8 minute read

IBOR transition: implications of COVID-19 on spread adjustments from a conduct risk perspective - by Maximilian Beckmann, Stefan Wingenbach, Peter Woeste Christensen

IBOR transition: implications of COVID-19 on spread adjustments from a conduct risk perspective

by Maximilian Beckmann, Stefan Wingenbach, Peter Woeste Christensen

Advertisement

ISDA has played the central role in developing the framework to end LIBOR. A long and transparent process has resulted in a seemingly simple approach. The LIBOR benchmark will be replaced by an Adjusted Reference Rate (ARR) plus a fixed Spread Adjustment. Usually, the ARR is the compounded risk-free rate (RFR). The spread adjustment reflects a compensation for risk premiums embedded in LIBOR compared to a risk-free rate.

The spread adjustment is fixed by ISDA and Bloomberg on the day the cessation is triggered by either the benchmark administrator or another competent authority. The fixing of the spread adjustment relies on past fixings only. No market data or other forward-looking information is used in the determination.

Market participants with LIBOR exposure maturing after 2021 are all exposed to the fixing of the spread adjustment. COVID-19 triggered market uncertainty has caused a sharp increase in the risk premiums embedded in LIBOR. Banks now have the following challenge: what is the right transition approach and how to advise clients on it during the course of the transition?

ISDA approach: details of the methodology

The fallback approach embedded in the 2006 ISDA Definitions has three central aspects.

1.

2.

3. Adjusted Reference Rate: Which rate will replace LIBOR?

IBOR Cessation Trigger Date: When is the Spread Adjustment fixed? Spread Adjustment: How is the Spread Adjustment calculated?

The Adjusted Reference Rate (‘which rate’) was determined by ISDA in 2019 and for each LIBOR it represents the RFR in the respective currency.

The timing (‘when’) is determined by the so-called trigger event. This is either a ‘cessation announcement’ or a ‘non-representative’ determination of the benchmark.

The spread adjustment between LIBOR and the adjusted reference rate is calculated and fixed as of the IBOR cessation trigger date. In July 2019, ISDA announced that Bloomberg Index Services Limited (BISL) would be the adjustment service vendor to calculate and publish spread adjustments related to fallbacks under the 2006 ISDA definition.

Nine months later, on April 22, 2020, BISL published the detailed rule book 1 on how spread adjustments will be calculated using the ISDA fallback approach: The spread adjustment for a specific IBOR is calculated as the median of the daily spreads between the corresponding IBOR and the ARR.

The adjusted reference rate (ARR) corresponds to the backward-looking compounded RFR in the respective currency, determined ex-post in relation to the interest period of the IBOR. The observation period comprises a 5-year period ending one, three, six or twelve months in the past, depending on the tenor of the IBOR.

According to ISDA, the publication of indicative fallback rates will start from mid-2020. The final spread adjustment will be fixed on the IBOR Cessation Trigger Date, most likely the date when the benchmark administrator announces the end-date of IBOR publication.

Despite several COVID-19 related shifts (including the CCP discounting switch for EUR-Derivatives 2 or the targeted end of new GBP-LIBOR-business), FCA has reconfirmed that they do not intend to prolong support for the LIBOR panel beyond the end of 2021.

impact of COVID-19 economic crisis on spread adjustments, using the sterling market

To provide a tangible example, we assume that ICE, as the benchmark administrator of LIBOR, announces the end-date of IBOR publication on January 04, 2022. Then, more than 70% of the 5-year observation period has passed already until June 2020. Therefore, current market developments in the wake of the COVID-19 crisis only have a limited impact on the fixed spread adjustment (see below).

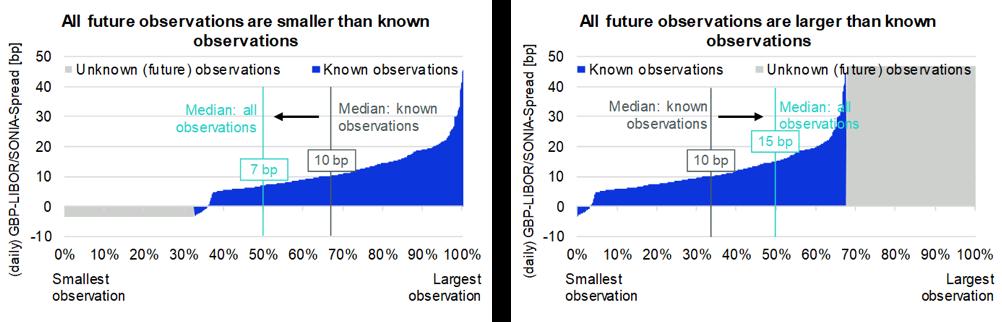

Figure 1. Spread adjustment in case of a cessation announcement on January 04 2022

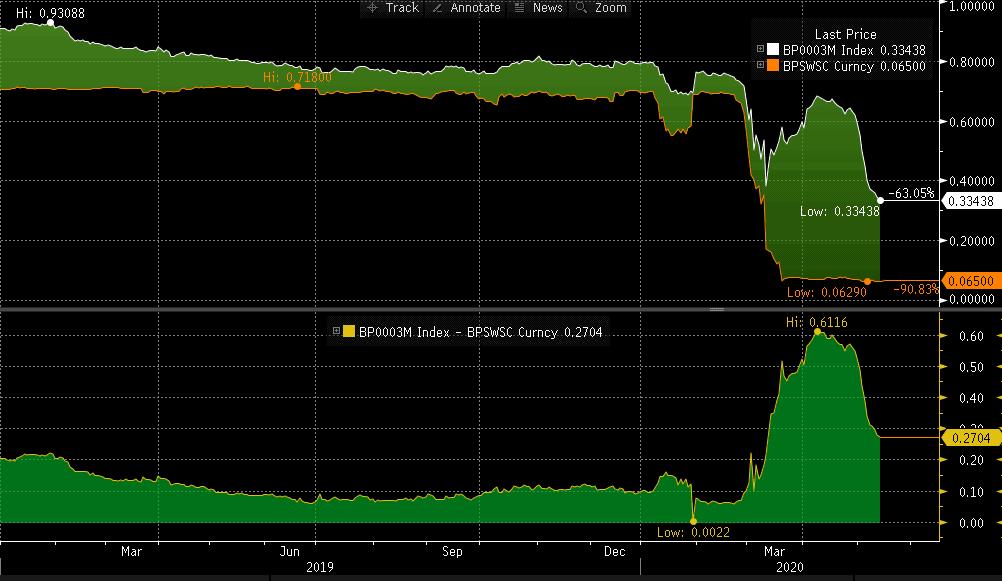

Chart 1: Timeseries of the daily GBP LIBOR/SONIA (ARR) Spreads and the resulting Median

Hence, due to the selected statistical measure (median), a range for the final spread adjustment can be derived from the realized time series until today. Based on a typical 3-month GBP-LIBOR (assumed spread adjustment fixing date January 04, 2022), the final spread adjustment will be roughly between 7 and 15 bps (see below).

1 / https://data.bloomberglp.com/professional/sites/10/IBOR-Fallback-Rate-Adjustments-Rule-Book.pdf 2 / Eurex (and LCH) decided to postpone the Discounting switch by five weeks to July 27, 2020

Chart 2: Calculation of the bandwith of the spread adjustment (Median of (daily) LIBOR/SONIA-Spreads)

If the IBOR cessation trigger date occurs earlier, an even higher fraction of the relevant time series is known and the bandwidth for the fixed spread adjustment decreases accordingly. In the case of an immediate ‘cessation announcement’ triggering the fixing of the spread adjustment, the current spread adjustment would be approximately 12 bps.

market approach: current basis spreads

Looking at the traded spread between 3-month GBP-LIBOR and the 3-month SONIA, we see a sharp increase in March to over 60 bps. Until May 14, 2020, the spread decreased to approximately 28 bps. This is still well above the possible maximum spread adjustment, derived under the assumption of a LIBOR cessation on January 04, 2022 (see above).

Chart 3: Spread between 3M-GBP-LIBOR and 3M-OIS (SONIA), Bloomberg 14th May 2020

While BoE’s March cut in interest rates of 65 bps was fully reflected in SONIA, GBP LIBOR did not respond to the rate cut to the same extent. The reason is clear: LIBOR contains liquidity and default risk premiums not reflected in the risk-free SONIA. CDSs reflect the higher risk premiums accordingly.

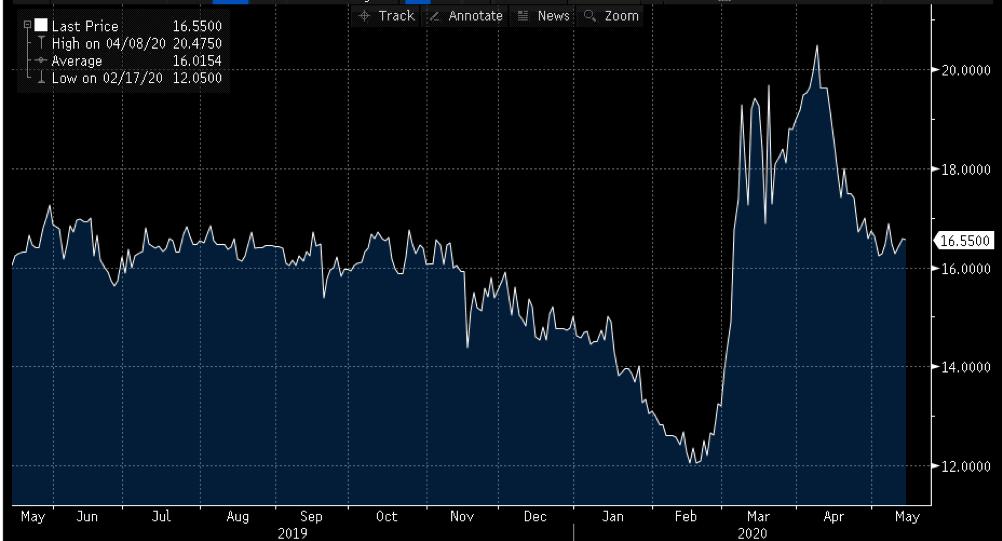

Looking at the spread of long-dated basis swaps, we also see a widening in the course of the COVID-19 crisis - however, much less compared to spot spreads. The chart below shows only an 8 bps widening from mid-February to mid-April for the 10-year basis swap compared to more than 50 bps for the 3-month spread.

Chart 4: 10-Year GBP-LIBOR/SONIA basis swap, Bloomberg 14th May 2020

The pricing of the long-dated basis swap depends on different factors. Without the upcoming end of LIBOR, such a swap would typically exhibit a smaller increase in the spread compared to short-dated swaps. This is due to the typical mean-reverting behavior of basis spreads.

Currently, the main pricing component in the long-dated basis swap is the expected spread adjustment. Once the fallback is triggered, the basis swap would become a SONIA-SONIA swap paying a fixed spread until maturity. Therefore, the spread movement of long-dated basis swaps can be decomposed into two factors: the spread change of a shorter basis swap until the anticipated IBOR cessation trigger date and the anticipated IBOR cessation trigger date itself.

As a result, information about the anticipated IBOR cessation trigger date can be derived from traded market data. We will further elaborate on that in one of our next papers.

conduct risk due to different spread adjustments

Bilateral legacy transitions from LIBOR to RFRs prior to a cessation event are highly recommended by Working Groups and other stakeholders. However, it requires a commercial agreement and finally the determination of a (fair) adjustment spread. The methodology for determining the adjustment spread leads to big economic differences depending on whether a conversion is based on:

a.

b.

c. The ISDA approach (indicative spread adjustment published by BISL from mid-2020)

An interpolated market approach (current market quotes for spreads)

A value-neutral approach (spread is determined implicitly in the pricing)

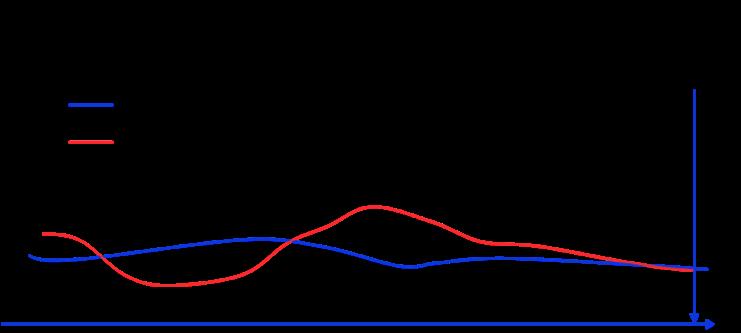

The benefit of the first two options is that the adjustment spread can be established using a “neutral” approach based on public fixings. It is fair to assume that all approaches will converge over time, if the market establishes a consensus that the cessation is inevitable and if that date approaches.

Chart 5: Schematic convergence between BISL spread and market spreads

In many real-world situations, it will be difficult to determine the fair adjustment spread without using a financial model to account for characteristics of the underlying transactions such as amortizing schedules or broken dates.

The fact that xVA considerations influence the NPV adds further to the complexity. Therefore, in many situations, the bank will have an information advantage over clients and counterparts who do not necessarily negotiate on equal terms. The larger the differences between alternative methodologies, the higher the litigation risk. Therefore, recent market developments have contributed to an increased litigation risk.

Even a fair amendment from LIBOR to RFR plus spread will result in different day-0 cash flows. This is due to the difference between spot and term spreads. Depending on the transaction side of the client, an amendment could possibly lead to an initial advantage. This would clearly support voluntary transitions. However, such a situation seems vulnerable to conduct risk in particular, as clients might be willing to lock in an initial advantage even if the adjustment spread is worse than the fair value.

However, a main focus of the FCA in the context of the LIBOR transition is that “firms have taken reasonable steps to treat customers fairly” 3 . In order to ensure this and to mitigate corresponding conduct risks, appropriate processes including customer communication, documentation and reporting should be established for the transition of legacy LIBOR trades.

authors

Stefan Wingenbach Senior Manager in the LPA Consulting Practice

Stefan Wingenbach joined Lucht Probst Associates (LPA) in 2009. He has many years of experience in consulting in the financial industry with a strong capital market focus. As senior manager he is responsible in particular for projects on IBOR transition, Advanced Analytics and distribution in Corporate Treasury Sales. During his career, he gained experience at globally active financial institutions, especially in the DACH region. Stefan holds a Diploma in math & economics from the Philipps-University Marburg is certified PMP and CFA-Charterholder.

Peter Woeste Christensen Director in the LPA Consulting Practice

Peter Woeste Christensen joined Lucht Probst Associates (LPA) in 2016. With more than 20 years of experience in the financial industry, Peter offers a unique combination of deep business understanding and a strong background in technology and IT project management. Throughout his career, Peter has held senior management positions at banks, system houses and consulting firms.

Maximilian Beckmann Manager in the LPA Consulting Practice

Maximilian Beckmann is Manager at Lucht Probst Associates (LPA) GmbH. As a member of LPA’s Consulting practice, he focuses on capital markets strategy and is currently working on topics related to IBOR transition. Prior to that Maximilian worked for a risk and capital management consulting boutique in Frankfurt and London.

3 / https://data.bloomberglp.com/professional/sites/10/IBOR-Fallback-Rate-Adjustments-Rule-Book.pdf