5 minute read

The risks and opportunities ahead

Gold Fields has added solar grids to its WA gold mines.

Mining execs seek opportunity amid green risk

Global mining executives consider environmental and social issues as the top risk and opportunity in the year ahead.

As the mining industry moves towards a greener future, emissions targets and stakeholder pressure are playing a part in the changes the mining industry is undertaking.

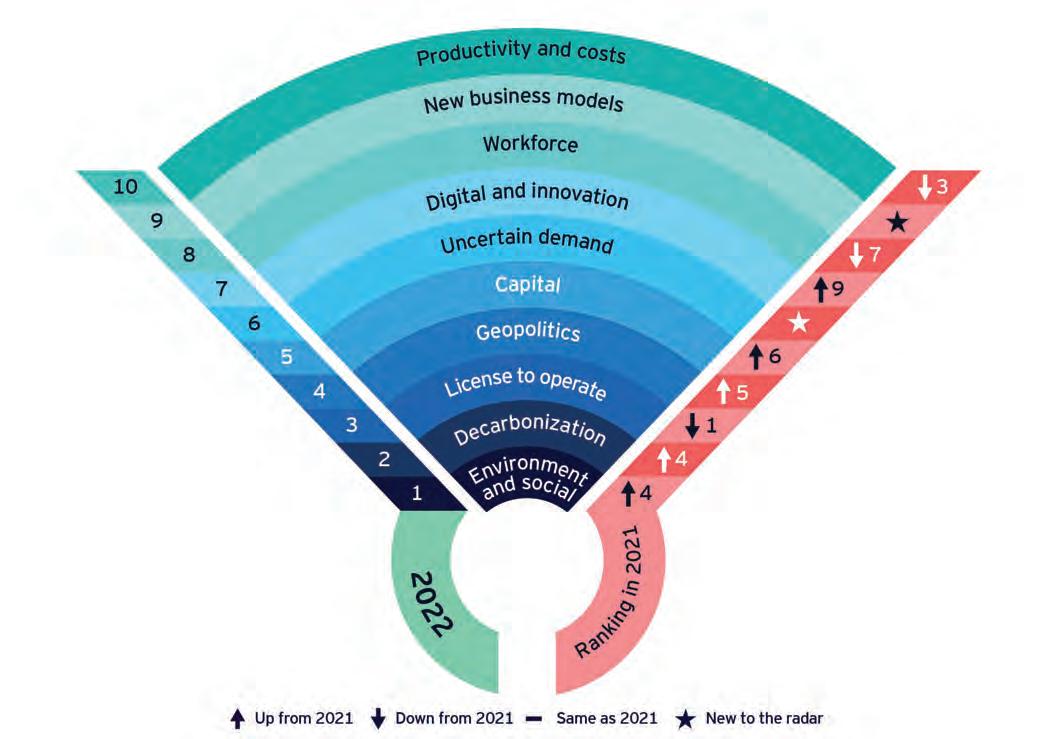

The EY report, Top 10 Business Risks and Opportunities for mining and metals in 2022, outlines how environmental and social risk has jumped to the top of the agenda for mining executives.

It includes a survey of 200 global mining executives who have given insight into the most significant risks the industry is facing in the next year.

The report reveals that 25 per cent of mining executives list environmental and social issues as the number one risk and opportunity for the industry, after it placed fourth in last year’s survey.

This is followed by decarbonisation in second place and licence to operate, which ranked as the most significant risk last year.

EY global mining and metals leader Paul Mitchell says stakeholder pressure has brought environmental and social risk to the forefront.

“The biggest factor has been the influence of the capital markets. Those capital markets reflect more and more what society is thinking,” Mitchell tells Australian Resources & Investment.

“The other factor is just change in leadership ranks and just a better recognition of what people are looking for.

“The average CEO (chief executive officer) tenure is five years but 50 per cent of them turn over in two to three (years) and so you can almost get generational change in CEO attitudes every two or three years, and so those factors have been playing out and meaning this is much higher up the agenda for people and a much higher focus.”

Mining companies have been pushing a greener focus in recent years as stakeholder demands for environmental, social and governance (ESG) factors increase.

Fortescue Metals Group launched Fortescue Future Industries, which was established in 2018 and has created high purity iron ore using 100 per cent green energy, as one of its ESG initiatives so far.

BHP has shown a similar focus at its polymetallic Olympic Dam mine after signing a renewable energy supply agreement with Iberdrola as part of its zero-emissions position for 50 per cent of its electricity consumption by 2025.

The diversified mining giant has also joined forces with South Korean steelmaker POSCO under a $US10 million ($13.5 million) memorandum of understanding (MoU) to reduce greenhouse gasses in steelmaking.

The MoU aims to improve coking coal quality used to power steelmaking processes and explore emission reduction technologies such as using biomass in steel creation.

“I don’t think (ESG) is catching the mining industry off guard anymore at the top end,” Mitchell says. “If you went back to three or four years ago, they were surprised by how rapidly the change happened.

“Investor and community relations have really changed. If you went back in time,

community relations were down the flagpole and now it’s a factor that boards and CEOs ask questions about, and the importance of that role has increased.”

EY states that stakeholder pressure across biodiversity and water management will continue to increase, which will require progressive mine closure plans.

The most significant environment and social risks and opportunities listed in EY’s report include local community impact, water management and green production.

“There’s probably jurisdictions that are ahead of us in terms of what they’ve done with decarbonisation and water management,” Mitchell says.

“The one that always surprises me is how far some of the South American countries have gone in terms of decarbonisation. They’ve really taken advantage of the natural benefits of sunlight and flicked the switch on renewables at mine sites.”

The mining industry has also been dealing with the COVID-19 pandemic for almost two years, yet it has not impacted the progress of sustainability initiatives.

According to EY, the pandemic has also driven up the importance for mining companies to go beyond their regulatory obligations.

Forty-one per cent of mining executives surveyed are aiming to reduce their Scope 1 and 2 emissions between 2030 and 2040, while 49 per cent are aiming to reduce their Scope 3 emissions by 2041 to 2050.

The report states that incentives and grants may be on offer for early switches and capital markets are also expected to reward companies who make the move.

“Abating Scope 3 will be the real game changer in miners’ quest for long-term sustainability and performance,” EY states in the report.

“Our message to companies still hesitating over the issue is simple: unless you can control these emissions, you risk losing value and competitive advantage.”

New risks and opportunities in this year’s survey include uncertain demand (sixth) and new business models (ninth).

The pandemic has brought a newfound focus on digital technologies with digital and innovation being the seventh risk and opportunity listed in EY’s report.

For Mitchell, mining companies must apply a digital transformation strategy or risk falling behind the pack.

“They’ll lose competitive advantage without a doubt,” he says. “I always say that productivity or costs come on our lists every year, but the reality is every year mining gets more expensive every day.

“The tonne tomorrow taken out is more expensive than today. As time goes on it gets harder and harder as mines get deeper and grades get lower.

“If you don’t keep driving innovation and improvement you either go out of business or you fall significantly behind.”

The report states that the pandemic has also lent itself to the need for more automated technologies due to hard border closures.

Mitchell says the next edition of EY’s report will once again have societal-based risk and opportunities at the front of the minds of mining executives.

ESG requirements for mining companies fall into maintaining a licence to operate, and with shareholder expectations rapidly evolving, mining companies must be active in various stakeholder groups to ensure their stream of support remains steady.

“People are seeing the opportunity that these risks give this year as chance to demonstrate that they’re worthy of getting the capital and mining resources and they are seeing it as an opportunity,” Mitchell concludes.

EY’s top 10 business risks and opportunities for mining and metals in 2022.