Recommendations for Maine’s Transition to a State-Based Marketplace

PREPARED FOR Commissioner Jeanne Lambrew

Megan Garratt-Reed

Katherine Fritzsche

Maine Dept. of Health and Human Services

PROJECT ADVISORS

Heather Howard

Dan Meuse

AUTHORS

Danielle Beavers

Kishan Bhatt

Molly Brune

Alice Chang

Riley Edwards

Marissa Korn

Mark Lee

Kevin McCarthy

Nabil Shaikh

Martin Sweeney

Joseph Tso

Clarke Wheeler

JANUARY 2021

TABLE OF CONTENTS | 1 Table of Contents Acknowledgments ....................................................................................... 3 Acronyms ....................................................................................................... 4 Executive Summary ..................................................................................... 5 Introduction ................................................................................................... 7 Background ................................................................................................... 8 Methodology ............................................................................................... 13 Health Equity Approach ............................................................................ 15 Broad Recommendations .........................................................................17 Enrollment Periods .................................................................................... 22 Displaying Clear Choice Plans ................................................................. 29 Auto-Renewal ............................................................................................. 36 MaineCare Integration .............................................................................. 44 Planning for the Future ............................................................................. 53 Conclusion .................................................................................................. 57 Endnotes ..................................................................................................... 58 Appendices ................................................................................................. 66 Author Biographies.................................................................................... 72

Photo

Credits: David Anderson

Cate Bligh Katie Burkhart

Benjamin

Zachary Edmunson Tyler Finck James Fitzgerald Donald Giannatti Inera Isovic Antoine Julien Keith Luke Karl Magnuson Aubrey Odom Mark Olsen Evan R

Rascoe Shadman Sakib Stephen Walker Russ Ward

Acknowledgments

This report was prepared by Master in Public Affairs students at Princeton University’s School of Public and International Affairs. This report incorporates information gathered through students’ independent research, remote interviews conducted between October 11 and November 30, 2020, and invaluable guidance from course instructors Heather Howard and Dan Meuse. The report fulfills the Princeton School of Public and International Affairs’ degree requirements for an immersive policy workshop and associated policy proposal. We are especially grateful to our partners in the Maine Department of Health and Human Services that enabled us to conduct research and make recommendations on this important topic, particularly to Commissioner Jeanne Lambrew, Meg Garratt-Reed, and Kate Fritzsche. We also wish to extend our gratitude to the many policymakers, health professionals, consumer advocates, and subject matter experts who shared their perspectives with us throughout the course of this project. We particularly appreciate their willingness to spend time with us in the midst of the coronavirus pandemic. We hope that this report will contribute to Maine’s potential transition to a state-based marketplace.

Maine Stakeholders

Jeffrey Austin, Maine Hospital Association

Mohamud Barre, Maine Access Immigrant Network

Dan Cohen, Office for Family Independence

Dan Colacino, Maine Association of Health Underwriters

Hillary Colcord, Maine Primary Care Association

Allison Conroe, Maine Mobile Health Program

Stacy Dostie, Maine Association of Health Underwriters

Kathryn Ende, Consumers for Affordable Health Care

Karynlee Harrington, Maine Health Data Organization

Katie Harris, MaineHealth

Peter Hayes, Healthcare Purchaser Alliance of Maine

Marge Kilkelly, Maine Primary Care Association

Kathy Kilrain del Rio, Maine Equal Justice

Barbara Leonard, Maine Health Access Foundation

Patty Lovell, Western Maine Community Action

Kevin Lewis, Community Health Options

Sarah Lewis, Maine Access Immigrant Network

Steven Michaud, Maine Hospital Association

Kristine Ossenfort, Anthem

Anthony Pelotte, Office for Family Independence

Tom Perrey, Maine Association of Health Underwriters

Michelle Probert, Office of MaineCare Services

Trish Riley, National Association for State Health Policy

Lisa Sockabasin, Wabanaki Public Health

Molly Slotznick, Office of MaineCare Services

Lisa Talpert, Maine Mobile Health Program

Bob Wake, Maine Bureau of Insurance

David Winslow, Maine Hospital Association

Bill Whitmore, Harvard Pilgrim

Ann Woloson, Consumers for Affordable Health Care

External Stakeholders

Emily Brice, Northwest Health Law Associates

Stan Dorn, Families USA

Tekisha Everette, Health Equity Solutions

Michael Miller, Community Catalyst

Dustin Palmer, Code for America

Kevin Patterson, Connect for Health Colorado

Eva Marie Stahl, Community Catalyst

Marissa Woltmann, Massachusetts Health Connector

ACKNOWLEDGEMENTS | 3

ACA Patient Protection and Affordable Care Act

APTC Advance Premium Tax Credit

AV Actuarial Value

BOI Bureau of Insurance

CSR Cost Sharing Reduction

DHHS Maine Department of Health and Human Services

FFM Federally-Facilitated Marketplace

FMAP Federal Medical Assistance Percentage

FPL Federal Poverty Level

OEP Open Enrollment Period

OFI Maine Office for Family Independence

OMS Office of MaineCare Services

QHP Qualified Health Plan

SBM State-Based Marketplace

SBM-FP State-Based Marketplace on the Federal Platform

SEP Special Enrollment Period

4 | ACRONYMS

Acronyms

Executive Summary

Maine’s potential transition to a state-based marketplace (SBM) presents an opportunity to expand coverage and increase affordability for health care consumers in Maine. This report explores these opportunities and provides policy recommendations to advance these goals.

Under the Affordable Care Act (ACA), states can implement their own health insurance marketplaces for the individual and small-group markets, which provide states greater flexibility and independence than using the federally-facilitated marketplace (FFM) on Healthcare.gov. Prior to November 2020, Maine’s participation in the FFM exposed the state to the Trump administration’s shortening of open enrollment periods (OEPs), funding cuts to outreach and enrollment efforts, and the refusal to create a special enrollment period (SEP) for the coronavirus pandemic.

In March 2020, Governor Janet Mills signed the Made for Maine Health Coverage Act (H.P. 1425) authorizing the development of an SBM in Maine.1 This report explores the opportunities associated with a potential marketplace transition, informed by over 30 interviews with stakeholder groups across Maine in the fall of 2020. Through this work we learned that the transition to an SBM has the potential to close cover-

age gaps, enhance outreach to groups that have been historically marginalized in the health care system, and improve population health.

This report also applies a framework of targeted universalism throughout its analysis. This goal-oriented mode of equity analysis informs many recommendations focused on making health care accessible and affordable to all Mainers, particularly those historically marginalized by the health care system.

Broad Recommendations

In addition to our below recommendations on specific topics, our interviews and research led us to make the following overarching proposals, which should guide the overall transition to an SBM and ensure that consumer engagement and support is at the core of the transition.

1. Increase consumer assistance capacity.

2. Integrate consumer engagement into the process of designing and implementing Maine’s SBM.

3. As a longer-term initiative, re-establish the Maine Office of Health Equity and empower its staff to coordinate equity efforts across the SBM, the MaineCare program, and all Department of Health and Human Services (DHHS) Offices.

EXECUTIVE SUMMARY | 5

Specific Recommendations

Using information gathered in our research and interviews, we analyze several policy options pertaining to topics that Maine’s DHHS asked our team to explore. In particular, we were tasked with identifying opportunities for reducing complexity for consumers and improving overall enrollment and affordability. We

Enrollment Periods

employ a decision matrix that assesses these policy options for their consumer impact and state feasibility. Based on this analytical framework, we propose the recommendations listed below to guide the implementation and achieve the promise of an SBM.

• Establish an OEP that runs until January 31, so the period lasts a total of 92 days.

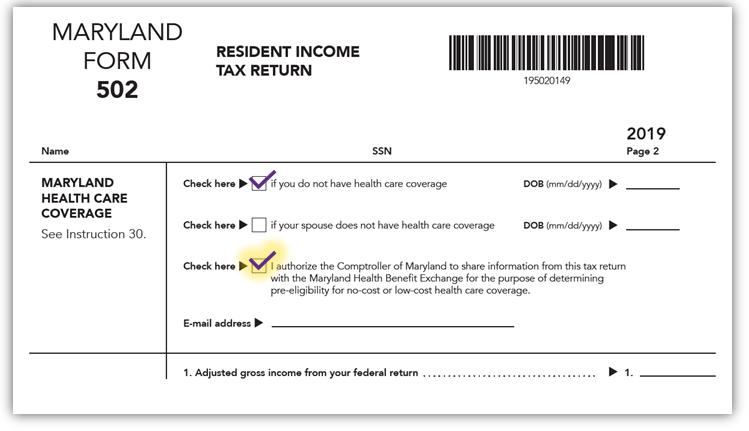

• Implement SEPs for public health crises, for individuals who become pregnant outside of open enrollment, and for uninsured tax filers beginning the day that their state tax return is filed.

• Explore options for an SEP directly after the OEP for Mainers who had valid reasons to miss the OEP deadline.

Displaying Clear Choice Plans

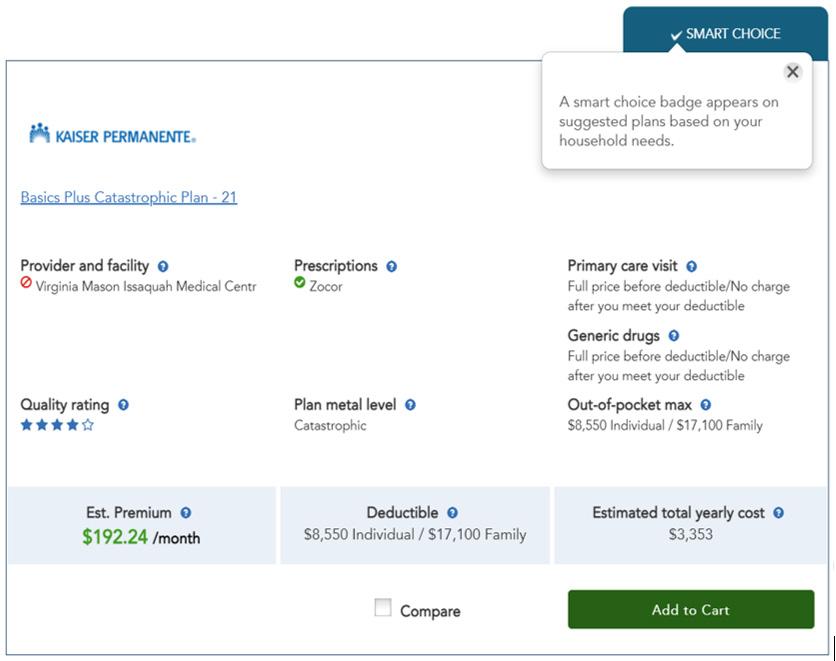

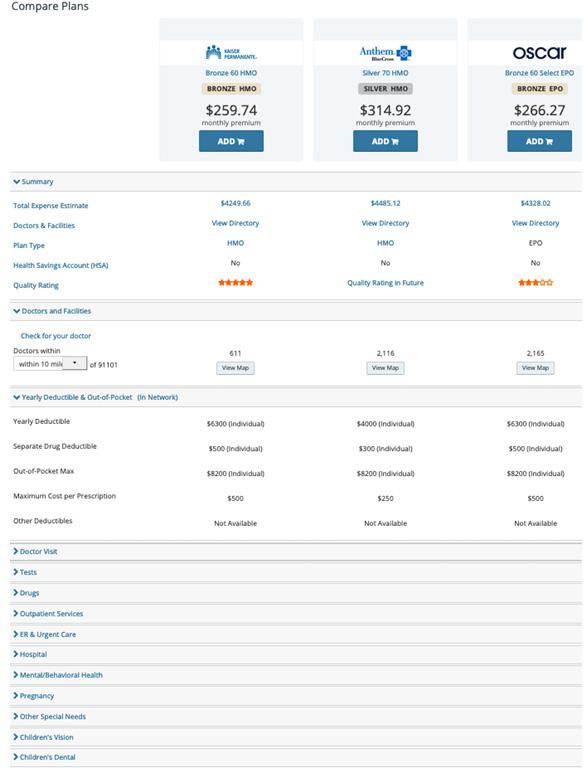

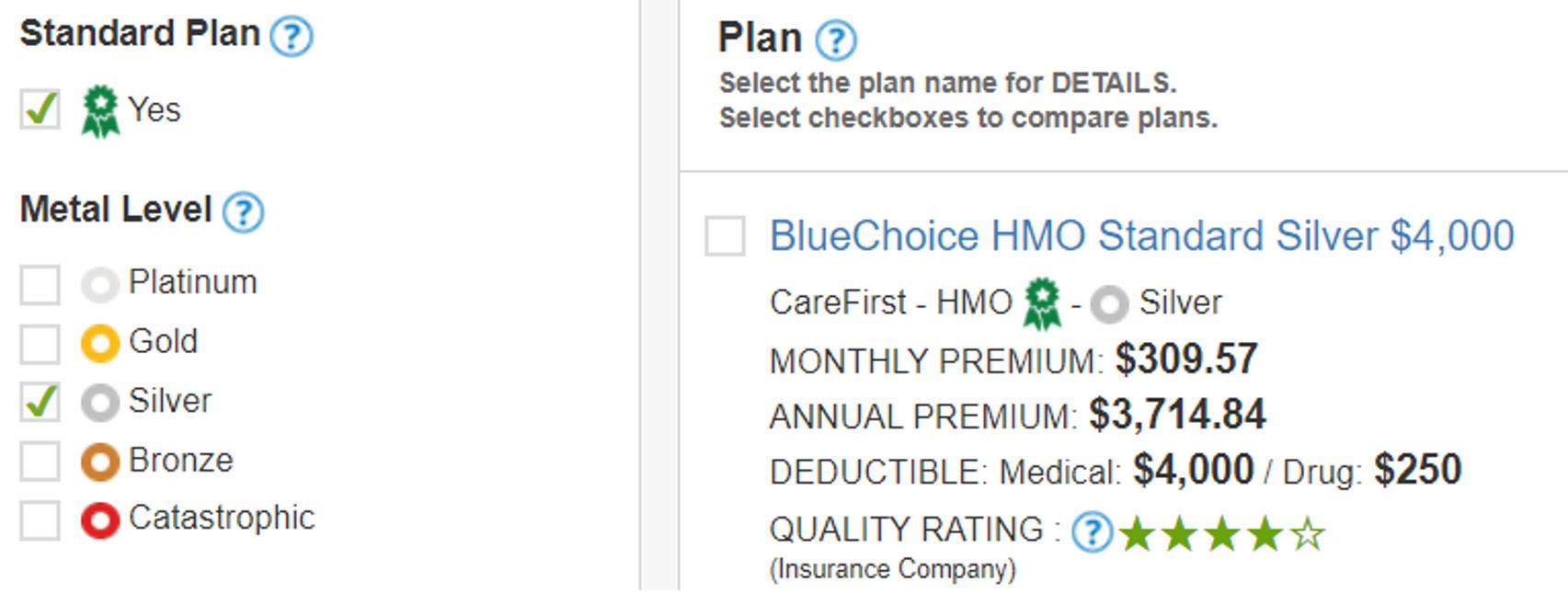

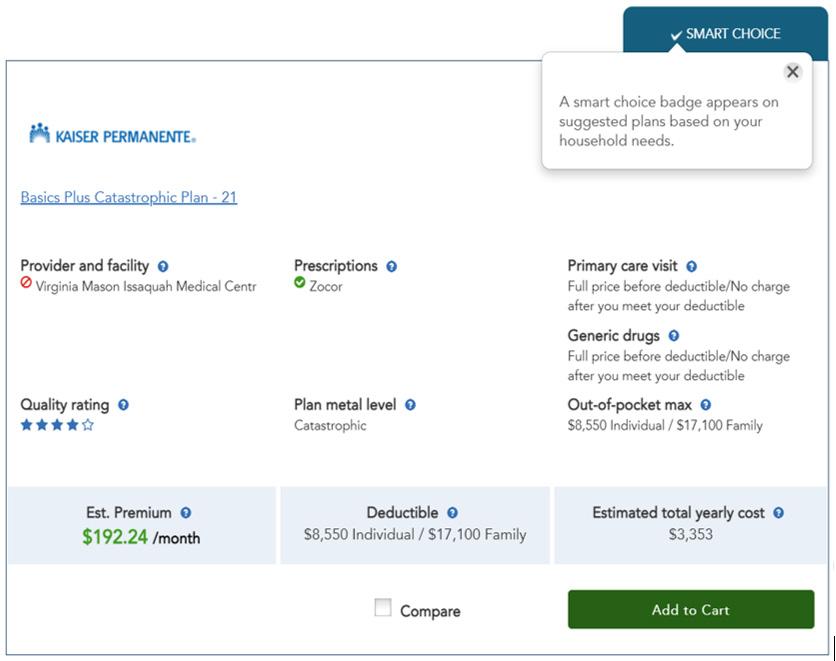

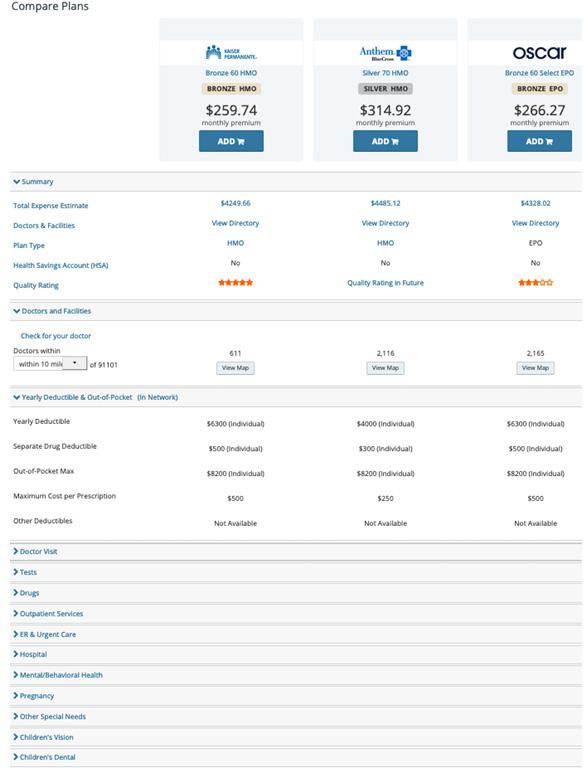

• Use an intake questionnaire and display plans based on responses.

• Build a comparison tool that: (1) automatically highlights differences between selected plans, and (2) includes a “Compare to Other Standard Plans” function.

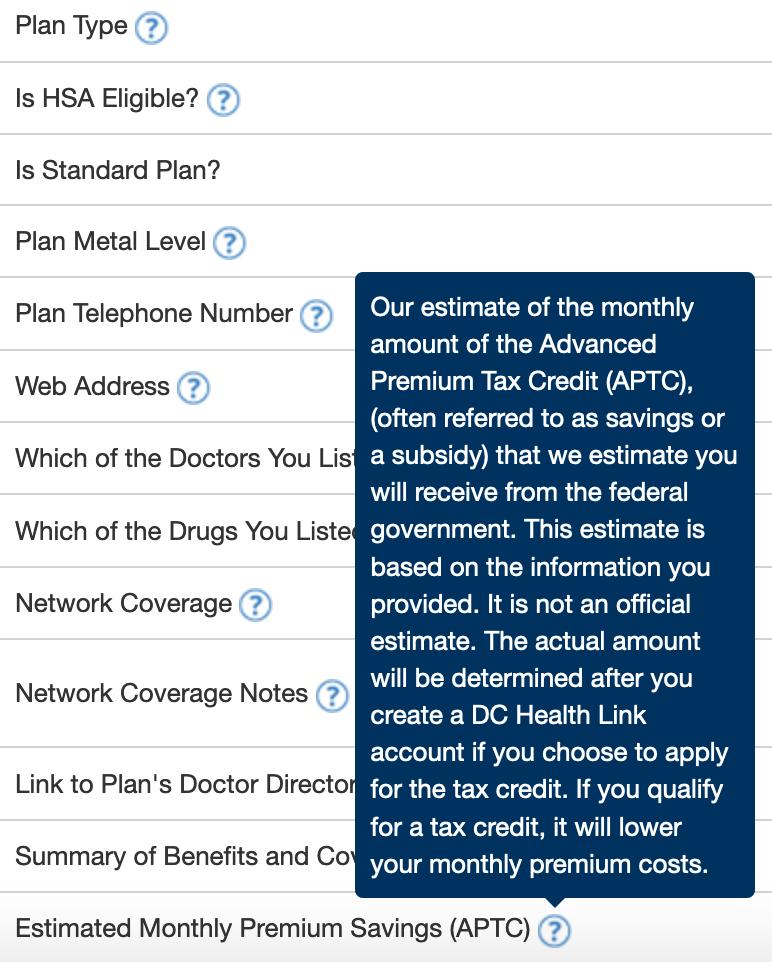

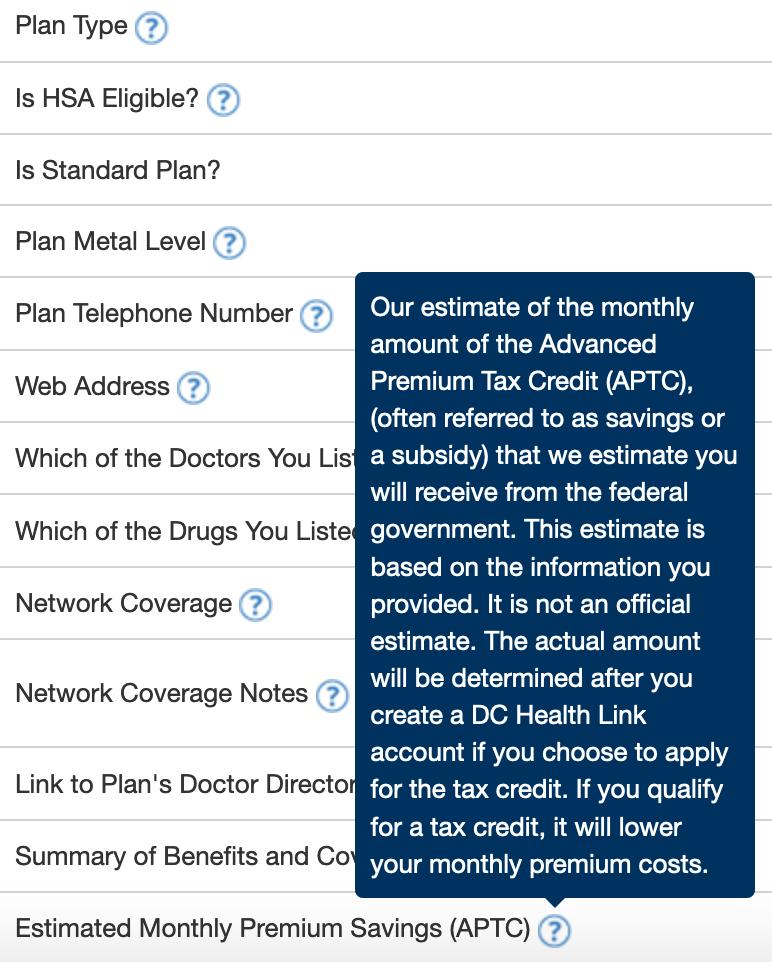

• Include a pop-up glossary feature when customers hover over a technical term, and enable screen reading audio capability for accessibility.

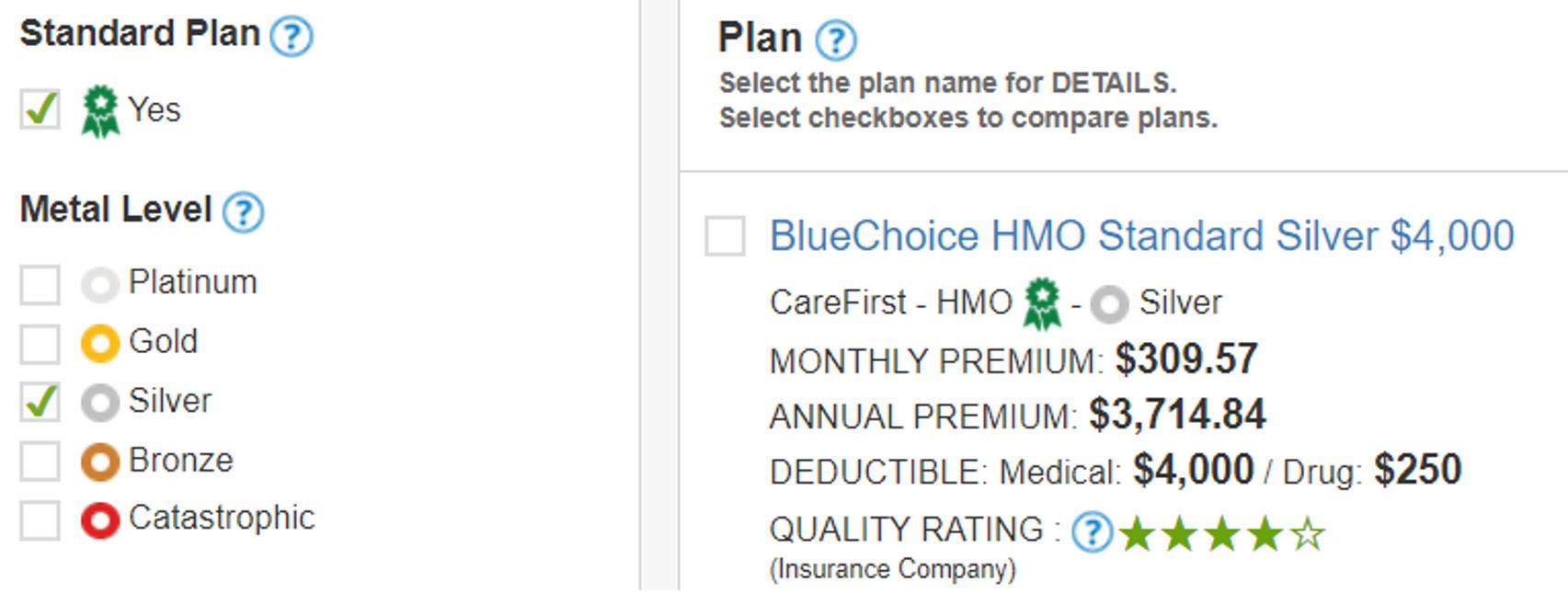

• Distinguish Clear Choice plans with naming, visual cues, sorting, and/or filtering.

Auto-Renewal

• Design more consumer-friendly auto-renewal notices.

• Set the default for consumers eligible for cost-sharing reductions to high-value silver plans.

• Auto-renew consumers with discontinued plans into Clear Choice plans.

• Explore using auto-renewal defaults to incentivize carriers to lower costs.

• Consider allowing consumers to choose their auto-renewal priorities.

MaineCare Integration

• Use existing state data to target and personalize outreach to facilitate enrollment.

• Resolve consumer-facing bottlenecks in MaineCare and SBM enrollment.

• Embed the Office for Family Independence (OFI) in the policy planning and SBM implementation process, given their responsibility for determining MaineCare eligibility.

Planning for the Future

• In the procurement, implementation, and maintenance of the SBM eligibility and enrollment system, prioritize platform capacity to adjust the inputs for the rules engine to adapt to federal policy innovations and changes.

6 |

EXECUTIVE SUMMARY

Introduction

In recent years, the State of Maine has taken several steps to embrace the ACA and expand health care access for its residents. Since taking office in January 2019, Governor Janet Mills has implemented Medicaid expansion2 and enshrined into state law the consumer protections outlined in the ACA.3

The OEP beginning November 2020 marked Maine’s shift to a state-based marketplace on the federal platform (SBM-FP) for private health insurance. This move away from the FFM aims to improve the State’s ability to develop a marketplace more responsive to the needs of Mainers.

DHHS requested our assistance in identifying important considerations for Maine’s potential transition to a full SBM, where the State would be responsible for operationalizing both outreach to Mainers and the enrollment platform, including a website, for marketplace insurance.

In this report, the Background section outlines Maine’s health care landscape and addresses challenges and opportunities associated with an SBM transition. Next, the Methodology section outlines our approach for identifying and evaluating policy options, examining each along dimensions of consumer impact and state feasibility. This is followed by a section on our Health Equity Approach describing the equity framework central to our analysis. Our Broad Recommendations section follows, drawing on themes that arose consistently in interviews and presenting cross-cutting proposals that center and support consumers while complementing many of the topic-specific recommendations we make.

After the broad recommendations, we delve into recommendations on specific topics that DHHS identified as areas of consideration for designing a potential SBM. The policy areas that we developed and evaluated are briefly described below.

• Enrollment Periods: Would flexibility to expand the OEP and SEPS help achieve state enrollment and affordability goals?

• Displaying Clear Choice Plans: How can Clear Choice plans be best displayed to maximize their impact?

• Auto-Renewal: Would changes to automatic re-enrollment (“auto-renewal”) policies help achieve state enrollment and affordability goals?

• MaineCare Integration: How could an SBM transition improve the integration between the marketplace and MaineCare?

• Planning for the Future: How can a potential SBM transition best be designed to take advantage of future federal policy making?

The authors of this report are 12 graduate students at Princeton University’s School of Public and International Affairs, and this report is prepared for the capstone project of the Master in Public Affairs program. This report is informed by secondary research as well as interviews with stakeholders across the state conducted throughout the fall of 2020. The research also benefited from the guidance of the course’s co-instructors: Heather Howard and Daniel Meuse, two national health care policy experts who lead the State Health and Value Strategies program of the Robert Wood Johnson Foundation, located at Princeton University.

INTRODUCTION | 7

The State of Maine has had two particularly significant health care policy developments since Governor Mills took office: the implementation of Medicaid expansion in 2019, and the ongoing transition towards an SBM. Both developments stem from the flexibilities granted to states in the passage of the ACA ten years ago. By financing state expansions of Medicaid eligibility, establishing health insurance marketplaces, and providing subsidies for individuals with qualifying incomes seeking health insurance on those marketplaces, the ACA’s implementation has had a significant impact on the accessibility of health insurance for millions of Americans.

The ACA presents states with a number of decisions around marketplace structure and oversight of Qualified Health Plans (QHPs). In essence, states can decide between operating and overseeing their own SBM or relying on the federal marketplace and its rules governing QHPs. SBMs provide states with significantly greater flexibility and autonomy regarding health insurance marketplace management.

This section first presents an overview of the national context and recent developments for Maine’s marketplace and MaineCare. Next, we describe key demographic characteristics of Maine’s overall population and of marketplace and MaineCare enrollees. Finally, we outline a number of the reasons that states pursue SBMs and the challenges that an SBM transition entails.

Marketplaces

Fourteen states and Washington, DC currently operate SBMs. Thirty states remain on the FFM, and six states operate an SBM-FP—Maine being a recent addition to this latter group, as of the OEP beginning November 2020. SBM-FP states continue to utilize HealthCare. gov’s technology platform and call centers but assume responsibility for certain marketplace activities, including plan management and oversight, consumer outreach, and marketing.

Nevada’s SBM launch in 2019 marked the first migration of a state to an SBM from an SBM-FP or the FFM since 2014.4 New Jersey and Pennsylvania have since followed suit, launching SBMs in November 2020.

In March 2020, Governor Mills signed legislation that formally established the Maine Health Insurance Marketplace, enabling the State to transition to an SBM-FP and to explore the feasibility of establishing its own SBM.5 DHHS is responsible for leading this exploration phase and would oversee SBM operations.

In August 2020, Maine submitted a blueprint application to the Centers for Medicare and Medicaid Services (CMS), confirming its goals to adopt an SBM-FP for plan year 2021 (i.e., by November 2020) and an SBM for plan year 2022 (i.e., by November 2021).6

In October 2020, Maine issued a request for proposal (RFP) for technology and call center partners to set up and operate an SBM.7 At the time of this writing, Maine has identified vendors and is currently in negotiations to finalize contract terms.8

In November 2020, the State officially transitioned to the SBM-FP. Like other states, Maine is funding these operations via 0.5% user fees charged on the premiums of plans sold on the marketplace (in addition to the 2.5% user fees which the federal government charges in partnership models).9

Medicaid Expansion

Court rulings since the ACA’s implementation have further opened up state flexibilities in health care provision. In particular, the Supreme Court’s ruling in NFIB v. Sebelius made Medicaid expansion optional for states.10 As of November 2020, Medicaid expansion has been adopted by 38 states and Washington, DC.11 Oklahoma and Missouri plan to implement their adopted expansion in July 2021.

After Maine voters approved Medicaid expansion by ballot initiative in 2017, former Governor Paul LePage refused to implement the expansion, which was set to take effect in July 2018.12 In January 2019, Governor Mills instructed DHHS to implement Medicaid expansion, retroactive to July 2018.13 As of December 2020, about 67,500 Mainers14—one in four MaineCare members,i and one in twenty Mainers—were enrolled in coverage through the expansion group.ii

i Nearly 237,000 individuals were enrolled in MaineCare or CHIP as of August 2020.That same month, DHHS estimated that nearly 60,000 were enrolled through expansion. Source for total enrollment: Center for Medicare and Medicaid Services.“August 2020 Medicaid & CHIP Enrollment Data Highlights.” https://www.medicaid.gov/medicaid/program-information/medicaid-and-chip-enrollment-data/report-highlights/index.html. Source for expansion enrollment: Maine Department of Health and Human Services. MaineCare (Medicaid) Update: August 3, 2020. https://www.maine.gov/tools/whatsnew/index.php?topic=DHHS-MAINECARE-UPDATES&id=3010756&v=article ii Expansion increased the eligibility threshold for parents from 105% of the federal poverty level (FPL) to 138% FPL and made most other adults with incomes up to

8 | BACKGROUND

Background

At the same time, Medicaid expansion has accelerated changes in Maine’s individual market. For plan year 2019, about 71,000 Mainers—one in nineteen statewide—enrolled in a marketplace plan. In plan year 2020, this number dropped to roughly 62,000 Mainers, or one in twenty-two statewide, likely due to Medicaid expansion.15

The coronavirus pandemic and corresponding economic downturn has led to significant increases in Medicaid enrollment nationwide and has placed enormous fiscal pressure on state finances.16 Maine is no exception to this trend. By taking advantage of generous federal match payments available for the Medicaid expansion population, the State has succeeded in enrolling over 20,000 Mainers into expansion-group coverage since early March.17

Demographics

Governor Mills articulated a goal of making affordable health care available to more Mainers when she laid out plans for a potential SBM transition in August 2019.18 This section presents statistics on Maine’s marketplace consumers, uninsured residents, and broader population, to provide context for the challenges of increasing enrollment and affordability.

Broader Population

Many of the stakeholders we interviewed highlighted Maine’s unique demographics and geography as relevant to its health care landscape.

Geography: Maine is a large state by area—larger than all other New England states combined.19 Its population is also rural: 40% of Mainers live in rural counties.20 These factors are relevant for a number of reasons. Rural areas tend to have higher premiums than urban areas21 and often lack enough physicians. Maine ranks second nationally for the number of primary care doctors in rural counties (99.5 per 100,000), nearly double the national rate for rural counties, but rural residents still find there are too few geriatricians.22 Many Mainers living in rural areas lack internet access: in 2018, an estimated 90% of Mainers had a smartphone or computer, but only 85% had internet access at home via those devices.23 Additionally, 83,000 Mainers had no access to the internet.24 Many Mainers in rural areas therefore rely on in-person or phone interactions to enroll (or

get assistance enrolling) in health coverage, and those that utilize in-person services may face long journeys to access them.

Age: Maine’s population has the oldest median age of any state in the US, and 23% of its residents are aged 5064 (compared to the national average of 19%).25 Since older residents face higher health care costs, Mainers are more likely to struggle to pay for the health care they need.These issues are exacerbated by higher rates of disability in Maine (16%, compared to the national average of 13%).26

Race, ethnicity, and language: 93% of Maine residents are non-Hispanic white (compared to the national average of 60%). Only 6% of residents speak a language other than English at home (compared to the national average of 22%).27 This can pose challenges for Mainers that do not identify as white: language and cultural barriers may present obstacles for accessing coverage.

Income: Maine has the lowest median household income in the Northeast.28 Disparities also exist within the state, with the poverty rate in the state’s rural areas 3.4 percentage points higher than in urban areas.29

Survey data suggests Mainers with low- and middle-incomes postpone needed treatments and ration prescriptions due to high health care costs in Maine.30

Marketplace Consumers

Data from plan year 2020 published by CMS sheds light on Maine’s marketplace consumers and the types of plans they select.

• 51,400 applications for coverage were submitted, covering 77,700 individuals.iii

• 8,200 individuals were assessed as eligible for MaineCare/CHIP and referred for OFI for determination.

• About 62,000 Mainers enrolled on the FFM for 2020 coverage.

• 84% of consumers were eligible for financial assistance.iv

• 82% of consumers who were enrolled in a marketplace plan for plan year 2019 re-enrolled for 2020.

• 61% of individuals enrolled in coverage on or after December 8. 25% of consumers auto-renewed their coverage, and this figure likely includes many such consumers.

138% FPL newly eligible. According to DHHS, as of December 2020, 84% of the currently enrolled expansion group is this latter group of adults without children or caretaking responsibilities.

iii Numbers presented in this section are rounded to the nearest hundred. Percentages are rounded to the nearest whole number; the denominator is the number of enrollees (62,031). Enrollees are referred to as consumers in this section.

iv APTCs or CSRs

BACKGROUND | 9

• Average monthly individual premiums after factoring in advance premium tax credits (APTCs) were $176 (compared to a sticker price of $642).

• One-third of consumers were aged 55 to 64. Another one-third were aged 35 to 54.

• 55% of consumers were from rural ZIP codes.

• 9,200 consumers (15%) had household incomes between 100% and 150% FPL. This was down from 15,900 consumers in plan year 2019.v 13,400 consumers (22%) had incomes between 150% and 200% FPL.

Uninsured Residents

Approximately 106,000 civilian noninstitutionalized Mainers were uninsured in 2019.31 Of those uninsured, about 29,000 had household incomes less than 138% FPL and about 55,500 had household incomes between 138% and 400% FPL. A significant proportion of uninsured Mainers are thus likely eligible for either MaineCare or subsidized marketplace coverage.

Appendix Table 2 presents uninsured rates by demographic group. Adults under age 34, men, and nonwhite populations—particularly American Indian and Alaska Natives—are more likely to be uninsured than older adults (aged 35-64), women, and non-Hispanic white people, respectively.

Health Equity

In every interview, stakeholders spoke about the rurality and age of Maine’s population. These factors contribute to health disparities, which are more pronounced with limited provider access, low population density, and high health care needs. SBM policies to address these disparities affect many Mainers, but especially historically marginalized groups.

The groups most commonly discussed in our stakeholder conversations were:

• People with limited English proficiency, who represent 1.5% of Mainers.32 Languages with more than 1,000 native speakers in Maine include Spanish, French (including Patois and Cajun), Chinese (including Cantonese and Mandarin), and Cushite.33

• Immigrants, who represent 3.6% of Mainers.34 Nine out of ten report speaking English well, over a third have a college degree, and more than half are naturalized citizens.35 However, the nature of their work makes them less likely to have employer-sponsored insurance; in 2018, 2,368 immigrant business owners accounted for 2% of all self-employed Maine

residents.36 Lawfully present immigrants ineligible for MaineCare due to their immigration status may be eligible for APTCs or cost-sharing reductions (CSRs), even if their income is below the FPL.37

• Black Mainers, who represent 1.7% of residents.38 Almost half are immigrants, the highest share in the nation, from nations including Somalia and the Democratic Republic of Congo.39 The latest five-year estimates, for 2014-2018, show the rate of poverty for Maine children who are African American or Black at 46%, down from 53% for the five-year period ending in 2017. This rate is more than three times as high as the rate for non-Hispanic white children (15% in poverty) and nearly twice as high as that of Hispanic children (24% in poverty).40

• Migrant farm workers, who make up 62% of hired farmworkers in Maine. Eighty-three percent of migrant workers are foreign-born.41 A 2015 survey by the Maine Department of Labor found that 56% of migrant farmworkers were born in Mexico, 17% were born in the U.S., 10% were born in Haiti, and 8% were born in Canada.42

• Wabanaki Mainers, who represent 0.7% of the population.43 Their life expectancy is 54 years, considerably less than the 78-year life expectancy for the general population.44

Reasons to Build an SBM

Flexibility: SBMs offer greater flexibility to state governments, including more control over marketing funding, open enrollment timelines, SEPs, and health equity efforts.45 SBMs can also offer additional state-funded subsidies to improve plan affordability and increase marketplace enrollment, as Massachusetts, Vermont, California, Colorado, and New Jersey do.46 Greater autonomy additionally allows SBM states to experiment with display features that improve the consumer experience, such as default orders, search filters, and comparison tool designs. DHHS recently noted in a public announcement that “operating a State platform provides greater flexibility and opportunities to customize the Marketplace to Maine’s needs.”47

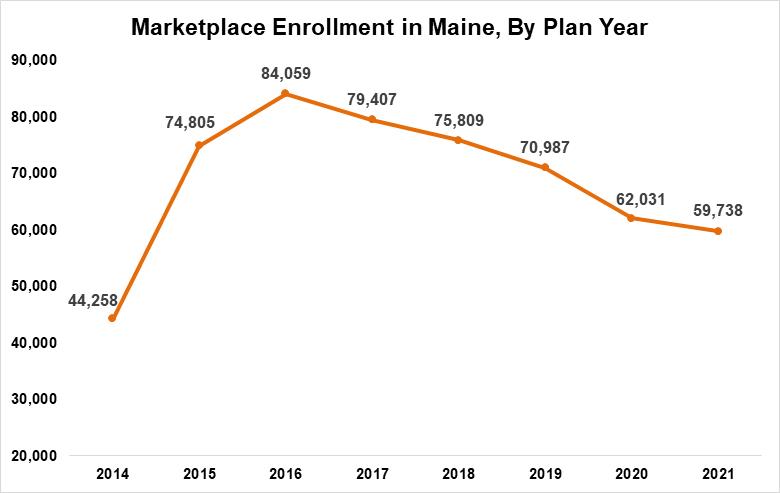

Protection: SBMs have some insulation from federal funding cuts and enrollment period restrictions, which have been common in recent years. CMS cut funding for outreach groups offering enrollment assistance, from $63 million in 2017 to $10 million in 2019, and halved the length of the OEP, from 90 days to 45 days.48,49 CMS also rejected proposals for an FFM SEP in response to the coronavirus pandemic.50 These decisions coincided with a 10% decline in individual market enrollment

v 5,300 consumers did not request financial assistance and therefore did not provide data on income.

10 | BACKGROUND

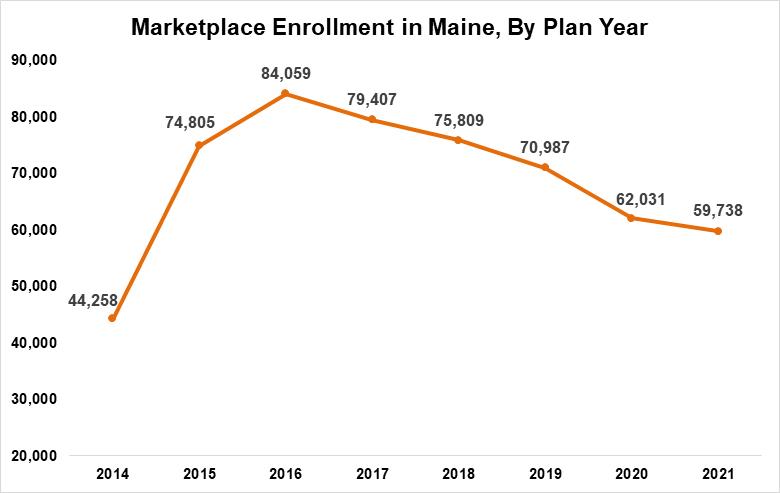

nationwide from the peak in 2016 to 2020.51 Figure 1 shows that Maine, which used the FFM during this time, experienced a steeper decline. The decrease likely reflects these and other federal actions, such as the zeroing of the individual mandate penalty, more than shifts to other coverage, as the shares of Mainers on employer-sponsored insurance and on MaineCare were stable prior to Medicaid expansion in 2019.vi

where ineligible applicants to one program are guided to another program for which they are eligible. SBM states have the opportunity to build a single streamlined application that directs enrollees to marketplace coverage or to Medicaid, depending on their eligibility.

Potential Issues in an SBM Transition

There are a number of issues that all states should consider before moving to an SBM:

Transitioning: There are significant one-time changes that carriers and others need to make, including but not limited to connecting enrollment functions with the new marketplace.

Financing: Most states rely on user fees to fund the large majority of the costs of setting up and operating their SBM. States have legislative flexibility to set user fees as they choose, but political constraints make it difficult to set fees far above 3% of premiums. Small states may have difficulty spreading the fixed costs of SBM operations over their marketplace population.ix There is a risk that some SBMs, given their limited budgets, simply replicate core functions of the FFM.55

Stability: An analysis from economists at the University of Pennsylvania reports that states with SBMs experienced much slower premium increases and fewer carrier exits than states using the FFM.53

Capturing user fees: Rather than sending premium assessment revenue (3% of total monthly premiums in FFM states, 2.5% in SBM-FP states) to the federal government, SBM states can keep this revenue in-state, creating savings to allocate towards other cost-stabilizing policies.vii

Data access: The transition to an SBM also improves state access to individual-level data, which can be used to guide outreach and improve insurance products.viii

Technology risks: Setting up a technology platform that is integrated with a call center—and integrating both with the state’s Medicaid eligibility systems—is a significant task. Some states may try to do too much at launch, resulting in core functions not operating optimally.

Accommodating stakeholders: Carriers and providers may oppose any actions which set the state on a path of increased regulation in the health care setting. Some may see the shift to an SBM as a precursor to further regulatory or administrative moves that constrain their actions or impact their business model. Internally, states may require significant resources from Medicaid eligibility offices, technology departments, or other state agencies.

Governance: Many states have flexibility in how their SBM can be established and operated under state law, including whether the SBM should be operated from

Coordination with Medicaid: SBMs are more closely connected with state Medicaid offices.54 This can (1) improve the experience of consumers experiencing churn between Marketplace and MaineCare coverage and (2) strengthen the “no wrong door” approach, vi A slight increase in the estimated share of Mainers on Medicare also contributes to this trend. See: Kaiser Family Foundation. “Health Insurance Coverage of the Total Population - Maine.” KFF (blog), October 23, 2020. https://www.kff.org/other/state-indicator/total-population/. Also, see: Centers for Medicare and Medicaid Services, 2019 Marketplace Open Enrollment Period Public Use Files https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/Marketplace-Products/2019_Open_Enrollment

vii Pennsylvania, for example, intends to use funds from the user fees on its new SBM to finance its reinsurance program. See: Pennsylvania Insurance Department, “PA 1332 Waiver Frequently Asked Questions,” Pennsylvania Insurance Department, 2019, https://www.insurance.pa.gov:443/Coverage/Pages/PA1332Waiver-Frequently-Asked-Questions.aspx. Livingston, Shelby, “CMS Wants to Cut ACA Exchange Fees, End Silver-Loading,” Modern Healthcare, January 17, 2019, https://www.modernhealthcare.com/article/20190117/NEWS/190119916/cms-wants-to-cut-aca-exchange-fees-end-silver-loading viii When New Mexico moved to an entirely state-run exchange, its leaders cited this as one of the top motivations. See: Garrity, Tom “New Mexico Makes Move to a State-Based Marketplace,” beWellnm, September 21, 2018, https://www.bewellnm.com/Blog/New-Mexico-Makes-Move-to-a-State-Based-Marketplace ix Of the 15 states operating SBMs, only Vermont, Washington, DC, and Rhode Island have fewer residents (and plan year 2020 marketplace enrollees) than Maine.

BACKGROUND | 11

Figure 1. Marketplace Enrollment, Maine (Plan Years 2014-2021)52

Source: Kaiser Family Foundation Data and Center for Medicare and Medicaid Services Data.

within state government or by an outside organization with close links to state government. This decision has implications for the degree to which the SBM is subject to legislative oversight or reporting requirements or is at risk of having board members with conflicts of interest.

Plan management and oversight: The greater au-

thority that an SBM grants state officials and insurance departments over plan management and oversight comes with greater responsibilities that require a host of decisions about permissible plan features, from marketing to network breadth to consumer-facing descriptions of coverage. This work may involve more regular and difficult conversations with carriers.

12 | BACKGROUND

Methodology

This section describes the analytical approach used to develop the recommendations in this report. We first outline our approach to researching Maine’s health policy landscape and relevant policy options, followed by a discussion of the criteria we use to evaluate them. Finally, we describe how we prioritize policy options within each area using our Decision Matrix.

Research Approach

The analysis in this report is driven by interviews with 38 Maine stakeholders performed throughout October and November 2020.i These stakeholders include representatives from health care providers, advocacy groups, and carriers; state health policy experts; and senior officials from key State of Maine departments. While the majority of interviewees were Maine-based, we also consulted several experts from nationally-focused organizations and other states. In our interviews, we discussed the opportunities and challenges that Maine’s potential transition to an SBM could pose

to increasing coverage, reducing complexity, and improving affordability.

Based on analysis of these stakeholder interviews and further background research, we then developed potential recommendations. Using the following criteria aimed at evaluating consumer impact and state feasibility, we rank the priority of each recommendation within each policy area.

Consumer Impact

Affordability: What is this recommendation’s impact on premiums, deductibles, and other forms of cost-sharing for consumers?

Complexity: How does this recommendation impact the ease with which consumers can navigate accessing health coverage?

Coverage: How does this recommendation impact uninsured levels, and do impacts vary across different populations? If applicable, how does it affect wheth-

i Normally, these interviews would have been conducted in person in Maine, but due to the coronavirus pandemic they were conducted over Zoom.

METHODOLOGY | 13

er people are getting the high-quality, comprehensive coverage they want?

Equity: How does this recommendation impact marginalized populations in Maine, such as immigrants or people living in poverty?

State Feasibility

Political: How easily is this recommendation likely to move through the administrative or legislative process? Will relevant stakeholders be supportive of this proposal?

Financial: What impact would this have on the state budget? Is this recommendation realistic in the context of severe fiscal challenges and a recession triggered by the coronavirus pandemic?

Implementation Capacity: Can this recommendation realistically be implemented in terms of start-up, ongoing implementation, and long-term maintenance?

Decision Matrix

We present our decision matrix in Appendix Table 1. Each cell of the matrix is assigned a color on a scale from dark green to dark red. Dark green indicates

strong feasibility or significant positive impact on consumers, while light green indicates likely straightforward feasibility or limited impact on consumers. Similarly, dark red indicates lack of feasibility or significant negative impact on consumers, while light red indicates limited feasibility or limited negative impact on consumers. Gray indicates neutral consumer impact. Again, these determinations take into account stakeholder interviews, background research, and analysis of the political and policy landscape both in Maine and nationally.

To generate rankings, we assigned numeric scores to each color determination, weighting consumer impact more heavily. This framework was selected because the core of a promising policy is not the ease of implementation but rather its impact on consumers with respect to affordability, complexity, coverage, and equity. For instance, if a policy is feasible but has limited positive impact on consumers, we consider it to hold less value than a policy with a stronger positive consumer impact that may face higher feasibility concerns. See Appendix 1 for more details on color determination and weighting.

14 | METHODOLOGY

Health Equity Approach

This project was launched in late 2020, in the wake of a national reckoning on anti-Black racism and a pandemic that has disproportionately harmed historically marginalized communities, including those who are Black, Indigenous and people of color (BIPOC).

In June 2020, the Maine Center for Disease Control & Prevention announced that, despite only comprising 1.6% of the state’s population, Black residents represented 24% of all COVID-19 cases in Maine at the time.56 While these harrowing statistics have improved slightly since, as of January 18, 2021, Black and African American Mainers represent at least 5.4% of all documented COVID-19 cases in Maine—more than three times their share of the total population.i

The coronavirus pandemic has exposed the ways in which existing policies and structures have failed certain communities, leading to racial disparities in health, safety, and overall well-being. White Mainers are only half as likely to experience unemployment or poverty compared to BIPOC Mainers, a disparity directly linked to health access and outcomes.57 Even prior to the pandemic, Mainers of color were nearly twice as likely as white Mainers to be unable to seek medical care because they could not afford the cost.58

Maine’s potential transition to an SBM would be a significant milestone. With an SBM-FP, the State already has opportunities to invest further resources into enrolling uninsured Mainers, including through more effective outreach and consumer assistance activities—a critical investment towards health equity in the state. DHHS officials have asked us to identify best practices and policy innovations to support the success of an SBM.This transition is a chance to step back and better understand how existing systems may be contributing to inequities and how to avoid repeating missteps in a new model.

LGBTQ+, houseless, immigrants, refugees, disabled, migrant and seasonal workers, living in urban or rural areas, and/or newly eligible for MaineCare. We sought expertise and feedback from organizations who currently lead efforts to support these communities in Maine, and we applied a racial equity framework while conducting our analysis and drafting recommendations. While an SBM has the potential to expand health access for Mainers with historically marginalized identities, we heard concerns from stakeholders that its impact may be limited without improving equity coordination across OFI, the Office of MaineCare Services (OMS), and a potential SBM. In the same vein, we believe that there is an opportunity for DHHS to restructure and enhance its equity operations across the Department, which we detail in Recommendation 3 in Broad Recommendations.

Throughout this report, we suggest a number of incremental improvements that DHHS can adopt in the short-term during its potential transition to an SBM. Simultaneously, we share longer-term possibilities—including policy options that are complex and politically challenging—that we hope can help expand the State’s vision and approach to health services. As with other policy considerations, we recognize that DHHS’s choices relating to health equity will need to contend with both immediate and longer-term constraints, and hope that our report strikes a balance to assist state officials in their decision-making.

In light of this context, we use targeted universalism, a goal-oriented equity framework, to propose recommendations that would move toward all Mainers having accessible, affordable health care.ii In setting this universal goal, we pursue targeted processes for Mainers who are BIPOC, immigrants, refugees, migrant and seasonal workers, queer, trans, disabled, and/or experiencing homelessness.

We articulate our goal through a lens of care, in addition to coverage. Care is a broader term that includes all the ways Mainers might seek to address their health needs, including not only private and public health in-

While compiling this report, our team grounded equity as a foundational pillar of our work. Prior to identifying and interviewing stakeholders, we conducted background research to better understand communities in Maine, including those who are Black, Indigenous, i We say “at least” noting that over 4,250 positive cases did not report the patient’s race and/or ethnicity. Source: “COVID-19: Maine Data.” Division of Disease Surveillance, Maine Center for Disease Control & Prevention. Accessed January 19, 2021. https://www.maine.gov/dhhs/mecdc/infectious-disease/epi/airborne/coronavirus/data. shtml

ii Targeted universalism is an equity framework, created by professor and critical race scholar john a. powell, in which “universal goals are established for all groups concerned… (and) the strategies developed to achieve those goals are targeted, based upon how different groups are situated within structures, culture, and across geographies to obtain the universal goal.” powell, john a. Stephen Menendian and Wendy Ake, “Targeted universalism: Policy & Practice.” Haas Institute for a Fair and Inclusive Society, University of California, Berkeley, 2019. https://belonging.berkeley.edu/targeteduniversalism.

HEALTH EQUITY | 15

surance, but also Free Care or the Maine Mobile Health Program. These programs are critical for migrant and seasonal workers, immigrants and refugees, and those with limited English proficiency, among other groups who are systematically excluded from coverage under certain circumstances. While our recommendations would facilitate increased access to coverage for those who are eligible and interested, they would not replace the need for these sources of care.

This articulation also stems from an acknowledgement

that even with coverage, many marginalized populations continue to experience discrimination and stigma in the delivery of health care services, undermining the care they receive. Given that a full examination of the social determinants of health and systems of oppression in Maine is outside of the scope of this report, we approach universal access to affordable health care in this report as a critical economic safety net, rather than as a standalone solution to health inequities in the state.

16 | HEALTH EQUITY

Broad Recommendations

Over the course of our stakeholder interviews, it became clear that the State’s potential transition to an SBM presents the opportunity to more comprehensively center consumer voices and needs. This section focuses on broader recommendations that surfaced throughout the interviews and have implications for the topic-specific recommendations that follow. These recommendations are grounded in the perspective that, to achieve universal access to affordable, quality health care, consumer voices are critical at every step, from design to implementation to evaluation.59

We identify three key recommendations:

1. Increase consumer assistance capacity.

2. Integrate consumer engagement into the process of designing and implementing Maine’s SBM.

3. As a longer-term initiative, re-establish the Maine Office of Health Equity and empower its staff to coordinate equity efforts across the SBM, the MaineCare program, and all DHHS Offices.

Background

The possible transition to an SBM provides the opportunity to address challenges related to reduced consumer support around enrollment activities. While our stakeholder interviews highlighted existing state efforts to support consumers’ enrollment needs, policies under former Governor LePage and former President Trump—which decreased funding for marketing, outreach, and consumer assistance in the marketplace60—have limited the potential for robust and sustained support for consumers.

In this context, foundations have stepped in to provide funding for outreach and enrollment efforts, directing crucial resources to advocacy groups and community-based organizations.i As Maine looks to transition to an SBM, stakeholders stressed that they hope to pivot from functions that could be performed by the State to grassroots organizing and capacity-building among local leaders.

Consumer-facing stakeholders also expressed broad concern that a transition to an SBM may not be responsive to the needs of consumers, particularly historically marginalized Mainers. While state officials have made inroads and hold regular meetings with community organizations and advocacy groups, some stakeholders voiced the perspective that information sharing

and collaboration opportunities between community-based groups and state officials can be improved.

Another theme that emerged among our interviews was the impressive institutional knowledge, close community, and policy capacity developed among grantees of the Maine Health Access Foundation. The tight-knit nature of this community of organizations was clear throughout our interviews, with community-focused stakeholders referencing conversations we had with previous community organizations -- an indicator of frequent collaboration among such groups. A stakeholder with a national advocacy focus also noted in a conversation that Maine has a particularly robust network of community-focused health policy organizations. Additionally, one stakeholder specifically highlighted that this cohort of advocacy and community-based organizations, which has collaborated since the rollout of the ACA, would likely bring significant value through its policy and consumer-facing experiences with the marketplace. These themes highlight the opportunity to more comprehensively engage this cohort to center consumer voices in the potential SBM transition.

Recommendation 1: Increase consumer assistance capacity.

Those providing enrollment support, including navigators, assisters, and call center staff, play an important role in helping consumers with low literacy, limited English proficiency, poor internet access, or who are facing other barriers to enroll in health insurance that meets their needs. While Maine officials should work with consumer groups to make the marketplace as easy to navigate and understand as is possible, many consumers will still likely need or prefer assistance to navigate the marketplace and select a plan. For example, many rural residents rely on navigators for enrollment because they lack access to the internet or can only access it on their phones, making in-person or over-the-phone consumer assistance a lifeline for coverage. Additionally, consumers with limited English proficiency may rely on translation services provided through the call center or other consumer assistance.

CMS reduced funding for navigators during 2018 and 2019, which limited funding for enrollment assistance in Maine. In 2019, Western Maine Community Action

i These external sources of support have come to play an integral role in the consumer assistance landscape. For instance, in 2019 alone the Maine Health Access Foundation granted the DHHS Office of MaineCare Services for MaineCare Expansion $450,000 and the Wabanaki Public Health Office $50,000 for ACA MaineCare Direct Outreach and Enrollment and Health Equity Capacity Building. Maine Health Access Foundation. “2019 Annual Report: Responsive Solutions to Improve Health.” https:// mehaf.org/wp-content/uploads/2019-Annual-Report.pdf

18 | BROAD RECOMMENDATIONS

received $100,000 of CMS funding, which was the only federal funding for navigators in Maine that year.61 While Maine officials increased funding for this year, the State should continue to prioritize sustained financial support for consumer assistance programs.

Recommendations include the following:

• Increase the number of enrollment assisters and call center staff funded by the State.

• Prioritize cross-cultural communication skills in hiring and training of staff.

• Invest in targeted enrollment outreach to communities facing higher rates of uninsurance, such as LGBTQ+ individuals.62

• Increase the number of enrollment assisters able to translate material into additional languages.

• Create a centralized navigator portal to provide enrollment assisters information about changes to consumers’ health insurance enrollment.

• Identify opportunities to train people within historically disempowered communities to serve as enrollment assisters.

Consumer Impact

This policy could substantially decrease complexity for consumers by providing them with trusted advice and assistance to enroll. This would likely lead more consumers to enroll, and could advance health equity if assisters can support groups with different language backgrounds, limited internet access, or other barriers such as time scarcity to enroll in coverage. Assisters and call center workers can help consumers find the most affordable plan that offers what they need.

State Feasibility

This policy would likely receive support from stakeholders because it facilitates enrollment by those who may otherwise remain uninsured. Sustained enrollment support could impose increased costs for the State, as it could require hiring of new employees or additional granting to community-based organizations.

Recommendation 2: Integrate consumer engagement into the process of designing and implementing Maine’s SBM.

State officials can also consider how to formally embed consumer voices and needs in decision-making processes related to the possible transition to an SBM. For instance, the State could establish a consumer advisory board with representatives from key communities and

organizations. The purpose of this structure would be to assure that SBM-related policies are informed by the perspectives of Maine consumers through meaningful collaboration.

DHHS officials could consider leveraging existing infrastructure focused on narrowing disparities and elevating consumer voices, particularly those of historically marginalized health care consumers such as immigrants or the Wabanaki people. One such structure, for instance, is the Permanent Commission on the Status of Racial, Indigenous and Maine Tribal Populations. The Commission—which recently received a one-time $50,000 funding award from the Mills administration63—could receive additional support to act as a channel to embed consumer input and advance equity-focused initiatives.

The enabling statute for this Commission outlines a number of roles that this body could engage in to elevate consumer voices and health equity concerns in the potential SBM rollout. For instance, the Commission could hold public hearings and workshops to consider how an SBM could narrow health disparities. The Commission could also carry out relevant research and work with the Governor to advance policy actions promoting health equity. Such activities align with the Commission’s overarching goal to “promote, carry out and coordinate programs designed to improve opportunities for racial and ethnic populations in the State.”64 The State could also look to the existing infrastructure and community of consumer advocates and community-based organizations supported by the Maine Health Access Foundation for opportunities for more robust consumer input.

Consumer Impact

Sustained engagement with consumer-facing stakeholders would benefit consumers by centering their needs and challenges in the potential development of the SBM. Providing consumer groups a forum to voice their concerns and authentically engage in the possible SBM transition can also potentially address coverage barriers and could lead to opportunities for expanded coverage access and increased affordability.

Consumer collaboration could also help officials identify ways to decrease marketplace enrollment complexity by identifying pain points experienced by consumers in the enrollment process. Finally, centering consumer voices—particularly those of marginalized populations—advances health equity by targeting at-

BROAD RECOMMENDATIONS | 19

tention and resources towards issues impacting populations historically excluded from policymaking spaces.

State Feasibility

This policy would likely be feasible. Many advocacy groups already participate in other state health policy settings, such as Maine Equal Justice on the MaineCare Advisory Committee.65 While this recommendation requires state action to convene and consider how the body informs other processes, it is unlikely to pose significant implementation challenges.

Challenges associated with this recommendation are related to broader obstacles around stakeholder and consumer engagement. State officials will need to balance competing needs of different organizations, set expectations for how they incorporate input, and determine which organizations should represent key voices.

Recommendation

All state officials we interviewed expressed an interest in partnering more closely with community organizations to reduce inequities regarding health access for historically marginalized communities in Maine. DHHS Offices are taking proactive steps to solicit input from and collaborate with community leaders, especially given the context of the coronavirus pandemic and its disproportionate impact on specific communities.

At the same time, officials acknowledged that existing equity activities are siloed, limiting operational efficiency and overall efficacy. Internally, the burden primarily falls on leaders within each Office to foster lasting relationships on behalf of the State, all while juggling multiple priorities. As a result, equity-oriented activities are often ad hoc and/or conducted independently from other Offices within DHHS, even those with closely related responsibilities. Externally, community health groups must maintain relationships with multiple Offices. Officials expressed worries that the State may be responding to communities with greater advocacy resources, rather than targeting the communities with the greatest needs. Overall, this lack of coordination has resulted in potentially duplicative and inconsistent equity efforts, which undermine the State’s ability to

foster trust and ultimately to serve communities.

Multiple state leaders also expressed concern at the lack of uniform standards for demographic data across DHHS, a challenge that other states are also grappling with.66 This limits the State’s ability to monitor health access and outcomes across programs, including between OFI and OMS. This is a critical issue if Maine officials wish to capture and monitor community health statistics at a level more specific than the categories used by the federal government (e.g., certain ethnicities, tribes, and LGBTQ+ identities), as inconsistent usage over time could hinder longitudinal analysis.

The shift to the SBM is a chance for DHHS to think more deeply about its operational structure when it comes to equity, especially given the significant role that assisters and community organizations will play to make the new SBM a success.

Prior to the LePage administration, DHHS contained an Office of Health Equity with a mission to “[promote] health and wellness in Maine’s racial and ethnic minority communities.”67 Currently, many of these responsibilities have been carried forward by DHHS’s Manager of Diversity, Equity, and Inclusion. As a longer-term initiative, we recommend that DHHS re-establish this Office but consider expanding its authority and responsibility to (1) coordinate health equity efforts, including data, within DHHS and (2) foster longer-term relationships with community health organizations on behalf of the State.

Such a model would follow existing examples in states like California and Connecticut. California’s Office of Health Equity contains multiple business units engaged with leading the State’s health equity policy and planning, fostering community development and engagement, and providing technical guidance on health research and statistics.68 In a similar model, Connecticut’s Office of Health Equity has worked since 2016 to “ensure that health equity is a cross-cutting principle in all [Department of Health] programs, data collection, and planning efforts,” which includes coordinating efforts with community-based organizations, contractors, and local health officials.69

Many of the access barriers and community disparities relating to the marketplace overlap with those impacting OFI, OMS, and MaineCare program activities, as well as other DHHS programs. If the underlying structure of Maine’s health equity coordination is not eventually addressed, it will limit the SBM’s full poten-

20 | BROAD RECOMMENDATIONS

3: As a longer-term initiative, re-establish the Maine Office of Health Equity and empower its staff to coordinate equity efforts across the SBM, the MaineCare program, and all DHHS Offices.

tial to serve Mainers, especially those with historically marginalized identities.

Consumer Impact

A more coordinated approach to equity at DHHS will benefit consumers, especially those who have been historically marginalized or excluded from health systems. It will make it easier for DHHS to develop lasting relationships with community organizations and incorporate their needs across the department, rather than simply on a project or program basis. If DHHS standardizes data collection during this process, it will allow officials to develop, target, and evaluate policies designed to close health disparities or eliminate barriers impacting specific groups.

State Feasibility

Across the country, the national reckoning on anti-Black racism following the murder of George Floyd has led many state governments to begin developing or further enhance their equity capabilities.70,71 There are no easy fixes; racism and other dimensions of oppression are complex and deeply pervasive, and require a long-term commitment to action from all levels of an organization. It is especially important that equity staff are empowered at a level of decision-making to work with Office leaders across DHHS, which will necessitate adequate funding for staff and operations. However, given the current political and cultural moment, state leaders may be more inclined to support health equity efforts, especially in light of the disproportionate impact of COVID-19 on Mainers of color.

BROAD RECOMMENDATIONS | 21

Enrollment Periods

The flexibility of an SBM offers opportunities to expand OEPs and SEPs, which can promote greater access to health care for populations in Maine that have historically faced barriers to accessing insurance and care.

This section first outlines the current status of OEPs and SEPs for the FFM and state marketplaces. This is followed by five policy recommendations, based on our research and interviews with Maine stakeholders. These recommendations are aimed at maximizing insurance coverage while accounting for some of the potential limitations presented by adverse selection.

We recommend the following:

1. Establish an OEP that runs until January 31, so the period lasts a total of 92 days.

2. Implement SEPs for public health crises, for individuals who become pregnant outside of open enrollment, and for uninsured tax filers beginning the day that their state tax return is filed.

3. Explore options for an SEP directly after the OEP for Mainers who had valid reasons to miss the OEP deadline.

Background

Open enrollment periods are intended to give consumers a window to enroll in health coverage and prevent consumers from waiting until they are sick to enroll. The FFM currently operates an annual 45-day OEP beginning on November 1 and ending December 15. In addition, the ACA offers eligible individuals the ability to enroll in coverage outside of the standard open enrollment timeframe through various SEPs.72 These SEPs are offered by both the FFM and SBMs and are triggered by qualifying life events. The primary types of triggers are loss of qualifying health coverage, change in household size or residence, change in eligibility for marketplace coverage or subsidies for coverage, or enrollment or plan error.i

The details of eligibility and verification for an SEP depend on the event type. In 2017, the federal government added restrictions for some of these events, making it more difficult for consumers on the federal platform to enroll in health coverage outside of the OEP.73 For example, the new rules required pre-enrollment verification for all SEPs, which could act as a hurdle to consumers and reduce overall marketplace en-

rollment. These new restrictions do not apply to SBMs.

In addition to shielding consumers from restrictive enrollment policies at the federal level, SBMs provide states their own unique decision-making flexibilities. SBMs have added a number of new SEPs such as:

• Public health emergency (COVID-19);

• Pregnancy;

• Change in disability status;

• Natural disaster or act of terror;

• Loss of military insurance;

• Loss of hardship exemption; and

• Issues with insurance carriers, enrollment processes, payment, etc.

Maine may benefit from instituting any or all of the above SEP types. Implementing new SEPs could offer an opportunity to increase coverage, especially for individuals experiencing life challenges that would be exacerbated by significant health care bills. For example, during the coronavirus pandemic, most SBMs implemented an SEP to allow marketplace enrollment, while the FFM relied on its usual SEPs.74 This policy provided an opportunity for many Americans to face the pandemic better prepared for the health and economic consequences of contracting COVID-19.

Meanwhile, some believe SEPs provide a disincentive to sign up during open enrollment as individuals may wait to enroll only when they need coverage if they know they will qualify for an SEP. One analysis of an insurer’s data in 2015-2016 provides some evidence that SEP enrollees have higher inpatient and emergency department costs.75 However, the stakeholders we interviewed did not express significant concerns about SEP impacts on premiums. While we heard some concerns from carriers about risk pooling, we also heard that SEP enrollment has not been as expensive for insurers as originally feared, at least since SEPs became more strictly verified.ii Therefore, it does not appear that risk pooling concerns in general should preclude an expansion of SEPs in Maine. When implementing any new SEPs, careful consideration should be given to whether verification is truly needed, as it adds complexity to the consumer experience which may reduce the policy’s effectiveness.

The Biden administration may potentially expand en-

i There are also a number of other more complex SEPs, such as when a Medicaid application filed during OEP is denied after the deadline. Source: “Enroll in or change 2020 plans — only with a Special Enrollment Period.” Healthcare.gov. https://www.healthcare.gov/coverage-outside-open-enrollment/special-enrollment-period/ ii This statement is based on background interviews with Maine stakeholders. For a recent analysis of changes to SEP risk-adjustment since 2017, see: Dorn, Stan, Bowen Garrett, and Marni Epstein. “New risk-adjustment policies reduce but do not eliminate special enrollment period underpayment.” Health Affairs 37.2 (2018): 308-315.

ENROLLMENT PERIODS | 23

rollment opportunities in order to bolster insurance coverage in the aftermath of the coronavirus pandemic. This may be a chance for Maine to glean additional perspectives using data from any SEP or OEP expansions in the FFM.76 In addition to the recommendations we discuss below, the State should seek to leverage federal outcomes in the upcoming year to enhance analysis of enrollment trends.

Recommendation 1: Establish an OEP that runs until January 31, so the period lasts a total of 92 days.

The Trump administration has reduced the length of the FFM’s OEP from 92 days (November 1 to January 31) to 45 days (November 1 to December 15). This policy constrains the time consumers have to enroll during a season in which many Americans are already experiencing a scarcity of time, money, or other resources.77 This lack of mental bandwidth can make it harder for individuals to complete complex tasks like health insurance enrollment.78 One opportunity for states transitioning to an SBM is the ability to decide the length of their OEP, which for the most part means extending the period. Table 1 displays the OEP closing

dates used by SBMs and Table 2 displays deadlines for January 1 coverage. No OEP begins before or after November 1.

Consumer Impact

A longer OEP would have a positive effect on coverage and would allow more time for enrollment assisters to provide outreach and enrollment support to marginalized communities. Particularly for community organizations serving Mainers whose primary language is not English and/or those who cannot or will not enroll directly, an extended OEP is critical to providing sustained enrollment support to consumers. It would also allow more time for consumers to sort through any complexities they face in the process.

State Feasibility

In our interviews, stakeholders demonstrated broad interest in extending the OEP under an SBM. In fact, one stakeholder expressed that if the State was not willing to extend the OEP and add SEPs, building an SBM would not be worth the effort. Enrollment assisters see an extended OEP as an opportunity to partially make up for the barriers to enrollment in Maine,

December 15

December 22

Connecticutiii, Idahoiv, Maryland, and Vermont

Minnesota

January 15 Colorado, Nevada, Pennsylvania, and Washington

January 23

January 31

Massachusetts and Rhode Island

California, New Jersey, New York, and Washington, DC

Table 2. Deadline for January 1 Coverage by State-Based Marketplace

January 1 coverage

December 15

December 22

December 23

December 30

SBM(s)

Coloradov, Connecticut, Idaho, Maryland, New York, Vermont, Washington, and Washington, DC

Minnesota, Pennsylvania

Massachusetts

California

December 31 Nevada, New Jersey, and Rhode Island

*Coverage purchased after this date is effective February 1; however, coverage purchased between January 15 and January 31 in New York and Washington, DC is effective March 1.

iii Connecticut has extended the 2021 OEP to January 15, 2021 due to the coronavirus pandemic. If residents enroll during the extension, their coverage starts February 1, 2021.

iv Idaho has extended the 2021 OEP to December 31, 2020, the last date to apply for January 1, 2021 coverage.

v This year, Colorado temporarily extended the enrollment deadline for January 1 coverage to December 18, 2020.

24 | ENROLLMENT PERIODS

OEP Closing Date SBM(s)

Table 1. Open Enrollment Period Length by State-Based Marketplace79

for

Deadline*

including technological limitations and system outages, language barriers, low call center capacity, and delayed notices by mail. We heard from these groups that Mainers rely on enrollment assisters because they lack internet access at home, in addition to wanting one-on-one support with the enrollment process. Assisters also cited lack of trust in the health care system and confusing eligibility requirements for certain communities, like immigrants and refugees, as barriers to enrollment in a short OEP. These assisters see the current six-week period as a “mad dash” and “absolute insanity,” and would benefit from more time to adequately serve Mainers.

Although carriers highlighted that many Mainers enroll close to the deadline80 regardless of the date, they were broadly accepting of an extended OEP, as long as the length would not facilitate increased adverse selection. In response to this concern, one consumer advocacy group pointed out that shorter OEPs discourage younger consumers, for whom the costs (complexity, time, money, etc.) of enrollment outweigh the benefits, potentially cutting out a population that is traditionally valuable to carriers.81

Finally, one stakeholder expressed interest in starting the OEP earlier, rather than pushing the deadline later, due to the time constraints for processing enrollments after December 15, and one stakeholder supported extending the OEP for as long as possible.

Extending the OEP would have a limited budget impact, with the largest expenses likely to be increased marketing and employing call center staff for a longer period of time. Implementation would be relatively straightforward. If the OEP were to be extended later, the State would need to work with insurers to build adequate processes to begin coverage no later than February 1 for consumers who enroll between December 16 and January 31. The State could join most other SBMs in requiring consumers to enroll by December 15 for January 1 coverage.

Recommendation 2: Implement an SEP for public health crises.

In response to the coronavirus pandemic, 12 of 13 SBMs opened a broad SEP, while the federal marketplace did not.82 These emergency SEPs ranged from six weeks to six months. While the FFM SEP for lost coverage allowed many of the newly unemployed to

enroll, those who did not have health coverage when they lost their job do not qualify.83 We recommend using such an SEP to improve health insurance coverage in future public health crises.

Consumer Impact

The most significant consumer impact of such an SEP is that insured rates could increase during the public health crisis. There is evidence that several SBM states with a COVID-19 SEP had much greater marketplace enrollment in the first months of the pandemic response than FFM states.84 Consumers who enroll using the SEP could gain the financial security to utilize more preventive health care or access a provider when sick. This might improve their health outcomes and also could have positive spillovers to the crisis response by limiting contagion.

State Feasibility

A number of the stakeholders we interviewed expressed support for an SEP in response to COVID-19 and similar public health crises. As this was implemented in almost all SBM states, it is likely feasible from a political and implementation standpoint. While there may be some variable costs, budget impacts should be limited given that the marketplace will already be providing other SEPs.

In our stakeholder interviews, one carrier expressed concerns about possible risk pooling issues for such an SEP. However, the COVID-19 instance provides a counterexample to this concern. Carrier spending on reimbursements has dropped significantly during the pandemic.85 It appears that carriers, at least in this crisis, would have substantial cushion to absorb risk pooling costs. Meanwhile, increasing the coverage rate might be useful to provide some help to hospital budgets given they have been deeply strained during the pandemic.86

Recommendation 3: Establish an SEP for individuals who become pregnant.

Uninsured individuals who become pregnant should be eligible for an SEP following verification of pregnancy by a provider. This would lead to greater access to prenatal care, which impacts maternal and infant health. Limiting the length of this SEP may reduce the risk of pregnant individuals waiting until they have significant health care costs before enrolling.vi

vi For example, consumers who are pregnant in a state with no time restrictions on a pregnancy SEP enrollment window may wait until they experience complications before enrolling.

ENROLLMENT PERIODS | 25

Under current FFM rules, pregnancy is not a qualifying life event that triggers eligibility for an SEP. Uninsured individuals who become pregnant outside of the OEP may become eligible for MaineCare due to higher income eligibility levels for people who are pregnant than for other adults, but only qualify for enrollment in a marketplace plan through other circumstances. An SEP for uninsured individuals who become pregnant is one potential solution that some states have implemented to raise coverage levels for pregnant individuals entering a period associated with high health care costs. This policy option has received substantial support from various groups, including the American Congress of Obstetricians and Gynecologists as well as Planned Parenthood.87

Table 3 lists the states that currently allow an SEP for pregnancy. Total length of the SEP varies; in New York and Vermont, pregnant individuals are permitted to enroll at any time during their pregnancy. All states require some level of verification from a provider, which can be a barrier for uninsured individuals.vii

pregnancy SEP. Data for 2017 indicates that 36.3% of Black pregnant individuals lacked insurance prior to pregnancy, compared to 12.4% of white pregnant individuals.96 Furthermore, Black, Hispanic, and American Indian individuals who are pregnant are all more likely than white pregnant individuals to receive late or no prenatal care in Maine.97 An SEP may be able to address these gaps by encouraging and facilitating coverage for those ineligible for MaineCare.

State Feasibility

Stakeholders we interviewed recognized the importance of establishing a pregnancy SEP, but some carriers also expressed concern about extensive SEPs allowing consumers to selectively choose when they enroll in the marketplace. Enabling a pregnancy SEP may also lead to an influx of consumers with higher health care costs.Yet data suggests that the actual burden on carriers to extend coverage to pregnant individuals should be modest.98 In 2017, an estimated 13.3% of expectant Mainers were uninsured prior to pregnancy.99 Combining this figure with data from Maine’s Division of Public Health Systems provides us with an estimated 1,635 pregnant individuals who were without insurance coverage prior to pregnancy in 2017.ix However, a significant number of these individuals would likely be eligible for MaineCare, given the program’s higher income limits for pregnant individuals. Considering that 39.2% of all births in Maine were covered by MaineCare in 2017 (before the State expanded MaineCare), we would expect only a fraction of those 1,635 individuals who were uninsured prior to pregnancy to require marketplace coverage.100

Consumer Impact

Pregnancy can present health considerations that require affordable access to health care services. For pregnant individuals with no insurance, “maternity care and delivery can cost $10,000 to $20,000 without complications.”94 An SEP for pregnancy ensures that expectant individuals are able to afford prenatal care, which is linked with better health outcomes including lower rates of low birth weight and maternal mortality.95 Encouraging greater utilization of important preventive services can also forestall costlier health issues in the future.

Existing racial disparities could be mitigated with a

Placing a time limit on this SEP could lessen concerns about pregnant consumers timing their purchase of insurance to avoid paying into the shared cost pool. If Maine chooses to set a time limit for this SEP, it can follow the examples of other states with limits ranging from 30 days to 90 days.

Ensuring that individuals receive prenatal preventive care is likely to translate to lower future costs by avoiding costly complications and NICU admissions.101 Furthermore, providing insurance coverage to pregnant individuals who are ineligible for MaineCare can reduce cost pressures on the State’s Free Care program. Improvements in health outcomes for individuals

vii If necessary, expanding the scope of practice for certain health care workers would enable greater access for uninsured individuals to be able to verify their pregnancy as a requirement for triggering an SEP. This expanded pool can potentially include nurse practitioners, nurse midwives, and physician assistants. viii Starting from the day of provider verification.