Ranging in size from trailer mounted 20kVA generators to multi-megawatt power plants, we have the rental power you need to get the job done and to keep your electricity on. So, whether you have a planned project or emergency requirement, give us a call today to safeguard your operations.

In the past three months, we’ve been inundated with reports and inquiries into the current state of the energy industry. Everyone from the Australian Competition and Consumer Commission to the Australian Energy Market Operator, the Australian Energy Market Commission, the Energy Security Board and the COAG Energy Council have had their say on where we’ve gone wrong, and what we need to do to fix the industry.

Faced with a multitude of evidence, opinion and political commentary, it’s been difficult to know who to believe – or more importantly, to decide how we can best come together and move forward.

One thing I think we can all agree on is this: the time for reports is over. Just about everyone who could potentially weigh in has had their say. The facts have been laid before us, and we now have the basis to establish the best path forward.

But more importantly, the time for political point scoring is over. If nothing else is taken away from the various reports that have been tabled in recent months, let it be this – we will not solve the energy trilemma without a bipartisan approach to energy policy.

Ultimately, we all want the same thing. The conjecture is how we achieve it. Let’s put it bluntly: it’s time for our governments to grow up, come to the negotiating table and agree on a fair and just energy policy that will achieve the best outcomes for our people, our productivity and the planet.

That is the challenge currently facing our federal and state government ministers. Will they rise to meet the challenge? Time will tell. But with a federal election year looming, it’s becoming increasingly clear that energy policy is going to remain front page news for a while to come.

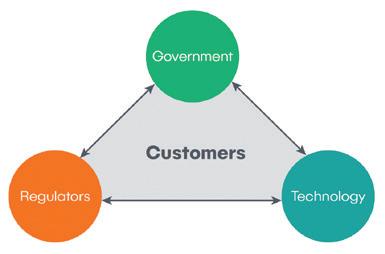

In the meantime, we need to remember what lies at the heart of our industry – and that is the customer. We must remember, they’re not interested in these increasingly politicised reports. What they do care about is working towards a solution that results in power that is clean, affordable and reliable.

This issue of Energy is full of stories from companies and individuals who are working to provide their customers and broader stakeholders with innovative energy solutions. The political landscape might feel gloomy, but there’s still so much we can do as an industry to tackle the challenges we’re currently facing head on.

We’ve had our time to have our say. Now’s the time to come together, with a unified voice, and provide the solutions our customers, large and small, are so desperately seeking.

Ed McManus became the Chief Executive Officer of Powershop Australia in January 2016. In this role, Mr McManus is driving a unique service that gives customers transparency and control like they’ve never had before over a key part of their household budget – their energy bill. With a strong and growing customer base, Powershop powers more than 100,000 households and businesses from across Victoria and New South Wales.

Mr McManus is excited by the challenge of trying to make a connection with customers in an industry where trust is currently low. But it’s also the idea of being a part of a business that strives to have a positive impact on the future of the planet that pushes him daily.

Mark Butler has been the Labor Member for Port Adelaide in Federal Parliament since 2007, and is the Shadow Minister for Climate Change and Energy. Mr Butler served as Minister for Ageing and Australia’s first Minister for Mental Health in the Gillard Government. He has also held the ministries of Housing, Homelessness, Social Inclusion, Climate Change, Water and the Environment. Mr Butler is the author of Advanced Australia - The Politics of Ageing, published in 2015; and Climate Wars, published in 2017.

Suzanne Falvi leads the team responsible for reviews and rule changes relating to system security and reliability in the Australian energy market. A principal focus of the team in the past year has been the extensive system security work program, and a detailed review of reliability frameworks in the national electricity market. She also leads the AEMC’s reliability panel secretariat. Before her appointment as Executive General Manager, Ms Falvi was an AEMC senior lawyer. She previously worked as senior energy policy adviser for the ACT Government , as in-house counsel for a solar technology R&D company, and for Minter Ellison specialising in competition, energy, administrative law and commercial litigation. She holds a Bachelor of Economics, a Bachelor of Law with Honours and a Master of Laws in International Law from the Australian National University.

Steven Neave began his 29-year career as an electro-mechanical draftsman and engineer, before moving into senior management roles responsible for design, and more recently control and operations. In December 2015, Mr Neave was appointed General Manager of Electricity Networks, overseeing asset management, strategic planning and augmentation, compliance and day-to-day operations activities for VPN. Mr Neave has a Bachelor of Electrical Engineering and a Masters in Entrepreneurship and Innovation.

Joining Standards Australia in 2017 as a Policy Manager, Michael Paparo works on the role standards play in supporting industry, government and consumers across each sector of the Australian economy. Prior to joining Standards Australia, Mr Paparo worked in professional policy for over five years at the Property Council of Australia, Chamber of Commerce & Industry Queensland (CCIQ), and as an official at the Commonwealth Treasury in Canberra.

As an enthusiastic entrepreneur with experience in founding and growing start-up companies, Lachlan Blackhall has combined his love of business and skills in engineering and mathematics to become an inspiring teacher, mentor and innovator. While completing his PhD studies in engineering and applied mathematics at ANU, Dr Blackhall founded InnovationACT, a business planning and entrepreneurship outreach program; and after finishing his PhD, he co-founded Reposit Power, a technology company that designs systems for grid-deployed energy storage. In his current role at ANU, Dr Blackhall leads a team designing and implementing the building blocks for powering the future electricity system with battery and energy storage.

Andrew Bray is the National Coordinator of the Australian Wind Alliance, which represents farmers, wind-workers, small business and community members who value wind power as a clean, safe and effective source of energy. Mr Bray has a passion for wind power and the positive contribution it can make to the local economy and to helping Australia transition to a cleaner energy supply. Mr Bray is based in one of NSW’s prime wind districts, near the Capital Wind Farm on Lake George in the Southern Tablelands.

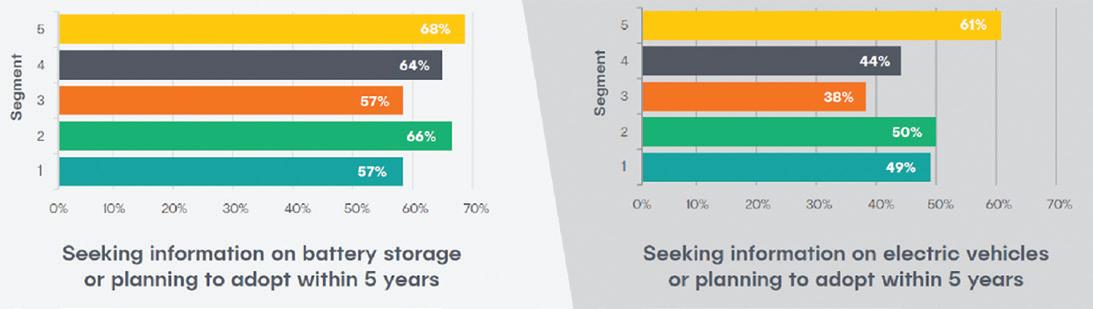

Pene Newitt is a Team Leader in the Business Intelligence and Data Analytics Function at Western Power. As leader of the Insights and Analytics team, she is responsible for providing actionable information for the business on both current and topical questions. Ms Newitt's team is accountable for insights regarding emerging technologies in the customer and commercial space, including electric vehicles, community batteries and solar PV distribution. Furthermore, it delivers relevant analytics in such areas as value positioning, reliability of supply, revenue protection and health and safety. Ms Newitt has been part of the Western Power team for five years, working in both customer and business strategy. She has 15 years’ experience in customer analytics for services industries, including banking, superannuation, land development, telecommunications and energy.

The electricity market has been scrutinised by the Australian Competition and Consumer Commission (ACCC), which released its final report from the Retail Electricity Pricing Inquiry in July.

The Inquiry, which commenced in March 2017, began by identifying the root causes of high electricity prices across the entire electricity supply chain, and has now made 56 recommendations detailing ways to fix the National Electricity Market.

“The National Electricity Market is largely broken and needs to be reset. Previous approaches to policy, regulatory design and competition in this sector over at least the past decade have resulted in a serious electricity affordability problem for consumers and businesses,” ACCC Chair Rod Sims said.

“There are many reasons Australia has the electricity affordability issues we are now facing. Wholesale and retail markets are too concentrated. Regulation and poorly designed policy have added significant costs to electricity bills. Retailers’ marketing of discounts are inconsistent and confusing to consumers, and have left many consumers on excessively high ‘standing’ offers.”

The ACCC estimates its recommendations, if adopted, will save the average household between 20 and 25 per cent on their electricity bill, or around $290-$415 per annum. Further, Australia’s 2.2 million small to medium businesses could save an average of 24 per cent on their electricity bill, and commercial and industrial customers could see electricity costs decrease on average by 26 per cent.

Energy Consumers Australia Director of Research, Lynne Gallagher, said the final report confirms what consumers are telling them: that the electricity market is not working as it should.

“Energy affordability is the number one concern of consumers – they want comfortable homes, competitive businesses and bills that don’t make them so anxious that they put off opening them,” Ms Gallagher said.

According to Ms Gallagher, this review is the most thorough assessment of the electricity market in a very long time, and provides the evidence base for reform to improve energy affordability.

“The report sheds new light on why prices are increasing, identifying significant issues around network costs, concentration and structure, and the way that retailers are presenting offers and engaging with consumers,” Ms Gallagher said.

The Australian Energy Council’s Chief Executive Sarah McNamara said, “There is no secret to why energy prices are high. The ACCC acknowledges that previous approaches to the design of policy and regulation over a decade have pushed up prices for households and businesses.

“The energy industry acknowledges that consumers find the retail market confusing and that is why we have been working with regulators at both the state and federal level to make energy offers easier to understand."

“The energy industry has also been dealing with more than a decade of energy policy uncertainty that has had an adverse effect on much needed investment in the wholesale market.

“The ACCC report indicates there are no simple solutions but that more steps can be taken to improve confidence in the energy market.”

Jemena has announced that a major project milestone has been reached, with the 622km Northern Gas Pipeline (NGP) now complete.

Antoon Boey, Executive General Manager of Corporate Development at Jemena, confirmed the landmark was reached with all 622km, and approximately 34,000 lengths of pipe, being welded, lowered in and now fully buried in the trench.

“The sheer scale of this project is enormous – the largest current gas pipeline project in Australia. This milestone is due to the fantastic effort of those working in remote, hot and often dusty conditions,” Mr Boey said.

“Overall the project is tracking on schedule. Apart from the pipeline, we’re thrilled that construction of the Mount Isa Compressor Station is also finished, and that completion of the Phillip Creek Compressor Station in the Northern Territory is imminent.”

The pipeline and both compressor stations will now be rigorously checked before gas commissioning later this year.

“When Jemena was awarded the contract to develop and construct the NGP in 2015 we committed to constructing the pipeline on time, safely, providing training and employment opportunities for people from the communities surrounding the pipeline, and introducing competition into the east coast gas market,” Mr Boey said.

“What we’re seeing today is these promises being fulfilled. We are so proud of how the NGP has provided training, development and other opportunities to people from the communities surrounding the pipeline.

“Almost 800 jobs have been created as part of the pipeline’s planning and construction phase – around 700 of which have been awarded to people from local communities along the pipeline route. Plus we’ve seen $120 million spent with businesses in the Northern Territory and Queensland.”

Mr Boey said the Northern Territory had a unique opportunity to grow its economy and contribute to the east coast gas shortage.

“Jemena is progressing its plans to extend and expand the Northern Gas Pipeline and will continue to work with the community to understand how they can contribute to this next phase of growth and activity.

On commissioning, the NGP will be able to deliver 90TJ of much needed gas per day, with 70 per cent of available capacity in year one having already been contracted to support manufacturing and jobs in Northern Australia.

In June 2018, Jemena announced its agreement with Incitec Pivot Limited (IPL) to transport at least 32TJ of gas per day to supply its Gibson Island facility. This follows Jemena’s foundation agreement with the Northern Territory’s Power and Water Corporation to transport 31TJ of gas to IPL’s Phosphate Hill facility for ten years.

“Discussions with other parties are also well advanced, and we remain confident that the NGP will be fully contracted by the time it is operational later this year,” Mr Boey said.

Australia is aiming to increase renewable electricity generation to 33GW hours by 2020, with hydroelectric power stations expected to play a huge role in achieving the goal.

According to a study by the Australian Renewable Energy Agency (ARENA), a project in Germany proves that wind farms, combined with pumped storage power plants, can help achieve the energy transition and stabilise the grid.

The procurement and investment costs for renewable energy sources, such as solar and wind farms, are steadily declining since solar panels and wind turbines have now become massproduced, which in turn has lead to falling production costs.

To ensure the success of the energy transition, power generation from volatile energy sources needs to be secured with energy storage. To this end, a study commissioned by ARENA identified 12,000 potential sites for pumped storage power plants throughout Australia.

According to ARENA CEO Ivor Frischknecht, “Pumped hydro is the most common and most mature form of energy storage. We are exploring the potential for pumped hydro to play a greater role in delivering Australia’s electricity needs. The findings of this study prove there are opportunities across Australia worthy of further investigation.”

The Water Battery from Max Bögl Wind AG is a completely

new and innovative large-scale storage system that combines renewable power generation with a modern pumped storage power plant.

The first Water Battery project is currently being developed near Stuttgart, Germany. It consists of a wind farm with four wind turbines – including the highest in the world at 178m – and a pumped storage hydroelectric power plant with an installed capacity of 16MW.

This storage concept is extremely flexible and can switch between electricity generation and storage within 30 seconds, which makes it possible to make short-term adjustments to the demands of the electricity market.

The storage concept uses the tower base of the wind turbines as water storage facilities, with a storage capacity of 70MW hours. A penstock connects them with a hydroelectric power station and its lower reservoir located 200m further down the valley.

“The Water Battery is a natural storage facility that stands out due to its durability and high degree of flexibility,” CFO at Max Bögl Wind AG, Jürgen Joos, said.

Josef Knitl, Board Member of Max Bögl Wind AG, added, “Without large-scale and forward-looking projects and ideas, the energy transition cannot succeed. With Water Batteries and Hybrid Towers, we are making wind energy a more attractive and efficient source of clean energy.”

Cromarty have successfully developed a simple semi-dispatch solution that not only meets AEMOs requirements but provides some significant benefits for intermittent generators.

> One off cost

> Supports multiple facilities from one server

> Flexible

> Rapid deployment

Innovative new technology being rolled out by Ergon Energy will assist electricity networks, allowing more homes and businesses to export power from solar PV systems into the grid.

Manager Intelligent Grid New Technology, Michelle Taylor, said the first low voltage static synchronous compensators – commonly known as statcoms – were installed in Mossman

and would continue to be rolled out to other parts of regional Queensland.

“This is an Ergon initiative that will assist the network, which was designed in an era of one-way power flows, to adapt to the rapidly changing network environment where many homes and businesses are both consumers and exporters of power,” Ms Taylor said.

“Queensland has one of the highest rates of solar PV penetration of any state in the world, with more than 140,000 systems connected to Ergon’s grid."

“This has resulted in some sections of Ergon’s network reaching their acceptable voltage limits due to rising voltage levels caused by solar PV systems.”

Statcoms regulate the voltage on sections of the network where they are installed, enabling more households to feed solar power into the grid and managing peak load voltages.

While statcoms are not a new concept, Ergon’s innovative application of the technology uses small-scale statcom devices to help manage the low-voltage network.

“Ergon’s technology innovation engineers successfully delivered a proof of concept for the statcom equipment in 2014 and successfully trialled test versions of the technology in 2015. This device can now be a new tool in the toolbox for solving network issues,” Ms Taylor said.

In the November issue of Energy, we’ll run an exclusive interview with Ergon Energy, looking at their new statcom technology, and the impact it can have on solar grid integration, in greater detail.

» Reliable Cat® engines designed and built for petroleum applications.

» Energy Power Systems Australia (EPSA), Australia’s only authorised Cat® engine dealer with seamless support provided by Cat®service dealers.

Industrial applications of energy storage systems are now about more than power reliability and durability, customers want a deep understanding of the cost of ownership and profit opportunities, tailored to drive efficiencies and gains from investment.

EXIDE’s energy storage solutions cover all this and more, from the highest quality deep cycle AGM, GEL & Lithium battery technologies, customised DC Systems for critical standby power and soon to be released modular and fully scalable solutions of the “Restore” product range.

Restore is a customisable energy storage solution for on & off grid energy storage applications. It comes inclusive of an intelligent all-in-one power and energy management system enabling most kinds of electrical power and energy flow. Restore solutions embraces many platforms for user interface and remote communication requirements, from the standard Local HMI, browser based, smart phone and tablet access for remote monitoring and diagnostics giving the user the autonomy to manage and maintain as required.

Contact GNB Industrial Power to find out about our energy storage solutions and our Restore pre-launch product data pack.

Construction on Tasmania’s $280 million Granville Harbour Wind Farm has begun.

Once completed, the wind farm will have 31 turbines providing 112MW of capacity, enough to power more than 46,000 homes.

Construction comes after Hydro Tasmania announced in 2017 that it reached an in-principle agreement with Westcoast Wind in relation to a power purchase agreement.

In addition to Granville Harbour, construction on Cattle Hill Wind Farm in the Central Highlands is progressing, and Hydro Tasmania is continuing with its $1 billion ten-year upgrade to facilities to increase generation by 250GWh, which is enough additional generation to power over 30,000 Tasmanian homes.

The Granville Harbour Wind Farm will contribute towards plans to double Tasmania’s renewable energy capacity, and connect to the network at Reece Power Station.

Hydro Tasmania's Director of Wholesale Energy Services, Gerard Flack, said the business will buy about 360GWh of energy and renewable energy certificates per year from the new wind farm.

“The birth of Granville is another sign that Tasmania’s national energy revolution is really taking off,” Mr Flack said.

“We’re delighted to be supporting the Granville Harbour Wind Farm, and helping to make it happen.”

Tasmania currently has about 300MW of on-island wind power capacity, providing almost 10 per cent of Tasmania’s electricity.

The Battery of the Nation initiative, including plans for more interconnection, will open the door for up to 3000MW of Tasmanian wind power.

“Tasmania has huge natural advantages, including an existing hydropower system, exceptional wind resources, elite expertise and the headstart we’re already taking,” Mr Flack said.

“Pumped hydro energy storage supports and complements wind development. Our work to identify Tasmania’s best possible pumped hydro sites under Battery of the Nation is progressing well.

“We’re pleased that the Tasmanian and Federal Governments have committed to pursuing the next stage of a business case for a second Bass Strait interconnector.”

Western Australia will soon be home to the country’s first green hydrogen innovation hub, with the Australian Renewable Energy Agency (ARENA) announcing that the project will be based in Jandakot.

In Jandakot, ATCO will trial the production, storage and use of renewable hydrogen to energise a commercial-scale microgrid, testing the use of hydrogen in different settings and applications including in household appliances.

The $3.3 million development project will evaluate the potential for renewable hydrogen to be generated, stored and used at a larger scale. ATCO aims to assess the practicalities of replacing natural gas with hydrogen at a city-wide scale across a municipality.

Green hydrogen will be produced from

on-site solar using electrolysis, fuelling a range of gas appliances and blending hydrogen into the natural gas pipeline.

The project will also build upon ATCO’s distributed energy hybrid energy system trial called GasSola, which includes the installation of rooftop solar with battery storage and standby natural gas generation for nine residential sites in Western Australia’s south west.

ARENA CEO, Ivor Frischknecht, said the ATCO trial could lead to hydrogen being used more widely across Australia.

“Green hydrogen offers opportunities to provide carbon free energy to cities and towns, while leveraging existing natural gas infrastructure,” Mr Frischknecht said.

“Along with ARENA’s research and development funding round focused on exporting hydrogen, this project will explore the opportunities for hydrogen in Australia, which could also include the development of standards for green

hydrogen production, distribution and use.” ATCO Managing Director and Chief Operating Officer, Pat Creaghan, said “Securing this grant is a major accomplishment. We intend to play a leading role in the development of forward-thinking, clean energy solutions, and our Clean Energy Innovation Hub is at the very heart of those plans. The project has many exciting elements, but what truly sets it apart is the use of excess renewable energy, which would typically be lost to the system, to produce hydrogen.”

Environmentally friendly, rock solid reliable and low cost

This is the power of the future.

Installing Capstone microturbines in trigeneration provides industry leading reduction in greenhouse gas emissions from power and provides building owners and tenants with electricity at up to 50% lower cost than grid power. Ultraquiet, zero vibration and 80,000 hour fixed cost lifetime warranty, Capstone turbines deliver class leading Green Star ratings and guaranteed low cost electricity.

With over 500 installed in Australia Capstone turbines are the first choice for Australia’s leading buildings.

Purchase | Rental | Power Purchase Agreements

Ed McManus, CEO of Powershop Australia and Meridian Energy, hasn’t been involved in the energy industry for a long time, but in the four years since he joined the sector, he’s made a big impact. At the helm of a company with the mandate no more simple, or more complex, than to be “a better power company”, he has his work cut out for him. Managing Editor Laura Harvey sat down with Mr McManus to discuss his thoughts on the energy trilemma, whether the market or policy is the best way forward, the integration of renewables into the grid and gaining back the trust of energy customers.

It’s the puzzle everyone in the energy industry is currently trying to solve – how do we provide users with energy that is cleaner, affordable and reliable, while taking into account things like our existing electricity grid, prevailing market conditions and the evolution of energy?

Over the past 12 months, the conversation within the industry has frequently focused on whether the trilemma is something that can be solved by the market, or whether policy intervention is required. And if policy intervention is required, what exactly would that look like?

Despite the lack of clarity, according to Mr McManus, the last 12 months has been promising for the industry. He refers to the range of large projects being committed to and under construction as a sign that the market does work – the industry has responded to the record wholesale prices we have recently seen by investing in renewables projects and other forms of new generation, which will increase supply and serve to drive prices down.

“When the market works, you get more investment in generation, and that investment is predominantly in renewables – not solely, but predominantly – and the positive there is that consumer bills will track downwards as a result of that.”

Given this faith in the market, it does raise the question – if the market is working, why then is it so common to see leaders in the energy industry calling for policy certainty?

“This is a central issue I’ve been grappling with,” notes Mr McManus. “Firstly, I think some policy certainty is important, because the investment is not sustainable long-term unless you have that.

“Secondly, if we want to meet our Paris target to reduce emissions to 26-28 per cent on 2005 levels by 2030, we will really need the electricity sector to overdeliver against other sectors, such as agriculture, where reductions will be much harder, and potentially much more costly to achieve.”

For Mr McManus, it ultimately comes back to what we want to deliver.

“If you just want to deliver market reform and for prices to come down, we probably don’t need a pull mechanism to drive more renewables into the market. But if we really want the electricity sector to overdeliver, then perhaps we do.”

The other key element of solving the energy trilemma is the need to provide energy that is reliable, and with more renewables entering the grid, we need to look at how we can firm these up.

“I’m pretty optimistic about meeting that challenge because we have got lots of options there,” says Mr McManus. “The in vogue word at the moment is firming, and there’s a few organisations that have released firming products. There’s also a huge debate at the moment about Snowy 2.0, and there is work that’s been done at ANU looking at potential sites for pumped hydro across the country.”

These technologies, along with others such as grid-scale batteries, and the potential to improve the efficiency of existing, regular hydro projects – are all examples of why Mr McManus is optimistic about the potential to firm the capabilities of some of the renewable technologies we have access to today.

“There’s also the next generation of technology, things that are either experimental or things that are no longer experimental but probably don’t stack up on a cost perspective, like thermal solar and tidal energy – eventually, these technologies will likely become viable from a cost perspective, further enhancing the arsenal of technologies we have to work with.

“I think it all adds up to a future where – and I’m not saying we’re going to get to 100 per cent renewables tomorrow – but we’re certainly going to see a lot more renewable, reliable power in the grid.”

Mr McManus also feels that demand management will play an ever increasing role in the way we manage, and solve, the energy trilemma.

Traditionally, in the national grid, demand management has been the domain of larger loads – when demand has been high in the grid, we look to large users, such as aluminium smelters, and turn them off for a short period.

But now, with residential demand management increasingly being recognised as having an important role to play too, Powershop has been one of the first retailers to put a demand management program in place for its customers.

Currently, approximately ten per cent of Powershop customers are subscribed to Powershop’s demand management program, which sees them sent a text message as periods of high demand are approaching, asking them to curb their usage by approximately ten per cent for a short period of time.

“We give our customers suggestions for what they need to do,” says Mr McManus. “When the temperature is 42 degrees, we’re saying turn the air conditioning from 17 degrees to 23, or cook on the barbeque instead of using the oven, or don’t do the washing at that time.”

It’s a relatively simple process, and according to Mr McManus, getting people to respond is pretty easy, which is impressive given that the financial incentive isn’t huge at this point in time.

“What we find is that many customers are interested in doing it not for the financial incentive, but because they feel it’s the right thing to do and it is part of the future.”

In the future, Mr McManus believes that we’ll start to see retailers sharing data and sharing their experiences in customer demand management as part of the process towards getting customer demand management right.

“For consumers, and for us as an organisation that essentially manages risk, that’s the core value we can add,” says Mr McManus.

“Having customers with peak demand when prices in the market are high is a huge risk for us, because that’s the price we pay as the retailer.

“Demand management is a win for customers, it’s a win for the grid and it’s a win for retailers. We’re quite bullish that it will become another form of firming, like gas peakers, pumped hydro, and batteries – all these things will be in the mix to manage the system.

“I think it’s very feasible for us to be able to turn down system peak demand by 20-30 per cent into the future,” says Mr McManus. “Think about large buildings for example, you could switch off the air conditioners for five minutes without people in the building having any negative discernible impact.

“And in the future, businesses will be more adaptable. Some businesses need to run 24/7, but others can chase load when prices are cheaper, like in the middle of the day when all the solar is running.”

Given the benefits that demand management can offer, it begs the question – should governments be mandating demand management programs from retailers and participation from customers?

According to Mr McManus, the answer isn’t so simple.

“I wouldn’t favour a system where it’s mandated, because in the end, the financial incentives will take care of participation.

“Don’t get me wrong, I’m a big supporter of demand management, but for individual consumers, the market will find the lowest cost.”

Mr McManus believes that as our energy system evolves, and more renewables enter the grid, it will effectively make the market more “peaky” – and more susceptible to price volatility.

“In the future, managing risk for a retailer will be more expensive,” notes Mr McManus. “So as a consumer, we might be able to say to you, ‘Hey instead of giving you $10 to reduce your load at certain times, we’ll give you $50’. And when it’s $50,

people are more likely to do it. And as a retailer, instead of having 10 per cent of your consumers on board, you might have 50 per cent.

“That’s just an example of the market working and finding the cheapest way of doing things. And I would always advocate for letting the market find the way because central planning will not find the cheapest way.”

Against the backdrop of the greater issues affecting the energy industry, Mr McManus, through the two companies he leads, is working to provide customers with a better power company.

“What does that actually mean? It means things like investing in renewable generation, which brings prices down; it means not door knocking people’s homes to bring customers on board; it means providing customers with an app that shows them how much of the product they’re buying each day – they’re the sorts of things we’re trying to do to improve how consumers view us as a company and the whole industry.

“And we’re seeing that has impact beyond us. Many of the large companies have stopped residential door knocking, and we’re not the only ones with an app now – although we were the first!

“That’s innovation though, that’s how it works. So we have to be on our toes and keep delivering the next thing, because others will follow when the innovation is good.”

Powershop has a long generation model, so a key focus will be on securing the customers to match the load the company currently has sourced.

One of the key ways the company will do this is by launching retail gas in Victoria. 80 per cent of electricity retail customers in Victoria have gas as well, and most of them prefer to purchase both fuels from the one retailer.

Also key will be continued experimentation to get the customer offering right.

“We don’t do big bang,” notes Mr McManus. “We try lots of different little things to see how they go. We have a culture where people feel like they can try things and not be penalised when they don’t work. No one in Powershop ever gets penalised for having a go at something and it not working.”

With its history of innovation in the sector, there’s little doubt the industry will be watching closely to see where Mr McManus steers his ships next.

by Mark Butler, Shadow Minister for Climate Change and Energy

by Mark Butler, Shadow Minister for Climate Change and Energy

Like every advanced economy in the world, Australia is faced with an energy sector undergoing rapid technological change. Yet for the last ten years, Australia’s transition has been hampered by the “climate wars” waged in Parliament and beyond. The heightened politicisation of climate and energy policy has resulted in a policy paralysis which threatens to stifle new generation investment from 2020, undermine a managed modernisation of our energy sector, undermine any decarbonisation efforts and expose the sector and the broader economy to heightened financial as well as operational risks.

While the technical and policy challenges that our energy transition entails are substantial, they pale into insignificance alongside the political challenge of establishing a bipartisan policy consensus on energy. What is often lost in the debate is the fact that, were climate change not an issue at all, we would still be facing a national need to replenish large parts of our electricity generation infrastructure. In particular, ageing and increasingly unreliable coal generation built in the 1960s, 70s and 80s will need to be replaced in the next two decades. With large and small-scale renewable costs continuing a long-term downward trend, and coal costs remaining relatively constant, even without a climate imperative, we would expect to see fundamental change in how and where we generate electricity, as well as how we use it. Managing this transition would be a national challenge, even in the best of all possible worlds, but we don’t live in the best of all possible worlds and we cannot ignore the imperative of climate change.

Australia has rightly signed up to the Paris Accords, which commit Australia to do our fair share of greenhouse gas abatement to limit global warming to well below two degrees. The Paris Accords include a process for increased ambition, and Australia’s initial Nationally Determined Contribution (NDC) of a 26 per cent economy-wide emissions cut is only the first in what is meant to be a series of commitments that increase over time to deliver the overarching Paris Accord goal.

We cannot ignore our obligations under the Paris Accords and we should not pretend they are fully exhausted by the Coalition’s initial NDC. This means the transition we would expect in the electricity system will need to be larger and faster than would occur without a climate change imperative.

Given the scale of the transformation we are facing, we need

sound policy to guide and manage the transition.

After several false starts with an Emissions Intensity Scheme and Clean Energy Target, the National Energy Guarantee (NEG) is now the policy we are debating to deliver this transition. The design of the NEG has come a long way since it was first released in an eight page letter from the Energy Security Board. While significant progress has been made, the core and seemingly intractable difference between Federal Labor and the Federal Coalition remains the emissions reduction obligation under the NEG.

We take the view that the NDC of a 26 per cent economy-wide emissions cut on 2005 levels by 2030 falls short of what we need to deliver. Labor has accepted the Climate Change Authority’s advice on our fair contribution to Paris, and adopted a 45 per cent emissions reduction target. But this isn’t the only point of contention. The Government has decided the electricity sector should only do its pro rata share of any economy-wide emissions reduction task, placing an equal abatement task on the rest of the economy. But electricity has the lowest abatement cost of any sector, and decarbonisation in electricity will drive decarbonisation in other sectors like transport and industry.

The Energy Security Board’s final design paper for the NEG shows by 2021, Australia would have already reduced emissions by 24 per cent, on a 2005 baseline – due to the current rush of renewable investment being driven by the LRET – essentially leaving the abatement task of the NEM over the 2020s to just two per cent by 2030. In contrast, the agriculture, transport and industrial sectors will need to cut their emissions by over 40 per cent over the same period, according to the government’s latest emission projection data. These are sectors that have far fewer abatement opportunities, and whose opportunities come at much greater cost.

It is not only economically efficient for the electricity sector to take up a greater burden of emissions cuts; it is increasingly seen as an opportunity by the sector itself. For example, Origin Energy has been clear that it sees the Government’s electricity abatement target as too low, saying “the electricity sector can do more than its pro rata share of the target, as it has costeffective abatement options available to it which could be unlocked given the right policy settings”.

It is clear to all the energy experts and industry insiders the transition of our energy sector, while being a challenge, is also a huge opportunity. It is an opportunity to better serve customers, to modernise our infrastructure, to create

new businesses and jobs, to develop new supply chains and export markets, and to take advantage of our massive human and natural renewable energy resources.

In order to make sure this transition benefits the Australian people, creates new wealth and doesn’t leave people and regions behind, we need government policy that works with the currents of technology and economics, not against them. The role of government, especially when large transitions occur, is to manage risks, protect equity and guide the country to a more prosperous future. It is not to fight against an inevitable future.

The debate in Parliament has been reduced to the Prime Minister proclaiming coal may be in the energy mix “possibly forever” and signalling further market intervention into extending ageing, increasingly unreliable coal-fired power stations. While coal will continue to play a part in our energy mix for years to come, to ignore the inevitable transition to a clean energy economy is a farce. It flies in the face of the need for what we call a “just transition” plan for communities that will inevitably be confronted with the closure of their power stations.

Just transition puts affected workers and communities at its centre. It means industry, workers and governments coming together and doing what’s needed to ensure no one is left unemployed and without support. But central to any just transition is a cooperative and collaborative approach between workers and their unions, industry and government, regardless of party affiliation.

While working towards a bipartisan solution to the energy crisis has been our preferred solution, Federal Labor has had a clear commitment to emissions reduction since the 2016 election. Our targets, a 45 per cent cut in emissions (on 2005 levels) by 2030, net zero emissions by 2050 and 50 per cent renewable energy by 2030, need to be workable under any energy policy.

The complexity and divisiveness of energy policy make it easy to get bogged down in the details. That’s why it is crucial to remember the big picture.

Any sensible energy policy must do one central thing: support the modernisation of our energy system. That means replacing old coal generation that will close in coming decades with cleaner and more flexible renewables backed up by dispatchable technology, whether battery or pumped hydro storage, gas generation or demand management. Delaying this inevitable transition isn’t a plan for cheaper, cleaner or more reliable power; it is a recipe for wasted time and resources, higher prices and pollution.

In July, the ACCC released the final report from its inquiry into electricity supply and prices in Australia. Here, Sarah McNamara takes a comprehensive look at the recommendations in the report, and highlights the one critical factor we need to get right to avoid being faced with another detailed report in the not too distant future.

The National Electricity Market is one of the most examined, reviewed and regulated markets in Australia.

Last year we had the comprehensive Finkel Review, and more recently, extensive work on the proposed National Energy Guarantee (NEG). Rounding out consideration of the electricity market is the Australian Competition and Consumer Commission’s (ACCC) forensic report into electricity prices.

The 400-page ACCC Retail Electricity Pricing Inquiry is an exhaustive survey of more than 10,000 documents from across the sector and delivers 56 recommendations on how to ‘reset’ the National Electricity Market (NEM).

The debate which has followed its release highlights a simple truth known by anyone who works in the industry: we are living with the results of at least a decade of fumbled energy policy at various levels of government. So there are no real secrets why energy prices are high for the average household.

The Australian Energy Council doesn’t accept all the characterisations in the ACCC’s report, but it is a valuable outline of how we arrived where we are now. While many of its recommendations appear straight forward, others will take time to properly assess – this is highlighted by one of the report’s key points, that there can be unintended consequences with significant repercussions from not getting it right. In fact, it is how we got here in the first place.

The lead up and final release of the ACCC report revived strong debate on what is needed to ‘fix’ the NEM –ranging from more renewables to new coal-fired plants, price re-regulation, limits on ownership, asset breakups and government-backing for new entrants. It also encouraged renewed finger pointing variously at networks, at wholesale markets and generators, government green schemes and at retailers, privatisation, market interventions and government ownership to name a few.

Overall the report makes it clear that the electricity market has been compromised

by the approach of policy, regulatory design and promotion of competition: “At all stages of the supply chain decisions have been made over many years by many governments that set the NEM on the wrong course,” it says.

So at different parts of the electricity supply chain, decisions were made over many years by governments of all persuasions and in different jurisdictions that ultimately led to the claims that the NEM is ‘broken’.

Despite this commentary, the NEM has operated as it was designed. The big bumps in the road have come from various interventions, with the biggest being in the form of not having bipartisan policy to manage the transition to lower emissions generation.

The ACCC has pointed to increased spending on networks, driven by reliability standards for some networks that were set too high. It also points to state government decisions over generation assets, excessively generous solar feed-in tariffs – like the so-called premium feed-in tariffs that effectively led to an ‘arms race’ as jurisdictions appeared to outdo their neighbours in supporting rooftop PV at a time when the costs of solar panels were much higher than today. The result, as noted by the ACCC, was that the subsidy to consumers for the energy they produced outweighed “by many multiples” the value of the energy. The cost of these premium schemes continue to be felt by all electricity users in their bills.

While political parties argued over the best way to shift to a lower emissions generation sector, the main pillar that was used to encourage low emissions electricity generation was the Renewable Energy Target (RET).

The RET has been effective at drawing wind and solar generation into the system, but has blurred investment signals for investors. The only policy for years was to support renewable generation, which accelerated the closure of older, firmer generation. And as this dispatchable generation closed it pushed up wholesale prices – again this is what the market was designed to do.

In fact, the ACCC notes that the NEM was designed to have high prices to prompt new investment in new generation. And because there was no emissions policy in place (aside from the RET, which drove just one type of generation) older, dispatchable plants were pushed out and not replaced.

The report suggests that existing generators had not invested and taken advantage of higher spot prices. But there was nothing to invest against –dispatchable generation tends to be long-life assets, so investors had not wanted to commit to generation until they understood what might be coming. They also find it harder to get financing given this carbon risk.

Higher prices were additionally exacerbated by an increase in gas prices, with gas generation becoming the price setter in NEM regions like South Australia with the exit of older, coal-fired plant.

The ACCC has also pointed to retailer discounting and electricity customer confusion as a factor in households paying more for their electricity. There is work underway to look at ways to address this and an acknowledgement from retailers that discounting can be confusing and requires addressing. Already we are seeing fixed price products entering the market. We can expect to see more changes.

If the ACCC’s work has told us anything, it is that getting policy wrong will ultimately lead to higher prices and distortions which, ironically, then require intervention to achieve a change in direction.

The ACCC has provided a rear view mirror look at how we got off track, and it has tried to present a map so we can navigate back onto a firm base.

We still have a way to go until we have smooth running, but all that is needed for consideration has been put forward and now it is up to government at all levels and of all stripes to agree. If they don’t, things will continue to go from bad to worse and we will be discussing another detailed report in the not too distant future.

So now the hard work begins –implementing the myriad of suggestions on how to reset the electricity market.

The Clean Energy Council, the peak body for the renewable energy and energy storage industry in Australia, recently released its annual Clean Energy Australia Report. The 2018 report provides a comprehensive overview of the current state of the Australian clean energy sector and the latest key figures and statistics on the national energy market.

It is the only analysis that includes the National Electricity Market, the Western Australian electricity grid and other major regional grids across the country in areas such as the Northern Territory.

Approximately 700MW of renewable projects were completed and began generation in 2017. With seven times that amount either under construction or with financial support at the end of 2017, the clean energy industry is on the verge of a major breakthrough.

According to Bloomberg New Energy Finance data, large-scale wind and solar project activity pushed investment in Australia up 150 per cent to a record US$9 billion in 2017.

Globally, clean energy investment amounted to US$333.5 billion last year. This was three per cent higher than 2016 and the second

highest annual figure ever – just seven per cent less than the record US$360.3 billion reported in 2015.

Almost 1.1GW of solar PV was installed in the small-scale market in 2017, which was a record for the rooftop solar industry. Considerable growth also occurred in the medium-scale solar sector, with 131 projects adding 53MW of new capacity. There is now 167MW of cumulative capacity in the medium-scale solar sector, representing an increase of more than 500 per cent over the past five years.

Four new large-scale solar projects were completed in 2017, with the largest being the 50MW plant built by Genex at Kidston in North Queensland. Total installed large-scale solar capacity reached 450MW at the end of 2017, compared to just 34MW at the end of 2014.

The wind sector also experienced a large amount of activity in 2017, with 15 new wind farms either under construction or financially committed at the end of the year. The 547MW of new capacity added in 2017 was the third highest amount added in the history of the Australian wind industry, bringing total generation capacity across the country to 4816MW.

For the first time ever, wind and hydro generation contributed an almost identical amount of electricity – approximately 5.7 per cent each – to total national electricity generation during the year.

Early in 2018, the Clean Energy Regulator (CER) announced that there were enough projects at a sufficiently advanced stage to meet the large-scale Renewable Energy Target (RET).

The CER has previously estimated that approximately 6000MW of large-scale generation capacity would need to be announced and built between 2016 and 2019 to meet the target of 33,000GWh of additional renewable energy by the end of the decade.

There has been 6532MW of new large-scale generation firmly announced between 2016 and the time of the CER announcement in January 2018. The majority of this is either under construction or already operating, and the rest is expected to begin construction in 2018.

The Australian Capital Territory has the most ambitious renewable energy target in the country, and is on track to deliver on its goal of 100 per cent clean energy well before its 2020 deadline.

The ACT was the first state or territory to run a reverse auction scheme for new renewable energy, a process that invites companies to bid on the construction of new wind and solar projects for the lowest cost. The first reverse auction for 40MW of

large-scale solar projects was held in 2012 and 2013, followed by three 200MW wind power reverse auctions in 2014, 2015 and 2016.

The feed-in tariffs awarded as part of the auctions are fixed for 20 years, helping to protect Canberra residents from sharp rises in wholesale electricity prices.

The last project to be built under the scheme will be Union Fenosa’s Crookwell 2 Wind Farm, which is due for completion in the second half of 2018. All the other projects have now been completed.

Although New South Wales does not have a specific renewable energy target, the State Government has set a long-term target for NSW to have zero net emissions by 2050, including in its energy sector. As part of this goal, the government’s Climate Change Fund Strategic Plan aims to double the state’s level of renewable energy capacity to more than 10,000MW by 2021.

NSW was one of the leading states for new large-scale renewable energy projects at the beginning of 2018, with the government approving eleven largescale solar energy plants in the previous 12 months. State renewable energy penetration was recorded as 11 per cent but this figure includes the ACT.

The Northern Territory has set itself a target of 50 per cent renewables by 2030, but renewables only accounted for four per cent of its power generation in 2017.

In late 2017, an independent expert panel produced the Roadmap to Renewables report, which provided eleven recommendations on how the NT Government can achieve its target. These included making renewable energy a central pillar of the NT Government’s economic policy and a series of other financial, regulatory and technical recommendations.

Meeting the 50 per cent renewable

energy target will allow NT to move away from its reliance on gas and diesel, which currently accounts for 96 per cent of its energy generation.

Queensland

Queensland has set a 50 per cent renewable energy target by 2030, but in 2017, only eight per cent of the state’s electricity came from renewables.

As part of its $1.16 billion Powering Queensland plan, the government’s Renewables 400 initiative held a reverse auction for up to 400MW of new renewable energy capacity, including 100MW of new storage. Renewables 400 attracted 115 proposals from 79 businesses, adding up to more than 9000MW of new capacity –more than 20 times the amount needed.

Several areas of the state have emerged as large-scale solar hubs, including Townsville in North Queensland and the Darling Downs west of Toowoomba.

Queensland already has the largest number of rooftop solar installations of any state or territory, as well as eight of the top ten solar postcodes in the country.

South Australia set a target of 50 per cent renewable energy by 2025, which it had almost achieved in 2017, with 45 per cent of the state’s electricity coming from renewable sources.

In March 2018, after 16 years of Labor in power, the state elected a Liberal government. The effect that this will have on renewable energy in the state is yet to be determined.

The new Premier has promised support for storage at the household level, and pledged to build a new interconnector to NSW. He has also backed the solar thermal plant planned for Port Augusta.

Electranet is conducting extensive analysis about whether the proposed transmission line to NSW will be a positive for South Australia. Its report is due mid-2018.

Tasmania

With its extensive hydro power network supplying almost 90 per cent of the state’s energy needs, Tasmania has traditionally been Australia’s renewable energy leader.

In April 2017, Hydro Tasmania announced its Battery of the Nation plan, which could double the state’s renewable energy capacity from 2500MW to 5000MW through pumped hydro storage, wind farms and upgrades to existing hydro power facilities.

A number of new wind farms are under development in Tasmania, with the state’s north-west being touted as “Australia’s wind farm capital”. The Robbins Island Renewable Energy Park is a proposal for a 450MW project, with the possibility of being expanded to 1000MW if a second interconnector is built to the mainland. This would make the wind farm the largest in the Southern Hemisphere.

Victoria

The Victorian Government has committed to two renewable energy targets: 25 per cent by 2020 and 40 per cent by 2025. Renewable energy penetration in 2017 was 16 per cent.

This will be supported by the Victorian Renewable Energy Auction Scheme, a reverse auction to fund 650MW of new renewable energy, with 100MW of this specifically for large-scale solar. The scheme is the largest renewable energy reverse auction in Australia and will result in a significant increase in renewable energy projects in Victoria.

The Victorian Government has also announced the outcome of tenders under its Renewable Certificate Purchasing Initiative, which involves the government procuring renewable energy certificates directly from new Victorian projects.

The 31MW Kiata Wind Farm and the 132MW Mt Gellibrand Wind Farm were the successful projects under the first stage of the initiative, while the 88MW Bannerton Solar Park and 34MW Numurkah Solar Farm were awarded tenders under the second stage of the competitive tender process.

Western Australia

Western Australia has traditionally lagged behind the eastern states when it comes to renewable energy, but during 2017 more than 1000MW of wind and solar projects were seeking connection approvals and finance in the state’s south-west.

However, WA is the only state or territory in Australia that hasn’t committed to a target for renewable energy or zero net emissions. Renewable technologies accounted for 14 per cent of the state’s total electricity generation in 2017.

In late 2017, the WA Government announced that state-owned power utility Synergy will set up a green power fund with investment from the Dutch Infrastructure Fund, providing an opportunity for investors to finance a portfolio of renewable assets to diversify risk and reduce costs.

The Australian Energy Market Operator (AEMO) estimates that another 700MW of new renewable energy capacity will be

required to meet WA’s share of the Renewable Energy Target, and Western Power estimated in mid-2017 that more than 1000MW of new projects are in the pipeline.

Increased confidence in renewables has resulted in an unprecedented level of industry activity, with the rooftop solar sector reporting a shortage of qualified electricians in some areas.

By the end of 2017, many established solar retailers were reporting that the increased level of activity sometimes made it difficult to find enough qualified electricians to complete all the work that was coming in, and these market conditions helped trigger a steady increase in the number of accredited solar installers.

By the end of 2017, the number of installers accredited with the Clean Energy Council had grown to 4941. This was slightly more than the 4824 registered at the end of 2012, which was the previous highest year for the sector. The number of new accredited installers per month increased by 60 per cent in 2017 compared to the year before.

If the demand for solar continues throughout 2018 – and many of the factors that drove the strong results in 2017 are still in place – the level of opportunity will lead to more electricians doing the necessary training to expand into the solar sector.

Increased project activity for large-scale wind and solar also resulted in a growing number of jobs in regional areas across the country.

Affordability challenges continue across the National Electricity Market, following significant price rises over the past decade.

According to the Australian Electricity Market Commission (AEMC), the national average annual residential electricity bill in 2016-17 was $1424, up from $1296 in the previous financial year. The prediction for 2017-18 is a further rise to $1576, before falling to $1495 in 2018-19 and $1387 in 2019-2020.

The AEMC found wholesale electricity costs – the cost of generating power – has been the single biggest driver of residential electricity bill increases recently. Earlier price trend reports had identified network costs as the main upward driver. High gas prices and the closure of several coal-fired plants combined to lift wholesale electricity prices by almost 11 per cent nationally.

A report by the Australian National University showed that between 2006 and 2016, electricity price rises were highest in the states with relatively low levels of renewable energy and a high reliance on gas and/or coal generation (136 per cent in Queensland, 118 per cent in Victoria and 109 per cent in New South Wales). In contrast, South Australia, which now generates almost half of its energy from renewables, experienced a far lower electricity price rise (87 per cent) over the same period.

For communities and businesses in remote areas, the choices with regard to reliable power sources have traditionally been somewhat limited, but Aggreko’s solar-diesel hybrid package has been designed to change all of that.

Traditionally, these customers would rely on generators powered by fuel sources such as diesel. And while such fuel sources are very reliable, they’re often expensive, and they’re not the best energy choice as far as the environment is concerned.

With decreasing costs in recent years, solar power is rapidly becoming an attractive proposition for remote customers. However, the reality is, it is an intermittent fuel source – night falls or clouds come in, and power is lost. Seasons change and power capacity drops, which means that businesses cannot rely on it as a sole energy source.

Looking for a solution that combined the benefits of diesel and solar, and counteracted the weaknesses of each fuel source, Aggreko developed its solar-diesel hybrid package. Combining solar with diesel-generated modular power to complement, the

result delivers the best of both worlds – uninterrupted power 24/7 at an affordable cost.

Battery storage is the third pillar of Aggreko’s offering, and key for a stable and reliable power supply. It strengthens a customer’s grid by buffering the impact of fluctuating power demand and supply; and at the same time, the lifespan of generators is increased, and associated operations and maintenance costs decrease because the generators are run less often and more efficiently.

The hybrid package seamlessly combines solar, diesel and battery storage thanks to a state-of-the-art energy management system, minimising operating costs without compromising on reliability. The result is constant, reliable power around the clock, with significant cost savings – all packaged into a single contract, for customer peace of mind.

Aggreko’s hybrid package is designed to benefit any customer or industry with a power need in locations with limited or no access to permanent power. These include remote communities, and the construction, mining and utilities sectors.

For more information about Aggreko’s solar-diesel hybrid package, head to www.aggreko.com.au.

KEY BENEFITS

Significant cost savings

Available, reliable power 24/7

A single turnkey contract for solar and diesel

No upfront capital outlay

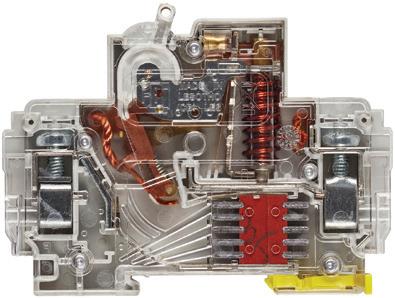

REMOTE ACTUATION UNIT

CBI circuit breakers utilise Hydraulic Magnetic Technology which always carry 100% of rated current with the trip point unaffected by changes in ambient temperatures.

The RAU is a factory fitted module that enables the automated switching of our DD frame circuit breakers. It can actuate the breakers both on and off. Supports DC TO 300Amps and AC to 100Amps

LOW VOLTAGE RELEASE

The voltage release (LVR) unit is a factory fitted module that will trip the attached circuit breaker(s) when the supplied voltage at the LVR terminals reduces below the release value. Two LVR units can be connected, namely, one to either side of the circuit breaker unit, for fail safe applications where redundancy is required. The unit will prevent the reconnection of the circuit if the voltage present on the LVR terminals is less than the latching voltage.

300V 400V 600V DC 13MM CIRCUIT BREAKERS

Space saving Circuit breakers 13mm wide single pole or double pole. The space saving is achievable by the use of the hydraulic magnetic technology, available up to 50Amps

SOLAR BATTERY STORAGE

80Vdc and 80,100,125,150 200 and 250Amps units available.Units come complete with 2 breakers in a compact enclosure for easy connection to the circuit breaker busbar. Also available without the enclosure for retro fitting.

Australia’s most comprehensive clean and renewable energy exhibition and conference, All-Energy Australia, is expected to hold its biggest event ever as it celebrates its tenth anniversary on 3-4 October 2018 at the Melbourne Convention and Exhibition Centre.

All-Energy Australia’s 2017 event was attended by more than 6500 renewable energy industry professionals from across the country and overseas, making it the largest attendance on record.

Robby Clark, Exhibition Director of AllEnergy Australia, said the event’s success is reflective of the remarkable progress in the renewable energy industry.

“Last year’s attendance exceeded our expectations, with queues of people lining up to get into the plenary sessions and exhibition floor. The tremendous success of the event is an indication of the rapid growth of the renewable energy industry.

“All-Energy Australia has provided the perfect venue to celebrate the industry’s successes and discuss the challenges and new market opportunities for Australia’s energy system. We’re confident that this year’s program will maintain the event’s reputation as the must-attend event for the renewable energy industry,” Mr Clark said.

Kane Thornton, Chief Executive of the Clean Energy Council, strategic partners for the event, echoed this sentiment.

“The robust conversations and meaningful connections that come from this event are of immense value to an industry

in the midst of an unprecedented boom.

“All-Energy Australia 2018 takes place at an important stage as we continue to work towards achieving our vision of an Australia powered by clean energy,” Mr Thornton said.

Now in its tenth year, All-Energy Australia 2018 will remain Australia’s largest all-encompassing clean and renewable energy event, featuring more than 180 industry speakers, over 180 exhibitors, six conference streams and four networking opportunities.

The conference program will be divided into six streams, with more than 180 industry leaders sharing exclusive insights and projections on how to tackle the future of the energy sector. The speaker list includes representatives from Federal, State and Local Government, the Clean Energy Finance Corporation, CSIRO, KPMG, Redback Technologies, DNV GL, Hydro Tasmania, the Clean Energy Regulator, Smart Commercial Solar and Siemens.

The first day will kick off with an opening plenary, featuring a ministerial welcome by

On Day 2, Powershop’s Chief Executive Officer Ed McManus and Zen Ecosystems’ Chief Financial Officer Michael Joffe will take part in a panel discussion in the opening plenary, discussing the game changers of the energy industry and looking at bringing positive disruption to the future energy system. This will be followed by a presentation from Shadow Assistant Minister for Climate Change and Energy, Pat Conroy.

This year’s All-Energy Australia is over 40 per cent larger than the 2017 event, which means more industry-leading companies showcasing more innovations and emerging technologies, more expert advice and more live demonstrations.

Over 180 companies have already confirmed to be part of

the exhibitor lineup at All-Energy Australia 2018 including ABB, NEXTracker, Tesla, Jinko Solar, Fronius, Canadian Solar, SolaX Power, Array Technologies, Flex, Clenergy, Delta Energy Systems and Ecoult.

All-Energy Australia has scheduled a number of networking opportunities for attendees to meet like-minded professionals, such as the Grand Networking Event where All-Energy Australia will celebrate its tenth anniversary, and the Clean Energy Council will hold the Solar Design and Installation Awards.

Other networking opportunities include the Clean Energy Council’s Women in Renewables lunch, the all new lounge called the Power Club and the Meet the Speakers social.

To access the 2018 program and register for free, please visit the All-Energy Australia website, www.all-energy.com.au.

Selecting the right foundation for a ground-mounted solar PV installation is critical for its success as the use of an incorrect foundation can result in premature refusal, costly change orders and project delays.

Selection should be based on a geotechnical study of the project area to determine the best option. Here, we will look at the different types of foundation, and how to select the right one for your installation.

Jeff Lawson, National Construction Equipment Sales Manager at Vermeer, said there are four main types of foundation that can be used for ground-mounted solar PV systems.

“There are four major types of foundations that are commonly used: helical piles, earth-screws, ballasted foundations and helical piles,” Mr Lawson said.

“When selecting a foundation type, and the machinery that will be used to install it, it is important to understand the positives and negatives of each type of different ground condition.

“For example, areas with loose sand and a high water table or low soil cohesiveness require the foundation to be embedded at a greater depth so a helical pile or ballasted foundation would be the best choice.

“However, in areas with harder, more difficult terrain, earthscrews and ballasted foundations are better.

“Driven piles on the other hand are best suited to areas with good soil cohesiveness and low water tables.”

Helical piles are best suited to areas where soil cohesion is poor as they are easily installed using auger attachments on excavators or other equipment that can rotate it into the ground. Once installed, they act as an anchor and lock the structure into the soil.

They require only a small amount of earth to be dug out, so contractors can save time and money. They also have minimal environmental impact as there is little noise pollution and little to no ground movement.

A pull test needs to be done before installing helical piles to determine the embedment depth and ensure there is enough resistance to satisfy the load requirements of the PV support structure.

Earth-screws can be installed by pre-drilling holes into the ground before they are screwed in using excavators and other equipment which use auger attachments. They can also be installed straight into the ground if there are no refusal issues.

Earth-screws can have a higher cost of installation than other foundation types if a separate machine is needed to be brought in for pre-drilling.

Historically, ballasted foundations have been more expensive than driven or screwed foundations, however over time prices have declined and they have become a more viable option. They

are particularly suited to areas where there is a high refusal rate and low soil cohesiveness, where helical pile and earth-screws are not as effective.

However, ballasted foundations have some limitations, especially if the area is sloped or uneven as there are extra calculations that need to be made to accommodate the slope and relative change. Soil settling, erosion and heaving also need to be taken into account before installation as ballasted foundations can be subject to stresses from soil movement.

Driven piles are best suited to areas which have clay, gravel, dense sand and low water tables, where the ground has good soil cohesiveness. They are commonly used on large-scale projects as they have a number of advantages over other foundation types, including speed of installation, accuracy, lack of cure time and low cost.

While driven piles are a cost-effective option for large-scale projects, they may not be the best option for small-scale systems as specialised equipment needs to be used, equating to a higher cost per unit.

“Driven piles are commonly used in Australia on large-scale solar PV projects due to their suitability to ground conditions and their low cost. One of the key factors reducing the cost of driven piles

construction methods and making them considerably cheaper than other foundation types is the availability of highly sophisticated equipment,” Mr Lawson said.

“Equipment such as Vermeer’s PD10 pile driver has a number of features which can help drive down project costs and make contractors more competitive.

“The PD10 partners with leading GPS guidance systems to increase efficiency and productivity while an incolmeter with auto-plumb and laser-controlled post-depth-control feature ensures every pile is installed accurately.”

Mr Lawson said that features such as these, which increase accuracy, are important for ground-mounted solar PV systems as the piles need to be driven into the ground at precise levels no matter the ground conditions.

“The piles need to be installed correctly as they provide the foundation on which the solar panel systems will be built.

“That’s why machines like the PD10 are important for large-scale projects, because it not only eliminates the guesswork but does so consistently.

“The foundation forms the backbone of a solar mounted PV system so it’s important to not only select the right foundation type for the prevailing ground conditions, but to also choose a contractor with equipment that increases productivity and keeps project costs low.”

South Australia continues its leadership in sustainable energy with the introduction of a District Energy Scheme at Tonsley Innovation District, to be powered by one of Australia’s largest rooftop solar arrays.

When complete, approximately 20,000 solar photovoltaic panels will be installed on the expansive eight-hectare roofs of the Main Assembly Building (MAB) and adjoining TAFE SA building, with a total installed capacity of up to 6MW providing power for Tonsley businesses, organisations and residents.

Enwave Energy was selected as the preferred proponent, through an Expression of Interest, to deliver a renewable energy solution for Tonsley, in keeping with the district’s commitment to sustainability and innovation and its Six Star Green Star Communities Rating.

The company will build, own and operate the district energy facility, drawing on its experience in owning and operating similar district energy services at Sydney Central Park and Sydney Airport.

The company will invest approximately $40 million over a 50-year period for battery storage, photovoltaics, smart technologies and future MAB electrical assets.

The system will optimise solar energy generation and battery storage for the peak load of the entire Tonsley precinct, enhancing security of energy supply and providing competitive energy pricing to all customer classes, including commercial and residential.

Tonsley is managed by Renewal SA on behalf of the State Government, and is the home of leading firms in the renewable energy sector, including SIMEC ZEN Energy, Tesla, AZZO and Siemens.

Renewal SA General Manager Property Mark Devine said the District Energy Scheme would further consolidate the district’s role as a hub for investment and innovation in this sector.

“To help make the most of this on-site expertise, Enwave Energy will subcontract SIMEC ZEN Energy to install and maintain the solar panels infrastructure and will engage Siemens to provide smart network design services,” said Mr Devine.

“Initially, the District Energy Scheme will include access to electricity and recycled water services for the entire Tonsley community, and gas and domestic hot water services for the residential community only.

“There are also plans to expand the scheme to include a thermal network for the entire site for building space heating and cooling requirements.”

Businesses at Tonsley have the choice to buy their electricity from Enwave Energy at competitive market rates, or from the energy retailer of their choice.

Enwave Energy will employ five full time staff in professional roles, as well as contracting local businesses to provide ongoing services. There is also potential for collaboration with Flinders University and TAFE SA to train people to work in the energy sector.

All costs and risks associated with operating and maintaining the utility infrastructure will be the responsibility of Enwave Energy.

Enwave Energy is backed by Enwave Australia, a wholly-owned subsidiary of Brookfield Infrastructure, which designs, builds, owns and operates water, gas and energy networks for entire communities.

Mr Devine said the Enwave proposal would deliver on Tonsley’s commitment to become a climate smart district.

“It will offer a world-class District Energy Scheme, incorporating on-site renewable power generation, battery storage and smart technologies that can be scaled up as the district grows."

The scheme will supply businesses and organisations at Tonsley with a reliable, competitively priced and secure electricity supply generated by renewable energy.

The scheme will help consolidate Tonsley as a hub for renewable energy investment and innovation, and help to attract more businesses keen to establish in an environmentally sustainable innovation district.

Tonsley Innovation District is located at the premises of the former Mitsubishi car manufacturing plant in Adelaide’s southern suburbs.