4 minute read

Risk leadership: a critical adhesive to risk culture by Katlego Majola

risk leadership: a critical adhesive to risk culture

by Katlego Majola

Advertisement

Various risk culture models have surfaced over time; these include those from the Institute of Risk Management (IRM) and the Financial Stability Board (FSB), as well as consulting firms. Some models are quite similar and others somewhat different from one another. Power, M, Ashby, S and Palermo, T (2013) compare similarities and variances between the models, which indicates that there is currently no conclusive model for risk culture. Primarily because each model offers a new perspective, hence improvements and adjustments will continue to be made as researchers study the concept further.

The concept of risk culture seems simple enough, yet many still struggle to establish measurement and monitoring mechanisms. Risk culture is a breathing and living element within the organizational context, where changes are easily recognizable if baseline information is in place. Organizations have over time collected enormous amounts of data that can be used for this purpose but may not even recognize it as such. A systematic and well-designed approach provides insights, which can be used to construct an overview of attitudes and behaviors that drive risk culture.

This somewhat elusive risk management element is attributed to human attitudes and behaviors, which are not always easy to measure and monitor. It, therefore, becomes critical for those in leadership to have an in-depth understanding of risk culture and their fingers on the pulse at all times. We have in recent days observed how abrupt change can throw even the most stable of organizations into an array of reactive risk management, where changes adversely/positively affect various areas.

Changes can be as a result of internal or external influences, which if not adequately prepared for may have dire results on performance and sustainability.

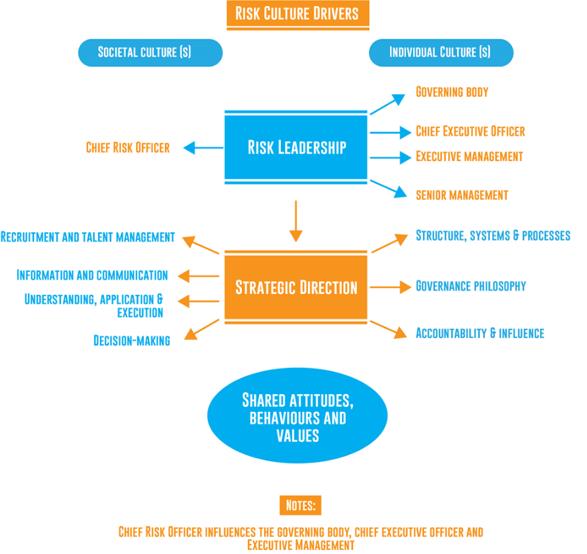

The current landscape where companies have appointed new leaders, underwent restructuring, and introduced new systems have presented a plethora of risks and opportunities. Equally, this has contributed to risk culture changes, and such should be assessed, managed, and reported on. Who then takes the lead? Risk leadership is the anchor of risk culture where those expected to set the tone from the top by giving overall strategic direction and vision embrace the concept of risk management. These include the board of directors, executive management, senior management, and the Chief Risk Officer. These critical players as outlined individually and collectively play a pivotal role in challenging issues and making choices using a risk lens.

Effective risk leadership enhances the ability to manage uncertainty by placing a demand on mature risk culture. Leaders have a broader responsibility to make more informed and inevitably wiser decisions through critical testing of assumptions and their associated impacts. They should carefully and prudently be aware of their limitations and guard against overconfidence. Leaders should seek out a diversity of opinions and perspectives before making decisions.

Figure 2.

Navigating the changing risk landscape effectively and increasing value proposition requires boards and executives to ask the right questions and reflect risks in all decision-making. This, considering how damaging consequences will always rest solely with leadership. Thus, risks should not be limited to major programs or projects but all decisions within the organization. The roles of the board, executive, and senior management cannot be trivialized, as these critical actors are deemed risk influencers who can encourage and embed risk discussions. Making it easier to identify emerging risks and opportunities proactively but most important changes that may affect culture.

The necessity to build risk leadership competencies is proving to be critical, especially at a time where many corporate governance and risk assurance failures are observed. These competencies should translate to leaders who will challenge assumptions, reports and promote robust discussions. Training interventions and risk competencies required at the leadership level differ a great deal from those of operational staff. Tailor-made interventions are therefore pivotal for an effective “tone at the top.” Investment in credible risk leaders will ultimately determine the success of risk management efforts.

references

1. Domańska-Szaruga, B. (2020, 03 / 01 /). Maturity of risk management culture [Article]. Entrepreneurship and Sustainability Issues, 7(3), 2060-2078. https://doi.org/10.9770/jesi.2020.7.3(41)

2. Ruchi, A., & Sanjay, K. (2018, 08/20/). Cognitive risk culture and advanced roles of actors in risk governance: a case study [JOURNAL]. The

Journal of Risk Finance, 19(4), 327-342. https://doi.org/10.1108/JRF-11-2017-0189

3. Yihui, P., Siegel, S., & Tracy Yue, W. (2017). Corporate Risk Culture [Article]. Journal of Financial & Quantitative Analysis, 52(6), 2327-2367. https://doi.org/10.1017/S0022109017000771

authors

Katlego Majola

Chief Risk Officer for a government regulatory institution in South Africa

Katlego Majola is a Chief Risk Officer for a government regulatory institution in South Africa. She has experience in governance-related fields, specialising in enterprise wide risk management. She holds a Certified Risk Management Professional CRM Prof (SA) designation and facilitates training programs for risk professionals on various aspects of risk management. Katlego is a technical specialist in risk culture and develops innovative as well as effective risk management solutions to strengthen the ability to measure and manage different risk portfolios and areas. She has been recognised in several platforms and organizations for her fresh approach in risk culture building as well as strategy and risk integration.