IS AI COMING FOR YOUR JOB?

It is highly skilled jobs such as finance, medicine and law that are most exposed to AI-driven automation, according to a ground-breaking report from the Organisation for Economic Co-operation and Development (OECD).

The report, ‘OECD Employment Outlook 2023: Artificial Intelligence and the Labour Market’ claims: “Occupations in finance, medicine and legal activities which often require many years of education, and whose core functions rely on accumulated experience to reach decisions, may suddenly find themselves at risk of automation from AI.”

Unlike previous technology innovations AI can automate non-routine tasks. And generative AI has made most progress in areas such as information ordering, memorisation, perceptual speed and deductive reasoning – all of which relate to non-routine, cognitive tasks. And, as a result, the report says it is now the highly-skilled occupations that are exposed.

OECD stressed that AI adoption is still relatively low because many firms, so far, prefer to rely on voluntary workforce adjustments. The available data suggest that the share of firms

that have adopted AI remains in the single digits, although large firms are more likely to have done so (approximately one in three). That means any real negative employment effects of AI are a little

AAT IS SEEKING MEMBERS FOR NEW STUDENT ADVISORY GROUP

AAT has unveiled plans to give its students a real voice with the launch of its new Student Advisory Group.

This is part of changes to give stakeholders a say in how AAT can best support their needs moving forward. AAT is also creating both training provider and employer advisory groups at the same time.

AAT told PQ magazine: “At AAT we put our dynamic, inclusive community of 70,000 students at the heart of everything we do, to provide them with accessible qualifications and support to achieve their goals for the future.

“However, we also know each student’s

experience is different, and understanding those experiences is key to informing and understanding customers as we shape the future direction of our products and services so they meet the needs of students, employers, and the wider economy in a rapidly changing world.

“That’s why we’re launching our new Student Advisory Group, which will play a key role in how AAT develops over the next year and beyond.”

The group aims to build a strong, supportive student community and create a clear voice for students within AAT. It will focus on topics such as study support, student experience, qualifications,

way off. However, the report said firms do not hide the fact that one of the main motivations to invest in AI is to improve worker performance (productivity) and reduce staff costs.

However, the authors of the study says the world’s major economies are now at a tipping point when it comes to AI.

Hardly surprising then that one in five (20%) workers in finance are extremely worried about job loss in the next 10 years.

Looking for the positives the report says AI can reduce tedious and dangerous tasks, leading to greater worker engagement and physical safety. However, there are risks. By automating simple tasks AI leaves workers with a more intense, higher-paced work environment. AI can also change the way work is monitored or managed, which may increase perceived fairness, but also poses risks to workers’ privacy and autonomy to execute tasks. AI can also introduce or perpetuate biases.

You can read OECD Employment Outlook 2023: Artificial Intelligence and the Labour Market (all 267 pages) at https://tinyurl.com/ m9axznch

communications, barriers to progression, and career development.

AAT stressed that the group will be a collaborative and confidential environment for students. As part of the group, they’ll also have access to networking and professional development opportunities and a chance to provide feedback on AAT products and services.

AAT is looking for 30 students who can commit to the group for 12 months from 1 September 2023, with one meeting per quarter (three online and one face-to-face).

If you’d like to be part of this group, please visit the AAT website and complete the expression of interest form before 31 August.

Training providers and employers will also have the opportunity to be a part of their respective advisory groups – they can express their interest by speaking to their AAT Account Manager.

Incorporating NQ magazine www.pqmagazine.com/www.pqjobs.co.uk September 2023

IN THIS ISSUE

Stories about AI are everywhere, and many people have been saying the accountancy professional would be largely immune from the changes that are coming. But the latest report from the OECD confirms that AI will be after your job, too! In fact, years of education and exams will not provide any cover for what is around the corner. I always thought the very nature of accountancy, with its regulations, rules and numbers, would always be vulnerable to generative AI and blockchain technology. And if the AI is crunching the numbers there will be fewer accountants needed. Accountants are expensive and when companies look to automate, they can see where the easy savings can be made. If they do not see this, AI will tell them!

PQ magazine has been working closely with the AAT to try to minimise the disruption from the transition to Q2022. We told them that they had to give students a real voice, so they could tell them directly what is happening when it happens. The result is the Student Advisory Group. Please get involved and put your name forward. You really will be able to engender change and help those following behind.

We have also gone big on the changes to the ACCA SBL exam (see pages 24 & 25). The new pre-seen will be here any day now for those September sitters.

Graham Hambly, Editor and Publisher, PQ magazine

9 ICAEW exam results

What were the good papers and what were the bad ones at the June sitting?

10 ACCA exam results PM and APM were once again the problem papers in June 12 Tech news Generative AI is coming to your workplace soon Features, etc

14 Have your say It’s no surprise many accountants are thinking of

quitting; and where’s the transparency, ACCA? Plus our social media round-up

16 AAT Level 3

Teresa Clarke explains how to calculate the working capital cycle

19 CIMA spotlight

We highlight some of the study resources available to CIMA studiers

20 AAT spotlight

All the CBA pass rates, for both AQ2016 and Q2022

23 Law

What is good consideration, and when and how should it be paid?

24 Changes to SBL #1

We provide a summary of the changes to Strategic Business Leader for September’s exam sitting

25 Changes to SBL #2

How to use the SBL pre-seen material

26 IFA spotlight

Changes at HMRC highlight value of being agile

27 AAT optional units

Your guide to the optional units at AAT Level 4

28 AAT advanced synoptic AAT has published some key facts about the advanced synoptic – so what do you need to know?

29 ACCA exam tips

We’ve got SIX pages of hot exam tips – but please don’t forget to revise properly!

35 The PESTLE model

Karen Groves explains how PESTLE can help a company better understand the environment it is working in

36 Brands survey

So what are the strongest brands in Britain, and how are the accounting giants faring?

37 ACCA PM exam

Top advice on how to tackle tough questions on the Advanced Performance Management paper

p22

38 London Business Show 2023

We preview this leading business expo, which takes place in November

39 Careers

CFOs need integrative thinking, says new report; tackling your career issues; and our Book Club review

40 Fun

The lighter side of life – and accountancy

The columnists

Lisa Nelson Are you consumer or a customer? No, you’re a learner! 4

Robert Bruce Global warming is boiling our brains

6 Prem Sikka Exploding the myth of the free market

8

Anna Kate Phelan A bird in the hand is worth ‘X’ in the bush 10 David Rothera Celebrating a great 12 months working with you 12

News

VIVA

Young

training in developing their soft skills

4 ACCA timetable changes Association is altering some exam days – and we explain which ones 5 New ACCA courses

launches its online ACCA tuition courses 6 FRC changes at the top Richard Moriarty appointed new CEO of the financial watchdog 8 KPMG soft skills initiative

recruits given

to www.pqmagazine.com September 2023

To subscribe for FREE go

contents p26 p24 www.e-careers.com (accounting) +44 (0) 20 3198 7600 Mon - Fri | 9am - 6pm Why study with us? ✓ Selected courses include Online Training, Books, Live Online Classes and Tutor Support ✓ We have trained over 10,000 AAT students ✓ 0% finance payment plans available ADVANCE YOUR CAREER IN ACCOUNTING PRICE MATCH GUARANTEE We will match like-for-like price.

A note from the Editor

NELSON Customer or consumer?

learner!

ACCA timetables are a-changin’

changes at least six months ahead of time.

See: https://rb.gy/59lne

September 2023 ACCA exams (4-8

September)

Monday AA & AAA; Tuesday TX (UK), ATX & SBL; Wednesday PM, APM & TX(MYS); Thursday FR, SBR & LW; Friday FM, AFM & ATX (UK).

December 2023 ACCA exams (4-8

December)

When it comes to ACCA centrebased exams everyone knows it’s AA and AAA on the Monday and FM and AFM on the Friday.

Well, things are changing! From December, APM will be joining the audit papers on the Monday for one time only, and LW will move to the Friday.

The big changes, however, come in March 2024. Both the audit

papers move to Thursday and FR and SBR become the first papers of exam week.

ACCA said that it was making the changes to ensure as many students as possible have the opportunity to take their exam at their preferred exam centre. It added that it regularly reviews the timetable to minimise popular clashes and will always announce

Monday AA, AAA & APM; Tuesday TX & SBL; Wednesday PM & ATX; Thursday FR & SBR; Friday FM, AFM & LW.

March 2024 ACCA exams (4-8 March)

Monday FR & SBR; Tuesday TX & SBL; Wednesday PM, ATX & APM; Thursday AA & AAA; Friday FM, AFM & LW.

New ICAEW E&T MD unveiled

It has taken some time, but ICAEW has finally appointed a new MD of education and training to replace Hazel Garvey.

Will Holt will oversee ICAEW’s student offering, including the ACA qualification, routes into the profession, and talent and diversity.

He qualified with PwC in 2006 as a chartered accountant, and is the former dean of the business school at Pearson College London. More

CIMA May case study pass rates

The May 2023 CIMA case study exam pass rates are out, with a mixed bag of results.

The Operational case study pass rate dipped four percentage points to 64% (when compared with February 2023). It hasn’t been this low since May 2022,

when the pass rate was 62%.

The Management case study pass rate also fell to 67% in May (it was 72% in February). We went back to February 2021 pass rates and this is the lowest it has been for more than 10 exam sittings.

The good news was the

recently he founded a technology business focused in supporting inclusivity through recruitment.

Holt is no stranger to the ICAEW. He worked for them as a senior manager from 2011 to 2013.

He said: “I am excited to join the ICAEW, where my focus will be on attracting and supporting the next generation of chartered accountants to succeed thorough our world-leading qualification.”

Strategic case study, which saw the pass rate rise to 62%. The Strategic case study has the most volatile pass rates; it has been as high as 72% (February 2022) and as low as 56% (February 2023).

CIMA May 2023 Case Study exam pass rates: OCS 64%; MCS 67%; SCS 62%

ACCA's exam tips when you need them PQ magazine has again joined forces with BPP to provide you with pages of great exam tips and guidance. Students are reminded they should remember the pass mark is 50%, so you don’t need to be perfect. It is good exam technique if you don’t know something to have a guess and move on. Sometimes you have to do that in order to get follow through marks in section C questions. If you make a mistake,

but then use that incorrect figure later in a subsequent calculation, that’s fine – you can only lose the mark once. See our tips on page 29

PQ Coursefinder

Looking for a top tutor for your AAT, ACCA or CIMA studies? Well, look no further – we have added a new PQ CourseFinder feature to the website at www. pqmagazine.com. Just click on the ‘Coursefinder’ bar and you can see all the top tutors in one place. We

think if you choose one of these top colleges you will be able to get where you want to be in doublequick time – you can now find a course that ticks your boxes in 60 seconds!

It means we have rejigged the website a bit and you can now find our Testbank series in the study zone.

AI to help with revision?

Help with exam revision is on the way in the form of artificial intelligence and chatbots.

Education publisher Pearson has announced it is stepping up its use of new technology to help students struggling with difficult subjects.

The Daily Telegraph reported that new software will be launched this autumn as part of the Pearson+ app. The AI will summarise the content of videos into bullet points and provide realtime support for problem areas. The chatbots have been trained on Pearson textbooks, so know them better than students do.

PQ the PQ Magazine September 2023 4

In brief It used to be so simple. You went to school, the teacher stood at the front of the class and the students sat in rows, eagerly awaiting instruction. The teacher was the expert, the student the empty vessel to be filled with knowledge. Most people accepted this approach. That was until September 1998 when, for the first time, many university students had to pay up to £1,000 a year for tuition. This was the start of students becoming customers and consumers. It has raised some interesting questions; after all, isn’t the customer always right? But right about what? How best to learn, what makes good teaching? And what is the consumer actually buying – an education, a qualification, a future job? Money has a way of muddying the water, making it necessary to put a price on something that is priceless. It also changes relationships; the student becomes more demanding, has higher expectations and (possibly) takes less responsibility for their learning. Professional education might easily fall into a ‘consumer trap’. Educators certainly have a responsibility to provide a good service and highquality delivery. However, learning only happens when a learner is actively engaged in their own learning, wanting to improve, wanting to learn. The teacher’s role is to instruct, coach, empower and inspire. This doesn’t mean, as a learner, that you shouldn’t challenge, disagree or demand change, but the motivation should stem from a thirst for knowledge, development of your skills set and personal growth.

LISA

No,

Lisa Nelson is Director of Learning at Kaplan

Will Holt

A record enforcement year for FRC

The lack of professional scepticism was the major reason accountancy firms found themselves facing the wroth of the Financial Reporting Council last year.

The latest Annual Enforcement Review reveals this lack of scepticism was a common issue in 11 out of the 16 cases that were resolved by the FRC’s conduct committee.

Insufficient audit procedures was also an underlying issue in eight of the cases, and a lack of professional judgement came up

in five.

A record number of cases were resolved in the year 2022/23, with financial sanctions of £40.5m imposed. However, after discounts this figure drops to £28.5m.

The year saw the FRC’s highestever sanction of £20 million (imposed by the Independent Tribunal) in a case against KPMG, after the firm provided deliberately misleading information and documents to the FRC’s inspection teams.

The FRC’s Executive Director of Enforcement, Elizabeth Barrett,

VIVA ACCA online courses are now live

Top tutor VIVA is rolling out its online ACCA tuition, and for a limited time is offering early bird discounts.

It is offering video lectures by ACCA subject experts covering the whole syllabus, integrated exam scenarios and solutions, and downloadable lesson decks

covering the whole paper. Live sessions with tutors are coming soon, too.

Learning starts from as little as £149 per ACCA course.

VIVA’s Hugo Newman told PQ magazine: “VIVA is delighted to be bringing its unique blend of award-winning tuition and ground-

said: “The record number of cases concluded this year reflects the strengthened capability and determination of the FRC to hold firms and individuals to account for serious accounting and audit failures.

“Timeliness has been a key priority over the past five years and significant ongoing improvements in this area are recorded in this year’s review.

“While higher financial sanctions are an important marker of the seriousness of the failings, nonfinancial sanctions continue to play a key role in driving improved behaviour and outcomes to deliver long-term positive change.”

breaking value to the ACCA space. Our first eight accredited ACCA courses are now live and open for enrolment. Early birds get a 50% discount on all courses. The remaining courses will be rolled out the rest of 2023, with new features being added to existing courses all the time.”

For more go to https://www. vivatuition.com/acca

THE MONTH: Commercial Finance analyst

Elevation Accountancy & Finance are recruiting a commercial finance analyst to join a market-leading business based in Sheffield, as part of their pricing and profitability team.

The ideal candidate may have previous experience within a commercial finance function and demonstrate exceptional analytical skills, encompassed with an outstanding interpersonal manner and well-developed stakeholder relationship management.

Up for grabs is a salary of £40,000 to £45,000 per year.

To find out more go to https://tinyurl. com/px3vha3z

PQ magazine posts a top job each week on our website, or you can just go to www.pqjobs.co.uk to check out what other great positions are out there right now. We recently had jobs for a finance analyst (renewable energy), audit senior or semi senior (hybrid), and an accounting and control specialist accountant – to name but a few!

PQ 5 PQ Magazine September 2023 PQ PQ JOB OF

news

ROBERT BRUCE Climate change is boiling our brains

New CEO for FRC

Richard Moriarty (pictured) has been appointed the new CEO of the Financial Reporting Council. He succeeds Sir Jon Thomson, who left the FRC on 31 July.

Moriarty takes up his post at the beginning of October, so Sarah Rapson will be acting CEO and accounting officer for August and September.

The new chief has had a 20-year career at various regulatory bodies, most recently as CEO of the Civil Aviation Authority. He has undergraduate and postgraduate degrees in economics, and an MBA from University of Warwick

Business School.

Moriarty said: “The FRC has a critical role to play in underpinning investor and public confidence in financial reporting and corporate governance in the UK. It is a privilege to be asked to lead the organisation at this important time and oversee its successful transformation into the new Audit, Reporting and Governance Authority.

“I’m very much looking forward to leading the FRC team at such a key time for all of the work in its very broad and important remit. Having undergone such a strong

transformation in recent years there is still so much to be achieved in the years to come and I’m excited to get started.”

CIMA launches new climate resource

Accounting for Sustainability is a global network. Sustainability standards are in place. Climate-related financial disclosures are part of the reporting architecture. The risks of climate change are now embedded, more or less, in the financial decision-making. Yet, as a colleague said gloomily to me at the outset of all this, I think we are already too late. It is hard not to agree. As the UN’s Secretary-General said the other day: “The era of global warming has ended. The era of global boiling has begun.”

What is now commonplace would have seemed horrifying to us 20 years ago. But what of the children we were then trying to protect? Well, anecdotally and from talking with colleagues, they care but feel it will tarnish their dreams of prosperity. The consensus is fraying. As with politicians in recent weeks platitudes are preferred to action. We will continue to boil.

CIMA and AICPA have launched more online resources designed to help finance professionals build their sustainability literacy.

The latest in the series

– Accounting for Climate Resilience – outlines the six steps for applying scenario analysis to climate-related risk and opportunities:

• Ensure governance is in place.

• Assess materiality of climaterelated risks.

• Identify and define a range of scenarios.

• Evaluate business impacts.

• Identify potential responses.

• Document and disclose key

inputs, assumptions, analytical methods, outputs, and potential management responses.

CIMA’s Martin Farrar, who

Pre-seen SBL changes

The introduction of the pre-seen for SBL will mean some format changes to the September exam. ACCA has said the number of exhibits students will need to deal with will be ‘significantly reduced’. The exam itself will also have three compulsory tasks. In previous

exams there was no set number of tasks. Each of the three tasks will have a varying number of parts and total marks.

Moving forward, each professional mark will be tested only once and will be worth four marks each.

authored the report, said climate resilience is something accountants should be doing. He said they are ideally placed to build climate resilience in their organisations through scenario analysis and the development of adaption plans. This plan then needs to sit alongside a net zero transition plan.

Farrar explained: “If accounting for carbon is about mitigation and bringing down your emissions to help keep the temperature stable, resilience is about forming strategies to prepare for impending environmental changes.”

Finally, the exam itself will no longer be answered as a single requirement in one word document. Each task will be completed as a separate requirement in a separate response option/options. You will also not be able to view all tasks together, so only one task will be shown at a time.

Check out our feature on page 24.

LUCA awards nomination time

The ICB has launched the search for its Student and Tutor of Year –yes, the LUCA awards are back.

Nominations are open until 31 August, for what really are the Oscars of the bookkeeping world.

Among the other 21 awards up for grabs are friendliest

training provider and friendliest software (which we love).

The LUCA awards themselves are exclusive statuettes of Luca Pacioli, the Cistercian monk who is credited with first documenting the process of double entry bookkeeping that endures today. PQ magazine won one in 2017!

Check out the award nomination and support pack at https://rb.gy/lbefr

PQ giveaways: latest winners

The June and July issue PQ magazine giveaways are on the way to readers. The prize draw winners are: Manga Business Book series – Izabela Szymanowicz, Barry. Budget Planners – Roberto Martin, Chichester; Clare Richards, Ceredigion; Nicola Perry, Shrewsbury. ICB socks – Zahra Jiwa, Milton Keynes; Zoe MelsomeSmith, Barnoldswick; Ildiko Torok, Woodford Green. July Book Club –Violeta Ingaunyte, London;

Commission adopts

sustainability standards

The European Commission has adopted the European Sustainability Reporting Standards (ESRS) for all companies subject to the Corporate Sustainability Reporting Directive (CSRD).

ICAEW CEO Michael Izza said that this was a major milestone for sustainability reporting across Europe.

6 PQ the PQ Magazine September 2023

Christine Newton, London; Debra Stevens, Exeter.

In brief

Almost 20 years ago when I started work with what was then the Prince of Wales’ project to entwine the financial reporting world with sustainability objectives we had a simple mantra. We would hold roundtables with business leaders. And one of the most frequently uttered reasons for wrapping accounting and sustainability together was that they would not be able to look their children in the face if their future was completely buggered by climate change. The work has grown massively since then and much of the initial objectives are being steadily achieved.

Robert Bruce is an award-winning writer on accountancy for The Times

LUCA 2022 Student of the Year Helen Brooks with Garry Carter, co-founder and President of ICB

PREM SIKKA

Gen Z recruits get extra training

Exploding the myth of the free market

Our lives are increasingly governed by myths that rarely withstand scrutiny, but enrich a select few. One of these is the assertion of free markets. This implies that markets consist of numerous buyer/ sellers and no one is a price maker.

This is a fiction – too many sectors are dominated by monopolies and oligopolies, dedicated to advancing private interests. Oil, gas, electricity, banking, supermarkets, shipping, pharmaceuticals, water, railways, mobile phone and internet services are just some examples. Customers are rarely able to curb predatory practices, regulators are weak and the state does little to check abuses.

Left to themselves markets devour communities. They don’t rescue ailing businesses and expect the state, on behalf of the people, to resuscitate or bail them out and hand billions of public cash to private entities. The state bends laws to give advantages to big business. The City of London, the assumed citadel of free markets, has been the biggest recipient of financial and non-financial state aid.

Markets show little appetite for longterm risks, and companies are subsidised by the public purse. Recent examples include £13.3bn subsidy for train companies; £5bn for broadband providers; £500m for Jaguar Land Rover; £600m for steel; £617m for Drax; and £24bn for petroleum companies to decommission old rigs. Companies keep the resulting assets and income streams. None of this results in fair competition or level playing fields, the supposed essentials of free markets. Debunking neoliberal myths is a necessary condition for emancipatory change.

KPMG’s young recruits are receiving new intensive courses in soft skills amid concerns that their confidence and development was stifled during lockdown.

The Big 4 firm is providing all its graduates and apprentices training on topics such as ‘how to collaborate with colleagues’ and ‘how to give effective presentations in person’.

It is also understood that KPMG has also scrapped its remote induction weeks for grads, and is bringing them into the office at least three days a week.

A report in the Daily Telegraph said KPMG will also reduce the prevalence of virtual lessons as part of the graduates’ accounting qualifications and demand more

face-to-face learning and office attendance.

KPMG CEO Jon Holt told the Telegraph: “There is no doubt that the pandemic has impacted recent graduates and apprentices, who are now joining the workforce. They have missed out on a lot. If I think back to my own time at the University of Nottingham it’s hard to image how my experiences –

including the friendships I formed – might have been affected.

“I admire their resilience and it’s important that as a business we support them as they begin their training and careers with us. This includes offering additional courses to help them build soft skills, as well as training them in the big issues facing our clients such as ESG and technology.”

ACCA gains audit accreditation in South Africa

ACCA members, and future members, will have a route to attaining registered audit status in South Africa following the accreditation of the ACCA qualification by the Independent Regulatory Board for Auditors (IRBA).

The announcement means that ACCA members with the right experience can from 1 April 2024 register for IRBA’s Audit Development Programme (ADP), an

18-month audit specialism process which is its pathway to Registered Auditor status. Further details

Students behaving badly

CIMA student Sasvinth Sarveswaran of Chessington, Surrey, has been removed from the student register after telling his employer he had sat a series of exams, when this did not happen.

The student even created screenshots of his ‘MyCIMA’ account purportedly demonstrating he had passed P2.

Global digital services tax update

Some 138 countries and jurisdictions have agreed to honour the voluntary pause on creating their own digital service tax (DST) until the end of 2024, says the OECD. However, there is one fly in the ointment –Canada. It told the OCED that its new DST will come into force in January 2024 because of fears there could be further delays. Canada’s finance minister, Chrystia Freeland, explained: “Canada does not disagree with the substance of the multilateral treaty that has been negotiated; indeed, we support it fully.

“However, without any firm and binding

CIMA’s disciplinary committee concluded that the appropriate and proportionate sanction was one of removal from the Student Register. The committee further determined that Sarveswaran should contribute a sum of £4,075 in costs.

Meanwhile, ACCA student Fawaz Bashir of Multan, Pakistan, was

multilateral timeline to implement [the reform], Canada cannot support the extended standstill.”

How not to pay corporation tax

Asda and Morrison, who are both owned by private equity, did not pay any corporation tax last year.

Before the private equity takeovers the supermarkets paid on average £200 million in corporation tax each year. By comparison Tesco, paid £247 million in corporation tax last year and Sainsbury’s £120 million.

Asda and Morrison have no profits as they are paying off the interest payments on their new debt, which has been loaded onto the balance sheet.

for ACCA members and future members are available here Helen Brand, ACCA chief executive (pictured), said: “We’re delighted that the skills and knowledge of ACCA members in audit have been recognised in South Africa. This will increase opportunities for our members and future members, as well as our ability to make a strong and positive contribution to South Africa’s economy and society.”

recently found guilty of taking photographs of two exam questions in breach of exam regulations. He then shared these photos. The obvious worry is these questions could be seen by other entrants of the same exam in order to obtain an unfair advantage.

The ACCA disciplinary committee orders that Bashir be removed from student membership and to pay costs to ACCA in the sum of £6,000.

Professor Richard Murphy said private equity companies should not be allowed to offset interest against profits when buying companies. He believes firms should only be allowed to offset interest against profit if the expenditure benefits the company.

India goes after online gaming

The Indian government is imposing a 28% tax on funds collected from customers by online gaming firms.

Interestingly, the Indian Goods and Services Tax (GST) Council said it saw no difference between a ‘game of skill’ and a ‘game of chance’. So, the 28% tax will apply to online gaming, casinos and horse race betting.

8 PQ the PQ Magazine September 2023

news

Prem Sikka is Emeritus Professor of Accounting at the University of Essex

June ACA exam results are in

Just over 7,000 ICAEW PQs turned out for the June Professional Level exams, and the pass rates are now out.

The ICAEW stats show 12,138 exams were sat, with 5,415 trainees passing all the exams they took.

That means 1,650 students now move on to the advanced stage, and 908 of these are doing so without failing any exams.

Most students (3,115) sat two

UK accountants love to WFH

UK financial professionals are leading the globe in making hybrid working ‘work’, according to ACCA’s UK Talent Trends in Finance 2023 report.

The research – based on a global survey of over 8,000 finance professionals – found that the UK is one of the most advanced regions in the world in terms of high levels of remote and hybrid working, with Scotland the global leader. The data also suggests that, across a range of

papers and 70.4% of sitters passed both, with another 13.9% passing one paper.

Some 2,899 PQs sat just one paper, and the pass rate for these sitters was 74.4%. That left 25.6%, or 741, with no pass.

The June sitting saw some very strong paper pass rates. The

work satisfaction metrics, hybrid workers are significantly happier than those working full time in the office.

Jamie Lyon, head of Skills, Sectors and Technology at ACCA, said: “Only one-fifth of respondents in the UK identified as fully office based, with the remaining 80% either adopting a hybrid approach to work or being fully remote. However, globally, the picture is notably different, with over half of respondents being fully office based. And 77% of respondents in the UK feel they are more productive when working remotely.”

Financial Management paper’s 88.3% is the highest on record – well, we went back to 2018.

The Audit and Assurance and Business Planning: Taxation pass rates of 84.3% and 84.6% respectively were only bettered in March 2021.

Tax Compliance also came in at a

healthy 84.6%, and this was beaten in September 2021 with 88.4%.

ICAEW PROFESSIONAL LEVEL

JUNE 2023 PASS RATES: Audit & Assurance 84.3%; Financial Accounting & Reporting (IFRS) 80.6%; Financial Accounting & Reporting (UK GAAP) 80.8%; Tax Compliance 84.6%; Business Planning: Taxation 82.9%; Business Planning: Banking 71.6%; Business Planning: Insurance 75%; Business Strategy & Technology 85.8%; Financial Management 88.3%

CIMA and CPA Canada sign MoU

CIMA and the Chartered Accountants of Canada (CPA Canada) have signed a Memorandum of Understanding which allows members of each body to concurrently become members of the other body and adopt, subject to criteria, the relevant designation.

CIMA members are now able to join a provincial/regional CPA body, subject to passing days two and three of CPA Profession’s Common Final Exam. CPA Canada members will need to pass the CGMA Strategic case study. Both sets of

members will also have to meet the other body’s practical experience requirements.

CIMA’s Andrew Harding said: “The agreement will mean that CIMA and CPA Canada members will now have a bigger range of employment opportunities and will be able to use their skills even more widely. Holding the CPA and CGMA designations shows a depth of accounting and finance knowledge that companies all over the world will be looking to acquire to enhance their competitive advantage.”

PQ 9 PQ Magazine September 2023 PQ news

an Intermediate Financial Accountant Unlock you career potential with the IFA Graduates, recently qualified and part qualified accountants get the support, guidance and recognition you need to set yourself apart in a competitive SME job market with: • Designatory letters IFA AIPA • Access to a variety of technical resources • Relevant CPD webinars and networking meetings • Financial Accountant, our member magazine • MyCommunity, our online member space • A weekly enewsletter covering accounting, finance and business FIND OUT MORE at IFA.ORG.UK/ROUTESIFA

Become

ANNA KATE PHELAN

Performance management problems

The June PM and APM pass rates were exactly what students expected – they were the worst pass rates for the Applied Skills and Strategic Professional Levels respectively.

PM had a pass rate of 40% this time around, and APM 34% (joint with AAA). Students will not be surprised to hear that the APM pass rate has been lower – in 2017/2018 it was 29% for two sittings in a row.

Both SBL and SBR had healthy pass rates of 51%, despite the SBR exam being top of the Open Tuition Instant Poll ‘naughty list’.

At 56%, TX had the highest pass rate of the traditional Applied

Skills papers. For this paper you will not find a higher pass rate than June 2009 (61%), but that was very much a one-off. Sitters will be hoping the new TX pass rate level is here to stay.

AA was also a healthy 45% this time around. This is the fourth

exam where the pass rate has remained above 40%.

Alan Hatfield, executive director – content, quality, and innovation, was particularly happy with the uplift of the Strategic Professional pass rates. He wants to encourage all students to use the new digital platform – the ACCA Study Hub. He reiterated that the Study Hub content has been proven to show an increase in student pass rates – meaning you will be qualified quicker.

ACCA JUNE 2023 PASS RATES: LW 80%; TX 56%; FR 49%; PM 40%; FM 52%; AA 45%; SBL 51%; SBR 51%; AAA 34%; AFM 47%; APM 34%; ATX 43%

The intention is to turn Twitter into a ‘super app’. Musk greatly admires the reach and influence of these types of apps in Asia. Apps such as China’s WeChat, Indonesia’s GoJek and India’s PayTM provide a wide range of services from social media to video/audio to shopping/payments.

There have already been some embarrassing teething issues. An ‘X’ sign was erected at Twitter’s San Francisco headquarters and then quickly removed due to lack of planning permission. There are also some concerns about the rebranding itself.

Twitter's own website states its previous logo, the blue bird, is “our most recognisable asset”. To tweet has made its way into the lexicon as a method of communication, with entries in both the Oxford and Cambridge dictionaries. Brand awareness has not quite reached that level with ‘X’. The comedian David Baddiel makes an excellent point: “Twitter had some realworld evocation – the sound of birds, all vying to be heard. ‘X’ is just an abstract, signifying… um… that Elon likes the letter, and naming things with it.”

New support for Black professionals

BYP Network, a leading organisation focused on empowering Black professionals and corporations, has launched a ground-breaking career advancement platform, Javelin.

Designed to bridge the gap between Black talent and career opportunities, it is hoped Javelin will accelerate BYP Network’s mission to help millions of Black professionals in their career progression. It is also hoped the platform can help eliminate traditional barriers and

biases that can hinder career progression.

Javelin is currently in beta

phase and is welcoming users to be the first to try it out. Sign up at https://tinyurl.com/yf3k4ct4

BYP Network’s CEO and Founder, Kike Oniwinde Agoro (pictured), was a javelin thrower for Great Britain, so the name Javelin holds deep significance for her. Agoro explained: “By leveraging this innovative technology and our extensive network of corporate partners, Javelin will empower Black professionals and propel them towards exceptional career opportunities.”

New international standards on the way

The International Accounting Standards Board (IASB) will be issuing two new standards in the first half of 2024.

The first new accounting standard will result in companies reporting more consistently and transparently on their financial performance, making it easier for investors to compare companies.

It will, says IASB, help to build trust between companies and investors and ultimately ease the flow of capital. The IASB is now satisfied that it has refined its original proposals published in 2019 to reflect stakeholder feedback. This new standard will supersede IAS 1 Presentation of Financial Statements.

The second new accounting

standard will reduce disclosure requirements for subsidiaries that are not traded on a public market, or hold assets entrusted to them by their customers. This standard will enable those subsidiaries to prepare full IFRS financial statements locally by using the information reported to their parent company but with reduced disclosures.

PwC partner promotions

PwC UK promoted 69 directors to its partnership this summer, and admitted five further direct partner hires. This brings the size of the UK partnership to 1,057.

Some 42% of the directors promoted to partners in the July cohort were women (up from 39% last year) and 19% came from an ethnic minority background (up from 14%). This moves the firm closer to its 2025 gender and ethnicity representation targets at partner level of 30% and 15% respectively.

Reflecting the increasingly important role technology plays at PwC, 15% of the new

partners are technologists. Among this group, half (50%) are female, 30% are from an ethnic minority background, and 20% are based outside London.

Gender equality

Deloitte UK has been named in The Times Top 50 Employers for Gender Equality list for the eighth year running. The list recognised Deloitte as one of the top organisations that continues to prioritise gender equality.

Deloitte in the UK has recently launched new policies to support gender equality and inclusion, including enhancements to its parental leave policies, bereavement and baby loss leave, and a new menopause policy. It also introduced cover for assisted fertility treatment

and gender dysphoria as part of the firm’s private medical insurance.

• KPMG, PwC, and Grant Thorton were also on the Times list, along with Sage and IRIS software.

Companies under stress

Quarterly company insolvencies reached over 6,300 for the first time since 2009 in Q2 as many UK businesses struggled to contend with a sustained mix of pressure, says EY.

It explained that although company insolvencies have been steadily increasing over the past 18 months, largely driven by Creditors’ Voluntary Liquidations (CVLs), in Q2 there was a significant rise in the number of compulsory liquidations, which rose 67% year-on-year.

10 PQ the PQ Magazine September 2023 news

By now, many of you will be aware Twitter has rebranded from the infamous blue bird to Elon Musk’s favourite letter ‘X’. Musk is the founder of SpaceX and made headlines worldwide by naming his child ‘X’, so this appears to be the latest step in the ‘Muskification’ of Twitter. Tweets are to be replaced and posts will be called “x’s”.

A bird in the hand is worth ‘X’ in the bush

Anna Kate Phelan is Head of Product at Eintech

Get your head around the new question types from AAT. Get Rogo. Easily create accurate practice exams with Rogo’s question types, matching the new formats from AAT assessments. Visit getrogo.com to learn more

DAVID ROTHERA A year to celebrate

Generative AI is coming to your workplace

More than a quarter of UK adults are now using generative AI at work, according to new research from Deloitte. That equates to around four million workers.

The Deloitte survey found just over half (52%) of the population have heard of generative AI, and one in 10 of those surveyed use it at work.

The report revealed a generative AI tool had been used by 26% of respondents, with one in 10 of these using it at least once a day.

The Deloitte survey found that of those who had used generative AI, more than four out of 10 believe it always produces factually correct

answers. One of the biggest flaws in generative AI systems so far is that they are prone to producing glaring factual errors.

Tech expert Sjuul van der Leeuw,

Blockchain ‘a force for good’

Blockchain has the potential of playing an increasingly positive role in how public services are delivered, says a new CIPFA study.

The report, called ‘Exploring blockchain technologies for collaboration and partnerships’, found that the key features of blockchain, such as immutability, decentralisation and programmability, allows the creation of networks that can be used to support collaboration

across stakeholders and organisations.

Blockchain is also considered ‘tamper proof’, so it can significantly improve accountability and transparency, which are both key to good public financial management.

Jeffrey Matsu, CIPFA’s Chief Economist, said: “Wider adoption of blockchain has the potential to improve public policy outcomes in more collaborative ways.

“Digital ledgers can enable

CEO of Deployteq, said: “These figures underline the fact that generative AI is already playing a crucial role in our daily lives and this trend is set to continue indefinitely. From transforming public services, shaking up traditional business models and turbocharging the creative industries, it will continue to have a major impact on our economic growth.

“However, it’s vital that nobody is left behind, and this means having the right training and governance policies in place so that this technology can be used responsibly.”

Orkney gets first drone delivery

The UK’s first-ever mail drone service has begun in Orkney. A partnership between Royal Mail, Orkney Islands Council Habour Authority, Loganair and Skyports will see letters and parcels delivered between the Scottish islands ‘by air’. This is very much a pilot and will initially operate for three months. Poor weather in the region has often affected the delivery service, and drones are seen as a way of improving the service.

innovative ways of managing contracts and relationships that enhance transparency and confidence – delivering longer-term value.”

Download the report at https:// tinyurl.com/3dkk7hhy

Creating a trustworthy AI ecosystem

The UK government needs to work fast on the detail of regulating artificial intelligence (AI) to give business the certainty it requires. At the same time, the UK should work to secure international co-operation and interoperability, while ensuring that on the domestic front there is a high level of joined-up thinking across sectors

Skyports will be using Speedbird Aero DLV-2 drones, which can carry up to 6kg. You will be pleased to hear that the aircraft are also equipped with a parachute!

AI helping to increase completion rates

A new software platform has been developed to improve apprenticeship completion rates, by identifying students most at risk of dropping out.

A collaboration between Aston University and Advanced Smart Apprentices has seen the creation

and stakeholders (government, business, regulators, and civil society) to avoid duplication or things falling into gaps between different regulators.

These recommendations from ACCA and EY form part of a joint response to the UK government’s AI white paper, ‘A pro-innovation approach to AI regulation’.

of ‘Smart Coach’, which can spot students who are thinking of leaving their apprenticeship after just three months of study.

The Smart Coach module analyses patterns in learner behaviour and identifies areas for closer learner support by combining complex data consolidation and in-depth predictive analytics based on learner records.

The project team used machine learning to create a prescriptive analytics model, which identifies at risk learners while also indicating possible interventions to mitigate

The response, called ‘Building the foundations for trusted artificial intelligence’, strongly supports the pro-innovation approach. However, it also makes clear that AI impacts the lives of all citizens. Involvement and feedback are needed across the whole of the socio-economic spectrum, and across all sectors, industries and sizes of business. AI development cannot be confined to a narrow coterie of influencers, it said.

risks and support each student’s learning journey.

Two-hour limit

Chinese regulators are proposing new rules that would limit those between 16 to 18 years old to two hours on their phone a day. The regulator is now calling on providers of smart phones to introduce a ‘minor-mode’ on all their devices. The idea is to stop those between 16 and 18 from accessing the internet on their mobiles from 10pm to 6am.

12 PQ the PQ Magazine September 2023

tech news

Tech briefs

Just over a year ago, we embarked on a ground-breaking mission – to create a pathway to net zero, designed exclusively for accountants. We were lucky to have some amazing partners join us on this journey, including the ICAEW, ACCA, AAT, AIA and Sage. Today, we are thrilled to share that the response to our initiative has exceeded our wildest expectations. Working with over 60 firms, ranging from small enterprises with just one employee to some of the largest in the UK, we have already made a significant impact on the accounting industry’s move towards sustainability. Our vision was clear from the start: we aimed to empower accountants to take meaningful action in the fight against climate change. We recognized the vital role that accountants play, not only in managing financial matters but also in helping their clients navigate the complexities of carbon accounting and sustainability. By creating a specialised Net Zero Initiative for accountants, we hoped to open doors to a world of opportunities in the realm of environmental responsibility. Now, just one year into the initiative, we are delighted to see our vision coming to fruition. Working with 10% of the UK's largest 100 accountancy firms is an achievement we take immense pride in. It demonstrates the growing recognition among accounting professionals that sustainability and climate action are not just optional add-ons but essential components of their practice. To find out more go to www. netzeronow.org/accountants

David Rothera is Climate Project Manager at Net Zero Now

WŝĐŬ�,d&d ĨŽƌ���d

tĞ�ŚĂǀĞĂ�ƌĂŶŐĞ�ŽĨ�ůŝǀĞ�ĐŽƵƌƐĞƐ�ĨŽƌ���d�>ĞǀĞů�ϯ�ĂŶĚ >ĞǀĞů�ϰ�ƵŶĚĞƌ�YϮϬϮϮ ƐƚĂƌƚŝŶŐ�ŝŶ�^ĞƉƚĞŵďĞƌ�ϮϬϮϯ ƚŽ� ĐŽŵƉůĞŵĞŶƚ�ŽƵƌ�ŽŶ ĚĞŵĂŶĚ ŽƉƚŝŽŶƐ�Ăƚ�>Ϯ �>ϯ�ĂŶĚ�>ϰ

,d&d ůŝǀĞ �ƉƌĞ ƌĞĐŽƌĚĞĚ�ƐLJůůĂďƵƐ�ǀŝĚĞŽƐ�ƚŚĂƚ�ůĞĂĚ�ŝŶƚŽ�ƐĐŚĞĚƵůĞĚ�ůŝǀĞ�ŽŶůŝŶĞ�ŝŶƚĞƌĂĐƚŝǀĞ�DĂƐƚĞƌĐůĂƐƐĞƐ ;ǁŝƚŚ�ĞdžƉĞƌƚ�ƚƵƚŽƌƐ �Ăůů�ĚĞƐŝŐŶĞĚ�ƚŽ�ƐƵƉƉŽƌƚ�LJŽƵƌ�ŵĂƐƚĞƌŝŶŐ�ŽĨŬŶŽǁůĞĚŐĞ – ĂĐĐŽŵƉĂŶŝĞĚ�ǁŝƚŚ� ĐŽŵƉƵƚĞƌ�ďĂƐĞĚ�ƚĞƐƚƐ�ĂŶĚ�ŵŽĐŬ�ĞdžĂŵƐ &Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ�ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ĐŽƵƌƐĞƐ ĂĂƚ

dŚŝŶŬ����� �ƚŚŝŶŬ�,d&d

tĞ�ŚĂǀĞ�Ă�ĨƵůů�ƐƵŝƚĞ�ŽĨ ������ƉƉůŝĞĚ�^ŬŝůůƐ�ĂŶĚ ^ƚƌĂƚĞŐŝĐ�WƌŽĨĞƐƐŝŽŶĂů�ĐŽƵƌƐĞƐĨŽƌ �ĞĐĞŵďĞƌϮϬϮϯ ĞdžĂŵƐ �ƐƚĂƌƚŝŶŐ� ĞĂƌůLJ�^ĞƉƚĞŵďĞƌ

▪ DĞŵďĞƌƐŚŝƉ�ŽĨ�ŽƵƌ�ǀŝďƌĂŶƚ�KŶůŝŶĞ�>ĞĂƌŶŝŶŐ��ŽŵŵƵŶŝƚLJ ĂŶĚ�ĂĐĐĞƐƐ�ƚŽ�Ă�ĚĞĚŝĐĂƚĞĚ�ƚƵƚŽƌ ▪ ,d&d�WĂƌƚŶĞƌƐŚŝƉ�ƐƚƵĚĞŶƚŶŽƚĞƐĂŶĚ������ĂƵƚŚŽƌŝƐĞĚ�ƐƚƵĚLJ�ƚĞdžƚ �ĞdžĂŵ�Ŭŝƚ�ĂŶĚ�ƉŽĐŬĞƚ�ŶŽƚĞƐ ▪ &Ƶůů�ƐLJůůĂďƵƐ �dŽƉŝĐ�ďLJ�dŽƉŝĐ�ƌĞĐŽƌĚŝŶŐƐ�ƐƵƉƉŽƌƚĞĚ�ďLJ�ƚŝŵĞƚĂďůĞĚ ‘live online’ dƵŝƚŝŽŶ DĂƐƚĞƌĐůĂƐƐ�ƐĞƐƐŝŽŶƐ�–

�ĚŽǁŶůŽĂĚĂďůĞ�ĂŶĚ�ƉůĂLJĂďůĞ�ŽŶ�Ăůů�ĚĞǀŝĐĞƐ

▪ Scheduled ‘live online’ ZĞǀŝƐŝŽŶ DĂƐƚĞƌĐůĂƐƐ�ƐĞƐƐŝŽŶƐ�– ƌĞĐŽƌĚĞĚ �ĚŽǁŶůŽĂĚĂďůĞ�ĂŶĚ�ƉůĂLJĂďůĞ�ŽŶ�Ăůů�ĚĞǀŝĐĞƐ

▪ ,d&d�ĐŽŵƉƵƚĞƌ�ďĂƐĞĚ�ƚĞƐƚƐ�ĂŶĚ�ŵŽĐŬ�ĞdžĂŵƐ �ŵĂƌŬĞĚ ǁŝƚŚ�ĂŶƐǁĞƌƐ�ĂŶĚ�ǀŝĚĞŽ�ĚĞďƌŝĞĨƐ

&Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ�ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ĐŽƵƌƐĞƐ

^ƚƵĚLJŝŶŐ��/D� KƵƌ�,d&d ůŝǀĞ �,d&d ŽŶ ĚĞŵĂŶĚ�ĂŶĚ�,d&d ƉůĂLJ�ƌĞƐŽƵƌĐĞƐ�ĂƌĞ�Ăůů�ŚĞƌĞ�ƚŽ�ŚĞůƉ�LJŽƵ�ƉƌĞƉĂƌĞ�ĨŽƌ �ĂŶĚ� ƉĂƐƐ �LJŽƵƌ�ĞdžĂŵ

,d&d ůŝǀĞ �ũŽŝŶ�ŽƵƌ�ĞdžƉĞƌƚ�ƚƵƚŽƌƐ�ůŝǀĞ�ŽŶůŝŶĞ�ĨŽƌ�ŝŶƚĞƌĂĐƚŝǀĞ�DĂƐƚĞƌĐůĂƐƐĞƐ �ĚĞƐŝŐŶĞĚ�ƚŽ�ƐƵƉƉŽƌƚ�LJŽƵƌ�ĂƉƉůŝĐĂƚŝŽŶ�ŽĨ� ƐLJůůĂďƵƐ�ŬŶŽǁůĞĚŐĞ

,d&d ŽŶ ĚĞŵĂŶĚ �ĚƌŝǀĞ�LJŽƵƌ�ůĞĂƌŶŝŶŐ �ǁŝƚŚ�ĨƵůů�ĨůĞdžŝďůĞ�ƌĞƐŽƵƌĐĞƐƚŚĂƚ�LJŽƵ�ĐŽŶƚƌŽů

,d&d ƉůĂLJ ��ŽdžƐĞƚƐ�ŽĨ�ƚŽƉŝĐ�ƌĞĐŽƌĚŝŶŐ�ĂŶĚ�WƌŽĨŝĐŝĞŶĐLJ�ĞdžĂŵ ƐƚLJůĞ�ƉƌĂĐƚŝĐĞ�ĂƐƐĞƐƐŵĞŶƚƐ

&Žƌ�ŵŽƌĞ�ŝŶĨŽƌŵĂƚŝŽŶ�ǀŝƐŝƚ

�/D��&ϭ �&Ϯ�ĂŶĚ�&ϯ�ůŝǀĞ�ŽŶůŝŶĞ�ĐŽƵƌƐĞƐ�ƐƚĂƌƚŝŶŐ^ĞƉƚĞŵďĞƌ

ƌĞĐŽƌĚĞĚ

ĂĐĐĂ

^ƚƵĚLJ��/D� �ĐŚŽŽƐĞ�,d&d

�ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ĐŽƵƌƐĞƐ ĐŝŵĂ ^ ^ƚƚƵĚLJ ǁ ǁŝƚƚŚ , ,dd&d d WĂƌƚƚŶĞƌƌƐŚŝƉ ǁ ǁŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ tŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ &Žƌ ŵŽƌĞ ŝŶĨŽƌŵĂƚŝŽŶ ĞŵĂŝů ŝŶĨŽΛŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ KŶůŝŶĞ��ŽůůĞŐĞ�ŽĨ� ƚŚĞ�zĞĂƌ�ϮϬϭϳ WĞƌƐŽŶĂůŝƚLJ�ŽĨ� ƚŚĞ�zĞĂƌϮϬϭဒ WƌŝǀĂƚĞ�^ĞĐƚŽƌ��ŽůůĞŐĞ� ŽĨ�ƚŚĞ�zĞĂƌ�ϮϬϮϬ

Just why aren’t accountants happy?

Only PQ magazine would dare to put the fact that ‘accountants are not happy being accountants’ on its cover (PQ, August ’23). Others might worry about alienating their readership, but not you!

If you read all the other news outlets it’s all rosy in the accountancy garden. And, if you live to read endless software and app reviews, they are good for that, too!

However, you and Dext are right, there are underlying problems that need addressing. In recent months you have highlighted the skills shortages and that fewer graduates are attracted to accountancy. Now you are saying those doing the job

do not like it, either.

As a PQ I was forced to work long hours on boring manual work and it appears that has not changed. When will the benefits from automation be here? Automation will be too late

for many accountants who are planning to leave the profession long before then.

Software companies aren’t helping matters. They advertise that their products can do the job of the accountant, but that is just not so. Any slight deviation from the norm and we have to pick up the pieces. They send the message that you don’t need to value the work accountants do, but it will be us that has to ‘take care of business’.

Name and email address supplied

The Editor says: It nice to think we go where others fear to tread. We pride ourselves on our independent approach, seeking out the stories that matter.

Our star letter writer wins a fantastic ‘I love PQ’ mug!

I want to see my examination paper!

Firstly, thank you for the monthly issue of the PQ Magazine, it is always full of great information.

I have been really upset with the last results on ACCA AAA. The fact that pass rates are so low on some subjects makes me think if this is done on purpose by ACCA, so they can recharge the exam fees again and again.

I can’t really understand how ACCA can claim to be transparent and open, but choses to keep exam papers and not allow us to see them when they are marked. How are we meant to improve if we don’t actually see where we went wrong in the first place?

Is this something PQ magazine can look into? How about starting a petition?

Name and email address supplied

The Editor says: OK, you ACCA students out there, do you want to be able to see your marked exam paper? Drop me a line and if there seems to be a demand we will take it up with ACCA.

Where’s the business case for MTD?

Who is surprised that HMRC’s Making Tax Digital project is ‘out

of control’? CIOT’s Alison Kerrey is right when she says the costs are spiralling, there were unrealistic timescales and questionable benefits.

Lots of people said that HMRC was underestimating the costs and overestimating the benefits, but no one listened.

Now we have the National Audit

Office’s report and the facts are there in black and white. But will it change anything? No is the answer! The HMRC seem to be on a mission and nothing is going to stop them, not even the cost.

Digitalisation was going to happen, but a proper business case needed to be made first, and it never was.

Name and email address supplied

If you have any problems with delivery, or if you want to change your

Our lead story last month, ‘Why aren’t accountants happy being accountants?’, certainly hit a chord with many accountants (see our lead letter).

Just over a third (36%) of accountants in a poll said they were considering leaving the profession in the next five years. Among the under 25s the figure was slightly lower, but still 30%. The lack of a healthy work/life balance was cited by many as the main reason why they were looking at a change of career. Interestingly, some 90% of accountants actually enjoyed their roles, but completing so many manual tasks was grinding them down.

Willard Chovinda loved the article and agreed “the accountant’s role involves too much manual work”. Jantin Ghaghda felt the story was “painful but quite true!” And Lori Ann White felt accountants are not paid enough: “Too much work for little pay.”

Marie Speakman said: “I think they are bored and not able to use their skills and training to make a difference in companies. With AI automation we can get accountants away from robotic work.”

Another story that got a lot of interest was

Professor Richard Murphy’s call for the nationalisation of the UK water industry. He suggested shareholders should not be compensated, either. His idea was to issue water bonds via ISAs to the public to help the industry raise the funds it needs. Murphy (pictured) felt that people would want to save in a way that ensures we all get clean water in the future. “Sounds like communism,” said one LinkedIn response we received!

14 PQ PQ Magazine September 2023

PQ Magazine PO Box 75983, London E11 9GS | Phone: 07765 386489 | Email: graham@pqmagazine.com Website: www.pqmagazine.com | Editor/publisher: Graham Hambly graham@pqmagazine.com | Associate editor: Adam Riches | Art editor: Tim Parker Contributors: Robert Bruce, Prem Sikka, Lisa Nelson, Anna Kate Phelan, Tony Kelly, Phil Gammon, Edward Netherton | Subscriptions: subscriptions@pqmagazine.com | Origination services by Classified Central Media

delivery address, please email admin@pqmagazine.com Published by PQ Publishing Ltd © PQ Publishing 2023

email graham@pqmagazine.com

0203 7908674

Bookkeeping & VAT Return Training Course

Train To Be

Sales/Purchase Ledger Clerk

Accounts Payable/Receivable

Bookkeeper

With Average Salary of 18K 22K

Now Available Online

Management Accounting Training Course

Train To Be

Cost Accountant

Finance Controller

Finance Assistant

With Average Salary of 32K to 35K

Now Available Online

Bookkeeping and Payroll Training Course

Train To Be

Sales/Purchase Ledger Clerk

Payroll Administrator

VAT Manager

With Average Salary of 23K 24K

Now Available Online

Final Accounts Training Course

Train To Be Finance Manager Assistant Accountant

Accountant

With Average Salary of 38K to 45K

Now Available Online

Accounts Assistant Training Course

Train To Be

Finance Manager

Finance Assistant

Bookkeeper

With Average Salary of 26K 28K

Now Available Online

Customised Accountancy Training Course

Train To Be

Finance Controlling

Finance Management

Bookkeeper

With Average Salary of 18K to 38K+

Now Available Online

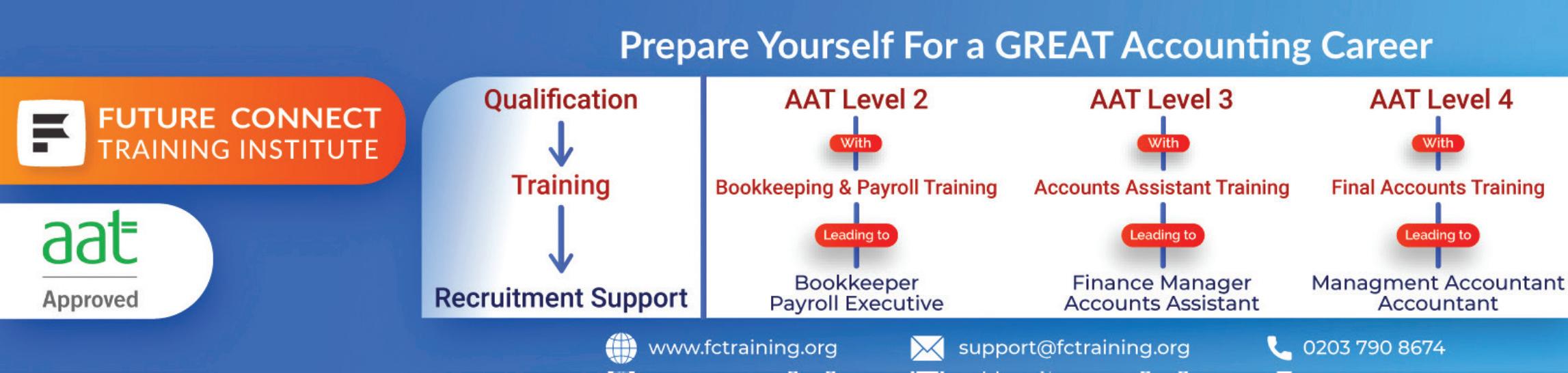

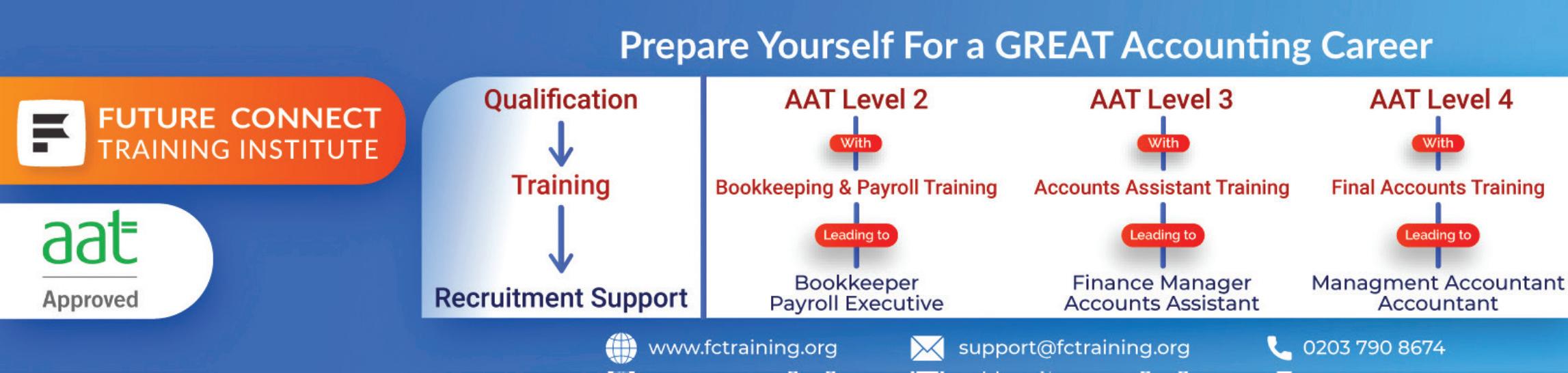

AAT Level 2 Foundation Certiicate in Accounting AAT Level 3 Advanced Diploma in Accounting AAT Level 4 Professional Diploma in Accounting Prepare Yourself For a GREAT Accounting Career Bridge The Experience gap between AAT Theory & Practice Now That’s an Education For your Successful Accounting Job! AAT Qualiications With Integrated Practical Accountancy Training

: Online info@fctraining.org

London : Birmingham : Manchester

Learn Sage, Quickbooks, Xero, Payroll, Advanced Excel & More High Quality CPD Approved Training Award Winning - Practical Accounting Training under Supervision of Chartered Accountant Firm

Capital ideas

Teresa Clarke explains how to calculate the working capital cycle

As part of your AAT Level 3 studies for management accounting techniques you will need to be able to calculate the working capital cycle.

To calculate the working capital cycle, we first need to calculate the following periods. These are usually calculated in days.

• Inventory holding period.

• Receivables collection period.

• Payables payment period.

In your exam, you will be given information regarding a business and will need to be able to calculate the working capital cycle. Try not to rely on remembering the formulas, but instead look at the logic in the task.

Example

Here is the information you will need. The task may give you information that is not relevant, so make sure you know what you are looking for.

Inventory £60,000

Trade receivables £40,000

Payables £30,000

Sales revenue £800,000

Cost of sales £250,000

Inventory holding period

The formula for this is inventory/cost of sales x 365, but let’s understand why. We are looking for how long the inventory is held for before it is used. The first piece of information is inventory. Then we look at the information given. Inventory is part of the cost of sales, so we need this piece of information next. We want the average holding period for the whole year which is 365 days.

£60,000 / £250,000 x 365 = 87.6, rounded to 88 days.

Trade receivables collection period

The formula for this is trade receivables/sales x 365, but let’s understand why. We are trying to find out how long, on average, it takes customers to pay us. The first piece of information is the trade receivables. Then we look at the information given. Trade receivables is money that the customers owe us from sales, so we use the sales revenue next. We want the average collection period for the whole year which is 365 days.

£40,000 / 800,000 x 365 = 18.25, rounded to 18 days.

Payables payment period

The formula for this is payables/cost of sales x 365, but let’s understand why. We are trying to find out how long, on average, it takes us to pay

our suppliers. The first piece of information is payables. Then we look at the information given. We are paying suppliers for the purchases we have made from them, and this is part of cost of sales. We want this payment period for the whole year which is 365 days.

£30,000 / 250,000 x 365 = 43.8, rounded to 44 days.

Once we have all this information, we can work out the working capital cycle by thinking about the assets and liabilities.

Inventory is an asset because it is something we own which can be converted to cash when sold.

Trade receivables is an asset because it is money we will receive.

Payables is a liability because it is money we owe to others.

Inventory holding period: 88 days

Trade receivables collection period:18 days

Payables payment period: 44 days

Now we can add together the assets, inventory, and trade receivables, and deduct the liabilities, the payables.

88 + 18 – 44 = 62 days

Working capital cycle = 62 days

Now try a question from one of your study books.

• Teresa Clarke FMAAT. If you like my way of explaining things, you might like my workbooks, which are all available from Amazon in both paperback and as eBooks. The links to all my workbooks can be found at https://www. teresaclarke.co.uk/

Award-winning AAT courses and apprenticeships

16 PQ PQ Magazine September 2023 AAT Level 3

mindful-education.co.uk/students

Flexible learning to suit your lifestyle

ACCOUNTANT with AAT BECOME AN Benefit from an excellent career, with an average salary of £30,000 a year* *Source: Payscale www.e-careers.com (accounting) +44 (0) 20 3198 7600 Mon - Fri | 9am - 6pm Excellent Why study with us? ✓ Selected courses include Online Training, Books, Live Online Classes and Tutor Support ✓ One of the largest AAT providers in the UK ✓ We have trained over 10,000 AAT students ✓ We won’t be beaten on price! ✓ High Pass Rates ✓ 0% finance payment plans available. VALUED BY EMPLOYERS AND BUSINESSES AROUND THE WORLD PRICE MATCH GUARANTEE* We will match like-for-like price.

Achieve professional recognition from wherever you are. The CGMA ® Finance Leadership Program (CGMA FLP) is a digital-first learning and assessment platform that lets you get the CGMA designation anytime, anywhere and at your pace. With the CGMA FLP, you can fit your learning into your schedule, sit with fewer formal exams and uncover a new realm of career possibilities upon completion. Founded by AICPA® and CIMA®, the Association of International Certified Professional Accountants® powers leaders in accounting and finance around the globe. © 2023 Association of International Certified Professional Accountants. All rights reserved. AICPA and CIMA are trademarks of the American Institute of CPAs and The Chartered Institute of Management Accountants, respectively, and are registered in the US, the EU, the UK and other countries. The Globe Design is a trademark of the Association of International Certified Professional Accountants. 2301-771946 Find out more at cimaglobal.com/CGMAFLP

Top study resources for learning success

Getting skilled for exam success requires you to aggregate various components that will sharpen your performance. But where can you find trusted resources to get you exam ready?

Let’s examine five top CIMA resources to get you up to speed.

Exam answer walkthroughs Walkthroughs of real exam answers, assessed by examiners from the three Case Study Exams, analyse differences between candidates who passed or failed. The comparison between real answers – good and poor – helps illustrate the marking system and where marks can be won and lost.

Here’s an Operational Level Case Study

Exam question example: ‘Explain the decision tree and how we should use it to make our decision about which agent to use’.

Passed answer – The candidate demonstrated strong technical knowledge of decision trees and the topics tested through detailed explanation and applied their technical understanding to the given scenario.

Failed answer – The candidate demonstrated a lack of technical understanding and knowledge of decision trees in the context of the given scenario and failed to apply the theory of decision trees to the scenario.

And a Management Level Case Study Exam question example: ‘Firstly, prepare briefing notes for me to use in my presentation to the Board. Please use {given note} and consider both financial and non-financial factors’.

Passed answer – The candidate demonstrated a good technical understanding of investment appraisal. They also provided a theoretical overview of each investment appraisal technique.

Failed answer – The candidate’s technical understanding of capital rationing was incomplete. Their four financial factors mentioned were assessed as a mere repetition of the scenario information provided. There was no discussion regarding application of technical knowledge to the scenario information.

Finally, a Strategic Level Case Study Exam question example: ‘Firstly, I need you to evaluate the claim by Diamond Chip that it can prevent any further unauthorised access to Roundabout’s system’.

Passed answer – The candidate paraphrased the sub-task requirement into a title that demonstrated their understanding

of an expectation to evaluate the claim by Diamond Chip. A clear title (and introductory paragraph) provided structured focus for the rest of the answer, including content and answer planning.

Failed answer – Although the candidate demonstrated some structure planning of the answer through sub-headings and key points, they failed to plan the content. Content planning helps you to think through all the points and produce a logical and comprehensive answer, applying technical knowledge to the scenario’s specifics.

Application skills

Application skills are essential for exam success. Our application skills video resource offers a step-by-step guide on how to demonstrate such skills in CIMA’s CGMA Case Studies. The video illustrates the difference between a good pass, a borderline pass and a fail.

The difference between a pass and a fail is the ability to apply theoretical concepts to the given scenario and to consistently incorporate this application into your answers.

The resource also highlights the thought process and techniques to follow – with five best practices – to make application second nature.

Interview with Case Study Examiner

This exclusive interview with our CIMA Case Study Examiner provides a unique insight into what the examiner is looking for. This is a rare opportunity to hear directly about what examiners want to see when they mark your paper.

The examiner talks about why it’s crucial to be familiar with the pre-seen information. She also discusses using resources to develop exam and application skills and answer planning.

Valuable tips include making sure you “answer the question that’s been asked, not what you hope has been asked”.

Time management in Objective Test exams

Time management is one of the biggest challenges in an Objective Test exam. Being well-prepared and knowing how you’ll approach the exam in advance can help you perform better on exam day.

The time management techniques in Objective Test exams is a comprehensive video resource. You’ll learn time management techniques to help you succeed in your CGMA

Objective Test exams.

Try to plan how you would like to manage your time in the exam. The earlier you can start practicing these management skills, the more exam ready you will be.

Resitters guide

The resitters guide is an extensive resource to help you prepare for a retake and bounce back after an exam set back. It’s very common not to know how to move forward after an exam disappointment. Whether you’re resitting an Objective Test exam or a Case Study exam, the resitters guide will help you rebuild confidence and plan ahead to achieve your goal.

This must-read guide will give you the tools to understand what happened and help you prepare with relevant tips to address your needs. You can easily find the CIMA resources specific to your needs in one document with plenty of targeted advice.

AICPA & CIMA provide a wide range of support materials, including tips from examiners to support you in your studies.

For further resources, explore the CGMA Study Hub and view the various categories relevant to your learning level. Good luck!

• Nasheen Wuisman, Senior Manager of Global Academic Progression at AICPA & CIMA, together

as the

Association of International Certified Professional Accountants

PQ 19 PQ Magazine September 2023 CIMA spotlight

Nasheen Wuisman guides you through the CIMA resources available to you, all designed to help you get that all-important pass

The CBA pass rates are…

The latest assessment pass rates are in, and here they all are – both AQ2016 and Q2022

AAT has released the latest worldwide pass rates for the year ending 31 December 2022. The computer-based assessments (CBA) pass rates are only published for assessments that have been available for at least 12 months or where there has been a minimum of 500 sittings. AQ2016

*Please note that the information in the above table refers to the pass rates based on the CBAs only and not achievements rates for the qualification. It is not possible for AAT to calculate and provide qualification achievement rates.

The following table shows the pass rates for the End Point Assessments for year-ending 31 December 2022.

20 PQ PQ Magazine September 2023 AAT pass rates

Level Assessment name Short code Worldwide Access Access to Accounting Software AASW 81.2% Access Access to Business Skills ABSK 94.3% Access Access to Bookkeeping ATBK 94.8% FoundationBookkeeping Controls BKCL 66.1% Foundation Business Communications, Personal and Learning Skills BPLS 92.9% FoundationBookkeeping Transactions BTRN 86.7% FoundationElements of Costing ELCO 86.3% FoundationFoundation Synoptic Assessment FSYA 85.2% FoundationIntroduction to Business and Company Law IBLW 62.1% FoundationIntroduction to Payroll INPY 91.8% FoundationUsing Accounting Software UACS 86.3% Advanced Advanced Diploma Synoptic Assessment ADSY 48.2% Advanced Advanced Bookkeeping AVBK 67.9% Advanced Final Accounts Preparation FAPR 79.7% Advanced Indirect Tax IDRX 82.9% Advanced Management Accounting: Costing MMAC 86.4% Advanced Spreadsheets for Accounting SPSH 78.1% ProfessionalBusiness Tax BSTX 72.5% ProfessionalCredit Management CDMT 69.3% ProfessionalCash and Treasury Management CTRM 74.0% ProfessionalExternal Auditing ETAU 73.7% ProfessionalFinancial Statements of Limited Companies FSLC 67.7% ProfessionalManagement Accounting: Budgeting MABU 70.8% ProfessionalManagement Accounting: Decision and Control MDCL 60.4% ProfessionalProfessional Diploma Synoptic Assessment PDSY 56.9% ProfessionalPersonal Tax PLTX 62.8% AccessFoundationAdvancedProfessional CBA pass rate* 90.8% 80.2% 72.5% 65.1%

CBA pass rates

End Point Assessments

End Point Assessments Short codePercentage AAT Accounts/Finance Assistant End Point Assessment EPA In-tray test ITAF 57.6% Structured interview SIAF 83.3% AAT Assistant Accountant End Point Assessment Advance Diploma Synoptic assessment ADSY 57.1% Assistant Accountant Portfolio and Reflective AARF 96.2% AAT Professional Accounting Technician End Point Assessment

Graded qualifications

Qualifications awarded by AAT include four graded qualifications. The table below shows a summary of the grades awarded for each qualification between 1 March 2022 and 28 February 2023.

The provisional date for the publication of the next set of CBA pass rates is the end of September 2023.

Qualifications 2022 CBA pass rates

Detailed in the table below are the worldwide pass rates for computerbased assessments (CBA) for the 12 months ending 31 December 2022.

Pass rates are only published for assessments that have been available for at least 12 months, or where there has been a minimum of 500 sittings. Pass rates for units within the newly launched Qualifications 2022 (Q2022) are included where they have met the minimum of 500 sittings.

The pass rates shown are the rates for assessments sat as part of the pilot and between 1 September and 31 December 2022.

Please remember that the new qualifications are very different to their AQ2016 counterparts, both by way of content and assessment approach. For this reason, you should avoid making direct comparisons between Q2022 and AQ2016 pass rates. Also, since the Q2022 pass rates are being released at an early point in the Q2022 lifecycle, they should only be used as a guide at this point; AAT would expect pass rates to change as they get through their embedding period.

AAT are also pleased to let you know that it has released interim Chief Examiner reports for several Q2022 units. These reports are based on a relatively low number of results released at this early stage in the qualification lifecycle.

Full Chief Examiner reports will be available in due course, when the qualifications have been live for more than one academic year. In the meantime, AAT hopes that the interim reports will give you an early indication of areas of strength and weakness for learners, allowing tutors to tailor any additional support for students.

PQ 21 PQ Magazine September 2023 AAT pass rates Professional Diploma Synoptic assessment PDSY 70.1% Professional Accounting Technician Portfolio and Reflective PPRF 93.5%

Qualifications and grades awarded Pass MeritDistinction Foundation Certificate in Accounting 9% 50% 41% Foundation Diploma in Accounting and Business 23% 68% 8% Advanced Diploma in Accounting 24% 58% 18% Professional Diploma in Accounting 54% 43% 2%

LevelAssessment name Short code Worldwide 1 Bookkeeping Fundamentals BKFN 90.7% 2 Introduction to Bookkeeping ITBK 86.6% 2 Principles of Costing PCTN 68.8% 2 Principles of Bookkeeping Controls POBC 72.5% 3 Business Awareness BUAW 61.9% 3 Financial Accounting: Preparing Financial Statements FAPS 58.8% 3 Tax Processes for Businesses TPFB 52.9% 4 Applied Management Accounting AMAC 67.8% 4 Drafting and Interpreting Financial Statements DAIF 71.8%

AAT: What level should I start at?

Identify the right AAT qualication for you with Premier Training’s Skills Checks.

Your free online Skills Check is automatically sent to a Premier Training tutor who will contact you on which AAT level to study rst. Head to our website at www.premiertraining.co.uk for more details.

You can start AAT distance learning courses on any day and t your studies around your job and other commitments.

Interest-free instalment plans are available for all courses as well as FREE Xero training and certication.

Get Started Today

Start your studies the same day24 hour online access with instant access to tutor support.

Learning Resources

Award winning learning resources including printed books, eBooks & e-learning, videos and quizzes.

Assignments

Prompt marking turnaround –marked by a tutor (not a computer).

Xero Advisor Certication

Premier Training has teamed up with Xero and is pleased to offer the Xero Advisor Certication Equivalency Course FREE OF CHARGE to anyone who enrols.

01469 515444 AAT Distance Learning AAT Distance

info@premiertraining.co.uk

Consideration: anything, anywhere, all at once?

Consideration is a regularly examined topic in LW ENG. Marina Matyuhina wants to help students understand this basic element in contract law: what is good consideration, and when and how it may be paid?

be valid consideration. Knowing this may not always stop a person from engaging in a criminal ‘deal’, but they won’t be able to enforce it in court.

Fourth, a special exception relates to new share issues by companies since they are also contracts between the company and subscribers. A company issues shares, subscribers pay the price as consideration. For this particular consideration, it is not enough to be simply sufficient. It must be adequate in the sense that it may not be lower than the shares’ nominal value. This is not always adequacy from the market price point of view, but adequacy of complying with the Companies Act 2006 restrictions.

Anywhere?

Consideration is a necessary part of every contract, except for contracts by deed (also known as specialty contracts or contracts under seal). These contracts impose a legitimate covenant (or promise) on one party and place no obligations on the other. They must be made in writing and signed in order to be valid, for example a regular donation to a charity.