Mesda outlines ambitious plans for the European market

“Already

05 COMMENT

All eyes are on bauma CONEXPO India and the country’s buoyant infrastructure construction sector.

06 NEWS

22 LOADING

Record quarterly profitability for Holcim; AfriSam & Cashbuild form landmark partnership; China aids Volvo CE resilience.

50 EVENTS

All of the key events in the quarrying and aggregates world.

08 INTERVIEW

Antonis Antoniou Latouros: Relentlessly pursuing a long-term aggregate victory.

Liebherr, Volvo CE and Hitachi are among the original equipment manufacturers seeing their latest machinery tested out on job sites.

26 DRONES/STOCKPILE ANALYSIS

How a leading stockpile analysis technology supplier is delivering for a US quarrying customer.

28 ASTEC & TELESTACK

US quarrying and road construction giant Astec and dry bulk material handling solution specialist Telestack are poised to prosper from renewed customer demand buoyancy.

32 CRUSHING & SCREENING

Anaconda with added market bite; Coming to a European quarry near you.

38 SUSTAINABILITY

COVER STORY:

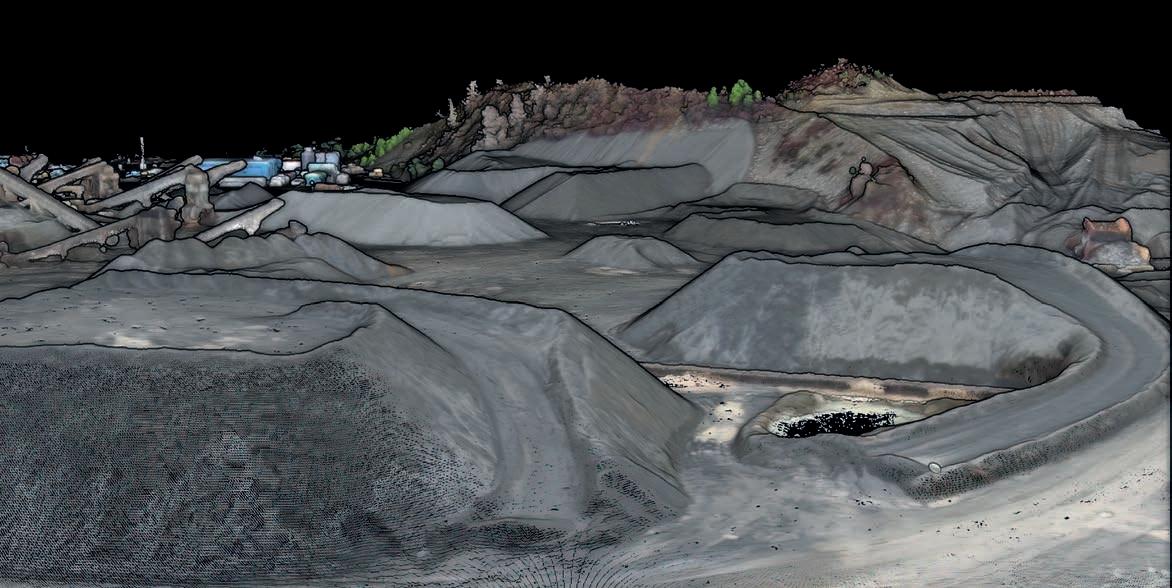

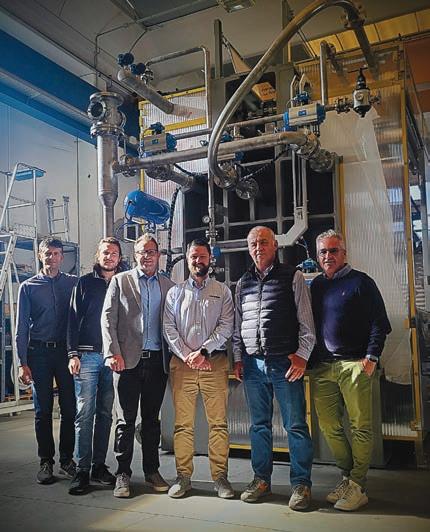

A busy quarry site equipped with a wide range of Mesda crushers and screeners.

36 CRUSHING & SCREENING

China’s biggest crushing and screening brand is keen to make its mark in Europe.

Companies and associations across the aggregate sector are taking action to boost sustainability via new research, initiatives and operational changes.

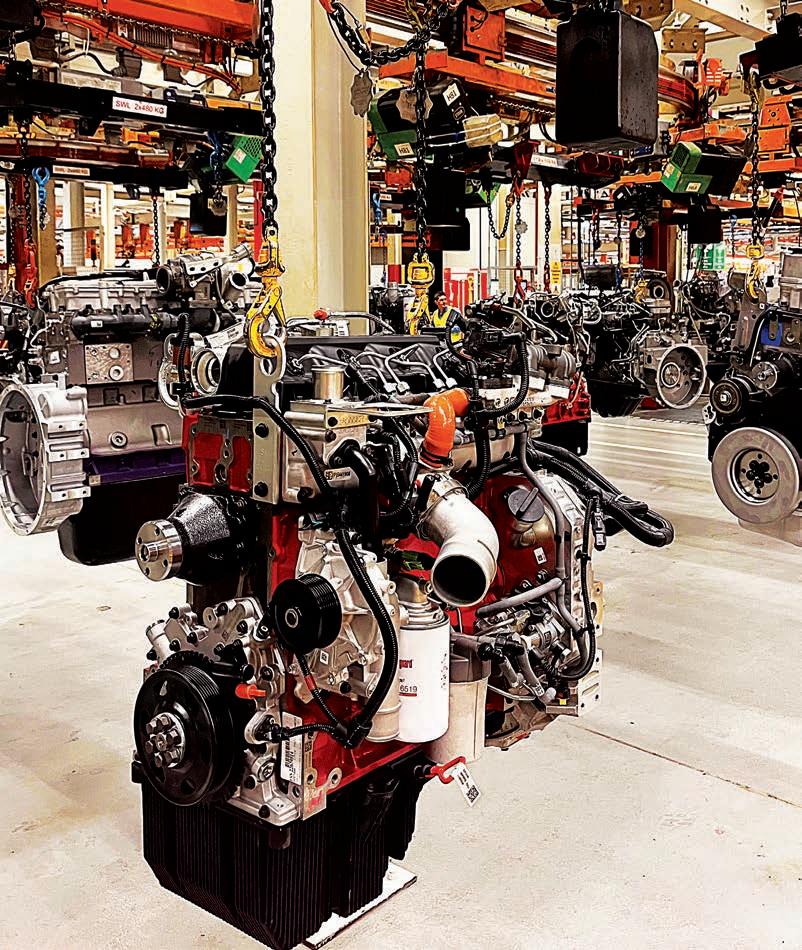

42 ENGINES – 2

An empowering Cummins response to a testing market.

46 WASHING -2

Premium washing plants scrubbing up well in Sweden and Switzerland, while a leading sector name looks to build on its healthy market share.

14 QUARRY PROFILE

Located on the doorstep of one of South Africa’s largest road infrastructure projects, KwaZulu-Natal-based AfriSam Coedmore is enjoying the best of quarrying times.

18 MARKET REPORT

Chinese aggregates production down amid big sustainability focus.

The only derived fuel from renewable sources (E-Fuel)

No odorous emissions

No CO2 emissions

Promoted by Governments

Same performance as the gas burner

Easier to get “White Certificates”

Cleaner process compared to other fuels

FOR

HEAD OFFICE

Prime Global Publishing Capitol Square 4–6 Church Street Epsom, KT 17 4NR

EDITOR

Guy Woodford +44 (0) 7879 408 069 guy.woodford@primeglobalpublishing.com

ASSISTANT EDITOR

Adam Daunt adam.daunt@primeglobalpublishing.com

SALES DIRECTOR

Philip Woodgate +44 (0) 7795 951 373 philip.woodgate@primeglobalpublishing.com

CHIEF EXECUTIVE OFFICER

John Murphy

CHIEF OPERATING OFFICER

Christine Clancy

GROUP MANAGING EDITOR

Paul Hayes

CLIENT SUCCESS MANAGER

Janine Clements +61 432 574 669 janine.clements@primeglobalpublishing.com

ART DIRECTOR

Michelle Weston

COVER IMAGE CREDITS Mesda Kleemann Aggregates Europe – UEPG AfriSam Coedmore

SUBSCRIPTIONS subscriptions@primeglobalpublishing.com

No part of this publication may be reproduced in any form whatsoever without the express written permission of the publisher. Contributors are encouraged to express their personal and professional opinions in this publication, and accordingly views expressed herein are not necessarily the views of Prime Global Publishing. From time to time statements and claims are made by the manufacturers and their representatives in respect of their products and services. Whilst reasonable steps are taken to check their accuracy at the time of going to press, the publisher cannot be held liable for their validity and accuracy.

PUBLISHED BY

Prime Global Publishing

AGGREGATES BUSINESS USPS: is published six times a yea.

PRINT: ISSN 2051-5766

ONLINE: ISSN 2057-3405

PRINTED BY: Warners (Midlands) PLC

his issue went to press just before the start of bauma CONEXPO INDIA, the 7th international trade fair for construction machinery, building material machines, mining machines and construction vehicles, taking place at the India Expo Centre in Greater Noida, near Delhi, 7–11 December 2024.The last staging of the event, in January 2023, attracted over 600 exhibitors from 26 countries and more than 41,000 participants from 83 countries. Similar numbers were expected at this year’s off-highway machinery showpiece, which covers an impressive 135,000m² of exhibition space.

Global off-highway equipment machinery big hitters showcasing their new and latest products for Indian customers were set to include Caterpillar, JCB, Volvo Construction Equipment, Sandvik, Ammann, Terex, and LiuGong. They were to be joined by Indian manufacturing majors such as Tata Hitachi, HG Infra, and Dinesh Chandra R. Agrawal Infracon.

The buoyancy of India’s infrastructure construction sector is no short-term phenomenon. An eye-catching 21% rise in sales (to 83,912 units) in 2023, reported by leading business market intelligence consultancy Off-Highway Research, took demand to 4% above the previous record sales in 2018. Many industry insiders report continued market vibrancy in 2024, with 2025 set to be another strong year, fuelling demand for equipment.

The Indian construction equipment market is forecast to be worth $7.3 billion in 2024 and $10.9 billion by 2029, growing at a compound annual growth rate of 8.3% in the forecast period (2024–29), according to Mordor Intelligence, another market intelligence company.

“Improvement in road construction infrastructure, increasing urbanisation rate, and higher investment to boost infrastructure activities serve as the major determinants for the growth of construction equipment in India,” Mordor Intelligence stated in its latest India market report. “With better road transportation infrastructure and a rise in urban population, there exists a greater demand for convenience

in personal mobility, healthcare, sanitation, and water supply, among others, which in turn contributes to the boosting demand for construction equipment, attributed to the growth in the construction sector across India.”

Given close ties between construction and quarrying, Mordor’s perspective will hearten quarry machinery manufacturers and customers. Further encouragement is offered in GlobalData’s latest Indian construction market report, published in September 2024, which highlights major infrastructure projects green-lighted this year. They include Indian multinational conglomerate Adani Group’s March 2024 announcement that it plans to develop multiple projects in Madhya Pradesh, including the construction of the Mahan Energen Plant and the Mahakaal Expressway by 2030.

GlobalData notes that in early July 2024, the Indian government also approved the construction of a four-lane road from Silchar to Umiam via East Jaintia Hills district to improve road connectivity between Assam, Meghalaya, Mizoram and Tripura.

India’s aggregate production suffered a decline in 2020 during the COVID-19 pandemic; however, it bounced back with an estimated 6.6 billion tonnes produced in 2023, according to an estimate by the Global Aggregates Information Network (GAIN) based on member data.

Quoting GAIN data is a tting segue into highlighting this issue’s big industry executive interview. Aggregates Europe – UEPG president Antonis Latouros was in Córdoba, Argentina, in October for GAIN’s 7th Annual Conference. He was appointed its vice president, having made history in June this year when he became the rst Aggregates Europe – UEPG president to be elected for a second three-year term.

Latouros spoke to Aggregates Business about his second-term agenda. Given his now global platform and Europe’s often leading role in conveying aggregate industry best practice, Latouros’ candid and thought-provoking commentary should greatly interest this publication’s knowledgeable readership. GW guy.woodford@primeglobalpublishing.com

The records continue for Holcim, with a new profitability high in Q3 2024.

The world’s biggest building materials group posted record recurring EBIT (earnings before interest and taxes) of CHF1647 million (€1760m) in the third quarter, with a margin of 23.5% (+170 bps). Q3 2024 net sales stood at CHF7120m (€7609m), up 0.5% in local currency.

The company’s nine-month net sales of CHF19,933m (€21,303m) were up +1.2% in local currency. The recurring EBIT for the period was CHF3884m (€4151m), up 11.1% in local currency.

The quarter also saw the accelerated expansion of ECOCycle, with a 23% increase in recycled construction demolition materials sales.

“Across all our markets, our teams advanced our sustainable building solutions from ECOPact and ECOPlanet to Elevate, meeting our customers’ most ambitious needs,” Holcim CEO Miljan Gutovic said. “Our Q3 results confirm Holcim’s strong earnings profile, with broad-based growth drivers delivering record recurring EBIT and a record margin. Our disciplined M&A execution has continued with six value-accretive acquisitions to expand Solutions and Products, strengthen our footprint in Europe and grow in attractive Latin American markets.

“With our track record of creating superior value across all market conditions and economic cycles, our resilient business model positions us to deliver another year of record results, executing on our strategic priorities.”

After completing the full acquisition of US-based ASI Mining earlier this year, Epiroc announced that it would no longer market its surface autonomous business under the ASI Mining name but solely under the Epiroc brand.

A major manufacturer of drill rigs and hydraulic breakers for the global quarrying, mining and construction industries, Epiroc said the transition underscores its commitment to delivering advanced surface automation solutions, focusing on accelerating integration and advancing functionality development.

As part of this rebranding, the ASI Mining autonomous mining solution, Mobius, has been renamed LinkOA. LinkOA (open autonomy) is an advanced integration platform revolutionising mining operations by offering claimed unmatched exibility, scalability and safety.

As an OEM-agnostic solution, LinkOA empowers mining operations to integrate eets

of various makes and models seamlessly, ensuring interoperability across all mining systems.

Under Epiroc’s leadership, LinkOA will now be expanded to support a broader range of surface mining applications. Its agship products include the Autonomous Haulage System (LinkOA for Haulage) and autonomous drills (LinkOA for Drills).

LinkOA for Drills improves decision-making and operational safety by integrating drills into a eet-wide autonomy ecosystem,

allowing for real-time data sharing and optimised performance.

LinkOA for Haulage coordinates and controls mixed eets of autonomous haul trucks, increasing safety, reducing downtime, and improving productivity through scalable automation.

LinkOA for Blasting enhances safety and ef ciency with teleoperated, semiautonomous and fully autonomous blast operations, reducing personnel exposure in hazardous environments.

price enquiry (at cashbuild.co.za/ shop). Once the enquiry is received, customers will promptly receive a quote tailored to their speci c application and site location. Finally, customers can securely make their payment online and enjoy the convenience of hassle-free delivery to their construction site.

AfriSam has collaborated with Cashbuild, one of South Africa's largest building material retailers, to offer Cashbuild customers online ordering of AfriSam Readymix concrete.

This is a rst in South Africa and the wider African continent. It aims to provide Cashbuild customers in Gauteng and selected parts of

Mpumalanga with a seamless and ef cient online experience in procuring high-quality concrete for their construction projects.

With this new digital offering, an end consumer can conveniently order AfriSam Readymix concrete online through a simple threestep process. First, customers are encouraged to submit their Readymix

This online offering comes at a time when the construction industry is increasingly embracing digital solutions to enhance ef ciency and productivity. By offering online ordering of AfriSam Readymix concrete, Cashbuild and AfriSam are meeting the evolving needs of their customers and ensuring that they have access to the highest quality construction materials.

Cashbuild customers in Gauteng and selected parts of Mpumalanga can now take advantage of this new online ordering service to streamline their construction projects and ensure timely delivery of high-quality AfriSam Readymix concrete.

Despite a sales drop globally, growth in Volvo Construction Equipment’s (Volvo CE) China market business, fuelled by government policies to stimulate the real estate market, and in South America enabled the construction and quarrying equipment major to showcase its resilience in Q3.

Despite lower volumes in Europe and North America for Q3 compared to the very high levels of last year, Volvo CE said its positive China and South America trading and maintenance of good margins allowed the company to continue what its head Melker Jernberg described as its “steadfast commitment to the industry transformation”.

In Q3 2024, Volvo CE net sales decreased by 23% to SEK18.809

billion (€1.647b), compared to the high earnings of SEK24.296b (€2.127b) for the same quarter last year. When adjusted for currency movements, net sales decreased by 20%, of which net sales of machines fell by 24%. Service sales increased by 2%, reflecting the market’s growing interest in digital solutions.

More positively, Volvo CE's net order intake rose slightly, largely due to a 59% increase in South

America and a 44% increase in Europe, strengthened by a more modest rise in all other regions, except North America. Global deliveries were down from last year due to continued lower market demand and reduced inventories at the dealerships in Europe and North America, partly o set by increased deliveries for the SDLG brand in China.

“We live in turbulent times and, like other companies, are feeling the e ects of a market slowdown,” Jernberg said.

“But we maintain our leading position with a strong portfolio, the continued rollout of new products and services and our steadfast commitment to the industry transformation.

“The ambitions we have set out towards building the world we want to live in remain unchanged, and we take pride in working together to balance today's priorities with our confident vision for tomorrow.”

AMetso LT300HP mobile cone crusher, owned and operated by Danoher Group, a leading mining contractor in southern Africa, has clocked more than 30,000 hours, with more to come.

Acquired in 2012, the Metso LT300HP mobile cone crusher is currently deployed at a job in Mbombela, Mpumalanga, where Danoher Group is contracted to produce 350,000 tonnes of road stone for the rehabilitation and upkeep of the N4 Toll Concession.

The machine was previously deployed on some agship projects in South Africa and Botswana. In the past 12 years, it has been in Botswana

on four occasions, where it executed some major projects at agship mines such as Debswana’s Orapa Diamond Mine and Khoemacau, a long-life copper-silver mine located in the Kalahari Copper Belt. In addition, it has been deployed at Danoher’s own Kgale Quarry in Gaborone.

With just over 30,000 hours on the clock, the machine is one of the several Pilot Crushtec-supplied Metso units in Danoher’s crushing and screening eet with a long lifespan. CEO Scott Danoher said the company has neither retired nor scrapped a single unit in the past 15 years, shining the spotlight on its drive to achieve extended operational

CRH has confirmed its appointment of an interim chief financial o cer who will take over from Jim Mintern in 2025.

Alan Connolly has been appointed as the interim chief financial o cer from January 1 2025. Connolly will take over from Jim Mintern, who will step up as the chief executive o cer of CRH from 2025.

Connolly’s appointment comes as CRH continues its process to find a permanent successor to Mintern in the key position. The company confirmed it had engaged an independent recruitment consultant and is considering internal and external candidates for the role.

“Alan brings extensive and relevant expertise to the interim chief financial o cer role and is deeply familiar with CRH’s business and financials,” Mintern said.

lifecycles out of its capital assets and a testament to the quality of the Metso products.

Danoher Group values several factors when investing in capital equipment, such as standardisation and relationships with suppliers. However, equipment longevity is one of the principal factors that informs the company’s buying decisions. While various elements in uence longevity, Danoher stressed that the fundamental ‘raw material’ is the design of the machine, which is why the company trusts Metso for its comminution equipment needs.

“We do not necessarily buy a crusher or a screen, for example, for whatever amount; we buy the number of hours that the machine gives us,” Danoher said. “For us, it is also not about the price tag but more about the cost per tonne or hour – ‘cradle to grave’, which is a totally different approach. We are prepared to pay a premium upfront in exchange for, say, 30,000 trouble-free hours out of our crushing equipment.”

“As our director of strategic finance, Alan and I have worked closely together on key finance initiatives, and I look forward to continuing to partner with him to execute on our strategy and drive value for our shareholders.

“We are grateful that he is stepping into this interim role while we conduct a search to identify a permanent chief financial o cer.”

Connolly is a chartered accountant with more than three decades of experience. He has held several senior finance roles across the CRH’s European and Americas businesses.

During his time with the company, Connolly served as director of strategic finance, finance and performance director of Europe materials, chief financial o cer of global building products, and director of group finance.

Antonis Antoniou Latouros made history in June 2024 when he became the first Aggregates Europe – UEPG president to be elected for a second three-year term.

Antonis Latouros is used to getting results. A highly successful Cypriot aggregates and waste recycling sector entrepreneur, he is keen to achieve as much as possible after his groundbreaking re-election as Aggregates Europe – UEPG president.

Latouros sat down with Aggregates Business to discuss his rst term at the in uential Brussels-based aggregates industry association, as well as his ambitious second-term agenda

In the immediate term, he urgently wants to see an amendment to the Critical Raw Materials Act or a new Essential Raw Materials Act that prioritises approving new quarry licences and extending existing licences to enable quarrying rms to access more of their mineral reserves.

“The issue of insuf cient new quarry approvals and the challenges in extending existing quarry permits is a pressing concern for the aggregates industry in Europe,” he said. “We are actively addressing this through our collaboration with academic institutions, notably the comprehensive study we’ve commissioned at the University of Leoben in Austria.

“This study aims to identify gaps and problems in the permitting processes across various EU member states and proposes actionable solutions.

“One key nding emphasises the need for streamlined permitting procedures. We’ve recognised that lengthy and complex approval processes hinder the ability to meet the growing demand for aggregates, especially in light of increasing infrastructure needs tied to the Green Deal and other initiatives.

“Establishing a ‘one-stop shop’ for permitting can signi cantly reduce the time and complexity of securing approvals. Some countries have already implemented such systems, reducing permitting times and enhancing ef ciency.”

If these issues remain unaddressed, Latouros said, it could result in a scenario where the supply of aggregates cannot keep pace with demand, leading to potential shortages and increased prices.

“In the medium-to-long term, this could sti e economic growth and hinder the progress of essential infrastructure projects across Europe,” he said.

“Therefore, it is crucial that we advocate for legislative reforms through an amended Critical Raw Materials Act or new Essential Raw Materials Act and improved collaboration among regulatory authorities to ensure that our industry can sustainably meet future demands.”

Aggregates Europe – UEPG has represented the European aggregates industry in Brussels since 1987, with members in 25 countries. It is by far the largest non-energy extractive industry, covering a demand of three billion tonnes of aggregates per year. It is produced on 26,000 sites by 15,000 companies, mostly small and medium

enterprises (SMEs), and employs 187,000 people across Europe.

The Aggregates Europe – UEPG general secretariat conducts public affairs activities. It promotes the interests of its members at national and European levels in economic, technical, health and safety and environmental policies.

The association coordinates the EU network and proactively identi es EU initiatives and policies likely to impact European aggregates producers, keeping members updated on relevant policy developments and ensuring EU decisionmakers consider Aggregates Europe – UEPG positions. The organisation currently has 16 associations as full members, four associate association members, two associate company members, and four af liated members.

“One of the biggest challenges we faced during my rst term was expanding our membership,” Latouros said. “When I was elected in June 2021, I committed to visiting all our current members and reaching out to countries not yet part of our association. Over the past three years, these visits revealed various issues that prevented some countries from becoming full members or even joining.

“To address this challenge, we developed a new membership scheme, which was approved during our last Delegates Assembly. This scheme is designed to be more inclusive and adaptable, allowing us to better

1. Antonis Latouros speaking at Aggregates Europe –UEPG’s Late Summer Reception 2024 event in Brussels.

2. Regular visits to Aggregates Europe – UEPG member quarry sites are a key part of Antonis Latouros’ work as the association’s president.

accommodate the unique circumstances of potential member countries.

“With this new approach, I am optimistic that we will successfully enlarge our membership base in my second term.”

Because of his success in visiting all members and potential new members throughout Europe, Latouros said his Aggregates Europe –UEPG colleagues call him “the travelling president”.

“I have managed to do this because my family, especially my wife Eleni, understands and supports me; otherwise, it wouldn’t be possible,” he said. “In the meantime, this personal touch is very helpful in fostering stronger collaboration among our member associations.”

How does Latouros feel about being named Aggregates Europe – UEPG’s rst two-term president?

“It’s a tremendous honour. This opportunity allows me to build upon the momentum and achievements of our rst term, driving forward our mission to promote sustainable practices, innovation and advocacy within the aggregates industry across Europe,” he said. “I am deeply committed to advancing our industry’s interests, collaborating closely with our members and stakeholders to navigate challenges and seize opportunities for growth and sustainability.”

Latouros, who has served as president of the Cyprus Aggregates Producers Association since 2013, brings a wealth of industry experience to the Aggregates Europe – UEPG presidency. His MSC Latouros Investments group comprises three aggregates quarries (Latomia Latouros, Latomio Pyrgon, and Elmeni Latomia) and one gypsum quarry (Latouros Gypsum). Additionally, the group operates a construction and demolition waste recycling plant and a comprehensive chemical laboratory (Veltia Cyprus). The group’s annual turnover is around €30 million.

Given Latouros’s Aggregates Europe –UEPG commitments and with succession planning in mind, the group is governed by an executive committee whose members are Latouros’s daughters Maria, an Oregon State University industrial engineering graduate with a Master’s in management, and Konstantina, an economist and King’s College, London, alumni; his son-in-law Kyriakos Konstantinou, a Liverpool John Moores University civil engineering graduate with a Master’s in project management; and Christos Zapitis, an Imperial College London mathematics alumni and chartered accountant with vast experience in business development and nancials.

When asked what he sees as the association’s biggest achievements during his rst Aggregates Europe – UEPG presidential term, Latouros is quick to point out that it’s been a team effort in many respects.

“First of all, I want to emphasise that none of the achievements would be possible without the unwavering support of my colleagues on the board, and of the chairs, vice chairs and secretaries of our committees,

task forces, and working groups,” he said. “Their dedication and tireless efforts have driven our achievements, and I am immensely grateful for their collaboration and partnership.

“I also want to express my heartfelt appreciation to the secretariat for their hard work and dedication. Their behind-the-scenes efforts often go unnoticed, but they are essential to the success of our association. A special note of appreciation goes, of course, to our secretary general Dirk Fincke. His leadership and vision have signi cantly shaped our path as an association.

“Regarding our achievements, the most signi cant ones include fostering stronger collaboration among our member associations, getting even closer and having even stronger collaboration with the big international NGOs [non-governmental organisations], enhancing our advocacy efforts at the EU level, and promoting sustainable practices within the aggregates industry.

“We successfully launched initiatives to increase the recycling of construction and demolition waste, strengthened our focus on sustainability through various projects and partnerships, and improved our communication strategies, which helped raise awareness of the importance of aggregates in construction and infrastructure development.

“These efforts have laid a solid foundation for our continued progress, and I’m excited to build on them in my second term.”

So what are the association’s key areas of focus during his second term as president?

“Our priorities will align closely with our newly established Business Plan for 2024–2027, titled ‘Sustainable Foundations: Building Europe’s Future through an Essential and Sustainable Aggregates Industry’,” Latouros said.

“First and foremost, we aim to enhance our role as a global leader in sustainable

aggregate production by promoting innovation, environmental stewardship, and social responsibility. Key initiatives include increasing our public relations and communication efforts to highlight the aggregates industry’s essential contributions to economic growth and daily life.

“We will also focus on enhancing membership value and collaboration, aiming to expand our membership base through a new and invigorated membership policy that comprehensively represents all of Europe.

“Another priority is strengthening stakeholder engagement and public perception through comprehensive programs that bring together NGOs, community leaders and policymakers to discuss industry challenges and opportunities.

“Lastly, we will emphasise our commitment to sustainability by promoting climate resilience, biodiversity and resource ef ciency initiatives, which align with our goals for a circular economy and digital transformation.

“By focusing on these areas, we can effectively address our industry’s challenges and ensure a sustainable future for the aggregates sector in Europe.”

How does Latouros, who was also appointed vice president of the Global Aggregates Information Network (GAIN) during its 7th Annual Conference in Córdoba, Argentina (20–23 October), see the current health of the European aggregates industry? What are its biggest challenges, and from where will growth come?

“The European aggregates industry is relatively stable, although it varies across different countries – some are experiencing downturns, others an upturn, while many remain stable,” he said.

“As I said, the biggest challenges we face throughout Europe primarily involve permitting procedures, which can be slow and cumbersome. There is a pressing need

for fast-tracked and streamlined processes to support timely project delivery.

“Additionally, accessing local resources has become increasingly dif cult, posing another industry challenge.

“While our carbon footprint is relatively low, we are committed to achieving carbon neutrality and have developed a comprehensive roadmap.

“Despite these challenges, growth in the aggregates sector is expected to remain strong. The ongoing need for infrastructure development and construction, particularly concerning the European Green Deal, will drive demand for our products. Moreover, we are seeing signi cant growth opportunities in recycling, which aligns with our sustainability goals and the circular economy.”

Latouros stressed that sustainability is at the core of his work as Aggregates Europe – UEPG president and integral to the association’s mission.

“We recognise that our industry is vital in promoting environmental stewardship, resource ef ciency and social responsibility,” he said. “During my rst presidential term, we initiated several projects that underscore our commitment to sustainability. For example, we launched a comprehensive roadmap to achieve carbon neutrality, outlining speci c targets and actions to reduce our carbon footprint. This roadmap serves as a guide for our members to adopt more sustainable practices in their operations.

“Additionally, we focused on enhancing recycling initiatives, working collaboratively with stakeholders to promote using recycled aggregates. This contributes to resource ef ciency and supports the circular economy by minimising waste and reducing the demand for virgin materials.

“But I want to emphasise that, even though recycling can reduce the need for virgin materials, lower environmental impacts and contribute to a circular economy, it will never be enough.

“We build much more than what we demolish. Even if we use the most modern techniques, it will never be possible to regain 100% of the aggregates used to build a certain building. Today, we demolish buildings that were built 50 to 60 years ago, but what we build today is more durable and will last more than 100 years. Therefore, the available C&D [construction and demolition] waste rate will decrease.

“Our statistics show Europe’s average substitution rate of recycled aggregates is currently 10%. A few countries manage it better, substituting 20 to 25% of their aggregate needs with recycled aggregates while declaring that they recycle all their C&D waste. This indicates that the ceiling for substituting aggregate needs with recycled aggregates is 20 to 25%. Even if we achieve these percentages across Europe, we will always need virgin materials for the remaining 75 to 80% of our aggregate needs.

“Additionally, factors that need to be considered with recycled aggregates are quality, availability and logistics.

“We also emphasised the importance of biodiversity and environmental protection in our extraction processes, advocating for best practices in restoration and sustainable resource management. Through these efforts, we aim to elevate the aggregates industry’s role as a leader in sustainability and demonstrate our commitment to building a more sustainable future for Europe.”

With production process digitalisation and arti cial intelligence (AI) increasingly prominent in the modern European aggregates sector, what effect does Latouros see them having in the long term?

“Digitalisation and AI are poised to signi cantly transform the European aggregates industry, offering numerous opportunities for increased ef ciency, safety and sustainability,” he said.

“In the short term, we are already seeing the adoption of digital tools for operational management, which help streamline

processes, reduce costs and enhance productivity. Technologies such as predictive maintenance and automated monitoring systems can improve equipment reliability and minimise downtime, resulting in more ef cient operations.

“Digitalisation and AI will have a profound impact in the long term. We anticipate these technologies will enable us to implement advanced resource management techniques, optimise production processes and enhance decision-making through data analytics.

AI can facilitate better environmental monitoring, helping us track our progress toward sustainability goals more effectively.

“As we move forward, embracing digitalisation and AI will be critical in fostering innovation and ensuring that the aggregates industry remains competitive in a rapidly evolving market. By leveraging these technologies, we can improve our operational resilience, reduce our environmental

footprint and ultimately contribute to a more sustainable and ef cient industry.”

Given many aggregate professionals across Europe are retiring or nearing retirement age, does Latouros think enough is being done to attract the next generation of industry talent? How is the association supporting efforts in this area of the business?

“Attracting the next generation of talent in the aggregates industry is a critical focus for Aggregates Europe – UEPG,” he said. “Our business plan for 2024–2027 outlines several initiatives aimed at promoting workforce development and inclusion.

“We are implementing industry-wide skillenhancement programs focusing on essential areas such as digital literacy, environmental management and sustainable leadership. These initiatives will help equip young professionals with the necessary skills to thrive in our evolving industry.

“Additionally, we are committed to enhancing diversity and inclusion within the aggregates sector. We aim to create more opportunities for underrepresented groups, particularly women, by promoting inclusive policies, mentorship programs and networking events. Partnering with educational institutions is also a key strategy, as we seek to introduce students to the aggregates industry through internships, scholarships and workshops.”

Latouros stressed that by fostering a culture of equality and actively engaging with educational institutions, Aggregates Europe – UEPG can help attract and develop the next generation of talent needed to drive the industry into the future.

“This comprehensive approach will not only help address the impending skills gap but ensure the aggregates industry continues to thrive competitively and sustainably,” he said.

When re ecting on how he sees the European aggregates industry a decade from now, Latouros envisions it as “a more sustainable, technologically advanced and socially responsible sector”.

“The ongoing focus on environmental stewardship and carbon neutrality will signi cantly change our operations,” he said.

“Average quarry work sites will likely be equipped with advanced technologies such as AI and automation to optimise processes, enhance safety, and reduce environmental impact. We can expect to see the widespread use of digital tools for monitoring and managing resources, which will improve ef ciency and reduce waste.

“Sustainability will be at the forefront, with quarries implementing more rigorous environmental practices. This includes adopting renewable energy sources, enhanced biodiversity initiatives, and strongly emphasising land rehabilitation and restoration practices.

“Moreover, the workforce will be more diverse and skilled, with ongoing training and development programs ensuring employees can handle new technologies and practices. Integrating social responsibility into our operations will be paramount, with quarries engaging more with local communities and stakeholders.”

Latouros said the aggregates industry will be pivotal in supporting Europe’s infrastructure needs while demonstrating a commitment to sustainability and innovation. He believes this evolution will enhance the “industry’s reputation and ensure our longterm viability in an ever-changing landscape”.

“Firstly, the successful expansion of our membership base will be a crucial indicator,” he said.

“By implementing our new membership scheme and fostering stronger collaborations, I aim to ensure we comprehensively represent the aggregates industry across Europe.

“Secondly, I will consider our advocacy efforts to be successful if we have effectively in uenced EU policies and regulations to create a more favourable environment for the aggregates sector.

“This includes streamlining permitting procedures and promoting sustainability initiatives aligning with our carbon neutrality roadmap.

“Furthermore, enhancing the public perception of our industry will be vital.

“We will have made signi cant strides if we can effectively communicate aggregates’ essential contributions to society and infrastructure and demonstrate our commitment to sustainability.

“Lastly, cultivating a skilled, diverse workforce prepared for future challenges will be essential. It will mark a signi cant achievement if we can attract and retain new talent, ensuring that our industry is equipped to adapt and thrive.

“In summary, success will be measured by our ability to grow our membership, in uence policies, enhance our industry’s reputation and develop a capable workforce ready to meet the future demands of the aggregates sector."

When considering how he will measure his two terms as Aggregates Europe – UEPG president, Latouros believes achieving several key objectives will make it a success.

Given his relentless drive and focus, few would be likely to bet against Latouros and the talented and diligent Aggregates Europe – UEPG General Secretariat achieving those goals. AB

Having commenced operations in 1927,

quarries

Several upgrades at AfriSam Coedmore, located at the doorstep of one of the largest road infrastructure projects in South Africa, have put the quarry in good stead to meet local demand for aggregates.

Having commenced operations back in 1927, AfriSam Coedmore is one of the oldest quarries in South Africa. And with an annual production capacity in excess of one million tonnes, it is one of the largest quarries not only within the AfriSam portfolio, but in South Africa at large.

AfriSam Coedmore mines competent quartzite rock, with some dolerite and tillite intrusions.

The dolerite intrusions are generally used to make sub-base materials such as G5, while the other two competent rocks are central to the manufacture of highly sought-after concrete aggregates and roadstone.

Located to the south of Durban in the KwaZulu-Natal province, AfriSam Coedmore has enjoyed high aggregate demand in the past few years, especially given its close proximity to the ongoing agship N2/N3 road upgrades implemented by the South African National Roads Authority Limited (SANRAL). The upgrades, which form part of the national government’s Strategic Integrated Projects (SIP2): Durban-Free State-Gauteng Logistics and Industrial Corridor, are expected to take eight to 10 years to complete.

The upgrade of the N2 focuses on a 55km stretch from Illovu River on the south coast to Umdloti on the north coast, while the N3 project focuses on an 80km section from Durban to Pietermaritzburg. The upgrades entail widening the N2 and N3 carriageways, with four or ve lanes in each direction, as well as recon guring most major interchanges.

One of the major legs of the project to which the quarry supplies materials is the upgrade of the EB Cloete Interchange on the N2. Located within a 10km distance of AfriSam Coedmore, the EB Cloete Interchange is said to currently be the single largest road infrastructure project in South Africa. With a project value of ZAR5 billion (about £220 million), SANRAL said it is the biggest single project value undertaken by the roads authority to date.

“We are fortunate to be situated right at the doorstep of the many faces of the N2/N3

road upgrades,” AfriSam Coedmore works manager Lloyd Maringa said.

“In the past few years we have enjoyed high aggregate demand, initially supplying mostly base and sub-base materials during the early days of the projects. With the upgrades now moving onto surfacing, we are starting to move more high-value products such as roadstone and concrete aggregates.”

Despite a huge spike in demand, AfriSam Coedmore did not necessarily need to invest in more capacity. The existing capacity – a million tonnes per year – put the operation in good stead to meet the rising demand.

“To provide context, we run one of the biggest primary crushers in the South African quarrying sector – a 700-tonnesper-hour [tph] Allis Chalmers 3655 superior gyratory crusher. To meet rising demand, we simply increase the number of shifts when necessary,” Maringa said.

The production process starts in the pit, with at least a single blast per month. Blasts – outsourced to well-known contractor Brauteseth Blasting – are kept reasonably large at an average of 60,000t of material on the ground per blast, according to AfriSam Coedmore maintenance superintendent Dustin Naidoo.

The load and haul function is outsourced and the contractor deploys a 50t excavator, which loads 35t articulated dump trucks (ADTs). The ADTs haul material from the face to the primary section of the plant, tipping directly into the in-pit Allis Chalmers 3655

gyratory crusher. The primary plant then feeds a 280m conveyor belt running from the primary section to the intermediate stockpile (ISP).

“Installing the primary plant in the pit has ensured reduced haul distances, thus cutting down on diesel costs,” Naidoo said.

“This is particularly bene cial, especially given the deep nature of the pit. The depth of the quarry pit is now 140m and is 54m below sea level.

“As part of our ef ciency drive to reduce our cost per tonne of operation, we also found it cost-effective to run an electric conveyor instead of hauling material using diesel-powered trucks.”

From the ISP, the material is fed into a tunnel with two conveyor belts moving material to the secondary crusher, a Symons 5.5-foot cone crusher, running at an average 35mm closed side setting (CSS). AfriSam Coedmore is one of the few quarries in South Africa still running this old-generation cone crusher, which typi es longevity and durability. From here, the material moves to the tertiary crusher, a new-generation Metso HP400 cone crusher running at an average 18mm CSS. The material goes to a series of vibrating screens and is screened into various product sizes, from 50mm down to a -7.1mm sand.

“In recent years, the plant has bene tted from major upgrades, which put us in good stead to meet the current high aggregate demand in our area,” Naidoo said. “One of the most recent upgrades was the installation of the new Metso HP400 tertiary crusher

in 2019, replacing the older Nordberg 1352 omnicone crusher.

“The HP is an industry standard in aggregate production. It features a unique combination of crusher speed, throw, crushing forces and cavity design, providing higher capacity and superior end-product quality in secondary, tertiary and even quaternary applications.”

AfriSam Coedmore also recently replaced its old Nordberg 1144 omnicone crusher with a new-generation Telsmith SBS-38 cone crusher supplied by Astec Industries. One of the key features of this crusher is the large feed opening, which yields high performance.

Quarry operations cannot afford to ignore the bene ts of using the latest technologies to drive ef ciencies. The increased economic and operational pressures, Maringa said, demand that today’s quarries stay ahead to remain competitive.

One area where this is particularly crucial is in blasting – a critical function that signi cantly in uences operational ef ciency, costs and the success of all the other downstream processes, such as load and haul, and crushing and screening.

With the use of electronic blasting systems, it is now possible for AfriSam Coedmore to not only meet higher safety levels and environmental impact control but also to gain more blast control and improve fragmentation, thus delivering more downstream value to the whole operation.

“AfriSam uses the latest technology when executing our blasts. This enables us to operate in harmony with the communities surrounding our operations,’’ Maringa said.

To preserve uptime in loading operations, AfriSam Coedmore quarry is taking advantage of the bene ts of modern Loadrite on-board weighing systems from Loadtech. The company’s three Volvo wheeled loaders, deployed to load customer trucks, are tted with the Loadrite L3180 SmartScale, which uses weighing intelligence and solid-state sensors for more accurate, precise and faster loading.

“Loading is a key function of our operations. Traditionally, we relied on weighbridges alone, which are known to be prone to product errors and weight challenges,” Naidoo said.

“With the Loadrite system, we are able to eliminate guesswork in our loadout processes, which means customer trucks are loaded correctly the rst time.”

In addition, the quarry has recently invested in a Tru-Trac belt scale. The AfriSam Coedmore team had struggled with monitoring production output and inventory, with the margin of errors with the previous belt scale dramatically affecting operations.

“The Tru-Trac belt scale facilitates weighing the real mass of the material from the ISP to the secondary crusher,” Naidoo said. “We have found it to be a simple and extremely accurate system

Coedmore recently invested in a Tru-Trac belt scale, which facilitates weighing of real mass of the material from the ISP to the secondary

engineered to provide precise data. In fact, we were impressed by the static calibration accuracy error levels as low as 0.06%, which is outstanding. Our accuracy error margins were as high as 15% with the previous belt scale.”

Maringa called this type of technology “the lifeblood of our operations”.

“We will therefore continuously investigate new technologies in the market to ensure ef ciency and productivity of the highest orders,” he said. AB

While Chinese aggregate production has reduced in recent years, the world’s biggest producer continues embracing the sustainability agenda.

China’s aggregate production stood at 16.8 billion tonnes in 2023.

That is according to gures quoted by China Aggregates Association’s (CAA) international department director Xu Beibei on RocksTalk, the podcast of Aggregates Europe – UEPG, during an interview at the 7th Global Aggregates Information Network (GAIN) Conference in Cordoba, Argentina, in October.

While that gure of 16.8 billion tonnes is signi cantly down from the nearly 20 billion tonnes produced in 2020, RocksTalk stressed that China remains by far the world’s largest aggregate producer (India is second, producing a GAIN-estimated 5.6 billion tonnes in 2023).

China has around 13,000 extraction sites, a huge reduction from more than 56,000 a decade ago. The nation produces over ve times the tonnage in Europe annually on half the number of sites (Europe has around 26,000 extraction sites). China’s largest quarry sites produce around 100 million tonnes of aggregates annually.

Shortly after the latest issue of Aggregates Business was due to go to press, the global aggregates industry was descending on China for major dual conferences.

More than 1000 senior quarrying sector professionals will share their experience, good practice and vision for

the aggregates industry’s future during the 9th China International Aggregates Conference and the 7th China International Conference on Comprehensive Utilisation of Construction and Demolition Waste, Tailings and Waste Rock.

The CAA was hosting the dual conferences in Chongqing from 16–18 December 2024.

Speaking to Aggregates Business ahead of the big events, CAA president Hu Youyi said the continued decline in Chinese real estate investment and the slowdown in infrastructure spending were major factors in the country’s declining aggregates production volumes and product prices.

“The industry is going to face big challenges for a long time. However, the challenges also provide valuable opportunities for the industry’s transformation and upgrading,” Hu said.

“With the adjustment and transformation of the Chinese macro-economy, the aggregates industry, as the cornerstone of the construction industry, is inevitably impacted.

“According to the ‘China Aggregates Industry Operation Report’, released by the China Aggregates Association, from 1 January to 31 October 2024, China’s national aggregates production was 12.5 billion tonnes, a [year-on-year] decrease of 10.6%. Behind this gure is the grim reality and heavy pressure the industry faces.”

On the supply side, Hu said, the shadow of gradually expanding overcapacity looms over the entire Chinese aggregates industry. Although China’s existing aggregate production lines can meet the current market demand, the continuous addition of new production lines has further exacerbated the risk of overcapacity.

“This phenomenon not only re ects the industry’s blind expansion in the past few years but also exposes the problem of enterprises’ lack of foresight and exibility in the face of market changes,” Hu said.

“Real estate and construction investment have declined on the demand side. Although infrastructure investment has maintained growth, the growth rate has slowed signi cantly, making it dif cult to effectively ll the gap in the real estate market, resulting in insuf cient effective demand for sand and gravel.

“Regarding price, statistics from CAA show that in October this year the average comprehensive price of aggregates in China was CNY94 (US$12.91) per tonne, a year-onyear decrease of 9.6%.”

Looking at the next few years, Hu believes China’s aggregates industry will experience a process of de-capacity and enter a new round of adjustment, deep adjustment and high-quality development. In this round of adjustment, some enterprises with overcapacity, backward technology, high

costs and no comprehensive advantages will be eliminated until the supply-and-demand relationship reaches a basic balance.

“Faced with such a predicament, the aggregates industry started to have profound re ection and self-examination,” Hu said. “How to survive adversity, nd opportunities in challenges, and reshape the industrial ecology under the new situation have become issues that every sand and gravel company must face and think about.”

Faced with a complex industry environment, Chinese aggregates-producing companies have begun to explore the path of transformation and upgrading.

“The aggregates and equipment industry is a eld full of in nite possibilities. A small technological improvement, concept innovation or model change may bring huge bene ts,” said Hu.

The CAA president outlined the key dif culties faced by China’s aggregate enterprises.

For the built quarry, there is still pro t to obtain if the design and equipment selection is reasonable, but as the price of sand and gravel continues to fall, the pro t margin will become smaller and smaller; for enterprises with the cement, aggregate and concrete industry chain, there is still room for price reduction; and for newly-built quarries, the cost of investment in resource fees and construction is large, and it isn’t easy to recover the cost when the price of sand and gravel products is reduced and the company’s funds are tight.

For quarries with unreasonable design and equipment selection, the operating expenses are high and the room for price reduction is limited. Technical improvement is required to reduce costs but requires a large amount of capital investment.

Hu believes innovation is the key to breaking the deadlock, with aggregatesproducing companies’ focus needing to be “actively exploring new market areas and growth points”. He said green building and ecological conservation concepts have become more popular in China, and the

“With the adjustment and transformation of the Chinese macro-economy, the aggregates industry, as the cornerstone of the construction industry, is inevitably impacted.”

Hu Youyi

government’s support for new energy and materials has continued to increase. Hu believes the national aggregates industry can take this opportunity to develop in the direction of high-end, re ned and green products and improve the core competitiveness and market share of enterprises by developing high-quality aggregates products and expanding new application areas and market channels.

“Although the current aggregates industry faces many challenges and dif culties, we should remain optimistic,” Hu said. “Although market demand has declined, the total volume is still huge and a certain intensity of

A Powerscreen Premiertrak 400X jaw crusher being showcased at a Powerscreen open day in Zhejiang province.

construction is maintained. The renovation of old urban communities and constructing small and medium-sized rural infrastructure are also key support projects.

“Accelerating the ‘three major projects’ – construction of affordable housing, the renovation of urban villages and public infrastructure for both normal and emergency use – are major strategic deployments made by the CPC [Communist Party of China] Central Committee and will remain an important task at present and in the future.”

According to Off-Highway Research (OHR), the Chinese off-highway machinery market collapsed in 2022 with a 39% decline to 237,317 units after two years of “abnormally high” sales in 2020 (412,595 units) and 2021 (389,312 units). OHR noted that this was partly due to government stimulus money being spent. The same source adds that the steep fall in demand was also compounded by shocks in the Chinese real estate sector, coupled with dif culties in tackling the COVID-19 pandemic.

A further 38% drop in construction equipment sales in 2023, to 146,981 units, was, OHR said, partly attributable to falling prices and mounting bad debts in the retail estate sector.

OHR forecasts a further 4% fall in sales in 2024 to 140,710 units, which it believes is the market “bottoming out” and “arguably the best-case scenario for the country.” However, further bad news and property developer insolvencies could further depress the equipment market.

OHR also reported that wide-bodied trucks (WBTs) have emerged as by far the most popular type of off-road hauler in the Chinese mining, quarrying and construction sectors, with sales reaching almost 18,000 units in 2023, compared to 260 traditional rigid dump trucks and just three articulated haulers.

Produced exclusively in China by local original equipment manufacturers (OEMs),

WBTs are said by OHR to be manufactured primarily with locally available diesel engines or batteries, transmissions and axles. They feature a large hopper on a relatively low chassis, and have a much lower purchase price than traditional off-road dump trucks and better rough terrain capabilities than standard on-road trucks.

The increased width of the vehicle body has signi cantly improved its load capacity. However, the prominent feature of the ‘wide body’ exceeds the national standard limit of 2.5 metres, OHR said in a November news release. As a result, WBTs are not allowed to travel on the highway but are limited to use in open-cast mines or on private land.

The payload capacity of WBTs usually ranges from 20–130 tonnes. Demand for smaller models with payloads under 60 tonnes was evident around 20 years ago, OHR further noted, while the most popular models in their rst decade of use had a gross weight of 70 tonnes.

MarketsandMarkets supports OHR’s analysis that the Chinese construction equipment market is mainly supported by stimulus spending provided by the government in 2020, which resulted in “tremendous growth” in the next two years.

After weaker demand in 2022 and 2023, akin to pre-2020 sales levels, the leading US-based business markets consultancy predicts a recovery in 2024, mainly due to growing demand for compact equipment and the gradual increase in residential housing projects.

The size of China’s construction market was US$4.7 trillion in 2023, according to GlobalData. The market is projected to attain an average annual growth rate (AAGR) of over 3% from 2025 to 2028. Investment in energy and infrastructure projects will support the sector’s growth.

The Chinese government plans to invest CNY92.4 trillion (US$13.7 trillion) by 2060 for green power transformation. As part of the programme, the government plans to attain net-zero emissions of greenhouse gases by 2060. China plans to source 33% of power from renewable sources by 2025.

At the start of 2023, China’s Ministry of Industry and Information Technology (MIIT) unveiled 15 measures to stabilise growth further and adjust the structure of small and medium enterprises (SMEs). This includes nancing support for highquality SMEs.

GlobalData stated that China plans to increase the number of SMEs involved in manufacturing to 150,000 and ‘little giant’ enterprises to 10,000 by the end of 2024. In September 2023, the Chinese government revealed plans to add 2500km of high-speed railway lines and expand its total rail network by 50,000km by 2025.

Reportlinker, an AI-driven market intelligence platform, agrees with GlobalData’s take that the Chinese construction market will grow over the next three years. The same source said the market’s prospects will be boosted by continuing urbanisation, which leads to a rising demand for sustainable building practices and construction materials like concrete, cement, steel, bricks, sand and gravel.

Meanwhile, the World Cement Association’s chief executive of cer (CEO) Ian Riley has welcomed China’s recent expansion of its national carbon trading market to include the cement industry, among other hard-to-abate sectors, by the end of this year.

The move announced by China Minister of Ecology and Environment Huang Runqiu in June 2024 marks a signi cant step in China’s environmental plans.

L–R: Terex MP president Kieran Hegarty; Terex Materials Processing aggregates business vice president Pat Brian; Terex group engineering director David Trimble.

“The inclusion of cement in the Chinese ETS [emissions trading scheme] is a critical and long-awaited step,” Riley said. “As we have seen in Europe, a well-implemented carbon ETS can be bene cial by not only curbing emissions but also catalysing industry restructuring that favours the most ef cient and lowest-emitting producers.

“This move signals China’s intent to prioritise sustainability in high-emission sectors, a move welcomed by the World Cement Association.

“In addition to the ETS, China has also successfully used energy ef ciency standards to encourage widespread adoption of the latest low-energy technology. This approach is essential for meaningful climate action.”

China is by far the world’s biggest national producer and user of cement, producing 2.1 billion tonnes a year, half the global total. India is a very distant second, producing around 410 million tonnes annually. In January 2024, the China Cement Association (CCA) and the Global Cement and Concrete Association (GCCA) signed a memorandum of understanding (MoU) to help accelerate the sector’s decarbonisation worldwide.

“We are delighted with this MoU and will work with the CCA to deliver a China cement industry roadmap similar to that used in India and the rest of the world to achieve decarbonisation. This means that the roadmaps are consistent and comprehensive across geographies,” GCCA director of concrete and sustainable construction Dr Andrew Minson said during an interview with Aggregates Business earlier in 2024.

“Getting China on board is also signi cant in a wider context, as the country is a signi cant manufacturer of cement and concrete machinery and plants and a big contributor to the industry sustainability research agenda. China is also a major player in developing and commercialising carbon capture solutions.”

The Wirtgen Group showcased new products and technologies for the Chinese and wider Asia market at bauma China 2024 in November. As part of Wirtgen extensive display, its Kleemann brand highlighted how its premium crushing plants can be operated easily and ef ciently with the SPECTIVE operating concept.

Since 2004, the Wirtgen Group has been manufacturing products that ful l German quality standards at its ultra-modern factory in Langfang, a city in China’s Hebei province. Tailored to the speci c needs of the local market, the models manufactured here offer long life, cost ef ciency, ease of use, and low operating and maintenance costs.

Delegates at the China Aggregates Associationhosted 2023 China International Aggregates Conference in Shanghai.

With seven locations, two service centres and an extensive dealer network, Wirtgen China operates an ef cient sales and service network that serves almost all 22 Chinese provinces. The Wirtgen Group subsidiary in China is always close to its customers and can offer solutions from a single source.

During another key industry exhibition, Hillhead 2024 in Buxton, England, in June, Terex Materials Processing (Terex MP) vice president of aggregates business Pat Brian highlighted the notable increase in the production of Powerscreen and Finlaybranded crushers and screeners at Terex MP’s 18,000m² site in Shanghai’s Jiading district.

“We acquired the facility just as the coronavirus pandemic hit. The team there has done a remarkable job,” he said. “This year, we will pretty much double production from last year. We use that facility to supply the local Chinese market and support our business in Southeast Asia and Australia.

“Due to the domestic economy, the China market has been quite dif cult; however, we are seeing a few signs of improvement. To our bene t, some other international [crushing and screening] brands have now exited that market. From our [China] factory, we can, in time, leverage many of our brands and products.” AB

No matter how challenging your needs, BKT is with you offering a wide range of OTR tyres specifically designed for the toughest operating conditions: from mining to construction sites. Sturdy and resistant, reliable and safe, able to combine comfort and high performance.

BKT is with you, even when work gets tough.

OEMs are delivering flagship wheeled loaders to new markets worldwide, and Liebherr, Volvo CE and Hitachi are among the latest to put their machinery to the test.

Afather-and-son team producing some of the nest architectural stone in the world relies on Liebherr equipment for extraction and processing duties.

Gwrhyd Specialist Stone is found high in the Swansea Valley overlooking the Black Mountains of Wales, and it’s here that Michael Walton and son Charles have spent the last decade assembling a eet of specialist equipment to help develop the site to its full potential.

Together, they are responsible for the day-to-day running of a quarry employing 22 people to produce just 5000 tonnes a year; quarries of similar size could output up to 500,000 tonnes a year, but the volume at Gwrhyd is small dues to the specialist nature of its stone.

Liebherr has been an important supplier of equipment since the beginning of Gwrhyd Specialist Stone. The operation still uses its original L 510 Stereo wheeled loader and, over the years, it was joined by an L 509 Tele wheeled loader and an R 926 G8 excavator, the latter having since been replaced by a slightly larger R 930 G8.

“The R 926 did exactly what we wanted it to do and served us well over the past few years,” Charles said.

Working alongside another manufacturer’s used 14t excavator, used for loading the site’s two-deck screen, the new R 930 has been a hit with regular operator Jamie Evans, who came off the 45-tonner initially used at the site.

“It was an ideal machine at the top of the quarry, but as space got a little tighter it proved to be too big,” Evans said.

“The R 926 was also great and a massive step up in comfort over the older model and it’s now the same for the R 930. It’s a really comfortable machine, still has bags of power but hardly uses fuel.

“We don’t do a great deal of ne work here – we’re usually at-out moving the stone – but we’re still averaging just over 16 litres per hour.”

Boom and stick options for the R 930 G8 model include a standard mono boom, a straight demolition boom and a variable arm version, with Gwrhyd specifying the standard con guration, which combines a 6.2m boom and 3.2m stick, topped off with a Miller

Groundbreaking coupler for fast changes between buckets and a breaker.

Regular use of the breaker means the excavator has a dedicated drain line back to the hydraulic oil tank to ensure the oil is returned to lower its temperature as quickly as possible.

The R 930 G8 tips the scales at just under 31 tonnes in its LC undercarriage version and has a Liebherr seven-litre, D 934 engine developing 245hp at 1800rpm. The engine is designed to deliver peak torque at low engine rpm, the R 930 achieving 1255Nm at just 1350rpm. That lowers internal and external noise levels and signi cantly reduces fuel consumption.

The excavator is used for a variety of duties, from frontline extraction to a current major programme of site development. Any spare time is spent moving a large pile of material left over from the previous owner’s operations. That material gets taken to the screener and a portion is then cut into smaller blocks to increase the percentage of usable material being quarried.

“We are hoping to gain planning permission in the future to process the remaining waste material into a variety of crushed and screened aggregates to further increase the percentage of materials we are able to win from the site,” Charles said.

With more than 100 years of reserves, Gwrhyd is set to continue producing its distinctive stone for the building projects of the future – and to provide work for future generations of Liebherr equipment.

The Italian job

Hitachi has also been busy with its customers across Europe, where the company’s ZX530LCH-7 has been put to the test in the north-east of Italy.

Vaccari Antonio Giulio SpA’s basalt quarry in San Pietro Mussolino produces essential materials for railway and road construction projects. With a 15-year licence to continue its operations, the quarry dedicates 60 per cent of its output to railway projects and 40 per cent to road sites, such as the aggregates for the asphalt and required drainage.

Following its positive experience with Hitachi construction machinery, Vaccari recently added the Stage-V-compliant ZX530LCH-7 to its eet, including two other Hitachi large excavators: a ZX470 and ZX490.

The large Zaxis-7 excavator was purchased from local authorised dealer Comac.

1:

2: Hitachi ZX530LCH-7 excavator at Vaccari Antonio Giulio SpA’s basalt quarry in north-east Italy.

3: Vaccari’s experience with Hitachi Zaxis excavators influencedthe decision to purchase the ZX530LCH-7.

“I have been working with Vaccari for four years, and like all our customers they recognise Hitachi as the benchmark for reliability in the market,” Comac Padova branch manager and Veneto regional sales manager Mario Rebella said.

“In addition, the customer signed a maintenance contract of up to 10,000 hours to bene t from our rapid response times.

“This, alongside Vaccari’s previous positive experience with Zaxis excavators, certainly in uenced their decision to purchase the ZX530LCH-7.”

Volvo Construction Equipment (Volvo CE) has taken the step of testing its latest machinery in the considerably warmer climates of the United Arab Emirates (UAE), ultimately launching the L120 Electric wheeled loader in the Middle East.

The L120 Electric is engineered to deliver the same powerful performance as its diesel counterpart and has already undergone rigorous testing in the extreme heat of the UAE, passing all operational and durability benchmarks with ying colours.

The launch of the Volvo L120 Electric wheeled loader in the UAE and Turkey helps to showcase Volvo CE’s commitment to the electric machinery space. A forward-thinking approach to equipment electri cation helps to show the company’s ability to deliver a viable alternative to diesel-powered machines without sacri cing power, reliability or performance.

Before making the L120 Electric available in these key markets, Volvo CE tested the machine thoroughly in collaboration with trusted Volvo CE made the decision to test its equipment in the hotter climates of the United Arab Emirates.

A new Australian event for the municipal works, commercial and civil construction industries.

Melbourne, Australia September 2025

Converge is Australia’s premier event for Sub-Contractors, Project Engineers, Council Fleet Managers, and Large-Scale Construction Contractors across the municipal works, civil construction and infrastructure space.

Through a mixture of live demonstrations, equipment showcases, and conference spaces, Converge will bring industry experts together to share knowledge and deliver solutions for building and maintaining Australia’s future.

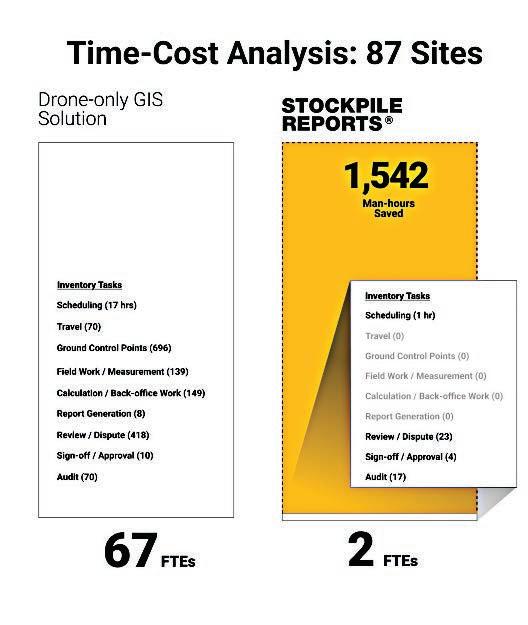

How does fast and accurate stockpile inventory positively impact aggregate producers’ bottom lines?

In the fast-paced aggregates world, accurate and timely stockpile inventory is crucial for operational ef ciency and nancial reporting. Yet the traditional methods of measuring bulk materials like rock, dirt and mulch often deplete internal resources and lead to delays, disputes and inconsistencies.

Enter Stockpile Reports, a computer vision software company revolutionising how companies track and manage their bulk material assets.

Stockpile Reports enabled one large global, vertically integrated bulk materials producer to verify more than 10 million tonnes of inventory across 87 sites in less than 24 hours, setting a new industry standard. The sites in question are situated across ve US states.

The challenge of stockpile inventory management

Managing stockpile inventory in the aggregates industry is no small feat.

Companies often grapple with resource intensiveness, as traditional measurement methods require signi cant manpower and time. Then there can be inconsistencies and errors, as manual measurements are prone to human error and internal biases. Delayed reporting prolongs measurement processes and can delay nancial reporting and decision-making. Finally, there are audit risks, with inaccurate inventories potentially causing nancial discrepancies and audit challenges.

These were the challenges faced by Stockpile Reports’ major bulk materials producer customer. With operations spanning multiple locations, the customer needed an accurate, scalable and ef cient solution.

Stockpile Reports offers an enterprise SaaS (software as a service) platform that automates the measurement of bulk materials using advanced photogrammetry and computer vision technology. By leveraging imagery from drones, planes and even smartphones, the company provides precise and reliable measurements without the traditional hassles.

Stockpile Reports’ success with the customer resulted from a meticulously

planned and executed work ow. Site parameters were set up as a one-time task to streamline future measurements, and a coordinated plan was established to capture inventory across all sites simultaneously.

High-resolution aerial imagery was collected without ground control points thanks to ight-to- ight image registration, with the imagery data uploaded to Stockpile Reports’ cloud-based intelligent image processing service on the same day and stored securely.

Managing stockpile inventory in the aggregates industry can be challenging.

Advanced algorithms automatically identi ed individual stockpiles, while automated processes calculated volumes using precise measurements of toes and base planes. Any reports agged for potential issues underwent a quality review. Automated reports were generated and posted on a secure portal.

Interactive site images were provided for product identi cation and veri cation by the customer. The system identi ed risks such as combined piles, obstructions or environmental factors affecting accuracy. Only measurements that met stringent accuracy criteria were nalised and comprehensive PDFs were generated for audit transparency.

A controlled process was also in place to manage any discrepancies or disputes.

Stockpile Reports believes several key attributes set its offer apart from traditional methods and other technological solutions.

The automated system helps to eliminate internal biases and errors by removing the need for manual clicking or point selection. Algorithms are able to handle heavy lifting traditionally performed manually, from pile identi cation to volume calculations.

Company policies for density factors and product speci cations are tightly controlled, which means modi cations to these subjective assumptions are restricted, ensuring consistency and reliability. Each measurement is independently evaluated for over a dozen common problems that can corrupt accuracy. The system provides con dence scores and does not publish unreliable reports, mitigating nancial statement risks. The detailed reports and transparent processes meet the scrutiny of major audit rms, classifying Stockpile Reports as a third-party veri cation service.

EveryPoint in precision measurement Stockpile Reports’ image processing is powered by EveryPoint, an intelligent software service that continuously replicates real-world assets.

This technology ensures that imagery from various sources, such as drones, planes or smartphones, is integrated and cohesively processed.

Obstructions are auto-corrected, with the system identifying and adjusting for equipment, vegetation, or other obstructions. The objective surface scoring provides an unbiased assessment of the stockpile surfaces.

Compared to GIS tools and drone GIS solutions

While geographic information system (GIS) tools play a vital role in mapping for mine planning and inspections, they often fall short of ef cient stockpile measurement, according to Stockpile Reports.

Drone GIS solutions require substantial manual work for measurements and data processing. Stockpile Reports cites studies indicating these solutions can take up to 20 times more internal manpower than its own. The absence of automated pile identi cation and volume calculation is said by Stockpile Reports to lead to inconsistencies and errors.

“Using a traditional GIS tool, the customer likely would have incurred more than 1600 hours of eldwork managing ground control and measurement calculations and reviewing estimates,” Stockpile Reports said.

“This would have required more than 60 FTEs [full-time employees] to achieve in the same timeframe.

“The cost of monthly inventory veri cation using traditional methods is exponentially more expensive than digitisation.”

Stockpile Reports’ automated system helps to eliminate internal biases and errors.

Setting a new industry standard

Stockpile Reports’ collaboration with the customer exempli es how technology can transform traditional industries. By achieving an enterprise-wide inventory across 87 sites in less than a day, the company demonstrated that accuracy, ef ciency and scalability are not mutually exclusive.

This represents a signi cant advancement in operational ef ciency for the industry, Stockpile Reports said. Rapid measurements free up resources for other tasks, reliable data supports nancial reporting and reduces audit risks, and timely and precise inventory data informs better business decisions. AB

The cost of monthly inventory verification using traditional methods is more expensive than digitisation

US quarrying and road construction giant Astec and its dry bulk material handling solution specialist Telestack are among the OEMs whose future-proofing endeavours leave them poised to prosper from renewed buoyancy in customer demand.

It is a very rainy day in late September and Aggregates Business is facing Damian Power, Astec’s managing director for Europe, and Malachy Gribben, Telestack’s commercial director, across the meeting room table at Telestack HQ in Omagh, County Tyrone, Northern Ireland.

Their stark assessment of the state of the present off-highway equipment market mirrors the early-autumn weather.

“I think the equipment market is 15% down year-on-year,” Power said. “On the Telestack side, we’ve not had big dealer inventories, as they would never carry big [mobile dry bulk material handling] rental eets. We’ve been fairly judicious in managing that side of our SIOP [sales inventory and operational planning] process.”

Astec expanded into Northern Ireland in 2014 after acquiring Telestack. The company nished the US$6.5 million 44,000ft² expansion of its Telestack-site-neighbouring Astec Doogary facility in 2023, bringing the Astec Omagh footprint to 100,000ft². The extension took Astec’s total investment since the Telestack acquisition to more than US$10 million, with an employee base of over 230 people in Northern Ireland.

More than half of the global market supply for mobile crushing and screening equipment originates in Northern Ireland. As such, Astec’s enlarged manufacturing presence in Omagh will enable it to grow its international market business and better serve its customers and partners.