9 minute read

Automation process challenges in a highly regulated environment by Visweash Subramanian & Anthony Harris

automation process challenges in a highly regulated environment

by Visweash Subramanian & Anthony Harris

Advertisement

Financial Institutions are aiming to drive transformation across their businesses leveraging digital capabilities such as Robotics Process Automation (RPA), Machine Learning (ML), and Artificial Intelligence (AI). It is no longer a fad to use these terms as cutting-edge transformation levers, given the current healthcare crisis and the projected contraction of global GDP by 7- 9%, signaling the possibility of one of the deepest global recessions in decades raising the need for higher productivity, reduced cost and better security.

Automation solutions are gaining in acceptance and prominence, especially in the financial services sector. This is partly due to the cultural shift where “I want it now, anywhere and at any time” has become embedded in our psyche. This created the need for a 24/7 operational model for processes that were never thought to be in-scope, couple that with increased regulations halting the offshoring of some key processes, you can see why automation is the only way to achieve the “now.” There are a number of benefits, such as custom tailored oversight, instantly available reporting, the elimination of human error, such as keyboard input error or mouse mis-clicks, and the leveraging of multiple systems of records to produce a report. However, among stakeholders from executives to process owners, there remains a significant disparity between the Perception of Impact and the Real Impact of these solutions.

Perception: “Technology” is a panacea; simply bringing in more tech will provide a magic wand for all problems.

Marketing departments have done a superior job of promoting automation platforms as if they have a solution to all the challenges we face currently, and they drive sales by promoting this concept of “technology” as a magic wand to be waved and everything is fixed. This may not be entirely true, given that most out of the box solutions will need moderate to significant customization to fit an organization, which would increase cost and complexity of the process. Point to note: As per platform providers, the Financial Services industry is the biggest market to drive transformation through automation over the next few years. The revenue for service providers is expected to grow by 20% YOY. This in most cases will be achieved by reducing the human element and removing tacit knowledge, automating transactional tasks, and removing vintage technology. This all comes with a cost that will be seen through third-party resources for implementation and maintenance, licensing, patches, and upgrades.

Reality: Based on industry estimates, over 75% of automation initiatives do not provide the desired results on day 1 and realization of benefits takes almost 3 years1. According to a leading industry analyst, over 65% of CXOs realized that their processes were broken when remote working had begun around March 20202. Testing and oversight should have exposed problems in systems and automation processes long before the systems were stressed in the COVID-generated business continuity environment. However, the unfortunate reality is that, because of several reasons, (such as an overconfidence in technology), many of the largest companies were left scrambling to address broken processes and critical failures.

Even in a business as usual environment with no stress placed on the system, the value of technology upgrades is limited in the ability to extract meaningful results or data. Based on a Public Company Governance Survey, nearly 50% of CXOs say that they are not able to make informed decisions using the risk data they receive.

““Expectations do not produce the desired results at initial deployment, I thought I was getting a Lamborghini but what I received was a Pinto without an engine”

“Ruminations: Finance and the movement of money is the bloodline for all industries globally. Why does Financial Services lag other industries in automation maturity?

Is automation really mature in banking and how successful has it been?

The maturity of automation in Financial Institutions, including Insurance, is far behind other industries when compared to Consumer Goods, Manufacturing, Automobile, and Healthcare to name a few. Take for instance the advent of self-driving cars or the ability to map a protein strand using AI and 3D printing used in manufacturing.

Considering future Regulatory changes, such as the US Financial Stability Oversight Council and its enhanced monitoring, global regulatory & jurisdiction-specific laws, the oversight approach they mandate, and expected regulations such as Fintech, RegTech and InsuranceTech, the approach to transformation needs to be more robust to achieve scale and success at a faster pace. The current approach of “technology first,” coupled with the assumption that technology will instantly provide solutions will increase the inherent risk to an over-reliance on misunderstood technological solutions.

Automation is mature in certain pockets of banking. The advent of Fintechs has changed the game in the payments space, and the rise of technology companies front ending in Consumer Lending has significantly improved the Interaction Layers and Experience for the Consumers. Look no further than Venmo, Zelle, or Apple Card to see the impact technology solutions have.

But, largely across the industry, while the front-end processes are getting slicker, the back end is still largely managed by monolithic technology platforms and processes built on high tacit knowledge and compounding manual workarounds.

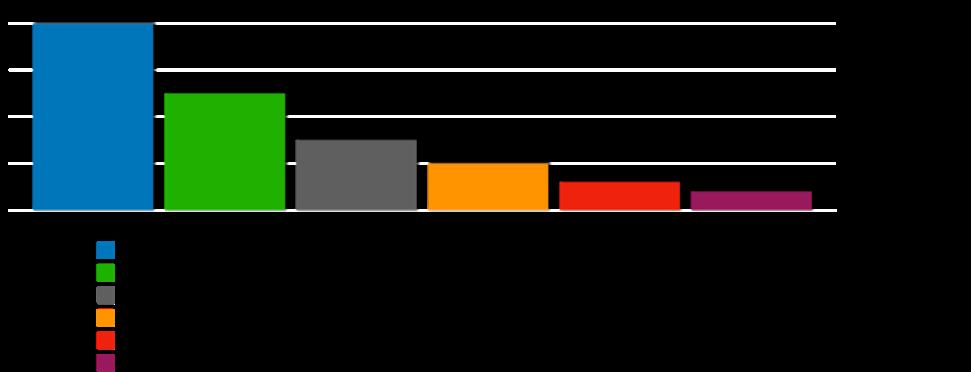

The below chart shows the concentration of factors that drive the erosion of benefits from automation in the Financial Services industry.

According to a Risk survey conducted by RSA, over 70% of CXOs believe that the Digital Risk Profile will either somewhat or significantly increase over the next few year.

Figure 1- Drivers eroding benefits

Source: Industry analyst survey conducted across ~ 50 CXOs.

entry barriers and dependency levers to large scale transformation through automation in financial services

Entry barriers that are clearly visible across industries include:

The below illustration depicts the Entry barriers.

1. Disjointed and Low to Moderate Maturity Tech stack: The Financial Services industry goes through phases of organic growth during economic cycles. Large banks and financial institutions have also grown, often times through mergers and acquisitions. When banks have merged or grown, the impulse is generally to amalgamate technology platforms that are dramatically different in composition, intent, and output. This creates a complex pool held together with figurative duct tape, rather than rationalizing the stack to create high-performance technology solutions.

2. Low to moderate process maturity: The rapid-response (E.g.: Agile, Scrum) used to drive technology transformations, which has become the norm in recent years and with 85% of organizations adopting agile3, is probably the leading reason for increase in manual and nonstandard processes in the middle and back office. An average process would comprise about 20-30% manual work-arounds which are neither documented nor standardized.

it’s important to get to the truth of the current state, to effectively

transform in the future state ““Data will replace cash as King in the near future”

Almost 60-70% of processes in the middle and back office of a bank are performed in a multi-platform manner. For example, an operator receives a case through a workflow, accesses the System of Record to obtain account information, works on an excel worksheet to capture/update financials, and then updates information through a workflow to a System of Record. This is presumed to be the happy path with no variation. Considering the variations in a process and the potential idiosyncrasies of each different person who handles information on the path, one can safely assume that just 30-40% of the processing happens in the Systems of Record or the Workflow. Even when things occur ideally, the best-case is data that is potentially disparate and difficult to manage.

Considering data is on track to replace cash as king in the near future there is a need to streamline a process and drive standardization. This requires an understanding of the process at a granular level, understanding every step and sub-step. Currently, the data acquired to analyze the process or measure its performance is so often nothing more than a directional indicator in most scenarios.

Where is the truth?

Most solutions are constructed upon processes that lack up-to-date documentation, have limited to no standardization, require manual work-arounds, and are owned / performed by individuals that have a high to moderate amount of operational tacit knowledge. Building solutions on technology platforms that are so divergent in composition, intent, and data output is not the path to understanding any underlying truth.

Like the protein strands in a living being, data is the most fundamental and important footprint of any solution. It encourages accurate and holistic processing, provides focus on ensuring documentation is adequate and correct, enables standardization by producing results driven by the desired outcome and comprises the building blocks for a technology solution’s functional and technical requirement.

An approach to tie all the process steps at the most granular level as a String of data is where the truth resides. At the end of the day the goal is simply stated - to automate data. Prime examples of this are the moving of a widget or the processing of a transaction. These are examples of data enrichment, movement, and/or decoding. Why not take a data-led and domain-aided approach to increase the success rate of automation in Financial Services.

The entire universe works on a set of laws that makes every matter within it very intricately connected. Humanity has long endeavored to understand the vastness of our observable Universe by building an understanding of unimaginably small fundamental particles and the way they behave. Our Quantum approach mirrors this methodological framework and aims to build a strategy which understands the process is a subset of the universe and data is the building blocks of the same. The question is, how can we understand the most Lilliputian data in the process to help us develop and transform it.

This below approach will help us get to the most granular part of the process and data to help us understand the working of the complex business:

The above approach will help with successful transformation; however, Automation Risk Propensity must be incorporated as a lever to mitigate the risks inherent to automation.

introduction to the 6th dimension approach

your opinion matters

Should Automation initiatives be led by Risk and Data organizations in Financial Institutions? Should the Technology organization be answerable to the Risk organization for technology risk propensity?

Disclaimer: This paper is the personal view of the author(s) and does not reflect or contain data, information, or practices that are bound to their current employer.

references

(1) https://www.mckinsey.com/industries/financial-services/our-insights/the-value-of-robotic-process-automation (2) https://go.forrester.com/blogs/covid-19-automation-and-you/ (3) https://www.gartner.com/en/newsroom/press-releases/2019-02-19-gartner-survey-finds-85-percent-of-organizations-favor-a-product

• https://research.aimultiple.com/rpa-stats/ • https://go.forrester.com/blogs/category/robotic-process-automation-rpa • https://go.forrester.com/blogs/what-it-means/ep173-scaling-rpa/

authors

Visweash Subramanian

Robotics and Digital Transformation Leader

Business Process Engineer Leader for Corporate Risk

Vishy is a Banking and Financial Services Transformation expert with over 25 years of Global Banking experience. He has been a Consultant to various Banks globally, supporting their transformation initiatives ranging from Setting up Enterprise Transformation Office, End to End Product Transformation and Strategy design to name a few. His vast experience of working in several strategic initiatives across geographies and business lines has enabled him to devise unique approaches to driving transformation utilizing RPA, AI and ML.

Anthony Harris is a Transformation, Strategy, Change-master and consummate leader with more than 16 years’ experience in a variety of industries including the Global Consulting, Banking and Financial Services, GSE’s, Mortgage, Healthcare, Retail, and Technology. He is a Lean Six Sigma Black Belt and SAFe Practitioner and has led large scale Operational excellence improvement programs with some of the largest fortune 500 institutions. His career has focused on the identification and deployment of RPA, AI, and ML capabilities and industry leading methodologies for designing and improving Business Processes.