UNIQUE CONTENT AND INSIGHT FOCUSED ON KEY TRENDS IN THE GLOBAL CONSTRUCTION EQUIPMENT AND TECHNOLOGY MARKET FROM THE INDUSTRY’S BEST-INFORMED AND MOST INFLUENTIAL SOURCES

GLOBAL REPORT

CONSTRUCTION EQUIPMENT AND TECHNOLOGY 2023

ARTIFICIAL INTELLIGENCE IS BUILDING TOMORROW’S WORLD TODAY POWERING THE FUTURE: CUMMINS ON HOW DIESEL ENGINES FIT IN AMMANN’S GREEN PLANT INITIATIVE MOVES INTO FAST-FORWARD

EUROPE IS DRIVING HEADLONG INTO AN INFRASTRUCTURE HELL-HOLE BENTLEY’S DIGITAL TRANSFORMATION IS DRIVING DIGITAL ADOPTION

ENHANCE SAFETY AWARENESS BY LEVERAGING LEICA TECHNOLOGY

BKT INVESTS IN A CONFIDENT FUTURE FOR OFF-HIGHWAY TYRES

VOLVO SAYS BE HONEST ABOUT THE REAL IMPACT OF GOING ELECTRIC

www.worldhighways.com | www.aggbusiness.com

Published by

CONTENTS

05.

GLOBAL MARKETS REVIEW

A battle is raging to decide the future direction of the construction equipment market. You can easily make a case that the industry currently resembles a hotly-contested tug-of-war between growth drivers and market challenges.

19. GROUND-SCANNING

TECHNOLOGY

Ground scanning is vital to finding out what lies beneath. For any construction project, having an extensive knowledge of the ground conditions is essential before work can begin. And the technology that enables all this is getting ever more sophisticated.

24. SUSTAINABILITY: GOING ELECTRIC

Be honest: Measure the real impact of going electric. It’s vitally important to measure the ramifications of going electric, says Mats Bredborg of Volvo Construction Equipment. … But what does going electric really entail?

28. ARTIFICIAL INTELLIGENCE

AI and machine learning are constructing tomorrow’s world today. The world’s leading construction equipment firms are all jockeying for position as artificial intelligence and machine learning take root. What are the implications for the construction equipment sector?

35. ASPHALT TECHNOLOGY:

Ammann’s green plant initiative moves into fast-forward. Ammann knows that big and small steps are the best way forward on the march toward sustainable asphalt-production. The company openly says that: “At Ammann, we know it’s time to clear the air at asphalt production sites around the world. We are doing exactly that through sustainable technology and innovative solutions.”

39. THE WORLD IN NUMBERS

The world in numbers. As usual, our research team has prepared a selection of key factors affecting the global construction outlook.

44. ENGINE TECHNOLOGY: CUMMINS

Powering the future: where does the diesel engine fit in? The construction and aggregates sectors, like virtually all other industries around the world, are taking a hard look at how to decarbonise without experiencing reduced productivity and increased costs.

48. TECH SUMMIT: BENTLEY SYSTEMS

Digital transformation is key for transportation agencies and their partners to do their jobs better and faster. One way to do this is through digital delivery using digital models, data, and supporting field tools for roadway design, structures design, and construction, say the tech experts at Bentley Systems.

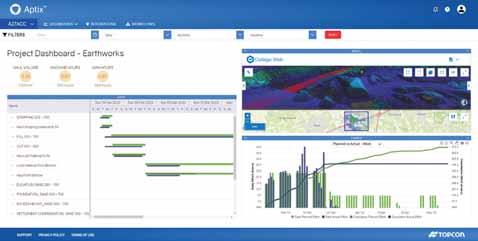

51. TECH SUMMIT: TOPCON APTIX

Get a hi-tech reality check with Topcon Aptix. The biggest challenge facing construction professionals and general contractors is disconnected data and/or siloed data sources. The recently launched Aptix integration platform has broken down these silos, explains Topcon’s Scott Langbein.

54.

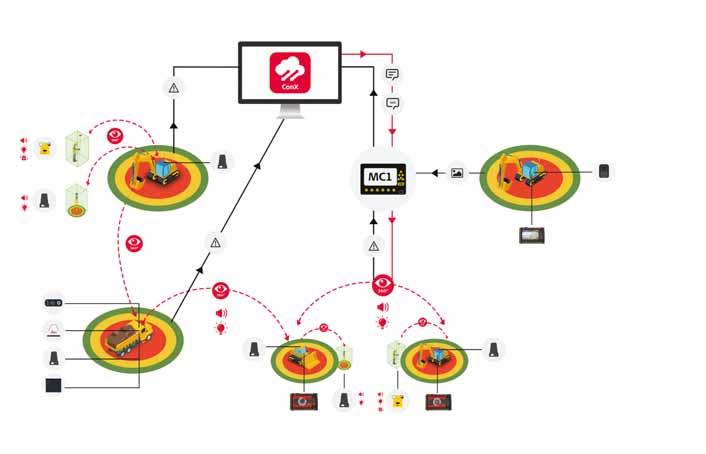

TECH SUMMIT: LEICA GEOSYSTEMS

Enhance your safety awareness by leveraging technology. When a vital fibre-optic cable was cut during construction work in Germany, the impact was huge. Flights in and out of Frankfurt Airport were suspended, and Lufthansa’s global IT system crashed. Leica Geosystems explains the vital role digital solutions can play.

58. THE EU’S BROKEN INFRASTRUCTURE

It comes to something when contractors, manufacturers, transport firms, and even NATO are all pleading for the same thing: urgent action on heavy-transport corridors, weak bridges, crumbling road surfaces, and inept local government. Who is allowing expert engineering departments to disappear as things fall apart? And why?

63. WORKER SHORTAGE: AUTONOMY & ROBOTICS

Many studies have been completed on the global labour shortage in the construction industry. The shortage has arrived, and it’s not ending any time soon. What is going to happen next?

68. SUPPLY CHAIN

MANAGEMENT

Predictive analytics offer the global construction equipment supply chain an important new opportunity to be proactive in fostering resilience, improving efficiency, and driving growth. Exploit every bit of data you can find because, if you don’t, your business is going to fall further and further behind.

75.

TYRE TECHNOLOGY

BKT is confident about the future. Indian off-road tyre giant BKT, Balkrishna Industries, recently invited the world’s trade media to its state-of-the-art site at Bhuj in Gujarat to showcase the group’s exciting plans for the future.

78.

CARBON FOOTPRINT

Get your carbon costs right if you want to win business. It’s all very well congratulating ourselves on how developments in construction equipment and technology are reducing the industry’s carbon footprint, but are we concentrating our efforts in the right places?

83. CECE CONFERENCE

REPORT

Alternative energy: are we getting any closer? Alternative energy for construction equipment focused the minds of the 170 delegates attending this year’s CECE conference. This was the first in-person gathering postCOVID for the Brussels-based Committee for European Construction Equipment, and how best to power up the future was very much on their minds.

Editor: Geoff Hadwick

Contributing Editors:David Arminas, Guy Woodford, Mike Woof

Designers: Simon Ward, Andy Taylder

Production Manager: Nick Bond

Office Manager: Kelly Thompson

Circulation & Database Manager: Charmaine Douglas

Internet, IT and Data Services Director: James Howard

Managing Director: Andrew Barriball

Chairman: Roger Adshead

Editorial contributors: Graham Anderson, Elizabeth Kaye, Pete Kennedy, Kristina Smith

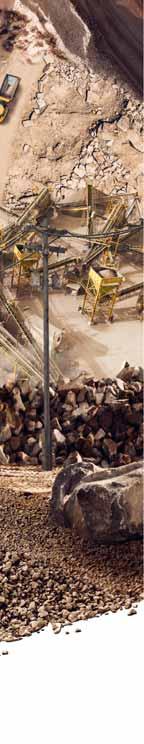

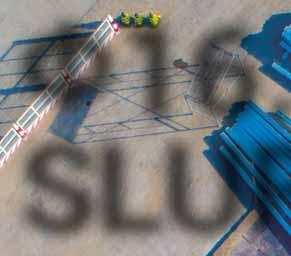

COVER IMAGE: © Pop Nukoonrat | Dreamstime.com

ADVERTISEMENT SALES

Head of Construction Sales: Graeme McQueen

Tel: +44 1322 612069

Email: gmcqueen@ropl.com

Sales Director: Philip Woodgate Tel: +44 1322 612067

Email: pwoodgate@ropl.com

Sales Director & Classified: Dan Emmerson Tel: +44 1322 612068

Email: demmerson@ropl.com

Italy: Fulvio Bonfiglietti Tel: +39 339 1010833

Email: bonfiglietti@tiscali.it

Asia / Australasia: Roger Adshead

Tel: +44 7768 178163

Email: radshead@ropl.com

ADDRESS:

Route One Publishing Ltd, Second Floor, West Hill House, West Hill, Dartford, Kent, DA1 2EU, UK

Tel: +44 (0) 1322 612055

Fax: +44 (0) 1322 788063

Email: [initialsurname]@ropl.com (e.g. radshead@ropl.com)

GLOBAL REPORT

Global Report Construction Equipment & Technology ISSN 2634-3223 (Print) ISSN 2752-8375 (Online)

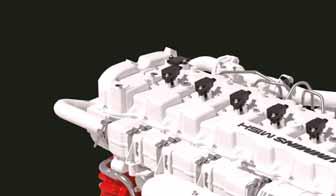

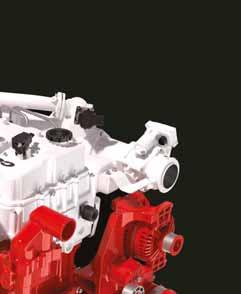

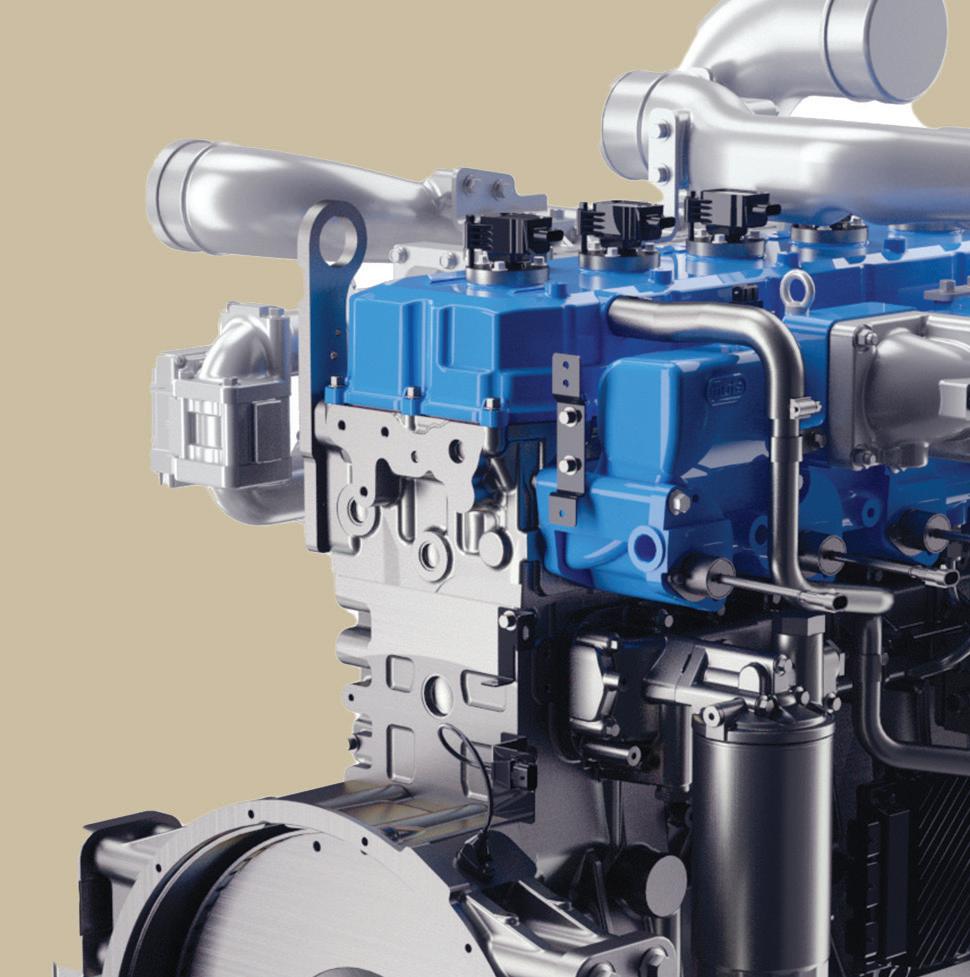

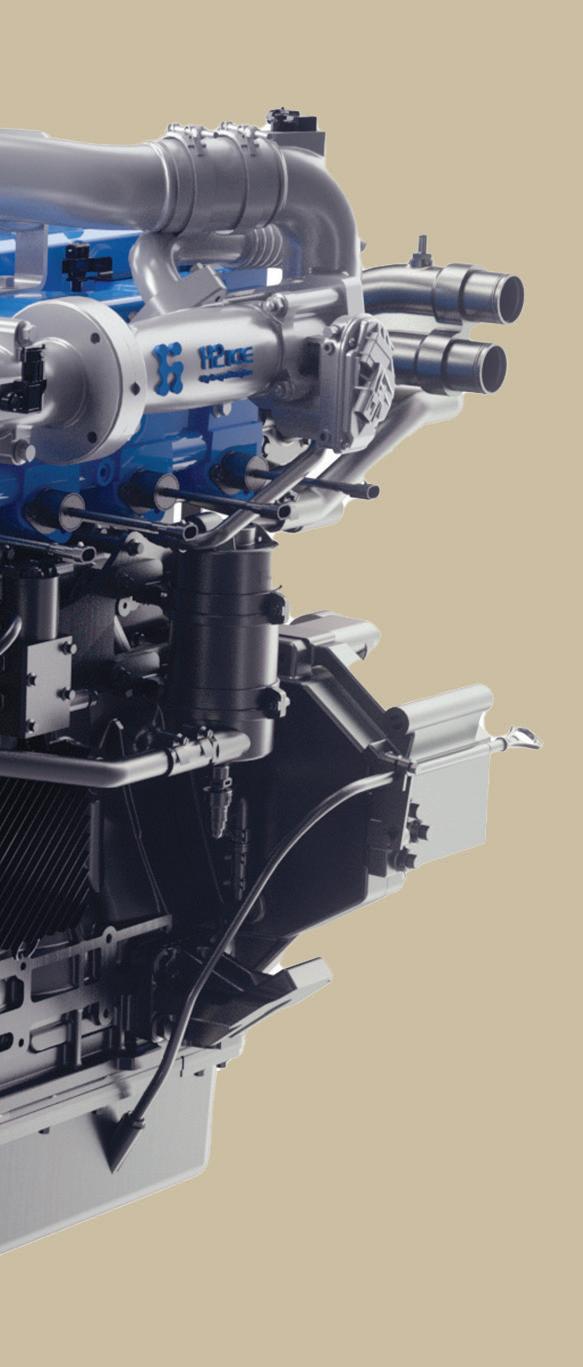

POWER TO MAXIMIZE PRODUCTIVITY

Offering more power with less complexity and less weight. This engine delivers the productivity you need to keep your equipment running. Proven in a wide range of industrial applications, its power increases to 326 hp/243 kW enabling replacement of engines with higher displacement with no impact on productivity.

cummins.com/construction

A TUG-OF-WAR IS RAGING BETWEEN GROWTH DRIVERS AND MARKET CHALLENGES

You can easily make a case that the global construction equipment market currently resembles a hotly contested tug-of-war between growth drivers and market challenges. Guy Woodford reports.

Global construction equipment sales may have fallen 7% last year to 1,201,126 units from the record high of 1,292,739 units sold in 2021 but, as Off-Highway Research (OHR), a leading business market intelligence consultancy, highlights: The downturn was all due to the collapse of demand in China. Sales in the world, excluding China, have risen by 7% in 2022. This year, OHR forecasts a 7% decline in global sales in 2023, a slightly steeper downturn than previously envisaged due to the weakness of the Chinese market. Stripping China out of the equation, the remaining world will only see a 5% downturn overall.

OHR is classifying the 2022-2025 market downturn as a “soft landing”. Only singledigit year-on-year (YOY) falls in equipment sales are expected, and the volume of machines sold should stay above one million units per year over the next four years. Before the current up-swing, OHR notes that such a volume was only achieved twice before.

The OHR forecast is based on the indication that infrastructure investment will be strong and that although interest rates are rising, they will only slow down residential construction rather than push it over a cliff

However, OHR stresses that there are risks to the forecast. Inflation was a serious

issue throughout 2022, and although improving, it remained too high in early 2023. The war in Ukraine continues to heighten inflationary pressures worldwide and exert upward pressure on interest rates.

Another leading business market intelligence firm, GlobalData, tips the

world’s construction industry output to grow modestly by 1.8% in 2023

The same source expects the global construction industry to regain some growth momentum from 2024, assuming an improvement in global economic stability.

Global sales of construction equipment by region, 2018-2022 (units)

Source: Off-Highway Research

EUROPEAN MARKET RESILIENCE

Riccardo Viaggi, secretary general of CECE (Committee for European Construction Equipment), reports that in 2022 Europe faced supply chain disruptions, high inflation, and a war in Ukraine due to Russia’s aggression, which impacted energy security and affordability in the European economy. However, Viaggi notes that the European construction equipment market remained resilient and strong, with sales in Europe, excluding the Russian market, increasing by almost 3%. And overall, Viaggi highlights that the sales in the European market were almost equal to the previous year, with only a slight decline of 0.6%.

“This shows that there is strong and sustained demand for equipment in Europe, and if the supply chain issues had not existed, the market would have experienced growth for another year,” explains Viaggi. He adds: “This underlying stability is reflected by robust industry sentiment. The climate

index in CECE’s Business Barometer survey went down moderately over the year as the economic fallout of the war in Ukraine unfolded. It bounced back in November after the bauma [Munich 24-30 October] exhibition.”

Viaggi continues: “If we look at the sales by country, there are only minor changes, with a few exceptions. Southern Europe was the best-performing market region in equipment sales, with a 12% growth. The exception was Turkey which experienced a growth of almost 40%, while Russia had a decline of the same magnitude.”

Analysing equipment sub-segment sales, Viaggi reports that European sales of tower cranes remained unchanged, sales of roadbuilding machinery increased by just 1%, and earthmoving and concrete machines fell by 1% and 2%, respectively. The performance of small and lightweight machinery (-0.5%) was slightly better than that of big machinery (-2%).

Additionally, machine availability increased in the second half of 2022 as supply chain problems lessened throughout the year.

Viaggi says the European building industry’s economic climate was negatively impacted by the conflict in Ukraine, tightening credit, central banks altering policies, and issues with the pricing and availability of building materials. “Among the member states of which data we have available, the highest annual increases in construction output in 2022 were in Slovenia (+44.0%), Romania (+20.4%), and Belgium (+12.9%). On the contrary, the largest decreases were in Spain (-6.9%), Slovakia (-5.8%) and Germany (-1.2%). The construction output in the EU started to grow in the last quarter of 2022, and if we compare the last quarter with the third quarter, there is an average of 0.7% growth, according to the European Commission’s latest report.”

Viaggi notes that despite all challenges, the order books of EU construction firms indicate up to nine months of workload at the beginning of 2023. Additionally, Viaggi believes that construction output in the EU should continue to increase during 2023 but at a moderate pace. The civil engineering sector looks resilient, he says. Other sectors are expected to record declines in activity.

“Supply chain issues are still impacting construction equipment sales, but investment rates in infrastructure and construction are driving the market forward,” Viaggi explains. “The market is dominated by miniexcavators, with crawler excavators, telescopic handlers, wheeled excavators, skid-steers, and backhoe loaders following closely. As sales in the European market have been steady, manufacturers report positive business conditions and near-term expectations.

“We can say that 2023 will be a year of transition for the construction industry, marked by a slowdown, but overall production growth is expected to remain in positive territory.”

NORTH AMERICA

A RECORD 2022, BUT A MIXED GROWTH PICTURE

North America was the pick of the major markets last year, reports Off-Highway Research (OHR), with an 8% increase in sales to take demand to a record high of 318,855 machines sold. Compact tracked loaders are now firmly established as the most popular equipment type in the region and mini excavator sales have also grown to a significant level. Sales of these machines have largely been at the expense of skid-steer loaders and backhoe loaders.

Although a modest 1% decline in sales is expected this year, OHR says the North American market will still enjoy the secondhighest volumes ever seen. The long lead times for equipment mean that suppliers are confident of sales well into the third quarter of the year, even though rising interest rates are starting to cool off the housing market.

While this is expected to lead to a fall in sales of smaller equipment types, OHR states that infrastructure investment is on the rise in the region, thanks in part to the stimulus plans which were put in place during the pandemic years.

OHR continues: “By nature, machines used in infrastructure construction are higher value/lower volume than the compact equipment sales driven by residential building. This is therefore expected to lead to a shallow dip in sales from 2023-2026. However, North America suffers from a housing shortage, which is expected to stimulate an upturn in compact equipment sales towards the end of the forecast period.”

The American equipment manufacturing

industry is still recovering from the impacts of the Covid-19 pandemic nearly three years after its onset, according to the AEM (Association of Equipment Manufacturers).

AEM regularly surveys its members regarding their thoughts on various economic trends and how they affect their business efforts, both within the United States and abroad. In the latest survey, most respondents stated that they are still experiencing supply chain issues, with many saying that conditions continue to worsen.

“Nearly all respondents still face supply chain issues, with more than half experiencing continuously worsening supply chain conditions,” said Kip Eideberg, senior vice president Government and Industry Relations at AEM, during the association’s recently held quarterly Equipment Market Outlook Webinar. “The two driving factors we hear are the current supply chain disruptions and the workforce shortages.”

The information obtained through the association’s surveys is detailed in AEM’s Business Intelligence Dashboard and later summarised in the quarterly webinar.

The AEM says the ongoing challenges of high interest rates and energy and material prices have plagued the construction industry. However, hope is on the horizon for these issues and others to eventually be resolved.

GlobalData expects the US construction industry’s output to grow at a 4.5% annual average growth rate

North America sales of construction equipment 2018-2022 (units)

Source: Off-Highway Research

High interest rates and energy and material prices have plagued the construction industry

(AAGR) from 2024 to 2027, supported by investment in the energy, transportation, housing, and manufacturing sectors. As part of the Inflation Reduction Act (IRA), the government allocated $369bn to energy security and climatechange mitigation programmes, intending to increase the US’s efforts to reduce emissions by 40% below 2005 levels by 2030. In line with the government’s focus on reducing carbon emissions, the Biden-Harris Administration set a goal of deploying 30GW of offshore wind capacity by 2030, enough to power 10 million homes with clean energy, and aims to advance lease areas in deep waters to deploy 15GW of floating offshore wind capacity by 2035. Furthermore, residential construction will pick up again in the latter part of the forecast period, particularly if the government goes ahead with its planned budget to invest $175bn to increase the housing supply and alleviate the affordability crisis.

CENTRAL & SOUTH AMERICA

BIG INFRASTRUCTURE CONSTRUCTION BOOSTS REGION

The Latin America infrastructure construction market size was valued at $230.6bn in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 3.8% between 2022 and 2026, according to GlobalData. The project pipelines from countries including Brazil, Mexico, Colombia, and Argentina strongly support regional growth and offer great potential sales for off-highway equipment manufacturers.

GlobalData states that the aforementioned four countries, in terms of construction output value, accounted for more than 70% of the overall regional share in 2023. In addition, these countries are estimated to dominate the regional project pipeline with an approximate share of 69%. Brazil is anticipated to remain the front-runner with a share of more than 42% of the overall regional project pipeline.

Road infrastructure in the Latin America region is the largest segment of the infrastructure construction industry as of 2023 and is projected to continue its dominance over the forecast period, continues GlobalData. Regarding output value, Brazil is estimated to emerge as the key

country within this region, accounting for approximately 34% in 2023

The largest project in Brazil’s pipeline is the $6.2 billion Mario Covas Northern Stretch Ring Road project, which involves constructing a 44 km-long ring road. It will include the construction of road lanes, tunnels, overpasses, bridges, and highways.

GlobalData believes Mexico will follow Brazil in second place regarding construction output value and project pipelines. According to the reports released by the Ministry of Economy in November 2022, foreign direct investment (FDI) in Mexico increased by 29.5% YoY in the first nine months of 2022, reaching MXN32.2bn ($1.3 billion), with the manufacturing sector accounting for 36.3% of the total investment followed by the transport sector which accounts for 14.5%.

Source: GlobalData

Argentinian infrastructure construction is estimated to see an average growth rate of nearly 2.7% from 2023 to 2026, supported by transport investment. The construction of 218 roadway projects under the Ministry of Public Works is expected to be completed by 2025. GlobalData reports that the National Highway Authority of Argentina plans to rehabilitate 2,292km of roads, complete the construction of 261km of highways, and have 1,192km of highways under construction by the end of 2023.

Furthermore, as part of the Argentina Rail Modernisation Plan for 2030, the Ministry of Transport signed three memorandums of understanding (MoU) in February 2022 with Chinese companies to develop three rail projects.

GlobalData tips Colombia to register an annual average infrastructure construction growth rate of 5.9% from 2022 to 2026, primarily backed by ongoing efforts to accelerate the completion of Colombia’s 4G road infrastructure programme and push forward with plans for its 5G concessions programme. Furthermore, the new government announced the Intermodal Transportation Master Plan and National Development Plan to connect the Pacific to the Atlantic through 657km of railway lines

and 30 railway projects financed through public-private partnerships (PPPs).

According to ResearchandMarkets. com, the Brazilian construction equipment market is set to grow at a CAGR of 6.79% by 2028 against a 2022 benchmark. Prominent OEMs in Brazil include Caterpillar, Volvo Construction Equipment, Komatsu, Sany, JCB, Liebherr, John Deere, and XCMG (Xuzhou Construction Machinery Group).

The same source notes that the Argentinian construction equipment market is expected to grow significantly over the next few years due to increased funds from Inter-American Development Bank and the World Bank for new roads, rail, ports, and utilities. Foreign companies are investing in the mining sector in Argentina; for instance, ResearchandMarkets.com points to the Canadian Lundin Group investing $3,000 million in its Josemaría copper, gold, and silver mine in San Juan province.

CHANGING MARKET DYNAMICS

Off-Highway Research (OHR) notes that after two years of abnormally high sales in 2020 and 2021, thanks to stimulus spending, the Chinese market collapsed in 2022 with a 39% decline. This was not only due to the stimulus money running out, says OHR, but the impact was compounded by turbulence in the Chinese real estate sector and the country’s difficulties in getting to grips with Covid last year. Last year, the only bright spot in China was the mining segment, says OHR. Mine operators invested in dump trucks and large excavators to exploit high global commodity prices.

OHR forecasts the Chinese construction equipment market to continue to fall in 2023, but at a slower decline of about 18%, to settle at just below 195,000 units.

According to the industry consultancy, domestic demand may flatten out during 2024-2025, and the recovery will be very slow. OHR expects a real recovery during the period of the 15th Five Year Plan (2026-2030), primarily

as a result of increased sales of compact equipment and the recovering replacement demand; by then, the market may return to 270,000-300,000 units, but even that volume is still very much lower than what has been seen in the recent past.

OHR says a significant challenge to the future market lies in lower demand from the real estate sector, which, in line with experience, has been closely allied to the overall demand for equipment. “In the light of the saturated population and overheated supply, demand for new housing projects will decline, even though construction in the most developed areas may remain steady. Therefore, the traditional equipment demand from this sector will be significantly eroded, and other sectors will not make up this lost demand,” concludes OHR.

The China construction market size was valued at $4.6trn in 2022, according to a new GlobalData report. The market is projected to grow at an AAGR of more than 4% from 2024 to 2027.

GlobalData says investment in infrastructure will support growth in the construction industry as part of the 14th Five-Year Plan (FYP 2021-2025). The 14th FYP has 20 quantitative targets under five categories: economic development; innovation; people’s well-being; green development; and food and energy security. GlobalData reports that the residential construction sector dominated the Chinese construction market in 2022, followed by infrastructure construction.

Mordor Intelligence (MI), a global market intelligence and advisory firm, states that the Chinese construction equipment market is valued at $50bn. The same source says the market is expected to reach $68bn, registering a CAGR of 5.55% over the next five years.

According to Mordor Intelligence, excavators constitute around 60% of China’s total construction equipment sales. The China Construction Machinery Association (CCMA) says there are about 25 excavator manufacturers in the country, more than in any other country. In 2021, 274,357 excavators were sold in China. Sany Heavy Industry (Sany) was the market leader for excavators in China, with an estimated market share of around 18% in 2021, by volume.

Mordor Intelligence says that massive infrastructure projects are fuelling the Chinese popularity of excavators. In 2021, the industry research consultancy says the Chinese government spent $3.4trn on infrastructure development in China. The country’s infrastructure development focuses on constructing superhighways, high-speed railways, airports, bridges, ports, and metro systems.

Over the long term, the Chinese government’s increasing focus on infrastructure, the development of automation in the construction and manufacturing processes, and the introduction of electric construction equipment, including excavators, is expected to significantly impact construction equipment market growth, concludes Mordor Intelligence.

JAPAN

CONSTRUCTION STABILITY

Construction equipment sales in Japan fell 4% last year following a strong post-pandemic surge in 2021, reports Off-Highway Research (OHR). As such, the decline is seen as closer to a return to normal sales volumes rather than a cyclical downturn. Indeed, OHR notes that the Japanese market tends to be relatively flat and stable and generally only experiences singledigit percentage changes from year-to-year.

“Having said that, sales in Japan were constrained last year due to component shortages and long lead times for machines,” says OHR in its latest market update. “Some of that pent-up demand is expected to spill over into 2023, helping the market to a 2% rise in sales [to 66,370 units]. Thereafter, the market is expected to stabilise at more normal levels of around 63,000-65,000 unit sales per year.”

OHR highlights that the Japanese market is dominated by excavators, with 28,000 mini excavators and 24,500 crawler excavators expected to be sold this year, representing almost 80% of all equipment sales. The other high-volume machine type is the wheeled loader, which, OHR says, accounts for a further 18% of demand.

The

The Japan construction market size was valued at $552.6bn in 2022 and is expected to achieve an AAGR of 1% during 2023-2027, states a February 2023-published report by GlobalData. Investment in renewable energy infrastructure, telecommunication, and manufacturing will support the industry’s growth during the forecast period.

The key sectors in the Japanese construction market are commercial construction, industrial construction, infrastructure construction, energy & utilities construction, institutional construction, and residential construction. The residential construction sector led the Japanese construction market in 2022, says GlobalData.

An improvement in housing demand and the resulting improvement in the construction of new dwellings and residential sales will support the Japanese residential construction market’s output during 20232027.

The government plans to construct a residential building initiative comprising 560 residential units in Tokyo from Q4 2024 to Q4 2028 at a total cost of JPY70bn ($580mn).

Japan construction output by sector (% of total, 2022)

Source: GlobalData

Japan’s infrastructure construction sector’s output during the next four years will be supported by the government’s aim to develop transport and other heavy infrastructure.

Investment in renewable energy and telecommunication projects will support Japanese energy & utilities construction -2027, continues GlobalData. Prime Minister Fumio Kishida’s government intends to generate more than 36% of the power mix from renewable energy sources before becoming carbon neutral in

Japanese commercial construction 023 will be supported by improved tourism activity and wholesale and retail trade. The country’s industrial construction sector is expected to grow over the next four years, supported by increased investment in manufacturing plant construction and an improvement in export

Due to Japan’s increasing elderly population, GlobalData tips Japan’s institutional construction market to receive continued government investment in conventional healthcare infrastructure and aged-care facilities over the next few years.

A LONG WAY TOGETHER

WHEREVER YOU ARE, BKT IS WITH YOU

the toughest operating conditions: from mining to construction sites.

Sturdy and resistant, reliable and safe, able to combine comfort and high performance. BKT is with you, even when work gets tough.

HEALTHY INDIAN DEMAND

Broad-based growth in Indian construction equipment sales is expected to resume this year, with the market forecast to rise 10% to 76,350 units, says Off-Highway Research (OHR). This will be driven, says OHR, by a range of infrastructure investment plans. With a general election due in 2024, this year’s budget particularly strongly emphasises investment as Prime Minister Modi seeks a third term in office.

Unfortunately, OHR says next year’s election will temporarily derail growth, and further market-specific disruption will be felt due to the introduction of CEV Stage-V emissions laws in April 2024.

However, OHR says it remains bullish about the medium- and long-term growth prospects in the Indian market, expecting equipment sales to resume their ascent from 2025 onwards.

GlobalData reports that in its latest budget, the Indian government increased its total expenditure by 7.5%, from an estimated expenditure of INR41.9trn ($522.2bn) in FY2022/2023 to INR45trn ($561.6bn) in FY2023/2024. The capital investment outlay

for FY2023/2024 is equivalent to 3 3% of the country’s GDP and is nearly three times the outlay made in FY2019/2020.

Pooja Dayanand, an analyst at GlobalData, said: “The sharp increase in capital investment is in line with the government’s focus on boosting economic growth and increasing job creation through investment in infrastructure development. The increase in funding will also be necessary to assist ministries in implementing projects that have been delayed by constraints such as rising interest rates, construction material prices, and labour shortages.”

The latest Indian government budget is based on seven key priorities, says GlobalData. These include inclusive development, reaching the last mile, infrastructure and investment, and green growth. As part of the latest budget, the government increased its allocation to the state-owned National Highways Authority of India (NHAI) by 14% to INR1.6trn ($20.2bn). It also announced a record-high capital outlay of INR2.4trn ($29.9bn) for the Ministry of Railways.

Dayanand continued: “The NHAI had been facing constraints in reaching its construction targets and is likely to miss its target for the second time in a row –in FY2022/2023. The increase in budget allocation could help the NHAI meet its targets in the upcoming financial year while completing its backlog targets. The significant capital expenditure allocations for highways and railways will also help improve connectivity, ease traffic congestion, and reduce travel times.”

The Indian government also increased its PM Awas Yojana (PMAY) initiative allocation by 66% to INR790bn ($9.9bn) in FY2023/2024.

Dayanand added: “The increase in allocation for the PMAY will help increase the supply of affordable housing and address the issue of housing shortages. However, increasing inflation and rising interest rates will likely affect housing demand in the short term.”

The budget includes significant allocations for supporting sectors such as renewable energy, healthcare, logistics, and irrigation. To help the country reach its net-zero emissions target by 2070, the government allocated INR350bn ($4.4bn) for priority capital investments towards energy transition and net-zero objectives and energy security.

The renewable energy sector is expected to witness an increase in investment over the coming years, given that ‘Green Growth’ is listed as one of the seven priorities in the latest budget. This will also help facilitate the economy’s transition to low-carbon intensity and reduce dependence on fossil-fuel imports.

Dayanand concluded: “The increase in capital expenditure outlay is expected to boost construction activity by fast-tracking projects that have been delayed due to rising inflation and interest rates. However, headwinds such as delay in land acquisition, inadequate manpower, delay in receiving necessary permits and rise in construction material prices could pose a downside risk to the industry’s output in 2023.”

SOUTHEAST ASIA

SOARING PRICE CONCERNS, BUT GROWTH TIPPED

Government spending on major infrastructure projects has increased across Southeast Asia, including the Philippines, Vietnam, and Thailand. But the soaring price of construction materials, lockdowns in China and the ongoing RussiaUkraine war have been significant concerns for the regional industry’s stakeholders.

In its latest report, Southeast Asia Construction Industry Report 2022: Analysis & Outlook 2018-2022 & 2023-2032, ResearchandMarkets.com forecasts that the construction industry in Southeast Asian countries, including Thailand, the Philippines and Vietnam, will continue to grow from 2023 to 2032, which is good news for offhighway equipment manufacturers and their dealer distributors.

“Relatively cheap labour and land costs have attracted many foreign investors to shift production capacity to Southeast Asia. Foreign trade has expanded, and the development of the industrial real estate, commercial real estate and infrastructure sectors has boosted the construction industry. On the other hand, with the economic growth in Southeast Asia, the real estate industry is also growing rapidly, promoting the development of the construction industry,” the report noted.

GlobalData says the Southeast Asia infrastructure construction market will be valued at $209.3bn in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% over the forecast period. The rising need to provide an efficient infrastructure to the region’s growing population is expected to drive market growth between 2022 and 2026.

infrastructure represents exciting new sales opportunities for construction machine makers.

Indonesia is expected by GlobalData to remain the front-runner within Southeast Asia’s overall infrastructure construction sector, accounting for more than 62% in 2022. In the 2023 state budget, the government allocated IDR392trn ($25.8bn) for infrastructure development in 2023, a 7.8% increase from the 2022 budget allocation of IDR363.8trn ($23.8bn). The state budget will establish important facilities such as basic infrastructure. It will also be used to develop the new capital city (IKN) in East Kalimantan province in 2023

GlobalData anticipates Vietnam to occupy second place, following Indonesia’s regional market share in 2022. Regarding the project pipeline, Vietnam is expected to dominate the regional dynamics over the predicted timeline. The development and commencement of infrastructure projects in the country will likely aid the sector’s growth, the market research consultancy states. For instance, the construction of Dai Ngai Bridge is scheduled to commence in the first quarter of 2023, according to the Ministry of Transport. This is a 15.1km project that includes seven bridges and five

GlobalData tips the Philippines to register the fastest compound annual growth rate of 9.1% between 2022-2026

The significant volume of metro, tube and light-rail developments in the region is unsurprising, says GlobalData, given Southeast Asia’s rapid urbanisation and robust population growth. Insufficient urban rail-transit coverage has exacerbated traffic congestion in the region, generating high economic costs for many Southeast Asian economies. All this new transport

intersections, with the Dai Ngai Bridge being the main component. Set to cost around VND8 trillion ($342.9mn), the project is expected to be completed in 2026.

GlobalData tips the Philippines to register the fastest compound annual growth rate of 9.1% between 2022-2026. The government’s plan to improve regional connectivity through transport infrastructure development is anticipated to remain a key driver. The government’s allocation of PHP1.2trn ($22.6bn) as part of the 2023 budget will, says GlobalData, support the development of infrastructure projects in 2023

GlobalData estimated Malaysia and Thailand to occupy almost equivalent regional infrastructure construction market shares in 2022. However, Malaysia is expected by the same source to showcase 6.4% of the annual average growth rate from 2023 to 2026, and Thailand will likely record a 4.7% share over the same timeline. The Malaysian government is keenly focusing on maintaining its federal roadway network. For instance, in August 2022, the Minister of the Infrastructure Development Cluster and Works, Fadillah bin Yusof, announced an allocation of MYR1.8bn ($419mn) for maintaining federal roads throughout Malaysia during 2022.

SUB-SAHARAN AFRICA

A RISING DEBT HEADACHE

Construction output in sub-Saharan Africa grew by an estimated 1.7% in 2022, compared to a growth of 3.2% registered in 2021. The industry is forecast to record a growth of 3.2% in 2023. However, significant downside risks persist, notably the rising regional debt levels, says GlobalData, a leading data and analytics company.

GlobalData’s latest report, Construction Market Size, Trends and Growth Forecasts by Key Regions and Countries, 2022-2026, is a tough read for construction equipment manufacturers seeking demand growth in sub-Saharan Africa. It states that the region’s post-pandemic economic recovery has been halted since the second half of 2022. The IMF’s Oct 2022 World Economic Outlook forecasts GDP growth in sub-Saharan Africa to remain subdued at 3.7% in 2023, following a deceleration to 3.6% in 2022. Public debt has reached about 60% of the GDP, with several countries in the region in debt distress condition or at high risk of debt-distress

Dhananjay Sharma, an analyst at GlobalData, comments: “With the gloomy economic backdrop and additional challenges specific to the construction industry, notably high construction material costs, the region’s industry will remain subdued in the short term. Both public and private sector projects will face hurdles, with the government’s revenue continuing to be directed at efforts to deal with immediate socioeconomic crises. Concurrently, high construction material prices will make projects unviable for the private sector.”

In the last two decades, GlobalData notes that Chinese funding has been a major source of growth for infrastructure projects in the region, helping Africa bridge its US$100bna-year infrastructure deficit. However, the post-pandemic Chinese economic slowdown, coupled with the substantial losses on the loans it granted to multiple countries, is resulting in a recalibration of Chinese focus on the Belt and Road Initiative (BRI) and a slowdown in Chinese investment in the region. A tightening monetary policy across developed countries also affects the region. At the same time, higher interest rates due

to high inflation weigh on both business investments and household consumption. Sharma concludes that over the longer term, growth is expected to increase from 2024 onwards, with energy and utilities outperforming other sectors. He adds: “In the short term, growth will be driven by increased activity in oil and gas projects due to higher prices. The shift towards green energy and the region’s underlying potential in renewables will drive longer-term investments.

The region’s industry will remain subdued in the short term

Sub-Saharan Africa construction output by sector (% of total, 2022)

Source: GlobalData

Along with energy & utilities, investments in infrastructure and the institutional sector will be driven by the continued realisation of the inadequacies of the current transport and utility systems and education & healthcare facilities.”

Deloitte’s Africa Construction Trends Report 2021 analyses a Southern Africa region comprising Angola, Botswana, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, South Africa, Swaziland, Zambia and Zimbabwe. The region recorded 106 construction infrastructure projects, an increase of 3.9% from 2020. The total value of projects increased by 18.6%, reaching $147.7bn.

South Africa recorded 37 projects (34.9%), the highest number of projects in the region. Mozambique had 16 projects (15.1%), followed by Zambia with 14 projects (13.2%) and Angola with ten projects (9.4%). South Africa also registered the highest share in value terms, accounting for 37% ($54.7bn) of the total value of projects. Mozambique followed with a share of 33.2% ($49.1bn), and Angola with 14.1% ($20.8bn).

In terms of sectoral breakdown, the transport sector recorded 44 projects (41.5%), the largest number of projects in the region. The energy & power sector came second, recording 23 projects (21.7%) under construction, followed closely by the real estate sector with 19 projects (17.9%).

MIDDLE EAST & NORTH AFRICA

MENA GROWTH IN FULL SWING

There are clear winners and losers from rising fossil-fuel prices, with the MENA (Middle East & North Africa) region firmly residing in the former camp. Additional funds generated by oil producers across the region due to the sustained fossil-fuel price hike are largely being spent on various forms of construction, which, in turn, has pushed up demand for aggregates, such as gravel, concrete, sand, and crushed stone. The GCC (Gulf Cooperation Council) countries have taken the lead in the past year, announcing building projects worth billions of dollars. This is good news for growth-hungry global construction and materials processing equipment manufacturers.

Two major events – the 2022 FIFA World Cup in Qatar and Expo 2020 in Dubai (the event was deferred by one year due to the Covid-19 pandemic) – gave a fillip to GCC construction activity.

Encouraged by the success of World Expo 2020 in the UAE, Saudi Arabia wants to hold the World Expo in 2030 as the Kingdom has already initiated infrastructure projects worth over $750bn, including NEOM city, which alone is estimated to cost around $500bn.

MENA’s construction sector growth, particularly in the oil/refinery, petrochemical/industrial, and commercial construction, is fuelled by the US$90 to $125 a barrel of crude oil. On 8 March 2023 the price of Brent crude oil stood at $80 but is expected to rise in the coming months.

More importantly, the huge spending by various regional governments in executing various infrastructure projects is expected to create thousands of direct and indirect jobs leading to more economic activity throughout the region.

For example, Morocco has approved 26 investment projects with a total budget of $2.8bn. These projects will create over 3,735 direct jobs and 23,182 indirect jobs, the country’s investment commission, chaired by Morocco’s Prime Minister Aziz Akhannouch, said on 23 January 2023

Even in Egypt, which is still recovering from the Covid-19 pandemic, the award of construction projects is set to grow by 18% to $23.5bn in 2023 from $19.9bn in 2022.

Morocco has approved 26 investment projects with a total budget of $2.8bn

While the building sector walked away with the lion’s share of $9.7bn in 2022, it was followed by the $5bn industrial and $2.7bn infrastructure sectors.

Mordor Intelligence, a

global market intelligence and advisory firm, values the MENA construction equipment market at $4.26 billion and expects it to reach $6.4 billion by 2028, registering a CAGR (compound annual growth rate) of 4% over the next five years. Saudi Arabia represents the second-largest market for the construction sector in the GCC region after the UAE, which represents more than 34% of the revenue generated, Mordor Intelligence reports. Saudi Arabia holds a revenue share of 29%, followed by Qatar and Oman with 12% and 10%, respectively. Mordor Intelligence anticipates the construction of high-rise buildings like the Jeddah Tower in Saudi Arabia to increase the demand for construction equipment in Saudi Arabia.

“The Covid-19 pandemic severely affected the [MENA] construction industry and associated equipment demand due to disruptions in the supply chain, reduced investment in new equipment procurement, [the halting] and postponement of construction projects, and unstable economic growth in many countries,” states Mordor Intelligence.

However, the same source says that since last year, the construction industry across the region has been experiencing significant growth in investment and economic development, witnessing major orders for construction equipment from GCC countries, likely to fuel market demand over the next five years.

For example, in August last year, Doosan Infracore Co., a subsidiary of Hyundai Construction Equipment, won an order to supply 62 units of construction equipment to major customers in Saudi Arabia and Bahrain.

Another major factor that is expected to push up MENA demand for construction equipment and building materials is the tragedy that struck two Middle East countries - Turkey and Syria - in the form of the massive earthquake on 6 February 2023

The Turkish government’s initial recovery plan is to build 200,000 apartments and 70,000 village houses at the cost of at least $15bn. The government anticipates that reconstructing damaged buildings, roads, and airports will take at least three to five years.

Integrating logistics data with information from on-machine technology can deliver greater efficiency for road construction

USING GROUND-SCANNING TECHNOLOGY TO REVEAL MORE AND MORE OF WHAT LIES BENEATH

For any construction project, having an extensive knowledge of the ground conditions is an essential factor before work can begin. Geological surveys are vitally important in determining what lies underground, such as varying rock strata, buried water courses, utility pipes, and other hazards. And the technology that enables all this is getting ever more sophisticated. Mike Woof reports.

Assessing the condition of road surfaces, whether old or recently paved, can provide essential information regarding their structural strength and potential longevity. And what lies beneath can be just as important, sometimes more so.

Understanding the complex geology of any area is crucial both for structural and environmental reasons before roads or bridges or tunnels or any other structures can be built. Reinforcement may be required to provide necessary support under weightbearing columns. Meanwhile, the location of natural springs may require environmental measures to prevent contamination.

And when road works are being carried out, determining the condition of the surface is essential to know what a project will entail.

Also, knowing where utilities lie can be an issue. Councils do have maps showing the location of these but for a number of reasons,

they could be inaccurate or incomplete. Sewers or water mains can be very old in some instances, so they may not be marked accurately on local maps.

During the construction of the Crossrail project in UK capital London, for instance, the contracting team had to carry out extensive surveys before tunnel-boring machines (TBMs) could be allowed to start tunnel drives. The location of underground cables and drains had to be determined accurately. In some instances, historic structures and sites came to light during these surveys. Some were many hundreds of years old, and the authorities had absolutely no record of their existence.

HIDDEN SECRETS

The location of utilities may be unclear for other reasons too. Some years ago, a contractor was using a chain trencher to open

up a drainage channel at a roadside in East England. The trencher struck an obstruction that was not marked on the council map and the machine was then stopped as the contracting team figured out what to do.

Minutes later, several military vehicles screeched to a halt at the scene and personnel jumped out, pointing weapons at the road crew and demanding an immediate halt to the work. Unknown to the contractor, the trencher had cut through key communication cables leading to a nearby military base. These utilities were not marked on the council maps of buried utilities because they were considered secret by the military.

The bemused highways contractor team then faced a barrage of questions and tense moments passed until the military officer in charge realised that this was not a deliberate act of espionage by a hostile foreign power. Instead, this was an innocent mistake by a ➔

civilian contractor unaware of the location, as well as the importance, of the cables.

The incident was entirely avoidable. It is understandable that the military would not want to make public the location of key communication links to a major military base where strategic weapons were sited. It is understandable too that the civilian contractor would feel able to rely on maps of buried utilities provided by the council, especially since this was a rural area in the midst of farmland.

But simple checks using basic cabledetection equipment would have averted the incident entirely.

Using drilling rigs to take core samples is a common method of determining geology. But this can be time-consuming and is not inexpensive, requiring skilled analysis of the core samples. Seismic equipment can be used to determine geology also and is less time-consuming than using a drill rig to take core samples. But even here, analysis requires skilled professionals to carry out the work. There are, however, simple tools that can be employed for many applications instead. Cable detectors are comparatively cheap and can be bought or rented. These units are simple to operate with just basic training and can be used onsite by any construction personnel.

More sophisticated ground-penetrating radar (GPR) equipment is also available, although this is more costly and requires proper training to use. This can reveal the location of cables and pipes before any works are carried out.

SATELLITES AND 3D MAPPING

Data recovered using GPR tools can be geolocated using satellite positioning systems and integrated into 3D maps of project areas, highlighting to designers where underground obstructions are located. This can ensure that clash-detection measures can be employed so that construction works will not interfere with existing utilities.

Using GPR systems can also ensure that important archaeological finds in areas of historic importance are undamaged and can be excavated sensitively by experts before construction works commence.

Greek contractor Terna has used GPR systems extensively for this purpose during major highway construction contracts in the country. In a number of instances, highway alignments have been moved on Greek projects due to large and important archaeological finds initially located using GPR tools.

Meanwhile, when building a new highway in Kosovo the joint venture partners Bechtel Enka made use of GPR systems to detect unexploded munitions left over from the civil war of the 1990s, averting potential accidents onsite.

In recent years, new technology has helped

The GSSI system for GPR can accurately determine the condition of paved surfaces to set depths

take resurfacing projects in new directions in terms of the materials used, the equipment deployed, and the workflows which followed … all of them important factors in increased speed and efficiency.

For both road construction and road repair works, an assessment of the condition of existing networks is essential. Laser scanning technology can be utilised to generate point clouds of project areas, yielding important information with regard to roadside obstructions. Firms such as Bentley Systems, Leica Geosystems, Topcon and Trimble all offer an array of tools that can recover point cloud data, employing a range of equipment including automated drone systems.

DATA FROM THE CLOUD

Data from point clouds that is integrated with satellite positioning systems is vital for utilisation in 3D models of projects.

For example in Australia, recent heavy flooding has caused extensive damage to roads in Victoria State. Repair and rehabilitation works are required to ensure that road links are returned to an adequate condition. Victoria State enacted an Emergency Road Repair Blitz to deal with the issue, requiring a total of 8,400km of roads to be surveyed to determine what type of improvements will be needed.

A budget of US$115 million (A$165 million) was set for the work. The highly sophisticated intelligent Pavement Assessment Vehicle (iPAVe) will be used for the surveying process as the machine is

equipped with sophisticated laser scanning systems able to analyse a road’s structural condition. The iPAVe machine also feaures ground-penetrating radar (GPR) equipment, allowing it to assess a road’s base structure. The iPAVe machine is operated by the Australian Road Research Board (ARRB).

For road or airport runway resurfacing works, tools such as Topcon’s RD-M1 Scanner can be employed to deliver highly precise analysis of surface conditions. This system can be fitted to a van or pick-up truck, while recovering extensive data revealing the precise condition of the road surface.

The innovative RD-M1 scanner collects a constant stream of data as the user drives, delivering precise surface conditions. This allows a firm to quickly scan long stretches of road without the need for costly lane closures or rework. Normal traffic conditions continue uninterrupted,

saving time and increasing crew safety.

The sophisticated design works seamlessly with an integrated HiPer SR GNSS receiver and inertial measurement unit (IMU) to capture point data accurately while cruising at normal highway speeds. Data is automatically timestamped and stored for easy management and point cloud generation.

Once a road has been paved, it is still important to asses the quality of the work that has been carried out

The downward-facing LIDAR scanner is said to deliver optimal road surface definition, allowing speed scanning without the need for lane closures. The system can collect millions of points from a truck cab safely, while allowing scan rates of up to 100 times/second. The package allows easy installation and removal for daily use and also features graphical software for intuitive processing.

Once again, this data can be incorporated directly into 3D models, providing a highly

accurate, geolocated picture of road surface quality. Not only will this reveal cracks or potholes, it will also highlight undulations in the surface, showing how a road will have to be made more smooth to improve its ride quality. Data from this type of system can be used directly in milling machines with automatic controls governing the height of cut so that only an exact quantity of material is removed. This leaves a precise surface on which paving can be carried out.

PAVING BENEFITS

The subsequent paving operation can then be carried out in the knowledge that all surface undulations have been removed, along with failed areas such as cracks and potholes. Because only the material needing to be milled is removed, this delivers substantial savings in materials costs. Road surface materials are increasingly expensive (and asphalt-wearing courses in particular), so minimising the quantities required for a project will ensure construction-project costs are kept in check.

The Topcon RD-M1 system can be fitted to a pick-up truck and used to carry out accurate, high-speed checks of road surface condition

During asphalt paving, sophisticated tools can now be employed to ensure quality is optimised. Heat-scanning equipment mounted on the asphalt paver will monitor temperature gradient of the mat behind the screed. This highlights inconsistencies and areas of temperature segregation, as well as showing sections that are cooling and which will require a priority for compaction to be carried out. Paver manufacturers such as VÖgele offer their own proprietary heat-

Sophisticated tools can now be employed to ensure quality is optimised

Using scanning systems can ensure milling operations are carried out accurately to deliver smooth surfaces that can be paved on directly

scanning systems, alongside equipment from specialist suppliers such as Moba or Leica Geosystems, Topcon or Trimble.

Similarly, heat-detection equipment fitted to asphalt compactors can be combined with technology that determines the degree of compaction carried out. Major compactor manufacturers such as BOMAG, Caterpillar, Dynapac, Hamm and Volvo CE offer their own proprietary systems, in addition to the technologies from

specialist suppliers like Leica Geosystems, Topcon and Trimble.

These systems can also be integrated with tools such as the BPO package from Volz Consulting that track the logistics of materials supplies, to ensure more efficient working. Meanwhile, the Wirtgen Group offers its own proprietary system with similar performance. These packages can be used for the value chain, from operation and resource management to merchandise management such as purchasing, sales, invoicing, freight accounting, production data collection, production and logistics. Users of such packages can employ them for material production, as well as road-milling and paving applications.

Due to real-time networking, data such as delivery notes, invoices, material orders or offers can be exchanged. Deliveries of minerals from an asphalt mixing plant can be monitored automatically and only need to be confirmed. Raw material orders can be transmitted electronically, reducing order costs.

Once a road has been paved, it is still important to asses the quality of the work that has been carried out. The PaveScan RDM 2.0 is a second-generation asphalt density-assessment tool ideal for nondestructive asphalt compaction testing, quality assurance/quality control of new pavements and determining pavement nonconformity.

By uncovering inconsistencies that occur during the paving process, including

During road construction work in Greece, contractor Terna used GPR technology to ensure the road alignment did no damage to archaeological sites

poor uniformity and significant variations in density, PaveScan RDM 2.0 helps to avoid premature failures like road ravelling, cracking, and deterioration along joints.

SEAMLESS INTEGRATION

The seamless GPS integration, realtime onscreen data output and export options mean that this system is ideal for government transportation agencies and paving contractors alike. The pavement density-measurement technology used in PaveScan RDM 2.0 is an accepted American Association of State and Highway

When the Bechtel Enka joint venture partners built a new highway in Kosovo, GPR systems were used to ensure there were no unexploded munitions in the way of the excavation works

Transportation Officials (AASHTO) specification, PP 98-19.

The complete PaveScan RDM 2.0 system includes a rugged deployment cart and an integrated concentrator box that accommodates up to three sensors. It includes housing for cable management and hot-swappable, dual batteries.

The new sensor design was built specifically for the extremes of the asphalt paving environment and features a green laser to aid location accuracy. Also available is a system upgrade kit to expand to three sensors for better pavement coverage.

Additional GPS options and mounting pole provide high-precision location information and work seamlessly with the PaveScan interface.

Using laser scanning and GPR tools in combination with geolocation systems to augment 3D renderings of projects has become essential for construction works both before and after any work is carried out.

Analysing conditions can deliver major cuts in construction time, reducing the need for reworking and delivering higher quality while also lowering overall projects costs.

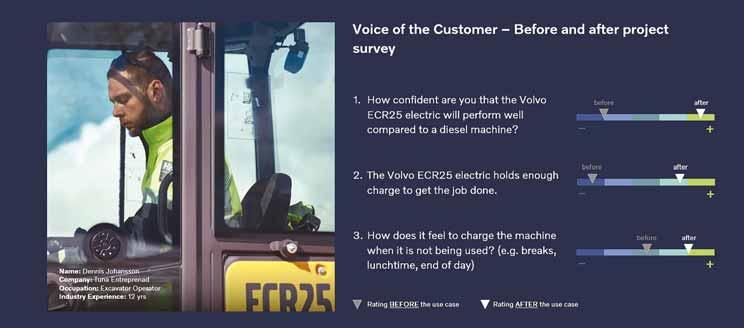

BE REALISTIC AND MAKE SURE THAT YOU MEASURE THE REAL IMPACT OF GOING ELECTRIC

It’s vitally important to measure the real impact of going electric says Mats Bredborg, Head of Customer Cluster Utility at Volvo Construction Equipment. In 2021, the construction industry accounted for around 35% of energy and process-related CO2 emissions according to a report by the UN Environment Programme. Our industry plays a vital role in healthy economies, but it must play its part in cutting emissions and pushing for a more sustainable way of working of course. What does going electric really entail?

It’s clear that sweeping change is needed if we are to collectively transform the highway construction, maintenance and utility works industries and we understand the complex challenges that lie ahead for customers ... from materials choice and production technology, to supply chains and transport.

As we all know, steps are being taken already, and there are solutions available today that can significantly reduce emissions. Electric machines are one of these solutions and they are growing in popularity. No longer just a vision for the future, they are in operation today on sites across the world in a wide variety of different applications including highway maintenance and utility work. Aside from being zero emission, they

are also quieter, helping meet ever-stricter air pollution and noise disturbance regulations.

Whilst many customers understand the benefits offered by electric machines, concerns about cost and performance can be a stumbling block towards adoption. Changing the way we measure their impact is one solution to help pave the way for wider uptake.

We need to look beyond the initial purchase or rental cost for an electric machine, which in many cases may well be higher than for a conventional machine equivalent and dig a little deeper to uncover equally important benefits that we can and should be measuring. Cost to operate, the reduction in CO2, health and safety benefits for operators and passers-by, their ease of use,

operator feedback and of course, their ability to get the job done.

Measuring their impact is something that Volvo Construction Equipment (Volvo CE) has been doing in its own assessment projects … and the following results may come as something of a surprise:

COST

INCREASE IS MARGINAL

Electric machines are often considered prohibitively expensive from an upfront capital cost point of view. It’s important however, to look at the full picture.

Fuel costs and servicing are traditionally significant contributors to the operating costs of construction machines. With no engine to service and no need for diesel – the cost of which is at an all-time high – electric

Source: Volvo CE

machines can be cheaper to run. We found a less than 1% increase in project costs to use electric machines over diesel. Whilst the initial rental price was higher, the cost of electricity to power the machines was much lower than the price of diesel.

Add in reduced maintenance and the cost savings from machine idling time – which is eliminated with electric machines - and suddenly the cost for electric machines becomes more favourable.

KINDER ON THE POCKET AND THE PLANET

Arguably the strongest and most widely understood argument for electric machines is the reduction in CO2 emissions they deliver. If the road construction industry is to get to grips with its CO2 contributions, electric machines offer a ready-made solution, especially when they are powered by renewable energy.

On an 11-week project to install electric charging stations, electric machines used in

Source:

place of their diesel counterparts saved an impressive 3,000kg in CO2 emissions. That’s equivalent to taking 17 cars off the road for a month.

QUIET PLEASE

Noise pollution still constitutes a major environmental health concern in Europe, being a problem for 1 in 5 EU citizens. Directives to reduce environmental noise are becoming increasingly stringent, ➔

➔ necessitating construction sites to implement preventative measures like acoustic barriers and providing workers with personal protective equipment (PPE). Eliminating noisy processes is the best way to deal with noise on a construction site.

Using electric equipment in place of traditional diesel engines delivers a noticeable reduction in ambient noise and pollution. The noise levels from electric machines are around 20% lower than for diesel machines, making them ideal for use in busy inner city and urban environments, outside schools, shops, offices and hospitals for example, where noise regulations may be toughest. They also allow work to continue later into the night or begin earlier in the morning, helping to get the job done faster and delivering cost savings. Operators, too, benefit from the lower noise levels making work more comfortable and allowing them to communicate more easily with site managers and other site staff without the need to shout or shut down the machines. Better communication also has a positive impact on health and safety on site.

COMPARABLE – OR IN SOME CASES BETTER – PERFORMANCE

Electric machines are based on conventional construction design, with just the electric components replacing the diesel engine. This means comparable performance to the diesel versions. In fact, the controls themselves are identical to a diesel-powered machine.

Once operators adapt to the charging

requirements, any reluctance is overcome, and they quickly realize electric machines can get the job done in just the same way as their traditional diesel counterparts but with zero emissions.

And with less noise they can communicate more effectively without having to halt operations to discuss the job at hand, meaning it can be completed more efficiently, with less room for confusion or errors and creating a safer work environment for everyone. In fact, feedback is usually so positive electric machines become the operator’s choice.

PAVING THE WAY FOR MORE SUSTAINABLE WAYS OF WORKING

Being more sustainable is achievable without compromising on performance or profitability. For what can be marginal cost increases on a project, it is possible to radically transform highway construction operations.

The world is changing and we need to adapt and find more sustainable ways of

working. With their zero-emission operation, electric machines offer a transformative solution for the highway construction sector to significantly reduce its carbon emissions. Climate-saving choices exist already today. Adopting these now will pave the way for new innovations and initiatives in the future. Together we can play our part to deliver a more sustainable construction future.

Mats Bredborg

Having spent more than 30 years with the Volvo Group, based in Europe, Asia and the Americas, Mats Bredborg has been at the centre of the great technical transformation that construction equipment has undergone. In his latest role with the company, Mats has become a global influencer, championing the many benefits (and undoubted challenges) of what is without doubt the industry’s biggest and most ambitious challenge yet: the transition toward electromobility.

TAKE A LOOK AT THE FULL POWER OF AN ELECTRIC ECOSYSTEM WITH VOLVO’S E-WORKSITE

Last year, Volvo CE set up a fully-electric worksite (E-Worksite) in Gothenburg, Sweden, not only to benchmark an electric jobsite, but also to test how a set of electric construction and utility machines could work successfully across different tasks within a demanding urban environment.

The company saw this assessment project as “a vital next step in the electrification journey.”

According to Carolina Diez Ferrer, Head of Advanced Engineering Programs, at Volvo CE: “We are already delivering electric solutions that offer zero- exhaust emissions, reduced noise, and a much more comfortable work environment, but that is only half the challenge.

“We are also committed to helping our customers reach their own climate goals through complete site solutions with a holistic sustainable approach. This exciting partnership allows for a comprehensive investigation into the varied infrastructure and support system needs for electric machines to really perform to their best, no matter the task at hand.”

On-the-ground testing like this is essential in helping to move the transition to e-power forwards

And for Peter Lindgren, Business Developer Electrified Transports at the City of Gothenburg Urban Transport Administration, the aim is a real-life test: “To achieve the City of Gothenburg’s climate goals we need to reduce greenhouse gases and we see that electric construction machines will help us in this environmental work by reducing local emissions of both nitrogen oxides and particles, as well as noise. The partnership as part of the Electric Worksite is of great value and we see that this research project has the capacity required to speed up our green transformation”.

As Mats Bredborg explains, on-the-ground testing like this is essential in helping to move the transition to e-power forwards. As Volvo CE says: “Project planners are answering questions such as how to ensure best value for money for customers and what are the most energy-efficient methods of supplying

electricity to power the machines. Beyond the technology itself, business models, infrastructure and support systems, regulatory frameworks and a mindset change are all required on the road to full acceptance.

“It is a complex puzzle to solve as there will

be no one size fits all. The findings will prove important not only for municipalities in deciding how to develop the appropriate legislation, but also for industry partners in bringing technical solutions to market – both in the immediate future and over the next two decades.”

info@fae-group.com fae-group.com A new era has begun for skid steer road planers. The FAE RPL/SSL and RPM/SSL are dedicated to resurfacing roads in preparation for laying a new layer of asphalt or concrete. The FAE RWM/SSL , with disc rotor is ideal for

ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING ARE CONSTRUCTING TOMORROW’S WORLD TODAY

The world’s leading construction equipment firms are jockeying for position as AI takes root. Companies based in China, USA, Europe and India are all battling for control as another new industrial revolution transforms the world. Graham Anderson reports.

Back in the 1970s, the gravel-voiced American singer-songwriter Tom Waits wrote “Step Right Up”, a sort of musical monologue about a super product that would do everything its owner wanted.

It would mow the lawn, deliver the pizza, pick up the kids, walk your dog, double up on sax, and get rid of your gambling debts. He sang: “It’s a friend, it’s a companion, it’s the only product you will ever need.”

Tom Waits was satirising what he saw as out-of-control consumerism. But he might as well have been welcoming his listeners to the coming world of artificial intelligence.

Political leaders of all stripes are certainly beginning to take note of the social and economic changes that are heading our way, and their impact on geopolitics and individual industries.

Last September, US National Security Advisor Jake Sullivan, made a speech at a Global Emerging Technologies summit in which he stressed the huge significance of AI to the US and the West’s economic ambitions.

He said that the US has been complacent

in the past and allowed its competitors and adversaries to take advantage of its openness - something that would not happen in future.

According to Sullivan: “Advancements in science and technology are poised to define the geopolitical landscape of the 21st century. They will generate game-changers in health and medicine, food security, and clean energy.”

TAKING THE LEAD

He added that a select few technologies are set to play an outsized importance over the coming decade, including microelectronics, quantum information systems, and artificial intelligence, and leadership in these would be both a national security and economic imperative.

On one level, he and the US government are responding to the challenge posed by China. In July 2017, China’s State Council announced that the country aimed to become a leader in AI by 2030

By some metrics China seemed until recently to be already ahead of its

competitors. Earlier this year Japanese media conglomerate Nikkei Asia reported that the number of published Chinese AI research papers had risen five-fold in little more than a year.

But the recent and rapid emergence of generative AI technologies such as ChatGPT in the West has significantly altered the competitive landscape, challenging China’s perceived position.

An added complication in these times of polarised political stress is that many Chinese companies work successfully in the West and vice versa. Away from geopolitical rivalries, industrialists of all stripes are trying to understand the real-world implications for their companies and markets.

The major-projects end of the construction industry has been grappling with the rise of BIM - building information management- for some years along with its impact on design, planning and project management.

Now, the industry is beginning to see the development of increasingly sophisticated AIinspired autonomous equipment, with major

intelligence.

TRIMBLE’S 5-STAGE PROCESS

One company at the cutting edge of such trends is Trimble, the US-based industrial technology specialist. Construction is one of Trimble’s core markets and it works with a range of companies across the supply chain from architects and project managers to utilities and OEMs.

A particular focus has been on the rise of autonomous equipment. Cameron Clarke, earthmoving industry director for Trimble Civil Construction, says that the company

sees autonomy as a five-stage process, starting from Level 1 where the operator performs most tasks, but AI provides guidance assistance that optimizes human decisionmaking, through to the total autonomy of Level 5 with the vehicle replacing human operator tasks at an experienced operator level.

Clarke explains that this has huge implications for the wider industry well beyond the operation of a specific piece of equipment.

“Each level has different requirements for an autonomous piece of equipment to be safe, for it to know what to do, to be able to receive a task, to report what it is doing etc. These requirements can be broken into valueadd items that can be added to a portfolio of solutions to make sites more productive and safer along the way to a future state of autonomy.”

He continues: “But for any level of autonomy to be safely deployed to a job site, site data has to be captured and fed back into a repository where analytics can be applied and decisions be made to have the intelligence to optimize and coordinate the site.

“Autonomous equipment can only be successfully applied in an ecosystem that is set up for sophisticated use of site data. To support the making of plans and optimizing the work of the autonomous equipment on the ‘whole’, a complete picture is required, not an incomplete or outdated data set. Only then autonomous machines can work in harmony together with other autonomous machines and manned machines.”

He adds that connected site technology is part of a whole system of autonomy in construction. “It enables the management of multiple types of machines from multiple

brands to be orchestrated from an integrated environment.

“Construction sites are very dynamic environments: adding a machine has a massive impact on all the other machines on the job.”

XCMG IS TRYING OUT AUTONOMOUS ROAD CONSTRUCTION

In China, leading equipment manufacturer XCMG has been running a series of projects trialling autonomous road construction and maintenance.

To date, what the company calls its “unmanned cluster construction equipment” has participated in 15 highway construction projects that cover 12 provinces across China, including the Pan-Dalian Expressway, the Jingxiong Expressway, reconstruction and expansion of the BeijingTaipei Expressway and the Shanghai-Nanjing Expressway maintenance contract.

XCMG - which signed a strategic cooperation agreement with Trimble in March this year - concluded that the unmanned equipment was between 15-20 per cent more efficient than traditional construction operations.

Cui Jisheng, general manager of XCMG’s road machinery division, said: “Our

autonomous road construction technology efforts focus on three core points: efficiency, quality, and cost.

“Just like automated production lines in the manufacturing industry, automated construction technology can improve standardization and achieve high-quality, high-efficiency construction solutions.”

Fellow Chinese OEM Sany - known for its cranes and heavy construction equipment - has teamed up with Californian autonomous vehicle specialist Pony.ai to develop, produce and sell fully autonomous self-driving heavy-goods vehicles and build a highend autonomous driving heavy-truck brand. And in India, both big and small firms in its fast-growing technology sector are also moving rapidly into the space offered by AI-related opportunities, like their Chinese counterparts.

Company CEO Vikshut Mundkur says that Constra helps construction leaders and project managers to streamline their project management processes by allowing them to oversee their project remotely, resulting in faster, more accurate, cost-effective, and more efficient design, construction and postconstruction management.

He believes that the application of AI in construction is scaling rapidly and says that real estate and construction companies are steadily adopting visual-intelligence platforms for remote management of their projects - with many solutions built on AI technologies by Indian companies.