UNIQUE CONTENT AND INSIGHTFUL OPINIONS ON THE SHIFTING MOVEMENTS WITHIN THE MARKET BY THE INDUSTRY’S MOST INFORMED AND INFLUENTIAL SOURCES

GLOBAL REPORT

CONSTRUCTION EQUIPMENT 2019

Get more from every earthmoving machine and operator on site.

The Trimble® Earthworks Grade Control Platform is a next generation machine control system that optimizes your mixed fleet for an integrated site solution. This simple, intuitive platform enables your operators to stop the guesswork and start using the friendly Android™ UI and 10-inch touch screen to drive efficiency, deliver on schedule, and do more with dirt than ever before.

Ask for the full family of next-gen machine control. From the company that invented machine control. construction.trimble.com/earthworks

For excavators, dozers, and motor graders.

CONTENTS

06. Global markets review: Looking up

Global construction equipment demand looks much healthier as governments and private companies spend on new infrastructure megaprojects and buy the latest, state-of-the-art machines.

22. 3D printing: Additive manufacturing

3D parts printing, or additive manufacturing as it is sometimes called, is revolutionising the rapid prototyping of new equipment and making it easier to support older machinery in the field.

27. Supply chain management: Logistics 4.0

The world’s leading construction equipment OEMs are seeing a revolution on the factory floor as new, intelligent technologies are put into place to create connected and interoperable workflows.

33. Regional focus: The “Stans” It is nearly 30 years since they emerged from the old Soviet Union, but the “Stans” still require major infrastructure upgrades and many significant new opportunities still exist. Where are the hot spots?

40. Artificial intelligence: Rise of the robots

It is hard to work through the confusing, controversial and sensitive subject of machine learning in the construction equipment sector. Artificial intelligence will change everything. Is it something to fear?

44. Aggregate production: The drive to bigger machines

Quarry operators are demanding ever-bigger crushers and screeners that combine the higher capacity and lower costs per tonne of stationary equipment with the mobility and flexibility of mobile units.

48. Regional focus: Latin America revives

In a vast territory of more than 20 million square kilometres, the region’s major economies - Brazil, Mexico and Colombiahave all elected new presidents recently and Argentina has gone from hope to economic crisis. What is really going on?

52. Compaction:

New thinking and new trends

New developments in compaction technology are allowing road builders to deliver better quality road surfaces, even in difficult applications. It’s all about being as efficient and profitable as possible.

57. The world in numbers

We live in interesting times. The global economic and political landscape is in a state of flux. We have selected a mix of key facts and figures … indicators that might help you make sense of it all.

59. Diesel engines:

Stage 5 has arrived

2019 is a landmark year for off-highway engine emissions as Stage V regulations start to take effect. How are the engine makers meeting the challenges involved and clearing the air?

63. Sustainability: Being eco-friendly

The sustainability of asphalt-mixing plants has come a long way. Ammann can now foresee a future in which resources, investments, technological development and institutional change can all work together in harmony.

67. Remanufacturing:

The future looks bright

Remanufacturing gives parts and components a ‘second life.’ In the construction equipment manufacturing sector, the leading players have long championed the benefits. What is coming next?

71. Regional focus: China

- what will its OEMs do next?

China’s construction equipment manufacturers are facing a new slowdown after an explosive recovery from the depths of the dramatic slump in 20122016. We report on a country that always takes the long view.

Save minimum 15% in fuel consumption

Renewed Lokotrack® LT200HP™ crushing plant

The renewed Lokotrack® LT200HP™ mobile crushing plant can save minimum 15% in fuel consumption compared to hydraulic-driven cone crushers thanks to its direct belt drive from gearbox, and is the first Lokotrack to comply with Stage V emission regulations.

In addition to being more efficient, the renewed LT200HP also features several safety and maintenance improvements. These include elevated service platforms to ensure safe, easy access to service and maintenance points and improvements that make daily maintenance quicker and easier.

Scan QR code below to see how it looks!

Editor:

Mike Woof

Deputy Editor: David Arminas

Contributing Editors:

Guy Woodford, Enrique Saez

Designers:

Simon Ward, Andy Taylder, Stephen Poulton

Production Manager: Nick Bond

Office Manager:

Kelly Thompson

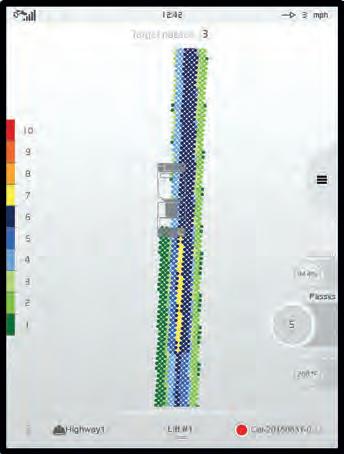

Circulation & Database Manager: Charmaine Douglas

Internet, IT and Data Services Director: James Howard

Managing Director: Andrew Barriball

Chairman: Roger Adshead

Publishing Director: Geoff Hadwick

Editorial contributors:

Liam McLoughlin, Adam Hill, Colin Sowman, Dan Gilkes, Kristina Smith, Geoff Ashcroft, Graham Anderson

COVER IMAGE: © Mirexon | Dreamstime.com

ADDRESS:

Route One Publishing Limited, Waterbridge Court, 50 Spital Street, Dartford, Kent DA1 2DT, UK

Tel: +44 (0) 1322 612055

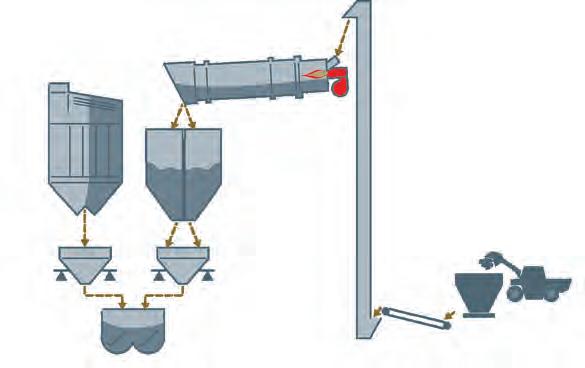

Fax: +44 (0) 1322 788063

Email: [initialsurname]@ropl.com (e.g. radshead@ropl.com)

ADVERTISEMENT SALES

Head of Construction Sales: Graeme McQueen

Tel: +44 1322 612069

Email: gmcqueen@ropl.com

Sales Director: Philip Woodgate Tel: +44 1322 612067

Email: pwoodgate@ropl.com

Sales Director: Dan Emmerson

Tel: +44 1322 612068

Email: demmerson@ropl.com

UK / Classified, North America: Yvonne Tindall

Tel: +44 1622 844027

Email: ytindall@ropl.com

Italy: Fulvio Bonfiglietti Tel: +39 339 1010833

Email: bonfiglietti@tiscali.it

Japan: Ted Asoshina

Tel: +81 3 3263 5065

Email: aso@echo-japan.co.jp

Asia / Australasia: Roger Adshead

Tel: +44 7768 178163

Email: radshead@ropl.com

Global Report Construction Equipment

Print ISSN 2057-3510

Digital ISSN 2057-3529

WELCOME

Welcome to the Global Report: Construction Equipment 2019 provide an incisive, informative and insightful read for anyone involved in specifying the equipment that is used in the world’s highway construction and aggregates production industry.

Our team of expert writers has put together thoughtful pieces on a host of important topics, giving guidance on changing business trends as well as providing pointers to future demand. And don’t take our word for it. Global Report: Construction Equipment has twice been highlighted as one of the best business publications in the world, winning its place on the Tabbies International Editorial and Design winners’ shortlist.

This year, the report focuses on areas such as the outlook for road building and construction equipment sales in two interesting regional markets: Latin America and the “Stans,” as well as the latest trends in logistics 4.0 and the integrated supply chain. We take a look at the fast-growing worlds of artificial intelligence, 3D printing and remanufacturing … three fascinating areas that could revolutionise everything we do and everything we use in the years ahead.

We have also lined up authoritative articles on the latest thinking in the road surface compaction market and on asphalt plant technology trends from the experts at Ammann, plus there is our usual, fact-packed review of how the global markets are shaping up around the world.

And don’t miss chapters on developments in the diesel engine market as it prepares for Stage 5, on how China’s top construction equipment manufacturers are thinking about the future, on new ideas in the recycled bitumen sector and on the drive towards ever-bigger machines in the aggregates industry.

We hope that you will find plenty of relevant facts and figures, as well as detailed thought pieces that are of interest to you and your business.

Mike Woof Editor, World Highways

A MUCH HEALTHIER OUTLOOK

Global construction equipment demand looks much healthier as we approach the end of the current decade, with governments and private companies within key regional markets spending big on new infrastructure, releasing pent-up demand for state-of-the-art machine fleets. Guy Woodford reports.

Things are definitely looking up for the global construction equipment industry. Off-Highway Research (OHR), a leading global construction equipment market research consultancy, expects worldwide construction equipment sales to increase 12% in 2018, following on from the 27% rise seen in 2017. This will take total sales to almost one million units in 2018. The total retail value of sales is tipped to approach US$99 billion.

Continued infrastructure investment in China was expected to drive up 2018 earthmoving equipment sales by 31%, following on from the 81% surge seen in 2017. This will take demand to 283,500 units, or 325,000 machines including mobile cranes and compaction equipment, making it by far the largest construction equipment market in the world in volume terms. OHR also notes that the Indian construction equipment market is set for a third consecutive year of double-digit growth. Demand is expected to rise 16% in 2018, following on from the 15% increase

in 2017, and the remarkable surge of 39% recorded in 2015. This is expected to take earthmoving equipment sales this year above the 70,000-unit mark for the first time and push the value of the Indian market to a record US$3.5 billion.

2018 was also set to be a year of strong growth in North American equipment demand. OHR states that after a hiatus in sales in 2016 due to uncertainty in the run-up to the presidential election, growth resumed in 2017, taking volumes back to their 2015 levels. Sales in 2018 are expected to rise another 13% to almost 200,000 units.

Like the North American market, demand for equipment in Europe is at a good level. Sales exceeded 160,000 units in 2017 for the first time since the global crisis, and in 2018 the market is expected to edge up to 165,000 machines. However, OHR expects this to represent the high-water mark for Europe in this cycle.

Overall, OHR forecasts that global equipment sales over the medium term will stabilise around the one million units per year mark, with a retail value of around US$100 billion.

GlobalData, another leading international business market research consultancy, expects the pace of expansion in the global construction industry to average 3.6% a year over the 2018-2022 period. In real value terms (measured at constant 2017 prices and US$ exchange rates), global construction output is forecast to rise to US$12.9 trillion in 2022, up from US$10.8 trillion in 2017.

Global construction output is forecast to rise to US$12.9 trillion in 2022

Although there are intensifying downside risks to global economic growth, notably stemming from the ongoing trade war between the U.S. and China, GlobalData tips the global economy to continue to expand in the range of 2.5% to 3% a year over the 20182022 period.

CONTINUED EUROPEAN GROWTH

On a macro-economic level, the European Union (EU) economy is entering its sixth year of uninterrupted growth, according to the Committee for European Construction Equipment (CECE).

Within the euro zone (that part of the European Union whose member countries use the euro as common currency), growth was forecast to slip back slightly in 2018 - from a 10-year high of 2.4% in 2017 to 2.1%. Growth will likely ease back even further to 1.9% this year, 2019, and 1.7% in 2020, according to the CECE’s November 2018 Economic Bulletin

For the EU as a whole, growth is expected to follow a similar pattern, settling at around 1.9% in 2020.

The European construction equipment sector delivered another positive surprise in the third quarter of 2018. Equipment sales in Europe grew by 9.4% in the third quarter and year-to-date growth was at 9.2% after nine months.

Earthmoving equipment sales (excluding telescopic handlers) grew by 10% in the third quarter of 2018, which means that the pattern of on-going growth was confirmed again in Q3. After nine months, yearto-date growth within the earthmoving sub-sector had reached 9%. Rental demand, which had showed signs of a slowdown in the second quarter, was robust in Q3 2018. The total market volume was close to the

*note: no data for concrete equipment available at the time of writing

levels seen in 2008, but still below the peak levels of 2007.

The top three earthmoving equipment markets – which were already at very high levels – saw further growth in the third quarter: the German market grew by 4% (Q1-Q3 2018: +5%), the UK market by 17% (+4%) and France by 10% (+2%). Between them, these countries make up more than 50% of the European market. ➔

Source: CECE

Comparing product segments, growth in the third quarter showed differences, after being fairly similar in the first half of 2018. Compact equipment sales grew by 12% (Q1-Q3 2018: +9%), while heavy equipment sales only went up by 6% (+7%). Higher volume sales of compact equipment resulted in the double-digit sales increase within the overall earthmoving equipment sector.

Within the compact sector, skid-steer loaders were the best-performing product –sales grew by 20%. Mini excavators recorded a 13% increase, compact wheeled loader sales rose 6% and sales of backhoe loaders increased by 4%.

The European road equipment sector continued to show growth in the third quarter 2018. Sales were 8% above the previous year’s levels and year-to-date growth was still at 9%. As investment in road building was a part of many countries’ stimulus policies after the economic crisis, road equipment is one of the segments where recovery is most advanced.

Similar to earthmoving equipment, the three largest markets saw growth in the Q3 2018. Germany increased by 18% (Q1-Q3 2018: +6%), UK sales rose 7% (Q1-Q3 2018: -12%) and the French market saw 3% growth (ytd:+16%).

Sales were 8% above the previous year’s levels and year-to-date growth was still at 9%

In the heavy equipment sub-sector, sales of articulated dump trucks (+30%) and motor graders (+17%) showed the strongest growth. Rigid dump trucks (+8%), wheeled excavators (+8%), dozers (+7%), wheeled loaders (+4%) and crawler excavators (+3%) saw more moderate growth in Q3. With growth in sales continuing to improve over the year, the CECE’s report suggested that a double-digit increase was still a possibility for earthmoving equipment sales in Europe in 2018.

NORTH AMERICA

STRONG U.S. DEMAND

2

018 was a strong year for construction equipment demand in the United States.

Off-Highway Research (OHR) notes that after a hiatus in sales in 2016 due to uncertainty in the run-up to the presidential election, growth resumed in 2017, taking annual sales to more than 171,000 – akin to 2015 levels. In 2018, OHR expects sales to rise again to almost 200,000 units.

Construction in the US - Key Trends and Opportunities to 2022 published in October 2018 by GlobalData, a leading international business market research firm, states that the U.S. construction industry is expected to record encouraging growth over the 20182022 period, driven by president Donald

It is noteworthy that the growth in Q3 sales was attributable to growth in the light compaction segment (+9%). Heavy compaction sales were flat (-0.3%).

However, within the light compaction segment there were mixed performances for different products: sales of vibratory plates were up by 14% in Q3. Vibratory tamper sales dipped 1%. The low-volume product of pedestrian rollers saw sales rise 30%. In the heavy compaction equipment segment, tandem roller sales were up by 15% and single-drum rollers by 1%. In

contrast, trench roller sales tumbled 27% and combination rollers fell 13%.

Finally, asphalt paver sales in Q3 were 44% higher than in the previous year, but this is a low-volume product.

After a better-than-expected third quarter 2018 for the European market, the CECE report noted that sales growth in 2018 would be “almost guaranteed”. The only question is whether growth can exceed the 10% threshold, or whether it will reach only single-digit levels. Much will depend on whether the bad situation in the Turkish market will continue – a market that saw severe drops in sales.

The cyclical pattern of the sector still suggests that towards mid-2019 (after the bauma exhibition) the market peak will be reached, and the industry can expect a slight downturn. By then, recovery of the market will be very advanced, but will still fall short of the peak levels reached in 2007. Based on current economic fundamentals, and the underlying level of demand, a strong recession can be ruled out for 2019, according to the CECE report.

*CECE, based in Brussels, represents the interests of the European construction equipment industry and also works with other organisations worldwide to achieve harmonised standards and regulations.

Trump’s plans to revamp the country’s disintegrating infrastructure. In addition, GlobalData expects public and private sector investments in residential, commercial, healthcare and educational infrastructure construction projects to support growth in the industry over the forecast period.

In February 2018, the White House released its infrastructure initiative, under which the Trump administration seeks to provide US$200 billion in the next ten years to spur a projected US$1.5 trillion in state, local government and private sector investments to rebuild what Trump called America’s crumbling infrastructure.

The GlobalData report also quotes American Society of Civil Engineers estimates which suggest the country requires US$3.6 trillion to repair, upgrade and modify its aging transport infrastructure by 2020.

MAKE EVERY HOUR COUNT

AMMANN SERVICELINK THE DIGITAL FLEET MANAGEMENT SOLUTION

Manage your equipment – anytime, anywhere – with Ammann ServiceLink. This comprehensive fleet system provides key data for light compaction equipment, heavy compaction machines and asphalt pavers. You can choose which machines to track.

• ServiceLink utilises telematics that give you the locations of the machines, hours of usage and other essential information. You’ll have access to data that will keep your machines running – and make them more productive, too.

• ServiceLink also makes it easy to plan and schedule the maintenance that protects your fleet.

Accordingly, under the Airport Improvement Program, the U.S. government plans to invest US$3.2 billion for the development and modernisation of airports in the country.

The total construction project pipeline in the US, as tracked by GlobalData, stands at $629.3 billion. The pipeline, which includes all projects from pre-planning to execution, is skewed towards late-stage projects, with 62.1% of the pipeline value being in projects in the pre-execution and execution stages as of October 2018.

A further GlobalData report, Infrastructure Insight: The U.S. published in August 2018, notes how reduced tax rates and deregulation are expected to boost overall investment levels over the coming years, especially in the telecommunications, energy and air transportation sectors. States and local governments are pushing for higher gas tax and user fees in order to gain increased revenues for public works, while the Trump administration is seeking to harness private capital to take advantage of government spending on infrastructure at the federal, state and local levels.

The Association of Equipment Manufacturers (AEM), the North Americanbased international trade group representing off-road equipment manufacturers and suppliers, has voiced its concern about the Trump government-imposed tariffs on $250 billion worth of Chinese goods coming into the U.S. The move has led to retaliatory tariffs imposed or proposed on $110 billion-worth of U.S. goods imported to China.

BELOW: Get selling ... America requires US$3.6 trillion to repair, upgrade and modify its aging transport infrastructure by 2020.

Speaking in September 2018, AEM president Dennis Slater said: “This extreme use of tariffs hurts our nation’s access to global markets and threatens many of the 1.3 million good-paying equipment manufacturing jobs our industry supports.”

Despite the continuing trade war with China, the United States economy remains red hot

On a more positive note, the AEM president welcomed the October 2018 unveiling of a new United StatesMexico-Canada Agreement (USMCA) on trade, hailing it as a “step in the right direction.” He added: “Trade agreements provide better access to customers across the globe and help us add to the 1.3 million jobs our industry supports in the United States. We urge this administration to continue working closely with the Canadian and Mexican governments to enact policies that promote continued economic growth for our industry.”

The AEM notes that nearly 30% of all equipment produced in the U.S. is intended for export, and Canada and Mexico are the

CENTRAL & SOUTH AMERICA

BIG POTENTIAL FOR CONSTRUCTION OEMS

Anew report by GlobalData highlights the enormous economic potential for infrastructure in Latin America. According to the major global business market research consultancy, the infrastructure sector in Latin America could reach a value of US$175.8 billion by 2020.

Such a huge sum creates a welcome wealth of commercial opportunities for the world’s construction equipment manufacturers.

The GlobalData report suggests that the total value of infrastructure spending in Latin America will reach $142.5 billion in 2019. The report adds that anticipated growth will

biggest and second biggest export markets respectively for both U.S. construction and agricultural equipment. The association says that since the creation of NAFTA two decades ago, the construction equipment manufacturing industry has benefited greatly from duty-free access to its two largest export markets, Canada and Mexico.

Despite the continuing trade war with China, the United States economy remains red-hot and continues to be an extremely attractive market for the global construction equipment industry.

After two years of contraction, the Canadian construction industry rebounded in 2017, and registered an annual growth of 3.1% in real terms, reported GlobalData in its May 2018 report Construction in Canada – Key Trends and Opportunities to 2022. This momentum was expected by GlobalData to continue in 2018, with annual growth of 2.6% in real terms, driven by government efforts to stimulate the economy through investment in public infrastructure and energy projects. Gradual improvements in consumer and investor confidence, as well as new policies related to the manufacturing sector, are expected by the global business market research firm to drive private sector investment in construction projects in the coming years.

Despite the possibility of new private sector investment in the construction sector, GlobalData notes that the likely persistence of high labour costs, constrained government revenue and low capital investment in the oil and natural gas sector will constrain the industry’s growth over the 2018–2022 period. Consequently, the industry is expected to register slow growth over the forecast period.

see infrastructure spending in Latin America hit $175.8 billion for 2020. GlobalData has made this analysis based on the activity for 1,711 large-scale projects in Latin America that are planned or being built at present. These have a combined value of $829.2 billion according to GlobalData.

The firm’s report: Infrastructure Insight: Latin America shows that there is a wide range of infrastructure investment opportunities for investors in Latin America due to favourable demographic trends and

the implementation of legislative reforms.

Dariana Tani, economist at GlobalData, said, “Brazil, Chile, Mexico and Peru are set to drive overall investment between 2018 and 2022 with an expected annual average spend of $36.3 billion, $17 billion, $13 billion and $12.4 billion respectively. Projects will include the $2.7 billion SP-99 Tamoios Highway Duplication in São Paulo, as well as major metro and power projects.

Tani said that in Mexico, infrastructure project spending will be fuelled by large projects such as the construction of the $848 million Jala-Compostela-Las Varas-Puerto Vallarta Highway.

However, deteriorating external conditions such as global trade tensions, higher US interest rates and slowing global growth could slow growth in Latin America. And political uncertainty over coming elections in the region could also hinder growth. Furthermore, Tani added that there are questions over Mexico City’s $13 billion international airport project.

The GlobalData report says that with a total of 421 projects valued at $241.5 billion, Brazil has the highest number of infrastructure projects in the pipeline. This is followed by Chile with 309 projects worth $117.1 billion, Peru with 230 projects worth $83.1 billion and Mexico with 209 projects worth $98 billion. Colombia and Argentina also have a large number of projects, the former with 114 worth $66.8 billion and the latter 92, worth $58 billion. Number of infrastructure projects in the pipeline

Euromonitor International’s Construction in Brazil report published in May 2018 says the construction industry turnover of Latin America’s biggest nation is set to see an 8% increase in its CAGR (compound annual growth rate) in the 2017-2022 period, supported by an anticipated rise in private sector investment in infrastructure and initiatives such as the ‘Minha Casa, Minha Vida / My House, My Life’ programme. Although the Brazilian government failed to meet its annual target of building 610,000 new affordable housing units in 2017, plans for 2018 were set high. In spite of Brazil’s high budget deficit, authorities released a BRL45 billion (US$11.91bn) infrastructure programme.

The World Bank notes that with its GDP (Gross Domestic Product) of more than $628 billion, Argentina is one of the biggest economies in Latin America.

In its October 2018 published overview report on Argentina, the World Bank highlights how the presidential elections at the end of 2015, which saw Buenos Aires mayor Mauricio Macri narrowly defeat FPV candidate and Buenos Aires province governor Daniel Scioli, led to significant change in Argentine economic policy.

The report continues: “The new administration has moved with significant speed to implement core reforms

of the exchange rate, the agreement with international creditors, the modernisation of the import regime, reduction of inflation and the reform of the national statistics system.”

The World Bank report also notes how Argentina has taken a “very active role” on the international stage, taking the presidency of the G20 in 2018 and expressing its intention to join the OECD (Organisation for Economic Co-operation and Development) and become an observer in the Pacific Alliance.

However, the World Bank also notes that after economic growth of 2.9% in 2017, economic activity started to slow down in the second quarter of 2018, with the year set to end with a recession. The World Bank report highlights the plight of the Argentine peso, which has suffered a depreciation since April and fell close to 100% against the dollar up until October 2018. Consequently, inflation accelerated in the second half of the year.

The economic situation in Argentina led the Macri government to launch a new economic programme that includes a budget cut, an increase in revenues, and a $57 billion agreement with the IMF (International Monetary Fund).

With the country’s economic headwinds somewhat back under control, global construction equipment manufacturers may see new unit sale opportunities Argentina has taken a “very active role” on the international stage Buenos Aires, Argentina.

BELOW: As China strives to improve the working conditions in quarries, larger customers with a focus on efficiency will want the benefits that telematics can deliver.

THE CHINESE RECOVERY

Currently home to the world’s largest population at 1.3 billion, China is the second biggest economy in the world, after the United States, and, as a September 2018 China Overview from the World Bank notes, is increasingly playing an important and influential role in development and in the global economy. Indeed, the same World Bank report highlights that China has been the largest single contributor to world growth since the global financial crisis.

China’s infrastructure spending is huge. The hugely ambitious US$4 trillion-plus ‘One Belt, One Road’ Initiative, focusing on connectivity and cooperation between China and its Eurasian neighbours via the landbased Silk Road Economic Belt (SREB) and the ocean-going Maritime Silk Road (MSR), is continuing.

Other Chinese infrastructure megaprojects include the US$20 billion Hong KongZhuhai-Macau Bridge (HZMB) – a new 55km road, bridge and tunnel link spanning the Pearl River Delta’s Lingdingyang channel via three cable-stayed bridges and one undersea tunnel. HZMB, which was due to open to traffic before the end of 2018, will connect three popular destinations in the Pearl River Delta, providing a convenient and cheap option for business travellers and tourists. It will be the world’s longest sea-crossing bridge.

125% in 2017 to just under 100,000 units. According to the global construction equipment industry market research consultancy’s analysis, sales will grow a further 40% this year to take the market to the peak of its cycle.

The sharp rise in excavator sales has been due to several factors, says OHR, including the launch of major infrastructure projects, the introduction of public-private partnership (PPP)-financing models and the clearing of old stocks and used machines from the market following the 20122016 downturn.

OHR notes that sales of hydraulic excavators alone in China rose a staggering 125% in 2017

Infrastructure megaprojects can only be completed with great volumes of construction equipment, creating exciting sales opportunities for global and leading regional original equipment manufacturers (OEMs). Sales of construction equipment in China will exceed 325,000 units this year, according to the August 2018-published Mid-Year Review from Off-Highway Research’s Chinese Service. The forecasted 30% year-onyear rise in 2018 will follow on from an 81% increase in demand seen in 2017, compared to the previous year.

OHR notes that sales of hydraulic excavators alone in China rose a staggering

Excavator sales are expected to stay reasonably high for the next four years, states OHR, although 2018 is expected to be the highwater mark in the current cycle. Slower growth in real estate projects and a reduction in PPP activity is likely to impact on sales. On the other hand, OHR notes that stricter environmental policies and the forthcoming introduction of China IV emissions laws could see an accelerated machine replacement cycle take hold.

Commenting in an interview last autumn with Aggregates Business International magazine about the Chinese construction and quarrying equipment buyer’s growing preference for excavators over wheeled loaders, David Beatenbough, LiuGong’s vicepresident of R&D, said: “Historically, wheeled loaders were used for nearly every job. They

were much lower price than excavators, more easily available, and could accomplish nearly any task required, although perhaps not as efficiently as an excavator could in many cases. Now there is much more emphasis on efficiency on jobsites. Utilisation of wheeled loaders in China is becoming more similar to usage patterns in other countries, and the ratio of wheeled loader to excavator is shifting towards the global norm.”

Beatenbough said certain groups of Chinese quarrying and construction equipment buyers are also very focused on technology. “These customers are very knowledgeable about total cost of ownership and the efficiency of their business. They are very interested in telematics and the information it can deliver. As China works to improve the working conditions in quarries, larger customers with a focus on efficiency will be favoured. These are the customers who want the benefits telematics can deliver. This type of customer is also interested in other technology advances. However, customers in China who are interested in telematics or technology are not willing to pay for it unless they can see direct economic benefits. I think this condition is stronger here than in many other markets.”

In addition to meeting rising domestic demand, OHR states that Chinese manufacturers have been exporting machines in increasing numbers over the last three years. This includes international OEMs with a footprint in China, as well as indigenous companies.

TOUGH JAPANESE MARKET

In 2018 Japan had the world’s third biggest economy - valued at $5.1 trillion - but leading economists are predicting a fall to eighth place by 2050.The forecast large drop in the country’s comparative global economic prowess will be of grave concern to the leaders of such a fiercely proud nation, as is the current weak growth in the Japanese economy, which is already affecting its national industries, including construction.

Off-Highway Research’s (OHR) August 2018 updated Global Volume & Value Service reported that Japan was one of the few key construction equipment markets not expected to grow in 2018. Although OHR predicts that demand should edge up over the coming years, it expects the Japanese market to remain relatively small at 60,00065,000 units per year.

The wider Japanese construction industry is anticipated to post only marginal growth in 2018, thanks to a decrease in building permits and generally weaker demand. GlobalData

workforce population and labour shortage is expected to continue to hamper the industry’s output growth.

Over the 2018-2022 period, GlobalData strikes a more positive note saying that the Japanese construction industry’s output value is expected to be supported by the government’s concerted efforts to promote economic growth through investment in tourism, manufacturing, energy and healthcare infrastructure projects. The Japanese government’s investment in developing expressways will also support the construction industry’s output over the forecast period. For example, GlobalData highlights Prime Minister Shinzō Abe’s January 2018 unveiled plan to invest JPY1.5 trillion (US$13.9 billion) on the development of the Metropolitan Inter-City Expressway and the Tokai Expressway.

Additionally, the works related to the upcoming 2020 Tokyo Olympic Games are expected to drive the growth of the construction industry. The total cost of construction related to the games is expected to be JPY182.2 billion (US$1.7 billion).

The Japanese construction industry’s output growth in real terms is expected to remain fairly stable

The Japanese construction industry’s output growth in real terms is expected to remain fairly stable, predicts GlobalData, recording a compound annual growth rate of

including all megaprojects with a value above US$25 million - stands at JPY28 trillion (US$249.9 billion). The pipeline, which includes all projects from pre-planning to execution, is skewed towards late-stage development projects, with 62% of the pipeline value being in projects in the pre-execution and execution stages as of 2018.

GlobalData also notes that the Japanese Ministry of Land, Infrastructure, Transport and Tourism has revealed government plans to attract 40 million foreign visitors by 2020 and 60 million by 2030. This has led the government to increase its spending on the tourism sector by 15%, going from JPY25.6 billion (US$228.2 million) in 2017 to JPY29.4 billion (US$262.1 million) in 2018.

Hitachi Construction Machinery notes that Japanese housing investment, public investment, and capital investment have increased. The Japanese-headquartered global construction, quarrying and mining equipment manufacturing giant says that Japanese demand for hydraulic excavators and wheeled loaders dipped between April and June 2018 due to the end of last-minute demands in anticipation of new emissions regulations.

In a ‘Corporate Vision’ presentation to construction and quarrying equipment trade media at Hitachi Construction Machinery (Europe) HQ in Amsterdam, The Netherlands, last autumn, the leading OEM forecast a 4% fall in hydraulic excavator unit sales in Japan in 2018, compared to the previous year.

Japan’s construction equipment manufacturers will benefit from plans to invest JPY1.5 trillion (US$13.9 billion) on the development of the Metropolitan InterCity Expressway and the Tokai Expressway ... plus works related to the upcoming 2020 Tokyo Olympic Games.

REST OF ASIA

GROWTH APLENTY

Indonesia, one of the world’s key emerging market economies, has a shopping list of impressive megaprojects that will require a huge quantity of construction equipment, building materials and personnel.

For example, the Trans-Java toll road, with a length of more than 1,100km, has an estimated cost of some US$5.5 billion. It is planned to stretch from the ports of Banyuwangi in East Java to Merak in Banten province in West Java.

Another huge project is the planned $20 billion, 40km Selat Sunda Bridge, the longest in Indonesia, to connect the western Indonesian islands of Sumatra and Java through road and railway, while the JakartaBandung super express train, which will travel the 144km between Jakarta and Bandung is estimated to cost $6.7 billion.

Suhen Agarwal, VP, sales & services, aggregates, Asia-Pacific, Metso, says that Indonesia has favourable demographics (50% of the population is under 30).

“Urbanisation, a strong labour market, and steady real-wage gains provide a solid base for 5-6%/year consumer demand growth in coming years.” And he also points to the increasing market for infrastructure.

“A flurry of major infrastructure projects in Indonesia is set to boost the construction sector. Over the next five years or so, the government aims to build 5,500km of railways; 2,600km of roads; 1,000km of toll roads; 49 dams and 24 sea ports as well as to construct power plants with a combined capacity of 35,000MW,” he says.

Off-Highway Research (OHR) reports that construction equipment sales in Indonesia are expected to exceed 17,000 units in 2018, following a third successive year of growth. This will take demand to more than twice what it was in the recent low point of 2015. This volume of equipment sales makes Indonesia by far the largest equipment market of the Association of Southeast Asian Nations (ASEAN) bloc.

Although demand is expected to be somewhat volatile over the next few years, OHR’s September 2018 report, The Construction Equipment Industry in Indonesia,

Singapore has road and tunnel contracts worth a combined $603 million

forecasts that demand will remain between 12,500 and 17,500 units up to 2022.

Investment in the mining sector has been a key driver of the recent growth in equipment sales. Construction has also played a part and is expected to continue to do so. However, OHR notes that the 2019 presidential election is expected to cause a hiatus in spending.

As well as being a large market, Indonesia is also an important manufacturing base, particularly, OHR states, for crawler excavators. In addition, compaction equipment, crawler dozers, dump trucks and motor graders are manufactured in Indonesia, making it an important country for component suppliers. The high population of equipment – OHR puts this at more than 115,000 construction machines plus a further 20,000 agricultural tractors – also makes it a significant country for global and regional companies active in the equipment aftermarket.

Other nations within South-East Asia are spending big on new transport infrastructure, generating attractive sales opportunities for global and major regional construction equipment manufacturers. Plans have been drawn up for a new highway connecting Laos’ capital Vientiane with Hanoi, the capital of neighbouring Vietnam. Expected to cost more than US$4.5 billion, the 707km route includes a border crossing between Namphao in Laos and Cau Treo in Vietnam. Sri Lanka is home to a $1 billion Central Expressway project; the $832.8 million Manila-Taguig Expressway (MTEX) is taking shape in the Philippines, and Singapore has road and tunnel contracts worth a combined $603 million.

Given its rich array of earmarked government and private company-controlled projects, South Korea’s construction GDP is forecast to grow to US$86 billion in 2018, compared to $70 billion in 2017, with construction GDP forecast to hit $91 billion in 2019. Unsurprisingly, leading global business market research consultancies believe the South Korean construction sector success story will continue beyond next year. For example, Timetric’s Construction in South Korea – Key Trends and Opportunities to 2021 report states that the South Korean construction industry’s output value is expected to rise with a compound annual growth rate of 3.99% in the 2017-2021 period.

The growth follows a 4.93% CAGR in the years 2012-2016, and will be driven, says Timetric, by the investments in public infrastructure, energy, commercial and industrial projects, and improvements in consumer and investor confidence. Moreover, a rise in building permits for the construction of residential and nonresidential buildings in the country is expected to support the industry’s growth over the forecast period.

Timetric’s study highlights that the government’s focus on developing transport infrastructure, as well as efforts to boost energy production, particularly renewables, is expected to drive funding towards the construction industry over the forecast period. The government is committed to investing KRW42 trillion (US$36.6 billion) on renewable energy infrastructure, with an aim to eliminate coal power plants in South Korea by 2020.

AFRICA

MAINLY POSITIVE SIGNS

Infrastructure spending across Africa continues at a decent pace, driven by rapid urbanisation. Indeed, the World Bank has predicted that the proportion of Africans living in urban areas is projected to grow from 36% in 2010 to 50% by 2030. This is creating eye-catching commercial opportunities for global and regional construction equipment manufacturers. The pace of construction sector growth in sub-Saharan Africa - will be particularly strong, averaging 6.6% a year in 2018-2022, according to GlobalData’s Q3 2018 Update. Meanwhile, a Deloitte study, A shift to more but less - Africa Construction Trends Report 2017, states that South Africa continues to account for the largest share of infrastructure and capital project activity in southern Africa - which includes Angola, Botswana, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, South Africa, Swaziland, Zambia and Zimbabwe – with 47.3% of projects, followed by Angola with 14% and Mozambique with 12.9% of projects. South Africa is the largest African-nation buyer of construction equipment – 5,5006,000 units/year in a 23,000-25,000 units/year continent-wide sales market.

In its South Africa Economic Update 11: jobs and inequality, published in April 2018, the World Bank argues that although its economic outlook has improved, South Africa remains constrained by its low growth potential. The Economic Update says: “Slow private investment growth and weak integration into global value chains prevent the country from reaping the new economic opportunities emerging around the globe, and from catching up with living standards in peer economies.”

West Africa – which includes Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, the Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone and Togo - has, according to Deloitte’s Africa Construction Trends Report 2017, 79 projects currently underway, with a committed value of US$98.3 billion. The region, highlights the Deloitte study, accounts for 26.1% of all

projects in Africa and 32% of the total project dollar value.

GlobalData notes that there will be a steady acceleration in construction activity in Nigeria over the period 2018-2022, supported by government efforts to revitalise the economy by focusing on developing the country’s infrastructure. Ethiopia will be Africa’s star performer, with its construction industry continuing to improve in line with the country’s economic expansion.

Further research by GlobalData into the East African infrastructure sector indicates that it is expected to grow steadily over the 2018-2022 period. The industry market research consultancy says there are huge infrastructure upgrades underway across the region in roads, railways and power generation. GlobalData states that the total

Cairo, Egypt.

“In terms of the number of $50 million-plus projects, Egypt has the most with 17”

Kenya and Tanzania) reached US$25.92 billion in 2017, a significant rise on US$6.73 billion in 2012. Output is projected by GlobalData to almost double to US$98.82 billion by 2022 (in nominal value terms).

GlobalData notes that in East Africa, the transport (rail and road) and energy sectors account for a large proportion of the infrastructure project pipeline, making up 37.1% and 45.2% respectively, with project values amounting to US$77.51 billion and US$94.55 billion respectively. Across the Eastern African economies, public-private partnerships are said by GlobalData to be funding the majority of projects in the pipeline (51.8%), while 32.8% of tracked projects are publicly funded.

A more stable political and security climate in North Africa - which includes Algeria, Egypt, Libya, Morocco, South Sudan, Sudan, Tunisia and Western Sahara - has helped pave the way in the last few years for a significant increase in the number of the region’s US$50 million-plus infrastructure projects. Deloitte’s Africa Construction Trends Report 2017 states that North Africa features 40 $50 million-plus projects, valued at a combined US$77.1bn. Deloitte highlights that the region represents 13.2% of all projects on the African continent. In terms of the number of $50 million-plus projects, Egypt has the most with 17 projects, followed by Algeria with 12 and Morocco with eight. However, the number of projects in North Africa decreased by 4.8% from 42 in 2016 to 40 in 2017, notes Deloitte, while the value of projects rose by 1.3%.

In contrast to recent years, Deloitte points out that the number of real estate projects in Northern Africa has overtaken transport projects, with the former making up 32.5% and the latter 27.5% of projects respectively. Real estate is dominated by commercial real estate (rather than industrial real estate) in terms of both US dollar value and the number of projects.

The Deloitte study emphasises the shift away from major transport works in reporting that the number of big transport projects in North Africa decreased from 18 projects in 2016 to 11 projects in 2017. This is due to the completion of seven major transport projects, with no new large-scale transport projects beginning construction between 2016 and 2017.

For 100 years, we have defined ourselves by our unwavering values and promise of innovation and dependability. We have led our industry by consistently turning challenges into opportunities. In the next 100 years, we will continue to defy boundaries and unleash our ingenuity in a world hungry for new power solutions.

see how we’re challenging the impossible at Bauma 2019, Hall a4.325.

BOOM-TIME INDIA

India’s prime minister, Narendra Modi, is backing a five-year national road sector investment programme worth more than $90 billion. It has increased road building in India to more than 40km a day, which has already grown from 3km a day to a staggering 27km a day. A total of 200,000km of national highways is expected to be completed by 2022. When you add in close to 10,000kms of railways under planning, and the development of port infrastructure around 10 coastal economic regions, you can understand why the world’s construction equipment manufacturers are excited about commercial opportunities in India.

According to the 2018 Mid-Year Review from Off-Highway Research’s (OHR) Indian Service, sales of earthmoving, roadbuilding and materials handling equipment, along with portable compressors, were expected to reach 90,115 units by the end of the year. That would represent a 15% increase on the 78,109 machines sold in 2017 and a near doubling of the market since the trough of 2014 and 2015.

OHR notes that the previous peak in construction equipment sales was 72,492 units in 2011, so demand in India had already surpassed that by the end of 2017. The robust growth and recent record demand has been largely due to the Modi government’s efforts to speed up the pace of infrastructure development.

Commenting on the current market drivers, OHR’s report said: “The surge in demand in the first half of 2018 resulted from increased activity in the construction and mining sectors, and the continued momentum following the GST (national sales tax) rate reduction in November 2017. Easy availability of finance, positive sentiments and replacement demand are other factors which helped the market to grow.”

According to other industry estimates, the size of the Indian excavator market is expected to be close to 25,000 units in 2018. Demand for 3-tonne class wheeled loaders, predominantly used in quarry sites in India, is up by 30%, while 5-tonne class model demand is up 60% in 2018 compared to 2017.

Sales of rigid dump trucks (RDTs) have also been rising and manufacturers continue to launch newer hauler products, primarily

materials, processed minerals and overburden. Sales of RDTs are expected to be close to 80,000 units in 2018, compared to 65,000 units last year. The market trend indicates a transition to higher capacity trucks, from 16tonnes to 25tonnes, and to 8x4 axle trucks with 31-tonne capacities over 6x4 axle trucks offering up to 25-tonne payloads. This transition has been noticeable during the past two years.

Demand for 3-tonne class wheeled loaders, predominantly used in quarry sites in India, is up by 30%

A key reason behind rising loader and hauler demand is due to pent-up demand, as contractors and equipment rental agencies held back from updating their fleets due to the reduction in infrastructure sector projects between 2011 and 2015.

Euromonitor International (EI) tips Indian construction industry turnover to see a 4% CAGR in the period 2016-2021, as the country’s government approves new measures to expedite investment for housing construction and infrastructure development. Private sector firms are moving ahead with plans for new speciality hospital facilities as demand for high-end diagnostic and treatment services increases. EI states that the launch of new affordable homes across eight major Indian cities expanded by 22% in 2016 alone. The entire Indian construction industry grew 6% in the same year thanks to the government’s affordable housing stimulus and increased road infrastructure investment.

GlobalData’s Construction in India –Key Trends and Opportunities to 2022 report states that government investment in transport infrastructure, energy and residential projects under flagship programmes such as the 100 Smart Cities

Housing for All 2022, UDAN (Udey Deshka Aam Nagrik) scheme and the Ayushman Bharat programme is expected to drive the growth of the construction industry over the 2018-2022 forecast period.

In its April 2018 members’ newsletter, the Indian Construction Equipment Manufacturers Association (ICEMA) said that going forward, there could be some disruptions in the construction equipment industry, both from product and service perspectives. Some likely developments, says the ICEMA, are: growth in the pre-fabricated concrete business, which could lead to increased use of concrete equipment like transit mixers, concrete pump and boom; an increase in usage of specialised equipment, which could impact the backhoe loaders business in a “small way” through competition from under 14-tonne class excavators and wheeled loaders.

The ICEMA newsletter also points to rising manual labour costs, despite considerable mechanisation across key infrastructure projects, real estate, rural roads, etc. The association stresses that the need for manual labour will continue to be considerable.

Unsurprisingly, the ICEMA sees a growing digital presence within the Indian construction equipment sector. It sees that the higher penetration of e-commerce across the country is, in turn, slowly gaining traction in the construction industry.

The ICEMA believes e-commerce portals providing men and material for the construction industry, and an exclusive equipment financing institution which caters to the needs of the entire sector could materialise.

www.liebherr.com

MIDDLE EAST

MEGAPROJECTS IN FULL EFFECT

Ahuge array of construction machines and building materials suppliers are helping create the world’s biggest airport, currently taking shape in Dubai in the United Arab Emirates (UAE). The US$32 billion expansion of Al Maktoum International Airport will see 140 million passengers pass through its doors by 2025. Following its completion in 2050, the airport will have the capacity to handle 200 million passengers a year – a world away from the paltry by comparison current 7 million passenger capacity site, which is mainly used today for cargo traffic.

Al Maktoum International Airport will be a key part of a new type of city development, an aerotropolis named Dubai South. When completed, Dubai South will be home to 900,000 inhabitants, and reachable within an eight-hour flight for two-thirds of the world’s population. Dubai is hosting the next official

World Expo in 2020 and the Expo area is being built next to the airport. The bulk of the 25 million visitors expected to attend the Expo will travel through Al Maktoum International Airport.

Given the airport’s expansion and other large-scale infrastructure works in Dubai and other parts of the UAE, it is no surprise that the World Bank tipped the GDP of the federation of seven states to grow 2.5% in 2018. In its United Arab Emirates Economic Outlook, published in April 2018, the World Bank says that UAE oil production capacity is likely to increase, and the strength of the non-oil economy will boost economic prospects as key infrastructure projects ramp up ahead of Expo 2020.

GlobalData reports that Qatar’s economy has largely recovered from a boycott imposed in June 2017 by other Arab states, and economic growth returned to positive territory in 2018. Construction activity remains resilient, as government spending has continued on projects, despite a sharp downturn in the residential real estate market that was exacerbated by the boycott.

GlobalData expects to see strong growth in Qatar’s construction activity in 2018. Construction work related to the 2022 FIFA World Cup will help support the country’s construction industry growth over the next few years. Up to 200,000 football fans a day will attend the late November-mid-December tournament, swelling Qatar’s population by 8%.

Euromonitor International, a leading provider of global business intelligence and market analysis, reports that growth in Saudi Arabia’s construction industry is forecast to remain flat until at least 2021, as the country’s budget deficit and government austerity measures are expected to keep construction industry growth at minimal level.

In 2016, the Saudi government reduced its infrastructure and transport projects budget by 62% to SAR23.9 billion (US$6.36 billion), on the back of persisting low crude oil prices, falling exports, and the consequent soaring fiscal deficit. During the same year, Saudi Arabia’s construction industry witnessed a 1.2% decline in turnover, mostly due to re-assessment of all government capital

“Construction work related to the 2022 FIFA World Cup will help support the country’s construction industry growth over the next few years”

expenditure projects launched under Saudi Arabia’s Vision 2030 programme.

More positive news for global construction original equipment manufacturers (OEMs) can be found in some major developments within the industrial, commercial and hospitality construction sectors in the kingdom, supported by economic diversification strategies and greater involvement of the private sector. Despite the challenging operating environment, work has also continued apace on the Riyadh Metro and King Abdullah Economic City - two of Saudi Arabia’s most prestigious projects.

Saudi Crown Prince Mohammed bin Salman has made several impassioned calls for greater economic diversification in Saudi Arabia, including a greater role for the private sector. This could lead to new eye-catching and lucrative infrastructure

opportunities that require a wealth of new construction and quarrying machinery in their delivery, along with millions of tonnes of new building materials. Unfortunately, such projects are unlikely to be diggerready for several years.

Encouragingly, the World Bank forecasts that the Saudi Arabian economy will expand in 2018 with a 1.8% increase in GDP.

Iran’s economy is expected by the World Bank to maintain a steady growth of slightly over 4%, fuelled by a recovery in consumption and investment demand. The same source notes “some signs of pickup” in the construction sector, helping to confirm a more feel-good vibe around the country’s economy. Timetric notes that the removal of international sanctions and a rise in oil production and exports will add momentum to Iranian construction industry growth, as will an increase in the awarding of building permits

for the construction of residential and nonresidential buildings.

Kuwait is among the Gulf countries witnessing a burgeoning construction sector. The country’s ambitious Vision 2035 programme is seeing the Kuwaiti government ploughing huge sums into developing the nation’s road, rail, airport and related infrastructure, generating fertile territory for growth market-seeking construction equipment manufacturers.

Oman is another Middle East nation whose large transport and other infrastructure projects and ongoing development of its tourism industry is driving regional construction and construction equipment demand.

In the Middle East as a whole, Deloitte’s GCC Powers of Construction report 2018 predicts that transport infrastructure spending will increase from $6.847 billion in 2018 to $7.509 billion in 2019.

That level of investment is creating some exciting opportunities for global market construction equipment manufacturers.

CUT YOUR COSTS AND EXTEND YOUR MACHINE’S LIFESPAN WITH 3D PARTS PRINTING

3D parts printing, or additive manufacturing as it is sometimes called, is revolutionising the rapid prototyping of new equipment and making it easier to support older machinery in the field. Downtimes can be significantly reduced if you 3D print a new part locally instead of waiting for the courier to deliver a replacement component to your site. Dan Gilkes reports.

Even the simplest piece of construction equipment is made up of hundreds of individual parts. Larger, more complex pieces of machinery can incorporate literally thousands of specific components. These can be purchased from external suppliers or developed in-house by the machine manufacturer but, either way, they require just as much research and development time as the more noticeable styling parts.

Cutting the time required to design and fabricate every component, particularly when prototyping new or improved machinery, can reduce cost as well as project duration. To achieve this, many manufacturers have been turning to 3D printing, or what is often called additive manufacturing (AM), to create evermore complex components in a fraction of the time that conventional casting, milling and welding would require.

Additive manufacturing is the opposite of subtractive manufacturing, where material is cut out or reduced using milling or drilling machinery. It is a process of making three dimensional solid objects from a digital file. The object is created by laying down successive layers of material, until the component is produced. Each of these layers can be seen as a thinly sliced horizontal cross-section of the finished object.

“Two of the biggest advantages are the cost savings and the time savings that we have achieved in prototyping,” said Lukáš Mandik, advanced technology manufacturing

engineer in Doosan Bobcat’s prototype shop in Dobris, Czech Republic.

“Cost savings largely arise with the making of parts that cannot be produced by traditional technologies such as machining and welding … parts that had to be produced by form-casting in the past: A process which required a much larger investment compared to 3D printing. The time savings using 3D printing are made as an engineer’s design can take physical shape in a matter of a few hours, ensuring that prototyping time is significantly reduced. This also allows us to reduce the number of hours needed for projects, again providing cost savings.”

Bobcat is not alone in using the technology. “We started some time ago, with plastic in-cab components,” said Marco Baffoni, CNH Industrial’s parts lifecycle manager. Indeed, CNH sister company Iveco, has used 3D printing to replace internal plastic components for its bus lines for some time.

“Up until the recent past, 3D printing was used primarily for parts prototyping,” said Don Jones, Caterpillar’s general manager of global parts strategy, speaking in an interview with Aggregates Business Europe’s editor Guy Woodford last year. Indeed, Caterpillar has been printing prototype machine parts in its R&D work since the mid-1990s.

“An engineer would do a new design and want to see what it looks like and whether it works, before taking it for production tooling. The second area it has been heavily

used in is jigs and tools for the assembly line, primarily using plastics, but we also have used 3D metal printers.”

Volvo CE will be using AM to prototype future equipment, maintaining several 3D printers for research and development purposes. However, prototyping is not the only area where AM offers a benefit.

“We are supporting customers through the life cycle of their equipment,” said Jasenko Lagumdzija, Volvo CE manager of business support.

“It’s especially good for older machines where the parts that have worn out are no longer made efficiently in traditional production methods. Producing new parts by 3D printing cuts down on time and costs, so it’s an efficient way of helping customers.”

The turnaround time for replacement parts can be as short as a week, cutting downtime for a machine in the field. This ability to replace parts for older machines also extends the equipment’s life and, because AM is designed for small-run sizes, there is no minimum order requirement, making it easier for a manufacturer to support individual customers.

TOP: 3D printing or additive manufacturing allows the creation of ever- more complex components in a fraction of the time that conventional casting, milling and welding would require.

TOUGH IS WHAT WE DO

OUR LINE OF TOUGH EQUIPMENT WORKS HARD IN TOUGH ENVIRONMENTS. DURABLE AND POWERFUL, YOU CAN BE CONFIDENT YOU CAN INCREASE YOUR PRODUCTIVITY WITH LIUGONG’S POWERFUL LINE OF MACHINES. WITH A FOCUS ON THE EASY AND FLUID OPERATION AS WELL AS COMFORT, OPERATORS HAVE AN EASY TIME KEEPING UP WITH OUR MACHINES.

The type of parts being produced is changing, as impressive new technology like this develops and the price of AM equipment continues to fall.

CAR MAKERS LEAD THE WAY

As is so often the case, the automotive industry is ahead of the construction equipment sector, and 3D printing is no exception. Late last year, Volkswagen announced that it would be using the HP Metal Jet process to produce metal components for production vehicles.

Developed by printer manufacturer HP with component firm GKN Powder Metallurgy, parts are produced layer by layer using a powder and binder. The component is then ‘baked’ into a metallic component in what is called a sintering process. This differs from previous processes in which the powder was melted by a laser. Productivity is said to have improved by 50 times compared to traditional 3D printing methods and VW is pressing ahead with the development of the technology for mass production.

“Automotive production is facing major challenges, our customers are increasingly expecting more personalisation options,” said Dr Martin Goede, head of technology and planning at VW.

“At the same time, complexity is increasing with the number of models. That’s why we are relying on state-of-theart technologies to ensure smooth and fast production. 3D printing plays a particularly important role in manufacturing of individual parts.

“Previous 3D printing processes can only be used for the special production of individual parts or prototypes. The additive 3D Metal Jet technology from HP enables the production of a large number of parts using 3D printing for the first time. As a result, the process is now interesting for the production of large quantities in a short period of time.”

➔To produce parts for those customers, Volvo relies on its own archive of drawings and other product information, though it currently has components made by a supplier in thermoplastic. Such components include plastic coverings, portions of air conditioning units and cabin parts. However, while plastic is the primary material at present, the company is considering offering metal parts in the future.

“The customer is getting exactly the same part in replacing plastic with plastic,” said Annika Fries, Volvo CE’s aftermarket branding manager.

“We do a lot of quality assurance, the 3D parts have the same specifications and go through the same process as the original and get the same warranty, so customers can be confident they are getting a genuine Volvoapproved part.”

“We are talking about different materials too, not only plastic,” said Bobcat’s Mandik.

“First of all, it’s necessary to say we use plastic materials, like PC, ABS, ABS M30 or ULTEM 9085. Although they are plastic we are able to print some parts that can work under load. The ULTEM 9085 for example has a tensile strength of around 72MPa.

“We are investing to ensure the reliability and quality of materials is stable. The cost is coming down and the technology is developing faster, but cost is the major barrier. But we think it will be a trend that we are investing in.”

The type of parts being produced is also changing, as the technology develops and the price of AM equipment continues to fall.

“There are lots of parts for our products, especially Bobcat loaders and excavators, which could be made by 3D printing, such as fuel tanks and body parts,” said Mandik.

“Being able to produce these parts ourselves, we could be almost independent of both local suppliers and those abroad. I say ‘almost’ because 3D printing consumes lots of raw materials which still need to be supplied.

BELOW: OEMs are seeing constant advances in carbon fibre, Kevlar and 3D-printed plastics ... the latter having the same strength as metal,while also being lighter, easily 3D-printed and made of composites that don’t rust.

“Our building process runs by the FDM method - fused deposition modeling. All the parts we produce can be divided into two types – installation parts and functional parts. Under the first group, we can include body parts, some interior parts and counterweights. We use 3D printing to look at how the design works in reality, so we can assess whether or not it will work.

“In contrast, with functional parts such as a fuel tank, we are already able to print a tank, which after some small cosmetic adjustments is ready to be used in normal operations. At present, our maximum dimensions are 914 x 914 x 610cm.”

In such a rapidly developing new technology there are constant advances in carbon fibre, Kevlar and 3D-printed plastics, the latter having the same strength as metal, while also being lighter, easily 3D-printed and made of composites that don’t rust.

Crushing equipment supplier Metso has recently gone a stage further, delivering the first valves with 3D-printed parts from its Helsinki plant. The valves include 3D-printed metal components, that allow the valves to perform in a particularly demanding application, where they need to withstand numerous fast open-close cycles without maintenance.

“We are at the forefront of using 3D printing in valve applications, having started testing the suitability of 3D printing technologies for metal components already years ago,” said Jukka Borgman, director of technology development.

“We have defined and prototyped several concepts where the 3D-printed components can provide new levels of valve performance compared to components manufactured with

RIGHT: Spare parts distribution centres and local dealers could be equipped with 3D printers, with manufacturers sending digital files to allow localised production of components.

“The beauty of 3D printing is that it allows the customer to have devices whose new properties can only be implemented using the 3D printing method,” said Jani Puroranta, Metso’s chief digital officer.

In addition to valve component production, Metso is already using 3D printing to additively manufacture tools used to make minerals consumables parts.

“With certain products, a key benefit for the customer can be exceptionally quick delivery times,” said Puroranta.

Liebherr’s aerospace division has been producing metal components using AM for some time. In 2018, the firm installed a second 3D printer for titanium components at its Lindenberg plant, with one now used for production and the other for R&D work. However, though the construction and mining divisions are evaluating 3D manufacturing, the company has yet to produce parts for its heavy-machinery businesses using the technology. There seems little doubt though that most manufacturers will use some form of AM as the technology continues to develop.

“What’s exciting now is the recent development of new printing technology for both plastics and metals,” said Caterpillar’s Jones.

in racks. As mentioned earlier, this is particularly relevant for older equipment that may no longer be in production. While manufacturers commit to support their products long after line production has finished, this often means holding stock of slow-moving parts, or having to have individual components produced to meet a customer requirement and get a machine up and running in the field. Inventory costs should fall as a result.

“Establishing whole departments of 3D printing going forwards will take place as fast as we can get the information that supports this. Currently there is a trend to join several technologies together in one functional unit. For example, combining a five-axis milling centre with a three-axis welding head in one machine tool. In this way, we would be able to create a raw piece of steel by gradually welding in a second step … we would machine the raw steel exactly using the five-axis milling centre. This scenario would be incredibly useful for making complex shaped parts. It will allow us to be independent of external suppliers.”

Visitors to the last CONEXPO-CON/ AGG in 2017 will have seen the world’s first 3D-printed excavator at the event’s Tech Experience. The Association of Equipment Manufacturers (AEM) was part of the team that developed that 3D-printed excavator, with the Oak Ridge National Laboratory.

“3D printing is not going to change all of manufacturing overnight,” said Dr. Lonnie Love, corporate research fellow at Oak Ridge National Laboratory.

“Our solar subsidiary Solar Turbines in San Diego, makes very large gas turbine engines and they have a fuel swirler that’s 3D-printed out of metal. That fuel swirler can’t be created with traditional manufacturing. It was designed for 3D printing.

“They are producing those for full production use on their gas turbine engines. This shows that technology is moving to being able to produce very complex parts in one piece using 3D printing. If you try to make complex parts in one piece using traditional manufacturing methods, you can’t afford to, given the type of machines required. But 3D printers are faster and use less material.”

FPT intends to have some form of 3D parts printing available in some of its parts centres from as early as 2019, though only for very low-volume products.

”We are taking a basket of components that are critical but no longer easily available,” said Baffoni. “Especially for older machines that might not be in production any more.”

“At the moment, all the parts which are produced by the 3D printer in the Bobcat Innovation Centre in Dobris are fully dedicated to prototyping,” said Mandik.

The excavator was 3D-printed using a variety of machines

As the technology develops, the 3D printing process does not necessarily need to be carried out centrally by the manufacturer. Once the price allows, spare parts distribution centres and even local dealers could be equipped with 3D printers, with manufacturers sending digital files to allow localised production of components.

This would also allow dealers to carry less costly spare parts stock, with inventories stored digitally, rather than actual parts

“So, we are a long way from producing machines consisting of parts entirely produced by 3D printing. On the other hand, in industry, it’s a common thing to buy a machine tool with a part produced by 3D printing. If all standards are met, with stress testing of parts, then everything is okay in our opinion. For example, our Fortus 900MC 3D printer from the US company Stratasys, has a few parts made by 3D printing. So, it’s one 3D printer making parts for another 3D printer.

“Lots of factories around the world implemented additive manufacturing years ago. Bobcat will not be an exception in the future in my opinion, as long as the cost calculations for 3D printing give us the green light,” said Mandik.

“It’s not going to displace casting. It’s not going to displace welding. When you make these great parts at low volumes, you don’t care that it takes a week or a month, but we’ve got to go faster because it drives the productivity up and the costs down.”

Known as Project AME (Additive Manufactured Excavator), the excavator was 3D-printed using a variety of machines to create and assemble three components: a cab, a boom and a heat exchanger. The excavator’s boom was fabricated using a free-form additive manufacturing technique to print large-scale metal components.

While this was perhaps an extreme example and one that would struggle to perform on an actual construction site, it was a very graphic demonstration of what could be possible in the short- to mediumterm future. As with any new technology, developments will be driven by volume. As more equipment manufacturers invest in additive manufacturing, so the price will come down and the technology will develop at a rapid pace.

Anyone visiting a major manufacturer’s excavator factory or wheeled loader plant this year is not suddenly going to see a line of 3D printers replacing the fabrication shops that support the assembly lines. Not yet anyway … but give it a few years and additive manufacturing looks set to play an increasingly important role, both in new machine manufacturing and in supporting equipment already working in the field.

Our screed heating is ready for operation three times faster than conventional systems –cost cutting with technology.

Perfect all-round visibility of the machine edge, hopper and screed – the unique BOMAG SIDEVIEW system.

The active engine and hydraulics management system reduces fuel consumption by 20% – intelligent energy saving.

For faster screed extension set up times – the smart QUICK COUPLING attachment system.

LOOK OUT FOR LOGISTICS 4.0 AS THE WORLD GETS SMARTER AND REVOLUTION TAKES HOLD

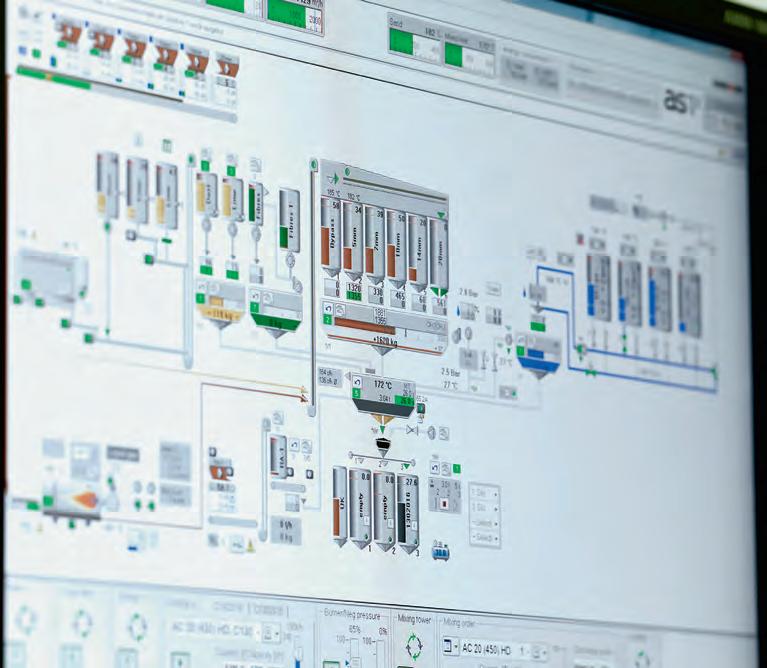

The world’s leading construction equipment manufacturers are seeing a revolution on the factory floor as new, intelligent technologies are designed to create connected and interoperable workflows. Developments such as 3D parts printing are changing age-old processes and the modern supply chain is having to become faster, smarter and more technologically integrated in order to keep pace. As we go through the fourth great industrial revolution, Logistics 4.0 has become a catchphrase for where the industry will go next. Geoff Hadwick reports.

According to flexis AG, a global leader in supply chain management software, Logistics 4.0 is about to change everything. In a recent report, the German specialist in automotive, manufacturing, and logistics software solutions said: “Industry 4.0 has been partially defined by its use of machine-to-machine communication and of internet of things (IoT) devices to create factories that operate like smart homes … (places where) an array of appliances and machines are brought into constant communication in order to create a cohesive, highly visible system.”

The objective is to create “an ideal world (in which) areas of waste and inefficiency are uncovered, certain decisions can be more thoroughly optimised, and some simple (or not so simple) processes are automated. Logistics 4.0 operates under these

same principles, but with a different set of component parts. Specifically, it makes use of ‘smart’ containers, vehicles, pallets, and transport systems in order to create a fully networked supply stream that offers supply chain managers, shippers, freight forwarders, and others the necessary visibility to perform logistics tasks in an optimal way. It becomes possible to see potential bottlenecks and breakdowns well in advance and develop counter-measures or back-up plans in time to preserve smooth operations.”