Aggregates ascent

“Job-site

Investing

and management solutions is a must in modern quarrying 39 ROTARY CUTTER HEADS

Rotary cutter heads are making an increasingly strong case for their deployment in quarries globally

Hi-tech solutions for optimised drill and blast in quarries and surface mines

Specials

Arnaud

Premium

RELIABILITY AND VERSATILITY SECOND TO NONE

of our customer, Macleod Construction Ltd in Scotland. As a longstanding customer of over two decades, Macleod invest in Sandvik mobile crushers and screens due to their reliable Fleet telematics as standard, which gives you access to your equipment data 24/7, enabling you to operate smarter and maximize uptime.

HEAD OFFICE

EDITOR: Guy Woodford

ASSISTANT EDITOR: Liam McLoughlin

CONTRIBUTING EDITORS: Patrick Smith, Dan Gilkes

EQUIPMENT EDITOR: Mike Woof

DESIGNERS: Simon Ward, Andy Taylder, Stephen Poulton

PRODUCTION MANAGER: Nick Bond

OFFICE MANAGER: Kelly Thompson

CIRCULATION & DATABASE MANAGER: Charmaine Douglas

INTERNET, IT & DATA SERVICES DIRECTOR: James Howard

WEB ADMINISTRATORS: Sarah Biswell, Tatyana Mechkarova

MANAGING DIRECTOR: Andrew Barriball

PUBLISHER: Geoff Hadwick

CHAIRMAN: Roger Adshead

ADDRESS

Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612055 FAX: +44 (0) 1322 788063

EMAIL: [initialsurname]@ropl.com (psmith@ropl.com)

ADVERTISEMENT SALES

SALES DIRECTOR:

Philip Woodgate TEL: +44 (0) 1322 612067

EMAIL: pwoodgate@ropl.com

Dan Emmerson TEL: +44 (0) 1322 612068

EMAIL: demmerson@ropl.com

Graeme McQueen TEL: +44 (0) 1322 612069

EMAIL: gmcqueen@ropl.com

SUBSCRIPTION / READER ENQUIRY SERVICE

Aggregates Business International is available on subscription. Email subs@ropl.com for further details. Subscription records are maintained at Route One Publishing Ltd.

SUBSCRIPTION / READER ENQUIRIES TO:

Data, Route One Publishing Ltd, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

TEL: +44 (0) 1322 612079 FAX: +44 (0) 1322 788063

EMAIL: data@ropl.com

No part of this publication may be reproduced in any form whatsoever without the express written permission of the publisher. Contributors are encouraged to express their personal and professional opinions in this publication, and accordingly views expressed herein are not necessarily the views of Route One Publishing Ltd. From time to time statements and claims are made by the manufacturers and their representatives in respect of their products and services. Whilst reasonable steps are taken to check their accuracy at the time of going to press, the publisher cannot be held liable for their validity and accuracy.

PUBLISHED BY © Route One Publishing Ltd 2020

AGGREGATES BUSINESS EUROPE USPS: is published six times a year. Airfreight and mailing in the USA by agent named WN Shipping USA, 156-15, 146th Avenue, 2nd Floor, Jamaica, NY 11434, USA.

PERIODICALS POSTAGE PAID AT BROOKLYN, NY 11256

US POSTMASTER: Send address changes to Aggregates Business Europe, WN Shipping USA, 156-15, 146th Avenue, 2nd Floor, Jamaica, NY 11434, USA

Air Business Ltd is acting as our mailing agent

PRINT: ISSN 2051-5766 ONLINE: ISSN 2057-3405

PRINTED BY: Warners (Midlands) PLC

OThe race is on to deliver carbon-neutral concrete by 2050

n 1 September 2020, 40 of the world’s leading cement and concrete companies unveiled a joint industry ‘2050 Climate Ambition’, with an aspiration to deliver carbon-neutral concrete to the world by 2050.

Launched by the London, Englandheadquartered Global Cement and Concrete Association (GCCA) on behalf of its member companies, the ambition statement represents a critical milestone for the industry. It is the first time it has come together globally to state a collective ambition for a carbon-neutral future. The statement identifies four essential levers for achieving carbon-neutral concrete: reducing and eliminating energy-related emissions; reducing process emissions through new technologies and deployment of carbon capture, more efficient use of concrete; reuse and recycling of concrete and buildings; and harnessing concrete’s ability to absorb and store carbon from the atmosphere.

The 2050 Climate Ambition builds on the long-standing climate commitments and sustainability progress of GCCA member companies and affiliate associations across the world, setting out a global vision for the longterm sustainability of concrete. This magazine wholeheartedly agrees with the GCCA when it refers to concrete as a vital building material that has shaped the modern world.

Speaking on 2050 Climate Ambition launch day, Dinah McLeod, GCCA chief executive, said: “As we face the challenges for future generations and begin global economic recovery, concrete will be even more critical to building the sustainable world of tomorrow. That’s why we are making this commitment today so that our crucial industry aligns with global targets, including the Paris Agreement.

“Concrete has a vital role to play in addressing the need for sustainable communities and prosperity. It is a key ingredient of infrastructure, homes, clean water and community resilience as our climate changes. Crucially, it will also help facilitate

the transition to clean/green energy. We believe this journey will be challenging but are fully committed to working together with our members, partners and stakeholders across the industry and supply chain to achieve this ambition.”

As the GCCA notes, the concrete and cement industry is an essential part of the construction sector – which accounts for 13% of global GDP (gross domestic product) – with a track record of taking climate action. This has included delivering a 19% reduction in CO2 emissions per tonne of cementitious material along with a nine-fold increase in alternative fuel use since 1990.

Albert Manifold, GCCA president and chief executive of CRH, said the 2050 Climate Ambition represents the industry’s commitment to further reducing emissions and ensuring that the “vital product we provide can be delivered on a carbon-neutral basis by 2050”. He added: “There is a significant challenge involved in doing so and achieving alignment across our industry on a sustainable way forward is an important first step. We cannot, however, succeed alone and in launching our ambition statement, we are also highlighting the need for our industry to work collaboratively with other stakeholders in support of our ambition for a more sustainable future.”

GCCA member companies are currently developing a 2050 concrete roadmap which will set out the detailed actions and milestones that the industry will enact to achieve its ambition. It will include working across the built environment value chain to deliver the vision of carbon-neutral concrete in a circular economy, whole-life context. The 2050 concrete roadmap is due to be published in the second half of next year.

Aggregates Business Europe/International will be keeping a close eye on the delivery of the 2050 Climate Ambition in the years to come. We wish all involved with the project great success. GW gwoodford@ropl.com

FRENCH QUARRY LAKE USED AS FLOATING POWER STATION

The Saint-Maurice-LaClouère quarry near Poitiers has become the second-largest floating photovoltaic power station in France.

Synhelion’s 250kW solar receiver glows after testing because it reached over 1,500°C

A total of 8,330 floating solar panels have been installed on 4.5 hectares of redeveloped water at the limestone quarry. The power they generate will cover the electricity needs of 2,000 inhabitants.

CEMEX sun-seeking route to decarbonised cement

Global building material giant CEMEX and Synhelion have developed a groundbreaking technology designed to fully decarbonise the cement manufacturing process based on solar energy.

The groundbreaking advancement is an important element of CEMEX’s current Climate Action strategy. Synhelion, based in

emissions, which are then utilised as feedstock for fuel production, enabling cement manufacturing to achieve net-zero level. This is made possible by the unprecedented temperature levels of solar heat provided by Synhelion’s technology and its pioneering process to turn CO2 into synthetic drop-in fuels, such as kerosene, diesel, and gasoline.

expected to be incorporated into an existing CEMEX cement plant by the end of 2022 and gradually extended to a fully solar-driven plant.

The floating power station could be 10% more efficient than a conventional photovoltaic power station because, in hot weather, the water that evaporates cools the solar panels, which improves their production. produces quality limestone used in the preparation of concrete.

The floating photovoltaic power station will be inaugurated and commissioned at the end of September.

This solution is the very first to offer a comprehensive approach to decarbonise the cement industry. Following the research collaboration completed in spring 2020, CEMEX and Synhelion plan to adopt a staged approach towards implementing the technology. A pilot installation is

“Our solar receiver demonstrably provides process heat at unparalleled temperatures beyond 1,500°C, and offers a clean alternative to burning fossil fuels,” said Gianluca Ambrosetti, CEO of Synhelion. “The CO2 emissions from the cement manufacturing mix with the heat transfer fluid for our solar receiver and are integrated into the process. As we are working in a closed-loop system, the CO2 emissions can be easily extracted. We then close the carbon cycle by using CO2 to produce fuels.”

HeidelbergCement supplies material for Germany’s first 3D-printed residential building

Germany’s first 3D-concrete printed residential building.

The high-tech material, ‘i.tech 3D’, was developed by the HeidelbergCement subsidiary Italcementi specifically for 3D printing and is suitable for versatile use with various

The two-storey detached house in Beckum, North Rhine-Westphalia, with around 80m² of living space per floor, consists of three-shelled walls filled with insulating compound. The premiere house was produced by a 3D concrete printer installed on site. The printing results of HeidelbergCement’s material are convincing, and the

for 3D printing is a major challenge. It should be easy

head of the Engineering & Innovation department at HeidelbergCement Germany. “It must also quickly develop sufficient load-bearing capacity so that the lower layers do not give out under the load of the upper layers. At the same time, the bond between the layers must be ensured,” says Scheydt.

The house in Beckum is printed by PERI, one of the leading manufacturers of formwork and scaffolding systems for the construction industry. “The construction of the 3D-printed residential building in Beckum is a milestone for 3D construction printing technology”, says Thomas Imbacher, Innovation & Marketing director at

The HeidelbergCement research team is developing material formulations that can be used in various 3D printing techniques

PERI. “We are very confident that construction printing will become increasingly important in certain market segments over the coming years and has considerable potential.”

Engineering company Schießl Gehlen Sodeikat helped secure official approvals for the project. This included the pre-application testing of the project’s 3D concrete printer conducted by staff based at the Technical University of Munich. The 3D concrete printer was developed by COBOD, a Danish manufacturer PERI has held a stake in since 2018.

Pic: GPI HC Group

WHEN FLEXIBILITY AND HIGH PERFORMANCE ARE PARAMOUNT. The MOBICAT MC 120 Z PRO mobile jaw crusher and the MOBICONE MCO 11 PRO mobile cone crusher are exactly what you need – perfectly combined with the mobile screening plants from KLEEMANN. Their high production output and low-maintenance operation make them a real alternative to stationary solutions. The PRO-Line from KLEEMANN: Power packs for the quarry.

www.kleemann.info/pro

MCO PRO MC PRO

NEW PRESIDENT STARTS AT INSTITUTE OF QUARRYING

Martin Riley, senior vicepresident of Tarmac, has been appointed the 69th president of the Institute of Quarrying (IQ), taking over from the previous incumbent, Phil Redmond.

The new president, like his predecessor an FIQ (Fellow of the Institute of Quarrying), was officially confirmed at the Institute’s AGM, which took place via video conference on 22nd September 2020.

Riley said: “I’ve been involved in the aggregates industry all my working life. I have been a proud member of the Institute of Quarrying for almost four decades. It is a fantastic opportunity to represent IQ at such a critical time for both the industry and our members, as we enter a post-pandemic economy.

“As a proud former industry apprentice, for me, one of the key motivational factors for taking on the role of IQ president is the opportunity to ‘make a real difference’ within the field of education, training and professional development. I hope to use my position to better engage with younger members and attract potential ones by raising awareness about the rewards of working in the quarrying and mineral extractives sector and breaking through the misconceptions that jobs are mainly for men.

“The growth of IQ in the past few years has been impressive and shows how important the industry considers education, training and professional competence. So, it is a huge honour to be the new IQ president, and I am more excited than ever to be playing my part in the Institute’s ongoing development and look forward to championing the needs of the sector at every opportunity.”

Norway government backs Norcem Brevik carbon-capture project

The Norwegian government has formally proposed to the national parliament the launch of the carbon-capture project at HeidelbergCement company

Norcem’s Brevik cement plant.

With 400,000 tonnes of CO2 to be captured annually and transported for permanent storage, HeidelbergCement is planning for Brevik to become the first cement production facility globally to implement an industrial-scale carbon-capture and storage (CCS) project.

The proposition of the Norwegian government is the second last step in the approval process for the project. As the final step, the Norwegian parliament is expected to sign off the project budget later this year.

“We are very pleased with the proposal of the Norwegian government,” said Dr Dominik von Achten, chairman of the managing board of HeidelbergCement.

“This allows us to continue the pioneering work that we started together with our partners in

Brevik. The carbon-capture and storage project in Norway is an important cornerstone in our climate strategy. It will enable us to significantly reduce otherwise unavoidable greenhouse gas emissions related to the cement production process.”

Giv Brantenberg, general manager HeidelbergCement Northern Europe and chairman

of the board of Norcem, said: “We have been developing this project since the first desktop studies in 2005 and have interacted well over many years with the Norwegian authorities and our supportive partners. We are proud and honoured that we may soon initiate the building of the world’s first fullscale carbon-capture plant in the cement industry.”

Hanson UK launches new marine aggregate dredger

Hanson UK has successfully launched its new marine aggregate dredger (MAD), Hanson Thames. The MAD 3500 model, built by Damen Shipyards Group at its Galati yard in Romania, is capable of extracting marine-dredged aggregates in water up to 55 metres deep and has been designed to ensure safe, comfortable operations – even in

adverse conditions.

The vessel’s innovative design provides increased payload and efficiency, which will allow it to carry up to 7,000 tonnes of marine aggregate per trip, as well as improved fuel consumption and operational and maintenance savings.

It is also equipped with enhanced safety features including an enclosed bow to protect equipment and dredge pipes positioned above the main deck. Hanson Thames will operate in the North Sea and the English Channel.

Hanson CEO Simon Willis said: “The introduction of the new MAD forms part of our strategy to replace our existing ageing dredgers, which supply essential sand and gravel to ready-mixed concrete, concrete block and aggregate bagging plants.

“Coordinated teamwork and Damen’s robust approach to safety have been instrumental in ensuring production continued during the COVID-19 pandemic, so its launch could be completed. The project team have been commendable, and we look forward to working with the group during the next phase.”

Damen will complete further work on Hanson Thames before commissioning, including its dredge equipment and screening installation.

Hanson UK has successfully launched its new marine aggregate dredger (MAD), Hanson Thames

HeidelbergCement’s Norcem Brevik cement plant

Fighting to secure a rock for all ages

A long-standing and passionate campaigner for mineral-resource sustainability, Arnaud Colson had a highly rewarding career at French building materials giant Lafarge, while holding presidencies and vice-presidencies in a wide range of industry unions and associations. Now running a successful environmental development consultancy, Colson talks to Guy Woodford about his impressive career and the key current and likely future issues within the European and wider-world mineral products industry

After a long and distinguished career in the European building materials sector, Arnaud Colson now runs Paris-based Territoires Consulting

To any large or ambitious small to medium quarry operator looking for advice on more sustainable ways of running their production sites, Arnaud Colson’s CV catches the eye.

After nearly four decades working for Lafarge, the giant French building materials maker, including many years at the forefront of delivering on the company’s sustainability goals, the 67-yearold established ‘Territoires Consulting’ (www.territoires-consulting.com), a Parisbased environmental consultancy helping companies and public and private landowners in their development projects.

Colson left Lafarge in 2017, two years after the firm’s merger with Switzerlandbased Holcim. As a former president of UEPG (European Aggregates Association), an ex-president of UNPG (the Association of French National Aggregates Producers) a former vice-president of UNICEM (the French National Union of Quarrying and Building Materials Industries), and in his long and highly successful career with Lafarge and as chair of the UEPG Environment Committee, Colson has been a prominent champion of the quarrying industry, not just in France but across Europe.

As such, his thoughts on what more still needs to be done in terms of improving mineral-resources sustainability are well worth hearing.

“The European Commission should more pragmatically tackle the issue of mineral resources by deploying and putting in place tools, including directives, regulations and good practices, for equitable access by all countries. We don’t want something like the EU Framework Directive on Water, which, in my view, is very unevenly applied. Improving and achieving consistently high standards of health and safety in building materials production across European countries, including reducing employee exposure to crystalline silica dust, must also be a priority.”

Born in Ksar-es-Souk, a city in east-central Morocco now known as Errachidia, Colson, whose father was a mining engineer, speaks of his alarm at the findings of the United Nations Environment Programme’s (UNEP) 2018 report on sand and sustainability around the world. “The impact of the extraction of the world’s most widely used solid material is increasing as reserves decrease. Some continents such as Asia, South America and Africa exploit these reserves. Europe is, in general, way at the top of CSR (corporate social responsibility) in this area.

“I have seen in Vietnam or Morocco how these sands are squandered. In Morocco, my mother used to walk me on the sandy beaches of Casablanca. Today, this beautiful sand no longer exists. It has been looted and leaves the mother rock bare.

“Let’s not forget that only 50% of the aggregates sold in the world comes from sandpits while the remaining 50% comes from massive rock quarries, extracted by explosives and crushing. It is regrettable that the drafters

of the UNEP report do not mention this nuance.”

Colson welcomes the efforts of GAIN (the Global Aggregates Information Network), created and managed by former UEPG president Jim O’ Brien, to create a worldwide network of aggregates quarries and to produce more statistics and analysis on this issue.

“To save mineral resources, the solution is for engineers and architects to use a combination of building materials and to place great emphasis on construction innovation,” stresses the former Lafarge senior executive.

I ask Colson about his biggest frustrations and obstructions in his work for Lafarge and in his leadership positions at UEPG, UNPG and UNICEM.

“It is to have started a global vision for concrete- and aggregates-sector sustainability, but one that is still to be fully understood by French and EU policymakers. Other building material lobbies such as those around wood are strongly carried by ecological movements because of their obviously apparent link to nature. However, this can create a misunderstanding about concrete, which is a very noble building material that offers great lifetime durability.

“Wood is not recyclable and will inevitably release CO2 into the atmosphere at some point, either by burning or drying. Contrast this with concrete, which is eternally recyclable, and the aggregates that make up its structure are more useful and necessary than ever. The everyday reality is that politicians act under pressure and follow fashion, which is often dictated by ill-informed lobbies. It also shows the importance of better

“I spent 39 years working for what was one of the most beautiful French flagship companies”

communication of how concrete can exist in perfect harmony with people and is a material consistent with approaches to tackling climate change.”

Colson says there is a big difference between the countries operating in Europe when it comes to the pace of adoption of environmentally friendly production methods for building materials. He believes this also has an impact on competition in the international market.

“Marine aggregates production is another good example of an inconsistent European approach,” he continues. “For example, it may take 10 to 20 years to obtain an operating licence in France, but only three to five years in the UK. I would also like to ask why European politicians are slow to recognise the contribution of quarries to biodiversity? The UEPG also fights illegal extractions in some European countries alongside the authorities, which are sometimes deprived by national governments of the means to control the problem.”

A Maritime Spatial Planning Framework Directive, adopted in 2014, gives EU member states sole competence on land-use planning and permitting; so a new framework directive formalising a consistent approach to marine aggregates production licencing applications

Arnaud Colson’s final role in his 39-year career with Lafarge was as the company’s director of French Public Affairs and Sustainable Development (Aggregates, Cement & Concrete). Pictured is the LafargeHolcim Martres-Tolosane cement plant in south-west France. In recent years, the site has benefitted from a €100mn modernisation project

is likely to require a change of EU treaties.

Colson had a near four-decade working life at Lafarge, with his final senior role being the company’s director of French Public Affairs and Sustainable Development (Aggregates, Cement & Concrete).

“I prospered there and was very proud to have been able to participate in the launch of a true approach to sustainable development via the launch of an environmental policy encompassing the company’s 500 establishments (quarries, ports, cement plants, concrete plants) and driven by the dynamism and vision of Bertrand Collomb. Bertrand was, for me, a captain of industry, a strategist and a real team player.

“In my personal opinion, Lafarge merged with, or more accurately, was bought by Holcim because of too much debt and strategic errors. I spent 39 years working for what was one of the most beautiful French flagship companies in the world of heavy industry, but I did not enjoy my latter time before leaving the group. LafargeHolcim is now a new group established by and managed from Switzerland. It is well structured internationally and well managed.”

Returning his attention to how to achieve a more sustainable building materials industry, he says: “It is essential to consider the size of the industry’s carbon footprint. Financial analysts need to regain confidence in the building materials industry and major companies like LafargeHolcim. This requires tangible results on CO2 reductions, the use of alternatives to fossil fuels, and water management. New constructive systems are an opportunity. The consideration and improvement of biodiversity in aggregates extraction sites is a key issue for site staff and the sector in general. It also creates new jobs. A lot has already been done. The UEPG has gathered around 200 good biodiversity practices in aggregates extraction sites on its website, but there is still room for progress. That has not escaped NGOs (non-government

2006 and 2017, and I still expect an ambition to be laid out in this regard by LafargeHolcim. From a European policy perspective, it would be nice to introduce a tax at Europe’s borders to limit the unfair competition of low-cost materials, especially cement. This would certainly be a guarantee of improving the competitiveness of our European businesses. These companies absolutely need to get their profit margins back.”

Colson served as UEPG president from 2012 to 2015 and is a firm believer in the association’s ability to represent the interests of and campaign for the continent’s €15-20bn turnover, 15,000 companies-strong mineral products industry in its dealing with EU policymakers.

“I am still a member of the UEPG board of directors as honorary president. The association does an outstanding job with a small and close-knit team representing 23 member countries.”

The UEPG ‘engine room’ comprises four committees, their task forces and working groups, plus a standalone public relations and communications task force. The four committees are Health and Safety (RCS [respirable crystalline silica] working group); Environment (biodiversity; air quality; marine aggregates; and water management task

The top-level meeting is the delegates assembly held in May or June each year, where all members debate and decide on UEPG activities and strategy.

Colson says: “More than 30 years ago, UEPG invented a sustainable development competition chaired by an independent external jury every three years. The association also organises multiple field trips for members covering various topics. We did not hesitate to intervene on behalf of the various member countries, as I have been able to do in Romania or Poland to promote a virtuous industry, helping to eradicate corruption, truck overload, and compliance with safety rules. What is important in the future is to improve the visibility of UEPG and the recognition of the importance of aggregates for the European construction sector.”

Colson has some thought-provoking and data-supported views on the current state of the COVID-19 pandemic-disrupted European quarry and building materials sector.

“It will undoubtedly emerge better from this delicate period than those of services, aeronautics or automobiles. We need to build. XERFI [a leading French business market research company] estimates that the decline of French GDP is expected to be in the order

A quarry site visit during the UEPG General Assembly in Barcelona, Spain, in 2018

A site visit during the UEPG General Assembly in Helsinki, Finland, in 2014

accommodation and catering are logically the sectors most directly affected by COVID19 closures and administrative restrictions, followed by some trade and household services, such as nursery and school childcare, leisure and cultural activities. On the other hand, real estate leasing activities, the agri-food sector, energy, water and waste management, financial and non-market services are cushioning the economic shock. Other industries and business services are now halfway towards recovery.”

Colson notes that in France this year, it is estimated by market analysts that aggregates sector production will be down around 17%, assuming there is no further lockdown due to a second wave of COVID-19. He says a production increase of “at least 15%” could take place in 2021 but stresses that there are currently no official figures on this.

“Aggregates quarrying activity in Europe is down. The UEPG-estimated percentage difference in full-year 2020 production compared to 2019 shows that the least affected countries are expected to be Norway, with no decline in production; Denmark -2%; Germany -2.5%; and Hungary -3%; The Netherlands -10%; and Belgium -25%. The most affected nations are tipped to be Italy and Spain at -40%; followed by Greece and the United Kingdom at -30%.

“Overall, UEPG estimates there will be a 15.4% decrease in European aggregates production to 2.61 billion tonnes in 2020

compared to 2019. This would be comparable output to 2013. The UEPG estimates that production will rise to 2.71 billion tonnes in 2021, 3.7% up on 2020. In 2021, some countries are expected by UEPG to see a particularly notable recovery, including Spain +25%; France +15%; and Denmark and the Netherlands, rising by 10% and 15% respectively. Overall, however, there is a low degree of optimism about a wider economic recovery in 2021. After the crisis of 2008, there were five years of decline, then six years of recovery.”

Colson believes that for construction and wider industry, the possibility of a production catch-up is limited or delayed by capacity. “To catch up, we would have to produce more building materials, and for several months. This would mean mobilising additional resources, but where would they come from?”

The French-German-led initiative seeking to revive Europe-wide economic activity via a massive €750bn EU economic stimulus fund may, says Colson, be the key to getting out of the current COVID-19-induced economic crisis. Colson believes it could accelerate ecological and digital transitions, increasing the EU’s resilience and economic and industrial sovereignty and giving new impetus to the single market.

Looking further ahead, Colson is optimistic about the long-term future of the European building materials and construction sectors.

“The arrival of the circular economy, along

with recycling, and composite materials or even bio-based materials, will profoundly change some areas of construction. However, we will always need natural aggregates, exploited rationally and economically, for civil engineering and construction projects.

“When I left Lafarge three years ago, I immediately set up my Territoires Consulting business. It helps companies and public and private landowners in their development projects. Working in the renewable energy sector, I have also established a partnership with a company that creates and sets up photovoltaic [solar] farms on sites, including quarries. I am very pleased with this innovative approach to renewable energy. It is a natural extension from my career with Lafarge.”

A long-time resident of Paris, when he’s not working Colson, a former student at the city’s Ecole Nationale des Ponts et Chaussées (National School of Bridges & Causeways), enjoys spending time with his wife, four children and four grandchildren. He also finds time for many other interests. “I also enjoy skiing, high mountains, nature and time spent as a reserve officer of the French army and as an auditor at the Institute of Higher National Defence Studies (IHNDS). This allows me to delve deeper into geostrategic issues related to national defence.”

Working to defend a nation as well as a continent’s mineral products industry. Life remains full for Arnaud Colson. AB

UEPG at a virtual EU Green Week 2020

The COVID-19 crisis has affected the health of people on a global scale, as well as the economy. It has also shown the impact of human activities on the environment and what it can trigger, from the coronavirus pandemic to the reappearance of nature induced by a temporary general lockdown. Climate change, the unprecedented loss of biodiversity, and the spread of pandemics sent a clear message on the need to change and improve our way of life.

The European Commission put on top of its political agenda the adaptation to climate change, reversing biodiversity loss, increasing circularity and digitalisation of the economy. The Covid-19 crisis has increased further the urgency to address our impact on the environment. Therefore, to accelerate the process, European institutions opted for a ‘green recovery’. The European Commission will put the European Green Deal and its new EU Biodiversity Strategy 2030 at the heart of the economic recovery.

The EU Green Deal is a package of measures addressing several policy areas to modernise the European economy, enable a sustainable green transition and to become the first climate-neutral continent by 2050. It is the new growth strategy of the European Union for the coming years. It includes among the proposed measures, a new EU Biodiversity Strategy, considered a central element in the EU recovery plan.

The European Commission will address these issues at its largest

European Environment Conference: the EU Green Week, but this time in the virtual world. The 2020 edition will be taking place from the 20 to 22 of October 2020 on the theme ‘Nature and Diversity’. The conference will focus on how to build a resilient society and a sustainable economy, by reversing biodiversity loss and stimulating a green recovery. Exchanges will examine how to change economic activities, driving biodiversity loss and balancing the implications for the future of the economy and society.

solitary bees among many other species. Biodiversity protection can surely benefit from the dynamic management of extractive sites.

Given the ongoing COVID-19 pandemic and related health policies and travel restrictions, the European Commission will organise the entire EU Green Week event exclusively online, in a new virtual experience. Conference sessions and the exhibition area will be designed for virtual visits, enabling live interactions with speakers and exhibitors, providing the possibility to explore the stands and network with other participants.

UEPG, the European Aggregates Association, will have a virtual stand at the EU Green Week 2020. This will be an opportunity to present the aggregates industry’s contribution to the conservation of nature and demonstrate how it can be part of the solution, as a partner that can extract raw materials and at the same time help to protect and to restore nature. By the very nature of its operations, aggregates extraction sites create new habitats and attract pioneer and rare species, such as the sand martin, eagle owls, lizards, natterjack toads, and

UEPG will display over two hundred good practice examples across Europe, showcasing the compatibility of sustainable aggregates extraction with nature conservation objectives. As one of the few sectors represented among major actors on the EU Biodiversity Policy, the European Aggregates Industry is now widely recognised as a trusted partner for nature conservation by EU institutions and a growing number of NGOs and academic researchers.

These exceptional circumstances make way for new opportunities. The messages of our industry will reach out to a broader and more international audience for the first time through an online and virtual Green Week.

Indeed, not only will it reach out to high-level EU decision-makers but also stakeholders throughout Europe and the whole world, from local authorities to companies, from industry representatives to environmental organisations and citizens. Be part of these exchanges, discover how the aggregates industry can contribute to nature conservation. More information and the registration portal for the EU Green Week 2020 is available on the following link: https:// www.eugreenweek.eu/en. AB

• For more information on UEPG and its activities, please visit: http://www.uepg.eu/

The UEPG is taking part in a virtual EU Green Week 2020. Pictured are sand martins, Europe’s smallest hirundines.

Source: UEPG SDA 2019, Destia, Finland

Our expert engineers design customised solutions which transform natural sand & crushed rock reserves into high-value products for an exceptional return on investment. An integrated water management system recycles up to 90% of process water for immediate re-use in the system, significantly reducing footprint & maintenance of settling ponds.

WA475-10 WHEEL LOADER

Komatsu WA475-10 – Get ready to rumble!

With the Komatsu Hydraulic Mechanical Transmission (K-HMT) that delivers an outstanding combination of ultra-low fuel consumption and massive productivity increase, the all-new WA475-10 is an industry-leading top performer. A unique, independent control of driveline and work equipment eases operation and shortens cycle times like you never experienced before in a wheel loader.

INTELLECTUAL PROPERTY MYTHS DISPELLED

Intellectual property is an asset that adds value to your bottom line and stops others benefitting from your innovation. Specialist intellectual property lawyer Kathryn Heath explains why aggregates businesses should protect their intellectual Property and dispels some common myths about it

Intellectual property (IP) refers to creations of the mind and includes inventions, designs and symbols, names, images, and written materials.

There are various ways to protect your IP, including the use of patents, copyright, trademarks, confidentiality obligations and unregistered and registered design rights. IP is intangible, and perhaps that is why there are many myths and misunderstandings around it. One of the best ways to understand IP is to dispel some of those myths.

I don’t have any IP

Aggregates and mining businesses are likely to have a variety of IP rights. Innovations in this area which are likely to attract IP rights include tools and machinery, sensors, robots, software, and autonomous vehicles. These innovations may be used to carry out assessments, improve productivity, increase yields, and increase safety.

Collaborations and joint ventures are also common in the aggregates sector, with organisations often working together to create intellectual property jointly.

Intellectual property rights will also exist in digital assets such as data analysis software and modelling tools for mine designs, as well as digital mapping technologies.

Written reports with photographs and diagrams and the use of academic research are also impacted by IP rights.

I can’t afford to worry about IP I would argue that you can’t afford not to worry about it. IP is a valuable asset. Protecting it properly will add value to your business and prevent competitors from using it. If you do not adequately protect your IP, it is likely to cost you more in the long run.

I have a domain name – I don’t need to register my trademark

Owning a domain name, or being a wellestablished business in your market place, does not protect your business name or brand. The only way to do that and prevent others from using it is to register your trademark in the territories you operate in.

“You need to look at how to protect your IP in each territory and seek specialist legal advice”

Someone created materials for me; I paid them – I own it

Although copyright occurs automatically, the owner will usually be the person who created the work. This can cause issues, for example, where a contractor (such as a web developer, designer or consultant) completes work on your behalf. It is important to ensure this is assigned to you in a written document.

NDAs are not worth the paper they are written on

Correctly drafted non-disclosure agreements are a useful way to protect your business and can act as a deterrent. NDA’s limitations often arise when they have been poorly drafted. Issues to think about include; who needs to sign the document, what the remedies will be if there is a breach, what territories the agreement needs to be enforceable in, etc.

I do not need to think about IP unless I spot an infringement If you leave it until you spot an infringement, unless you already have the relevant registrations and protections in place, there is often very little you can do about it. Unregistered rights are usually much harder and more expensive to enforce.

I am covered in the UK; therefore, I am covered everywhere else IP rights are territorial in nature, so just because you have a trademark or other right protected in the UK, it does not mean you will be protected overseas. If, like many aggregate

and mining businesses, you work across multiple territories, you need to look at how to protect your IP in each territory and seek specialist legal advice.

My developer is working on an agile basis, so I cannot write a contract Agile is a development methodology which gives increased flexibility for developers and their customers as it enables the parties to continue to define the project as they go. It can be an effective way of working, but the flexibility can cause tension, so having a wellwritten contract is imperative. It is possible to create contracts which will work with an agile methodology, and it is important you put written contracts in place with thirdparty developers to protect your business adequately. AB

CONTACT

Kathryn Heath is a senior associate in the intellectual property and IT team at Stephens Scown LLP. The firm has over 70 years of experience in the mining and minerals sector, and its specialist team is recognised by independent legal guides Legal 500 and Chambers.

To contact Kathryn please call 01872 265100 or email solicitors@stephens-scown.co.uk. For more information visit www.stephens-scown.co.uk

The ‘Le Grand Paris’ project has been a main source of recent demand for France’s aggregates and concrete producers.

Image: @Eurovia/Przemek Kulaga

“Grands projets” give cause for optimism in France

The French aggregates and construction materials markets are among the most heavily impacted in Europe from COVID-19, but ongoing major construction projects such as the “Grand Paris” redevelopment scheme and the 2024 Olympics can help maintain materials demand. Liam McLoughlin

The demand for aggregates in France reached 435 million tonnes in 2019, according to data from UNICEM, the national quarry industry and construction materials association. Most of French aggregates production (65%) is used for road construction/maintenance and railways, network and infrastructure, 27% is dedicated to concrete production, and 7% to coated road materials.

UNICEM says it expects overall production to be down between -15% to -20% in 2020, much of this decline stemming from the impacts of the COVID-19 pandemic.

In a statement issued at the end of July UNICEM commented on how aggregates market conditions had unfolded this year: “While the activity indicators for the very beginning of 2020 seemed rather well oriented with a certain strengthening of the production of materials, the arrival of the Coronavirus epidemic on French territory and the start of containment in mid-March put a stop to a large part of economic activities, especially in the construction sector.”

In terms of materials, UNICEM said that activity plunged over the first four months of the year, while in mid-June, even if almost all sites were open, their activity rate still remained at -5% to -10% below their pre-crisis level.

Mathieu Hiblot, secretary general of the National Union of Aggregate Producers (UNPG), says that over the last two years the works related to the massive ‘Le Grand Paris’ urban renovation project in the French capital have had the biggest influence on demand for aggregates and ready-mixed concrete.

“This effect applies both in the Ile de France region, but also in neighbouring regions that supply materials for the construction of stations, roads, housing and business premises etc.” says Hiblot.

Started in 2007 under Nicolas Sarkozy’s presidency, the Grand Paris scheme encompasses large and iconic initiatives such as the Grand Paris Express public transport project, a rethinking of road transport, the creation and strengthening of urban centres, better integration between districts, and preservation of the green belt.

Etienne Lalande, Terex Trucks regional

sales director for France, Germany, Central Europe, North Africa and the Middle East says that the Seine-Nord Europe Canal is another important project that is expected to boost the French construction sector and provide business opportunities for original equipment manufacturers (OEMs). The scheme will involve the construction of a 107km inland waterway link extending from France to Belgium, connecting the Seine basin north of Paris to the Rhine basin and the northern European waterway network.

“For the construction [of the Seine-Nord Europe Canal] 55 million m3 of earth will have to be excavated and transported,” Lalande says. “Robust and reliable dump trucks like the [Terex Trucks] TA300 and TA400 are the natural choice for this task.”

Florient Myrope, GCI (global construction & infrastructure) marketing manager at Bergerat Monnoyeur, dealer in France for quarrying equipment manufacturer Caterpillar, says: “The Grand Paris project is moving forward, the 2024 Olympics Games [in Paris] are coming up. There is mid-term

In terms of how the French aggregates sector can recover from the pandemic, Myrope says this will depend on France’s aid plans for the construction and building sectors, but he adds that Caterpillar believes that demand will still be strong in 2020 and

He says that, for the most part, quarries in France did not stop producing during the health crisis, although they were no longer

“Quarries used that time to reorganise

Mathieu Hiblot, secretary general of the National Union of Aggregate Producers (UNPG)

their stocks and take care of the crushing of non-treated demolition materials,” says Myrope. “On the balance sheet, the months of April and May were very weak in terms of generated revenue but made it possible to organise a good recovery in June and July.”

Hiblot says that, although quarries and materials production sites were heavily affected by the drop in activity, they were very quickly reopened, or even still available during the containment period.

“The configuration of the production sites – outside and with few contacts – explains why, at the beginning of May, at the height of the crisis, nearly 88% of the sites were open,” he says, adding that it was chiefly the lack of demand that prevented quarrying activity.

Since the deconfinement period, aggregates production activity has picked up again. Hiblot says that aggregates production was at around 75% of the normal level in May and around 100% or even more in June, according to the latest UNICEM surveys. Moreover, by mid-June, almost all France’s materials production sites were open (98%).

“The COVID-19 pandemic has affected almost all markets and industries and France was no exception, with many activities coming to a standstill,” says Lalande. “However, the population has been returning to work and our dealers are once again busy with their sales activities.”

Of the annual 435 million tonnes of aggregates in 2019, 314 million tonnes were produced in quarries and 121 million tonnes (28%) came from recycling. Recycling in quarries, with materials from demolition, has been growing rapidly for the last five years.

This is a fundamental trend that will continue to grow in the coming years, according to Myrope.

“We can see it all over the country. The large quarries all have their own areas

dedicated to this activity, and we know that it is profitable,” he adds. “This trend will be confirmed in 2020, and the customers of quarries are increasingly demanding this share of recycling in their requests.”

Hiblot estimates that the use of recycled aggregates has doubled over the last ten years, which has led to a decrease in aggregates production at French quarries.

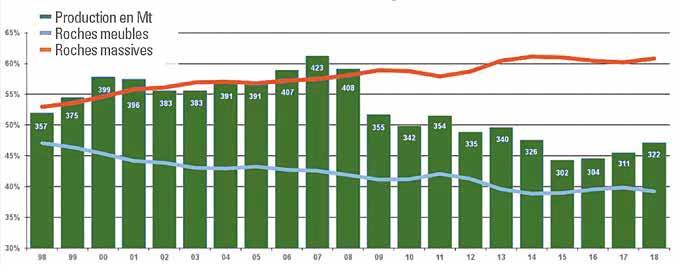

Over the last 20-30 years, the average annual production level of aggregates in France has been around 370-380 million tonnes. Since aggregates demand peaked in 2008, French producers are now producing 100 million tonnes a year less. This can be explained by a sharp drop in demand and a significant increase in aggregates recycling, according to Hiblot.

“Today’s production does not cover

the entire demand and requirements for aggregates,” Hiblot says. “Indeed, in addition to the different substances extracted (which varies according to the uses and destinations of the aggregates - concrete, asphalt mixes, ballast, public works uses, etc.), a significant proportion of materials are produced in the circular economy through recycling and recovery.”

In 2018, the demand for aggregates in France was estimated at 445 million tonnes, of which one-third was accounted for by recycled materials.

Major building materials suppliers in the French market expect a heavy ongoing impact on their business from COVID.

In its 2020 half year report, building materials supplier LafargeHolcim said that cement volumes in some major European markets such as France had been particularly impacted by the COVID-19 pandemic with construction activity heavily down compared to less affected territories like Germany, Switzerland and Eastern Europe. The group’s cement volumes in Europe in H2 2020 reached 20.9 million tonnes sold, or a 7.0% decline on a like-for-like basis compared to 2019.

HeidelbergCement became a large player in the French building materials market through its acquisition of Italcementi in the second half of 2016. This deal saw it take ownership of Ciments Calcia (cement production and distribution), Unibéton (ready-mixed concrete), GSM (aggregates production and distribution) and Socli (lime production). HeidelbergCement also owns Tratel, a major transport company of pulverulent/bulk powder products.

In June 2019 HeidelbergCement also finalised the acquisition of 100% shares in the aggregates and ready-mixed concrete activities of Cemex in central France. This deal saw it acquire production sites and distribution facilities for aggregates, including 28 ready-mixed concrete plants and seven aggregates quarries, strengthening the group’s vertically integrated market position in central France.

In its financial report for the first half of 2020 HeidelbergCement said that economies in countries such as France suffered significantly in the first half of 2020 due to the

Florient Myrope of Caterpillar dealer Bergerat Monnoyeur

Terex Trucks says its robust vehicles will be suitable for the demands of the Seine-Nord Europe Canal project

pandemic. For the full year, the European Commission expects a decline in economic output of over 10% in France.

In terms of products that are most in demand from French quarry operators Florient Myrope says rigid trucks are very popular, such as Caterpillar’s range of 770G to 777G (100 tonne) models.

He adds that Caterpillar wheeled loaders are also in demand: “For wheeled loaders working at the quarry loading sites from the 950M to the 980M, and for those working at the quarry face, from the 980M to the 992K. Those models combine maximum driving comfort with minimum fuel consumption for optimum efficiency.

“But it’s not just about the equipment, quarries constantly strive to maximise their productivity, and of course, safety is paramount.”

To meet this requirement and support its customers, he adds that Caterpillar has developed a range of services and connected solutions such as the Cat Driver Safety System (DSS), an in-cab monitoring technology that helps keep operators alert. It also provides proximity awareness systems, and fleet management solutions to increase fleet utilisation, control costs and use capital more efficiently.

France is the second-biggest market for articulated trucks in Europe and an important market for Terex Trucks. “The largest of our two articulated dump trucks, the TA400, is the most popular with customers in the French quarrying industry due to its bigger payload,” says regional sales manager Etienne Lalande.

“Customers are looking for robust haulers with a strong body and low operating cost, as well as quarry tyres and telematics – all of which our trucks can deliver. One of the reasons customers choose our trucks is because they are robust and reliable. At a quarry, continuous production is key – so you need a durable truck that will deliver high uptime.”

Rigid trucks such as the Caterpillar 770G are popular with French quarry operators

He adds that another important aspect for customers is aftersales service. Terex Trucks is expanding its distribution network in France and currently has four dealers: The Manu Lorraine Group, Framateq Sud-Est, Promatex and Griset Materiel.

“All our dealers have a strong reputation for customer service excellence and a vast amount of experience,” he says. “They sell both the Terex Trucks TA300 and TA400 articulated haulers, as well as stocking parts and components.”

Framateq recently sold one of Terex Trucks’ upgraded TA300s to a company in the south-east of France, which is using the truck at a quarry. Lalande says the hauler delivers a 5% improvement in fuel efficiency, a 5 km/h increase in speed to 55 km/h, an extended 4,000 hours oil change period and enhanced performance.

Founded in 1996, Griset Materiel was relatively recently appointed as a Terex Trucks dealer. It sells, services and repairs construction equipment from two locations in the Rhône-Alpes area.

Looking ahead at potential developments in the quarrying and aggregates sector over the next 18 months, Myrope says: “We notice a trend for tertiary material demand (0-35mm diameter) for surface layer road maintenance and concrete. Less demand for primary and secondary aggregates which sometimes need to be re-crushed in some quarries.”

Mathieu Hiblot of the UNPG says the best-case current scenario is a level of activity close to 10% below normal at the end of 2020. In other words, beyond the technical rebound of the summer, activity would not return to its ‘normal’ level and the year 2020 would end at 15% down for aggregates. Fiscal 2021 would also remain below normal, in part because of the effects of the pandemic.

The construction project pipeline in France provides cause for optimism, having been estimated at a total value of €374.8bn. Under the Housing First plan, the French government is investing €4bn to build 40,000 affordable housing units per year across the country until 2023. AB

National production of quarry and marine aggregates in France (1998-2018)

Source: UNPG

Production (in millions of tonnes)

Loose rocks

Large rocks

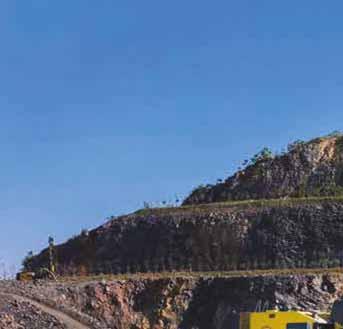

Falkland Islands quarry upgrades to meet thriving demand

The only operational quarry in the Falkland Islands has invested in new mobile crushing and screening equipment to meet the South Atlantic Ocean archipelago’s increasing demand for aggregates. Liam McLoughlin reports

Pony’s Pass Quarry in the Falkland Islands has invested in three new crushers, an impactor and two triple deck screens. Despite its isolated position on East Falkland, the quarry is a booming site which annually produces 160,000 tonnes of quartzitic sandstone using a state-of-the-art mobile crushing and screening train.

Sandvik Mobiles has advised the quarry on a train of equipment to best complement the uptime required for an operation of this scale. The chosen crushers and screens have been deployed since the start of 2020 and comprise a UJ440i jaw crusher, two UH440i cone crushers, a QI442HS impactor and two QA451 triple deck doublescreens.

Pony’s Pass currently provides perfectly sized aggregates for road construction and infrastructure development projects as well as supplying an on-site asphalt plant. Future developments are likely to see the current 160,000 tonnes annual production increase to over 300,000 tonnes per year.

Due to the isolated geographic position, over 300 miles from the mainland of Latin America, and the extreme weather conditions that are frequent, this meant that the solution chosen had to tackle all potential challenges. As the only Falkland Islands quarry, almost every project on the island requires aggregates from Pony’s Pass, meaning

service and aftermarket support is also a vital component to keep operations running smoothly.

The new equipment has performed with output levels always meeting expectations, according to Pony’s Pass quarry manager Marc Short, who added: “We currently use our mobile crushers to produce three small end materials: these being 10/20mm, 5/10mm and 0/5mm crusher dust. However, we have the ability to produce type 1 (all in

bottom of the quarry) where they are fed with as-blasted material.”

The feed material is crushed quarzitic sandstone, with a maximum feed size of 700mm.

The abrasive nature of the rock and the need for machines that can deliver maximised uptime meant that it was essential for the quarry to have a durable and productive primary jaw crusher before the material is passed through to the secondary

The new crushing and screening train in action at Pony’s Pass, East Falkland

The new trommel drum cleaner from MDS

hydraulically with a choice of jaw plates to suit the needs of the operation. This means that the crusher can work at optimum levels for longer periods, with all impact zones having a rubber lining to reduce wear and noise. In addition, the 62.5 tonne crusher has a 1,200 x 830mm jaw opening enabling it to deal with Pony’s Pass’ 700mm feed. The UJ440i can crush at a throughput of 250mtph.

Following on from the UJ440i jaw crusher, the rock is then fed into the UH440i cone crushers and the doublescreens for precision sizing. Sandvik claims that its QA451 is the world’s first triple deck doublescreen, whilst the 50 tonne UH440i cone crushers are specifically aimed at large-scale aggregates producers’ requirements. The result is the production of fractions the quarry’s customers require.

“0/5mm, 5/10mm and 10/20mm is used for concrete and asphalt production,” said Short. “Type 1, secondary and crusher dust is used for road construction. Some of the larger products are also used to build up sites with fill etc.”

He added that one of the main reasons for choosing Sandvik was the fact that the quarry already has the same type of cone crushers on the site which is beneficial for compatibility.

“We also already use two Sandvik drill rigs on site which adds to this,” said Short. “A lot of research was carried out prior to committing to Sandvik, they proved to be a good return in investment. The procurement of a mobile crushing train was a huge commitment and investment which took a lot of research. In the end, these particular machines best suited our requirements.”

In addition to the above, the highway’s section acquired a QI442HS impactor to provide primary and secondary crushing and screening in one unit. The features include a new rotor position and locking device, innovative hammer-locking wedges for quicker removal and fitting, as well as a new wedge removal tool to provide safer installation and removal. This means that it is also able to deliver a wide range of high reduction ratios, superb product shape and outstanding uptime which are essential to the requirements of the island’s authority.

UK trommel screen and accessories manufacturer MDS says its new drum cleaner

is a “game changer” for the trommel market.

The trommel drum cleaner features a cog wheel-style configuration that meshes with the drum openings and punches out the holes to keep them clean. The cleaner is designed to replace the traditional method of trying to brush trommels clean.

MDS says the drum cleaner is at its happiest when punching out the soils and clays that traditionally blind over scalpers in both quarries and recycling yards.

Luke Jones, quarry manager for Whitelock Developments, near Skipton, North Yorkshire, England, said: “Without the [MDS] drum cleaner we wouldn’t have been able to screen our wet and sticky recycled products. It gives us a competitive advantage in the market when others can’t produce clean aggregate material.”

All the current MDS trommel range can be fitted with the drum cleaner. This includes the tracked range (M412, M413, M515 two or three split, and M518R) and the static range (M615, M620, M720, M820 and M925).

MDS says its business has continued to grow despite the global pandemic, and the company has made a 15,000 square feet extension adjacent to its current factory.

The new unit will provide increased production capability for the existing range in addition to extra capacity for new product introductions such as the M518R and other trommels that are planned for launch in 2021.

ABOVE: Bauhof Deutschlandsberg has deployed a Rockster R1000S impact crusher BELOW: MDS is expanding production capacity for its trommel range

its products has meant the new facility is a necessity to maintain its existing lead times.

Jason Purllant, MDS UK and EU sales manager, commented: “We needed to maintain our target of 6-8 weeks lead time on all products whilst introducing new products into the range.”

MDS CEO Liam Murray added: “We are really excited about the continuing growth of our business globally with new dealers being appointed all around the world.

“We plan to have an open day towards the end of the year to celebrate the opening but also give future and current customers the chance to see first-hand what we do at MDS.”

Austria-based Bauhof Deutschlandsberg is a major player in the country’s provision of high-quality recycled building materials. As part of its recycling activities the company has deployed a Rockster R1000S closed-circuit impact crusher with a screening system & air blower since the beginning of 2020.

In addition to a trommel screen, excavators, loaders and road rollers, Bauhof has also previously used a rented crushing plant which processed around 40,000 tonnes of debris, asphalt and concrete per year.

At the end of 2019, the company decided to replace this rented plant with a new closedcircuit impact crusher R1000S from Rockster.

The company says the crusher has three major assets in terms of guaranteeing high quality of the end-product in one workflow: a screening system for a precisely defined size of end-product; a magnetic separator for removing iron and other metals, and an air blower for separating non-aggregates such as polystyrene, wood, plastic, paper and similar.

“To be honest, we were surprised at how well the Rockster Air Blower works, especially when it comes to recycling debris, it brings a huge increase in efficiency,” says Pistolnig.

Since being deployed in January, the R1000S has already produced 16,000 tonnes of concrete 0/80, 8,000 tonnes of asphalt 0/18, 600 tonnes of wall ballast 0/16 and 500 tonnes of construction debris 0/20.

“We are extremely satisfied with the quality of the end-product,” Pistolnig adds. “The mixture of coarser and fine grain is just right for further use in the concrete mixing plant or on construction sites.” Rockster’s hydrostatic crusher drive is particularly responsible for the sizes of the final product to be precisely adjusted to the desired quality.

Bauhof’s processing capacity is 80,000 tonnes per year - which corresponds to a saved landfill volume of 55,000m³ - and it has a recycling rate of 98%. Its principle expertise

AMMANN ARS SOIL COMPACTORS

PRODUCTIVE. SUSTAINABLE. COST-EFFECTIVE.

• Multiple vibration frequencies and centrifugal forces enable productivity on a wide range of materials and compaction thicknesses.

Ammann ARS Soil Compactors utilise advanced technology that meets the latest emissions standards, reduces fuel usage and gives operators valuable data that eliminates unnecessary passes.

That’s just the beginning of the advantages these machines offer.

• The new ECOdrop initiative and new technologies improve efficiency and reduce fuel consumption and the amount of required fluids.

• The compactors are extremely manoeuvrable and stable thanks to the no-rear-axle structure.

is in building demolition, container services and the recycling of all types of construction debris.

Pistolnig commented: “The management of construction waste is of growing interest for both the construction industry and waste management. Residual building materials that do not end up in a landfill but are returned to the economic cycle as highquality RC [recycled] building materials are an ecological necessity.”

Lars Bräunling, director of product technology at wire screen manufacturer MAJOR, says that self-cleaning screen media offers a number of benefits, including the elimination of pegging and blinding for aggregate and mining operations. However, certain design characteristics, such as limited opening sizes, leave producers with little option on where to employ self-cleaning screen media in their operation. Because of this, self-cleaning screen media is often thought of only as a bottom deck solution.

Bräunling adds that, recognising the opportunity to take the principles of selfcleaning screens a step further, engineers looked for ways to increase durability and provide application-specific customisation for a productivity-boosting solution producers could use on any deck. The result was a new category of screen — high-performance screen media.

In terms of what makes high-performance media different, Bräunling says: “One of the biggest drawbacks of using traditional self-cleaning media on upper decks is that it cannot stand up to the impact and abrasive forces of larger material. High-performance screen media addresses these issues by incorporating enhanced wire and a unique structure to maximize durability and wear life.”

It begins with the wire, according to Bräunling. Wire quality plays an essential role in screen performance, and he says many manufacturers choose their wire based on current market prices, resulting in fluctuating wire quality and inconsistent performance. “Some manufacturers, on the other hand, rely on high-quality wire in their screen media to ensure consistent quality and durability. It offers improved molecular structure over other techniques for optimum tensile strength, hardness and ductility, resulting in the highest quality, longest-lasting wire.”

High-performance screen media’s strategically engineered wires are held together with polyurethane strips, eliminating the need for cross wires with high wear spots. This innovative design maximises open area and extends wear life as much as five times longer than wire alone — even on top decks.

Taking advantage of these design benefits, Bräunling says that producers who employ high-performance screens on the top deck are able to realize the screen media’s payoffs earlier in the screening process, as well.

He adds that stratification is one of the key benefits. “High-performance screen media wires vibrate independently from hook to

hook under material contact, supplementing vibrations from the screen box with additional frequency to accelerate the stratification process.,” says Bräunling. “This added frequency can be as high as 8,000 to 10,000 cycles per minute — up to 13 times higher than the standard screen box vibration — helping fine material to stratify and pass through the screen faster.”

Optimising stratification at the very start of screening results in faster screening and optimal throughput, according to Bräunling. Greater quantities of fine material pass through the screen media’s open area earlier in the process, which increases the effective capacity of the machine and virtually eliminates carryover. Some aggregate and mining producers have shown as much as a 40% increase in overall production with highperformance screen media.

UK plant hire company P&L Barton - based in Carnforth, Lancashire - has reconfigured its EvoQuip Colt 1000 scalping screen to meet the requirements of the latest project it is involved in. The application has been to produce limestone walling stone for one of its regular clients where space was limited.

P&L Barton set about reconfiguring the Colt 1000 so that both conveyors discharged out the same side into segregated areas, maximising the area available and eliminating double handling.

Richard Barton, plant manager at P&L Barton, commented: “The Colt 1000 is the perfect machine for us due to its flexibility. Being suited to scalping and fine screening and the ability to quickly convert from

3-way to 2-way split and to swap conveyor configurations means it’s suitable for many applications and job sites.”

P&L Barton purchased the Colt 1000 in June 2019 from equipment supplier Blue Central, and since then the machine has been on hire contracts in multiple configurations to suit the required job sites. “We have been able to run the machine in 2-way split on one project then convert it so that mids and fines are discharged on the same side on a really compact site, and in standard set-up on another site,” said Barton. “With the range of media options available I don’t think there is any job she can’t do.”

P&L Barton started out in 1972 when Peter Barton invested in his first digger, a JCB 3C, and set up P Barton Plant Hire. Almost 50 years later the company remains a familyrun business and has evolved and expanded working on a vast array of projects. Its clients include private households and businesses, local councils and large multi-nationals. It provides plant and services on a sub-contract or hire only basis, offering a wide range of services to the quarrying, construction, groundwork, civil engineering, recycling and haulage industries.

The Colt 1000 is able to operate in both heavy-duty scalping and precision-screening applications and is designed to manage the most difficult of materials. Flexibility is enhanced with configurable conveyor options and two-way split conversion. It features an aggressive double deck screen, variable screening angle with numerous screen media options, broad fines conveyor, quick set-up time and tall discharge heights. AB

LEFT: An aerial view of the EvoQuip Colt 1000 scalping screen BELOW: Using high-performance screen media can extend wear life up to five times, according to manufacturer MAJOR

Loads of appeal to quarrying customers

The new Hitachi ZX490CLH-7 crawler excavator is part of the quarrying-suited, next-generation Zaxis-7 range of large excavators

Next-generation, quarrying-suited excavators and high-perfoming wheeled loaders are contributing to an eye-catching global loading machine market. Guy Woodford reports

Hitachi Construction Machinery (Europe) says it is putting owners and operators in complete control with its next generation of Zaxis-7 large excavators. The new ZX490LCH-7, ZX530LCH-7, ZX690LCH-7 and ZX890LCH-7 Stage V-compliant models have an industry-leading cab with firstclass comfort and safety features. Hitachi says their exceptional reliability, efficiency and productivity provide owners with opportunities to increase profits and reduce costs.

An impressive claimed fuel saving of up to 20% in PWR mode (power mode) compared to previous models is said to be achieved by Hitachi’s industry-leading HIOS-V hydraulic system. This also enhances efficiency in the swing, boom lowering and arm bucket rollout. Productivity is further increased by the improved front speed for loading operations, and the increased engine output of the new Zaxis-7 machines contributes to a higher workload.

The fuel efficiency of Zaxis-7 large excavators can also be controlled by using the new ECO gauge, clearly visible on the cab’s multifunctional eight-inch monitor. Besides reducing costs, better fuel economy has a positive impact on environmental performance. The new machines are Stage V-compliant thanks to the combination of the SCR (selective catalytic reduction) system, DOC (diesel oxidation catalyst) and CSF (catalysed soot filter).

A new Hitachi

The state-of-the-art, ultra-spacious cab is the perfect working environment. It is said to offer operators ultimate comfort and quality, with reduced noise and vibration levels in the cab, both vital in the quarrying and mining industries.

New features include the synchronised motion of the seat and console – to reduce operator fatigue – and the adjustable console height with three positions to choose from. Easy operation comes from the ergonomic

design of the console and switches, and the hi-res anti-glare screen is also easier to view.

Job-site safety is said by Hitachi to be enhanced by the exceptional view from the Zaxis-7 large excavators. Operators can control their own safety, as well as that of those around them, thanks to the Aerial Angle camera system. It provides a 270° bird’s-eye view, and users can choose from six image options to see the machine’s immediate environment. When working in challenging conditions, new LED work lights and a windscreen wiper with an increased sweeping area further improve visibility.

Tested rigorously at dedicated facilities in Japan, Hitachi Zaxis-7 large machines have been built to last and maximise uptime. New engine parts enhance reliability, oil leakages are less likely, and the durability of the track frame has been improved.

In addition, the undercarriage of the ZX490LCH-7 has robust new components that prevent potential damage. Hitachi says the ZX530LCH-7 has 30% greater traction force than the ZX490LCH-7 and increased steering force – particularly advantageous for manoeuvrability on sites with inclines, such as quarries.

The ZX690LCR-7 and ZX890LCR-7 models are built with reinforced parts that are ideal for the digging and loading of heavy materials. Strengthened to cope with the rigours of mining and quarrying, they provide lower costs over the machine lifetime.

Easy maintenance and cleaning features

ZX890LCH-7 crawler excavator feeding a primary crusher

on all Zaxis-7 large excavators save operators and owners both time and money. The fuel filter is now integrated with the water separator, and the larger radiator improves heat dissipation and is easier to clean.

To enable owners to feel in total control of their fleet and workload, Hitachi’s remotemonitoring systems, Owner’s Site and ConSite, give them access to vital data and tools. Both systems send operational data via GPRS or satellite from the excavator to Global e-Service on a daily basis. ConSite summarises the information in a monthly email, while the ConSite Pocket app shows real-time alerts for any potential issues.

The quality of the engine and hydraulic oil is monitored continuously by a Hitachi innovation. Two sensors detect if the oil quality has deteriorated and data is transmitted to Global e-Service. This novel feature provides customers with peace of mind on the condition of their excavators and reduces maintenance and unscheduled downtime.

“We’re proud to present the latest range of Hitachi large excavators to our European customers,” says Hitachi Construction Machinery (Europe) NV president Makoto Yamazawa.

“Hitachi has continuously improved on previous generation machines to enhance the operator’s experience in the cab, to meet the needs of owners, and to provide support over the life cycle of our machines. By working in partnership with customers, we can help them to create their vision.”

Doosan has launched the new DX800LC-7 Stage V-compliant 80-tonne crawler excavator, the largest excavator model ever manufactured by the company. Coinciding with the launch, Doosan has announced the sale of the first DX800LC-7 in Europe to a customer in Finland.

Driven by the most powerful engine in the 80-tonne class, the DX800LC-7 also has the highest hydraulic flow for this size of machine, providing best-in-class performance, with higher productivity, lower

fuel consumption and smoother controls.

Like all Doosan excavators, much attention has been given to operator comfort and safety. The DX800LC-7 has a new, very spacious operator cab, equipped with ergonomic controls and instrumentation. Special care has been taken to ensure noise is kept to a minimum through enhanced sealing of the engine compartment and extensive use of sound-dampening materials.

All components and assemblies are designed, built and tested to ensure durability. Multi-stage filters and features such as track guards and cylinder guards for the boom and arm, the auto grease system and greased and sealed track links are designed to provide superior reliability and long service life. The DX800LC-7 is easy to maintain, further reducing downtime to a minimum.

The DX800LC-7 excavator is powered by the new stage V version of the well-proven Perkins 2506J diesel engine, providing a high power output of 403 kW (548 HP), more than any other machine in this class. The engine meets Stage V emission regulations by utilising exhaust gas recirculation, selective catalyst reduction, diesel oxidation catalyst

system (D-ECOPOWER+), providing a bestin-class hydraulic flow of 1008 l/min and a high system pressure of 343 bar, together contributing to the best performance in the 80-tonne market.