11 minute read

There is No Good Excuse

by Tammy Robbins

Advertisement

As seen on WealthManagement.com, October 2019

Whether it’s hurricanes like Dorian that routinely pummel the Southeast and parts of the Atlantic coast or the wildfires that wreaked havoc up and down the West Coast last year, summer has a way of reminding everyone in our industry about the importance of having a disaster recovery plan.

Thankfully, many advisors have taken the time to cover this aspect of contingency planning, putting procedures in place that protect against devastating weather events, a fire or even a terrorist attack.

When it comes to other elements of contingency planning, however, most advisors haven’t been quite as proactive, slow to draw up plans that deal with short- and long-term disability, as well as death. Theories abound for why this is the case. One is that advisors are very protective of the businesses they have built and are uncomfortable imagining anyone else running them. Another is that they don’t want to consider their own mortality.

Whatever the case, there is no good excuse for failing to have a contingency plan. Advisors devote their entire professional lives to helping others plan for the future but then don’t do the same for themselves? It’s nonsensical.

With that in mind, consider the following essential contingency planning questions:

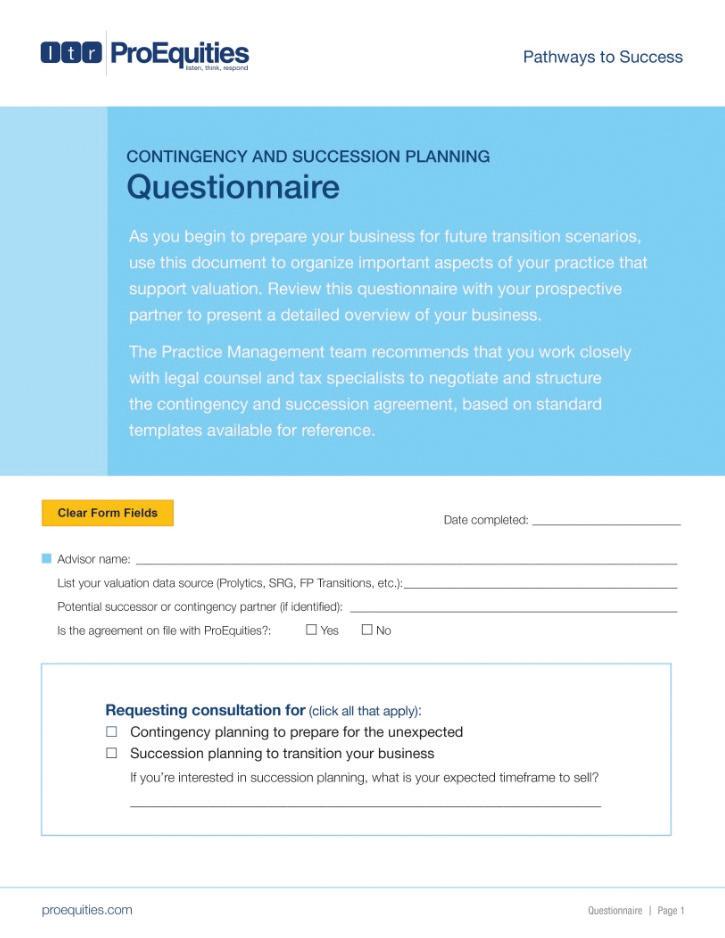

Is My Plan Valid? Often, advisors think they have a plan that covers them in case of death or disability, but upon closer inspection, they either haven’t filed it with their broker-dealer, or it lacks the required language that makes such agreements valid. While many in our industry came of age at a time when back-ofthe-envelope agreements were commonplace, a more formalized approach is the best way to protect your business, your clients, your heirs and your staff.

Check with your firm to see whether they have a template to use to make sure you are using the mandated verbiage. Otherwise, you’ll have to pay a securities attorney to draw up your paperwork, which can be costly. Then, once you have drafted a formalized agreement,

take the time to discuss it with the appropriate person at your firm and put it on file. Without taking that step, broker-dealers have a limited ability to compensate would-be contingency plan partners, allow them to service existing clients and ensure your heirs and/or estate are receiving the compensation you intended.

When is The Last Time My Practice Was Valued? Some firms have tools that not only allow advisors to find out what their practice is worth but also what steps they can take to boost its value. However, most consult these services too infrequently, using them only as they near retirement or on a one-time basis when they want ideas for how to improve growth. But these tools also help with contingency plans.

Contingency plans should include not only the beneficiary information and current contingency partners but also reflect the current valuation of the business. If an advisor doesn’t regularly value their practice, it could end up hurting their estate. By continuously leaning on tools that benchmark and appraise businesses, advisors can better avoid that pitfall.

Can Someone Support My Business in a Pinch if Something Happens to Me? For many advisors, it’s not possible to have a contingency partner who lives and works in the same town. That could be because they are in a remote area or merely because they couldn’t find the right fit for their clients. So, they look outside the city limits.

In these cases, it may not be possible for the contingency partner to assume the sidelined advisor’s responsibilities immediately. This is where firms should step in to fill the void by servicing clients, managing staff and communicating with beneficiaries. But what happens if an advisor has a contingency plan on file with their firm but no partner? A firm should be able to find a suitable match to take over the business, allowing an advisor’s estate to benefit if a long-term disability or death occurs.

Contingency planning resources are available on Advisor Portal to prepare your business for the unexpected.

Should I Have an In-House Contingency Partner? Critics always say that it’s very selfserving for firms to tout the benefits of having an in-house contingency partner. Nonetheless, the reality is that such an arrangement is no doubt more beneficial to all interested parties because the transition is far simpler. That’s due to a variety of reasons, including:

• Advisors are incapable of servicing out-of-network accounts, even in the shortterm; • Clients, familiar with the firm and its process, will face far less disruption, underscored by the fact that they would not have to repaper their accounts; • Client-facing technology, service center support structures and account statements remain the same; and, • Because broker-dealers are limited in how they can compensate outside partners, in-house advisors better protect the practice’s value and, thus, the estate. The good news about contingency planning is that as clients begin to age, more of them are asking advisors about their plans for the future. That has sparked a greater sense of urgency across the industry.

At the same time, the number of advisors who have comprehensive plans spanning short- and long-term disability, death and even disaster recovery remains frighteningly low. That needs to change now.

Tammy Robbins Business Development Managing Director 205-268-1796 Tammy.Robbins@proequities.com

How can we help you deliver financial wellness? Learn more

The services and materials described herein are provided on an ‘as is’ and ‘as available’ basis, with all faults. Nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Envestnet reserves the right to add to, change, or eliminate any of the services and/or service levels listed herein without prior notice to the advisor or the advisor’s home office.

© 2019 Envestnet, Inc. All rights reserved.

Three Ways to Take Your Planning Business to the Next Level

by Libet Anderson, CIMA ®

As seen on InvestmentNews.com, June 2019

It’s no secret that there’s been a trend toward providing advice and planning. This has been a good development, reflecting not just evolutions in the regulatory world but the preferences of an increasing number of investors.

For advisors who are making this shift — or those who have focused on planning for years but are in the process of reevaluating their practice — here are some ways to jump-start your planning business.

Listen! Don’t approach planning with all clients the same way, using the same technology, the same communication plan and the same fee structure. That might be a mistake.

Many clients, for instance, will never read a detailed market data report, nor do they care about tech bells and whistles that provide granular insights into their plan. Indeed, they may just want something that will tell them whether they are on track to reach their goals, caring very little about the journey, only the destination.

You could also encounter prospects who want help with just one of your services, such as college planning. If you have the scale, it could be worth coming up with a pricing structure for a la carte offerings like that. While most advisors listen to their clients, many don’t hear what they say.

Segment All Aspects of Your Business Advisors have used segmentation techniques to prioritize the clients who provide the best opportunities for growth, based on assets or in some cases potential assets.

Advisors should apply this basic concept to planning as well, segmenting clients, for example, based on the various stages of their life. When filling out a profile, use different technology tools in addition to varying fee structures. Find out what your clients want and then be sure to have the tools, platforms and flexibility that can deliver it to them.

If You Don’t Have What You Need, Ask for It If you are clamoring for a strategy or service that could help meet the needs of your clients, whether it’s a piece of technology or an investment model, talk to your firm and ask them to add it.

With behavioral finance becoming more of a focal point, for instance, advisors are increasingly sensitive to the ways fear and anxiety can roil the investment process. New tech platforms are hitting the market that will alert advisors when clients log in to their accounts or make changes to their plan.

Getting frequent alerts — especially during times of hyper-volatility — would be a surefire signal it’s time to pick up the phone or schedule a meeting. More and more advisors are being tasked with tempering their clients’ emotions, so it’s easy to see why they would want access to a platform like this.

Advisors should always be willing to take a close look at their businesses to see where they have opportunities to improve. That’s true whether you’re relatively new to the industry or a longtime financial services industry veteran. At the same time, when advisors try to grow and evolve, firms must be a big part of that process, always searching for ways to help them.

Libet Anderson Advisory and Planning Managing Director 205-268-7085 Libet.Anderson@proequities.com

Use a powerful new website for IRA Rollover prospects!

CHECK IT OUT

The top three factors IRA owners consider when choosing an IRA provider.*

1

Brand Recognition Voya ranked #1 2018 Brand Tracking Study on brand awareness

*Source: Cerulli Associates 2019

2 3

Quality Funds Over 100 funds from 25 well-known fund managers

Minimal Fees 0.50-0.60% annual recordkeeping fee No front/back-end fees or transaction fees

Voya Select Advantage IRA Mutual Fund Custodial Account Offer the easiest, fastest and most client friendly IRA platform backed by a trusted retirement brand.

For a retirement solution that offers minimal fees, quality funds and full liquidity, call us at 1-800-344-6860 or click VoyaSelectAdvantage.com

Voya Institutional Trust Company is the custodian for mutual fund custodial accounts distributed by Voya Financial Partners, LLC (member SIPC) or other broker-dealers with which it has a wholesaling or selling agreement. Both are members of the Voya® family of companies. Not FDIC/NCUA Insured | Not A Deposit Of A Bank | Not Bank Guaranteed | May Lose Value | Not Insured By Any Federal Government Agency For Registered Representative use only. Not for public distribution. ©2019 Voya Services Company. All rights reserved. WLT 250001195 CN0522-42350-0620D 201331 10/31/2019

The Tactical Core for Client Portfolios

The portfolio team achieved Strategist of the Year honors in 2016 and was named a finalist in 2018 by Envestnet.

A Risk-Managed Core Holding

Our portfolios are designed to lower costs and volatility, while producing long-term capital appreciation. We are asset allocators, our portfolios evolve over time to manage risk and capture opportunities, rather than switching quickly between assets. Our portfolios are used as the risk-managed core of a client’s portfolio.

We offer 4 risk-adjusted Global Tactical strategies ranging from Income to Growth. Global Tactical Allocation is our flagship moderate risk portfolio.

Global Tactical Income Global Tactical Conservative Global Tactical Allocation Global Tactical Growth

Receive our monthly Markets in Motion and keep up to date with our CIO’s global perspective on the markets. Visit: JAForlines.com/Request-Access

Call us �516� 609-3370

Visit www.jaforlines.com

The material contained herein is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. Returns can vary dramatically in separately managed accounts as such factors as point of entry, style range and varying execution costs at different broker/dealers can play a role.

The 2016 & 2018 "Strategist of the Year" awards are based on using the systematic, proprietary, and multi-factor evaluation methodology developed by Envestnet | PMC. The evaluation framework considers performance, firm profile, customer service, investment process and style, composite, tax efficiency, and other quantitative and qualitative criteria. JAForlines’s receipt of these awards is in no way indicative of any individual client or investor’s experience with JAForlines or W.E. Donoghue & Co., LLC or of future performance.

For broker/dealer use only.