6 minute read

MARKET RESEARCH

Getting a jump on the opposition

Mintel Purchase Intelligence could be the difference between a product being on a consumer’s radar or not. Food & Beverage Industry News explains.

Most new products only get one shot at the big time when they are launched. All the money spent on marketing, promotions and ad campaigns can go down the gurgler if companies don’t do their due diligence on public perceptions, which can be fickle. Anybody remember Crystal Pepsi? McDonalds’ Arch Deluxe? How about Cosmopolitan yoghurt? Or New Coke?

Well, the last one is certainly seared into the memory banks due to it being a colossal failure back in 1985. The others, not so much. Bringing a new product to market is no easy task. It takes a lot of recipe tweaking, taste tests, and a fair bit of money. New Coke showed that even with the backing of a worldrenowned brand, failure is possible.

A key ingredient is market intelligence. Formed in London 47 years ago, Mintel is a company that has pioneered research in many arenas including food and beverage. A conjoining of the words “market”

Mintel uses a huge database to get information from consumers about new products on the market.

and “intelligence”, Mintel has several consumer insight tools – the latest being Mintel Purchase Intelligence, which is product comparison technology, providing rapid, reliable consumer opinion on every reported new food and drink product in the Australian marketplace.

It was developed because the company knew that manufacturers of food and beverages not only wanted to know what consumers wanted to buy, but why.

“It was developed in-house to help food and beverage manufacturers understand which products consumers want to buy and which product attributes are correlated to a purchase decision,” said Mintel’s senior purchase intelligence analyst, Megan Stanton. “The tool goes beyond purchase intent with data and insight on the key attributes consumers care about. What attributes help them make those purchasing decisions? Quality, taste, the trustworthiness of a brand, how fun, exciting, or environmentally friendly are they – these are some of the 16 product attributes that consumers are asked to rate.”

Manufacturers can use Purchase Intelligence in many different ways. They can analyse how a group of products, a newly launched chocolate bar range for example, compares to the benchmark of chocolate bars already in market. This gives manufacturers an insight on why a new product might be underperforming, and then identify areas of improvement. There might be an issue with the packaging – maybe people just don’t like the look of it. Perhaps, there is something fundamentally wrong with the way it’s getting their brand message across. This helpful feedback is available through the words of consumers who rate the products on the Purchase Intelligence tool. The other way Purchase Intelligence can be utilised is as a go-to market tool where a manufacturer can buy what Mintel calls “concept intelligence”.

“You can buy the information as ad hoc if you are launching a new product,” said Stanton. “It gives you the opportunity to have a pre-look at what consumers would say about your product before it launches to the public, as well as benchmark your concept against products that are already in the market.”

How does the information get collected, and how does the company get feedback? Mintel has shoppers throughout the different states who look for new products that are being launched. When they find the product, they send it to Mintel headquarters in London where all the information – packaging, nutrition, type of product – is photographed and recorded and added to Mintel’s Global New Product Database. The market intelligence agency then conducts surveys on the new product, with responses then filtered through to the Purchase Intelligence tool.

“We survey 100 people on each product, a statistically reliable number,” said Stanton. “The survey is always based on the general population in Australia. We make sure we use the Australian Bureau of Statistics (ABS) figures to make sure that we have a representative population.

“For example, we make sure that the population represents a certain percentage from New South Wales, Victoria, Queensland and other states, and we manage also for age and gender.”

Stanton said food manufacturers want to know about their products, and have an indication of the group of people who are going to buy their products. Purchase Intelligence will give them this information, as well as on other factors that will allow manufacturers to compare their product against that of their competitor’s.

“If a respondent says they would buy the product we ask them why,” said Stanton. “Conversely, if they say no, we ask them why, too. Then, we are able to filter and search through all that information to help manufacturers understand why the respondent has given a particular answer.

“There are 16 questions we ask – eg good value, quality, trustworthy brand, natural, and environmentally friendly etc to give us a gauge of what consumers think of a product. Then, we are able to correlate which of those attributes has a strong relationship to a purchase decision.”

Useful information that Purchase Intelligence will show manufacturers includes how many Australians have the intention to purchase their product; what attributes are correlated to a purchase decision; how does that product, or group

Mintel has shoppers throughout the states who look for new products that are being launched.

of products, compare to their competitors, or how it compares to a category on the whole.

Mintel’s Purchase Intelligence tool enables manufacturers to analyse the numbers or explore thousands of verbatims to learn the context of purchase decisions directly from consumers.

And how do manufacturers feel about their product being on the database? Do they have any issues with it being compared to other, similar products?

“A lot of manufacturers are really interested in Mintel Purchase Intelligence,” said Stanton. “We’ve had a number of our manufacturing customers, including retailers, who are very interested in not only how their product is performing but their competitor’s products, too.”

Overall, the reaction in the market to the product intelligence tool has been good, said Stanton. And she believes its reputation will grow as it gets a foothold in the market research space.

“Mintel Purchase Intelligence has been very successful in the US and we’ve been there for just over three and a half years,” she said. “We launched the product intelligence tool in Australia in November of 2018 and we’ve had fantastic feedback.” F

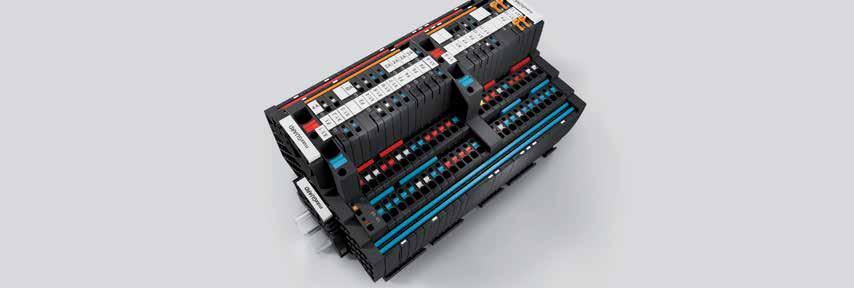

maxGUARD Electronic DC circuit breakers

Protect your 24VDC devices with the maxGUARD series of resettable electronic circuit breaker terminals. This innovative, modular system, combines both electronic overload protection and 24VDC distribution in the one terminal. maxGuard overcomes the limitations of 24VDC switch mode power supplies, such as foldback/loss of supply under short circuit or high inrush conditions. The current-sensing feature enables overload trips and instant trip of the breaker under short circuit, allowing isolation of faults on a 24VDC control system without losing the 24V supply. With maxGUARD, the terminal blocks previously installed separately for 24VDC distribution are now integrated with the electronic circuit breaker module. This saves considerable time during installation and reduces the overall amount of space required on the terminal rail by up to 50 percent. Let’s connect.