11 minute read

Market analysis

exceeding expectations

Winter crops show high production but summer crops to fall short, ABARES data shows

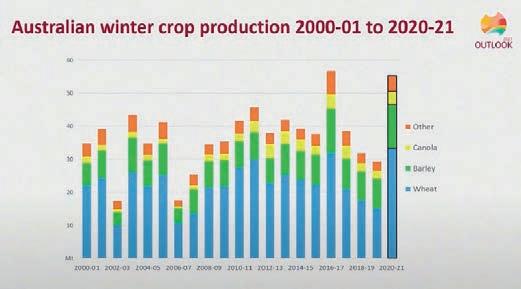

Above: Australian wheat production is expected to more than double in 2020-21

Production is higher among all winter crops, while resurgent summer crops will likely be below average, according to new data from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES). The 2020–21 winter harvest has the potential to be the second largest on record, it says. The bureau’s Australian Crop Report – February 2021 indicates an 89 per cent increase in crop production in the 2020–21 winter harvest from the previous year, with over 55.2 million tonnes of crops recorded. These figures have already exceeded prior industry estimates from ABARES, which forecasted a 76 per cent increase in its December quarter 2020 Commodities Report and now looms as the largest harvest since 2016–17, where over 56 million tonnes of harvest were produced. Across the country, winter crops were planted in 23 per cent more land than in 2019–20, as all major winter crops saw an uptick in area planted to a total of 22.66 million hectares; again the highest since 2016–17. Acting ABARES executive director Jared Greenville says figures from the winter harvest are encouraging as the industry continues to recover from three years of lower production, influenced sizeably by droughts. “This is a 7.4 per cent growth from the forecast presented in the December 2020 crop report,” says Greenville. “The upward revision was the result of yields continuing to exceed expectations progressed.” The drastic upturn for winter harvest figures came following increases in production across all major winter crops. Australia’s wheat production in particular was a large beneficiary and saw an increase of 120 per cent in 2020–21 to 33.3 million tonnes. As a result, Australia is expected to export around 21 million tonnes of wheat in 2020–21, a figure more than double the 2019–20 export figures. The production of canola too saw a steady increase with by 4.1 million tonnes cultivated – a 74 per increase from 2019–20, while barley also increased steadily by 45 per cent to 13.1 million tonnes. Together, the production of the three crops was further amplified by a rise in planted areas with wheat (+27.17 per cent), barley (+9.18) and canola (+31.52) all expanding across the country. ABARES also indicates that the 2020–21 summer harvesting season will also be much improved from 2019–20, which was severely hampered by drought, but still considerably below the average. Seasonal conditions suggest summer harvest production may benefit from the La Niña weather pattern, which brought above average rainfall to much of eastern and northern Australia until February 2021, generating favourable growing conditions for summer crops. While La Niña weather patterns may not be true indicators of agricultural performance, as has been the case in previous La Niña patterns, ABARES says heavy rainfall across December and January may benefit late sown summer crops. Over 1.04 million hectares of summer crops are estimated to have been planted, almost three times that of the 2019–20 summer period. But while winter harvests have yielded near-record highs, the summer harvest, while responding to the down 2019–20 year, is still forecast to be 13 per cent lower than the 10-year average, largely influenced by a below average planted area. These figures are largely due to unfavourable seasonal conditions experienced during spring, while some flood affected regions are expected to fallow across the summer in anticipation for the upcoming winter period. Greenville says the below average planted area follows seasonal changes across the eastern states, despite total crop production projecting upward from 2019–20. “Summer crop production is forecast to increase to 3.3 million tonnes in 2020–21,” says Greenville. “[The] planted area remains below average due to limited planting in New South Wales on the back of large winter crop plantings and a poor start to the summer crop season in some areas of Queensland.” Summer crops such as grain sorghum are expected to increase by 409 per cent to 1.5 million tonnes following a 259 per cent growth in area planted. Similarly, cotton will be planted across 295,000 hectares (395 per cent) following improved soil moisture and a greater supply of irrigation water in cottongrowing regions.

road to nowhere

A lack of investment in regional infrastructure is in the spotlight – raising concerns among industry analysts and regional groups. By Lincoln Bertelli

Australia did not have the necessary infrastructure to import grain on short notice during the most recent drought, a senior public servant has told a recent conference. Speaking at the ABARES Outlook 2021 conference, held as a virtual event in early March, the Department of Agriculture, Water and the Environment’s Craig Scheibel said Australia’s biosecurity, storage and transport requirements had put pressure on potential grain importers. Scheibel, an assistant director of plant import operations with the Department, added that the challenges around this needed to be prepared for with future droughts. “The majority of our grain handling sites and ports are geared towards export, which is understandable because in normal years we export a lot of grain,” he said at the conference. “Imported grain may have requirements regarding place of production, so area freedoms, even conditions regarding harvest method, storage restrictions, transport, segregation of that grain if it’s being loaded out through terminals or if it’s being stored off-site or at terminals, making sure of that product preservation and that it’s not getting contaminated with grain that may not meet our requirements. “All of those things were proven to be major challenges for the existing infrastructure and in most cases in order to meet department requirements, the sites would have required – or the Department did request – significant infrastructure changes to meet our requirements. “All of those types of changes and capital works involved a significant cost. “The time that would be taken to make some of those capital changes was significant and it’s not something that could have been done quickly. “When we’ve got good times, we need to be thinking about and ensuring we’ve got systems and infrastructure in place for those times when we’re not in such a positive position. “The previous experience over the last year or so has shown that at the moment we don’t have a lot of infrastructure in place that we can ramp up.” These ‘good times’ appear set to return, at least in the shortterm, with figures shown during the conference projecting that 2020–21 winter grain crop production is set to come close to the 2016–17 production peak. This comes after three consecutive years of declining production, due mostly to the drought in New South Wales. Another speaker at the conference, Professor Mark Howden from the Climate Change Institute at Australian National University, said the future of Australia’s grain industry depended on how the nation responded to climate change challenges, particularly compared to our competitors. “One of the critical things here is that everything points to a very substantial increase in variability of production in many places around the world, so the difference between the good years and the bad years is likely to increase and that generates fluxes in exports and imports and also movements of grain across the country,” said Howden. “These sorts of issues about maintaining import markets so we can bring material into Australia in a safe way and maintaining our export relationships so they are stable and robust in the face of variability are going to become increasingly important, just like maintaining very effective and low greenhouse gas footprint trade routes across the world is going to become increasingly important.”

LACK OF PRIORITY

The announcement came as a list of priority projects released by independent government advisory body Infrastructure Australia was praised by transport groups but condemned by regional bodies. Infrastructure Australia’s 2021 list is divided into four sections – high priority projects, priority projects, high priority initiatives and priority initiatives – and will be used to shape government thinking and spending. The high priority projects identified are a new motorway and airport in Western Sydney, the next stage of Sydney’s Metro, the North East Link and an upgrade to the M80 Ring Road, both in Melbourne, and the development of Brisbane’s Metro network. National Farmers Federation president Fiona Simson says she is disappointed that no regional projects were identified as ‘high priority’ in the list. “Regional Australia needs transformational infrastructure, just like the Western Sydney Airport development, to finally capture all the benefits and economic potential of our regional communities and economies,” she says. “The NFF also acknowledges Infrastructure Australia’s efforts in identifying regional initiatives; however they need to be fullycosted and shovel-ready.” Simson identified several sectors she believes deserve regional infrastructure investment. “Australia is lacking processing facilities for produce such as wool, cotton and forestry products, despite being world leaders in growing the raw fibre,” she says. “Regional Australia should be the host of a world leading export industry in food and fibre manufacturing and to achieve that we need equitable investment in transformative infrastructure.” Infrastructure Australia’s list received support from other bodies, with Civil Contractors Federation South Australia chief executive Rebecca Pickering saying projects on the list would provide an economic boost to that state. “Earthmovers, road constructors, pipelayers, road maintenance, traffic control, mobile plant operators and other civil business are digging deep for South Australia to deliver these projects, and the industry’s uptake of new civil apprenticeships is evidence of this,” she says. Five new projects and 39 initiatives have been added to this year’s list, while another 10 projects from last year’s list have already started construction.

Above: National Farmers’ Federation president Fiona Simson says she was disappointed that no regional areas were mentioned in Infrastructure Australia’s list of priority projects Left: Grain production is set to increase in the 2020–21 financial year, ABARES figures show

Left: The Tractor and Machinery Association is recording “remarkable” levels of activity in tractor sales

boom birthday

The sales of agricultural tractors have now completed their 12th consecutive month of record sales to be 34 per cent ahead on an annualised basis compared to the same time last year

Gary Northover is executive director of the Tractor & Machinery Association of Australia (TMA). He can be contacted on (03) 9813 8011 or at gary@tma.asn.au Tractor sales passed the 13,000 unit mark for the first time in around 40 years in 2020, and we are currently tracking above that level at around 14,000 units per year. February sales were up 74 per cent on the same month last year and this reinforces the extent of the challenges felt by the industry 12 months ago. The current level of activity is even more remarkable given the strains with supply being experienced right across the supply chain, although there are early signs that this may be improving. Since mid-2020, supply of product from manufacturing facilities in Europe, the US and Asia has been heavily impacted by the COVID-19 lockdowns and social distancing requirements. An indicator of this is the amount of shipping activity being seen through Australian ports, which were reported to be around 40–50 per cent of normal capacity mid last year. This has now improved to around 90 per cent of normal capacity. Activity in February was strong in all states, with NSW again the standout – up 104 per cent on the same time last year and now 107 per cent for the year to date (YTD). Victoria reported a solid lift up 53 per cent, sitting 43 per cent ahead for the year. Meanwhile, Queensland was up 61 per cent to be 62 per cent up YTD. Western Australian sales picked up 92 per cent to be 72 per cent ahead for the year, sales in South Australia were solid at 83 per cent up and, finally, Tasmania finished the month 45 per cent ahead. The increase in sales numbers is spread evenly across the four reporting categories, supported by the Instant Asset Write-Off Scheme. The under-40 horsepower (30kW) range was up 66 per cent for the month (73 per cent YTD). The 40 to 100hp (30–75kW) range was again up strongly 68 per cent in the month (63 per cent YTD), while the 100 to 200hp (75–150kW) category was up 55 per cent (50 per cent YTD). The large 200hp (150kW) plus range enjoyed another strong rise, up 141 per cent, and is now 110 per cent ahead for the year. Sales of this category of larger tractors have been the most heavily hit by supply issues and we are now seeing evidence of the backlog of orders from 2020 now coming through. The Instant Asset Write-Off Scheme is due to expire on June 30, 2021, so we expect a continuation of the strong demand for machines to remain at least until then. Sales of combine harvesters are in a period of hiatus with the usual order intake season now well underway. Baler sales were up 55 per cent on the same month last year and are expected to remain strong in 2021 and sales of out-front mowers are still flying, up 51 per cent ahead of the same time last year.