Keeping up in a changing landscape: your predictions for 2019

Causes and variables of waterhammer

Procuring engines for a new power station

ISSUE 26 SUMMER 2019

pumpindustry

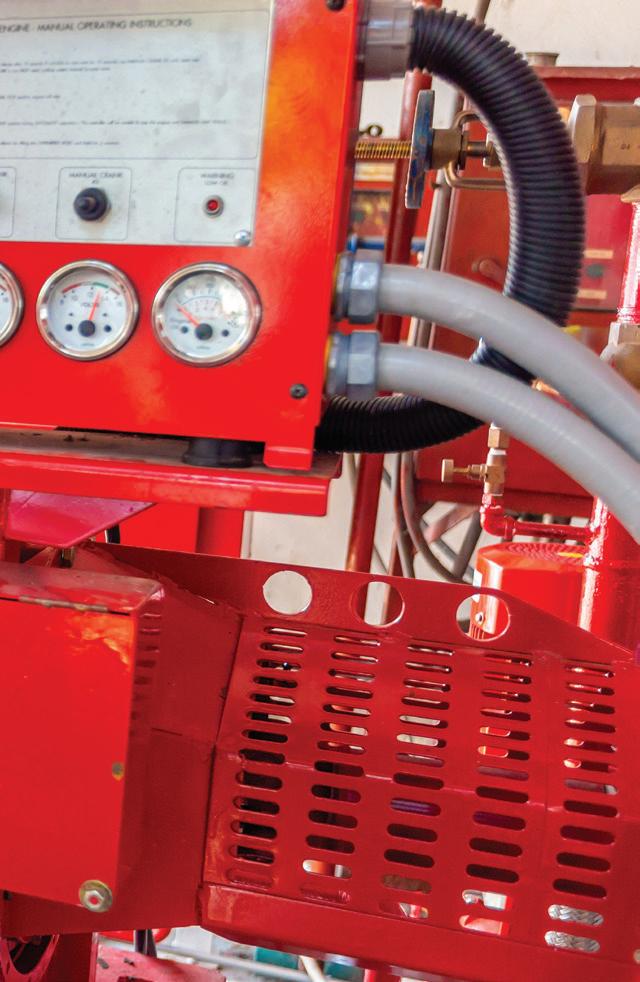

Our No.1 engine solution is now bigger than ever.

DEUTZ Drive is a fully assembled ‘plug and play’ Power Pack package, that’s beautifully designed and can be customised to suit any stationary platform.

The bigger range boasts more horsepower, is easy to assemble and uses less fuel.

Best of all, you can control it from anywhere with remote start and stop.

Proudly Australian, DEUTZ Drive is the preferred pump and irrigation solution.

It just got bigger. DEUTZ Australia | www.deutz.com.au | deutzoz@deutz.com | 03 9549 8400 The engine company. 21-300 kW available

Pump Industry Australia Incorporated

PO Box 55, Stuarts Point NSW 2441 Australia

Ph/Fax: (02) 6569 0160 pumpsaustralia@bigpond.com

PIA Executive Council 2019

John Inkster - President Brown Brothers Engineers

James Blannin - Vice President Stevco Pumps & Seals

Kevin Wilson - Treasurer/Secretary Executive Officer

Alan Rowan - Councillor

Executive Officer - Publications and Training, Life Member

Ken Kugler

Executive Officer - Standards, Life Member

David Alexander - Councillor KSB Australia

Andrew Black - Councillor Envirotech Water Solutions

Mike Bauer - Councillor DynaPumps

Jim Athanas - Councillor Xylem Water Solutions

Hem Prakash - Councillor Davey Water Products

Anant Yuvarajah - Councillor ASC Water Tanks

President’s welcome

Welcome all to this frst edition for the year and my frst as President of PIA. Let me frst thank Dave Alexander for his sterling job as President over the last two years. Whilst Dave has stepped down as President, he is remaining as a Councillor. His experience as former President will be an invaluable voice and continuing source of knowledge to both the incoming Council and as a representative of the industry.

In November, Pump Industry Australia held the AGM at the Box Hill Golf Club in Melbourne, where a new Council for 2019 was elected by members. We are saying farewell to some retiring Councillors and welcoming some new faces. First of all, let me thank those who are moving on for their contribution to the PIA: retiring from their roles on the Council are Keith Sanders, Ashley White and Malcolm Eyre.

Special mention should be made of Keith Sanders who has been a stalwart of the PIA for — should I say — some decades from its inception as the APMA, and has been a tireless and dedicated contributor throughout that period. Keith has served as Secretary, President, Councillor and more recently as the Marketing and Statistics Executive Ofcer, and whilst I am sure his services won’t entirely be lost to us, the PIA and Council will certainly miss his depth and breadth of knowledge of the workings of the pump industry.

Thank you Keith for your considerable and valued contribution to the PIA over such a long period of time. We also thank Ashley and Malcolm, and on behalf of all members, we thank you both for your contribution to the PIA.

Joining the Council, we have Hem Prakash from Davey Water Products and Anant Yuvarajah of ASC Watertanks — we congratulate you both on becoming Councillors and extend a warm welcome to you.

Continuing on as a Councillor is James Blannin from Stevco, who has also accepted the position of Vice President, and along with Hem and Anant, will introduce somewhat of a ‘youthful enthusiasm’ to Council, which is encouraging! Also continuing in their commitment to their roles as Councillors are Alan Rowan, Andrew Black, Mike Bauer and Jim Athanas. With James stepping into the role of VP, this presents a vacancy for one more representative on the Council, so if you would like to take up this position or know of someone who might, please don’t be shy and make contact.

It is clear from the AGM that the PIA faces challenges; it has been said that what is needed is a set of shortterm objectives specifcally related to the current state of the association and the industry, and how successful we have been in representing the expectations of members in the past. The incoming Council faces challenges, but I am confdent that where there’s a will there's a way; the incoming Council will review the feedback from members at large and work to ensure that our members — current and future — obtain value from the services PIA provides and, more importantly, they are what you see as being relevant to you and your business.

See you all in 2019.

John Inkster

2 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au PUMP INDUSTRY

Volvo Penta. Robust, fuel efcient industrial diesel engines that keep running even in the toughest conditions. Easy to install, operate and maintain. A powerful partnership you can trust all the way from the drawing board throughout the operational life of your engine. Competitively priced complete power-pack units ready for delivery Australia wide with a local support team on hand 24/7. To find your nearest dealer visit www.volvopenta.com

105-515 KW

A POWERFUL PARTNERSHIP

ABN: 36 426 734 954

PO Box 1763

Preston South VIC 3072

P: (03) 9988 4950

F: (03) 8456 6720

monkeymedia.com.au

info@monkeymedia.com.au

pumpindustry.com.au

magazine@pumpindustry.com.au

Editor: Lauren Cella

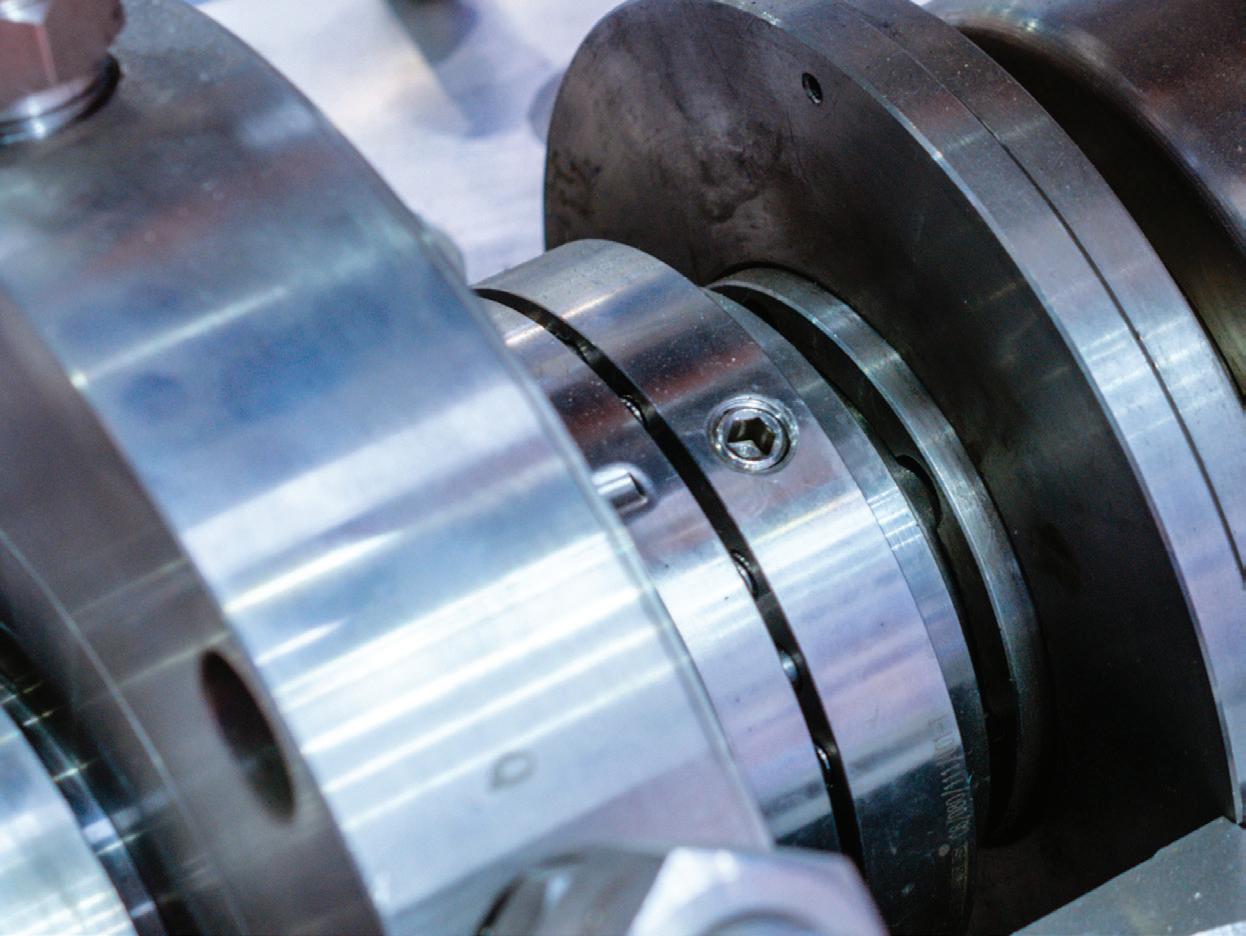

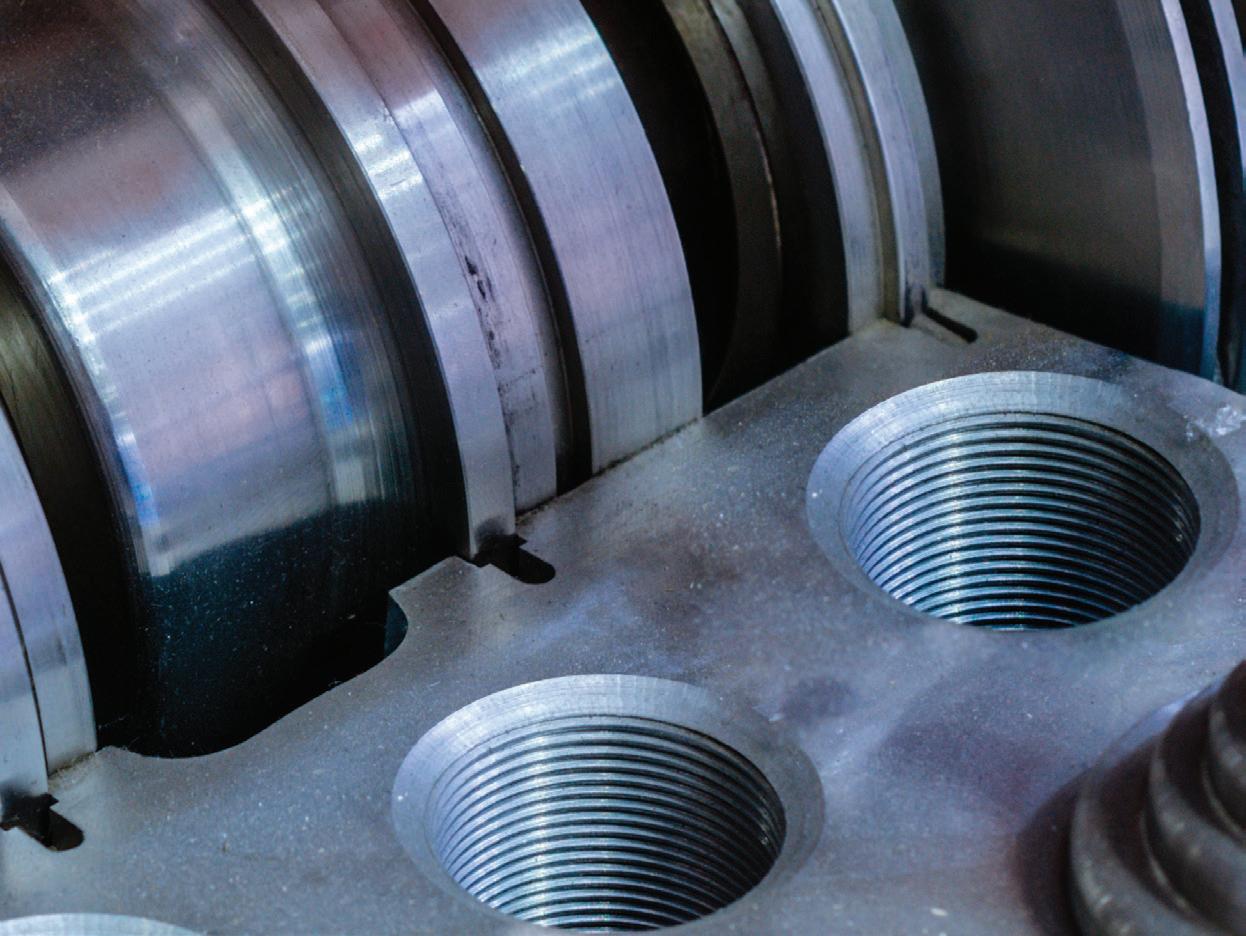

Assistant Editor: Claire Gaynor

Journalists: Elisa Iannunzio

Lauren Butler

Digital Marketing Manager: Sam Penny

Business Development Manager: Rima Munafo

Marketing Assistant: Helena Brace

Melissa Charalambous

Senior Designer: Alejandro Molano

Designer: Aileen Ng

Publisher: Chris Bland

Managing Editor: Laura Harvey

ISSN: 2201-0270

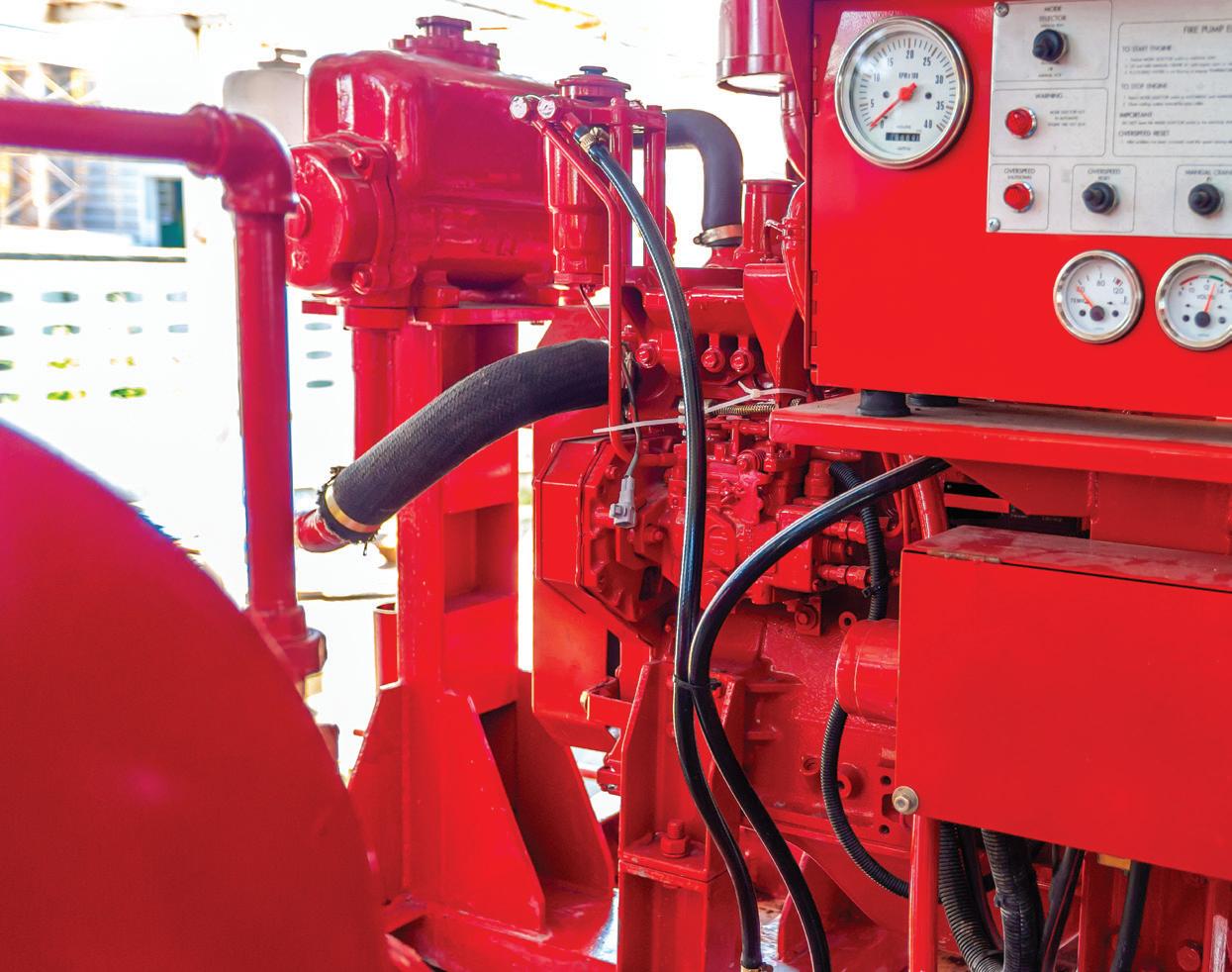

INDUSTRY NEWS

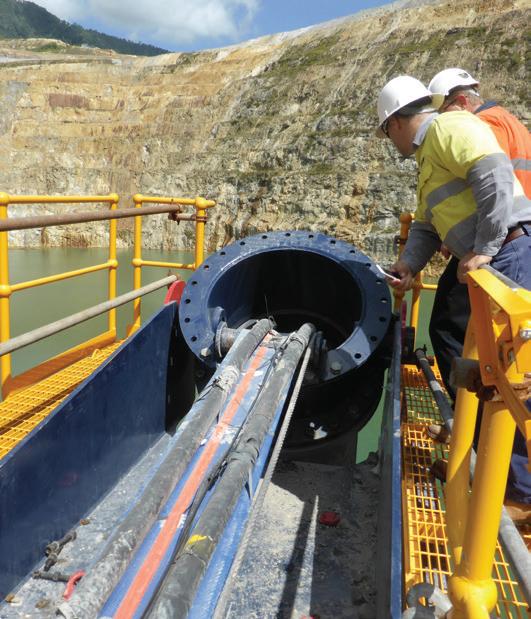

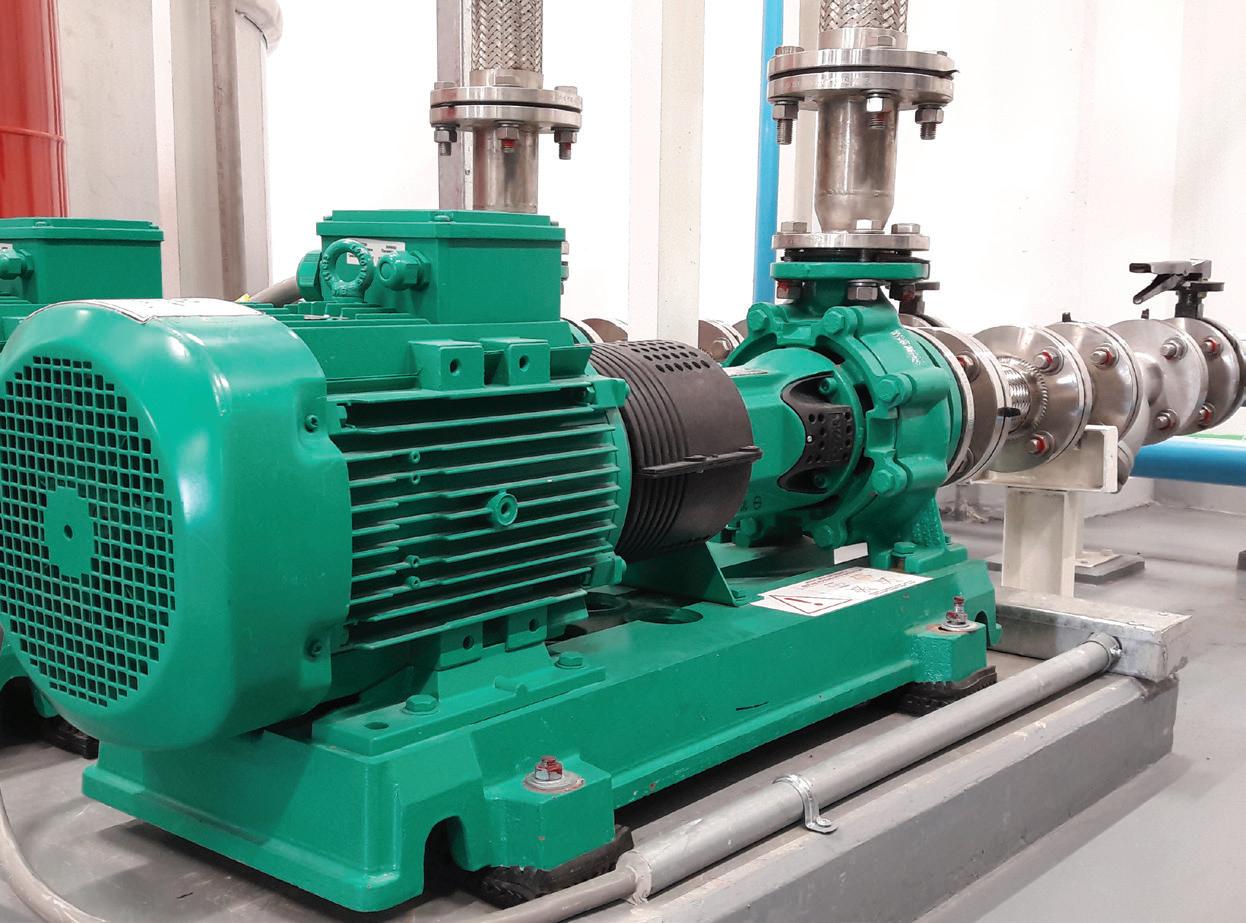

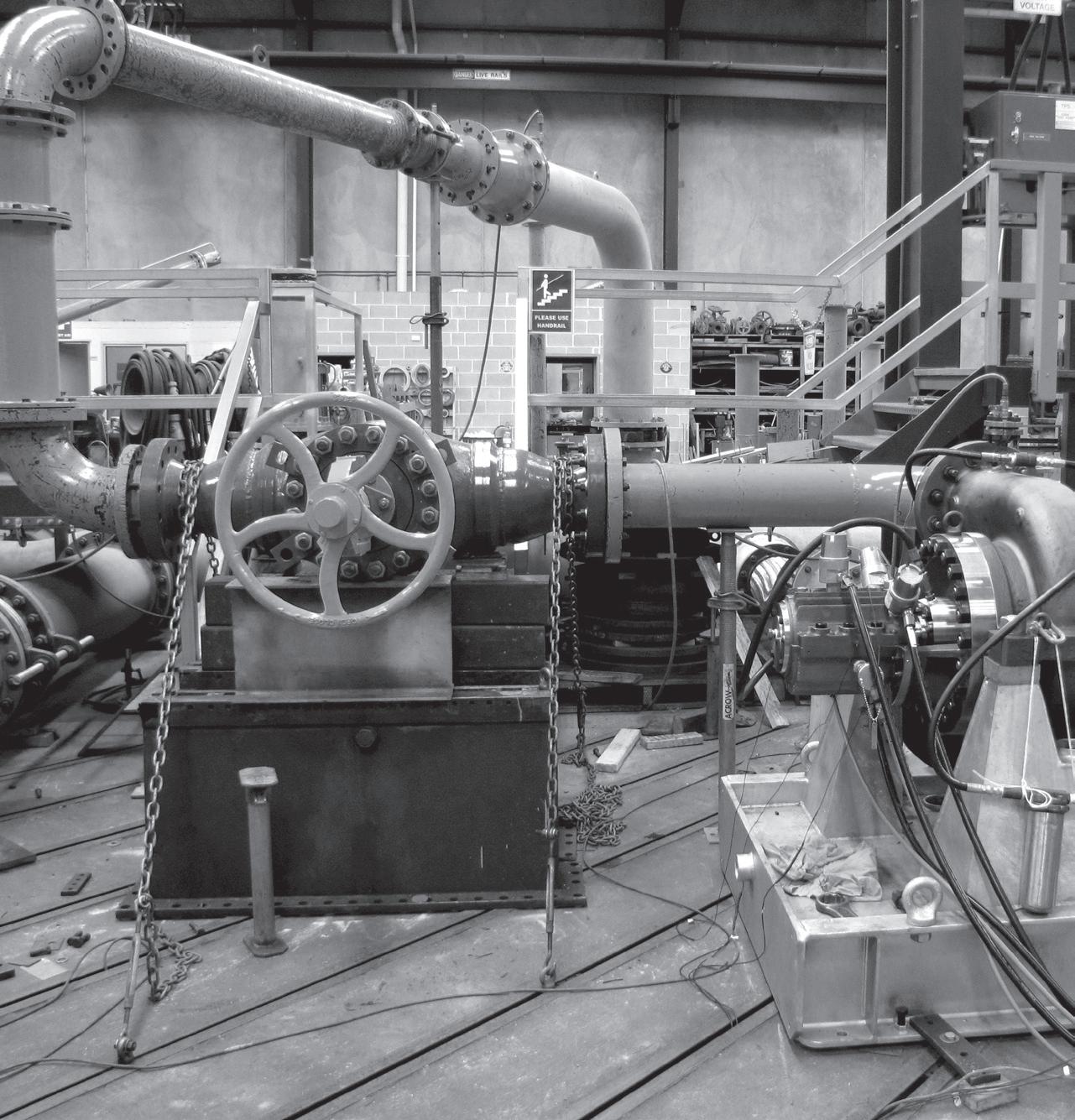

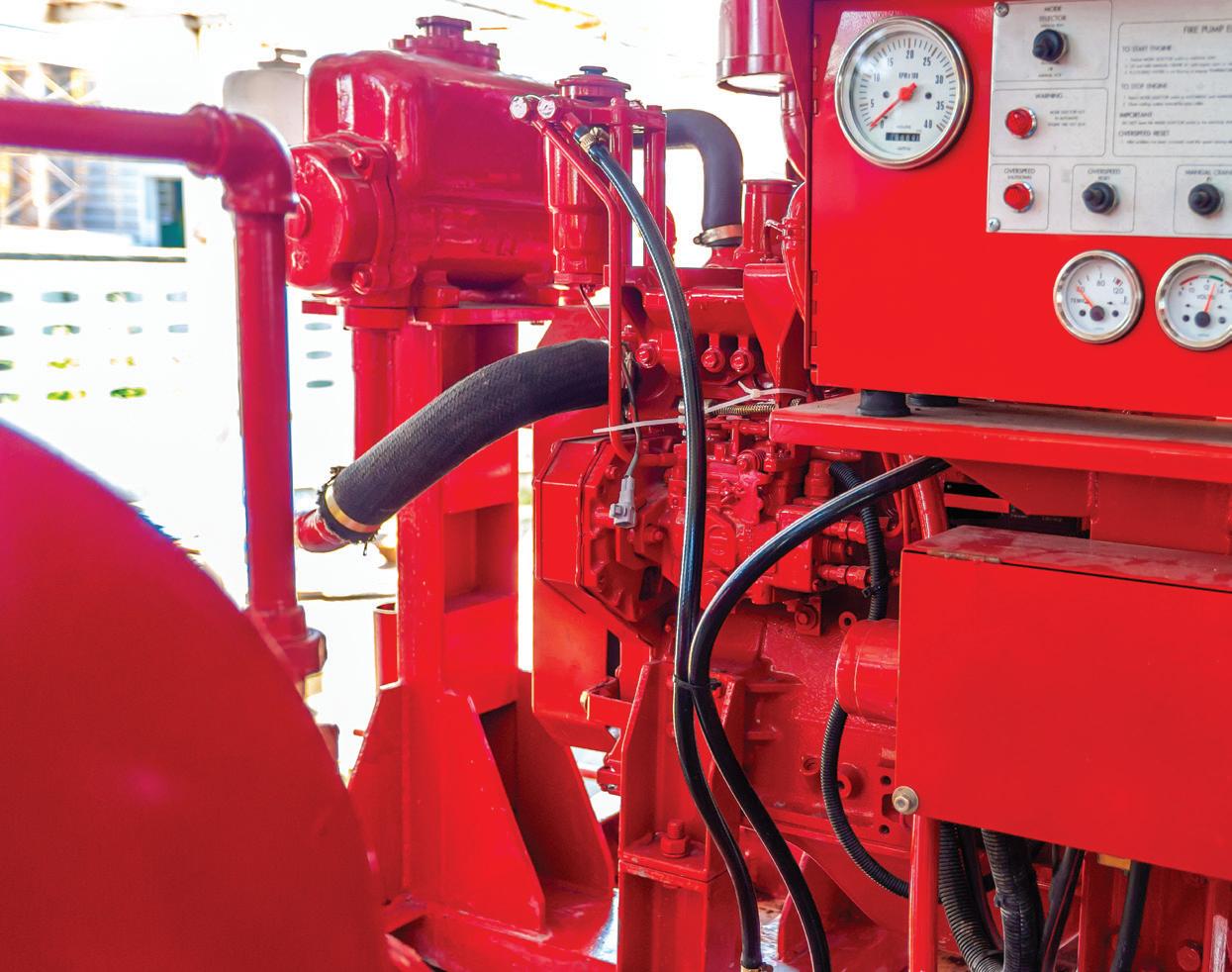

CONTENTS Cover image highlights the power generation feature which looks at the procurement of engines for a power station. This magazine is published by Monkey Media in cooperation with the Pump Industry Australia Inc. (PIA). The views contained herein are not necessarily the views of either the publisher or the PIA. Neither the publisher nor the PIA takes responsibility for any claims made by advertisers. All communication should be directed to the publisher. The publisher welcomes contributions to the magazine. All contributions must comply with the publisher’s editorial policy which follows. By providing content to the publisher, you authorise the publisher to reproduce that content either in its original form, or edited, or combined with other content in any of its publications and in any format at the publisher's discretion.

1 April 2018 – 30 September 2018 Published by Monkey Media Enterprises

4,706

NEWS Contract awarded for TasWater capital works 6 Caloundra sewerage network upgrade complete 6 Tenders for Longford sewage treatment plant upgrade being assessed .. 7 $500 million to boost regional water infrastructure 8 Hiding HVAC and water treatment facilities in a Barangaroo basement 10 Ammaroo Phosphate Project gets the green light ................................. 12 PIA NEWS PIA looks towards the future in 2019 ....................................................... 14 PIA

NEWS New range of EN733 pumps: world leading performance ...................... 18 On a crusade to create the best layfat hoses 20 The new DryWet sewage pumps set to change the market 22

MEMBER

Polymer vanes last three times as long in vacuum rotary pump 24 Gorman-Rupp pumps selected at Southern Meats ................................ 25 High performance motors for energy-efcient pumping 26 A new engine for sustainable farming 28 Highly durable Sectional Panel Tanks available at Masterfow ................ 30

Ask

5 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 pumpindustry STATE OF THE INDUSTRY Keeping up in a changing landscape: State of the Industry 2019 32 OIL & GAS Upgrading general purpose steam turbines - Part 2 40 VALVES Waterhammer: causes and variables 48 System simulation as a troubleshooting tool ............ 50 POWER GENERATION Procuring engines for the Barker Inlet Power Station .. 52 The pumps and engines powering cogeneration and trigeneration systems 56 FIRE Battery failure risks in fre pumps 60 Complying with fre pump standards ......................... 64 PUMP HANDBOOK Selecting and applying slurry pumps - Part 2 ............ 68

: President’s welcome ..................................................... 2

Regulars

an expert: Valveless fow control with progressive cavity pumps and their usefulness in oil and gas 66 This

and

school: Restarting motor-driven centrifugal pumps after power failure 71 Editorial schedule ........................................................ 72 Advertisers’ index ....................................................... 72

edition of Ask an Expert will look at valveless fow control with progressive cavity pumps and their usefulness in fow control

Oil & Gas applications. Pump

CONTRACT AWARDED FOR TASWATER CAPITAL WORKS

TasWater has selected its preferred contractor to deliver a capital works program to support and develop water and wastewater infrastructure and major regional water projects in Tasmania.

CIMIC Group companies UGL and CPB Contractors, and TasWater, intend to establish an alliance to deliver infrastructure planning, project development and delivery of all capital works across TasWater’s regional asset network in Tasmania, including:

• Water and wastewater treatment plants

• Water networks

• Dams and water storage

• General asset renewal programs

CIMIC Group Chief Executive Ofcer, Michael Wright, said, “The unique combination of UGL’s expertise in the water sector and CPB Contractors’ experience in major project design and construction projects positions us strongly to partner with TasWater to deliver world-class infrastructure to the communities of Tasmania.”

Caloundra sewerage NETWORK UPGRADE COMPLETE

The construction of a new 15m-deep sewage pumping station at Duck Holes Creek in Caloundra, South East Queensland, is complete, signalling the end of a sixyear-long upgrade to the area’s sewerage network.

Unitywater Executive Manager Sustainable Infrastructure Solutions, Scott Barnes, said Unitywater had invested $30 million across fve major infrastructure projects to ensure the area’s sewerage network will meet the needs of a growing population.

“Greater Caloundra is experiencing considerable growth. Upgrading the sewerage network improves its efciency and lowers maintenance costs into the future. Importantly, the new infrastructure minimises the risk of sewage overfows in extreme weather, and tackles odour and corrosion concerns,” Mr Barnes said.

The upgraded sewerage network services Caloundra, Golden Beach, Aura, Pelican Waters, Little Mountain and Bellvista.

As well as the new pumping station at Duck Holes Creek, works have included new sewer mains in central Caloundra, a new odour control facility in Aroona and relining the Kalana Road sewerage main. Along Nicklin Way, between Caloundra and Aroona, a new sewerage pipeline was built using the longest horizontal directional drill of its kind in Australia.

All new infrastructure was expected to be completed and in service by the end of 2018.

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au 6 NEWS

TENDERS FOR LONGFORD SEWAGE TREATMENT PLANT UPGRADE BEING ASSESSED

Improvement works on the Longford sewage treatment plant are one step closer, with TasWater assessing tenders for the design and construction of an upgraded plant.

During 2018, TasWater undertook an early contractor involvement process where potential contractors assisted to workshop design solutions to the unique issues facing the sewage treatment plant.

TasWater said this was the most appropriate, innovative and collaborative method to get a ft-for-purpose solution, and will enable improvement in both the quality of treatment and odour management.

The successful contractor is expected to be awarded the contract in early 2019. Construction is expected to start in late 2019 after a comprehensive design phase.

“This is a complex project, and it’s crucial we get it right from the start,” TasWater Senior Project Manager, Rennie Brown, said.

“It is a comprehensive process, but it is also an opportunity to make sure we are getting the best outcome for all stakeholders, TasWater and the environment.”

The upgrade is designed to accommodate a mix of domestic waste and trade waste from Longford, including waste from the JBS livestock processing facility, and will improve the environmental and odour impacts from the site.

“We understand the community remains concerned about odours, which may persist from time to time until the new treatment plant is commissioned in late 2020,” Mr Brown said.

7 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 NEWS PROTECT YOUR PLANT & PERSONNEL Arc Flash Protection PGR-8800 Ultra Fast (1msec) light detecting relay to minimize Arc Fault damage to plant and personnel. Earth Leakage EL731 Wide frequency band (DC-6kHz) earth leakage detection for variable speed drive applications (AS2081:2011 compliant). 6/8 Selkirk Drive, Noosaville, QLD 4566 P.O. Box 1965, Noosaville, QLD 4566 T 07 5455 5060 | F 07 5455 5062 E sales@startco.com.au www.startco.com.au Representing Littelfuse Inc Australia & New Zealand.

$500 MILLION

Transformational water infrastructure projects for regional communities could now become a reality, with an extra half-a-billion dollars added to the National Water Infrastructure Development Fund.

Minister for Infrastructure, Transport and Regional Development, Michael McCormack, announced the fund’s increase of more than $500 million will be used to work with state and territory governments to identify and co-fund the construction of new water infrastructure projects across regional Australia.

“This announcement will turbocharge the construction of water infrastructure in regional Australia because our agricultural industries expect it and our communities deserve it,” said Mr McCormack.

Mr McCormack said water is the lifeblood of regional communities, and this historic injection of funds will be a game changer for many communities.

“This funding pipeline represents the single biggest commitment to investment for building water infrastructure across the nation.

“Access to secure and afordable water is critical to the lives of many Australians in regional areas, and investment in water infrastructure is vital to keep Australia thriving, especially during tough times of extended drought.

“Having the right water infrastructure in the right place will provide greater opportunities for new and expanded highvalue irrigated agriculture.

“This is not just about storing water in times when it is dry; it is also about protecting communities through food mitigation in times when it is incredibly wet.”

Minister for Agriculture and Water Resources, David Littleproud, said water means wealth and jobs in the regions.

“As a former rural bank manager, I know the value of a megalitre of water to a rural community,” Mr Littleproud said.

“We’re proud to be delivering water and wealth to rural communities.”

The Fund’s expansion to more than $1 billion, as well as the existing $2 billion National Water Infrastructure Loan Facility program, means more than $3 billion is now available from the Federal Government to support state and territory governments and their project partners, to build new water infrastructure and provide greater social and economic opportunity for Australians.

“From Myalup in regional Western Australia to Queensland’s Rookwood Weir, we believe in dams and water security, and are investing to make it a reality for regional Australians,” said Mr McCormack.

“This announcement is exciting for regional Australians, who understand full well the importance of water storage.”

The expanded funding includes:

$2 million for the North and South Burnett regions (Queensland)

A $2 million commitment has been made for a feasibility study to investigate increasing water supply and security in Queensland’s North and South Burnett regions.

Federal Member for Flynn, Ken O’Dowd, said the study would help to drive economic and social growth in regional Queensland.

“The feasibility study is great news for farmers in the region, as it will examine a range of options and identify solutions to increase water supply that would underpin an expansion of irrigated agriculture, delivering new jobs and economic growth in the North and South Burnett regions,” Mr O’Dowd said.

“Through the National Water Infrastructure Development Fund, we have committed over $426 million to get construction underway on a series of key water infrastructure projects in Queensland.”

$1 million for the Southern Forest Irrigation Scheme (Western Australia)

The government has committed up to $1 million to fnalise the regulatory approvals required for the Southern Forest Irrigation Scheme to progress towards construction.

The approval process will include developing the fnal business case, design and Environmental Impact Statement for the agricultural irrigation scheme situated in the ManjimupPemberton region of Western Australia’s south-west.

“In Western Australia, one benefciary of this $30 million feasibility component will be the Southern Forests Irrigation Scheme, which proposes construction of a dam and supporting irrigation supply infrastructure to reliably deliver 923ML of water annually to support new irrigation in the Manjimup and Pemberton regions, benefting the horticulture, livestock beef and nursery industries,” Mr McCormack said.

Federal Member for O’Connor, Rick Wilson, welcomed the announcement, saying the project — subject to receiving essential planning approvals and detailed design work — stood to generate a number of benefts for the state’s southwest region.

“If constructed, the Southern Forest Irrigation Scheme will increase water availability to our job-producing regional industries and create up to 150 direct jobs, 75 indirect jobs and up to 125 construction jobs during the estimated two-year construction period,” Mr Wilson said.

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au 8 NEWS

to boost regional water infrastructure

“Greater water security will provide growers with the confdence to invest in their business to underpin an expansion of high-value irrigated horticulture of up to 1675ha.”

$250,000 for the Coldstream Recycled Water Pipeline (Victoria)

A new commitment of up to $250,000 to help progress the Coldstream Recycled Water Pipeline Scheme in rural Victoria would help it become construction-ready.

Mr McCormack said the $250,000 commitment to the Coldstream Recycled Water Pipeline Scheme would assist with fnalising the project design, regulatory approvals and operational arrangements.

“The proposed Coldstream Recycled Water Pipeline Scheme, located adjacent to the Yarra River between Coldstream and Healesville in Victoria, involves construction of

two Class A water treatment sub-systems, and a pipeline and distribution network to deliver up to 1500ML of recycled water to producers,” Mr McCormack said.

Federal Member for Casey, Tony Smith, welcomed the announcement.

“If built, agricultural production, tourism and seasonal employment relating to food and fbre all stand to gain, helping support our exports such as cool climate wines, strawberry farms, fruit orchards, and livestock,” Mr Smith said.

“Subject to fnalising the project design and operational arrangements, and receiving all necessary regulatory approvals to proceed to construction, the Coldstream Recycled Water Pipeline Scheme is expected to provide businesses covering approximately 1000ha in the region with improved water security and reliability.”

DiamondFace technology: Unbeatable performance for mechanical seals

DiamondFace by EagleBurgmann is the solution for difficult mechanical seals applications. Wherever poor lubrication, partial dry running, abrasive media or electrochemical corrosion leads to high wear, DiamondFace offers the most robust solution.

9 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 NEWS

EagleBurgmann Australasia Pty. Ltd. 16 Stennett Road, Ingleburn, NSW 2565 Sydney, Australia Phone: +61 2 9605 0600 info@au.eag eburgmann.com http://eagleburgmann.com.au

HIDING HVAC AND WATER TREATMENT FACILITIES IN A BARANGAROO BASEMENT

A77,000sqm basement constructed beneath the surface of Sydney’s Barangaroo South precinct is allowing the area to maximise sustainability outcomes while reducing costs.

Containing everything from a cooling plant to water treatment facilities, the basement is a prime example of how to implement less obstructive utility rooms.

James Peterson, Head of Operations for Barangaroo South – Lendlease, was part of a diverse design, development and construction team responsible for bringing the basement to life.

“We wanted to create something that was an example of global operational best practice in terms of its ability to leverage scale to run more efciently, and removing duplication, whilst creating an exciting place for people to live, work and play,” Mr Peterson said.

“Most large commercial buildings around the CBD have poor ground planes because they have to house plant rooms, driveways, loading dock entries and exits, which leaves room for only a cofee shop or two at best. At Barangaroo we’ve taken the plant, access ways, services and systems required for nine buildings into one basement with just two entry points.”

Some key features include:

District Cooling Plant

A typical building’s air conditioning relies on cooling towers on their roof, consuming on average approximately 20,000L of water per day. Rather than following this approach, the design team wanted to utilise the scale and location on the harbour of Barangaroo and developed a harbour heat rejection central district cooling plant in the basement. By using the harbour water this saves the environment approximately 60,000L per day whilst also freeing up the rooftops for solar panels.

Recycled water treatment plant

The plant is capable of creating more water than the precinct uses each day. All black and grey water is taken through mechanical and chemical process to convert used water into high-quality recycled water used for toilet fushing and irrigation. With an ultimate capacity of more than a million litres a day, the plant can process not only used water from the precinct, but also that from neighbouring buildings. This means more recycled water could be exported than the potable water imported.

10 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au NEWS

59 Export Dr Brooklyn VIC 3012 Email: sales@wellcross.com.au wellcross.com.au 656 276 AUSTRALIA’S TRUSTED DIESEL POWER AUSTRALIA’S TRUSTED DIESEL POWER Adelaide | Brisbane | Melbourne | Perth | Sydney | Townsville POWERED BY POWERED BY CROSSLEYTM ARE YOU RUNNING YOUR PUMPS WITH GENERATORS? We can custom design generators to suit your pumping and irrigation needs, soft start, VFD or DOL.

INSTALLATION & COMMISSIONING course brisbane

Lowara has an extensive range of pumps and pressure systems suitable for commercial buildings, homes, general industries, agriculture and irrigation.

Reliable, high performance, quality materials, and the widespread Lowara support network make these pumps an ideal selection for your water supply requirements.

11 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26

FOR MORE EVENTS, NEWS & UPDATES, KEEP IN THE LOOP BY JOINING US ON LINKEDIN @PUMPINDUSTRYAUSTRALIA W H A T ' S O N I N 2 0 1 9 . . . ?

t e c h n i c a l m e e t i n g b r i s b a n e

SEMINARS STAY TUNED! t e c h n i c a l m e e t i n g a d e l a i d e t e c h n i c a l m e e t i n g p e r t h t e c h n i c a l m e e t i n g s y d n e y j u l y a u g u s t o c t o b e r Ph: 1300 4 BBENG www.brownbros.com.au

TECHNICAL MEETING MELBOURNE

HALF-DAY

Call us today to see how we can deliver your pumping solution. DELIVERING PUMPING SOLUTIONS 05/17

AMMAROO PHOSPHATE PROJECT gets the green light

Aproposed Verdant Mineral Limited phosphate project — including new pipeline infrastructure and borefeld — has been deemed environmentally acceptable by the Northern Territory Environment Protection Authority (NT EPA).

The proposal is to construct and operate the Ammaroo Phosphate Project, located approximately 270km north-east of Alice Springs. Key elements of the proposal include:

• A phosphate mine, processing plant and surface tailings storage facility

• An infrastructure corridor accommodating a 105km rail spur (connecting to the Adelaide to Darwin railway line) and a 137km underground gas pipeline (connecting to the Amadeus gas pipeline)

LEAD CHANGE

CHALLENGE YOURSELF TO ACHIEVE PERSONAL AND PROFESSIONAL GROWTH

Get the business management, leadership and enhanced technical skills you need to progress in your career.

Take the next step and advance your skills through specialized leadership, with a comprehensive 12-month professional master’s degree.

• A borefeld and 12km pipeline for water supply

• Supporting infrastructure

• The realignment of approximately 12km of the Murray Downs Road to bypass the mine site

NT EPA Chairman, Dr Paul Vogel, said the NT EPA identifed potentially signifcant environmental impacts and risks associated with the Ammaroo Phosphate Project and made 12 recommendations to avoid and mitigate these, including regular audits and peer reviews of critical aspects of the project by independent experts, and public transparency of the mine’s water management.

The expected mine life is 25 years, with an additional two years for closure and rehabilitation. The mined-out

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au 12 mel.ubc.ca/pump

Integrated Water Management NEWS

pits will be progressively rehabilitated. The mine will have a construction workforce of up to 300 people with an operations workforce of up to 150.

Benefciation (processing) will occur on site, producing up to 2Mt/y of 32 per cent phosphate rock concentrate that will be transported by rail to the Port of Darwin for export.

Water will be sourced from the Georgina Basin carbonate aquifer. The NT EPA identifed the proposed groundwater abstraction of 3.6GL/y as substantial, and paid particular attention to potential impacts on groundwater resources and associated environmental values in the arid zone of the NT where the proposal is located.

The NT EPA’s key recommendations focus on ensuring leading practice in the management of groundwater resources, rehabilitation and closure, and community engagement, in order to provide a high level of confdence that the proposal will meet the NT EPA’s environmental objectives.

In addition to stringent monitoring and mitigation measures, the NT EPA recommended full transparency in relation to the mine’s groundwater abstraction through

stakeholder consultations and public disclosure of all water management plans and annual reports.

Although initial investigations indicate that mined and processed materials will be unlikely to produce saline, acid or metalliferous drainage, the NT EPA recommended a stringent precautionary approach to avoid, minimise and immediately mitigate any of-site efects from the proposed mine.

The NT EPA supports the proposed progressive rehabilitation of the mine, and has made recommendations to ensure that mine closure planning is thoroughly considered prior to authorisation of the proposal and on an ongoing basis throughout the mine life, including appropriate stakeholder consultation and an agreed post-mining land use.

“The NT EPA considers that, subject to the implementation of all recommendations and the commitments and safeguards listed in the proponent’s Environmental Impact Statement, the proposal can be managed in a manner that is likely to meet the NT EPA’s objectives, and avoid signifcant or unacceptable environmental impacts and risks,” Dr Vogel said.

NEWS

13 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26

PIA

looks towards the future in 2019

Last November, the PIA council and its members gathered in Melbourne for the association's annual general meeting and dinner. Atendees were updated on the association’s activities and achievements over 2018, as well as its plans for 2019 and beyond.

The PIA reported it had been a busy year, with the council working on a number of projects to further standards in the industry, improve knowledge and skills training, and industry collaborations.

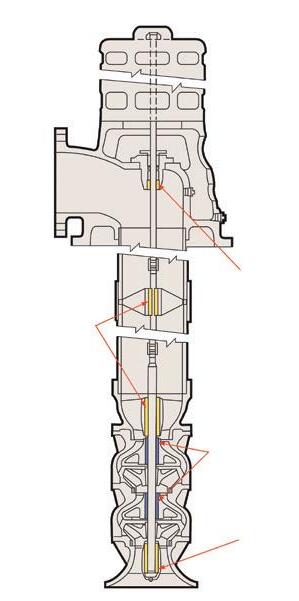

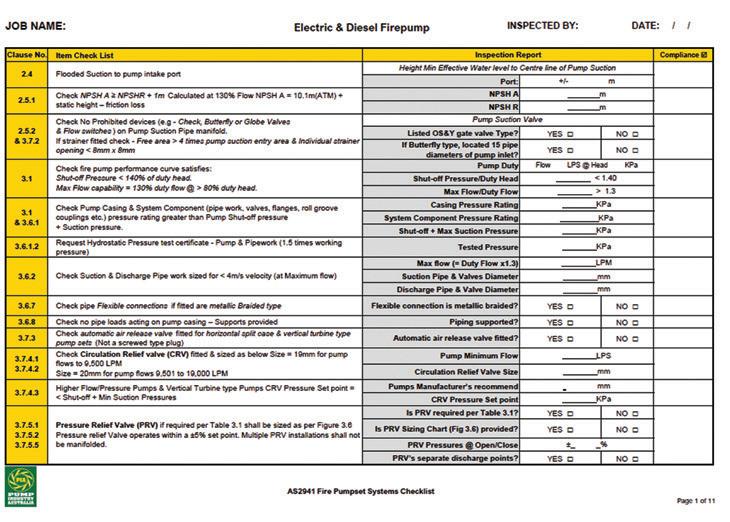

A lot of work was undertaken on standards in 2018, with AS/ ISO 9906:2018 Pump Performance Acceptance Test Standard replacing AS 2941 last February. The PIA is also leading a proposal to adopt ISO/ASME 14414:2015 Pump System Energy Assessment as an Australian Standard, and will be voting for the acceptance of the draft AS 2304 Water Storage Tanks for Fire Protection Systems.

The PIA also collaborated with a number of external stakeholders throughout the year with activities, including:

• Collaboration with AMCA to provide support for the new Centre of Excellence being developed at Holmesglen TAFE in Victoria, with work already underway

• Collaboration with the Fire Protection Association Australia (FPAA) on adoption of a AS 2941 fre equipment certifer’s checklist, see page 64 for more details

• Discussions with Standards Australia to be an "International Participant” so PIA can have direct input to the ISO committee in Europe for pump standards

• Chairing the Department of Energy and Environment subcommittee on Minimum Efciency Performance Standards (MEPS) for pumps regulations

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au 14

PIA NEWS

Training and seminars

The PIA said a number of training courses and seminars had been successfully held, with the year kicking of with a Technical Meeting held at Regal Beloit in Melbourne in March.

In May, a one-day efciency seminar was held in Melbourne looking at energy efciency and savings in pumping systems. Around 30 pump professionals attended the event to hear presentations from ten industry experts and government personnel. Attendees heard about the latest developments on the impacts of pumping systems on energy and the environment, energy efciency policies and planned legislation, and technical and commercial advances made in the application and penetration of energyefcient pumping systems.

The seminar was well-received by attendees, so two half-day energy efciency seminars were held in September in Brisbane and Sydney.

Further Technical Meetings were held throughout the year in Brisbane and Adelaide in July and September, and an Installation and Commissioning Course was held at KSB in Brisbane with eight certifed pump professionals graduating.

Looking towards the year ahead

The council announced the PIA is looking towards the future, with activities in 2019 set to further the reach of the association, and provide more opportunities for members and non-members to further their skills and learn about changes to the industry.

A key objective of the council moving forward is to increase membership, with plans now underway and upcoming to achieve this, including:

• Introduce digitalisation, such as live streaming of AGM, e-learning, LinkedIn, Facebook, and email signatures for current members

• Include Pool (Domestic and Commercial), Irrigation, Rural and Domestic Sectors to the PIA

• Better use of website for communication and payments

The PIA is also looking to continue providing opportunities for training and seminars on topics of interest to the industry, as well as improvements to qualifcations. Plans include:

• Formalisation of Selection, Sales and Installation qualifcations, such as generic VET qualifcations, which will be transferable to all employees at all levels. Has acceptance with IAL, ABCB, Master Plumbers and industry

• Continue energy efciency seminars

Dr Margaret Beavis from 2017 Nobel Prize winning organisation International Campaign to Abolish Nuclear Weapons (ICAN) gave a thought-provoking and debate-inducing presentation about the work being undertaken by the organisation to promote adherence to and implementation of the United Nations nuclear weapons ban treaty.

15 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 PIA NEWS

Greg James and Ken Kugler.

Les Boelckey, Lynne Sanders and Keith Sanders.

• Organise additional meetings on changes to standards

• Organise and identify potential speakers who will be of interest and beneft to members

• Continue to hold regular meetings in capital cities for members

• Continue to organise seminars and workshops in capital cities on technical topics such as energy efciency, fre pump installations, general pump technology and to increase industry awareness of Australian capabilities for pump equipment

• Organise training programs to service the needs of members, including the new PIA Installation and Commissioning course, and promotion of the BPMA and HI training programs

There will also be some changes to the PIA moving forward, with key council positions being updated and expressions of interest sought, and portfolios will be allocated to each councillor.

Along with upcoming changes, the council will continue liaising with industry organisations and government departments to promote cooperation between industries, and improve standards.

16 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au PIA NEWS

Alan Rowan, Anant Yuvarajah and Ashley White.

Nick McNamara, Mark Alexander and Ron Astall.

Listening to the needs of the members

The PIA aims to help its members grow and operate successful, sustainable businesses through representation, promotion, information and research. In order to do this, it needs feedback from members so it can provide them with the information and knowledge they want and require.

In late 2018, an anonymous online survey was conducted which will help shape activities in the year ahead, in particular training and seminars. The council strongly encourages all members to take part in such surveys in the future or to email feedback or suggestions for topics and speakers to the council directly, to ensure you are getting the most beneft from the association.

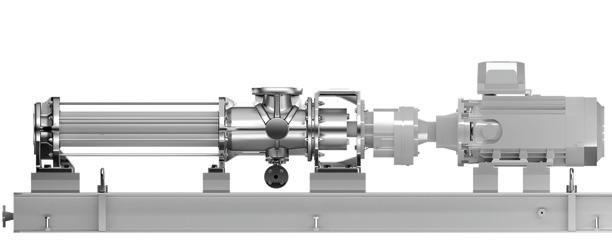

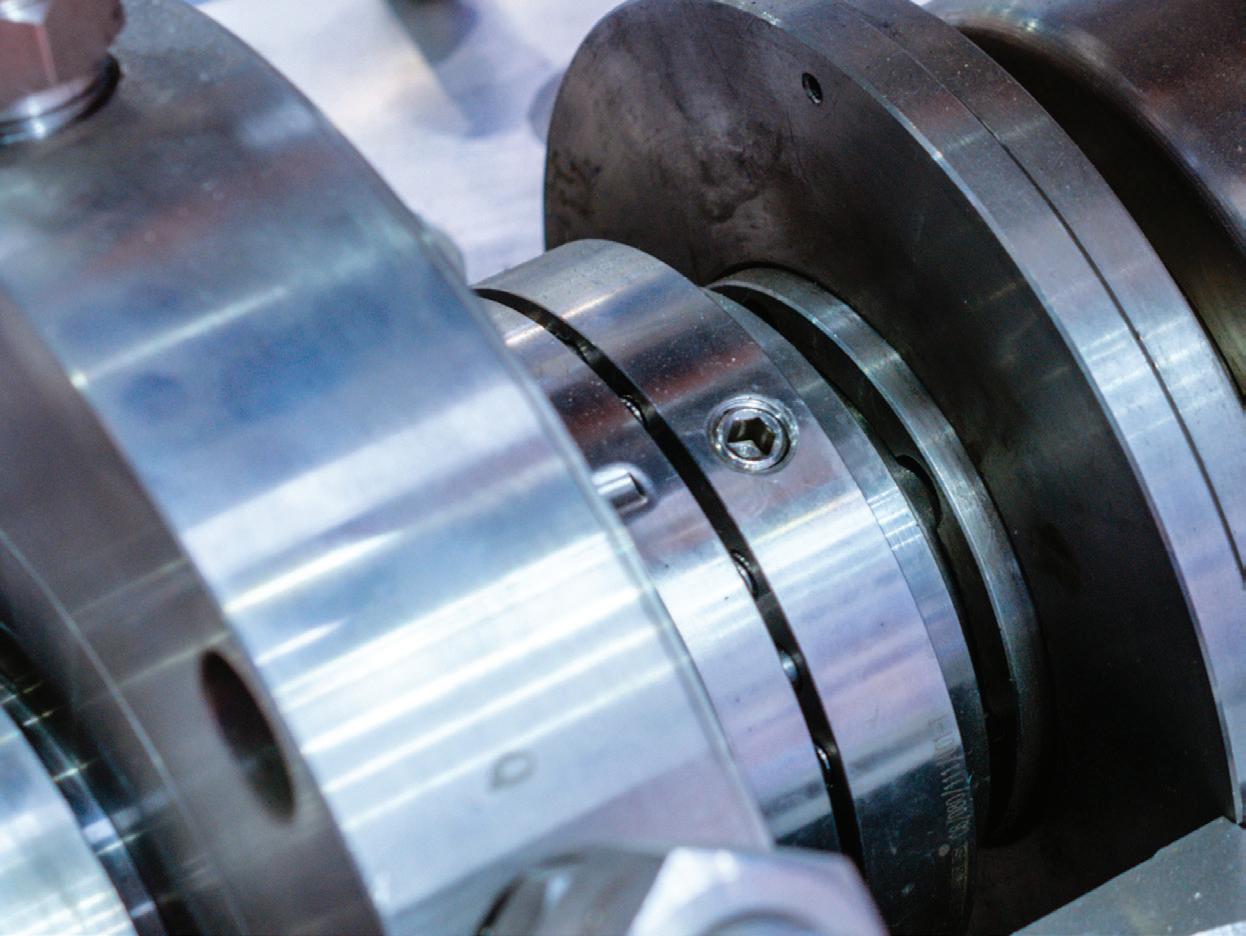

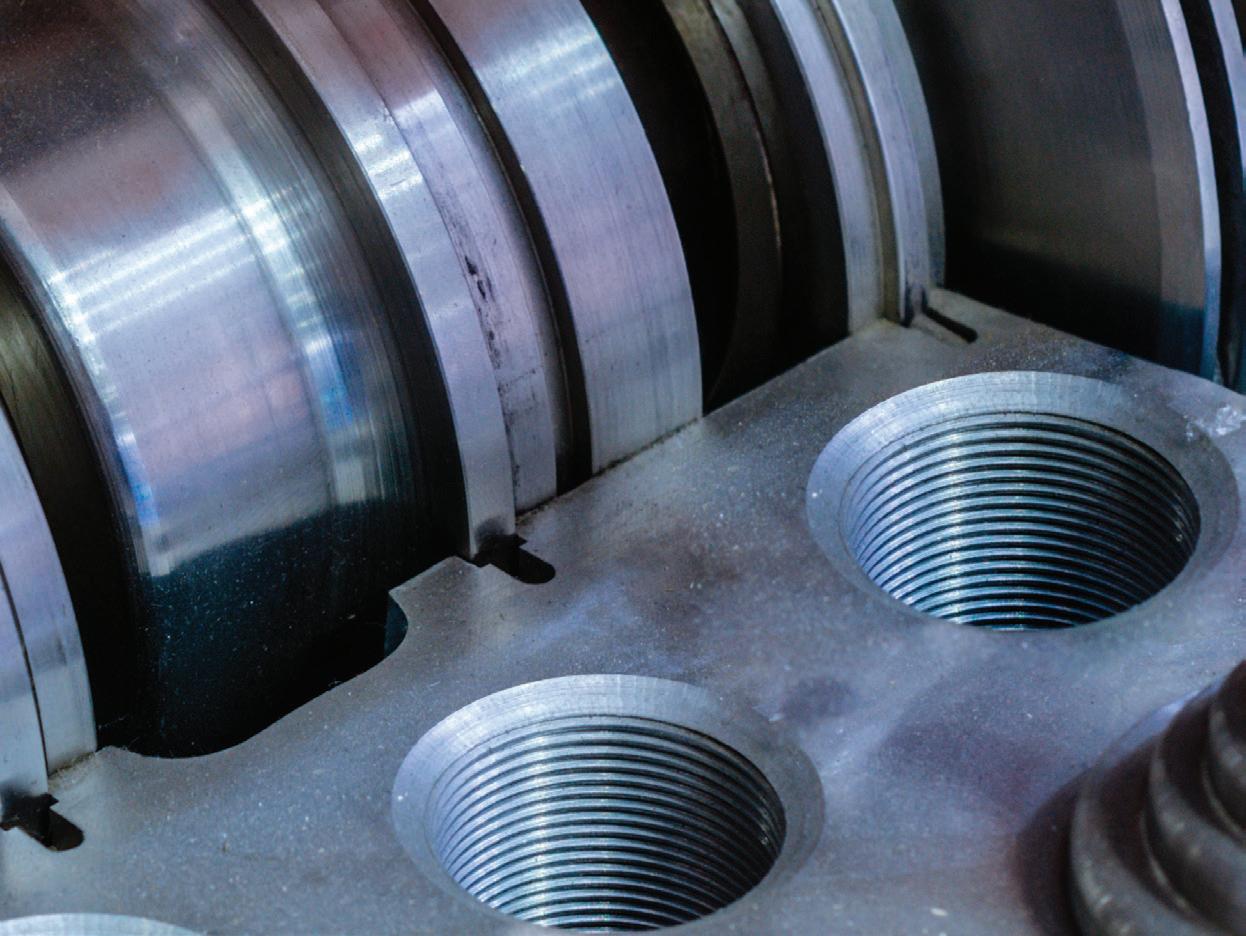

TO EXACTING STANDARDS

The new BNA pump ensures compliance with API 676 and API 682 while reducing costs in petrochemical applications.

YOUR BENEFITS

676 and API 682

www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 17 PIA NEWS

SEEPEX Australia Pty. Ltd. info.au@seepex.com www.seepex.com

API

compliant Extremely robust design High containment pressure and corrosion resistance Simple integration into piping systems Non-welded casing means reduced documentation and fewer inspections Shorter lead time High operational safety Act now to experience the benefits of this API pump for yourself.

API 676 PUMP

PIA Vice President, John Inkster, gave an overview of PIA activities over 2018.

Cameron Shaw, Peter Kropf and Jaydan Steel.

Je

ff Greely and Malcolm Eyre.

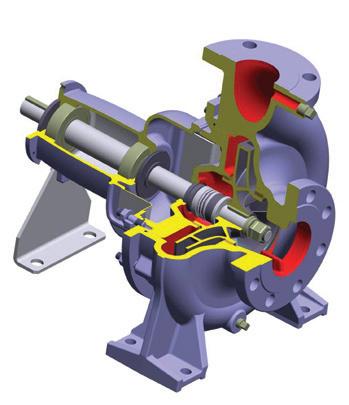

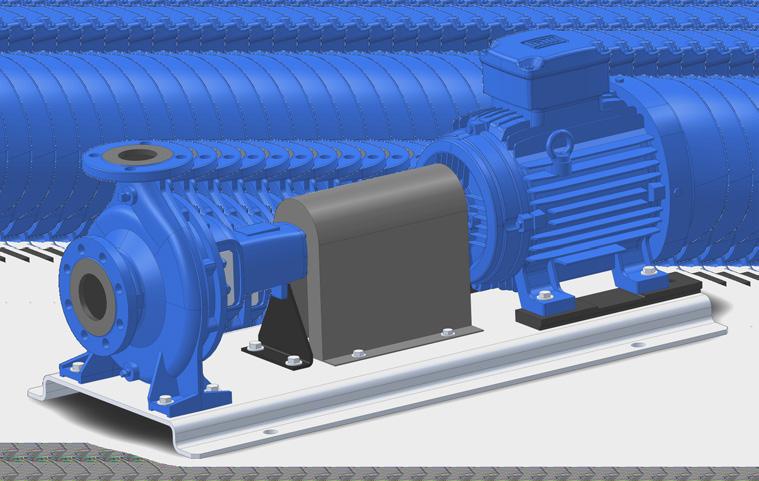

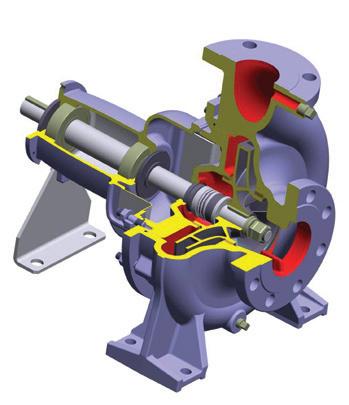

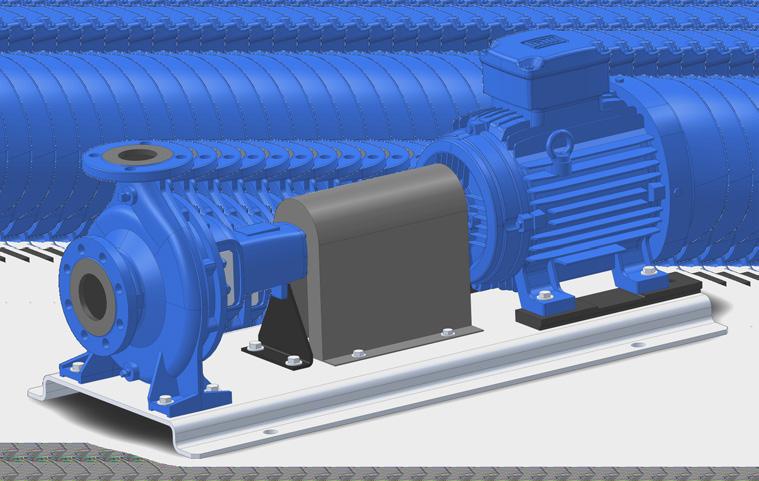

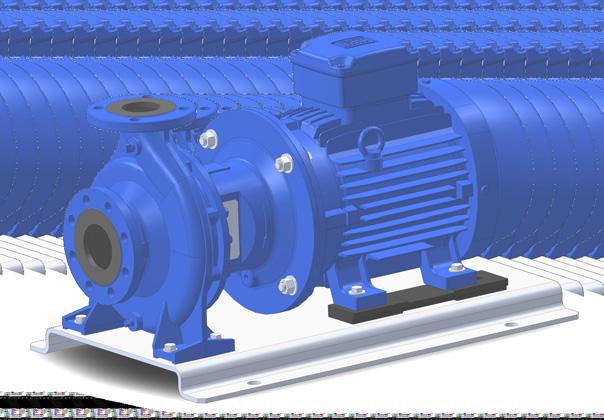

New range of EN733 pumps: WORLD LEADING PERFORMANCE

As a major manufacturer of industrial pumps to JIS and API610 standards, Ebara Corporation has embarked on a globalisation of its range of pumps for the world market. This includes the introduction of a range of industrial pumps to European EN733 standards and a new range of vertical multistage pumps.

Ebara Corporation (Japan) has recently released its new global range of EN733 standard end suction centrifugal pumps.

Utilising the most advanced hydraulic computer design software available, Ebara engineers in Japan have been able to improve and increase the pump efciencies of the new GS range above most other available pumps of similar design and standard on the global market.

The new Ebara GS range of EN733 standard pumps are manufactured in component form at Ebara Corporation Japan owned and managed factories in the Asia Pacifc region with fnal assembly of market range models undertaken by skilled tradesmen at Ebara Pumps Australia’s Melbourne facility.

A 16 bar rated pump — the new GS — will be available in both long coupled and close coupled versions (GSD) and will be available for release in Australia early 2019.

About Ebara Corporation

Ebara Corporation was founded in Japan in 1912 as a manufacturer of pumps. Today, as a group, it consists of more than 70 companies in six continents with a workforce of more than 11,000 people, and with company owned and Japanese managed factories in eight countries covering four continents.

The huge scale of production and distribution is matched by a constant commitment to research, development and design of new products and the

modern technologies for manufacturing them. Ebara products have gained a worldwide reputation for their technology and quality.

Contact your local Ebara dealer or Ebara Pumps Australia for more information.

Two of the more popular models that are stocked in Australia are both solids handling pumps. For more details contact us at Ebara Pumps Australia or visit our website.

MODEL DWO

Stamped stainless steel pumps with open impeller

Maximum 19mm passage size

50mm discharge

1.1 to 1.5kW - 1 phase

1.1 to 3.0kW - 3 phase

MODEL DVS

Cast iron submersible pumps with semi vortex impeller

32 to 56mm passage size

(Depending on model)

50 and 80mm discharge

0.4 to 0.75kW - 1 phase

0.75 to 3.7kW - 3 phase

Manual or automatic

18 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au

PIA MEMBER NEWS | PARTNER SOLUTIONS

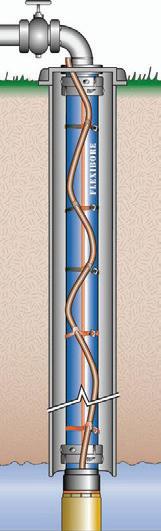

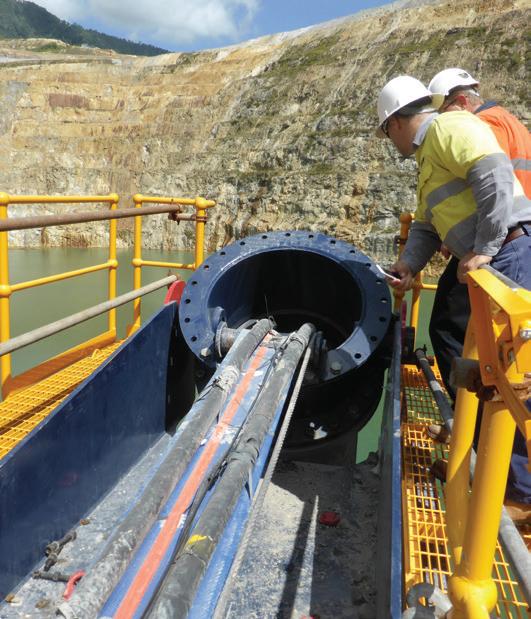

ON A CRUSADE TO CREATE THE BEST LAYFLAT HOSES

Crusader Hose was the first fire hose manufacturer in the Australian market, having created its first hose in 1985. Initially comprising the fire hose division of Wormald, the company has grown to create one of the most sought-afer range of products suitable for application across the agricultural, industrial and mining industries.

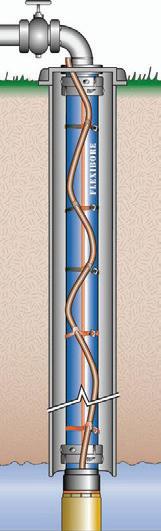

By 1990, Crusader Hose had developed the bore water pumping hose series Flexibore, which was made for mine dewatering applications. The company’s existing weaving and extrusion machinery meant it was ready to produce its bore water pumping fexible riser.

Crusader Hose National Sales Manager, Daniel Seow, who has previously held senior management roles in the electronics industry, said, “Crusader Hose focused on its ability to manufacture everything that was layfat — all the fttings, the winders, the systems. That’s what we do, and we do it to the best quality possible.”

At the time, only one international brand supplied layfat hoses to the Australian market, but at a premium price — meaning Crusader Hose could be competitive.

“Our customers wanted to support an Australian-made product. That’s when we went about developing a hose that is made for Australian climate and conditions,” Mr Seow said.

Making bore water retrieval simple

Bore water retrieval can be a difcult process, with use of rigid pipes a thing of the past. That’s why Crusader Hose developed its layfat hose.

After listening to feedback from its target market, Crusader Hose presented the Flexibore 250 series fexible riser hose, a high-pressure hose that can go up to 250m underground.

“I thought a hose was just a hose. But there’s so much more to it,” Mr Seow said.

“If we’re going to go down 250m, the hose must have the tensile strength to be able to handle all that weight.

“The key to the layfat hose manufacturing process is building the right jacket for the right pressure, and precision extrusion with proper quality checks.”

Crusader Hose crafted these resilient hoses by integrating thermoplastic polyurethane into a woven textile fabric of hightenacity polyester. This heavy-duty internal fabric creates a hose that is fexible, yet has the strength to sustain the weight of a submersible pump.

The Flexibore 250 series is designed to withstand highpressure bore water pumping, unlike many rigid pipes. The movement of the hose during pumping also prevents the build-up of iron bacteria inside.

“Because of how strong it is, the use of a safety cable to secure the pump is almost negligible,” Mr Seow said.

Designed for practicality

Users can be rest assured that they’ll get great value with the Flexibore 250 series hose, as the hose swells by up to 15 per cent, pumping more water out for greater efciency and an excellent fow rate.

Each part of the design has been carefully thought through — from the loops at one-metre intervals to thread your power cable through, to the customised stainless couplings designed to work with the whole Flexibore system.

Crusader Hose is also happy to create the perfect hose for your individual needs, with diferent lengths and types available.

“We are able to customise our hose to user requirements, and we pride ourselves on our customer service,” Mr Seow said.

Unlike rigid pipes, the layflat style of the hose means it can easily be transported to and from mine sites, saving time and money.

And, most importantly, Crusader Hose always puts safety frst: each hose must also pass a hydrostatic pressure test before leaving the factory.

With all of these features incorporated for ease of use, the design of the Flexibore 250 series hose truly has the customer front of mind.

20 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au

PIA MEMBER NEWS | PARTNER SOLUTIONS

FLEXIBORE FLEXIBORE

Crusader Hose Pty Ltd 22 Industry Place, Bayswater, VIC 3153 Australia Telephone: +631 3 9720 1100 www.crusaderhose.com.au For any enquiries, email sales@crusaderhose.com.au

NO IRON BACTERIA BUILD UP NO CORROSION Flexibore Coupling Flexibore Hose Power Cable Power Cable Strap Borehole Pump PUMPING EFFICIENCY & COST SAVING EASY STORAGE, HANDLING & TRANSPORT QUICK AND EASY INSTALLATION & RETRIEVAL Customised Layflat Hose Systems CRANE ON TRUCK ON CRANE OVER A ROLLER WALK IN BORE PUMP BORE PUMP THE SYSTEM OF CHOICE FOR GROUND WATER PUMPING THE SYSTEM OF CHOICE FOR GROUND WATER PUMPING If it’s a bore, think FLEXIBORE!

The new DryWet sewage pumps set to change the market

Thanks to its dedicated research and development division, Caprari—headquartered in Modena, Italy—is able to ofer its customers products with high efciency and distinctive performance. Each new pump is designed be efcient and technologically advanced, ensuring they meet market demands.

To meet the needs of end users who are increasingly concerned about energy savings and operational costs, as well as to anticipate changes to the European Union’s Ecodesign Directive, Caprari has released a new pump range which has unique and revolutionary features for dealing with wastewater—the K + Energy range.

The new K + Energy range of pumps is designed with IE3 Premium Efciency motors, as defned in EC Regulation 640/2009 specifc for surface motors, to ensure optimum efciency. The careful selection of the best performing materials and cooler motors ensure total reliability of operation, even in critical applications.

A turning point in pump design

The brand new K + Energy range represents a turning point due to its innovative and unique "DryWet" system which keeps the pump cool.

The "DryWet" cooling system is simple and reliable, can be easily activated, and is standard for the full

Caprari has launched an innovative new product with an exclusive patent, that is set to be a turning point in wastewater pump design. The new K + Energy range of pumps take reliability and efficiency to a new level, and captures Caprari’s core business to find new efficient solutions for water management.

There are numerous features of the new DryWet pump to ensure reliability over time and operational performance, including:

• Configuration

» Anti-sedimentation system on the suction side

» Fibre-cutting system on the back impeller to protect the mechanical seal

» Blades on the back have the dual advantage of cleaning the area for seal protection, as well as compensating for axial thrust to protect the bearings

range. Customers are able to use a single model for both submerged applications and in dry chambers.

In addition, the "DryWet" system has two important advantages: it does not require additional maintenance and does not absorb energy, allowing the pump to perform at its best. The K+Energy range is also available in an explosion-proof version with ATEX and IECEx (North America explosion protection directive) certifcations.

Another interesting feature is the conductivity probe in the oil chamber— also available in the ATEX version (patent pending)—which is unique to the K + Energy range.

If the frst seal is damaged, an alarm signal is immediately sent to the panel so that repairs can be carried out before the pumped liquid passes the barrier created by the second seal. This ensures the electric motor is always protected.

The connector—supplied as standard on all K+Energy models—allows the pump to be disconnected without having to remove the cables from the panel, before transporting and reconnecting them. This signifcantly reduces intervention time and guarantees the safety of operations.

The large precision cast stainless steel handle is robust, ensuring easy handling of the pump and allowing operators to easily recover it when submerged.

» It has amongst the widest passages for real anti-clogging

• Double mechanical seal

» Independent and nonproprietary mechanical seals (no cartridge system)

» Less oil is required to ensure low environmental impact and ease of disposal

» Disassembly of mechanical seals has been improved so they can be replaced on the pump side, leaving the motor safe

• The gasket is between pump and coupling foot to ensure perfect sealing between components with no head loss over time

Caprari, with its new K + Energy range and exclusive "Dry Wet" system, presents itself as the leading company in advanced solutions for water management and meeting customers needs.

22 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au PIA MEMBER NEWS | PARTNER SOLUTIONS

Designing the future with highly appreciated and advanced solutions for Industrial Applications Pumps and electric pumps able to raise primary process water and waste water. ENERGY | METAL INDUSTRY | PAPER INDUSTRY | FOOD & BEVERAGE YOUR RELIABLE PARTNER IN INDUSTRIAL APPLICATIONS EXPERIENCE SINCE 1945 www.caprari.com |

Vanes made of the bearing polymer Hitemp 150 have lasted three times as long as traditional vanes in servicing company Septic Tanks’ vacuum rotary pump, a Broom B35.

The pump is used to create a pressure diference that sucks up the waste liquids from septic tanks.

Ideally, the pumps involved in such operations should not come into contact with sewage. However, where septic tank pumping is not monitored continuously, overfow from the transport truck can make its way to the pressure vessel and on to the vacuum rotary pump.

The vanes in these pumps thus need to be cleaned.

In addition, the vanes need to be able to operate at high temperatures, since the pumps can overheat due to operation for long periods.

Armed with information about vane operating requirements — when the original laminate vanes in Septic Tanks' Broom B35 pump needed replacing as frequently as every six months — the waste sector servicing company turned to Vesconite Bearings, the maker of various polymers, for a solution to this

POLYMER VANES last three times as long in vacuum rotary pump

unique operating environment.

Vesconite Bearings technical sales consultant Phillip de Villiers recommended Hitemp 150, an engineered polymer that is wear resistant and can withstand temperatures of up to 150ºC.

This material will not delaminate as does the original equipment manufacturer supplied material, a thermosetting phenol formaldehyde resin that impregnates layers of cotton to produce a hard synthetic plastic.

The trial result has been impressive; Hitemp 150 did not delaminate, unlike its competitor, and it was resistant to overheating.

In addition, the new polymer vanes coped well with the frequent pump cleaning that was required when waste material accidentally entered the pump.

Septic Tanks owner, Charl Neuhof, is also pleased that the Hitemp 150 vanes continue to operate after a year and a half, while the phenolic alternative had to be replaced after six months.

Moreover, he is enthusiastic about the reduced maintenance costs that are associated with the product, which can

be cleaned in-situ,unlike the previous variety of vanes that had to be removed prior to cleaning because of their high levels of swelling when exposed to water.

Since testing of the B35 vacuum rotary pump vanes has gone well, Mr Neuhof plans to replace the vanes on his feet of truck pumps as they fail.

His four trucks are used in the Johannesburg North, Pretoria, Hartebeespoort and Brits areas of South Africa, with three out on the road daily, each carrying six 6000 litre loads of waste material a day.

The fve vanes that were employed in the B35 pump measured 35mm by 6mm by 330mm and had chamfered edges, but vanes for the other pump models that will be introducing the Hitemp 150 vanes will have diferent dimensions.

Depending on the size required, the vanes will be cut from extruded or moulded Hitemp 150 plates, with Vesconite Bearings able to machine the vanes as a result of the company’s extensive machining capability, including more than 65 computer numerically controlled lathes and machining centres.

Mr de Villiers is excited about the use of Hitemp 150 engineered polymer vanes in vacuum rotary pumps employed in the septic tank servicing industry.

“Septic tanks are an important and reliable means of disposing of and treating household wastewater in South Africa and globally,” Mr de Villiers said.

“The servicing of these tanks is equally important, as good hygiene practice requires that they be pumped out every year.”

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au

24 INDUSTRY NEWS | PARTNER SOLUTIONS

The septic tank cleaning vehicle

The Hitemp 150 vane

A view of the pumps that the vanes are used in

GORMAN-RUPP PUMPS

SELECTED AT SOUTHERN MEATS

Southern Meats is a hi-tech sheep and lamb processing facility strategically located just south of Sydney where it has access to sheep grown in the healthy environment of NSW’s Southern Highlands region. It prepares quality meat for the local market and global exports using hi-tech automated equipment in its slaughtering, boning, chilling, freezing and rendering facilities.

In line with its quality approach to processing, the plant did not want its operators spending needless time attending to unreliable equipment in its wastewater treatment systems. So when it went looking for a dependable and reliable wastewater pump to deliver 50L/s plus to its treatment area, the plant looked no further than Gorman-Rupp.

Gorman-Rupp is the world leader in self-priming pump technology, particularly in wastewater pumping applications. Being able to mount the pump at ground level (and not in the wet well) means the pumps are safer and more conveniently accessed by operators. Additional safety features built into the pump are designed to protect operators and the pump from damage.

By using self-priming pumps, asset owners don’t need to buy rated lifting chains or have the yearly burden of inspection or replacement of these as they would need if using submersible pumps. And because wet well lids remain closed, the need to have fall protection equipment such as anchorage points, body

support, connectors and descent/rescue equipment is greatly reduced — some of these items requiring annual trips back to the manufacturer for service/inspection.

Plant Engineer Mick Speering is very pleased with his purchase and is happy to recommend Gorman-Rupp pumps to anyone wanting a quality wastewater pump.

For more information on Gorman-Rupp pumps, email Hydro Innovations at info@hydroinnovations.com.au.

www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 INDUSTRY NEWS | PARTNER SOLUTIONS

25

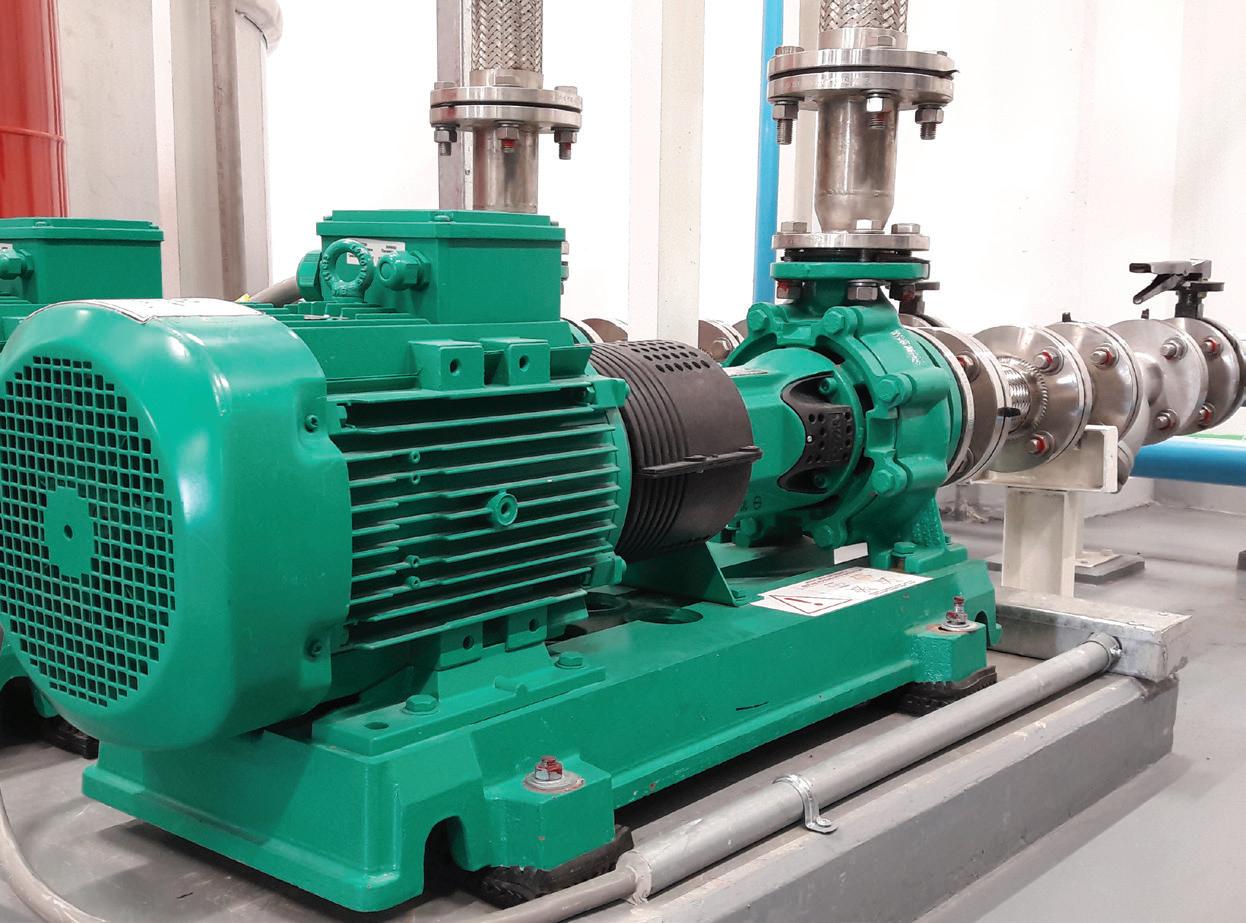

High performance motors for energy-efcient pumping

The world market for industrial IE4 low voltage motors was estimated to be worth $114.7 million in 20132, with nearly 260,000 units shipped1. IE4 motors sold for pumping applications has been the fastest growing and highest valued IE4 motor application segment, generating $31.4 million in revenues with over 90,000 units shipped in 2013. This market has continued to grow strongly and its steady growth is expected to continue into 2019.

Lafert Electric Motors, one of the world's leading manufacturers of IE4 and IE5 high performance (HP) electric motors, has won the contract to supply its HP motors to two of the largest pump manufacturers in the US.

These multi-million dollar contracts will ensure Lafert remains one of the most important IE4 and IE5 motor manufacturers for the foreseeable future.

This uniquely engineered product combines the electrical design of brushless servo motors with the mechanical design of AC induction motors. The result is a compact motor primarily designed for the HVAC and pump industries where there is an emphasis on reducing the operating cost or weight, and size of the motor.

fficiency values referred to the variable torque requirement (pump application)

Lafert HP motors have an increased starting torque when compared to a standard 3 phase induction motor. The reason for this is because of the permanent magnets which also assists the current draw at reduced speeds, so when motor speed is decreased, the current drops away signifcantly to virtually no current draw at all.

Peter Harrington, Managing Director of Lafert Australia, said, "Our goal is to assure our clients and partners that the technology developed by Lafert is the right choice for today and, more importantly, for the future. For Lafert, it is essential to meet the demand for improved levels of efciency in view of an increasingly green-oriented market.”

The high operating efciency ofered by Lafert's PM Synchronous Motor leads to lower electricity consumption costs. The uniquely efcient design also improves the life of this motor, thereby reducing potential down time and reftting costs. The motor meets the IE4 efciency class at all operating speeds, making it one of the most efcient electric motors available in the European market.

Horizontal and Vertical pumps

Horizontal pumps Vertical pumps

Sensorless PM Synchronous Motor

• Rated speed: 1500-1800-30003600-4500 rpm

• Rated power: 0.55 to 30 kW

• Frame sizes: 71 - 90 - 112 - 132

• CASCADE mode (CANBus or RS485)

Input/output signal for pressure transducer

Sensorless PM Synchronous Motor

• Energy saving and optimised flow/pressure control

• Variable speed grants more control modes

• Continuous operation increases comfort

Possibility to apply cascade control

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au 26 INDUSTRY NEWS | PARTNER SOLUTIONS

1 The World Market for IE4 low-voltage Motors - 2015 Edition 2 Ibid HPS stand alone motor 3000 min-1

AC motor

motor 5.5kW 90 100 80 IE2 + FC IE4 + FC (HPI) IE3 + FC 60 70 Eff [%] 40 50 0 500 1000 1500 2000 2500 3000 3500 Speed [min-1]

E

5.5.kW vs HPI

8 6 4 2 0 0 500 1000 2000 3000 2500 1500 HPS71 3000 rpm 0,75 kW HPS71 3000 rpm 1,1 kW HPS71 3000 rpm 2,2 kW HPS71 3000 rpm 1,5 kW

3000 rpm Num

Torque HPS71

A NEW ENGINE FOR SUSTAINABLE FARMING

FPT Industrial headed up a major event on 26 September themed ‘A new engine for sustainable farming’. In collaboration with FPT Industrial OEM Idrofoglia, a custombuilt IPU (Irrigation Power Unit) system was designed and manufactured as part of a new water management project in Kenya. The advanced system was donated to Jomo Kenyatta University of Agriculture and Technology (JKUAT) in Nairobi, at this inaugural event.

The FPT Industrial water management project in Kenya has many sustainability targets, including the successful training and support of new entrepreneurs in the agriculture segment, and full technical collaboration with JKUAT. Around 40 ffth-year engineering students at JKUAT will begin courses and use the donated IPU system for training and education.

Federico Gaiazzi, Head of Global Marketing at FPT Industrial, said, "We are proud to support the project, ‘A new engine for sustainable agriculture’. It represents an opportunity for us to further afrm our values and our commitment to supporting training programs for young people and new generations.

"For this purpose, we decided to donate a complete product, consisting of a motor pump and the related irrigation system. We have chosen this IPU, equipped with an FPT F32 engine because it is a compact and fexible solution that ofers high performance with low operating costs. Today, we give the Jomo Kenyatta University of Agriculture and Technology in Nairobi an engine capable to contribute to a more sustainable future, drawing a unique opportunity to contribute concretely to promote the technological development of Kenya.”

The event ‘A new engine for sustainable farming’, involved corporate presentations by all the major stakeholders, including CNH Industrial,

FPT Industrial, the Milan Center for Food Law and Policy (MCFLP), the E4Impact (Entrepreneurship 4 Impact) Foundation, and respective authorities. In addition, the event focused on the custom-built IPU, with a walk-around scheduled as part of the proceedings.

Comprehensive training sessions were also planned to take place between September and October, and included 40 hours of training provided by FPT Industrial, both in the feld and in the classroom. Additional in-class training was delivered by the E4Impact Foundation and MCFLP.

E4Impact is an initiative launched in 2010 by ALTIS — the Graduate School of Business and Society at the Università Cattolica del Sacro Cuore (UCSC) in Milan, Italy — with the objective of training entrepreneurs in the developing world to support the start up and growth of their businesses. In Kenya and various other African countries, E4Impact ofers an MBA in Global Business and Sustainability to provide active and aspiring entrepreneurs with results-oriented education, coaching and interaction with the local business community and access to potential investors.

MCFLP was frst established in 2015. The association collects and stores legislative materials and documents regarding the right to food and nutrition,

with the ultimate goal of raising awareness on these important issues.

Both E4Impact and MCFLP lay the foundations for future development, which is why they joined FPT Industrial’s water management project in Kenya. The successful cultivation and harvesting of crops on a reliable and repeat basis could experience a huge boost through the application of technology, such as irrigation systems. In combination with the right education and training, it is hoped that signifcant strides forward will be achieved.

IPUs from FPT Industrial are highly capable systems that comprise an engine, frame, subbase, industrial clutch, cooling package, starting battery, exhaust mufer and industrial power take-of unit. Also included is a fuel tank and connection for DEF (Diesel Exhaust Fluid – AdBlue), and an ATS system rack mounted to the top of the body panelling. With regard to irrigation, the IPUs can be used in horizontal and vertical pump installations, as well as for center-line pivot systems. Further uses include systems that transfer water from rivers into defooding channels and feld drainage. Beyond stationary applications, FPT Industrial’s IPU technology also has many mobile uses in the agriculture sector, including for machinery such as sprayers and windrowers.

pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au 28

INDUSTRY NEWS | PARTNER SOLUTIONS

The FPT Industrial IPU system for Jomo Kenyata University of Agriculture and Technology

At the center, Federico Gaiazzi, Global Marketing Manager of FPT Industrial, shaking hands with Victoria Wambui Ngumi, Vice Chancellor of the Jomo Kenyata University of Agriculture and Technology of Nairobi

HIGHLY DURABLE SECTIONAL PANEL TANKS AVAILABLE AT MASTERFLOW

Masterflow Solutions is a specialised supplier of customised equipment to heating, ventilation and air conditioning industries throughout Australia. A range of Sectional Panel Tanks made of highly durable material is now available.

Masterfow Solutions stocks a range of GRP Sectional Panel Tanks made from sheet molding compound. Created using hydraulic hot presses under high temperature, these tanks are made to withstand high pressure conditions. The panel tanks demonstrate excellent resilience to corrosion thanks to their stainless steel interior and plated steel fnish.

The Sectional Panel Tank can be utilised in several applications and can be installed however tight or difcult the surrounding environment is. The company also ofers a pre-insulated panel to reduce heat loss during system operations. Because of the sectional design, tanks can be constructed in irregular shapes to go around pillars and other obstructions.

Masterfow’s panels and their related parts conform to international water quality standards, namely:

• Certifcate of Water Regulations Advisory Scheme (UK)

• Certifcate of Productivity and Standard Board Water Pressure Test

• ISO9001:2000 Quality Assurance Certifcation

• FDA Certifcation

Masterfow Panel Tank features and benefts

Following are some features of the Masterfow Sectional Panel Tank:

• Hygienic – Masterfow’s panel tanks are completely opaque. This prevents any light passing through its panels. Opaque panel tanks also hamper the growth of algae and other microorganisms.

• Water tightness – Masterfow water tanks have a self-sealing feature that eliminates the possibility of panel separation and prevents leakage.

• Complete Drainage – Masterfow

TOP QUALITY VALVE KNOWLEDGE WITH SUPPLY AT AN AFFORDABLE PRICE

bottom panels concave drain panel design allows complete and efcient drainage, which is great for maintenance inside the water tank.

• Safety of water pressure – Unlike other tank types where water pressure can loosen the joints, breaking the seal and allowing water to leak out, Masterfow Convex bottom panel tank seals will hold the water pressure created by flling joints preventing leakage.

About Masterfow

Masterfow Solutions is an established provider of customised equipment for storing, pumping and fltering fuid. The company strives to supply the most comprehensive range of quality products and innovative specialty solutions throughout Australia.

Want to know more about Masterfow Solutions – visit www.masterfow.net.au

30 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au (02) 6374 2808 133 Mayne St, Gulgong, NSW 2852 mail@midwestvalves.com.au www.midwestvalves.com.au Midwest Valves & Controls is your one stop shop for the valves, poly fittings, hoses and pumps that complete your project.

INDUSTRY NEWS | PARTNER SOLUTIONS

THE ASM V-SERIES IS PRIMED AND READY TO PUMP.

The key to successful, hassle free sump pumping is to eliminate priming issues.

Which is exactly how our ‘V’ Series Vertical shaft column pump works. Unlike a surface mounted unit, the ‘V’ Series is always primed as it’s submerged in the liquid, avoiding the need and expense of a suction line or foot valve and the NPSH restrictions associated with surface mounted pumps.

Its space saving design minimizes or eliminates floor space required for installation with the motor out of the liquid for easy maintenance and monitoring.

With the ability to pump water, suspended solids or semi viscous products and be used in high temperature applications and explosive atmospheres, the ‘V’ Series is also very versatile.

Save time, money and space up top, with an ASM ‘V’ Series pump down below. For more information contact ASM Pumps on (03) 9793 7577 or visit asmpumps.com.au

KEEPING UP IN A CHANGING LANDSCAPE: STATE OF THE INDUSTRY 2019

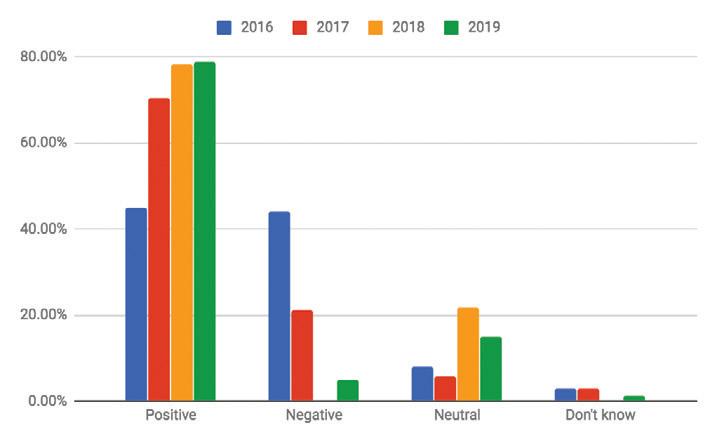

The sixth annual Pump Industry State of the Industry survey, which was conducted recently, is showing there’s an increasingly positive outlook for the year ahead despite the challenges a changing landscape is presenting. The industry is on the lookout for new opportunities to drive business growth in an increasingly competitive industry. Optimism is high entering 2019, as it rides the success of 2018.

With the few tough years experienced by the industry now appearing to be well and truly over, the industry has steadily been fnding its way back on its feet. That is not to say that there are no challenges facing the industry now or in the future, but there is a willingness by companies to adapt and take hold of the opportunities that are there.

The Pump Industry survey this year produced some interesting insights around what has had a positive and negative impact on the industry, as well as business behaviour. While a number of respondents had a particularly good year in 2018, others struggled depending on the services ofered and sectors they focus on.

Looking back at 2018 and the outlook for

the year ahead

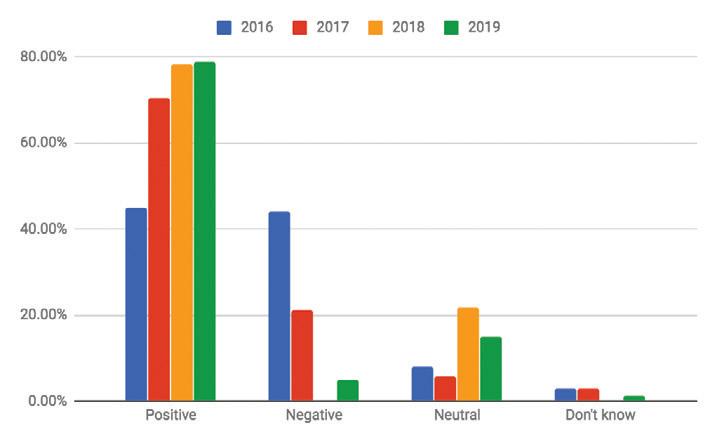

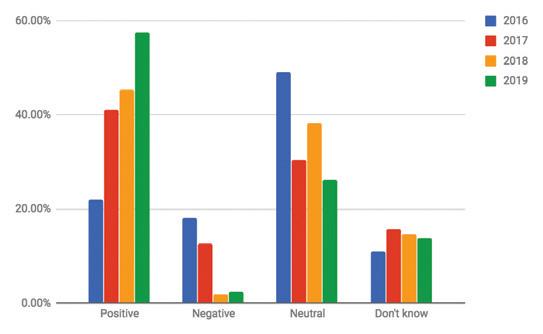

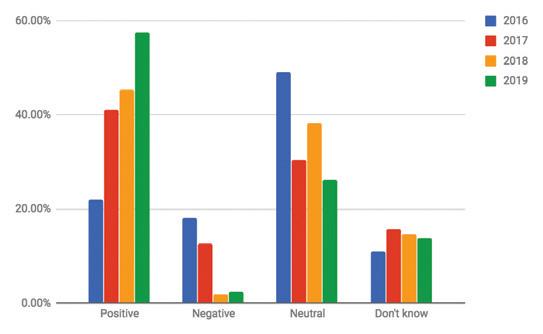

Following a tough few years at the start of the decade, the survey this year shows there is an increasing trend of optimism in 2019, with almost 80 per cent of respondents reporting that they had a positive outlook for their company, and 15 per cent are neutral. There is a slight increase in negative outlook with fve per cent of respondents reporting this for 2019 compared to zero per cent in 2018. The increase in negative

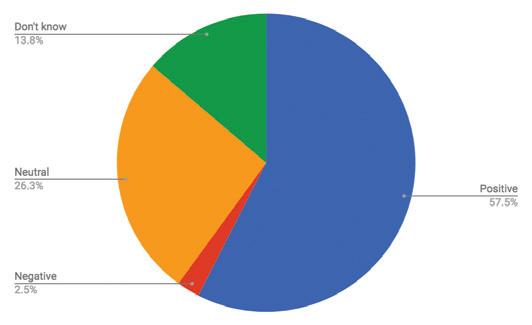

outlook could be attributed to a variety of factors, including the drought and changing customer behaviour. However, overall, comparing results over the past four years shows a growing positive outlook in the industry and a decreasing negative outlook. These results can be seen in Figure 1.

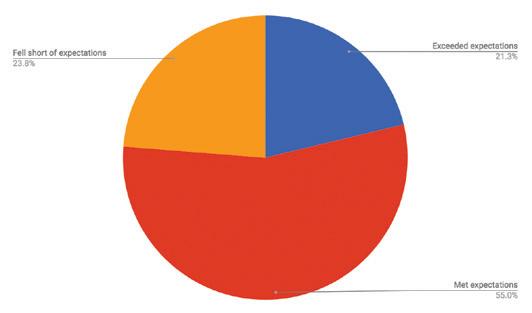

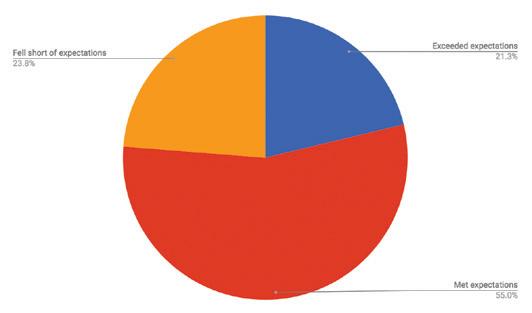

The trend of a positive outlook is also refected in Figure 2, which shows that 21.3 per cent of respondents felt their company’s performance exceeded expectations in 2018 and 55 per cent

said it met expectations. While almost 24 per cent reported that it fell short of expectations, this is almost six per cent lower than what was reported for 2017. Respondents expect this positive growth to continue, with a massive 80 per cent expecting their company to perform better in 2019 than in 2018.

This continued positivity could be due to companies feeling there is a greater stability in the market than in past years, when there was greater uncertainty due to the mining downturn.

Figure 1: Company confidence has been slowly increasing since the downturn earlier in the decade.

32 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au

STATE OF THE INDUSTRY

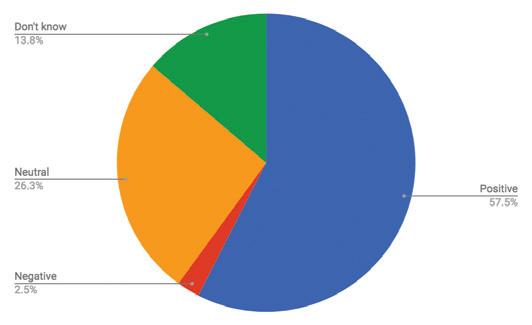

Along with respondents expecting 2019 to be a good year for their company, the industry outlook as a whole is extremely positive — as can be seen in Figure 3. More than 57 per cent of respondents have a positive outlook for the pump industry in 2019, up by more than ten per cent when comparing to the expectations for 2018. This is a massive change since our 2015 survey, which saw only 22 per cent of respondents as having a positive outlook for the following year (Figure 4).

At Brown Brothers Engineers we have expanded our capabilities with two more quality pump manufacturers. In addition to the current world leading brands we can now offer the following range:

VERTICAL TURBINE PUMPS

Layne Bowler vertical turbine pumps have a proven record under the most demanding and toughest of conditions.

WELCOME TO THE BIG END OF TOWN.

When high head and high flows are required look no further than this quality Italian made range.

• Flows to 5000m3/h

• Head to 220m

• Pumps that exceed EN733 (DIN 24255 standard)

Brown Brothers Engineers have innovative solutions whatever your application. Contact us today about your requirements.

Ph: 1300 4 BBENG www.brownbros.com.au

33 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 STATE OF THE INDUSTRY

NCBK Series SKD Series NCA Series

DELIVERING PUMPING SOLUTIONS

03/18

Figure 2: Overall, companies felt that their performance in 2018 met or exceeded expectations.

Figure 3: What is the outlook for the Australian pump industry in 2019?

Figure 4: There has been a trend of increasing optimism in the industry over the past four years.

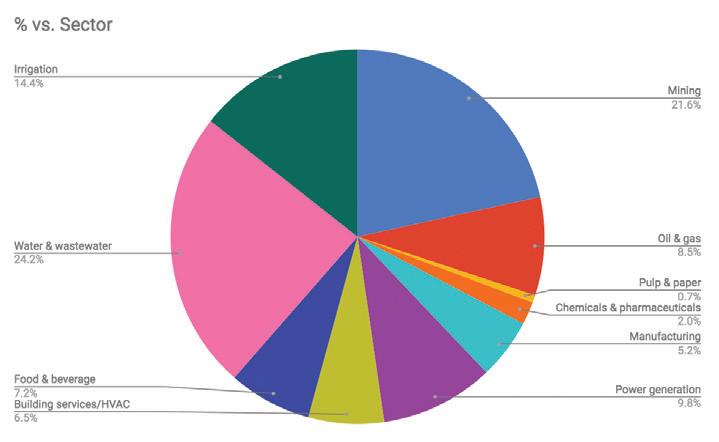

Performance by vertical

Key to understanding the current state of the pump industry is to examine which particular verticals performed the best and worst for businesses during 2018, and to identify how key sectors are expected to fare in 2019.

We asked our respondents how the volume of work across key verticals had changed for their businesses during 2018, and how they expected them to change in 2019.

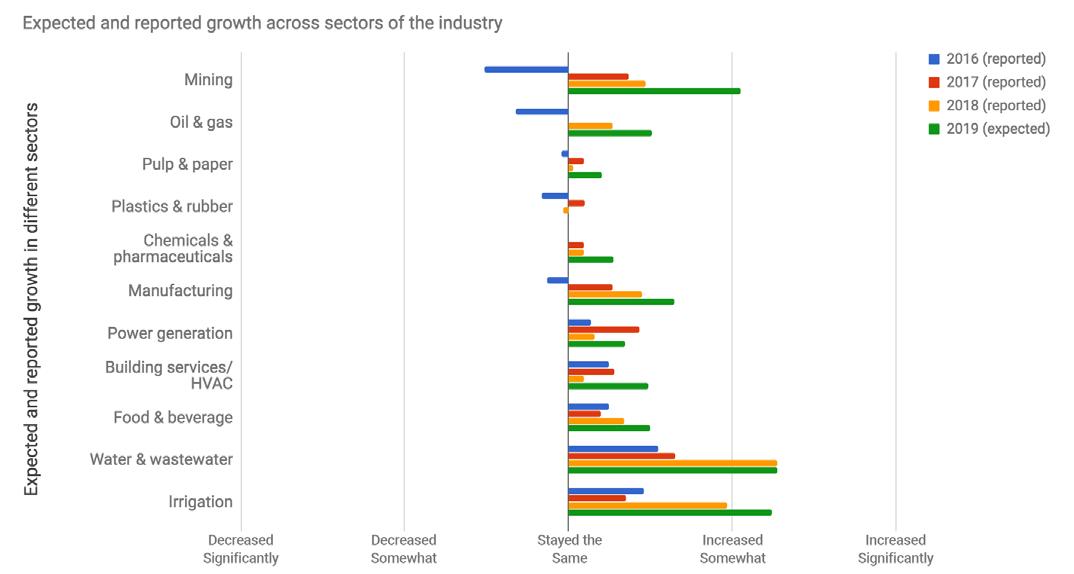

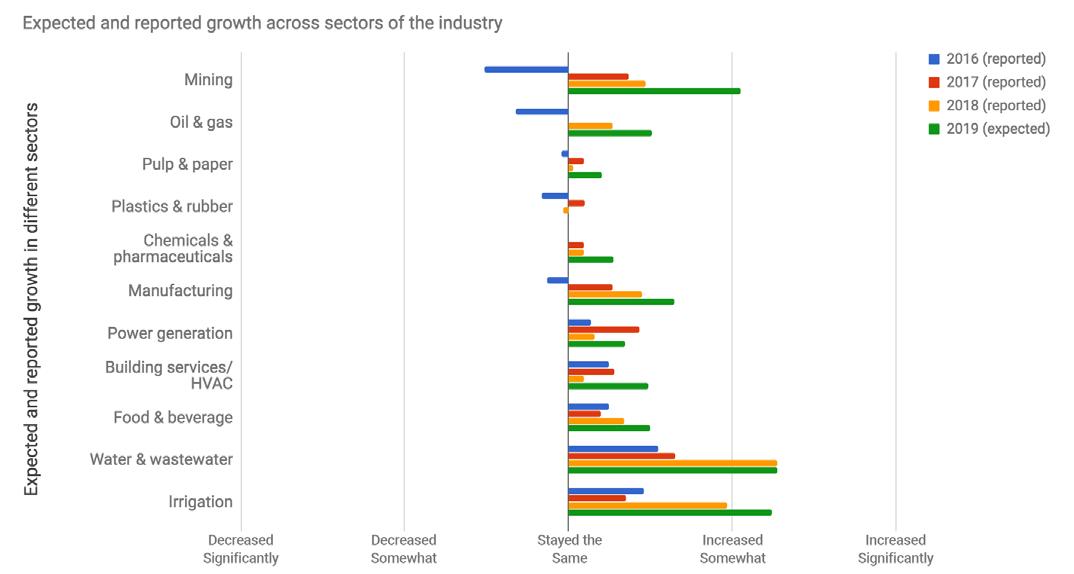

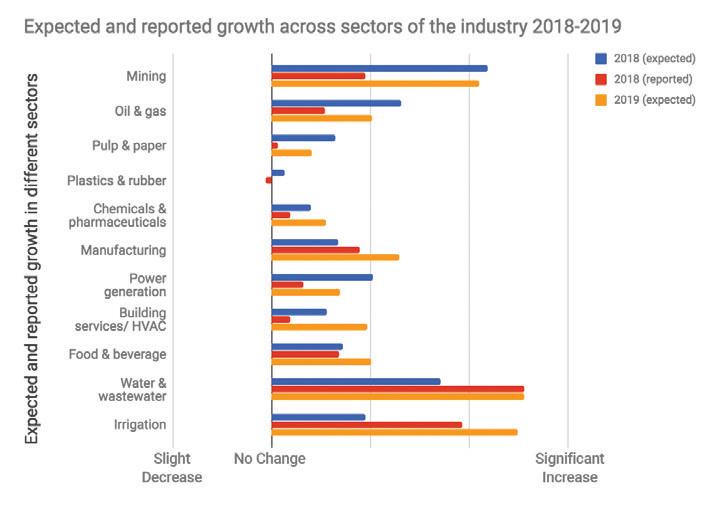

Figure 5 illustrates the actual reported performance of various verticals for our respondents from 2016–2018, and their anticipated performance in 2019.

How did the verticals perform in 2018?

According to our respondents, the best performing verticals were water and wastewater, irrigation, and mining. On the other hand, the vertical that performed the worst was plastics and rubber, which was the only vertical to experience somewhat of a decrease in the volume of work.

There were mixed results in the volume of work reported for 2018 compared to 2017, with building services/ HVAC, power generation, and pulp and paper not performing as well in 2018 as initially expected. Other verticals saw an increase, and in a turnaround, the oil and gas sector saw an increase in work, following a largely negative performance in 2016, and poorer performance in 2017 and 2018 than expected.

Looking ahead to 2019

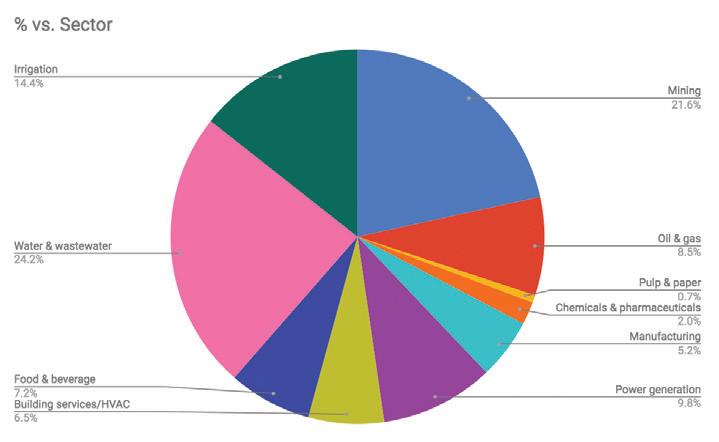

Figure 6 shows a breakdown of which verticals are expected to drive growth in 2019. Similar to respondent expectations for 2018, the water and wastewater, and mining industries are expected to be the best performing verticals in 2019. Most respondents think the volume of work in these areas will increase in 2019. The irrigation sector is also expected to see continued growth in 2019, following a greater increase in work in 2018 than originally expected. The outlook for

manufacturing is also positive, with the sector seeing a steady increase in performance over the past few years.

What is making an impact on the industry?

Increasing investment in water and wastewater

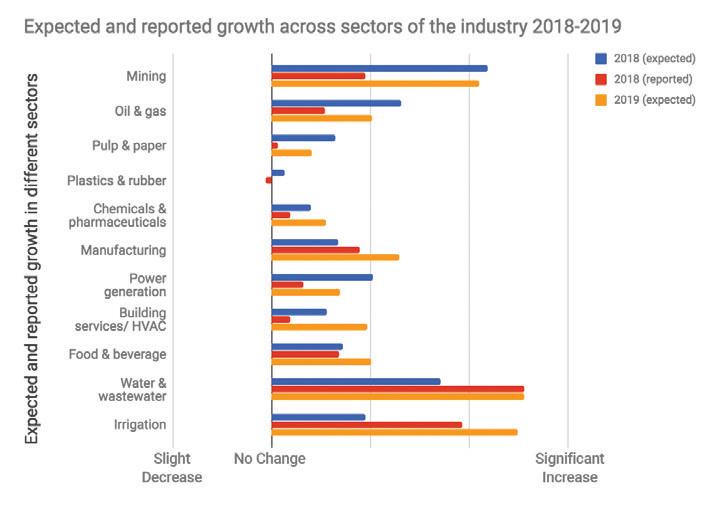

Figure 7 shows the areas of growth reported and predicted across the industry. Water and wastewater did slightly better than expected in 2018 with more than 15 per cent of respondents reporting the volume of work had

34 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au STATE OF THE INDUSTRY

Figure 5. Reported growth areas by vertical from 2016–2018, and their anticipated performance in 2019.

Figure 6. What are the key verticals expected to drive growth in 2019?

increased signifcantly and more than 40 per cent said it had increased somewhat. Almost a quarter of respondents said the volume of work had not changed, and only 5.66 per cent said there was somewhat of a decrease. This is compared to the reported expectations, where almost 40 per cent thought the volume of work would not change, 28.2 per cent predicted it would increase somewhat and 15.38 per cent said it would increase signifcantly. Expectations for growth in 2019 are in line with the volume of work reported in 2018.

The better than expected results could be attributed to a number of factors, including wariness of performance heading into 2018 following lower-than-predicted growth in 2017. Respondents also noted that a focus and greater spending by government and water authorities on water and wastewater projects helped drive growth.

Factors driving irrigation

Irrigation also saw a much better result in 2018 than originally expected, with 5.13 per cent of respondents initially predicting that the volume of work would increase signifcantly, 23 per

7. Expected and reported growth in different sectors 2018–2019.

cent that it would increase somewhat and another 23 per cent predicted that it wouldn’t change. The reported results were much more positive, with almost 17 per cent saying there was a signifcant increase in work, almost 19 per cent that it increased somewhat and 28.3 per

cent that it didn't change. There was, however, 3.77 per cent that reported the volume of work had decreased somewhat. The better-than-expected growth in the sector has led to a positive prediction for 2019, with the volume of business expected to grow.

Removes up to 90 % of water

● Dewatering of waste & process sludges

● Cost-efficient processing and transportation in one closed unit

● For cold climates the unit can be isolated and heated

Roll-of unit includes:

● Container & geotextile filter bag

● High performance slurry pump*

● Chemical dosing pumps*

● Flocculation reactor module*

● Integrated controls*

*optional

Flowrox GeoBagTM is for:

● Sewage sludge dewatering

● Tailings dewatering

● Concentration of oily sludge

● Separation of precipitated solids and impurities

● Filtration & dewatering of clay, sand and other fne particles

IIoT/AI & remote controllability w/ Flowrox MalibuTM smart platform

www.fowrox.com

35 www.pumpindustry.com.au pump industry | Summer 2019 | Issue 26 STATE OF THE INDUSTRY Flowrox GeoBagTM — Roll-of geotextile fltration ASK FOR MORE! +61 2 9114 9715 / sales-au@fowrox.com

Figure

There were several factors at play in 2018 that impacted the upturn in the volume of work in the irrigation industry, with respondents citing the requirement for pump servicing and the drought as some of the factors that had an impact. Respondents said favourable conditions would continue into 2019 with a greater demand for irrigation expected. One respondent sees this trend continuing into the near future stating, “Water and wastewater, along with irrigation, are booming markets for at least the next fve years.”

There are upcoming opportunities that the pump industry can jump on, including a record funding commitment by the Federal Government for water infrastructure across regional Australia. Last November, an additional $500 million was promised for the National Water Infrastructure Development Fund. The fund’s expansion to more than $1 billion, as well as the existing $2 billion National Water Infrastructure Loan Facility program, means more than $3 billion is now available from the Federal Government to support state and territory governments and their project partners, to build new water infrastructure, and provide greater social and economic opportunity for Australians.

However, while irrigation has been a booming sector for some, not all respondents saw growth in this sector. Not everyone thought the drought had helped propel business, citing that the continued dry conditions and a lack of water had seen the volume of work in the irrigation sector drop. The outlook considered by these respondents is expected to continue to have a negative impact on their business into 2019 if there isn’t enough rain.

The severe drought across eastern Australia is heavily impacting sentiment in the nation’s agricultural sector, which could negatively impact the pump industry in 2019. The September Rabobank Rural Confdence Survey found the lowest farmer confdence levels recorded since the depths of the millennium drought in 2006. With dry conditions

preventing many farmers from capitalising on what remain high prices for most commodities, the overall Australian rural confdence index dropped signifcantly in the latest quarter, with more than half of those surveyed having a pessimistic view of the 12 months ahead.

The Rabobank survey found 56 per cent of the nation’s farmers now expect conditions in the agricultural economy to deteriorate in the coming 12 months, those expecting an improvement in conditions declined to 13 per cent, while 25 per cent expect similar conditions to 2017.

These sentiments could afect investment in on-farm water infrastructure over the next 12 months, with the report fnding that 21 per cent were intending to decrease investment in their farm businesses, while those looking to maintain current investment levels fell back to 59 per cent, and 18 per cent reported an intention to increase investment. This potential decrease comes despite positive longer-term business outlooks.

It is likely that the pump industry will feel the efects diferently depending on which state they service.

One respondent to our survey noted those around the Murray Darling catchment area in particular could be negatively impacted in the next few years if weather patterns don’t improve, saying, “This will have a signifcant impact on irrigation businesses that don’t have the capability to service pumping infrastructure and are just relying on sales alone for revenue.”

A cautious optimism for mining

In a positive sign for those servicing the mining sector, the mining slump seems to be well and truly over, with a report by the Department of Industry, Innovation and Science in the September edition of Resources and Energy Quarterly predicting a new export boom due to the combination of a weaker Australian dollar and the increasing global demand for coal, oil and LNG.

The overall fndings of the report indicate “strong economic growth, industrial production and manufacturing output” for

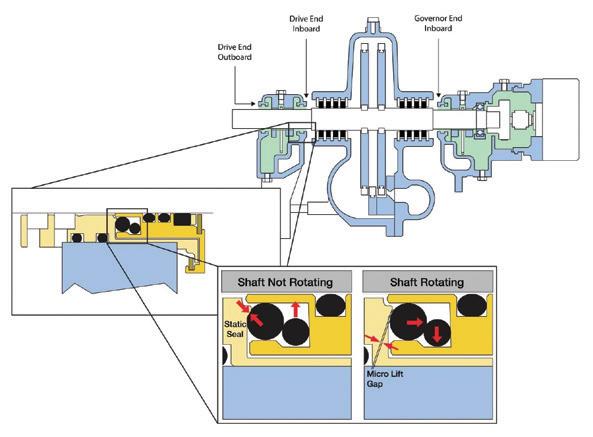

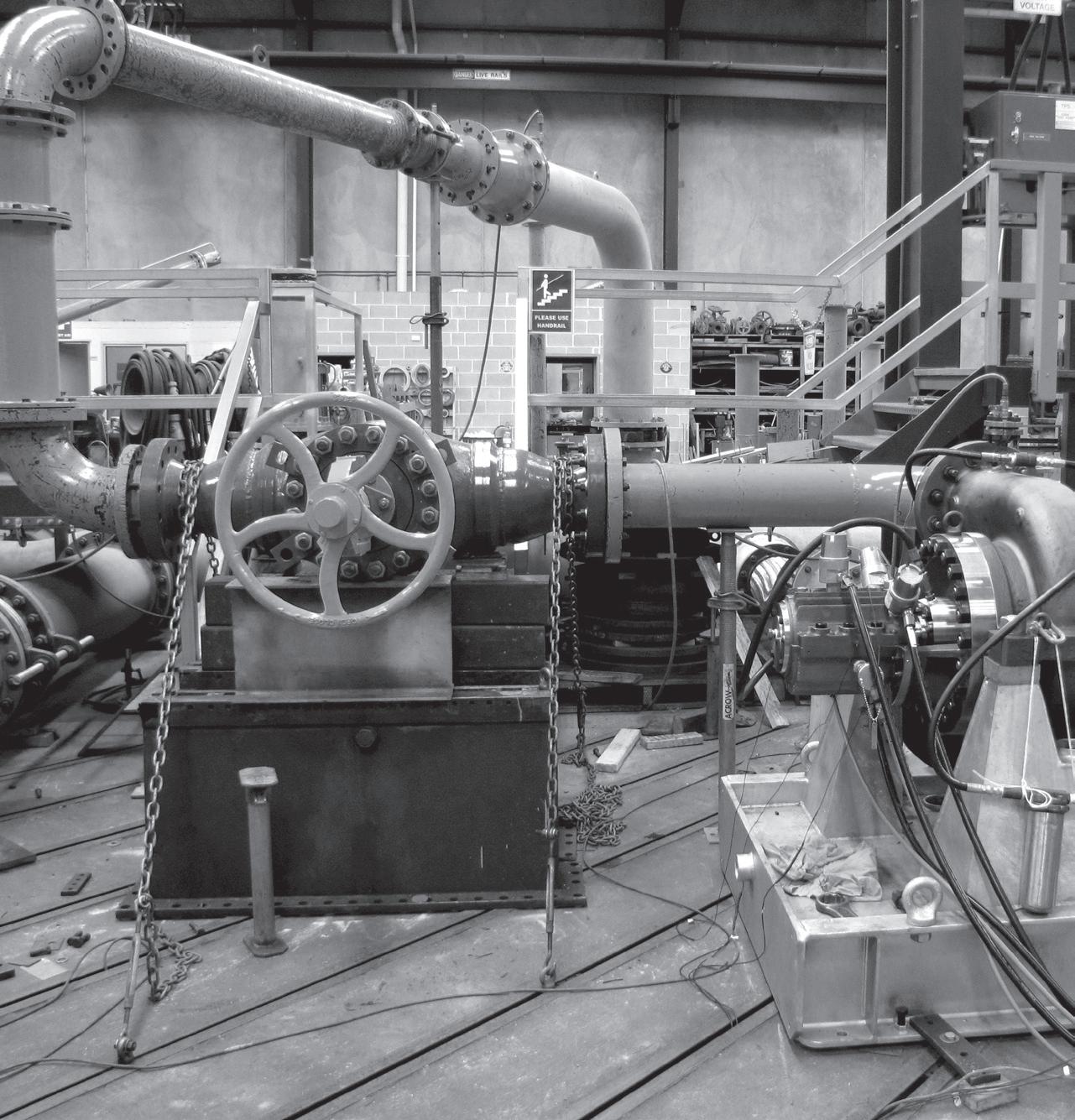

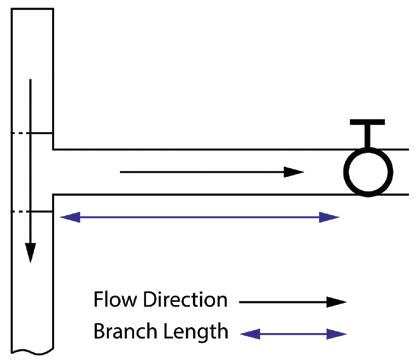

36 pump industry | Summer 2019 | Issue 26 www.pumpindustry.com.au STATE OF THE INDUSTRY