I went to Word on the Street (WOTS) in downtown Toronto on the last Sunday in May. I’ve been going every year since it started as a small bookselling festival. It’s grown over the years and moved around different parts of the city. It’s also shrunk compared to previous years, with fewer vendors, authors’ tents, seminars, and other features. When it was at Harbourfront, it was “better” than it is now. But when it initially moved to Harbourfront, it became “worse” before it got “better”. Things change with time, and different does not always mean better or worse. Change can be difficult to handle but it’s often up to the individual to make the most of the experience.

This issue of RHB Magazine features a summary of the most recent episode of Real Estate Legends: Past, Present, and Future on BoldTV. Vanessa Topple, Anchor and Producer of BoldTV, sits down with Gloria Salomon, CEO of Preston Group. You will learn about Gloria’s initiation into (and views on) the rental housing industry, how Preston Group has changed over the years, her family and charitable involvement, her plans for the future, and advice for people entering the industry.

The second article describes how deep retrofits can significantly reduce a building’s carbon emissions. It uses the Castleview case study to examine three different levels of energy retrofits, showing the potential GHG savings and change in the whole building’s effective R-value. The third article describes what people would experience if they attended this year’s CFAA Rental Housing Conference in Halifax (June 14-16, 2023).

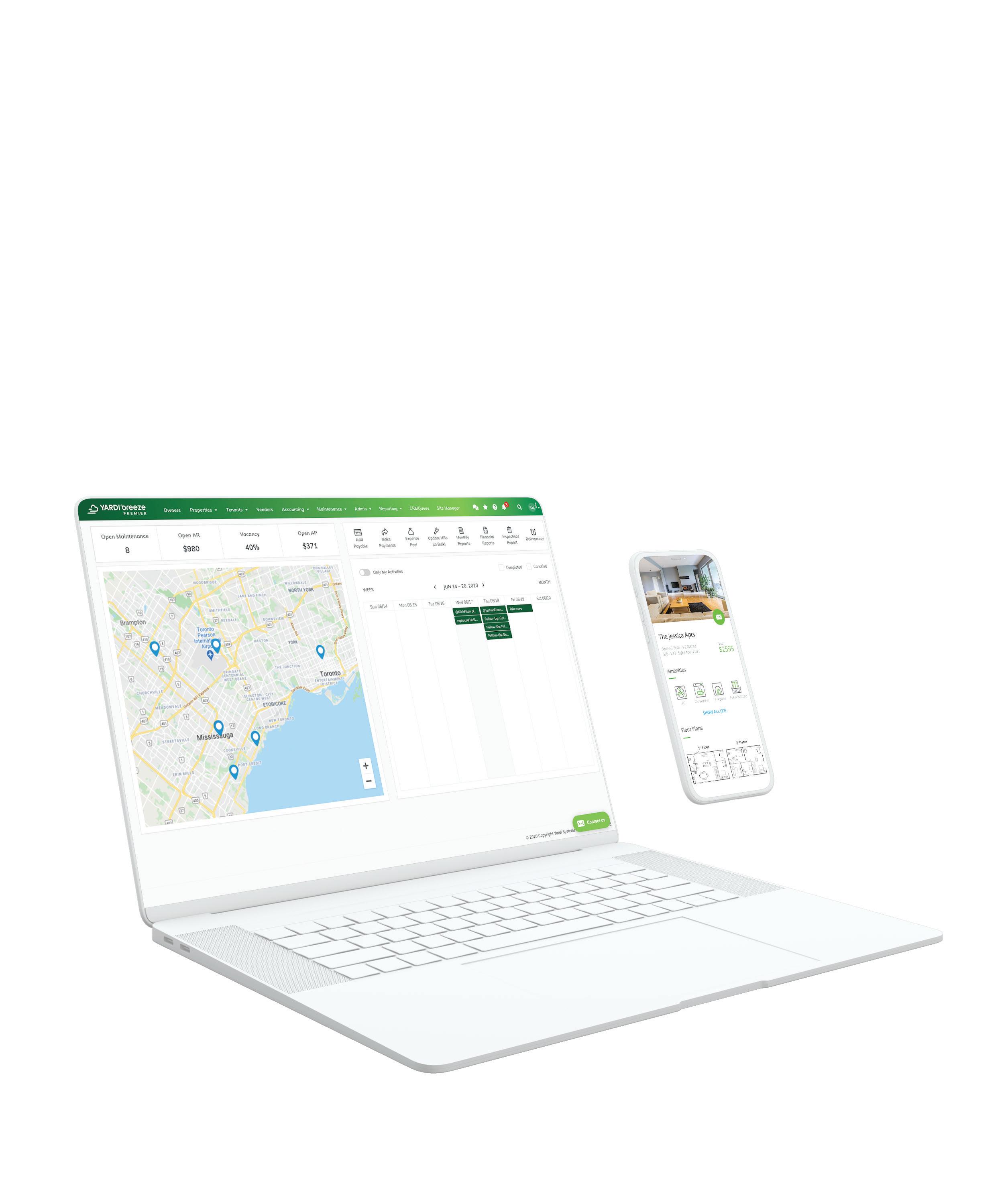

Don't forget to read CFAA’s newsletter, National Outlook , as well as the Regional Association Voice. FRPO is launching the third annual Conscious-Living Box giveaway as part of its CRB Living GREEN Together™ program. Yardi Canada wraps up this issue by explaining the benefits of benchmarking your data to guide rental housing decisions.

We enjoy hearing from our readers, and we want to support twoway communication. If you have any comments or questions, send them to david@rentalhousingbusiness.ca. I look forward to your emails.

Publisher Marc Côté marc@rentalhousingbusiness.ca

Associate Publisher

Nishant Rai

Editorial David Gargaro david@rentalhousingbusiness.ca

Contributing Editor John Dickie, President CFAA jdickie@rentalhousingbusiness.ca

Creative Director / Designer Scott Clark

Photography Noah Goldentuler

Sales Executive Justin Kreslin

Office Manager

Geeta Lokhram

Subscriptions

One year $49.99 Cdn

Two years $79.99 Cdn

Single copy sales $9.99 Cdn

Opinions expressed in articles are those of the authors and do not necessarily reflect the views and opinions of the CFAA Board or management. CFAA and RHB Inc. accept no liability for information contained herein. All rights reserved. Contents may not be reproduced without the written permission from the publisher.

P.O. Box 696, Maple, ON L6A 1S7 416-236-7473

Produced in Canada

David Gargaro Senior EditorAll contents copyright © RHB Inc. Canadian Publications Mail Product Sales Agreement No. 42652516

This episode of Real Estate Legends features Gloria Salomon, where we learn about her background, her family, and her future plans.

Investing in energy retrofits can reduce your building's GHG emissions and improve its effective R-value.

four member associations.

Successfully benchmarking your data Property owners and managers can analyze their data to guide rental decisions.

To address Canada’s housing crisis, the federal government knows it must encourage more housing supply, but it also wants to curb what it sees as bad behaviour among housing market actors, including rental owners. Two important consultations will address ”financialization”, the profit motive, and how they interact with the new federal right to housing. One consultation is at the House of Commons HUMA Committee, while the other is in front of a Review Panel of the National Housing Council. See page 35 for more details.

CFAA has been heavily involved in representing all segments of the rental housing industry through meetings with, and representation to, different government decision makers and advisors. That work is continuing at the HUMA Committee, the National Housing Council, the Minister of Housing, the Finance Department and the Prime Minister’s Office.

CFAA is also working closely with the Federation of Rental-housing Providers of Ontario (“FRPO”), the five publicly traded apartment REITs, and REALPAC, which represents many of the largest rental housing providers in Canada as well as office tower and shopping centre owners. We are coordinating our efforts to achieve the best results for rental housing providers of all sizes.

CFAA has been informing CFAA-member associations and direct members about the issues. Volunteers have been providing input and taking part in the consultations to date. CFAA expects to inform and consult with member associations and direct members more as various issues come to a head.

CFAA-Rental Housing Conference 2023 is being held in Halifax from Wednesday, June 14, to Friday, June 16, 2023. See the article on page 30 for a description, and why you should plan to attend CFAA-Rental Housing Conference 2024 in Toronto in May 2024.

The Home Depot is a CFAA Strategic Partner. By registering your membership in CFAA (either directly or through one of CFAA’s 13 member associations) with Home Depot Pro, you benefit yourself and CFAA. This partnership benefits every rental housing provider reading this magazine.

Yardi Systems is another long-standing CFAA Strategic Partner. As well as receiving Yardi’s help with rent information, we look forward to continuing to work with Yardi to bring you the latest and best information on technology for rental housing providers.

If you are not already a direct member of CFAA, please join CFAA as a Direct Rental Housing Provider Member, or a Suppliers Council Member. Visit www.cfaa-fcapi.org or-e-mail admin@cfaafcapi.org today!

35. How can you find out what the Federal Housing Advocate thinks about private rental housing providers, and what tax and mortgage rules she wants to change? What is coming up at the HUMA Committee? Why is it so important for rental housing providers?

Corporation des Propriétaires Immobiliers du Québec (CORPIQ) www.corpiq.com

P: 514-748-1921

Eastern Ontario Landlord Organization (EOLO) www.eolo.ca

P: 613-235-9792

Federation of Rental-housing Providers of Ontario (FRPO) www.frpo.org

P: 416-385-1100, 1-877-688-1960

Greater Toronto Apartment Association (GTAA) www.gtaaonline.com

P: 416-385-3435

37. The CFAA Rental Housing Awards for 2023 have been judged. Who are the finalists? What are the awards categories? Find out who the winners are from the Awards Dinner in Halifax, or a CFAA e-Newsletter.

Hamilton & District Apartment Association (HDAA) www.hamiltonapartmentassociation.ca

P: 905-632-4435

Investment Property Owners Association of Nova Scotia (IPOANS) www.ipoans.ns.ca

P: 902-425-3572

LandlordBC www.landlordbc.ca

P: 1-604-733-9440

Vancouver Office P: 604-733-9440

Victoria Office P: 250-382-6324

41. Want to raise net revenue for your company? Optimize employee pay, satisfaction, motivation and retention. Provide your compensation data, confidentially, by June 30, for a substantial discount on the CFAA report you need!

To subscribe to CFAA’s e-Newsletter, please send your email address to communication@cfaa-fcapi.org.

The Canadian Federation of Apartment Associations represents the owners and managers of close to 1.5 million residential rental suites in Canada, through 13 apartment associations and direct landlord memberships across Canada.

CFAA is the sole national organization representing the interests of Canada’s $950 billion rental housing industry.

For more information about CFAA itself, see www.cfaa-fcapi.org or telephone 613-235-0101.

London Property Management Association (LPMA) www.lpma.ca

P: 519-672-6999

New Brunswick Apartment Owners Association (NBAOA) www.nbaoa.ca

jbrealsetate@nb.aibn.com

Manufactured Home Park Owners Alliance of British Columbia (MHPOA) www.mhpo.com

P: 1-877-222-4560

Professional Property Managers’ Association (of Manitoba) (PPMA) www.ppmamanitoba.com

P: 204-957-1224

Saskatchewan Landlord Association Inc. (SKLA) www.skla.ca

P: 306-653-7149

Waterloo Regional Apartment Management Association (WRAMA) www.wrama.com

P: 519-748-0703

Wyse delivers green technologies to multi-unit residential and commercial buildings across Canada.

Metering more than 250,000 units nationwide, Wyse products and ser vices help owners reduce utility costs and achieve ESG goals.

2

4

5

source: 2022 National Edition theAnnual

1 St. John’s, NL - 22.5%

Moncton, NB - 19.6%

3 Saint John, NB - 15.3%

Halifax, NS - 11.1%

Charlottetown, PEI - 10.2%

1 St. John’s, NL - 22.5%

Moncton, NB - 19.6%

3 Saint John, NB - 15.3%

Halifax, NS - 11.1%

Charlottetown, PEI - 10.2%

BoldTV recently recorded another episode of Real Estate Legends: Past, Present, and Future. The show features the biggest names in real estate, digging into the parts of their lives that are not found in articles and corporate bios. Viewers will learn how those big names became legends from their personal life stories and the struggles they overcame to build the lives they have today.

This episode of Real Estate Legends featured a personal and candid conversation between Vanessa Topple, Anchor and Producer of BoldTV, and Gloria Salomon, CEO of Preston Group. RHB Magazine attended and recorded the event to share it with our readers. To watch a video of the interview, visit BoldTV.ca/exclusives.

Gloria’s father, David Salomon, started Gonte Construction Limited in the 1960s, forming the foundation for what would become the Preston Group. He later partnered with WJ Realty to develop multi-unit residential properties, which WJ Realty also managed. In the 1980s, David restructured and separated from WJ Realty, taking his share of the rental properties.

“In 2015, with family succession planning, a division of properties took effect,” said Gloria. “I separated from family members, took over full control of my own properties with the help of my son, Bryan, who a year earlier joined my company. and continued with the Preston Group name.”

In addition to its current portfolio, Preston Group has more than 1,700 units in the pipeline over three sites, and more than 1,200 currently under construction. They anticipate having approximately 3,000 units constructed over the next six years. The company’s most recent development, 2Fifteen, is located on Lonsdale Road in Toronto’s Forest Hill neighbourhood. The luxury rental property provides high-end, boutique hotel-style curated services for its residents.

While she was in university, Gloria worked at WJ Realty in the summer, which gave her a foundation in the apartment management industry. She joined her father in managing the company’s rental properties, along with her brother-in-law. As the company grew and added more properties, they set up a separate property management office.

“My father was my mentor,” said Gloria. “He taught me the importance of hands-on management, being preventative rather than reactive to issues that may occur. He had great skill in dealing with people. He was always very comfortable working with people and he admired people who had ambition and an ability to adapt. He promoted people from within. If he felt that they were capable, he’d move them up to higher levels of responsibility. He was a shrewd businessman. He always made a good deal but he was always very well respected in the industry.

Gonte Construction later began developing a lowrise home building business. They were involved in developing a large community in Prestonvale, Ontario. This led to a decision to rebrand the business to incorporate all of their various businesses. The Salomon family established the Preston Group as the umbrella name, and then moved to their new (and current) head office on Curity Avenue.

Preston Group has two active developments under construction. Bela Square, located on Eastdale Avenue in East York, consists of two towers with 404 and 80 units, respectively. These purposebuilt rental units include both affordable and midrange rentals. They are also building two condo towers at Metro Park in the Don Mills and Eglinton area of North York, with 412 and 140 units, respectively. Phase one is sold out, with phase two coming to market later this year.

Gloria believes in giving back to the communities in which Preston Group does business. Fifteen years ago, while building Copper Hills, a housing community in Newmarket, the company supported Southlake Regional Hospital by donating to its new women’s health facility. More recently, Preston Group has committed to helping Scarborough Health Network expand its new imaging department in women’s health with a new digital mammography system. The donation is a tribute to Gloria’s father, who always admired strong, independent women who had control over their professional and personal lives.

“My father saw the importance of a secure home life as a basis for future growth,” said Gloria.

Vanessa: Before we talk family, which I know is a huge passion of yours, I want to ask you about another passion and that’s your background in accounting. How did that translate for you into the apartment industry?

Gloria: Through circumstances that evolved with timing, I think the accounting profession is a great background to have. My skills as a CPA has allowed me to feel very comfortable dealing with the financial aspects of the business, which is very important. I mean, your whole operating schedules, budgets, dealing with income and expenses, and making a building profitable, you need to have that financial background to really help guide you through it.

Vanessa: You’ve been in the industry now for over 40 years. I’m sure you’ve seen your fair share of challenges. Can you tell me sort of what the biggest challenge you face to date has been?

Gloria: I would say that there have been many ups and downs in the industry over the years. But it is mostly challenges dealing with government intervention, rules and regulations, trying to regulate the industry. Professionally managed buildings know how to manage their buildings. They know that tenants are their clients and they have to treat them properly and run their buildings

efficiently. I think that some of the challenges are, of course, bad apples that get written up in the newspaper and it sort of stains the industry personnel as a whole. But I think the idea of landlords has gone through a transition in the past few years that it’s more respected in the industry due to the education and the associations of professional associations that have come about, such as FRPO and GTAA, guiding people in their buildings.

Vanessa: What advice would you give to somebody who is thinking of getting into a career in this industry?

Gloria: I say jump right in! There’s such a need for qualified people in all levels. I mean, if you have an idea of enjoying financial analysis, you can start in head office working in accounts payable, accounts receivable, financial budgeting, all those things. But if you’re more hands-on and enjoy working with people, on-site staff are very important in doing repairs, superintendents, property managers, dealing with the residents. There’s something for everybody.

Vanessa: It sounds like there’s lots of opportunity and a definite need there as well.

Gloria: Absolutely.

“Women’s health is fundamental to a family. That is something I truly believes in and want to help others achieve.”

Internally, Preston Group created an employee recognition and rewards program. Gloria is proud of the fact that some of their employees have been working for the company for over 30 years.

“We hope to further show our appreciation to all our employees through the recognition and rewards program,” said Gloria. “We will also be giving away an annual award named after my father called the David Bela Solomon Award, featuring an employee that really goes above and beyond.”

Vanessa: What are your thoughts on the industry today?

Gloria: The industry is very, very vibrant. I think it’s challenging in that we are providing homes for a growing population. And the industry is tasked with providing these homes and we need to provide accommodation for all types of people. That’s where the government may still have to step in and help us. But our job is to provide good quality accommodation for people. They’re looking for a great place to raise their family, they’re looking for newer, nicer buildings and that’s what we’re hoping to provide.

They don’t necessarily have the down payment to get into the housing market, but they want nice new accommodation. And our existing legacy buildings are always going to be affordable and well maintained for people who cannot afford the new professionally managed rental buildings that are being built now. That’s what we’re striving to cover in both ends of our business.

Vanessa: I know you’re a bit of a philanthropist yourself and you have a couple charities that are near and dear to your heart that I want to speak about. One of them is the Friends of Simon Wiesenthal and the other is the Association for the Soldiers of Israel. Can you tell me how you got involved with these charities and why they’re so important to you?

Gloria: They’re important to me because they were my father’s two favourite charities and I carry on with them in his honour. When he arrived in Toronto shortly after the war as a single man with very little money in his pocket, he worked very hard to establish himself and once he was successful, he went back and he supported these organizations. One is the Association for the Welfare of Soldiers in Israel, which is a great organization that provides for the well-being of soldiers who are in Israel fighting to maintain safe homes for people there. The other is the Friends of Simon Wiesenthal, which is a great organization that tries to educate people on tolerance, fights against hate, and educates people about antiSemitism and the Holocaust. In 2016, I became a Board Director of FSWC, and volunteer my time working with FSWC in helping build a more inclusive and tolerant society by educating Canadians about the lessons of the Holocaust, advocating for human rights, and combatting both anti-Semitism and hate in all its forms.

Vanessa: And what do you think the solutions to some of these issues would be other than the government getting involved?

Gloria: Well, there are always going to be people who are hard to house through various aspects. It’s not their fault due to illness or through an inability to maintain their home on their own. And those are the people that need to be helped by the government. But on the whole, most people are looking for good quality housing to raise their families and we want to provide nice new buildings with new amenities for those people who want to live comfortably for the long term.

Vanessa: Both are wonderful organizations and it’s so nice that you’re involved in those. Let’s talk about your family a little bit. I know we’ve discussed quite a bit at length your dad, but tell me a little bit about your mother. And I know you’re also a grandmother now and you have daughters-in-law. Tell me what that’s like.

Gloria: My mom Rosita is still very well and happy to be with us and I enjoy spending time with her whenever I can. She cherishes her grandchildren and now great-grandchildren. My husband Allan and I have three sons, Bryan, Jason, and Aaron. Both Bryan and Aaron are working with me in our company, which is great. Bryan is the CEO of DBS Developments. He works on all our asset management and runs our head

office. He’s also a CPA, so he runs most of our financial work at the office. I’m very happy that Aaron has come back and joined us as a project coordinator in the property management of our communities. And our middle son, Jason, is in the Air Force. He’s a pilot and flying Chinook helicopters for Canada. I enjoy making family dinners and getting together with our boys and their lovely wives. They are the daughters I never had, and I love seeing the relationships grow.

Vanessa: And you have a grandson.

Gloria: I now have a bundle of joy. My little Elijah, our first and only grandson so far and now I truly understand what all my friends were talking about when they said you just can’t wait to become a grandma.

Vanessa: We can’t talk about your family though without including your other half, your husband, Allan. He is a dentist by profession. With you being in the industry for 40 years, being married for 41 years to Allan, how did you guys maintain a work-life balance together?

Gloria: Well, you know what? My husband has been very, very supportive of my career. I mean, he understood right when we got married, I was just working to obtain my CA designation. He knew I was going into the family business and it would be very demanding, and he supported me with raising our children. We always had some extra help, of course, because I maintained my job throughout my children’s lives, but he was a very, very important part of helping me succeed. And we relied on our family members, his mother, my mother, to come in and step in when we needed them, and we were very fortunate to have their support.

Vanessa: When you’re not busy working or with the family and it’s time to relax and unwind, what can we find you doing?

Gloria: I’ve always enjoyed keeping fit, doing exercise. I don’t know if I told you, but when we built our office at 11 Curity, we built a gym in the basement. And it is great. We could work out at lunch times. We have yoga once a week for staff who would like it. And it’s been a great asset to us. I also enjoy swimming and spinning. Now that I spend some time in Florida, I’ve been playing a little more golf. My husband and I play golf once a week. We call it divorce golf. We try to get through a round without getting divorced: so far so good. He’s trying to teach me the art of the perfect swing and consistency. I’m still learning that.

Vanessa: You and me both on that one. I know you’re semi-retired now, but what does the next five years hold for you, Gloria?

Gloria: Well, we are going through another brand positioning with our company and very shortly we will be known as DBS, which is named in honour of my father, David Bela Salomon. Because we’re going back to the beginning. We’re building apartment buildings like he did. I will be Chairperson of DBS, our new umbrella company, encompassing DBS Developments who will be investing in and building new assets to grow the company, and DBS Communities, which will ensure the properties are managed well into the future. I will still keep in touch whether remotely or in person with our staff and ensure everybody is doing well and being happy.

Vanessa: You have an amazing life, an amazing career, and an amazing family, you know I could talk to you for hours and it’s very obvious why you’re a legend in real estate. But I’d love to take a tour of this beautiful new building. Should we go take a look?

Gloria: Let’s go. I’d love to show you.

The Byng Group provides end-to-end turnover services for multifamily residential properties across Ontario. Ranging from a standard apartment turn to a full reposition, Byng’s vertically integrated offering combined with proprietary technology to provide customers with a reliable solution that is unmatched in the market.

Whether you’re turning over one unit or a hundred, the renovation process presents significant complexities for all stakeholders.

• Short lead times

• High volume

• Sequencing and coordinating the multitude of tasks required

• Minimal time to complete

• Cost uncertainty

The Byng Group offers end-toend turnover services so clients are involved in the process in a more time and cost-effective way, allowing them to focus on the performance of their business.

...all contribute to extended downtime resulting in unncesscary vacancy and lost revenue when any part of the process breaks down.

The Byng Group specialize in navigating industry challenges to provide the right renovation services, at the right price, and within the shortest time possible.

The Byng Group’s integrated end-to-end project approach efficiently coordinates and accelerates every aspect of the turnover process so units can go back to generating revenue without costly delays.

This sophisticated approach coupled with our proprietary technology produces the most seamless renovation experience – and the best result - in the business.

Due to rising energy costs and the imposition of stricter carbon emission targets, there is increasing demand to reduce all current buildings’ energy usage and greenhouse gas (GHG) emissions. One potential strategy that will help owners of multi-unit residential buildings to reach these targets is to invest in energy retrofits.

Every building is different, so there’s no one size fits all solution when it comes to doing energy retrofits of multi-unit residential buildings. But there are general approaches that can provide GHG savings, as well as improve the whole building’s effective R-value, for different building owners’ budgets and needs.

Energy retrofits can help owners of existing multiunit residential buildings to reduce their GHG emissions and energy usage. Such reductions serve to mitigate climate change. Energy retrofits can also plan a major role in adaptation to climate change.

Adaptation involves ensuring buildings can withstand changing and increasing environmental loads, serving to protect the building, the tenants, and the owner’s return on investment. These loads result from changing environmental situations, such as shorter winters, hotter summers, wetter falls and springs, and more extreme weather events. Adaptation strategies can include:

• Installing active heating and cooling control systems to maintain heating, cooling, and thermal comfort

• Using more durable materials, assemblies, and systems to handle higher levels of precipitation and wind

• Adding air filtration systems to ensure higher air quality within the building and units

• Implementing water reduction strategies and technologies

• Protecting buildings against potential flooding scenarios

• Adding backup power systems, ideally from renewable sources that include battery storage Mitigation involves reducing a building’s GHG emissions to reduce the impact of future environmental events. This approach will

contribute to a more sustainable future. Several of the measures will also help to protect the building and its ROI over the long term. Mitigation strategies can include:

• Using passive design to reduce the building’s energy loads

• Upgrading the windows, which produces energy savings and improves the overall comfort level of living spaces

• Improving the efficiency of the building’s mechanical systems

• Implementing renewable energy systems to offset the building’s energy and carbon usage

• Installing LED technology and low flow water fixtures

Canadian governments at all levels are committed to meeting strict carbon emission goals. As a result, there is greater focus on reducing existing buildings’ GHG emissions. To support these goals, the federal government has established a number of programs and incentives to help owners of multi-unit residential buildings to fund energy retrofits.

Some of these programs and incentives include:

• Deep Retrofit Accelerator Initiative: Funding for projects that support the accelerated development of deep retrofits projects in large multi-unit residential buildings

• ENERGY STAR® Portfolio Manager: Benchmarking tool that enables building owners to monitor energy use and GHG emissions

• National Housing Co-Investment Fund: Funding for retrofit construction of mixed-income, mixed-tenure, and mixed-use affordable housing

Minto Apartment Limited Partnership (Minto) owns the Castleview building in Ottawa, Ontario. Built in the early 1970s, the 242-suite multi-unit residential building is 26 storeys and has a gross leasable area of 171,000 square feet. It had never gone through a major retrofit of its building envelope, although the building and its systems have been maintained and upgraded over the years.

The building has a conventional exposed roof assembly, and is primarily clad with precast wall panels and single-pane aluminum glazing systems. The HVAC system consists of five hot water boilers, with suites heated by baseboard convectors. Common areas are ventilated via an air handling unit with hot water heating coils, and there is only a small ductless air conditioner for the elevator penthouse. Three natural-gas fired boilers and eight storage tanks provide the building with domestic hot water. All lighting systems in common areas are equipped with LED bulbs, and units have been outfitted with low flow plumbing fixtures.

Minto contracted RDH Building Science to provide retrofit options for improving the building’s carbon footprint. The study involved conducting an on-site assessment of the property and analyzing two years of weather-normalized utility data to create the foundation for specific retrofit options. According to the data, Castleview uses approximately 7,000 MWh of energy per year, 80 per cent of which is natural gas. The most enlightening discovery was that 70 per cent of the building’s natural gas usage is related to the building envelope and air infiltration-related heat loss.

Minto was given three types of energy retrofit options to choose from: light, medium, and deep. While these options are specific to this building, they demonstrate the amount of work involved in each type of energy retrofit, which could be applied to different types of buildings.

The light energy retrofit consists of repairs to existing systems and like-for-like replacements.

This primarily involves retro-commissioning the existing HVAC system, such as tuning the equipment and controls to ensure the system performs as designed. Calculating the actual energy reduction is difficult to estimate for this type of service, although it could produce 16 per cent in annual energy savings.

This option focuses on base building repairs to the roof and building envelope to maintain serviceability. The majority of the work would involve replacing the existing roof and penthouse roof assemblies, as they have not been serviced in over 20 years. A light retrofit would include renewing the exterior sealant joints on the windows and precast panels.

A light retrofit would have a relatively low capital cost and would result in little to no disruption of tenants. However, there would be no aesthetic improvement of the building and it would result in minimal overall improvements to the building’s performance and tenant comfort. It would also require more regular maintenance than the other energy retrofit options.

The medium energy retrofit builds upon the light energy retrofit plan, and consists of capital repairs and energy retrofit enhancements. This strategy includes installing through-wall packaged terminal air conditioning (PTAC) units with makeup air capabilities to support in-suite ventilation. This would help to reduce airflow from the central air-handling unit (AHU), which could also be upgraded with a variable frequency drive (VFD) or a smaller unit to reduce the central ventilation system air flow.

This option includes replacing all single-pane aluminum windows and balcony sliding doors, which are the main culprits for the building’s heat loss, with aluminum framed, thermally broken windows and doors that have either clear doubleglazed or triple-glazed view glass. The uninsulated underground parking garage would have its soffit insulated to help with preventing heat loss.

A medium energy retrofit would improve in-suite ventilation and could increase resiliency with insuite cooling. Improving the windows’ thermal performance would also save a substantial amount of energy, but it would come at a high

capital cost, and the work would be disruptive to tenants.

The deep energy retrofit builds upon the medium retrofit plan, and results in a comprehensive building upgrade. This plan includes two options

the suite baseboard convectors. If they select the heat pump option, the current condensing boiler would be retained to provide additional heat on particularly cold days.

Both deep energy retrofit options involve a comprehensive building envelope upgrade, which adds an exterior insulated rainscreen overcladding and reduces thermal bridging at the slab edges and balcony curbs. This would significantly improve the building’s overall performance and lifespan. The windows would also be upgraded to fiberglass framed punched windows with clear triple glaze.

A deep energy retrofit would result in long-term improvement to the overall building performance, as well as tenant comfort, and significantly reduce its energy usage and GHG emissions. It would also support flexibility in the design of the new façade and require less maintenance over time. However, it would involve a longer construction period, more interior disruption of tenants, and higher capital costs. Also, if they select the central air-source heat pump option, utility costs could increase in the short term due to the shift from natural gas to electricity.

for improving the central heating plant: either replacing natural gas with electricity via air-towater heat pumps as the main source for the central hot water system, or replacing the hot water boilers with high efficiency condensing boilers. In either case, a terminal unit that can use low temperature heating water would replace

The following table shows the costs, potential GHG savings, and change in the whole building’s effective R-value for each of the energy retrofit options. Costs do not include potential offsets from government incentives for energy retrofits of existing multi-unit residential buildings.

As you can see, the deep energy retrofit has the largest cost but also produces the greatest reductions in GHG emissions and energy usage. This option also significantly increases the building’s overall R-value.

Investing in energy retrofits for multi-unit residential buildings will provide significant opportunities to reduce energy consumption, lower operational costs, and decrease carbon emissions. Deep retrofits can result in significant reductions in GHG emissions, as well as substantial improvement in the building’s effective R-value. While deep retrofits require relatively large investments and will require more time to complete, the long-term benefits to owners, tenants, and the environment are impossible to ignore. However, owners of existing multi-unit residential buildings should choose the energy retrofit solution that fits their specific needs, budget and need for return on investment.

Wednesday, June 14, 2023 12:30 to 5 pm

Departing from the Westin Nova Scotian

Followed by CFAA

Welcome Reception

www.cfaa-rhc.ca

Principal Conference Sponsor |

Principal Conference Sponsor |

CFAA’s annual Rental Housing Conference (RHC) serves several important purposes. Rental housing providers who attend CFAA-RHC 2023 can:

• Learn about best practices and new developments in effectively and profitably managing their portfolios

• Experience the latest in unit layouts, finishes, and amenity packages in impressive new rental buildings

• Network with colleagues and peers, and make new contacts, at social events

• Meet industry suppliers offering new or established products and services

• Understand the issues facing the rental housing industry and how CFAA is addressing them

• Feel good about the role they play in housing Canadian residents, while earning a living for themselves and their clients

CFAA-RHC 2023 is taking place in Halifax from June 14 to 16, while the 2024 conference will take place in May in Toronto.

CFAA-RHC 2023 is timely because the rental housing industry is facing many political threats. Regular readers of RHB Magazine or CFAA’s e-Newsletters are aware of these threats, but here is a short recap.

The federal government has promised to stop renovictions and introduce a system of reporting rent increases on turnover, as well as tax “excessive increases” and implement other measures to limit “excessive profit” in rental housing, including both REITs and corporations. New measures could easily apply to every rental housing provider. The federal government could act on its own, or pressure provinces to enact new rules. Consider what the federal government has done on the carbon tax.

The Federal Housing Advocate and tenant advocates see the solution to the current housing issues as tighter rent control, limiting access to CMHC’s mortgage insurance, and “driving profit out of rental housing”. Both the rental housing industry and mainstream economists believe the opposite: encouraging more rental supply from all suppliers at all price points is the way to increase availability and affordability.

CFAA-RHC 2023 offers discussions of the industry’s political problems and how to address them. Those discussions include the views of

the Executive Roundtable. In a closing keynote, attendees will hear from Paula Munger, VicePresident, Policy, for NAA about her research on the Advocate’s views and the value of profitmaking in rental housing. There are also two breakout sessions for anyone who wants to hear more about the industry’s political issues.

For others who want to focus on improving their management capabilities, CFAA-RHC 2023 offers a selection of sessions on key topic areas:

• Marketing

• Leasing

• Human resources

• Heating and energy issues

• Technology

• Other operational issues

Many sessions involve experienced rental providers and dedicated industry suppliers discussing practical issues facing rental providers and how to address them. Sessions vary year to year. If a topic is repeated at next year’s conference because of its continued importance, the topic usually involves new speakers to provide different perspectives.

If a topic has wide appeal, CFAA may address the fundamentals in one session and exciting new trends in a different session. For example, this year involves two different sessions on digital marketing. Those sessions will be followed by a session on reaching particular audiences of prospective tenants (e.g., students, empty nesters, people of different income levels or work locations).

CFAA conference topics are organized in streams to appeal to attendees with particular interests. For example, there are three human resources sessions this year: programs to promote equity, diversity, and inclusion; cultural interactions to get the best results; and labour market strategies and trends. The sessions take place sequentially on Friday morning so human resources professionals can attend all three. No other conference offers this level of focused human resources education. Sessions entitled “The magic of heat pumps” and “Decarbonization and electrification” make up a stream. They cover topics on which there are numerous education programs, but those other programs focus mostly on single-family homes or commercial buildings, while CFAA’s sessions address the impacts and issues in rental housing buildings and the rules that will apply to rental housing providers.

CFAA-RHC 2023 brings together rental housing providers from across Canada, who operate in somewhat different environments, particularly as to rent control. Rent control laws in Nova Scotia and New Brunswick have changed. Change is in the wind in Ontario.

Many CFAA panellists operate in several provinces. The different approaches and strategies for adapting to new or different rules are valuable insights that cannot be easily found at other conferences.

For most readers, CFAA-RHC 2023 will be over by the time you read this. However, you have plenty of time to prepare for CFAA-RHC 2024, which will take place in Toronto in May 2024. Next year’s conference will cover both new and similar issues, with new twists and updated information.

To stay informed about CFAA-RHC 2024, join CFAA’s e-Newsletter mailing list by sending an email to admin@cfaa-fcapi.org. All CFAA’s e-Newsletters include clear and informative relines, enabling you to easily choose to read them or not as you wish.

CFAA and many colleagues hope to see you next May in Toronto at CFAA-RHC 2024.

The federal government has two main housing policy goals, namely to encourage more rental housing supply, and to rein in “bad behaviour” in the real estate market, including rental housing. It requires deft handling by the government to achieve the second goal without interfering with the first goal. Steps in that direction were discussed in the last issue of National Outlook.

In the 2021 election, the Liberal Party made promises to prevent votes from bleeding to the NDP. Those promises continued in the mandate letter to the Minister of Housing, which tells him to develop:

• Amendments to the Income Tax Act to require landlords to disclose in their tax filings the rent they receive pre- and post-renovation and to pay a proportional surtax if the increase in rent is “excessive”;

• policies to curb “excessive profits” in investment properties …;

• measures to prevent “renovictions”.

Many members of the public think that the problem is rising rents, and the way to deal with rising rents is to limit rent increases more than they are already limited. The advocates want no new construction exemption, no vacancy decontrol and no above-guideline rent increases (AGIs). In provinces with no rent control, the advocates want full, unit-based rent control.

Since rental providers quote rents to prospective tenants, people can easily think that we determine rents. In fact, rising rents are caused by a shortfall of rental supply versus rental demand, and tighter rent control would make that shortfall worse.

Within the House of Commons, the HUMA Committee is studying financialization in rental housing. On May 9 and May 16, the HUMA Committee heard from the Federal Housing Advocate, several left-wing researchers and ACORN. To watch the recordings, visit https://www. ourcommons.ca/Committees/en/HUMA/Meetings. CFAA expects to present several witnesses at the HUMA Committee.

In keeping with the processes created by the National Housing Strategy Act, the National Housing Council has now established a review panel, which will hold a series of hearings on the financialization of purpose-built rental housing, and its impacts.

The NHC review process will include written and oral hearings to hear directly from the public, especially individuals and members of communities affected by the issue under review, civil society organizations that represent and/or serve them, and experts in human rights and housing. CFAA will represent rental housing providers in that process.

Written submissions are due by June 23. From the written submissions, the Review Panel will select the people they will hear from orally. Please let CFAA know if you are willing to participate in a written submission. CFAA will prepare its own submission, but will also gladly work with associations or rental housing providers on additional submissions to counter what the advocates are organizing.

CFAA will also continue to lobby key government decision makers hard on the value to society of the ability to earn profit from rental housing, and of avoiding tighter rent controls everywhere in Canada.

Rental Housing Provider of the Year Over 10,000 units

Rental Housing Provider of the Year Under 10,000 units

Suppliers Council Member of the Year

New Product or Service of the Year - Operations

GrydPark Lot Management

Charging Coast to Coast

Tour

New Product or Service of the Year -

Association Achievement of the Year

Marketing Program Excellence of the Year Brand Awareness

Just Steps Away. Literally. A Venue For

Marketing Program Excellence of the Year Lease-Up

Renovation of the Year

Common area/ Amenity over $750,000

Rental

Rental Development of the Year

Property Manager of the Year Under 1,000 units

Off-Site Employee of the Year

On-Site Employee of the Year

Resident Manager/Superintendent of the Year

As we have done every second year for more than a decade, CFAA will be producing the one and only Compensation & Benefits Survey focused exclusively on the rental housing industry in Canada. For employers in rental housing, the CFAA Report will provide:

Pay averages and ranges for 9 Property positions

Pay averages and ranges for 20 Head Office positions

National, regional and City specific information

The property positions include building superintendent (resident manager), cleaner, doorman (concierge), leasing agent, maintenance technician, property administrator, property assistant manager, property manager and security guard.

Presuming sufficient data is received, the data on property positions will be reported for Toronto, Ottawa, the rest of Ontario, Ontario as a whole, Edmonton, the rest of the West, the West as a whole, and Eastern Canada. All reports will include Canada-wide data for the property positions, and for the head office positions. We also expect to produce a separate report on building superintendents, which will include a breakdown by building size. The benefits report will be Canada-wide, with a breakdown by company size. All specific data will be strictly confidential to the survey consultant, Steven Osiel, who has performed this survey from its inception. Data will only be reported on an aggregate and

As in the past, contributing your employee data will get you a substantial discount on the report pricing. Data collection has begun. The survey results will be provided in September. If you are interested in participating, please e-mail admin@cfaa-fcapi.org.

Spring is quickly turning into summer, as temperatures are on the rise and we are experiencing many more sunny days. If you haven’t already planted your flowers and vegetables, now would be a great time do so. As always, FRPO is hard at work in many areas that would interest members of the rental housing industry, and I welcome the opportunity to update our members in this column.

As the president of FRPO, I am thrilled to be attending this year’s CFAA Rental Housing Conference in Halifax, which is taking place from June 14 to 16. For most of you, the event will have passed by the time you read this. But if you have not attended CFAA-RHC in the past, then you’re missing a lot. This incredible event brings together industry leaders, professionals, and stakeholders from across Canada. It’s an excellent platform for networking, exchanging ideas, and staying informed of the latest trends and innovations in the rental housing industry. I hope that those who attended the event were able to take in some of the vibrant maritime culture, as well as find value at the conference.

FRPO will be announcing the new Chair in the next issue of FE Magazine. Make sure you don’t miss it!

Thank you for your support. We are here to serve our members, so don’t hesitate to reach out with ideas, feedback or just to say hello.

- Tony Irwin, PresidentOn June 15, FRPO’s Canadian Certified Rental Building™(CRB) program will be launching its third annual Conscious-Living Box giveaway. The initiative is part of the program’s goal to promote environmental awareness and its Living GREEN Together™certification.

The Canadian CRB program enables Canadian renters to more easily identify rental properties that are well run, professionally managed and maintained. To receive Living GREEN Together™ certification, rental property owners must demonstrate their commitment to their buildings’ environmental policies.

One of FRPO’s goals of creating the CRB program was to promote a healthy, competitive rental housing industry that benefits both rental property owners/managers and tenants. This program serves as a “good housekeeping” seal of approval for rental properties. The Living GREEN Together™certification is an extension of that commitment to quality, and emphasizes the focus on bettering the community and protecting the environment.

“This national campaign aims to educate the public that our individual environmental efforts matter, especially in our multi-residential communities, and that together we can make a difference,” said Maria Arangio, Creative Director, Creativo Advertising. “For industry members that are actively engaged in environmental, social, and governance (ESG) and Global Real Estate Sustainability Benchmark (GRESB) reporting, the Canadian CRB program provides impactful support to these endeavours. As a GRESBapproved green building sustainability program, it provides members with quantifiable measures for incorporating ESG factors into daily operations and supports their efforts with residents, the community, and government stakeholders.”

The CRB program is the only resident-focused apartment building certification program in North America, and provides renters with the highest standard in apartment living. All registered buildings must be in strict compliance with 52 Best Practice Standards, which involve hundreds of property management requirements, to ensure a high level of quality service. These buildings must also be Living GREEN Together™ environmentally certified. For the third year in a row, the Living GREEN Together™program is putting together a Conscious-Living Box giveaway to remind people of living life with purpose and meaning. CRB is partnering with a number of Canadianbased eco-friendly and sustainable companies to create the Conscious-Living Box. Using these products will help tenants commit to better lifestyle choices. They will also contribute to a healthier environment for tenants in buildings that participate in the CRB program. The CRB program encourages building managers to provide information about the ConsciousLiving Box giveaway to their residents to grow their community engagement and open up conversations around environmental impact. Last year’s Conscious-Living Box included the following eco-friendly Canadian products:

• Bee by the Sea face polish

• Magic Oats oat milk powder

• PurelyGreat unscented cream deodorant

• SoLuxury coconut oat milk bath

• Meeku hand cream

• Pascoe tussiflorin tea

• The Great Elephant Poo Poo Paper journal

• Better Snack. Better You. popcorn

• Chrisoda all-natural soda

• Charlie’s Soap laundry packets

• OlaBamboo reusable bamboo straws

“Last year’s giveaway was a huge success with incredible participation, exposure, and online engagement,” said Maria. “Contest entries more than doubled over the inaugural year, and we experienced a boost in online social engagement throughout the duration of the campaign. Winners who received their box were posting unboxing photos and videos for additional prizing.”

For more information on the CRB program and the Living GREEN Together™certification, or to participate in the Conscious-Living Box giveaway, visit https://www.crbprogram.org/

Annual Charity Golf Classic

Date and Time: July 18, 2023

9:00 am – 7:30 pm

FRPO Annual General Meeting (Virtual)

FRPO held this year’s Annual General Meeting on Monday, May 29 at 10:00 am. This meeting took place in a virtual format and included an overview of the past year, updates from our Chair of the Board and President, approval of the financials, appointment of auditors, and election of Directors. The event was well attended. Please check out the next issue of FE Magazine for full details.

Registration is now open for the 2023 FRPO Annual Charity Golf Classic in support of Interval House. This event will take place on Tuesday, July 18 at Lionhead Golf Club in Brampton. Join us for a fun-filled day of golf and networking. This event will sell out quickly, so please register as soon as possible to avoid disappointment.

Details

7:30 am Registration

9:00 am Shotgun start Cocktail reception and dinner to follow

FRPO member registration pricing

Early Bird pricing will be available until June 16

Foursome $1700

Individual Golfer $450 Dinner Only $150 (limited tickets)

Regular Pricing as of June 16

Foursome $1800

Individual Golfer $475 Dinner Only $150 (limited tickets)

Sponsorship opportunities

If you are interested in sponsoring this event, please contact Lynzi Michal at lmichal@frpo.org. Please use your FRPO credentials to register for this event. If you do not have a login, please contact us at events@frpo.org to obtain one. Refunds are not available for this event; should you wish to transfer your registration, please contact us to update our list.

FRPO is the largest association in Ontario representing those who own, manage, build and finance residential rental properties.

For membership inquiries please contact Lynzi Michal, Director, Membership & Marketing

Federation of Rental-housing Providers of Ontario

20 Upjohn Road, Suite 105 Toronto M3B 2V9

416-385-1100 x 22

lmichal@frpo.org www.frpo.org

Since MetCap Living established itself as a leader in property management, we have routinely been asked one, simple question; “Can you help us run our property more effectively?” And, for well over thirty years, the answer has remained — Yes, we can! Our managers are seasoned professionals, experienced in every detail of the day to day operations and maintenance of multi-unit rental properties. From marketing, leasing, finance and accounting, to actual physical, on-site management, we oversee everything.

Guaranteed vacancy reduction, revenue growth and net profitability — when you’re ready to discuss a better option; we’ll be there. You can count on it.

Kazi Shahnewaz Director, Business DevelopmentOffice: 416.340.1600 x504

C. 647.887.5676

k.m.shahnewaz@metcap.com

www.metcap.com

EOLO reports on upcoming solid waste changes, the City’s Vacant Unit Tax appeal processes, and Provincial funding for Cityrun housing programs. Members’ work on the federal political issues and at the CFAA Conference is also highlighted. pg. 49

HDAA warns of City of Hamilton moves to require landlords to provide building cooling, to support tenants in fighting evictions for renovations, and to bring in a vacant unit tax. Helpful advice from recent dinner meetings is also provided. pg. 53

LPMA explains how to deal effectively with tenants with mental health issues, including practical and legal issues and assistance from the local Canadian Mental Health Association service, and a crisis service telephone line. pg. 57

IPOANS reports on its advocacy work to fight the continuation of Nova Scotia’s rent cap, to fight the Halifax rental registration changes, and to preserve fixed term leases. Recent education events and award winners are also highlighted. pg. 61

This report addresses two federal issues and four City of Ottawa issues. The City issues include curbside solid waste collection (i.e. garbage collection), and the City’s broad course on disposing of solid waste. Also grinding along is the vacant unit tax, for which the two-stage appeal process is now open. The last City issue is the housing and homelessness funding from the Province of Ontario. City leaders felt the City was shortchanged, and successfully asked the Province to increase Ottawa’s funding.

The two federal issues are EOLO’s role in key issues and consultations by the federal government about financialization and tenants’ rights to housing, and the support EOLO members are giving to CFAA for its annual conference.

John Dickie, Chair,

John Dickie, Chair,

In the last issue of Regional Association Voice, EOLO reported on the organic recycling that the City of Ottawa will soon require in multiresidential buildings. We also reminded rental housing providers of the advice on that issue in the March/April 2022 issue of RHB Magazine . The City’s plan is proceeding.

Now the focus has turned to curbside waste collection for owner-occupied homes and small, low-rise rental buildings. City staff reported on their expectations about the length of time the Trail Road landfill will have the capacity to receive solid waste under the current waste collection rules or under revised rules. Trail Road is the main City landfill, although there are also a few privately-owned landfills.

City staff also proposed ways to extend the life of the Trail Road landfill. For curbside collection for owner-occupied homes and small, low-rise rental buildings, City staff presented three options:

• Partial Pay-As-You-Throw (Partial PAYT)

• A ban on the contents of solid waste enforced through requiring clear bags

• Reducing the garbage limit per household and enforcing the limit

While the details are yet to be finalized, the Partial PAYT program would see each household issued with 55 garbage tags per year, or enough for two items every two weeks, plus a few extras. To put out residual waste above the free tag issue, residents would have to buy tags at $3.00 per tag.

Staff reported the preference of the public, among the three, for Partial PAYT. At EOLO’s video meeting seeking input on the three choices, a majority of rental providers also preferred Partial PAYT.

In June, City Council will give staff direction as to which of the three possible programs to pursue, or whether to pursue a different course.

Among the three proposals, City Council is almost certain to choose Partial PAYT since that is the preference of the majority of the public. However, City Council might take a different course. Regardless of taking any one of the paths proposed, the City will still need to make provision for solid waste in the future. The City needs a major expansion of the Trail Road landfill, another landfill or a different way of disposing of solid waste, such as incineration.

In adopting a motion by Councillors Hubley and Brown on May 24, City Council directed city staff to report back to Council as part of the Draft Solid Waste Master Plan in Q4 2023 on recommended technology (technologies) that are available, in active operation, and that are proven for managing and diverting municipal solid waste from landfills in comparable jurisdictions.

City Council directed city staff to be ready to conduct a feasibility study and Business Case for Council’s preferred alternative disposal technology, including a thorough market sounding to understand the various contracting models, as well as benefits and risks of the preferred approach, all of which will be presented to Council as soon as is practical, but no later than the end of the 2022-2026 term of Council, and prior to the beginning of the new approved technology procurement process.

Since the 2023 final property tax bills have been sent to all property owners, the Vacant Unit Tax (VUT) appeal period is now open for owners who were charged the VUT, but believe they should not have been charged the tax.

The first stage in the appeal process is to file an online Notice of Complaint, now available on ottawa.ca/vut. The deadline for filing is September 15, 2023. The City will review your Notice of Complaint, and you will receive a decision by mail or email.

For those residential property owners who did not complete a VUT declaration, their properties were automatically considered vacant, with the one per cent tax added to their final property tax bill. To appeal the VUT charge, those owners must complete the online declaration in addition to the Notice of Complaint. (In effect, the declaration can be filed late, at least for this year.)

If a property owner disagrees with the decision from their Notice of Complaint, they have a second appeal available. That is a Request for Review. The form for that is also online at ottawa.ca/vut. It must be filed within 90 days of the decision on the Notice of Complaint. To complete any of the forms – Notice of Complaint, Request for Review and VUT declaration –owners or property managers need the assessment roll number and the access code found on the previous VUT information notice or the final property tax bill. Owners registered with MySeviceOttawa can go directly to the forms from their property tax account.

The City has set up alternate options for residents who require accessibility-related support and for those without access to the internet or digital devices – like computers, tablets, and other hand-held devices. Call Revenue Services at 613-580-2444 and select option 3 to complete the appeal and declaration forms over the phone, or to book an in-person appointment at the Mary Pitt Centre at 100 Constellation Drive.

In Provincial Budget 2023, the Ontario government promised an additional $202 million annually for supportive housing and homelessness programs across Ontario. Of that additional funding, the City of Toronto is to receive $48 million a year. Ottawa, the province’s second-largest city, was to get $845,100.

Toronto is nearly three times as large as Ottawa, which would suggest that Ottawa’s share should have been somewhere between $16 million and $18 million, Ottawa Mayor Mark Sutcliffe said. After trying to resolve the issue privately, the City of Ottawa went public, and encouraged all housing stakeholders to protest.

The protest paid off for now because the Province announced an additional $24.1 million to support a new Ottawa Community Housing building on Mikinak Road that will provide 271 homes for seniors, families, Indigenous people and people with disabilities.

In other housing funding news, the City voted on the application of the base funding being received from the Province for the Housing and Homelessness Investment Plan (HHIP). A total of $48.5 million was allocated as follows:

• Community outreach and support services: $2.6M

• Emergency shelter solutions: $21.4M

• Housing assistance: $8.2M

• Supportive housing: $13.8M

• Administration: $2.4M

The “housing assistance” is City-funded housing benefits and rent supplements, in addition to the rent supplements provided through Ottawa Community Housing. The funding will be available to help keep low-income households in their housing, thus preventing homelessness. EOLO has long advocated such funding, as well as the funding for supportive housing for people who need support other than money.

EOLO has long been a member of CFAA, and supports CFAA’s work. See National Outlook on page 35 for CFAA’s summary of the key issues and consultations.

Besides the Review Panel of the National Housing Council (NHC), whose work on “financialization” is now beginning, the NHC conducted an extensive consultation about the “right to housing”. CFAA called for volunteers to participate in that consultation. Christian Szpilfogel stepped up, and attended several planning meetings and consultation meetings. EOLO and CFAA thank

Christian for his very helpful work on that issue, in support of John Dickie, in John’s role as CFAA President.

Christian has also volunteered to represent EOLO at the HUMA Committee. He has not yet been invited to be a witness at the Committee, but may well be invited soon. Geoff Younghusband has agreed to act as a backup if Christian is invited but cannot attend at the date and time for which the invitation is issued.

It is essential to have articulate, knowledgeable and sensible representation in order to project a good impression of the rental housing industry in the various public forums in which key debates are now taking place. Geoff and Christian supply that, for the benefit of rental providers in Ottawa, and across Canada.

For the NHC Review Panel, witnesses will be selected from people who make written submissions. Those are due by June 23. Please let EOLO know if you are willing to participate in a written submission. In cooperation with CFAA, EOLO will prepare its own submission, but will also gladly work with rental housing providers on additional submissions to counter the input the tenant advocates are organizing.

Over recent years, more and more EOLO members have been attending CFAA’s annual conference. This year that conference is taking place in Halifax from June 14 to 16. Fifteen EOLO members have registered to attend, including five small-scale rental housing providers, and ten from five larger companies.

Alf Hendry, Kandas Miller, Ciana Canci, and Christian Szpilfogel will be appearing on panels at the conference. CFAA appreciates their work, and everyone’s support, to make the CFAA conference a success.

EOLO invites Ottawa area landlords to join the organization. Have your interests and concerns heard, and benefit from EOLO’s support. As an EOLO member, you will be able to:

• Receive prompt emails of relevant City rule changes

• Attend two networking receptions a year

• Attend two free education events a year

• Receive all 6 annual issues of RHB Magazine with current developments, City and provincial funding programs, and landlord-tenant laws.

To apply for membership, go to www.eolo.ca, download the membership application form and send it to us at the contact info on that website.

The year is going quickly and we are already approaching the summer months. The HDAA is looking forward to our golf tournament on June 6 and then will be fairly quiet for the summer until our September dinner meeting. However, the City of Hamilton continues to discuss more rental housing legislation and we expect some updates over the next few months on renovictions, the licensing program, and new temperature bylaw. We wish everyone a wonderful summer and hope everyone is able to get some rest and relaxation.

- Arun Pathak, President, HDAA

- Arun Pathak, President, HDAA

Hamilton could be the first municipality in Canada to implement the “adequate temperature” bylaw. It would require rental housing owners to ensure unit temperatures don’t exceed 26°C by installing central air conditioning systems or ensuring residents have access to AC units.

The motion, which requested staff develop the bylaw in time for council to vote on next year’s budget process, was unanimously supported and will set a maximum heat standard for indoor spaces. During the meeting, the public health manager stated it would not be surprising if some rental property owners downloaded the costs to tenants, which seemed to be one of the more realistic comments.

As we know, rising costs are making it more challenging for rental housing providers and additional costs will ultimately need to be downloaded to tenants through higher rents. We are disappointed with the council’s poor understanding of the nature of the rental market and the many hurdles rental housing providers face. If the City of Hamilton wishes to push all private housing providers out of the industry, they are certainly creating the atmosphere for that to occur.

The City of Hamilton is looking to create another piece of legislation to further attack its rental housing providers. The City of Hamilton’s Emergency and Community Services Committee met on April 20 to discuss a renoviction bylaw. Staff had prepared a report based on previous instruction to consider the feasibility of creating a renoviction bylaw, which came as a disappointment to the committee as they were not looking at feasibility but how to proceed with implementing a bylaw. Regardless, the staff report advised that creating a renoviction bylaw

was not within the municipality’s jurisdiction and recommended additional funding of $50,000 to increase the balance in the Tenant Defence Fund (TDF).

The TDF Program, originally established in 2019 with a budget of $50,000, provides financial and other support to assist eligible tenant groups with preparing and presenting a defence against AGIs and/or renoviction applications at the Landlord Tenant Board.

To date, all AGI-related applications funded through the TDF have been successful. We support this program as there should be support for tenants dealing with bad faith evictions.

The report acknowledged the need for tenant education and supports for tenants in knowing and exercising their rights. The report stated there should be a review of existing tenant and landlord engagement and education resources to find areas of improvement and the resources required to enhance existing programs and processes.

There should be a focus on educating and helping tenants be informed of their rights related to N13 evictions, exercising their rights with providing notice of their intention to return after a renovation to their rental property owner, and keeping them connected to the rental property owner during this process, as well as working with rental property owners to ensure they understand the scope of their responsibilities and requirements before issuing N13 eviction notices.

The report continued to say that, by focusing on new funding for the TDF, working within existing resources for education, and supporting tenants in exercising their rights, the City is able to offer supports to help minimize the issue of displacement while allowing for maintenance of quality rental housing in Hamilton.

We also appreciate the report mentioned an alternative for consideration of creating a funding source for renovations targeted at units where the rental property owner is considering displacement and increasing the rent for the unit. The program could fund renovations with a requirement for an affordability period and would require voluntary participation from rental property owners. While not resolving the issue of displacement during major renovations, the program would increase the City’s ability to ensure the displaced tenant can move back into the existing unit once renovations are completed.

The report provided backing on the reason why the municipality would not be able to enact a renoviction bylaw, stating the City cannot interfere with the requirements as set out in the Residential Tenancies Act ; section 37 provides clear exclusivity has been made for the RTA to govern terminations of tenancy. Despite this and other points made against the municipality’s ability to enact a bylaw, the committee directed City staff to find a way to proceed with doing so. Staff advised they will look at this and other measures and report back in the summer.

We are disheartened to see the City is looking to enforce a renovictions bylaw and cannot help but see the irony of the situation as the City proceeding with something they should not be, which is similar to what they think rental housing providers are doing with renovictions.

In June 2022, Hamilton’s City Council voted to proceed with the implementation of a vacant home tax. Mailers were sent out over the last few months to residents with information on the Vacant Unit Tax (VUT), an annual tax on residential units that have been vacant for more than 183 days. All residential owners must submit a mandatory occupancy declaration annually starting January 2024. The tax will be charged for any residence that does not submit their declaration. All principal residences will not be subject to the tax but will be required to submit the declaration.

The tax (1 per cent of a property’s assessed value) is intended to help create more affordable housing in the City by encouraging owners to rent or sell empty properties. As expressed in our comments to the City, we are doubtful the tax will provide significant change to Hamilton’s rental supply. We argue it creates a significant burden on Hamilton residents, as all property owners must provide a declaration.

May 10, 2023 – Dinner meeting

Photography: Témo Cruz, LeafBox Concepts

The HDAA brought back our Meet the Board panel at the last dinner meeting. It was a great evening of conversation, networking, and discussions on the rental housing market. We were joined by several board members, new and old, for some Q&A.

Our panel started with a discussion on tenant selection. The panel provided tips such as making sure to do credit checks, discussing the lease thoroughly, and checking social media. To avoid allegations of breaking the Human Rights Code, rental property owners are best to never let someone know they are the only applicant, and to never provide a reason why someone’s application was not accepted. If something feels wrong about the application, there may well be a reason for it. Dig until you find it. Make sure the unit is reasonably suitable for the tenants. You don’t want a family of five moving into a one-bedroom unit because they would break the occupancy standards. Make sure the applicant’s income is stable so they are able to continue paying their rent. Make sure any guarantor form states the guarantor is responsible until the tenancy ends, as otherwise a guarantor may only be responsible for the initial year-long lease period.

An important point raised is to be aware that rental housing providers are currently without their “tools”. The LTB was our tool for rectifying issues and now it is no longer to an effective tool because hearings and orders are so badly delayed. Rental housing providers must be careful with

tenant selection and subsequently make sure to keep positive relationships. As the LTB is no longer a useful option, it is more important than ever to treat tenants well; don’t be too rigid and instead kill them with kindness. Try to mitigate as much as possible directly with the tenant. If things go awry, be cognizant that video and audio recordings are prevalent and providers should document everything.

a rental property, be mindful of choosing the right location. Make sure the unit looks clean and address anything that would be a safety concern. You want to attract the right tenants as they are looking for units that look presentable. With community members often having negative views of rental properties, your rental property should look taken care of; make sure the grass doesn’t get too long and garbage is not left on the property.

The panel discussed ways to save money, which included buying wholesale when possible and taking AC units out in the winter so they do not draw additional power.

When considering where to invest, it is wise to put money into projects that will make the most impact and allow you to maximize profits. Be mindful of how presentable your units are and their curb appeal, as the front door is the first and last thing people see. When choosing

Lastly, it was noted rental housing providers must be more proactive than ever with their media relations and ensure their voice is heard. There continue to be coordinated attacks against rental property owners on all fronts and at all levels of government. We must make sure the blame is put where it belongs: with bad government measures and legislation.

June 6 – Golf tournament

The HDAA golf tournament is quickly approaching! Our golf tournament is one of our more popular networking opportunities and a great way to spend a day out of the office. As in previous years, you can look forward to a great day of golfing, have an opportunity to win some great prizes, and meet other rental housing providers and suppliers. We will be bringing back our 50/50 draw, as well as our greatly anticipated wine cellar prize. You may find more details and register on our website.

Since 1960, the Hamilton & District Apartment Association has grown significantly. Our members manage over 30,000 units throughout Hamilton, Burlington, Brantford, Guelph, Mississauga, Oakville, St. Catharines and into the Niagara Peninsula. The association is a highly respected organization, sought out regularly by government, industry, media and the public.

Interested? Call us or join online!

Ph: 905-616-2058

Web: www.hamiltonapartmentassociation.ca

It’s a great honour to address you as your incoming president. I promise to work tirelessly to uphold LPMA’s values.

I’ve been part of the rental housing industry for more than 10 years and have held key positions, from managing multi-residential and commercial properties to being a small landlord. I understand the challenges our membership faces, but I also see opportunities.

As we move into the year ahead, I want to emphasize the importance of collaboration. LPMA is comprised of individuals with unique perspectives. By working together, we can strengthen our organization to the benefit of our members and the broader community.

I plan to focus on several key areas: advocating for property managers/owners; giving our members access to the latest information and resources; and fostering collaboration through regular events, networking opportunities, and forums for discussion.

I’m looking forward to working with you to achieve our shared goals. Thank you for your support.

Sincerely,

- Richie Anand, President, LPMAMental health conditions are so prevalent that one in five Canadians, or four tenants in a building of 20, experience them in any given year. Experts agree that landlords need to intervene early not only to help stop a tenant’s downward spiral, but also to ensure the safety of other residents.

London lawyer Kristin Ley says landlords need to be observant. For example, they might witness a resident shouting at another tenant or notice squalid conditions during the annual suite inspection. Tenants may also complain strangers are coming into their unit without authorization and moving furniture or planting listening devices. “I see that probably six times a year from clients and I’m just one legal representative so I suspect the problem is more pervasive than I even experience,” Ley says.

Mental health disorders such as hoarding can be a symptom of a disability — a protected ground under the Ontario Human Rights Code, she notes. It’s the responsibility of housing providers to accommodate tenants’ needs to the point of undue hardship and to get the situation headed in the right direction.