RECOGNITION Global for Australian WHISKY

CEO: John Murphy

COO: Christine Clancy

Managing Editor: Mike Wheeler

Editor: Adam McCleery

Ph: (03) 9690 8766

adam.mccleery@primecreative.com.au

Art Director: Michelle Weston

michelle.weston@primecreative.com.au

Sales/Advertising: Joanne Davies

Ph: 0434 785 611

joanne.davies@primecreative.com.au

Production Coordinator:

Salma Kennedy

Ph: (03) 9690 8766

salma.kennedy@primecreative.com.au

Subscriptions AUS NZ O/S

1 year subscription 99 109 119

2 year subscription 189 199 209

For subscriptions enquiries please email subscriptions@primecreative.com.au

Copyright Food & Beverage Industry News is owned by Prime Creative Media and

Importance of software management

Fpublished by John Murphy. All material in Food & Beverage Industry News is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published.

The opinions expressed in Food & Beverage Industry News are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

© Copyright Prime Creative Media, 2023

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Cover Image: APS

Head Office

379 Docklands Drive

Docklands VIC 3008

Ph: +61 3 9690 8766

enquiries@primecreative.com.au

http://www.primecreative.com.au

Sydney Office

Suite 11.01,

Editor: Adam McCleery

ood and beverage manufacturing stakeholders and decisionmakers are currently navigating critical changes driven by rising consumer expectations and a heightened focus on sustainability.

As the global population increases and environmental concerns become more pressing, the industry is turning to software innovation to adapt and meet these evolving demands.

Software technology has forever altered operations within the food and beverage sector.

Modern solutions such as Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) platforms have introduced real-time data analysis and automation, leading to improved production efficiency, reduced waste, and optimised supply chains.

These advancements help companies enhance productivity, minimise downtime, and lower maintenance costs, enabling quicker responses to market changes.

Predictive analytics, particularly those leveraging artificial intelligence (AI), are now used to anticipate equipment failures, thereby reducing production interruptions.

Additionally, software tools for process optimisation help ensure consistent product quality by refining ingredient blending and processing techniques.

In terms of food safety and regulatory compliance, software innovation plays a critical role. Advanced systems enable detailed tracking of ingredients throughout the supply chain, helping manufacturers quickly address potential contamination issues and maintain product safety.

Automated compliance systems also assist in adhering to complex regulations by generating necessary documentation and facilitating audits, thereby mitigating the risk of penalties, and saving time.

As a result, advanced automation is becoming increasingly prevalent, with robotics playing a central role in streamlining production processes. Automated systems are enhancing efficiency in packaging, sorting, and quality control, while reducing labour costs and minimising errors.

Sustainability has become a key concern in the industry, which faces pressure to reduce its environmental impact.

Software solutions are instrumental in this area by optimising energy use, reducing water consumption, and minimising waste.

Data analytics identify energy inefficiencies and support the formulation of recipes that reduce waste and utilise by-products effectively, contributing to environmental preservation and providing a competitive advantage in a sustainability-focused market.

Furthermore, as consumer preferences shift towards personalised experiences, software innovations enable manufacturers to better understand and cater to these preferences.

Data analytics and AI insights allow for product customisation and enhanced consumer engagement through digital channels, which can improve brand loyalty and customer satisfaction.

The integration of software innovation in food and beverage manufacturing is crucial for achieving operational efficiency, ensuring safety, driving sustainability, and enhancing consumer engagement.

As the industry continues to evolve, embracing these technological advancements will be essential for addressing current challenges and unlocking future growth opportunities.

By leveraging advanced software solutions, manufacturers can optimise their operations, respond to market demands, and achieve long-term success in a competitive industry.

Until next month, happy reading.

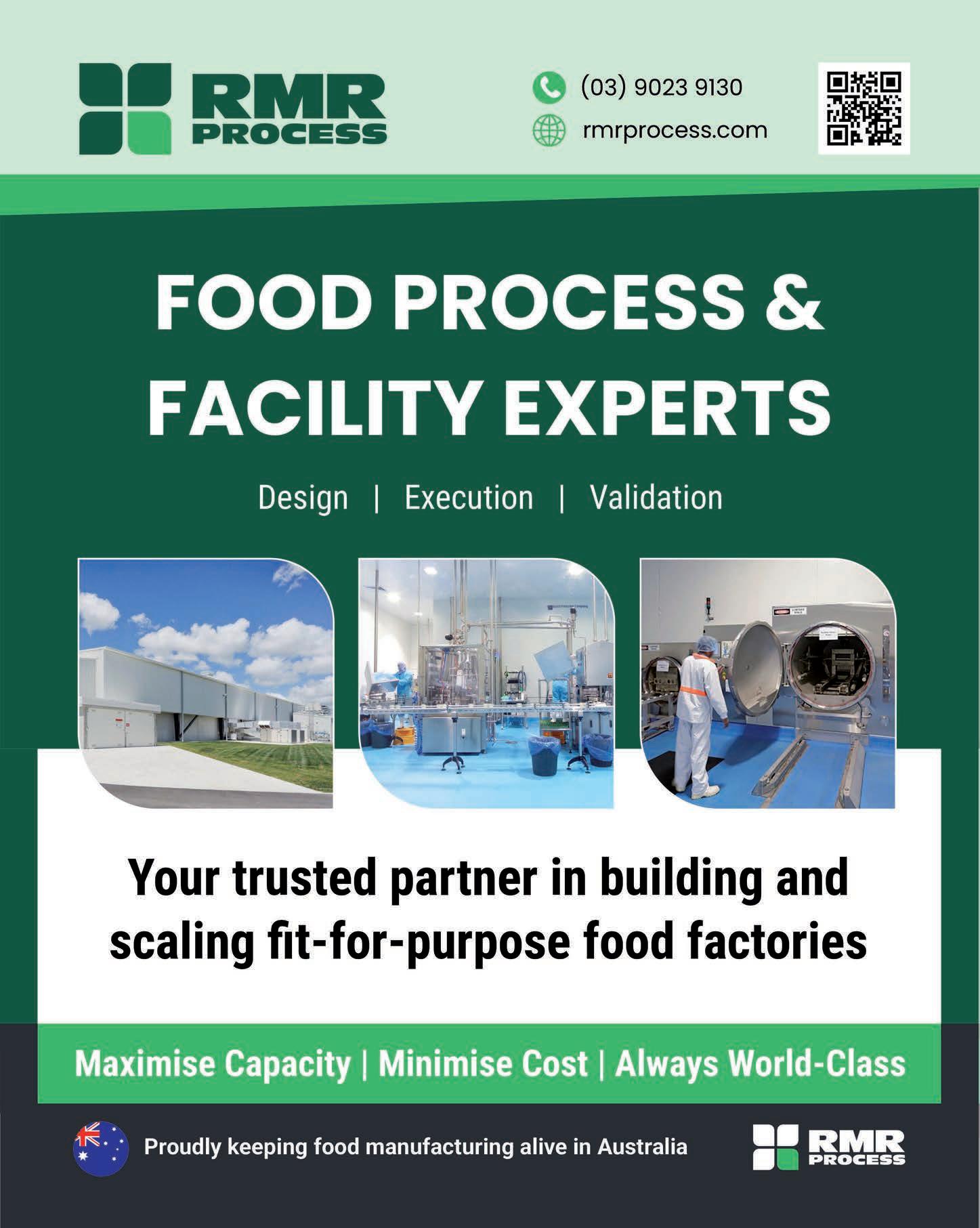

Digitize production, elevate efficiency

Evocon automates and digitises data collection from machines using sensors, PLC-s and HTTPS requests and visualises the data in an intuitive way. Evocon combines plug and play hardware and a user friendly browser-based interface

Evocon will help you achieve OEE optimization. It will help you increase equipment effectiveness, and you’ll gain real time insight on product quality, and plant and line performance. You’ll have real-time intuitive insight into production performance

Machine operators, QA , Maintenance, Operations & Production & Supply chain Managers all benefit from using Evocon. Evocon empowers everyone with information including automated reports, dashboards and checklists

CONTACT

Dan Southern CitySoft Consulting Evocon Product Champion 0480 440 989

Free Evocon trial for the first ten companies to register. Register now at citysoft.net.au/freetrial

Run Smart Run Simple

CitySoft deliver food and beverage manufacturers with market-leading business solutions with an exceptional ROI.

CitySoft supply smart business solutions. We implement globally recognised products which simplify doing business. We connect equipment and software systems and use the data to create competitive advantage for our clients. Importantly, we understand the food & beverage manufacturing industry from both a business and technology basis and provide the insight and expertise to help companies run smart and run simple.

CONTACT CITYSOFT

To discover how we can help your food and beverage manufacturing business capitalize on new and existing technologies.

sale@citysoft.net.au1300 762 762

16 MEET THE MANUFACTURER

Founder of Starward Whisky, David Vitale, talks about the origins and ambitions of the acclaimed Australian distillery.

20 FEATURE INTRO

The food and beverage industry benefits greatly from the advancement and adoption of advanced software solutions

22 SOFTWARE SOLUTIONS

CitySoft are helping manufacturers make the most of real time production data.

24 SOFTWARE SOLUTIONS

Centric Software provides solutions to complement private label products

26 CONSULTATION

The team at RMR Process helps clients increase output and develop more efficient processes through expert consultation.

28 SUSTAINABLE PACKAGING

Bunzl provides various types of sustainable packaging solutions that have been developed on the back of key research.

30 INDUSTRIAL HOSES

Continental’s expertise in rubber continues to give rise to innovative industrial hose solutions.

32 PACKAGING STRATEGY

Details of APCO’s new 2030 Strategic Plan.

34 INFRASTRUCTURE

Stakeholders calling for a renewed focus on better infrastructure.

36 ARTIFICIAL INTELLIGENCE

Those willing to adopt AI could capitalise on its benefits.

38 GOVERNMENT

The Federal Government’s Future Made in Australia agenda has been designed to strengthen the country’s manufacturing sector.

40 FOOD SCIENCE

A collaboration between several universities is aiming to accelerate the development of new produce ranges.

42 FOOD SCIENCE

A team of researchers have introduced a new continuous manufacturing process for cultivated meat.

44 REGIONAL MANUFACTURING

The role of Australia’s regions when it comes to supporting food and beverage manufacturing can’t be understated

46 AIP

The winners of the 2024 annual Scholarship program.

48 DAIRY OUTLOOK

A look at the dairy market’s performance so far in 2024 and an outlook towards the future.

50 NEW PRODUCTS

Fonterra to expand NZ site

Fonterra is set to expand its Studholme site in the South Island to create a hub for high value proteins.

functionality and are designed to perform well in premium product applications such as medical and high-

protein sports nutrition.

Fonterra CEO Miles Hurrell said the investment of around $75 million is part of the Co-op’s strategy to

“We have valuable expertise in dairy science and innovation, making us leaders in the manufacture of dairy proteins and other advanced

ultimately grow returns to farmers.”

Fonterra president Global Markets Ingredients, Richard Allen, says the Co-op’s dairy ingredients are highly sought after by customers globally.

site will allow us to increase production

Site works at Studholme began in September with the first product due to come off the line in 2026.

Woolworths to stop sourcing beef linked to deforestation

The Australian Conservation Foundation (ACF) has welcomed Woolworths’ announcement that it will stop selling beef linked to deforestation, in accordance with the Science-based Targets Initiative.

“No one sells more beef to Australians than Woolworths, so this commitment has enormous implications for nature and for people who want to make sustainable food choices,” said ACF’s nature and business lead Nathaniel Pelle.

“Australia is an international deforestation hotspot, but that problem is being driven by a small number of operators.

“While most graziers are not engaged in broadscale bulldozing of bushland, Australians can’t choose deforestationfree beef because supermarkets don’t differentiate.”

Pelle said the commitment–which follows in a similar path to Aldi–will change this reality.

“Australian consumers will soon be able to buy beef knowing they are supporting farmers who protect forests and woodland on their properties,” said Pelle.

“Koalas need mature trees to live in.

Threatened species like red-tailed black cockatoos need tree hollows to nest in –these only form in trees that are decades old.

“Not acting to end deforestation could have consequences for farmers, shareholders, nature and ultimately our food security.”

ACF, Greenpeace and the Wilderness Society published guidance this year that outlines what is required for Australian corporate deforestation commitments to align with global frameworks.

The Science-based Targets Initiative (SBTi), one of the world’s most influential corporate targetsetting standards, requires all food and agriculture companies to commit to zero deforestation by 2025 to retain a valid SBTi net zero target. F

“We see significant opportunities in the global high protein dairy category, which is projected to grow by close to USD$10 billion over the next four years, at an annualised growth rate of 7 per cent per annum,” said Allen.

“Increasing our manufacturing capacity for functional proteins will enable us to continue to strengthen our offerings with existing customers as well as attract new business.”

Site works at Studholme began in September with the first product due to come off the line in 2026.

In addition to producing advanced proteins, the site will continue to support the South Island’s milk processing as it has done since Fonterra acquired the site in 2012. F

The SBTi is one of the world’s most influential corporate target-setting standards.

Our increased stretch capabilities ensure a reduction in plastic, while maintaining consistent performance.

Shop our puncture resistant pallet wrap today.

www.bunzl.com.au

$15.6 million funding to re-manufacturer soft plastics

Thanks to a $15.6 million investment in advanced recycling and remanufacturing technology by the Federal Government, more than 43,000 tonnes of soft plastics are set to be recycled or remanufactured.

Three projects that were delivered in partnership with the Victorian Government have been announced under the new Recycling Modernisation Fund Plastics Technology stream.

The Recycling Modernisation Fund is a national initiative expanding Australia’s capacity to sort, process and remanufacture glass, plastic, tyres, paper and cardboard.

Naula Pty in Altona received more than $5 million for advanced sorting and processing of up to 32,000 tonnes of soft and mixed plastics products each year, to refine them to produce new plastics such as food-grade packaging.

This will help Australia to develop an advanced recycling supply chain that will turn post-consumer soft plastic waste back into food and other packaging. The project will deliver is set to deliver 61 direct jobs.

“We will fill the gap in the plastics recycling supply chain and circular economy for these plastics in Australia,” said Naula CEO and Founder, Nassib Thoumi.

“We are incredibly proud to receive this grant, it is truly a milestone in Australia’s recycling maturity.”

The first project under the $60 million Recycling Modernisation Fund Plastics Technology stream was announced in July – a $20 million investment in a recycling facility in Kilburn.

When combined with co-investment from all states and industry, the Fund has the potential to give a $1 billion

The government funding has the potential to give a $1 billion boost to Australian recycling.

boost to Australian recycling. Nationally, the Federal Government is increasing recycling capacity in Australia by more than a million tonnes every year while creating over 3,000

jobs, including over 525 in Victoria.

The Australian Government is also supporting soft plastics recycling by improving packaging design through new national packaging laws. F

Vinehealth Australia appoint new CEO

The Board of Vinehealth Australia has announced the appointment of Dr Samantha Scarratt as CEO.

The appointment follows a national recruitment campaign to find a strong leader for the company.

Vinehealth Australia is an independent statutory authority in South Australia with a single-minded focus on grape and wine biosecurity, primarily keeping phylloxera out of the state.

Scarratt is an experienced leader and most recently was a senior consultant for Wine Network Consulting, specialising in viticulture and wine business advice.

Previously, Sam was director of Grape Supply for Accolade Wines, leading a large team to deliver grapes to winery networks across Australia and New Zealand.

The appointment follows a national recruitment campaign.

Sam has significant experience across a variety of roles in viticulture in Australia and New Zealand and has sat on Research Advisory Committees for more than 12 years, advising on the and Oenology (ASVO) and the Australian Wine Industry Technical growers, winemakers, suppliers, and industry stakeholders to empower them Register underpins the biosecurity activities of Vinehealth Australia. F

Report aims to maximise potential of NSW aquaculture industry

The NSW Government has committed to working with industry to double the farm gate value of the NSW aquaculture sector to $300 million by 2030 with the release of the NSW Aquaculture Vision Statement.

The new statement outlines an overarching approach to the development of the State’s aquaculture industries which includes research, investment in breeding programs and a commitment to water quality improvements.

The statement came as more than 300 state, interstate and international delegates attended the national Oyster Industry Conference in Port Macquarie.

The Vision Statement is a joint industry and government initiative built on a shared approach to seafood production, developing bioproducts and climate change adaptation.

Key to delivering a doubling in the farm gate value of the NSW aquaculture industries will be industry

and government supported initiatives including:

• Managing oyster industry risk through a breeding program, plus alternate species.

• I nnovative research at DPIRD research stations and with partners.

• Opening up new areas for marine aquaculture (mussels, oysters, algae).

• Promoting the environmental benefits of aquaculture – e.g. algae, oysters and mussels all take up excess nutrients and help improve water quality.

• Streamlining aquatic biosecurity rules to facilitate access to interstate spat supply

• Protecting and enhancing water quality.

• Providing opportunities for Aboriginal people to participate in aquaculture businesses.

The Government and industry will develop a detailed roadmap that will guide implementation of the target initiatives.

Government and industry will develop a detailed road map that will guide implementation of the target initiatives.

The Government has also provided financial support for aquaculture and commercial fishing businesses with fee relief as they were impacted by natural disaster and aquatic disease. F

The NSW Government has recently announced it is investing more than $3 million to provide much needed upgrades at the Port Stephens Fisheries Institute.

Arange of single use plastic products have been banned in one of the most significant phases of the South Australian Government’s efforts to reduce plastic waste.

The following items are now banned in South Australia:

• Single-use plastic coffee cups and lids

• Plastic barrier bags used fresh fruit or vegetables, nuts, or confectionery

• Plastic-laminated paper shopping bags

• A ll plastic food bag tags used to close plastic bags containing food

• Plastic balloon sticks, plastic balloon ties and plastic confetti.

Next year, plastic barrier bags used for dairy products, meat, poultry, fish and seafood, plastic fruit stickers, and plastic soy sauce fish containers will join the list of banned products.

Several plastic food and beverage products banned in SA New Zealand Winegrowers launches Roadmap to Net Zero

New Zealand Winegrowers has released the New Zealand Wine Roadmap to Net Zero 2050.

The launch took place during the Research & Innovation Forum, one of the events featured in the Altogether Unique 2024 annual wine celebrations, which were held on August 30 in Wellington.

Fabian Yukich, chair of the New Zealand Winegrowers Environment Committee, emphasised that the wine industry requires a clear pathway to reach its Net Zero goal.

“Climate change is the biggest long-term challenge facing our industry. It will influence our choice of grape varieties, wine styles, viticultural techniques and regions, and importantly, the purchase decisions of our customers,” said Yukich

Community consultation shows South Australians overwhelmingly support action to ban single use plastic items.

Of more than 3,000 people surveyed, 97 per cent of respondents said they supported more single-use plastic items being banned.

“Single-use plastics are often used for seconds but they last a lifetime in our natural environment. The carbon footprint associated with making and transporting and disposing of single-use plastics is not sustainable if we are to more than halve our carbon emissions by 2030,” said deputy premier Susan Close.

Phasing out single-use plastics is an important way to reduce pollution, cut carbon emissions and protect marine life.

South Australia has taken steps to address the impacts associated with a range of single-use plastic products and

South Australia has taken steps to address the impacts associated with a range of single-use plastic products.

was the first jurisdiction in Australia to do so on a state-wide basis, beginning with single-use plastic shopping bags in 2009.

The Plastic Free SA program,

funded through Green Industries SA will continue to provide free advice for South Australian Businesses on the best alternatives for their products and services. F

The Roadmap was made possible through the support of EECA (Energy Efficiency & Conservation Authority) and produced by thinkstep-anz.

The Roadmap outlines the wine industry’s current greenhouse gas (GHG) emissions and sets targets for

2030, 2040, and 2050.

It provides vineyards and wineries with practical strategies for innovation,

aimed at reducing emissions as quickly and effectively as possible, in alignment with the industry’s goals.

In the short term, focusing on reducing scope 1 emissions is the most practical approach. Addressing scope 2 and 3 emissions will require innovative solutions across the entire value chain, particularly in electricity generation, transportation, and packaging.

The Roadmap to Net Zero 2050 is just one component of the New Zealand wine industry’s commitment to sustainability.

ince 1995, Sustainable Winegrowing New Zealand (SWNZ) has been the wine industry’s independently audited sustainability certification programme.

As wine consumers increasingly demand greater transparency of environmental credentials, this next step by the New Zealand wine industry could give critical insight for the Australian wine industry moving forward. F

The NZ Winegrowers Roadmap to Net Zero sets targets for 2030, 2040, and 2050.

‘Too Good To Go’ aims to help fight food waste

Too Good To Go, the world’s largest marketplace for surplus food has announced its official launch in Australia beginning in Melbourne.

The Danish-born certified B-Corp aims to help households and businesses halve Australia’s annual food waste by 2030 in line with the National Food Waste Strategy.

The free to use mobile app will allow users to purchase a Surprise Bag of food, at a reduced price from a range of bakeries, cafes, restaurants, grocery stores and other businesses.

O ver 80 local businesses have joined Too Good To Go for its launch in Australia.

FoodCo’s Muffin Break and Jamaica Blue will also be joining the marketplace with select sites rolling out across Victoria throughout September.

More stores will continuously be added on the app, which worldwide already partners with more than 170,000 food businesses.

In Australia, food waste is a multibillion-dollar problem, with over 7.6 million tonnes of food wasted annually.

How the Too Good To Go App works 1. Find surplus food near you: Users search Too Good To Go’s

3. Pick up your food: Users arrive within the pick-up window that the store sets, shows their in-app receipt

at the end of the day, including prepared food, beverages and ingredients that would otherwise be thrown away.

New GM of research and innovation for Wine Australia

Wine Australia has announced the promotion of Dr Paul Smith to the position of general manager, Research & Innovation.

Smith was previously Wine Australia’s Senior Research & Innovation Program Manager and replaces Dr Liz Waters who was recently promoted to COO.

In his new role, Dr Smith will have oversight of co-investment of industry and Commonwealth funding into research, development, and adoption activities to benefit Australia’s grape growers and winemakers.

“I am excited to bring my experience in leading research projects, teams and managing a portfolio of complementary projects to this role,” Dr Smith said.

“I’m particularly passionate about maximising the innovation aspects of the investments we make by realising value from the research that forms a

foundation for practical, profitable outcomes for the Australian grape and wine community.”

Smith joined the Wine Australia team in 2017, taking a critical role in the research and innovation portfolio after a 14-year tenure with the Australian Wine Research Institute where he managed teams of grape and wine researchers.

Prior to this he completed postdoctoral research at CSIRO Molecular Science and the Department of Clinical Pharmacology at Flinders University. Dr Smith has a PhD in Organic Chemistry from Flinders University.

Wine Australia CEO Dr Martin Cole said he is delighted to announce Smith’s promotion, as over the last few he has been an instrumental part of

the organisation.

“I’m delighted to announce Paul’s promotion into this critical leadership role at Wine Australia. Paul has been instrumental in guiding continued advancement of the research and innovation responses to the critical issues identified by the sector,” said Cole.

Wine Australia is currently recruiting to backfill Dr Smith’s role which has been re-titled research impact manager and will focus on developing and executing business investment plans to drive innovation in the grape and wine sector.

Both appointments are among several that have taken place at Wine Australia in recent months to replace staff who have moved on, taken parental leave, or been internally promoted. F

Image: Wine Australia

Paul Smith is the general manager of research and innovation for Wine Australia.

The Too Good To Go App already has more than 100 million registered users in 18 countries.

Record exports for beef and sheep meat

The release of the September cattle and sheep projections updates from Tim Jackson, MLA Global Supply Analyst, show record exports of beef and sheep meat for the upcoming calendar year.

Australia’s strong market access position has improved diversification and competitiveness in the global market.

As an export-oriented, red meatproducing nation, free trade has been

In the year to August 2024, 93 per cent of Australian beef exports were shipped to countries with which Australia has FTA.

$15 million investment into QLD aquaculture

The Queensland Government will invest $15 million into the continued growth of Queensland’s booming aquaculture industry.

The Queensland Aquaculture Strategy 2024–2034, launched last month by Agricultural Industry Development and Fisheries Minister Mark Furner, outlines the plan to put more premium Queensland seafood on plates in our state and across the globe.

“Queensland seafood is highly desired by consumers who value high-quality, great-tasting food that is sustainably produced,” said Minister for Agricultural Industry Development and Fisheries and Minister for Rural Communities Mark Furner.

“It’s important we’re continuing to invest in our aquaculture sector to give consumers choice, variety, and confidence that all Queensland seafood is sustainable and responsibly sourced.

This investment is a further boost to the $7.5 million committed to aquaculture in March 2023.

New grants for Queensland manufacturers

Queensland Manufacturing

Minister Glenn Butcher has launched a new round of Made in Queensland (MiQ) grants, with an additional $20 million available to help manufacturers grow and create more manufacturing jobs.

MiQ is a $121.5 million Queensland Government grant program

helping small and medium sized manufacturers to increase international competitiveness, productivity, and innovation, and to generate high-skilled jobs for the future.

Over six rounds, MiQ has supported 161 advanced manufacturing projects across the state, creating and supporting more than 6,500 jobs.

The Guidelines for

These investments have also leveraged over $261 million in private sector investment. MiQ projects are helping local manufacturers to bolster competitiveness and create more good manufacturing jobs.

“We’re helping manufacturers build supply chain resilience and grow their workforce. MiQ is a proven winner, with more than 6,500 jobs created many of those in regional Queensland,” said Butcher.

“I’m proud to help these Queensland manufacturers grow their business and I’m proud to see that Queensland is the leading state for manufacturers with more and more businesses wanting to move here because of the incredible support on offer from the Queensland ...Government.

Just like at Berg Engineering, with locations in Brisbane and Gladstone, who have received more than $975,000 in MiQ grant funding from the Miles Government.

This funding enabled Berg to buy

a multi-axis CNC machining centre and CNC horizontal boring machine. The new equipment will help this Queensland manufacturer to increase production capacity and will see six new full-time jobs created in their Brisbane facility and a further eight jobs in their Gladstone facility.

This grant program is part of the Miles Government’s more than $240 million investment in supporting manufacturers across the State, including through the Manufacturing Hub Grants and the establishment of six Manufacturing Hubs across Queensland.

The Guidelines for Made in Queensland Round 7 are available online now with applications opening from 24 September 2024 and closing on 24 January 2025.

Queensland manufacturers seeking more information about project eligibility criteria, key time frames and assessment criteria should visit the RDMW website. F

Suntory Oceania’s new $400 million Queensland facility

Production has officially started at Suntory’s +$400 million multibeverage manufacturing facility in Queensland, Australia.

This marks a significant milestone in the global drinks giant’s growth strategy, with its new $3 billion partnership, Suntory Oceania set to launch from mid-2025.

The 17-hectare site will power the partnership as the new manufacturing and distribution hub for the company’s multi-beverage portfolio of over 40 market leading brands.

The site has the capacity to hold over 50,000 pallets of product, with a highspeed glass line and two canning lines that fill at an industry-leading speed of 180,000 cans per hour.

Australia’s number one energy drink, V Energy, was the first product off the line. By mid-2025, the facility will also produce Suntory’s iconic Ready-ToDrink (RTD) alcohol brands, including – 196, Canadian Club and Dry, and Jim Beam and Cola.

The new Suntory Oceania site has the capacity to hold more than 50,000 pallets of product.

CEO, Darren Fullerton, said he was proud to see Suntory’s first Australian facility built, the largest FMCG investment into the country in the last decade.

“We are excited about the growth this will unlock for Suntory in the region, and the opportunities we will be able to offer our people, our customers,

ignite the category with our full multibeverage offering.”

The facility boasts strong sustainability credentials with a

heating and cooling technology and on site waste management and water recycling facilities sets a benchmark for sustainable manufacturing. F

Made in Queensland Round 7 are available online now.

Image: Suntory

Oceania

Coca-Cola Europacific Partners (CCEP) will meet its target to use 100 per cent renewable electricity across its Australian operations by 1 January 2025, one year ahead of schedule.

The achievement will be made possible thanks to the signing of a new Virtual Power Purchase Agreement (VPPA) provided by global renewable energy player, ENGIE.

CCEP joined the global RE100 initiative in 2021 and made a commitment to power its Australian operations with 100 per cent renewable electricity by the end of 2025.

The company has since supercharged its efforts, investing in rooftop solar panels at its production sites around Australia and securing several key power purchase agreements.

This latest 10-year agreement with

CCEP Australia to achieve 100 per cent renewable electricity Investment into biosecurity for grain growers

The NSW Government has invested $13.5 million to advanced research and diagnostic technology to protect NSW grain production and food security from the threat of exotic pathogens and pests.

The $13.5 million will be a five-year co-investment through National Grains Diagnostics and

ENGIE will enable CCEP to secure the remaining energy needed to fulfil its RE100 commitment.

This will make CCEP one of the first FMCG players in the country to achieve the RE100 commitment and is an important milestone for our business,” he added.

Under the PPA with ENGIE, CCEP will purchase a percentage of renewable energy and associated Renewable Energy Credits (RECs) from the newly built Wellington North Solar Farm, owned by Lightsource bp, located in the Orana region of New South Wales.

The site spans over approximately 970 hectares, over three times the size of Sydney’s CBD, utilising more than 1.2 million solar panels and has the capacity to generate 925,000-Megawatt hours (MWh) of renewable electricity per year.

The site spans over approximately 970 hectares, more than three times the size of Sydney’s CBD.

Surveillance Initiative.

The co-investment will be led by the NSW government scientists at the Elizabeth Macarthur Agricultural Institute (EMAI), with work also underway at the Wagga Wagga, Tamworth and Orange Agricultural Institutes.

The project which aims to address critical gaps in grain biosecurity is part

It has also provided economic benefits to the local community,

including the creation of up to 400 local construction jobs. F

of the Government’s $946 million investment in protecting the State’s primary industries against biosecurity threats.

NSW Department of Primary Industries and Regional Development (DPIRD), in partnership with Grains Research and Development Corporation (GRDC), is creating new early warning

and molecular diagnostic tools.

These tools are essential to identify and reduce the impact of exotic biosecurity threats.

The work, which is targeting 16 exotic grain pathogens and 62 exotic grain pests currently not in Australia, aims to prevent billions of dollars damage to the state’s agriculture sector if there were future domestic outbreaks of these threats.

Targeted pests and pathogens, currently not present in Australia but causing significant damage internationally, include wheat blast, exotic fusarium wilt diseases and hessian fly.

Overseas, the exotic wheat blast disease, present in South America, Bangladesh and Zambia, has resulted in devastating crop losses of up to 100 per cent when the environmental conditions were conducive.

The possible spread of the wheat blast and other diseases from overseas to Australia has increased in recent years because of the international seed and grain trade, Australia sharing similar environmental conditions and global warming. F

The NSW Government’s $13.5 million investment into grain growing will be a five-year co-investment through National Grains Diagnostics and Surveillance Institute.

Starward Whisky: Australian flavour and global ambition

Founder of Starward Whisky, David Vitale, talked to Food and Beverage Industry News about the origins and ambitions of an acclaimed Australian distillery. Jack Lloyd writes.

Nestled within the historic Port Melbourne, Starward Whisky has evolved from an idea held together by sheer belief into a multiple award-winning distillery.

When David Vitale founded Starward, his aim was to move whisky away from the ‘special occasion’ cabinet.

“I started Starward to move whisky from something rare and scarce to something that’s readily available all around the world,” said Vitale.

Vitale’s number one priority was to make a product that was authentically Australian. Taking inspiration from the patriotic flavour profile of Scotch Whiskies, he made it his mission to make this notion a reality.

“We had to do something that was radically different to what already existed so that we had permission in the whisky world. When you open the cork, you need to know this is an Australian whisky,” he said.

Distinctively Australian whisky

This desire to create a whisky that was undeniably Australian in origin, taste and smell would lead Vitale down a path of experimentation. This is where he would stumble across a process that is now synonymous to Starward Whisky.

When traditional distilling production processes end, Starward ages its whiskies in red wine barrels that are sourced locally near Port Melbourne.

“Starward is more Australian than Scotch is Scottish. Those barrels are sourced literally from winemakers a day’s drive away,” said Vitale.

“Because we’re so close to wineries, we can empty the barrel in the afternoon and then fill it still wet with that wine character, which is a novel process that we’ve pioneered.”

Vitale described this as the moment when he and his team knew they could add to the already established

conversation of Australian whisky.

“All of a sudden, we’ve got a reason to exist,” he said.

Not only are the barrels Australian in origin, but Starward insists on sourcing local grain from farmers between the South Australian border and Geelong.

“Within a day’s drive, we’ve got all this amazing malted barley that’s sourced and then malted for us in Geelong, which is 100 kilometres down the road,” said Vitale.

“Not only are the products we source local, but they’re really distinctive and delicious.”

Local ingredients and resources aren’t the only way Starward Whisky is shaped by Australia. Vitale noted that the whisky is even affected by Melbourne’s ‘four seasons in a day’ weather conditions.

“We couldn’t make this whisky anywhere else apart from Melbourne. The reason for that is the climate,” he said.

Vitale said that as heat rises, the barrel expands and forces the spirit into the wood, which further helps the spirit extract the flavour from the barrel. When the climate turns cold, the wood contracts, leaving the whisky in a resting state.

“Instantly we’re having more of that reactive process happening all the time compared to Scotland,” said Vitale.

The lack of constant humidity in Melbourne is also a factor in the retention of alcohol during evaporation.

“Think about Scotland, it’s quite humid. That means that as the temperature rises and falls, they’re losing more alcohol than they are water from evaporation,” said Vitale.

“In Melbourne, it’s quite a unique environment where we’re losing as much alcohol as we are water, which makes for a softer maturation.”

Starward’s ‘Two-Fold’ whisky is among products to win gold at the 2024 San Francisco World Spirits Competition.

When David Vitale established Starward, his number one priority was to make a product that was authentically Australian.

Undivided focus on Whisky

Alongside its local flair, Starward’s decision to exclusively focus on whisky allows the distillery to refine its production processes.

“Focusing on the one product was critical to us,” said Vitale.

As a part of its production processes, Starward departs from traditional distilling practices by using brewing barley.

“It’s a darker malt that creates a real luscious mouth feel and texture to the whisky,” said Vitale.

Starward then ferments the barley using ale yeasts to create a more tropical flavour.

“It’s like a Belgian style yeast and a distilling yeast put together. A lot of those tropical characters you get in Starward are from the fermentation process,” said Vitale.

Vitale believes these methods mean Starward isn’t 100 per cent reliant on the barrel for its flavour profile.

“While I have a strong belief that even though 70 to 80 per cent of the flavour comes from the barrel, the other 30 per cent can make a big difference too,” he said.

Starward then distils the whisky for around six hours and can do three batch runs in a day.

Vitale said despite the quality of its processes, Starward couldn’t operate without its BRC Global Standard for Food Safety (BRCGS) certification.

Recovering and reusing energy used to heat its stills is just one of Starward’s sustainability initiatives.

program to be certified globally under the UK initiative. That’s levelled things up quite substantially in terms of our quality assurance programs. A lot of that’s anchored in good process that we were doing anyway,” he said.

“If you just want to run a business effectively, having those programs in place sort of gets you ahead of the curve.”

In addition to its commitment to product quality, Starward Whisky is dedicated to sustainability.

“We’ve got pretty ambitious goals to have a net zero carbon footprint,” said Vitale.

A recent initiative saw the company taking 200 grams of excess glass out of each bottle they ship.

overseas, so once you start to put together the carbon footprint in terms of exports, it’s huge,” he said.

Starward also sources the glass for its core ranges domestically, allowing for a higher rate of glass to be recycled.

Energy efficiency is another priority with systems in place that aid the distillery in recovering energy that

would otherwise go to waste.

“It’s a resource-intensive business in terms of energy that we use to heat the stills up, and then cool them down again. What we try to do is recover as much of that energy as we can,” said Vitale.

Anticipating market dynamics

Aside from Starward’s focus on distilling, Vitale and production director Sam Slaney believe a large part of the process is anticipating where the market is going to be in the now and in the future.

The two have applied their previous

“I think we can get people to fall in love with our whisky 20 years before they think they’re ready for it.”

International achievements and products

Due to a blend of its processes, Starward was awarded the title of ‘Most Awarded International Distillery of the Year’ at the 2024 San Francisco World Spirits Competition.

Vitale was humbled, especially because it is the second time the distillery has been awarded the title in the event’s 22-year history.

was Starward’s fan favourite ‘Two-Fold.’ “ Two-fold is my favourite whisky that we make because it’s just so versatile, approachable and easy to drink,” said Vitale.

“It has just the right amount of complexity to it, yet it is still sessionable.”

Vitale said the product’s availability is a large factor in its popularity.

“This is what I love about these awards. It’s the ones that are most readily available that have been accoladed the most,” he said.

Aside from Starward’s award winning products, Vitale has a soft spot for a whisky that was inspired by the founder himself. ‘Vitalis’ is a single malt that was released for the distillery’s 15th anniversary.

“We don’t do 15-year-old whisky’s, because Melbourne’s climate would make them not taste that great. But we’ve got a 15th anniversary whisky called Vitalis, and that was launched December 2023,” he said.

“It’s the greatest hits of all our whisky’s

in one bottle, and that’s hard to do. If you say, just grab a little bit of everything and put it into one cask, everyone is probably thinking of Frankenstein’s monster, but it is outstanding.”

Unwavering belief through uncertain times

Despite Starward’s current success, Vitale admitted that until the distillery won hearts and minds with its modern approach, it was “touch and go for a while”.

“Those first few years of finding our feet in the Australian market when we didn’t have much of a reputation of making whisky, even though the quality of all of the whisky being made was amazing, was really hard,” said Vitale.

“I think we were like 90 days away from insolvency for two years.”

Vitale insisted the key was the belief in all the reasons why the distillery would work as opposed to all the reasons it shouldn’t.

“We started the business with a

Nestled within Port Melbourne, Starward Distillery and Bar is open Thursday to Sunday.

fearless kind of belief that we could do it. It was almost irrational,” he said.

“I remember thinking no one even knows Australia makes whisky. Why are they going to choose yours instead of that product? And there were a lot of people that doubted. But equally, there were enough people that believed.”

Pioneering the future of Australian Whisky

Vitale takes this belief outside the walls of Starward in his role as vice president of the Australian Distillers Association. With knowledge gained in both roles, he believes that now is an exciting time for the Australian Whisky sector.

“It’s an exciting time for Australian whisky. We have, I think, the most innovative platform to create whisky’s that are distinctive and talk to the place they’re made,” he said.

Despite the sector’s promise, Vitale believes the industry still faces an awareness issue. For Australian whisky to take off in global export markets, he said it

will need government funding to establish a body like that of Wine Australia.

invested in Wine Australia to establish a body that can help build the credibility of Australian wines around the world. Now, four of the top ten most valuable wine labels in the world are Australian,” he said.

“We just need the government to support us the way they did wine as an export industry.”

“We’ll always be a rolling stone when it comes to innovation, flavour and quality,” he said.

“The job to be done for Starward and our other whisky-making friends in Australia is to start putting Australian whisky on the map around the world.

“There’s so much opportunity for us to take these award-winning products to

the world. That’s what gets all of us out of bed every day.”

Starward’s ambitious global goals are already underway, including the further development of its already streamlined US operations.

“The complexity in the US liquor market is the most complex in the world in terms of navigating. Now, however, the team in the U.S. is up and running and growing year on year, which is exciting,” said Vitale. F

‘Vitalis’ is a single malt whisky that was released for the distillery’s 15th anniversary.

Starward ages its whiskies in red wine barrels that are sourced from within a day’s drive of the distillery.

The impact of software solutions on the food and beverage industry can’t be understated.

The power of one’s and zero’s

The food and beverage industry is benefiting from the continued advancement and adoption of advanced software solutions in the manufacturing process.

The adoption of advanced software and product life management (PLM) solutions in food and beverage manufacturing has become integral to optimising operations and ensuring product quality.

As the industry faces increasing demands for efficiency, regulatory compliance, and innovation, these technologies offer crucial tools for managing the complexities of modern manufacturing.

Software solutions in food and beverage manufacturing encompass a range of applications designed to streamline production processes, enhance traceability, and improve overall operational efficiency.

These software and business management tools assist in the integration of various functions within a manufacturing organisation, allowing for real-time data analysis, automated reporting, and seamless communication across departments.

These systems provide a platform for managing core business processes, including inventory management, procurement, production planning, and financial reporting.

For food and beverage manufacturers, software solutions

offer specialised features such as batch production tracking, recipe management, and compliance reporting.

These capabilities are essential for maintaining consistency in product quality and meeting stringent regulatory requirements. For example, PLM solutions like those supplied by Centric Software.

PLM solutions complement other software tools by providing a framework for managing the life cycle of a product, from concept through production to end-of-life.

PLM systems enable manufacturers to track and manage product formulations, packaging designs, and ingredient sourcing, ensuring that all aspects of a product’s life cycle are optimised for efficiency and compliance.

In the food and beverage industry, PLM solutions facilitate innovation by enabling manufacturers to streamline the development of new products and variations.

By integrating PLM with other software systems, manufacturers can accelerate time-to-market for new products, reduce development costs, and enhance collaboration across teams. Additionally, PLM solutions support regulatory compliance by maintaining detailed records of product

specifications and changes, which is crucial for meeting the requirements of various food safety standards.

The integration of software and PLM solutions also supports better data management and analytics.

Advanced analytics tools embedded in these systems allow manufacturers to derive actionable insights from their data, enabling more precise forecasting, demand planning, and resource allocation.

This data-driven approach enhances operational efficiency and supports strategic decision-making, ultimately contributing to improved profitability and competitiveness.

CitySoft is one such company that provides data-based solutions, and director Ian Hill said being able to leverage data points provides businesses with a host of benefits.

“The technology introduced into the industry has caused enormous change,” he said.

“The shift from paper-based processes and manual spreadsheets to sophisticated digital solutions is no longer optional but essential for modern businesses.”

In this edition we detail how CitySoft’s success in this niche is largely due to its adaptability to the

evolving food and beverage industry, which has been reshaped by compliance requirements, smart machines, and the integration of IoT and big data.

Hill highlights how globalisation and new competitors have impacted the industry, among other key points of note.

He said the industry has embraced software innovations and by doing so the face of the industry is changing.

Despite the advantages of adopting these technologies, food and beverage manufacturers must navigate several challenges, including the cost of implementation, the need for staff training, and the integration of new systems with existing infrastructure.

Successful adoption requires careful planning, investment in technology, and a commitment to ongoing support and maintenance.

By leveraging advanced software tools and PLM systems, food and beverage manufacturers can achieve greater efficiency, compliance, and success in their operations.

The integration of software solutions and technological innovation in food and beverage manufacturing is more than a trend; it is a necessity for staying competitive in a rapidly evolving market.

By enhancing operational efficiency, ensuring quality and compliance, driving innovation, and supporting sustainability, software solutions are transforming the industry. F

Utilising data to improve manufacturing

Software solutions are helping manufacturers make the most of real time production data to improve output, efficiency, and profitability.

CitySoft, once a traditional ERP consulting firm focused on delivering business solutions to the mid-market, has evolved into a specialised leader in the food and beverage manufacturing sector.

The company’s transformation began in earnest around 2010, when they adopted a new application called Sage X3 designed to cater specifically to this industry. By 2015, CitySoft’s expertise in food and beverage became a cornerstone of its business.

Initially, CitySoft explored various market solutions, evaluating products like BatchMaster and Beas for SAP Business One.

The company settled on representing three main products: two catering to the needs of growing and established businesses and one designed for small to medium sized enterprises.

This diversified approach allowed CitySoft to serve a broad range of businesses, including manufacturers of well-known brands, emerging brands and contract manufacturers.

Over time, CitySoft has become synonymous with food and beverage manufacturing expertise.

Its success in this niche market can be attributed to its ability to adapt to rapid changes in the industry. According to CitySoft, the landscape of food and beverage manufacturing has been reshaped by evolving compliance requirements, the rise of smart machines, and the proliferation of IoT and big data.

“There’s been a significant shift in the industry due in part to globalisation but also due to the availability of smart technologies,” said CitySoft director, Ian Hill.

The firm has focused on providing the industry with technology solutions that go well beyond the traditional domain of ERP software systems. This includes integrating smart machines, sensors, MES systems, and CMMS systems to industry specific ERP software to help clients capitalise on the new sources of digitised data.

CitySoft addresses a common

challenge in the industry: information silos. Often, dissimilar systems fail to communicate effectively, leading to inefficiencies and costly errors.

Hill spoke about a recent case where the absence of systemised storage controls and system integration resulted in a major write off of stock.

“The flow of new technologies into the industry has resulted in enormous change,” said Hill.

“The shift from paper-based processes and manual spreadsheets to sophisticated digital solutions is no longer optional but essential for businesses to compete and succeed.”

CitySoft is helping modernise businesses by introducing and integrating new industry specific software and hardware systems with existing systems; optimising business operations; and by providing businesses with actionable insights.

The company’s approach involves more than just implementing new technology.

“We help stakeholders take digitised data from many sources and turn it into effective information,” said Hill.

This process turns multiple sources of data into valuable insights that drive better decision-making and operational efficiencies.

In an industry where adoption of new technologies continue at pace, CitySoft stands out as a forwardthinking partner that not only understands the complexities of food and beverage manufacturing but also provides practical solutions to help businesses thrive in a data-driven world.

“In the past, the primary challenge was how do you convince businesses that they’ll be better served by spending money on modernising their business systems first, rather than investing in a brand-new machine,” said Hill.

“The thinking has changed. Now there is a growing recognition that prioritising the optimisation of existing machinery at the same time as modernising business systems is a strategy worth exploring”

CitySoft addresses a common challenge in the industry: information silos

By introducing real-time monitoring of equipment businesses can optimise machinery performance, better schedule maintenance, and avoid unnecessary downtime.

“Smart sensors can extend the life and effectiveness of manufacturing equipment, from an output and a quality perspective,” said Hill.

“This real-time information makes a huge difference to the efficiency of the operation and, by extension, improves profitability by drawing down costs.”

Consider a scenario where a piece of equipment is designed to process 2,000 items per hour with 95 percent efficiency but has dropped below this benchmark.

“That information is fed back to the ERP system in real time, which may lead to the production manager scheduling a top up production order to meet production targets,” said Hill.

“Rather than discovering at the end of a run that you’re short, you can avoid that outcome altogether.”

This proactive approach is demonstrated by a recent success story with a large CitySoft customer in Victoria.

The introduction of a new Overall Equipment Effectiveness (OEE) solution led to impressive results for the client.

“We put in a trial for them and within a very short period of time they contacted us to say how thrilled they were with the results already,” said Hill.

“They’ve now introduced the product across all their machine lines.”

The simplicity of this innovative solution adds to CitySoft’s appeal.

“The great thing about the OEE solution is that it is a plug and play device,” said Hill.

“It doesn’t need any extensive technology capabilities to implement it, and the information it generates for the production manager, and others, in dashboard and report formats are easy to read and intuitive.”

The digitisation of data from multiple data sources combined with systems integration means every department involved in production has access to real-time accurate data which they can act upon with great confidence.

“It’s a well of information in real time,” said Hill.

“Our integrated solutions include information about equipment performance, linked to production schedules, work orders, the ERP system, and maintenance management software, to give operators and management the full picture of what’s happening in their business.”

Another benefit of modernising these business systems is also in being able to utilise your workforce in more efficient ways by giving them more time to work on other important tasks.

“You don’t want intelligent people wasting time on manual tasks that can be managed through automation, you want them to have more time to conduct other important tasks including

Major rewards will flow from bringing all the data and systems together in the simplest and most efficient way.

interpreting data,” said Hill.

Ultimately, Hill said, the foundation of CitySoft’s software solutions can be easily defined.

“Our industry solutions are all about turning data into information, automating and optimising business processes, connecting systems and helping companies capitalise on technologies that cut operating costs and improve profitability ,” he said.

“Whilst the industry has embraced technology, mainly in the form of smart machines, IoT and sensors, it hasn’t necessarily made the most of the streams of data the modern technologies now produce. They haven’t invested to the same extent in modernised ERP, Bi and big data analysis tools and IT infrastructure to support the growth in data volumes and their reliance on technology.

“The major rewards of IT modernisation will flow from bringing all the data and systems together in the simplest and most efficient way so a business can perform at their optimum.”

Private label gaining ground in grocery

Private label products have been steadily growing in popularity thanks to economic factors such as inflation and the changing spending habits of consumers.

Over the last few decades, private labels have continued to grow steadily in popularity.

Store brands aren’t a new idea; they’ve been around for a long time, and Centric Software can help you capitalise.

From A&P’s launch of Eight O’clock Coffee in the early 1900s to Loblaws’ famous bright yellow ‘no name’ boxes in the 1970s, and now modern retailers like Aldi and Trader Joe’s, where most products are private labels, store brands have steadily risen in popularity.

Record-breaking numbers

The 2024 PLMA Private Label Report confirms this trend with data, showing a YOY record-setting 4.7 percent increase in private label dollar sales compared to a 3.6 percent rise for national brands.

The primary force behind private labels is economic, as indicated by a PYMNTS Intelligence survey of over 1,700 US consumers where 86 per cent of grocery shoppers have altered their purchasing habits due to inflation.

Meanwhile, total store brand dollar sales during 2023 moved ahead to

$236.3 billion, an increase of $10.1 billion from the previous year and setting another record, surpassing the former high mark that was set last year Research firm Numerator also revealed that private label products are capturing a substantial share of leading retailer sales, ranging from a peak of 80 per cent at Aldi, 69 per cent at Trader Joe’s, 33 per cent at Sam’s Club and H-E-B, 29 per cent at Dollar Tree, 27 percent at Kroger, 24 per cent at 7-Eleven, to 23 per cent at Target. And the list continues beyond this.

Leaning into private label

Want to join the private label trend?

Consider a modern, flexible Product Lifecycle Management (PLM) solution to boost and refine your store-brand options for cost-conscious shoppers.

Centric PLM centralises product information and streamlines product development processes.

Retailers can quickly adapt to economic changes and the demand for affordable, high-quality products.

This streamlined approach is key to staying competitive with national brands

Research has shown a YOY record-setting 4.7 percent increase in private label dollar sales.

Image:

on pricing.

Meanwhile, consumer habits are shifting as well. Since the COVID-19 product shortages, people have learned to take what they can get if the national brand is unavailable.

Now that those shortages are mostly in the rear-view mirror, consumers have not reversed course to fully go back to national brands.

The quality perception of store brands is up; price is no longer the only reason for shoppers to turn to private labels.

The main draw

A 2024 FMI report reveals that more than half of consumers now choose specific stores due to private-label products. This marks a rise from 2016 when only a third of shoppers selected stores based on brand offerings.

Beyond cost, still the primary driver for buying store brands, quality and value is increasingly important.

Retailers are approaching private label lines as if they are manufacturers because that’s effectively what they’ve become.

They handle all product development stages, including marketing, research and development, ingredient sourcing, regulatory compliance, labelling, and packaging, in-house.

This is where having real-time visibility into every supply chain step and tools for better supplier collaboration become crucial.

With PLM, retailers can now ensure consistent quality, which is essential for building customer loyalty and attracting new shoppers.

Modern PLM enables quick response

Grocery retailers’ advantage over national brands is that they have consumer databases and can react quickly to create products people want.

Food trends like organic, gluten-free, and plant-based items can be developed and slotted into a company’s private label lines while controlling exact product characteristics, introductiontiming and coordination with shelving and marketing strategies for the product launch.

Meanwhile ‘healthy’ product attributes within a unified store-brand line address consumer needs effectively.

Centric PLM manages complex product portfolios effortlessly, providing retailers with tools to innovate and adjust its private label offerings to align with consumer preferences.

Centric PLM centralises product information and streamlines product development processes.

The company also simplifies tracking of government regulations (FDA, USDA, EU, FSANZ) and ingredient certifications such as kosher, halal, and vegan when all are housed in one digital repository.

Sustainability

Consumers are increasingly aware of sustainability and make choices based on it. According to an NIQ report, 69 per cent of consumers feel that sustainability matters more now than two years ago.

They seek assurance that the ingredients in their food are sourced without harmful environmental practices.

Meanwhile, legislation also plays a role: in the EU, Environmental Social Governance (ESG) reporting is mandated for companies that meet certain criteria, such as size and being listed on EU-regulated markets.

In terms of consumer perception, packaging is the most visible factor—less

plastic is preferred, and recyclability is important if plastic must be used.

With Centric PLM, grocery retailers can incorporate sustainable practices into product design, manage ingredient sourcing, ingredient certifications as well as sustainability metrics.

Centric is set up to track the percentage of recycled materials in a package to make sure it meets eco-requirements.

The future of private labels is bright

Recently released figures from Circana (the merged IRI and NPD firm) indicate that private label sales could surpass $250 billion in 2024.

Currently, private label accounts for about 22 cents on the dollar of grocery spend.

It is not disappearing. As companies advance into higher-end private label products and expand current storebrand lines, the private label market

share is set to grow.

With Centric Software solutions, flexibility and configurability support adapting to future retail trends, such as the demand for more personalised customer experiences, for instance.

The software’s scalability guarantees that retailers can consistently innovate and remain ahead of the competition as consumer demands change.

Centric Software solutions enable grocery retailers to adeptly manage their private label products, tackling economic pressures, evolving consumer preferences, and the demand for highquality, sustainable items.

This positions Centric as a crucial partner in advancing the success of private labels in today’s competitive grocery market.

To learn more, down the F&B Rise to the Sustainability Challenge eBook on the Centric Software website F

A 2024 FMI report reveals that more than half of consumers now choose specific stores due to private-label products.

A new factory is not always the best approach

The team at RMR Process helps clients increase output and develop more efficient processes through expert consultation that ultimately saves on costs.

RMR Process has established itself as a key player in Australia’s food and beverage manufacturing industry through expert insights on how to best enhance the entire production process.

Based in Melbourne, RMR Process employs a team of expert engineers with a proven track record in designing and constructing top-tier food processing facilities, alongside providing strategic growth support to clients.

RMR Process takes pride in helping customers form strategies to achieve their growth objectives, partnering with manufacturers aiming to enhance their process capabilities and facility design, as well as with multinational corporations seeking expert consulting for expansion and optimisation projects.

Leveraging over 25 years of industry experience, RMR Process has developed a scaling model that supports growth while adapting to the dynamic market landscape.

This model helps manufacturers make cost-effective decisions about expanding their capabilities while managing associated risks.

Before the onset of COVID-19, manufacturing industries primarily focused on streamlining or optimising their process lines.

Today, however, the landscape

As businesses navigate the complexities of the post-pandemic world, they are expanding and enhancing existing process lines to boost throughput capacity, aiming to meet heightened demand while managing operational costs.

Peter Taitoko, director of RMR Process, is seeing first-hand this ongoing transformation of the food and beverage manufacturing industry.

The pressure on food manufacturers today comes from all directions, including high supply chain costs, margin pressures from retailers, high energy costs and compliance costs.

For those needing to expand operations the challenges extend to high construction costs, onerous town planning conditions and lengthy planning processes.

The post-pandemic era has driven a transformation towards local manufacturing, driven by both necessity and cost-saving measures.

Many manufacturers are experiencing unprecedented activity due to the demand for locally produced food and beverages as well as emerging growth channels such as direct-to-consumer products.

Companies that are well-positioned with high-demand products, like readyto-eat meals and convenience foods, are facing soaring demand and struggling to

Conversely, those not adapted to the current market conditions are struggling. This development reflects a “two-speed economy” in the food sector.

Both ends of the spectrum are increasingly looking to increase output and reduce costs. Optimising the balance between operational staff and automation remains critical.

This development arises from a dual challenge: while governments push for job creation, manufacturers grapple with high labour costs and a shortage of suitable workers.

For example, most grant funding options target job creation rather than how Australia’s high-quality products for local and overseas markets can be lever-aged, creating a stronger food and beverage industry and supply chain through non-traditional channels.

This has created tension between the desire for more employment opportunities and the necessity of using automation to control costs.

As a result, manufacturers are striving to find an ideal balance between operational staff and automation.

“More and more we’re looking for opportunities to speed factories up and increase process throughput and reliability before we consider capital intensive facility up-grades or new builds,” said Taitoko.

Every factory has unique needs, which is why the initial step in RMR’s model is to encourage the manufacturer to consider a pivotal question, if they maintain the same number of operational staff but increase productivity, would that be appealing? The typical response is ‘yes’.

“Although our core business is designing and building food factories, we always start by minimising or eliminating the need for construction simply because of cost and the fact that the food industry tends to move at a much faster pace than the construction industry and local councils” said Taitoko.

While full automation is feasible for large high-end companies, most local

businesses lack access to such advanced technology.

Therefore, the focus is on enhancing process efficiency and accelerating operations while retaining essential human roles in a staged approach.

“We start by reducing or removing labour-intensive repetitive tasks and providing automated solutions where it is practical and affordable” said Taitoko.

“Our intention is not necessarily to remove labour from factories, rather to increase productivity and increase outputs with existing staff numbers.”

Upskilling is a crucial aspect of this transition.

Workers are trained to move from manual roles to more technical positions, such as line technicians.

Staff may be redeployed to roles in raw materials handling, packaging, or distribution.

Alternatively, they are upskilled for quality control positions. The approach aims to make the most of the existing workforce while adapting to evolving demands.

The focus then changes to enhancing facility performance with the current workforce and infrastructure.

For instance, by incrementally increasing the instantaneous throughput of key capital equipment throughout the entire process and adding automation capability to help smooth out the line performance, you can gain significant upside in production volumes, in some cases many times existing capability.

Taitoko said RMR Process has a string of examples of working with clients where throughput was significantly increased without adding extra operational staff or expanding the facility.

These cases underscore the potential of optimising existing operations rather than constructing new facilities allowing

RMR Process employs a team of expert engineers with a proven track record in designing and constructing top-tier food processing facilities.

RMR Process takes pride in helping customers form strategies to achieve their growth objectives.

companies to scale in control.

If new products are desired, a modest investment to modify the existing line might be proposed.

This strategy emphasises leveraging existing facilities, equipment, and workforce effectively, rather than relying solely on facility expansion.

COVID-19 has also exacerbated global supply chain issues, complicating the ongoing procurement of imported ingredients.

In response, manufacturers are exploring ways to add value to these ingredients domestically and this should have a positive long-term impact on

the industry.

For example, efforts are being made to source and mill dried ingredients locally, leading manufacturers to explore local value-adding processes, whether through co-manufacturers or by maximising their own facility through in-house development.

The challenge extends beyond local production.

The Australian food industry struggles with the underutilisation of its potential, particularly regarding exports.

“We need to do better at leveraging off our high-quality products and increase our own value-adding opportunities from ingredient supply to finished goods,” said Taitoko.

The prevailing mindset of exporting primary produce with minimal value addition persists, despite the government’s focus on manufacturing jobs rather than strengthening existing industries.

“It’s rather like watching iron ore get shipped off only to import it back as ball bearings a year later. In food we need a total mindset shift towards a local supply chain that keeps up with rapidly changing local and overseas consumer demands,” said Taitoko.

However, funding remains an obstacle, exacerbated by the withdrawal of manufacturing grants during the last

election cycle.

Meanwhile, Taitoko said, relying solely on government support is not always a viable strategy but thankfully there are alternative funding options available that are more accessible today than ever before, however it is still critical to remove unnecessary costs from expansion projects.

The introduction of the RMR process is a unique advantage that helps offset the challenges posed by lower labour costs and cheaper manufacturing overseas.

“We believe the primary reason manufacturing has traditionally moved offshore is due to the high capital cost to establish a site and we’ve seen many projects abandoned because of this,” said Taitoko.

“Companies need to demonstrate that they will get a return on their investment.”

Over the past two decades, RMR’s model has resulted in numerous projects being salvaged by managing to remove traditional roadblocks and find alternative scaling options.

“For instance, a project initially quoted at $24 million was reduced to $13 million,” said Taitoko.

“It must be said that this is not necessarily by finding cheaper builders for example, but rather by finding

smarter ways to expand such as staging the project over a number of phases to facilitate a controlled expansion over a longer time frame and still allowing the manufacturer to scale their operations.

“We have many of these examples. Such cost reductions are achieved by designing fit-for-purpose processes without inflating costs or enriching construction companies or equipment manufacturers.”

The model has also enabled some food manufacturing to be repatriated back to Australia once a positive return on investment was achievable.

“Our model suits all size companies and off the back of industry challenges and the need to increase local supply, we’ve not experienced this much activity in the industry despite a lot of companies struggling at the moment,” said Taitoko.

As companies increasingly seek more efficient ways to manage projects, the role of specialist consultants becomes crucial.

The post-pandemic era has seen an increase in workload for manufacturing consultants as the reputation of consulting firms extends beyond local borders. This recognition underscores the importance of specialised consulting in navigating the complex landscape of modern manufacturing. F

NEED TO REDUCE

BOD BILL?

Bunzl’s innovative approach to sustainable industrial packaging

Bunzl provides various types of sustainable industrial packaging solutions that have been developed on the back of market and scientific research.

Wand efficiency

ith a focus on innovation and meeting customer demands around industrial solutions, Bunzl Australia and New Zealand’s dedication to sustainability is evident across its product range, including with its Advantage pallet wrap.

“Pallet Wrap is a high focus area for us because it’s something that is always going to be used in the market,” said Bunzl ANZ national business development manager for Industrial Packaging & Machinery, James Beleno. “And it’s an often-ignored area of plastic reduction for a lot of businesses.”

One key innovation of the wrap is its high stretch capability, allowing for more pallets to be wrapped with a single roll.

This not only reduces the amount of plastic used but also minimises the amount of wrap that needs to be disposed of.

In an effort for further innovation in industrial packaging, Bunzl ANZ explored the use of recycled, biodegradable, and compostable pallet wraps.

However, trials quickly showed that recycled pallet wrap can lead to increased plastic usage due to inconsistent quality and variability in the recycled materials.

“It’s incredibly difficult to pursue because of the inconsistency. You can’t control the quality of plastic that’s getting recycled and it often doesn’t hold up to the standards required,” said Beleno.