Incorporating NQ magazine www.pqmagazine.com/www.pqjobs.co.ukNovember 2022 WHAT LIES AHEAD NOW: KEY FACTS AND TRENDS Accountants are the new innovators –don’t be left behind! Wednesday 7 December 2022 Free online event – see details inside LSBU Business School & PQ Magazine invite you to join our 6th annual conference...

DON'TMISSOUT! USECODE PQMAG FOR10%OFF! WWW.BOOKKEEPERSSUMMIT.COM HOSTEDBY PARTOFHEADLINEDBY 7-9 NOV "AttendanceisaMUSTfor anybookkeeperinspirationaland informative."IN-PERSONANDONLINE TICKETSAVAILABLE GUESTSPEAKERSAND SOFTWAREEXHIBITORS SOCIALISINGAND NETWORKING

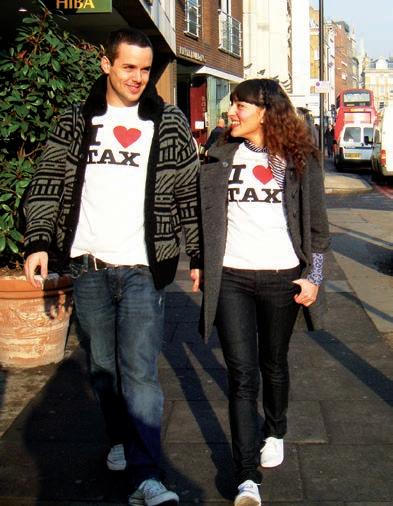

Well, in the UK the nights are drawing in, but that doesn’t mean you have to stay indoors! Come and join us at the ‘Future of Tax’ seminar in Mile End, East London. Our speakers include Anita Monteith, the ICAEW’s head of tax policy, and ACCA’s Glen Collins.

I will be there too, throwing in my two-pennies worth. Did you know, for instance, that National Insurance was introduced in 1911 and then expanded in 1948. Initially it was a contributory form of insurance against illness and unemployment, then retirement pensions and other benefits. There was even a Ministry of National Insurance – very 1984. But is NIC just another tax? There needs to be a simplification of tax, maybe an Office of Tax Simplification would help? No sorry that just got abolished! Sign up for this in-person event at: https://tinyurl.com/2psjj4ey.

Then there’s our sixth conference with London South Bank Business School. The one-day virtual conference takes place on Wednesday 7 December. You can sign up to ‘Accountants are the new innovators –don’t be left behind’ at https://tinyurl.com/3d73wjjf

And don’t miss the ICB’s Bookkeepers Summit on 7 November. PQ readers can get a 10% discount by using the code PQMAG. For more go to www.bookkeeperssummit.com.

Graham Hambly, Editor and Publisher, PQ magazine

News

04 Cost of living crisis Students are hardest hit as inflation soars

05 FRC trends reports All the facts and figures about the profession you’ll ever need

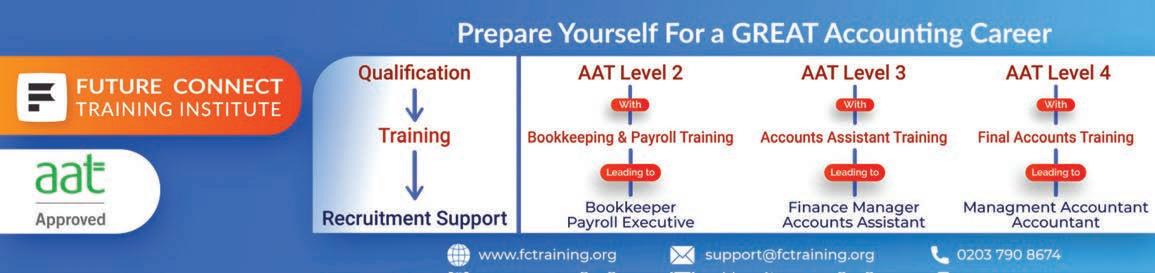

06 AAT campaign Association has unregulated accountants in its sights

08 PQ tax seminar Have you signed up for our fabulous free tax seminar on 26 October? Then get to it!

09 Deloitte growing Big 4 firm

aims to boost consultancy arm

10 New AAT President Christina Earls to put focus on social mobility and sustainability

12 Tech news Huge fine for Google for ‘abuse of position’ Features, etc

14 Have your say Tax doesn’t have to be taxing – but it is; and confusion over CIMA’s new route to membership. Plus our social media round-up

17 Key Facts and Trends The Financial Reporting Council

crunches the numbers in its lates ‘state of play’ report

18 CIMA spotlight How to bounce back from exam failure

20 Ethical accounting What to do if you suspect false accounting has taken place

21 AAT Level 3 Risk and risk management explained

23 Study advice AAT qualified Andy Murray gives some study –and life – advice to his younger self

24 Climate change Accounting firms have a key roles in helping their clients go Net Zero

25 A question for Tom Top tutor Tom Clendon answer a query about international standards

26 Viewpoint Why online learning is here to stay

27 ACCA spotlight Three steps to achieving PER success

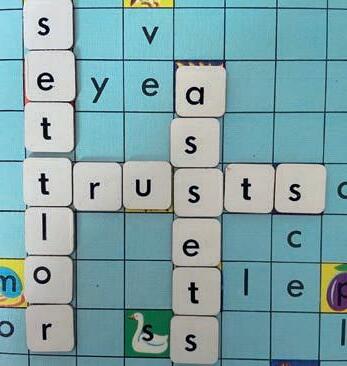

28 Trusts explained Neil da Costa likes to ‘keep it simple’ when explaining how trusts work

31 The future of learning New

p22

educational tools put the onus on students to engage with the materials

34 ACCA tax condensed A fiendishly clever way of getting through the ATX exam

34 Study tips LinkedIn careers coach James Perry shares his unique hacking tips and tricks

39 Careers New economic crime bill designed to tackle financial crime; Hays’ Karen Young tackles your career issues; and our book review

36 Fun The lighter side of life; and more great PQ giveaways

The columnists

Lisa Nelson The myth of the digital learner 4

Robert Bruce WFH is storing up trouble for future generations 6

Prem Sikka Why the UK’s energy market just won’t work 8

Anna Kate Phelan Let music soothe you to exam success 10

David Rothera Why not become a Climate Champion? 12

3PQ Magazine November 2022 IN THIS ISSUE To subscribe for FREE go to www.pqmagazine.com November 2022

p17 p21A note from the Editor contents p18

LISA NELSON

The myth of the digital learner

Students hit harder by cost-of-living crisis

Students everywhere will struggle to cope with the cost-of-living crisis unless the government steps in, a new survey has warned.

Do you recognise yourself in the groupings below, based on the year you were born?

1946-1964 – Baby Boomers have a strong work ethic, are disciplined and focused. 1965-1980 – Gen X are resourceful, independent and want a work-life balance.

1981-1996 – Gen Y, Millennials, or digital natives, value a worklife balance, are confident and tech-savvy.

1997 to date – Gen Z, or digital natives, are independent, entrepreneurial and competitive.

Of course, these characteristics are generalisations. Categorising or putting labels on people can speed up decision making but it’s not always helpful.

In 1991, Mark Prensky came up with the term ‘digital native’. He argued that “students today, having grown up in the ‘digital age’, learn differently from their predecessors”. They are used to receiving information really fast, prefer graphics to text and thrive on instant gratification and frequent rewards.

But there’s very little evidence that people are radically different in the ways they use and process information and as a consequence learn. Thousands of years of evolution cannot be reversed in such a short period of time, this is just another learning myth. Technology may change the way teaching and learning happens. But don’t worry, it’s not rewiring your brain – you’re still human!

The study by website Save The Student found 82% of students are worried about making ends meet. Worryingly, some four out of five have thought about dropping out of university at some point, and this includes 52% who gave ‘money worries’ as the main reason.

One in 10 students in the survey has used a food bank in the last academic year too, and that figure may rise as colleges and universities return.

Students are experiencing inflation that is higher than the national average. Living costs

have seen a 14% increase since Save The Student’s 2021 survey, with the average student now spending £924 per month. In London, the average is £1,089 per month.

The average student's Maintenance Loan falls short of

covering their living costs by £439 every month. This is a big increase from last year, when the shortfall between average Maintenance Loans and living costs was £340.

For more go to https://tinyurl. com/4xups998

Accountants are the new innovators

LSBU Business School and PQ magazine are back with our sixth annual conference, and this year we are looking at innovation.

This free global conference on Wednesday 7 December will be delivered online again and you can sign up to ‘Accountants are the new innovators – don’t be

left behind’ at https:// tinyurl.com/5yu59c7y

We have also lined up some of the most outspoken and provocative speakers in the profession to really put accountancy under the microscope. ACCA member and PQ columnist Lord Sikka will open up the conference, and he will be

My ACCA Exam Performance

ACCA has introduced ‘My Exam Performance,’ a tailored feedback service on a student’s exam performance.

All those who took the September 2022 Applied Skills exams will be able to avail themselves of the new service during the week beginning 17 October.

ACCA is currently developing feedback for Strategic Professional students and dates

for providing this service will be published shortly.

ACCA said that My Exam Performance will help students who have failed and passed. It believes it will become an invaluable resource for students preparing for a re-sit, and those who passed will better understand where their areas of weakness still are.

The move follows a successful pilot of 1,000 students

followed by ACA Professor Richard Murphy. Our afternoon session will be kicked-off by Generation CFO’s Chris Argent and we end the day with our now-familiar roundtable debate – what’s not to like!

This year’s event is sponsored by AAT, ACCA, CIPFA, ICAEW, Rogo, GAAPweb, AMLCC and FA Simms. Check out page 7 for more details.

Free Test Bank

How well do you know your accountancy concepts?

Well, www.pqmagazine.com has a whole test bank of subjects to help you on your way.

Test yourself to see if you are exam ready – here’s the list of subjects compiled by Professor Phil Dunn:

• Accounting Standards.

• Shareholders’ Interest and Risk.

• Process Costing.

• Marginal Cost Break-Even Analysis.

• Investment Appraisal.

• Year End and other adjustments.

• Limiting Factor Analysis.

• Activity Based Costing.

• Material Control and Reporting Director Material Cost.

• Disposal of Non-Current Assets.

Just click on the ‘Test Bank’ bar at the top of the PQ home page for another great free resource from PQ magazine.

Laptops second lease of life Deloitte has donated a total 6,865 laptops to schools, charities and community groups

across the UK since making the commitment to donate its used laptops in 2021.

Over half (3,600) of the reconditioned laptops have been donated to pupils from 58 schools across the UK, including 25 of Deloitte’s 5 Million Futures partner schools.

A survey of schools that received the laptops during the third national lockdown in 2021 found that teachers reported an improved quality of learning and attendance in online lessons, improved progress and attainment, improved mental

following the June exam. The feedback itself is split into four sections: syllabus, time management, OT skills and constructed response.

health and increased digital skills.

CGMA study hub

Planning your CIMA studies just got easier with a new study hub. PQs can access free resources, schedule their exams and progress towards the CGMA designation. You need to log on to https://hub. cimaglobal.com/support with your MyCIMA details to get started. When we took a look there were 17 technical articles and 11 technical webinars on the hub. The latest webinar is a case study masterclass.

PQ Magazine November 2022 the 4

In brief

news

Lisa Nelson is Director of Learning at Kaplan

How long to qualification?

Some 167,000 students have been studying more than five years to obtain their professional qualification, according to the latest stats from the Financial Reporting Council. That is 28% of all students signed up with ACCA, CIMA, CIPFA, ICAEW, CAI, ICAS and AIA. The good news is this figure in down two percentage points on last year.

Some 597,106 PQs are currently studying with the seven bodies. And while ACCA has the most students still studying with them after five years, three other professional bodies have a higher

percentage of their students stuck with them for five years or more

Some 54% of CIPFA students are still not qualified after half a decade with the institute. The AIA has just over 50% of its students with it after five years, and 35% of CIMA PQs have still not passed all their exams after the same period.

The accountancy body with the lowest percentage of students still studying after five years is ICAS. Just 5% are still studying after this time.

For more from the FRC’s key trend survey go to page 17.

You must question managers

Despite having ‘considerable sympathy’ for junior auditor Pratik Paw, an independent disciplinary hearing’s full report said he should have questioned his manager’s instructions to deceive the UK’s audit watchdog.

The 25-year-old PQ was told to forge documents by superiors

for an inspection of KPMG’s Carillion audit. The tribunal said he “acted without the integrity required of an accountant and became a party to the deliberate misleading of the Audit Quality Review (AQR)”.

The tribunal felt that being asked to copy meetings’ minute

Back to Basics videos – a free resource

Have you tried out the PQ magazine Back to Basics video series yet?

The aim of our online series is to provide short, sharp videos on some of the key topics that students struggle with. We have ones on double-entry bookkeeping, assets and trial balance.

Here’s the list in full of the videos on offer:

• Cost Behaviours, with Jo Tuffill https://vimeo.com/680501310

• Double Entry Bookkeeping, with Tom Clendon https://vimeo.com/429252329

• Financial Maths for AFM and FM students, with Sunil Bhandari https://vimeo.com/446780185

• Trial Balance, with Michele Baker https://vimeo.com/500074449

• The Strategic Planning Process, with Sean Purcell https://vimeo.com/437139421

• VAT Calculations, with Michele Baker https://vimeo.com/584904867

Assets, with Tom Clendon

Business Valuations, with Sunil Bhandari

Weighted Average Cost of Capital (WACC), with Sunil Bhandari

merely followed his manager’s instruction without any thought was rejected. What, asked the disciplinary tribunal, could be the conceivable reason for such an act other than to deceive?

documents into an old document should have immediately rang alarm bells and “would have raised questions in anyone’s mind”. Paw’s claim that he had

Paw received a severe reprimand, but was not fined.

The full decision of the FRC’s Executive Counsel can be found at https://tinyurl.com/yrfha557

5PQ Magazine November 2022 the PQ

•

https://vimeo.com/545939340 •

https://vimeo.com/584900540 •

https://vimeo.com/536755049

news

ROBERT BRUCE

Time ripe to tackle unregulated accountants

Renewed calls for the UK government to implement measures to tackle the issue of unregulated accountants has come from AAT’s director of professional standards and policy, Adam Harper.

It is Autumn, and soon it will be winter. And yet they are still there. From the window of the room where I work I look towards the many windows opposite. And most of them still have a lone figure. They have painted the room white and they gaze at their screens, emoting and gesticulating.

Who thought this would go on for so long? Most people I know are now back at work on a twoday/three-day-in-the-office regime. But many are not. Why commute if you can avoid it, both for the grim grind and the cost? The top end of the market has gone. Hundreds of thousands of people over 50, according to the ONS, have become, as the statisticians describe it, inactive. Yet in 2019, on the cusp of the pandemic, had anyone known it, the figures for the economically inactive were the lowest since records began.

There has been a great period of reassessing what people really want. Lockdowns gave people time to think, and they rejigged their priorities, ambitions and lifestyles.

Where this great resetting of society hasn’t worked, and probably can’t work, is for the young entrants into work. People with a firm grip of their roles can survive, even thrive, on hybrid working. Anyone starting off in work is denied the human contact, the gathering of experience, and the social glue of working in an organisation. That is where the problems of the future lie.

Robert Bruce is an award-winning writer on accountancy for The Times

In brief

ACCA student removed from register

Yet another ACCA PQ has been found guilty of having someone in the room while sitting a remote exam (see PQ magazine, August ’22, page 10). Adnan Khan of Peshawar, Pakistan, tried to claim “there was no one else in my room”. However, he later admitted he had his brother with him. Khan was also accused of having headphone or a mobile phone at his exam desk. He claimed that “I only used headphones to translate English into Urdu.” ACCA’s disciplinary committee was satisfied that

The AAT has long campaigned for legislation to be introduced requiring anyone offering tax advice to be a member of a recognised professional body.

AAT said that research has shown that unregulated

accountants account for one-third of the profession, but twothirds of complaints to HMRC. Added to this, AAT members last year revealed seven out of 10 had dealt with businesses suffering problems from unregulated accountants, with 44% saying the situation had worsened since the beginning of the pandemic.

Harper (pictured) said: “The

issue of regulation in the tax profession needs to be a higher priority than ever and the reason for that is simple – the value and importance of good advice intensifies in a time of crisis. Smaller businesses are facing huge challenges and the government simply expecting voluntary adherence to HMRC standards across the board isn’t an effective strategy.”

Building capacity in West Africa

The International Federation of Accountants (IFAC) has launched pilot accountancy capacity building programmes in both Ghana and Burkina Faso.

IFAC has joined forces with Gavi, the Vaccine Alliance, and the Global Fund to Fight AIDS, Tuberculosis and Malaria, to help strengthen the accountancy profession’s infrastructure in both countries.

The pilot projects aim to support robust accounting practices in the public health sector, help to improve the

financial management of donor funds, and provide long-term benefits to the economy and society.

Are au pairs earning more than you?

Does it pay to know another language? A new study by Preply has found that au pairs in the UK earn more than people working in the accountancy and the banking sectors! Using salaries posted on LinkedIn and Glassdoor, researchers discovered the average annual salary for an au pair was £39,000 compared with the £37,975 average earnt by accountants, with no second language ‘required’.

The highest paid bi-lingual job on the Preply list was international sales manager, where the average UK salary was £50,400.

The researchers also discovered that 32% of the richest people in the world can speak another language. Some 23 out of 25 on the World Billionaire List for 2022 spoke English as one of those languages.

Assietou Diouf, managing director, finance and operations at Gavi, said: “Sound financial management is key to ensuring Gavi’s programmes are able to improve the lives of as many people as possible.

“These pilot projects in Ghana and Burkina Faso are intended to boost transparency and build local skills and capacity at the local level. However, beyond that, we also expect them to contribute to a framework for better accounting practices that could one day benefit all Gavisupported countries.”

Khan was guilty of misconduct and have removed him from the student register and ordered him to pay £200 costs.

New director for ICAS Foundation

The ICAS Foundation has appointed Sanjay Singh as its new Director to lead the work of the charity in supporting young people from disadvantaged communities study accounting and finance. Singh takes over the role from Linda Jamieson, who has been Director of the ICAS Foundation since 2014.

He explained: “I am delighted

and humbled to lead the ICAS Foundation into the future, creating more opportunities for young people to flourish by reducing barriers to higher education and addressing the attainment gap. The ICAS Foundation has a critical role to play in leading positive change in the accountancy and finance sector.”

Can’t come out to play!

Gen Z and Millennials are cutting their spending on hospitality and leisure activities as concerns over the cost-ofliving crisis grow, according to a

For more on this go to https://tinyurl.com/yntby8nk

new PwC consumer survey.

In order to save money, over half of 18–34-year-olds are either reducing or stopping eating out (69%), subscriptions to their streaming/TV services (57%), and going on holiday (58%). This compares with only 51%, 28%, and 37%, respectively, in the over-55 age group.

As the younger generation cuts spending in some areas, they are also planning to be more financially resilient overall. Significantly, more 18–34-yearolds (42%) say they plan to ‘save money’ more in the next 12 months.

6 PQ Magazine November 2022 the

news

Working from home is storing up trouble for the future

Accountants are the new innovators

don’t be left behind!

7 December 2022,

online event

The world is changing fast and accountants need to change with it. This event is a great opportunity to look at how accountants can adapt and lead from the front.

shift is happening, so make sure you are on the right side of the curve. We are here to help that happen.

Business School & PQ Magazine are back with our 6th Annual Conference organised

discuss the important issues, share best practice, address your learning needs and

We have some fantastic guest experts lined up for you, including:

Lord Sikka

Professor Richard Murphy, Tax Justice Network

Nilushika Alwis, CIMA

Claire Gravil, NHS England and NHS Improvement

Sotiris Kyriacou, London Skills Development Network

Professor Ian Thomson, Lloyds Banking Group for Responsible Business and University of Birmingham

Dr Ross Thompson, Arden University

David Rothera, Net Zero Now

Chris Argent, Generation CFO

many more to be confirmed!

During the conference, we’ll explore...

What innovation looks like for accountants

Blockchain and how it can change your life forever

How all firms can become net zero

What the job market looks like right now

Integrating carbon accounting into the curriculum

How the NHS survived the pandemic

This global conference will be delivered virtually and we hope you can join us from wherever you are in the world as we continue to shine a spotlight on the profession & the impact we have on it.

–

Wednesday

9.15am–4.15pm Free

A

LSBU

to

more!

•

•

•

•

•

•

•

•

•

...with

•

•

•

•

•

•

Register here

PREM

SIKKA

Why the UK energy market just won’t work

The annual average UK household energy bill is around £2,500, compared with £803 for a typical French household. Why the difference? The French government owns energy production and distribution companies, so it can freeze prices and absorb losses via general taxation. In contrast, the UK system is privatised. Six private companies, namely British Gas, EDF Energy, E.ON UK, npower, ScottishPower and SSE, control 77% of the UK energy production market. Another six control distribution of electricity and four control distribution of gas.

Genuine competition is not possible. It is inefficient to have multiple sets of gas pipes and electricity transmission systems. Customers must buy energy and are therefore captive. Given the crucial role of energy in the economy, the government can’t let any major firm collapse, so we have a monopoly in private hands. Its profits affect household bills and inflation.

Electricity is produced from oil, gas, nuclear, wind, solar, hydro and other sources. Each has a different cost structure: renewables are the cheapest and gas is the most expensive. So how should it be priced? If priced at the lowest cost input then electricity generators using gas can’t make a profit. So the regulator, Ofgem, prices it at the cost of the highest marginal input, which is gas. This generates large profits for energy firms, and is a major reason for a public outcry.

Prem Sikka is Emeritus Professor of Accounting at the University of Essex

Taxwatch

Views on corruption drive attitude to tax systems

Taxpayers’ attitudes to paying taxes correlate closely with perceived levels of corruption, according to a major new study, Public Trust in Tax, by accountancy bodies ACCA and the International Federation of Accountants (IFAC). A survey of 5,900 people across 14 countries – many in developing economies – found that trust in tax systems is lower when taxpayers perceive higher levels of corruption and diversion of public funds.

The survey found politicians are

The Future of Tax – a free evening seminar

Queen Mary University of London and PQ magazine have joined forces to provide you with a free evening looking at the future of tax. Now, who doesn’t love tax? The current government certainly likes to play around with it!

The PQ team and a whole list of guests will be descending on Queen Mary University on Wednesday 26 October to discuss how the government will tax us in the future and what the new priorities should be. Please come and join us.

The evening will start at 6pm, but doors will open at 5pm for networking. Isn’t it time you got out a bit more? To sign up go to https://tinyurl.com/2psjj4ey

Our top panel will include

ICAEW’s head of taxation policy, Anita Monteith, and ACCA’s Head of Policy, Technical and Strategic Engagement, Glenn Collins. We will also have Kaplan’s Neil da Costa and Queen Mary’s very own Andrew Wade on hand. And Makayla Combes from the Ad Valorem Group will also be there

EY partners to vote on radical split

EY partners have agreed to vote on separating its audit and consulting businesses into two distinct, multi-disciplinary organisations, in what is being described could be the biggest shake-up of a Big 4 firm in decades.

The global firm revealed that voting is expected to begin on a country-by-country basis in late 2022, and concluded by early 2023.

In the UK the firm will need 75% of partners to back the plan for the split to happen.

to answer your questions. The event is supported by AAT, ACCA, ICAEW, CIPFA and the ICB.

EY’s UK chairman, Hywel Ball, said: “The needs of our clients, people and stakeholders are changing and I’m proud that we are reviewing the shape of our business in the UK and globally so that EY is well positioned to build on its success into the future.

“We believe the creation of two strong, independent businesses would help us to better meet the needs of our clients; create compelling careers for our people; and serve the public interest by providing greater choice in the market and a global response to regulatory concerns.”

Update of IFRS for SMEs proposed

The International Standards Board (IASB) is proposing an update to IFRS for SMEs.

The IASB’s proposals include updating the principles of the standard to align to those of The Conceptual Framework for Financial Reporting, issued in 2018, and simplified requirements based on IFRS 13 Fair Value Measurement and IFRS 15 Revenue from Contracts with Customers.

The IASB is also proposing to update the standard for

widely distrusted, recording a net trust deficit of -25%. In contrast, professional tax accountants and lawyers are trusted (67.1% and 64.6% respectively).

OTS abolition ‘hugely disappointing’

The Chancellor’s decision to abolish the Office of Tax Simplification (OTS) is hugely disappointing, and a ‘very strange first step’ to getting serious about simplification, says the Chartered Institute of Taxation (CIOT).

The Government announced in the ‘mini Budget’ that “instead of having a separate arms-length

new requirements in IFRS 3 Business Combinations, IFRS 9 Financial Instruments, IFRS 10 Consolidated Financial Statements, and IFRS 11 Joint Arrangements. The proposed

updates include other improvements made to full IFRS Accounting Standards since the second edition of IFRS for SMEs Accounting Standard was published in 2015.

Andreas Barckow, Chair of the IASB, said: “The IFRS for SMEs Accounting Standard has always been about keeping accounting requirements as simple as possible and cost-effective for eligible companies. These proposed updates respond to the feedback on how to keep the Standard current while maintaining its simplicity.”

body oversee simplification, the government will embed tax simplification into the institutions of government”.

CIOT’s John Barnett said: “That the OTS’s most ambitious suggestions have been ignored –or, at worst, that Chancellors have used the OTS as a parking lot for the too-difficult-to-implement – is down to the decisions of ministers rather than the OTS.”

Back to square one with IR35

As part of his ‘mini Budget’ the Chancellor Kwasi Kwarteng said he was repealing recent reforms

to off-payroll working (also known as IR35) from April 2023. While reversing the 2017 and 2021 off-payroll working rules will significantly reduce compliance burdens for big business it does not solve the problem of IR35, said CIOT President Susan Ball.

She said: “This is likely to lead to either widespread non-compliance, as happened under the old IR35, or to costly compliance activities for HMRC and a lot of pain for contractors having to defend their status assessments or face significant penalties from misunderstanding complex rules.”

8 PQ Magazine November 2022 thePQ news

Pre-seen for SBL in 2023

From September 2023, ACCA will introduce a pre-seen element to the Strategic Business Leader (SBL) exam.

These changes have been made to ensure that the SBL exam continues to remain relevant in the fast-changing world and fully meets the needs of its stakeholders.

Since much of the background information will now be provided in advance, the SBL exam duration will be reduced from four hours to three hours and 15 minutes. In addition, the format of the exam will change to reflect the reduced time available.

ACCA told PQ: “With less emphasis on reading in the

exam time, students will be better able to demonstrate their strategic thinking and professional skills.

“We have been consulting employers and tutors on the pre-seen introduction and have received positive feedback.”

The association added that the pre-seen will be released two weeks in advance of the exam, to both students and learning providers at the same time. Students do not need to do further research on the industry or organisation as all the relevant information will be contained either in the preseen material, or in the case study exam released on the exam day.

Deloitte consultancy going for growth

Deloitte has said its UK consulting headcount will grow to around 11,000 over the next five years –that’s a 40% increase.

This latest move is in addition to the 1,200 new roles created in FY22, with the practice forecasting around 1,500 new posts for the current financial year (June 2022 to the end of May 2023).

The growth plans come as a direct response to the increase in demand from businesses across the UK for help with digital transformation, cloud and sustainability. Deloitte is currently advertising for digital architects, cloud and machine engineers, app and web designers and data scientists.

Anne-Marie Malley, UK managing partner for consulting at Deloitte, said: “Whether its adopting new technology, implementing sustainability initiatives or undergoing large-scale digital transformation projects, our people help businesses and leaders up and down the UK deliver the best possible outcomes for their organisations."

High CO2-producing companies can’t comply

Current corporate reporting by a majority of companies producing the highest levels of greenhouse gas emissions would not comply with proposed new requirements from the International Sustainability Standards Board (ISSB).

This is the key finding of research carried out by ACCA and the Adam Smith Business School at Glasgow University, which aimed to find out how prepared companies

are for new climaterelated reporting rules being developed by the International Sustainability Standards Board, formed last November.

Analysis found that most companies fall short of the type and level of disclosure that the ISSB is proposing. The researchers also found that disclosures were often scattered and duplicated across different company.

9PQ Magazine November 2022 PQ

news

ACCASBRSTUDENTS TakeTomClendon'sSBRonline course... Pass assurance 24/7 WhatsApp support Revision,Tuition and3mock exams! Personalised feedback

ANNA KATE PHELAN

Exam time is always stressful, unless you’re a robot or have magical not-caring superpowers. In the absence of some sort of divine intervention, us lowly humans must look for ways to circumnavigate the tumult of stress that is exam season. One obvious way to reduce stress is to listen to soothing music and, according to researchers at DeMontfort University, it may have an added benefit – you’ll snack less on rubbish! The researchers found that people who were mildly stressed tended to eat about a third less unhealthy food when they listened to soothing music as opposed to when they didn’t listen to anything at all. Interestingly, this effect was not seen when people listened to distracting upbeat music or music that mirrored their emotions when stressed.

You may have assumed that in stressful exam times that the food you’re more likely to over-indulge in would be ‘comfort’ foods (am partial to a good shepherd’s pie, personally). However, researchers at the University of South Carolina have found that in periods of stress you’re far more likely to nibble on something unfamiliar (whatever that is to you). They have dubbed this seeming contradiction “the comfort food fallacy”.

Another unexpected upside is that you may broaden your horizons. So enjoy some new food (30% less if you get those soothing tunes on) during this stressful time and, fingers crossed, you’ll also be one step closer to qualification by the end of it!

Anna Kate Phelan is Senior Product Manager at Eintech

New AAT President installed

Christina Earls is the new AAT President (left above), succeeding Heather Hill to become the association’s 42nd President.

Earls was the first in her family to go to university, gaining a

place at Hull University where she read politics. After graduating, she got a job in revenue at Leeds City Council, then worked across different departments in five local authorities, going on to be

IASB issues amendments IFRS 16

The International Accounting Standards Board (IASB) has issued amendments to IFRS 16 Leases, which add to requirements explaining how a company accounts for a sale and leaseback after the date of the transaction.

A sale and leaseback is a transaction in which a company

sells an asset and leases that same asset back for a period of time from the new owner. IFRS 16 includes requirements on how to account for a sale and leaseback at the date the transaction takes place. However, IFRS 16 had not specified how to measure the transaction when reporting after that date. The

a member of CIPFA.

Her focus as President will include supporting social mobility, helping students develop a personal ethical code to support them through the challenges of their career, and making AAT more sustainable.

She said: “AAT qualifications are open to all – there is no age or cultural barrier – and that’s what’s so appealing.

AAT gives people life-changing opportunities, wherever they are in their professional journey, and also helps ensure all our members and students are able to continue developing their skills and technical knowledge.

I’m looking forward to working closely with the team to help make even more students and employers aware of how AAT can help them – showing that AAT really is for everybody.”

amendments… add to the sale and leaseback requirements in IFRS 16, thereby supporting the consistent application of the Accounting Standard.

New crackdown on fraud and money laundering

New wide-ranging reforms have been introduced to clamp down on the activities of kleptocrats, organised criminals and terrorists.

The Economic Crime and Corporate Transparency Bill means anyone who registers a company in the UK will need to verify their identity, in the hope that this helps to tackle the use of companies as a front for crime.

The reforms to Companies House – its biggest upgrade in 170 years – will also see the

Deloitte UK partners now paid over £1m

It has been a bumper year at Deloitte’s UK, with partners being paid an average of £1.06 million each for their efforts. Revenues for the year ended 31 May 2022 surged 10% to £4.9 billion, meaning distributable operating profits increased by 21% to £771 million.

During the year Deloitte welcomed more than 4,500 new colleagues and is planning to take on almost 2,500 graduates and apprentices across all regions and nations in the UK – a 67% increase on last year. Deloitte CEO Richard Houston said: “Our results have enabled us to make record investments – the highest in over a decade

organisation armed with new powers to check, challenge and decline incorrect or fraudulent information, making it a more active gatekeeper over company creation. The investigation and enforcement powers of Companies House will also be upgraded, enabling the organisation to cross-check data with public and private partners, as well as reporting suspicious activity to security agencies and law enforcement.

– in reward, promotions and skills. We enter the new financial year with momentum and are well placed to navigate the current economic headwinds.”

EY global revenue soars

EY has posted record global revenues just weeks before its 13,000 partners vote if the time is right to split the firm into two (see page 8). The firm operates in 150 countries and turnover to the end of June rose 16.4% to $45.4 billion. That’s the best growth rate for nearly two decades. Revenue in the consultancy division jumped a massive 27.1% to just under $14 billion. In contrast, global assurance revenue rose 9% to $14.4 billion. The tax teams brought in another $11.3 billion, an increase of 10.5%.

Business Secretary Jacob ReesMogg said: “This historic Bill will equip Companies House and law enforcement with the tools they need to root out criminals attempting to hide their activities without burdening law-abiding companies with unnecessary bureaucracy.”

PwC publishes sexual orientation pay gap

As part of its FY22 annual report PwC UK has published its sexual orientation pay gap data for the first time. This move follows the firm publishing socio-economic background and disability pay gaps last year.

Some 90% of staff shared information about their sexual orientation, with 4% of those disclosing that they identified as lesbian, gay or bisexual. PwC’s median sexual orientation pay gap, including partners, is 20.4%. This compares with the median gender pay gap of 10.3%. One worry with be the rise in the median socioeconomic background pay gap, which grew year-on-year from 12.1% to 17.5%.

10 PQ Magazine November 2022 the

news

Is music the food of exam success?

The Future of Tax –the Queen Mary University of London annual seminar

Queen Mary University of London has joined forces with PQ magazine to provide a free evening seminar on the future of tax.

As Benjamin Franklin famously said: “In this world nothing can be said to be certain, except death and taxes.” However, the world is changing and so is tax!

How will government tax us in the future? What will the new priorities be? Do we need to pay more tax?

Digitalisation and blockchain will change the tax industry forever, and could even spell the end of tax evasion.

who will provide their

started.

We are putting together a top panel of experts,

vision and help to get the debate

This event will start at 18.00 BST, but doors will open at 17.00 for networking. There will be a sandwiches, too! Click here to book your FREE place Date and time Wed, 26 October 2022, 18.00-20.30 BST (networking from 17.00) Location Graduate Centre Lecturer Theatre, Queen Mary University of London Mile End Road, Bethnal Green London E1 4NS

An exciting new initiative is being announced by ICAEW this month – the Climate Champions programme. I am proud of the fact that Net Zero Now has worked closely with ICAEW throughout the development of this and we look forward to showcasing Climate Champions with them.

We have worked with ICAEW on several initiatives, including the development of the Net Zero Accountancy Protocol. This protocol clearly lays out what Net Zero looks like for an accountancy practice and the steps needed to be taken in order to be certified as Net Zero.

The ICAEW Climate Champions programme is there to celebrate and support members, students and firms that have made a commitment to tackle the climate crisis. This commitment can be made in various ways – whether it’s reducing emissions, embedding climate resilience, tackling nature loss, or playing a wider advocacy role.

As part of the programme, any company that signs up to Net Zero Now and commits to going Net Zero, will automatically be eligible to be an ICAEW Climate Champion. We will work with accountants to help them understand their carbon footprint, look at how they can reduce their emissions and certify them as a Net Zero business along the way.

Being a Net Zero business and an ICAEW Climate Champion sends a powerful message to all those in your practice’s sphere of influence: that you are doing something about the climate crisis and doing it now.

David Rothera is Climate Project Manager at Net Zero Now

Tech

Data centres soak up water Thames Water is investigating the water consumption of data centres, which use vast amounts of drinking water to cool down their servers.

John Hernon, strategic development manager at Thames Water, said the review is homing in on the Slough area, which is set to become the second-biggest data centre hub in the world.

He said: “It isn’t necessary for data centres to use drinkingquality water for cooling. We

Google must pay $4.13 billion fine

Google has been told by a top European court that it must pay the $4.13 billion fine it received for abusing its dominance of the Android mobile phone market to thwart rivals.

The judgement also paves the way for other regulators to claim against the tech giant.

Google did manage to reduce the penalty by 5%, but the decision was broadly upheld by Europe’s second-highest court. This is the largest-ever fine imposed on a company by European courts, with the judges saying that Google ‘acted intentionally’.

The European Commission has now issued Google with

over $8 billion in fines after three long investigations covering over a decade.

Google can still appeal to the European Court of Justice.

Google is also facing a $25 billion class action in the UK and Europe over claims that it has broken the law by restricting competition in the digital advertising market. In the

Sage and Square partner up

Sage and Square, the global payments technology provider, have teamed up to help small business work smarter and save time. The partnership allows Sage Accounting and Square’s point of sale (POS) software to integrate, and is now live in the UK, Ireland and Canada. It means customers using both products can do business and take payments anywhere –

in-person, online or over the phone. Sales data then flows into Sage Accounting, keeping traders’ books up-todate and accurate.

“Processing cashless payments effectively is critical to business owners especially as more shoppers choose digital payment methods over cash,” said Neal

UK it has been reported that all websites that carry banner advertising will be considered part of the suit.

A spokesperson for Google said: “Google works constructively with publishers across Europe – our advertising tools, and those of our many adtech competitors, help millions of websites and apps fund their content, and enable businesses of all sizes to effectively reach new customers. These services adapt and evolve in partnership with those same publishers. This lawsuit is speculative and opportunistic. When we receive the complaint, we’ll fight it vigorously.”

Watkins, EVP, Product, at Sage. “Through this partnership, Sage and Square are taking the pain out of keeping on top of finances for small businesses. They can keep track of sales transactions with ease, and get paid with confidence, and Sage Accounting is automatically updated so their books are covered.”

QuickBooks launches new cloud-based offering

Quickbooks has launched its new cloud-based offering for accounting professionals and small businesses – Quickbooks Online Advanced.

It said as businesses grow their operations bookkeeping become more complex. It is hoping Quickbooks Online Advanced will address these problems head-on by making core business functions easier, quicker and safer.

Nick Williams, UK Product Director at Intuit QuickBooks, said: “Small businesses have had

a challenging time of it over the pandemic, and now the cost-ofliving crisis is continuing to pile on the pressure. Many of these businesses require support from professionals to help their back-

office run smoothly – and those best positioned to help are accountancy professionals.

“An accountant can help small business owners to streamline their finances and improve their back-office processes, and allow them to refocus on running the business itself. By expanding and developing new features in QB Advanced, we’re proud to be able to continue backing these accounting professionals to keep supporting the small business community.”

want to look at how raw, nondrinking water can be used and reused.”

Have to paid the CGT?

Young investors are shunning bonds and gilts for the bright lights of bitcoin and meme stocks, according to Growthdesk.

A study by the investment firm said that during the pandemic there was a rise in interest in investments among the under-35s, and with that have come some unexpected capital gains tax bills. In the

past year, CGT bills for under35s more than doubled, to £421 million.

Growthdeck’s Amy Shrives said these tax claims can be both unexpected and large. The worry for tax experts is these gains aren’t in any selfassessment either, and there was also the obligation to notify HMRC of all the gains by 5 October 2022.

‘Judgement day’ fears

Worryingly, more than a third of scientists believe development of AI could lead

to disaster. A team of New York University researchers discovered that 36% of scientists agreed it was “plausible that decisions made by AI or machine learning systems could cause a catastrophe this century that is at least as bad as an allout nuclear war”.

Some 61% also thought that private companies were having too much influence in the field, and 73% said AI could lead to changes in society not seen since the industrial revolution. Whether this is a good thing remains to be seen!

12 PQ Magazine November 2022 the

briefs tech news

DAVID ROTHERA Why not become a Climate Champion?

Tax cut nightmare

It may just be me, but it seems PQ magazine seems to have got more ‘interested’ in tax in recent months. You had something on the plastic tax in the October issue, and you are also selling your Future of Tax seminar with Queen Mary University of London on the same page (page 4). I see you even have my old tax tutor, Neil da Costa, speaking at the event – he must have taught thousands of us…

The current government has shown just how important it is to understand tax! With PM Liz Truss being a qualified management accountant they may now have to look at upping their tax content, because she hasn’t got a scooby

Have a lemonade

I was shocked by the story about the PwC employee who lost half their skull when they fell over following a boozy work night out (PQ, October ‘22).

But surely the firm isn’t totally to blame. The three-line whip of attending is something we all have to endure in the name of ‘team building’. How much you then drink is down to you. We are talking adults here, and people who have to manage other employees. You have to be stronger in these situations and leave your hedonistic student days behind!

Name and email address supplied

Thanks, John

Can I take my hat off to Open Tuition’s John Moffat. Open Tuition is such an unsung resource for ACCA PQs. It is totally free and I don’t know how they do it. I think he should get a medal from the ACCA as he must have helped thousands of students become fully qualified. I know because I am one of those. The Open Tuition family is such a great place to study – it’s all about being on the journey together. I really don’t know what I would have done without them. Name and email address supplied

doo how it actually works. Yes, she has made cuts in personal tax to the tune of £20 billion, but the average household is going to be

£1,500 worse off, says the IFS. Why? Because we have inflation, wages growth and a freeze on tax thresholds. That freeze will bring an extra £41 billion into the Exchequer at the very least!

I will see you on 26 October for your tax seminar, as I am keen to know how people think we are going to pay back all the money we have borrowed to cover the pandemic and the energy crisis. It will have to come from tax, surely. But we need to be creative in how we do it, so we don’t stifle entrepreneurship and growth.

Oh dear, I sound like Truss there, and creative taxation sounds too much like creative accounting!

Gerald Robbins, by email

Sage’s Chris Downing opened a can of worms when he put a picture of all the business cards he had collected recently. He asked: “Does anyone else wish to admit to owning a now useless (and potentially embarrassing) mountain of business cards?” He wondered if business cards were now a thing of the past and if there was still a need for them.

CIMA confusion

Can I admit to being a bit confused about the new route to CIMA membership? Doesn’t the CGMA Finance Leadership Program mean CIMA is now in direct competition with its college suppliers? These are

the same people who have ensured CIMA’s students have pushed on through to qualification despite the pandemic.

I am not sure they are going to be very happy.

Name and email address supplied

Mark Lee said that even prepandemic he wasn’t giving or receiving them as often as in the past. He has a very personalised card, which means he still encounters people who claim to have held onto one he gave them years ago. Maybe that’s an argument in favour!

Heather Elkington felt there was still space for cards in some form in the future, because searching LinkedIn profiles or writing down emails on a first meeting isn’t smooth, either.

Stuart Hurst said they are a waste of money and resources: “LinkedIn and WhatsApps deets swap all the way.” Tony Stevenson agreed and explained he had “binned um years ago, it’s almost a point of pride saying I don’t have one now”.

However, Sarah Douglas explained she still loves her cards, despite the fact that a lot of her contacts are digitally stored. “I like having the cards with notes for people I really do want to contact for the future,” she said. Douglas also explained that her card has her picture on and “so many people have said that really helps them to remember”.

Well, that’s it for the debate –now to get some new business cards! Or shall we?

Our star letter writer wins a fantastic ‘I love PQ’ mug! PQ Magazine PO Box 75983, London E11 9GS | Phone: 07765 386489 | Email: graham@pqmagazine.com Website: www.pqmagazine.com | Editor/publisher: Graham Hambly graham@pqmagazine.com | Associate editor: Adam Riches | Art editor: Tim Parker Contributors: Robert Bruce, Prem Sikka, Lisa Nelson, Anna Kate Phelan, Tony Kelly, Phil Gammon, Edward Netherton | Subscriptions: subscriptions@pqmagazine.com | Origination services by Classified Central Media If you have any problems with delivery, or if you want to change your delivery address, please email admin@pqmagazine.com Published by PQ Publishing Ltd © PQ Publishing 2022

email graham@pqmagazine.com

INVEST IN YOUR FUTURE WITH LSBU BUSINESS SCHOOL

Jumpstart your career journey – study Accounting and Finance at LSBU Business School. Our Croydon campus o ers state-of-the-art teaching spaces fit for the future of learning.

Stand out in the job market

You will become a partqualified accountant with exemptions from the leading chartered accountancy membership bodies.

We are ranked 1st among London moderns for Graduate Prospects (Complete University Guide 2021)

Find out more at www.lsbu.ac.uk/croydon or search ‘LSBU Croydon’ www.lsbu.ac.uk/croydon

www.e-careers.com Mon - Fri | 9am - 6pm (accounting) +44 (0) 20 3198 7600 Excellent Quote ‘ PQEC ’ to get these exclusive prices WAS £695 NOW £545 PASS RATE 82.2% NATIONAL AVERAGE 68% LEVEL 2 WAS £1,095 NOW £995 LEVEL 2 & 3 WAS £695 NOW £545 PASS RATE 87.6% NATIONAL AVERAGE 75% LEVEL 3 WAS £1,295 NOW £1,145 LEVEL 3 & 4 WAS £795 NOW £645 PASS RATE 91.2% NATIONAL AVERAGE 85% LEVEL 4 WAS £1,795 NOW £1,595 LEVEL 2, 3 & 4 Fulfil your goals accounting with us this Autumn!

YOUR KEY FACTS AND TRENDS

We take a look at the Financial Reporting Council’s annual report on the state of the

If you are just joining the profession, it will be good to know you are not alone!

Did you know, for instance, that there is a qualified accountant in the UK and Republic of Ireland* for every 186 people?

If you add those studying into the mix there are over half-a-million members and students in the profession, just on these two islands.

The body count

Membership of the accountancy bodies continues to grow. The seven bodies** in the report have nearly 390,000 members in the UK and ROI, and over 590,000 members worldwide. The growth in membership between 2020 and 2021 was 2.1% in the UK and ROI, and 2.8% worldwide.

So, while there are 135,681 ICAEW members in the UK and ROI, ACCA has 106,561 members and CIMA 85,517. ACCA leapfrogs ICAEW when worldwide figures are added in – ACCA has 236,827 members and the ICAEW has 161,411. CIMA also has 116,302 members worldwide.

There are nearly 162,000 accountancy students in the UK and ROI, and over 597,000 worldwide. Between 2020 and 2021, student numbers increased by 0.3% in the UK and ROI, and by 1.6% worldwide. UK and ROI student numbers fell slightly for ACCA (-1.3%) and CIMA in 2021 (-1.7%) and worldwide student numbers also fell for CIMA (-5.2%).

ACCA with 75,188 students in the UK and ROI leads the way here, with CIMA on 47,101 and ICAEW with 25,014 PQs. The gap is bigger when you look at the worldwide figures – ACCA has 446,232 students, CIMA has 93,690, and ICAEW has 33,958.

The figures show that 97% of AIA and 83% of ACCA students were based outside the UK and ROI. In contrast, ICAS and CAI had 1% or less of its students based outside the UK and ROI.

That all means just 27% of all students from the accountancy bodies were studying in the UK and ROI.

Does age count

In 2021, 39% of all students from the seven accountancy bodies were under the age of 25 compared with 38% in 2017.

ICAEW, ICAS and CAI had the highest percentage of students aged 34 or under at 97%, 96% and 88% respectively in 2021.

In comparison, CIPFA had the largest proportion of students aged 35 and over at 49%.

A question of degrees

The Irish institute, the CAI, has the highest number of graduate entrants with degree at 91%. It also has the highest number of grads with relevant degrees too (77%).

At the other end, 14% of CIPFA students have a relevant degree and just 27% have a degree of any some sort.

Women on the rise

Since 2017, all the accountancy bodies have increased their percentage of female members worldwide. AIA experienced the largest increase of 3 percentage points, in this period (from 34% to 37%). ACCA continues to have the highest percentage of female members of all the accountancy bodies, at 48%. The ICAEW retains its title as the professional body with least female members with just 30%. That said, the overall percentage of female members worldwide has increased from 36% in 2017 to 37% in 2021.

The overall percentage of female students is 50% (for the third year in a row). ACCA had the largest percentage of female students in 2021 at 60%. Both CIPFA and AIA also have more female students than male at 56% and 51% respectively. ICAS seems to have the hardest problem attracting women with a female intake of 43% in 2021.

This will mean the ICAS will struggle to increase female membership numbers above its current 35% rate.

all the stats go to

* Figures for the Republic of Ireland and UK are included together in the report.

The seven bodies in the report are: ACCA, AIA, CAI, CIMA, CIPFA, ICAEW and ICAS.

17PQ Magazine November 2022 state of accountancy

accountancy profession

For

https://tinyurl.com/ycxj4pxx

**

Bouncing back after an exam set-back

CIMA’s Mark Foley offers some advice on how to deal with the disappointment of exam failure, and explains how you can come back stronger next time

You worked hard for your exams. But the preparation hasn’t paid off. You received the disappointing news that you didn’t pass. And you want the CGMA designation because you know it’s key for employability. What can you do to dust yourself off and bounce back after the setback?

Take a break

Relax and take deep breaths. Relaxing may seem counterintuitive, but it’ll help you reset. Do something enjoyable — go out to dinner with friends, walk your dog in the park, dust off your roller skates. A carefree activity will help you to let go of your disappointment. Breathe

Back to basics

Reflection is essential — it underpins and strengthens good study habits going forward.

Review your exam preparation performance. What did you prepare? How did you prepare? When did you prepare? This review provides essential feedback on your learning journey.

Review what you did in the exam itself. Do this in detail and be honest with yourself. Learning from your mistakes is the key to success next time around. CIMA has lots of resources in the CIMA Study Planner to help you prepare for the case studies. Have a look at the self-test checklists in the study planner. These will help you reflect further on what you should have done to prepare. Make sure you fill in any gaps and address any shortcomings in knowledge or techniques before your next attempt.

Identify useful resources

Sometimes identifying which resources are the most useful can be the biggest challenge. Fortunately, this dilemma has been solved for you. There’s a set of

specifically curated resources — articles, webcasts and animations — that will take you through your exam prep, right up to the last 24 hours before the exam. There’s one for each level of the CIMA’s CGMA Professional Qualification. Here’s the link to the study guides for the Operational Level Objective Test exams and the Operational Level Case Study as an example.

Talk to other students

Chat with other students who have just received their results, either at work or on the CIMA Student Group on Facebook

Maximise their feedback. Ask them why they think they passed or failed. Does any of their feedback ring true for you?

For example, did you immerse yourself in the pre-seen materials and look at the organisation from every angle and context?

Did you make sure your knowledge of the three Objective Test subjects was sharp or were there some gaps you glossed over?

Were there topics you knew were wobbly but hoped wouldn’t come up? Did you get a bit hung up on writing down everything you knew in parts of the question you were confident in, rather than making sure you covered all parts of the requirement?

The combination of talking to your peers and reflections will provide insights into what you did last time. And how you can improve next time for success.

Next steps

Book your next exam as soon as possible. Don’t leave it too long (unless you are a long way short of the pass mark and have some serious studying to do).

It’s best to book into the next available exam while the knowledge is fresh in your mind and you feel you’ve learned the lessons from your previous attempt.

Envisage the rewards of a pass next time around.

Confidence is important

True confidence comes from knowing your stuff and being fully prepared. If you know the syllabus inside out and upside down, trust your judgement when it comes to tricky questions such as the “select all that apply” ones. With these, for each of the given responses, just ask yourself ‘Am I sure this response is true/correct?’ If the answer is a definite ‘yes’, tick that response.

If you are at all hesitant, ignore that response and move on as your first answer is almost certainly right.

You must study and feel competent in all parts of the syllabus as anything can and will be tested.

Summary of tips

• Read the questions carefully the first time around, before you start answering.

• Resist the temptation to ‘fiddle’ with your answers (tempting though it may be).

• Doing the practice tests will show you that if you first read the questions very carefully, you do select the correct answer. Practice is key.

• Re-book your exam promptly and prepare well to pass next time around. If you are set and follow our guidance on time management and exam technique, you should succeed.

• Most importantly, don’t give up. Take pride in how far you have come and have faith in achieving exam success.

• Go for it and good luck!

To bring your re-sit preparation together, explore the Resit guide. It’s essential reading and will support your journey to exam success.

• Mark Foley, Director of Relationship Programmes – Management Accounting at the Association of International Certified Professional Accountants, representing AICPA & CIMA

18 PQ Magazine November 2022 the CIMA spotlight

Jo Tuffill – Cost behaviour (newly uploaded)

Understanding a business’s cost structure is vital for its success. It is why cost behaviour is the first concept taught in management accounting. Her video runs for just seven-and-a half minutes and explains exactly what a cost is, looking at both variable and fixed costs. Jo has also written an accompanying feature (PQ magazine, April 2022). You can check out her video

Tom Clendon – double entry bookkeeping

You should be able to master the rules of double entry bookkeeping in just eight-and-a half minutes. So do you know your credits and debits? You can find Tom’s feature explaining all on page 22 of PQ magazine, July 2020.

out the video at: https://vimeo.

Accountancy can be simple if you know the basics! PQ magazine has gathered together the top tutors in the world to help us help you. Our Back to Basics video series will guide you through some of the fundamental topics of accountancy. Many of the videos even come with an accompanying article! The series includes:

Michele Baker – trial balance

In just six short minutes Michele Baker explains how to create the trial balance and why you are doing it. Michele will let you know whether a balance is a credit or debit, and help you get to grips with ‘DEAD CLIC’. She has had over

Check out the video at: https://vimeo.

Sunil Bhandari – financial maths

This presentation is slanted to ACCA FM and AFM students sitting the CBE exams, but will be useful for any PQs wanting to understand financial maths that bit better. See pages 20-21 of PQ magazine, September 2020, for the accompanying article. Check out the video at: https://

more great Back to Basic videos at www.pqmagazine.

the video

at

top of

page

at: https://vimeo.com/680501310

Check

com/429252329

550 views already.

com/500074449

vimeo.com/446780185 Check out

com. Either click on

bar

the

the home

or scroll down to the video section

Suspicion of false accounting

We outline a case from the CCAB’s ethical dilemmas for professional accountants working in business

Outline of the case

You are a recently qualified accountant and have accepted a job as financial controller for a well-established family business which supplies equipment to photographers, both online and from its warehouse outlet. Its customers range from enthusiastic amateurs through to part-time professionals and owners of busy studios.

The customers’ payment methods reflect their diversity. There are debit/ credit card transactions and customers with 30-day credit business accounts. There is also a surprisingly large number of customers who collect their goods from the warehouse and pay in cash. You are told that cash payment probably reflects the nature of the customers’ own receipts, as some photographers will often be paid in cash for weekend wedding assignments. In your first week at the company, the sales director (the principal shareholder’s close family relative) brings to you a cheque in settlement of the account of a major customer. They explain that the cheque (which appears to clear the amount due) is in fact an overpayment, as the balance showing on the sales ledger is before allowing a bulk discount (which is calculated retrospectively).

The sales director shows you the calculations and the agreement as authorised by the board of directors. The sales director states that the customer’s managing director has come to collect the discount in cash. They say that this is not an unusual occurrence for some of the company’s better customers. It helps to maintain a good relationship with those customers, which leads to purchasing loyalty. Another benefit of this arrangement is that it gives the sales director regular face-to-face meetings with the senior staff of those customers. It also reduces the high charges that the bank makes for handling cash.

You ask the sales director why the customers prefer to receive a refund in cash, rather than simply pay the net amount needed to settle the account. They reply, with a smile, that it is not for them to question the customers’ motives.

Questions

As a professional accountant in business:

a. Which fundamental principles feature more prominently for safeguarding?

b. What would be your key considerations in your approach to resolving the dilemma present?

c. What course of action would you take to resolve the dilemma?

Key fundamental principles

Integrity: You and the sales director have suspicions about the motives of some customers who regularly overpay the company and receive refunds in cash. Are you acting with integrity if you do not question those motives?

Objectivity: Being new to the company, you are likely to feel intimidated by the directors, who are all members of the same family. Can you ensure that the intimidation threat does not adversely affect your ability to make ethical decisions?

Confidentiality: You should consider whether you have a responsibility to discuss the practices of the company and its major customers with third parties, once all other reasonable steps have been taken. Professional behaviour: You must comply with relevant laws and regulations and not assist others to act illegally or unethically. You must not do anything that may discredit you or the accountancy profession.

Considerations

Identify relevant facts: You are aware that some of the company’s customers are overpaying their accounts with the company and receiving repayments in cash. If credit notes are issued to the customers in respect of the retrospective discounts, these could be concealed by the customers, who can then understate their profits. Although there are quite legitimate benefits to your employer, you and the sales director have reasonable suspicions that the customers concerned are false accounting.

Identify affected parties: These include you, the sales director, some of the company’s customers, the tax authority and other stakeholders in the company.

Who should be involved in the resolution: You, the sales director and maybe those charged with governance should be involved in the discussions. Are there other trusted colleagues with whom you can discuss your position? Is it necessary to involve those charged with governance in the customers’ businesses?

Possible course of action

As you are currently unfamiliar with the

procedures of your new employer, you should try to establish the extent of the issue. You might achieve this by reviewing the sales ledger accounts that have shown credit balances in recent months and have subsequently been cleared by cash refunds. If your understanding is correct, these accounts will relate to some of the company’s major customers.

Having established the facts, you should discuss the issue with the sales director and then, if necessary, those charged with governance such as the other board members. In each case, you should prepare for the meeting and try to propose an acceptable solution to overcome any resistance that you may encounter. You may wish to discuss the issues, taking care to maintain confidentiality, with a trusted advisor, e.g., a colleague or your professional body. You should advise the directors of the opportunity for fraud that you have noticed regarding the cash refunds, and that the company could suffer adverse consequences and reputational damage if it is allowed to continue.

You could also explain to the directors the ethical code of your professional body, and that you cannot simply ignore the situation.

If you feel the need to resign in order to disassociate yourself from the unethical practices, then you may wish to seek legal advice on your employment and whistleblowing rights and responsibilities and any protection you might seek from legislation. However, resigning is not a substitute for taking required actions.

You should document, in detail, the steps that you take in resolving your dilemma, in case your ethical judgement is challenged in the future.

•

The CCAB case studies illustrate how the codes of ethics of the CCAB bodies can be applied by professional accountants and the five sets can be found

20 PQ Magazine November 2022 the ethical dilemma

at https://tinyurl.com/ycxj4pxx

Risk and risk management explained

Karen Groves explains what is meant by risk and risk management in a business scenario, which is now assessed in the AAT Level 3 Business Awareness unit

What is the difference between risk and uncertainty? Risk in a business is things not going to plan, for example, sales not being as high as expected or costs higher than expected. A risk to a business could also include losses from theft or fraud. Risk is inherent if an outcome is not guaranteed, for example, a business launching a new product that might fail.

Uncertainty is whereby there are several possible outcomes to a situation, and the outcomes are very difficult to predict. For example, a new product launch has uncertainty regarding the volume of unit sales. If a situation is uncertain, then a business can’t predict what the likely outcome will be as there is insufficient information, or past experience to draw on. Uncertainty can be reduced by the business obtaining as much information as possible before any decisions are made.

With risk, there can be a number of possible outcomes, however the probability of each of the outcomes is known, whereas with uncertainty, there are a number of possible outcomes, however the probability of each outcome is unknown.

Types of risk:

• Business risk – relates to the industry the business operates in. This risk is there due to the nature of goods or services the business sells. Some industries are inherently riskier than others.

• Financial risk – relates to a financial situation, for example, a change in interest rates, which impact on the business financial circumstances, or the risk of non-payment by customers.

• Strategic risk – relates to the risk that the business strategies will fail, for example, expanding in a new market involves risks.

• Operation risk – relates to the risk of business operations failing, and losses occurring due to this.

• Cyber risk – relates to the risk of disruption, damage, or financial loss due to the information technology systems in use. As digital systems are increasing, so are the cyber risks which can include malware, trojans, viruses and spyware.

• Reputational risk – relates to the risk of damage to the business’s reputation, which can be caused by environmental damage or pollution by the business, company behaviour/ attitude overall, mis-selling of

products or incompetence. If a business has a good reputation, this can easily be damaged by adverse posts on social media.

Risk management

Risk management involves identifying the risk and then evaluating the risk further. A business will assess the likelihood of the risk and what the impact of the risk will be. For example, how likely is it that a new product will fail and what is the impact to the business of this.

Risks can be managed as follows:

• Transfer – the risk can be transferred to a third party, for example, an insurer to cover possible business losses.

• Accept – the business will accept the risk and deal with any consequences of such. This approach should only be taken on risks that have a low impact if they did occur.

• Reduce – the business will aim to reduce the risk, for example, by regular servicing of the delivery vehicles to avoid breakdowns and delays of goods being sent to customers.

• Avoid – the business may opt to avoid the risk altogether as they deem the risk as highly likely and would have a high impact on the business if it were to occur.

Question 1: Which of the following statements is true?

• Risk can never be reduced.

• Uncertainty can never be reduced.

• Risk can be reduced in some situations

Question 2: A loss of a major customer is what type of risk?

• Business risk.

• Financial risk.

• Strategic risk.

• Operational risk.

Question 1 answer: risk can be reduced in some situations.

Question 2 answer: business risk.

• Karen Groves is an AAT tutor and AAT Course Director at e-Careers

21PQ Magazine November 2022 AAT Level 3

Pick HTFT for AAT

Starting January2023, we have live courses for AAT Level 4 under Q2022, to complement our on-demand options at L3 and L4.

HTFT live: pre-recorded syllabus videos that lead into scheduled live online interactive Masterclasses (with expert tutors), all designed to support your mastering ofknowledge accompanied with computer based tests and mock exams

For more information visit www.htftpartnership.co.uk/courses/aat/

Think ACCA, think HTFT

We have a full suite of ACCA Applied Skills and Strategic Professional coursesfor March2023 examsstarting early December startplanningfor that pass now!

▪ Membership of our vibrant Online Learning Community and access to a dedicated tutor

▪

HTFT Partnership studentnotesand ACCA authorised study text, exam kit and pocket notes

▪ Full syllabus, Topic by Topic recordingssupported by timetabled ‘live online’ Tuition Masterclass sessions recorded, downloadable and playable on all devices

▪ Scheduled ‘live online’ Revision Masterclass sessions recorded, downloadable and playable on all devices

▪ HTFT computer based tests and mock exams, marked,with answers and video debriefs

For more information visit www.htftpartnership.co.uk/courses/acca/

Study CIMA, choose HTFT

Studying CIMA?Our HTFT live, HTFT on-demand and HTFT play resources are all here to help you prepare for, and pass, your exam.

HTFT live: join our expert tutors live online for interactive Masterclasses, designed to support your application of syllabus knowledge.

HTFT on-demand: drive your learning, with full flexible resourcesthat you control

HTFT play: Boxsets of topic recording and Proficiency exam-style practice assessments

For more information visit: www.htftpartnership.co.uk/courses/cima

^ƚƵĚLJ ǁŝƚŚ ,d&d WĂƌƚŶĞƌƐŚŝƉ ǁŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ tŚLJ ǁŽƵůĚ LJŽƵ ŐŽ ĂŶLJǁŚĞƌĞ ĞůƐĞ &Žƌ ŵŽƌĞ ŝŶĨŽƌŵĂƚŝŽŶ ĞŵĂŝů ŝŶĨŽΛŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ ǁǁǁ ŚƚĨƚƉĂƌƚŶĞƌƐŚŝƉ ĐŽ ƵŬ Online College of the Year 2017 Personality of the Year2018 Private Sector College of the Year 2020 We have a full setof E pillar and P pillar courses starting in the new year, along with OCS, MCS and SCS for February2023exams

‘Studying AAT positively shaped my future’

Andy Murray gives some study – and life – advice to his younger self

It’s a little over two years since I completed my AAT study journey and becoming a full member (MAAT). Someone recently asked me what advice I would give to my younger self, and reflecting on my studies, I am sure the thoughts and feelings below will strike a chord with many student members.

Managing additional commitments

Firstly, taking on additional commitments is time consuming and can often feel like untold pressure. One of the first things I would tell my younger self is that embracing pressure rather than fighting it is key to turning fear into energy. Making time to study, preparing for exams and allowing yourself the space to absorb the learning takes time and adjustment. The initial weeks and months often feel quite daunting. However, realising that being in control of your studies and accommodating all of these new feelings is what’s truly important.

Going back to work on a Monday after another weekend studying continuously, working all week and studying every evening, only to face another weekend of studying. I would certainly tell my younger self that this pattern is not sustainable. It’s only once you become consumed by your studies that you realise that quantity doesn’t equal quality. Looking back, I always believed that results deserved reward. What I would tell my younger self is that being kind to yourself fuels a positive mind set.

Managing your studies