5 minute read

What’s driving shortages in

from MHD November 21

by Prime Group

SHORTAGES AND OPPORTUNITIES IN WESTERN SYDNEY

Demand for industrial land is far outstripping supply in Western Sydney. David Hall, National Director – Department Head, Sydney West Industrial, and Jock Tyson, Executive | Industrial at Colliers, discuss trends, innovations, and prospects for the area as we head towards 2022.

David Hall, National Director – Department Head, Sydney West Industrial at Colliers, says that the Western Sydney land market is experiencing levels of demand well in excess of available supply.

“Demand is at record highs, and will remain so for some time,” says David. “Looking at the market supply and demand for existing assets, the current amount of leasing demand in the market exceeds current supply by a factor of 3.6.”

This is no coincidence, says David, as COVID-19 has been the catalyst placing significant pressure on the warehousing and distribution sector.

“Tenant demand has continued to accelerate as occupiers take a deeper look into their supply chains in order to find further efficiencies and identify new opportunities – where locational efficiencies can improve their internal costs and delivery timeframes.”

To illustrate this point, David draws attention to Australia Post’s recent activity in the area, having taken up three different short-term leases across Western Sydney to accommodate the increasing movement of online orders and supply chain pressures – all in the past three months.

BUILD TO CORE AND INNOVATION AGENDAS

David says that large institutional developers, who are competing to grow funds under management in Western Sydney – where prime development opportunities of scale are increasingly scarce – have adopted a ‘build to core’ strategy: a long term-approach of developing and holding quality industrial assets within their portfolios.

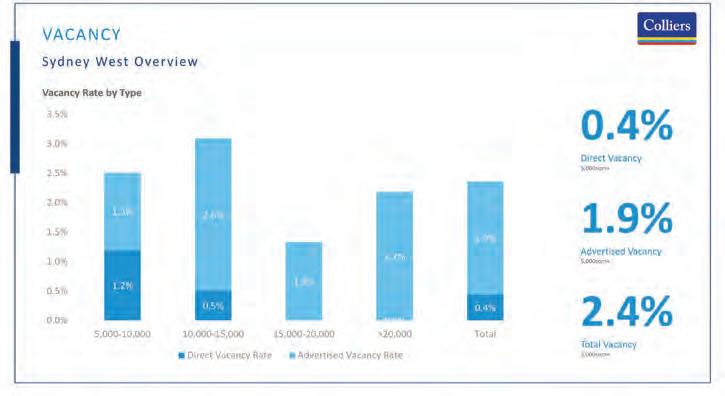

“It’s not only the security of returns that has reinforced this approach – due to record low vacancy rates of 0.4 per cent across Western Sydney [for properties of 5000 sqm or more],” he says. “There is also the key advantage of facilitating and retaining prime leasing covenants within their portfolios.”

So, what are the kinds of supply chain innovation agendas that companies are looking at in this industrial property context? David says that there is a broad, overarching reconsideration of supply chain management, as well as the unfolding role of automation.

“The warehousing and distribution sector is constantly evolving as occupiers more frequently review their supply chain models and look to find efficiencies in their outbound logistics costs (movement of stock to store or direct to customer). In some instances this final stage of the supply chain can contribute up to 60 per cent of the total

Vacancy overview in Western Sydney.

Mamre Road Precint ownership map.

This shot shows the Mamre Road precinct, as taken from above Aldington Road. In the distance is the Western Sydney International Airport under construction.

cost. Utilising older style facilities with innovative solutions (e.g automation) in well positioned central locations could provide cost and delivery timeframe advantages (particularly when delivering direct to customer).

Getting goods from A to B, or warehouse to consumer, is clearly an important pecuniary consideration, but it’s also intertwined with changes in customer expectations. And this is where automation comes in, David says.

“Automation within distribution facilities is enabling new levels of efficiencies to be met,” he says. “This is beneficial for cost saving reasons over time, but also the ability to move more inventory through the same footprint in a strategic location to faster service customers in the current consumer environment where there are expectations for fast and consistent results.”

David points to the new Coles Customer Fulfilment Centre – approaching completion at Cowpasture Road, Wetherill Park – as illustrative of the dramatic move towards improved automation and efficiency. “With world leading single-pick fulfilment technology and home delivery solutions, Coles is able to provide an improved service to online customers and aims to increase its market share through offering a better service than its competitors.”

WILL INDUSTRIAL LAND SUPPLY IN WESTERN SYDNEY BE INCREASED?

David says that the main constraint on development is planning and servicing land, and the timeframes within which planning and services are finalised and delivered.

“This is evident in the Mamre Road precinct, which is awaiting the DCP [Development Control Plan] release that will allow for the majority of the precinct’s development to commence.

“Looking further outwards from the current development spotlight, areas outlined within the Western Sydney Aerotropolis Structure Plan have potential to provide some relief to current levels of demand,” David says. “However, this has yet to be finalised following the public exhibitionof the initial Precinct Plans in March of this year, and now the more recent exhibition of the refined Phase 2 plans in October.”

RECENT DEVELOPMENTS AND THE ROAD AHEAD

Jock Tyson, Executive | Industrial at Colliers has had his eye on the Mamre Road precinct for some time – having spoken earlier this year to MHD about its status. Earlier, Jock had noted that the short-term development uncertainty around Mamre Road was a result of having to wait for the DCP for the precinct to be finalised. In our last conversation, Jock noted that the DCP was expected to be finalised in Q3 of 2021.

So, has the DCP been finalised?

“Since we last spoke, there has not been a result in its finalisation,” Jock says. “The main issues that are being addressed are largely around the main development controls: the delivery of key infrastructure such as the road network and the management of stormwater.”

But Jock does expect the DCP to be approaching finalisation soon. “The existing developers within the precinct have been actively involved in driving these outcomes through regular engagement with the relevant regulatory departments.”

Looking more broadly at the Western Sydney market as we move towards 2022, Jock emphasises that broad trends will follow much the same patterns they are now.

“I would say that Colliers’ broad view is that, ultimately, we are going to see rental growth due to continued supply shortages together with high levels of demand. In this environment, occupiers must begin discussions as soon as possible in relation to their real estate needs. By starting those conversations now, occupiers give themselves more time. And that additional time will provide opportunities for better outcomes – both commercially and operationally.” ■