PFAS and asbestos – what are the risks?

By Inside Waste

WE ALL KNOW they are hazardous, and maybe those in power worry that complacency is the enemy, but how dangerous are PFAS or asbestos? We know that asbestos comes in various forms, and there are different risk levels. When mixed with cement, it’s not as hazardous as that which has been sprayed onto surfaces or used as insulation. The tiny fibres from spray applications are more prone to be airborne and therefore get stuck in the lungs, which could eventually cause chronic lung diseases like asbestosis.

PFAS is a different beast altogether. Also known as forever chemicals, they get that nom de guerre due to nothing other than almost being impossible to destroy under normal circumstances. Electrochemical oxidation can destroy most long-chain PFASs, but short-chain versions are a lot more challenging.

At a recent NSW Waste Collection and Recycling Association (WCRA) event

in Sydney, a couple of seminars were held that addressed these issues.

PFAS and PFOS

Andrew Mitchell from ADE Consulting spoke succinctly, and in layman’s terms, how PFAS chemicals worked.

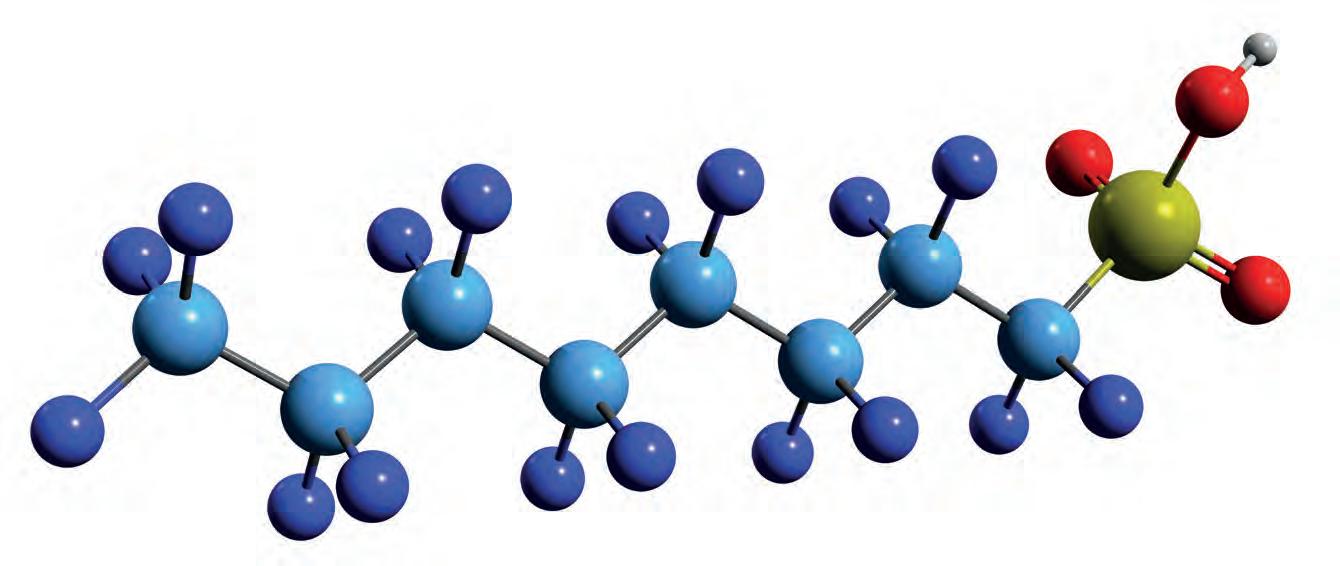

He said that in PFAS’s simplest form, carbon atoms get stuck together w ith fluorine atoms. He said fluorine is the most electronegative element that exists.

What that means is that it holds on tightly to the carbon, and doesn’t let go, and doesn’t allow any space for microbes and bugs to get in and cut that bond,” said Mitchell. “They don’t break down naturally in the environment very well. Due to their special properties, PFAS molecules are extraordinarily useful in all sorts of industrial and chemical applications.”

He said that because they’re surfactants, they prefer to stay on edges and boundaries, it also means they don’t like water or oil, instead they like

the air/water interface, and they can travel extraordinarily long distances in water. They’re very bioaccumulative in ecosystems, and the human health and ecological guidelines are very low.”

So where do they sit on the toxicity table compared to other elements that are known to harmful to humans t he environment? Mitchell talked about lead. He said that the NSW waste C T 1 guideline for lead is 100 milligrams per kilogram.

“So that is like the thickness of four sheets of paper stacked on each other compared to my height, which is nearly two metres, or, for a time analogy, it’s about one second in three hours,” he said.

Mitchell said when looking at NSW landfill guidelines with perfluorooctane sulfonic acid (PFOS – a type of PFAS), then it was equivalent to about 1 second per week, or the thickness of 40 sheets of paper side by side along the Sydney Harbour Bridge.

(Continued on page 10)

Bigger than bottles and cans

By Neville Rawlings

RECYCLERS OF South Australia Incorporated (RSA) has represented the operators of most collection points (known as depots) in the South Australian Container Deposit Scheme for more than four decades. In doing so, it is acutely aware of how the community feels about recycling. The community are our members’ customers, the participants in the scheme and who our members are speaking with every day, as they go about their business.

Our members are leading in innovation and are regularly telling us that they want to invest further in their operations to provide more efficient services to customers, but they are being hampered by a regulatory environment that hasn’t kept up.

Following the introduction of CDS in other jurisdictions, a review of the South Australian scheme was commenced in January 2019, with the scope of the review to consider:

l Objectives of the CDS.

l Scope of containers included in the CDS.

l Scheme approvals and container markings.

l CDS container return rates, including deposit value and payment methods.

l Governance of the CDS.

The review is now well into its sixth year, and industry and the community are still awaiting any clear findings and recommendations, while the landscape of recycling and circular economy has transformed drastically. If we get the outcomes of the review wrong, everything we have built over more than 45 years is at risk.

(Continued on page 16)

Image: Shutterstock AI Generator

3-Stage Grinding Process

Provides Faster Reduction

Astec - Peterson's powerful up-turn 3-stage grinding process provides better fracturing of material and a more consistent product, giving you just the product your buyers are looking for.

The Impact Release System

Protects Your Investment

Astec - Peterson's patented Impact Release System's air bags provides uniform grinding and protection from contaminated feedstock, a feature unique to Astec - Peterson grinders.

Land clearing, mulch, compost, asphalt shingle tiles, scrap wood, biomass, green waste-we can handle it am

www.komatsuforest.com.au

The Impact Cushion System

The Second Line of Defence

Urethane cushions and shear pins help protect the mill from catastrophic damage in the event of a severe impact from contaminants in the feedstock.

Astec - Peterson offers horizontal grinders from 433-839 kW, offering grinding solutions with output at the lowest cost per ton. Visit us at www.astecindustries.com and see why we have been leading the industry for over 35 years!

2710D Horizontal Grinder

5710D Horizontal Grinder

6710D Horizontal Grinder

Largest

How bad is bad?

IN THE FIRST half of 2024, there was a hullabaloo in the inner west Sydney suburb of Rozelle over mulch that was riddled with asbestos. Everybody knows that asbestos is bad for the environment, and even worse for human health if dust finds its way into your lungs.

But how bad is bad? It depends on the form the asbestos takes. In cement form? Not too bad. In dust form? Terrible for your health.

It was with that in mind that I attended two speeches, one by CDE Consultants’ Andrew Mitchell, and Hibbs and Associates Samantha O’Callahan at an event ran by the NSW Waste Contractors and Recycling Association.

O’Callahan put some perspective on the mulch issue. While she was quick to outline the dangers of the substance, she also believes that people need to be informed of all the facts.

One such instance was an editorial in a daily newspaper where the writer advocated for mandatory asbestosfree certification for recycled products.

Chief Operating Officer

Christine Clancy christine.clancy@primecreative.com.au

Managing Editor

Mike Wheeler

mike.wheeler@primecreative.com.au

Brand Manager

Chelsea Daniel chelsea.daniel@primecreative.com.au

Ar t Director

Bea Barthelson

Client Success Manager

Louisa Stocks louisa.stocks@primecreative.com.au

Head Office

Prime Creative Pty Ltd

379 Docklands Drive

Docklands VIC 3008 Australia

p: +61 3 9690 8766

enquiries@primecreative.com.au www.insidewaste.com.au

Subscriptions

+61 3 9690 8766

subscriptions@primecreative.com.au

Inside Waste is available by subscription from the publisher.

The rights of refusal are reserved by the publisher

amounts – are everywhere, but the cost of doing such a thing would not only be prohibitive for a lot of businesses, but the pass-on costs to the public would not go down well.

Mitchell’s speech was about the asbestos of the 2020s – PFAS.

Again, he knows that most of these forever chemicals are not good for you – although there is nowhere near as much data on them as asbestos – and he has shown some interesting figures on just how low of a tolerance governments might be willing to accept - i.e. not much at all.

I don’t think anyone would argue how bad these substances can be for humans and the environment, but getting some insights helps put a lot of scenarios in perspective.

Have a good month.

Articles

All articles submitted for publication become the property of the publisher. The Editor reserves the right to adjust any article to conform with the magazine format.

Copyright

Inside Waste is owned by Prime Creative Media and published by John Murphy. All material in Inside Waste is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. The Editor welcomes contributions but reserves the right to accept or reject any material. While every effort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. The opinions expressed in Inside Waste are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

Isuzu’s FVY Dual Control

We’re about to make a big splash in trash, because we’ve just launched a new range of dual control trucks. With lower tare weights than similar models from our competitors, these new trucks can carry bigger payloads. Up to 300kgs per trip! Apply that across a fleet and you’ll see huge boosts in e ciency and reduced operating costs. Visit isuzu.com.au/waste

From the CEO’s desk

Waste industry needs to lead the way – government won’t

The last National Waste Report in December 2022 shows there has been an increase in recovery of about one million tonnes over the past two reporting years, whereas Australia needs over 10 million additional tonnes to be recovered to hit our 80 per cent target by 2030.

Environment Ministers will meet for the second time this year on 7 December, following the first 2018 Meeting of Environment Ministers (MEM) in April, which was in part a response to the import restrictions driven by China’s National Sword Policy and the effects this policy has had across the Australian waste and resource recovery (WARR) industry. Key decisions derived from the April MEM include:

The next report is due out by early next year. I guess it remains to be seen if there will be any material change in recovery rates, given the pace of policy implementation, facility development and real market development for our essential industry nationally.

Let’s hope though, that we do see a shift up from the current resource recovery rate of 63 per cent, given in 2024 we still need to recover more than 1.5 million tonnes a year – a jump we have not seen previously.

•Reducing waste generation, endorsing a target of 100% of Australian packaging being recyclable, compostable or reusable by 2025, and developing targets for recycled content in packaging.

• Increasing Australia’s domestic recycling capacity.

We all know what needs to be done to get to this goal – we need to use less for longer. The reality is that it is not hard, but possibly it is brave to try and shift both the consumption and production behaviours of the lucky country.

• Increasing the demand for recycled products.

• Exploring opportunities to advance waste-to-energy and waste-to-biofuels.

In 2024, we desperately need co-ordinated government action that drives regulation, investment (with certain planning support), genuine market settings that values recycled materials and local green jobs, and genuine green public procurement. Seriously, when will we get beyond viewing the use of recycled materials and repaired products as unique behaviours to realising they are mandatory habits – necessary not just for our industry but the planet. As Kamala Harris said (yep girl crush here)... “it’s (both) an environmental imperative and economic good”.

•Updating the 2009 Waste Strategy by year end, which will include circular economy principles.

It is time to take stock and examine what has been achieved since these decisions were announced. Now, seven (7) months may not seem like a long time, however in that time we have seen further markets close (Malaysia, Indonesia, Vietnam) and if you are an operator under continued financial stress, seven (7) months could make or break you.

I understand it is always a fine line for governments between showing leadership on an issue and riding roughshod over public opinion. Increasingly after two years it is looking like this Federal government is frozen by inaction either because change is seen as being too scary, too big, too risky, too expensive, too fast or a combination of all the above.

I fear this is where we are now with the Federal Government’s recent announcement of a Productivity Commission inquiry into the circular economy. It’s a topic that could arguably fall into all of the above categories (except fast), but I would argue it also falls into another – too late.

Following the April MEM, we have had three (3) states step in with varying degrees of financial assistance for industry (councils and operators). This should be expected considering almost all states (except Queensland and Tasmania) have access to significant waste levy income each year. On the eastern seaboard, Victoria has approximately $600 million in waste levy reserves in the Sustainability Fund and NSW raises more than $700 million per annum from the waste levy. There is certainly no lack of funds that can be reinvested into our essential industry.

It was with some sadness that I noted the inquiry into the circular economy. Not because of any misgivings about the PC (in fact, it will be headed by Joanne Chong, who appears eminently qualified), but because I fear the inquiry will be able to now be used as yet another excuse for government inaction.

Funding helps but as we know, the money goes a much longer way with Government support and leadership, as well as appropriate policy levers.

VICTORIA

There is a real risk that both sides of politics will argue they cannot do anything substantial on circular economy (or waste and resource recovery policy) until the Commission reports back, which is on the other side of the Federal election. The inquiry could be the fig leaf of cover the major parties will hold onto like a life buoy. Tick, tick, tick, as we head to 2030.... Not to mention that the PC report on Right to Repair, which was released on 1 December 2021, has still not been responded to by government.

Victoria has arguably been the most active and earnest in supporting the industry post-China, with two (2) relief packages announced to support the recycling industry, valued at a total of $37 million. The Victorian Government has also gone above and beyond all others states by announcing it would take a leadership role in creating market demand for recycled products.

SOUTH AUSTRALIA

Maybe there are positives to the PC inquiry. Hopefully it will, for example, expand circular economy thinking beyond just environment departments given it must be a paradigm shift that applies to whole of government – treasury, infrastructure, finance and industry just to name a few. This inquiry could provide that impetus. But the fact is we cannot tread water for another 12 months. The world is leaving us behind.

Government announced a $12.4 million support package comprising $2 million of additional expenditure, $5 million additional funding for a loan scheme, together with targeted funding from the Green Industries SA budget. The Government has also offered grants for recycling infrastructure.

NEW SOUTH WALES

At first glance, New South Wales’ eye-watering $47 million recycling support package was heralded as the spark of hope industry needed. However, on closer inspection, the bulk of this package that was funded via the Waste Less, Recycle More initiative and therefore the waste levy, was not new, making it very difficult for stakeholders, including local government, to utilise the funds as they were already committed to other activities. Some of the criteria proposed by the NSW EPA also made it challenging for industry to apply to these grants. On the plus side, efforts are being made by the NSW Government to stimulate demand for recycled content through the intergovernmental agency working groups that have been established, though no tangible increase in demand or facilities have developed… Yet.

QUEENSLAND

We can only kid ourselves for so long before the (plastic) straw breaks the camel’s back – whether it is battery fires, packaging or PFAS. Issues keep piling up and go largely unaddressed.

There are, however, plenty of actions governments could take to use less for longer that won’t fall foul of the PC report. Most of you have probably heard of the nudge theory of behavioural economics, which attempts to persuade rather than compel people to make specific decisions. And it strikes me that we could do with a little of that in the WARR space.

Given the apparent reluctance of government to take bold action to make the transition to a circular economy a reality, perhaps we need to harness other methods to elicit change?

I attended a Mood of the Nation research report presentation from SEC Newgate Australia, and it gave me some thoughts and a few key takeouts, beyond the obvious like cost-of-living issues, are top of mind for Australians.

industry however the Queensland Government has embarked on the development of a waste management strategy underpinned by a waste disposal levy to increase recycling and recovery and create new jobs. The State will re-introduce a $70/ tonne landfill levy in March 2019. There are also strong attempts to use policy levers (levy discounts and exemptions) to incentivise the use of recycled material and make it cost competitive with virgin material. However, little has been done to establish new markets and Government has not taken the lead in the procurement of recycled material. There are grants available for resource recovery operations in Queensland although no monies have been allocated to assist in 2018. This is troubling as Queensland rolled out its Container Refund Scheme on 1 November, which will likely impact the cost and revenue models of the State’s MRFs – as we have seen most recently in NSW.

WESTERN AUSTRALIA

Broadly the research found that while people do not want government to tell them how to live their lives, they are open to government showing them how to do things differently. It struck me as something we could use in WARR to highlight the importance of consuming less, making materials last longer, only getting what we truly need and shifting to circularity.

The Western Australian Government set up a Waste Taskforce in direct response to the China National Sword. As part of this announcement, the State Government urged all local councils to begin the utilisation of a three (3)-bin system - red for general waste, yellow for recyclables and green for organic waste - over the coming years to reduce contamination. While this taskforce is a step in the right direction, we are yet to see any tangible results from it or any funding for industry. In October, the WA Waste Authority released its draft Waste Strategy to 2030, which comprises a comprehensive and detailed roadmap towards the State’s shared vision of becoming a sustainable, low-waste, circular economy.

In part, this is why WMRR has been calling for years for a well-funded nationwide education campaign to drive behaviour change about consumption. We are not talking about a ‘what goes in which bin’ campaign, but one which makes people aware of the consequences of their choices on the environment – whether it relates to so-called switching from goods to services, making better use of existing products or tackling food waste, as used in the WRAP UK: Net Zero Why Resource Efficiency Holds Answers campaign.

COMMONWEALTH

One that transitions from linear to circular. And with Australia’s currently circularity rate calculated by CSIRO at 3.7 per cent compared with global average of 8.6 per cent, we really need to get moving. Australian’s value their natural environment and overwhelmingly want to leave it a better place for future generations.

The SEC Newgate report also showed strong support for the concept of the Federal Government’s Future Made in Australia plans (67 per cent) with only 11 per cent of people opposed. Our industry is key to this, as we are able to provide the input materials to ‘making in Australia’. There really is a great opportunity to embed both WARR and circularity at the heart of the plan.

We haven’t seen much to date on that, but it is not too late. Not only does it reduce the drain on the planet’s resources and help address the climate challenge, it derisks the Australian economy by making us more independent, free from overseas shocks and grows domestic green jobs. Back to Kamala – ‘when we invest in climate, we create jobs, we lower costs and we invest in families’, seriously what is not to love?

Following the MEM in April, Australia now has a new Federal Environment Minister, Melissa Price, who in October reiterated to media MEM’s commitment to explore waste to energy as part of the solution to the impacts of China’s National Sword, which is troubling (EfW is not a solution to recycling). The Commonwealth has also backed the Australian Recycling Label and endorsed the National Packaging Targets developed by the Australian Packaging Covenant Organisation (APCO), which has to date, failed to incorporate industry feedback in the development of these targets. To the Commonwealth’s credit, there has been significant coordination in reviewing the National Waste Policy, with the Department of Environment bringing together industry players and States during the review process.

So why aren’t we seeing much more action much faster in Australia (it’s not like there is a Planet B!)? Let’s hope the government grasps this opportunity with both hands.

The updated Policy will now go before Environment Ministers on 7 December. The Commonwealth can play a key role – one that goes beyond the development of the National Waste Policy. WMAA is supportive of the Federal Government maximising the levers it has, including taxation and importation powers, to maintain a strong, sustainable waste and resource recovery industry.

AHEAD OF MEM 2

On the bright side, Newgate’s research highlighted that recycling is now seen as ‘hygiene’ – simply something we must do (well done all – that message has got through), but it really is time we moved the dial so that circularity becomes hygiene too, and not just a buzz word in yet another framework.

Gayle Sloan, Chief Executive Officer, WMRR

There may be movement across Australia, with some states doing better than others, but the consensus is, progress is still taking way too long. It is evident that there are funds available in almost all States to assist with developing secondary manufacturing infrastructure, however the only way that this will really happen is if there is government leadership around mandating recycled content in Australia now, not later.

Unlike its neighbours, Queensland did not provide any financial support to

Voluntary schemes like the Used Packaging NEPM, under which APCO is auspiced, are not working. We have 1.6million tonnes of packaging waste in Australia, which needs to be used as an input back into packaging. Barriers to using recycled content in civil infrastructure must be identified and removed, and Government must lead in this field and prefer and purchase recycled material. A tax on virgin material should also be imposed as it is overseas. MEM must show strong leadership on this issue. Ministers have, since April, dealt directly with operators and councils that are under stress and we have a chance to create jobs and investment in Australia at a time when manufacturing is declining. Ministers have the opportunity to be leaders of today, not procrastinators – leaders of tomorrow and we are urging

Chief Executive Officer

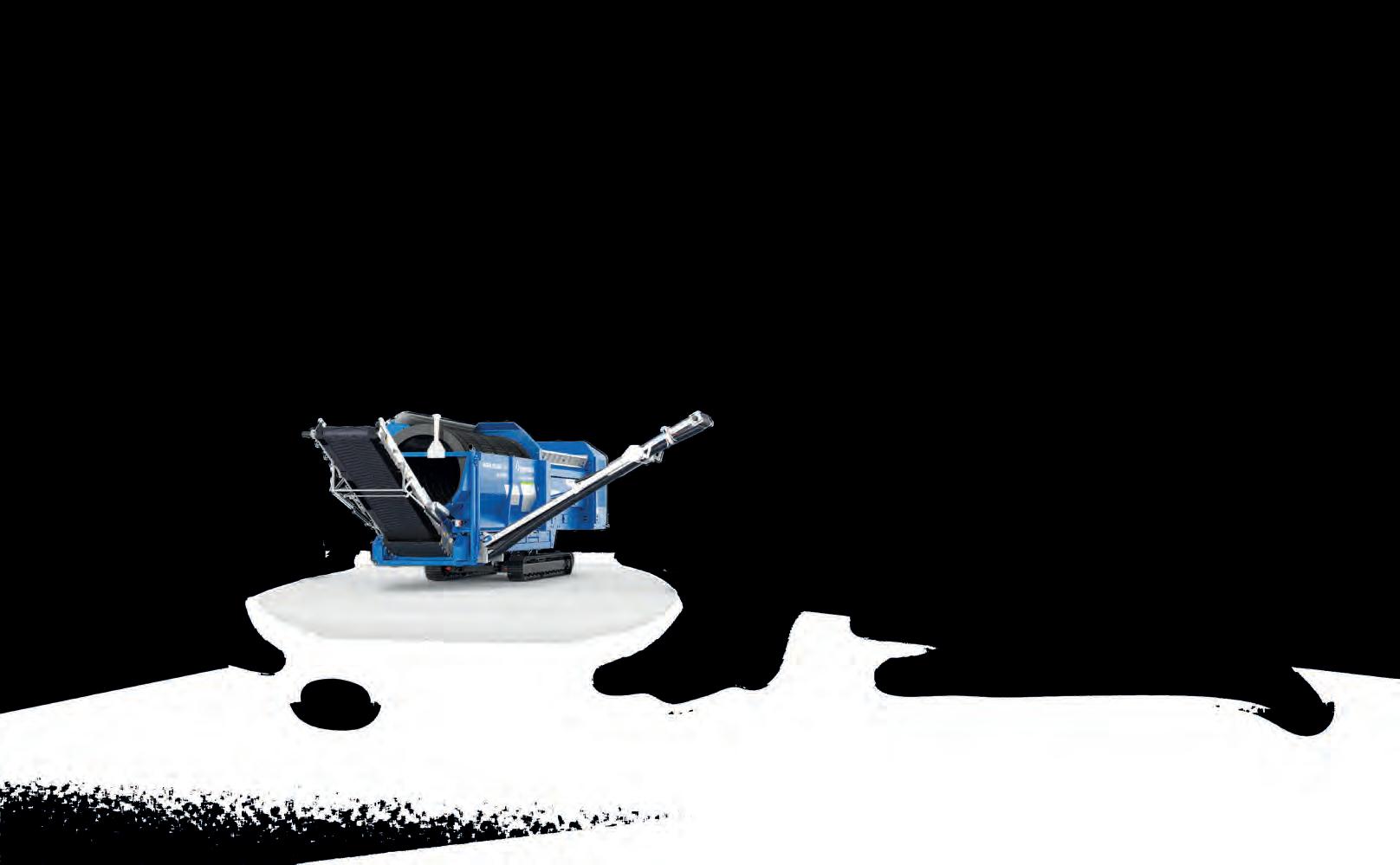

The Impaktor 250 evo is the perfect combination of shredder and crusher. Its compact dimensions, low weight, and quick setup times make it a game changer in waste processing efficiency.

For those interested in sustainable waste management, explore the possibilities with the ARJES Impaktor 250 evo.

E: sales@triconequipment.com.au www.triconequipment.com.au

With its multi-rotor design the Genox J-series pipe shredder easily shreds HDPE pipes of all sizes.

When combined with a Genox washing plant and Genox pelletising system, you can truly close the loop on HDPE pipes. Pipe to pellets. Pellets to pipe. This is the circular economy in action.

Genox make world-class recycling solutions, for real-world recycling applications.

Call: Email:

with, and that can be seen in a few resource recovery orders and exemptions. That’s equivalent to about one second in about

itchell said the Australian drinking water guidelines were 0.07 micrograms per litre, which he said is about a thickness of one sheet of paper lying across the Hume Highway between Sydney and Melbourne, or about one second

“These numbers are really low, but they are testable,” he said. “Consultants, contractors, and operators are trying to work out what to do with them.”

And how prevalent is it in the community and products? Very, according to Mitchell. It’s in firefighting foams, waste products, textiles, clothing, footwear, and carpets, which all have been treated with PFAS to make them easy to clean. It’s in an array of waterproof and grease proof packaging. It’s in the F component of FOGO. He said garden organics are pretty good, but when it comes to commercial FOGO waste, there is a lot of PFAS.

“It’s also in soils and concrete,

and asphalt is contaminated with it, so it’s everywhere,” he said.

Currently, there are not many requirements when it comes to testing for PFAS in waste, unlike asbestos, which has a myriad of rules and regulations around how it is to be handled and disposed.

“If you’re working with the site-specific resource recovery orders and exemptions, most of the recent ones require some testing for PFAS,” said Mitchell. “And that flags where the EPA is headed with the resource recovery framework in the (Dr Cathy) Wilkinson Review. Sometimes, if you have a licence to discharge from a site that’s known to have PFAS contamination, you may have to test for PFAS in that discharge. Contaminated land investigations often include testing for PFAS.”

Mitchell said there is a new standard – Industrial Chemicals Environmental Management Standard (IChEMS) – that is pointing the finger at the bad chemicals.

“This is a commonwealth government regulatory package that is about banning chemicals that are really, really bad,” he said.

Andrew Mitchell likes to put the risk of PFAS contamination in perspective. Image: Andrew Mitchell

It’s surprising the amount of products that contain PFAS – but how dangerous is it?

Image: Francesco Scatena/ Shutterstock.com

“PFAS have been listed in IChEMS. Every state has indicated that they will make it a law, but so far only New South Wales has done so via the POEO (Prevention of the Environment Operations) Act. You’re not allowed to dispose of PFOS greater than one milligram per kilogram. You’re not allowed to use it if you have more than 25 micrograms per kilogram –that’s parts per billion.”

The Queensland compost guidelines state that only one microgram per kilogram of PFAS, or one part per billion, is allowed in compost.

A recent study found that the concentration of PFAS in Queensland compost, on average, was 12 times higher than the guideline.

“This could effectively ban composting in Queensland, which, I’m sure, is not what was the

measured these parameters,” said Mitchell. “They were 7 parts per billion on average. So, some biosolids are going to comply, many are not. And where are they going to go? Who’s going to pay for that? Is that what our society wants?”

Mitchell suggested that time is needed to bring in these guidance measures. There will also need to be some expensive investment in

“Guaranteeing that materials in the recycling and waste industry are asbestos free is, quite frankly, something that can’t be achieved.”

And this might lead to some problems, according to Mitchell. This is because the concentrations outlined in the guidelines are exceeded in some of the circular economy feedstocks. He said it is possible to get an exemption under an EPL, but if a company or person doesn’t have that EPL exemption, and they use or dispose of the chemical outside those guidelines, they’re committing an offence.

He also said that Queensland could be in trouble when it comes to PFAS contamination of compost, if the results of a recent study are true.

intention,” said Mitchell. “But it’s an illustration of making policy without the connection with science and industry.”

And what about biosolids and the amount of PFAS they have? It is going to be challenging, according to Mitchell. NSW released a draft guidance on biosolids in 2023. There is a range of margins of safety that depends on the policy parameters. With unrestricted use, the PFAS limit is between 0.2 and 1 parts per billion, whereas restricted use, is between 6 and 31 parts per billion.

“Three different studies have

infrastructure and in wastewater treatment systems, and some time for the operators of those networks to find the point sources of PFAS in these systems. He thinks that endof-pipe solutions are not going to solve this problem.

Asbestos risks

When it comes to asbestos, Hibbs and Associates Samantha O’Callahan, gave the lowdown on the various types, which are the most dangerous and how they need to be handled.

F irst is the high-risk, or friable,

material. This is in materials like sprayed insulation, which can be easily reduced to powder when crushed by hand, when dry. O’Callahan said this version of asbestos is uncommon in the waste industry but does find its way into some streams on occasion.

She also pointed out that it is important to know the difference between the different types of exposure that can occur.

“We can be exposed to it every day,” she said. “For instance, during a home renovation, there is a risk because you’ve been exposed, but that risk is low. But as soon as you start seeing situations where – over your working life – you’re constantly exposed to asbestos, such as in the mining and manufacturing industries, there is a very high risk of developing asbestos-related diseases.”

O’Callahan’s biggest talking point was the recent asbestos exposure in public parks in NSW that occurred at the beginning of 2024. She pointed out that the media almost bordered on hysteria in some cases, when the facts didn’t play out in favour of what the media

BOB HOOKLIFT SYSTEMS

Versatile, Durable, Dependable

The BOB hooklift system offers ultimate flexibility, allowing you to effortlessly switch between containers to meet a variety of waste management needs. It delivers consistent performance even in the most challenging environments. With its quick loading and unloading capabilities, the BOB hooklift maximises productivity, streamlining operations and minimising downtime. With readily available spare parts and 24/7 service support, you can ensure long-term performance.

Upgrade your fleet with BOB today!

Contact Us:

FOR CONCRETE AND STEEL

was trying to portray. One article stated that “research highlights the importance of making it mandatory to certify recycled products such as mulch to ensure their safety. These obstacles must be overcome, so we have certification of recycled products to ensure their quality performance, environmental friendliness, and safety”.

“This example article highlights a fundamental lack of understanding, or lack of reaching out to experts, with regards to the waste industry resource recovery and the perception of what certifying products actually means,” said O’Callahan. “Guaranteeing that materials in the recycling and waste industry are asbestos-free is, quite frankly, something that can’t be achieved.”

As she pointed out, it is important that everybody does their best to mitigate the exposure of asbestos in the atmosphere, but the resource recovery industry has little or

by the consultants that looked at it,” said O’Callahan. “But from an Occupational Health and Safety viewpoint, cement sheet, whether it goes through a seven mm sieve or not, is non-friable and a low risk. And the regulator did see it that way, and did allow for the cleanup to be done under the same conditions as if it were larger than seven mm.”

According to O’Callahan, occupational hygienists have stated that there needs to be significant disturbance to generate respirable fibres from asbestos cement, which is the typical contaminant the resource recovery industry has to contend with.

“It’s really important that we manage the perceived risk of asbestos as well as the actual risk,” she said.

“They are both super important and can also both shut down projects and industry. What’s the status in industry today with regards to asbestos? Essentially, you guys are in

“There were a couple of asbestos cement fragments that were smaller than seven mm, so they were classified as friable by the consultants that looked at it.”

no control of how the material is handled further upstream.

But perception matters. And although the contaminated mulch was presented as high risk for playgrounds, schools and parks, people kept going about their daily activities, said O’Callahan.

Even though the public was outraged, they didn’t seem to have an issue with the fence being the only thing that separated them from asbestos-contaminated mulch, which was really no barrier at all.

“From a health risk perspective, that most certainly was a reasonable way to isolate the contaminated mulch, because the risk actually was really quite low,” said O’Callahan. “However, the way it was hyped up in the media…it really did have a flow-on effect and got out of control.”

Once all the handwringing, investigations were completed and reports had been written, less t han five square metres of asbestos was found in the thousands of tonnes of mulch that was removed. Of that five square metres, 90 per cent of it was cement sheet, which is non-friable.

“There were a couple of asbestos cement fragments that were smaller than seven mm, so they were classified as friable

limbo with regards to how asbestos is handled. There’s still no formal process for dealing with unexpected fines.”

What happens now and into the future? There was a draft document that came out in 2014 that was designed to manage asbestos in its recovery in the construction and demolition industries. That document was then replaced by one called Standards for Managing Construction Waste in NSW, but set unrealistic expectations.

O’Callahan said that NSW is reviewing how it approaches the management of asbestos, especially about how to get greater consistency between jurisdictions.

“This is an independent scientific review, so I am hopeful that we’re going to see change in government policy, and that’s certainly the feeling that I’ve been getting at workshops and speaking to other people in the industry,” she said.

“The chief scientist’s office will deliver a report to the Minister for Environment and the New South Wales asbestos contamination committee, and we’re expecting that towards the end of this year. So hopefully we can start to see some change and some stakeholder engagement next year about moving forward.”

Bigger than bottles and cans

(Continued from the Cover)

It is important to recognise that while the South Australian CDS is the oldest in the country, and is un ique in its quasi-market-based system and limited regulation, it remains the best performing scheme in the country.

A review of the comparative performance of schemes undertaken by Total Environment Centre in 2023 (using a mix of FY21 and FY22 data) shows that South Australia remains at the top of the leader board, with return rates more than 10 per cent above NSW, Queensland and WA. One reason for this success is it being almost exclusively depot based. In addition to CDS containers, many of our members depots also accept

a range of out-of-scope products including wine bottles, cardboard and plastic, gas bottles, fluorescent tubes and even paint cans. Our customers love the fact that they can come and talk to us, and that even if our members don’t accept a product, they can generally tell them who does. It’s this human interaction and feedback that you can’t get from a website, an app or a reverse vending machine.

It’s continued success does not mean that the South Australian CDS is not without its issues.

As an example, advanced sorting machines, including those developed and built in South Australia and used extensively in Queensland, the ACT, WA and Victoria, cannot yet be implemented effectively as they would see customers presenting

materials to be automatically counted, only for aluminium cans to then be manually hand-sorted and separated by brand. This is an utterly ridiculous and archaic requirement. Some depots are also restricted from baling collected products before transport, resulting in trucks transporting loads that are largely air, leading to higher transport movements and carbon emissions than necessary.

Changes to the scheme in South Australia must not introduce barriers such as machines that can’t read crushed containers, which are a prime example of how ineffective decisions hamper success and impede progress. Continuing to accept crushed containers is non-negotiable, as it offers volume efficiencies

for both transport and collection, while simultaneously maintaining incentives for reducing litter – a primary objective of the original CDS in SA. Similarly, harmonisation of scope must not exclude currently accepted containers, such as those with a volume less than 150 ml.

These inefficiencies are simple to solve, with the solutions already developed by experienced recyclers who understand what works, what the community wants, and what the system needs.

As part of the CDS review, a discussion paper in 2021 highlighted that a revised governance model could be closer to the models employed in Queensland and Western Australia, where a single network operator is responsible for the operation of the scheme. Such a model may have worked for the establishment of greenfield schemes, including a network of collection points and logistic

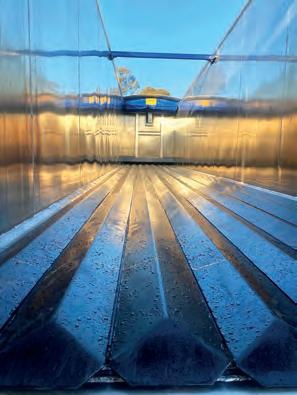

Unlike most other states, South Australia already collects wine and spirit bottles at its collection points. Image: Gemenacom/shutterstock

operations where none previously existed. The situation in South Australia is totally different with an existing network of well-established collection point operators served by competing network operators, which is delivering the best return rates in the country.

While not without its issues and anachronisms, it cannot be denied that the South Australian CDS is still delivering the best return rates in a now national set of schemes and doing so in possibly the most cost and environmentally efficient way.

As an example, in South Australia, the ownership of the returned glass containers is by the collection points; those containers are aggregated through a company and on-sold to one of South Australia’s glass container manufacturers, where the cullet is processed through a new beneficiation plant and goes directly into new glass containers. This mechanism reduces the input costs and carbon emissions from the glass plant and provides a per tonne value for the glass back to the scheme that would make our friends in other states weep. This high value product ultimately reduces the cost of the

scheme for all participants.

The risk for South Australia is that we now have a review in its sixth year, which needs to be urgently concluded, but without destroying the best performing scheme in the country.

A dopting a scheme model from other states for the sake of expediency would be a grossly retrograde step that risks 45 years of hard work by existing scheme participants.

Rather than focussing on destroying a working governance model, which requires only minor tweaks, the conclusion of a review should focus on the issues on which the community is demanding action.

The Queensland Government’s recent inclusion of wine and spirit bottles in their CDS shows they have ‘read the room’ understanding public frustration and responding accordingly. In the eyes of the community, excuses for not increasing scope have lost all relevance, and have the appearance of pandering to lobbying by parties with vested interests.

The recent behavioural report prepared by the Heads of EPA group

Recyclers Association of South Australia’s president Neville Rawlings. Image: Neville Rawlings

Invest in quality machines that are backed by a national parts and service footprint for the ultimate

From material handlers, to trommels, stackers, grinders, screens, dozers and more. Our industry specialists will create a personalised solution for your business. Onetrak, the exclusive national distributor for Fuchs, Tigercat, Anaconda, Dressta, Hidromek and Striker.

has provided further insight. The HEPA report indicated that for consistent users and irregular users, increasing the refund amount was the biggest insight to maintain and encourage participation at 43 per cent and 42 per cent respectively. RSA has long advocated for review of deposits to ensure that they remain set at a level that encourages participation.

In an Inside Waste article several years ago, RSA highlighted that the 5 cent deposit applied to containers in South Australia in 1977 would today be worth more than 35 cents., With the current 10 cent deposit, consumers have seen the real value of their deposit eroded by more than 70 per cent since the introduction of the South Australian scheme. With 10 cents in 2008 now worth 15 cents, the real value of the deposit has eroded by over 30 per cent since South Australia increased the deposit from 5 cents to 10 cents.

While achieving a deposit value equivalent to that at the introduction of the South Australian CDS may not be achievable in the immediate term, the increase in scope demanded by the community would go some way to offsetting the erosion of the

deposit through inflation. Moving forward, there should be a clear and defined pathway to review of the deposit amount, such as a review every decade being enshrined in the scheme legislation taking inflation into account.

With the medium-term potential for scope to move beyond just beverage containers, reform must ensure that the scheme

containers and litter reduction.

This is bigger than just bottles and cans. Ultimately it is about the amount of material that moves through the scheme to true circular outcomes, and the governance of a modernised scheme must reflect this.

RSA advocates a model that builds on the established depot network in South Australia, retains competitive tension in the ‘back-of-house’ of the

community that the CDS operates transparently and prioritises environmental and social outcomes over commercial gains.

RSA’s vision for a modern CDS integrates more than 40 years of innovation and experience. This approach is about enhancing an already successful system by addressing its flaws and adapting to new challenges. It’s about leveraging

“The community’s demand for change is clear, and the benefits of a modernised CDS are undeniable. By embracing these proposed changes, South Australia can once again lead the way in recycling and circular practices, setting a standard for others to follow.”

facilitates such ongoing growth and improvement of the scheme. The governance model adopted now will control what happens in the future. That governance model needs to be independent and free of conflicts. The governance outcome can’t entrench the beverage industry as the custodian of the scheme, as has occurred in several jurisdictions. To do so would be a huge step backwards for South Australia as the scheme needs to truly move beyond beverage

scheme, and provides for oversight by an independent governance board who has the powers required to ensure the scheme meets objectives.

In addition to raising refund values, RSA emphasises the importance of independent governance. The current system’s entanglement with vested interests has led to compromised decisions. An independent governing body would act as the ‘people’s representative’ and ensure on behalf of the

past successes to create a more robust and efficient future.

The community’s demand for change is clear, and the benefits of a modernised CDS are undeniable. By embracing these proposed changes, South Australia can once again lead the way in recycling and circular practices, setting a standard for others to follow. The time to act is now, and the opportunity for positive change is within our grasp. Let’s seize it.

Maximise Recovery... Reduce Landfill Costs

through…

Superior Equipment

equipment

MobileMuster looks to up the recovery rate

By Inside Waste

MANAGED BY THE

Australian Mobile Telecommunications Association (AMTA), MobileMuster is ramping up its presence in the mobile phone reuse/recycling and refurbishment market. While it has seen an increase in collection of mobile phones, there is still a long way to go, according to its marketing and public relation manager, Joel Murray.

In 2022/23 the association collected 96 tonnes via its MobileMuster initiative, while for 2023/24 that has gone up to 109 tonnes. Murray said that while it is a good start, there are still millions of broken phones sitting in homes and businesses around the country.

T he association is aware that there is a lot of work to do, and has initiated a lot of engagement with the community, with plans to do much more in the near future.

“We’ve done a lot of work, and we are working hard to increase awareness and change behaviours through marketing campaigns,” he said. “We’re getting better traction and we’ve also increased efficiency on the back end, focussing on working with more business partners for larger collections, rather than the consumer just dropping one phone off at a time.”

He said that it’s those efficiencies that are leading to larger gains, as the numbers indicate. A recent IPSOS

“It’s the aluminium, plastic, the glass that’s valuable, and that’s the stuff that can be reassembled over and over.”

year they have gone from 13.8 million down to 13.3 million – a decrease of 500,000.

From an environmental perspective, refurbishment or reuse are the best outcomes for a second-hand phone, but if these options are no longer viable, recycling is the only way to go. And while the status quo might suggest the importance of the rare earth and other metals being reused, Murray said there is more value in the aluminium, plastic and glass because those materials make up the greatest volume of ingredients when it comes to the construction of a phone.

“There is a bit of a misconception that the gold is what recyclers are after in phones,” he said. “People don’t realise that the cost to post a

MobileMuster collected 109 tonnes of used mobile phones in the past year. Images: AMTA

Recycling is the last resort for mobile phones – reuse and refurbishment are preferred.

phone back or send it to a recycling facility costs more than the amount of gold that’s in a phone. It’s the aluminium, plastic, the glass that’s valuable, and that’s the stuff that can be reassembled over and over. There’s also cobalt, nickel, iron, lithium, that kind of thing, but only in small quantities.”

Murray also says there are more altruistic reason for making sure mobile phones are disposed of correctly. He said the more materials that are recycled, “the less we need to dig up habitats of various animals and dig into the Earth in order to get those materials to make new mobile phones”.

MobileMuster has worked hard to get the message across. Murray said that current statistics show that one in three people have claimed to have recycled a phone, with one in two intending to do the same. It is converting that other two thirds that is the tricky issue. And it’s not like the organisation hasn’t offered a myriad of options for people to recycle their mobile handsets. Vodafone, Optus and Telstra stores – and their partners –have drop off points. Australia Post has also come to the party whereby you can post your old phone back to

MobileMuster at no cost to the consumer.

The hardest part is the motivation for people to go to their drawer or shed or wherever, and actually pick it up and put it in a bag,” he said. “Some people think ‘there’s no tangible outcome for me,’ but they should do it because it’s the right thing for the environment.”

MobileMuster has also learned that they key to scale is with other businesses, with a view to work with more organisations and find opportunities that benefit both parties. Whether that be working with existing waste management organisations, or otherwise.

pack them up in a box and send them to us,” said Murray. “You just jump on our website and all that information is there. We can also provide a certificate to show how your business is improving its sustainability measures through mobile phone recycling.”

One aspect that worries a lot of people – across the spectrum – is what happens to their stored data. Murray said he can assure the public and businesses that MobileMuster does not access phone data.

for their recycling efforts.

In the case of zoos, the monies go to initiatives that help protect habitats of animals that are affected by mining of materials that go into making mobile phones.

Murray also said the organisation is looking at ways to incentivise consumers to return the phones, to keep up with trade-in services.

“Some people think ‘there’s no tangible outcome for me,’ but they should do it because it’s the right thing for the environment.”

Companies are always changing providers, updating phones, and making sure they have the most upto-date communication features. This means there is a lot of churn in that space and therefore plenty of phones that need to be refurbished or recycled.

“If you own a business and have a backlog of outdated, unused devices floating around, it’s absolutely free to

“Once it goes into a MobileMuster Box and is picked up, it’s never turned on,” he said. “It’s never accessed. It’s literally dismantled and chucked into a shredder, and there’s no way to access that data once it’s been processed. Your data is safe through the process. And if people do want to be extra safe, we have instructions on how to wipe it off before you drop it off.”

MobileMuster also partners with charities such as the Salvation Army, DV Safe Phone, and several zoos. It gives a rebate to these organisations

Melbourne, 23-24 Oct 2024

www.eldan-recycling.com • info@eldan-recycling.com

“Those trading and resale services typically will refurbish the phone and then resell it, and they will give consumers some cash back,” he said. “When it reaches a point where it no longer has value, that’s when you send it to MobileMuster for recycling.”

Murray also said that at the end of the day the MobileMuster service is easy to use and it’s free. Users or businesses don’t have to pay to ship to anyone and they don’t have to sign up to anything.

“Send them our way and it’s all sorted,” he said. “Get in touch with us, and we’ll discuss your needs and what we can do.”

A3:502

Rimini, Nov 5-8 2024

• Modified for recycling of tough material, e.g. ASCR cables Cu scrap & Al cables and low-grade cables.

• The rotor is manufactured with hard-face welding.

• Screens with different hole sizes are available .

• Exchangeable wear parts makes it a virtually indestructible machine.

• Large fly wheel to minimize current spikes.

The State of packaging recycling

By Mike Ritchie

IN 2018 THE AUSTRALIAN Government established the 2025 National Packaging Targets. The four targets to be achieved by 2025 were:

1. 100 per cent of (all) packaging being “reusable, recyclable or compostable”.

2. 70 per cent of plastic packaging being recycled or composted.

3. 50 per cent average recycled content (RC) included in packaging (not to be confused with the recycling rate (RR) –the amount that is actually recycled).

4. The phase out of problematic and unnecessary single-use plastic packaging.

A few observations:

1. Being “reusable, recyclable or compostable” does not mean that it actually is reused, recycled or composted. Just that it is capable of being so. Whether it is or not is a matter of economics and systems –see below.

2. The current rate of plastic packaging recycling is a paltry 18 per cent (target 70 per cent; APCO).

3. The weighted average RC is 42 per cent with most of it in cardboard (54 per cent) and glass (41 per cent). The laggard is plastic of course (average 9 per cent). Steel cans are also surprisingly low (8 per cent). (Refer Table 1).

4. Phasing out problematic single-use plastic packaging is a no-brainer and needs to go faster.

But there is some good news –the total packaging RR is 61 per cent. Cardboard (71 per cent) and Glass (63 per cent) do all the heavy lifting.

New RC targets were applied per packaging stream in 2019 (Table 1):

l Cardboard/paper (60 per cent).

l Glass (50 per cent).

l Metal (35 per cent).

l Plastic packaging (20 per cent).

- PET (Polyethylene; 30 per cent).

- HDPE (High density polyethylene; 20 per cent).

- PP (Polypropylene; 20 per cent).

- Flexibles (20 per cent).

None are achieving their RC targets, but cardboard (54 per cent) and glass (41 per cent) are close.

Fast forward to 2023 to a new Environment Minister in Tanya Plibersek and a crop of new State Environment Ministers. In June 2023 they put out a release saying:

“In an Australian first, packaging will soon be subject to strict new government rules aimed at cutting waste and boosting recycling … These new rules will help make sure packaging

is minimised in the

first place, and where packaging is used it is designed to be recovered, reused, recycled, or reprocessed.

The rules will include mandatory packaging design standards and targets – including for recycled content (RC) and to address the use of harmful chemicals in food packaging.”

Good stuff. There has been an almost unanimous round of applause for such action. But five years on from the National Packaging Targets and a year on from Minister Plibersek’s announcement, not much has happened. Two-and-half million tonnes of packaging is still sent to landfill each year. More than one million tonnes of cardboard, 800,000 tonnes of plastic packaging and 500,000 tonnes of glass are still landfilled each year.

Surely if we want to create a circular economy, we need to start with the obvious right in front of us. We need to create the market incentives or policy proscriptions to get this recyclable packaging out of landfill. It is not difficult. But it requires political will and political support.

It requires investment in infrastructure and systems to lift RR and RC. The 2.5 million tonnes of packaging that goes to landfill does so because it is cheaper or easier to landfill it compared to recycling. Rational for many generators.

Similarly, if we want to improve recycled content then it needs to be mandatory and applied to all packaging both imported and locally manufactured (otherwise only responsible companies

will do it and others will free ride).

Table 1 shows the increase in recycling rates and recycled content required to achieve the targets, based on the latest (2021/22) APCO data on RC and RR.

Some key points from Table 1:

Overall:

l Achieving the current RC targets will drive an uplift in recycling of more than 382kt over all streams (761kt required).

l Aluminium is the only stream already achieving (and exceeding) the RC target.

l But we still need to recycle another 13kt to achieve the RR target. For two streams a mandatory RC rule

Glass is one of the waste streams doing well when it comes to recycling rates, but it could do better. Image: Josep Curto/Shutterstock.com

would also see RR grow substantially:

l Paper and cardboard – by 203kt and by default it also achieves the RR target.

l Glass – by 103kt and by default it also achieves the RR target.

l For these materials lifting RC lifts RR in a material way.

l Bit of a no-brainer.

However, plastic and steel require stronger interventions than just an RC mandate. Key plastic streams:

l Achieving the current RC will drive an uplift in recycling of only 78kt.

l 353kt is required to hit the RR target. Steel:

l Achieving the current RC will drive an uplift in recycling of only 23kt.

l 4 4kt is required to hit the RR target.

- To hit the plastic/steel RR targets other additional interventions will be required. RC alone will not go far enough.

We must do mandatory RC reform. Good on Ministers for pushing it. But we will need to do much more to get a handle on plastic recycling. The gap is more than half a million tonnes. We must fix it. We need to walk and chew gum.’ Ministers must put in place a mandatory packaging system with targets for RC and RR. Mandatory means there

are no free riders. Costs should be met via an “eco-modulated” levy on packaging placed on market. That levy should be lower for products with high RC and RR, and vice versa. It is what Europe has been doing for a decade.

As an aside – for RC rules to actually help lift RR for plastic in Australia, they will probably need to be accompanied by some sort of incentive to use Australian recycled plastic pellets. Why? Because it will almost always be cheaper to import

PROVEN RELIABLE AND PRODUCTIVE

recycled content plastic pellets than make our own here in Australia, due to scale and the costs of labour.

Summary:

l Reform is taking too long. There are green shoots of investment in RC and RR, but it is far too slow and patchy.

l Minister Plibersek has made the right noises and has been strongly supported by industry and communities (including the

manufacturing and retailing sectors via APCO).

l We need to create the political space for her and colleagues to introduce legislation to create a mandatory packaging scheme with real targets and real teeth. ASAP.

l Please let the Ministers know you support such action.

Mike Ritchie is the managing director of MRA Consulting Group.

Standard designed for those doing the right thing

By Inside Waste

LIKE MANY INDUSTRIES, the resource recovery/waste sector has a lot of rules and regulations. Rightly so, most would say, due to the nature of the business. And the nature of the business also means that there are certain expectations around how activities are conducted. Not only from within the industry, regulators, and government entities, but the public at large. Yet, how can such activities and their impact on the wider world be measured? More importantly, how can businesses offer a reliable indicator to those with limited knowledge of how the resource recovery is run that they are crossing their t’s and dotting their i’s?

Standards. Every industry has them. Qualified, bona fide, measurable standards. With that in mind, GECA, an independent, not-for-profit organisation, has developed the Construction & Demolition Waste Services ecolabel standard aimed explicitly at the C&D waste market. A critical aspect of becoming certified against this standard is that “... applicants must show that they follow the waste priority hierarchy, starting with waste avoidance. These measures divert waste from landfills and reduce the burden on raw materials”

Josh Begbie is the CEO of GECA and has been with the company for just

over 16 months. While he concedes that the diversion from landfill rate for C&D, at about 70 per cent, is good, getting to those 80 and 90 per cent targets is not easy.

“It starts getting much harder, and it requires effort, thought, innovation, collaboration, and communication to get past that 70 per cent,” he said.

“I think there can be a tendency for some people to feel, ‘Ah, you know, we’re doing alright. We’re good. We’ll just stay there’. At GECA, we want to encourage people to keep minimising their impact and grow their circular outcomes.”

This is why he believes having a standard that pushes beyond current thinking and expectations is vital. GECA wants to help drive improving behaviours and find the right balance between being aspirational and being achievable. He realises that there are a lot of dodgy players out in the market who will get rid of their construction waste by not doing the right thing. This is why it is essential to have a standard because it provides a rigorous thirdparty framework for accountability and transparency.

“The certification helps with that because with the standard, these things get checked, and they get checked regularly,” said Begbie.

And where did the standard come from? Who decided what would go into the standard, and what type of things

does it encompass? GECA’s strategic communications manager, Kendall Benton-Collins, explains.

“We adopted and modified a standard initially developed by our fellow Global Ecolabelling Network (GEN) member, Eco Choice Aotearoa in New Zealand,” she said. “They developed the recipe for best practice in C&D waste services following ISO 14024 principles. We then adapted that standard to the Australian landscape, which has its own nuances and needs.”

As is the case for all 27 of GECA’s product and service ecolabel standards, Benton-Collins said it involved a lot of research internally with GECA’s standards and technical team, and then a large amount of consultation. This process included a voluntary technical advisory group of critical players

along the construction and demolition value chain. Once feedback had been received, it was incorporated into the draft standard to balance best practices and industry capabilities.

“Our standards aim to deliver substantial environmental benefits, but if we set the bar so high that it’s out of reach, we’re not able to affect positive change,” she explained.

Finally, the draft standard was open for feedback from the public and industry professionals during a 90day consultation period before being finalised by a Standards Committee.

In other words, GECA wanted to open it up to as many interested parties as possible to get the best results for the standard itself.

Begbie also pointed out that the standard can be malleable – not as a

Standards increases expectations that C&D specialists will do the right thing when it comes to disposal of the waste stream. Image Credit: GECA

matter of course, but more about if there are changes within the industry that might need to be considered when companies go through the process.

“We have a continuous improvement mindset,” he said. “This doesn’t mean we do a full update every year. It often can be quite a few years between a formal update, but we’re always seeking feedback from the market, such as, has anything significant changed? Has there been a technological shift that means we can be more aspirational than we could have been?”

And does the state or federal government have a say in how the standard is put together? The government’s part in the process is somewhat different, but it does have a role.

“Their part is not to judge whether or not our standard is okay; they judge whether or not GECA is a reputable organisation with a clear process for developing a good standard,” said Begbie. “They don’t assess each standard; they assess the process that we use to create standards, which is our ecolabelling scheme. They have to give their tick of approval whenever we change that process. That’s what

the ACCC (Australian Competition and Consumer Commission) does for us.”

In addition, GECA is the only Australian member of GEN, a network of the world’s credible and robust lifecycle ecolabels, with 39 members across nearly 60 countries. GECA’s membership includes a formal peer review process for mutual trust and confidence. Begbie said not all ecolabels on the market have this level of assessment. Some of them use the fact a government has okayed

the bar in a way that drives positive change for people and planet.”

Grasshopper Environmental was the first organisation to certify against GECA’s C&D Waste Services standard. It was doing work with Laing O’Rourke, and the construction company wanted an entity that had the best practices and was a leader in its field while working on Sydney’s Central Station Metro project.

According to the team at Grasshopper Environmental, “many of

demolition waste that is being created correctly.

“Everyone knows that this is a problem, right?” said Begbie. “The building and construction industry knows there’s underreporting of construction demolition. This standard helps prove that those doing the right thing are doing so.”

Finally, Benton-Collins also points out that it’s not just about monitoring what is happening to construction and demolition waste. The standard

“The building and construction industry knows there’s underreporting of construction demolition. This standard helps prove that those doing the right thing are doing so.”

their processes as a green light, whereas GECA welcomes the additional oversight of GEN. The GECA team also monitors what other reputable ecolabel organisations are doing worldwide, especially in North America and Europe.

“When they start to signal a change with something that we haven’t seen yet, we can say, ‘Is that coming? What does that look like? How can we encourage that in the Australian context?’” said Begbie. “And we try and keep that balance right, but also raise

our customers require their own GECA certification for their projects, so it made sense for us to get ours too. This has made it easier for our customers to know their waste contractor is reliable and committed to helping them achieve their waste diversion targets. It’s a win-win”.

One aspect where the standard will win favour, will be among the companies that are doing the right thing already – making sure they are reporting the right amount of

A proud Australian-owned family business, Garwood International has been at the forefront of specialised waste collection & compaction equipment design and manufacture for over 45 years, providing high quality, innovation equipment solutions to meet the needs of even the most challenging operating environments.

• Rear, Side & Front Loading compaction units

• Single and split-body collection vehicles from 4m2 to 33.5m2

encompasses peripheral subjects that must be considered in the C&D space.

“Yes, you’re going to get those hot spot criteria around diversion from landfill, but we also need to make sure that all human health is looked after in the construction process,” she said. “Even issues like modern slavery, or if there are any chemicals of concern, need to be covered. It’s a start-to-finish standard that looks beyond what you would expect in areas of recycling and waste.”

• VWS Enviroweigh bin weighing equipment for refuse vehicles

Training needs to take front seat to industry needs

AUSTRALIA’S WASTE management sector has traditionally focused on conventional methods of waste collection, transport, and disposal. However, the sector is gradually evolving with the incorporation of technologies such as automated sorting systems, advanced recycling processes, and data analytics for waste tracking and reduction. Despite these advancements, existing t raining programs often lag, failing to equip workers with the necessary skills to operate and maintain new technologies effectively.

According to IBIS world the Waste Treatment and Disposal Services in Australia are worth about $4.5bn annually via 802 businesses and employing 7,079 people.

The shift to a circular economy and alternate disposal models such as councils’ introducing FOGO services has dampened the industry’s revenue growth. Smart operators are meeting these challenges by changing business models and introducing novel waste treatment and disposal methods, like energy generation and composting soil conditioners and road bases.

Regulatory fees and charges are forcing up the costs of handling treatment and disposal services for hazardous materials like asbestos, chemicals and biomedical waste. The key Industry sectors include the treatment and disposal of:

approximately.

2. L iquid waste – (sewerage) – 21 per cent approximately.

3. H azardous materials (Asbestos, medical waste) – 20 per cent approximately.

4. Organics (food and garden waste) –15 per cent approximately.

5. Heavy materials (masonry, concrete and steel) – 10 per cent approximately.

6. O ther waste – 1 to 2 per cent approximately.

In the latest Australian Government Labour Market Insights this industry sector is lumped together under, electricity, gas, water and waste services occupations. Occupations related to electricity, gas, water and waste services industry, by skill, indicate environmental specialists’ occupations make up 39 per cent of this industry sector, with 31 per cent being professional-level engineers, scientists, and consultants and only 8 per cent listed as environment managers.

According to the Australian Bureau of Statistics, the waste management industry employed more than 30,000 people in 2021, yet a large portion of these workers lack formal training in the latest technologies and sustainable practices. Current training programs primarily cover basic operational skills, with limited emphasis on advanced technological competencies and the principles of a circular economy.

It’s the environmental managers that develop and implement

environmental (including waste) management systems. Their roles may vary from organisation to organisation. The job role will likely include identifying, solving, and alleviating environmental issues including waste streams.

To support these job roles waste management qualifications were created and have been used for several years now.

The current qualifications are the Certificate III in Waste Management (CPP30719) and the Certificate IV in Waste Management (CPP40919).

These qualifications are contained in the Property Services

Training Package (CPP).

The Certificate III in Waste Management (CPP30719) aligns to job roles including waste collection (and transfer) and processing (including resource recovery) in municipal, solid, commercial, industrial, construction and demolition (C&D) waste management. The elective categories are:

1. Waste operations with a focus on safe operations withing waste transfer stations and landfill sites including static waste processing plant.

2. Waste collection, utilising imported transport and logistics units of

CHART 2. NSW Traineeship Commencements 2020 to 2024

CHART 1. NSW S&S Commencements in Waste Management

Some resource recovery/waste workers lack training in the latest technologies and sustainable practices. Image: Nordroden/ Shutterstock.com

TABLE 1. Waste Management qualification national up take 2018 to 2022

competency, with a focus on transport of both solid and liquid waste and hazardous materials.

3. Waste processing with a focus on green waste processing for compost.

(Note: wastewater and sewerage treatment is not included).

The Certificate IV in Waste Management (CPP40919) facilitates job roles in supervising waste collection, processing, waste minimisation and resource recovery operations across commercial, residential, industrial and C&D waste management.

These people will be leading teams, identifying and solving common collections and processing problems.

Key focus areas include:

1. Work health and safety and environmental regulations.

2. Facility management including environmental controls, site

operations and stakeholder engagement.

The national data seen in Table 1 shows NSW leads the country in the uptake of the national waste management qualifications, with the Certificate III in Waste Management

“Smart

Commencements in the Certificate III have waned from 157 in 2020 to 109 in 2023 , but inversely, commencements in the Certificate IV in Waste Management have grown from just 8 in 2020 to 52 in 2023.

Traineeships

Since 2020 the number of people taking up traineeships in NSW has been declining. The Federal Governments “Boosting the Apprenticeships Commencements (BAC)” funding did not appear to have a major impact on the traineeship commencements as can be seen in Chart 2.

pattern recognition in recycling plants, and even robot street sweepers and autonomous garbage trucks are being employed. If they are not in Australia yet, they will be in the future.

Waste management and logistics companies will need to take advantage of these new technologies to remain competitive. The Transport and Logistics Training Package has qualifications that underpin waste collection services. The Certificate III in Waste Driving Operations (TLI30419) was the original qualification, but it was superseded by the Certificate III in Driving Operations (TLI31222). This

operators are meeting these challenges by changing business models and introducing novel waste treatment and disposal methods, like energy generation and composting soil conditioners and road bases.”

being the predominant qualification.

Interestingly, there has been an increase in First Nations people commencing the Certificate III in Waste Management from just five in 2019 to 15 in 2022. In NSW Smart and Skilled (S&S) supported training in waste management commencements have had their ups and downs as seen in Chart 1.

Transport and Logistics in Waste Management

Technology is having a major impact on all industries now, not least in waste management. Artificial Intelligence, robotics and machine learning are already part of the waste management infrastructure in various roles. In advanced economies things like smart bins, machine learning through

qualification is designed for those engaged in driving-related job roles such as a waste vehicle driver.

The Certificate III in Waste Driving Operations, which was superseded in 2021, was used only across Queensland, South Australia, Western Australia, and Tasmania. Table 1 shows 2019 was the peak year for this qualification.

Waste driver training is critical to

Stand out from the crowd and give clients confidence your C&D waste service is a better choice for people and planet!

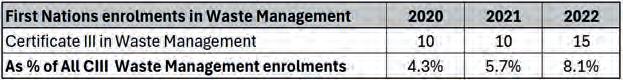

TABLE 2. First Nations people commencement in the CIII Waste Management

TABLE 3. Certificate III in Waste Driver Operations enrolments in Australia 2018 to 2021.

the waste management Industry. The various sectors use specialised vehicles to collect and process waste materials. The training needs to reflect this. Given the loss of the specialised Waste Driving Operations course there only remains the Driver Operations course. A breakdown of the data demonstrates training in this area has increased in some states, notably NSW (up 66 per cent) but not in the other populous states of Victoria (down 14.4 per cent)and Queensland (down 17.2 per cent), see Table 5. If we compare the enrolments across the two qualifications we see that waste Driving Operations accounts for around 0.54 per cent (on average) of the total

number of drivers being enrolled over the years observed. See Table 6. If we apply 0.54 per cent to the total number of enrolments in driving operations you might consider the number of waste drivers being trained in each state to be similar to those in table 7.

The future for waste management training In Australia

The future for the industry will be technology driven with automated sorting systems utilising: l R obotics and artificial intelligence to sort waste more efficiently and accurately than manual processes.

l A dvanced recycling technologies such as chemical recycling and bio-based recycling are emerging.

l Digital skills and data analytics and devices to assist in monitoring waste streams, optimising collection routes, and predict maintenance needs.

l Waste-to-Energy technologies used to convert putrescible waste into energy, offering an alternative to landfill disposal. Training programs should cover the operation, safety, and environmental implications of waste-to-energy facilities. Modern vocational training programs must incorporate training that reflects these emerging skills and be flexible enough cater to the different needs of industry sectors and skills levels required and provide a pathway to higher education operations.

ACFIPS Industry Training Advisory Body is a not-for-profit organisation funded by the NSW Government to be a conduit to and from industry to

government on vocational education and training matters relevant to the waste Industry. The body wants to hear from the industry on what it s ees as the critical training issues for the sector. BuildSkills Australia is the new Jobs and Skills Council initiative started by the federal government that is responsible for the development of the Property Services Training package under which the Waste Management qualifications.

Greg Cheetham is the senior project officer - ACFIPS Industry Training Advisory Board.

TABLE 6.

TABLE 4. Certificate III Driver Operations enrolments X State

TABLE 5. Comparison between Waste Driving Operations and Diving Operations enrolments

AORA assesses paper for improved state harmonisation

By John McKew

THE AUSTRALIAN Organics Recycling Industry (AORA) is currently reviewing its position paper on Food Organics and Garden Organics (FOGO). This review has been undertaken to ensure the Australian organics recycling industry has a clear guidance framework for the key issues and considerations for recycled organics throughout the transition from household Garden Organics (GO) collections to the mandated FOGO collections, and the delivery of Food Organics (FO) and FOGO collections for businesses by 2030 (as per the National Waste Policy Action Plan 2019 – updated 2022 – Action 6.04).