12 minute read

MEET THE MANUFACTURER

Healthy snacking proving lucrative for companies like Gourmet Food

The purchase of premium cracker manufacturer Gourmet Food by global snacking company Mondelez is an indicator of the current growth in the sector. Adam McCleery reports.

Healthy snacking products have experienced strong growth in recent years as consumers move towards more balanced diets, which has had a knock-on effect of seeing strong investment in the sector.

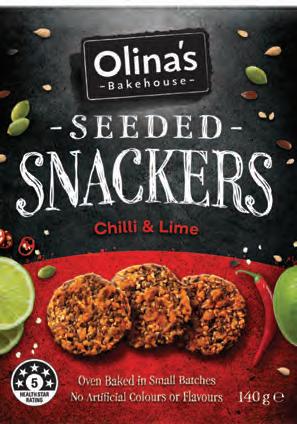

Gourmet Food, manufacturers of Olina’s Bakehouse gourmet and artisan crackers, is an example of the current and future potential the healthy snacking space has after being bought by multi-national food giants, Mondelez, in May of 2021.

“Gourmet Food is a cracker that has done a great job being ranged in both Coles and Woolworths,” said vice president of sales, Toby Smith.

“The business identified that growth in the entertaining space was a trend that would continue to grow into the future. Working with the retailers gave us that insight and aligned very much with the retailers. That premium entertaining space was something to be further unlocked, and therefore we went out and sourced the manufacturing assets that we have today.”

It was in 2015 when Gourmet Food made the decision to step up its manufacturing of premium-style crackers with the intention of helping to reinvigorate the category, while aiming to set benchmarks around quality and flavour.

“We have been really successful with – and something we check in the marketplace – strong relationships with customers, Coles and Woolworths in particular,” said Smith.

While now under the Mondelez banner, it was a calculated decision to not upset a winning business model and instead Gourmet Food will continue to run how it always has and will remain autonomous in many ways.

“The agility of Gourmet Food, the innovation pipeline for example, has been phenomenal,” said Smith. “The company has stepped into some new places very quickly and probably more nimbly than a big multinational would.”

That was another key selling point for the company and one of its market offerings, Smith said – the ability to adapt quickly and continually innovate products to match everchanging consumer trends.

To create the capability for continued innovation required a manufacturing plant that was fit for purpose. Smart investment while building the factory also helped to ensure the correct capital purchases were made with one eye toward future growth.

“The asset is state-of-the-art because the quality of product, ingredients and so forth, require a specific type of asset, which the company invested in,” he said. “It’s also built to grow significantly; you can clearly see the road map to growth and, if not more, the assets have ensured we can do that.

“The baking line is state of the art and there is still room to invest, and we currently are. Gourmet Food invested in doubling the size of the business and it was bought for growth; it was never a synergy play for Mondelez.

“My involvement has helped keep the business separate so it can fulfil

Vice president of sales, Toby Smith, says home entertaining as a result of the pandemic helped drive growth in the healthy snacking space.

Gourmet Food continues to cultivate a strong relationship with major retailers like Coles and Woolworths.

"The asset is state-of-the-art because the quality of product, ingredients and so forth, require a specific type of asset, which the company invested in,” he said. “It’s also built to grow significantly. You can clearly see the road map to doubling, if not more, the size of the business. The assets have ensured we can do that."

its growth goals. We didn’t want to bring it into Mondelez and create different levels of process because the assets, and ways of working them, have been all about aggressive growth and being flexible.”

Meanwhile, the COVID-19 global pandemic forced the company to demonstrate just how flexible and agile the business model was, and according to Smith, the company came through with flying colours.

“They hit the sweet spot,” said Smith. “Premium entertaining is a money space globally and Gourmet has built relevance in the space by adapting to trends, and depending on seasonality, being able to pivot to new flavours to ensure the product is feeling fresh and contemporary.”

Smith said the company had done so well it was ‘stretching the evolution’ of the product space through its approach.

“A lot of organisations may look at an annual refresh of flavours and portfolio offerings but the way we treat gourmet food is as a constant evolution; it isn’t defined by calendar years, it’s defined by where the consumer wants us to be,” added Smith.

Smith gave a real-world example of how Gourmet Food built the capability to shift process methods nimbly when required.

“Our latest Olina’s Bakehouse snackers launch went with a solid proposition but we got some feedback that the cracker was a little too big and we were able to turn that around within 14-15 weeks and it is back in market exceeding all our forecasts,” said Smith.

“I think it is a great demonstration on how the business is set up to be agile. It’s a testament to just how great the asset is that you can pivot and get a product right where you want to be.

“A lot of factories wouldn’t be able to make those adjustment to manufacturing, or product footprint, without the agility and investment being done up front.”

The Australian market also provides opportunities for growth because of the country’s affinity with outdoor entertaining. This is why the nation has one of the highest concentrations of indoor and outdoor entertaining products in the world, according to Smith.

“I think as outdoor entertaining in Australia evolves beyond the barbecue and the sausage in bread – this space will continue to grow,” said Smith.

“People are now wanting to entertain at a different level, so the premium entertaining sector is just such a sweet spot here in Australia and you can see it in a supermarket today – products that are high in quality are in high demand.”

While Australia is a lucrative

Gourmet Food manufactures Olina’s Bakehouse snackers, which has experienced growth in the market.

As a result of its success, Gourmet Food was recently acquired by Mondelez.

Investment in the healthy snacking space is increasing as products become more popular with consumers.

market for the entertaining and snacking space, so is much of the rest of the world and Smith said one of the first key benefits to come from the sale to Mondelez was the ability to have that global powerhouse’s resources behind it when it moved into new foreign markets.

“We’ve got a train of work to get our product into Japan and we’ve got a good base in New Zealand, and we are reaching out to the United Kingdom and the United States,” said Smith.

“We already do a little work with COSTCO, but we will leverage the Mondelez muscle to see if we can get Gourmet into more retailers like Walmart. But that is in its infancy.

Gourmet Food was experiencing growth in the lead up to was named Top Ranked Supplier in the Australian Grocery Deli Category of the Advantage Report.

The report was survey based and like Gourmet Food against key performance indicators, such as innovation and growth.

“Also, we will be continuing with new propositions, catering packs for example, into 2022 also,” said Smith

“The catering, or what we call the away-from-home space, is also another area of growth we have identified as a huge opportunity for the business and is a part of the expansion plan that we have for the immediate future.”

Smith said Mondelez only recently approved capital for Gourmet Food to help speed up the company’s growth. F

JSG Industrial’s automated lubrication systems help reduce labour costs and overheads

National manager at JSG Industrial NZ, Brendon Ladewig, said the company offers a level of technical expertise which makes it attractive to the Australian industry. Food & Beverage Industry News reports.

JSG Industrial Systems provide the food and beverage industry with specialist lubrication systems that help limit production downtime, increase health and safety and reduce wastage.

John Sample Group, through its JSG Industrial Systems business, holds the distribution rights to SKF Lincoln Lubrication Systems in Australia, New Zealand and the Asia Pacific region.

Brendon Ladewig, the company’s national manager for JSG Industrial NZ, has spent years helping apply the company’s range of lubrication systems and applications to the New Zealand food and beverage industry.

“In terms of the food and beverage industry, we supply mostly lubrication products relating to automated greasing and oil systems,” said Ladewig.

One important application that is used across the food and beverage industry is chain and conveyor lubrication.

Among JSG’s offering is an automated application that is coupled with a proximity switch that counts the rotors as the chain comes past and as it counts it activates the nozzle and drops the required oil onto the chain.

“In New Zealand we’ve done a few different solutions for companies, systems include automatic greasing in a prominant bottling plant, a cheese processing factory and a soup packaging production line,” said Ladewig.

One of the key benefits of applying JSG systems to a food or beverage production line lies in the company’s primary focus – health and safety.

“We try looking at it from that aspect because these machines are dangerous, and you are not supposed to lubricate a machine while it is operating, in most cases” said Ladewig.

“Some lubrication points are hard to get to so the machine must be stopped to reach them.”

“That means you lose production time but with an automated system, it lubricates the machine while it’s running, and you don’t lose production. From a health and safety perspective, it avoids situations where operators are in a risky environment.”

For example, in recent years many of the lubrication systems being employed across the industry are being caged off, limiting when operators can access the system for maintenance purposes.

For JSG, the solution to this new problem was a simple one, and it lied with automation.

The company supplies a system with an controller fixed on the outside of the cage so operators can monitor it from a safe distance.

“The control will tell the operator if there are any faults with the system. It will tell them what the entire system is doing at all times. It helps both ways, increases productivity and keeps the operator safe,” said Ladewig.

One of the questions Ladewig is frequently asked when it comes to automated lubrication is, “does this mean some staff will lose their jobs due to the automation of the task?”

“The answer to that question is no,” he said. “What you are actually doing is repurposing your labour. Instead of them doing a menial task you can have that employee do more effective maintenance stuff like planning the next shutdown, or planning the next machine overhaul.”

It’s not uncommon for some sites to have up to 3,000 lubrication points that

Automatic lubrication can limit wastage and mitigate cross-contamination risks.

Automatic lubrication machines from JSG help speed up the manufacturing process.

need to be lubricated on a weekly basis, so being able to repurpose that labour has a positive flow-on effect.

Automated lubrication can also limit wastage on a level that is hard to achieve manually because of issues that arise from overlubricating, including grease dropping on the floor or contaminating other areas of production and the environment.

“And those are things you don’t want to see happening,” said Ladewig.

“The purpose of such an automated system is the right amount of lubrication at the right time and more frequently.”

JSG Industrial’s lubrication systems can be applied to almost all areas of food and beverage production including the dairy industry, which the company will put extra focus on in the 2022.

“Dairy is quite a large industry and we will be looking to get into that one more,” said Ladewig.

Everything from fruit and vegetable sorting and cutting machines to food mixers, blenders and large industrial bake ovens all require some level of lubrication system that can be supplied by JSG.

Ladewig said a renewed push in the New Zealand market for increased health and safety, which the company already meets, indicates its ability to stay ahead of the curve.

The same thing applies when it comes to the Australian food and beverage industry’s requirements and standards.

“We don’t need to tweak anything in terms of our offerings.

“Our products use an engineered plastic that is fine for the food industry, and we make sure we use Stainless Steel Grade 314, a food safe material, for our hoses and fittings,” said Ladewig.

When the company quotes a job, it always ensures it is a full stainlesssteel project because it allows for the greatest flexibility.

“We can fill the pumps with any lubricant we want or need. Usually, the site will already have its own foodgrade lubricant and will make some cartridges available for us to install in the pump,” Ladewig said.

The company will also help a customer work out the return of investment on JSG Industrial systems and applications by calculating a range of factors including bearing turnover.

“We look at how many bearings the company is buying, which indicates how often they have bearing failure,” said Ladewig.

“We also look at how much the labour to fix a machine would cost and we look at the loss of production for the times the machines are down. We also look at the cost of labour for a person to run around with a grease gun and manually lubricate these points.”

On top of this, JSG also calculates the amount of grease a customer buys each year and then from these figures the company gives the customer a ballpark idea of how long it will be until the machine has paid for itself through the reduction in these costs.

Working as the SKF Lincoln Master Distributor for the New Zealand region, JSG Industrial NZ works exclusively with selected distribution partners to offer a complete package to their respective industries. F

JSG Industrial’s lubrication systems can be applied to almost all areas of food and beverage production.