We are delighted to announce an exciting new chapter for FRPO and FE Magazine. We’ve made the decision to partner with RHB Magazine to manage the content development and publication of FE Magazine, Our Annual Report and Membership Directory.

If one good thing has come from the pandemic, it was the opportunity to pause and reflect on business processes and how to move forward in a world that has changed in some fundamental ways. This brought us to an important realization that in order to communicate with our members more effectively and frequently, it was necessary to cut back on print advertising and expand our digital footprint which has been working great for us!

TONY IRWIN President & CEO

FRPO has had a positive relationship with RHB for many years. Taking this next step in our journey together will streamline and enhance our publications so we can continue providing timely and relevant digital content to our membership.

Our Membership Directory, which was published in print format on an annual basis, will also be moving online. This will allow us to update the publication more frequently and provide members with new advertising opportunities. We will be circulating a media card in the coming weeks with more information on to make the most out of your advertising dollars!

We continue to prioritize FRPO’s focus on providing current and new members with valuable educational content. We always encourage our members to reach out and submit articles for consideration. FRPO will be extending our reach through our new partnership with RHB Magazine. In addition to making editorial contributions to the magazine, we will be offering enhanced advertising opportunities to current and new FRPO members.

We’re excited to work with RHB Magazine and continue growing our relationship. They have a great reputation for producing solid content within the rental housing industry, and we are certain that our members will benefit from this partnership as much as FRPO will.

We’ve enjoyed hosting interactive webinars over the last two years, as they have been effective in educating our membership while keeping everyone safe during the pandemic. Going forward we’re looking forward to welcoming our members back at some in-person meetings and events. We will continue to keep our members’ health and safety top of mind as we ease into hosting events like our Spring Social, Golf Tournament and more! Stay current by checking out the magazine and website for information on what’s to come!

Feel free to reach out to me or any FRPO staff member at any time, if you have any feedback, questions or concerns.

KG Group has been instrumental in defining Toronto’s rental housing landscape for almost 50 years. The private real estate company builds and manages multi-residential rental properties, owning and managing approximately 2,500 rental units throughout the GTA. Over the years, it has won numerous awards for its rental developments and for its customer service, including Property Manager of the Year and Amenities Award of Excellence. Most recently, E18HTEEN—KG Group’s rental development at Yonge and Eglinton—won the 2021 MAC Award for Rental Development of the Year and the Customer Service Award of Excellence.

Marvin Katz and Sam Goldband, founders of The KG Group, started the business in the early 1970s by purchasing older buildings, gas stations, and corner lots on the subway line and near major intersections in downtown Toronto. They developed properties with streetlevel retail stores and apartment units above, which they would either rent or sell after legally subdividing the building into retail and residential units.

Several years later, the founders met Ian Nichol, an English architect, which led them to create more efficient and better-designed buildings. The KG Group developed mixed-use properties that made more efficient use of the space, maximizing building efficiency and unit space. They included features uncommon at the time, such as underground parking and elevators in low-rise properties.

In the 1980s and 1990s, The KG Group focused on developing commercial and retail properties. At one point, its portfolio included more than one million square feet of commercial space. However, ownership found its niche in building, owning, and managing multi-residential rental and condominium properties including luxury condo-rental communities, and eventually divested its entire commercial portfolio by 2003.

Over the years, The KG Group has been recognized for its luxury condo-style properties with high-end amenities and white-glove customer service. For example, Hampton House North, located at 299 Roehampton Avenue, has won several MAC Awards, including for its suite renovations and amenities. The Harrison (located at 105 Harrison Garden Boulevard), which they completed in 2010, was nominated for Rental Development of the Year; it was touted for the quality of its redevelopment and featured on a CFAA Building Innovation Tour.

The KG Group’s vision is founded on developing and managing communities that exceed its residents’ expectations. They call it KG Better Living, which consists of four key tenets. First, it focuses on properties in better locations, ensuring that residents live near transit connections, shopping, restaurants, culture, parks, and everyday conveniences. Second, it includes better amenities to deliver a luxury lifestyle. This includes state-of-the-art fitness centres, entertaining spaces, co-work studios, pet-focused amenities, and in-person and virtual resident events. Third, it employs better designs that include functional layouts and modern, upgraded finishes (such as stone backsplashes), and extra-large balconies, throughout the units. And fourth, it provides better teams to support its residents. This includes a 24/7 concierge and security, guaranteed 24-hr maintenance response, and a Resident Experience Manager who helps them to exceed residents’ expectations. The KG Group curates a luxury rental lifestyle for residents that is redefining rental living.

E18HTEEN, completed in 2020, is a 35-storey, 315-unit building located at 18 Erskine Avenue in the Yonge and Eglinton area of Toronto. It includes units with one or two bedrooms, with or without dens. The large, open-concept suites are designed with built-ins, pantries for extra storage, extended kitchen uppers, designer roller blinds, curtain wall windows with panoramic views, and extra-large balconies.

The building includes hotel-inspired upgrades and design. The outside features beautifully functional landscaping, seating, and designated rideshare pickup/drop-off areas. The grand lobby incorporates trendy metal columns with convenient USB ports for charging devices. All amenity spaces offer free Wi-Fi and Netflix. One key amenity is the state-of-the-art YOU! Fitness Centre and Yoga/ TRX Studio; residents have access to free personal training, wellness classes, and boot camps, as well as a spa-inspired indoor pool with wet steam and change rooms. Entertaining spaces include the Fireplace Lounge (equipped with big-screen TVs), The Bar, Chef’s Kitchen, Dining Lounge, and The Bistro, featuring a fully landscaped outdoor BBQ Terrace and Fireplace. The Co-Work Studio with outdoor Zen Garden is an ideal work-from-home space.

The custom-designed KG App enables building residents to perform a number of tasks from their smartphones. Using the app, they can open suite and amenity doors, contact management and submit maintenance requests, pay rent, access special offers, reserve amenity spaces, book elevators, connect with other residents, access cameras at building entrances, request visitor parking, monitor deliveries, and participate in surveys.

of

stable and continued

of

E18GHTEEN is designed with accessibility in mind. It offers one- and two-bedroom barrier-free suites with lever door handles, wheelchair-accessible paths and doorways, accessible light switches and electrical outlets, adjustable shelf heights, and lower counters. Modified suites offer grab bars and safety devices, redesigned closets, bathrooms with special toilets, modified showers and vanities, and lowered kitchen countertops and cabinets.

Accessibility features extend to common areas and amenities. The building has a flat entrance with a wide pathway. It includes a designated barrier-free accessible transit area with direct building entry and designated wheelchair parking. All common area doors have touchless keypads at accessible heights. Elevators have braille numbers, voice-an nounced door closing/opening and floors, and infrared sensor alarms on door closing.

The pool has an accessible lift chair and changerooms are wheelchair accessible. Amenity spaces (including the leasing office) have echoreducing acoustic material to accommodate the hearing-impaired. The KG App and resident portal have text size adjustments to further accommodate the sight impaired. Front-line staff are trained on special needs accommodations. For example, the Concierge will assist with package deliveries and heavy objects.

Another unique aspect about E18HTEEN is that it provides a curated rental lifestyle tailored to residents. The KG Group surveys its residents and then amends the offerings based on the feedback. For example, the residents determined the types of on-demand in-person and virtual fitness classes they wanted to have available in the gym.

The Resident Experience Manager hosts regular events for residents, such as holiday parties, wine tastings, and Meet the Team nights, to help residents of E18HTEEN meet and mingle. They organize special events to support local businesses and the community, including VIP nights, meet-and-greets, and exclusive offers. Special activities are geared toward residents with pets, hosting dog yoga sessions, fun events and treats in the heated pet play area and covered snow-free dog walk, free pet training events, and pet-focused parties at the nearby park. During pandemic lockdowns, they hosted virtual events including bingo, baking, movie screenings, yoga, meditation, and stretch and nutritionist sessions.

E18GHTEEN is a net-zero building, as it produces enough renewable energy to cover its annual energy consumption. It uses 34 per cent less electricity, 43 per cent less potable water, and 57 per cent less natural gas than a typical building. The building is airtight and well-insulated. The central heat recovery system collects and reuses heated air throughout the building, and variable frequency drive motors help reduce equipment energy usage. The 100+ point monitoring system optimizes the performance of all components in building systems. High-performance, thermal double pane windows help retain hot/cool air inside suites. The building is air-balanced and tested regularly to ensure efficient airflow. A built-in grey water tank collects and reuses rainwater for car and bike washes.

Suites and amenity spaces are equipped with Energy-Star rated appliances, low-flow showerheads and faucets, and dual-flush toilets. All suites have LED lighting and common areas have sensor-activated LED lights. Suites also have individually controlled and programmable thermostats with occupancy sensors.

The building has multi-tiered initiatives to help reduce and divert waste from landfills. The trisorter diverts blue and green box waste from garbage collection. The KG Group has a hazardous waste collection facility and a designated area for bulk recycling. The designated pet waste disposal area has biodegradable bags. The KG Group runs regular education programs and posts signage to encourage residents to reduce waste.

The building is equipped with bird-friendly glass. Environmentally friendly materials were used in the design, including low VOC paint, blinds, adhesives, and sealants. Electric vehicle charging stations promote usage of low-emission vehicles and designated Uber/Lyft pickup areas promote ridesharing. The building includes extra bike storage and a free bike wash area, and management holds promotions with Uber gift cards and TTC pass prizes to reduce car use.

The KG Group makes customer service central to its philosophy of providing top-quality property management services to its tenants. It goes above and beyond the services they offer at E18GHTEEN.

The owners and property managers with The KG Group ensure that they stay in touch with industry best practices, which include attending industry conferences, workshops, seminars, and training on customer service. They regularly engage with industry and cross-industry partners and work with consultants to conduct objective reviews and get recommendations on their management models. Their managers and employees are also actively involved in industry associations, which enables them to learn from and share with counterparts on customer care.

This level of service exhibited by ownership and management extends to frontline staff. The staff will help with a range of needs, including TV mountings, replacing lightbulbs, installing grab bars, and painting feature walls for free. They re spond to all maintenance requests within 24 hours. Even ownership monitors maintenance requests for efficiency and response times. They also pay attention to the small details, from handing out pet treats at the concierge desk to providing free car, pet, and bike washes.

The KG Group encourages and monitors ongoing resident feedback. All comments are immediately forwarded to their respective departments with the goal of improving their customer service. They also monitor social media, Google, and email reviews, and will respond quickly and organize meetings or additional training to ensure follow-through and follow up. Each department meets weekly about resident service and how the team can improve. They send feedback surveys after prospect tours, leasing, move-ins and maintenance requests, and monitor the leasing team through mystery shop ping and training follow up.

Education is part of The KG Group’s commitment to customer service, as they cover all learning expenses for professional training. Its senior man agers visit other major rental markets to learn best practices. Its property managers are certified through the Institute of Housing Management, and take condo management or specialized college training courses as well as relevant workshops and seminars. The company provides training on customer service for building administrators and maintenance staff, while the leasing staff take cus tom-designed training programs.

The owners and management of The KG Group are hands-on and actively involved. They visit E18H TEEN and all communities every day, walking the buildings, interacting with residents, and attending resident events with their families. Their super vision ensures that staff deliver superior levels of customer service.

Every department has specific guidelines about its response times. Leasing has 24 hours to respond to inquiries, and follow-ups take place within 48 hours. Maintenance has 24 hours to respond and initiate a resident request. The Concierge has one hour to respond to special requests and the Movein Concierge has one day to reply to new resident requests.

The KG Group will continue to develop and manage luxury condo-style, award-winning rental proper ties, and provide white-glove services and ameni ties to its tenants. They are currently in the plan ning process to redevelop their next community in the Yonge and Sheppard area. The development will include over 400 new rental apartments in var ious sizes with modern amenities and enhanced green spaces.

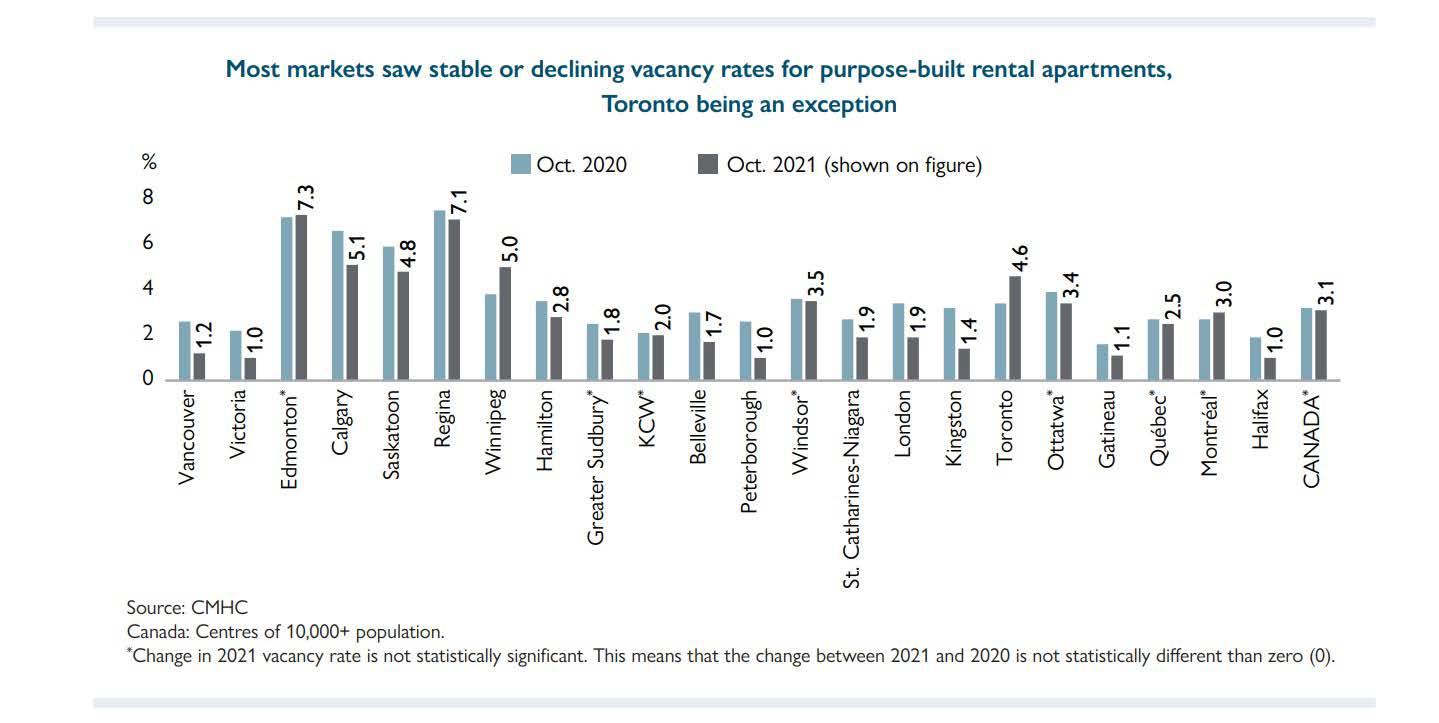

Theaverage vacancy rate for purpose-built rental apartments across all Canadian centres was 3.1% in October 2021, a statistically insignificant change from 3.2% in 2020, according to the latest Rental Market Report released by Canada Mortgage and Housing Corporation (CMHC). The vacancy rate remains above the low levels of 2018 and 2019 but in line with its longer-run average.

(1)

“Different rates of economic recovery led to an uneven pattern in rental demand in Canada. Rents grew in the Maritimes, British Columbia, and Quebec, while some other markets, such as Toronto, saw rental demand continue to be outpaced by supply,” said Bob Dugan, Chief Economist, CMHC. “Affordability continues to be a concern across the country, with few units available to renters with the lowest household incomes.”

Vacancy rates declined in 21 of the 37 census metropolitan areas (CMAs) surveyed, including Vancouver, most centres in Alberta, Saskatchewan, and the Atlantic region. Vacancy rates increased in only three centres: Toronto, Winnipeg, and Abbotsford-Mission. Rates held steady in the remaining 13 centres, including Montréal. The stability in Montréal’s vacancy rate was a key factor behind the stability of the overall national vacancy rate. Montréal’s rental market accounts for roughly 30% of the rental market universe, well above Toronto (about 15%) and Vancouver (about 5%).

As a result, vacancy rate trends in Montréal greatly influence national trends. The difference in vacancy rate trends between Toroto and the other large markets of Montréal and Vancouver reflects a relatively delayed pandemic recovery in Toronto. This delayed recovery held down the pace of growth in rental demand in Toronto, placing upward pressure on Toronto’s vacancy rate. The Prairies generally continued to see the highest vacancy rates.

“Yardi Investment Manager has been a critical element of Baceline’s ability to grow our investor base and scale our investor relations department. The level of comprehensive, dynamic investment data brings confidence to our investors and credibility to our business.”

Lindsey Reevie Partner

Between October 2020 and October 2021, the rental market universe grew by about 40,000 purpose-built rental apartment units or 1.9%. Demand kept up with supply as the number of occupied apartments grew by roughly 41,000 units or 2%, resulting in a stable vacancy rate. This represents a significant recovery in rental demand from October 2020. At that time, supply growth had outpaced demand growth by about 26,000 units.

While rental demand in most provinces and major markets roughly kept pace with supply by October 2021, the provinces of Ontario and Manitoba were exceptions. Supply continued to outpace demand in these provinces by significant margins. This includes their major centres of Toronto and Winnipeg, where supply outpaced demand by roughly 4,000 and 1,000 units, respectively. Within British Columbia, Abbotsford-Mission was the only CMA that saw supply outpace demand. The increases in vacancy rates of Toronto, Winnipeg, and Abbotsford-Mission reflect this condition where supply outpaced demand.

In a context of highly supportive monetary and fiscal policies, rising vaccination rates and the easing of pandemic-related restrictions have allowed economic conditions to recover much of the ground lost to the pandemic.

This includes the employment of young people aged 15 to 24 years old, a key driver of rental demand. When job prospects improve for young adults, renter household formation tends to increase since young adults find it easier to leave the family home for independent rental accommodation. Young adults saw the deepest and most prolonged losses in employment among all age groups in the wake of the pandemic, contributing to higher vacancy rates in October 2020.

Another important source of rental demand is net international migration since most newcomers to Canada tend to rent when they arrive. This source of demand fell to historic lows with the onset of pandemic-related travel restrictions.

However, with the easing of pandemic restrictions, net international migration began to recover by late 2020, with recovery accelerating over the first half of 2021. As a result, net international migration in the first half of 2021 was about 45% higher than in the first half of 2020. On the other hand, net international migration remains well below pre-COVID-19 levels. The first half of 2021 was 36% lower than in the first half of 2019. This implies that net international migration is likely to continue to fuel growth in rental demand and place further downward pressure on vacancy rates, assuming migration continues to recover to pre-COVID-19 levels.

Mostotherprovincesremainbelow2019preCOVID-19numbersofnewpermanentresidents admitted. All CMAs in British Columbia, including Vancouver, were above pre-COVID-19 levels. Several centres were also above pre-COVID-19 levels in Québec, but Montréal fell just short of its 2019 level. Several centres in Ontario were above pre-COVID-19 levels, but this was offset at the provincial level by Toronto, which remains further below pre-COVID-19 admissions than does Montréal.

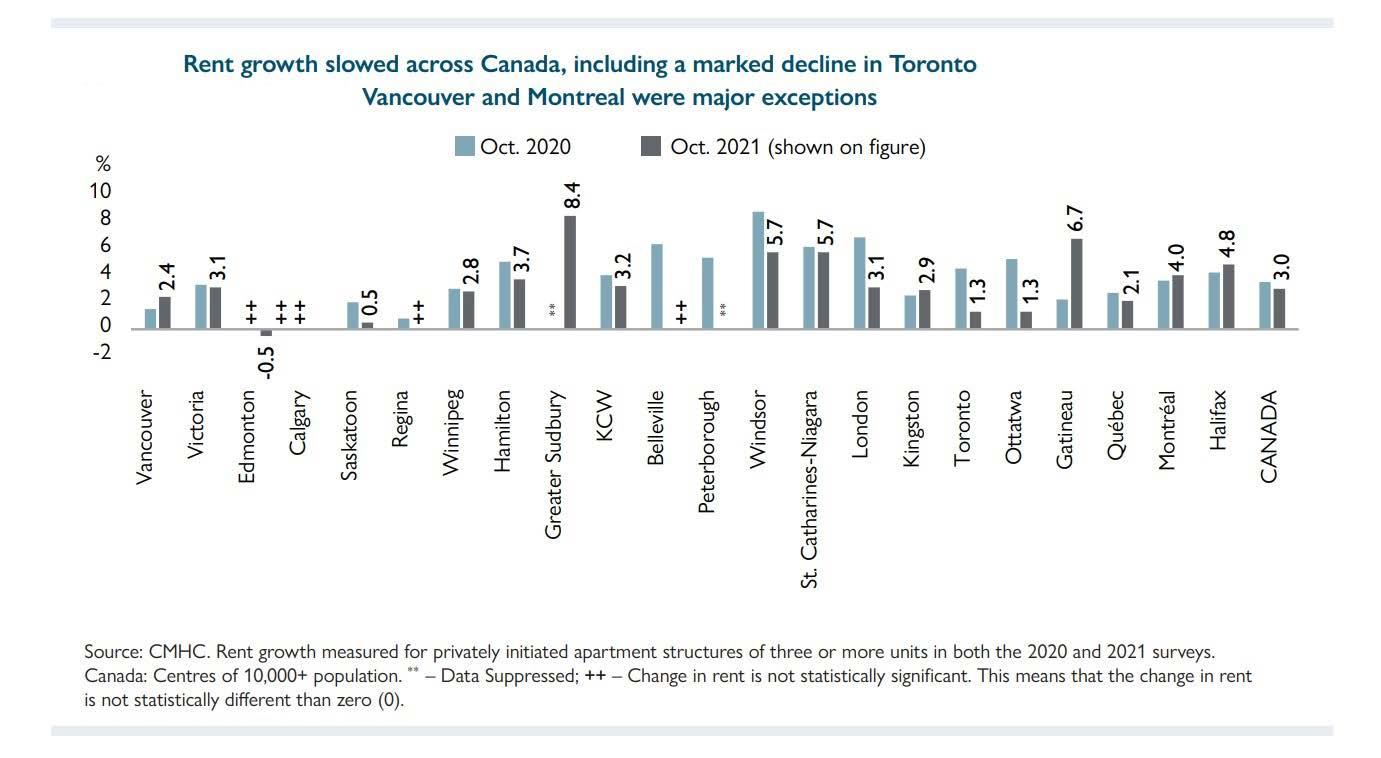

Across all surveyed centres, growth in the average rent for two-bedroom apartments in structures common to both the October 2020 and October 2021 surveys slowed for a second consecutive year, to 3% from 3.5%. This growth is significantly below the 18-year high of 3.9% registered in October 2019 and closer to the historical average of 2.7%. It was also below

overall inflation in Canada during the same period. The all-items CPI increased by 4.7% between October 2020 and October 2021. Several centres were exceptions to the national trend and saw the pace of rent growth increase, including Vancouver and Montréal. Conversely, Toronto registered one of the largest declines in same sample rent growth, consistent with Toronto being one of the few centres to see a significant rise in vacancy rates. The CMA with the highest average monthly rent level for a two-bedroom purpose-built rental apartment continued to be Vancouver, followed by Toronto. Centres in Québec, including Montréal, continued to report the lowest rent levels in Canada. Vancouver, were above pre-COVID-19 levels. Several centres were also above pre-COVID-19 levels in Québec, but Montréal fell just short of its 2019 level. Several centres in Ontario were above pre-COVID-19 levels, but this was offset at the provincial level by Toronto, which remains further below pre-COVID-19 admissions than does Montréal.

Across all surveyed centres, growth in the average rent for two-bedroom apartments in structures common to both the October 2020 and October 2021 surveys slowed for a second consecutive year, to 3% from 3.5%. This growth is significantly below the 18-year high of 3.9% registered in October 2019 and closer to the historical average of 2.7%. It was also below overall inflation in Canada during the same period. The all-items CPI increased by 4.7% between October 2020 and October 2021. Several

centres were exceptions to the national trend and saw the pace of rent growth increase, including Vancouver and Montréal.

Conversely, Toronto registered one of the largest declines in same sample rent growth, consistent with Toronto being one of the few centres to see a significant rise in vacancy rates. The CMA with the highest average monthly rent level for a twobedroom purpose-built rental apartment continued to be Vancouver, followed by Toronto. Centres in Québec, including Montréal, continued to report the lowest rent levels in Canada.

The tenant turnover rate measures the proportion of units where new tenants moved in since the pre vious survey. Nationally, the average turnover rate increased to 15.5% from 14% in October 2020 but remained below the pre-pandemic level of 17.3% in October 2019. This implies that renters were likely more able and willing to leave one dwelling for another than they were during the pandemic, but not as much as they were before the pandem ic. Compared to pre-COVID-19 rates, most excep tions to the national trend of lower turnover rates in 2021 were concentrated in Ontario, including Toronto. These centres registered solid growth in turnover rates in 2021, exceeding pre-COVID-19 levels.

The affordability of mortgage payments on a new mortgage has generally deteriorated fast er since October 2020 as average home prices have generally outpaced rents in most centres. This deterioration likely increased the barriers to transition from rent to homeownership, par ticularly for lower-income households, further supporting rental demand as fewer renter households may have been able to make the transition to homeownership.

CMHC’s reporting on the rental markets has been a mainstay of the sector for over 50 years. The data and analysis gathered provide a com mon language for businesses, governments, and the public to discuss rental market issues and developments. For more detailed rental market information, visit our website.

To provide more information on the affordability of the purpose-built rental stock, CMHC calcu lates the number of units in the rental universe that would be affordable for each quintile of the renter income distribution. An affordable dwell ing is where the renter household is spending no more than 30% of its gross income on rent. Most centres report a relative lack of affordable units for households in the lowest income quin tiles, with several centres reporting declines in such units since the previous survey.

The below figure shows the estimate of the total number of hours an individual would have to work in a month to afford the average rent on a two-bedroom apartment, assuming they are earning the average wage in their CMA. Full-time employment equates to 150 hours a month (or 37.5 hours a week). Therefore, cen tres showing more than 150 hours required for affordability implies the average rent is not affordable for a single average wage earner without another source of income, even if they work full time.

Since MetCap Living established itself as a leader in property management, we have routinely been asked one, simple question; “Can you help us run our property more effectively?” And, for well over thirty years, the answer has remained — Yes, we can! Our managers are seasoned professionals, experienced in every detail of the day to day operations and maintenance of multi-unit rental properties. From marketing, leasing, finance and accounting, to actual physical, on-site management,

vacancy reduction, revenue growth

option;

net profitability — when you’re ready to

When the owner of a condominium unit elects to rent out their unit to a tenant, it is important to keep track of the various obligations owed to both the tenant and the condominium corporation. Even when the relationships between all parties continue with no conflicts, consideration must be given to the intersection of various agreements, bylaws, and legislation. Of course, this complexity increases dramatically when a problematic tenant is involved. As a standard rule, courts frown upon duplicitous proceedings, but these various duties create a unique situation in which concurrent proceedings will be permitted and may even be necessary.

The Residential Tenancies Act places obligations on both the landlord and tenant in residential units, and creates a framework for resolving disputes between parties. The landlord’s obligations extend both to the individual tenant and to the residential complex as a whole. In a multi-unit building, this creates the additional obligation for the landlord to ensure that the tenant does not interfere with the reasonable enjoyment of other residents. A positive obligation also rests with the landlord to take action against a problematic tenant. Of course, as many landlords are aware, correcting the behaviour of, or lawfully evicting, a problematic tenant is easier said than done.

The added complexity of renting a unit in a condominium complex arises due to the additional interests and responsibilities created by the Condominium Act, along with any condominium declaration, rules or bylaws.

Courts have repeatedly noted that individuals living in condominium complexes, whether as owners or tenants, must be willing to live by the rules of the community they wish to join. If these rules are not respected, the condominium corporation has additional avenues by which issues can be addressed. A landlord who is renting their condominium unit should remember they may be liable, wholly or in part, for the tenant’s actions.

From a practical standpoint, if issues ever arise with a tenant, the landlord would be wise to discuss the matters and try to resolve the issues directly with the tenant. Although this may not always be possible, the time, cost, and frustration of proceeding with a formal application to the Landlord Tenant Board (LTB) can sometimes be avoided altogether.

C O V I D 1 9 S A F E T Y A W A R E N E S S

W e f o l l o w s t r i c t s a f e t y p r e c a u t i o n s w i t h a f o c u s o n s a n i t i z a t i o n , p e r s o n a l p r o t e c t i v e e q u i p m e n t a n d p h y s i c a l d i s t a n c i n g .

P A C B u i l d i n g G r o u p i s a f u l l s e r v i c e G e n e r a l C o n t r a c t i n g f i r m s e r v i c i n g S o u t h e r n O n t a r i o , M o n t r e a l a n d O t t a w a r e g i o n s . W e d e l i v e r c o m p r e h e n s i v e b u i l d i n g s o l u t i o n s f o r a l l p r o j e c t t y p e s . W e p a r t n e r w i t h o u r c l i e n t s t o u n d e r s t a n d t h e i r g o a l s a n d i n t e r p r e t t h e i r v i s i o n , b u i l d i n g s p a c e s t h a t a r e d i s t i n c t l y s u i t e d f o r e a c h e n v i r o n m e n t . W i t h a n i n t e g r a t e d a p p r o a c h a n d s e a m l e s s p r o c e s s , w e o u t p a c e t r a d i t i o n a l e x p e c t a t i o n s .

C O M M O N - A R E A S b u i l d i n g e n v e l o p e

A M E N I T Y S P A C E S s u i t e r e n o v a t i o n s

If the matter cannot be resolved directly, an application should be brought before the LTB in an attempt to resolve the issue before the condominium corporation is forced to bring an application before the court. If the courts deal with the matter, not only will the time and cost of the situation drastically increase, but both the landlord and tenant become jointly responding parties, and both may be liable for damages and potential cost awards. Evidence of a landlord’s attempt to deal with the issues with the tenant in a satisfactory manner (i.e., via an attempt to discuss the issue followed by an appropriate LTB application) will often reduce the landlord’s exposure should a court proceeding be commenced.

Under the Condominium Act, the court has the express power to issue a compliance order requiring the individual subject to the order to abide by the condominium corporation’s various rules and bylaws. If the tenant does not comply with this order, the court may order that the tenant vacate the unit. Due to the necessity of seeking a compliance order and then on its subsequent breach seeking a secondary order removing the tenant, this process may be costly and timeconsuming. If the landlord has not taken proactive steps to address the actions of the problematic tenant, they may be liable to pay the associated costs. Landlords should also be mindful that courts often award full indemnity costs against the unsuccessful party in actions brought by condominium corporations to avoid other unit owners having to subsidize the expense resulting from the conduct of a problematic unit owner (or their tenant).

One would assume that a proceeding before the LTB would be more timely; however, due to the significant backlog caused by the ongoing COVID-19 pandemic, the tribunal is not currently able to proceed at peak efficiency. As such, a landlord should submit their application to the LTB as quickly as possible once an issue arises.

A tenant may attempt to have a court proceeding stayed pending the resolution of an application before the LTB; however, courts have declined to do so in the past. As the relief sought under the Residential Tenancies Act and the Condominium Act stems from different obligations, involves different remedies, and involves different parties, the two actions should be considered similar rather than truly duplicitous.

As all condominium corporations have somewhat different rules and bylaws, a landlord wishing to rent out their condominium unit should carefully review all relevant governing documents. Care must be taken to ensure the landlord and their perspective tenant understand, and can comply, with all relevant declarations, rules, or bylaws of the condominium corporation, the Residential Tenancies Act, and the Condominium Act

When FRPO first introduced its Certified Rental Building™️ program (CRBP) in June 2008, at what was a joint Minto/GWL location in High Park, Toronto, few would have predicted it would one day become Canada’s foremost “quality-assurance” accreditation program supporting the multi-residential industry. Initially conceived as a corporate social responsibility (CSR) initiative that would demonstrate the industry’s ability to self-regulate, it has grown into a highly robust integrated professional property management program. It is now Canada’s leading sustainability program supporting multi-residential industry member environmental, social, and corporate governance (ESG) strategies and efforts. It supports all three factors through recognizable standards and requirements that are independently third-party audited.

The program’s growth has included several major milestone steps that have led to its cur rent state as a “value-added” accreditation program in support of the industry and its mem bers. These steps include:

•

The addition of two new major Standard of Practise disciplines: #1 -Environmental Standards (2016) and #2 - State of Condition Assessment Standards (2019). They go along with the original four disciplines covering Human Resource Management, Resident Management, Building Operations, and Financial/Risk Management.

• The establishment of Living GREEN Together™️ and CRB Green Apartment Living™️ certi fication recognition (2018) for participating members. The Living GREEN Together™️(LGT) Environmental standards were designed for the multi-residential industry with the intent to address climate change through reducing energy and water usage, promoting effective waste diversion, and improving asset longevity.

• Initially established with 31 standards CRBP, it has now grown to 54 standards with over 250 requirements that are audited as part of its independent third-party assessment regime (2008 to 2022).

• CRBP has earned official status on the GRESB list of recognized and approved Building Certification Schemes and “operational green building certification” programs (2018).

• In January 2022, we merged the B.C. CRB and ON CRB programs into a new Canadian Certified Rental Building™️ program.

Led by Canada’s REIT, investment, institutional, and large private players, Canada’s multi-res idential industry has been going through a major transformation to ESG-centric rent al-housing providers. This substantive change can “only be a good happening for the multi-res industry.” Let me change that thought to “only be a ‘great’ thing for the multi-res industry.” So often our industry is portrayed in the light of the evil landlord focused only on collecting rents. Little recognition is given to the growth of the industry over the past 25 years due to highly professional property managers invest ing hundreds of millions of dollars annually in upgrading older assets and providing consum ers with safe, affordable apartment homes and quality service. We are also adding much-need ed new apartment buildings at a time when many of Canada’s major municipalities are facing severe housing shortages. The growing ESG movement across the Canadian mufti-res idential sector will undoubtedly highlight the industry’s care and efforts to support environ mental challenges (e.g., climate change, car bon reduction), combat social issues of the day (e.g., diversity, inclusion, equality), and effec tively manage important corporate governance matters (e.g., resilience planning, cyber risks). Positively impacting the public’s image of the

multi-residential industry can go a long way to changing the perception of our industry as just simply “landlords” collecting rent to “profes sional property” management organizations playing a vital role in contributing to the reso lution of the challenges facing Canada’s ESG landscape.

The caCanadian Certified Rental Building™️ is committed to supporting the multi-residential industry’s ESG transformation across Canada, and to continually raising the bar of “industry professionalism” in serving rental-housing consumers in all provinces. In the next few weeks, we will have completed the expansion of the program to Alberta. Over the summer and fall periods, caCanadian Certified Rental Building™️ will complete its western expansion efforts and will then look eastward to establish the program in Quebec and the Atlantic prov inces.

For more information on the caCanadian Certified Rental Building™️, please contact Ted Whitehead, Director of Certification, twhitehead@frpo.org.

September 2021 federal election crystallized the importance of housing affordability for the middle class as a live political issue. The federal government sees more housing supply as the main solution, which is the position FRPO and CFAA have been advancing for years.

The federal Minister of Housing is to create a Housing Accelerator Fund to support the municipalities in speeding up approvals for new housing. The outcomes of the fund should be faster, more, and denser development approvals. CFAA made several submissions to CMHC about the fund, including recommendations on rewarding communities that build more homes and build faster, and identifying vacant or underused property that should be converted to housing.

The Prime Minister’s mandate letter to the Minister of Housing also directs him to create a new Rent-toOwn Program to help current or new renters rent-to-own. If rent-to-own is applied to existing rental developments, that would run against the business plan of almost all rental owners. We want to keep renting out our properties, not sell them off piecemeal. However, rent-to-own might be more interesting as a means of supporting new developments, which could be partly rent-to-own and partly rented on ordinary terms, depending on the preferences and financial abilities of prospective occupants.

Other rent-to-own programs are attractive to some investors who operate in the secondary rental market. CFAA’s member associations include investors in rent-to-own purchases. CFAA worked with the Canadian Association of Rent to Own Professionals (CAROP) to make a joint submission that is respectful to ordinary renting and rent-to-own arrangements. CFAA seeks to educate CMHC and the government on the economics of renting and rent-to-own. CFAA also aims to emphasize the value of rental housing in addressing Canada’s housing needs.

The federal Department of Finance has issued draft legislation to limit the interest that can be deducted by corporations, trusts or partnerships that have any foreign income. If your entity or related entities have foreign income, email admin@cfaa-fcapi.org today to receive CFAA’s memo about the new draft rules.

Also ask for the memo if your corporation pays interest or lease payments to pension funds, nonprofit housing corporations, municipalities or their agencies, or environmental trusts.

There is still time to seek changes, but CFAA needs to hear from you to seek the changes that rental housing providers need.

However, ACORN and other left-wing housing advocates have taken aim at REITs and large real estate corporations, complaining about the “financialization of housing.” Such attacks can lead to rules that impact rental housing providers of all sizes. Attacks on rental housing providers can make people reluctant to invest in real estate, thereby driving up the return demanded and the costs and prices (rents) in real estate. However, that economic fact will not deter ACORN and other misguided housing advocates.

CFAA and other real estate associations are seeking to educate federal policymakers on the issues. We are also opposing the proposed use of federal tax powers to interfere in housing policy and rental housing rules, which are matters of provincial jurisdiction. The provinces are not eager for the federal government to act on matters that are clearly within provincial jurisdiction.

The CFAA Rental Housing Conference took place in person from May 9 to 11 at the Hyatt Regency Hotel, located at 370 King Street in downtown Toronto.

CFAA-RHC 2022 featured two days of timely and relevant education sessions, the Building Innovations Tour, the annual Rental Housing Awards Dinner, and more!

Two of this year’s highlights were Benjamin Tal’s informative and entertaining Economic Update and an address from CMHC’s President, Ms. Romy Bowers.

This year’s Building Innovations Tour featured one winner of CFAA’s Rental Development of the Year 2021 award, “Lillian Park” by ShipLake Properties, as well as Novus by BentallGreenOak, a beautiful and contemporary development in Liberty Village.

Within the many education sessions, CFAA addressed the financialization of housing and how the industry can best respond. We heard from rental housing leaders and leading rental housing suppliers on technology, clean energy requirements and solutions, human resources, marketing, leasing, operations, and many other topics, including equity, diversity, and inclusion.

Date and Time: Jun 22 – 24, 2022, 9:00 am – 4:00 pm

Location: San Diego, California

Experience the unstoppable energy of Apartmentalize, where the industry’s thought leaders, trendsetters, and innovators come together to share ideas and solutions. The schedule is designed to maximize your connections with other attendees and exhibitors. With interactive sponsored activities, the NAA Exposition, and structured networking sessions, Apartmentalize provides countless opportunities to meet and exchange ideas with the best in the industry.

Innovative learning formats and open spaces that foster knowledge exchanges allow you to align your education to your personal learning level, needs, and interests. As you design your education experience with your professional objectives in mind, you will be able to challenge yourself to explore and find fun in your learning.

Date and Time: Jul 18, 2022, 8:30 am – 7:00 pm

Location: The Country Club - Woodbridge

We are pleased to announce the 2022 FRPO Charity Golf Classic will take place on Monday, July 18 at the Country Club located in Woodbridge. This event will support our charitable partner, Interval House. Stay tuned for more details. Registration will open in Spring 2022.

Date and Time: Sep 20, 2022, 10:00 am – 2:30 pm

Location: Metro Toronto Convention Centre

Year over year, the Canadian Apartment Investment Conference brings together owners, managers, developers, investors, and lenders to provide valuable insights into the multi-unit residential market. The 2021 virtual conference brought together those interested in learning about major trends, issues, opportunities, and strategies in Canada’s multi-unit residential market. The Canadian Apartment Investment Conference is organized by the producers of The Real Estate Forums, in conjunction with a steering committee of apartment owners, lenders, brokers, and valuators. Stay tuned for more information about the 2022 Canadian Apartment Investment Conference.

Date and Time: Nov 30 – Dec 2, 2022, 8:00 am – 4:00 pm

Location: Metro Toronto Convention Centre

Supported by TCA, BOMA, BILD, Concrete Ontario, and CABA, The Buildings Show, comprised of Construct Canada, PM Expo, HomeBuilder & Renovator Expo, and World of Concrete Toronto Pavilion, is back in person from Nov. 30 to Dec. 2, 2022. For over 30 years, The Buildings Show has provided a unique platform for the industry to see first-hand a complete overview of the built environment. The health and safety of attendees, speakers, exhibitors, and partners is a top priority. We will continue to closely monitor the situation around COVID-19 and will update you across our channels.

Date and Time: Dec 1, 2022, 5:00 – 9:00 pm

Location: Metro Toronto Convention Centre

The MAC Awards is the most important annual event for our members and recognizes the leaders in Ontario’s vibrant rental housing industry. These prestigious awards highlight excellence in a variety of categories including customer service, construction, sustainability, marketing, and personnel. Find out more about these awards by visiting www. frpomacawards.com.This year’s Awards Gala will take place on Thursday, December 1 in conjunction with the Buildings Show. More information about this event will be provided this summer/fall. We can’t wait to see everyone back in person to celebrate the ‘best in the business’ this December.

regularly for newly added events.

energy.

social housing and affordable multi-family apartment buildings have oversized mechanical equipment that isn’t optimized to

Affordable MultiFamily Housing program helps affordable multi-family and eligible private marketrate housing providers with low-income tenants make upgrades that improve energy efficiency, lower costs and more.

ongoing

2550 Victoria Park Ave, Suite 602, Toronto, ON M2J 5A9

Attn: Mohsen Mansouri

T: (416) 635-9970 mohsen.mansouri@ salasobrien.com

Attn: Customer Service

511 Edgeley Blvd, Unit 2, Vaughn, ON L4K 4G4

T: (855) 873-2964 customerservice@ thebynggroup.com

Attn: Robert Kuh

6 Gurdwara Road, Suite 205, Ottawa, ON K2E 8A3

240 Richmond Street West, Toronto, ON M5V 1V6

T: (416) 399-3849 rkuh@vistaservices.ca

Yuhu Inc.

Attn: Hugh Kolias

T: (416) 992-9038 hughkolias@yuhu.io

150 Bridgeland Ave Ste 100, North York, ON M6A 1Z5

Attn: James Haehnel

T: (888) 705-0097 james.haehnel@getsynergy.ca

Attn: Ron Buffa

72 Corstate Ave, Vaughan, ON L4K 4X2

7077 Keele Street, Suite 201, Concord, ON L4K 0B6

T: (905) 663-3334 rbuffa@torquebuilders.com

36 Kelfield Street, Toronto, ON M9W 5A2

TAC Mechanical Inc.

Attn: Patrick Carbone

T: (416) 798-8400 patrick@tacmechanical.com

3055 Lenworth Drive, Unit 2, Mississauga, ON L4X 2G3

Attn: Peter Mills

T: (416) 709-0079 pmills@wysemeter.com

Attn: Victoria Thornbury

5925 Airport Road, Suite 605, Mississauga, ON L4V 1W1

Attn: Ayman Ashebir ayman@uniluxcrfc.com

Yardi Canada Ltd.

Attn: Peter Altobelli

T: (888) 569-2734 sales@yardi.com

100 Main Street, Suite 2030, Dartmouth, NS B2X 1R5

T: (289) 527-4040 vthornbury@zipsure.ca

Magneto Design

National Efficiency Systems Inc.

Rental Housing Business (RHB) Magazine

H&L Management Limited

Ignis Building Solutions

Municipal Property Assessment Corp.

Parcel Pending

Performance Solutions Network Corp.

Taeus Group Inc

DBS

ECNG Energy L.P.

Elexicon Group Inc.

Enersavings Inc.

InLight LED Solutions

Metrosphere

Nerva Energy

Novitherm Canada Inc.

Watershed Technologies Inc

Mann Engineering

Pretium Engineering Inc

Sense Engineering Ltd.

Synergy Partners

WSP Canada Inc.

Wynspec Engineering

Canadian Mortgage Capital Corporation

Peoples Trust Company

Accurate Fire Protection And Security

Trace Electric

Absolute Ventilation Inc.

All Professional Trades Services Inc.

Altona Renovation

Beautiful Floors & Janitorial

HCS Contracting

Ltd

Intact Renovations

Contracting Inc.

Modern Pro Contracting

Inc.

Parcel Pending

Debra Fine Barrister & Solicitor

Dharsee Professional Corp

Dickie & Lyman Lawyers LLP

Gardiner Roberts LLP

Sheryl Erenberg & Associates

Spar Property Paralegal Professional Corporation

Zarnett Law Professional Corporation

Altus Group Ltd.

Veritas Valuation Inc

JDavis Painting

Pascoal Painting & Decorating Inc.

HomePro Pest Control

Orkin Canada

Pest Control Plus Inc.

Terminix Canada

Bonnie Hoy & Associates

CB Richard Ellis

EPIC Investment Services LP

Skyview Realty Ltd.

SVN Rock Advisors, Inc.

Conterra Restoration Ltd.

HIP Mould

Roma Building Restoration

First OnSite Property Restoration

Forest Contractors Ltd.

Kaya Group Inc

Maxim Group

Contracting

Neutral Contracting Group

New-Can Group Inc.

Payquad Solutions

Property Vista

Amre Supply

H & S Building Supplies Ltd.

Canadian Credit Protection Corp

Canadian Tenant Inspection Services Ltd.

Gatemaster Inc.

Rent Check Credit Bureau

Waste Management

Canada Corp.

Aquatics AI Services

Water Matrix Inc.

Stay connected when it matters the most by safely attracting prospects, converting quality leads and supporting residents. A single connected solution for Canadian multifamily marketing management.

• Revolutionize the prospect journey by automating the entire lead-to-lease cycle

Enrich the resident experience with a comprehensive service portal

Increase conversions with dynamic and integrated websites and internet listings

Optimize your online presence and attract more prospects with SEO and PPC advertising