9 minute read

Turbulent times for

The coronavirus outbreak has many implications for the oils and fats market in the months ahead John Buckley

The oils and fats market is trying to quantify the multi-layered implications of the current coronavirus pandemic. So far, the impact of Covid-19 has been almost exclusively bearish due to:

• The threat of global economic recession, along with currency volatility, affecting consumer spending power and with it, demand for oils and meals around the world. • Uncertainty over near-term demand from China, which accounts for nearly 20% of world vegetable oil consumption. • A slowdown in the ‘return to normal’ for US soyabean exports that were picking up in the wake of US President Trump’s ‘phase one’ trade agreement with China. • The collapse of energy markets, questioning the recently-promised fast expansion in biodiesel use of vegetable oils, potentially depressing palm, rapeseed/canola and soya oils as well as maize (45% of US corn consumption goes to ethanol). Ironically, crude oil appeared to be heading in the opposite, upward direction earlier in the year amid US/Iranian hostilities. • Potential obstacles to the movement of commodities which, amid restrictions on people’s movement, could carry bullish as well as bearish risk.

Commodities and ‘macro’ markets are behaving in shock mode as we went to press, aware that answers to the questions of duration and depth of these and other multiple impacts are possibly many months away. For the oilseed complex some key losses at this point (from the start of 2020) include Malaysian palm oil futures (down 33%), Chicago Board of Trade (CBOT) soya oil (–28%), CBOT soyabeans (–12.6%) and EU rapeseed (–17%).

Prior to the coronavirus scare, politics had been heavily influencing trade, notably a political feud disrupting palm oil flows between key trading partners Malaysia and India, just as US soya trade with China seemed to be normalising. As the leading internationally traded oil, palm had been the key driver to the upside over much of the period since our last review. Extending the rally it began mid-2019, crude palm oil (CPO) on the Bursa futures market in dollar equivalent

Turbulent times for commodities

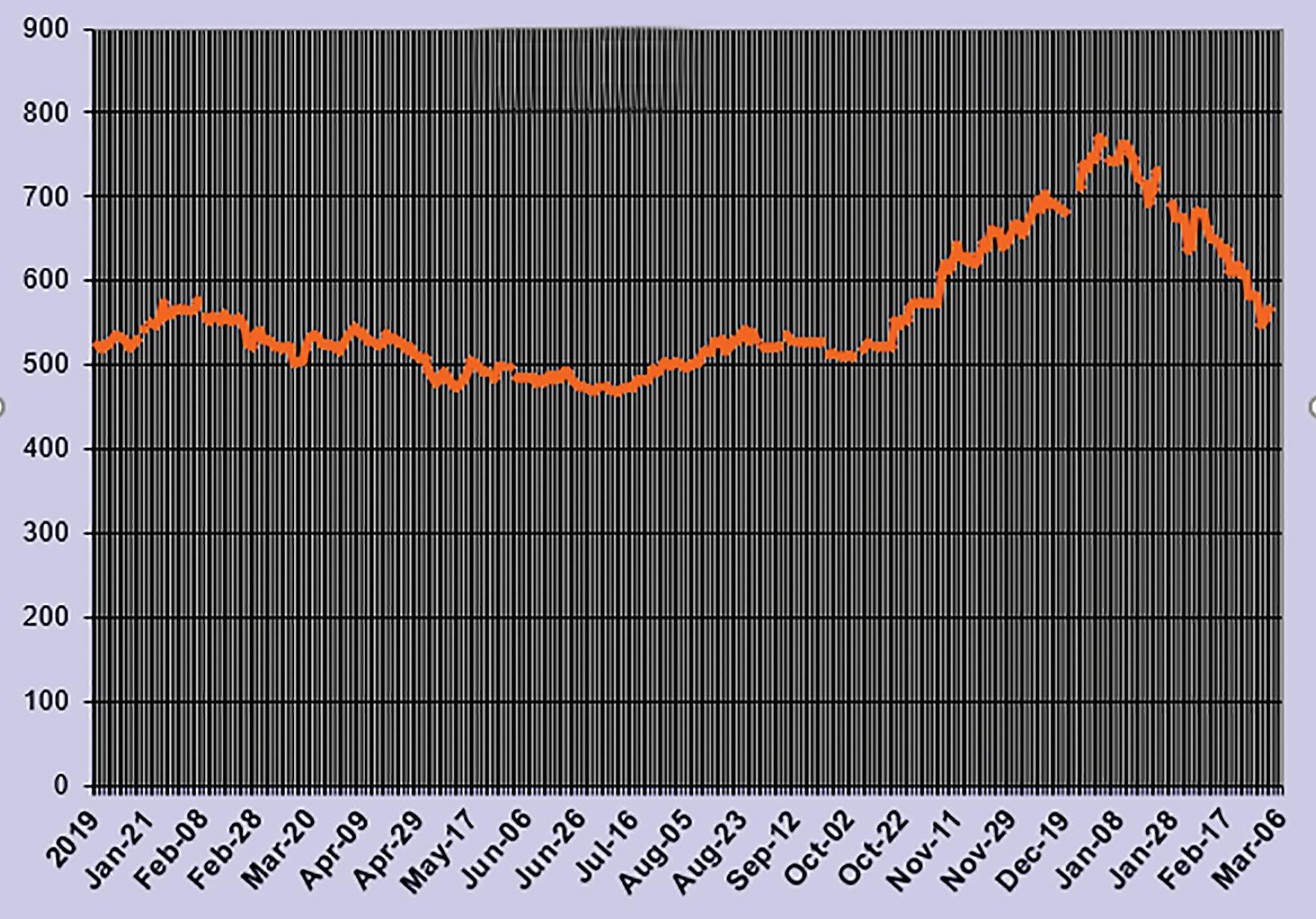

Figure 1: Malaysian palm oil futures prices (US$)

had reached US$770 levels at the turn of the year as traders believed production would slow down or stall after earlier dry weather and reduced input use.

That threat was accompanied by forecasts that key producers would add a few million tonnes of demand to their domestic biodiesel programmes. Top palm importers India and China were also revealed to have made steep increases in their 2019 imports for food use while third largest customer Europe had not yet cut demand as feared.

However, ideas that palm might be heading for even higher prices were quickly scuppered as the New Year unfolded. India and Malaysia had fallen out over the latter’s stance on Kashmir and India’s new citizenship laws, resulting in Malaysian sales to its top customer crashing, leaving rival supplier Indonesia to pick up a trade windfall.

This shift was partly enabled by India blocking refined palm olein imports from Malaysia but still allowing in over 1M tonnes from Indonesia. As China’s palm oil demand was questioned by coronavirus, Europe continued to import less and energy markets continued to weaken. Palm oil stocks fell to new lows but more slowly than expected and the inflated price quickly returned to the low US$500s – its steepest drop for some years. One question was whether Malaysian palm exports would pick up from their January/February lows after a near 30% fall. Pakistan and some other buyers had been taking more and early reports suggested March and April Malaysian trade was looking more promising, partly due to the approach of stocking up for Ramadan and partly a general consumer response to much cheaper prices.

A change of Malaysian prime minister also appears to have opened the door to a calmer relationship with India that may help restore palm trade. On the downside, Indian refiners continue to demand their government curb olein imports to protect their margins and avoid discouraging domestic oilseed farmers.

Malaysia also announced full implementation of a 20% palm biodiesel programme to take up to 1.06M tonnes annually although where that stands amid sub-US$30/barrel oil is anyone’s guess.

Also bearish were new EU measures to restrict potentially harmful contaminants in refined edible oils which its producers say unfairly targets palm with lower limits than applied to competitor oils.

The market now waits to see if Asian palm oil production does slow in the first half of 2020 as some analysts have forecast. Dry weather and less fertiliser use take many months to work through to u

yields and trade reports suggest the price rally encouraged many producers to start using more inputs again. But above all, the trade needs to see how demand shapes up under the coronavirus cloud. u

Soya supplies on the rise again Rising Latin American soya crop estimates are promising to compensate for last year’s lost US output but the latter’s farmers are also said to be planning their own comeback. Some United States Department of Agriculture (USDA) economists have been looking for a potential 10-12% recovery in this spring’s planted area.

The full weight of Brazilian competition from a potential 125M tonne crop has been postponed by wet weather slowing harvest and port loading but exports were expected to rocket from March, possibly doubling to as much as 10M tonnes, keeping them on track for a higher seasonal total.

Along with Argentina raising export duties, Brazil’s shipping delays allowed CBOT soya futures some respite from selling pressure linked to lack of Chinese demand for US beans under the ‘phase one’ deal and Argentina raising its own crop estimate to 54.5M tonnes.

China had been expected to contribute 28% to global soya crush and 58% to imports this season although that would still be less than in the peak 2017/18 period. Despite an Argentine crop shortfall in 2017/18, the Latin Americans have raised their shipments to China in recent years.

A restraint on the soya market has been weakness in the oil sector, under pressure from cheaper palm and plummeting energy markets. In addition, while record monthly US soya crush numbers have made for supportive headlines, these have masked the pileup of US oil stocks. US soyabean oil prices have consequently dropped back to the lows of mid-2019. After a weak trend in early February, US soyameal futures held up better, partly due to less competition from top meal exporter Argentina. Against that, Latin American currencies are weak – the Brazilian Real reaching record lows versus the US dollar. This means cheaper as well as more soyabeans from Latin American suppliers.

The USDA has been forecasting higher US exports and more total use (including domestic) than last year. However, the projection for a seasonal average US soya oil price some 11.5% higher than last year’s may be questioned, as this is based on other oil price trends, especially that of now struggling palm oil.

Figure 2: Crude vegetable oil prices other than refined palm (US$/tonne)

Falling demand for canola oil Rapeseed continues to face stock drawdown in the wake of last year’s crop shortfalls but the extent of the deficit depends on uncertain demand from top importer China and the EU biodiesel industry’s response to collapsing energy markets. Overall, the recent USDA prognosis was for global rapeseed oil consumption to drop from over 29M tonnes in 2017/18 to under 28M this season, some of that loss to be filled by larger sunflower and soya oil supplies. In tandem with other markets, EU rapeseed went into a steep downturn as coronavirus fears escalated in early March. Although EU oil consumption is down again, rapeseed imports have rocketed by 40% for the season to date to offset last year’s poor crop.

European grain lobby Coceral estimated the next harvest could be marginally up rather than down as initially thought. However, it would still be among the lowest in recent years after last autumn’s rains delayed and downsized planting intentions. Lost acreage has been the main cause of poor French and UK outlooks but Germany’s crop could be up by over 10% as unusually mild weather spared crops from frost damage. EU imports are expected to stay large in 2020/21, led by supplies from Ukraine, where another promising crop appears to be in the ground.

The Winnipeg market also eased into the corona meltdown period, having held up better than soya for most of the first quarter on strong Canadian crush, offsetting weaker exports to China.

Canada’s total exports were recently estimated at 4.7M tonnes for the season to date, down about 500,000 tonnes year-on-year. However, domestic use jumped 13% to 5.5M tonnes.

Environmental protests over a new oil pipeline have held up Canadian export flows and there are concerns that coronavirus might delay normalising trade to former top outlet China.

The slump in palm oil prices also weighs on ‘oil-rich’ rapeseed along with the energy market collapse. However, even with still ample old crop supplies, bellwether Winnipeg futures have, so far, suffered relatively modest losses for the year to date.

However, by the end of the season, lower carry-outs in both Canada and Europe are expected to reduce the world 2019/20 ending stock to a low 6.5M tonnes – about 2M tonnes down on the year. Going forward, much will depend on how much Canada sows this spring and on how quickly Australia can recover from the past year’s devastating droughts and heat-waves. The Australian government forecaster Abares recently lifted its forecast for the coming crop to 2.3M tonnes but this remains well down on the historical norm.

Better sunflower oil supplies Sunflower oil supplies are looking good after big increases in Russian and Ukrainian harvests and a decent crop in Europe as well. Global sunflowerseed production is now estimated at around 54.8M tonnes against last year’s 50.6M tonnes and supplies of the oil are seen rising by about 1.4M tonnes to a new record 20.8M tonnes.

Russian analyst Sovecon recently suggested the country’s sunflowerseed exports could be 200,000 tonnes higher than expected at 1.2M tonnes. Ukrainian exports of sunflower oil have meanwhile rocketed by 63% to some 2.48M tonnes. Global demand was recently estimated to be growing at an above-trend 7.5% as consumers respond to the relatively lower prices large supplies have enabled.

MORE THAN ENERGY

Efficient high temperature energy solutions with steam and thermal oil.

Services by GekaKonus:

Engineering | Design | Consulting Commissioning | After Sales Service

GekaKonus GmbH · Siemensstraße 10 · D-76344 Eggenstein-Leopoldshafen Tel.: +49 (0) 721 / 9 43 74 -0 · Fax: +49 (0) 7 21/ 9 43 74 - 44 · info@gekakonus.net · www.gekakonus.net