EnergyConnect

Published by

EnergyConnect

Published by

What a difference three months can make!

Prime Creative Media

ABN: 51 127 239 212 379 Docklands Drive Melbourne VIC 3008 Australia P: (03) 9690 8766 www.primecreativemedia.com.au enquiries@primecreative.com.au ISSN: 2203-2797

Editor

Katie Livingston

A ssistant Editor

Sarah MacNamara

Journalists Tess Macallan Kody Cook

Art Director

Alejandro

N ational Media Executive

Brett Thompson

M arketing Manager

Radhika Sud

M arketing Associates

Bella Predika, Emily Gray

Amy Boreham

Publisher Sarah Baker

M anaging Editor

Laura Pearsall

Since the last issue of Energy, we’ve seen the Federal Budget deliver major investments in renewable energy development with the $22 billion Future Made in Australia package. This investment has paved the way for further support for a plethora of clean energy projects, including approval for REZs and offshore developments, as well as a string of policy changes to drive the energy transition in Australia.

In the September 2024 issue of Energy, we take a deep dive into some of the key storage and transmission projects that are enabling Australia’s net zero future, and unpacked the research and policies that are underpinning the transition.

Reaching net zero emissions by 2030 involves more than just new renewable infrastructure, it requires coordinated decarbonisation efforts from businesses, communities and governments alike.

This issue looked at how sustainability initiatives from Australia’s largest transmission project, EnergyConnect, are both enabling the clean energy transition and helping the grid itself go green. We also spoke with researchers at the University of Technology Sydney about how new hydrogen storage technology could help decarbonise the transport and energy sectors.

Over in Western Australia, Synergy is undertaking some exceptional work in energy storage, and Energy took a close look the state’s isolated electricity system and the unique challenges that this presents for Western Australia’s transition to renewables.

Consumer energy resources and solar PV will continue to play a critical

to scratch. This is a task that CSIRO’s PV Performance Laboratory is committed to fulfilling, and the organisation shared how the research it has undertaken over the past decade is helping drive successful and sustainable energy transition.

While there can be no transition without transmission, equally, neither can exist without a skilled workforce to deliver and operate the essential infrastructure. This transition presents a significant opportunity for First Nation’s Australians to build long-term careers, and the First Nations Clean Energy Network has identified pathways to empower Indigenous Australians in the energy sector.

I hope you enjoy this issue of Energy, and look forward to bringing you relevant and engaging content for another year

As always, if you have any topics, projects technologies or challenges that you want to see us cover in future issues, I’d love to hear from you.

Katie Livingston Editor

If you have a story idea, tip or feedback regarding Energy, I’d love to hear it. Drop me a line at katherine.livingston@primecreative.com.au , and don’t forget to follow us on social media – find us on LinkedIn, Twitter or Facebook.

The New South Wales Government has begun to roll out its Heat Pump Hot Water Rebate initiative, a component of the Energy Savings Scheme (ESS).

The rebate is designed to accelerate the adoption of heat pump hot water and other energy-efficient technology across New South Wales.

Heat pump hot water heaters use about one-third of the energy consumed by conventional hot water heaters, lowering greenhouse gas emissions and contributing to environmental sustainability.

The New South Wales Government said it recognised the potential to promote environmentally-friendly consumption. As a result, the ESS specifically supports the installation of heat pump hot water systems with consumer rebates.

The rebate program is designed to reduce the upfront costs of greener alternatives.

New South Wales households and businesses interested in the Heat Pump Hot Water Rebate may access a variety of benefits, including:

• Cost efficiency – by adopting heat pump technology for their hot water systems, you can enjoy lower operating costs and reduced energy bills. The rebate covers a substantial portion of the installation cost, so it’s financially feasible for much of the New South Wales community

• Energy reduction – heat pumps are known for their ability to drastically decrease energy consumption. These reductions align with ESS goals to cut energy usage and extend the life of existing energy infrastructures

• Environmental impact – when you transition to heat pump technology, you contribute to reduced carbon emissions. Heat pump adoptions support statewide and national environmental targets for combating climate change

The ESS was launched in 2009 as part of New South Wales’ effort to enhance energy efficiency and reduce greenhouse gas emissions. The program incentivises the purchase and installation of innovative technologies that lower energy usage.

The government said the ESS initiative has reduced both energy consumption and costs. By the end of 2022, it was responsible for a decrease of 23Mt of greenhouse gas emissions.

By 2030, the energy savings target will increase to 13 per cent. By increasing the target, New South Wales hopes to

reduce 70 per cent of emissions by 2035 and achieve net zero by 2050.

Part of the ESS, the New South Wales Heat Pump Hot Water Rebate provides rebates for eligible New South Wales households and businesses that have an existing electric or gas hot water heater.

The Heat Pump Hot Water Rebate is available to all residents of New South Wales who replace their old electric or gas hot water systems with newer, qualified heat pump models.

The financial incentives come in the form of tradable certificates known as energy savings certificates (ESC). They provide a quantifiable and verifiable record of reductions in energy consumption or greenhouse gas emissions.

Each ESC symbolises saving 1t of carbon dioxide-equivalent emissions through reduced energy use.

Once issued, ESCs can be sold and bought on a special market. There, electricity suppliers and other entities purchase the certificates, which supports their obligations to meet governmentmandated targets.

ESC trading therefore provides a financial incentive to companies and individuals to invest in energy efficiency improvements.

world-class plate processing capability, optimised supply chain solutions with diversified transport options, and a dedicated project management team to help deliver projects on time and to specification.

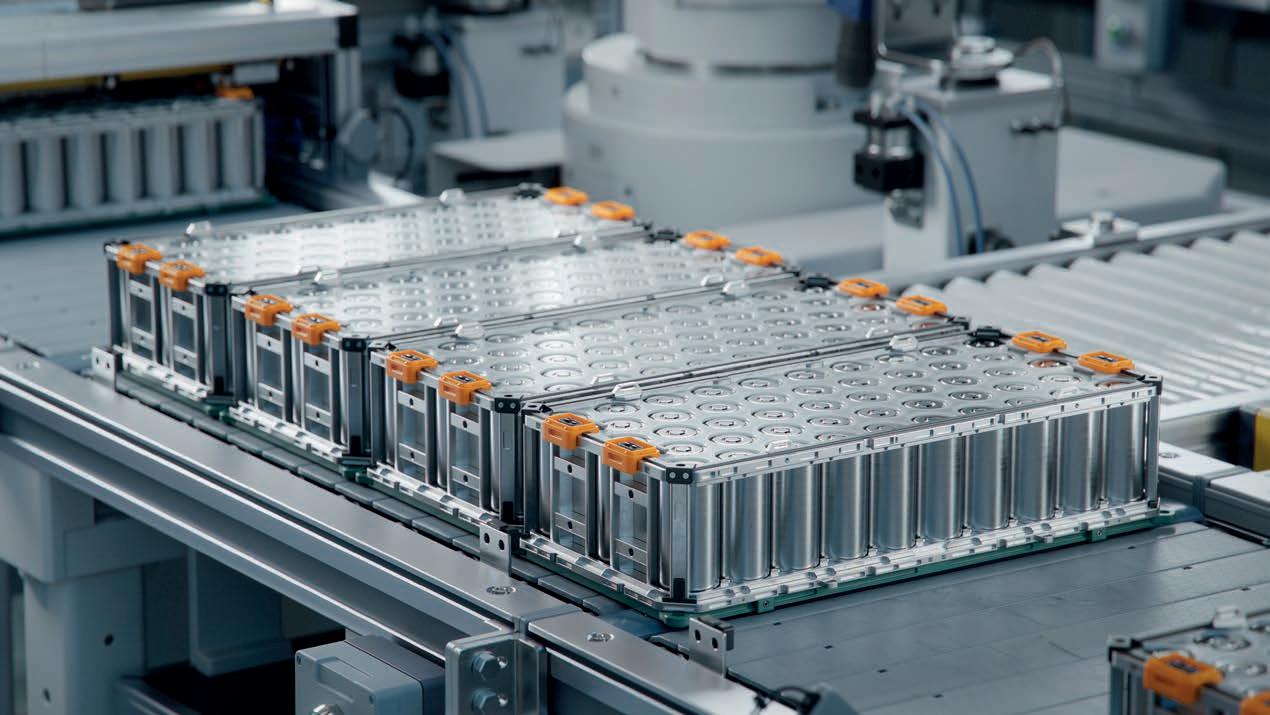

The Federal Government has released a strategy that outlines how Australia can use its natural and industrial advantages to develop a leading domestic battery manufacturing industry.

This includes making more batteries in areas that best suit Australia’s advantages. The focus is on energy storage systems, battery active materials, manufacturing industry inputs and safe and secure batteries.

The strategy outlines the strategic battery priorities to achieve this:

• Build battery manufacturing

and add value to the nation’s economy

• Build knowledge and skills to create secure Australian-made jobs

• Secure Australia’s place in global battery supply chains

• Lead the world on sustainability, standards and the circular economy

• Bring all levels of government together

• The Department of Industry, Science and Resources said that it consulted broadly to develop the strategy and its actions, and that it will continue to work with industry, government, business and experts to apply it.

New measures in the 2024–25 Budget

• Battery Breakthrough ($523.2 million) to promote the development of battery manufacturing capabilities through production incentives targeted at the highest value opportunities in the supply chain. ARENA will administer the initiative

• Building Future Battery Capabilities ($20.3 million) to enhance industry and research collaboration, including workforce training for battery research, manufacturing, transport and recycling

• Support to deliver the Australian Made Battery Precinct ($5.6 million)

The Clean Energy Council has commissioned an independent report, which found that nuclear power is the most expensive form of new energy in Australia.

Conducted by construction and engineering firm Egis, the review analysed the CSIRO and Australian Energy Market Operator (AEMO)’s GenCost report against the Lazard Review and the Mineral Council of Australia (MCA)’s research into Small Modular Nuclear Reactors.

The report has these key findings:

• The research showed that nuclear energy is up to six times more expensive than renewable energy and even on the most favourable reading for nuclear, renewables remain the cheapest form of new-build electricity

• The safe operation of nuclear power requires strong nuclear safety regulations and enforcement agencies, none of which exist in Australia. Establishing these frameworks and new bodies would take a long time and require significant government funding which would ultimately be borne by taxpayers

• Nuclear may be an even higher cost than currently forecast as waste management and decommissioning of nuclear plants have been omitted by cost calculations in the relevant research available

• The economic viability of nuclear energy will further diminish as more wind, solar and battery storage enters the grid, in line with legislated targets. Put simply, nuclear plants are too heavy and too slow to compete with renewables and can’t survive on their own in Australian energy markets

Transgrid has published its Project Assessment Draft Report (PADR), identifying the combination of solutions required to meet the needs of the New South Wales power system as the state transitions to renewable energy.

Transgrid conducted an Expression of Interest in 2023, which identified 100 possible non-network and network solutions to provide system strength to the New South Wales power system.

After reviewing, Transgrid published the PADR identifying the preferred portfolio of solutions.

The solutions are designed to maintain system security by creating a strong signal – much like a human heartbeat – to help the energy system ride out interruptions and avoid instability.

Transgrid Executive General Manager of Network, Marie Jordan, said, “Our power system is undergoing a high velocity transition. As coal retires and more renewables are connecting, we are facing unprecedented challenges to maintain the security and reliability of an increasingly complex system.

“We have a comprehensive System Security Roadmap in place and one of our key pillars is maintaining the strength of the system so it can operate effectively without coal.

“The release of this report is a big step forward in our planning to

ensure the heartbeat of the grid stays strong throughout the rapid transition,” Ms Jordan said.

Transgrid is undertaking a Regulatory Investment Test for Transmission (RIT-T) process to identify the optimal combination of solutions required to meet the needs of the power system in the coming decade.

The PADR identified potential solutions, including:

• Between eight and 14 synchronous condensers to replace system strength that comes from retiring coal assets and unlock additional renewable generation

• Modifications to several synchronous hydro generators and a future compressed-air energy storage facility

• Contracts with a range of existing hydro, gas and coal generators to ensure they can switch on or operate in synchronous condenser mode when needed

• 4.8GW of batteries with grid forming capability to support the stable operation of new renewable generators

“The future power system must be capable of operating at up to 100 per cent instantaneous renewable energy in the coming decade. To support the amount of wind, solar and hydro required we must invest in a diverse range of options to keep

the system strong,” Ms Jordan said.

“As part of this process, we assessed more than 60 individual non-network solutions and 40 unique network solutions to meet requirements.

“There are so many moving pieces in our energy puzzle and no single solution can meet the need – in fact, dozens of solutions across New South Wales will be required at any one time to keep the system operating securely.”

Transgrid is the first transmission provider in Australia to launch a comprehensive program to safeguard system strength, which is necessary to support the Federal Government’s target of 82 per cent renewable generation by 2030.

“We are acting to ensure the lights stay on as we work to deliver the priority projects and investment to support the New South Wales and Federal Governments’ vision for a clean energy future,” Ms Jordan said.

“Currently our energy system relies on system strength produced by large spinning machines such as coal, gas and hydro generators – which provide a strong heartbeat to keep the grid stable so it can ride through disturbances.

“Renewable sources like wind and solar don’t have the same capabilities and need to follow a strong signal from the network, or they will disconnect, which is why we urgently need new sources of system strength.”

The State Government will fund several projects to help Victorians invest in renewable technologies.

The projects will be funded as part of the Residential Electrification Grants program, helping households make the switch to all-electric.

By phasing out fossil gas and going all-electric, the Victorian Government said that households are expected to save around $1,400 per year off their energy bills or up to $2,700 if paired with solar panels.

The Victorian Government said that more than $4 million will be provided to seven approved providers to deliver 1,875 solar and 1,545 hot water rebates, which will reduce the upfront costs of installing solar and energy efficient heat pumps.

Since 2018, Solar Victoria has provided more than 350,000 rebates and loans to households across the state to install solar panels, energy efficient hot water systems, and solar battery systems.

“We are helping more Victorians make the switch to all-electric homes – cutting

The Australian Marine Complex Common User Facility (AMC CUF) suppo s the renewable energy sector by providing extensive ocean-front assets, services and infrastructure including:

• Loadout and maintenance wharves for cargo receival

• Laydown area for staging and dispatch

• Access to the High Wide Load Corridor for road transpo

• 24 hour manned security with CCTV

Contact us to discuss your next project or to find out more about our capabilities and infrastructure.

info@amccuf.com.au I +61 8 9437 0500 australianmarinecomplex.com.au/cuf

down power bills and investing in a renewable energy future,” Victorian Minister for Energy and Resources, Lily D’Ambrosio, said.

“The Residential Electrification Grants program is increasing solar by broadening the reach and scope of the program to encourage innovation in the use of solar energy.”

Member for South-Eastern Metropolitan Region, Lee Tarlamis, said, “This is part of our commitment to achieving net zero emissions while lowering energy bills and ensuring reliability though electrification.”

The Federal Government has made a preliminary decision to shortlist the offshore Novocastrian Wind project for the next stage of the feasibility licensing process.

Equinor and Oceanex have been preliminarily offered a feasibility licence for the potential Novocastrian Wind project.

The Offshore Infrastructure Registrar received eight feasibility licence applications across the 1,854km2 zone.

The Federal Government said that only one feasibility licence is being proposed because other applications were for overlapping areas and found to be of lower merit.

If approved, the proposed project could:

• Deliver 2GW of renewable electricity

• Power 1.2 million homes

• Deliver around 3,000 jobs during construction and between 200 and 300 ongoing jobs

• Provide more job opportunities withsuppliers

New South Wales Minister for Climate Change and Energy, Chris Bowen, is expected to conduct further consultation

with applicants and First Nations groups before a final decision is made.

Consultation with First Nations groups, communities, unions and marine users will continue throughout the feasibility licence process, while environmental studies and a detailed management plan is prepared.

As well as providing reliable renewable energy to Australian industry, offshore wind projects will be required to maximise their use of Australian supply chains and closely consult with local industry and workers on their project plans to ensure local workers and businesses benefit from the establishment of this new industry.

project did the most to support the Hunter’s industries and communities while protecting the environment and sharing the ocean.

There are also clear requirements for the offshore wind developer to consult with fishers and avoid, mitigate and offset any impacts on fishing.

If feasibility for the Novocastrian Wind project is proven, the developer can then apply for a commercial licence to build an offshore wind project to generate electricity commercially.

Mr Bowen said that the shortlisted

“The Hunter has been an industrial and economic powerhouse for generations, and my decision is a big step towards providing that powerhouse with reliable renewables,” Mr Bowen said.

“The project I’ve shortlisted offers the biggest rewards for the Hunter and Australia – supporting our workforce and energy security, protecting our environment and sharing our marine space with the people and industries who rely on it today.”

The Federal Department of Climate Change, Energy, the Environment and Water has announced it will partially fund the Hydrogen Zero Emission Maritime (HyZEM) project, designed to drive decarbonisation in the maritime sector.

The project will receive £1.44 million ($AUD 2.77 million) from Innovate UK with a similar sum to come from the Federal Government.

The news was welcomed by Freeport East, a major port in the UK, which commended the significant investment in the international green hydrogen project.

The HyZEM project focuses on developing low-carbon green hydrogen technology for high powered workboats. The Aus–UK partnership was facilitated by Freeport East and includes leading UK and Australian businesses specialising in green hydrogen storage and propulsion technologies.

The project’s goal is to reduce the risks of deployment of new technology and accelerate the adoption of marine green hydrogen.

The HyZEM project also aims to demonstrate practical applications for green hydrogen storage and propulsion on vessels, including bunkering technology, port storage, refueling infrastructure, and how it will support local supply chains.

Freeport East said it aims to support deployment in the regions’ ports, with the number of tugs, workboats and offshore wind vessels in Harwich and Felixstowe making these technologies of particular relevance.

The international collaboration is designed to support the development and adaptation of new climate-friendly, zero-emission technologies and advance the use of green hydrogen in the maritime industry in both Australia and the UK.

The partnership includes Steamology as lead, National Composites Centre (NCC), Duodrive Limited, Chartwell Marine Limited and The Offshore Renewable Energy (ORE) Catapult. The Australian sister project will be led by Rux Energy Australia.

The diversity of the group is expected to help drive the adoption of green hydrogen through the unique expertise of each partner. Steamology brings to the table its zero-emission hydrogen steam turbines, while Duodrive Limited brings expertise in electric contra-rotating marine propulsion. CTV designer Chartwell Marine Limited is also involved, working to improve vessel efficiency.

Through the project, Freeport East and ORE Catapult will further support regional innovation, as well as building collaborations between subject matter experts, global industry and academia in offshore renewable energy.

The NCC and Rux Energy’s Australian consortium are expected to lead next generation hydrogen storage systems development, dovetailing Rux’s breakthroughs in advanced nanoporous materials with innovations in carbon composite tanks, delivering step changes in efficiency, safety and costs for high powered work boats like tugboats and crew-transfer vessels.

Managing the quality and efficiency of Australia’s solar cell technology could be key to a successful and sustainable energy transition.

With CSIRO’s recent GenCost report confirming that renewables remain the lowest cost new build electricity technology, and the Federal Government announcing a $1 billion SunShot program to reinvigorate Australia’s solar manufacturing industry, photovoltaics (PV) continue to be a critical part of Australia’s energy transition.

However, to ensure that this renewable energy source fulfils its potential for generations to come, it’s fundamentally important that effective structures are put in place to manage the quality and performance of solar technology. This is where the research taking place at CSIRO’s PV Performance Laboratory (PVPL) comes in.

CSIRO Principal Research Scientist, Dr Chris Fell – who played a key role in launching CSIRO’s PV research program – said, “We need to stay focused on the quality and performance of imported solar modules but extend that attention to the proposed 20 per cent of the Australian market that is expected to be manufactured locally.

“Competing with imported products directly on price will be challenging, so quality will be crucial to the long-term success of the SunShot initiative.”

A brief history of CSIRO’s PVPL Australia’s research infrastructure is a fundamental part of the scientific ecosystem, and as the national science agency, CSIRO is a steward of much of that infrastructure – providing the evidence base to guide technical innovation and expansion and inform the allocation of public and private investment.

The early work to establish CSIRO’s PV Performance Laboratory took place between 2005 and 2010. The aim was to enhance the credibility of Australian researchers working on new organic solar cells by ensuring that they were using internationally agreed methods to measure and report the performance of their devices.

Measurements of solar cell efficiency can be straightforward if accuracy is not a concern, and this situation had led to some suspicion that results from around the world were exaggerated to secure

lucrative grants for commercialisation or further research.

“As the price of mainstream solar PV came down, it became clear that CSIRO could apply our skills to commercial products,” Dr Fell said.

“In 2012, we designed a PV Outdoor Research Facility when there were very few of these in the world, with 60 testbeds for current-voltage testing of commercial scale PV modules. In 2013, we purchased our first solar module flash solar simulator – sometimes known as a ‘flash tester’. By 2015, our solar measurement ground station was deemed so comprehensive and accurate it became a site for the global Baseline Surface Radiation Network (BSRN).”

The logical next step for CSIRO was applying to become the first PV measurement facility in the southern hemisphere accredited to the IEC 17025 laboratory competency standard, which places auditable requirements on the laboratory relating to governance, personnel, resourcing, equipment, procedures, training, supervision, authorisation, impartiality and more.

One example of these complex requirements is that the PVPL must regularly calibrate 32 instruments with external labs accredited to international standards. Additionally, the lab uses more than 50 instruments that don’t require calibration, and there are 68 sources of measurement uncertainty that must be understood and quantified.

“We believe that PVPL’s status as an IEC 17025 accredited laboratory is a clear indicator of the world-class services we can provide to Australian solar industry stakeholders, as well as other domestic and international research institutions,” Dr Fell said.

Armed with this accreditation, CSIRO was invited to join the handful of PV measurement labs around the world that have been trusted to endorse new solar cell efficiency world records. Dr Fell now also represents Australia in the International Electrotechnical Commission Technical Committee 82, responsible for maintaining the international standards for solar PV.

National laboratories play a crucial role

Australia boasts the highest uptake of rooftop solar in the world. It is now the country’s second largest source of renewable electricity generation, and its contribution to the grid is forecast to more than triple in the coming decades.

However, Australia’s love of solar extends well beyond urban rooftops; it also encompasses remote megawatt solar farms and cutting-edge solar cars hurtling along roads in the Australian outback.

This recent embrace of solar’s potential across the Australian context – and the groundbreaking work that is currently taking place to develop the next generation of technologies like perovskite PV – has been driven and supported by robust, evidence-based research to measure the quality and performance of solar cells.

By 2020, CSIRO’s PVPL cell measurement laboratory had verified the performance of countless researchscale solar cells, including two new world records.

The module testing laboratory had measured more than 1000 solar panels, including critical quality control for six utility-scale solar power plants and more than a dozen small companies.

Meanwhile, the PV Outdoor Research Facility had underpinned

internationally published research to better understand the role of the solar spectrum on the energy yield of solar PV; and had made measurements for a consumer advocacy magazine and several companies developing ancillary technologies such as solar coatings and passive cooling schemes.

“The ongoing work of measuring cell efficiency might not always be a headline grabber,” Dr Fell said.

“But it’s a vital part of the technology chain for many reasons – not least the fact that inaccurate or exaggerated results can lead to false promises, misdirected funding, and loss of trust in the industry.

“With new Australian PV manufacturing on the near horizon, quality has never been more important to the Australian solar industry.”

Dr Nikos Kopidakis, PV Cell and Module Performance Team Lead with the US National Renewable Energy Laboratory (NREL) said that national laboratories and science agencies like NREL and CSIRO are uniquely placed to conduct this kind of research.

“Accredited labs that measure and rate solar PV module performance are essential for supporting the PV industry,” Dr Kopidakis said.

“While collaboration is key in the renewables sector, precision performance measurement is the type of work that is best suited to a national facility. It’s unlikely to be a priority for university researchers, and private companies can’t justify the direct investment. They couldn’t spend an entire day measuring two modules like one of our researchers would do.”

solar

Successfully navigating the energy transition is a key issue both within Australia and around the world. Reliable and actionable energy research will be critical in supporting that transition.

As well as being well connected to the NREL in the US, CSIRO also collaborates closely with the European Commission’s Joint Research Centre, the organisation tasked with research to support the goals of the European Union and the European Green Deal – one of which is supporting the rapid development and deployment of solar PV.

JRC’s activities include developing standards for photovoltaic products,

with a focus on quality and performance; providing a focal point for research on PV performance assessment; providing an independent reference for research projects, laboratories, and industry; coordinating harmonisation across the sector; and sharing best practice.

In Australia, CSIRO’s longstanding track record of productive collaborations with universities, research institutes, industry, and governments position it well to take a similar leadership role in the solar energy space over the coming years.

“What I’m trying to create through the work of the PVPL is an industry framework to support sustainable solar manufacturing in Australia,” Dr Fell said.

“We need an industry that embraces innovation but is also robust, evidencebased, and can stand the test of time.

“As the national science agency, our job is not to cover every base ourselves. Instead, we need to support and foster growth within the industry through collaboration, the provision of complementary services, maintaining key infrastructure and the promotion of industry standards that prioritise quality and reliability.”

Battery storage can help remote communities tackle energy insecurity, access cheaper power and reduce their carbon emissions, but transitioning these towns to renewables requires purpose-built solutions.

As many of Australia’s remote and First Nations communities are either on the fringe of electricity networks or separated from the grid entirely, they are often dependent on diesel generators where fuel supply can be unreliable or prepaid power services that lead to constant outages.

In addition, frequent extreme weather conditions can both increase their reliance on heating and cooling services and cause long-term disconnections.

Battery storage presents an opportunity for these communities to build greater network resilience while reducing their energy costs and emissions. However, their remote locations and harsh climates create several barriers that need to be addressed before they can transition to renewable energy.

Mictronix Power Systems (MPS) Director, Anthony Micallef, sheds light on these challenges and discusses the technology required to tackle them.

Off the beaten track

Before any battery system can be installed, the first challenge is often gaining access to the site.

“A lot of the time, these places are really remote; the roads are very rutted, especially up north, and there are parts of the year that you just cannot get there,” Mr Micallef explained.

Many battery systems come in containerised solutions, which are prefabricated to make installation easier. However, this means that these systems are quite heavy and need to be

transported using forklifts or cranes.

As access is an issue for these communities, a system that can be easily transported and installed without special equipment is required.

“You need things that can be moved by local people, and not heavy equipment, which means breaking the system down and then putting it back together on site,” Mr Micallef said.

“We try and avoid anything that involves software ... our modules have pluggable connectors and can be assembled with regular tools and don’t require any updates.”

Communities are often reliant on government funding for both the installation of new systems and the repair or replacement of damaged infrastructure, and Mr Micallef said that they could sometimes have to wait long periods of time for a failed system to be repaired or replaced.

As many remote and First Nations communities are also home to extreme temperatures, these conditions need to be taken into account to prevent a battery storage system from failing.

Mr Micallef explained that batteries have a temperature range that they are designed to operate in, and they will fail if they are pushed outside that range.

“The harder you push the battery, the more it heats up, and the hotter the temperature is, the faster the batteries degrade.

“We build a robust battery and we under promise and over deliver on what it can do so that you’re not

pushing into the limits all the time,”

Mr Micallef said.

“We use lithium iron phosphate cells, which don’t have cobalt in them. So, when they fail they don’t create a fire event. Whereas lithium cobalt oxide batteries just burst into flames if you overcharge or damage them.

“We also build redundancy and resiliency into the system design itself. Each battery is self-managed to protect from conditions outside of the allowable operation range, and if one of them fails then the [system] could still run just off one battery.”

Made in Australia, for Australia

Supported by MPS distributor, R&J Batteries, Mr Micallef’s goal is to ensure that affordable renewable electricity is available to everyone who needs it, regardless of location.

With a focus on off-grid solutions, Mr Micallef designed MPS from the ground up for the Australian market.

“International batteries that meet the standards in different countries might need to be [adjusted] for us. I built [MPS’ solutions] to suit Australian’s climate and our manufacturing. It might work for overseas markets, but it’s built for us,” Mr Micallef said.

“We got a full support network all the way from manufacturing through to the end user. R&J has staff who are ex-installers so they understand the product and how to support it.”

“I’ve got a really good team of people to help me make the product bigger, better and support long-term sustainable growth.”

As one of the largest isolated power systems in the world, Western Australia’s energy grid has to tackle some unique challenges in order to successfully transition to renewable energy.

Western Australia is home to world-class solar and wind resources, abundant gas supply and a wealth of battery metals. However, as its grids are isolated from the rest of the country this presents both challenges and new opportunities for the state. Synergy Executive General Manager, Future Energy, Kurt Baker, shares how battery energy storage systems (BESS) are helping the state navigate this transition.

Large-scale battery storage offers an opportunity to provide long-term system stability and support additional renewable

generation. To achieve this, Synergy has three major BESS projects in the pipeline, with one already operational and two under construction.

In June 2022, the Western Australian Government announced that the Collie Power Station is set to be retired in late 2027, followed by the Muja D power station in late 2029, which would remove a combined 1,127MW of electricity generation from the South West Interconnected System (SWIS).

To help replace this capacity, Synergy

is delivering an additional 410MW of renewable generation, backed by 1,100MW of energy storage infrastructure.

Synergy Executive General Manager, Future Energy, Kurt Baker, explained that in order to deliver on these projects, Synergy established a new business unit in 2022 called Future Energy, to lead the development of this renewable generation and storage infrastructure, from concept, pre-feasibility and feasibility, through to execution and operation.

“The challenge we have on our hands, or the opportunity, is to deliver those programmes of investments,” Mr Baker said.

“We’re putting in 1,100MW of additional storage to assist with the retirement of our coal plants. This storage will both help to soak up the rooftop solar generated during the day and timeshift that into the evening peaks. And to help contribute to keeping the system reliable and stable.”

Mr Baker said that as Western Australia’s grid operates differently from the way in which the National Electricity Market (NEM) operates in the rest of the country, this means that the state has to take a unique approach to its energy transition.

“The way we’re set up over here in Western Australia is that while we have

some similarities to the NEM – for example in that we have the AEMO as our market operator – the Wholesale Electricity Market (WEM) operates a little differently.

“In the NEM you have many different transmission systems, which are owned by different parties. Here, we only have one party, which is Western Power who are also owned by the State Government.

“In terms of Synergy itself, we do everything generation and retail. We are a government trading enterprise, but we are also one of many market participants in the generation and storage side of the market. One of the unique characteristics

of Synergy is that we’re the only entity that can actually sell to the residential customers here in Western Australia,”

Mr Baker said.

There are two separate electricity grids in Western Australia, the North-West Interconnected System (NWIS), which covers the north-western part of the state and the South-West Interconnected System (SWIS), which is the main grid and covers the south-western part of Western Australia. Western Power owns and operates the transmission and distribution infrastructure within the SWIS. Synergy is the generator and retailer of electricity in the SWIS.

is a fraction of the size of the NEM, and completely isolated from the rest of Australia.

“Unlike the NEM, where you’ve got transmission networks that connect each state together, we’re all on our own here in Western Australia.

“We’ve got abundance of wind and solar resources, which is a great opportunity for us. But that also brings about challenges in managing the overall system.

“There is lots of sun during the day, but once that sun goes down, that generation associated with that sun disappears. This means we’ve got a big differential between demand on the system during the middle of the day, when the sun is shining, versus the peak periods.

“We also don’t have geographical diversity. In the NEM, if the sun stops shining because the clouds come over in Queensland, then there might be sun down in New South Wales and because the transmission lines are interconnected you can move electricity from state to

the system here. So generally, if it’s not windy, it’s not windy everywhere on our system.

“Rooftop PV is also being installed at a great rate, which is excellent for the decarbonisation of the system.

“However, all that electricity that gets generated during the day needs to be soaked up, and then we need to replace it when the sun goes down at night.

“We want to support customers to continue to put solar on their roofs. It’s generating the renewable electricity, which is great for the energy transition and decarbonising the energy system.

“By installing the battery energy systems, they soak up the rooftop solar produced on people’s homes and can then time shift energy to the peak period, so that we can then withdraw that energy from the batteries to support the peak load on the system.

“Battery energy storage systems also help contribute to the Essential System Services, which help keep the electricity grid in a safe, stable, and secure operating state.”

To date, Synergy has completed one major BESS project – Kwinana Stage 1 (KBESS1) – and has two more in the pipeline; Kwinana Stage 2 (KBESS2) and the Collie Battery Energy Storage System (CBESS).

“Our first one was what we now call KBESS1, which is 100MW/200MW/h or, in other words, two-hour storage. We completed that in September 2023, but we were about halfway through the construction of that particular system when the State Government made its announcements in 2022, which lead us to launch into KBESS2,” Mr Baker said.

“As the name suggests, KBESS2 is pretty much next door to that existing facility, but it’s a 200MW/800MW/h, so it’s a four-hour battery. This one will be complete in October this year.

“The next one underway is CBESS, which is 500MW/2,000MW/h. So that project, like KBESS 2 is on track, on schedule and budget.”

Mr Baker explained that both KBESS2 and CBESS are schedule-driven, as the overall system in the state has a need

be completed.

“Demand for electricity is growing at even greater rates than initially thought, which results in these projects having pressure to deliver on time,” Mr Baker said.

In May 2024, Synergy awarded a $160 million contract to SCEE Electrical to undertake civil, electrical and major equipment installation works for CBESS.

“We’ve completed all the all the early stage earth works for that particular project, so we’re pleased to say we’re off and running,” Mr Baker said.

Synergy also announced in January 2024 that it had reached another milestone in the delivery of KBESS2, having completed the installation of containerised battery systems.

Mr Baker said, however, that with the three batteries combined, Synergy was still 400MW shy of its 1100MW target.

“Now we’re investigating what our next project will be. We’ve got quite a good pipeline of storage projects, and like all infrastructure projects, they’ve got challenges. But we’re pleased to

say we’ve been able to navigate our way around those various challenges successfully so far to get these things delivered on time,” Mr Baker said.

Mr Baker also said that another focus area for Synergy is to support the transition with distributed energy resources (DER).

“We’re doing the work to grow our capabilities, so that we can orchestrate those assets in customers’ homes and help customers contribute to keeping the system stable, and help them get better value out of systems they’ve got installed in their homes. So, it’s complementary to the large-scale storage as well.”

Despite the positive outcomes for the BESS projects, delivering these works was not without its challenges, which required exceptional problem solving from Synergy.

“For storage projects, when you’re trying to deliver those as quickly as you can, one of the challenges is securing long lead items, which is the batteries themselves, the battery modules, and the inverters,” Mr Baker said.

“One of the initiatives that we took is we engaged with the battery inverter market early and then put our supply arrangements in place so that we could essentially forward book production slots for batteries and inverters before we finished fully designing out the remainder of the projects.

“This also helped us build the relationships with the suppliers early in these projects, which allowed us to work more closely together with them.”

Mr Baker explained that another challenge for Synergy was securing the resources and capability needed to deliver the projects.

“The initiative that we took there was to approach these projects with an integrated project management team, which really means we’ve got a combination of Synergy people and engineering partners, and put together a project team to do both engineering and project management.

“In the interest of making sure that we deliver these projects as quickly as we can, we’ve been trying to engage organisations, partners and people who are aligned to our objectives, with our plan as much as possible. If you can get the right motivated people who are all aligned with a common purpose

and objectives, then you can just about overcome anything,” Mr Baker said.

Mr Baker notes that this approach helped Synergy to tackle some major obstacles with KBESS2.

“We were due to ship our inverters out of Spain, but not too long after a lot of geopolitical tension was created across the Suez Canal and we couldn’t get our inverters to come through the standard shipping routes.

“That was going to set our delivery right back. So, what we did was we worked with shipping agents, we worked with the inverter suppliers themselves, and we ended up chartering vessels to come the long way around. And we actually managed to do it in a way that those inverters landed In Fremantle Port slightly ahead of the original schedule. Which is just an example of how having the right people, the right partners, all with the same common purpose working together helps to overcome these challenges.”

As part of delivering it’s BESS projects, Synergy is committed to making a positive impact on the communities that it serves, and the utility ensures that it works with local Western Australian suppliers whenever possible.

Synergy also supports community organisations, charities and not-for profits driving positive, sustainable outcomes for people and the environment across the SWIS through its Community Investment programs.

Synergy’s Collie Small Grants Program provides one-off grants of up to $5,000 to local not-for-profit organisations that demonstrate their ability to deliver social, economic or environmental benefits to the Collie community.

As of 2024, this is the sixth year Synergy’s Collie Small Grants Program has been making a positive impact in the region. During that time about $170,000 has been distributed to the community.

“We try and get the local community involved as much as we possibly can,” Mr Baker said.

Synergy regularly hosts face-to-face engagement and information sessions with Collie community members, supports local community initiatives and events and recently arranged a local jobs fair to aid in the appointment of local people in the project.

The late evening of 24 December 1974 forever etched itself into Australian history; Cyclone Tracy, a monster storm with winds exceeding 217km/h, tore through Darwin, leaving a path of devastation. The initial shock was compounded by the crippled communication infrastructure – a stark reminder of the critical role electricity and connectivity play in times of crisis.

Many Australians only learned of the disaster the next day due to the destruction of transportation and communication networks. Yet amidst the wreckage, a spark of hope emerged. RG Ladd, Decon’s switchboard manufacturing arm, was on the ground within a week, playing working to restore vital communications for the stricken city.

Almost five decades later, this spirit of resilience continues to be a cornerstone of Decon’s mission. The company remains committed to supporting Australian communities by providing critical telecommunications equipment and emergency switchboards. From

Electricity and connectivity are critical to navigating natural disasters, and ensuring communities have access to these services in times of crisis is vital.

the floods in New South Wales to the devastating Victorian bushfires, Decon has consistently stepped forward to ensure that communities can stay connected during disasters.

Safeguarding connectivity

Resilience isn’t just about reaction, it’s about preparation. Recognising the growing threat of extreme weather events, Decon is proactively deploying a fleet of Smart Power Cells (SPCs) to support disaster resilience and response efforts at remote and disaster prone sites.

These innovative hybrid power solutions combine renewable energy sources and traditional backup, providing reliable power even when the grid fails.

At the heart of the SPC’s resilience lies its Sodium Metal Chloride (NaNiCl) battery technology. Ideal for Australia’s harsh climate, these batteries excel in:

• Durability: Withstanding extreme temperatures.

• Low maintenance: Reliable performance in remote areas.

• Safety: Reduced risk of thermal runaway, especially post disaster.

With these features, NaNiCl batteries within the SPCs become the perfect complement to Australia’s diverse climate, ensuring dependable power even in the harshest environments.

Getting communities back online

With NaNiCl battery technology at the core of SPCs, Decon is committed to ensuring that future disasters

don’t leave communities isolated. Pre‑deploying SPCs in cyclone‑prone areas allows Decon to provide a lifeline of communication during critical recovery efforts – not unlike how RG Ladd’s swift response helped Darwin get back on its feet.

In addition, Decon is actively collaborating with telecommunication providers and government bodies to develop robust disaster resilient infrastructure and purpose built, off grid, transportable power solutions specifically designed for at risk or remote locations.

Decon is committed to building a future where communities facing a natural disaster are equipped with the tools they need to stay connected; emergency services personnel can coordinate effectively, and residents can access vital information and support.

Decon understands that energy isn’t just about powering homes and industries, but about building stronger, more resilient communities.

Cyclone Tracy serves as a potent reminder of nature’s raw power, but it also highlights the unwavering human spirit of resilience.

Decon Corporation is committed to playing its part by providing the power to connect, to rebuild, and to move forward, together.

Traffic tunnels are dangerous places, but with the addition of two critical pieces of equipment, the humble smoke spill motor can provide important safety benefits, while saving energy and money.

Underground traffic tunnels are notorious for the accumulation of smoke, dust, and other pollutants that impact the air quality and visibility within the confined environment. Any vehicle stoppages or emergencies further add pollutants to this already noxious cocktail.

A smoke spill motor’s primary role is to provide thorough ventilation and extraction within a tunnel setting to disperse any dust, toxic fumes, and pollutants from the air. Under normal operating conditions they run continuously, driven by a low voltage (LV) motor that keeps it running at a low, steady speed.

In an emergency, smoke spill motors need to be able to ramp up into ‘fire mode.’ The LV motor needs to kick into operation immediately, with a variable speed drive (VSD) supporting the jump to high speed to move contaminated air in the opposite direction of the evacuation route, dispelling the smoke, allowing safe evacuation, or even exhausting the fire entirely.

The VSD is the real hero in this application. During a fire, cables can start to burn, leading to short circuits and faults.

This would typically result in equipment tripping or shutting off altogether, however, during a fire, VSDs are designed to keep running. While they usually run on three phases, in a fire situation they can continue operating without limits. If one cable burns out, it can still run with two phases of power.

Choosing the right combination of smoke spill motor, LV motor, and VSD has a big impact on your tunnel project.

The right motor will:

• Operate effectively in high temperature emergency conditions if called on to do so

• Function effectively for the long term, limiting any unnecessary maintenance

• Run with any control system, including soft starters

By connecting a VSD with a LV motor to drive a smoke spill motor, the motor can then operate at a lower speed – which, when run day in, day out, saves significant amounts of energy. In fact, the application of a VSD could repay the cost of the equipment in less than two years. However, this will not occur if the VSD and LV motor aren’t compatible to begin with.

The issue many companies face is this compatibility. By working with different suppliers on their projects, businesses often end up with pieces of equipment that aren’t specifically designed to work together.

If the two devices aren’t compatible, the necessary reliability cannot be guaranteed. And without reliability, what good is a fire safety system? Without reliability, you don’t get the energy savings – and it may end up costing more money in the long run.

Choosing VSDs and LV motors that are supplied by the same supplier ensures compatibility, and with compatibility comes the guarantee that the system works. It’s the rule of three – allowing you to save energy, save money, and potentially save lives.

To ensure network plans align with consumer’s ong-term needs, AusNet undertook a groundbreaking study to quantify the value customers place on a range of benefits.

Twenty years ago, it may have been hard to believe that we could power our cars using a standard power-point in our home garage, or use smart technology to automatically warm our homes before we arrive home on a cold winter evening.

People are engaging with the energy system in new ways, such as electric vehicles, solar and smart technologies. The journey toward net zero emissions and electrification also means many in our community are facing a greater reliance on electricity, while at the same time we are experiencing the impact of climate change through severe weather events and cost-of-living challenges.

Amid these and other challenges, electricity distribution networks need to ensure that plans for their networks align to customers’ preferences, needs and long-term interests.

Every five years, distribution networks in the National Energy Market (NEM) engage extensively with their customers to formulate plans that determine the service levels customers will receive and the prices they will be charged.

In addition, network investments across the NEM are subject to rigorous economic tests, to numerically check that the customer benefits of the investments are higher than their costs. The customer benefits have traditionally focused on reducing short outages.

This worked well in a stable operating environment, where the focus is on maintaining the status quo. In these circumstances, traditional economic tests are very useful for keeping costs down for customers.

However, we are in the midst of a once-in-a-generation energy transition and customers are interacting with the network in new ways. The benefits delivered by network investment are much broader than in the past and can be qualitative, intangible and hard to quantify.

To bridge this gap, AusNet saw an opportunity to extend existing research about what electricity distribution customers value – to help better connect network investment plans with customers’ needs and preferences amid a key time in the energy transition.

Measuring what customers value AusNet undertook a study to quantify the value customers place on a range of benefits. These benefits include how much value customers place on reliability,

enabling electric vehicle charging, ensuring rooftop solar is not ‘wasted’ and for the electricity distribution network to better cope with increasingly frequent extreme weather events.

Importantly, AusNet considered not only how much customers value certain benefits, but what service changes they’d also be willing to accept. For example, whether customers would accept a lower level of service for cost savings and adjustments for overall affordability.

This enabled AusNet to consider the value customers place on individual benefits, and their overall willingness to accept changes to their electricity bills.

In turn, these insights help AusNet better understand which investments in services customers find most valuable.

This groundbreaking study is believed to be the largest of its type in the NEM and is the first time AusNet customers’ values have been quantified at scale.

The study included more than 3,500 residential and small business customers on AusNet’s distribution network in the north and east of Victoria.

The study was initiated in early 2023 and began with extensive engagement with customer advocates on the design, and a program of qualitative research before collecting quantitative data between November 2023 and January 2024.

The participation of customer advocates in the study’s design was a major part of the process. A sub-set of AusNet’s Electricity Distribution Price Review (EDPR) 2026–31 customer panel members formed a working group and together collaborated on all key aspects of the study, including the scope, selection of research partners, values to be quantified (e.g. reliability, resilience, exporting solar and EV charging flexibility), wording, and recruitment strategies.

Striking agreement on the design was not straightforward and passionate customer advocates on the working group brought different perspectives to this debate.

Given the importance of this study to customer outcomes, it needed to be robust and subject to appropriate scrutiny.

This process helped ensure that customers, government, regulators and AusNet could trust the study and its insights.

“People power is at the heart of the transformation of our energy system that is underway, from one that is carbonbased to one that is net zero by 2050, based on renewables and storage. Yet it is the area that is the least researched.” Lynne Gallagher, former CEO, Energy Consumers Australia.

The design that was ultimately adopted comprised of:

• A qualitative phase involving 12 in-depth interviews

• A total of five customer workshops with approximately 120 customers

• A quantitative phase that involved an online survey of 3,178 residential and 349 business customers. Cognitive interviews were also used to pre-test the questionnaire to ensure that customers understood the questions. The study also combined the research data with actual network data on customer usage and outage probabilities to calculate an overall network value of customer reliability, suitable for use in network planning decisions.

The results validated findings from other sources of research and customer engagement: that customers are concerned about cost-of-living pressures or place the highest value on resilience are two examples of this.

However, beyond the validation of existing themes lie rich, quantified, and at times surprising insights into what customers value and would be prepared to pay for, or forgo. The study verified that: Resilience is valued above all

• Households and small businesses placed the highest value of all tested benefits on resilience to long outages. Electricity needs to be affordable, but customers want value

• Customers are concerned about affordability but still see the value of investment in the network.

• Residential customers were about half as willing to pay for a total bundle of values (e.g. flexibility in EV charging, plus enabling more solar exports and improving reliability for those with

poorest supply) than paying for each value individually. This suggests that while customers are concerned about overall affordability, they still see value in investment.

Customers are thinking of others (as well as themselves)

• Customer segments are willing to fund investments that benefit others even if they themselves will not directly benefit. Qualitative research suggests that this is coming from a strong desire for equity (supply improvements for customers with the poorest reliability) and an aversion to waste (solar), and the “beneficiary” not always being clear (in the case of solar exports, a household sharing their excess and a household receiving cleaner electricity may both be beneficiaries of an investment). Households and businesses customers would pay more to improve reliability for those with poorest supply.

Customers want to minimise solar wastage

• Customers place a high value on ensuring that both their own and others’ solar exports are not “wasted”.

• Household and businesses customers also both attach a positive value to investing to enable more solar exports – they would pay more to enable the more solar to be exported. An expectation that EV charging is flexible and convenient

• Convenience is highly valued, including flexibility around when they choose to charge EVs.

• Both household and business customers attach a positive value to having flexibility in their EV charging. In other words, they indicated they would pay more to have more flexibility in when they can charge their EV.

Insights such as these will play a key role in AusNet’s decision-making about future investments in its electricity distribution network. These planned investments will be outlined in the EDPR 2026–31 proposal it submits to the AER for assessment, the draft of which will be published in late September. Research outputs will inform decisions on topics such as network resilience and reliability, improving reliability for those with poorest service, EV charging, and solar exports.

As collaboration was key to the study’s development, so too will it inform the application of the study’s findings. AusNet’s Coordination Group is now discussing how best to apply the insights to AusNet’s EDPR 2026-31 proposal. Others in the industry are also looking closely at this study and its insights – more than 100 industry stakeholders attended a recent webinar on the study as part of a research seminar series.

A study of the scale and complexity of Quantifying Customer Vaues is not a small or straightforward undertaking. Utility businesses that do so, however will be rewarded with richer insights into their customers, and plans that can be more closely aligned with customer needs and preferences.

Among the many learnings, there are four that AusNet call out:

1. Allow plenty of time to engage on research design. Investing in this earlier stage of the process will build confidence and trust in the results.

2. Electrification is highlighting equity issues between customers who have very reliable electricity, and those who don’t. Customers with a reliable service are aware of this.

3. Customers do have affordability concerns – however given their evolving needs and expectations of the network, they see investing in the network as value-for-money.

4. Both qualitative and quantitative research have valuable roles to play. In this case quantitative research results closely match with findings from the earlier qualitative stage and AusNet’s other customer engagement, building an understanding of customers’ thinking that sits behind the numbers revealed in the QCV study.

Customers are changing their interactions with energy – be it plugging in their EVs to charge from the comfort of their (remotely-heated) home or

setting smart appliances to make the most of solar energy. Networks have an opportunity to investigate and apply new approaches to ensure rigorous, up-todate customer insights inform planning, decisions and, ultimately, the services customers receive.

The QCV study:

• Attaches hard numbers to things customers value that otherwise would be hard to quantify, building more holistic, customer-centric business plans

• Provides robust customer data stakeholders can trust

• Shows customers’ priorities across investment drivers

• Captures value-of-service

improvements and degradations to support cost-benefit assessments and trade-off discussions

• Complements qualitative engagement The results:

• Apply to residential and small business customers on AusNet’s electricity distribution network

• Connect to and validate relevant insights from other customer research, for example know that customers hate it when solar energy is ‘wasted’

• Offer relevant insights to stakeholders who are involved in the price reset process e.g. regulators, customer advocates, industry groups, government agencies and other distribution businesses.

Over the coming months, AusNet will share more insights from its industry-leading customer research and engagement initiatives through the AusNet Tomorrow Customer Insights Series. Those interested can register to receive updates about future events via the QR code below. Recordings of past webinars and copies of the slides are also available.

Scan the QR code for more information about AusNet’s broader program of customer research and engagement, available via Community Hub, AusNet’s online engagement platform.

While increasing uptake of CERs is a positive step towards net zero, it could have unintended consequences on the low voltage network.

aximising the contribution of consumer energy resources (CERs) is key to meeting Australia’s climate goals, and at 30 per cent penetration (20GW of total capacity) rooftop solar is growing faster than any other renewable source. However, replacing a few large plants on the transmission network with millions of CERs in the distribution network creates a paradigm shift for the energy marketplace.

connected generation time visibility and control, however, CERs are installed in low voltage distribution and are not operated by energy market professionals. At eleven per cent of installed capacity, this lack of control is already causing minimum demand and localised stability issues.

voltage network in real time; and the ability to map this physical information to the financially responsible aggregators who connect CERs to the market for dispatch,” Mr Beveridge said.

Solution of the future

Area Vice President of Itron Australasia, Alex Beveridge, explained that as the economies of scale for CERs are so different from traditional generation, a new approach is needed.

“It’s not economically feasible to extend HV control systems to millions of CERs. Getting the full value from CERs will require improved low voltage network modelling, integrated with measured data from multiple sources like IEEE2030.5 inverters, and smart meters to provide a measured plus modelled view of the state of the low

Itron’s Low Voltage Distributed Energy Resource Management Solution

Enables network operators to dispatch CER control signals et mechanisms or direct to aggregators and inverters Allows optimisation of CER on market price or customer

DERMS) is designed specifically to provide demand the tools they need to manage CERs within the low voltage network. When integrated with existing systems – like ADMS, GIS, and AMI – LV DERMS helps transform the planning and operating risks caused by CERs into opportunities.

DERMS addresses challenges facing the low voltage network by providing network operators with a time data processing suite that: Consolidates data from multiple sources including ADMS, GIS, IEEE2030 AUS inverters and smart meters to provide the most accurate measured view of the network state in near real

Meeting Australia’s market needs

Australia has the highest residential penetration of PV in the world, and Mr Beveridge said that the challenges this presents are driving

Provides a fully IEEE2030

CSIP AUS compliant utility server for connection to aggregators and inverters

“The transition to renewables will bring a number of challenges, including the integration of battery storage, mass market adoption of EVs, and the transition out of natural gas, the impacts of all these changes will happen in the low voltage network, so it is critical that operators have a clear understanding of what’s happening at the edge of the network,” Mr Beveridge said.

DERMS augments the existing utility landscape by focusing on the low voltage network, to provide increased visibility, better understanding of understand capacity constraints, and dispatch control signals through a variety of market mechanisms.”

Uses fault tolerant state estimation to model the state of unmeasured points, forecast constraints, and generate DOEs

Amid growing concerns about its environmental impact, utilities worldwide are seeking to eliminate sulphur hexafluoride gas from their switchgear.

When it comes to electric power systems, switchgear is essential for safety as it allows for the regulation, protection and isolation of power systems. Gas insulated switchgear – most commonly with sulphur hexafluoride (SF6) – was previously a popular choice for power distribution systems because it effectively manages the flow of high voltage electricity.

However, following the EU’s proposal of the Green deal: phasing down fluorinated greenhouse gases and ozone depleting substances in 2022, SF6 was acknowledged as one of the most potent greenhouse gases and it was recommended that SF6 be phased out in all new switchgear by 2031.

Some utilities have already started replacing their fleets of SF6 insulated sectionalisers and load break switches with modern switchgear that uses solid dielectric insulation instead of gas.

A local product for local demand

With the detrimental effect of SF6 on the environment now so widely understood, many utilities are seeking to implement more sustainable practices, and demand for SF6 gas-free switchgear continues to rise.

Australian manufacturer NOJA Power is one of the world’s largest manufacturers of reclosers and has announced an increased

manufacturing capacity at its Brisbane headquarters, making it easier and faster for Australian companies to make the transition to sustainable alternatives.

NOJA Power’s Group Managing Director, Neil O’Sullivan, said, “We are pleased to see the NOJA Power VISI-SWITCH® now rolling off the production line as it is the perfect solution to eliminate the use of the SF6 gas switches in our customers networks and help them take further steps to achieve their net carbon zero targets.”

The company’s solid dielectric insulated load break switch, the NOJA Power VISISWITCH, has zero SF6 gas insulation and is the first of its kind with visible isolation.

NOJA Power has developed expertise in solid dielectric insulation through its OSM Recloser product, with more than 100,000 installations in 106 countries over the last 20 years.

The same technology has been applied to load break architecture to develop the VISI-SWITCH, enabling Australian utilities to implement a sustainable alternative to SF6 gas insulated switchgear.

The VISI-SWITCH consists of an enclosed air-break isolator and vacuum interrupter in series and is operated by a mechanical sequencing mechanism.

The vacuum interrupter in this design is responsible for all electrical makes and breaks, while the isolator provides all the necessary BIL to meet standards for a point of isolation.

NOJA Power’s VISI-SWITCH features an innovative viewing window inside the insulator bushing that allows operators to visibly confirm the point of isolation prior to linework, enhancing safety and providing peace of mind.

With its increased manufacturing capacity and innovative solid dielectric insulated load break switch, NOJA Power and its VISI-SWITCH is set to play a pivotal role in the shift away from SF6 gas insulated switchgear

By Maartje Feenstra, Dr Scott Dwyer and Professor Charlene Lobo, University of Technology Sydney

Australia has the potential to be a key player in the global hydrogen market, but a cost-effective hydrogen storage solution is needed to achieve this vision.

Australia is one of many countries that have signed a pledge to reduce carbon fossil fuel emissions to net zero by 2050. To reach this target, all sectors of the economy must develop their own sustainable pathway.

One particularly promising pathway is using green hydrogen (i.e. hydrogen and hydrogen-derived fuels produced from renewable electricity sources such as solar and wind). In some sectors, hydrogen competes with other technologies such as direct electrification, but for the maritime, aviation, chemicals, iron, and steel production sectors, green hydrogen or its’ derivatives are typically viewed as the only solution.

including advances in existing hydrogen derivatives like ammonia and methanol, as well as promising novel solutions such as boron hydrides.

Key sectors for green hydrogen Green hydrogen is a versatile chemical energy carrier that could fulfill various purposes across many economic sectors. However, because the production of green hydrogen requires renewable energy sources, it is key that green hydrogen is applied in those sectors where it is a critical commodity and not in those where other technological solutions

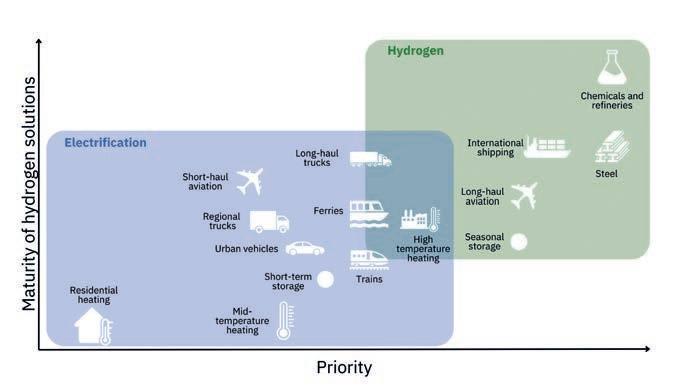

would be a better fit. The International Renewable Energy Agency (IRENA)1 has organised hydrogen applications from low priority to high priority (Figure 1). In the low priority areas, such as residential heating and urban vehicles, there are existing electrification alternatives with higher overall efficiency and lower cost. However, in the high priority areas, such as long-haul aviation and international shipping, there are no alternatives providing both high volumetric and mass energy density at reasonable cost, and green hydrogen is thus a critical commodity for sustainability strategies.

Australia has all of the attributes required to become a key player in the global hydrogen market. In particular, our abundance of cheap renewable solar and wind energy gives us the potential to produce cheap hydrogen. However, transporting this energy across the world and using it where needed requires a means of cost-effective hydrogen storage with high efficiency, high volumetric energy density, and high mass energy density. Therefore, hydrogen storage technologies are a key research topic, Transporting hydrogen requires cost-effective storage.

Hydrogen market opportunity

Global status

While hydrogen has had previous peaks in the last 20 years, it is now displaying an unprecedented momentum. On a global level, there are now ten major (>200MW) hydrogen plants under construction. The first of these projects to be completed was in Kuqa, China, owned by Sinopec. With 260MW of electrolysers, it should be capable of producing 20,000t of green hydrogen per year (although it has been reported to be having challenges and isn’t expected to be operating at full capacity until 2025). There are also several other large projects under construction in China and a 200MW green hydrogen facility powered by offshore wind in the Netherlands. The renewable hydrogen produced by these facilities will be used for oil refining and coal deep processing. There are also several GW-scale global hydrogen projects that are in various stages of planning and engineering up to 2040.

Green hydrogen in Australia

The Australian and Western Australian state governments have invested $140 million in Australia’s first large scale hydrogen project in Pilbara, Western Australia2. The Pilbara Hydrogen Hub is envisaged to be a major centre for clean hydrogen production and export while serving the needs of the local green steel and iron production industries. Australia also has more than 114 other hydrogen-related projects in various stages of development, including projects developing synthetic fuels, hydrogen hubs, hydrogen process heating, hydrogen mobility and many more applications. In December 2023, six hydrogen projects were shortlisted for a $2 billion hydrogen fund from the Australian Renewable Energy Agency (ARENA) with a combined proposed hydrogen capacity of more than 3.5GW3. Final funding recipients will be selected in late 2024, hereby opening the opportunity to propel Australia into the position of a global hydrogen market player. Another noteworthy 2024 development is the development

of a local Australian electrolyser manufacturing line (capable of producing 2GW of electrolysers annually), opened by Fortescue in Gladstone4

Green hydrogen is currently produced at higher cost than fossil-fuel based hydrogen. In the long term, larger plants and cheaper renewable electricity will lower the price of green hydrogen, but the current cost gap limits early technology implementation. Therefore, policy and regulatory mechanisms are necessary to accelerate research and technology deployment. Both the USA and Europe have recently introduced regulatory frameworks designed to accelerate the emergence of supply and demand markets for green hydrogen and other renewable energy technologies.

The US Inflation Reduction Act (IRA) awards up to $3 per kilogram of hydrogen with a greenhouse gas emission of lower than 0.45kg of CO2 per kg of hydrogen5. In response to these regulatory developments in the USA, Europe developed the Hydrogen Intermediary Company, which is designed to compensate producers for the difference between supply and demand prices6. Funding for the mechanism will be provided by public funding bodies, with a commitment of €4.5 billion from the German government alone.

Australia’s national hydrogen policy is based on the National Hydrogen Roadmap released in 20187, in which the focus is on investing in technology scaling up projects for pilots, trials, demonstrations and hydrogen supply chains. In light of the recent international policy developments, in 2023 the Australian government revised the National Hydrogen Roadmap, which led to the establishment of a $2 billion fund for large hydrogen projects8,9 Moreover, the 2024 Federal Budget included several billions for hydrogen production tax incentives and research and development10. With an existing innovation ecosystem composed

1 IRENA, Global Hydrogen trade to meet the 1.5°C climate goal part 1, trade outlook for 2050 and way forward 2022

2 Department of Climate Change, Energy, the Environment and Water (DCEEW), New Hydrogen Hub for Pilbara

3 ARENA, Six shortlisted for $2 billion Hydrogen Headstart funding

4 Fortescue, Fortescue officially opens Gladstone Electrolyser Facility

5 US Environmental Protection Agency, Summary of Inflation Reduction Act provisions related to renewable energy

6 HINT.CO GmbH, Hydrogen Intermediary company

7 COAQ Energy Council, Australia’s national hydrogen strategy

8 S&P Global, Australia to revise, renew its 2019 hydrogen strategy

9 ARENA, $2 billion for scaling up green hydrogen production in Australia

10 Australian Hydrogen Council, Federal budget sets bold vision for Australia’s hydrogen industry

of universities, research institutes, incubators, funding agencies, start-ups, technology companies and many more contributors, hydrogen projects can now be pushed to larger scale applications in Australia.

A significant part of this roadmap is research and development of new hydrogen storage technologies besides compressed/liquefied hydrogen. This includes storage in gaseous hydrogen compounds such as ammonia (NH3), methanol or boron hydrides such as diborane (B2H6) and Mg(BH4)2 with the boron hydrides still in the early stages of technology development.