3 minute read

MARKETS

from Fluidos nº 455

by Publica SL

German building valves defy difficult times in the construction industry

In short: Backlog of orders is reduced; international business becomes growth engine; German housing construction with gloomy outlook.

The German building valves industry continued its successful course in the first half of 2022. Overall, manufacturers recorded a 9% increase in sales. In Germany, sales rose by 4% following a good prior year. Abroad, sales even climbed by a strong 15%.

“At the beginning of the year, the construction industry was still running smoothly and benefiting from favorable weather conditions. In the meantime, however, consequences of the Ukraine war have become increasingly noticeable,” says Wolfgang Burchard, Managing Director of VDMA Valves, assessing the current situation. “However, numerous projects are still in the implementation phase, which will only gradually become reality due to material and logistics bottlenecks. Part of the sales growth this year is therefore due to the backlog of orders from 2021,” explains Burchard.

Sanitary pulls ahead of heating

In contrast to previous years, sanitary fittings recorded the strongest growth in the first half of the year. However, this was solely due to strong foreign business (up 20%). In Germany, sales rose by only 1%, resulting in an overall increase of 10% for the division. In the case of heating valves, on the other hand, domestic business again picked up strongly, rising by 12%. Business outside Germany was somewhat weaker, with the result that total sales increased by 9%. In the case of technical building valves, domestic and foreign sales grew at roughly equal rates. Overall, sales were up 5%.

Exports grow despite headwind

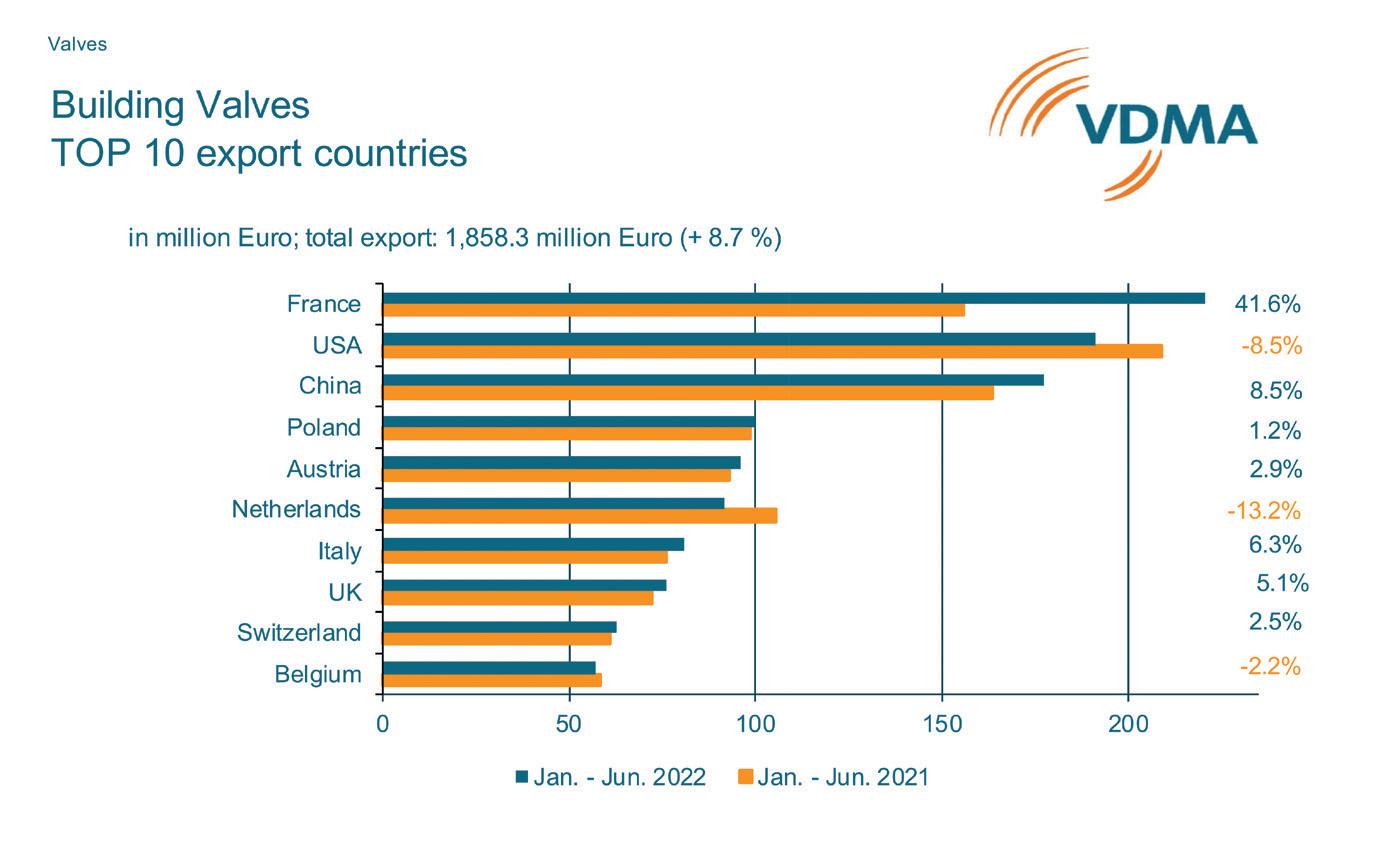

Export business, which recovered quickly last year from the decline in 2020, continued to grow in the first half of 2022. Exports of German building fittings rose by 8.7% to a total of 1.9 billion EUR. The list of the top 10 sales countries was headed by China - unlike in previous years. Despite the lockdowns in the country and the increasingly gloomy outlook for the construction industry in the People’s Republic, German exports to China climbed 41.6% to 220.8 million EUR. France dropped to second place as a result of an 8.5% decline in German shipments to 191.2 million EUR. The USA again took third place. Exports to the USA increased by 8.5% to 177.4 million EUR. Concrete effects of the war in Ukraine were felt above all in business with Poland. Exports to the neighboring country fell by 13.2% to 91.7 million EUR.

Europe’s construction industry remains on growth track

Even though Europe’s construction industry is cooling off against the

backdrop of the war in Ukraine, it will remain on an expansionary course for the time being. According to the latest forecast by the Euroconstruct research and consultancy network, residential construction in Europe will grow by 2.2% in real terms this year. However, a further slowdown is expected in the coming years.

Demand for housing remains high in Germany and Europe. In Germany and some neighboring countries, however, business is being hampered by supply bottlenecks and, above all, by price increases for building materials. In addition, the shortage of skilled workers in the trades is making itself felt. Many private consumers are unsettled and have to recalculate in view of rising interest rates. As a result, building permits have recently declined. Nevertheless, German residential construction is currently facing a building surplus of around 700,000 units.

In principle, German manufacturers of building valves are also well positioned to compete internationally on the trend topics of hygiene, sustainability, and digitalization. “Against this background, VDMA Valves expects only a slight slowdown in growth in the current year. Overall, we are sticking to our sales forecast of 6% for the building valves industry. However, there could be a dip in growth in the coming year,” summarizes Wolfgang Burchard. VDMA

The VDMA represents about 3,500 German and European companies of the mechanical engineering industry. The industry stands for innovation, export orientation and mediumsized businesses. The companies employ around four million people in Europe, more than one million of them in Germany. Mechanical and plant engineering represents a European turnover volume of around 800 billion EUR. With a net added value of around 270 billion EUR, it contributes the highest share of the entire manufacturing sector to the European gross domestic product.