ACKNOWLEDGED

ACKNOWLEDGED

With the Jollift 1330 Fast Repair Bench you can now equip each work bay with a quality Italian manufactured car bench.

The flexibility of the modular design means that multiple benches can share one pull post, one set of clamps and one set of wheel stands, which makes it totally affordable for each work bay to have its own repair bench.

• 100mm lowered height

• 1300mm lift height

• 3000kg lift capacity

The Jollift Flat Line NM65 is a cutting-edge vehicle lift redefining industry standards. Crafted with precision in Italy, this powerhouse boasts a lift capacity of 3000kg, effortlessly handling various vehicle types.

With a sleek lowered height of just 65mm, it offers unparalleled accessibility for low-profile vehicles.

The National Collision Repairer doesn’t like to shy away from looking at the issues faced by the industry. Almost two thirds of the way through 2024 and many of these challenges don’t appear to have got much easier. Whether it is grappling with tightening margins, staring down the barrel of advancing technology or tackling the long, slow quest to get skilled sta , there appears to be no easy fi x.

But with each of these problems it is important to remember workshops are not alone. Professional business services, associations and groups, even the shop down the road, all have a surprising number of resources to help willing businesses take on these problems and thrive.

At NCR we have always felt that these pages are a mirror to the industry and can also portray some of its successes and achievements. Not least of these are the stories of the many people who encounter these challenges, often on a daily basis, but with a combination of innovation, commitment and energy, fi nd ways to overcome them. These too can be of assistance. The celebration of role models is fi tting in an industry that is too often overlooked for its vital role in keeping things moving. In addition, these stories can also form a salutary example that inspires others to try new ideas or new approaches.

The many networks and groups repairers belong to can often serve the same inspiring purpose. There may be much to complain about but there is also much worth celebrating.

In this edition, we sit down with retiring Capricorn CEO David

Fraser. His story is a good example of someone who refl ects the culture of an organisation whose fundamental aim is helping its members. If ‘Stronger Together’ is a catchy slogan, its real weight lies in how e ectively the cooperative can make that motto real in the everyday working lives of its members. And Capricorn has been doing this for some time; ever since a few Golden Fleece service stations got together back in 1974.

Now in 2024, 50 years and almost 30,000 members strong, the cooperative gives an indication of just how many automotive businesses have embraced the concept of strength in a collective. As Fraser’s insight shows, this is about a lot more than a buying group.

For instance, Capricorn’s yearly State of the Nation report is open-eyed about examining and facing up to the problems confronted by the repair and wider automotive industry, but it is also increasingly o ering advice, examples and resources on how members could potentially overcome some of these problems. This underscores the truth that cooperatively the industry can achieve so much more in tackling industry-wide issues like the skills shortage.

Innumerable small shops competing for the same dwindling pool of talent is a recipe for disappointment. But with the help of organisations like the Australian Collision Industry Alliance, the Australian Automotive Aftermarket Association, the MTAs and other active bodies, there is the potential to collectively change policy, promote the industry and increase the pool of talent. The workshops, big and small can add their voice to these collectives and reciprocally benefi t from the advice and experience to make their workshops the employer of choice.

Together, everyone is better o .

Eugene Du y Editor

The National Collision Repairer

Needing integrated and e cient, yet visually pleasing products and systems for your busy workshop? Look no further than Car-O-Liner’s Workshop Solutions series.

An organised inventory of control solutions such as tool boards, wall sections and separators allow workshops to configure their own unique work bays. Car-O-Liner’s WorkShop Solutions specialises in meeting collision repair workshops’ space requirements. Ensure your workshop is well equipped and well planned out with parts silhouettes on your tool board. This quick and streamlined approach will save you time on the job as tools and equipment always return to their correct place.

One piece of equipment on the Workshop Solutions series is CarO-Liner’s EVO System. This system provides workshops with a flexible and universal clamp that will e ortlessly integrate with workshop flow and Car-OLiner products.

The EVO System

A flexible product that can fit unique repair requirements, the EVO™ System has three separate fittings for universal anchoring, holding and fixturing.

The EVO System 1, 2 and 3 is made of an optimal number of components, allowing the products to be used

alone, or combined with one another.

For optimal workshop e ciency, the anchoring, holding and fixturing EVO System works for every vehicle year, make and model. This swiftly eliminates the traditional fixture costs.

Fully integrated with Car-O-Liner® data and software, the EVO System is modular and upgradeable.

Benefits of Caro-O-Liner’s Workshop Solutions

The Workshop Solutions series comes with many features and benefits that will elevate your workshop experience.

Creating a workshop that has e cient inventory control ensures tools are returned to the proper location.

The ergonomic factor also enables workshop technicians to complete repairs faster.

Creating a workshop environment that is organised is more attractive to customers as it increases confidence and trust in the repair team.

The high-quality clamps hold multiple parts and gives a long-life cycle with low maintenance costs.

The flexible product design range matches multiple car manufacturers’ parts design, creating a seamless process for integrating Car-O-Liner products into your workshop.

For more information, visit, https://car-o-liner.com/

To celebrate our 50-year milestone, we are offering unbelievable ‘Special 50-year Promotion Deals’ on all Car-O-Liner Benches and Car-O-Tronic Measuring Equipment ... and you also receive our normal ‘Trade-in Deal’ which is still available. This Special Offer is 50-years in

Great restorations take e ort, attention to detail and passion, but doing a job right takes time.

Over 1,000 hours and more than 12 years in the case of Anthony Cappelluti’s 1967 Austin-Healey 3000 Mark III BJ8 sports convertible.

The Austin-Healey 3000 represents the end of an era. Assembled on 25 June 1967, in Abingdon UK, it was one of the last before production of the 3000 ceased and Austin-Healey merged with Jaguar.

Cappelluti’s 3000 was imported to Australia, changed hands a couple

of times before ending up in “The Healey Factory” in Melbourne (a classic sportscars specialist business), where Cappelluti found it.

“We went to The Healey Factory with a mate to look over it for him, intending for us to restore it. But once we pulled it apart and after abrasive blasting, we realised it would be a huge and costly project. I o ered to buy it o him.”

As owner of CAPPA Motor Bodies in Naracoorte, SA, Cappelluti has been repairing and restoring vehicles for more than 30 years, and was determined to give the car a faithful,

high-end restoration. But with family and a business to run, the project took a back seat.

“It sat in the shed for 10 years. I wanted it finished for our daughter’s graduation, then our son’s wedding, then our daughter’s wedding… We did work when we could.”

The car had previous but incomplete restoration work, a lot of further work was still needed, including the chassis. The 3000 is unique for its welded interior construction and aluminium body over steel chassis. A full ‘body o ’ restoration required cutting sections and precision rewelding.

The panel restoration also needed special jigs, so Cappelluti relied on the experts at The Healey Factory while undertaking the bulk of the restoration back at CAPPA Motor Bodies.

“After it had been abrasive blasted, we used the RAPTOR 2K Epoxy Primer, which is a great base for applying filler over the top,” says Cappelluti.

“Restoration cars often sit around for a while, so they need something to stop moisture corrosion. The RAPTOR Epoxy is perfect, providing a good base for filler and nothing gets through to the steel.”

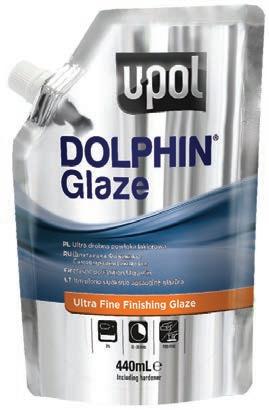

The CAPPA team opted for U-pol’s Dolphin Glaze Fine Filler.

“It would be a disservice to all that e ort to not use the highest quality

refinish products,” says Hayden Bennier, who worked on the car at CAPPA.

“Having the right products makes all the di erence. U-pol’s Dolphin Premium was the only choice. It adheres great, it sands easily and smooth. We use it every day, have done for years now. It’s a no brainer for us.”

Cappelluti and the team finished the car with a classic Healey Blue over Ivory White two tone paint job and tan interiors.

As the best known of the ‘Big Healeys’ the 3000 Mark III BJ8 is highly sought after by collectors - Jerry Seinfeld has one in his famous collection. Restored 3000s can sell for over $100,000 in Australia. But Cappelluti is not about to sell.

“You’re never going to go into a restoration thinking you’ll make money out of it,” he says.

Instead, for Cappelluti, it’s about sharing the hard work and dedication that went into this meticulous restoration.

As a registered historic vehicle, Cappelluti has driven his 3000 in the Bay to Birdwood, one of Australia’s premiere vintage car rallies, as well as

photoshoots for the occasional wedding.

“It’s great taking people for drives with the top down and watching them enjoy a classic car that really doesn’t have any modern features.”

But mostly, Cappelluti enjoys spending time driving with his wife Sarah to wineries and enjoying the countryside, weather permitting. “It’s a car for nice weather, it’s a holiday car. A good time car.”

For further information on the products Cappelluti used contact the U-pol (Australia) technical support team on (02) 4731 2655 or visit the website www.u-pol.com.au

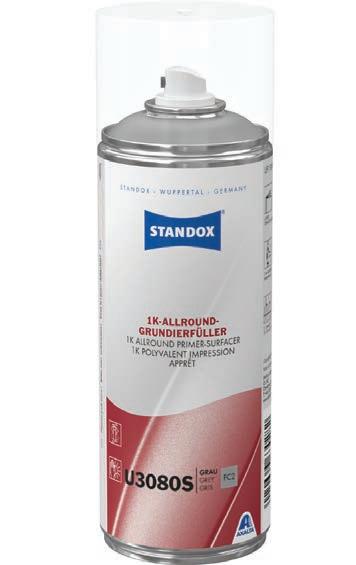

Ease of use, adding to workshop e ciency by reducing repair steps and enhancing sustainability are just some of the benefits all contained in a new aerosol primer Axalta has released.

Standox, a global refinish coating brand from Axalta, has introduced a new 1K-Allround Primer Surfacer U3080S as an aerosol, which shortens the repair process considerably. During preparation, small sand-throughs are common and these must be primed or sealed before top-coating. Available in grey and designed to maximise e ciency and sustainability, the innovative 1K-Allround Primer Surfacer U3080S allows fast processing as it provides excellent filling power and good adhesion on both metal and plastic substrates.

Axalta Product and Technical Manager for Australia and New Zealand Jim Iliopoulos, says the 1K-Allround Primer brings multiple benefits to the workshop.

“Thanks to the 1K-Allround Primer Surfacer’s simple and universal application and its fast-drying

performance, bodyshops can be more e cient, profitable and sustainable,” he says.

1K-Allround Primer Surfacer U3080S is suitable for use on bare metal providing very good corrosion protection, and on all common plastic substrates with required flexibility.

Application is very easy with good sprayability and flow, thanks to SprayMax technology.

“1K-Allround Primer Surfacer U3080S delivers high filling power with easy sanding. It can be re-coated after sanding with waterborne basecoats as well as with solvent-borne basecoats or topcoats.” Iliopoulos says.

1K-Allround Primer Surfacer U3080S Aerosol in grey is available now from your local Standox distributor.

Additional colours – black and white – will be available in due course.

For more information, contact your local Standox distributor or visit standox.au

At a time when energy costs continue to climb, repairers need to choose the best solutions for their workshops ensuring lower overheads and better environmental outcomes.

Coatings giant PPG has developed its Sustainability CO₂NCEPT system as a practical service aimed towards longterm profitability and sustainability.

PPG created the Sustainability CO₂NCEPT, consisting of a suite of products, processes, digital tools and consulting services, it o ers unique opportunities to embrace sustainability and reduced energy consumption as a pathway to long term profitability.

Using the app-based Sustainability CO₂NCEPT Calculator, a PPG representative can work with individual collision repairers to input a variety of the business’ parameters. This includes the current gas and electricity price, estimated gas usage per booth cycle, booth airflow, estimated electricity draw for lights, motors, etc, average ambient temperature for the area and product bake times.

Using these parameters, the Calculator generates an estimate of the current energy e ciency and carbon emissions. As well as providing a handy starting point, it’s also a springboard to exciting improvements in both sustainability and profitability.

Although it was created by the PPG Europe team, the Sustainability CO₂NCEPT Calculator available to local repairers has been thoroughly tuned to this market using local data and information.

Rather than going through the hassle of actually introducing a new product or process into the workshop and then monitoring it to check its impact, the Sustainability CO₂NCEPT Calculator o ers a quick, simple alternative.

By using simulations, it’s easy to do instant virtual changes to any of the many di erent product or process options that are on o er to PPG customers, including things like UV cured technology, air dry primer and clearcoat technologies and shorter bake cycle clearcoats.

With immediate results on hand, it’s very straightforward to see the impact any changes would have on cycletime, energy usage, waste and the collision centre’s carbon footprint. That makes the Sustainability CO₂NCEPT an extremely powerful tool that can be used to rein in electricity and gas costs, as well as meet any sustainability targets.

Whichever options you choose, PPG support is available right along the journey, such as training to bring your team quickly up to speed and guidance from your MVP Business Solutions Manager to give you peace-of-mind that you are making the most of any opportunities.

For more information about the PPG Sustainability CO₂NCEPT, speak to your MVP Business Solutions Manager, your PPG Territory Manager or the PPG Customer Service Hotline 13 24 24 (Aust) or 0800 320 320 (NZ).

As it looks forward to its next 50 years, Capricorn is going from strength to strength as a cooperative. Recently it has enjoyed unprecedented growth and is fast nearing 30,000 members. The secret is in its culture of service to its members, exemplified by the passion and belief of outgoing Group CEO David Fraser.

After 18 years at Capricorn, five as its head, and over twice that in the automotive industry David Fraser has many illuminating memories. One he recalls, with a lesson about growth, was a time some years ago when talk at the cooperative was, they would reach a limit at 15,000 members.

“And I remember thinking perhaps we’ve set the bar too low,” Fraser says. “We really need to be thinking a lot more holistically and believe that we had something special.

The something special was the wide range of services and support they could o er members and the collective strength a large member-based organisation could have in improving the automotive aftermarket industry. This became the catalyst for more growth, but always returning to those basic principles.

“It took us 30 odd years to get to that first billion in sales and took another 10 to get to the second billion. We will be near $4 billion this time next year on the back of some of that strategic work that we did.”

But proud as he is of the growth of the cooperative, Fraser believes it is the importance of keeping the culture vibrant and living up to its ‘stronger with’ promise and the service this plays for the wider automotive industry that he considers the real achievement of his time at Capricorn.

“We are the collective of those 29,000+ small businesses, and their success is our success, and our success is their success. And for me, it’s really important that we continue to grow

As

celebrates its 50th

the membership because it’s a great opportunity for those small business owners to have a stronger and more sustainable future in what’s going to be a decade of change, with regards to the vehicle car parc changing to meet its future Net Zero targets.”

“We are very much a purpose driven business. Every time we make a decision, whatever that decision is, we will always look to do the right thing for our members. If those decisions were based purely on the commercial viability

or the commercial perspective, you wouldn’t always do it, but sometimes it’s the right thing to do because it helps them as a small business owner, to be stronger, be sustainable and maintain a position of competitiveness.”

The collective strength for Fraser goes back to 1974 when a group of WA service stations formed the first buying group.

“The whole reason Capricorn was formed or founded in the first instance was the fact that you had these like-

minded business owners who thought that if they collaborated and cooperated together, they would be able to be stronger than by standing alone.”

In times of change.

Capricorn’s success as a cooperative with a wide range of Preferred Suppliers and its rewards programs for members are well known, but it also believes strongly in extending the help to service and support.

Investing in market research is one way Capricorn has been able to help members both by giving them more insight into the challenges facing the industry and where solutions lie. Last year their annual State of the Nation report, which takes a comprehensive look at the automotive aftermarket sector, focussed specifically on the skills shortage and made some striking findings. Fraser says it was part of a theme that has come through from members for three or more years and so the specific focus was stepping up to that need.

“We’re not going to be the silver bullet that fixes that problem, but we want

to be part of the solution the industry needs to find by working together to help address it.

“We’re all feeling the pain of the problem, whether you’re small, medium or large business, whether you see it in the supply chain or the value chain, it’s a common problem for everybody and we want to be part of helping find the solution.

“For us, it’s using that information, looking at what more Capricorn can do to help drive better outcomes. Whether that’s opportunities for us to work directly with members, or whether its working with other industry associations or trade associations or working a little bit more closely with advocates to help and drive government decision making.”

What was di erent about the depth of the State of The Nation: Special Report on the Skills Shortage in 2023, is it looked comprehensively at all the sectors within automotive including collision repair and o ered a dedicated website with resources, case studies and ideas on how workshops could overcome some of the issues of recruitment and retention of sta .

New technology, new ideas

Fraser says the surveys and research also help in shaping better decisions on how the cooperative can help its members on other key issues such as meeting the advance of automotive technology.

“This is about us stepping up and wanting to be part of shaping a future market. And by being really clear about the direction our industry is heading.”

This included an intense study tour for a small group, comprising of Executives and Directors, to understand where new drivetrains like EVs were heading and their potential impact on Australia.

“We visited Norway, Sweden and the UK, because those markets are more advanced than the Australian marketplace, to try and understand the impact of the changes that had already occurred in some of those Nordic countries. It was also about understanding what the downstream impact was at the at the workshop level.

“That intelligence now helps us be part of shaping the future of our industry, and specifically helping our members understand some of the things that they

want to or should be aware of.”

Fraser says information they can o er can help a workshop understand whether they should be preparing to adapt or should be becoming proficient and equipping immediately.

“Our members will say one of the most significant marketing tools is word of mouth, contributing to more than 50 per cent of their new business. My message is; if you start turning away vehicles because you’re not ready for them, you risk losing, not just the customer you’ve turned away, you risk losing other future customers.”

Fraser says other learnings from visiting advanced workshops can also be shared with members such as how EV uptake a ects workflow for maintenance and repair.

“A workshop of that kind in the future would be reliant on higher volumes and therefore, you’re going to need more cars in and out on a daily basis. Then you’ve got to think about trying to help the customer understand not to come back at the end of the day, for instance, but come back by lunchtime because otherwise you need to find some way to store that car.”

Lights, cameras, action

Fraser explains that one of Capricorn’s strengths is having the breadth to investigate future technology to see how it will serve members needs and help them meet these future demands. Their joint venture with remote technician service providers Repairify, who have established a global reputation before their launch in Australia in 2023, was an example of bringing the leading technology into the Australian marketplace.

“We saw that as a growing opportunity, a growing need for the market as more people invest in that sort of service and repair perspective.”

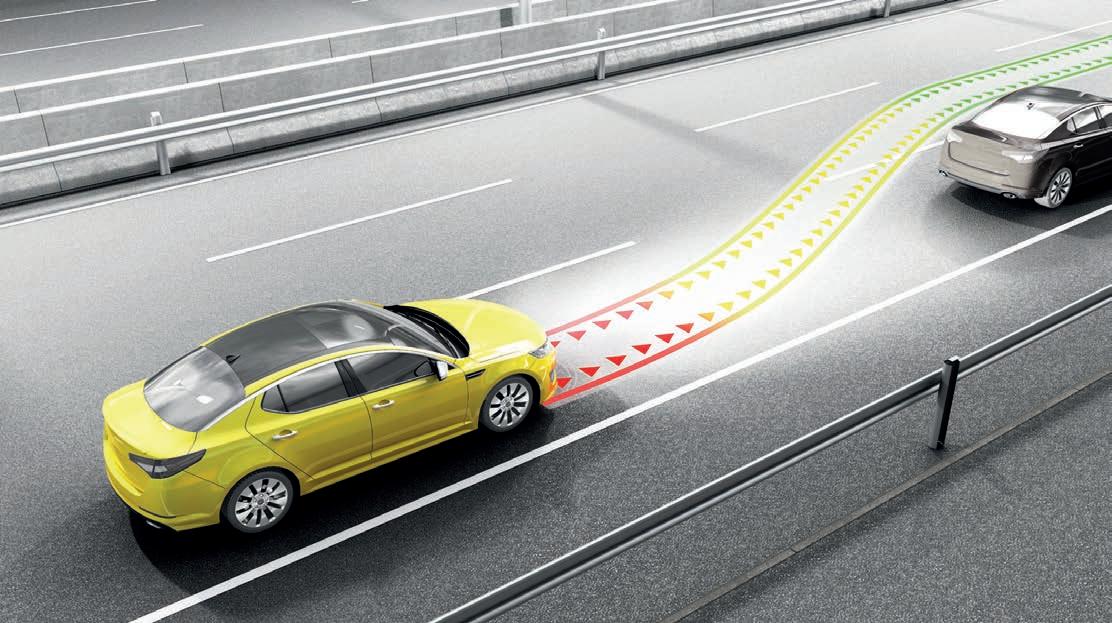

He said Capricorn was vigilant to the increasingly prevalent ADAS technology and the recognition that cameras, radar and in the future, LIDAR sensors were inescapable elements in new car comfort and safety.

“It doesn’t really matter whether it’s

an electric vehicle, or whatever mode of drive train, the reality is ADAS is the future,” he says.

“I think vehicle connectivity is another way of the future. Telematics has been around for a long time but clearly vehicle connectivity is going to be a key future driver. As Capricorn’s business evolves over the coming decade, we will look to help our members and have a bigger part of that.”

Another example of Capricorn’s growth lies in the uptake of other services including loans and risk protection (an alternative to insurance).

“I look at our loan book as a barometer as to the health of the industry,” Fraser says.

“If people are prepared to reinvest in their businesses, through the need to buy more capital equipment then I see that as a positive. It’s another example of us helping out. We’ll always be looking for new pillars of growth to help support not just our growth but our members growth.”

This ethos and a brand loyalty to Capricorn have also helped with their insurance products which have enjoyed

a 98 per cent renewal rate.

“Capricorn Mutual is a discretionary mutual and unlike an insurance company, operates as a non-profit entity solely for the benefit of its members. That is something we promote as a benefit.”

The industry specific application of risk protection also helps members because of the increased focus and knowledge of automotive businesses, their particular risks and liabilities.

“It’s very tailored to our members’ businesses. Our risk account managers can visit the members’ workshops, they can do a proper risk assessment in the business and help the member understand what might have changed because they sometimes overlook things themselves. We can help them understand their protection needs.”

He says the dedicated sales force means they can advise with preventative measures whether it is helping prevent fires in a spray booth by ensuring service is up to date or taking precautions with Lithium-Ion batteries, both in EVs and the multiple applications they have in tools in the workshop.

But growth often comes with the risk of dilution and the challenge of keeping a culture alive. During his years at Capricorn, Fraser was determined to avoid this.

“We needed to grow the membership, but we also needed to be able to support a growing membership, and make sure that we were having good quality conversations each time we visited the workshops.

“The last thing I wanted to do was to grow the membership to a point where our sales force were only focused on new member acquisition and therefore weren’t able to spend quality time with those members who had joined.

“For me it was about really repositioning Capricorn in the marketplace. Certainly, grow the membership, because a growing membership would help grow our business, but I also genuinely believe that it would make our industry stronger. What was driving me was wanting a

stronger, independent aftermarket industry.”

Fraser is a firm believer a culture must be the foundation for successful growth.

“You can have the best dressed strategy in the world but if you haven’t got the culture to support it, then you won’t be successful. That’s been an important part of what we’ve tried to build. My goal was to really work hard on developing our culture and that’s something that you should never stop working on.”

Stepping away from Capricorn later this year, he will leave the helm in the hands of current CEO of Automotive Brad Gannon. Fraser will look toward more board activity where he believes he still has a lot to o er. He believes it is a passion for the industry that he will take with him, after it has been one of his formative characteristics over the decades.

But looking back, Fraser says, his greatest satisfaction has come on a more basic level, with the direct contact

with the members, talking to them about their businesses and how Capricorn can help.

“They are salt of the earth people. And I’ve really enjoyed trying to understand what their pain points are and by listening to them, work out how we can foster a better Capricorn,” he says.

“You’ve got to be a good listener and you’ve got to encourage people to have those kinds of honest conversations. I’ve always been one that says, ‘don’t be defensive, be curious.’”

His parting thoughts return to an optimism about the industry and his belief in strength that grows out of unity.

“You can achieve more by working together than you can by standing alone,” Fraser says.

“When I consider the numerous challenges our industry is currently facing or will encounter as it evolves over the next decade, it’s clear that many of these issues are shared. By collaborating, we can work together to find solutions to these common problems.”

Leading the way with a revolutionary way of work for Australian businesses, Iain Kippen from Bissell’s Paint and Panel has cracked the code for creating a healthy and sustainable balance between personal life and work.

A four day working week and year round sunshine sounds pretty idyllic.

For Bissell’s Paint and Panel in Noosaville, Queensland, this dream lifestyle is fast becoming a reality.

Having been nominated and awarded three best bodyshop of the year awards since 2021, there is something that Bissell’s Paint and Panel is doing that is working in their favour.

Spearheaded by businessman Iain Kippen, Bissell’s Paint and Panel is a workshop embracing a new way of both working and living.

National Collision Repairer sat down with Iain Kippen to discuss how workplace productivity has risen since going to a four-day work week, and

how he promotes and maintains a happy, and balanced community of sta .

Hailing from the United Kingdom, Kippen and his family relocated to Noosa from England for a change of scenery in 2001.

The Bissell’s Paint and Panel business had already been in operation for over two decades before Kippen took over in 2010.

Coming out of retirement after nine years, Kippen bought the panel shop for his son who had experience in the automotive industry.

Despite not having experience in the

technical side of automotive, Kippen had a keen interest in collecting cars. In the early 2000’s, Kippen would take his cars to the former owners of Bissell’s who had a niche for restoring old cars.

“When they o ered to sell the business to me, I initially had no plans of going back to work. As a family we took the challenge on, and built it up to what it is now,” Kippen says.

In 2010, the shop was relatively small, but it already had a solid reputation locally.

“As a family, we decided to build a purpose-built workshop. We are now a medium to large sized workshop. My son is now at the helm of the business, and my daughter is also the business accountant,” Kippen says.

A businessman with a good eye for opportunity, Kippen brought his British expertise to Australian shores to create a well-respected workshop where sta are treated as the main priority.

Before Bissell’s, Kippen had no prior experience in the automotive industry, but that has not stopped him from creating an e cient and streamlined business that is always looking for areas of improvement and sta

satisfaction. Kippen identified how the Australian automotive scene in 2010 was starkly di erent from the UK.

“It was quite a shock to begin with, there was no real regulation. After a few years, and a few workshops uniting to initiate change, we were among the first onboard to welcome and embrace the new ways of operating,” Kippen says. “I come from a business background, not a panel background, so I view change quite di erently. I have been very fortunate to have also had great sta who have embraced the change as well.”

Embracing change has helped Kippen to propel his business into new territory on how a business can potentially operate in Australia.

What makes Bissell’s Paint and Panel stand out from other businesses and repair shops, is their revolutionary fourday work week; e ectively covering the full allotment of working hours with one less day on the roster for sta .

Kippen cites the COVID-19 pandemic as the major instigator for the four-day change. Bissell’s was still operational during the COVID lockdowns, and it was during this time that the idea

was planted in Kippen’s mind to really consider a major dynamic shift in the workplace.

“The pandemic was life changing, and it changed everyone in some way. Our business certainly changed after COVID,” Kippen says.

“It was during a smoko break, around the time when the Queen passed away, and the guys were talking and joking about how great it would be to have a four-day work week every week.”

Kippen’s business mind quickly clicked into gear, and he began thinking of the logistical side of implementing such a change.

“If you run a workshop correctly, you are only billing hours, not selling days or weeks. You have X amount of hours you can use. So, I told the guys if they wanted to work four days, go for it, it shouldn’t make much di erence,” Kippen says.

After consulting his family, and discussing the potential side e ects, they decided to run with the idea. However, with twenty-two sta members under Kippen’s leadership, the change didn’t come without precautionary measures.

“I put out a survey for everyone to fill out. I had to make sure that everyone

was happy to have a four-day work week to start with,” Kippen says.

Addressing the advantages and the pit falls was also part of the process in changing the work structure.

“With a go ahead with the survey results, and through increasing the hours each day slightly, we were able to make it work,” Kippen says.

Kippen outlined how his sta have 20 per cent less travel time each day, and the equivalent of nine extra weeks at home.

“By reducing our work week from five to four days, our turnover went up by 20 per cent. Everyone got a wage rise, so everyone was happy. I also found that there was less downtime, as everyone wanted to complete the work,” Kippen says.

After the three-month trial Kippen had a meeting with each sta member individually to discuss the four day work week.

“The emotion in the guy’s faces was unbelievable. They were happy to come to work,” Kippen says.

“I had one guy say that for the first time ever, he was able to pick up his children from school. I had another guy, who was a surfer and he loved surfing on Friday when nobody else was on

the waves. The benefits are fantastic,” Kippen says. “The four-day work week works. It absolutely works.”

Creating a community in a workplace is one of Kippen’s strengths. Listening to sta and implementing their feedback on work/life balance was the driving force for Kippen’s decision to move to a four-day work week.

“Over the last three years, I have really focussed on the mental state of everyone who works with me. I ensure it is a positive place to work. We put work happiness and satisfaction over a profit,” Kippen says.

Constantly analysing e ciency standards and processes is Kippen’s speciality. Working one week on-site in the workshop in Noosa, and three weeks remotely from his home in

Victoria’s High Country, Kippen has the luxury to be that one step removed from physically working in the business.

“Any business needs to run e ciently, with streamlined processes, with very little waste. It needs to be easy,” Kippen says.

Bissell’s Paint and Panel’s streamlined processes include low cycle time, high quality repairs and equipment and quality service to the customer and work provider.

“Getting your car repaired isn’t a nice thing to do. So, we try and make sure that the experience is as comfortable as possible,” Kippen says.

For Kippen, refining the booking systems and progress reports allows for a streamlined structure that benefits not only the flow in the workplace, but the clients as well.

“If the car isn’t being touched, it

shouldn’t be in the workshop. Having everything in check and operating well allows smooth and e cient sailing throughout a work day,” Kippen says.

Creating an atmosphere where the sta are happy to work and challenge themselves is also part of Kippen’s streamlined e ciency ethos.

“After implementing the four-day work week, our business was more streamlined because our sta were happier. Everyone wanted to be there, everyone cruised through their work,” Kippen says.

Sta meetings once a month allow Kippen to touch base with his sta and ensure everything is on track.

“When I am up in Noosa we have a training day after work. But it is really just a chance for everyone to catch up and have a chat,” Kippen says.

“It is the sta that make a business, you have to listen to them.”

Identifying weaknesses within the business structure is also a strength of Kippen’s, and acknowledging the limitations in the chain is something Kippen embraces.

“For a panel shop, repairing 40 to 50 vehicles a week is optimum, and the most e cient profit per vehicle. We have the capacity to repair more, but we ensure quality is our main target,” Kippen says.

With one successful shop with happy sta and a system that works well, Kippen is not too interested in expansion at the present time. However, fine tuning the existing structures will always be a priority.

Bissell’s Paint and Panel have embraced the new technologies of the future. With I-CAR Gold Class Collision Status under their belt, they are constantly upskilling and training their sta for the new developments on the horizon.

“We always stay up to date with the latest technologies and trainings. You can fall behind really easily, so it is important for us to remain ahead of the game,” Kippen says.

Working on EVs has broadened Bissell’s Paint and Panel clientele,

but the EV landscape hasn’t taken over ICE vehicles just yet.

“I’m still not convinced that the volume of electric vehicles will overtake petrol cars in the expected time frame,” Kippen says.

“But there will still be a good percentage of EVs coming through our workshop, but it is not the 30 per cent we expected. Yet, you still need to be able to handle that.”

“We focus on keeping ahead of the game through upskilling our sta and equipment. We need to stay aligned with the evolution of the industry.”

Even with each workshop member either an I-CAR Gold Class or Platinum member, there is always something new to learn in the next wave of automotive developments.

“There is always something to keep up with, whether that is the di erent metals being used, or the carbon fibres, there is always something to keep up with. EVs and ADAS are the latest and biggest thing,” Kippen says.

Since implementing a few key changes, including the four-day work week, Bissell’s Paint and Panel has not had any trouble retaining or finding sta .

“People want to come and work here. We are lucky to have loyal workers as well,” Kippen says.

Bissell’s Paint and Panel has four apprentices who stayed on after their training. They are now fully qualified panel technicians and they are still working in the shop.

“We are fortunate to have good sta , including our apprentices. We have really focused on creating a community where people want to stay,” Kippen says.

“We don’t give our sta any reason for them to go elsewhere.”

Extreme weather events including hailstorms are having an increasing impact on the auto-insurance and collision repair industries.

2023 may have been a calmer year for insurance claims but one extreme weather event still cost the nation $1.6 billion in losses, including about $170 million in motor losses.

The latest damage estimates of the Christmas storms across the eastern states comes at a time of increased focus on extreme weather events under climate change across the globe and their impact on the repair and insurance industries.

Perils, an independent Zurich-based organisation providing industry-wide catastrophe insurance data, released its third loss estimate for the Australia Christmas Storms which a ected Victoria, New South Wales, and Queensland from 23 to 29 December last year.

The updated industry loss figure is of $1,563m and is based on detailed loss data by postcode and property and motor hull lines of business that Perils collects from the majority of the Australian insurance market.

While the majority of the figure, 72 per cent, relates to property losses

from the private sector, eleven per cent has been attributed to motor losses including damage caused by extreme elements such as large hail shattering windscreens and damaging panels.

Almost three quarters of the claims were made in Queensland, a quarter in NSW and five percent Victoria.

Perils Head of Asia Pacific Darryl Pidcock says the damage came amidst a relatively benign period of major natural catastrophes in 2023 compared to previous years.

“Notwithstanding, it highlights the increasing risk not only of severe convective storms along coastal regions but, as we observed in this case, the potential for competing air pressure systems prolonging storm activity over an extended period,” he says.

“Combined with PERILS Industry Exposure data it enables further insights to be obtained especially regarding vulnerabilities of the di erent lines of business by linking physical intensities with insurance losses.”

In the US, the CCC Intelligent Solution Q2 Crash Course Report has a

specific focus on hurricanes and convective storms in the US with a specified aim to help the industry to navigate the 2024 extreme weather season.

While hurricanes in the US wreak the largest amount of damage, it is hailstorms that account for the largest amount of automotive damage with a 17 per cent increase in the number of storms unleashing hailstones three cm or larger. This resulted in an increase of comprehensive claims to 11.8 per cent for all claims in 2023 from nine percent in 2020.

But they are also 21 per cent more costly than a comparable comprehensive claim and while they often include dented panels and broken windscreens, they can also include costly damage to sensors and cameras.

As recently as May 2024 hail shattered windscreens in Texas and in June reports of hails as large as pineapples were made in the same state, possibly the largest ever recorded.

Some scientists like, Associate

Professor of Atmospheric Science, University at Albany, New York, Brian Tang believe the atmospheric conditions that produce very large hail have increased in the US.

The CC report also noted higher frequency of this damage with severe weather events occurring in states where they were once less likely and with larger populations there a ected.

The report has interesting lessons for Australia where extreme weather events are also of concern to the insurance industry, most frequently from floods and bushfires but also from other extreme weather.

The Insurance Council of Australia has highlighted the growing protection gap of many Australian households as risk and premiums increase.

It lists extreme events like the 2023 Christmas’s deluge a ecting three states and two major hailstorms in Queensland in 2020 that caused $2.5 billion of damage, as examples of the damaging conditions this weather can produce.

An Insurance Council of Australia (ICA) spokesperson outlined why vehicle insurance premiums are increasing, “Each insurer calculates its motor vehicle insurance premiums according to their own underwriting (insuring) criteria and will use these criteria to determine the risk of individual policies,” the ICA spokesperson said.

“Currently motor vehicle premium prices are rising because of the increasing value of motor vehicles making them more costly to replace, inflation and supply chain issues driving up repair labour costs and price of motor parts, and the increasing cost of capital for insurers driven by ongoing extreme weather events.”

According to the ICA, motor

insurance claims costs rose by 43 per cent between 2017 and 2023, which is double the rate of inflation for the same period.

“Cars are now more complex and sophisticated - a small ding that might have once sent drivers to the panel beaters for a straight-forward repair now requires fixing and testing the complex sensors that are used for navigation and safety systems,” the spokesperson said.

The latest Crash Course report from the US cited the Colorado State University as also predicting 11 hurricanes for the US this 2024 season with five categorised as major events.

The CCC industry analysts and experts provide an insight into historical claims and repair data, while also evaluating geographical and migration trends, as well as non-peak perils, such as hail.

“Extreme weather events are increasing in severity, becoming major disruptors in the auto claims and repair industry,” said Crash Course co-author and CCC Industry Analytics Director Kyle Krumlauf.

“Our Q2 report delivers critical insights, showing that the frequency and severity of storms are not just a seasonal issue but a persistent challenge that demands strategic planning and swift adaptation from industry players.”

The report’s insights and data allow repairers to validate their current strategies, make informed adjustments, and enhance their preparedness. It also recommends:

Utilise claim management technologies. Claim management technologies can

help reduce the need for carriers to put personnel physically on the ground and streamline repeatable processes. This approach can vastly improve the employee experience while also ensuring storm-related claims are settled accurately and e ciently.

Prepare for downstream impacts. As economic challenges persist for consumers, the potential for vehicle damage to go unrepaired continues to rise, especially as motor vehicle costs rise. As of April, the consumer price index for motor vehicle insurance was plus 22.6 per cent year-over-year and plus 41.7 per cent since April of 2022.

Assess repair inventory. Hurricanes and other severe storms may impact supply chains, potentially halting or delaying parts deliveries to shops, which can impact productivity. While the unpredictable nature of weather events can make planning ahead di cult, there are two ways shops can prepare for this possibility. One, is to review current parts inventory, assess stock levels and identify critical components that are likely to be in high demand. Two, is to maintain strong relationships with suppliers to secure priority access to parts when supply chains are disrupted.

Communicate clearly and regularly. Given the unpredictability of storms, it’s important for carriers to engage with policyholders by maintaining open and transparent communication. Providing timely updates on storm forecasts, evacuation orders, and claims procedures will help mitigate losses and get people out of harm’s way. Repair shops can leverage social media and online communication tools to update repair timelines, operation hours, and rental car availability.

‘Work

smarter not harder’ is the adage and, according to PPG’s business experts, there has never been a better or more important time to look closely at workshop e ciency.

Repair industry veteran Greg Tunks has visited hundreds of shops in his capacity as a business advisor and manager for PPG’s MVP Business Solutions and he is forthright when it comes to the challenges they will continue to face.

Maximising volumes, skills shortages, insurer negotiations, the pressure from MSOs and new technology are all pressures adding to the everyday grind facing workshops, he says.

But Tunks says this is why an outsider’s objective view can be the first step in helping small to medium businesses find solutions to some of these issues.

“I think a lot of body shop owners and managers don’t get out and see what is going on down the road, while we have the luxury of visiting hundreds of body shops right across the country and seeing what works and what maybe doesn’t work in a wide variety of places. Having an open mind and thinking about how they can do things a little bit di erently from a shop owner perspective, and listening to outside suggestions can be a big help for them.”

Best of all, he explains, these incremental improvements can be made without any compromise to quality but have demonstrable benefits to turnover and profitability.

“They need to look at how they can become more e cient by changing the way they process the vehicle through the shop, to enable some of those businesses to do the volumes without sacrificing the quality.”

“A common misconception is people say ‘I’m working flat out; I physically can’t do any more.’ A part of our business solutions program is going in

and looking at businesses and seeing where they can eliminate the waste. A lot of people don’t really have an understanding of lean methodology, or lean training. Where you can eliminate the waste out of the business, you can produce more without working any harder. But until you actually take a step back and have an outsider come into your business, and physically stand back and look at what you’re doing you may not discover these elements. The numbers tell us one thing from a financial perspective, but the shop floor experience comes into play as well.”

One example Tunks cites is the possibility expensive equipment can be underutilised, such as not harnessing the full potential of spray booths.

“One spray booth should be able to do 25 cars a week comfortably, and yet, we have shops with two spray booths, and they’re still only doing 20 to 30 a week. By utilising your spray booths better, as an example, we can produce more work”.

He says the expert consultants from MVP Business Solutions can look at the workshop process to ensure each stage of a repair helps this e ciency and volume.

“You don’t spend $150,000 on a spray booth to mask a car,” he advises. “You spend it to spray, flash and bake a car. You don’t buy one to mask a car. You don’t buy one to prep solid in.”

Tunks says some large MSOs have a target turnover time for their booths of 45 minutes and if he sees a booth cycle time in a shop of 2-3 hours, he identifies how much more capacity they have.

“If you look at how equipment is

utilised, you can pick up how some of that wasteful time can be put into producing more cars, putting more work through a shop without increasing your overheads.”

He said they also look at the layout and design of a workshop and how it can a ect this e ciency.

“Go back to the 80’s and the spray booth was down the far back corner of a workshop and if it is like that now it’s totally in the wrong place. Existing shops can change things by just moving some stu around and changing the layout.”

He says workflows and tra c management plans are other areas where the advice from outside experts can have a significant e ect on e ciency.

“With Business Solutions it is about having a structured business from front to back, not just in reading numbers and facts and figures, but looking at processes and everything else that goes on the workshop floor.”

The holistic approach to the workshop can then look at the other elements a ected by the increase in cars numbers whether it is check-in, estimating or fitting.

No matter where the business is, the starting point for Tunks and his team of six consultants at MVP Business Solutions is listening. The individual qualities of each business and the issues they face are important to hear and study, so they can enrol their expertise into a range of tailored suggestions that form part of the consultation.

Listening is what the MVP team are good at, and they are also hearing from shop owners about industry wide issues like the skills shortage, Tunks says. While they don’t consult specifically on sta solutions like recruiting or utilising skilled migration to fill the gaps, they can advise on

elements in the existing business that may ease some of the sta pressures.

“Sta are the backbone of your business, and you cannot survive without them. We aim to make a better workplace for all the sta that are involved, so they actually enjoy coming to work. By providing an organised work environment, it makes it better to work for those business owners.

“We’ve made shops more e cient and the sta more e cient. They don’t physically work any harder, they just work easier by removing the hurdles they have to jump over all the time in the workshop. They become better, more e cient and generally happier.”

Tunks explains that this has an enduring impact on sta retention because people remain in jobs where they are happy, but it can even help attract new recruits considering desirable workplaces.

“Having an organised, clean work environment counts for a lot. If you’ve

got a well-organised, well stocked workshop and you’ve got decent equipment, you’re halfway there.”

He said elements like investing in dust extraction in a panel beating workshop are a practical step that can change the work environment and bring it up to date, similar in the way paint shops evolved with protective equipment for spray painters.

Tunks’ experience has also given him insight into advising on how businesses can meet the challenges of advancing technology such as ADAS calibration. His understanding of workflows, the space available in the workshop and the equipment needed can be helpful in assisting business owners in deciding whether to invest in the business opportunity.

Whatever decision they make, Tunks advises a passive “wait and see” attitude can mean potentially losing business. This alertness and “staying on the front foot” are critical as competition increases and he cites the example of traditional hardware stores which declined as they failed to change.

“If you keep doing the same thing and the same way that you’ve always done, you will become extinct. The world is going to move on by, and you know you need to do something di erent to survive.”

But if businesses have the willingness to change and thrive, he says, this is where MVP Business Solutions’ perspective and expertise can be a great advantage to ensure a business’s health and profitability into the future. The way they study each business is not as a list of problems but as opportunities for improvement. The consultation also comes free to PPG supplied businesses.

“It costs you nothing to try and you’ve got nothing to lose.”

PPG’s MVP Business Solutions program is available as part of PPG’s comprehensive support package. Enquire at mvp.anz@ppg.com or call PPG customer service on 13 24 24 (Aus) 0800 320 320 (NZ).

The Sheen Community Fund has a long history of philanthropy but one practical and inestimable reward is the smiles it brings to young people’s faces.

With a well-known culture of generosity and philanthropy, Sheen Panel Service is focussed on building strong relationships within the community and workshops.

Sheen Panel Service created The Sheen Community Fund to help streamline their community work. The Sheen Community Fund is a dedicated charity fund helping families and children in need.

In July, The Sheen Community Fund

focussed their e orts on partnering with a true and trusted children’s charity, Variety, to deliver bikes for underprivileged children for the Bikes for Kids Foundation.

Head of Operations at Variety, Kellee Ireland, spoke about the work the charity does to help improve the lives of disadvantaged children.

“At Variety we really focus on helping children and families who come from low socio-economic backgrounds, and

children with disabilities. We recognise the stress that families are under, and we want to help in any way we can,” Ireland says.

“We are grateful that Sheen partner with us to deliver such a great day for the kids who really need it the most.”

The day kicked o with members of the Sheen Panel Service Sunshine building the bikes in their pristine workshop. In under two hours, members of the Sunshine Workshop built twelve bikes of all sizes for twelve lucky children.

Sheen Panel Service Sunshine manager, David Farrugia highlighted the importance of the day for the community.

“All the guys jumped on board to help put this day together. No one had to come in on their Saturday, but everyone was happy to help,” Farrugia says.

“It’s a great day, everyone enjoys it. It’s priceless seeing the families and children come in and see their bikes.”

By midday, red, fluorescent pink,

and rainbow coloured bikes lined the workshop walls waiting for their new owners to take them home and enjoy them.

As the families arrived with eager anticipation, the children inspected the bikes as they patiently waited for the presentation.

While the finishing touches were being made on the bikes, the families and team members enjoyed a BBQ and co ee van.

Once the bike building was completed and each bike was given all clear by a safety technician, the families listened to a speech from Variety CEO Mandy Burns. Each child was then called up to receive their bike, with a goody bag and chocolates from Sheen Panel Service.

One parent kept the day as a surprise for her two sons, who did not realise they were going to be gifted a bike each.

“They were a bit confused when we arrived, but now they’re so happy and cannot stop smiling,” the parent says.

“They can ride the bikes to school, to their friend’s houses, it will be great.”

The strong community spirit on the day was underpinned by Sheen Panel Service and the team members at Variety who went the extra mile to make the day an inclusive experience for everyone involved.

“We’ve addressed a specific need, and everyone gets a bike. We bring

the family in under the Sheen banner, and everyone’s had a great, heartfelt day,” a Sheen Panel Service spokesperson says.

The vision of Variety – the Children’s Charity is for all children to reach their full potential regardless of background or ability.

With a network of 40 o ces across 14 countries, Variety is dedicated to supporting children who are living with illness, disability or experiencing disadvantage through the lack of the provision of grants, scholarships, programs and events.

Variety’s work helps children to achieve freedom and mobility, access

their community, communicate and achieve independence and increase self-esteem.

In Victoria, Variety holds numerous events every year to help. disadvantaged children.

“Every year we have an event for 5,000 children across Victoria. We all come together, and everyone gets a gift. For some children who attend, it will be their only present for the entire year,” Ireland says.

“For Sheen to facilitate a day like this, it makes all the di erence.”

Sheen Panel Service ensure that their fundraising e orts flow into some of

Victoria’s much needed charities.

Sheen Panel Service has a prominent history in Victoria’s repair industry. Their philanthropic history spans more than 30 years, and the culture they have crafted brings a sense of community.

The Sheen Community Fund is expected to raise more than $300,000 in 2024 through donations.

Whichever causes are the beneficiaries, the fund’s principle remains the same; a conscious determination to change people’s lives for the better.

The flexibility of the Sheen Community Fund was again on display in April for the Good Friday Appeal.

In April, the fund, supported by Sheen Panel Service, donated $35,000 to the Royal Children’s Hospital – Good Friday Appeal. Sheen partnered with 3AW and the Sheen team members

joined the Climb for The Kids event. Sheen committed the event’s largest contribution.

Sheen Panel Service has a long history of supporting the Good Friday Appeal.

“The shops contribute to the fund every year on a corporate level, so all our businesses pay their way and contribute to the community fund. That’s built into the way our business operates,” a Sheen spokesperson says.

The funds raised went towards research and equipment at the Royal Children’s Hospital to treat critically ill children. The fund’s contribution helped the Good Friday Appeal raise an incredible $20 million in 2024.

These positive results of making a di erence then flows onto the 27 Sheen Panel Service workshops that contribute to the Community Fund.

Shining a spotlight on the Apple Isle, this month’s Future Leader is award winning Jack West from southern Tasmania.

NCR spoke with Jack about his most recent award win, and on his experiences and learnings so far in the automotive repair industry.

The Tasmanian Automotive Chamber of Commerce (TACC) and the Victorian Automotive Chamber of Commerce (VACC) held their annual President’s Gala Dinner at the Palladium at Crown on the 29th of June.

An array of awards were presented on the night, including apprenticeship and automotive excellence awards. Jack took home the TACC Apprentice of the Year Award under his apprenticeship workplace, European Technology Bodyworks, Bocchino Pty Ltd.

Jack says he was thrilled by the

recognition of his e orts with the award.

“I am very happy to have won and I thoroughly enjoyed my time at the presentation night,” Jack says.

Growing up in Hobart, Tasmania, Jack’s first dabblings in the industry was through work experience while completing his Year 10 studies.

Now, five years later, Jack has completed his certificate 3 in Automotive Body Repair Technology at TasTAFE, and is working full time at European Technology Bodyworks, Bocchino Pty Ltd.

“I am currently working on small to large jobs on all types of vehicles. It is great to reflect on how far I have come,” Jack says.

Navigating the automotive repair industry is a challenging career path, with the constant changes and training, and Jack has done well to adapt and continues to work hard at learning.

Jack’s favourite part of the job is seeing the end result.

“Seeing the final product of my hard work is my main motivation,” Jack says.

Jack identified the key traits and attributes that he has observed in his career so far that have made a good leader.

“Problem solving and communication are two areas that I would highlight. Both traits have been essential in my learning and apprenticeship so far,” Jack says.

NCR recognises the ongoing support of IAG for the Future Leader’s series, along with the continued support of I-CAR in developing industry skills.

Jack’s colleagues at Bocchino Pty Ltd have encouraged him each step of the way, and celebrated his Apprentice of the Year award with him at the President’s Gala.

The General Manager at Bocchino Pty Ltd, Angelo Bocchino, praised Jack for his growth and integration into their team.

“Since joining our team, Jack has shown remarkable growth and development. Initially quite shy, he has developed into a confident and integral part of our team,” Bocchino says.

“His hard work and diligent focus on

every task have been exemplary. He consistently collaborates e ectively with his colleagues, always willing to go the extra mile to ensure his work is flawless.”

“His respectful and honest demeanour has garnered him the trust and admiration of both his peers and clients.

“Furthermore, his readiness and proactiveness in assisting others whenever needed highlights his commitment to the success of our team and to the workshop as a whole.”

Next in line for Jack is to further

develop his training and development through upskilling in his new area of interest.

“I would like to start a spray painting apprenticeship in the future. I am always thinking of ways to improve and learn new skills,” Jack says.

With five years in the industry, and an apprentice of the year award to his name, Jack is well placed to share some advice for young people entering the automotive repair industry.

“My main advice would be not to be afraid to ask for help,” Jack says.

“We all have to start somewhere.”

EV training and compliance are a matter of urgency for the collision repair industry and Australia’s leading aftermarket association is turning up the pressure on governments to ensure businesses get the support they need.

Sometimes it comes down to a di erence between the idea and the reality.

Legislation for a New Vehicle Emissions Standard has passed parliament but the details of how this will look as the Australian car parc transitions to EVs and how they operate successfully, is not so clear.

The Australian Automotive Aftermarket Association (AAAA) is pushing for the whole life cycle of vehicles, particularly repair, to be properly looked at by government, along with industry readiness to meet the change.

“We need to ensure that there’s the expertise out there to work on these vehicles safely and e ciently, and that just isn’t being prioritised by governments, and it will mean that people have poor ownership experiences,” CEO Stuart Charity says.

“It potentially increases the cost of insurance, and if cars are having to be written o because the industry doesn’t have the skill sets or the ability to repair them e ectively, the public will lose confidence in the technology.”

Charity has been a voice of warning that the best intentions of a push towards a zero-emission fleet could be undermined if the whole of the lifecycle experience is not considered, including e cient and widespread charging infrastructure and the ability to meet the repair needs of the new vehicles.

“A holistic EV transition approach needs to be implemented to ensure that someone’s first EV purchase is not their last.”

Already the US market, that has a higher uptake of EVs, is encountering repair problems and leaving EV owners with a bad experience to the point where

some are turning back to ICE vehicles, To avoid these future issues of unwanted vehicles stockpiling and lowering targets, Charity says governments need to act now.

The AAAA has also highlighted the willingness of the repair industry to play its part in supporting a new low-emissions car parc with one in ten shops ready for EVs and a further 24 per cent planning to do so within the next two years. This takes on a heightened urgency for the collision repair industry.

“For repair and maintenance, newer cars need less and traditionally they go to the dealers for a while under warranty. So, the general mechanical repair community has a bit more time to prepare but the collision repair industry doesn’t. These vehicles can potentially be involved in a collision, which can happen in week one of a car’s life.”

Charity says all levels of government need to have a more realistic and broader focus to ensure the transition to low emissions vehicles is a lasting success.

“They are still a small percentage of the overall car parc but we’ve seen a massive lift in the number of EVs sold, and we will continue to see a strong growth over the coming years, particularly with the new vehicle emission standard, along with the FBT benefits if you lease a car, and states also have incentives. But they’re all designed to get cars into the pipeline and that’s only one side of the equation. Governments can’t then just wipe their hands of everything else that happens from that point on in the life of a vehicle.”

“The whole ownership experience is really important. We hear from the federal government that we need more electric cars on the road, but very little in terms of policy and focus around that whole infrastructure to support this rollout.”

One of the key areas where governments can make a di erence is ensuring there is an adequate workforce to meet the demand and ensure owning an EV doesn’t turn into a repair nightmare of delays and limited options.

Charity commends the changes the Federal Government made in May by widening the criteria of the New Energy Program for apprentices, a subsidy of $10,000 for working with EVs. This was a change the AAAA and the MTAA had lobbied hard for. Now Charity says governments need to look at upskilling the existing workforce.

“There literally is not enough registered training organisations and TAFEs and other training institutes that have the expertise or the capacity to train. The issue here is we’ve got

an existing workforce of somewhere above 70,000 technicians that need upskilling and training in this area.”

Access and cost are becoming key barriers to adequate training, he says.

“One issue is the availability and the accessibility of training. Even if you want to do the training, it’s very di cult to access, and that gets magnified when you’re in rural and regional areas because the training infrastructure there is even less. It often means that technicians have to go into metropolitan centres to do that training.

“The other problem is the cost to train a technician fully, beyond the basic safety training. If you want full competency in EV repair, it’s a sixmodule training course that can cost up to $20,000 per technician.

“Then you’ve got time out of the workshop to do the training. Workshops have to invest in insulated tools and other equipment to work on EVs and set up dedicated EV bays.

“It’s a big financial commitment and many of our businesses are familyowned operations, and there is not the

business case at the moment to invest in this because they’re not seeing the government support. Without support, if you did it on commercial reasons now, based on the number of cars on the road, it doesn’t stack up.”

The AAAA would like to see governments, at both state and federal level, focus on increasing the capacity of the training organisations to be able to deliver this training and potentially subsidise it, to make it more a ordable for all businesses. The AAAA is also looking for support, whether through tax incentives or other programs, to help businesses with the capital equipment purchases, to encourage workshops to invest in this capability.

“The government wants something like 80 per cent of all new cars sold by 2030 to be electrified, if we want to achieve that, we need to be investing in the infrastructure now to be able to support it.”

Charity says there have been positive steps so far in training, including

grants for EV training undertaken by the MTA NSW and MTA SA and some private industry players. The Australian Automotive Service and Repair Authority has also seen strong interest, with around 700 industry participants signing up for the EV accreditation to access the OEM information AASRA can open up to technicians. But he stresses this is only a starting point.

Charity says compliance with the basic EV safety module will also have serious implications for the risk assessment of a business and occupational safety of workers across the industry, so governments have a responsibility to support these developments.

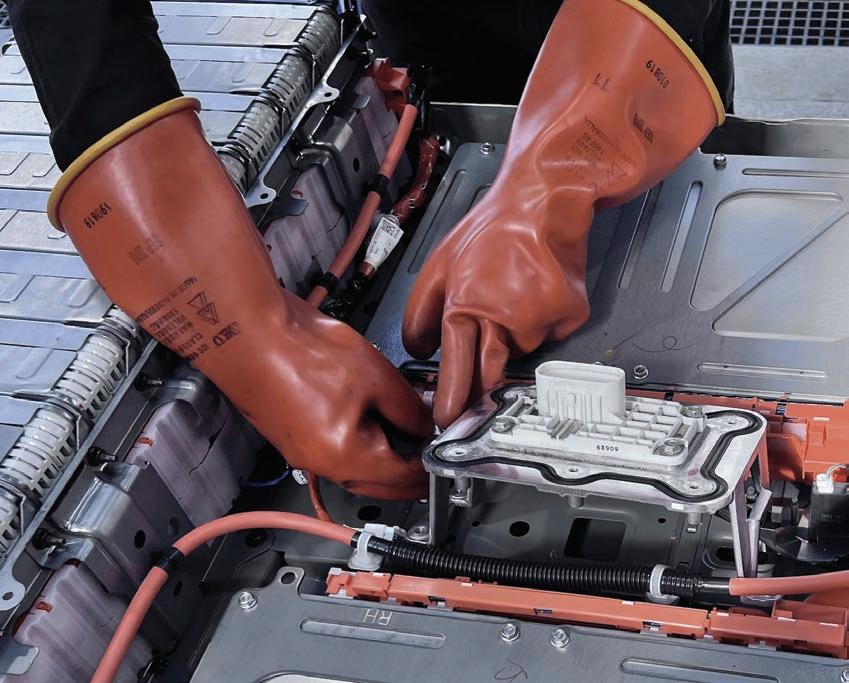

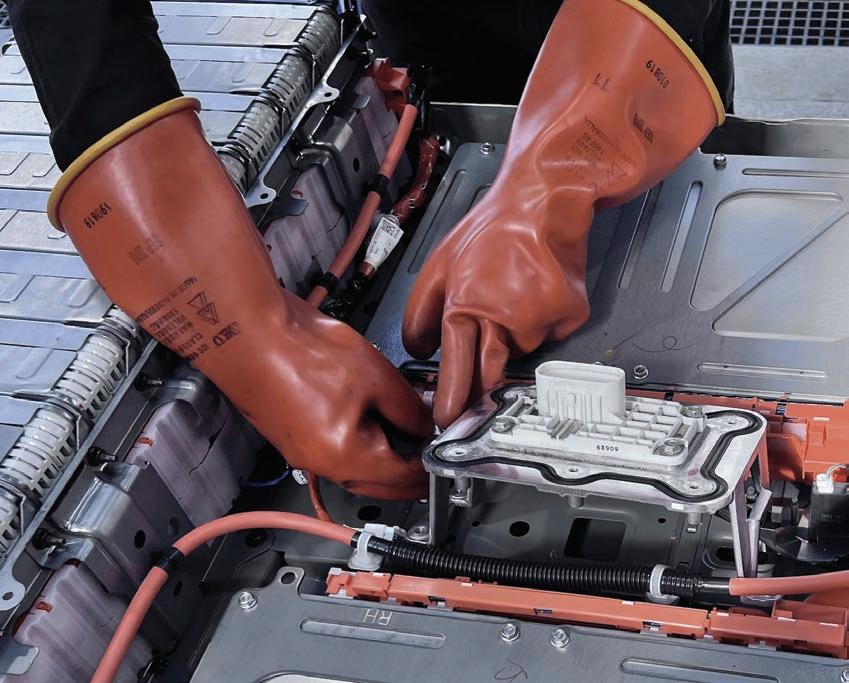

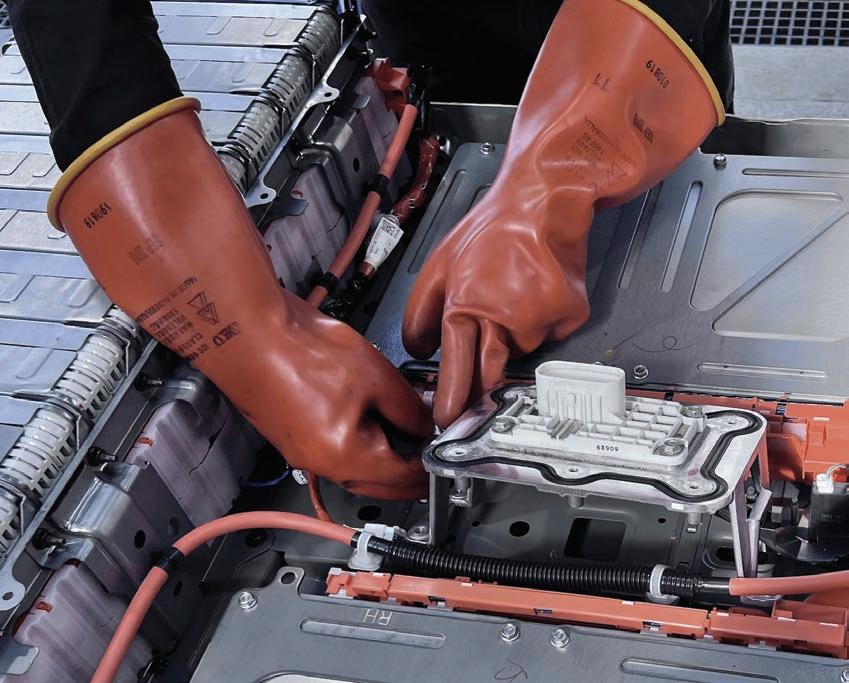

“As a bare minimum, particularly collision repair workshops if they’re taking in electric or even hybrid vehicles, they should have all their sta trained in that basic safety procedure to be able to depower and make a vehicle safe. We should have Australian standards around an EV bay set up and personal protection equipment etc.”

Charity also stresses that dedicated and supported training will also be crucial in shaping a future generation of workers.

“The challenge with the apprentice scheme is they’re going to take four years before they’re fully qualified,” he says. “But that is a good start and will help attract talent into the industry. Electric vehicles and new-vehicle technology will help attract the sort of calibre of young talent into the industry that we need to take us forward. That’s a positive.”

The next step in the journey will be the release of the parliamentary committee’s report into the transition. Whatever that reveals, it is certain the AAAA and other industry advocates will be keeping a close eye on its results and taking the arguments to the key players in government.

“We’re talking to all those ministers regularly about these issues, creating a bit of awareness about this and hopefully we can get focus from government on helping the industry to transition.”

As car manufacturers gear up to deliver automated driving technology, Australian regulations surrounding crash responsibility could shift to insurers and automotive manufacturers.

As car manufacturers like MercedesBenz deliver their Level 3 autonomous driving technology, the Australian Government is working towards establishing a safe deployment of automated vehicles.

Mercedes-Benz has begun rolling out Level 3 autonomous driving technology on a market-by-market basis through its Drive Pilot software.

The Drive Pilot software was first introduced in Germany as an optional extra on certain models from May 2022. The US states of California and Nevada followed suit in 2023.

In media reports Mercedes also said for crashes using autonomous settings of level 3 or upwards, responsibility could lie with insurance providers, software developers, and automotive manufacturers rather than the driver.

Mercedes-Benz’s autonomous driving program head Jochen Haab, told website Drive that while the approach was still only theoretical as they had had no accidents yet with those applications, they could take financial responsibility for the crash under certain circumstances.

Australia currently allows Society of Automotive Engineers (SAE) Level 2 standard of automated driving.

Level 2 is categorised as partial driving automation. These features provide a combination of steering and brake/ acceleration support to the driver.

Level 3 means conditional automation under certain conditions – the car can be in control of up to 60km/h, but only on a freeway and the driver must be able to take back control within 10 seconds.

Mercedes is hoping to increase the speed permitted to 90 km/h later this year, and 130km/h by the end of the decade.

From Level 3 upwards, instead of drivers being held to blame in the event of a crash, the responsibility can be put in the hands of insurance providers, software developers, and automotive manufacturers – when the car is operating under autonomous settings.

Current Australian laws do not allow for the use of automated vehicles on public roads. Australia is in the process of updating regulatory frameworks for vehicles to ensure the safe operation and use of automated vehicles on public roads.

Infrastructure and transport ministers, through the Infrastructure and Transport Ministers’ Meeting, have agreed on a national approach to regulating automated vehicles. The department is working with the National Transport Commission and state and territory governments to implement this national approach.

A new law called the Automated Vehicle Safety Law (AVSL) will be an important part of this framework. The AVSL is being developed by the department in line with the National inservice safety framework for automated vehicles developed by the National Transport Commission.

The AVSL will place the responsibility for the safety of an automated driving system on a corporation and not the human driver. This corporation will need to have the right skills, capacity and capabilities to look after the automated driving system over its operational lifetime. The corporation will be known as the Automated Driving System Entity.

The new Automated Vehicle Safety Law will be supported by

complementary changes to state and territory legislation and to existing Commonwealth legislation such as the Road Vehicle Standards Act 2018. Together these laws will form the end-to-end regulatory framework. This includes:

• making sure an automated vehicle is safe when it is first supplied in Australia, including that it meets any relevant technical standards for an automated driving system

• ensuring that there is a corporation (the Automated Driving System Entity) with the right skills and capabilities to take responsibility for the safety of the automated driving system for its on-road life

• keeping the automated driving system safe when it is operating on the road by placing clear safety duties and other obligations on the Automated Driving System Entity

• ensuring that people that use and interact with an automated vehicle understand what their roles and responsibilities are

• These laws will create the regulatory arrangements to enable safe operation of automated vehicles on our roads and should help Australia to gain the potential benefits of automated vehicles.

Crash damage caused when the driver is not even in the car are the among most common form of insurance claims according to a new report.

The Royal Automobile Association data highlights that vehicle damage caused while it is parked is the most common reason for making a car insurance claim – accounting for more than 10,000 claims every year.

The South Australian insurance provider and motoring association highlighted the top 10 most reasons for a car insurance claim and with ‘damaged while parked’ was the highest at 18 per cent of all motor claims.

This cause was followed by hit fixed object, (17 per cent), windscreen damage (16 per cent) and rear end collision (12 per cent).

PPG has found new fertile ground for its coatings expertise by bringing insurers up to speed with complexities of vehicle paint.

PPG has utilised its training network to develop a specialised, national training

Head of Claims at RAA Insurance

Jess Lyons said the RAA received more than a thousand car insurance claims every week.

“In the 2022-23 financial year we paid out more than $250 million in car insurance claims,” Lyons says.

“The list of most common claim types makes for interesting reading – with the most common cause being vehicles damaged while they’re stationary.

“Having your vehicle hit while parked is unfortunate and often out of your control – so you probably don’t want to be footing the repair bill yourself.

“In this instance, we always recommend getting the details of the driver who hit you if you can, so your insurer can help you investigate potentially having your excess waived if you weren’t at fault.

“If you’re the one who hits a parked car, you must stop and provide your details or report the incident to the police.

“We also receive a lot of claims for damaged windscreens, which can be a real safety hazard, so we recommend getting these repaired as soon as possible.”

program with specialist transport and logistics insurance provider, NTI.

The NTI training program will reach about 45 people from the NTIS’s repair management team conducted at PPG Training Centres in Brisbane, Sydney, Adelaide, Perth and Melbourne

Fabian Gaida, PPG Market

Development Manager says PPG was requested if it could provide a targeted training program to help expand the paint knowledge of the repair management team.

“NTI and PPG have worked closely together on a number of projects over the years, so we have a very good relationship.,” Gaida says.

“When NTI requested some support with training, we were happy to help out. We developed a comprehensive paint training program to suit NTI’s needs and, although it covered some quite technical aspects, it was delivered in an easily understood format. During