can subscribe to any of the five institute faculties for free? By joining you will receive the latest technical advice and best practice guidance delivered straight to your inbox. You can also hear from industry experts on a range of topics, and meet and engage with like-minded professionals on topics that are important to you. In brief

impact of the pandemic on their education. And although this year's A-level students will have experienced a nearly normal Year 13 and exam period, they will potentially never have sat a GCSE or undisrupted AS exam. Combined with recent strike action, PwC recognises the potential for these factors to impact final A Level grades. Students joining the firm on the apprenticeship

application

Time

join

Robert Bruce is an award-winnin g writer on accountan cy for The Times

Audit reform: it’s the same old story…

PREM SIKKA Money going down the drain

England’s

AAT moves forward with 2030 strategy

AAT has announced changes to its internal structure to help support its new strategic plan to 2030.

The strategy, announced in February, aims to advance the recognition of accounting technicians globally and strengthen AAT’s community through innovative and relevant products and services.

Since

company in the past two years, but the public statement is that it hasn’t paid any dividend for the last six years.

Yorkshire Water has paid £116m in dividends to its parent company in the past two years, but the PR spin is that company hasn’t paid any dividends.

In accordance with accounting standards, water companies capitalise interest payments on part of repair/ maintenance which they consider to be an enhancement. Thames Water has capitalised £330m interest in the past two years.

Capitalisation of interest payments is imprudent. It inflates distributable profits and enables companies to pay higher dividends. Inevitably, companies borrow money to pay dividends. It overstates investment in assets, which bears no relationship to any market or fair value. The folly of these practices was highlighted by the 2018 collapse of Carillion, but there has been no reform.

Water companies submit an annual Performance Report to regulator Ofwat, to enable it make assessment of company resilience. Capitalisation of interest is not permitted in such reports. Why are other stakeholders given imprudent accounts?

Tax briefs

Taxing private schools works!

The Labour Party have committed to remove tax exemptions from private schools, including exemptions from VAT and relief on business rates.

A new report from the Institute of Fiscal Studies has estimated that such a move would raise tax revenues by about £1.6 billion.

The evidence suggests that putting VAT on private school fees would have a relatively limited effect on numbers attending

AAT’s new structure will put members and students at the core of its activities, and is organised around three new distinct portfolios: Strategy and Compliance; Customer, Partnerships and Innovation; and Performance and Transformation. Each portfolio will consist of four major functions.

One key change is the integration of AAT’s Awarding Body and Membership, which will enable the association to create a better and more seamless experience for its thousands of students, members, and partners

EY to make job cuts

EY is planning to make job cuts to its UK financial services consulting division. Over 5% of staff are expected to be made redundant –that’s around 150 people.

The Financial Times newspaper has also reported that all staff have been told their bonuses will be smaller this year.

In a statement EY said: “EY continues to perform strongly, with double-digit growth in the

UK, and the vast majority of our people will receive an annual pay rise and variable bonus payment this year. EY’s UK financial services consulting practice has taken measures to align current resourcing requirements with market demand. Regrettably, a group of employees in this part of the business are now subject to a redundancy consultation process.”

across the globe.

There have also been some changes to AAT’s leadership structure, including the Executive Team.

The new structure will now be implemented over the next eight months, and is due to be fully operational by March 2024.

Sarah Beale, Chief Executive, AAT (pictured), said: “Our new strategy outlines our ambition to achieve greater global recognition for accounting technicians, ensure businesses and government understand the value they bring in supporting productivity and growth, and ensure economies and societies around the world benefit from our community’s expertise.”

Birmingham issues Section 114 notice

Birmingham City Council has issued a Section 114 notice as part of plans to meet its financial liabilities relating to Equal Pay claims and an in-year financial gap within its budget, which currently stands at £87m.

In June, the council announced that it had a potential liability relating to Equal Pay claims in the region of £650m to £760m, with an ongoing liability accruing at a rate

of £5m to £14m per month. In July the authority ceased non-essential spending.

Birmingham City Council said it will tighten spending controls already in place and put them in the hands of the Section 151 Officer to ensure there is ‘complete grip’. The notice means all new spending, apart from protecting vulnerable people and statutory services, will stop immediately.

private schools

– perhaps a reduction of 3 – 7% in private school attendance. With a small movement of pupils into the state sector, costing perhaps £100 –£300 million a year, this would lead to a net gain to the public finances of £1.3 – £1.5 billion.

Italian windfall tax

The Italian government recently announced that it was planning a 40% windfall tax on banks, targeting the extra profit they had made from higher

interest rates. It sounded like a good idea at the time, but it saw billions wiped from stock market values – and even the European Central Bank wasn’t happy, and said so!

The government watered down the levy and put a cap on the tax in order the calm markets. The tax could raise €2 billion, which the government was going to use to lower taxes and help those on low incomes. Banks have been slow to pass on any rate rise to savers and the UK has looked at a similar tax.

Footballer’s tax debts

Tax officials have launched a bankruptcy petition against former Liverpool and England footballer John Barnes.

The judge was told Barnes owed HMRC £238,000 in unpaid taxes. It was revealed in court that Barnes is employed by Liverpool Football Club as an ambassador and is paid £200,000.

This is not the first time this year that HMRC has tried to take Barnes to court over his unpaid tax bills.

8 PQ the PQ Magazine October 2023 news

water companies boost their profits

dumping sewage in rivers and failing to plug leaks. This is accompanied

obfuscation and imprudent accounting.

by

by

1989, companies

paid £72bn in dividends and claim to

invested £190bn in infrastructure.

numbers are deceptive.

accounts say that they have paid ‘dividends’ to parent companies, but they

not considered to be dividends. For

Thames Water has paid £82m in

to its parent

privatisation in

have

have

Both

Their

are

example,

dividends

m Sikka

Emeritus Professor of Accounting at the University of Essex

Pre

is

Economic challenges for ACCA Pakistani students

Students in Pakistan are asking the ACCA to look again at the fees for exams and annual subscriptions.

One student appealed directly on LinkedIn to CEO Helen Brand explaining: “Our nation and our students are facing unprecedented financial constraints.”

They pointed out that the devaluation of the Pakistani rupee against the pound has meant the current exchange rate is £1 to PKR385 – last year it was £1 to PKR250. This has significantly inflated the cost of education and living for ACCA students. The student pointed

New faces at ICB

out that the rise in the WTH tax rate has also increased from 2% to 10%, adding to financial pressures.

The student told Brand that the prevailing economic climate had seen a rise in unemployment, meaning many students can no longer support their studies.

What they want is a reduction in fees. Brand responded to the student saying: “We recognise the economic challenges that you and all our students are facing in Pakistan and are working to support you as much as we can through our pricing policy and learning support.”

Audit reform to be shelved

The UK government looks set to remove the much-delayed overhaul of the audit and governance regimes from its programme of legislation for 2023.

The Financial Times said that the absence of legislation in the King’s Speech would

mean that the changes are now unlikely to happen before the next general election.

Questions will now be raised where this leaves the Audit, Reporting and Governance Authority (ARGA), which is supposed to be replacing the Financial

Reporting Council. It could mean the ARGA may not come into existence until 2027.

The FT did find someone ‘in the know’ who said some of the measures might appear as secondary legislation, but admitted ‘wholesale reform’ will not make it onto the current agenda.

The Institute of Certified Bookkeepers (ICB) has announced a series of appointments to help it meet the changing needs of the nation’s bookkeepers.

Ami Copeland (pictured), who was appointed CEO in January 2023, explained: “ICB bookkeepers are the best in the world, and they deserve the best team to represent them. Our new recruits have a proven track record of delivery, and will enhance our already excellent ICB team.”

New recruits include Yvonne Rennison-Stone, who joins as Director of Professional Standards.

Elizabeth Carter joined ICB in July as Head of Marketing.

Another key recruit is Abigail Chamberlayne, who joined ICB in May of this year as AML Professional Standards Officer.

Copeland said: “In addition to Yvonne, Elizabeth and Abigail, we have also welcomed Simon Milhomme and Nathan Tucker into our friendly member services team this year. Simon and Nathan work alongside Lorna Bailey under the management of Polly Thrasivoulou, who took up the role of Head of Member Services in March.”

Three ACCA scholarships up for grabs

PQ 9 PQ Magazine October 2023 PQ news

PQ magazine and VIVA Financial Tution are joining forces to offer three lucky ACCA students tuition for the entirety of their studies! VIVA is celebrating the rolling out of its online ACCA tuition, and the lucky students will unlock its All Access membership, until they don’t need it anymore! VIVA’s All Access membership gives entry to all 15 of its standard ACCA courses. To be in with a chance to win one of these three scholarships students simply have to register for VIVA’s free ACCA mailing list at: https://app.vivatuition.com/register-form. The draw closes on Sunday 15 October. We will announce the winners on Tuesday 17 October.

ANNA KATE PHELAN

One cable to rule them all!

could be a thing of the past very soon. A new EU law mandates that phone suppliers should all use the same charger (USB-C) by December 2024. The intention is to reduce waste and save the public money (diminished faff is just a wonderful by-product).

Although it’s an EU law it will affect manufacturing on a global scale, with Apple’s iPhone 15 due to have its ‘lightning’ cable replaced with USB-C when it’s unveiled to consumers. USB-C will also be launched with four new phone models, meaning you can have a single charging cable across some Apple devices, as well as with others including Android smartphones.

It’s been reported that Apple would have preferred to make their devices portless (utilising wireless charging) rather than make the switch to USB-C; however, this law forced their hand.

This change has been generally welcomed by consumers, Apple has concerns, stating: “Strict regulation mandating just one type of connector stifles innovation rather than encouraging it, which in turn will harm consumers in Europe and around the world.”

A fair point and one to be cognisant of when it comes to further legislation, but a small win in the battle against faff!

New CIPFA papers coming through

June saw the first sitting of some of the new CIPFA futures qualification exams.

While the CF Business Planning & Financial Management paper had a pass rate of 68.99%, the CF Business Reporting exam saw a pass rate of 57.50%.

The summer CIPFA exams show a massive jump in the CF Audit and Assurance paper. Last December it was 38.96%, in March it dropped to 36.11%, and then in June is rocketed to 74.7%.

In stark contrast, the old Business & Change Management pass rate went the other way –

from 73.91% in March this year to just 46.72% in June.

Two papers had pass rates

in excess of 90% – Corporate Governance & Law and CF Management Accounting.

A worry is the Strategic Case study pass rate, which has slipped to 50%. It has regularly been 70%plus and December 2221 it was 85.5%.

CIPFA students may have noticed there was a slight increase in exam fees from June 2023. The existing Strategic Public Finance and Strategic Case Study modules and the four new strategic papers in the new CIPFA futures qualification were increased to £240. All other modules increased to £120.

Advanced Level ACA results

The ICAEW July 2023 ACA Advanced Level exam results hit the streets in late August. In all, 5,516 PQs sat the exams, with 8,773 exams attempted (a 1.6 paper average).

The pass rates were: Case Study 82.7%; Corporate Reporting 83.7%; and Strategic Business Management 88.5%.

All the pass rates are ever-soslightly up on the November 2022 results.

The Level 7 Accountancy Professional apprentices who sat the Case Study exam this summer

achieved an 86.4% pass rate. Some 598 candidates sat all three papers and 74.6% (446) passed them all. Another 103 passed two out of three.

The pass rates varied for those

IASB amends IAS21

The International Accounting Standards Board (IASB) has issued amendments to IAS 21 The Effects of Changes in Foreign Exchange Rates that will require companies to provide more useful information in their financial statements when a currency cannot be exchanged into another currency.

The amendments respond

Deloitte welcome 1,700 new starters

Early September saw Deloitte welcome more than 1,700 new people to its graduate, BrightStart apprenticeship and industrial placement programmes.

New joiners took part in a two-day virtual/ in-person induction programme, which includes skills sessions on confidence building and networking.

Deloitte’s Jackie Henry said: “As a Deloitte graduate myself, I am particularly proud of all of our graduates, apprentices and those on placements with us. They’ll be building the skills they need to succeed in an ever-changing world of

to stakeholder feedback and concerns about diversity of practice in accounting for a lack of exchangeability between currencies. The amendments will help companies and investors by addressing a matter not previously covered in the accounting requirements for the effects of changes in foreign exchange rates.

work and I look forward to meeting them and can’t wait for them to bring their fresh approaches and new ideas to make a real impact for our clients and our firm.”

‘Strong and stable’ growth at PwC UK PwC UK consolidated Group revenue rose by 16% to £5.8 billion, according to the latest annual report (to year ended 30 June 2023).

The Big 4 firm said the group’s consulting revenues maintained “the significant growth levels of the previous year”, with growth of 30% (33% in FY22).

Expanded reporting requirements have likewise increased client demand for the group’s audit services. Group audit revenues were up 19%, with the UK practice winning a number of high-profile

sitting just one paper. For ALCS it was 86.9%; for those who opted to sit just ALCR this summer the pass rate slumped to 64%.

The stats also show that 717 PQs failed all the papers they sat.

These amendments will require companies to apply a consistent approach in assessing whether a currency can be exchanged into another currency and, when it cannot, in determining the exchange rate to use and the disclosure to provide.

The amendments will become effective from annual reporting periods beginning on or after 1 January 2025, although early application is permitted.

mandates, including becoming auditor to NatWest from 2026, and being reappointed by HSBC.

The average distributable profit per UK partner averaged £906,000, down from the £920,000 the previous year.

What keeps CFOs awake at night?

UK finance leaders expect incoming international regulatory reform and sustainabilityrelated reporting rules to have a major impact on their organisation’s finance functions, according to the latest EY Tax and Finance Operations Survey (TFO)

The reporting period for global 15% minimum tax rate called for under the base erosion and profit shifting (BEPS) Pillar Two will come into effect in the UK from 31 December 2023.

10 PQ the PQ Magazine October 2023 news

all had the experience of arriving somewhere only to find our phone is in need of charging. If you find yourself chargerless you might as well be powerless. “Could I borrow your charger?” “Oh no, not that charger, do you have another one?” This faff

We’ve

Ann a Kat e Phelan is Head of Produ ct at Eintech

THE ETHICAL ACCOUNTANT –ARE REGULATIONS, STANDARDS, AND CODES ENOUGH TO CREATE THE HONEST ACCOUNTANT?

The Queen Mary University of London seminar, brought to you in association with PQ magazine

The Queen Mary University of London and PQ magazine in-person award-winning seminar series is back.

Our latest seminar will look at who policies the accountancy profession, who sets the standards, and how we ensure accountants work in the public interest!

We are putting together a top panel of experts, who will provide the insight and help get the debate started.

Join us on Wednesday 25 October at the Graduate Centre Lecturer Theatre, as we search for the ethical accountant.

The event will start at 18.00 BST, but doors will open at 17.30 for networking. There will be sandwiches too!

Click here to book your free place.

The Ethical Accountant – are regulations, standards, and codes enough to create the honest accountant?

Date: Wednesday 25 October 2023

Venue: Graduate Centre Lecturer Theatre, Queen Mary University of London, Mile End Road, Bethnal Green, London E1 4NS

Time: 18.00 – 20.30 (networking from 17. 30)

This event is supported by

DAVID ROTHERA

Sharing accounts the way to go

With the appointment of the new Secretary State for Energy Security and Net Zero, Claire Coutinho MP, we hope that fresh vigour and focus will result in urgent, actionable steps to get as many businesses on the road to Net Zero as possible.

It is now widely recognised that urgent action is needed to mitigate the impact of climate change. In this context, accountants have an important role to play in tackling the climate crisis and this is why we launched the Net Zero Accountancy Initiative. We truly believe that accountants can save the world!

Accountants are responsible for tracking and reporting on the financial performance of businesses. This includes tracking their carbon footprint and other environmental impacts. By measuring carbon emissions, accountants can help firms identify areas where they can reduce their environmental impact.

Accountants can also play a crucial role in helping organisations to transition to a low-carbon economy. They can provide financial and strategic advice on how to reduce their carbon emissions, invest in renewable energy, and adopt sustainable business practices. This can include access to green finance and securing funding for sustainable projects. By promoting transparency and accountability in relation to environmental issues, they can help to hold them accountable for their actions and encourage them to take responsibility for their impact on the environment.

We provide all the tools you need to complete your journey to Net Zero and communicate your achievements to your customers, your employees and other key stakeholders. Find out more at www. netzeronow.org/accountants

More than a third (35%) of people with access to a subscription-videoon-demand (SVOD) services are sharing at least one of their subscriptions with others outside of their home, according to Deloitte.

Subscription sharing has also become more formalised, with a quarter of users (25%) sharing the cost of an SVOD platform they use

with other households. This is most prolific among younger users – 34% for 16-24 year-olds and 32% for 25-34 year-olds.

Among respondents who are currently using a service paid for by someone outside their household, the majority (57%) say that they would stop consuming the service if subscription sharing was banned.

Only 15% say that they would take out a new subscription themselves if sharing was banned.

Deloitte partner Paul Lee said: “Since the birth of subscriptionvideo-on-demand, the sharing of user IDs and passwords with other households has been widespread. As SVOD providers look to implement tighter guidelines around sharing to boost subscriber numbers and revenues, consumers are being faced with the choice of paying more, moving to lower-cost ‘with-ads’ packages or foregoing their access altogether.”

Time to get back to the office?

It may seem ironic but Zoom, the video calling app, is the latest big firm to tell staff they need to come back into the office.

Zoom wants staff in at least two days a week at one of its bases. The announcement follows similar moves from the likes of Apple, Amazon, BlackRock and Goldman Sacks.

A Zoom spokesperson said: “We believe that a structured hybrid approach – meaning employees that live near an office need to be onsite two days a week to interact with their teams – is the most

effective for Zoom.”

Oh, and Zoom doesn’t want people in the office more – they

UK fintech investment halved

Total UK fintech investment dropped to $5.9 billion in the first half of 2023, down 57% from $13.8 billion in the same period in 2022, according to KPMG’s Pulse of Fintech report, a bi-annual report on fintech investment trends.

The report said the first six months of 2023 were “quite challenging” for the global fintech market. Some of the challenges

were expected – high levels of inflation, rising interest rates, the ongoing conflict between Russia and Ukraine, depressed valuations and a lack of exits; others were less so, including the collapse of several banks in the US.

John Hallsworth, Client Lead Partner for Banking and Fintech at KPMG UK, said: “Despite a slowdown in UK fintech investment compared to last year, the UK

want them to return to ‘an engagement hub’! It has just opened a new one in London’s Holborn.

remains at the centre of European fintech innovation with British fintechs attracting over half the funding of Europe.”

X

This has all lead to the speculation that next on X’s list is a recruitment service for users. Earlier this year X Corp bought Laskie, a tech recruiting company. The new privacy policy comes into effect on 29 September 2023.

12 PQ the PQ Magazine October 2023 Send your AI assistant to the meeting! It is being reported that Google is ready to give users of its videomeeting software the option to send an AI assistant to meetings. Duet AI will take notes and then present ‘talking points’ on your behalf. Google says the technology is designed to give employees an alternative to cancelling meetings if they have an important work deadline. Some employers, however, might be worried it is another tool for work-shy employees, who will simply use the AI to work for them while they do the shopping. And what would happen if everyone sent their AI assistant to the meeting?

save you 100 hours

AI could save the average UK worker over 100 hours a year. A new report claims this will be the biggest improvement in worker productivity since

introduction of

engine. Google’s Economic Impact Report says unlocking UK’s productivity through AI could boost the economy by £400 billion. And its use in the public sector –primarily in health and education – could also free up an additional £8 billion. The report is a bit hazier about the impact to jobs.

to collect biometric data

formerly

has said it will be collecting biometric data

its

an update

Premium,

face it can also collect your employment and educational history.

AI will

Generative

the

the search

X

X,

known as Twitter,

on

users. In

of its privacy policy for X

on top of photos of your

says it will use this information to “recommend potential jobs for you, to share with potential employers

you

for a

when

apply

job”.

Tech briefs tech news

David Rothera is Climate Project Manager at Net Zero Now

Your planet needs you – now!

Earningindustryrecognisedqualifications fromAATand CIMA enablesyou toupskill fora promotion quickly and efficiently atwork or progress into more senior jobroleswith anew organisation.

Why study yourAAT or CIMA qualifications withe-Careers?

Award-winning training provider

5-star rating on Trustpilot.

Trained over 600,000 students worldwide.

-.. Like-for-like price match guarantee. High pass rates. Experienced Tutors. Additional resources to aid your studies. Tutor support

✓ Live online classes are included. We offer interest-free payment options.

AATPathway aat Approved CIMAPathway ·�CIMA

AATLevels 2 and3

Ideal for those considering a career as on Accounts orFinanceAssistant, Bookkeeper, or Payroll Supervisor. They would also be good choices for professionals looking to start their own business, offering some financial services.

AATLevels4

Suited for those consideringbecoming a qualified Accountant, or interested in senior accounting or financejob roles. It would also suit those individuals who are interested in a career as a VAT or Tax specialist.

CIMACertificate in BusinessAccounting

The entry-pointfor professionals looking to make the progression into business or management accounting. Typicaljobroles at thislevelincludeAccounts Assistant, and Sales LedgerClerk

CIMA Professional Qualifications

These three progressing levels will teachyou all you need to put you on the path to a career as a Finance Manager, Management Consultant, Finance Director, CFO, or CEO

B www.e-careers.com (accounting)

<6 +44 (0) 20 3198 noG Mon -Fri I 9am - 6pm *Trustpilot Excellent l!JrJrJrJfl w IJ ml a @ *

We need to see our exam papers!

First of all, I’d like to thank you guys for this amazing monthly magazine, so interesting and enriching.

I have to agree with the student who said ACCA should allow us to see our exam paper post-marking (Letters, PQ, September 2023).

This is something I have always wanted to happen, and have even tried to raise the issue via ACCA surveys. However, as I expected, ACCA never responded to my request.

I share my fellow students’ frustration; exactly how is a student supposed to know where he/she went wrong if they can’t see how they have been judged?

Yes to feedback

I agree with your letter writer last month that as an ACCA student we pay a huge sum to sit the exam, so we should at least get feedback on where we did well and where we can improve the next time we attend the paper. Otherwise, this just screams ACCA fail people to gain profit.

I also believe we should be able to challenge the marking just how we used to for GCSE or A-Level papers.

Name and email address supplied

I want one too!

I see the AAT has launched a new Student Advisory Group. A great move on their part. Now what about ACCA?

The AAT is an international body and seems to be embracing the idea of hearing genuine feedback. Surely ACCA can pilot a similar project?

Name and email address supplied

AI will be coming for us all

Like you Mr Editor, I am not surprised by the OCED’s report that AI is coming after the work of even the highly skilled staff members with years of education. For years accountants I worked with seemed

We need that feedback in order not to repeat same at the next sitting!

Like many students, it just makes me think ACCA is a purely focused on making money, and this could be the reason why ACCA does not return examination

papers after correction. Meanwhile, for students it means re-doing papers once, twice or even more times before passing.

To cut it short, I would be grateful if PQ magazine could look at a way we could see our papers. After all, they are ours! Name and email address supplied

The Editor says: You are not alone in your request (see below). I know ACCA does lots of surveys and tries to get feedback from students, but then it all sort of disappears. I think it should take a leaf out of the AAT’s book and create a student advisory group. This would give students a real voice and allow for a grown-up debate on such issues.

The announcement of a new CIPFA and ICAEW dual qualification got lots of people talking.

Since 2021 CIPFA and ICAEW have officially been working more closely. As ICAEW CEO Michael Izza said in the press release announcing the fast-track pathway to dual membership: “We have long been of the view that closer working between ICAEW and CIPFA will bring significant strategic benefits for both institutes, which will in turn be good for members and students, the profession and wider society.”

CIPFA boss Rob Whiteman agreed: “I’m confident that going forward we’ll see even stronger partnerships between CIPFA and ICAEW.”

So, the obvious next question for many is when are the two going to move in together?

Back in 2005 a merger was suggested, but it was voted down after an ICAEW membership vote fell short of the necessary majority –by just one percentage point. Some 65.7% of ICAEW members voted in favour of a merger, but it needed 66.7% to go ahead. CIPFA members voted overwhelmingly for a merger.

Then in 2007 the two signed a memorandum of understanding, but that fizzled out.

So, no talk of merger from the bodies themselves, but is it time for another go?

in denial that a smart computer could do a lot of what they did!

AI will become so integrated at work that juniors have to be careful – generative AI is a learning programme and once it has learnt what they can do some firms might ask: why do we need so many juniors anymore?

We still have some way to go,

but as a profession I think we need to understand what the future holds and be ready to change with the wind. Being an accountant is still a great thing to be, and something I have never regretted.

Understanding finance in a wider context is important and using your CPD to keep up with trends is vital.

Name and email address supplied

Some outside the profession are often shocked by the number of accountancy bodies operating in the UK, and many inside the profession believe if there was one main body then they would have a bigger voice. A merger between the ICAEW and CIPFA could be the start of creating a unified profession.

14 PQ PQ Magazine October 2023

PQ Magazin e PO Box 75983, London E11 9GS | Phone: 07765 386489 | Email: graham@pqmagazine.com Website: www.pqmagazine.com | Editor/publisher: Graham Hambly graham@pqmagazine.com | Associate editor: Adam Riches | Art editor: Tim Parker Contributors: Robert Bruce, Prem Sikka, Lisa Nelson, Ann a Kat e Phelan, Tony Kelly, Phil Gammon, Edward Netherton | Subscriptions: subscriptions@pqmagazine.com | Origination services by Classified Central Media If you have any problems with delivery, or if you want to change your delivery address, please email admin@pqmagazine.com Published by PQ Publishing Ltd © PQ Publishing 2023

email graham@pqmagazine.com

Our star letter writer wins a fantastic ‘I love PQ’ mug!

The CGMA Finance Leadership Program (CGMA FLP) is a digital-first learning and assessment platform that lets you get the globally recognised CGMA designation anytime, anywhere and at your pace. With the CGMA FLP, you can fit your learning to your schedule, sit with less formal exams and uncover a new realm of career possibilities upon completion. Find out more at aicpa-cima.com/flp. Founded by AICPA® and CIMA®, the Association of International Certified Professional Accountants® powers leaders in accounting and finance around the globe. © 2023 Association of International Certified Professional Accountants. All rights reserved. 2307-444079 Take the next step in your career with the CGMA® Finance Leadership Program. CFOs FUTURE WANTED

Last-minute tips for case study exam success

With the right approach and mindset, exam success is well within your reach, says Nasheen Wuisman

from examiners and students to optimise your planning for the case study exam.

Prioritise key concepts and topics

Focus on critical topics that are frequently examined in case study exams.

Revisit the core concepts and materials you have already studied rather than delving into new topics. At this late stage, attempting to learn entirely new content may lead to confusion and prevent effective retention.

Self-care for the right mindset

A well-rested mind performs better, so try to avoid pulling an all-nighter before the exam. After a good night’s rest, you’re more likely to retain information efficiently and demonstrate critical-thinking abilities.

As the exam day approaches, it’s natural to feel nervous. You’ve studied and worked hard, and the pressure is on. To combat the nerves, try relaxation techniques such as deep breathing, meditation, or light exercise to help keep anxiety in check.

Your next case study exam

As you prepare to take the next case study exam, adopt a structured approach and plan your study process in stages to ensure a comprehensive and efficient review.

The case study exams are critical milestones in your journey to achieving the Chartered Global Management Accountant (CGMA) designation.

As the exam date approaches, you might feel a mix of excitement and nervousness.

In the final 48 to 24 hours before the case study exam, work to reinforce your existing knowledge rather than trying to cram new topics. To set yourself up for success, focus on demonstrating your skills, prioritising key concepts and maintaining a confident and wellrested mindset.

A strategic approach during this critical period will maximise your chances of achieving a positive outcome in the exam.

Demonstrate your skills

The examiner wants to see you demonstrate your skills in the exam. It’s crucial that you can apply your theoretical understanding of key concepts and showcase practical problemsolving.

Focus on the following skills:

• Application: Before the exam, ensure that you know how to structure your answers to show the examiner that you can apply technical knowledge in practical situations.

Demonstrate that you are business aware

by practicing these application skills, so they become second nature.

• Answer planning: Although you have already familiarised yourself with the preseen, reading it over the day before the exam will keep the content fresh in your mind. That way, when you get the unseen on exam day, you’ll be prepared to link the information together and make brief notes in response to the task. This approach lets you jot down your ideas as they arise, ensuring you capture your thoughts in real time. Developing an answer plan during the exam will empower you to present your response effectively.

• Time management: Although the pressure of exam day can make it challenging, good time management during the exam is crucial to success. Integrate timed question practise into your study routine. As the exam date approaches, take the time to establish your comfort level with the allocation of minutes per mark. This ensures that you know the time required for each task so you can manage and adhere to your time allocation effectively. For more insight on case study exam preparation, explore The Little Book of Secrets from AICPA & CIMA, filled with practical tips

A well-structured study plan builds your expertise and instils a sense of preparedness that will be a powerful asset during the case study exam.

Consolidate your technical knowledge and focus on core accounting and management principles relevant to the exam. Once you’ve grasped the fundamentals, use them to analyse the pre-seen material. Familiarise yourself with the key stakeholders, businesses and intricacies of the scenario to gain a deeper contextual understanding.

Regularly integrate mock exams into your study routine. Practising with realistic case study scenarios allows you to hone your problem-solving skills, develop effective strategies, and gauge your progress.

In the final days leading up to the exam, focus your revision on crucial areas that require reinforcement. By keeping these essential concepts fresh in your mind, you can approach the exam day with confidence and clarity.

The CGMA Study Hub offers various free resources and study support. You’ve got a team of professionals working to help you reach your educational goals and find your dream job.

• Nasheen Wuisman, Senior Manager of Global Academic Progression at AICPA & CIMA, together as the Association of International Certified Professional Accountants

16 PQ PQ Magazine October 2023 CIMA spotlight

–▪ ▪ ▪ ‘live online’ –▪ Scheduled ‘live online’ –▪

September exam feedback

Were the ACCA exams a piece of cake? Here’s what those sitting the September exams thought of them…

SBL

Despite it being in the June exam some sitters were surprised to see culture come up again.

One sitter said: “The pre-seen was largely redundant in use, other than to give you a feel for the industry.” They also felt the exam required very little syllabus knowledge, but were worried because it did not feel challenging in any way.

Disruptive technology came up, but some felt all the answers were in the extract. Student struggled here, and many felt they were repeating themselves.

Unfortunately, we read that one student had prepared for a four-hour exam! Surely there are no excuses for not knowing about the changes.

AAA

Not many complaints about the AAA examiners – but the sudden hot weather in the UK and lack of air conditioning at some venues were a shock to some.

As one sitter said: “Exam was OK. I had group audit for 50 marks, forensic audit for 25 and final accounts sign off (material misstatement) 25 marks.”

Others had due diligence, redundancy and PPE.

AA

Many sitters thought September’s AA exam was OK. Some of the MCQ were ‘a bit difficult’ and even ‘tricky’, but section B was deemed ‘fine’.

As the exam wasn’t too bad many sitters are now worried that they found it too straightforward!

However, one PQ felt that the whole paper ‘horribly imbalanced’. Where, they asked, were the questions on review and reporting, ethics, and threats? Most of their paper was just substantive procedures and audit risk. They could not even get away from substantive procedures in the MCQs.

TX

Bit of a mixed review from students. As one PQ said: “Section A and section B was really tough, but section C wasn’t too bad.” Another said: “Personally found section C quite hard.”

Just over half (53%) of those registering their opinion on the Open Tuition Instant Poll said the exam was OK, with 29% saying it was hard, and a further 14% had a disaster.

PM

Many said they found this September’s PM a hard one. As another sitter said: “Section C, the first question was hard. Even some of the MCQs were tricky. I feel like all the worst little topics came up.”

A fellow sufferer agreed: “Terrible paper this morning – they picked three of my worst subjects!”

‘Awkward’, ‘tricky’ and ‘very tough’ were descriptions used a lot in Facebook groups. The exam was another hard test, according to the Open Tuition Instant Poll. Some 22% described

the September sitting as a disaster, and 43% said they found it hard. Just 32% said the exam was OK.

FR

Section B was not a favourite for many sitting September’s FR exam. However, this was offset with a much better section C. As one sitter explained: “Sections A and B were pretty brutal, but section C was rather nice.”

Another sitter agreed: “My section C was easy compared to what I was expecting.”

The Open Tuition Instant Poll saw 58% calling the exam OK, 24% said it was hard and 12% felt it was a disaster.

FM

Not the worst ever FM exam, yet one sitter felt it wasn’t the nicest of paper either: “I found section B particularly hard, section C I just had standard NPV and working capital ratios, which surprised me!”

In the Open Tuition Instant Poll some 6% said the exam was easy and another 46% felt it was OK. Just 12% called it a disaster.

SBR

“Dreadful, found it extremely hard” and “tough exam with very few calculations” were some of the comments about September’s SBR exam.

The question on hedging was particularly hard, and many admitted they found it difficult.

The Open Tuition Instant Poll had nearly one in four (24%) ticking the disaster box, and another 39% found the exam hard. A third (35%) said it was OK.

ATX

“Pretty happy” and “a reasonable set of questions”, with “nothing too niche or attempts to trip you up”. That is how some described this September’s ATX sitting.

One PQ admits they finished the exam 40 minutes early. We particularly like the student who said: “Question paper was really easy, but the answers seemed difficult!”

In the Open Tuition Instant Poll 16% of sitters said the exam was a disaster and 37% found it hard. Some 40% said it was OK.

APM

“Nice, with nothing too nasty,” is how one sitter described APM this time around. Another sitter explained: “I feel quite confident about APM this morning. All the questions were absolutely manageable, nothing too tricky.”

Yet another seemed shocked and simply said: “All OK, can’t complain!”

So, more decent subjects and formulas this time, compared with June.

AFM

“AFM is no joke,” is how one sitter put it! Another agreed: “Worst paper I have ever done.”

Hedging, mergers and ACQ, and some ratio analysis, was the test for some.

In the Open Tuition Instant Poll 32% of sitters voted the exam a disaster, with another 41% saying it was hard. Just 23% said the exam was OK.

18 PQ PQ Magazine October 2023 ACCA exam feedback

Developed with accountants in mind. Visit getrogo.com for your free trial Accurate replications of questions from ACCA, AAT, CIMA, ICAEW & ICB. Discover fully-functioning spreadsheet features for your accountancy training. Discover Rogo.

Become an Intermediate Financial Accountant Unlock you career potential with the IFA Graduates, recently qualified and part qualified accountants get the support, guidance and recognition you need to set yourself apart in a competitive SME job market with: • Designatory letters IFA AIPA • Access to a variety of technical resources • Relevant CPD webinars and networking meetings • Financial Accountant, our member magazine • MyCommunity, our online member space • A weekly enewsletter covering accounting, finance and business FIND OUT MORE at IFA.ORG.UK/ROUTESIFA

Celebrating 250 issues

Our October issue marks a milestone for PQ magazine – our 250th edition!

It has been an amazing journey and everyone at PQ magazine is proud to say this is our 250th issue!

We have loved every minute of it, and hope that we have been a guiding light at your side as you move from PQ to NQ. We have challenged the profession to change and pushed for that change. We believe just being around so long has meant we are also taken seriously! But we thought now is not the time to blow our own trumpet. Instead, we thought we would let other people do that:

first saw PQ magazine. So much has changed in our world through corporate crises, regulatory change, digitisation, Brexit and war. But PQ has remained consistent and valuable.

“At the start, PQ met a need for a free-thinking publication which supported accountancy students. It has never deviated from that –it provides vital communication, holds the examining bodies to account and builds student capabilities.

“Graham, you and your team have done a great job. We have not always agreed, but you have always been a critical friend. Long may that continue.”

many congratulations to PQ on reaching its 250th issue. The magazine provides invaluable insights and news for trainees and newly qualifieds, so here’s to the next 250!”

has campaigned on issues of tax transparency, representation of minorities, a better deal for students and much more. All this is due to the extraordinary efforts and vision of Graham Hambly, founder of PQ magazine. It has been a privilege and an honour to work with Graham over the past 250 editions and I look forward to next 250. The Beatles song will need to be rewritten.”

Helen Brand, Chief Executive, ACCA: “ACCA warmly congratulates PQ on its 250th issue. It is an amazing milestone and throughout that journey PQ has done nothing but champion the interests of students and newly qualifieds from all bodies, including of course ACCA. Here’s to the next 250 issues.”

Sarah

“Congratulations to PQ magazine on your 250th issue. This is a real milestone achievement, showing just how valued the magazine is among students for its high-quality content and details of what’s happening in the accountancy world, as well as tips, advice and support to help them complete their qualifications and go on to successful careers in the accountancy profession. We’re delighted to have worked closely with you on this over the years and hope to continue to do so well into the future. Here’s to the next 250!”

Phil Turnbull, Chief Executive, Association of International Accountants: “250 editions of excellence, knowledge, and inspiration – a true testament to PQ’s unwavering commitment to inform, educate and hold the accountancy industry to account. Personally, working with Graham over the past two decades has been an absolute privilege and I wish a wholehearted congratulations on this remarkable milestone! In an ever-evolving media landscape, your enduring presence speaks volumes about your resilience and ability to embrace change while staying true to your core values.”

Professor Richard Murphy, Professor of Accounting Practice, Sheffield University Management School: “UK business could not function without the work done by the UK’s PQs. It is they who keep this country’s cash flowing. PQ magazine has supported these vital people in all stages of their careers over 250 issues and plays an absolutely essential role within the accounting profession as a result. Long may it continue.”

Andrew Harding, Chief Executive – Management Accounting, AICPA & CIMA: “Congratulations on reaching the 250 issues milestone! I remember the first edition so well, those of us around at that time will all be delighted with the success you have achieved. I can’t believe that it is now 20 years since we

Prem Sikka, member of UK House of Lords: “Will you still need me, Will you still feed me, When I’m sixtyfour’, is a famous line from a 1960s hit song by the Beatles. Well, PQ Magazine has done far better. It has hit its 250th edition and we still love it and need it. Right from the first edition, PQ has been a champion of students and has given them a voice. It regularly calls professional accountancy bodies to account. It

Professor Atul K Shah, City University of London: “PQ magazine has been a very rare and influential student voice in accounting for decades. Given the millions of students globally studying for the profession it is vital that young people are engaged and supported in their professional journey. Regular columns by influencers like Professor Prem Sikka have helped

Continued on page 22

21

Magazine

2023

250

PQ

PQ

October

PQ –

issues young

Beale, Chief Executive, AAT:

Rob Whiteman, Chief Executive, CIPFA: “From everyone at CIPFA,

students understand the wider impact of accounting practices on the economy and society, sadly often leading to greater inequality and audit failures. It is so critical that students are able to see accounting beyond the textbook and understand how important it is to protecting public interest and what difference an ethical professional can make in wider society.”

Mark Ingram, Director of FMELearnOnline: “PQ focuses on ‘critical issues’ – whether it’s the accounting career attrition rates, social mobility, climate change, blockchain, ethics or AI, you’ll find it discussed in PQ. There are expert columns from some of the top ‘thought leaders’ of the accounting world, too.

“For me though, the real ‘meat’ of PQ is the issues it adopts and pushes – which frequently lead to real change. This is PQ ‘holding power to account’ (where’s the IFRS on this?). As PQ says: “We go where others fear to tread. We pride ourselves on our independent approach, seeking out the stories that matter.” Whether that’s exam fiascos, pass rates, well-being or pay levels, PQ is pushing for change – and attempting to get us to help ourselves.

“Like many ‘institutions’, and after 250 editions it is an institution, it is fragile. PQ doesn't always gain the support it should from the powerful. I guess it takes integrity to understand that having a ‘critical friend’ is more important long term than maximising your SEO score.”

Stuart Pedley-Smith, Head of Learning, Kaplan: “Becoming a qualified accountant is certainly not easy, it requires determination, hard work and support from tuition providers, employers, professional bodies, friends and family. But there is also a need to feel part of a community, a group of people effectively studying together, different subjects of course, but all facing similar challenges and asking similar questions. These can range from not understanding a specific topic, wanting to know how to study more effectively, to finding out what is happening in the sector. For 250 editions

PQ has provided this service for accountancy students. It has also been the voice of the student, shining a light on areas that are of concern and when required holding to account those of us who work in accountancy education.”

First Intuition: “I am old enough to remember Graham setting up PQ magazine. He wanted something that represented and supported students, that held institutes to account, that was fun but with a core of useful information in every issue. I think that over 20 years and 250 issues it is a testament to Graham and the team that they managed this and continue to. I know it is a tireless job to keep being able to bring relevant and up-to-date information to students, but the PQ team continue to do this. Well done to everyone involved over the years, a fantastic achievement!”

• I love PQ because it represents students’ interests, and holds the professional bodies to account.

• I love PQ because it publishes free useful, interesting and quirky content for students.

• I love PQ because of the PQ annual awards which celebrates our industry.”

Regwana Uddin, LSBF ACCA tutor, PQ award winner 2021: “PQ magazine was my source of news in the accounting world when I was a student. I was a mere 21 years old when I started studying ACCA, and my tutors would all recommend subscribing to PQ magazine straight away!

“I looked forward to the exam tips, news on the Big 4 firms and reading about an accountant’s typical day.

“Now that I am an ACCA tutor myself, I recommend the magazine to all of my students, especially the articles on mental health, positive thought processes and general well-being.

“Thank you PQ magazine, for giving me a telescope into the accounting world.”

Sunil Bhandari, ACCA AFM online tutor, PQ award winner 2020: “Personally, I want to say a big thank to Graham the editor and PQ magazine. When I set up my online courses nearly 10 years ago, I was very much a lone wolf in a market full of the big colleges. However, you were one of a very few people who helped and supported me, and I have never and will never forget that.

“From those beginnings FME Learn Online developed into what it is today, and I work with a great team of colleagues. I am a member of the pack and no longer that lone wolf.

Umar Tariq, Senior Training Consultant. FC Training: “I want to extend our heartfelt congratulations on you reaching this remarkable milestone. This achievement not only speaks to the magazine’s dedication to excellence but also to its unwavering commitment to delivering top-notch content to its readers.

“PQ magazine has been an invaluable resource in the field of accounting and finance, providing insightful articles, industry updates and professional guidance to students and professionals alike. The magazine’s consistent quality and relevant content have truly set it apart as a leader in its domain.”

magazine!

“I was also truly honoured to get my PQ Editor’s Award in 2020 which still sits proudly in my office.”

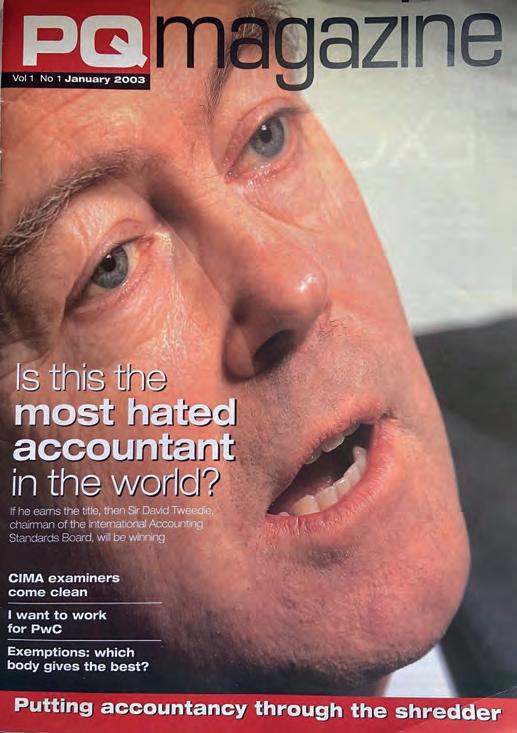

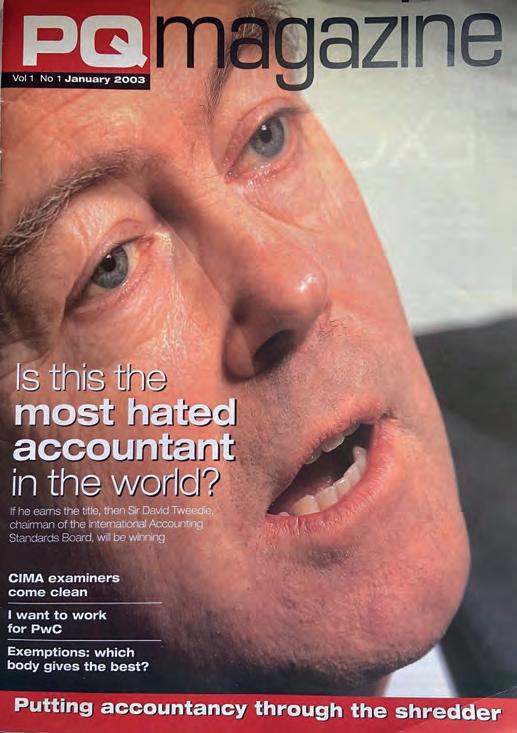

PQ magazine, January 2003

Sean Purcell, ACCA SBL online tutor, PQ award winner 2020: “Most people experience PQ magazine for a short window while preparing for their accountancy

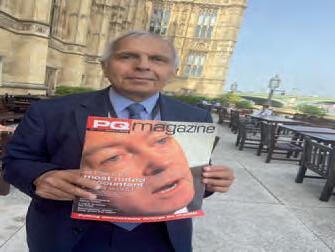

The first-ever issue of PQ magazine was published in January 2003, and apart from the editor, the other two constants have been award-winning journalist Robert Bruce and a certain Lord Sikka (pictured).

Sir David Tweedie, the chair of the International Standards Board, was our cover ‘star’, along with the headline: “Is this the most hated accountant in the world?”

While many things have changed in the profession over the past 20 years, some things remain constant. We had a feature on what CIMA examiners want and feedback from the December 2002 ACCA exams.

In the news there was anger over ICAEW exam centre closures in Guernsey, Sheffield and Leicester; we announced CIPFA was the first body to have a permanent student member sitting on council; and we reported on the ACCA leaving the net present value tables out of the 2.4 exam paper.

Our tech news section was called IT news, but it was still there.

22 PQ PQ Magazine October 2023 PQ – 250 issues young

Martin Taylor, CEO and chairman

Tom Clendon, ACCA SBR online tutor, PQ award winner 2011 and 2023: “Three reasons why I love PQ

Among our advertisers were Foulks Lynch, LCA, LVMT and Jeff Wooler College. None of these are offering ACCA training today, and some don’t even exist.

Continued from page 21

On our fun page we ran a story of a secretary at American Express HQ in Brighton who was sacked for sending an invitation to a sexy party to the company’s FD. It was supposed to go to a friend. Seemed a bit harsh, even at the time!