3 minute read

World statistical data

CPO sett lement prices (Malaysian ringitt )

MPOC/Bursa Malaysia

EU rapeseed, soyabean imports (M tonnes)

UFOP, EU Commission

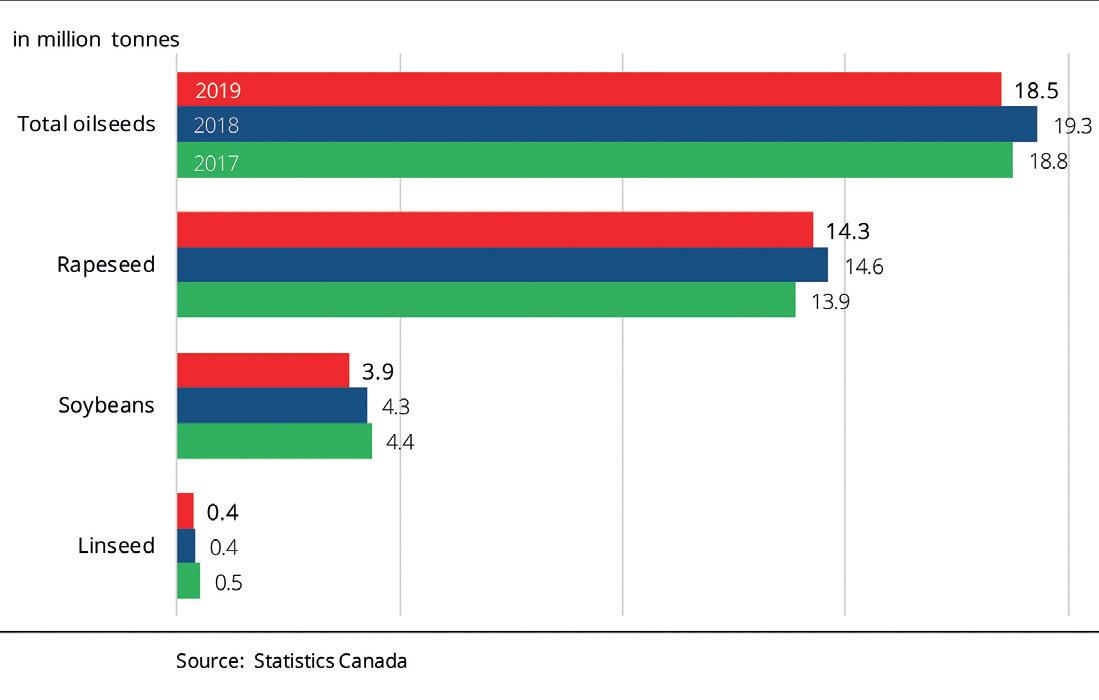

Canadian oilseed stocks, end of 2019 (M tonnes) UFOP, Stati sti cs Canada

Sept 19 Oct 19 Nov 19 Dec 19 Jan 20 Feb 20 Soyabean 746.8 753.8 748.5 826.1 857.3 772.8 Crude palm 578.2 615.1 692.2 772.5 801.6 718.7 Palm olein 541.4 573.1 648.8 720.0 728.3 656.7 Coconut 741.0 736.5 838.4 1,038.4 1,015.1 884.0 Rapeseed 881.7 888.4 872.4 918.8 935.3 870.3 Sunfl ower 751.2 720.3 758.9 803.9 841.4 762.7 Palm kernel 637.3 624.4 775.6 977.1 991.7 830.0 Average 697.0 702.0 762.0 865.0 882.0 785.0 Index 165.0 166.0 181.0 205.0 209.0 186.0 Prices of selected oils (US$/tonne) Mintec

STATISTICAL NEWS

Palm oil futures prices The palm oil market is hopeful of India resuming purchases aft er Muhyiddin Yassin was sworn in as the new prime minister on 1 March, Business Recorder writes. Former prime minister Mahathir Mohamad, whose criti cisms about India have soured palm oil trade with the country, unexpectedly resigned on 24 February.

The Malaysian palm oil market has been under pressure over lost sales to India and worries about falling global demand due to the novel coronavirus (COVID-19) spreading outside of China.

The benchmark palm oil contract for May delivery on the Bursa Malaysia Derivati ves Exchange rose 57 ringgit, or 2.41% on 4 February, to RM2,377 (US$565.41).

EU oilseed imports The EU-28 has imported around 8.7M tonnes of soyabeans in the 2019/20 season to date, down some 6% year-on-year, says UFOP. The USA supplied the largest share of imports, at 52%, since the marketi ng year began on 1 July 2019. This was also the case in the same period in 2017/18 but both the share and total amount were considerably bigger back then, at 79% and 7.1M tonnes respecti vely. The lower shipments in the current season are probably mainly due to the smaller US harvest (down 20% from the previous year).

Ukraine is the top rapeseed supplier to the EU-28, at around 2.8M tonnes in the current season, becoming signifi cantly more important as a country of origin for EU rapeseed imports.

Canadian oilseed stocks Stati sti cs Canada esti mates the country’s total oilseed stocks at the end of 2019 at 18.5M tonnes. This is a 4% drop year-on-year but a 3.2% increase compared to the average over the past fi ve years.

Rapeseed – which accounts for just over three-quarters of Canadian oilseed stocks – showed a similar trend. Stocks at 14.3M tonnes represent a 2.4% decrease from the previous year, but also a 4.9% rise from the fi ve-year average.

Stati sti cs Canada esti mates soyabean stocks at the end of 2019 at 3.9M tonnes, down 9.4% year-on-year, but 2.7% up from the fi ve-year mean.

Mintec provides independent insight and data to help companies make informed commercial decisions. Tel: +44 (0)1628 851313 E-mail: sales@mintecglobal.com Web: www.mintecglobal.com

The Union for the Promoti on of Oil and Protein Plants represents the interests of companies and associati ons involved in the producti on, processing and marketi ng of oil and protein plants in Germany

BANK ON B80 USE LESS. SAVE MORE.

Pure-Flo ® B80 is the most active natural product for bleaching palm oil. Its high level of activity means dosage can be reduced without compromising performance. Our Pure-Flo ® B80 customers report as much as a 30% reduction in bleaching earth usage and a beneficial reduction in 3-MCPD ester formation.

To start significantly lowering palm oil operating costs, visit BankonB80.com

A smart roller exchange technology.

Boosting equipment availability by smart engineering: Learn how the cracking mill OLCC and its revolutionary roller exchange technology is maximizing uptime and reducing labor cost.

Learn more about your benefits on our website or contact us via e-mail:

www.buhlergroup.com/olcc

oilseeds@buhlergroup.com