28 minute read

NEWS

from Food Jul 2020

by Prime Group

Australian Bureau of Agricultural and Resource Economics and Sciences’ (ABARES) latest Insights report confirms that our agriculture exports have stayed strong during COVID-19 despite disruptions to supply chains and logistics.

Analysis of Australian agricultural trade and the COVID19 pandemic released in early June found that government and industry’s nimble response to rapidly changing market conditions had been critical to ensuring the strength of Australia’s trade profile.

Co-author and ABARES’ Head of Forecasting and Trade, Dr Jared Greenville, said this positioned Australia well to take advantage of opportunities during the global economic post-pandemic recovery.

“Supply chain and logistics disruptions observed in the early stages of the pandemic are benefiting from government and industry responses, and despite the risks, overall export performance has remained strong,” Greenville said.

“While seafood exports experienced a significant decline in February 2020, March saw a slight rebound in export values for crustaceans and molluscs.

“The government acted quickly to establish the International Freight Assistance Measure.

“We saw government and industry respond to labour challenges, through, for example, visa extensions and permission for agricultural workers to stay with one employer for a longer period.

“Importantly, government has safeguarded the continuation of services that facilitate trade, such as certification, accreditation and other regulatory services, to ensure exports

Australia is in a good position to take advantage of opportunities that have been presented during the COVID-19 pandemic.

and imports still flow.

Live animal exports are a watch point as the pandemic evolves, as demand from Indonesia and Vietnam declines, but export values remain above the five-year average.

Greenville said while the pandemic precipitated a global economic downturn, it was unlikely to have a significant impact on demand for essential food products.

“This persistence of demand was seen during the Global Financial Crisis when agricultural trade remained steady,” Greenville said.

But not all products from the agriculture, forestry and fisheries sectors are essential items.

“As economic activity declines and global incomes are reduced, products consumed through more discretionary spending have been more significantly affected.

“These include high quality foods for cafés and restaurants. These effects were seen for seafood where the outbreak in China has been estimated to have led to a fall in export earnings of around $200 million in 2019–20.”

The pandemic is also driving some changes that will likely remain part of the future trade landscape.

These include shifts in consumers buying more online, higher demand for stable and safe food, a greater awareness of supply chain risks, increased use of digital trade systems and the risk of creeping protectionism.

“The prospects for recovery for Australian agricultural trade are good,” Greenville said.

“Australia’s agricultural sector and trade profile have a long history of adaptation, evolution and growth in the face of external challenges and pressure.

Call: (02) 9746 9555

| Visit: totalconstruction.com.au

World Class Facility Construction

With a specialist builder such as Total Construction you can be assured your next facility expansion goes without a hitch. Contact us today to find out how we can help with construction planning for your next project

Allergen-free food market to surge by almost 10 per cent

The global allergen free food market size is anticipated to reach $111bn by the end of 2030. According to a study by Future Market Insights (FMI), the market is expected to depict a strong positive growth trajectory at 9 per cent CAGR between 2020 and 2030.

According to the report, the rising demand for clean label food products and for meat and dairy alternatives from the vegan consumers will stoke growth in the market.

There is increasing demand for healthy products that are free from GMO, gluten, and other added ingredients. This will in turn create growth opportunities for the allergen-free food market.

The report provides an overview of the allergen-free food market. It covers prevailing trends, analysing growth drivers and potential restraints. The impact of various strategies adopted by the leading market players is studied as well in detail in the report.

It includes in-depth insights into the allergen free food market. Some of these are: • The estimated value of the market was at $47m in 2020. Through the course of the report’s forecast period, the market is projected to show an exceptional pace of growth. • North America accounts for a dominant share in the allergenfree food market. Europe also holds a sizable market share. East

Asia is bound to offer business opportunities to emerging market players. • Key players are likely to focus on product innovations and manufacturing technologies to widen their reach in emerging markets. • Digital advertising and adoption of online sales channel to attract the millennial and Gen Z consumers are some of the key strategies of market players.

Consumers have become quite health conscious and a majority of them spend a significant portion of their disposable income on fitness and well-being. They have also become increasingly aware that along with exercise, a proper diet is necessary to achieve physical fitness.

Food fortification is enrichment of everyday foods with essential proteins, vitamins, and minerals. Consumer preference for such foods is a result of various factors such as rising incidence of lifestyle-related diseases and weight management.

High protein foods aid in maintaining consumer health. Gluten-free bakery products and snacks comprising protein and vitamin ingredients are gaining popularity among consumers. Thus, the trend food fortification is rising, which will in turn support the expansion of the allergen free food market.

The demand for organic food products is rising at a higher pace than supply, creating a gap between the demand and supply of organic food.

Consumers are looking for produced without the use of any kind of fertilizers, pesticides, and chemical processing. Such farming and manufacturing practices are linked to deterioration of human health and environment.

The organic vegetables and fruits market happens to be the fastest growing one in the global food market.

This is indicative of rising prospects for the sales of preservative-free, GMO-free and other allergen free food products.

Lion Dairy & Drinks announces minimum pricing for 2020/21

Lion Dairy & Drinks has announced its minimum pricing for its direct milk suppliers across key Australian dairying regions for the 2020/2021 milk season. This pricing is applicable from 1 July 2020 to 31 August 2021.

In line with the requirements of the new mandatory Dairy Code, which came into play on 1 January 2020, Lion Dairy & Drinks has released all of its contracts for each dairy region on its website and is offering both exclusive and non-exclusive supply agreements for the 2020/2021 milk season.

Murray Jeffrey, agricultural procurement director for Lion Dairy & Drinks, said the publication of regional-specific contracts and pricing on Lion Dairy & Drinks website was designed to provide transparency to farmers.

He said the company was mindful of the impact COVID-19 had on southern milk pricing, together with the impact that drought has had on many farms in New South Wales, Southeast Queensland and Northern Victoria over the past 18 months and was sympathetic to the impact this was having on higher feed costs and farm profitability.

Murray said Lion Dairy & Drinks was committed to working with all its dairy suppliers on mutually beneficial partnerships and programs – this included continuing to facilitate its sustainability program, Lion Dairy Pride. The program, launched in 2017, is designed to help Australian dairy suppliers be more sustainable across five key areas of the dairy farm business system: milk quality, animal welfare, people, community and wellbeing, and the environment and business management. The program offers easy access to useful tools and templates, as well as links to external resources.

“Our minimum pricing for the FY2020/2021 milk season is a sign of our confidence in the Australian dairy industry, and in our growth strategy,” Murray said. “Our purpose-led vision is to deliver sustainable, enjoyable nutrition to help people live well and our strategy will see us continue to focus on driving profitability in key dairy categories with our premium dairy brands and market-leading innovation.”

Murray said the company had proven to be the natural partner for dairy farmers who wanted to focus on growing value through nutritious, branded dairy products that delivered competitive returns and a sustainable future for the industry.

“We are focused on driving profitable growth in milk-based beverages, white milk and yoghurt, as well as for the benefit of our farmer partners, customers, network partners, consumers and other stakeholders,” he said.

“Our approach to milk procurement for many years has been based on offering farmers, what we call the ‘3 Ps’: competitive pricing and contract terms, partnerships and a clear purpose and strategy built around growing profitable demand for dairy and ensuring sustainable returns through the supply chain.

“We are working hard to deliver compelling pricing underpinned by our focus on driving sustainable value back into the industry. Lion Dairy & Drinks is committed to working with all its dairy suppliers on mutually beneficial partnerships and programs.”

There are around 280 dairy farms supplying the Lion Dairy & Drinks business across Australia – this includes direct Lion Dairy & Drinks suppliers and suppliers through the Dairy Farmers Milk Co-Operative (DFMC).

Barramundi farm taps new markets to combat COVID-19

The world’s largest barramundi producer is now selling direct to the public after losing its restaurant and export markets due to the COVID-19 pandemic.

MainStream Aquaculture has more than doubled its retail sales of its premium Infinity Blue barramundi, and established an online store and commenced weekly farm gate sales at its Wyndham farm, 30 minutes from Melbourne’s CBD.

MainStream managing director, Boris Musa, said while the pandemic had “significantly disrupted” the business’s traditional supply channels, including exports to 25 countries, it had accelerated plans to build a new customer base through direct sales.

“It was always an aspiration to develop that side of the business to forge a closer connection with our customers. The supply chain dislocation caused by COVID-19 has provided us with an opportunity to create direct consumer channels,” Musa said.

“Smart people say you should

Centrapay, the digital asset integrator, has signed agreements with Coca-Cola Amatil in Australia and New Zealand to give thirsty antipodeans the option to use its Sylo Smart Wallet to pay for items across Amatil’s vending network using cryptocurrency.

Centrapay’s technology makes it easy for consumers, merchants and machines to leverage digital assets in the physical world. Its platform is designed to help brands connect directly with individuals and increase revenue and operational efficiency for merchants.

Transacting with digital assets never waste a crisis, and this has been a dramatic event that required decisive action and new way of operating to keep the lights on and staff employed. We are a far better business now and are poised to emerge stronger after COVID-19.

“One of the most exciting aspects has been the large percentage of repeat customers. They are obviously enjoying the product and our meal suggestions. We have had some really large orders, with people spending upwards of $500.”

While customers would typically pay about $180 per kilogram for the premium Infinity Blue barramundi at Australia’s top restaurants, online and farm gate prices are as little as $35 per kilogram, with delivery from farm to plate possible a day after harvest.

Farm gate customers also have the opportunity to catch a rare glimpse of MainStream’s Golden Barramundi, a collector’s item, with fish keepers paying up to US$20,000 a fish to keep the animals in private aquariums.

Musa said the business was also reduces how much people need to touch the vending machine, a concern during the COVID-19 pandemic.

Coca-Cola Amatil supports 140 brands and 270 million consumers. Amatil’s customers can use their Sylo Smart Wallet at any one of Coca-Cola’s 2000-plus vending machines with a QR code payment sticker. These are located across New Zealand and Australia and will accept payments in cryptocurrency or other digital assets with a scan of your phone’s camera when Sylo Smart Wallet is installed.

People only need to touch the embarking on a selective breeding program with the intention of adding the Golden Barramundi to its retail menu.

“We have isolated the genes that will enable us to produce the fish on a reliable basis. We are expecting huge demand because it has a whiter fillet and incredible taste, and also because of its striking gold colouring,” he said.

While adapting to its own vending machine once to take their purchase.

Centrapay CEO, Jerome Faury, said that integration complexity and poor user experiences are barriers to adoption of Web 3 technology, such as digital identity and assets.

“We have solved both these issues. Centrapay is pioneering the way to enable this new internet of value and bring its benefits to both consumers and merchants,” he said.

“And it comes with the added benefit of reducing physical contact and addressing the hygiene concerns we’ve all become acutely aware of due to COVID-19. business challenges, MainStream has also stepped up its philanthropic commitments since the pandemic, joining forces with seafood wholesale partners in Sydney to donate produce to out-of-work hospitality workers, and Melbournebased charity From Us 2 You to help feed the homeless.

“It was a very simple decision to help out during these difficult

MainStream Aquaculture’s managing director Boris Musa said the company is trying to build a new customer base through direct sales.

Coke vending machines to accept Bitcoin

times,” Musa said.

“At Centrapay, we’re working to create a future where individuals are in control of their own data and digital identity.

“Brands can connect directly and ethically with people, empowering them to make the right purchasing decision, while also supporting their retail and other distribution partners,” said Faury.

“Now we’ve shown how it can work in Australia and New Zealand, we’re looking to grow the business globally.

“We’ve established a presence in North America and will be targeting the US market next.”

Product diversification set to see gains in the energy drinks market

The demand for energy drinks is increasing, according to a report by Future Market Insights. There has been a sharp increase in the demand for coffee, dairy juice and other beverages as consumer’s stockpile on essential products to sustain them during quarantine period amidst the prevailing COVID-19 crisis.

Consumers prefer products that come from natural sources and are vegan, GMO-free, organic, and have other clean label attributes. Their focus on holistic living and wellness is a key factor driving the energy drinks market. Consumers are determined to make more purposeful choices with their buying power, purchasing with intention of creating positive and valuable experiences, which is supporting the expansion of the market. It has been found that the consumers are in favour of beverages that contain natural ingredients and added antioxidants, vitamins and minerals. In energy drinks, fruit concentrates are added which offer several health benefits. A rising awareness of this will fuel the demand for energy drinks in the coming years.

Manufacturers in the market are expected to focus more on their offerings and make drinks healthier due to increasing concern about sugar content among consumers.

Besides this, innovation in flavour is enabling growth in the flavoured drinks category of the energy drinks market, according to the report.

Key takeaways from the energy drinks market study • The energy drinks market is estimated to be valued $295bn in 2020, registering a CAGR of 7 per cent between 2020 and 2030. • Europe is forecast to account for the leading market share in the global energy drinks market in terms of value sales by 2030 owing to the ever rising consumption of healthy beverages in the Europe region. Demand for ready to drink energy drinks will rise in the coming years. Companies are focusing on augmenting their business presence in developing countries. They are focusing on geographical expansion. In addition to this, companies are entering into strategic alliances across the globe via acquisitions, mergers and partnerships.

Who is winning? A few of the companies operating in the energy drinks market are Red Bull, Monster Beverage Corp., Kraft Foods, Nestlé, The Gatorade Company, PepsiCo, Suntory Holdings, Rockstar, Arizona Beverage Company, Sinebrychoff, HYPE Energy, Living Essentials, Zipfizz Corporation, Asia Brewery, Unique Beverage Company, Bomba USA, Vital Pharmaceuticals, NEALKO ORAVAN, spol. s r.o. (Black Hoarse), Xyience Energy Drink, Energy Beverages, and others.

Producers of energy drinks are regularly offering consumers with more innovative products including unique ingredients and flavours. Innovation in energy drinks is intended to meet the evolving consumer demand for healthier beverages without compromising on the taste, flavour, texture, and nutritional qualities of the product. • In April 2019, PepsiCo launched

PepsiCo’s Propel Vitamin Boost, which contains vitamins and electrolytes. The product contains daily recommended values of vitamin B3, B5, B6, C, and E. It is available in three flavours peach mango, apple pear, and strawberry raspberry. • In 2015, Unilever signed a partnership agreement with JD.com,

China’s largest online direct sales company, which is expected to help the company to expand its presence in China through JD’s extensive online sales platform.

Woolworths further reduces plastic packaging

Woolworths has removed more than 230 tonnes of plastic waste in the past 12 months.

Even during COVID-19, 70 per cent of Australians are continuing to rank taking care of the planet and making sustainable choices as important to them, according to research revealed by Woolworths Group for World Environment Day.

Woolworths has introduced a number of initiatives to further reduce plastic across a range of fruit and vegetables, including bananas, carrots, tomatoes, potatoes, broccolini, sweet potatoes and organic apples.

By moving out of plastic clamshell and into adhesive tape for bananas, replacing rigid plastic trays with pulp fibre on tomatoes, moving to a paper tag on broccolini and reducing plastic film by 30 per cent in weight on carrots and potatoes, Woolworths has removed 237 tonnes of plastic packaging in the past year.

The tray Woolworths uses for its sweet potatoes and organic apples is now made of recycled cardboard, rather than plastic.

Woolworths has also commenced a trial where it will switch plastic packaging in its Fresh Food Kids range of apples, pears and bananas to easy-to-recycle cardboard boxes.

“Something that was very surprising during COVID was the continued relevance of the environment, with 70 per cent of Australians saying that taking care of the planet and making sustainable choices remained important to them, even at the height of the crisis,” said Woolworths Group CEO Brad Banducci.

“While we’ve made pleasing progress in reducing the amount of plastic in our stores, supported recycling labelling initiatives, and made improvements in energy efficiency, sustainable sourcing and reducing food waste, we know there is still much more to be done to meet our customers and our own aspirations,” said Banducci.

Since Woolworths removed singleuse plastic bags in 2018, more than 6 billion bags have been taken out of circulation. Woolworths has also started to offer paper shopping bags, made out of 70 per cent recycled paper, for customers to purchase to carry their shopping home in. In the past year, approximately 10,600 shopping trolleys worth of soft plastics have been recycled through its in-store RedCycle program. Woolworths also removed a total of 890 tonnes of plastic from its fruit, vegetables and bakery ranges over the past two years.

This means that all Woolworths stores now have food waste diversion partners in place. In the past year alone, the supermarket has diverted over 33,000 tonnes of food waste from landfill to our food relief partners or donated to farmers as feed stock.

GS1 Photography Make sure your product stands out in a crowd

High quality digital images and content for eCommerce, web, shopping apps, merchandising and marketing.

We offer:

2D and 3D images 360 degree photography

Planograms

Clipping paths Renders Video and multimedia Romance/Marketing copy Product content management Spritzing

Contact the Photography team:

E ContentCreationSales@gs1au.org W www.gs1au.org/product-to-market

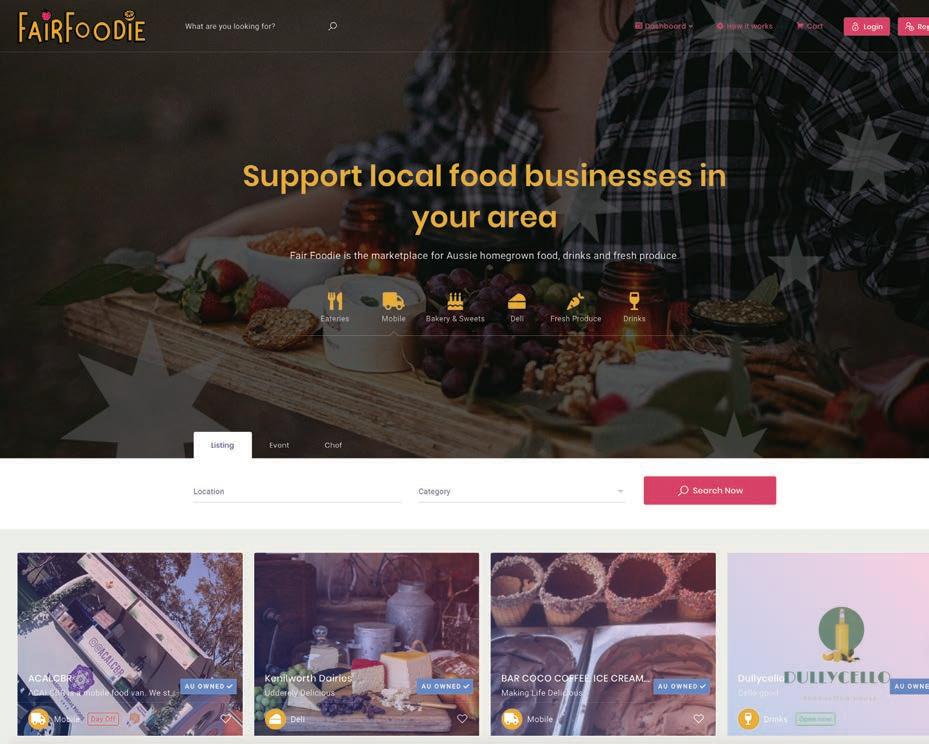

Digital market opens to connect producers to consumers

Anew digital marketplace is giving Australian producers a new home to connect with consumers seeking food and beverage products grown or made in their own backyard.

The website Fair Foodie has arrived with a mission to celebrate Australia’s diverse food and beverage producers through an interactive platform, bringing farmers, chefs, providores, brewers, winemakers and other artisans together with local-loving consumers to help Australian businesses flourish.

Fair Foodie is the brainchild of Lisa Papallo who always wanted to launch a similar platform to highlight Australia’s regional food and beverage producers. But with necessary restrictions to reduce the spread of COVID-19 in Australia, noticed farmers markets and their stallholders doing it tough. So she fast-tracked her plans to launch the service.

“Shopping local is very important to me, but with the temporary closing of my local farmers market during the pandemic, I didn’t have a place to purchase the usual pantry essentials I loved and that I knew were grown or made in my local area,” Papallo said.

“Through Fair Foodie I’ve been able to connect with small, independent business owners from dairy farmers through to brewers and food truck operators – all with immense passion about the products they make, but little by way of online or bricks and mortar storefronts. I saw this as a new opportunity to showcase these producers all in one place, giving them the opportunity to connect

with more consumers and sell their goods.”

The Fair Foodie platform allows vendors to sign up, free of charge, and create their own personalised digital shopfront. Each profile features images, videos, descriptions, products and pricing managed completely by the vendor. Vendors also have the opportunity to list and promote their own events.

Papallo’s goal was to make the onboarding process simple for any producer without any lengthy application or approval process, regardless of how big or small the business was.

“Many of these producers may not have experience building a digital storefront, so we want to make the process as easy and quick as possible to connect them with the Fair Foodie shopper. Rather than spending weeks or months building

Fairfoodie allows food producers to connect with consumers.

an expensive website, a small business can now have their own customised digital storefront within an hour,” Papallo said.

In terms of selling products through the platform, producers have the option of directing customers to their own web stores or, for a nominal five per cent processing fee, utilise Fair Foodie’s secure shopping platform (powered by PayPal) for shoppers to place orders directly. All fulfilment is managed through the vendors on the platform, giving them the freedom to choose their preferred delivery service and timeframes.

“Fair Foodie gives producers complete control over how their products are sold and delivered,” Papallo said.

By cutting out the middleman and standard shipping charges, more profit goes into the pockets of producers. Major delivery platforms in Australia have recently come under fire for charging upwards of 35 per cent commission fees to restaurants using their delivery services. In the retail sector, stock quantities and margins required to be on the shelves of Australia’s major grocery outlets may be unattainable for most small, independent producers.

“The control of delivery by vendors on the site ensures that no hidden charges are worn by either the producer or consumer – putting more money in producers pockets…” Papallo said.

At launch, the Fair Foodie platform hosted about 25 producers across New South Wales, Queensland, South Australia and Victoria, featuring a breadth of retailers from restaurants, food trucks, farm-fresh produce and cafes to kombucha makers, alcoholic spirits and baked goods.

Producers across Australia are invited to join Fair Foodie to host their own digital storefront. Any business based in Australia, creating Australian goods in the food or drinks industry, are welcome to join.

Wine app developer looking for funding

Astart-up, with a new augmented reality platform, has put out a call for investors from the wine, food & beverages, and packaging industries to back its funding round.

Winerytale has opened its Public CSF Share Issue Offer, seeking to raise up to $1.8m to roll out its muchanticipated platform to wine markets in Australia, USA, New Zealand, and South Africa.

The Winerytale app, purpose built for a young adult audience, encourages users to discover the story behind each wine, which is brought to life with augmented reality.

The concept, which also combines multimedia content, virtual interaction, and social media sharing is expected to capture the millennials wine market.

Winerytale founding partner, Dave Chaffey, said the response to the app had been positive.

“It’s an exciting concept that consumers have absolutely taken a shining to,” he said.

“The next step for us is to make it accessible to a much larger audience.”

According to Chaffey, the Capital Raise would fund an aggressive rollout to key markets.

“There’s an enormous opportunity that we intend to capture. Raising capital enables us to move rapidly into new markets, to win over audiences before the first lot of competitors arrive on the scene.”

Despite the promising outlook, Chaffey is aware that raising funds during a global pandemic will be a challenge.

“We’ve already been bitten”, he said. “Early this year, talks with two potential financiers were well advanced – then in March it all just stopped.

“It was the start of the pandemic, everyone was panicking. It was a time to lock down. It was just one of those things.”

Chaffey is keen to avoid a repeat, for one reason – it slows down his company’s move to market.

“A rapid roll out delivers a tremendous commercial advantage, and provides a robust foundation

Winerytale is an app that tells a story.

for growth,” he said. “This is why we’re calling on investment from within – from people established in, and around the wine industry, food & beverages, and even packaging industries. We make no secret of our ambitions to capture an emerging global market.”

Industry has a new choice

At APS Industrial, we’re the gateway that connects the world’s leading industrial manufacturers to the local industry. With exclusive local access to the market’s broadest portfolio of industrial low and medium voltage electrical and automation products, we offer a true one stop shop that promises simplicity, security and connectivity.

In an industry landscape rapidly transforming through digitalisation, quality and a competitive edge matter. APS Industrial is the new choice that gives you both.

NATIONAL DISTRIBUTORS OF CONNECT WITH US 1300 309 303

Australian technology helps wine industry prevent trillion dollar losses

Anew Australian-developed technology suite called eBottli has launched, with the potential to defend Australian wine export industry against the booming global trade in counterfeit wines. EBottli delivers a suite of new tracking and blockchain data technologies, geolocating services for bottles or containers, and unique identifier labels for winemakers. Developed with the support of the South Australian Government, eBottli helps guarantee a wine’s authenticity, and helps address the issue of brand trust for Australian exports – a huge issue in markets such as Asia.

Currently, Australia’s wine exports to China alone are valued at $1.25 billion; but fake plonk is even bigger business. Potential losses to the global industry due to counterfeits are estimated to reach $4.3 trillion by 2022. In China alone, experts claim around 50 per cent of wine over $35 is fake, and up to 70 per cent of bottles sold are fraudulent. This is a major problem for our wine exporters, who are already reeling from bush fires, drought, and the threat of a postCOVID trade war with China.

Founded by French-born, Adelaide-based Nathalie Taquet, eBottli is now working with 12 clients across Australia, including vineyards in the quality wine regions of McLaren Vale and the Barossa Valley in South Australia. Premium artisan wine labels are particularly vulnerable to export fraud.

“It’s quite unbelievable the extent that wine counterfeiters will go to,” Taquet said. “Some will simply replace valuable wine with cheap substitutes in the bottle, with fake labels. They also add juice, and spices for added flavour. Other dodgy bottles contain no grapes at all, and even have harmful substances added – such as lead acetate, which is a sweetener.”

There are a number of anticounterfeit technologies available to the Australian wine industry, but eBottli is the most comprehensive: it uses multiple tracking and geolocating technologies, is ready to use, has its own secure app, and is reliable and low-cost compared to others.

“The eBottli technology also allows wine drinkers to connect with the vineyard, and see the story of how the bottle came to be in front of them,” Taquet said. “Our ultimate plan is to have wine bottles arrive to the customer overseas, and then they can use their smartphones to scan the label and read its Australian story of origin.”

Taquet also envisages using technology as a major point of difference for her B2C business, the online wine club eBottli, which specialises in premium and luxury French and Australian wines. Bottli launched last year, and has already built a loyal wine-loving customer base.

Taquet and her family moved to Australia two years ago, and got their start in Sydney. The South Australian government provided attractive incentives to base eBottli in Adelaide, through the new Supporting Innovation in South Australia (SISA) program, so Taquet and her family made the move. Although both businesses have been disrupted by COVID-19, Nathalie has a strong vision for the future for both Bottli and eBottli.

“We started Bottli to ensure Australians could access the best quality exclusive French and Australian wines,” said Taquet. “We deliver a niche selection of wines from smaller, boutique Australian wineries that do not supply major

bottle shops along with some French wines, to customers once a month.”

Taquet said a family-owned winery in the Burgundy wine region in France grew her own passion for the industry.

“Our French family heritage and passion for wine guided us towards unique artisan winemakers. Bottli also offers wine concierge and sommelier services and we are able to track and source extremely rare and valuable bottles of wine from around the world on request,” said Taquet.

Before starting Bottli and eBottli, Taquet who has a PhD in Life Sciences and a background in science research, was working for Nestle Skin Health. She is on the Board of Wine Industry Suppliers Australia, and has future plans to move the eBottli technology into other produce export markets.

NSW government provides relief to indie brewers

NSW deputy premier John Barilaro (left) with the IBA’s Peter Philip.

NSW Deputy Premier and Minister for Regional NSW, John Barilaro, announced welcome support NSW independent brewers by providing financial assistance to the Independent Brewers Association (IBA) to implement a range of measures that aim to pave the way for recovery.

Barilaro revealed $135,000 would contribute to the cost of memberships for the 120 independent breweries in NSW for a year and $60,000 would go to a partnership associated with the IBA’s annual conference, BrewCon being held in November. These contributions ensure the industry body can continue to provide valuable assistance and resources for members during their recovery from the coronavirus crisis.

The Independent Brewers Association represents over 600 small and medium businesses in every state and territory across Australia with a majority of members located in regional areas. They employ over 3,000 people and support the employment of more than 25,000 in related industries of agriculture, logistics, hospitality, manufacturing and services.

“Our region depends on tourism, so we’ve been struggling to hang on, especially after the fires and then coronavirus. This support will allow us to keep staff onboard and focus on getting new beers ready for our local community and the next tourist season,” said Jacob Newman from Eden Brewery.

The support follows on from the NSW Independent Brewers

Action Plan launched by the Deputy Premier late last year which contained a broad range of initiatives to support growth in the sector. This new funding recognises that the industry has been devastated by the coronavirus pandemic and that NSW breweries will struggle to recover without assistance.

“We’d like to thank Deputy Premier John Barilaro for being a champion of the independent brewing industry, his support has been essential in delivering policy and regulatory changes that will have long-term benefits for every NSW brewery. This strong partnership with the NSW government is crucial for the health of our industry and it is the first step toward recovery for NSW breweries and their employees,” said Peter Philip, IBA chair and founder of Wayward Brewing Company.

“Our industry has been doing it tough, especially small breweries based in regional areas that rely so heavily on tourism and taprooms for survival. A large percentage have lost nearly all their revenue since the pandemic started. This support will go a long way to alleviating some of the immediate pressures being faced these small, family owned and operated businesses,” said Philip.

The NSW government is lending its voice and asking the federal government to provide tailored responses for our industry, including modifying the small brewer excise refund scheme and developing a national strategy for the independent beer industry.