H&S stands as your central resource for property maintenance needs. Our commitment goes beyond providing a diverse range of high-quality products; we are dedicated to delivering comprehensive solutions tailored to your unique needs. Whether it's everyday necessities or specialized tools, H&S ensures you have everything required for efficient property maintenance. With a focus on excellence and reliability, our mission is to be more than just a supplier – we aim to be your strategic partner in elevating property management standards.

Serving the Greater Toronto Area (GTA) & its surrounding regions, including Ottawa, Kingston, Kitchener-Waterloo, Hamilton, London, and Burlington.

Heating season is around the corner. Make capital improvements now to help save energy† and reduce operating costs. With the Affordable Housing Multi-Residential Program, you receive financial incentives up to $200,000 for boilers, energy-efficient technologies and energy assessments. Plus, free in-suite upgrades and expert assistance every step of the way.

Is your building eligible? This program is for:

• Reduce energy, maintenance and operating costs.

• Improve the energy efficiency of your building.

• Enhance resident comfort, health and well-being. Why upgrade now?

• Eligible private market-rate multi-residential buildings‡

• Shelters and co-ops

• Control costs more effectively with automated systems.

• Boilers and boiler controls

• Building automation controls

• Variable frequency drives

• Water heaters

• Hybrid heat pumps • Ventilation technologies

• Social, municipal and nonprofit housing providers

Thanks for supporting our annual golf fundraiser. With 288 players and the sponsorships completely sold out, everything indicated a spectacular day on the beautiful course. All were gathered on time for our shotgun start … then it started to drizzle. The apartment industry is resilient and strong, and undeterred by a bit of rain. Our people have thick skins and some are completely waterproof! But even the toughest had to call it quits and drive back to the clubhouse after an hour of sloshing about.

Thanks to the tremendous efforts of the Kaneff Family and their Lionhead team, our full cocktail reception was advanced by half a day, and the kitchen was fired up to serve our scheduled dinner at lunchtime. Incredible!

Bravo to our valiant golfers who roughed the weather and stuck around to enjoy precious in-person time to laugh with friends and soak up some comradery. Kudos for those who stayed for lunch. Fun times had by all.

We went beyond making the best of it –we had a great time.

Speaking of friends, fun, tough, resilient and great times … all of these describe Steve Weinrieb. Congratulations to Steve who retired in June after decades at Park Property Management. He was on GTAA’s Board of Directors since Day 1, way back a quarter century ago. We acknowledged his contribution a few years ago when he received the Sam Grossman Award of Excellence.

Steve has a wealth of knowledge and I relied on him as my personal encyclopedia, with a complete volumes dedicated to fire protection and electrical systems. He has promised to answer the telephone, when I call.

Debra Fine (Steve’s wife) also recently retired from her legal practice, and from GTAA’s Board. I wish them all the best!

Publisher Nishant Rai

Account Executive Justin Kreslin

Editorial Daryl Chong

Creative Director / Designer Scott Clark

Office Manager Geeta Lokhram

Published By:

GTAAOnline is published monthly by RHB Inc. on behalf of the Greater Toronto Apartment Association (GTAA) and is distributed online through controlled circulation to the GTAA membership.

Please contact the Publisher for advertising dates and rates. Opinions expressed are those of the authors and do not necessarily reflect the views and opinions of the GTAA Board or management. GTAA accepts no liability for information contained herein.

Opinions expressed in articles are those of the authors and do not necessarily reflect the views and opinions of the GTAA Board or management. GTAA and RHB Inc. accept no liability for information contained herein. All rights reserved. Contents may not be reproduced without the written permission from the publisher.

P.O. Box 696, Maple, ON L6A 1S7 416-236-7473

User Friendly Self Service 24/7 Package Access

Eliminates constant staff disruption for deliveries

Officially approved by Canadian Carriers

Robust Lockers designed and built in USA

6-8 week delivery timeline

Robin Simpson (416) 508-4095 robin@selkirkinvestments.com

Gobal Mailwaganam (416) 924-2244 x 259 gobal@biddington.com

Mark Shields (905) 886-1066 x 222 mark@EmiPromotionalProducts.com emipromotionalproducts.com

Jarrett Rose (416) 748-0330 x 351 sales@hallmarkhousekeeping.com hallmarkhousekeeping.com

Geoff Diffey (289) 772-7987

info@arkmgt.ca arkmgt.ca

Lorenzo Cicconi (416) 744-6900

lcicconi@eaglerestoration.ca eaglerestoration.ca

Gerald Grant (647) 882-7723 gehgrant@gmail.com

David Steinberg (416) 622-7000 dave@nusitegroup.com nusitewaterproofing.com

Matt Hildebrand (905) 397-5088 mhildebrand@rentsync.com rentsync.com

Arif Panchbhaya (416) 803-5234

info@quickbrightcleaning.com quickbrightcleaning.com

Viktor Okhnovskyi (416) 535-1686

viktor@dufferiniron.com dufferiniron.com

Mimmo Figliano (416) 747-9199

Mimmo@futurepaving.ca futurePaving.ca

Tony Marner (416) 449-4100 x 24 Tony@miramarpm.com

Denys Sagay (416) 857-0985 denys.sagay@odvinn.ca odvinn.ca

Stephanie Carmichael (416) 299-8890

Stephanie.Carmichael@pauldavis.com pauldavis.ca

Andrew Deonarain (416) 290-0033

info@torcangroupgta.com torcangroupgta.com

Brandon Murphy (416) 848-9205

bmurphy@bflcanada.ca

bflcanada.ca/realty-insuranceservices/apartments-and-multiunit-properties/

Fadi Ramani (416) 410-0337

info@a-plusquality.com a-plusquality.com

Alfonso Gurreri (647) 680-5109 ag@ricicon.com ricicon.com

Tony Nardone (416) 275-9479

tonywoodbinepaving@gmail.com woodbinepaving.com

Ahmet Tasdemir (905) 669-9494

info@zt-contracting.com zt-contracting.com

Sanj Patel (416) 751-8383

sanj.patel@ignisinc.ca ignisinc.ca

Joseph Visconti (416) 244-6161

jvisconti@novi-eng.ca novi-eng.ca

Jennifer Burks (972) 706-7094

jburks@kingsiii.com kingsiii.com

Anthony La Torre (647) 484-2588

anthony@lebengineers.com lebengineers.com

Ty McDonald (647) 385-9592

TBMenviromentalmanagement@gmail.com

Mathieu Laquerre (888) 777-9778

mlaquerre@wifiplex.ca wifiplex.ca

The newly bestowed ‘strong Mayor’ powers now make the Mayors of several Ontario municipalities solely responsible for putting together an annual budget for their Councils to review. Under this new system, these Mayors could exercise veto powers should their Councils disagree with their budget proposal package.

On February 14, 2024, Toronto City Council held a special budget meeting to consider the operating and capital budgets proposed by Mayor Olivia Chow. Toronto adopted a 9.5% residential property tax hike, the largest increase since amalgamation. This is made of two components: 8% property tax increase and a 1.5% “City Building” fund levy increase.

At the onset of the budget process which began in earnest in January, various city staff presented their draft budget which at that time recommended a 10.5% Residential (“R”) property tax increase.

Purpose-built rental apartment buildings are categorized as Multi-Residential (“MR”) and taxed at the MR property tax rate. For the past 15 years (or so) the annual increase in the Multi-Residential rate was exactly half of the Residential rate increase. Following the standard formula, the staff recommended 10.5% Residential rate increase would have resulted in a 5.25% Multi-Residential rate increase.

Early in the budget process, GTAA met with Mayor Chow’s staff – and separately with Councillors, and senior City officials – to highlight that this would trigger widespread Above Guideline Increases. It was important for the Mayor to understand the mechanics behind this type of AGI, and the process, in advance of her budget proposal.

GTAA explained that an AGI application can be submitted to the Landlord and Tenant Board (LTB) when:

The municipal taxes and charges for the residential complex increased by an “extraordinary” amount.

Further that the LTB defines “extraordinary” as:

An increase in the cost of municipal taxes and charges is extraordinary if it is greater than the annual rent increase guideline plus 50% of the guideline.

The LTB even provides a sample calculation to show extraordinary = 1.5 X Guideline

The 2024 Rent Increase Guideline was capped at 2.5% (despite actual CPI being 5.9%). Therefore, an AGI application could be triggered for a property tax increase that exceeds 3.75% (1.5 X 2.5%).

The AGI form provides a simple check box:

VANCOUVER

Lance Coulson*** Executive Vice President lance.coulson@cbre.com

604. 662. 5141

VANCOUVER

Greg Ambrose* Vice President greg.ambrose@cbre.com

604. 662. 5178

EDMONTON David Young* Executive Vice President dave.young@cbre.com 780. 917. 4625

EDMONTON Thomas Chibri* Vice President thomas.chibri@cbre.com 780. 424. 5475

CALGARY Richie Bhamra* Executive Vice President richie.bhamra@cbre.com 403. 303. 4569

Chairman david.montressor@cbre.com 416. 815. 2332

LONDON Kevin MacDougall** Vice President kevin.macdougall@cbre.com 519. 286. 2013

The required information is basic, and straightforward:

The LTB AGI application’s actual wording and forms were provided to Mayor Chow’s staff along with an explanation of how a ‘paper AGI application’ is generally approved.

In the week leading up to the Budget Council meeting, Mayor Chow publicly announced that she would propose a MR increase that was below 3.75% in order to avoid AGIs. She stated:

“In my upcoming budget, I will reduce the multi-residential tax rate so no renters will face huge increases. That’s what you want. That’s what I’m going to do.”

The Mayor’s final budget recommendation that Council approved set a 3.5% increase for MR, calculated to remain below ‘extraordinary’ with a small buffer.

This 3.5% MR increase is comprised of a 2.95% base property tax increase combined with a 0.55% City Building levy.

Keep in mind that the multi-residential MR category kicks in at 7 units.

Housing with 6 or fewer units are taxed in the residential R category.

Condominium units are individually taxed in the residential R category, despite their similarity to and appearance as multi-residential buildings.

In April 2002, the City of Toronto created a New Multi-Residential property tax category.

A significant amount of rental housing is provided in condominium units and in smaller buildings (whole houses, basement units, above commercial, multiplexes, etc), which is generally referred to as the “secondary” rental market. These owners will be saddled with a massive 9.5% property tax increase expense. For most, it could be impractical to apply for AGI due to unfamiliarity with the process and the upfront application fee. For many they may mistakenly believe that Mayor Chow’s catchall comment applies to all rental properties.

Now that the 2024 tax bills have been mailed to property owners we’ve noticed an abundance of condominium units listed for sale. Is this the last straw for many of the troves of condominium investors? Most are already slightly underwater in cash flow each year. With significantly higher mortgage rates, slower value appreciation (in some cases a decrease), and now increased operating costs, will they sell? Would another investor buy the exact same rental opportunity with the exact same financial situation? Or will we see a shrinkage in rental housing supply?

None of this helps us out of our housing supply shortage.

Ontario’s multi-residential sector remains one of the most resilient segments of commercial real estate capital markets. Notwithstanding market volatility over the last 24 months, investor sentiment for multifamily assets remains strong. As of Q3 2024, multifamily assets have weathered the impact of higher borrowing costs and are well-positioned in a changing rate environment due to stable and recurring income growth. Please see below for a summary of recent transactions and active listings as of Q3 2024.

For additional info on cap rates, valuations, and market trends in the current investment landscape, please reach out to a member of the CBRE National Apartment Group.

For

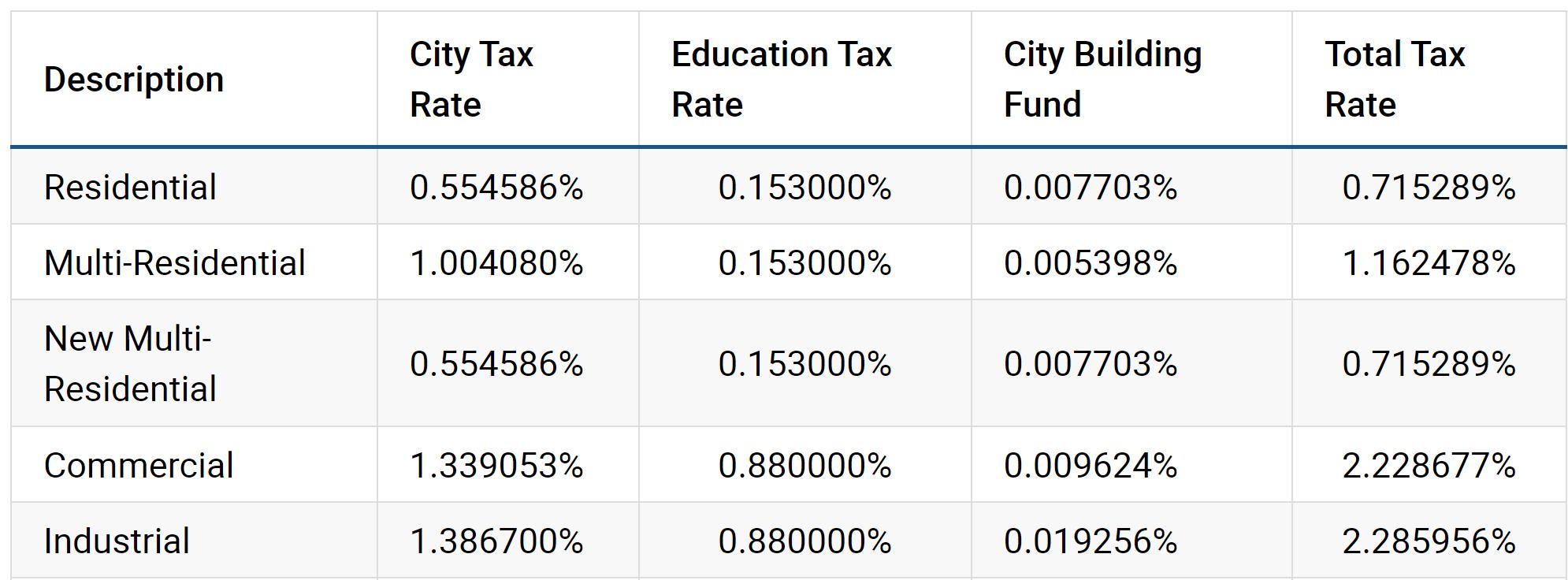

Property tax bill is calculated by multiplying MPAC’s current year phased-in property assessment value by the Total Tax Rate (City Tax Rate + City Building Fund Levy + Education Tax Rate).

9

City of Toronto By-law 154-2024

Wondering how much Toronto collects in property taxes? Below are the property classes and their assessment values. These values are then multiplied by their corresponding property tax rates.

SCHEDULE A

Rateable Assessment for Municipal Purposes

Rateable Assessment for Municipal Purposes

Column 1

(Property Class/Subclass)

Column 2

(2024 Rateable Assessment For Municipal Purposes)

3

City of Toronto By-law 154-2024

Whereas pursuant to this by-law, the City is opting to make paragraphs 3 and 4 of subsection 292(2) of the Act (as it has been modified by section 29.1 of the Regulation) applicable to the City for 2024, thereby adopting a threshold limit of $500 so that properties that are within that threshold of their full current value assessment level of taxation in the current year will be taxed at their current value assessment level of taxation and are excluded from the capping and clawing back of taxes; and

Whereas section 307 of the Act provides that the City may pass a by-law providing for the payment of taxes by instalments and establishing due dates for such instalments, and alternative instalments and due dates;

The Council of the City of Toronto enacts:

1 For the purposes of calculating the notional tax rate, the City elects pursuant to subsection 19(4) of the Regulation to adjust the total assessment for property in a property class so that the total assessment excludes changes to the tax roll for 2024 resulting from various prescribed assessment-related losses by opting to have subsections 19(4.2) to (4.4) apply

Here are the tax ratios for 2024, using Residential as base 1. Multi-Residential has decreased slowly and is now just under double the Residential rate. Recall that in 2005, MR was 3.71 TIMES the Residential rate!

2 The tax ratios for 2024 for each property class set out in Column 1 shall be established as the amount set out in Column 2:

Toronto’s Rentsafe Apartment Buildings Standards program, was introduced in 2017 as a bylaw enforcement program enabled by Toronto Municipal Code Chapter 354, Apartment Buildings, to ensure apartment building owners and operators comply with building maintenance standards. The program applies to purpose-built rental buildings with 3 or more storeys and 10 or more units. The program currently includes approximately 3,600 apartment buildings across the city, accounting for more than 362,000 rental units. Condominiums, townhomes, co-operative housing, or units in a private home (basement or main floor apartment), which do not meet the definition in Chapter 354, Apartment Buildings, are not part of the program.

The City’s stated objectives of the program are to strengthen enforcement of City bylaws, enhance tenant engagement and access to information, and promote proactive maintenance in apartment buildings to prevent the deterioration of critical housing stock.

Rentsafe’s fee structure includes an annual registration fee, along with one-time fees associated with the administration and provision of building inspections and building audits. Rentsafe operates with a partial costrecovery model whereby program funding is recovered through a combination of fee revenues and revenues received from the tax base. In 2023, 85% ($4.0 million) was recovered from fee revenues and the remaining 15% ($0.7 million) was recovered from the tax base.

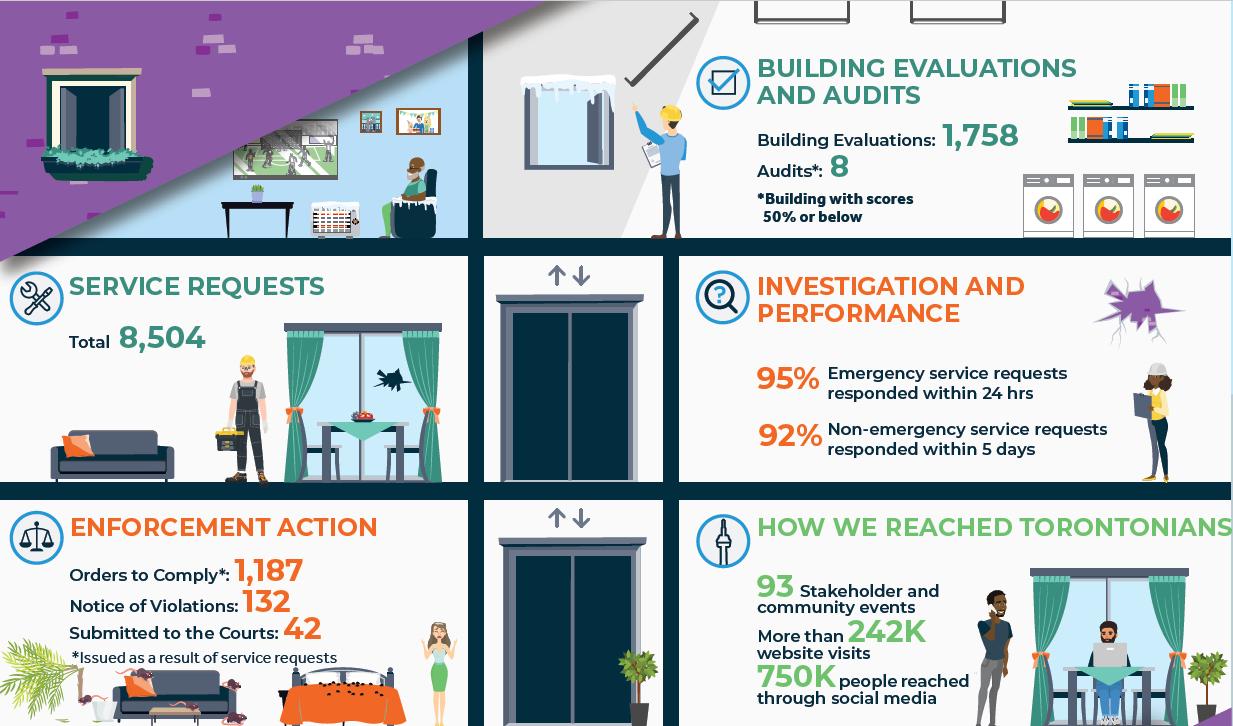

An overview of the program’s 2023 highlights undertaken by staff include:

• Conducted 1,758 building evaluations and 8 building audits with an average building evaluation score of 87.5%.

• Hosted 93 virtual and in-person stakeholder engagement events with approximately 1,650 residents in attendance;

• Received 242,000 webpage views and engaged 750,000 people through social media posts as part of Rentsafe public education campaigns;

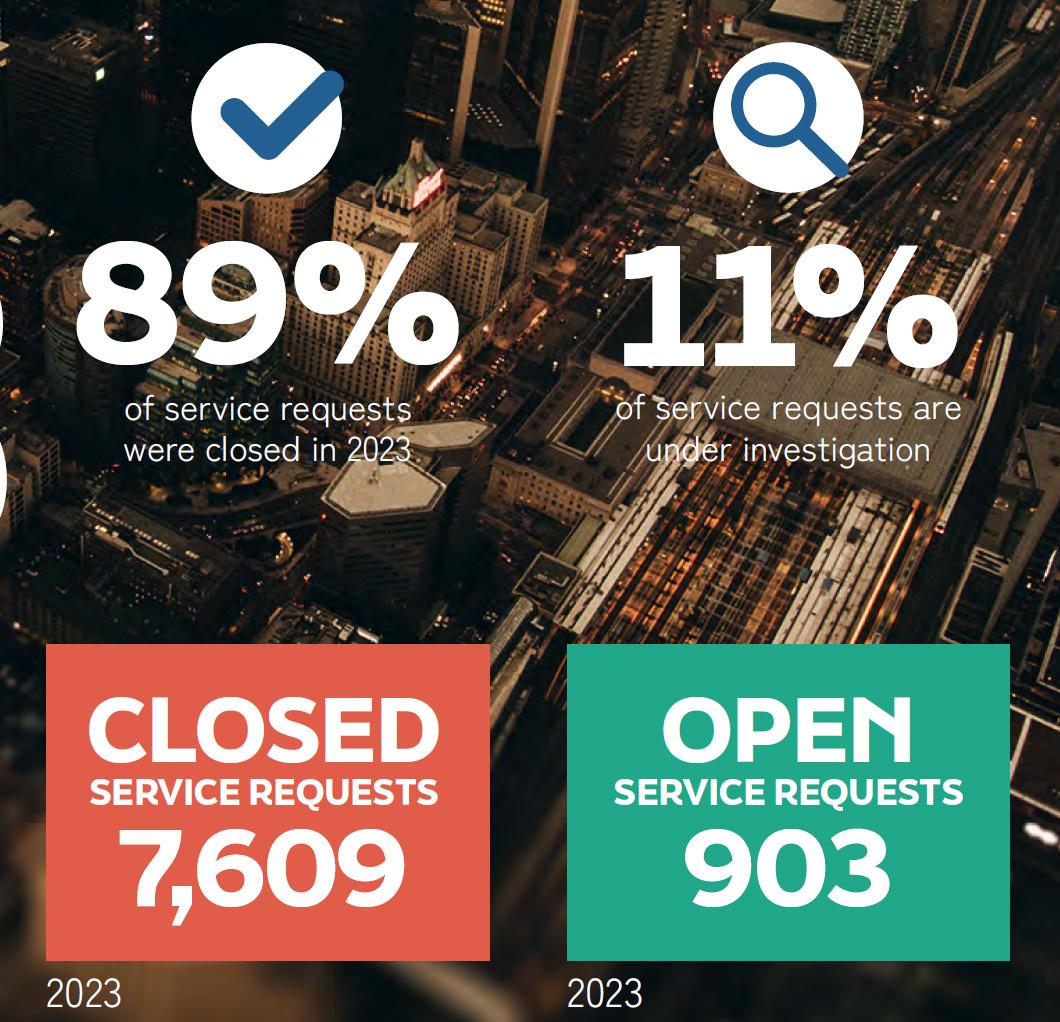

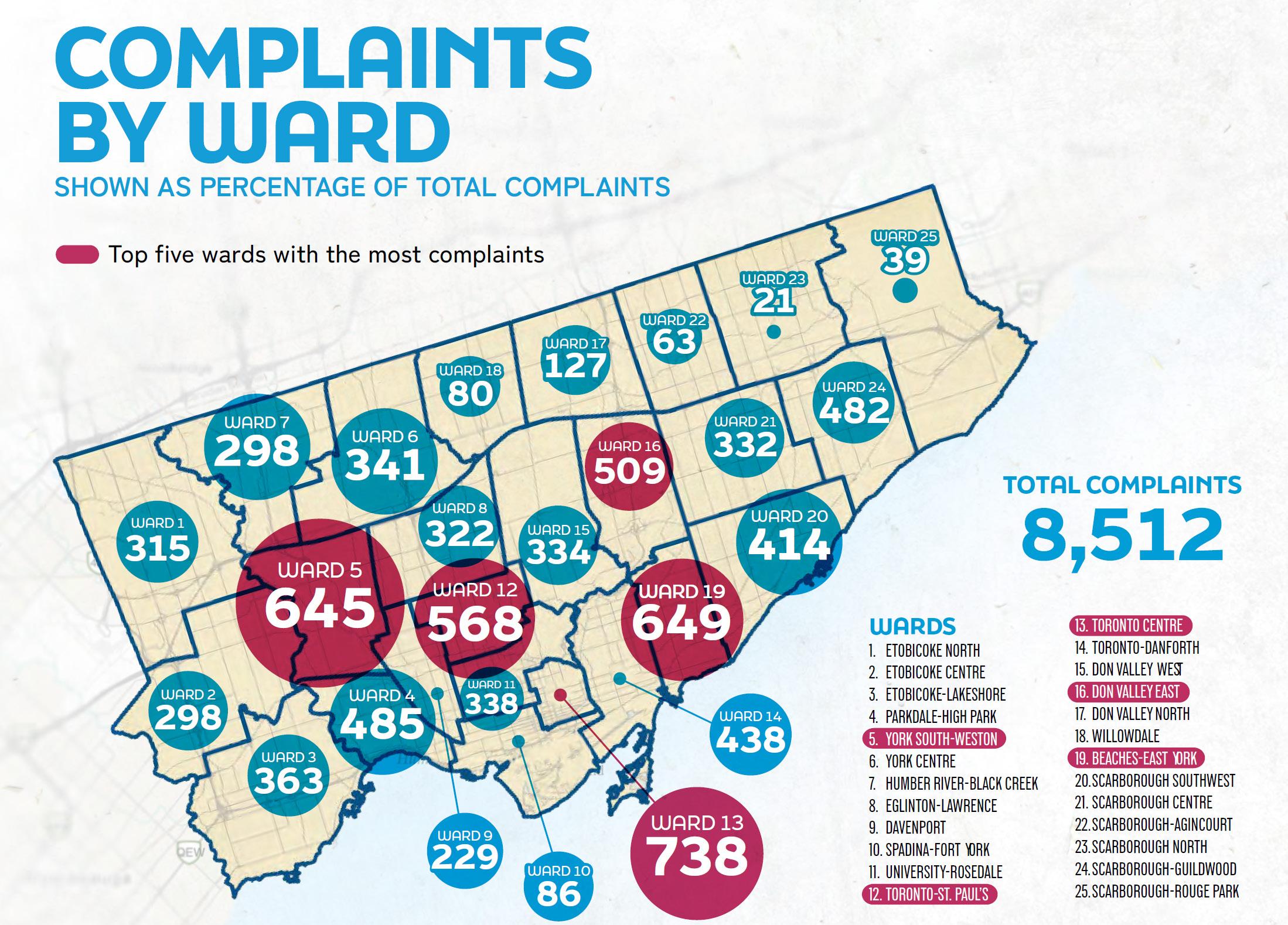

• Closed 89% of 8,512 service requests received (inclusive of audits); 903 (11%) service requests remain open;

• Responded to 95% of emergency service requests within 24 hours and 92% of non-emergency service requests within 5 days;

• Issued 1,187 Orders to Comply and 132 Notices of Violation as a result of Service Requests;

• Issued 20 Orders to Comply/Notices of Violation as a result of Building Audits; and

• Fines for violations totalled $110,950.

In 2022, staff began working on the redesign to ensure the tool prioritized issues with a greater impact on the health and safety in addition to ensuring ongoing violations and issues of non-compliance are factored into a building’s evaluation score.

Updated Evaluation Categories and Reactive Building Scores

A critical component of the tool’s redesign includes the addition of new evaluation categories and a new weighting mechanism to account for the health and safety risk posed by a particular score. Pilot testing was conducted concurrently with the 2022 evaluation cycle to obtain data and assess the potential impact of the proposed changes on building scores. The redesigned evaluation tool was phased in for building evaluations starting in June 2023, with full implementation expected in 2025.

As of June 1, 2023, registered buildings are now being evaluated against 50 categories organized according to building exterior and/or interior and mandatory plans and notification board requirements. Of the 50 categories, the redesigned tool has 17 High Risk categories, 23 Moderate Risk categories and 10 Cosmetic categories.

• A High Risk category includes components of a building that pose a health and safety concern and/or has a direct impact to a vital service.

• A Moderate Risk category addresses components of the building that if left unaddressed could result in heightened health and safety risks.

In-house

• A Cosmetic category contains component(s) of the building that affect the visual appearance of the property but does not interfere with the core functionality of the building.

applied for a minimum of 30 days or until compliance is achieved. If a building has an Emergency Order under Chapter 629, a 2% deduction is applied for a minimum of 4 months or until compliance is achieved.

Final building evaluation scores are calculated by subtracting the reactive data (i.e., Notices of Violation, Orders to Comply, Emergency Orders) from the proactive data (physical building evaluation score) and then converting the final score into a percentile ranking Through the revised tool, building audits will now be conducted in buildings that score in the bottom 2.5 percentile, rather than a static evaluation score of 50% or below. This revision to the building score methodology allows the program to take a more dynamic and comprehensive review of those buildings that are not meeting standards in comparison to all buildings registered within program. In addition, buildings will now be evaluated every two years to ensure that they are measured consistently and evaluated at the same frequency. This will help to simplify the scheduling of building evaluations, better allocate staff resources, and improve service delivery.

Given the goal of the RentSafeTO program is to improve how buildings are pro-actively maintained, changes to the evaluation tool are meant to enhance the ways in which the program can support building owners and operators to comply with various bylaw requirements. A summary of changes to the building evaluation are included below for reference.

Previous Process (2020 – 2022)

Categories 20

The categories are scored on a rating scale from 1 to 3 (1 being the lowest and 3 being the highest); if an immediate health and safety risk or high priority risk is identified, an Order to Comply will be issued and the related evaluation category will receive a score of 1. Once a building evaluation is completed, each category is then weighted based on the risk posed to health and safety. A score for a High Risk category is assigned a weight of 3% whereas a score for a Medium Risk category is assigned a weight of 2% and a score for a Cosmetic category is weighted as 0.5%. The total score a building receives for the 50 categories during a building evaluation constitutes its “proactive data”. Furthermore, in response to Council direction to take into consideration the impact of confirmed Notices of Violations, Orders to Comply or Emergency Orders, as well as in-suite conditions on a building’s score, the redesigned tool has introduced “reactive data”. Reactive data constitutes any established violations in common areas and in-suite. If a building has a Notice of Violation or Order to Comply, a 1% deduction is applied for a minimum of 30 days or until compliance is achieved. If a building has an Emergency Order under Chapter 629, a 2% deduction is applied for a minimum of 4 months or until compliance is achieved. Final building evaluation scores are calculated by subtracting the reactive data (i.e., Notices of Violation, Orders to Comply, Emergency Orders) from the proactive data (physical building evaluation score) and then converting the final score into a percentile ranking. Through the revised tool, building audits will now be conducted in buildings that score in the bottom 2.5 percentile, rather than a static evaluation score of 50% or below. This revision to the building score methodology allows the program to take a more dynamic and comprehensive review of those buildings that are not meeting standards in comparison to all buildings registered within program. In addition, buildings will now be evaluated every two years to ensure that they are measured consistently and evaluated at the same frequency. This will help to simplify the scheduling of building evaluations, better allocate staff resources, and improve service delivery.

Source: All graphics from City of Toronto, Rentsafe Program Update Report (2024

Current Process (started in 2023)

50 (17 High Risk, 23 Moderate Risk and 10 Cosmetic)

Rating Scale 1 to 5 1 to 3

Weighting No weighting

Evaluations Every year (< 65%)

Every 2 years (66% - 86%)

High Risk (3%)

Moderate Risk (2%) Cosmetic (0.5%)

Every 3 years (> 86%) Every 2 years

Audits All buildings that score < 50%

Measurements In-suite violations not factored

All buildings that score within the bottom 2.5 percentile

Order to Comply/Notice of Violation (1% deduction for a minimum of 30 days)

Emergency Order (2% deduction applied for a minimum of 4 months)

Building Envelope Repairs

Parking Structure

Roof Assessment & Replacement

Window Upgrades

Site Improvements

Interior Upgrades

.

The Canadian Human Rights Commission was established by Parliament through the Canadian Human Rights Act (CHRA) in 1977. It has a broad mandate to promote and protect human rights.

In 2019, Parliament passed the National Housing Strategy Act. The Act recognizes housing as a human right, and commits organizations and governments to reform housing laws, policies and programs from a human rights perspective; and to involve communities in meaningful ways.

The Act calls for the “progressive realization” of the right to housing. This means Canada must set specific timelines and goals in its housing strategy that make tangible progress towards the right to housing. It also means Canada must prioritize the most vulnerable groups and those in greatest need of housing while it works towards housing as a human right for all.

In March 2024, Toronto’s new Housing Rights Advisory Committee (“HRAC”) held its inaugural meeting.

According to the City, HRAC will provide a forum for those with lived/living experience of housing precarity, homelessness and discrimination, as well as housing advocates, academics and service providers, to advise and inform City Council on policies, programs and decision-making as it pertains to furthering the progressive realization of the right to adequate housing.

The City of Toronto is committed to advancing the right to adequate housing and recognizes that housing is essential to the inherent dignity and well-being of the person and to building sustainable and inclusive communities. This commitment is set out in the Toronto Housing Charter (which is) consistent with the federal Housing Policy Declaration adopted as part of the National Housing Strategy Act S.C. 2019

The mandate of the Housing Rights Advisory Committee is to provide advice to City Council on strategies and actions required to achieve the City’s commitment to progressive realization of the right to adequate housing:

• Advise on policies, programs and actions that the City can implement;

• Ensure that the interests and needs of those with living/lived experiences of housing precarity, discrimination and homelessness are reflected in City programs and service delivery;

• Support engagement with Indigenous, Black and other equity-deserving communities to help identify and remove systemic barriers to accessing and maintaining adequate housing;

• Advise on advocacy and communications with other orders of government by providing advice on actions that can be taken to address systemic barriers to adequate housing which lie outside of municipal jurisdiction;

• Independently monitor progress of the HousingTO 2020-2030 Action Plan’s implementation, through publicly available data;

• Take an intersectional approach to the work of the Advisory Committee in support of and aligned with the City’s commitments to Indigenous Peoples advanced through the City’s Reconciliation Action Plan from 2022 to 2032; and with the City’s commitments to confronting anti-Black racism in Toronto advanced through the Toronto Action Plan to Confront Anti-Black Racism in 2017.

There are twelve members, including Councillor Gord Perks as the only elected official on this committee. At the first meeting, Elizabeth McIsaac was elected as this Committee’s Chair.

Sam passed away peacefully on April 18th, 2024 surrounded by his family in Clearwater Florida. He was 83 and is survived by his loving wife Sharon (Feldman) of 62 years and his children Susan & Steven Snider, Michelle & Richard Gordon, and Aaron Grossman. He will be dearly missed by his adoring grandchildren Evan (Olivia), Brett, Jonah, Miles, and Shayla.

In 1998 Sam was selected as the inaugural Chair of the Greater Toronto Apartment Association. It was with his leadership in the early years that GTAA able to take seed. And beyond his term as Chair, he remained on our Board of Directors to ensure that GTAA blossomed.

Gladly he was on stage as we toasted to celebrate our 25th Anniversary at our Annual Dinner in October 2023.

Years ago upon his retirement, in recognition of his contribution to our industry, GTAA’s Board of Directors decided to create an award to recognize peers who distinguished themselves in our industry and in the community.

Sam was big a Blue Jays fan and made his retirement home not far from Dunedin, where the Jays held spring training. Although he was retired and spent much of his time in Florida, he pencilled in our Annual Dinner each year and always attended to present the Sam Grossman Award of Excellence.

Through the pre-dinner reception he caught up with many old friends, and often got reacquainted with younger generations who were continuing in our industry. He was always available to discuss policy and a variety of things as Sam seemingly knew everything.

Each year during dinner, Sam would marvel at how GTAA had grown. We’re here due to Sam and others who felt establishing GTAA was important so that the local voice of rental housing would be heard. The Sam Grossman Award of Excellence and its history of recipients will continue to inspire others to achieve and give back to society. Sam will be missed and the GTAA Family thanks him for his lifetime of commitment to our industry.

Providing Expertise in Building Science and Structural Restoration

Garage & Balcony Assessment & Restoration

Building Cladding Design, Assessment & Remediation

Roofing System Design, Assessment & Remediation

Building Condition Assessments

Capital Planning

Building Renewal

Energy Audits and Modelling

The 24th Annual Greater Toronto Apartment Association Golf Tournament in support of the GTAA Charitable Foundation was held on Monday, May 27, 2024.

Sold-out weeks in advance, eager golfers arrived in anticipation of a great day at the spectacular Lionhead Golf Club, owned and operated by the Kaneff family, longstanding GTAA Members. Unfortunately it rained … a lot, for a long time. Most threw in the towel after just 3 or 4 holes. While they braved the deluge many had an opportunity to have an ice cream bar or sip a hot latte on the course. Moreso, there was great discussions with GTAA Suppliers who all provided shelter with tents at the tees.

The Kaneff’s team accelerated the cocktail reception and converted our early dinner into a full served lunch. This outstanding performance was greatly appreciated.

And so many huge prizes: $1,500 Air Canada; 60 bottles of wine with a $500 LCBO boost; $500 Home Depot GC; Toronto FC, Blue Jays and Raptors tickets; Leafs’ jersey, and Wrapsody headphones. On top of this, every golfer received a $50 Home Depot gift card on their way in to start the day.

This event is only possible with the generous sponsorship of our members, especially our Headline Sponsors.

Sincerest gratitude to all the companies who sponsored our event, donated prizes and all the players who participated.

This event is our main annual fundraiser for our charity. All the proceeds are donated to a variety of local organizations to support their terrific community programs. With our industry’s support this year’s event raised an incredible $70,000 for our Charitable Foundation. We will present this, and more, to worthy groups during our annual industry celebration dinner on October 30, 2024.

Special thanks to all the volunteers who put everything together to make sure you had a great day. Our Grand Prize winner – Ron of Torque – took home a $1,500 Air Canada gift card.

Our golf tournament offers the opportunity to make great contacts, network with industry peers, see friends, enjoy a delicious meal, win fabulous prizes and have a fun day away from the office … all while raising much need money for very deserving organizations that rely on our Charitable Foundation.

To more than make up for the rainout, every golfer received a raincheck for a round of golf. Please use your voucher this season and introduce/bring your friends and family to Lionhead Golf. This is a perfect opportunity to practice for next year’s event … GTAA is returning in May 2025!

The increasing occurrence of lithium-ion battery related fires, especially in public places (TTC subway car) and apartment buildings is of growing concern. The use of micro-transportation devices has surged, and their propulsion batteries are often the ignition sources of fires.

In March 2024, GTAA hosted a webinar with Toronto Fire Services to educate our members. While lithium-ion batteries aren’t inherently dangerous, its valuable to be as knowledgeable as possible especially when related to resident safety and asset protection.

Our expert panel included Division Chief Marla Friebe and Division Chief Kevin Hooke both from Toronto Fire Services, and Kristin Ley, Partner, Cohen Highley Lawyers to provide legal insight from a housing provider’s perspective.

The following are a few key highlights provided by our experts.

Lithium-ion batteries are found in many common devices, including smartphones, laptops, tablets, e-bikes, mobility scooters, e-cigarettes, vacuums, lawn equipment, smoke alarms and toys.

These batteries store a large amount of energy in a small amount of space.

Certified lithium-ion batteries that are properly charged, used and disposed of are generally safe. Overcharged, modified or damaged batteries are not safe and can cause a fire or even explode.

When energy is released in an uncontrolled manner, it generates heat. Thermal runaway is when the lithiumion cell enters an uncontrollable, self-heating state and can result in extremely high temperatures, violent cell venting, smoke and fire.

Among the reasons this can occur are:

• Batteries are defective.

• Batteries have been damaged.

• Batteries are not used the right way.

• Batteries have been tampered or modified.

Some best practices:

• Always follow manufacturers’ instructions.

• Use only the battery that is designed for the device and the charger cable/cord that came with it. If you need to replace your charger, buy it from a trusted source and make sure the voltage and current are compatible with your device.

• Contact the original manufacturer if you need a replacement charger for items such as e-bikes, remote control cars and power tools.

• Only use chargers with a recognized Canadian certification marks, such as: CSA, cUL, cETL.

• Purchase and use devices that are listed by a qualified testing laboratory like UL / ULC.

• Never modify or tamper with your battery.

• Keep your battery in sight when charging and unplug it when charging is complete.

• Do not cover or charge your device on soft surfaces such as under your pillow or on your bed or couch.

• Lithium-ion batteries are household hazardous waste. Do not dispose of lithium-ion batteries in the trash; Take them to a battery recycling location.

Toronto has committed a webpage to this growing concern. It provides information and posters for you to distribute to educate your staff and residents: https://www.toronto.ca/community-people/public-safety-alerts/safety-tips-prevention/home-high-rise-schoolworkplace-safety/lithium-ion-batteries/

While you’re on the website, it’s always a good idea to refresh your memory and be up to date. Expand the first tab and scroll down for a brochure on High-Rise safety (available in many languages): https://www.toronto.ca/community-people/public-safety-alerts/safety-tips-prevention/posters-pamphlets-andother-safety-resources/

For more information, please contact us info@gtaaonline.com and stay safe.

The Greater Toronto Apartment Association continues to work on your behalf on a range of issues affecting our industry across the region.

Our local, regional and national attention is on our housing supply shortage. GTAA has explained to municipalities that they need to provide significant financial incentives to get much needed purpose-built rental developed. We’re nearing 50 years of chronic undersupply. Governments have finally started to give a bit, but with recent increases in construction costs and financing rates it remains one step forward and two steps backward. GTAA pursuit of this is consistent and ongoing.

As governments chase a carbonless society, GTAA has been at the forefront on several working groups and consultations. Housing is the largest source of GHGs, but we can’t easily all switch away from natural gas because our local electricity provider can’t supply the load required by all our buildings. The delivery of reliable increased capacity needs to be sorted and guaranteed. While this is happening, we are investigating the best ways to perform deep retrofits of our aging rental stock. Net zero comes with immense challenges and great opportunities. GTAA is working to decipher it and help show you a path forward.

Just as we started our current fiscal year, Toronto City Hall took a hard left turn. On June 23, 2023, ballots were cast and Olivia Chow was elected as Mayor. This included newly bestowed Strong Mayor Powers, and the sole responsibility for setting the City’s annual budget. In short order, Committee Chair’s and key roles shifted. It’s never easy at City Hall, and we keep working to protect our interests.

Our association is fiscally responsible and able to maintain affordable fees which have remained the same for more than a decade.

Our association has delivered tremendous value and is worthy of your continued membership. It is important that we all stand together to be heard with one large collective voice on matters of importance, especially as we enter a new landscape.

Thank you for your continued support as we work diligently for the industry!