7 reasons your house always looks messy

Experts weigh in on what could be causing you to struggle with maintaining your household. (Photo: FreshSplash).

By Amanda Lauren RealSimple.com / Living Space

Do you ever feel like no matter how much effort you put into decluttering and organizing, your home never looks neat? Or perhaps you spend a lot of time on a cleaning project, and a few days later, you get busy, and the whole house feels like a disaster again? There could be a few things going on that explain the chaos — here’s why your home always looks messy, along with some helpful tips from professional organizers on what to do about it.

1. There are dishes left in the sink. Open floor plans are more popular than ever these days. But unfortunately, that means everyone is subjected to seeing your messy kitchen. Not only does a sink full of dishes look unsightly, it can also smell. So prioritize getting this done ASAP. “If you do your dishes as soon as you use them, you will never have a mess,” says professional organizer and founder of organizing service O.C.D, Ashley Stewart. “If it is too hard to clean dishes throughout the day, make it a point to make sure you go to bed with no dishes left in the sink.”

2. Toys are everywhere. Children make it challenging to keep a home tidy, but it’s not impossible

to get things under control. “The best solution for toys is to have baskets and bins where you can put the toys in,” says Stewart. “Not everyone has time to organize every day, but everyone does have time to pick up toys and put them in bins — kids included. When you teach your kids from an early age they clean up at the end of play, they will learn to put things away after they use them.”

3. The bed isn’t made.

Your bedroom will always look clean and tidy if your bed is made. It only takes a minute and makes a big impact. “I can’t stress this one enough. There is something about a made bed that sets the mood for the rest of your house. If your bed is made, not only will your bedroom look cleaner, it will feel better getting into at night,” explains Stewart.

4. You’re not using the laundry hamper.

We’re all guilty of wearing a sweatshirt for a few hours, failing to put it away, and leaving it on a chair or worse — the floor. This often results in messy piles. “If you don’t hang up your clothes after you wear them or put them in the laundry, you are most likely going to have that one chair in your room that becomes an abyss for your clothes,” says Stewart.

To avoid a cluttered space, the organizer advises making it a habit to put your clothes away or in the hamper after you wear them. It only takes a few seconds and makes a major difference.

5. Things don’t have a home. Lindsey Mahanna, professional organizer and founder of Clutter to Clarity, says when things don’t have homes, they often end up in random spots, creating messes throughout a space. “If you make the time to tidy, you need to know where to put away those items that have accumulated on the counter. If you haven’t already figured out a home for each of these items, how can you know where to put them away?”

6. You have too much stuff. Whether you live in a studio apartment or a palatial estate, we all have a finite amount of room to store our things. So, if you have too much of anything, it’s crucial to declutter regularly. “It’s hard to tidy when there are too many items that will fit in a space,” says Mahanna. “Now, if you are more than reasons in play, they just compound and make it even harder to tidy up.”

Make a decluttering schedule and stick to it. It also helps if you think about whether you truly need

something before making a purchase. Do you really need another white T-shirt if you already have five?

7. There isn’t a system in place. Shantae Duckworth, professional organizer and founder of Shantaeize Your Space shares that one of the major problems messy homes have is a lack of effective systems “By implementing practical organizing strategies, establishing daily routines, and decluttering regularly, you can transform your space into a more organized space that will not get messy as quickly.”

So, don’t be afraid to figure out how to tackle this problem. Put the kids in charge of decluttering their rooms. Make a plan to sort through your pantry every third Wednesday. Evaluate your bathroom monthly. You can also hire a professional organizer to figure out systems that will be easiest for you and your family to maintain.

Real Simple magazine provides smart, realistic solutions to everyday challenges. Online at www.realsimple.com.)

©2024 Dotdash Meredith. All rights reserved. Used with permission. Distributed by Tribune Content Agency, LLC.

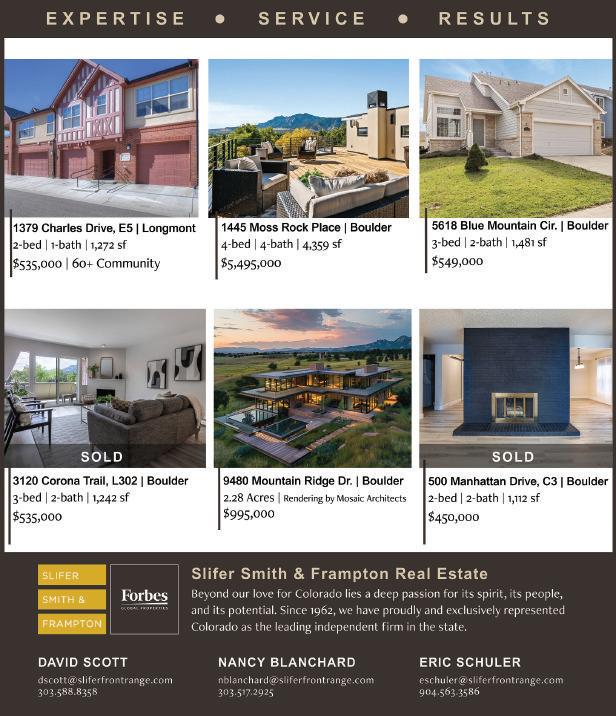

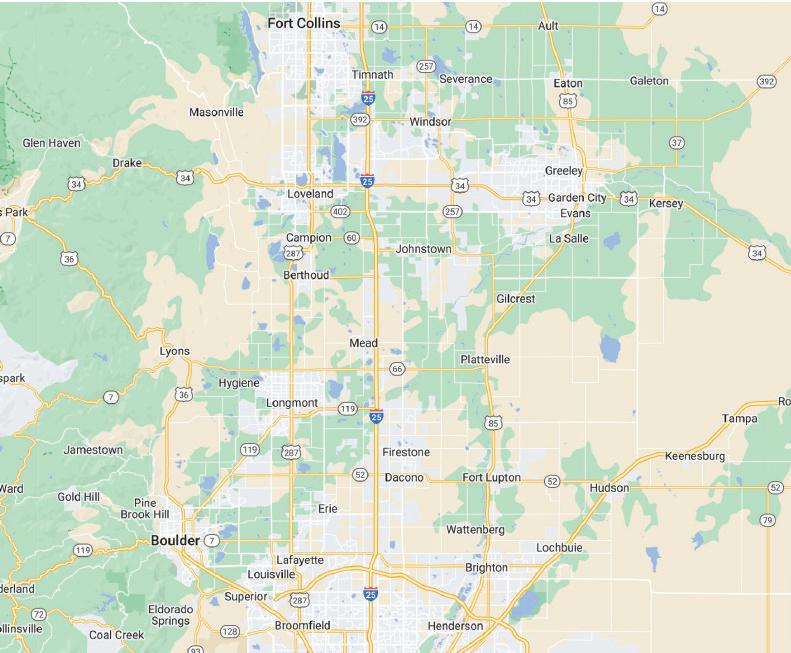

To view a more cities and a more complete list of new home communities and builders across the Colorado Front Range, view our interactive map online at: www.AtHomeColorado.com/NewHomeMap

Our region is home to more than 700,000 residents and includes some of the most diverse, natural landscapes and sustainable development along the Front Range of Colorado. Here we highlight a selection of the area’s new home communities and which builders are building where.

BERTHOUD

1 Farmstead

Builder: Sage Homes

2 Rose Farm Acres

Builder: Richmond American

BOULDER

4 Velo Condos

Builder: Thistle Velo LLC

BROOMFIELD

5 Baseline Colorado

Builders: Boulder Creek Neighborhoods, Meritage Homes, Thrive Home Builders

6 Vive on Via Varra

Builder: Meritage Homes

ERIE

7 Coal Creek Commons

Builder: Century Communities

8 Colliers Hill

Builders: Boulder Creek Neighborhoods, KB Home, Richmond American

9 Compass

Builder: Lennar

11 Erie Highlands

Builder: Oakwood Homes

12 Erie Village

Builder: Porchfront Homes

13 Flatiron Meadows

Builder: KB Home, Taylor Morrison, Toll Brothers

14 Morgan Hill

Builder: Lennar

15 Rex Ranch

Builder: Taylor Morrison

16 Westerly

Builder: McStain Neighborhoods, SLC Homes, Wonderland Homes

17 Wild Rose

Builder: Lennar

FIRESTONE

18 Barefoot Lakes

Builder: Brookfield Residential, Creekstone Homes, Lennar, Richmond American Homes

FORT COLLINS

57 Northfield

Builder: Landmark Homes

FREDERICK

19 Seasons at Silverstone

Builder: Richmond American

GREELEY

20 Northridge Trails Townhomes

Builder: Hartford Homes

21 Promontory

Builder: Journey Homes

59 Cottages at Kelly Farm

Builder: Benchmark Custom Homes

JOHNSTOWN

22 Thompson River Ranch

Builder: Oakwood Homes

23 The Ridge at Johnstown

Builder: Bridgewater Homes

24 Pintail Commons at Johnstown Village

Builder: Richfield Homes

25 Mountain View

Builder: Baessler Homes

LAFAYETTE

26 Blue Sage

Builder: Markel Homes

27 Avalon Meadows

Builder: Von’s Colorado Concepts

28 Silo

Builder: Cornerstone Homes

29 Silver Creek

Builder: Markel Homes

58 Trail Ridge West

Builder: PR Homes

LONGMONT

30 Highlands at Fox Hill

Builders: Dream Finders Homes, Landmark Homes

32 Terry Street Townhones

Builder: New Leaf Properties

LOUISVILLE

33 North End

Builder: Markel Homes

LOVELAND

34 The Enclave at Dakota Glen

Builder: Glen Homes

35 The Enclave at Mariana Butte

Builder: American Legend Homes

36 Eagle Brook Meadows

Builder: Bridgewater Homes, Challenger Homes

37 The Lakes at Centerra

Builder: Bridgewater Homes, Landmark Homes, KB Home

38 Kinston at Centerra

Builder: Richmond American Homes, Dream Finders Homes

MILLIKEN

39 Brookstone

Builder: Windmill Homes

40 Sunfield

Builder: Windmill Homes

SUPERIOR

41 Downtown Superior

Builder: Thrive Home Builders, Remington Homes

42 Heights at Downtown Superior

Builder: Toll Brothers

43 Lanterns at Rock Creek

Builder: Boulder Creek Neighborhoods

44 Montmere at Autrey Shores

Builder: Koelbel

45 Rogers Farm

Builder: Boulder Creek Neighborhoods

TIMNATH

47 Serratoga Falls

Builder: American Legend Homes, Richmond American Homes

48 Timnath Lakes

Builder: Toll Brothers

49 Trailside

Builder: Wonderland Homes

46 Wilder at Timnath Ranch

Builder: Landmark Homes

50 Wildwing Patio Homes

Builder: Hartford Homes

WINDSOR

51 Country Farms Village

Builder: Landmark Homes

52 Greenspire

Builder: Windmill Homes

53 RainDance

Builder: American Legend Homes, Hartford Homes, Wonderland Homes

54 Seasons at Hunters Crossing

Builder: Richmond American Homes

55 Vernazza

Builder: Landmark Homes

56 Village East

Builder: Journey Homes

REAL ESTATE TRANSACTIONS

The following Northern Colorado home sales were supplied by Colorado Weekly Homebuyers List., 303.744.2020. Listed are the buyer, the property and the amount.

BERTHOUD

• Brian Lee -- 1135 Summit Vista Drive, CB Signature Homes LLC, $453,000.

• Cynthia & Sean Halsey -- 216 E Colorado Ave., Robert N Kyvik, $500,000.

• Douglas & Tanya Scott -- 237 Beetle Lane, Meritage Homes Colo Inc, $526,000.

• Justin & Cherish Broady -- 1303 Vantage Parkway, Jenna & Andrew Chapman, $650,000.

• Sarah & Erich Rathmann -- 1927 Westport Ave., Melody Homes Inc, $674,900.

• Allison & Eric Kohnen -3985 Nations Way, Donald & Carolyn Schulte, $1,026,000.

• Thomas & Suzanne Bolling -- 2685 Bluewater Road, Three Lakes Devl Inc, $1,550,000.

BOULDER

• Mateo & Lisa Pardo -- 500 Manhattan Drive Apt D6, New Direction Ira Inc, $270,000.

• Tanner Valdez -- 4741 White Rock Circle Apt C, Wm Assoc Two LLC, $306,000.

• Alexander & Rebecca Radnaev -- 500 Mohawk Drive Apt 310, Lauren M Hoyt, $340,000.

• Josef Collins -- 1405 Broadway Apt 403, Theresa H Dowling Trust, $386,000.

• Charles Zhang -- 800 W Moorhead Circle Apt B, Lucas & Amy Ellis, $534,500.

• Kailey Fudge -- 2984 Eagle Way, Douglas & Leslie Jackson, $660,000.

• Justin Meiners -- 4506 Aberdeen Place, Jay Kominek, $775,000.

• Thomas Aldrich -- 4612 16th St., Alexander Jo-

seph Arman, $800,000.

• Melissa & Vannaro Keosann -- 104 Sugar Court, Lisa & Matthew Bethancourt, $846,000.

• Ethan & James Rice -- 3964 Fuller Court, Wendy Grunthal, $850,000.

• Elowyn & Bjorn Samadhi -- 8563 Flagstaff Road, Annie M Bruns, $921,000.

• Eric Brohman -- 325 31st St., Nathan & Ann Klein, $924,000.

• Wayne Pak -- 845 Grant Place, Nat Revocable Trust, $975,000.

• Morgan Roche -- 1635 Lost Angel Road, Brian & Elaine Gifford, $1,086,900.

• Jacqueline Malcolmpeck -- 2202 Stony Hill Road, 2202 Stony Hill LLC, $1,100,100.

• Cedric Calousdian -7091 Olde Stage Road, Brandon M Kaufer, $1,369,000.

• Kathryn Materna -- 2995 Darley Ave., Henri & Irene Helden, $1,403,000.

• Zachary Moritz -- 7353 Meadow Court, Sarah Schupp, $1,490,000.

• Cassandra Anderson -- 2056 Walnut St. Unit B, Jennifer E Hume, $1,500,000.

• John Augst -- 6919 Frying Pan Road, Mitchell Brian Campbell, $1,517,200.

• Barbara Macalpine -490 Erie Drive, James R Schiffman, $1,545,000.

• Helen Scatliff -- 6722 Flagstaff Road, Tonya & Benjamin Williamson, $1,640,800.

• Jason Oeltjen -- 1600 Quince Ave., David & Margery Carney, $2,150,000.

• Tristan & Alexandre Rubadeau -- 403 Dewey Ave., Dewey LLC, $2,375,000.

ERIE

• Erskine & Maria Dunson -- 58 Sun Up Circle, Dominique Montae Davis, $650,000.

• Stephen & Maura Martin -- 972 Pinecliff Drive, Edward & Marie Martinez, $670,000.

• Michael Holland -- 972 Laramie Lane, Thomas & Jeanette Peters, $800,000.

• Austin Hall -- 2075 Meadow Sweet Lane, Thomas E Potosky, $820,000.

• Noel & Cassandra Miramontes -- 673 Split Rock Drive, Richmond Am Homes Colo Inc, $830,000.

• Garrett & Sara Steed -1149 Petras St., Richard & Amanda Mcintire, $836,000.

• Maria & William Streidl -- 395 Dusk Court, Sergey E Shatalov, $850,000.

• John & Elise Grinstead -- 592 Winterfield St., Lennar Colo LLC, $989,000.

GREELEY

• Thomas Howard -- 5151 29th St. Unit 2006, Benjamin Edge, $300,000.

• Randolph & Valerie Bosanko -- 6380 W 10th St. Ste 8, Steven & Cynthia Harbert, $300,000.

• Terri Parris -- 3314 33rd Ave. Court, 3314 33rd Trust, $305,000.

• Austin Brown -- 2401 15th Ave. Court, David & Cassandra Johnson, $331,800.

• Hector Solares -- 1118 24th Ave. Court, Judy W Campbell, $338,000.

• Dillon Colton -- 3703 W 7th St. Road, Jeffery Scott Campbell, $357,500.

• Kinszia Erickson -- 2345 W 8th St., Rutherford Inc, $379,900.

• Timmer Mccroskey -1614 16th St., Lucas & Mikayla Ness, $400,000.

• Briana Mendoza -- 1714 7th Ave., Aliyah Holguin, $400,000.

• Ronda Smith -- 3026 68th Ave., Schneider Living Trust, $420,000.

• Shawnda & Steven Staten -- 2101 14th St. Road, Benjamin Perkins, $428,300.

• Kimberly Pigeon -- 4611 W 3rd St., Terry Phillips, $445,000.

• Nekoda Jacobs -- 129 63rd Ave., Cb Signature Homes LLC, $455,100.

• Fred & Yeni Cepeda

-- 1615 104th Ave. Court, Brandon Yeager, $475,000.

• Ian & Emily Ruge -4122 W 16th St. Drive, Miles & Aime Kiefer, $485,000.

• Lindsay Salazar -- 1876 25th Ave., Joan Marie Carvajal, $495,000.

• Caryn Ishmael -- 1628 36th Ave. Court, Trista K Nelsen, $505,000.

• James Allemang -- 4131 W 15th St., Alberto & Ashley Puga, $510,000.

• Brendon & Amy Mcbee -- 256 63rd Ave., Duffie & Revina Johnson, $518,000.

• Warren & Michelle Schaal -- 1607 37th Ave. Place, Abdul Latif Lone, $805,000.

JOHNSTOWN

• Alexander Starr -- 513 Condor Way, Baessler Townhomes Colo LLC, $386,800.

• John & Christine Olivas -- 2397 Harlequin Place, Landsea Homes Colo LLC, $400,000.

• Christian & Reveca Owens -- 242 Scaup Lane, Landsea Homes Colo LLC, $403,500.

• Alexander Zelinger -- 3657 Pinonwood Court, Joshua M White, $450,000.

• Benjamin & Savanah Schutt -- 4069 Zebrawood Lane, Clayton Properties Group Inc, $475,000.

• Nicholas Wells -- 910 Huron St., Century Land Holdings LLC, $525,000.

• Julia Ninefeldt -- 675 Piedmontese St., Hartford Constr LLC, $525,300.

• Jessie Albert -- 4392 Scenic Lane, Aspen View Homes LLC, $630,700.

• Sam & Marya Ayres -- 1111 Sandra Drive, Sydney Sue Fowler Trust, $650,000.

• Joey & Elizabeth Livingston -- 2599 Grizzly Place, Aspen View Homes LLC, $667,500.

• Andrew Fulton -- 4387 Big Horn Parkway, Aspen View Homes LLC, $689,800.

• Barbara Ullmann -- 4451

Big Horn Parkway, Aspen View Homes LLC, $698,100.

• Allyson & Nicholas Troutini -- 4435 Big Horn Parkway, Aspen View Homes LLC, $707,700.

LONGMONT

• Rita Burke -- 1314 Lincoln St., Patricia Pascoe Walker, $200,000.

• Mary Jensen -- 18 Empson Drive, Summit Invest Services LLC, $389,000.

• Anna & Barbara Barbara -- 1334 Dogwood Lane, James Hendrie, $441,000.

• Matthew Redabaugh -- 1035 Yeager Drive, Bradford L Larsen, $467,000.

• Kathryn & Larry Morgan -- 2788 S Flat Circle, Mount Brook Devl Colo LLC, $475,000.

• Michael Teegardin -1531 Peterson Place, Erin Hoelzel, $482,000.

• Eugene & Dana Dsouza -- 837 Emery St., Village Housing LLC, $489,000.

• Evelyn Flores -- 1211 Meadow St., Hm Constr Ltd, $493,200.

• Joseph & Julia Key -- 2424 Tulip St., 2424 Tulip LLC, $502,000.

• Alexandra Emory -- 413 Crystal Place, Sergio Atallah, $513,300.

• Sage Thomas -- 1035 Venice St., Oliver & Emily Jacobson, $530,000.

• Michael Price -- 544 Elliott St., Harvey & Christine Schwartz, $539,900.

• Christian Wigert -- 1029 Ponderosa Circle, Mark & Amy Dilullo, $570,000.

• Jose Vidana -- 1310 Trail Ridge Road, Opendoor Property Trust I, $577,000.

• Deborah Hummel -1337 S Grant St., Brandon Moquist, $615,000.

• Eric Morris -- 1300 Walden Court, Opendoor Property Trust I, $615,000.

• Jordan & Audrey Renner -- 2930 Buffalo Fork Lane, Dfh Mandarin LLC, $619,800.

• Lara Lorenzetti -- 1727 Lashley St., Brian & Ri

Valentequinn, $620,000.

• Kristin Stark -- 407 Deerwood Drive, B Charlene Evans, $650,000.

• Diana & Calvin Jouard -- 124 Baylor Drive, Melissa & Bruce Rishel, $680,000.

• David & Sari Puth -- 610 Clarendon Drive, Frederick & Holly Charles, $690,000.

• Steven Pateman -- 718 Pendleton Ave., Spencer Jack Schell, $705,000.

• Jane & Craig Ebert -- 2271 Winding Drive, Michael D Renecle, $765,000.

• Alejandro Sotocastillo -- 2467 Ravenswood Court, Danielle Fontaine Billings, $775,000.

• Dennis & Lorraine Powelson -- 2360 Spotswood St., Jason & Paula Maguire, $775,000.

• Kenneth Calahan -- 2042 Ridgeview Drive, Daniel & Darlene More, $1,108,100.

• Robin Maniglia -- 4710 Summerlin Place, Wendy L Sekler, $1,155,000.

• David Klauber -- 3101 Marlin Drive, Marie Klish Weeks, $1,200,000.

• Michael Frey -- 1809 S Coffman St., Matthew & Terri Musser, $1,245,000.

• Craig & Mandianne Berg -- 8483 Pawnee Lane, Bradley & Christoph Traver, $1,285,000.

• Linda & John Higgins -- 1537 Stardance Circle, James & Kaylyn Maurer, $1,600,000.

• David Rhodes -- 941 Neon Forest Circle, Thomas & Ani Ritenour, $1,600,000.

• Wynn & Ryan Martens -- 6625 Bluebird Ave., 710 Concord LLC, $2,075,000.

LOVELAND

• Christy Jorgenson -- 1405 Zoe Court, Brooke L Adamson, $344,000.

• Harold & Lindsay Wahlborg -224 Saint Louis Ave., Charles & Gina Simmons, $369,000.

• Dylan Ewald -- 833 Washington Ave., Noah & Roxanne Huber, $400,000.

• William Krueger -- 1325 Gard Place, Debbie Brooks, $415,000.

• Xuan Nguyen -- 1428 Avondale Place, Ryan & Zelene Didier, $420,000.

• Alvin Hanks -- 582 Cottonwood Place, Michael W Bailey, $425,000.

• Aspen & Dalton Newbanks -6132 Two Leaf Drive, Richmond Am Homes Colo Inc, $430,000.

• Mark & Debra Beimal -- 3443 Grayling Drive, Datlac LLC, $437,900.

• Leslie Brown -- 2940 Tabernash Drive, Connor Naudet, $439,900.

• Sabrina & Cal Archer -- 3256 Honey Locust Drive, Darrel Cromer, $440,000.

• Susan Free -- 6126 Two Leaf Drive, Richmond Am Homes Colo Inc, $440,000.

• Chase Walker -- 6108 Two Leaf Drive, Richmond Am Homes Colo Inc, $442,000.

• Ronald Mckenzie -- 1850 W 50th St., Schuler Family Living Trust, $464,000.

• Joshua Terry -- 2652 Hayden Court, Jelani & Tiffany Trawick, $480,000.

• Ryan & Ursula Blyth -- 1829 Eagle Drive, Bradley W Williamson, $485,000.

• Lisa Larsen -- 4131 Greenhorn Drive, Chanc & Kimberly Woods, $500,000.

• Diane Arndt -- 3423 Sheridan Ave., Real Solutions LLC, $520,000.

• Kurt & Janet Bryant -- 2916 Cub Lake Drive, Jacqueline M Crader, $521,500.

• Diana & Veronica Frank -- 3405 Janus Drive, Timothy & Tawnia Eckley, $559,900.

• William & Kathy Harper -- 1596 Persian Ave., Janaya & Philip Daily, $570,000.

• Dustin Clark -- 2009 Blue Mesa Court, John & Betty Becker, $570,000.

• Mark & Anna Luoma -- 3728 Foothills Drive, Steven & Amanda Pfalzgraf, $589,000.

• Katherine Huerta -- 1245 W 8th St., Kelly & Brett Wisniewski, $600,000.

• Jason Hardabura -- 725 E 4th St., Paul & Monica Sylvestre, $600,000.

• Sheryl Miller -- 5258 Rangeland Ave., Stephen Blake Greene, $625,000.

• Xiuying & Yuanfang Huang -- 4285 Lyric Falls Drive, Lori & Bryce Wenger, $635,000.

• Laura Teel -- 4485 Georgetown Drive, Hpa Borrower 2019 2 LLC, $635,000.

• Noemi Han -- 4847 Rodin Drive, Aspen Homes Colo Inc, $710,400.

• Christofer Dennis -- 4262 Martinson Drive, Weston & Aubrie Larsen, $760,000.

• Daniel & Leslie Haynes -- 3550 Valley Oak Drive, Darrell & Deborah Pozarnsky, $915,000.

• Robert & Adrianna Protzman -- 4044 S County Road 29, Monty S Sibley Family Trust, $1,087,500.

NIWOT

• Brian & Celia Bisgaard -- 7371 Meadowdale Drive, Dennis E Pelster, $900,000.

• Dane & Kristi Delozier -- 8861 Marathon Road, Ethan & Caroline Chutkow, $1,350,000.

• Dana Brolaski -- 7165 Redwing Place, Carolyn D Lee, $1,730,000.

• John & Marie Getter -- 8343 Pawnee Lane, Brett Landin, $1,833,000.

• Mihai Murarescu -- 8716 Skyland Drive, Robin J Maniglia, $2,100,000.

PLATTEVILLE

• Daniel Rios -- 718 Goodrich Court, Rick M Hauglid, $465,000.

SEVERANCE

• Braydan & Natalie Orth -- 634 Sawyers Pond Drive, Melody Homes Inc, $514,900.

• Lucas & Mikayla Ness -- 821 Elias Tarn Drive, Melody Homes Inc, $541,700.

• David Nicholl -- 833 Emerald Lakes St., Aspen View Homes LLC, $543,500.

• Christopher & Kathryn Crow -- 223 Haymaker Lane, Melody Homes Inc, $556,000.

• Scott & Cynthia Fisher -- 1057 Mt Columbia Drive, Mark & Patty Childs, $565,000.

• Timothy Foglesong -- 1173 Bowen Pass St., Cassandra & Noel Miramontes, $600,000.

• Alexis Tornquist -- 1515 Cirque Valley Lane, Chase & Mykel Harvey, $627,000.

TIMNATH

• Brian Fisher -- 5516 Second Ave., Lennar Colo LLC, $384,900.

• Baxter Brown -- 5431 Euclid Drive, Lennar Colo LLC, $387,000.

• Bryce & Aida Templeton -- 5544 Second Ave., Lennar Colo LLC, $389,900.

• Nikitha Amaram -- 5435 Euclid Drive, Lennar Colo LLC, $450,000.

• Deanna & Tony Blake -- 5006 Mckinnon Court, Hartford Constr LLC, $461,900.

• Kevin Smith -- 5012 Mckinnon

Court, Hartford Constr LLC, $465,300.

• Michael Lee -- 5415 Euclid Drive, Lennar Colo LLC, $474,000.

• Kelly Woessner -- 6102 Saddlehorn Drive, Hartford Constr LLC, $576,300.

• Ian & Shelley Sutton -- 4277 Fellows Drive, Lennar Colo LLC, $626,900.

• Donavin & Danielle Drummond -- 1238 Kitchell Lake Parkway, Th Kitchel Lake LLC, $867,100.

WINDSOR

• Abbie Blaylock -- 775 2nd St., David J Denniston, $395,000.

• Jose Gonzalez -- 2330 Golden Way, Journey Homes LLC, $452,400.

• Randy & Cynthia Rouse -- 1410 Windjammer Drive, Ilse L Stilson, $455,000.

• David & Myra Camarena -- 209 Valley Court, Mark & Anna Luoma, $455,000.

• Philip & Alexis Anderson -- 1012 Cherrybrook Drive, Mark & Angela Beadle, $485,000.

• Susan & Joel Hardy -- 436 Aurelia Drive, J J Constr Northern Colo LLC, $489,700.

• Thomas Gonzalez -- 309 4th St., Eric & Renee Tonnies, $490,000.

• Heriberto Menamoreno -- 1602 New Season Drive, Dale F Conlon Living Trust, $490,000.

• Ricardo & Geraldine Flores -- 2290 Graceful St., Journey Homes LLC, $491,500.

• Rodger & Susan Good -- 2339 Graceful St., Journey Homes LLC, $493,000.

• Shavaun & Kade Christensen -- 829 Hummocky Way, Century Land Holdings LLC, $500,000.

• Matthew Gilmore -- 2084 Blue Moon Court, Jodie & Adrian Severson, $505,000.

• Adrian Armenta -- 436 Aurelia Drive, J J Constr Northern Colo LLC, $525,000.

• Ryan & Marcelia Brannock -- 540 Rainbow Place, Ryan & Julia Spriggs, $720,000.

• Tyler & Lauren Grandbouche -- 1721 Lucent Court, Th Raindance Windsor LLC, $851,500.

• Bradford & Heather Machado -- 2138 Meander Road, Chris Ghigliotty, $962,500.

• Alexander Bally -- 8265 Spinnaker Bay Drive, Jeffrey & Mandy Logue, $998,000.

• Brittney Mcnaney -- 10625 County Road 72, Eric & Alexis Tornquist, $1,090,000.

To view a complete list of real estate transactions for our region, visit dailycamera.com/athomecolorado, timescall.com/athomecolorado, reporterherald.com/athomecolorado or greeleytribune.com/athomecolorado.