what did we learn from SA’s Five years on:

BLACKOUT?

QLD’s green power hub makes headway

Kurri Kurri gas plant: why the controversy?

ISSUE 15 · September 2021 · www.energymagazine.com.au

For more information, scan the QR code

What a difference a few months can make in between writing an Editor’s Welcome.

When I wrote my last welcome, I had just returned from a trip to Sydney, where a visit to a large-scale energy industry event had left me feeling excited about the upcoming opportunities for the sector.

Only a few weeks later, Sydney’s lockdown began, and a number of other lockdowns around the country have also been and gone since then.

transition that is currently underway in the world of energy.

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

energymagazine.com.au

We’re fortunate as members of the energy industry to be essential workers for whom the show must go on. But over the last couple of months, I’ve had many conversations with members of the industry – particularly those based in Sydney –about how to best manage the challenges of remote working. As a Melburnian, I know all too well how hard it can be to maintain a level of intensity and focus when working from home, but 18 months into this gig, I have a few tips which I’ve come to rely on.

Firstly, each day I write a list of five things I’d like to achieve professionally each day. They don’t always get achieved, but they help to provide focus.

Secondly, I try to schedule meetings at times when I know I often feel flat (10.30am and 1.30pm, for the record!) as a way to pep me up and push me through the day.

Imogen has written many brilliant features for the magazine over her time with the magazine, and this issue features perhaps her best piece yet – a deep dive into the system black event in South Australia in 2016, which is still regularly discussed and dissected across the industry.

This article is the first in a multi-part series which will cover the event, and will analyse not just what went wrong, but importantly, what we as an industry have learned, and can continue to learn from this event. I encourage you to give the article a read.

Laura Harvey Editor

Christopher Allan

Lauren DeLorenzo

Jacqueline Buckmaster

Thirdly, I try to focus on my most challenging tasks in the morning, and leave the work that I really enjoy doing for the afternoon.

Something that I really enjoy doing is mentoring members of my team, and that brings me to the second part of my Editor’s Welcome of this issue.

This is actually the last issue of Energy that I will be editing. Fortunately, I’ll still be staying on as Managing Editor of Energy, so it’s not really goodbye; and I’m thrilled to let you know that Energy’s current Associate Editor, Imogen Hartmann, will be moving into the Editor’s chair.

Imogen has been working with me on Energy for almost two years now, and she shares my passion for the industry, and the

1

you’d like to get in

new

you can reach Imogen at imogen.hartmann@monkeymedia.net.au ISSUE 15—SEPTEMBER 2021 WELCOME EDITOR’S WELCOME The 1P Tracker by Soltec PATENT PENDING www.energymagazine.com.au BLACKOUT? what did we learn from SA’s Five years on: Kurri Kurri gas plant: why the controversy? QLD’s green power hub makes headway

Media

If

touch with Energy’s

Editor,

Monkey

Enterprises ABN: 36 426 734 954 C/- The Commons, Office 1, 36–38 Gipps St, Collingwood VIC 3066

by We’re keen to hear your thoughts and feedback on this issue of Energy. Get in touch at info@energymagazine.com.au or feel free to give us a call on (03) 9988 4950. September 2021 ISSUE 15 Editor

Editor

info@energymagazine.com.au ISSN: 2209-0541 Published

Laura Harvey Associate

Imogen Hartmann Journalists

April Shepherd

Annabelle Powell Design Manager

Alejandro Molano Designers

Danielle Harris National Media and Events Executives

Rima Munafo Brett Thompson Marketing Manager

Radhika Sud Client Services Manager Stephanie Di Paola Publisher Chris Bland Cover highlights a major feature in this issue, an in-depth look at the 2016 South Australian blackout, using five years worth of hindsight to determine what went wrong, and what the industry learnt from the incident.

2 FUTURE ENERGY 14 And they’re off: the state race to network regions of renewables 18 Bioenergy investment to support Australia’s path to net zero 20 Victoria's gas infrastructure: what does the future hold? 22 It’s dark, it’s still – it’s dunkelflaute FUTURE ENERGY 24 National modelling data to help electricity sector plan around climate risk 26 Gearing up for the energy storage era 28 Zenaji Aeon Battery passes all Australian tests WIND 30 Kaban Green Power Hub gives QLD's renewable efforts a second wind 32 Enhance your turbine maintenance with the best service tools INDUSTRY INSIGHT 10 Examining the Kurri Kurri gas plant controversy 14 24 10 NEWS 4 EnergyAustralia’s potential pumped hydro facility 6 DER two-way market trial moves to next phase 6 AGL demerger creates two new businesses 8 Aurora Energy appoints new metering service provider 9 Australia’s largest gas and coal export partner slashes demand EACH ISSUE 1 EDITOR'S WELCOME 64 FEATURES SCHEDULE 64 ADVERTISERS’ INDEX CONTENTS September 2021 ISSUE 15 www.energymagazine.com.au

GAS PIPELINES

34 The role of gas pipelines in Australia’s future energy system

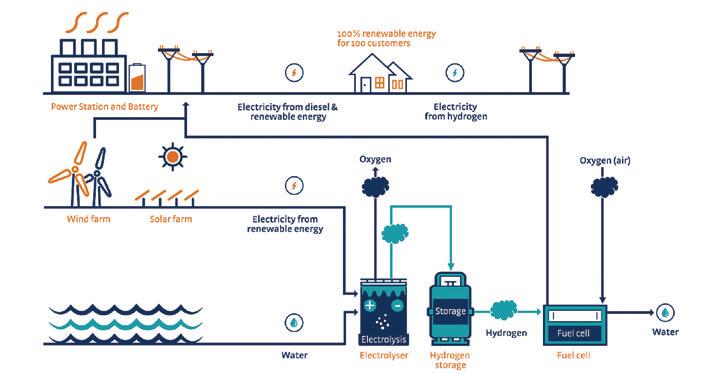

36 Delivering the future of gas through Australia’s most comprehensive green hydrogen demonstration 34

38

ENERGY EFFICIENCY

38 Room for improvement: Australia and Germany swap notes on energy efficiency reform

40 Why energy storage is an essential part of a smart electric grid

42

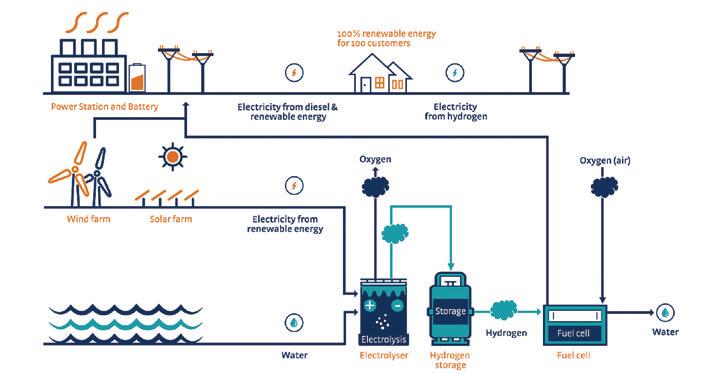

42 Australia’s first green hydrogen plant in a remote power system

44 Mitigating the risks of remote workplaces

DISASTER MANAGEMENT

62 Powercor tests new drone tech for powerline checks 46 52 62

46 Black system or black swan: learnings from South Australia’s infamous 2016 blackout

50 New technology transforms resiliency readiness

DISTRIBUTED GENERATION

52 Powering ahead with community batteries

56 Technology not taxes: the problem with technology-led energy futures

58 Deploying SPS for WA’s Cyclone Seroja recovery and beyond

60 How distribution businesses should embrace the transition DRONES

CONTENTS 3

REMOTE POWER

www.energymagazine.com.au September 2021 ISSUE 15

ENERGYAUSTRALIA’S POTENTIAL PUMPED HYDRO FACILITY

EnergyAustralia has revealed a new potential pumped hydro energy storage facility, to be located at the Lake Lyell dam – which supplies water to Mt Piper power station in Lithgow, NSW.

Energy Executive, Liz Westcott, said early estimates suggest a Lake Lyell pumped hydro energy storage facility would be capable of producing 350MW of electricity, with around eight hours of storage –enough to power approximately 150,000 households during peak demand.

“Initial studies show that a Lake Lyell pumped hydro energy storage facility has enormous potential to become a major piece of infrastructure for New South Wales in a transitioning energy system,” Ms Westcott said.

“Pumped hydro will continue to play an important role in providing reliable, affordable and cleaner power for homes and businesses into the future. One of the benefits of Lake Lyell is that it’s already located near major transmission lines."

Lake Lyell would be used as a lower reservoir and the upper reservoir would be located on the south side of Mt Walker, all on land owned by EnergyAustralia.

Head of Mt Piper, Greg McIntyre, said the facility would provide a welcome economic boost for the region and support Lithgow in becoming a future renewable energy hub.

“A new pumped hydro facility at Lake Lyell would ensure Lithgow’s legacy in energy generation is preserved well into the future,” Mr McIntyre said.

“If the project goes ahead, we anticipate hundreds of jobs would be created during construction, with roles also needed to oversee the facility’s ongoing operation.

“Detailed assessments will follow, including environmental impacts and planning approvals, before any firm decisions can be made; however, the first step is consulting with our community.”

NEWS 4 September 2021 ISSUE 15 www.energymagazine.com.au

COUNCIL MAGAZINE

your leading source of news for the local government sector

Council has been developed to keep you up-to-date with all of the latest news, discussions, innovation and projects in the local government sector.

Council is fully integrated across print and online, featuring a website updated daily with the latest industry news, a weekly e-newsletter delivered direct to your inbox, and a quarterly magazine that can be read in print and online.

Published by industry publishing experts Monkey Media, Council will arm community decision-makers with the critical information they need to deliver a better future for cities, towns and suburbs all over Australia.

HEAD TO THE WEBSITE TODAY to sign up for the FREE WEEKLY NEWSLETTER!

www.councilmagazine.com.au

info@councilmagazine.com.au

DER TWO-WAY MARKET TRIAL MOVES TO NEXT PHASE

AEMO, AusNet Services and Mondo have completed the first phase of a world-first trial to create a two-way market for distributed energy resources (DER).

The trial seeks to enable consumers to benefit from their DER participating in the National Electricity Market (NEM).

Project Energy Demand and Generation Exchange (EDGE) will run an off-market platform for eligible customers in north-east Victoria to trade electricity and grid services via an aggregator or Virtual Power Plant (VPP) operator from their DER, such as rooftop solar and batteries, similar to large-scale participants in the NEM.

AEMO’s Principal Analyst Member Services, Matt Armitage, said, “Project EDGE aims to build understanding of and inform the most efficient and sustainable way to integrate DER into the electricity system and markets, allowing all consumers to benefit from a future with high levels of DER.”

Since the inception of the project in November 2020, the partners have been working together to engage heavily with industry to define the research questions

Project EDGE will seek to answer and shape the project’s DER Marketplace design.

With Phase 1 of the project completed, AEMO has published a ‘lessons learned’ report on behalf of the project partners covering progress to date.

The project partners have established EDGE-specific stakeholder forums relevant to their respective roles.

AEMO is progressing the development of the EDGE marketplace with high-level design requirements established; AusNet Services similarly is progressing the build of the DSO platform that will integrate with the EDGE marketplace.

Mondo has commenced work on enhancing their UBI aggregation platform and behind the meter (BTM) technology to meet EDGE requirements.

Project EDGE has moved into Phase 2, which primarily focuses on establishing the marketplace minimum viable product (MVP) in preparation for DER to commence delivering wholesale and local network services and required data exchange infrastructure.

The project is on track for the planned commencement of off-line trials in November 2021 followed by operational trials in May 2022.

AGL DEMERGER CREATES TWO NEW BUSINESSES

AGL has confirmed details of its demerger, with the business to split into two new entities – Accel Energy and AGL Australia.

Accel Energy (previously referred to as PrimeCo) will be the new home for AGL’s coal and gas-fired power plants. AGL Australia meanwhile will focus on retail, flexible energy trading, energy storage and supply.

Graeme Hunt, the current Interim Managing Director and CEO of AGL Energy, will be the Managing Director and CEO of Accel Energy.

Mr Hunt will be in charge of the company’s coal and gas power plant fleet, under Accel Energy.

AGL Australia will be led by Christine Corbett, who will be the Managing Director and CEO.

AGL Energy Chairman Peter Botten said, “The impact of recent challenging market conditions on our financial performance emphasises that AGL Energy is now at an inflection point, as the transition of the energy sector accelerates, driven by the rapid evolution in renewables and decentralised energy technology, customer needs and community expectations.

“For Accel Energy, this means focusing on the transition of its existing electricity generation assets and investment in the longterm rejuvenation of its valuable operating sites as low-carbon industrial energy hubs, as well as new clean energy projects.

“For AGL Australia, it means focusing on being Australia’s leading two multi-product energy retailing business while investing

in flexible energy trading, storage, supply and decentralised energy services.”

AGL Energy shareholders will hold one share in each of Accel Energy and AGL Australia for every share they own in AGL Energy on the applicable record date.

Mr Hunt said that AGL Energy has received strong financing commitments from its banking group and new lenders, establishing independent borrowing facilities for both Accel Energy and AGL Australia.

AGL Energy intends to hold a scheme and general meeting to enable shareholders to vote on the proposal and to complete the demerger in the fourth quarter of FY22, subject to final AGL Energy Board, ATO and relevant regulatory, court and shareholder approvals.

NEWS 6 September 2021 ISSUE 15 www.energymagazine.com.au

We power up your health

so you can power up Australia

Did you know there’s a health fund specifically for people working in the energy sector? One that understands the job you do and your industry’s particular health issues. rt health is your industry health fund and is here to power up your health care needs.

1300

www.rthealthfund.com.au

886 123

AURORA ENERGY APPOINTS NEW METERING SERVICE PROVIDER

Aurora Energy has announced a new long-term partnership to fulfill its metering coordination to deliver advanced metering services to residential and small business customers across Tasmania.

TasMetering will replace Yurika as Aurora’s appointed metering coordinator.

TasMetering is headquartered in Hobart and is a Tasmanian focused operation of the Intellihub Group.

Advanced meters are the next generation of electricity meters and offer many more benefits than older style basic meters, including remote reading and an end to estimated bills, monthly billing and help to facilitate new home energy services in the future.

The announcement complements the Tasmanian Government’s election commitment to accelerate the roll out of advanced meters to all Tasmanians by 2026.

TasMetering CEO, Jon Bruschi, said the business would bring an experienced, reliable and customer focused service to Tasmanian homes and businesses.

“We’re focused on delivering outstanding customer service to Aurora Energy and its customers,” Mr Bruschi said.

“We’re aiming to set a new benchmark in quality metering, and we will be bringing the best technology to showcase right here in Tasmania.

“This includes advanced digital tools for customers to schedule, track and give feedback on our service.”

Aurora CEO, Rebecca Kardos, said advanced meters facilitate the development of modern products that empower customers to lower their energy costs.

“When paired with digital or other energy products that provide the metering data in a user friendly and informative way, advanced meters enable Tasmanians to make more informed choices about how and when they use electricity,” Mrs Kardos said.

“Being aware of your power use is an important energy saving tip. Knowing when and how much energy you’re using can help Tasmanians save money.”

Aurora said there is no upfront cost for a customer to have an advanced meter installed in the majority of situations unless works are required to upgrade existing infrastructure to meet current metering specifications and safety standards.

8 September 2021 ISSUE 15 www.energymagazine.com.au

NEWS

AUSTRALIA’S LARGEST GAS AND COAL EXPORT PARTNER SLASHES DEMAND

Japan, Australia’s largest thermal coal and gas buyer, has announced a switch to renewables – with the goal of doubling its renewable energy target for 2030 and halving its gas usage, slashing demand for Australian LNG and coal.

The changes were announced by Japan, which currently buys 67 per cent of its thermal coal and 39 per cent of its LNG from Australia, in a draft report from Japan’s Ministry of Economy, Trade and Industry.

The revised figures laid out in the draft plan state that renewables should account for 36-38 percent of power supply in 2030, double the 18 percent level in March 2020.

These changes have created turbulence in the Australian LNG and coal industry –especially as the Federal Government has

hailed gas as a key part of the country’s COVID-19 recovery and continues to invest in the industry, recently committing $224 million in funding to develop an onshore gas field in the Northern Territory Beetaloo Basin.

Japan’s choice shows a worldwide energy reset, moving away from fossil fuels and turning to renewables, to combat climate change.

Greens Leader, Adam Bandt, said, “This year, about 40 per cent of Australia’s gas and thermal coal exports have gone to Japan.

“This one decision from Japan alone could end close to 20 per cent of Australia’s thermal coal exports within a decade, and with China and Korea also committing to net-zero emissions, the industry could soon collapse.”

Mr Bandt said that the Federal Government must massively ramp up investment in manufacturing and green energy in Queensland and NSW to guarantee secure jobs after 2030, and that the Beetaloo gas fields in the Northern Territory developments should be halted.

“Opening up new gas fields isn’t just a climate crime, it’s an economic disaster,” Mr Bandt said.

Dr Madeline Taylor, Climate Councillor and energy expert, said that Australia could be generating and exporting renewable energy to meet rising global demand.

“The government must accelerate progress towards a renewables-powered economy instead,” Ms Taylor said.

9 www.energymagazine.com.au September 2021 ISSUE 15

NEWS

EXAMINING THE KURRI KURRI GAS PLANT CONTROVERSY

by Imogen Hartmann, Associate Editor, Energy magazine

The Federal Government has confirmed its decision to build the Hunter Power Project, a publicly-funded gas plant in Kurri Kurri aimed at replacing electricity supply lost from the upcoming retirement of the Liddell Power Station. The plans for the gas plant – seen by many as a backwards step in our transitioning energy market – and the spending of public funds to cover it, has come under criticism from the industry. Here, we talk to Dr Ross Gawler, Senior Research Fellow, Department of Data Science & AI, Faculty of IT, Monash Energy Institute, about the Government’s plans, which he warns will create a cost to electricity consumers that is too great to justify its means.

September 2021 ISSUE 15 www.energymagazine.com.au

10 INDUSTRY INSIGHT

www.energymagazine.com.au September 2021 ISSUE 15 11 INDUSTRY INSIGHT

n September 2020, the Federal Government issued an ultimatum to Australia’s energy industry – deliver 1000MW of new dispatchable energy to replace the Liddell Power Station before it closes, or the Government would do it themselves. The Government’s cut off for an industry-led project was April 2021, and with no projects put forward, the Government announced the controversial Kurri Kurri gas plant in May 2021.

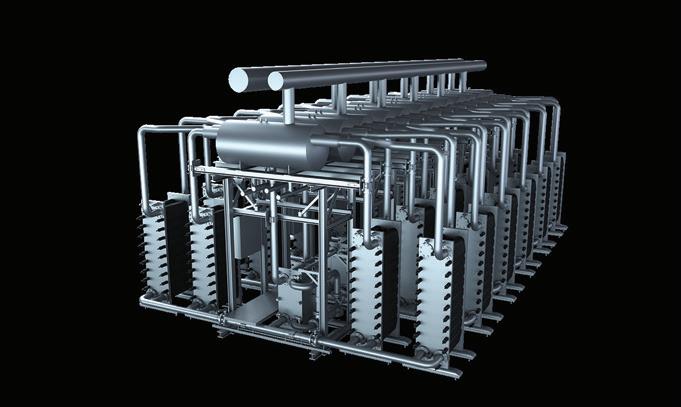

The Federal Government confirmed a $600 million-spend on the build of the new gas-fired power station in Kurri Kurri in the New South Wales Hunter Valley. The 660MW power plant, run by Snowy Hydro, will comprise two heavy-duty, open cycle gas turbines (OCGT).

Operating on natural gas, the OCGTs will also be hydrogenready, with diesel on hand as back-up for the extreme circumstances where the grid needs support. Snowy Hydro says the OCGTs will have the capability to run initially on up to 10 per cent hydrogen, but with “minor additional investment”, that number could jump up to 30 per cent, subject to fuel logistics.

The Federal Government is adamant that having electricity sources that can produce ‘on-demand’ or dispatchable energy are critical as large coal-fired power stations retire and we transition to renewable energy sources like wind and solar power. According to the Federal Government, the Hunter Power Project at Kurri Kurri is set to “fill the gap” in electricity demand in the wake of the Liddell Power Station’s retirement.

Rising electricity costs

In 2020, when the Government first issued its ultimatum, the Liddell Taskforce found closing the plant without adequate dispatchable replacement capacity would risk prices rising by around 30 per cent over two years, or $20 per MWh to $80 in 2024 and up to $105 per MWh by 2030.

However, Dr Gawler argues that instead of providing a cost effective solution to the ensuing price rises, the gas plant could potentially result in even more of a rise in electricity costs, although it may slightly lower bills to consumers. This is because of the displacement of a “more efficient combination of new electricity generation resources, which would offer lower costs”.

Dr Gawler said that there could be a slight decrease in electricity prices as a result of the surplus created by building the gas plant as proposed. However, Dr Gawler said his original analysis had assumed the plant would run on gas. This may not be the case, instead the proposed plant is a peaker plant, meaning it would run on liquid fuel – which is even more expensive than gas. Dr Gawler said it is this discrepancy between the Government’s plan and his original analysis that could mean an even more expensive result.

“A combination of increasing electricity costs and decreasing prices means that other generators’ profits would be reduced by the project for a time,” Dr Gawler said.

“This will be reflected in a loss of income to the Federal Government through its earnings from Snowy Hydro, as well as Australians whose superannuation funds have invested in Australian electricity companies (such as AGL).

“So, if we did get lower electricity bills from the project, our taxes will not fall but may rise to compensate – or Government services will need to be cut to match the lower tax and dividend income of the Government.”

Dr Gawler's colleague, Associate Professor Ariel Liebman, said, “The investment of gas-fired power would also increase total electricity costs by about $70 million per year, with total system costs over the period to 2043 increased by up to $1.011 million.

“Moreover, this project would reduce the Snowy Hydro net profit by up to $3.380 million over this same period.”

Greener alternatives on hand

New South Wales currently has a target of net zero emissions by 2050 – pioneering as one of the first jurisdictions in the world to set a net zero objective. According to Professor Liebman, the Hunter Power Project would increase carbon dioxide emissions by five million metric tonnes of CO2 over 20 years to 2042/43.

Dr Gawler said this means that carbon offsets would have to be purchased elsewhere to cancel out the emissions from the project.

“That would be yet an additional cost burden on the NSW community,” Dr Gawler said.

Alternatively, Dr Gawler says that the plant could be run on green hydrogen with no material increase in emissions. He also said that renewable storage solutions, like pumped hydro or batteries, would provide a sensible solution for the longer-term outlook.

“Pumped hydro has the advantage of providing longer-term storage than batteries, albeit at slightly lower cycle efficiency than batteries,” Dr Gawler said. “It can be used to store the surplus renewable energy available in summer and make it available for winter when wind and solar yield is generally lower. Cross-seasonal storage is really needed to get the best out of our renewable resources.”

Professor Liebman echoed his sentiments. “If the Federal Government were to drop this project altogether, an alternative option would be to generate power through the development of off-river pumped hydro energy storage (PHES), as included in the AEMO 2020 Integrated System Plan (ISP) modelled investment options.”

“Battery storage would just as well serve the low duty expected from the gas turbine power plant, and indeed AGL and EnergyAustralia are pursuing utility-scale battery projects for this reason,” Dr Gawler said.

“It also helps to make better use of their purchased solar and wind resources and enables them to lower their carbon emission profile.”

The hydrogen-gas conundrum

Dr Gawler said low-cost hydrogen fuel can be an option in gas turbine plants that are designed to accommodate it. In this case, and when sourced from renewable energy, hydrogen can act as the back-up for a variety of energy sources without adding carbon emissions. However, this is only effective when the hydrogen can be delivered to site via carbon-free transportation (such as pipeline or tankers/trains using hydrogen fuel).

I

12 INDUSTRY INSIGHT

“At the moment, bulk hydrogen costs more than liquid fuel and natural gas, so it cannot compete commercially for power generation in the absence of a carbon price,” Dr Gawler said.

“Development of large-scale electrolytic processes for producing hydrogen from water using spare renewable energy is needed.

“Carbon pricing would create a commercial incentive for this transformation. There is little incentive at the moment.”

“There is no doubt that gas turbine technology powered by green hydrogen could play a role in the transition to zero carbon,” Professor Liebman said.

“However, based on the current data for the expected improvement of performance and the costs of alternative technology, there is no overall economic basis for the Federal Government’s proposal for a new gas turbine power station in the absence of low-cost hydrogen fuel.”

Dr Gawler said there are four themes at play in order to encourage investment in the development of a hydrogen industry, as opposed to more investment in gas. These are:

1. Establishing carbon pricing to value the emission abatement benefits of green hydrogen

2. Providing funds for research and development of the hydrogen economy to supplement the above

3. Developing an infrastructure plan that will enable Australia to eventually export green hydrogen at least cost

4. Discouraging the further development of natural gas producing fields with a plan to convert gas pipelines to hydrogen over time

Industry exhausted with federal intervention

According to Dr Gawler, many in the energy industry are not on board with the project, and are concerned that it may discourage or delay efficient developments in the sector as a result of market intervention.

The Clean Energy Council said the Federal Government’s build of a new gas-fired power station in New South Wales is “reckless and undermines Australia's efforts to deliver lower-cost power, reduce emissions and build a reliable energy system”.

Clean Energy Council Chief Executive, Kane Thornton, said, "Government intervention to directly build their own high-cost generation is not only a poor use of taxpayer funds but also further undermines investor confidence in the new generation.

“In the Clean Energy Council's most recent survey of CEOs of Australia's leading renewable energy investors, after challenges with the grid, 'Unpredictable or unhelpful government intervention in the energy market' rated as the second most significant challenge.

"If Australia is to ensure we effectively manage the transition of the energy system, we need to restore confidence in the role of governments to work collaboratively and focus on clear market signals for investment and customer confidence.”

“As a former energy market consultant and price forecaster, I know that investors rely on comprehensive analysis of the fundamental physical, regulatory and commercial environment before they invest in new assets,” Dr Gawler said.

“Interventions of this nature make it harder to attract finance for new projects and make it more expensive due to the additional risk.”

Dr Gawler said instead of the gas plant, he would like to see the Federal Government:

» Support the investment in the interconnection development and planning to open Renewable Energy Zones under AEMO’s Integrated Strategic Plan

» Stimulate the development of PHES technology and planning for the sites needed during the 2030s

» Identify the most efficient deployment of batteries at residential and utility scale and establish the commercial infrastructure for these batteries to be optimised for value and to maximise system reliability

“Storage is the next big game before hydrogen becomes commercially viable,” Dr Gawler said.

Lack of carbon pricing costs industry and consumers

Dr Gawler said that the absence of carbon pricing is a core contributor to inefficient interventions and poor decisions made in the electricity industry, and while carbon pricing is not a perfect solution, it would pave the way for carbon abatement.

“Admittedly, carbon pricing has the disadvantage of creating some windfall gains for some (such as Hydro Tasmania during the 2013-2015 carbon pricing era) and requiring some expensive compensation for those unable to compete (such as brown coal power plants and aluminium smelters),” Dr Gawler said.

“We have complex schemes for large and small-scale renewable energy, which would not be needed if we priced carbon appropriately.

“Carbon pricing would enable the consumers to contribute to the abatement program through their own purchases and lifestyle changes. The value proposition of transition to electric transportation would be clearer and stronger.”

Dr Gawler said the reimposition of carbon pricing would likely result in an initial rise of grid electricity costs, but this would eventually be offset by consumer responses and new investment in grid-scale resources.

“Electricity could be better priced to avoid disadvantaged consumers cross-subsidising wealthy consumers through the smallscale certificate technology scheme and energy based network service charges.

“Those who cannot avoid the necessarily higher prices can be compensated through adjusted pension and transfer payments as the Labor Government enacted. If carbon prices raised too much revenue, the Federal Government could reduce income tax and other less efficient state taxes to compensate.

“The economists have said for decades that carbon pricing leads to the lowest cost outcomes. It just takes some thinking to mitigate those who are disadvantaged in the short-term.

“The path forward would be easier for investors if we had long-term firm targets for carbon abatement and a clear pricing mechanism to achieve it.”

13 INDUSTRY INSIGHT

AND THEY’RE OFF: THE STATE RACE TO NETWORK REGIONS OF RENEWABLES

by Chris Allan, Journalist, Energy magazine

In 2020, the Australian Energy Market Operator (AEMO) released its 20-year vision for the National Electricity Market (NEM). A winning move in their strategy for renewables is the state-led networking of Renewable Energy Zones (REZs) – regional hotspots rich with renewable potential. Here we take a look at how these special districts of renewables could completely transform both state energy infrastructure and the NEM.

Building an Australian energy market that is more secure, reliable and affordable will require nothing if not wellinformed decision-making. Over the next 20 years, Australia’s states will transform existing network transmission to meet challenges like emission reduction targets, the growth of load centres, as well as the fair integration of new and decentralised means of energy generation.

But despite mounting pressures to future-proof the NEM, it’s worth remembering that the smartest network upgrades can begin with simply ‘working backwards’: by closely assessing existing infrastructure and natural resource potential, policymakers and authorities can fine-tune the best strategies for state upgrades.

September 2021 ISSUE 15 www.energymagazine.com.au

14 FUTURE ENERGY

Enter the Renewable Energy Zones

REZs are geographic hotspots of potential – state-based regions that are best suited for large-scale renewable projects.

At present, the state governments of Queensland, Victoria and New South Wales alone have committed to 14 Renewable Energy Zones, each zone featuring technologies like wind, solar, pumped hydro and battery storage.

The REZ report card

In 2020, the Australian Energy Market Operator (AEMO) delivered a detailed report card of candidate REZs across the states as part of its Integrated System Plan (ISP), a twenty-year blueprint for the national electricity market.

AEMO’s REZ report card, a standardised assessment of renewable energy hotspots, graded REZs on key performance indicators like average capacity, correlation of output with regional demand, and best storage option.

Why REZs make sense

A standardised upgrade of Australia’s renewable energy hotspots would bring renewable hubs onto the same playing field as the highly-dispatchable energy sources of our recent past, such as coal-fired generation.

REZs empower state experts to find optimal solutions for current challenges like ‘at-capacity’ transmission infrastructure, emission reduction targets, and the fair management of decentralised and diverse energy sources.

And emerging research continues to show that Australia’s renewable energy policy stands to benefit from regional solutions and technologies.

In July, the Blue Economy Cooperative Research Centre (BECRC) published a report that found that over 2,000GW of offshore wind power could be installed across Australia, all within 100km of existing substations and led by critical hotspots such as Newcastle, Gippsland, and Gladstone.

Renewable Energy Zones: state by state

Victoria

Victoria has already committed to six Renewable Energy Zones across the state. The $540 million of REZ funding comes as part of a $1.6 billion clean energy package in the 2020-2021 State Budget.

While the Gippsland REZ has good existing network capacity via historical coal-fired power infrastructure, upgrades to address network capacity issues in other Victorian REZs would relieve the output restrictions and loss factors that currently face generators.

The Australian Renewable Energy Agency (ARENA) has already advised that existing thermal and system strength issues should be addressed to avoid further curtailment of current and future energy projects in two north-western REZs (Murray River, Western Victoria). The six Victorian REZs are:

1. Gippsland (includes Hazlewood, Loy Yang regions)

With Victoria’s highest rating of existing network capacity (2,000MW), AEMO predicts significant renewable energy generation in the Gippsland REZ with “the retirements of coal-fired generation”. The Gippsland REZ stands to benefit from both a robust existing network in the region as well as excellent potential for on- and off-shore wind power.

2. Central North (Shepparton, Glenrowan)

The Central North REZ hosts existing solar projects, with modest potential for future solar and wind projects. However, an upgrade in transfer capability with NSW would unlock greater host capability (MW) for new projects.

3. Murray River (Bendigo, Kerang, Wemen, Red Cliffs)

Despite its remoteness, large-scale solar in this REZ could boost interstate connections, should transfer capability with NSW be upgraded. At present, generators face restricted output due to network capacity issues (voltage stability, thermal limits).

4. Ovens Murray (Eildon, Dederang)

According to AEMO, Ovens Murray was selected as a REZ candidate for both its existing pumped-hydro generation as well as proximity to the Melbourne load centre, making it an ideal candidate for Step Change energy storage.

5. South West Victoria (Portland, Heywood, Terang, Mortlake)

With moderate to good quality wind resources and large existing wind farms, the South West Victoria REZ has a 750MW hosting capacity via the 500kV network from Heywood to Moorabool.

6. Western Victoria (Ballarat, North Ballarat, Waubra, Bulgana, Horsham) While wind resources in the Western Victoria REZ are graded by AEMO as good to excellent, the current network is constrained and desperately needs transmission upgrades, with both interstate and regional augmentations on the cards.

Queensland

In Queensland, the State Treasury has allocated $145 million to launch three Queensland Renewable Energy Zones (QREZs) – corridor-like projects that span many of the original candidate hotspots proposed by AEMO. In September 2020, 192 projects registered their interest to be part of Queensland’s renewables pipeline.

The three QREZs are:

1. The Northern QREZ (includes Cairns, Townsville and Mackay)

The Northern QREZ offers excellent wind resources, and the Queensland Government has already secured $40 million in transmission upgrades between Cairns and Townsville that could unlock 500MW of new energy production.

The lead project under construction in the Northern QREZ is a 157MW wind farm at the Kaban Green Power Hub, scheduled to be operational by 2023. Further wind projects in the region could importantly “balance out” the uptime of energy production further south in the national electricity market.

Queensland Premier, Annastacia Palaszczuk, assured that alongside the Kidston Pumped Hydro Storage Project, the Kaban wind farm will “power the North and keep Queensland on track to meet our 50 per cent renewables target by 2030”.

2. The Central QREZ (Gladstone, Bundaberg)

The Australia New Zealand Infrastructure Pipeline (ANZIP) has identified Fitzroy and Wide Bay as probable locations for new renewable projects in the Central QREZ, which accepted registrations of interest (ROI) in September 2020.

The AEMO REZ report card found that the Fitzroy REZ has good solar and wind resources despite no existing renewable projects, while Wide Bay already features modest solar farms.

Although AEMO concluded that “significant transmission build” is needed to allow new projects in the Gladstone region to service the state’s southern load centres, storage options such as pumped hydro and batteries could be invaluable for buffering any future generation in the region.

3. The Southern QREZ (Toowoomba, Brisbane)

The Southern QREZ accepted registrations of interest (ROI) in September 2020, with the Darling Downs region being a key site for future project announcements. AEMO’s report card on the Darling Downs region found that it offers not only good solar and wind resources, but also “a strong network with good potential to connect renewable generation”.

As the only Queensland candidate REZ with access to the transmission network at 330kV, the Darling Downs region could lead support of the nearby load centre of Brisbane via a combination of wind projects and solar projects, with select storage options.

www.energymagazine.com.au September 2021 ISSUE 15 15 FUTURE ENERGY

New South Wales

In its 2020 Electricity Infrastructure Roadmap, the New South Wales Government committed to building five Renewable Energy Zones, delivering an intended network capacity of 12GW. The leading project of NSW’s rollout is the Central West Orana REZ, which has already garnered $40 million in state funding by June 2020.

The five NSW REZs are:

1. Central-West Orana (Dubbo)

The first REZ to be developed in NSW will be the CentralWest Orana pilot REZ, which is set to unlock 3,000MW of generation by the mid-2020s – enough to power 1.4 million homes. Concurrent upgrades of Central-West Orana transmission infrastructure will allow new generators to export electricity to the rest of the network. AEMO’s report card of the Central-West Orana REZ notes its invaluable proximity to the Sydney load centre. AEMO graded its solar and wind resources as high and moderate respectively, also noting opportunities for pumped hydro and battery storage.

2. New England (Armidale)

The NSW Government has locked in $78.9 million to develop the New England REZ, intended to deliver up to 8,000MW of transmission capacity. Registration of interest for generation, storage and network projects for the New England REZ closed in late July.

AEMO’s report card entry for New England noted its moderate to good solar and wind resources, its proximity to the Queensland border as well as opportunities for largescale storage via batteries and pumped hydro.

3. South-Wes t (Hay)

Early planning for the South-West REZ suggests it will be located around the town of Hay. Of note, this REZ is proximate to EnergyConnect, a proposed interconnector that could importantly link the NSW and SA markets.

While AEMO found that there are good solar resources in this area, extensive transmission upgrades are required for new generation to reach the load centre of Sydney.

4. Hunter-Central Coast

The NSW government selected the Hunter-Central Coast region as a future REZ despite it not being a candidate ever suggested in AEMO’s 2020 Integrated System Plan. In 2020, NSW Energy and Environment Minister, Matt Kean, explained that, “The Hunter has been at the heart and soul of our energy industry for generations”. Mr Kean further noted that new generation could make use of the existing transmission infrastructure set up by previous generators, such as the soon to be closed Liddell Power Plant.

5. Illawarra

The NSW Government’s selection of Illawarra as a planned REZ is recognition of its growing hydrogen industry. Indeed, Labor Member for Wollongong, Paul Scully, and NSW Greens Energy Spokesperson, David Shoebridge, have both raised the valuable application of hydrogen in essential industrial processes such as steel making.

South Australia

While AEMO did release its analysis of South Australian candidate REZs, there has been minimal announcements on the project from state government authorities.

According to AEMO, South Australia has already been a net exporter of energy to Victoria for the last two years, driven by the state’s early uptake of large-scale renewable projects as well as the recent decline of coal-fired generation in Victoria.

In a 2018 discussion paper on AEMO’s ISP, South Australian Minister for Energy and Mining, Dan van Holst Pellekaan, stressed his commitment to address ongoing congestion issues faced by existing renewable generators of his state.

Mr van Holst Pellekaan called for further involvement of generators in network decision-making, arguing that involving generators in conversations around transmission upgrades will “reduce the risk of overinvestment in transmission networks”.

While state response to the REZ program has been muted, South Australia is still well on its way to reaching net 100 per cent renewable power by 2030.

Projects like EnergyConnect, a proposed $1.5 billion interconnector project with New South Wales, speak to South Australia’s ongoing commitment to bolster its transmission network for the future.

Tasmania

While AEMO has identified three candidate Renewable Energy Zones in Tasmania, namely the North West, North East and Midlands REZs, state government authorities are currently in a period of community consultation, and have emphasised that development of Tasmanian REZs “will be complex and take many years”.

All three of Tasmania’s candidate REZs have good to excellent grade wind resources, with the Midlands REZ also offering good pumped hydro potential.

Although Tasmania has been a net exporter of electricity since 2017, and hasn’t yet announced any REZ funding to boost its existing renewables, the state could become even more influential in the future – Tasmanian wind farms have the potential to support the national electricity market during the down time of mainland generators.

The gold standard

Over the next 20 years, AEMO prescribes a 200 per cent increase in distributed energy resources (DER), such as rooftop solar, to cover at least 13-22 per cent of total consumption.

According to AEMO, the gold standard in energy generation of the future is a ‘highly diverse portfolio’ of energy sources, that takes us away from a centralised coal-fired generation system. Achieving this diverse portfolio will require large-scale renewable projects and technologies, not to mention dramatic upgrade of transmission infrastructure.

THE REZ LIFE CYCLE

According to AEMO, each REZ project progresses through five stages of development, from initial concept through to final construction:

1. Concept (Identify and refine candidate REZ sites)

2. Architecture (Functional network design, identify actionable projects)

3. Configuration (Community engagement, land-use assessment, improved costing)

4. Detailed Design (Detailed engineering design, finalisation of funding)

5. Construction and Commissioning (Agreements executed, financial close)

September 2021 ISSUE 15 www.energymagazine.com.au

16 FUTURE ENERGY

South-West

Northern QREZ

Townsville

Murray River

Western Victoria

Central North

Shepparton

Bendigo

South West

Ballarat

Mortlake

Central-West Orana

Dubbo

Dederang

Ovens Murray

Loy Yang

Gippsland

REZs are starting to take shape across the country, especially in Queensland, Victoria, and New South Wales.

Central QREZ

Gladstone

Brisbane

New England

Armidale

Hunter-Central Coast

Southern QREZ

Newcastle

Illawarra

Wollongong

www.energymagazine.com.au September 2021 ISSUE 15 17 FUTURE ENERGY

BIOENERGY INVESTMENT TO SUPPORT AUSTRALIA’S PATH TO NET ZERO

Leading Australian resource recovery company ResourceCo says an increasing focus on Australia’s carbon footprint, future net zero commitments from larger corporations, and bolder government policy is driving strong confidence in the sector.

The Clean Energy Finance Corporation (CEFC) recently identified an investment pipeline of up to $7.8 billion across Australia’s waste, bioenergy, recycling, and resource recovery sectors.

New and expanded infrastructure requirements for the sector are expected to deliver 9,000 construction jobs, 2,600 indirect jobs, and as many as 1,400 direct or ongoing jobs.

CEO of ResourceCo, Jim Fairweather, says global market pressures, evolving consumer preferences and an increasing focus on the country’s carbon footprint, both at an individual company and nationwide level, are driving significant transformation.

“It’s an exciting time to be involved and it’s important that we all work together to capture the opportunities for expansion across the Australian sector, driving strong economic and environmental outcomes,” Mr Fairweather says.

As an experienced investor in the bioenergy and thermal energy from waste sectors, the CEFC sees immediate and important investment opportunities in recycling and resource recovery, drawing on proven technologies and products.

Amongst those is Processed Engineered Fuel (PEF), which has the potential to address constrained and increasingly expensive landfill, and growing demand from industrial facilities, both in Australia and overseas, for lower carbon waste-derived fuels.

Head of ResourceCo Energy Systems, Henry Anning, agrees the scope for PEF is increasing as the global market continues to explore options for accelerating emissions reduction, while achieving cost-efficiencies.

“Increasingly, large-scale businesses are looking to renewable energy as a viable alternative to expensive, emissions generating fossil fuels. We’re continuing to progress some interesting and ambitious new projects across our national footprint which bears testament to the evolving opportunity,” Mr Anning says.

As a company, ResourceCo is a leader in the development of energy from waste plants, which deliver strong environmental and economic outcomes by repurposing materials otherwise destined for landfill, to generate clean energy.

ResourceCo Energy manufactures PEF primarily from waste timber materials but also non-recyclable plastics, cardboard, paper, and textiles.

“We’re solidifying our commitment to make progress for real change and to play our part in progressing Australia’s transition to a circular economy,” Mr Anning says.

ResourceCo’s optimism is also shared by its tyre recycling division, Tyrecycle, which is undertaking an expansive capital investment program – the biggest in the history of the company – with new plants planned for Sydney and Perth, as well as bolstering operations in South Australia, Victoria, and Queensland.

“We’re expanding our production capacity and capability for tyre-derivedfuel (TDF) and rubber crumb (used in road construction), ahead of the December 2021 ban on the export of whole-baled tyres,” Mr Fairweather says.

“We’re focused on progressing growth opportunities to improve access to export markets and supply chains, while also expanding local markets for recycled tyre-derived fuel products.

“We’ve got an important role to play in embracing innovation to expand the sector into a sustainable global contributor to a circular economy. The upside is huge.”

18 FUTURE ENERGY SPONSORED EDITORIAL

TOMORROW’S SOLUTIONS. TODAY

VICTORIA'S GAS INFRASTRUCTURE: WHAT DOES THE FUTURE HOLD?

by April Shepherd, Journalist, Energy magazine

As Victoria continues to pursue its goal of net zero emissions by 2050, Infrastructure Victoria has invited the community to respond to the latest interim report, outlining the possible future for Victoria's gas infrastructure, and how the state needs to change its relationship with natural gas.

Infrastructure Victoria has been asked to advise the Victorian Government on the state's gas transmission and distribution networks, offering a range of 2050 energy sector scenarios. For a state that has relied heavily on gas for over half a century, transitioning to zero emissions is going to require a whole-of-economy response and dedication to the vision.

Infrastructure Victoria’s new interim report, Towards 2050: Gas infrastructure in a zero emissions economy, discusses the role of gas infrastructure in a zero emissions economy, presenting evidence and analysis that will underpin Infrastructure Victoria’s final advice.

Community feedback on the evidence and analysis presented in the report may influence Infrastructure Victoria’s final response to the government, which will be presented in a report released in December 2021.

The advice will assess the relative economic, social, and environmental impacts of each scenario and identify infrastructure decisions that need to be made, ensuring opportunities for existing gas infrastructure use is optimised.

Evidence from the report so far shows that significant change is required to meet interim emissions reduction targets and reach net zero by 2050, developing four distinct illustrative scenarios.

Four gas scenarios

In developing the report’s evidence base, Infrastructure Victoria considered four illustrative scenarios to achieve net zero emissions for gas use in Victoria by 2050.

The scenarios test key variables regarding the potential technology mix (electrification, natural gas, hydrogen and biogas) and the mechanism by which net zero emissions can be achieved – whether emissions are eliminated or managed by solutions such as carbon offsets and carbon capture and storage (CCS).

The four scenarios are:

» Scenario A: full electrification, no natural gas (by 2050), no CCS

» Scenario B: partial electrification, limited natural gas use (in 2050), limited CCS

» Scenario C: green and blue hydrogen with carbon offsets, electrification, no natural gas (by 2050), no CCS

» Scenario D: large-scale brown hydrogen, large-scale CCS, no natural gas (by 2050)

Early findings from the interim report show:

» A mix of approaches will be needed to transform how Victorians use gas, to reduce emissions, manage risks, minimise costs and create new opportunities for jobs and industry.

» The Victorian Government can support greater use of proven, low carbon solutions including energy efficiency, electrification and biogas to achieve emissions reduction.

» There may be a role for gas-fired electricity generation to support our increasing use of renewable energy during the transition to net zero.

» The Government can continue to support further development and demonstration of emerging technologies, including low emissions hydrogen, biomethane and carbon capture and storage until their viability at scale is known.

» Reducing Victoria’s overall gas demand, especially in the household and commercial sectors where it is mostly used for heating, can reserve supplies for critical industrial purposes such as chemical manufacturing.

» Future infrastructure and network investment decisions can be tested for compatibility with pathways to net zero. For example, expanding existing gas networks to new residential and commercial developments may embed future emissions and could mean a larger potentially underused or stranded asset.

Gas to become history

Victoria's relationship with gas began in the late-1960s, with pipeline gas powering much of Victoria ever since.

A large gas network extends across the state, with storage facilities to help meet demand peaks and significant interconnections with other states.

The Victorian gas network includes 1,900km of gas transmission pipelines, 32,000km of gas distribution pipelines and assets valued at nearly $6 billion.

Victoria’s gas usage accounts for one fifth of the state’s emissions, so when the state committed to a whole-of-economy, net zero emissions target by 2050, under Victorian Climate Change Act 2017, gas was an obvious obstacle to conquer.

Infrastructure Victoria CEO, Michel Masson, said, “Natural gas has been good to Victoria for more than half a century, heating

September 2021 ISSUE 15 www.energymagazine.com.au

20 FUTURE ENERGY

our homes, cooking our food, and powering our industries and businesses all thanks to cheap, local supply.

“But the days of cheap gas are coming to an end.

“Natural gas is also a fossil fuel responsible for 20 per cent of the state’s greenhouse gas emissions, meaning our use of gas must change significantly if Victoria is to meet its emissions reductions targets and reduce the risks of climate change.”

What does the future hold?

Mr Masson said the road to net zero, regardless of how it happens, is a critical opportunity for the state that will affect most Victorian households, businesses and industries.

Towards 2050: Gas infrastructure in a zero emissions economy, states that, “The Victorian Climate Change Act 2017 establishes a system of coordinated, whole-of-economy actions to achieve a net zero emissions target by 2050, including rolling five-year plans and targets to reduce emissions".

Meeting the state’s emissions targets will be challenging. The Victorian Government has a crucial role to play in enabling

the transformation by providing clear market signals, creating incentives to reduce, replace or decarbonise gas, and aligning its own policies and regulations with interim and 30-year emissions reduction targets.

The report supports these sentiments, with the journey to cutting emissions slowly slipping to a matter of urgency, as the report states, “Victoria’s energy system must transform to reduce greenhouse gas emissions and limit the impacts of climate change”.

“Reducing greenhouse gas emissions at the scale required to meet net zero emissions needs an economy-wide response, including the gas sector.”

21 FUTURE ENERGY

Victorians have long used gas for residential heating; but according to Infrastructure Victoria, this will need to change if the state is to achieve net zero emissions by 2050.

IT’S DARK, IT’S STILL – IT’S DUNKELFLAUTE

by Chris Gilbert, Energy Networks Australia, Senior Economic Advisor

by Chris Gilbert, Energy Networks Australia, Senior Economic Advisor

Dunkelflaute (dunk-el-flout-eh) is a German word meaning ‘dark lull’ and is a phenomenon energy professionals need to know about and energy systems need to manage. It describes extended events with minimal wind or sunshine in highly-renewable electricity systems – and as Australia’s energy system transforms, it’s something we need to be aware of, plan for and overcome.

Whether you’ve heard of it or not, the challenge dunkelflaute presents is obvious – how to guarantee electricity supply when the dark lull descends?

In Australia, this has been referred to as a renewable drought. A recent lull in wind generation in South Australia is a smallscale snapshot of what could become a much larger problem in the future.

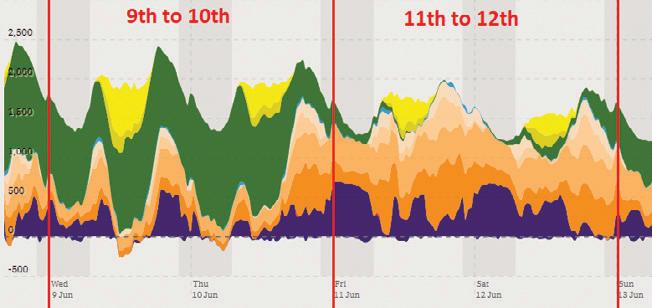

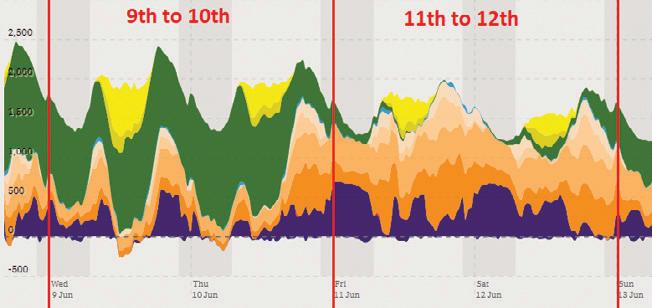

AEMO data (via Open NEM) shows that from 11-12 June, wind power (represented by green in Figure 1) generated fewer than 4,800MWh of a total demanded 55,000MWh, only 8.7 per cent of total generation. This is compared with 9-10 June when wind power generated 46,000MWh out of a total demanded 73,000MWh, contributing 63 per cent to generation.

Germany is in a similar position as South Australia in terms of renewable penetration. Renewable electricity in Germany contributed 45.4 per cent of electricity consumption in 2020, more than coal, oil and gas combined. Germany also has a significant transmission connection with the

EU, possessing more interconnectors than any other country in Europe.

In Germany there is a growing fear of dunkelflaute, as the share of renewable generation increases and displaces dispatchable generation. The type of event to cause dunkelflaute doesn’t have to be severe weather like we saw in Texas in February, it can be as benign as several still winter days in a row.

How do we manage dunkelflaute?

A recent Grattan Institute report, Go for net zero, referenced dunkelflaute as ‘the winter problem’. In the document, Grattan

notes that an energy system with 90 per cent renewable electricity would reduce emissions by 105 million tonnes at a cost of less than $20 per tonne. The final 10 per cent, however, is much trickier to achieve because the electricity system must increasingly rely on firming options.

The immediately available electricity storage option that might come to mind is batteries – but batteries tend to be best suited to managing hourly fluctuations across the day, charging from the midday sun and then discharging to help with the evening peak.

September 2021 ISSUE 15 www.energymagazine.com.au

22 FUTURE ENERGY

Figure 1. SA generation by resource type, 9th to 12th June 2021. Source: Open NEM.

Today’s batteries are not well placed to manage longer durations, with most having less than four hours of storage. The Victorian 300MW Big Battery project in Geelong is slated to be able to provide electricity to 400,000 households for one hour at full charge. That may be big, but managing dunkelflaute will require a much bigger battery.

Broadly, there appear to be three options that could assist the transition from 90 to 100 per cent renewables.

Lots of renewable generation and transmission

The first is building a diverse renewable generation fleet all across the country in hopes that the wind is blowing or sun is shining somewhere, while ensuring sufficient interconnection to transport large quantities of electricity all across the country. This option would result in a large amount of electricity being ‘wasted’, along with lowering the utilisation of interconnection, while still leaving room for dunkelflaute in severe cases.

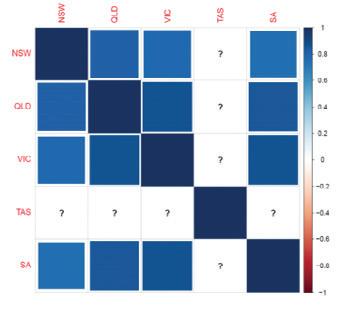

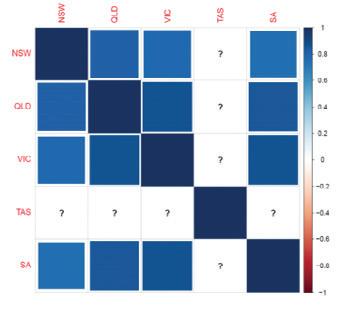

There is a positive correlation between solar energy across the National Energy Market (NEM) shown in Figure 2. When the sun is shining in one area, it is also likely to be shining in others, and vice versa. The absence of solar energy in one region may not be easily replaced by solar in another as different regions can be affected by similar weather systems.

Deep storage

The second option is building deep storage, like pumped hydro, that by its nature is well placed to provide storage capacity. Snowy 2.0 for example will be able to provide 2,000MW of generation capacity for 175 hours at full capacity. Grattan has modelled that across a ten-year period, up to 9GW of storage capacity might be required to bridge the largest gap between renewable generation and demand over 14 days. That’s about nine Snowy 2.0’s, assuming they all start at full capacity.

This type of deep storage solution is likely to sit idle most of the time and could be challenging to finance, with Grattan rightly noting that many optimal sites for pumped hydro have already been developed. Additional interconnection would also be required to connect this deep storage, which may again be poorly utilised.

Developing this much deep storage is likely to be incredibly costly and unlikely to be in the customer's best interests.

Zero emissions dispatchable energy

The third and most promising option is building zero-emissions dispatchable energy, consisting of renewable gas usage in gas powered generation plants. Natural gas already provides a similar role in today’s generation mix, and renewable gas will allow much of the current infrastructure to be utilised to support high levels of variable renewable electricity generation.

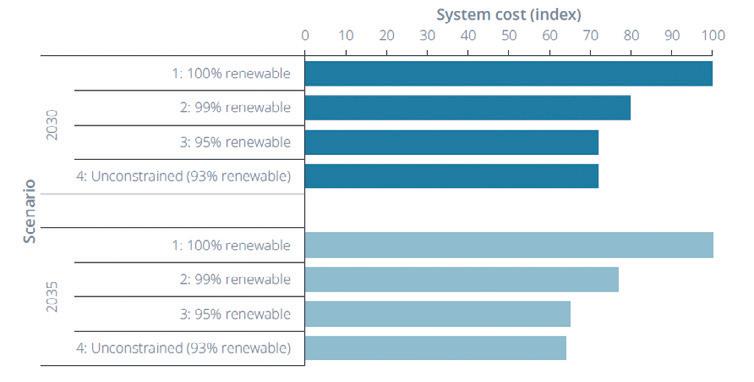

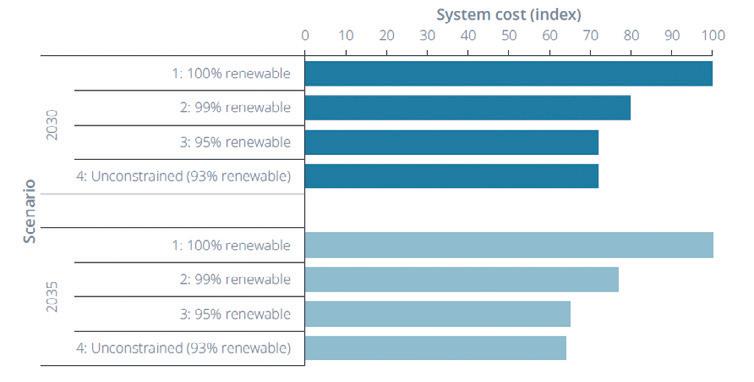

Frontier Economics examined the role of gas powered generation in South Australia during renewable droughts to support a

highly-renewable system and found that using gas powered generation could reduce the overall system cost by between 28 to 35 per cent per year, depending on the extent of the renewable drought during winter.

The optimal level of gas generation was found to be 7 per cent of total generation. If natural gas can be substituted by renewable gas into the future, it’s likely that full decarbonisation can be achieved by utilising existing infrastructure and lowering overall costs.

Managing the winter lull

Dunkelflaute is a challenging problem that requires detailed planning and mapping of the electricity system and usage throughout the year, rather than relying on averages that are more commonly talked about.

There are a range of technical options available to manage dunkelflaute. Batteries and pumped hydro can be good options for managing hourly and daily fluctuations in demand, but there are questions over longer durations. Shorter-term storage is likely to best be complemented by renewable gas electricity generation to manage longer periods of low variable renewable generation.

www.energymagazine.com.au September 2021 ISSUE 15 23 FUTURE ENERGY

Figure 2. Correlation of solar generation in the NEM. Source: Frontier Economics Bulletin – Sunny With a Chance of Wind.

Figure 3. Indexed systems cost for 2030 and 2035 – South Australia. Source: Frontier Economics (2021), Potential for gas-powered generation to support renewables.

NATIONAL MODELLING ELECTRICITY SECTOR PLAN

A federal climate research team – the Electricity Sector Climate Information (ESCI) project – this year achieved their $6.1 million goal of delivering high-quality climate data for the electricity sector to use. The publicly available resources of the ESCI project include high-resolution climate models, in-depth case studies, and a full risk assessment workflow – so it’s no surprise that industry leaders are already leveraging these new tools for electricity sector planning and risk modelling.

The ESCI project

Australia’s federal government is focused on delivering a more secure, reliable, and affordable energy market – but what does that look like in the context of future climate risk?

The Electricity Sector Climate Information (ESCI), a government project that provides climate modelling data for the national electricity market (NEM), has spent the last three years answering this question.

Born from recommendations of the 2017 Finkel review into the Future Security of the National Electricity Market (NEM), the ESCI project ran from 2019 to 2021, and brought together climate scientists with key actors in the electricity sector. Collaborators included the CSIRO, the Bureau of Meteorology (BoM), and the Australian Energy Market Operator (AEMO).

Key deliverables of the $6.1 million ESCI project include high-resolution climate modelling data, a comprehensive climate risk assessment workflow, and case studies of interactions between climate risks and the electricity market.

Some of the project’s intended outcomes for electricity market players include improving the safety of assets, maximising profitability, and pre-empting future shifts in consumer demand.

What’s on offer?

High-resolution climate modelling

A leading achievement of the ESCI project is the production of high-resolution climate projections that stretch as far as the year 2100, captured at sub-daily intervals.

The ESCI project’s national climate datasets simulate future change in climatic variables like minimum and maximum temperature, rainfall, wind speed, and forest fire danger index (FFDI).

According to a spokesperson for the Department of Industry, Science, Energy and Resources, climate modelling datasets have been specifically developed to address the interests of the energy industry.

“This data is available across all of Australia, however particular focus has been placed on 168 locations which are of interest to the electricity sector, including major demand centres and transmission lines, renewable energy zones and large conventional generators.”

The ESCI climate datasets, available in multiple formats including maps and time series plots, will empower industry stakeholders to consider how weather and climate variables can affect future infrastructure security, energy generation and demand patterns.

The climate risk assessment workflow

The three-year ESCI project has also delivered a comprehensive Climate Risk Assessment Framework, a five-step method for the electricity sector to integrate climate change risk into future decision-making.

Designed and tested by electricity sector stakeholders as well as climate experts, the ESCI’s Climate Risk Assessment Framework draws on existing documentation such as:

» International Standard ISO 31000: Risk Management

» International Standard ISO 14090: Adaptation to Climate Change

Each of the five steps in the ESCI’s comprehensive climate risk assessment is described and demonstrated by online user guidance resources.

24 FUTURE ENERGY

MODELLING DATA TO HELP AROUND CLIMATE RISK

Why consider climate risk in the industry?

The ESCI project statement points to existing evidence that the climate is fundamentally changing:

“Climate impacts on the electricity system have been felt through extreme weather events such as heatwaves, floods, wind-storms, drought and fires.”

A climate risk assessment considers the data of climate modelling, then answers the important question of how these trends could affect real-world vulnerabilities of our electricity market infrastructure.

Indeed, potential applications of climate risk assessment for the electricity sector include:

» Prioritising climate risks that require mitigation

» Managing asset safety, reliability, and potential for destruction

» Designing new asset specifications for future operating conditions

» Calculating market benefits attributable to regulate investments

» Looking at potential changes in cash flow and profitability

» Considering changes to operating conditions of the integrated power system

Case studies: climate and industry interactions

The ESCI project also delivered key case studies of interactions between climatic variables and industry infrastructure and priorities.

These case studies – covering topics such as the risk of bushfire along transmission routes – help show the applications of the ESCI project’s outputs, such as climate modelling and climate risk management – to solve real-world issues.

Case study: transmission in severe wind contexts

One of the ESCI project’s case studies considers how severe winds can cause transmission lines to fail, affecting the reliability of electricity supply to customers.

According to a Department of Industry, Science, Energy and Resource spokesperson, the ESCI project’s latest modelling of sever convective wind shows that “a number of existing transmission lines are built in areas that are vulnerable to high winds”.

“This does not necessarily mean these lines are built in the ‘wrong place’, because these risks need to be considered in conjunction with other business risks.”

The Department spokesperson pointed to risk reduction options such as transmission route planning, asset maintenance, engineering requirements and system redundancy options, to reduce the likelihood and impact of transmission line failures.

New horizons for ESCI data

The success of the ESCI project’s outcomes is already evident in uptake of project data by key industry actors such as the Australian Energy Market Operator (AEMO), and the Australian Climate Service (ACS).

A Department of Industry, Science, Energy and Resources spokesperson noted that AEMO has already used preliminary ESCI data in the influential 2020 Integrated System Plan (ISP), further stating that “the final suite of ESCI data gives AEMO an unprecedented collection of cutting-edge climate information to use in the 2022 ISP".

The ACS, a new Commonwealth body that launched its operations in July, will also draw on ESCI datasets among other resources to support Australia’s preparation for and response to climate events and natural hazards.

25 FUTURE ENERGY

GEARING UP FOR THE ENERGY STORAGE ERA

by Michael Bradley, Executive General Manager, Retail and Wholesale Markets and Victoria Mollard, Executive General Manager, Security and Reliability, AEMC

Whether they sit in our smartphone, garage remote control or laptop, batteries are integrated into our everyday lives.

As battery technology is increasingly used in consumer gadgets and electric cars, it has also gotten cheaper.

The costs of lithium ion batteries fell sharply by 89 per cent between 2010 and 2020 -- a trend that is set to continue, according to Bloomberg New Energy Finance research.

Battery technology is becoming more economic and more ubiquitous.

And batteries, along with other energy storage technologies, will play a more critical role in Australia’s future power system too.

The Australian Energy Market Operator’s 2020 Integrated System Plan forecasts an influx in storage across the grid: capacity is expected to be about eight times higher within the next two decades.

Meanwhile, state and territory governments across the southeastern and eastern states that make up the national electricity market (NEM) have rolled out policies to incentivise storage.

More households with solar batteries are expected.

So too are more grid-scale storage systems and the emergence of innovative new business models that combine different technologies behind a connection point to both consume and export electricity.

As batteries continue to play an increasingly important role in Australia’s evolving energy system, the Australian Energy Market Commission is laying the foundations for the best ways to integrate batteries – and distributed energy sources – into our grid.

To be sure, storage systems are not new in the Australian electricity grid. Part of the iconic Snowy Hydro scheme, Tumut 3, was built in 1973 as a pumped-hydro unit that can store energy.

Since the 2017 connection of the Hornsdale Power Reserve in South Australia, four further grid-scale batteries have been hooked up to the NEM. Others are planned.

Underscoring the potential for hybrid facilities, North Queensland’s Kennedy Energy Park – the nation’s first project to combine solar, wind and battery storage behind a connection point – has recently started sending electricity to the NEM.

Given the forecast influx of energy storage, the time is right to look at how changes to the national energy rules can accommodate the exciting new storage era that is upon us.

The Australian Energy Market Commission has been working on a slew of complementary projects that will get the market ready for a future where batteries have a pivotal role to play – to back up the cost benefits of a burgeoning fleet of weather-reliant renewables, soak up excess solar power from rooftop PV, and provide important system services as aging coal-fired generators retire.

These projects include our draft plan to integrate storage into the NEM, our final decision to create a fast frequency response service that rewards providers like batteries for providing ultra-quick frequency control, and our work to smooth how we embed distributed energy into the system so that all energy consumers benefit.

26 FUTURE ENERGY

All are aimed at providing stronger incentives for storage while also safeguarding the security of the electricity system.

All dovetail with the Energy Security Board’s (ESB) work in developing a fit-for-purpose future market.

While some of our work solves pressing immediate issues, it also takes important foundational steps towards the two-sided market being developed through the ESB’s post 2025 project.

Our draft decision on integrating energy storage, which we’ve released in response to a rule change request from the Australian Energy Market Operator (AEMO), makes it easier for grid-scale storage to participate in the NEM.

Our plan would allow the owners of both small household and grid-scale batteries to achieve greater value from their investment.

The draft rule creates a new category of market participant that accommodates a variety of different participants who can both offer and consume energy, and the important ancillary services that maintain security in the NEM.

The new category is technology-neutral and so includes grid-scale storage, pumped hydro, hybrids and aggregators of small-scale generation and storage units.

Importantly, by creating the one category we can also be ready for tomorrow’s technologies, helping spur innovation in them. Take hybrids. These weren’t in operation when the National Electricity Rules were first designed. But by allowing wind and solar projects scope to provide their own solutions to weather intermittency by co-locating with a battery, our proposal could help enable renewables.

Another example, aggregators, would be able to provide both energy and market ancillary services to the grid.

While some retailers are already doing this with customers through virtual power plant trials, we expect both aggregators and retailers would be able to do so if registered under the new participant category. This level playing field paves the way for innovative new businesses who would be better able to use batteries to their full potential and gives customers a greater choice of services.

Households with solar panels and batteries could earn extra income by signing up with these aggregator businesses who could access multiple markets on behalf of consumers that they weren’t able to before.

This is in line with our proposals on integrating small-scale solar and other distributed energy resources into the grid, by

having market signals that reward customers for exporting or not exporting power to grid at different times in accordance with system needs.

These projects work together to provide the incentives that will lead to batteries becoming an important feature of the future energy market and an enabler of the transition to a lower emissions power system.

For large batteries, our draft plan would streamline the way batteries register and participate in the NEM. It does this by removing the need for batteries to register under two different categories, which has been costly and complicated, and by allowing them to compete evenly with other market participants.

Also, as AEMO had raised concerns about a lack of clarity on how network charges apply to grid-scale storage and hybrids, we are proposing minor amendments to clarify how these network charges apply. Our draft doesn’t exempt any specific technology, including batteries, from charges associated with using the network. Instead, it makes it clearer that the network tariffs should better reflect the cost of how and when the network is used. We are taking submissions on these proposals until September 16 and welcome all views.

As well, under our final decision that creates a fast frequency response market, large batteries will be able to earn revenues by supplying two brand new markets: a “raise” service to correct falling frequency, and a “lower” service for rising frequency – each within two seconds.

While there are existing Frequency Control Ancillary Services (FCAS) markets – the fastest response time is currently six seconds. These new markets open the door to ultra-fast options not currently available in the energy sector.

The new markets allow any technology to participate that can provide this service to keep the system secure in real-time. Batteries are likely to be large participants because they are extremely well-placed to inject power to the grid in two seconds or less.

The type of large-scale disruption and change now occurring in the energy sector is throwing up plenty of challenges. But the opportunities to think about and do things differently are immense and exciting. We’re pleased to have advanced this important work that will pave the way for batteries and other storage solutions in the NEM. It’s a stride along the path to a very different future.

27 FUTURE ENERGY

ZENAJI AEON BATTERY PASSES ALL AUSTRALIAN TESTS