YEAR ENDED AUGUST 31, 2023

YEAR ENDED AUGUST 31, 2023

605 East Seventh Street, Prosper, TX 75078

Dear Prosper ISD Families,

We are pleased to introduce the Prosper Independent School District’s Popular Annual Financial Report (PAFR) for the year ending August 31, 2023. The PAFR is designed to offer Prosper ISD families and other stakeholders a clear and accessible summary of the district’s financial activities. This report highlights how taxpayer funds are utilized to support all students within the district. The information was compiled from our 2022-2023 Annual Comprehensive Financial Report (ACFR), a detailed document prepared in accordance with Generally Accepted Accounting Principles and audited by Hankins, Eastup, Deaton, Tonn, Seay, & Scarborough, LLC., an independent certified public accounting firm. Although the Popular Report itself is not independently audited, it reflects audited financial information, providing a simplified overview by omitting certain disclosures required in the ACFR.

Despite economic challenges such as rising operational costs and uncertainties in state funding, Prosper ISD is dedicated to maintaining fiscal responsibility and transparency. We commend the district leadership and staff for their commitment and proactive efforts in managing these financial challenges while safeguarding student opportunities. Prosper ISD strives to ensure that all resources are maximized for direct impact on teaching and learning.

We extend our gratitude to our community for its support, and to the Prosper ISD Board of Trustees, both current and former members, for their efforts to enhance public confidence through transparent communication. We reaffirm our commitment to accountability and the responsible stewardship of the resources entrusted to us.

Respectfully,

Michele Seese, MBA, RTSBA Chief Financial Officer

Bill Beavers

Dena Dixon

Jorden Dial

Kelly Cavender

Garrett Linker

Tommy Van Wolfe

Jim

Dr. Holly Ferguson

Dr. Greg Bradley

Jeff Crownover

Dr. Kyle Penn

Theresa Biggs

Rachel Trotter

Todd Shirley

Michele Seese

Charis Hunt

Bill McLaughlin

Dr. Blair Hickey

Prosper ISD is an independent public education agency recognized by the State of Texas to provide appropriate educational services to pre-kindergarten through twelfth-grade students. Prosper ISD has a 66-year history grounded in the humble roots of a farming community, now soaring to the fastest-growing school district in the State of Texas, due in no small part to the pursuit of excellence in the arts, academics, and athletics. Our students are routinely recognized on the local, state, and national level for outstanding achievements, and our teachers are highly qualified experts who bring out the best in every student.

Located north of Dallas in Collin and Denton Counties, the District spans approximately 58 square miles and comprises the Cities of McKinney, Frisco, Celina, Aubrey, Collin County, and Denton County, and currently serves over 28,000 students in three high schools, five 6-8 middle schools, seventeen elementary schools, one early childhood center, and one alternative school.

Over the past year, the student population has grown by over 3,500 students. We currently employ approximately 3,100 full-time and part- time employees, including over 1,850 teachers. We opened our third high school, fifth middle school, one elementary, and our first early childhood center to start the 2023-2024 school year. At build-out, Prosper ISD will have approximately 50,000 students and will be served by 20-25 elementary schools, 11-13 middle schools, and 6 high schools. For many years, Prosper was considered a small rural town on Preston Road in North Texas about 6 miles north of Frisco, but in recent years – true to its name – it has prospered. Prosper has maintained a spacious country feel while developing into an upscale suburb with rolling terrain, many trees, and large single-family-home lots. Prosper is growing rapidly regarding new home building (single-family houses in the $420,000 to $3,000,000 + range).

Number of Staff

3,100

The District student ethnic base during the fall 2022-2023 enrollment data collection was 9% African American, 13% Hispanic, 48% White, 22% Asian, and 8% two or more races. Eight percent of the District’s students are considered Economically Disadvantaged, 7% are English Language Learners, and 21% are considered at risk of academic failure.

ECONOMICALLY ECONOMICALLY DISADVANTAGED DISADVANTAGED

We BELIEVE

Students are first in all decisions

• In valuing all students and their success and well-being

• In innovation in curriculum and technology

• In being intentional in creating opportunities that will propel students forward

• In recruiting, hiring, and retaining employees with the Prosper heart

• In the importance of a supportive and demanding community

• In our commitment to our Graduate Profile

• In protecting our small-town feel

• In providing a safe and nurturing environment for students and staff

• Our success is grounded in tradition

Our VISION

Grounded by Tradition, Soaring to New Beginnings.

Our MISSION

The mission of PISD is to develop and graduate motivated, academically prepared individuals with the strength of character to contribute to a rapidly changing society through an educational system that maintains high expectations, provides quality instruction, and establishes a safe, orderly learning environment in the community that lives its name.

UIL STATE TRACK

-GIRLS 400M DASH -GIRLS 200M DASH -TRIPLE JUMP -LONG JUMP

UIL STATE SWIM & DIVE

-DIVING

UIL STATE TRACK -LONG JUMP

UIL STATE SWIM & DIVE

-100M BUTTERFLY

STUDENTS PARTICIPATE IN WATER POLO INAUGURAL YEAR

5 YEARS IN A ROW

TEXAS THESPIANS FOR THEATRE EDUCATION

NAMM BEST COMMUNITIES FOR MUSIC EDUCATION PREMIER COMMUNITIES TEAMS ACROSS

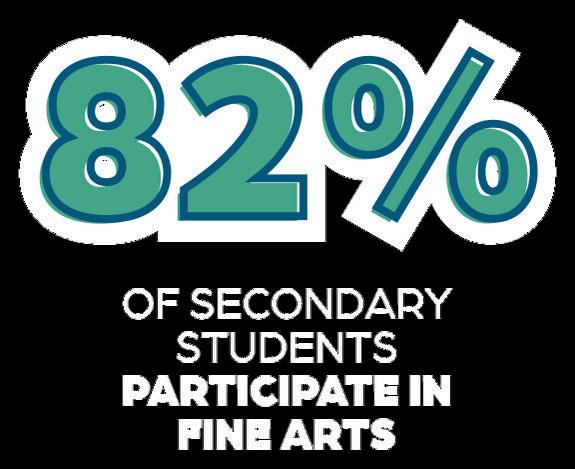

OF MIDDLE SCHOOL STUDENTS PARTICIPATE IN ATHLETICS

OF HIGH SCHOOL STUDENTS PARTICIPATE IN ATHLETICS

ADVANCED PLACEMENT (AP) COURSES TAKEN

TAEA VASE

TAEA VASE

STATE MEDALS

TAEA DISTRICT OF DISTINCTION 4 YEARS IN A ROW

INDUSTRY-BASED CERTIFICATIONS

NUMBER OF EARNED

MANSFIELD REGIONAL GRAND CHAMPIONS

PROSPER PITMASTERS

READY, SET, TEACH

NAEA DISTRICT OF DISTINCTION 2 YEARS IN A ROW 13 FORMER STUDENTS ARE TEACHERS IN PROSPER ISD

DISTRICT PARTICIPATING

ACADEMIC MEDALISTS

STUDENTS

962

The District received $273,913,943 in revenue for the general fund, an increase of 15.4% from the previous year. The increase in revenues is primarily due to increased earnings on investments and increased property tax revenue due to higher property values. The general fund is the District’s operating fund and accounts for 62.07% of the total revenues. The District’s revenues come from local, state, and federal sources.

that, this, these, those

Local revenues include, but not limited to, property taxes, earnings on investments, tuition and fees. Local revenues increased by 30.36% from the previous fiscal year due to increased earnings on investments, increases in property tax revenue due to higher property values, and additional miscellaneous revenue due to co-curricular activities, facility rentals, advertising, donations, and other miscellaneous receipts. LOCAL SOURCES

2%

State revenues decreased by 4.78% from the previous fiscal year. The decrease is primarily due to the Foundation School Program (FSP) leveling calculation which adjusted anticipated revenue for actual student enrollment and attendance.

Revenues received from federal sources increase by 56.9 % increase in indirect cost revenue on federal programs, primarily ESSER and lower revenue from reimbursable Student Health and Related Services (SHARS). Federal revenue received is based on reimbursements from expenditures incurred during the fiscal year. FEDERAL SOURCES

Property taxes, also called ad valorem taxes, are locally assessed taxes. The District is located primarily in Collin County with a small portion located in Denton County. Therefore, Collin Central Appraisal District and the Denton Central Appraisal District appraise property located in the Prosper ISD boundaries, while the District (a local taxing unit) sets tax rates and collects property taxes based on those values.

The tax rate of the District for fiscal year 2023 was $1.4429 per $100 of assessed value, a .0174 cent decrease from the prior tax year. Of this tax, $0.9429 is used for maintenance and operations and $0.50 to service debt and is collected in the debt service fund.

The 2022 tax year, 2022-2023 school year, experienced an increase in taxable values of $3,719,952,827 billion, which is a 28.5% increase over the 2021 tax year. Both the Collin County Appraisal District and the Denton County Appraisal Districts are the certifying agencies of the taxable values of our District.

The Collin County Tax Office collected $235,694,806 or 99.80% of the tax levied in the 2022 tax year. The Collin County Tax Office collects all taxes for Prosper ISD.

The District had $248,854,617 in general fund expenditures during fiscal year 2023, an increase of $39.9 million or 19.1% from prior fiscal year. The increase was due primarily to the growth of over 3,500 students, the onboarding of approximately 450 staff members and the associated instructional and facility costs.

Costs of $201,136,396 million were used for Gross salaries or wages and benefit costs for employee services.

Costs of $22.6 million were used for services rendered to the school district by utility companies, firms, individuals, and/or other organizations.

$248,854,617

Costs of $14.3 million include textbooks, testing materials, fuel to transport children, and other general supplies and materials.

Costs of $4.9 million were utilized and include property insurance, and student and staff travel fees.

Costs of $905,610 include principal and interest payments related to capital lease obligations such as copier leases.

Capital outlay of $4.9 million was spent on building and land improvements, furniture, buses and vehicles, and other equipment. These expenses were outside of the bond authorization, however deemed necessary for the district functionality.

MAJOR OBJECT

This function is used for activities that deal directly with the interaction between teachers and students.

These costs are directly and exclusively used for resource centers, establishing and maintaining libraries, and other major facilities dealing with educational resources and media.

Food Service items charged to general operating.

These are expenditures for school-sponsored activities outside of the school day. These activities are generally designed to provide students with experiences such as motivation and the enjoyment and improvement of skills in either a competitive or non-competitive setting. CO-CURRICULAR ACTIVITIES

These are expenses used to aid instructional staff in planning, developing and evaluating student learning experiences. INSTRUCTIONAL LEADERSHIP

These are expenditures directly used for managing, directing, supervising and providing leadership for staff who provide general and specific instructional services.

These costs are used to direct and manage a school campus and include activities performed by campus administrative staff

These are costs associated with the overall general administrative support services of the school district. These are expenditures for activities to keep the facilities and grounds open, clean, comfortable and in effective working condition and state of repair and insured.

1.44%

These are expenditures for activities to keep students and staff safe, whether in transit to or from school, on a campus or participating in schoolsponsored events at another location.

These are costs for psychological services, identification of individual characteristics, testing, educational counseling, student evaluation and occupational counseling.

These are expenditures used for providing physical health services such as appropriate medical, dental, and nursing services to students

These costs are for computer facility management, computer processing, systems development, analysis and design, and those interfacing costs associated with general types of technical assistance to data users.

These are expenditures incurred for transporting students to and from school.

1.68%

Consists of costs related to social work services, community services, capital lease principal and interest payment, payment to other governmental entities, and costs for acquiring, equipping, constructing, and/or making additions to real property and school sites.

Special Revenue Funds account for resources that are legally restricted to be spent for specific purposes. During 2023 Fiscal Year, the District received a total of $27,372,805 and spent a total of $26,164,700.

Federal revenues - $10.9 million

40%

The federal government provides grants to supplement educational opportunities for specific groups of students. The largest federal programs for 23-24 included:

The Elementary and Secondary School Economic Relief (ESSER) Fund. A federal stimulus fund intended to support the districts ability to maintain operational continuity during the COVID-19 Pandemic IDEA, Part B funds, provided to special education and related services to students with disabilities. National School Lunch and Breakfast Programs, provide free and reduced-price meals to low income students.

State Sources

State revenues - $1.4 million

5%

The District benefits from three state grant programs. The largest state grant is the State Textbook fund. It is a biennial instructional materials allotment funded by the state legislature to purchase textbooks and other instructional materials.

$26,164,700

Local Sources

Local revenues - $14.9 million

55%

Local special revenues primarily consist of student meal charges, school sponsored activities, earnings on investments, and generous donations from the Prosper Education Foundation and Childrens’ Health Stadium.

The Debt Service Fund accounts for the accumulation of resources for, and the payment of, general long-term debt principal and interest. The District issues general obligation bonds to provide funds for the construction and equipment of school facilities, to purchase technology devices, school buses, and to refund general obligation bonds. Debt Service requirements are payable solely from future revenue of the Debt Service Fund which consist principally of property taxes collected by the District and state funding. Prosper ISD owed $2.67 billion on bonds outstanding as of August 31, 2023.

Capital Project Funds are used to account for proceeds from the sale of general obligation bonds and other financial resources. The Capital Projects Fund expenditures for the fiscal year were $350.8 million which includes constructing four new school buildings, purchase of buses, white fleet vehicles, land and technology upgrades. Bond project planning and spending are project based and do not align with our fiscal year Consequently, it is common for expenses in these funds to vary significantly from year to year based on project needs. The ending fund balance in the Capital Projects Funds at the close of the fiscal year was $237.4 million. This is due to voter approval of the 2019 Bond Election held in November 2019. The Bond Election authorized $1.37 billion in bonds of which $250 million were issued in February 2023.

Original Authorization: $1.37 billion

Remaining Unissued Debt: $432 million

Significant growth in student enrollment is expected to continue in the coming year and we will see significant construction activity taking place in fiscal year 2024- as a result the District formed a Long Range Planning committee to establish needs for the next ten years and began plans for a Bond Election for November 2023. The committee consisted of Board Members, District Administration, and Community Members united for the shared objective of addressing the needs of our students.

The general fund is the primary operating fund of the District. At the end of the current fiscal year, unassigned fund balance of the general fund was $75,058,630, while the total fund balance was $152,297,542 As a measure of the general fund’s liquidity, it can be useful to compare both unassigned fund balance and total fund balance to the total fund expenditures. Unassigned fund balance represents 30.16% of the total general fund expenditures, while the total fund balance represents 61.20% of that same amount. The fund balance of the Districts general fund increased by $23,507,866 during 22-23. Key factors related to this change were a significant increase in property tax and other local revenues along with an increase in investment revenue. These contributed to a $36,489,245 increase in revenues or 15.4% overall increase in total revenues.

Expenditures increased by $39,897,870 or 19.1% with the majority of the increase in the areas of instructional and facilities costs.

A fund balance is revenue that a school district keeps in reserves to responsibly manage cash flow. Those dollars come from local property-tax collections and/or state revenue, depending on the school district. If a district receives payments from the state, those payments arrive on a monthly basis. If the district depends only (or predominantly) on local property taxes for funding, there is a gap between when expenses (such as teacher salaries) must be paid and when the tax payments arrive. Fund balances help temporarily fill that gap. Fund balances also help districts prepare for the unexpected: They allow districts to maintain services during crises like natural disasters, flood or pandemic. A healthy fund balance also allows districts to get a higher credit rating, which can save taxpayers millions of dollars in borrowing

The District depends on state aid, grant revenues, and property taxes for funding. The District received its revenues at various intervals during the year. The District recognizes the importance of maintaining its financial integrity; therefore, it has developed this policy to support its mission and its goals and objectives.

The District shall maintain a high level of financial stability and shall not compromise long-term financial integrity to achieve short-term goals. A financial goal of the District shall be to have a sufficient balance in the general operating fund to be able to maintain fiscal independent in the case of a financial need or crisis.

In an effort to provide adequate cash flow for its operations, maintain a strong credit rating, and plan for unanticipated extraordinary costs, the District shall maintain, where possible, three months of unassigned general operating fund balance.

If the Board determines this fund balance cannot be obtained for the proposed budget, it shall be the goal of the Board to reach the balance within a specified period, within three years.

Prosper Independent School District’s Business Services Department focuses on optimizing fiscal resources and implementing sound financial management practices to support district goals and initiatives.

Our Mission is to support the mission of Prosper Independent School District by building trust and fostering collaboration through consistent application of sound business practices and ethical standards that uphold our fiduciary responsibility to the community.

A few notable accomplishments for the fiscal year August 31, 2023 include:

Superior Achievement under School FIRST (Financial Integrity Rating System of Texas

Underlying rating for unlimited tax bonds is “Aa3” by Moody’s, and “AA-” by Fitch but is considered AAA as a result of guarantees of the Texas Permanent School Fund.

Texas Association of School Business Officials (TASBO) Purchasing Award of Merit

Texas Association of School Business Officials (TASBO) Award of Excellence in Financial Reporting

Various levels of certification completed through TASBO by staff

No material weaknesses, significant deficiencies or questioned costs in the annual financial audit

We would like to acknowledge and express heartfelt appreciation to the Prosper ISD Communications Department and the Business Services Department for their assistance in the development of this report.