Big trucks and novel innovations quickly capture our gaze, but without adequate maintenance processes in place, the resources industry would fall apart.

Proactive maintenance is not only central to keeping machinery on the park but also unlocking efficiency and productivity gains.

The best-performing mining operations prioritise predictive and preventive maintenance to limit costly downtime, enabling them to shift more tonnes more often.

While preventive maintenance is a routine practice, predictive maintenance is made possible by condition monitoring and data analysis.

This could involve sensor-based solutions, machine learning, parts and attachments, or inherent maintenance attributes built into existing equipment, enabling operators to anticipate pain points or breakdowns before they arise.

Such solutions are not possible without contributions from the mining equipment, technology and services (METS) sector.

The March edition of Australian Mining sees us celebrate the original equipment manufacturers (OEMs), suppliers and service providers supporting more proactive and intelligent maintenance practices.

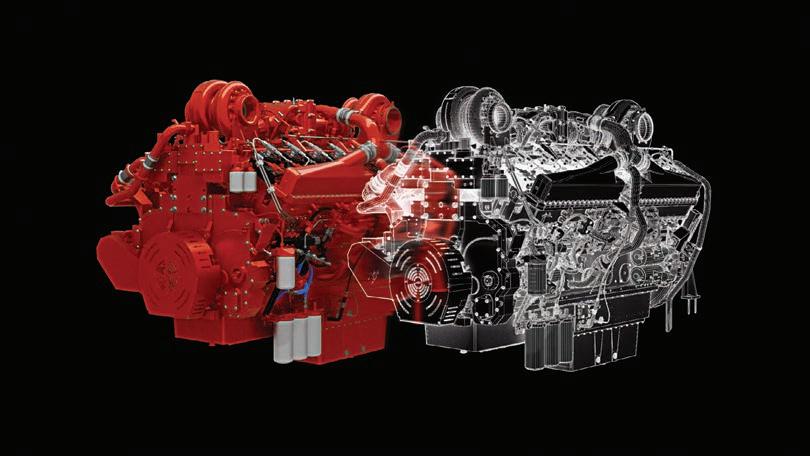

Cummins shares its unique maintenance approach. The company’s PrevenTech solution has become an important analyser of engine and equipment health.

CHIEF EXECUTIVE OFFICER

JOHN MURPHY

CHIEF OPERATING OFFICER

CHRISTINE CLANCY

MANAGING EDITOR PAUL HAYES

EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

ASSISTANT EDITOR

ALEXANDRA EASTWOOD

Email: alexandra.eastwood@primecreative.com.au

JOURNALISTS

OLIVIA THOMSON

Email: olivia.thomson@primecreative.com.au

Elsewhere, we learn of how Hastings Deering helped save a Queensland coal miner thousands of dollars in operating costs through its innovative ground engaging tools.

We also spotlight maintenance solutions from DomeShelter, Bedeschi, MAX Plant, Nivek Industries and Veyex, to name a few.

Through its novel dredging technology, Dredge Robotics is en route to international stardom, which is why the company graces the cover of the March edition.

Dredge has developed a fleet of robots to help clean lined ponds at all ends of the pH spectrum. Just as Dredge thinks it’s completed its technology development, more use cases are discovered, demonstrating the company’s significant upside.

“What we keep finding is that clients, and potential clients, are approaching us with new niche applications that are ideal for our tech,” Dredge chief executive officer Antony Old told Australian Mining. “We keep expanding into that rather than contracting.”

This edition also sees us spotlight the future of green iron and vanadium, and analyse what Northern Star’s acquisition of De Grey Mining will look like.

Happy reading.

Tom Parker Editor

KELSIE TIBBEN

Email: kelsie.tibben@primecreative.com.au

DYLAN BROWN

Email: dylan.brown@primecreative.com.au

CLIENT SUCCESS MANAGER

JANINE CLEMENTS

Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT

Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGERS

JAMES PHIPPS

Mob: 0466 005 715

Email: james.phipps@primecreative.com.au

ROB O’BRYAN Mob: 0411 067 795

Email: robert.obryan@primecreative.com.au

ART DIRECTOR MICHELLE WESTON michelle.weston@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl

Dredge Robotics creates unique, cost-effective robotic cleaning solutions that deliver significant savings to clients by keeping water assets online during the dredging process.

As an Australian-owned and -operated company, Dredge understands what’s required to provide superior quality dredging across the Australian mining, industrial, manufacturing, processing and wastewater industries. Dredge Robotics is backed by an extensive asset base, comprehensive management systems and over 35 years of experience.

With the demand for safe and effective dredging solutions rapidly rising and diversifying in the mining industry, Dredge is constantly evolving its platform and adding new tooling to support specific applications.

Cover image: Dredge Robotics

game-changer

Green Iron SA is working to transform the steel industry with the help of the Razorback iron ore project.

12 CRITICAL MINERALS

Vanadium: A critical player

Australian Mining highlights four projects vying to deliver the country’s first active vanadium mine.

14 COVER STORY

A burgeoning international success

Dredge Robotics is rapidly expanding its profile at home and overseas as mining companies recognise the value in its unique solution.

28 MAINTENANCE

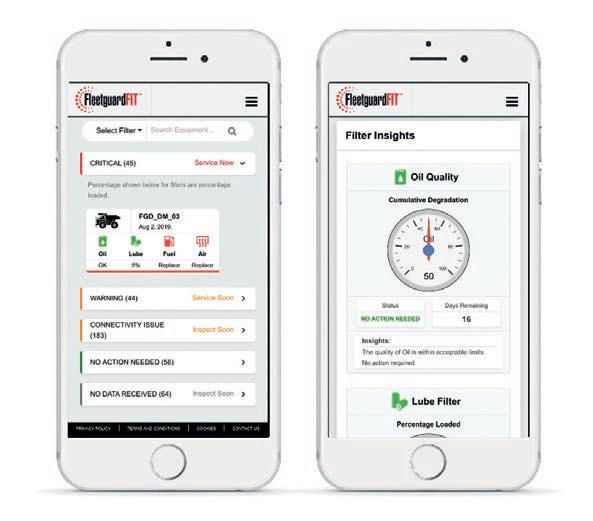

Intelligent filtration management

FleetguardFIT is a filtration intelligence monitoring system that helps prevent costly equipment damage and downtime.

52 MAINTENANCE

Keeping a lid on leaks

Compressed air leaks can wreak havoc on a mine site. Luckily, FLIR has a solution.

56 M&A

Reaching for the Northern Star

What does Northern Star Resources’ potential acquisition of De Grey Mining mean for the WA gold sector?

58 DECARBONISATION

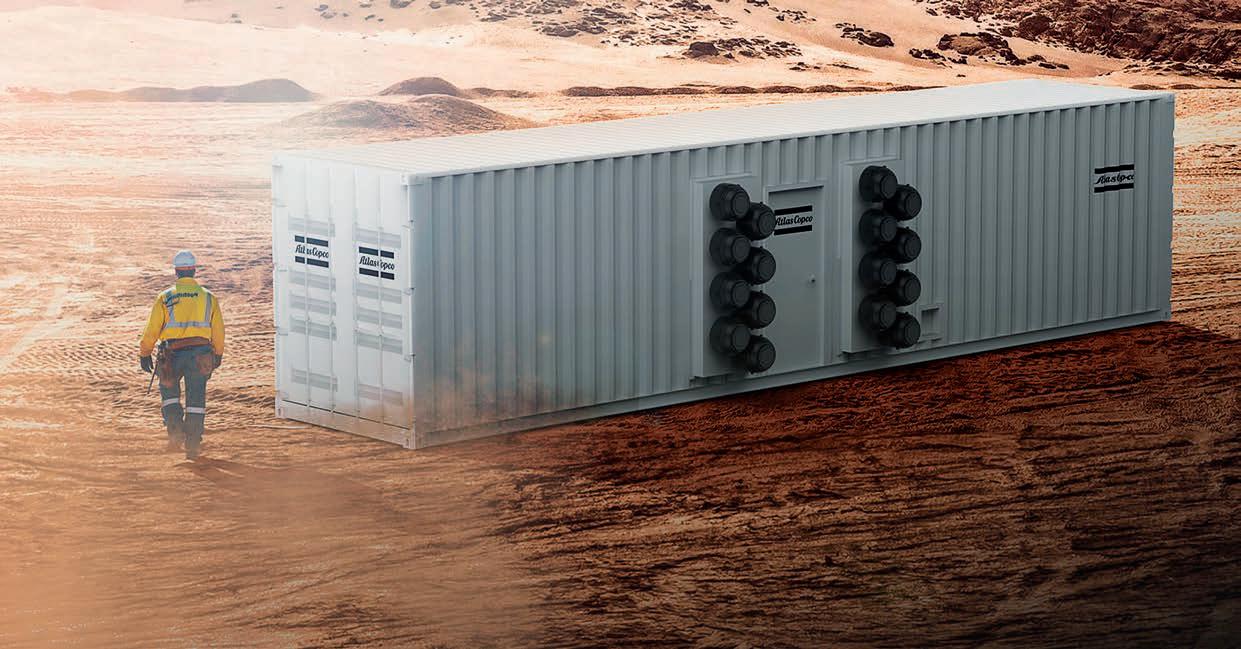

Mastering the path to decarbonisation

As mining companies look to slash emissions, robust and reliable renewable energy solutions are key.

64 DRILL AND BLAST

Go-go gadget

The narrow vein drilling solution Brokk developed for a South African mining company is now attracting attention in Australia.

AUSTRALIAN MINING PRESENTS THE LATEST NEWS FROM THE BOARDROOM TO THE MINE AND EVERYWHERE IN BETWEEN. VISIT WWW.AUSTRALIANMINING.COM.AU TO KEEP UP TO DATE WITH WHAT IS HAPPENING.

Native Mineral Resources (NMR) is ramping up refurbishment at its Blackjack gold processing plant in Queensland, with targeted for the third quarter of 2025 (Q3 2025).

NMR acquired 17 granted mining leases, one mineral development license, six exploration permits, and the Blackjack processing plant from Collins St convertible notes for $18.9 million in November 2024.

The tenements are situated in the Ravenswood-Charters Towers region, an area known to be rich with minerals.

Since the acquisition’s finalisation, NMR has advanced works to pave the way for gold production to recommence at Blackjack.

Such works include process plant refurbishment, regulatory compliance, site establishment and an assessment of the tailings storage facility. Ball mill inspections were also completed, with a report issued in late January.

NMR’s maintenance team has reviewed the draining of the carbonin-leach (CIL) tanks and assessed the process pumps, ensuring the systems are functioning as normal ahead of the targeted restart.

NATIVE MINERAL RESOURCES IS TARGETING FIRST GOLD POUR IN THE THIRD QUARTER OF 2025.

refurbishment team comprising 14 personnel to Blackjack in mid-January.

The team carried out demolition, equipment removal and cladding works in Goldroom Area 05, and ventilation and further electrical and

MEET THE WORLD’S LARGEST LITHIUM RESOURCE

Australia might be the largest lithium producer globally, producing 52 per cent of the world’s total, but Lithium Americas has laid claim to the world’s largest lithium resource.

Lithium Americas is currently advancing its Thacker Pass asset in Nevada, US, to production to meet the growing lithium demand in North America.

In a major milestone for Thacker Pass, the mineral reserve estimate has increased to 14.3 million tonnes (Mt) of lithium carbonate equivalent at an average grade of 2540 parts per million (ppm). This represents a 286 per cent jump from Lithium

Americas’ November 2022 feasibility study and paves the way for an expansion of up to five phases with an 85-year mine life.

Thacker Pass’ measured and indicated mineral resource estimate now sits at 44.5Mt lithium carbonate equivalent at an average grade of 2230ppm, representing a 177 per cent increase from the November 2022 feasibility study.

Lithium Americas president and chief executive officer Jonathan Evans said Thacker Pass’ new mineral reserve and mineral reserve estimate “demonstrates the multigenerational opportunity

AUSTRALIAN MINING GETS THE LATEST NEWS EVERY DAY, PROVIDING MINING PROFESSIONALS WITH UP-TO-THE-MINUTE INFORMATION ON SAFETY, NEWS AND TECHNOLOGY FOR THE AUSTRALIAN MINING AND RESOURCES INDUSTRY.

to pour first gold at our Queensland projects in Q3 2025,” NMR managing director Blake Cannavo said.

“With key milestones set to be achieved this month and essential activities progressing as planned, the company is focused on continuing this momentum and looks forward to providing further updates.”

television (CCTV), access control, and security systems were completed in early February.

“Our process plant refurbishment tasks are continuing to progress on schedule and we remain on track

for transformational growth the project creates”.

“Thacker Pass is now the largest measured lithium reserve and resource in the world and has the potential to become an unmatched district, generating American jobs and helping the US regain independence of its energy supply,” Evans said.

“We are committed to safely and sustainably developing Thacker Pass while engaging with our stakeholders to increase domestic production of critical minerals.”

Thacker Pass’ first phase is expected to reach a final investment decision by early 2025.

NMR is also progressing its mining tenements, environmental reporting, and regulatory submissions for the projects.

MEC Mining has also signed on to help with the process.

Phase one is projected to create nearly 2000 jobs during the construction stage, approximately 350 full-time jobs once operational and an average of about 1100 fulltime employees over Thacker Pass’ total mine life.

The project’s first four phases will target 40,000 tonnes (t) of batterygrade lithium carbonate per annum, with the overall expansion plan targeting 160,000t per annum.

Thacker Pass is indirectly owned by Lithium Nevada Ventures, a 62:38 joint venture between Lithium Americas and General Motors, a motor vehicle manufacturer.

BHP has awarded a contract worth approximately $40 million to support the proposed expansion of its Olympic Dam copper smelter and refinery facilities in South Australia.

A joint venture between Fluor Australia and Hatch have been granted the engineering, procurement and construction management (EPCM) contract following engagement with BHP’s major projects, procurement, commercial and Copper South Australia teams.

The contract will be executed in stages as BHP progresses towards

MINRES DELIVERED ITS FINAL TRAINLOAD OF IRON ORE FROM ITS YILGARN OPERATIONS IN WA BACK IN JANUARY.

“Fluor and Hatch are experienced EPCM partners with significant shared experience in delivering mega projects, who will bring the right level of scale and expertise to help BHP progress its copper growth plans in South Australia,” BHP Group procurement officer Rashpal Bhatti said. “The growth potential for Copper SA is exciting and this first stage of EPCM works will be key as we progress the proposal for an expanded copper smelter and refinery at the heart of South Australia’s growing copper province towards a

copper production in South Australia over the next decade.

The Big Australian would introduce a phased approach to increase refined copper cathode production to 500,000 tonnes (t) annually by the early 2030s, with a possible boost to 650,000t by the mid-2030s. This would be a significant jump from the approximately 322,000t produced in FY24.

Phase one of the strategy would involve upgrading the existing copper smelter and refinery at Olympic Dam to a two-stage smelter and extension

“It is critical that we prudently manage our spending to achieve the vision that BHP shares with many others to grow copper production in South Australia, and we have worked closely with Fluor and Hatch on a contract structure that supports this,” Bhatti said.

BHP’s Copper South Australia business comprises Olympic Dam, the Carrapateena and Prominent Hill mines, and the Oak Dam deposit, the latter of which has 13 rigs currently carrying out exploration in a bid to advance its studies.

Mineral Resources (MinRes) delivered its final trainload of iron ore from its Yilgarn operations in WA in January, signalling the end of the company’s involvement in the region.

MinRes faced limited remaining mine life, significant capital cost and lead time to develop new resources at Yilgarn, prompting the company to finish up and focus on other projects.

Many of the MinRes’ Yilgarn workers are set to work at the company’s emerging Onslow Iron operation in WA.

As one of the largest iron ore projects currently under development, Onslow Iron is set to unlock billions of tonnes of stranded deposits.

to 35 million tonnes per year, with an expected mine life of more than 30 years.

Onslow Iron is being developed by MinRes on behalf of Red Hill Iron joint venture (RHIJV), including partners Baowu, AMCI and POSCO.

“Our teams have done a tremendous job in delivering this world-class transport infrastructure, which highlights the capability within our business,” MinRes chief executive engineering and construction Darren Killeen said.

transport operations from the Ken’s Bore mine through to the Port of Ashburton and enabling Onslow Iron’s ongoing production ramp-up to nameplate capacity.

The haul road has been specifically designed to support the planned conversion of MinRes road trains to autonomous operation via a series of roadside monitoring bases positioned alongside the roadway.

While MinRes has finished up in the historic Yilgarn iron ore region, which has been a source of iron ore since the

project in the region through her company Hancock Magnetite.

A pre-feasibility study (PFS) exploring Mt Bevan’s development was completed in July 2024, with more than $5 billion of capital expenditure set to be invested in the magnetite project.

According to the PFS, Mt Bevan, which boasts a mineral resource estimate of 1.29 billion tonnes, has the potential to achieve a direct reduction iron (DRI) product grade of more than 70 per cent iron.

Maximise performance with MASPRO’s high-quality components for underground and surface mining machinery. Using cutting-edge technology and rigorous testing, we engineer solutions that extend asset life, enhance reliability, and improve safety - helping you drill deeper, haul more, and tackle the toughest mining challenges.

MAGNETITE MINES IS WORKING TO TRANSFORM THE STEEL INDUSTRY THROUGH ITS RAZORBACK IRON ORE PROJECT IN SOUTH AUSTRALIA.

South Australia is helping reshape the world’s steel industry and its economic future as the state ambitiously works toward decarbonisation.

And there’s one project that stands out as a critical pillar in this green transition: the Razorback iron ore mine.

The project has the backing of Green Iron SA, a consortium comprising its owner Magnetite Mines, construction and engineering company GHD, freight rail transport company Aurizon and Flinders Ports.

The days of utilising carbon-based materials to create steel may soon be behind us, as Green Iron SA looks

Tim Dobson said Australia holds lots of magnetite, which hasn’t been economic up until now.

“South Australia finds itself in a very fortunate position in that it already hosts the biggest magnetite reserves in Australia and has three different regions that contain massive amounts,” he said.

The state’s commitment to renewable energy has already positioned it towards a sustainable future and by 2027, SA plans to power its entire grid with 100 per cent renewable energy, having already reached 75 per cent through wind and solar.

“It’s then that you have the ability to make the magnetite concentrate and producers can use the renewable energy

A key player in this emerging green iron industry is the Razorback project, located in the Braemar region of SA.

Razorback is Magnetite Mines’ flagship project, containing 3.2 billion tonnes of magnetite ore and two billion tonnes of probable ore reserves.

“It’s quite a large and spectacular project that will sustain 50 to 60 years of operations just on its first reserve,” Dobson said. “We’re expecting at least 100 years of production ahead at a very substantial scale. This project is set to be an economic game-changer not only for the region, but for the state.

“It will add significantly to Australia’s balance of trade and export incomes as

So how exactly will Razorback support sustainable steelmaking?

Dobson said magnetite can produce an almost-pure iron oxide product by processing it at the mine site using its magnetic properties.

He explained the plan is to dig the magnetite out of the ground, move it into a processing plant, remove all of the impurities using magnetic separation to produce a pure product, and use that to make green iron using hydrogen.

“There are no impurities involved, and this is the differentiator between magnetite and hematite (a traditional steelmaking material) which uses copious amounts of coal and hence emits copious amounts of carbon dioxide,” he said.

“This is the shift to magnetite. It’s not new, it’s been processed for 150 years and there’s five magnetite mining operations already in Australia.

“The difference now is that our project is massive. It will support up to 100 years of production and has the ability to produce this very high quality concentrate.”

One of Razorback’s key advantages is its proximity to existing rail and port infrastructure, with the project located only 50km from an open access railway line.

Dobson described this as a fortunate coincidence as iron ore projects typically need to be moving very large tonnages to be profitable.

“Building rail into mining projects is usually one of the most expensive capital items, so the fact we only have to move our material 50km to get it onto a railway line and then move it to port is great,” he said.

The material will then be transported to either Port Pirie or Whyalla, two critical export hubs in SA.

To fast track the development of the Razorback project, a consortium has been launched with Magnetite Mines, Aurizon Holdings, Flinders Port Holdings and GHD.

Australia’s largest rail operator, Aurizon, is tasked with transporting the magnetite. Flinders Port will then facilitate the export of the material with GHD providing essential technical and engineering support. Magnetite Mines is the downstream customer of not only the magnetite, but also future green iron.

The consortium aims to supply high-purity magnetite to produce green iron. The project will then progress to the production of direct reduction (DR) grade pellets, before manufacturing and exporting direct reduced iron (DRI) in the form of hot briquetted iron (HBI) from Port Pirie.

The creation of a new green iron industry will deliver economic benefits to the Upper Spencer Gulf region, including long-term job creation and community revitalisation.

Magnetite Mines’ product will be in high demand from international

steelmakers, including JFe Shoji, the trading arm of Japan’s second largest steelmaker, with which the company recently signed an offtake partnership.

“They are seeking new a supply chain to decarbonise their steel operations in Japan as one of the bigger and more successful steelmaking nations,” Dobson said.

“With our first partnership being solidified now, we’re also talking with other Japanese partners, and other partners from countries such as Taiwan, Korea, India and China.

“They’re our logical partners, and all of them are trying to decarbonise, and therefore all of them need magnetite.”

The SA Government has shown strong support for the Razorback project, with both State and Federal Governments recognising its economic and environmental potential.

Magnetite Mines is set to hand its mining lease proposal into the SA Government, which will trigger the formal regulatory and approvals process to receive permission to mine.

“The government is quite enthusiastic because the economic shift that we’ll get from building a green iron industry is phenomenal and necessary,” Dobson said.

While the support remains strong thus far, Dobson and his team hope for more backing, particularly in the form of material support.

“We’ve been talking with the Federal Government to support this

new industry by providing funding infrastructure so the SA Government,” he said. “This can help build things like roads, rail, power lines and port facilities, which can move these projects along and help get them to market.

“This is a shared responsibility between government and the private sector – one that will provide thousands of jobs and help keep our standard of living in Australia where it should be: at a very high level.”

For Australia to seize its green iron opportunity, Dobson believes it will take strong collaboration between miners, Australian industry providers, downstream international steelmaking customers and all levels of government to move projects forward.

Looking toward the future, Magnetite Mines’ priorities include securing the necessary mining approvals to formalise partnerships and at least one other partner to support funding and offtake agreements.

These priorities will allow a feasibility study to be completed to enable the Razorback project to progress from construction and into operations.

Green Iron SA is ushering in an exciting opportunity for South Australia and the country, and as the world transitions away from fossil fuels, the consortium has the chance to lead a new era of green innovation. AM

Vanadium has firmly positioned itself as an emerging critical mineral in Australia.

Used in steel production, batteries and electronics, vanadium is set to play a key role in the global energy transition, where renewables such as vanadium redox flow batteries (VRFB) will become primary energy sources.

According to the United States Geological Survey (USGS), vanadium demand – like for many ferroalloys – largely depends on the global steel market, specifically China’s.

But the winds are changing.

“Vanadium redox flow battery technology continue to be an increasingly important part of large-scale energy storage as it allows for high-safety, large-scale, environmentally friendly, mediumand long-term energy storage,” USGS said in its 2024 vanadium mineral commodity summary.

“Installations of VRFB projects continued to increase worldwide as energy companies looked to support renewable energy projects as many countries attempt to lower their carbon emissions.”

As of December 31, 2022, Australia had 8.5 million tonnes (Mt) of vanadium economic demonstrated resources and 2.97Mt in vanadium ore reserves, making up 32 per cent of the world’s vanadium resources.

While there are currently no active vanadium mines in Australia, the commodity is there for the taking, with four companies vying to take the top spot.

Australian Vanadium

Recognised as one of the largest and highest-grade vanadium deposits being developed in the world, the Australian Vanadium project is located in the Murchison province of Western Australia.

The project comprises a vanadium mine and a crushing, milling and beneficiation (CMB) plant.

Australian Vanadium Limited (AVL), the project’s owner, finalised its $217 million merger with Technology Metals Australia in February 2024 and has been undertaking an optimised feasibility study (OFS) to enable an integrated project across an 18km-long orebody.

The first phase of the OFS has been completed, delivering several key outcomes including an updated mineral resource estimate (MRE), identifying the optimal location to commence mining and build a processing plant.

Australian Vanadium’s MRE now sits at 395.4Mt at 0.77 per cent vanadium oxide, with 105.4Mt falling under the measured or indicated categories – a 39 per cent increase from the previous MRE.

“Our ongoing work on the OFS underscores the project’s strength and long-term viability, supported by high-quality engineering that establishes a foundation for excellence in both construction and production,” AVL chief executive officer (CEO)

Graham Arvidson said in the company’s September 2024 quarterly report.

Australian Vanadium also received a grant from the Federal Government’s Modern Manufacturing Initiative for up to $49 million.

“The indication of support from the US EXIM bank and our Federal Government grants demonstrate the project’s significance and the calibre of the parties that we are attracting,” Arvidson said.

AVL is currently working on the OFS’ next phase, which includes finalising the detailed mining plan using the updated MRE, optimising project infrastructure, and completing the layout and key design criteria for the CMB plant at Gabanintha and processing plant at Tenindewa.

Barrambie

Situated approximately 80km northwest of Sandstone in WA, the Barrambie titanium-vanadium project has already been granted a mining lease and

proposal to mine approximately 1.2Mt per annum.

According to owner Neometals, Barrambie is one of the world’s largest vanadiferous-titanomagnetite resources.

It currently holds 280.1Mt at 9.18 per cent titanium dioxide and 0.44 per cent vanadium oxide and contains the world’s second highest-grade hard-rock titanium mineral resource of 53.6Mt.

“Barrambie is a large and unique ‘mine-ready’ development opportunity benefiting from exceptionally high titanium resource/ reserve grades in a Tier 1 jurisdiction,” Neometals said.

“Securing access to large, high-grade chloride feedstock sources is a strategic imperative to downstream users for sustainable production of pigments and metal alloys.”

Neometals has released three pre-

one in 2015, 2022 and most recently in 2023.

The 2023 PFS estimated that Barrambie has a 13-year mine life, a project pre-tax net present value (NPV) of $374.9 million and an internal rate of return of 45 per cent.

The Australian Critical Minerals Prospectus states Barrambie will produce 1Mt of direct shipping ore in its first year, followed by 1Mt per annum of more than 35 per cent mixed titaniumvanadium-iron gravity concentrate from year two to five.

It’s then expected to produce over 30 per cent mixed titanium-vanadium-iron gravity concentrate for the rest of its mine life.

While Neometals revealed in August 2024 it was advancing discussions to divest Barrambie to prioritise the progression of Primobius, its lithium-

with GmbH, the project remains essential in feeding Australia’s vanadium aspirations.

The Victory Bore vanadium project is tipped to be a key critical minerals asset.

Located roughly 450km north of Perth in WA, Victory Bore is described as “one of the largest advanced critical mineral projects in Australia” by owner Surefire Resources.

Victory Bore’s 2023 PFS states the project has a 24-year mine life, a NPV of $1.7 billion, and is expected to produce 2580t of high-purity vanadium and 5760t of ferrovanadium per annum.

“The project is one of the largest vanadium resources in Australia with a mineral resource estimate of 464Mt and an ore reserve of 93Mt at 0.35 per cent vanadium oxide, 5.2 per cent titanium dioxide, (and) 19.8% iron,” Surefire said in its September 2024 quarterly report.

Surefire has secured three agreements with the Ministry of Investment Saudi Arabia, AJLAN Bros, Mining and Metals, and RASI Investment Company, all of which concern processing vanadium from Victory Bore.

The company has received expressions of interest from several parties for vanadium offtake agreements and is currently progressing these discussions.

Unlike many vanadium projects in Australia, QEM’s Julia Creek vanadium and energy project is located in the North West Minerals Province of Queensland.

Covering a 250km2 landholding, Julia Creek is considered to be a unique,

The project will comprise a greenfield vanadium and oil shale mine, alongside processing facilities. It aims to produce 10,571t of high-purity vanadium pentoxide per annum over a 30-year mine life.

Julia Creek currently holds a vanadium resource made up of approximately 2.9 billion tonnes, with 461Mt falling under the indicated category, making it one of the largest vanadium deposits in the world.

In recognising this significance, Queensland Coordinator-General Gerard Coggan declared Julia Creek a ‘coordinated project’ in December 2024, allowing the environmental approvals process with the Queensland and Federal Governments to commence.

“The adoption of vanadium flow batteries is accelerating around the world and Queensland is uniquely positioned to establish a ‘pit to battery’ manufacturing industry,” QEM managing director Gavin Loyden said.

“QEM will expand its participation in the value chain by processing its vanadium pentoxide into vanadium electrolyte for flow batteries.”

Julia Creek was also named a controlled action by the Department of Climate Change, Energy, the Environment and Water in January 2025, providing certainty on the approval pathway for the project.

According to the International Energy Agency, vanadium demand is set to soar to 773,100t by 2050 under a net-zero emissions by 2050 scenario.

And with several local vanadium projects aiming to come online, Australia is readying itself as key partner in a green future underpinned by vanadium-driven energy

DREDGE ROBOTICS IS RAPIDLY EXPANDING ITS PROFILE AT HOME AND OVERSEAS AS MINING COMPANIES RECOGNISE THE VALUE IN ITS UNIQUE SOLUTION.

When Dredge Robotics attended MINExpo in Las Vegas last year, the company made a somewhat unlikely discovery.

“We were expecting we might find other players emerging into our market or having a crack at it, but we really couldn’t identify anyone else that was even remotely in our realm,” Dredge chief executive officer Antony Old told Australian Mining Dredge Robotics is generating significant interest in its novel dredging technology, which can safely clean lined ponds containing contaminants at both ends of the pH spectrum.

new clients at the event but also to visit nearby mining operations and gauge the appetite for its solution.

During his time in the US, Old pondered what could be perceived as a ‘good problem to have’, something that validates the unbridled growth potential of Dredge’s technology.

“We’re certainly more broadly capable than we were seven years ago (when Dredge Robotics was founded),” he said. “But I did envisage back then that if we did get to this point, we would be largely close to completing our development.

“But what we keep finding is that clients, and potential clients, are approaching us with new niche applications that are ideal for our tech

tonne, they all run the same software platforms and they run the same computational architecture.

“Everything is consistent and repeatable, so if you’re going to create a relatively bespoke solution you’re not starting from zero. A lot of the AI architecture and electrical and programming software is all embedded and very versatile.”

Old said Dredge is increasingly getting to a point where it’s developing bespoke tooling to accompany an established dredging platform.

“Where we have clients with a particular type of sediment or a particular challenge they want to execute with our robot, we design and build a customised tooling head for the

Old explained how developing an acid dredging solution created a ripple effect of interest.

“We were originally approached by one of our major clients five years ago about whether we could remove the human element from dredging a pond that had a very low pH with sulfuric acid in it,” Old said.

“At the time, this was a perplexing challenge that required a lot of day-one thinking. But as soon as we started engaging with the client, and the market became marginally aware of what we were doing, we started to find use cases everywhere.

“When you look around in mining and manufacturing, it’s amazing how

balloon depending on the pH and liquor being dredged.

In these situations, it could be said that Dredge, which needs to quickly adapt, is only as good as its research and development (R&D) team.

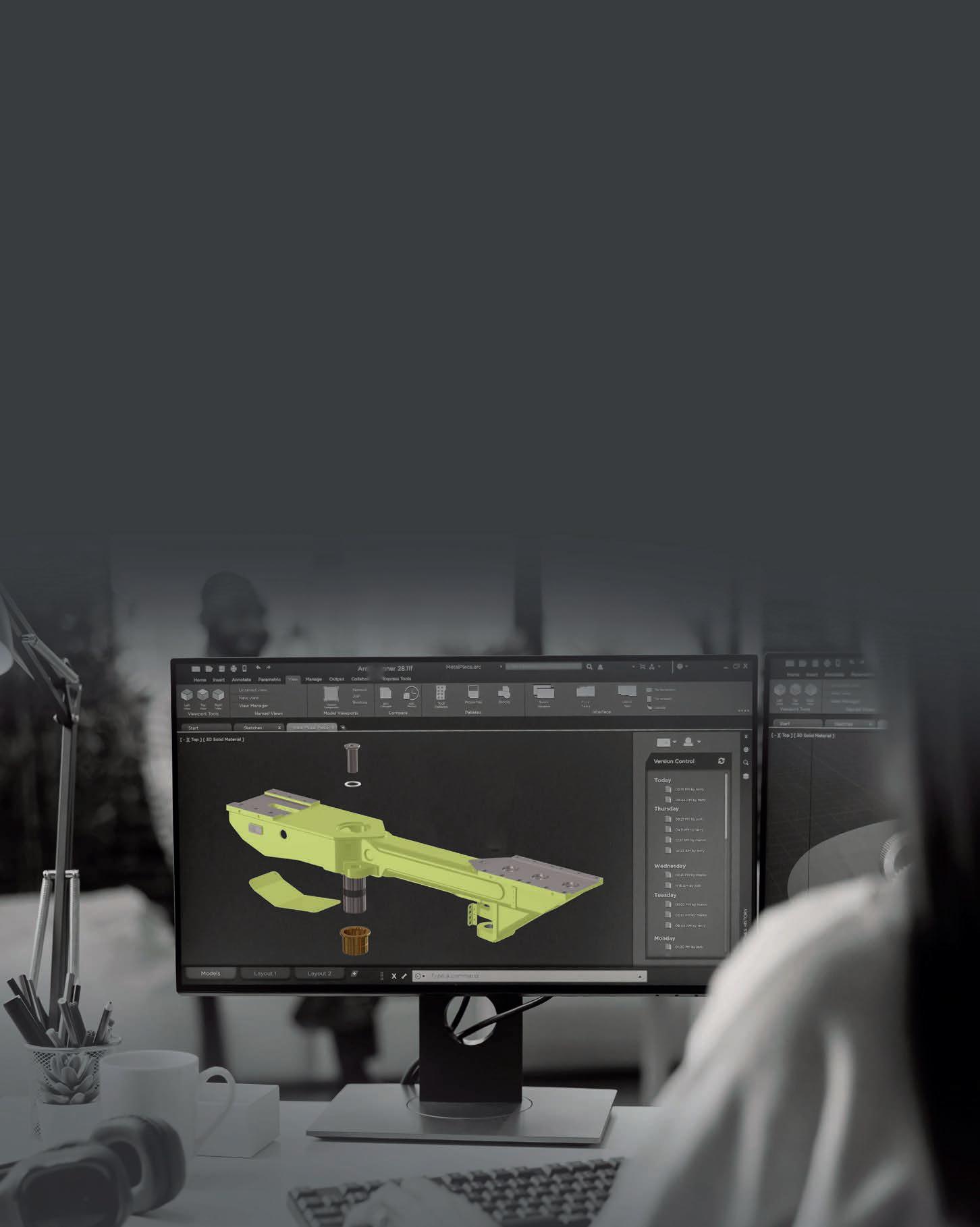

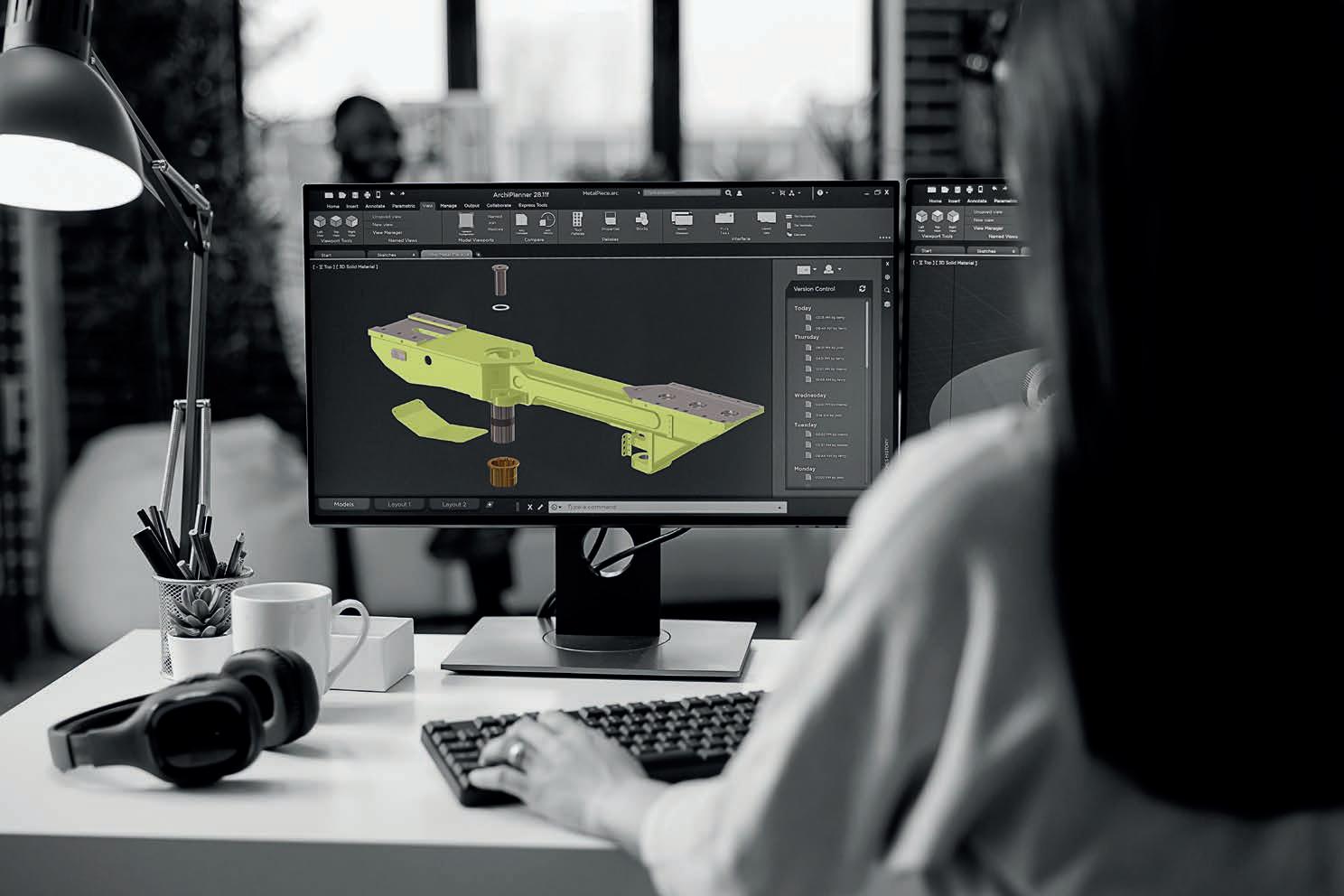

Luckily for the company, it has one of the best R&D teams in the business, boasting robotics engineers who conduct physical rendering of robot designs and stress testing, as well as an electrical team to take care of the software design and hardware configuration.

This is complemented by a few specialist engineers and a fitting and fabrication team that assembles the robots for site.

While there are sub-divisions within the company, Dredge employees work international success story.”

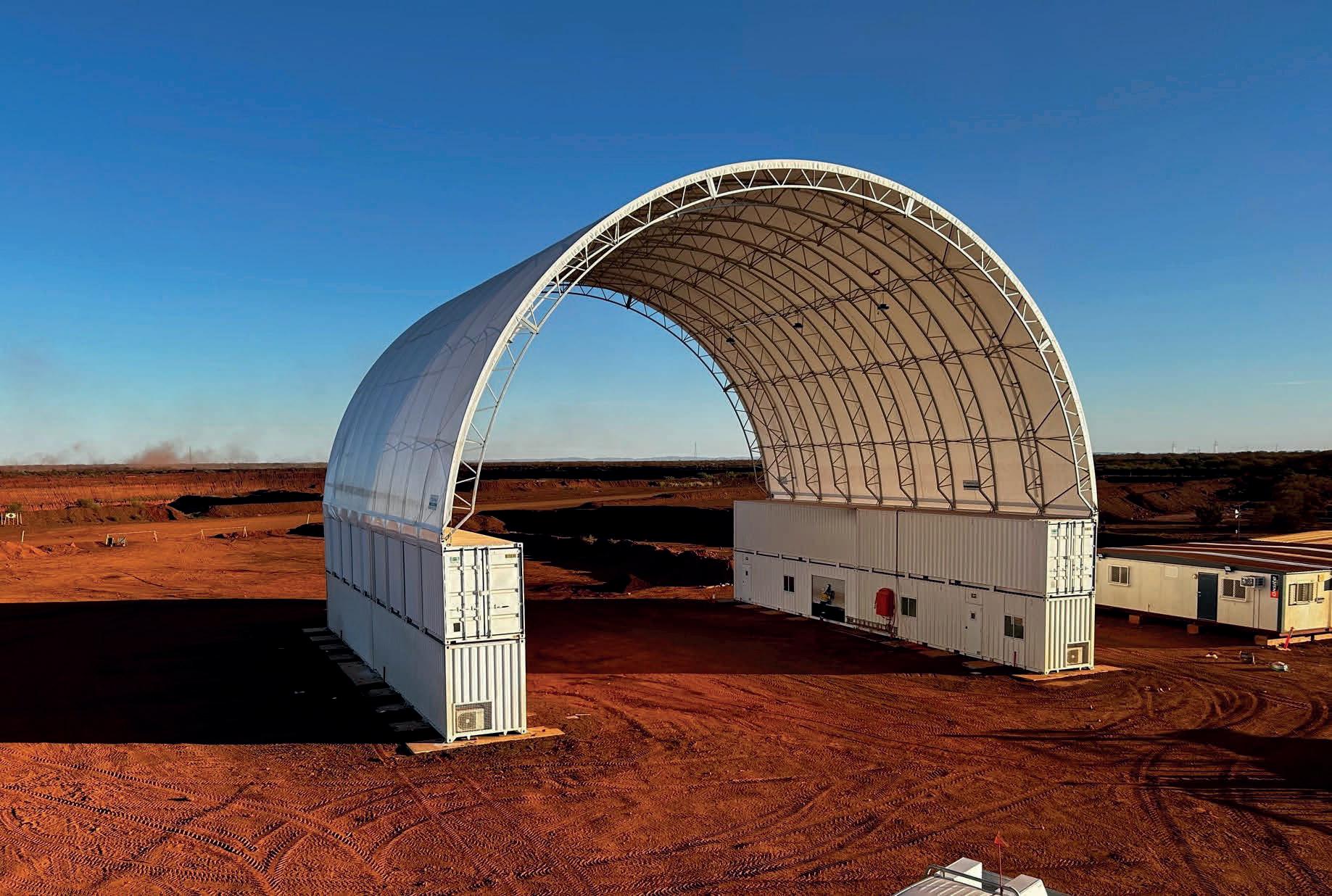

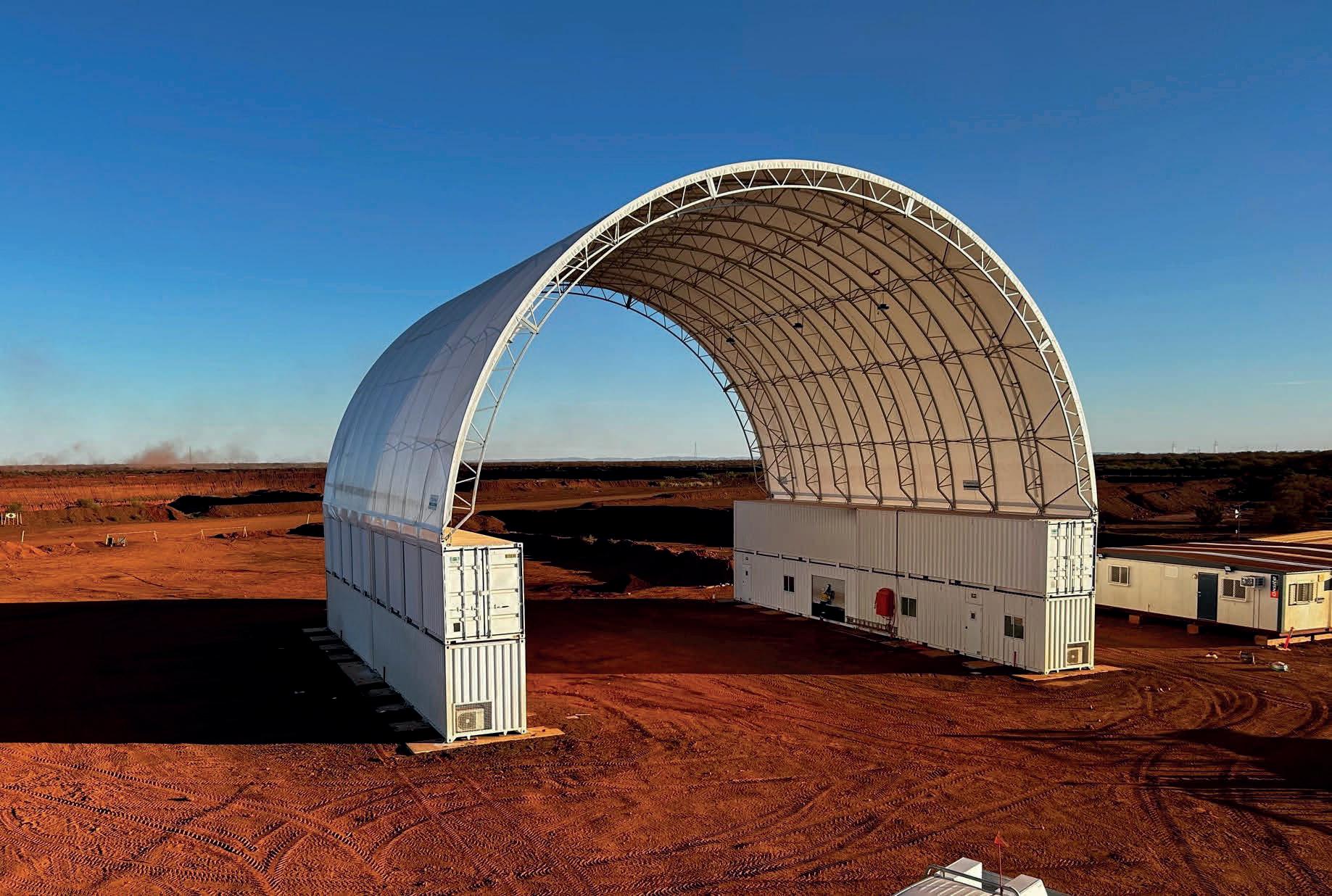

DOMESHELTER AUSTRALIA’S FABRIC SHELTERS HAVE BECOME AN ESSENTIAL PART OF MINE SITES ACROSS THE GLOBE.

According to Maslow’s Hierarchy of Needs, a key physiological need for humans is shelter.

This is especially true in the Australian mining industry, where workers operate under challenging weather conditions daily.

Enter DomeShelter Australia, a leading fabric shelter manufacturing company based in multiple locations across Australia.

“Our mission is to protect people and assets from the elements, quickly, simply and effectively,” DomeShelter Australia’s director of global sales Roy Fawkes told Australian Mining.

“Mine sites are dynamic environments, with commodity prices, expanding and contracting operations, and the weather all dictating what a site looks like and needs. Our semipermanent DomeShelter Structures adapt to these changes.

“Our shelters are relocatable, reusable, repairable, and resellable, meeting the needs of evolving mine sites.”

As a mining operation expands, its design and infrastructure scope changes. A site might require a maintenance facility to be built close to the mining

area, to eliminate travel time and operational downtime.

This is where DomeShelter Australia comes to the fore, with its fabric shelters offering an array of benefits, including the ability to be swiftly installed, disassembled and relocated.

“Instead of heavy vehicles travelling to a maintenance facility off-site, they can visit a purpose-built DomeShelter nearby,” Fawkes said.

“Then as the mine changes or expands, the mining company can easily relocate as needed. Being semipermanent, our structures can adapt to suit the evolving nature of a mine site.”

The mobility of the shelters also has environmental advantages.

“Getting approval to build a large permanent facility can take months if not years, whereas one of our semipermanent structures can be designed, engineered, manufactured and shipped within five or six weeks,” Fawkes said.

“The structures make less of an environmental impact, because we’re not installing deep concrete footings or concrete pads which is often the case with permanent structures.

“All the material needed to build the structure can be packed up in a light, compact kit when transported to site.

And once the mine has reached its end of life, the shelter can be easily packed up again and moved on, making things easy for mine-closure teams and post-mining land use.”

Having a fabric structure on-site for maintenance can also increase staff retention and satisfaction, leading to increased productivity.

“If you have a permanent shelter, when equipment breaks down it can take too long to get the machine back to the main facility,” Fawkes said. “This means maintenance crews will often complete their work out in the open for long hours, exposed to the sun, rain, and snow –conditions that can be challenging.

“Workers can be put at risk of heat stress, sunburn and dehydration, and even frostbite if they’re working in snow.

“By having our semi-permanent structures closer to the mining pit, workers can safely carry out maintenance under shelter and away from the elements.”

DomeShelter Australia follows its unique six-element design methodology – dubbed DomeShelter Logic – to manage the thinking, processes and outputs that go into delivering tailored shelter solutions to the mining industry.

Fawkes said by maintaining the DomeShelter Logic, the company ensures the shelter does what it’s designed to do.

“The orientation and design are extremely critical to the success of our structures, so we’re committed to assisting our customers from the very start of a shelter’s creation,” Fawkes said.

“We work closely on the initial design, ensuring the shelters always meet the unique requirements of our clients’ sites.”

DomeShelter Australia ensures all material used is the highest-grade material sourced in Australia. This ensures the facilities adhere to international quality assurance standards such as ISO 9001, AS 4801 and OHSAS 18001.

The company also recommends regular site audits, which involves a DomeShelter representative visiting site to make sure fabric structures are continually maintained.

“Our after-sales service gives customers peace of mind that structures are doing what they’re meant to be doing and abide by the standards they were designed against,” Fawkes said.

DomeShelter Australia utilises its multiple manufacturing facilities across Australia to ship fabric shelters from various ports, guaranteeing fast and efficient delivery to even the most remote locations.

“We have an in-house design and engineering team that collaborates with customers to ensure we’re building a structure that meets clients’ needs,” Fawkes said.

DomeShelter fabric structures are in high demand locally and internationally.

In 2022, the Bald Hill lithium mine in WA required several shelter solutions to use as on-site maintenance workshops.

The operation reached out to DomeShelter Australia with its specifications and the end result comprised three interconnected container-mounted structures with end walls, which are used as workshops

DOMESHELTER FABRIC STRUCTURES ACT AS A PROTECTOR TO ENSURE A SAFE WORKING ENVIRONMENT.

for heavy vehicles, light vehicles and drill maintenance.

Soon after, the Kibali gold mine in Africa asked DomeShelter Australia to create a solution that could be quickly transported and installed without compromising size and durability.

Several DomeShelter structures were provided for purposes such as maintenance, boilermaker workshops, lubrication and tyre bays.

Fawkes said these case studies illustrate how DomeShelter Australia puts customers first.

PROTECTING MACHINERY WITH A FABRIC SHELTER CAN PROLONG THE LIFE OF EQUIPMENT.

“We’re looking forward to strengthening existing partnerships and building new ones across Australia and the rest of the world,” he said.

Backed by over 30 years’ experience, and with over 8000 shelters installed across 50 countries,

DomeShelter Australia builds quality fabric shelters tailor-made for the mining industry.

“We’re creating an oasis for workers to go in and service their vehicles to ensure they get what they need out of their equipment,” Fawkes said. AM

KalPRO TireSight: autonomous tyre inspections and a 24/7 Condition Monitoring Team to validate and prioritize tire service work. TireSight sees it sooner to enhance safety, tyre performance and fleet productivity.

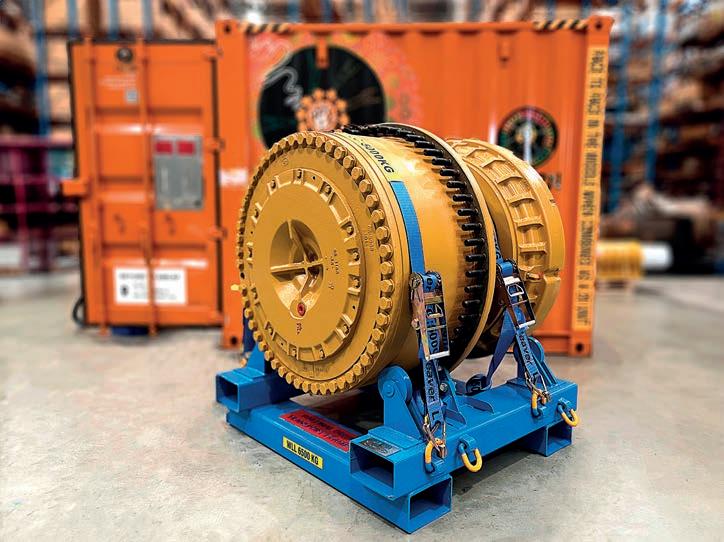

MASPRO HAS ESTABLISHED A REPUTATION FOR HANDLING THE MOST DIFFICULT MINING QUANDARIES.

As today’s mining equipment evolves, so too does the sector’s problem-solvers, with inspired solutions being engineered to respond to the most sophisticated site challenges.

MASPRO is one such problemsolver, leveraging deep domain expertise to significantly prolong asset life and bolster company balance sheets.

A partnership with a Tier 1 mining client in WA saw MASPRO extend the life of a drill gearbox by thousands of hours, boosting its reliability and reducing the need for scheduled downtime. It did this by reverse engineering the underperforming gearbox to isolate the problem, before reengineering it into a new solution.

This is not a singular case, with MASPRO unlocking significant productivity gains right across the Australian mining sector through its precise quality assurance (QA) processes and commitment to quality.

MASPRO head of engineering and quality Tony Waterman shared insight into the company’s QA approach.

“In-process inspection sees our staff check parts as they’re being machined to ensure tooling is behaving as expected,” Waterman told Australian Mining

“This ensures that if we’re making 500 of something, that we don’t face an issue with tooling halfway through which wasn’t picked up prior.”

MASPRO inspects parts on a percentage basis: how often and how

much of a part gets checked depends on what it is, its history, its application, and how critical the part is.

“If the part is something that’s difficult to access and replace, like a bush located inside a drill, which can only be accessed by pulling a whole drill apart, it will get a higher percentage of checks,” Waterman said.

“Our percentage of checks changes depending on the production output. If we’re consistently producing the same quality parts, we can reduce the number of checks as we can depend on the part

Waterman provided an example to back up his point.

“For pistons inside a drifter, where the pistons are getting smashed all day every day, every part will get 100 per cent checked because they are important components of the drifter and need to hold up against high stress,” he said.

“The customer can’t afford a failure, as it could lead to a breakdown and potential downtime. Completing a higher percentage of checks ensures that part is less likely to fail.

“In this instance, we would check everything at every stage of the manufacturing process, from the raw materials coming in to every heat treatment process.”

MASPRO conducts destructive

through its paces. This can be done on the raw materials prior to construction, on heat treatment processes, and on the final product.

This helps to ensure MASPRO can discover a problem at the earliest possible stage. Because a part can be a single component of a larger machine, problems that aren’t picked up right away can create much bigger headaches down the road.

“We treat every single part as if we’re only selling that one part,” Waterman said. “It doesn’t get skipped because it’s part of an assembly – everything gets checked the same.”

This meticulous approach to engineering is seeing MASPRO win many new clients in the Australian mining industry, where high-quality, long-lasting components can unlock millions of dollars of revenue.

MASPRO’s testing and QA processes underpin the company’s constant pursuit of quality, something Waterman believes is critical to the success of any company servicing the Australian mining industry.

“Our clients have a strict need for parts that perform,” Waterman said. “At the end of the day, everything we do is in our name, and if we make parts that fail and put our clients out, it isn’t good for the client or our brand.”

Whether it’s overhauling failing parts for drills, trucks or loaders, MASPRO can turn any mining quandary into a solution, no matter how niche it may be.

Such solutions can’t be achieved without MASPRO’s commitment to quality, highlighting the company’s unique value proposition in local and international mining sectors. AM

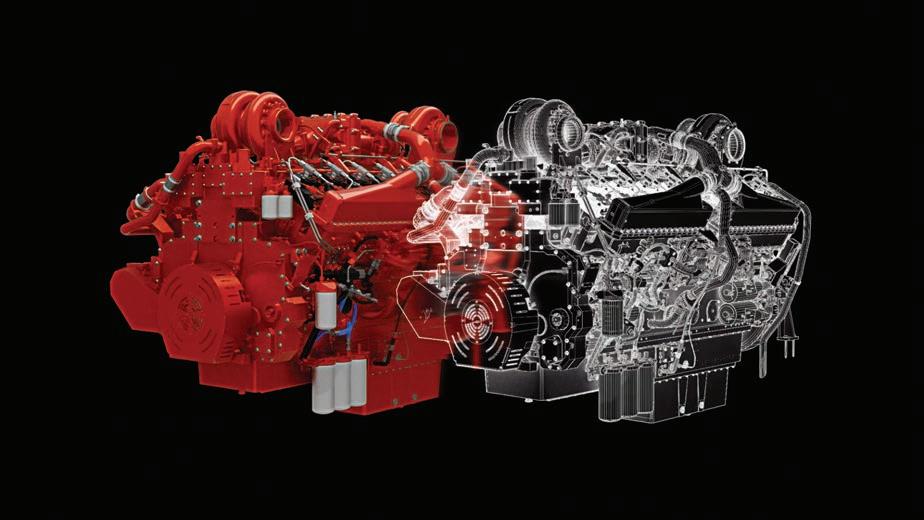

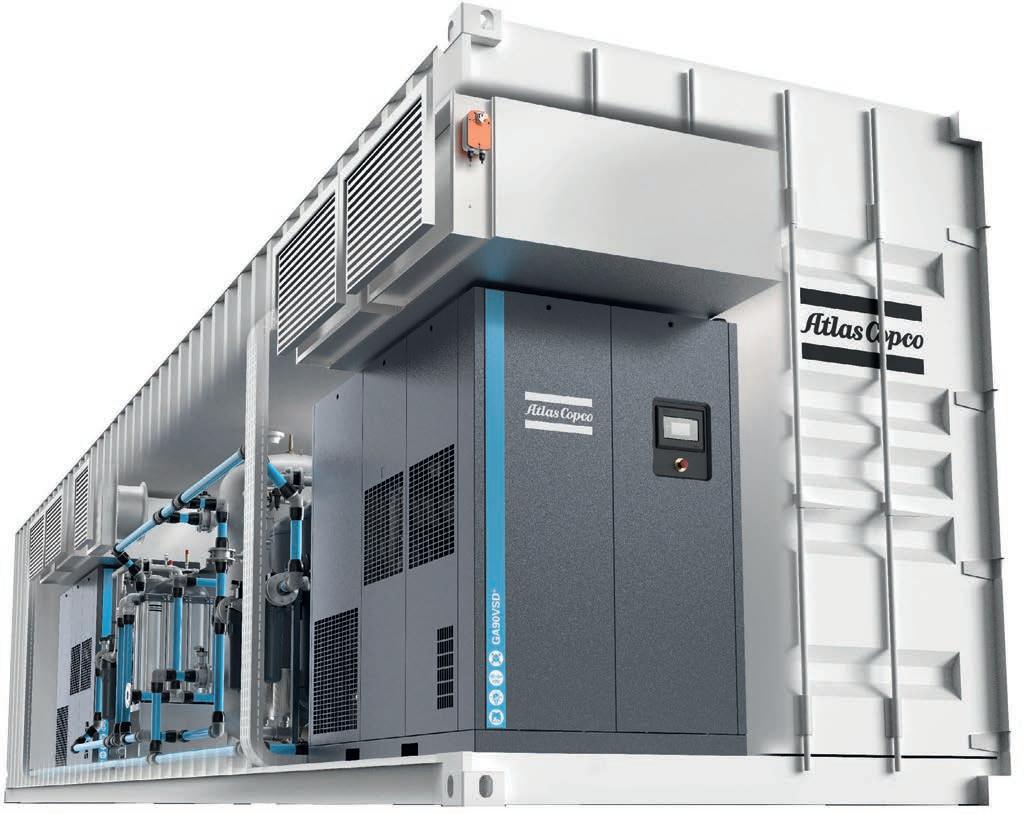

CUMMINS’ PREVENTECH FOR MINING IS A PROVEN MAINTENANCE SOLUTION OFFERING AN ARRAY OF BENEFITS FOR THE INDUSTRY.

Sensor-based solutions are becoming an important part of modern-day maintenance systems.

The trend, which sees mining equipment of all shapes and sizes attached with devices to measure critical metrics, is only going one way, with a growing number of reports from around the world acknowledging the rapid onset and importance of digitalisation in mining.

By predicting potential equipment ‘health’ issues before they occur, the bottom line for digital monitoring is obvious – reduced downtime and production costs.

Cummins’ PrevenTech for Mining is a proven real-time, data-driven digital solution to improve equipment reliability and reduce lifecycle costs.

Mining companies around the world testify to its effectiveness.

PrevenTech works by applying telematics, big data, advanced analytics and IoT (Internet of Things) technology to a machine’s engine hardware, helping a mine identify and diagnose issues faster and more accurately.

Features include real-time engine data logging and graphing, equipment mapping, and customised fault code management.

engine, securely transmitting alerts

A

for urgent and potential problems and recommendations for actions and servicing.

Miners can optimise maintenance intervals for each site individually, see the status of equipment in real time, and plan downtime and repair work to minimise disruption.

Alerts and recommendations are sent to the customer by the Cummins Care

remotely without the need for technician/engine interaction.

A logical step for Whitehaven

In Australia, PrevenTech is connected to around 100 Cummins-powered trucks and excavators at Whitehaven coal mines in New South Wales.

saw PrevenTech as a “logical step” for integration in the fleet while the system was being trialled at the mine.

“During the trial period we only had 10 engines connected but still prevented a couple of potentially significant downtime events,” Irwin said. “The machines were diagnosed and then repaired in a short period so as not to disrupt production. Anything that helps us trend data and get ahead of issues is important.

“We’ve gone from looking in the rearview mirror to learn from the past, to looking forward and making informed decisions with the real-time data we’re getting from PrevenTech. In other words, we’re now being more proactive, and less reactive, with our maintenance practices and that means reduced operational and maintenance costs.”

Another important element of PrevenTech is the ability to integrate it with FleetguardFIT, which monitors oil, air and fuel filters as well as oil conditions.

This allows Cummins to report on the condition of oil and engine filters on mining equipment, thus reducing reliance on standardised maintenance schedules and minimising unnecessary costs.

Customers have reported extended filter servicing intervals – for example, from 500 hours to 2000 hours –by combining PrevenTech with FleetguardFIT. AM

AMCAP IS ON A MISSION TO REVOLUTIONISE ITS PARTS SERVICES TO THE MINING INDUSTRY, EXPANDING ITS HEAVY MOBILE EQUIPMENT PORTFOLIO.

Wthe company is always looking to take its offerings a step further.

heavy mobile equipment (HME) service exchange components to AMCAP’s portfolio, the company seized it without hesitation.

components category about three years ago and never looked back,” AMCAP general manager Kevin Yap told Australian Mining

individual components that were utilised to fit these larger assets, so it made sense to expand that into its own category. Now, we supply large components for haul trucks, dozers, graders, wheel loaders and any other machinery that a mine uses for its operations.”

components work hand-in-hand with its maintenance service kits, providing customers with a superior level of reliability by having the replacement parts and components available when required.

AMCAP HAS EXPANDED ITS PORTFOLIO TO INCLUDE HEAVY MOBILE EQUIPMENT SERVICE EXCHANGE COMPONENTS.

their components will perform to original equipment manufacturer (OEM) specifications.

They also provide logistical cost savings through handling and transport of a single material line item, as well as the accuracy of having all parts consolidated within the kit. The kits are packaged appropriately in bespoke cabinets and containers, ensuring they are securely delivered on-site.

“Large component changeouts like engine replacements require longterm planning because they can cause a considerable amount of downtime,” Yap said.

“Most companies will give us a schedule to work with to ensure minimal downtime for assets that need component replacement, and we’ll make sure they get the required parts on that date maintaining as close to 100 per cent delivery in full.”

AMCAP’s services operate under three key pillars: minimising downtime, maximising efficiency, and maximising safety and sustainability. AMCAP offers a service exchange program to exchange old components for a remanufactured component that is both cost effective and efficient.

All of the company’s service exchange components are rebuilt

“We plan our inventory six months in advance, so if we’re due to provide a maintenance service kit to a customer in April and they bring forward the shut to February, we will have it ready to go,” Yap said.

“In addition to the efficiency gains our customers experience by working with us, we also take safety and sustainability incredibly seriously.”

In 2021, AMCAP was awarded ‘Best solution to a work health and safety risk’ at the Work Health and Safety Excellence Awards hosted by the Western Australian Government. This was followed by the AIM WA Pinnacle Award in the RAC Environmental Sustainability Excellence category in 2024.

“We’re committed to supplying our kits in a sustainable manner, including reducing waste by cutting down on packaging,” Yap said.

“We have also partnered with key charities including Aboriginal crisis line 13YARN, Lifeline WA and the National Breast Cancer Foundation, creating awareness of their messaging by printing it on our kits that travel around WA.”

The company has supplied service kits to major iron ore miners since 2018, supplying around 4000 kits per month.

Its partnerships with mining companies have enabled AMCAP to further research and develop its kitting services, providing an opportunity to implement different parts from both OEM and non-OEM products to optimise the cost of the finished product.

“Since we were already supplying many of the individual parts needed to fit larger components, it was natural to expand kitting these parts into a fitting kit for major components, e.g. complete corners, nose cones and total plug and play option,” Yap said.

“Whatever we can do to innovate our offerings is worthwhile investing in.” AMCAP assembles its kits and components out of its modern, purposebuilt storage and distribution facility in Welshpool, WA – but this doesn’t restrict them to only WA customers.

“We have the capability and capacity to supply nationally,” Yap said. “The maintenance service kits and components category is a fairly new and innovative market for us, and we’re excited to take that around the country.” AM

Certified Rebuild programs help you benefit from the multiple lives designed into Cat® machines, power trains and major components. They are “built to be rebuilt” for maximum value and longer life. Maximise the investment in your asset with full utilisation of a second life, at a fraction of the cost of buying new.

Access to advanced condition monitoring service with HDAdvantage™ program

Sustainability – reducing waste by reusing and recycling quality material

Finance options available

Call Hastings Deering on 131 228 or scan here to find out more

*Terms & Conditions apply.

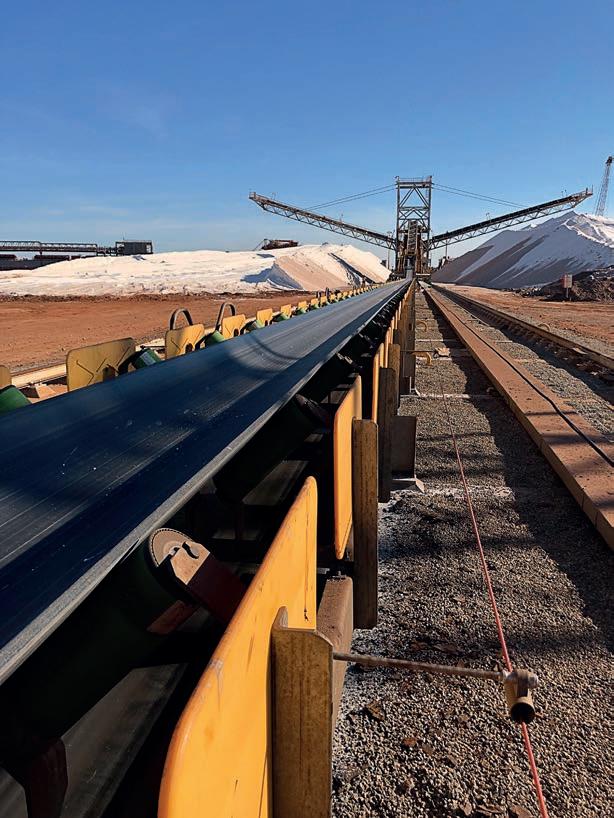

THROUGHOUT ITS LIFECYCLE. BEDESCHI DELIVERS JUST THAT.

The Australian mining industry is replete with unforgiving terrain, meaning equipment is constantly put to the test.

As a trusted original equipment manufacturer (OEM), Bedeschi not only delivers state-of-theart machinery, but also builds lasting partnerships with its clients to ensure assets remain at their peak performance throughout the lifecycle.

Bedeschi chief executive officer (CEO) Uwe Zulehner said the company has been focused on creating a successful aftermarket business in recent years.

“We now support the mining industry with services such as maintenance and shutdown support, delivery of critical spare parts, fabrication and parts repair,” he told Australian Mining

“We have cemented our position as a full-line OEM delivering not only new machines but also providing lifecycle support to mines and port operations.”

Bedeschi’s maintenance services are more than routine fixes; they represent a full-circle approach, with qualified technicians and field engineers readily available to respond to needs 24–7.

From integrating a new part into an existing machine, to removing parts and completing repairs, as well as the quick delivery of premium spare parts, mines can rely on Bedeschi for service support long after the machines have been initially deployed.

Bedeschi’s maintenance services have evolved in response to the everchanging needs of the Australian mining industry.

Zulehner said Bedeschi’s close relationship and proximity to its customers has helped it better understand service and maintenance demands.

“Our close proximity to customers has helped us develop a pool of experts and specialised services in the right places,” he said. “And our presence continues to expand, positioning Bedeschi in closer proximities to mine sites and ports.

“We will continue expanding our business within Western Australia and on the east coast of Australia.”

Holding close customer relationships provides Bedeschi with invaluable insights into their operational needs.

“Our client’s operational knowledge sparks ideas of improvement and development,” Zulehner said. “Backed by our deep experience of designing and developing technologies and products, we convert these ideas into physical solutions.”

Bedeschi has built a reputation for enhancing the longevity and performance of mining equipment.

Aftermarket general manager Marco Ringe explained how one Bedeschi customer had realised significant availability gains from the company’s solutions.

“One site experienced a seven per cent increase in machine availability across a 12-month period after Bedeschi undertook mechanical engineering inspections and servicing,” he said.

“Specialty tooling and methodologies were also implemented, creating safer, repeatable, and accurate testing

doesn’t come without its challenges, expecially when shutdowns occur with little-to-no notice, giving little time to mobilise labour.

Bedeschi overcomes unscheduled downtime by staying closely connected to its customers.

Longer-term partnerships see

enabling them to get on with the job.

To accompany its established maintenance offerings, Bedeschi is looking at new innovation techniques, including the use of digitalisation through discrete element method (DEM) modelling, which optimises equipment performance before costly modifications are made.

Though still early in its implementation, this technology can significantly improve maintenance processes and enable operators to work smarter by better understanding asset wear and performance.

As Bedeschi continues to expand its customer base, which includes a new order from a major mining company in recent months, Zulehner is proud of the company’s growth journey.

“We will continue to build on the back of our close relationships and regular order intake,” he said. “We’re also aiming to expand into new mining areas and assist new customers with maintenance services and aftermarket support.”

Bedeschi’s full lifecycle approach ensures Australian mining operations have the tools and support they need to thrive in one of the world’s most demanding industries.

It’s this commitment that will help shape the future of mining maintenance.

Hexagon is the global leader in precision technologies at any scale. We partner with customers for transformative improvements across the workflows that define a mine’s safety, value, reputation, and life expectancy. Designed by mining professionals for mining professionals, our solutions are backed by

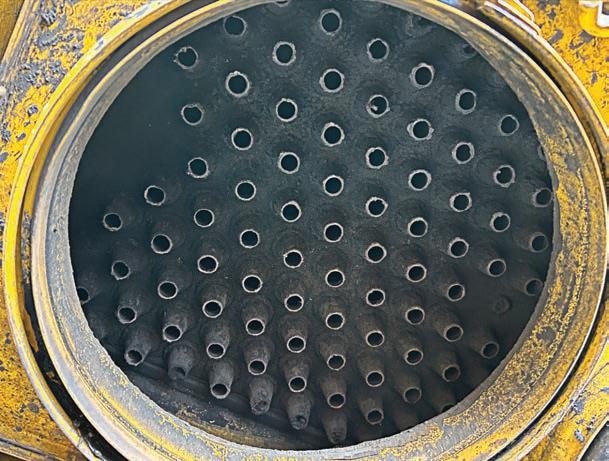

AFTER CONSULTING WITH ITS CUSTOMERS, DONALDSON AUSTRALIA HAS INTRODUCED A SOLUTION THAT REVOLUTIONISES AIR-CLEANER MAINTENANCE ON MINE SITES.

As Australian mining companies seek to reduce personnel exposure to dusts, they aren’t always receiving the right solutions.

Ironically, some practices introduced to help minimise dust are counterproductive and result in the need for additional primary filter services.

Today’s modern diesel engines can consume up to 20,000 litres of heavily contaminated air for every litre of diesel fuel burned, meaning air intake systems can be overwhelmed by vast volumes of dust, threatening these high-performing diesel engines.

A dual SSG Radial Seal air housing can separate and filter out more than 200kg of test dust prior to reaching the maximum allowable intake restriction common to modern engines.

It’s a reasonable assumption that the filter housings on your heavy mining equipment will have protected your engines from similar weights of dust between every primary filter change out.

While laboratory data is a valuable tool to make theoretical comparisons between competitor products, it does not always reflect real-world challenges.

SSG housings incorporate two-stage filtration to protect engines from vast amounts of dust.

The first stage of inertial pre-cleaning separates a high percentage of the heavy dust, which drops down to the lower dust cups for evacuation through the vacuator valves when the engine returns to idle or shuts down.

The dust evacuation process is highly effective in the laboratory, however, can experience challenges in the real world. Static and moisture can make some dusts stick or cling, preventing them from readily leaving the air housing.

Many sites have experimented with various approaches to address these challenges, but with limited or no success. These methods include installing earth straps, wiring in scavenge fans, installing reverse pulse units, replacing Donaclone tubes with centrifugal pre-cleaners, and even removing the vac valves.

To minimise personnel dust exposure, various pre-cleaner maintenance practices have also been trialled.

Some sites open the quick-release dust cups prior to the vehicle entering the wash pad. Water cannons blast the lower bodies to remove built-up dust, occasionally damaging the pre-cleaning tubes and always saturating the tubes with water.

Other sites will open the dust cups on the apron and utilise a high-pressure hose to wash out the lower bodies, while some remove the filters altogether and flush from the top down.

In a modern world of increased vehicle availability demands and pit stop servicing, pre-cleaning tubes don’t have adequate time to dry before the

returns to service. Water and fine dusts will make mud and set hard like concrete, preventing dust evacuation shortly after the vehicle returns to work.

With reduced pre-cleaning and no ability to evacuate dust, usable element life and service intervals are unacceptably shortened, resulting in additional labourintensive air intake maintenance events.

Donaldson Australia listened to its customers and initiated trials on a range of alternate dust evacuation systems.

The final concept is simple, replace the OEM (original equipment manufacturer) dust cups with a fixed cup that doesn’t include the quick release lower cup, additional gasket and threeinch vacuator valve fitting.

The trickle valve assembly features a tapered cup with an integrated six-inch trickle valve port, eliminating the need for an additional gasket.

Donaldson’s six-inch injection moulded EPDM (ethylene propylene diene monomer) trickle valve underwent rigorous testing in the company’s Minnesota air laboratories and was

extensively trialled at several Australian mine sites. The successful field trials confirmed the laboratory findings.

Donaldson’s trickle valve eliminates unnecessary mine-vehicle maintenance and can remain in position and function effectively without labour input for more than 6000 hours. This innovation transforms what was once routine maintenance to an annual task.

The soft, pliable trickle valve prevents water ingress during vehicle washdowns, preventing dust cup caking and preserving the integrity of essential precleaner tubes.

Combined with best practice maintenance procedures, the trickle valve prolongs element life, reduces high restriction events, minimises dust caking, eliminates service steps, and reduces workshop personnel’s exposure to nuisance dusts.

Leave your dust where it belongs, on the haul road and not in the workshop. AM

Optimising Sustainable Mining Operations: Your Partner for Shutdowns, Logistics and Maintenance

Scan the QR code to find out more!

Empowering Industries. Building Futures. One lift at a time.

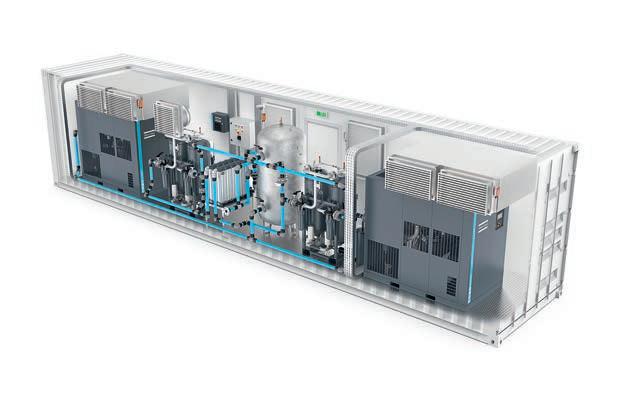

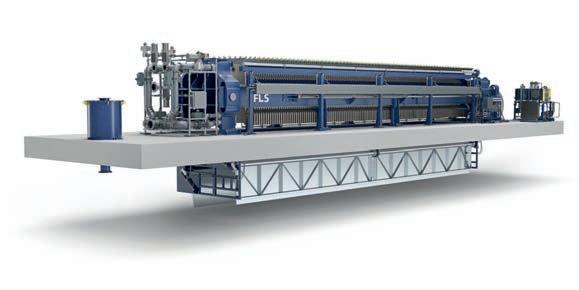

FLEETGUARDFIT IS A FILTRATION INTELLIGENCE MONITORING SYSTEM THAT HELPS PREVENT COSTLY EQUIPMENT DAMAGE AND DOWNTIME.

Fleetguard is transforming equipment maintenance in the mining sector with Filtration Intelligence Technology (FleetguardFIT), a predictive maintenance solution that enhances asset reliability, optimises service intervals, and improves environmental sustainability.

With filtration issues among the leading causes of avoidable engine failures, FleetguardFIT provides real-time monitoring of air, fuel, oil condition and oil filters, reducing unplanned downtime and preventing costly equipment damage.

The system is already deployed globally, operating in 25 countries, and continues to gain traction in the highhorsepower mining market.

FleetguardFIT comprises a suite of sensors connected to a microcontroller known as the filtration monitoring system, which processes raw data via advanced analytics and algorithms to provide actionable insights to customers.

“We are the only commerciallyavailable filtration monitoring solution that actually measures the real-time health of filters and oil rather than relying on preset fault codes,” Fleetguard chief engineer Matthew Ferguson told Australian Mining

“Customers are able to reduce unplanned failures by taking action at the right time and establish predictive condition-based maintenance practices.

“It helps customers optimise their spend on engine consumables, and it gives them the peace of mind that the maintenance that was supposed to be done, was done at the right time.”

Unlike traditional mining service intervals that rely on miles covered or a designated date, FleetguardFIT delivers condition-based maintenance, ensuring consumables are replaced at the optimal time.

Ferguson compared the difference between FleetguardFIT and conventional car maintenance alerts.

“If you drive a late-model car, and a light comes on the dash telling you to change your oil, that’s a systemgenerated alert based on kilometres, hours or time – it doesn’t actually analyse the physical condition of oil,” he said.

“FleetguardFIT, on the other hand, physically determines the oil’s condition in real time and provides an actual assessment every time the engine is running.”

FleetguardFIT helps miners avoid costly equipment failures by providing early warnings of potential issues.

This was demonstrated when the FleetguardFIT system detected a fuel dilution event well before the next scheduled service interval, where traditionally an oil sample would have been taken.

The system identified that the oil viscosity had fallen below the lower threshold limit on QSK60 MCRS (modular common-rail system) engines and automatically alerted the customer.

This early warning allowed the customer to prevent potential catastrophic engine damage.

Upon investigation, it was confirmed the fuel pump had failed, allowing the customer to make the repair in a timely manner. The data then returned to normal confirming the correct repair.

The FleetguardFIT system is sophisticated enough to not only detect when an air filter is approaching the end of its useful life but also features an anomaly detection function.

In one instance, the system identified abnormal air filter behaviour in a QSK78 haul truck containing six air filters.

One of the air filters was performing abnormally, triggering an alert and notifying the customer of a pending issue that would have otherwise gone undetected.

It was discovered that due to a lack of maintenance, the pre-cleaner was severely blocked but not enough to affect performance yet.

Further inspections revealed that nine other haul trucks at the site had the same issue.

Uncovering this issue early was only possible through FleetguardFIT’s anomaly alerts, preventing potential performance degradation and increased operational costs.

Before any catastrophic damage could occur, FleetguardFIT sent a critical air-filter alert, notifying a customer of a sudden spike in air filter differential pressure, exceeding the customer’s maximum custom threshold for air restriction.

Further investigation found that a technician had improperly installed the air filters on a dualengine QSK60-powered CAT 6090 Excavator, allowing dust to bypass the outer element.

This led to rapid loading of the safety (inner) element, causing a sharp rise in differential pressure.

By catching the mistake early, FleetguardFIT prevented a costly failure, enabling the engine to achieve its maximum expected life. FLEETGUARD

FleetguardFIT detected rapid loading of the fuel water separators (FWS) on two bulldozers operating at the same site.

The automated system alerted the customer in real-time, allowing them to investigate the issue.

It was discovered that the on-site bulk fuel tank was too low, allowing sediment and contaminants to reach multiple pieces of equipment.

Thanks to FleetguardFIT’s early detection, the customer was able to prevent a larger and more costly issue.

One of FleetguardFIT’s invaluable attributes is its ability to extend service intervals safely.

Ferguson said that over 80 per cent of customers were changing their filters too early, leading to unnecessary costs and waste.

“In industry terms, we’ve helped customers extend service intervals, in some cases from 500 hours to 2000 hours, all while ensuring filtration performance is maintained,” Ferguson said.

By leveraging FleetguardFIT analytics, customers can safely maximise filter life, reducing the frequency of replacements and lowering overall maintenance expenses.

Another often-overlooked advantage is that air filters perform better when they have a dust layer.

“Air filter performance is optimised after a certain amount of time because the filter builds up a ‘dust cake’ on the outside, which actually improves filtration,” FleetguardFIT sales manager Brandon Brinton said.

“If you swap them out too frequently, you’re removing the opportunity for that layer to form, making the filter less efficient.”

FleetguardFIT ensures air filters are changed only when necessary, improving efficiency and longevity.

FleetguardFIT also aligns with the mining industry’s environmental, social, and governance (ESG) goals by minimising waste and optimising maintenance operations.

“By ensuring filters and oil are used for their full lifecycle, we help customers

transport emissions from maintenance activities,” Brinton said.

“Reducing unnecessary maintenance trips also plays a role in sustainability.

“If a company doesn’t have to deploy a maintenance truck unnecessarily, that’s less fuel burned, less wear on tyres, and less overall impact on the environment.”

FleetguardFIT offers flexible integration options, ensuring compatibility with existing asset management systems.

Customers can choose between a cloud-based solution or edge computing

Recognising the importance of data security, FleetguardFIT can integrate with customers’ existing telematics service providers (TSPs), ensuring compliance with industry security standards.

“We simply provide the filtration intelligence layer without introducing additional cybersecurity concerns,” Brinton said.

advantage

FleetguardFIT provides a significant competitive edge by improving fleet efficiency and reducing unexpected failures.

However, due to its strategic benefits, some mining companies choose to keep their FleetguardFIT implementation confidential.

This exclusivity highlights the system’s game-changing potential in the mining industry.

With increasing pressure to enhance efficiency, reliability, and sustainability, FleetguardFIT is proving to be a critical tool for modern mining operations.

As Fleetguard continues to evolve, the company is continually working on new advancements, including more sophisticated oil condition monitoring and further integrations into predictive maintenance platforms.

“FleetguardFIT isn’t just a monitoring tool, it’s an intelligent maintenance solution that empowers mining companies to operate smarter, safer, and more sustainably,” Ferguson said.

For miners looking to reduce costs, prevent failures and improve ESG performance, FleetguardFIT offers

ELPHINSTONE IS SETTING THE STANDARD IN UNDERGROUND HAUL ROAD MAINTENANCE WITH THE RECENTLY RELEASED EG20 UNDERGROUND GRADER.

The role of the underground grader is to prepare and maintain quality haul and access roads with adequate drainage throughout the tunnel network.

The added benefit is a significant increase in haulage productivity, reduced tyre wear, increased component life, and higher speed on grade.

In 2018, Elphinstone identified an opportunity to expand its range of underground mining support vehicles by including a purpose-built underground grader based on the Caterpillar 120K and 120M surface grader platform.

Elphinstone UG20K and UG20M underground graders operate all around the world including Canada, Argentina, Chile, the Democratic Republic of Congo, India, Mongolia, Mali, Mexico, Peru, Burkino Faso, Kazakhstan, Tanzania, Saudi Arabia, South Africa, and the US.

Superseding the K&M series, the new EG20 series incorporates all Cat 120 standard upgrades and redesigned Elphinstone modifications, improving operator safety, ergonomics, comfort, and view of the blade.

When conditions get tough, the robust frame, work tools and powertrain of the EG20 gets the work done.

The EG20 drawbar is designed with hardened circle teeth for increased durability. Rippers (factory fit options) are available to assist with the grading of underground roadway surfaces.

The blade lift cylinder accumulators assist in reducing blade bounce and damage to the blade components.

Powered by the C7.1 ACERT Tier 3 engine arrangement, the EG20 meets the standard for regions with more stringent emission regulations and those without access to ultra-low sulphur fuel.

The Cat C7.1 uses Caterpillar’s breakthrough ACERT technology to meet exhaust emission-reduction standards. The engine boasts efficient fuel delivery and air management to provide outstanding performance and lower emissions, and electronic control for high productivity and longer service life.

The C7.1 ACERT Tier 4 Final Stage V engine arrangement is available as an option, adhering to EU Stage V exhaust emission standards.

The electronic throttle control provides easier, more precise and consistent throttle operation. Engine over-speed protection prevents downshifting until an acceptable safe travel speed has been established.

Variable horsepower plus (VHP Plus) comes standard providing more power in the higher gears.

All powertrain components are made to be rebuilt, adding value to the total cost and lifecycle of the machine.

The EG20 enclosed cab has been redesigned to improve ergonomics, machine control adjustability and visibility.

The cab, which features a rollover protection system (ROPS) or falling object protection system (FOPS), provides a quiet environment with low vibration levels, reducing operator fatigue.

Cab features include low-effort pedals and controls, adjustable implement controls, an adjustable steering wheel angle, and an adjustable seat, all providing a comfortable work environment.

Operator comfort is further enhanced with improved leg room across the spine and additional storage areas including cup holders located on both sides of the cab.

The digital instrument panel, with easy-to-read, high-visibility gauges and warning lamps, places vital machine information and diagnostic capability in direct view of the operator. Working in the dark is much easier with backlit transmission shifter and rocker switches.

The instrument cluster includes gauges for engine coolant temperature, articulation, voltage, and fuel level, along with a speedometer, tachometer, and an hour meter.

The air conditioning (HVAC) system dehumidifies and pressurises the cab, circulates fresh air, removes dust, and prevents the windows from fogging.

The EG20 is engineered to protect the operator and others on the job site, featuring a ground-level engine shutoff switch and refuelling, laminated glass windows, and door and seat belt park brake interlocks with visual and

THE NEW ELPHINSTONE EG20 UNDERGROUND GRADER IS PURPOSEBUILT TO THRIVE IN HARSH HARDROCK MINING ENVIRONMENTS.

audible detection alarms. Other features include a seat belt cutter, robust rearguard, and a front counterweight for machine balance.

Emergency stops and fire suppression actuators are conveniently located at ground level and inside the cab. Hydraulic brakes replace air brakes that were previously standard on the UG20K.

High-visibility green grab rails and steps for three-point contact, brake and back up lights, alarms, and blade and rear-view cameras with dedicated display all combine to ensure a safe work environment.

The ground level fuel fill system prevents the need to climb onto the machine for refuelling. An optional fast fill is also available at ground level.

Grouped service points make daily maintenance easier and faster while enhanced diagnostics and monitoring help reduce downtime.

Ground level access to service points reduces risk and time spent checking the machine’s status, while next-generation filters help reduce filtration costs.

OPTIONAL FEATURES INCLUDING RIPPERS CAN BE ADDED TO THE EG20 UNDERGROUND GRADER TO SUIT SPECIFIC APPLICATIONS.

providing location, machine hours, fuel usage, productivity, idle time, and other machine data on-demand through the VisionLink online interface, improving efficiency and lowering operating costs.

The Elphinstone EG20 can be optioned with a wide range of additional features to suit each specific mine site application, including fire suppression, automatic lubrication, and rippers.

All Elphinstone products, technical assistance, support, and access to spare parts are available through the global Cat dealer network with additional support available from the Elphinstone regional sales and support team. AM

HASTINGS DEERING HAS HELPED SOJITZ CORPORATION SAVE THOUSANDS OF DOLLARS IN OPERATING COSTS AT ITS GREGORY COAL MINE IN QUEENSLAND’S BOWEN BASIN.

For more than 40 years, the Gregory mine located 60km northeast of Emerald in Queensland has been known as one of Australia’s premier coking coal operations.

Gregory has a three-million-tonneper-annum production capacity and a mine life of more than 20 years, and boasts a fleet of 20 mining trucks, 80 per cent of which are Caterpillar (Cat) branded.

Since Sojitz Corporation acquired Gregory in 2019, the mine has utilised Cat’s ground engaging tools (GET) on its ancillary fleet, specifically using the EWL (extended wear life) cutting edges on its Cat D11 large track-type tractors (LTTT).

While using this system, Sojitz was flipping cutting edges at an average of 350 hours and changing a new set of cutting edges at approximately 700 hours.

The company manages its D11 tractors on a 500-hour preventive maintenance (PM) interval and wasn’t changing its GET in the field due to safety concerns.

This saw the machines trammed long distances to the workshop to both flip and change the GET, leading to two additional trips to the workshop within a 1000-hour operating period.

This had a ripple effect on Gregory’s operating costs, labour hours and reduction in physical availability.

As a long-standing and loyal customer, Sojitz reached out to Cat’s Queensland dealer Hastings Deering to implement an alternative solution that decreased operating costs and aligned with its 500-hour PM strategy.

The trial

Hastings Deering commenced a trial where three D11s operated under similar conditions.

Each dozer was equipped with different GET systems. The first, DZ38, was fitted with extended wear life (EWL) cutting edges and applied by Hastings Deering.

The second, DZ39, was set with extreme extended wear life (EEWL) middle edges and high abrasion (HA) end bits, while the third dozer, DZ40, was fitted with offset edges.

Each system was examined on a regular basis, specifically inspecting

the wear trends. To gather the results, Hastings Deering designed an inspection sheet and Microsoft Excel spreadsheet.

The original equipment manufacturer (OEM) also created a ‘Go-No Go’ gauge to analyse the wear on each system.

outcome

The trial concluded that the DZ40 fitted with offset edges offered the longest wear life, delivering 1385 hours.

Despite this, Sojitz was concerned the solution wouldn’t align with its 500-hour PM strategy due to the offset wear material.

Following further evaluation, the company implemented the EEWL middle edges and HA end bits method to its LTTT fleet, which achieved 1086 hours and was the second best of the three trialled.

This solution is projected to save Sojitz approximately $70,000 per annum in material and labour costs per annum.

According to Sojitz, the EEWL middle edges and HA end bits method was $0.79 per hour cheaper than the EWL cutting edges fitment. This totals $27,650 savings per year in materials across the company’s mining fleet.

CORPORATION’S GREGORY FLEET INCLUDES CAT D11 LARGE TRACK-TYPE TRACTORS.

Reduced worn undercarriage and labour hours were also estimated to save $200 per hour, or $40,000 per year across the fleet.