ACKNOWLEDGED

Connect. Automate. Digitise.

ACKNOWLEDGED

National Collision Repairer ’s Symposium24 certainly brought together a host of issues the repair industry is faced with in the years to come.

But it also brought together a fabulous collection of industry leaders and thinkers who have a common purpose in wanting the best for the industry and a readiness to work together to achieve those ends.

The problems workshops face, like skills shortages and ever-advancing technology, can seem daunting, even overwhelming, at times but putting these subjects into focus is what makes them relevant.

So, while there is a chance that focussing on the problems can turn a day such as the Symposium into a sombre a air, it is a great credit that all those who took part were so solutions driven.

The speakers on the day started from a point of honesty and clear-sightedness about exactly what is happening and then quickly proceeded to what they believed needed to be done. Nobody was o ering ‘silver bullets’, however tempting, because the complexity of the issues like recruitment and retention can vary from workshop to workshop and from person to person. Instead they demand a more nuanced and incremental approach if there is going to be lasting benefi ts from their resolution.

MTAA CEO Matt Hobbs who began the day with an overview of the automotive industry highlighted just how many disrupters of the industry were on the way, including new powertrains, technology and policy. But he also stressed the importance of a cohesive approach to meeting them and a clear, united voice on the policy action needed to back the industry.

Similarly, Stephen Jenkins who tackled the thorny issue of relations between insurers and workshops, stressed how important it was to have a governing document like the Code of Conduct that was relevant and e ective for this changing future.

The upcoming consultation period of the new draft gives

everyone in the industry a chance to have their say. That feedback will prove important in achieving the cohesive and representative result, that its success depends on.

In the same vein industry champion on the skills issue, ACIA director Rob Bartlett has always maintained that solving the skills issues is a long-term even generational issue.

Getting to the heart of the problem and doing it with evidencebased research rather than individual hunches, is what he and the team at ACIA have set their sights on. The resultant fi ndings and advice could then benefi t almost every single workshop in its ability to unravel the ‘whys’ of costly-sta turnover.

Similarly, the tone of the sessions on technology were fi lled with some amazing revelations of just what cars will be capable of in the near future. This was also tempered with a note of caution that these are the same cars that repairers will have to fi x. Meeting that will take some clear-sighted preparation and a lot of training.

A panel made up early adopters like ADAS Solutions founder Adrian Parkes and Hella Gutmann’s Steven Hines along with MTA NSW RTO compliance Anthony Tomassetti agreed that the Australian repair industry was currently behind in the adoption of ADAS technology. Repairify’s Director of Innovation Martin Brown, who had come all the way from the UK, highlighted just how much more-readily adopted these advanced technologies were around the world. He stressed the need to look to new expertise to ensure these repairs were not only done e ectively but safely.

The point is not whether this disruptive technology is coming, in many cases it is already here. But these people and companies are at the forefront of fi nding solutions to ensure a vital industry can keep things moving.

This magazine has repeatedly vaunted the industry’s capacity to adapt to change. Broad and complex as the challenges are, it is also reassuring that its greatest asset, its people, are willing to tackle that change.

When this many of its leading thinkers are also willing to get together and talk through some of these challenges, regardless of how di cult they seem, it appears also to be an industry with an encouraging and energetic future.

Eugene Du y Editor The National Collision Repairer

Powered exclusively by compressed air, the ERGO LIFT 1000 ROLL can lift and maneuver vehicles UP TO 2500KG. With 4 support arms that swivel and lock automatically, it can be adapted to suit all chassis types. Ergonomically designed, it has a LIFTING HEIGHT OF 95CM, so you can work upright around the vehicle to avoid fatigue.

Whether it is the fiercely fought out competition of the WorldSkills in France or the local workshop owner looking for the best solutions, Glasurit’s 100 Line is fast gaining a global reputation as the most outstanding waterborne basecoat line for ecoe ective paint results.

The Glasurit products from BASF will be centre stage at the WorldSkills International competition in Lyon, France in September where emerging talents from around the globe are getting to know the eco-friendly products as they showcase their skills.

This long-standing partnership between Glasurit’s and WorldSkills in the car painting category fosters talent development, promotes excellence in the automotive industry and the 100 Line products send a new message about the sustainability initiatives in the industry.

This is a theme reaching across the globe, down to the workshop where e ciency and the environmental impact of products and energy use are increasingly part of business decision making.

The 100 Line meets the highest requirements of modern body shops and focuses on eco-e ectiveness, process e ciency and highest product quality. The products also partner with their pioneering AraClass EcoBalance coatings for complete workshop solutions.

Since 1888, Glasurit has stood for quality, social and ecological responsibility and the 100 Line helps customers become more competitive and, at the same time, improve their environmental footprint as well as drive overall performance.

Continuing with this rich history, Glasurit 100 Line marked another

important milestone for BASF in the Australian and New Zealand automotive refinish market, when they became the first countries to introduce the waterborne basecoat system in Asia Pacific in 2020.

“Glasurit 100 Line is designed to increase the overall e ciency of modern body shops of the future and at the same time reduce the environmental footprint, exceeding all global VOC requirements. 100 Line truly demonstrates where sustainability meets e ciency” says Kirsten Dodd, ANZ Marketing Manager, BASF Australia.

Glasurit 100 Line is the first basecoat line on the market with a VOC value below 250 g/l, which is 40 per cent below the EU solvent limit. It also exceeds all global VOC requirements.

Glasurit has succeeded in producing a waterborne basecoat system of unprecedented eco- e ectiveness and quality with Glasurit 100 Line. Glasurit AraClass EcoBalance

clearcoats and undercoats are produced following a biomass balance approach, and 100 Lines’ excellent colour stability, robustness in application and its environmental attributes, Glasurit is able to provide customers with an innovative and sustainable paint system.

“Glasurit 100 Line is now perfectly complimented with the introduction of the AraClass EcoBalance range,” Kirsten says.

“The opportunity for body shops to contribute towards a more sustainable future in the automotive repair industry both ecologically and economically through new innovative products and an eco-e ective portfolio is very exciting”.

Glasurit 100 Line and AraClass EcoBalance products are available through your locally approved Glasurit distributor. www.100line.glasurit.com

WorldSkills: Preparing the best for international competition; Page 30.

All workshops and garages across Australia’s can benefit from a Rechargeable LED Inspection Light from Narva.

No matter how big or small your workshop is, Narva will provide high performance products that will stand the test of time.

The new See Ezy light from Narva provides the toughness and functionality that every workshop needs.

Product details

Narva’s See Ezy Rechargeable LED Inspection Light features 36 SMD LEDs that produce an ultra-bright output of 1000 e ective lumens.

The See Ezy illuminates engine bays to ensure the best visibility in the workshop. With a powerful 100 lumen torch light, the direct beam increases the functionality of the product. The See Ezy can be used in a variety of settings, from engine bats, to inspecting suspension, to steering components, and also to DIY jobs at home.

The See Ezy has three output modes which makes for a versatile piece of equipment for a busy workshop. With low, high and torch modes, the right setting for the right job ensures a long battery life.

The battery life ranges between 8 (high setting at 1000 e ective lumens) and 16 hours of continuous use (low setting producing 500 e ective lumens).

The ‘Auto turn-o ’ function also ensures battery life e ciency by automatically switching the light o after 2 hours. Before the light automatically switches o , a warning turn-o reminder, in the form of the flood light flashing will activate. However, if longer usage of the light is required, the Auto turn-o function can be disabled, by holding the power on button for 10 seconds. Minimising unnecessary equipment is essential for the e ciency in any workshop. The See Ezy light is a compact, yet smart device that disregards the need for attachments and adaptors. User can monitor the battery life of the light via the LED display, which illuminates once the power button is held on for two seconds.

With a simple charging system, the See Ezy has a built in USB-C charging port and compact docking station. To charge from flat to maximum charge takes 5.5 hours.

The See Ezy is a personalised torch that has the ability to remember flash pattern memory. This means that the light

retains brightness memory from the last used output mode. The next time the light is used, the brightness memory is activated after five seconds.

As well as the e cient battery life and the brightness memory, the See Ezy also has other features which make it a competitive product in the market.

The light includes two integrated heavy-duty magnets. This allows the user to conveniently position the light on a variety of metal surfaces for handsfree operation. The light also features a concealed, fold-out hanging hook for an easy hands-free operation.

The See Ezy is made out of durable materials that are designed for longevity in a tough workshop environment. The light’s shock-resistant body has been tested to IK07 levels to ensure top quality toughness. The polycarbonate lens, and weatherproof rubber housing (IP65) has also been chemically tested to resist oils and fuels.

The comfortable, ergonomically grip is designed for a periods of long term use, making it a sustainable piece of equipment.

Narva’s See Ezy Rechargeable LED Inspection Light (part No. 71322), is available from leading transport and automotive outlets nationwide.

A flat battery can leave you in a frustrated or even dangerous situation and cost businesses time and money. With Projecta’s patented Rapid Recharge Technology, Intelli-Start are the only jump starters in the world that replenish their charge after starting an engine, meaning they’re always ready for your next emergency. There’s a model to suit every engine and budget. Smart, compact, powerful. That’s Intelli-Start.

What could be better than bringing cutting-edge paint mixing technology right into workshops, wherever they are located? With expert support from key partners, PPG has created a unique, mobile ‘MoonVan’ to showcase the groundbreaking PPG LINQ™ technologies to all corners of the nation.

Australia is a very big country and, at times, that can present real challenges. This is the issue the PPG Australia team found themselves facing with the release of the remarkable new MOONWALK® automated colour dispensing technology. This ultra precise solution for mixing ENVIROBASE® High Performance waterborne tinters forms part of the PPG LINQ suite of connected technologies aimed at transforming the refinish paint shop. With such radically new technologies, seeing them in action was the key to getting a clear understanding

of the substantial gains they o er.

However, despite MoonWalk units being quickly set up at PPG Training Centres around the country, the question remained – how to reach collision centre owners/managers who were not able to drop in for a live demonstration? Due to its size, transporting a fully functional MoonWalk unit to individual repairers was simply not feasible – or was it …

European inspiration

It turns out this is a conundrum already tackled by the PPG Europe team who

also had to deal with customers spread across large distances. They settled on an innovative mobile solution, dubbed ‘MoonVan’, which has been so successful, there is now a fleet of these vehicles visiting customers all over Europe. Taking inspiration from their European colleagues, the local PPG refinish team decided to build an Aussie version of this tech-laden van. After sourcing a suitable high-roof van, Chris Edwards (PPG Business Manager Vic/Tas) and Ray England, (PPG Training Manager Vic/Tas), took charge of the logistics of the fit-out. The first step was to create an exact sized mock-up of a MoonWalk unit to determine the best placement and configuration for the interior which also had to house a next generation, DIGIMATCH ™ spectrophotometer and the VisualizID 3D colour visualisation software. At the same time, Chelsea Hilsberg, Senior Marketing Specialist, from the Refinish Marketing team at PPG’s headquarters in Clayton, set about designing the eyecatching interior and exterior graphics.

“We wanted to recreate the success of the European MoonVan design but put a local spin on it. We used some cool, lunar landscape images around the van’s interior to help create a sophisticated appearance that invites people inside where the new PPG LINQ technologies are on display,” Hilsberg says. When it came to completing this bespoke vehicle, says Chris Edwards, having a network of customer partners who span a wide variety of di erent sectors, gave PPG the opportunity to tap into organisations that o ered the specific skills, expertise and cando attitude.

“We quickly realised that a lot of this work was quite specialised so it was about getting a number of PPG partners involved who could get the job done to the level required. What is really striking now is the overall quality they have achieved – it ticks all the boxes.”

For decades PPG has been a strong supporter of the TAFE network, including Kangan Institute’s excellent facility at the Automotive Centre of Excellence (ACE) in Melbourne’s Docklands precinct, says Edwards: “When we sounded out the ACE team, they were keen to be involved with the MoonVan project. As

a result, a small group of enthusiastic apprentices, led by a TAFE teacher, were given the valuable opportunity to hone their skills on a ‘live’ job. After first removing any unnecessary fittings and trip hazards from the interior, the aim was to cover over the van’s standard ribbed floor. Using an aluminium substrate, they were able to measure up and fabricate a flat floor throughout the rear compartment so that it not only fits neatly, it also looks very classy.”

Centaur Products Australia is one of those companies which you get the feeling could turn its hand to almost

anything. For over three decades it has produced a variety of products and services for the OE automotive and recreational vehicle industries, along with other sectors. More recently, Centaur has been busy manufacturing its range of cleverly designed caravans, as well as innovative ‘Pods’ for police work. These days, the family business is headed up by highly experienced engineer, Al D’Alberto, and his racing driver son, Tony D’Alberto. While the MoonVan project was right up their alley, that doesn’t mean it was a simple job according to Al D’Alberto.

“We have had a very long and mutually successful partnership with PPG so we were more than happy to help out with completing the rear of the van. It was not a simple task because it’s not a flat surface inside the van and there were really no drawings or plans. It was a one o project that used all of our skills in the one job. We have a very strong team and it was a real team e ort that came up with some great solutions. Basically, we incorporated some of the materials we use in our caravans in order to cover some of the more complex areas. Using a conventional method would have meant boxing out a lot of

the area so we could get flat surfaces but that would have closed the van in and made it feel smaller. Instead, we used what we call a soft feel material which is a marine grade material, to fit directly over the complex areas of the van’s internal surfaces. When you look at this job, it’s a bit hard to be modest because it’s such a great fit out. It has turned out to be a showpiece for what our business is capable of.”

True to its name, FleetMark is responsible for leaving a high-quality mark on fleets of all shapes and sizes. FleetMark Group General Manager Stuart Farrow, says its fleet branding expertise leans more towards livery on large transport vehicles for wellknown names such as Linfox, Toll, Coles, Woolworths and Metro Trains but applying marketing graphics to MoonVan definitely fell into its regular scope of work.

“With fleet graphics, we have all the design and printing capabilities in-house, along with the skills needed to apply it, “ Farrow says. “We have had a 30-year partnership with PPG so it was nice to be part of the MoonVan project. Preparation is one of the keys to these jobs. We use specific materials to clean the vehicle and ensure there

is no residue that could a ect the end result. Once we have approval for the graphics, we print it onto high quality adhesive film and laminate it with a protective layer that shields the graphics from things like UV, washing degradation and scratching, before applying it to the vehicle. It’s a specialised process and we have

skilled people who manipulate the onedimensional graphics onto the threedimensional curves and recesses of a vehicle. They are almost artists who have an amazing feel for what they do.”

MoonVan mobility provides a PPG LINQ to customers

With its ability to travel far and wide, MoonVan is giving the PPG team a unique tool for generating extra excitement about the new technologies which have been so neatly packaged inside, says John Hristias, PPG Refinish Sales Director Australia: “The MoonVan concept is all about reaching more people, particularly those collision centres in regional and rural area. PPG LINQ has sparked enormous curiosity across the Australian market and the mobility of MoonVan helps us meet that demand by taking the technologies directly to individual repairers or groups of repairers, no matter where they are.”

To register your interest in MoonVan or in the PPG LINQ technologies, simply contact your PPG distributor, your PPG territory manager or the PPG Customer Service Hotline on 13 24 24 Aust.

A career in the automotive repair industry is guaranteed to be a challenging endeavour. For the Maher family, this challenge has been met with fierce determination to create a family legacy that is underpinned by loyalty, respect and adaptability.

For 60 years, L&M Smash Repairs has been a Western Sydney institution for automotive repairs. Known for their friendly and fair demeanours, the Maher family have grown and expanded their business over six decades, all while keeping the business in the family name. Bill Maher paved the way for his son, Gary Maher, and his grandson Dan Maher, to excel in the industry.

NCR spoke with Bill’s grandson, Dan Maher, about Bill’s legacy and the evolution of L&M Smash Repairs.

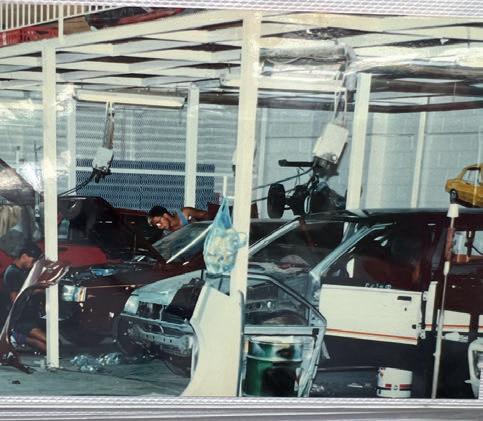

The early stages

The legacy of Bill Maher all began in the mid 1960’s in a backyard in West Pennant Hills in Sydney. From a backyard workshop, to a chook shed in Dural, and finally to a workspace in Seven Hills where it remains today, the history behind L&M Smash Repairs is one to call a true Australian legacy.

Starting from humble beginnings on a flower farm, Bill’s love of automotive quickly took hold, and his pursuit of

success in the industry was driven by strong will and determination.

“He was known for his approach to life. A sort of grabbing life by the horns and giving everything a red-hot go,” Dan says.

“In an industry as tough as ours, it is a real testament that his business is still where it is today, with his family running it,” Dan says.

“For a man that was taken from us over 20 years ago, to hear his name mentioned by clients, assessors, friends, and colleagues, he is a man that certainly left a lasting impression,” Dan says.

Known as a man for making a lasting impression among his clients, friends, and colleagues, Bill was a kind-hearted and generous man that valued respect and loyalty.

“He was a joker, kind-hearted, loud, large and intimidating man. He expected everybody to work hard with early starts and over time including late nights, he was always driven to be successful,” Dan says.

With a rocky start in business, Bill made the most of the cards he was dealt, after his business partner pulled the pin shortly after the business was established.

“The most creative business name they could come up with was L&M. After Leeds pulled the pin, Bill had only just paid for the new carbon copy invoicing books with the L&M name printed all through them, so changing the name was never an option,” Dan says.

So, the business remained as L&M Smash Repairs, and Bill’s desire for success grew even more.

From simple beginnings repairing and restoring old Holdens and caravans, to picking up contracts with local dealerships, Bill always had a vision for the future.

“Pop would send Dad overseas to train and to scout for new equipment and repair technology,” Dan says.

“That process has been carried on and continued over the years and has gotten us to where we are today, with highly trained sta in a facility filled with the latest equipment and technology.”

Known for his loud, proud, and in-charge personality, Bill made sure the workshop was a family a air.

“Just about all of the family has been involved in the business in one way or another. It has employed all of my aunties, my uncles, cousins, and brother,” Dan says.

“It has always been about “the family” and that all stared with Nan and Pop.”

For a brief period of time, the three generations of Maher’s, Bill, Gary (Bill’s son) and Dan, worked together from 2002-2003. Before Bill’s health took a turn, Dan was a first-year apprentice under Bill and Gary’s guidance.

“I do like listening to everybody’s stories about Bill. People sometimes draw some parallels between us, I reckon we would have worked well together,” Dan says.

An old school mindset of working hard and earning respect was, and still is a strong value at L&M Smash Repairs.

“Being a driven businessman, he expected his workers to work hard. He was an early riser so that meant everybody else was too,” Dan says.

“But to those that did right by Bill earned a spot at his table and were rewarded with his friendship and approval which was a coveted label.”

Bill’s ability to connect with both customers and strangers made him a respected and likeable man. He created a rapport with customers that resulted in a loyal client base.

“Everyone said Bill had the gift of the gab, everybody even complete strangers ended up being his ‘little buddy,’” Dan says.

“He would learn the languages of the local migrant residents in Western

Sydney and he prided himself on knowing how to say ‘hello’ in many di erent tongues. His signature ‘gratzi’ in his loud, deep, thick Australian accent still rings in my ears to this day.”

Rolling with the times

If there is anything that L&M Smash Repairs has done well, it is adapting to the climate of the time. From 1970 to 2000, the industry underwent significant changes, from technology, to equipment, to the creation of the internet, change was never too far away.

Being ahead of the competition was another strong suit of Bill’s. By embracing change and adapting quickly, he always attracted new sta who were willing to be part of the energy he brought to his workshop.

“Back in those days finding sta wasn’t an issue, we would have people knocking on the door every day

looking for a start at L&M,” Dan says.

“Having the right team in each department was his key. With Dad in the o ce running things, blokes like Harry Pearce overseeing Panel Shop Operations and high-level long-term painters like Roy Freeman and Andy Maglecic running the Paint Shop, operating a successful collision shop has always come down to having the right people.”

Dan, and his father, have continued the Maher name in the automotive repair industry. L&M Smash Repairs currently employs 19 full time sta , and five apprentices.

Like Bill, Dan makes sure that he gives clients the same face to face engagement that initially made the workshop a local success.

“I make sure people get that personal touch,” Dan says.

Even though Dan has been running the show for a few years, the progression from apprentice to tradesman was a memorable moment for Dan.

“I remember it like it was yesterday.

On day one, I asked Pop ‘ok mate which car you want me to fix?’. Dad laughed and said, ‘You’re not fixing anything, go sweep the workshop out.’ Plot twist, my OCD liked sweeping and cleaning so it wasn’t so bad for me,” Dan says. Dan’s drive to be the best in

the workshop fuelled his desire to learn everything he could about the automotive trade. However, it took him a few years to be on an even playing field with the rest of the tradesmen.

“When started doing the repairs I’d find myself dripping in sweat, making a mess, covered in dust and oil. I’d look over at my tradesmen and they’d be cool, calm, clean and have finished their job. I wanted to be better than all of them,” Dan says.

One day, everything clicked into gear, and Dan’s persistence paid o “Fast forward a few years, and was repairing a chassis with my tradesman, and we were having a hard time agreeing on what needed to be done to fix the issue,” Dan says.

“We went on and on about it so we measured it and I was right, he was wrong, so that made me the best and smartest tradesman in the world.”

“I have never considered doing anything else outside of being a panel beater. It was more of a birth right.”

L&M Smash Repairs has garnered an impressive resume, with a perfect 5-star score on Google Reviews, to investments in the latest technology, to achieving I-CAR Gold Class Status.

“My Mrs won’t even grab a co ee from a café unless it has 4.5 stars or more,” Dan says.

“Engaging the customers from the

earliest stages and extracting their actual needs is the key to meeting their expectations. We ask them to submit their feedback once the repair is done, and we are happy with the comments we receive.”

With quality customer service, a loyal workforce, training, and specialist services at the forefront of the shop, the business is a united front.

The workshop has been I-CAR Gold Class Accredited since 2006, and is an EV certified repairer. The shop is also OEM trained for Subaru and General Motors.

“We have tooled and trained for electric vehicles. But with EV sales dropping who knows where that market is headed. Regardless, there are tens of thousands of them already on the road and we are already prepared to take on that market,” Dan says.

With jobs relocated to L&M Smash Repairs from all over Sydney, they have made a name for themselves as some of the best in the industry.

Dan highlights how the team is the glue for the smooth operations of the business.

“We have highly trained long-term employees we look after, invest in and reward. Mark and have been here for 22 years. We have long termers who have been with us for over 15 years. Building a strong team is the key to success in business,” Dan says.

Advocates

L&M Smash Repairs’ mission statement is to provide the best possible collision repair and automotive services following three key objectives; repair quality, estimate accuracy, and speed of repairs, all at a fair and reasonable cost.

“We are 100 per cent an independent repairer,” Dan says.

“We are advocates for the industry and are pushing for realistic labour rates, better processes, improved standards and licencing to help lift the average quality of collision repairs and safety standards to benefit the consumer.”

The current climate in the automotive industry makes business growth a point of contention for many workshops. With the sustainability of the industry without reform and with apprentice numbers

and sign-up rates dwindling, and over 45,000 tradesmen short nationally, expansion is a di cult bet to make.

“One day I’d like to consider relocating to a larger and newer facility to expand our fleet repair service. I’d like to keep our workshop on Station Road and turn it into a restoration facility,”

Dan says.

The skills shortage is making it harder for workshops to find both qualified and entry level workers.

“During the pandemic we had an ad on Seek for a panel beater for 12 months and the salary figure was unlimited. We had zero applications,” Dan says.

“Apprentice numbers have collapsed and TAFEs in Western Sydney have all been shut down,” Dan says.

“We have two workers from the Philippines, who are both still with us. They have filled gaps in our labour supply, but international workers aren’t a long-term sustainable answer to the shortage.”

“We have 5 apprentices that we are getting up to speed. We are making room for the next generation of bodyshop experts.”

“Shops that don’t have any apprentices need to have a long hard look in the mirror in my opinion,”

Dan says.

Remaining true to legacy

Staying true to Bill’s legacy on creating a respectable working environment is something that Dan Maher still taps into in 2024.

“It’s a matter of ‘if they look after you, then look after them’ kind of deal,” Dan says.

“Sta that meet our expectations are rewarded with bonuses, events, holidays, 2 yearly pay rise opportunities, and the ability to progress within the business.”

“Our sta are along for the ride. We want to share our success with our sta , without them we have no product, service or business.”

Daniel Maher’s advice for young business owners entering into the repair industry rings true to the strong family values that were cemented by Bill.

“Run a profitable business, not a revenue generating business. Revenue is vanity, Profit is sanity.”

Major challenges in the years to come with technology and recruitment, as well as some incremental steps to meet these challenges, were all on the table at the key repair industry gathering, Symposium24, hosted by NCR.

Where the industry is heading

The first speaker of the day was the Motor Trades Association of Australia’s (MTAA) chief executive, Matt Hobbs. Stepping into the MTAA chief executive role in January, Matt Hobbs has paved his own way for making a mark in the industry.

The MTAA represents autobody associations across the six Australian states and two territories.

Hobbs brings a breadth of experience in the automotive industry, including senior executive roles with GM Holden, General Motors and Nissan Motors internationally.

Hobbs wants an incentive system that provides assurance and stability to businesses and encourages them to reengage in the apprenticeship and traineeship system and the incentive scheme was critical in helping o set additional costs.

“With the advocacy and the training we

do, as well as our apprentice programs, either directly or indirectly, the MTAA is a great place for businesses to get advice, people and to develop skills across the whole sector,” Hobbs says.

He says the MTAA are advocates for the whole industry, and will continue to support repair shops in navigating a new electric future.

Hobbs outlined the key issues in the industry, identifying the lack of infrastructure in place to support an EV transition, the lack of EV skills with some repairers, and the overall skills shortages as the main challenges.

He also rea rmed the reinvigoration of the Australian Motor Body Repairers Association (AMBRA).

Hobbs spoke about the National Vehicle E ciency Scheme (NVES) and the Insurance Council of Australia EV report, emphasising the changes in Australia’s car parc may take a few years but repairers needed to be ready.

“The industry as an eco-system needs to be ready to repair these cars,” Hobbs says.

“EVs are being written o at a much higher rate than other vehicles. Partly because of the technology, partly because of the batteries and the cost to repair them.”

Hobbs also highlighted the disconnect between the car companies and government regulations. Hobbs ensured the audience that the MTAA are there to support the industry.

The MTAA are conducting research into forecasting what the future of Australia’s car parc will look like.

The research has shown the growth of Chinese electric vehicle companies such as BYD, and the unpredictability of car companies’ policies.

“There are so many new Chinese electric vehicles companies coming. We have also seen car companies deviate from what we thought they would do. For

example, Toyota announced recently that they will only sell Hybrids for passenger cars,” Hobbs says.

The MTAA has commissioned a Body Repair Education Series that will be released in six parts each month, starting in July 2024.

Shining a light into the future

The Symposium was headlined by Repairify’s director of innovation Martin Brown.

Martin Brown has decades of automotive industry experience behind him. Having kept a close eye on the development of technology, Brown drew some valuable insights into where we might be in the years to come.

Repairify has o ces across the world, and has recently set up shop in Australia. With Repairify, you get access to OEM and OEM compatible diagnostic and programming tools, ADAS calibrations and all the help you could need at the touch of a button.

“Repairify has bridged the gap between the OEM’s piece of equipment, the certified technicians, and the diagnostics port. Essentially, we aim to reduce key2key time,” Brown says. For an industry veteran who can recall when the most sophisticated thing in a car was the electric windows, Brown is still amazed but undaunted by the ever-increasing sophistication of modern vehicles.

“There is a certain level of investment required in collision centres to prepare for all of the tasks, such as ADAS, and the programming of new modules,” Brown says.

The investment in the expertise and equipment to be ADAS ready holds a valuable lesson for Australia where it is rapidly emerging, as an opportunity for workshops to embrace it.

“The technical data and repair information tends to come out a little bit slower with deals imported from new markets and manufacturers,” Brown says.

“Being prepared and equipped with the right resources for the new technology is essential.”

Brown emphasised the importance for workshops to identify the challenges and new technology in

the automotive industry will bring.

“Now’s the time to get in on this because if you’re going to invest now, then you are in a good place to take on the work, perhaps also for other collision centres around you and make sure that you recoup the investment relatively quickly.”

The gathering also heard that the MVIRI Code of Conduct, the key governing document between insurers and repairers will shortly be rewritten and open for industry consultation.

The chair of the Code of Conduct Committee Stephen Jenkins who is also chief legal counsel for the MTA NSW emphasised the rapid change the repair industry is undergoing and the need for a functioning and relevant document adding clear and known parameters to insurers and workshops.

“This industry is completely flipping in the space of a few years,” Jenkins says.

“For small businesses the (current Code of Conduct) document is old, it’s complicated and doesn’t serve its purpose, more importantly it doesn’t serve the purpose of repair businesses over the next 10-15 years.”

He said the pace of change and the influx of new technology, as for instance with new entry of multiple new Chinese automotive brands, made an outdated Code even more pressing.

“What’s it going to look like in a fiveyear’s time? And yet we are bringing technology into the industry now that isn’t even documented yet and repairers still have to make it work.”

Jenkins hopes a legal firm commissioned to rewrite the code will be appointed before the end of the June and that following consultation period a finalised new code could be ready by the end of the year.

But he said the success of the code depends on the insurers and repairers collaborating and emphasised the importance of feedback from all sectors of the industry during the consultation period, likely to occur during this quarter of 2024.

The Symposium was designed to be an interactive and innovative day that allowed professionals and experts from an array of di erent backgrounds to talk about their perspectives on the industry.

The Technology in Collision: Challenges and Opportunities panel covered the topical issues of facing the collision repair industry.

The panel consisted of founding director of ADAS Solutions, Adrian Parkes, Motor Traders’ Association of NSW, RTO compliance and operations manager Anthony Tomassetti and Hella Gutmann ADAS Calibration Equipment territory manager Steven Hine.

The panel of three discussed the challenges and opportunities from their unique perspectives in the industry.

Anthony Tomassetti’s main concern for the industry was the increasing level of skills gaps and the lack of education and ongoing training for repair technicians.

“At the MTA NSW, we are aiming to grow both the collision repair industry and businesses. The new technology requires training and upskilling, it is vital for the future of the industry,” Tomassetti says.

Stephen Hine identified the major trends in the industry as not only the ADAS calibrations, but also the interconnectivity of vehicles to other vehicles, to infrastructure and to networks.

“The new technology is a challenge, but it is also an opportunity to learn and grow in the uncertain areas that are presented in the industry at this moment,” Hine says.

“When you are an early adopter, you can be at the forefront of the change.”

Adrian Parkes highlighted the shortage of industry training outside of TAFE and institutions.

“Learning about ADAS and other technological advancements is something you cannot learn at TAFE. There is limited training in Australia. In

the United Kingdom there is a di erent methodology around industry training,” Parkes says.

The lack of a pathway for the industry after TAFE is an area that Parkes said needs to be improved for the Australian collision repair workforce.

“At ADAS we partner with the MTAA for training on the new systems, however the uptake for training is not very good,” Parkes says.

Although there are skills shortages and a lack of uptake in upskilling in the industry, there are education opportunities that are addressing these challenges.

“It is good to know that the issues are being addressed. The access to the high tech equipment and knowing that help is there in the industry is a positive step. However, it is not in the numbers there needs to be,” Hine says.

The panel were united in agreeing on the ongoing level of training that is needed in the industry.

Finding the right people to fill the gaps

The Skills Gap and Recruitment: Issues and Solutions panel saw five industry veterans take to the stage to discuss the potential answers to the nation-wide recruitment issue. The session was MC’d by ACIA’s Rob Bartlett.

The panellists were Mark Lockwood from Capricorn Society, AMA Group chief people o cer, Alison Laing, 3M Collision Repair Specialist and Educator, James Lawson, AutoRecruiter managing director, Fred Molloy, and TAFE NSW autobody repair and surface coatings teacher, Carl Tinsley.

Capricorn is a member driven organisation that currently has 29,000 members and over 2,000 of those are in the collision industry.

“We are a voice for our members to ensure their voices are heard,” Lockwood says.

“From our market research, it is evident that sta retention and recruitment is a challenge. We are very much about maintaining homegrown talent.”

“At Capricorn we are always trying to make sure we connect our members

in the best way possible for their businesses.”

Alison Laing has been in the industry for over thirty years and emphasised the struggle in recruiting sta over the past 12 months.

“At the AMA Group we think about how we approach our team under a couple of di erent pillars. First and foremost is about our team being safe both physically and mentally,” Laing says.

“We also think about how we attract and develop future and current team members. We also think about our leadership style, and how we engage our team and keep them connected. Reward is also important,” Laing says.

James Lawson outlined how 3M wants to be a support for the industry as it navigates the skills shortages.

“At 3M we try to drive e ciency in the workshops. We try to drive up productivity with the people who are already in the industry to maximise and celebrate what is already there,” Lawson says.

Carl Tinsley emphasised the barriers for apprentices entering the automotive industry.

“It isn’t about recent school graduates not entering into TAFE, it is that they aren’t choosing our industry to enter into,” Tinsley says.

“The students who come to TAFE from school are usually the disruptive ones in class. A proportion of them also have learning di culties. However, we find that once we get them enrolled in a hands-on environment, they take on a whole new attitude which is great to see.”

“Mentors are so important, students want training and socialisation. We need to find a way to provide that in the workplace.”

Fred Molloy recruits across di erent sectors, including automotive, and he highlighted the industry as the most challenging to recruit.

“The collision repair industry needs the international workers. Workshops need to plan ahead for recruiting overseas workers,” Molloy says.

“Long term planning is essential. Being aware of the visa requirements and procedures is important in making sure that workshops aren’t continually short of sta .”

A new ACIA report has highlighted the severity of the skills gap in the repair industry, showing more than half of advertised jobs remain unfilled. But the literature review also gives a sharper focus to what may be causing the problems of retention and where solutions may lie.

The Australian Collision Industry Alliance conducted the study in collaboration with Gri th University Business School as a key part of its strategy to assess the gravity of the problem and develop solutions for the collision repair industry.

It found only 44 per cent of advertised jobs in the automotive industry were filled in the past year.

The report, a literature review, was commissioned by ACIA and conducted by the Centre for Work, Organisation and Well Being at Gri th University under Professor Paula Brough and her team. It is the first stage of a major research program aimed at capturing a clear picture of the current industry.

Professor Brough described the combinations of the loss of experienced technicians, older workers retiring or moving on and an early drop-o rate for new apprentices as “alarming”.

The report, authored by Brough along with Professor Ashlea Troth and others, studied existing workplace literature to establish the key causes and costs of

this high turnover and to categorise the driving forces undermining retention.

The study looks at a wide range of reports on turnover trends for the industry including the AAAA’s that found half of all workshops lost a technician in 2022 and a Labour Market Update from Skills Australia that found vacancies filled for Automotive and Engineering Trades Workers fell from 43 per cent in 2021, to 27 per cent in 2022.

The report says an 11 per cent growth in the number of shops and worldwide pressure for the skills would also exacerbate the issue into the future. ACIA board member Sarah Moynihan who is also Head of People, Culture & Change at Fortress Collision Repair Services says the report concentrated the known experience of many industries on sta ng issues and gave

Images: ACIA.

training opportunities, flexible hours, and the use of the workshop out of hours not o ered by one in three workshops.

Moynihan said the work environment element alone had many complex facets including a culture of mentoring and training, work-life balance as well as diversity and how people feel at work.

“People want more from their workplace, so we wanted to advise the collision industry on the best way to do this,” she says.

Moynihan says each group subject to high turnover, whether they were experienced workers or uncompleted apprenticeships, need investigation and tailored solutions.

“We can all see what the

is,” Moynihan told a presentation at NCR’s Symposium24.

“We need specific answers, and we need the evidence to explain the ‘why’. If we understand the barriers, we can identify the strategies to overcome them. As for example, having career pathways implemented at large and small workshops.”

The report identified two groups of factors that directly impact employee turnover and retention in this industry, Work Environment Characteristics and Employee Characteristics.

Out of the diverse reasons for turnover, the report also identifies eight key areas where the problems can be addressed including, pay, bonuses, flexible work hours, training management style, career paths and a special attention to Gen Y workers.

The report recommends to increase retention, the dissatisfaction factors that current employees have with aspects of their workplace need to be identified and addressed.

It identified; “While a stand-alone ‘piece rate’ reward structure was identified as not helpful, it could be considered further for the Australian context as an additional incentive to base pay.”

But it also found non-cash benefits at workshops were widely underutilised, with other solutions including industry

“A lot of young people want to excel very quickly so a four-year apprenticeship makes it very di cult particularly on lower wages, so how we can support them will be important.”

Brough noted in the report the female workforce was an often-untapped resource but also noted it could be a business opportunity.

Brough cited the example of a repair workshop in Bristol, UK that is sta ed by all female technicians and this sends a strong message to its clientele and prospective recruits that has proved successful.

“Having a diverse workforce is a reflection of a diverse customer base,” she says.

But she says what these models look like in Australia needed further investigation.

“We could see there were examples across Australia (of improved and diverse culture) but how far that has

been developed and to what extant was not clear. We asked, is this an example that should be championed?”

The report recommended that the exact steps to take and what ‘success’ looks like should frame future action. It will need to establish how much of the advice industry is utilising now, where the hotspots are for high turnover and what successful examples of counteracting these look like.

The ACIA has reported that the next stages in the long-term research program will conduct in-field data capture and analysis, benchmarking, policy review, recommendations, and best practice identification and information.

The ACIA and Gri th University are currently working on scoping phase two of the research program, which will be a deep dive on the specific factors raised by the phase one literature review.

“Members of the ACIA want to know what works ultimately, rather than throwing hopeful darts at the problem,” Moynihan says. “With a multi-phase report program, we can narrow the focus to just those things that work, and those things that are really getting in the way of the sustainability of the industry’s workforce needs.”

“Good information is so vital to making cost e ective decisions about programs and industry support. The ACIA is committed to making this information freely available to the industry and stakeholders, as it continues to develop its role in promoting the collision industry as a great place to have a long term and varied career.”

1. Identigy what the industry is doing now to address retention.

2. Identify places and occupations of acute need for employee recruitment and retention.

3. What is working? Identify instances of best practices for recruitment and retention.

4. Trial best practices in turnover ‘hotspots’

5. Consider wider policy context including skilled migration and training.

Source: ACIA report/ Gri th University

Sta retention and employee satisfaction are some of the key elements of a thriving workplace and a new style of leadership could be the answer to achieving it.

In an environment of sta ng shortages, retention issues and wage inflation, the collision repair industry faces a critical question: how do we do things di erently to overcome these challenges?

The Axalta Drivus team, renowned for its work on business improvement, has been working with customers to address sta ng issues, focusing on how to build a stable and reliable team. Axalta Drivus Business Manager for Australia and New Zealand, Robin Taylor, is passionate about the topic and finding solutions for businesses.

“I often see a command-style leadership in many of the shops I visit. It’s directive, autocratic, fixated on task e ciency - and not utilising the team’s full potential.”

At the core of the Axalta Drivus team’s work is the cultivation of a coaching culture—a paradigm shift away from short-term fixes toward

empowering management with the skills to champion sta retention and establish themselves as employers of choice.

But what exactly is a coaching culture? Picture a bodyshop where team member’s skills are harnessed, supporting one another, exchanging expertise, and proposing solutions.

The most reported benefits of a coaching culture are enhanced team and employee performance and higher retention rates of valued sta . This ultimately leads to increased productivity and profitability.

“Coaching requires us to change our approach and the way we think about our people, to recognise and understand they have more potential than their current performance,” Robin says.

The Axalta Drivus team encourage all business owners to reflect on their own business: Which employees have

the Axalta Drivus team are running a “Coaching for Performance” workshop throughout Australia and New Zealand over the coming months. This course is open to any repairer who is interested in transforming their workplace, one coaching session at a time.

For more information visit axalta.au/drivustraining

Skilled migration is often seen as a solution to ongoing recruitment issues, but few would see it as a simple solution. Fix Auto Morley and Fix Auto Malaga City owner Travis Arnold shows thinking and investing long-term can yield better results.

In Western Australia the skills and the housing crisis seem to have combined into a perfect storm. On one hand, immigration is often blamed for housing issues but there is a deficit of skills needed to build new housing. The automotive repair industry is feeling the skills shortage acutely but even if it arranges skilled immigrants to fill the vital roles, the housing crisis means they may have nowhere to live when they arrive.

For Travis Arnold this is the nub of the problem and he embarked on an innovative and dedicated journey to find his own solutions. This began not only with him investing in a trip to the Philippines in 2022 to make sure the best -possible recruits were secured but to some unusual commitment to ensure they are housed and happy when they are here.

The expense, red tape and delays of utilising skilled migration as an answer to the recruitment challenges, was in some ways only the first problem for Travis Arnold, which came down to the critical issue of housing.

“The problem is that trying to get a rental is flat out impossible at the moment. I think our vacancy rate is like less than one per cent,” he says. With single bedroom flats often beyond the price range of new workers, they must find shared accommodation from the few options available or look to their employer to help find a place.

“The houses that I’ve rented, just had to pay the whole six-month lease in advance,” he says.

Travis says this adds to the risk for the business owners if there are delays in the skilled workers arriving from overseas or

if their situations don’t work out and they go home, leaving gaps in accommodation that still must be paid for.

“I’ve gone and rented a couple of properties, and the rents have since gone up by 20 per cent.”

But in an e ort to protect the workers from being overwhelmed by this housing crisis when they pay for their own accommodation, Travis has not passed on the rent increases.

“I want their first experience in Australia to be a good one, I don’t want these guys to come over and say, what’s the point of being here with this cost of

living, I may as well just go home.”

Travis sees the issue of housing as so critical to worker stability and retention that he has decided to invest significantly in their support.

“The short-term solution is I’ve actually decided to cover the di erence in the increase. The long term is, we’ve just invested in a development block.”

This bold plan involves investing in a central block in Perth, that has a house on it that can accommodate the first of his workers, who has been with him for more than a year. Then he plans to subdivide the land and build units that have

the potential to house up to six other Filipino workers.

Travis believes the housing issue in Perth is likely to be a long-term one and the investment in housing, though substantial is worthwhile.

The stability of the housing has the added advantage of giving stability to the workers and a sense of permanence, he says. This is vitally important for workers so far from their homeland and families, particularly when cultures like those of the Philippines are so family centred.

“The long-time plan is, I can rent these properties to these guys so they can actually have an opportunity to bring their families here.”

Having his workers together in relative proximity not only helps overcome loneliness and isolation but helps them support one another and begin to imagine a long-term future in Australia.

“I said to them in the long term, you and your families could all be living next door to each other, and they are happy about that. A few years down the track and they can see they will all sort of stay together, like the kids can go to school in the same suburb so on, which I think is pretty important to them.

“We invest all this money and all this e ort into bringing these guys out and retraining them and trying to get skill sets up to the Australian standard. It’s a lot of money and you don’t want it just to fall over because these guys can’t fulfil their dream of bringing their family out or even getting a rental.”

True to ethos of the Fix Auto Network, which encourages the values of a family run business, Travis tries to embed this

in the lives of his sta based on the principle that those happiest in their work will give the most back.

“It is very much like a family business, especially for these guys that are living together. They’ve got a car which they share and pick each other up,” he says.

“But It’s bigger than just providing a happy workplace, you’ve got to try and give these guys a supportive environment and not just these guys, the local guys and the apprentices. You want to try and make sure that they’ve got a happy life outside of work, so they’re happy at work.”

While there are many factors outside of work that are beyond the control of a business owner, building the basics of a support and stability can not only ensure the skilled migrants stay for the long term but encourage the best attitudes at work and a commitment to developing.

These are the qualities crucial to Travis in deciding how he chooses the recruits.

“Because smash repairs is a team sport. We all do it di erently, but to me, it’s very much about attitude and being a team player over ability. I’d rather have someone with a little less ability that has a good team work ethic. It goes a lot further. And when you’re trying to instil all these processes in place, if you’ve got long-term guys, it’s far, far better.”

This is why he has focussed on keeping his workers for the longer term

and along with a focus on in-house training and development that benefits the workers and potentially the business into the future.

“The other thing is there’s obviously opportunities for growth. There’s always going to be need for a production manager or an estimator or a parts manager and so on. I’d always rather recruit those positions from within and from people that know the business.”

Travis is the first to say the whole process of getting skilled workers is not simple or quick, but he does believe it o ers solutions for businesses willing to dedicate the time and e ort.

“The amount you pay per person to get them over, can be quite costly. I think if you’re going to look at this long term, you need to start investing in property, which is hard and people are going to say, that’s a lot of risk. But getting into business to start with is a lot of risk. The risk factor never goes away.

“If you can take a really long-term approach, figured you can’t lose long term on residential property. If businesses can be in a position where they can do that, they will also have their own housing and accommodation. I’d recommend it, it’s worked for me, and I want to continue on with the programme.”

With more than two decades experience in the automotive industry, David Azzopardi represents the diverse and changing career pathways the industry can o er and the organisations, like SAPE Group, that can make them happen.

David Azzopardi recently culminated his decades in the automotive repair industry with a step into management at the SAPE Group, but the journey has been cumulative and brings with it the original passion he had for automotive and ensuring repairs are done right.

“I got into the automotive repair industry because I’ve always been passionate about cars, especially their paintwork. Fixing up paint problems and seeing the joy on customers’ faces when they got their vehicles back looking as good as new was a big motivation for me.”

The journey in the automotive repair industry began back in 2000 with a four-year apprenticeship at Linbar Smash. He then worked at Medicar

Revesby before completing stints at Hills Repair Facility Seven Hills with John Guest before joining Capital Smart under the new management of Jim Vais and Trifon Vais. He then worked at MVR Motor Vehicle Repairs with Vince Ruggiero.

This experience and diversity then set him up to embark on more technical specialisation with the SAPE Group, where he specialised in di erent paint systems like Glasurit, Baslac, Spies Hecker, Cromax, Duxone, and HB Body.

Not alone

Key to his development has been the support along the way, something he says he has found a particularly strong part of the culture at the SAPE Group.

“SAPE stands out because they’re really dedicated to helping their employees grow and making sure their customers are happy. They’ve always been there for me, answering my questions and supporting me whenever I needed it, which has really helped me grow both personally and professionally.

“The pivotal moment that propelled me towards a management role was the realization of the opportunity to not only expand my professional horizons but also to contribute to the growth of the organization, implement systemic improvements, and acquire new knowledge.

Azzopardi singles out Tony Maher, National Sales Manager at the SAPE Group, as a particularly valuable mentor on this journey.

“He has been a major inspiration to me in my career. Over the years, he’s o ered constant support and priceless guidance, really helping to shape the path I’ve taken in my professional life.”

brand and trusted support

Azzopardi believes given the challenges repair shops face, the need to back them up with expertise and support is one of the strongest opportunities to build partnerships and growth.

“Repair shops often struggle with issues like pricing, getting support when they need it, and getting timely assistance,” he says.

“SAPE really tackles these problems head-on by making sure they o er comprehensive support, building good relationships with their clients,

and coming up with innovative technical solutions to the problems the industry faces.”

He has recently taken on the role of Sales & Technical Manager with the HB BODY brand, products he believes have a great opportunity to grow in Australia,

“My main focus with HB BODY will be on dealing with customer inquiries, giving them thorough support, running training sessions, teaching about our products, and o ering help whenever it’s needed.”

Established and renowned in Europe for more than four decades, HB BODY Group has grown into a leading automotive brand established in 75 countries and o ering one of the widest ranges in the market and Azzopardi can only see this growing in Australia.

“The team behind HB Body is topnotch—they’re experts, dependable, and always ready to lend a hand, which means customers are always happy,” Azzopardi says.

“I’m really excited to dive into this role and help the brand reach its maximum potential.

HB BODY Marketing Director Mariza Vasileiadou says they are delighted to

welcome David as the representative of the HB BODY brand in Australia.

“With his extensive experience and profound expertise in the automotive refinishing industry, David brings a wealth of knowledge and substantial value to our brand. His proven track record and dedication make him invaluable to our team,” she says.

“This strategic partnership with the SAPE Group marks a significant milestone in our e orts to enhance our global presence. We are confident that this collaboration will enable us to expand our reach, strengthen our market position, and deliver exceptional products and services to our customers in Australia.”

One of David Azzopardi’s firm convictions garnered from the decades of experience and key to his future role, is a belief in building ongoing professional relationships.

“Good relationships are super important; they help suppliers and customers work together smoothly. When you have strong relationships, it builds trust, makes communication easier, and in the end, results in better service.”

If the commitment and expertise of young automotive trainees was ever in doubt, four intense days at Melbourne’s Kangan Institute should inspire confidence in the next generation of spray technicians.

Leading automotive training centre, Kangan Institute hosted a special delegation from six nations across the Asia Pacific region last month, who with the support of BASF were preparing for the global WorldSkills in France in September.

The Global Skills Challenge serves as a platform for young professionals to not only demonstrate but test their expertise in a host of fields, including automotive refinishing at the highest level.

The super-skilled youngsters from a diverse range of countries, including Japan, Korea, Taipei, UAE and Australia were each accompanied by a specialist and a translator in preparation for the grand final event in Lyon.

BASF has reciprocated this commitment hosting the nations with the opportunity to use and grow familiar with their premium refinish range of products, including Glasurit AraClass EcoBalance clearcoats and undercoats and the Glasurit 100 Line basecoat system.

BASF is also giving them access not only to its RCC centre in Sydney but also to spend time in their headquarters in Munster, Germany to prepare for this year’s global event.

Multiple painting and finishing tasks over the four days of preparation, including colour matching and finishing specific tasks like new guards and new bonnets, were critically assessed by the team experts. Some of these tasks involved intense six-hour days but competitors took it all in their stride.

BASF Asia Pacific Training & Services Manager, James Green, says the young technicians all shared an outstanding commitment to make the most of the challenges the competition opened up for them.

“This is not only an opportunity for them to use Glasurit’s eco-e ective range of products, but more importantly it’s about getting them competition ready,” he says.

He says the six nations brought candidates who were highly competitive, and career focussed with many of the contestants training full time compared to an industry aligned partnership such as an apprentice system.

James believes the excitement and the rewards of competition are a valuable way to foster engagement for young people in the trades and highlights the passion driving some of the best future talent.

“It all depends on how much time they can invest into developing their skills and knowledge in refinish products and processes,” James says. BASF o ers candidates the hours for training and practice, along with TAFE o ering extra hours per week.

It takes commitment but James says competition can be career confirming for the disciplined and skilled.

“As someone training the next generation of refinish technicians, you have to make it fun, but you also have to obtain a high level of engagement.”

The WorldSkills is also developing its green credentials, and this fits well with BASF’s movement toward eco-friendly products for the automotive industry.

“Part of the plan is for WorldSkills to have a global and environmentally sustainable competition, and this is why supplying Glasurit’s latest eco-e ective range of clearcoats and undercoats has been ideal,” BASF head of coatings ANZ, Kishen Khosa says.

Kishen says BASF are passionate about supporting events like the Global Skills Challenge that nurture and celebrate emerging talent in the automotive industry

Flying the flag for Australia is third year apprentice, Kynan Bonnani from Boxalls Automotive Industries in Pendle Hill, NSW who demonstrates that

artisan-like passion for the quality of his work.

“It’s all about seeing that final finish,” Kynan says.

“Some panel repairers talk about the feeling of a finished job but for a painter it’s even better, once you see a that shiny paint, it is something else.”

Kynan says he has inherited a passion for automotive from his father who owns and runs Boxalls and is eager to learn more as the industry changes.

He says the competition was an ideal way to work with Glasurit’s water-based products and sees it as a direction for the future.

“It’s better for the environment and it is the way everyone is going.

Over in Europe everyone is using water-based products.”

BASF will be the exclusive sponsor for the Car Painting category, where 24 countries are registered to compete.

They will also be the global silver partner of the WorldSkills Competition with its premium refinish paint brand Glasurit.

From September 10–15, over 1,500 participants from more than 65 countries will compete in 62 skill competitions at WorldSkills Lyon 2024 to promote worldwide vocational education and training, whilst showcasing current and future employment needs.

Yuto Hoshino, 22-year-old participant from the Aichi Province in Japan, says it is all about honing his skills.

While working at Toyota in Japan, Hoshino was told he had a talent for car painting, and that is what encouraged him to join the WorldSkills Competition.

“I had no experience in painting before working in the automotive industry, but I am really enjoying it so far. At the moment, I am dedicating all my time to training for the Competition,” Hoshino says.

Hoshino and his team, which consists of a translator and a judging expert, are enjoying their stay in Melbourne.

“The people here are nice, everything is very accessible, so we are having a great time here.”

Hoshino praised the facilities on o er at the Kangan Institute.

“It is a great institute with the spray painting and drying booths, it is well equipped for what we do,” Hoshino says.

“The only thing missing is Japan’s humidity, it is a bit cold in Melbourne!”

The advance and uptake of ADAS systems means few repairs are fully complete without calibrations. The know-how is now a vital part of e cient and safe repairs on modern vehicles.

Distracted driving is continuing to be on the rise, even if the incidence and severity of crashes have shown signs of declining with the rapid adoption of Advanced Driver Assistance Systems (ADAS). Ironically, some drivers’ greater reliance on ADAS has made them less vigilant. Customers often assume that even when they are preoccupied, the ADAS in their repaired vehicles would keep them safe. This demonstrates how important it is for collision repair specialists to precisely calibrate ADAS in compliance with manufacturer specifications.

In order to handle ADAS repair considerations and calibration methods, I-CAR Australia has been diligently improving its curriculum and materials. We cover both static and dynamic calibrations in our extensive training,

which includes practical sessions. This article explores the need for ADAS training, who should take it, and what our hands-on, virtual, and online courses entail.

Understanding ADAS features

Both driver convenience and vehicle safety elements are included in ADAS systems. These technologies are essential for a variety of tasks, including parallel parking assistance and blind spot detection. Driver monitoring systems that use facial recognition technology to alert drivers who are distracted are among the newest innovations. As ADAS technology advances, more cars will have numerous systems installed, which will increase the frequency of repairs requiring one or more system calibrations. The inconsistent naming of ADAS

functionalities is one of the first issues encountered. Although there are only a few dozen di erent varieties of ADAS, they go by hundreds of names. The vehicle manufacturer may refer to emergency braking systems as precollision system, forward collision warning system, or autonomous emergency braking. It is faster to retrieve service information if you are familiar with the OEM’s special terminology. As a point of reference, the Society of Automotive Engineers (SAE) has established standardised ADAS naming rules in recognition of the necessity for standardisation. Throughout the repair procedure, e ective communication is ensured within your operation by using uniform terminology for the various forms of ADAS.

Consult the vehicle manufacturer’s

service literature to find out where ADAS systems are located on a particular vehicle and when and how calibration is needed. A thorough grasp of ADAS system operation is essential for guiding repairs, particularly when confirming system performance on a post-calibration test drive. The owner’s manual for the car is another important resource, even though OEM service information also o ers specifics about ADAS functionality and description.

in calibration processes. As a result, the sector is seeing a rise in the number of ADAS professionals. These experts maintain current knowledge of scanning, ADAS repairs, and calibration techniques, guaranteeing precise and e cient calibration procedures.

can compromise ADAS operation. The performance of sensors embedded in a damaged panel, for instance, may be impacted if it is not replaced. Because of this, ADAS-trained personnel are essential to maintaining repair quality and guaranteeing client safety.

calibrated correctly.

Even skilled technicians need to do extensive research before beginning any calibration. Taking into account that a technician can have prior experience, it is crucial to check the OEM website for updates or modifications to repair protocols, guaranteeing precision and compliance with manufacturer guidelines.

Understanding that ADAS calibrations are time-consuming and require specific knowledge, training designed for technicians interested in learning the ins and outs of Advanced Driver Assistance Systems (ADAS) has been developed by I-CAR. While it is necessary for all collision repairers to comprehend ADAS repair issues, it might not be possible for every technician to receive in-depth training

Participants that take part in the many online modules and programs available at I-CAR Australia, as well as our industry training alliance partners, come from a range of backgrounds in the collision repair industry. Although larger companies occasionally assign non-structural professionals to perform calibration responsibilities, workshop management still look for training to ensure their personnel have the necessary skills. Furthermore, understanding calibration processes is crucial when collaborating with other suppliers. High-quality and reliable calibration services are assured when providers are evaluated based on their facilities, documentation practices, and personnel.

In addition, ADAS training has unanticipated advantages for quality control. One of the last quality tests in the repair process is an ADAS calibration, which enables skilled technicians to see any inadequate workmanship that

We encourage experts in the sector to investigate training possibilities provided by our Alliance partners, in addition to I-CAR Australia courses. You can access all the information regarding to ADAS training as well as many other courses associated to the automotive collision industry on or web page. Professionals in the sector must be knowledgeable and current as ADAS methods and technologies continue to develop. Through the utilisation of I-CAR Australia’s training programmes and resources, collision repairers can further develop their proficiency and guarantee superior repairs for their clientele. As we assist you in learning ADAS repair and calibration techniques, we look forward to having you in one of our interactive, virtual, or online classes.

For more information on training courses go to i-car.com.au

With an Apprentice of the Year title under his belt at just 17, Josh Coats proves that you are never too young to start pursuing your dreams.

Specialising as a panel technician, Melbourne native, Josh Coats has made a name for himself as one of the most promising apprentices at the Sheen Group.

At just 17 years old, Josh is halfway through his four-year apprenticeship, and is set to be fully qualified by 19 years old.

With a significant head start in the automotive industry, Josh has set himself up well for navigating the industry once he becomes fully qualified.

Recruitment and retaining sta has been an industry-wide issue. The Sheen Group has focussed on the grass roots level of recruitment, and Josh is one of their success stories.

“I was first introduced to the industry by Tony Todaro from Sheen. Tony came to speak at my school about the opportunities in the repair industry. I thought it sounded really interesting, so gave it a go,” Josh says.

“I did a school-based apprenticeship for a while and as soon as they

could, they signed me up for full-time employment.”

Despite being the first person in his family to enter the automotive industry, Josh embraces the challenges that come his way.

“I like cars and I have always wanted to get into some part of the automotive trades. I was lucky to find a workplace and division of the industry that I enjoyed. I found my spot in the collision repair industry,” Josh says.

“It also helps to like and get along

NCR recognises the ongoing support of IAG for the Future Leader’s series, along with the continued support of I-CAR in developing industry skills.

with the people around you. I like the guys, and they like me.”

With a vast array of skills to learn and develop in everyday work, Josh works alongside other tradesmen as the only apprentice in the workshop.

“I started enjoying the work straight away. I have been lucky to find work that I like and with people that are willing to help me develop my skills,” Josh says.

Josh highlights his tradesman as a guiding figure during his apprenticeship.

“My tradesman, Matt Johnson is someone I look up to. As I gain more experience, he is someone I want to be like. He is a great teacher and has taught me a lot,” Josh says.

“He knows it all and can do a bit of everything. He can spray paint as well being a great teacher in panel beating. I am learning a lot from him. He is a good bloke too which helps.”

With two years’ experience in the industry at 17 years old, Josh’s dedication and determination make him a positive role model for his peers and those looking to get into the industry.

“I have had a few young kids ask me about the industry. I will always encourage people to try it out. My experience has been great so far and I am keen to pass that on,” Josh says.