15 minute read

Some food export bans imposed

Various countries around the world have banned exports of certain food commodities, including edible oils and oilseeds, to protect domestic supplies in the wake of the COVID-19 pandemic.

The customs union of Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia announced on 2 April that it would restrict exports of sunflowerseeds, soyabeans and rye until 30 June, effectively from 12 April, according to Reuters.

Romania suspended most exports of grains, oilseeds and related products to markets outside of the EU, effective 10 April, World Grain said on 16 April. The measure included exports of barley, corn, oats, rice, wheat, wheat flour, soyabeans and meal, sunflowerseeds and oil, sugar, bakery products and oil cakes. Serbia also banned exports of unprocessed sunflowerseed, sunflower oil and semi-processed oil, N1info.com reported on 17 March.

Top wheat exporter Russia approved a 7M tonne quota for grain exports from April to June. The move, announced on 2 April, was unlikely to have a strong market impact as this was the volume the country had been expected to export for the period, Reuters said.

World number three rice exporter Vietnam temporarily suspended rice export contracts until 28 March, while Ukraine’s economy ministry said it was monitoring wheat exports and would take necessary measures if required, Reuters said.

Industry experts stressed that staple crops such as soyabeans, corn, rice and wheat were available in abundance and nations had no reason to stockpile, urging nations to cooperate.

“Given the problem that we are facing now, it’s not the moment to put these types of policies into place,” said Maximo Torero, chief economist at the UN’s Food and Agriculture Organization. “On the contrary, it’s the moment to cooperate and coordinate.”

AUSTRALIA: Canola production is expected to rebound in 2020-21 after several years of below average output due to drought, according to a US Department of Agriculture (USDA) report on 6 April.

China to allow some Canadian imports

The Global Agricultural Information Network report said higher prices and improved soil moisture at planting were expected to result in an expansion of canola planted area.

Canola output was forecast to rise by 800,000 tonnes from the previous year to reach 3.1M tonnes in 2020/21, significantly more than in the past two years. Exports were expected to reach 2.2M tonnes in 2020/ 21, up 600,000 tonnes from the previous year. IN BRIEF

China will allow some canola seed imports to continue from top world supplier Canada despite its year-long trade dispute with the country, Reuters reported on 31 March.

Last March, China stopped buying canola from Canada’s two top exporters, Richardson International and Viterra Inc, citing insect and weed contamination in shipments, although it was suspected that the move was linked to Canada’s arrest of Meng Wanzhou, vice president of Chinese technology firm Huawei.

Shipments from other Canadian firms were still allowed but an agreed standard between the two countries on the amount of foreign material allowed per shipment was due to expire on 31 March, Reuters said.

Canadian agriculture minister Marie-Claude Bibeau said on 31 March that Beijing would allow imports to continue provided shipments contained less than 1% foreign material such as straw or chaff. However, no agreement had been reached regarding exports from Richardson and Viterra.

China is Canada's biggest canola market.

Palm oil futures plunge as crude oil prices go below zero Malaysian palm oil futures plunged 7.5% on 21 April to their lowest level since last August in reaction to US crude oil trading negatively, AgriCensus reported on 21 April.

With global demand for both vegetable and mineral oils dropping, this was the first time in history that US crude oil had fallen below zero. Benchmark West Texas Intermediate (WTI) futures for May delivery settled at minus US$37.63/barrel on 20 April, as traders struggled to store a glut of oil caused by COVID-19 lockdown measures hitting fuel use and demand.

Meanwhile, the benchmark July crude palm oil futures contract (FCPO) on Bursa Malaysia fell to MYR2,604/tonne (US$469.84/tonne) by close on 21 April – its biggest daily loss since mid-January and down 34% since the start of 2020.

“Palm oil was relying on palm-based biodiesel blends to absorb the increasing production in Indonesia and Malaysia but ... extremely low gas oil prices – together with curbed transport – has put biodiesel use in question,” Anilkumar Bagani, research head at Mumbai-based vegetable oil broker Sunvin Group, told AgriCensus.

Vegetable oil futures in China also fell, with soyabean and palm oil futures on the Dalian Commodity Exchange shedding 1-5% across the board and rapeseed oil futures on the Zhengzhou Commodity Exchange slumping 1-3%.

In the USA, soyabean oil futures on the Chicago Board of Trade for July delivery had been trading 2.9% lower at US$564.61/tonne, its lowest level since 23 March, AgriCensus aded.

Inefficiency is your enemy.

CONQUER IT.

Minimize downtime with equipment that’s built to last.

Unleash the power of reliability when you partner with Crown. As the world leader in oilseed processing solutions, our equipment is backed by proven technology, superior design and more than a century of engineering expertise. Crown helps you minimize downtime and overcome inefficiencies, allowing you to consistently honor customer commitments with more confidence and control.

It’s time to lead your operation into victory. Crown shows you the way.

IN BRIEF WORLD: Global soyabean output as forecast by the International Grain Council (IGC) is expected to reach a record high in 2020/21 due to a bumper crop in Brazil, a standard USA crop and production increases in smaller producing states, the Union for the Promotion of Oil and Protein Plants (UFOP) reported on 14 April.

The world soya harvest area would see a growth of 4% in 2020/21 compared to the previous year. In combination with slight yield gains, this would lead to a 7% production rise to hit a new peak of 366M tonnes.

The IGC estimated that 2020/21 global soyabean consumption would surge to a new peak – 365M tonnes – for the ninth year running.

Palm oil market loses out on lost Ramadan exports

The palm oil sector is missing out on a traditional period of high demand as COVID-19 lockdowns during the Muslim holy month of Ramadan affect imports from countries such as Bangladesh, India and Pakistan, Reuters reported on 21 April.

Palm oil demand typically increased in the two months before Ramadan, which began on 23 April this year and ends with Eid al-Fitr on 23 May. Importers usually stocked up on the edible oil in anticipation of increased food consumption as families and friends met in communal feasts to break their daily fasts, Reuters said.

With people under lockdown unable to gather as normal this year – and with many restaurants, canteens and hotels shut – iftar, or break-fast meals, were expected to be on a smaller scale.

Traders and analysts told Reuters that purchases from major Ramadan buyers in Bangladesh, India, Iran, Pakistan and Saudi Arabia had picked up in early March, but had slumped since governments enacted lockdown measures.

“We have lost that window for Ramadan demand to pick up,” said Sathia Varqa, owner of Singapore-based Palm Oil Analytics.

March palm oil exports from Malaysia, the world’s second largest producer, had fallen 27% from a year earlier to 1.2M tonnes, the lowest volume for March since at least 2016, according to Malaysian Palm Oil Board data. Top producer Indonesia’s March exports had fallen 3% from a year earlier to 1.9M tonnes, Refinitiv data shows.

In India – the world’s biggest edible oil consumer – the hotel, restaurant and catering industry was a major user of palm oil but demand from this sector had fallen as much as 40% due to a nationwide lockdown, according to analysis by the Malaysian Palm Oil Council (MPOC).

The country’s palm oil imports in March had fallen 58% from a year earlier to 335,308 tonnes according to the Solvent Extractors’ Association.

“Purchasing power is falling. People are losing jobs or witnessing pay cuts. This will have an impact on palm consumption,” a Mumbai-based dealer with a global trading firm told Reuters.

Bunge Loders Croklaan lowers 3-MCPDE levels in oils

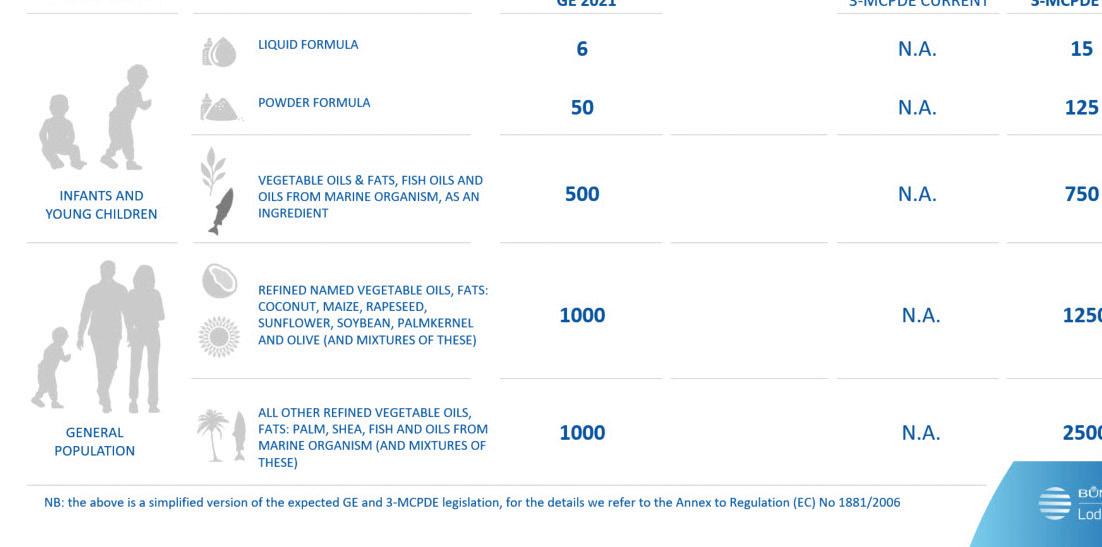

Global speciality oils and fats supplier Bunge Loders Croklaan (BLC) announced on 21 April that it had lowered 3-MCPDE levels in its oils portfolio ahead of expected EU legislation.

The European Commission (EC) was expected to set new, stricter maximum levels on 3-MCPDEs (3-monochloropropanediol esters) levels, effective in January 2021, BLC said. The potentially harmful process contaminants occurred when vegetable oils were exposed to high temperatures in the refining process.

A new legal limit of 750µg/ kg in all vegetable and fish oils incorporated into food

stuffs for infants and young children would be introduced (see above). Even stricter limits would be set for liquid and powder formula, while products intended for general consumers would have limits of 1,250µg/ kg for coconut, maize, rapeseed, sunflower, soyabean, palm kernel and olive oils; and 2,500µg/kg for palm, shea, fish and other marine oils.

The new 3-MCPDE limits would be complementary to existing glycidyl ester (GE) levels that had been in place in the EU since 2018.

“We are positioned to ensure food companies can transition smoothly into conformity with the regulations by January 2021," BLC vice president David Vandermeersch said.

The tighter regulations would largely impact food companies operating in the bakery, confectionery and infant food and formula sectors. Manufacturers would need to realign the fat formulation of their products to meet the new standards.

Maximum level (µg/kg)Product

Infants, young children Liquid formula Powder formula Vegetable oils & fats, fish oils & oils from marine organisms, as an ingredient Refined named vegetables oils/fats: coconut, maize, rapeseed, sunflower, soyabean, palm kernel, olive (and mixtures of these) All other refined vegetable oils/fats: palm, shea, fish & oils from marine organisms (and mixtures of these) 6 50 500 1,000 1,000 15 125 750 1,250 2,500

Target group

General population GE (2021) 3MCPDE (2021) SIMPLIFIED VERSION OF EXPECTED GE AND 3-MCPDE LEGISLATION Figure: Bunge Loders Croklaan

Sinograin releases 500,000 tonnes of reserve soyabeans China’s state-owned grain stockpiler Sinograin has released 500,000 tonnes of national soyabean reserves to COFCO amid low stock levels and weak imports in March, trade sources told AgriCensus on 7 April.

This was the second half of the 1M tonne volume that Sinograin had previously assigned this year to COFCO, the country’s largest food processor, AgriCensus quoted three China-based soya traders as saying.

The move was made at a time when commercial soyabean stocks had reached a near record low of 2M tonnes at the end of March, with imports during the month expected to fall about 15% year-on-year.

“It is probable that [Sinograin] is worried about shipment delays in Brazil so it wants to use reserves,” one soyabean trading manager at an international trading house was reported by AgriCensus as saying.

A number of small-to-medium oilseed crushers in China had faced supply shortages since mid-March due to logistics disruptions caused by the ongoing coronavirus pandemic.

Many had been forced to shut facilities to avoid overhead costs.

As unique AS YOUR FINGERPRINT

EACH OIL IS DIFFERENT. SO ARE OUR CUSTOMIZED SOLUTIONS FOR PURIFYING IT. LET US SUPPORT YOU IN LEAVING YOUR PRINT ON THE MARKET – WITH OUR TONSIL® SPECIALTY ADSORBENTS.

• First-class technical expertise, exceptional lab capacities and broad product range • Global mining and production network enabling high supply chain flexibility • Tailor-made formulations removing unwanted impurities while minimizing 3-MCPD/GE • Dedicated product line for bio- and renewable diesel • Sustainable environmental footprint

IN BRIEF

CHINA/USA: China imported more than 1.71M tonnes of soyabeans from the USA in March this year, up more than 13% from the same month in 2019, AgriCensus reported on 27 April.

This followed the two countries signing a 'Phase One' trade deal in January, in which China pledged to buy US$40bn of US agricultural goods this year, the majority expected to come from the soyabean sector. Before the deal, China and the USA had been locked in a trade battle which had seen the two countries imposing billions of dollars worth of tariffs on each other’s goods.

The March soyabean import volumes from the USA were still lower than those from Brazil, where a record harvest was underway, AgriCensus wrote.

US president Donald Trump says the country’s trade deal with China is now of secondary importance to the COVID-19 pandemic and has threatened new tariffs against Beijing in retaliation over the outbreak, Reuters reported on 30 April.

Trump signed the first phase of a trade deal with China in January that cut some US tariffs on Chinese goods in exchange for Chinese pledges to buy more US farm and energy goods, including soyabeans.

However, the US president made clear that his concerns

about China’s role in the origin and spread of COVID-19 had taken priority over his efforts to build on the initial trade deal.

“We signed a trade deal where they’re supposed to buy, and they’ve been buying a lot. But that becomes secondary to what took place with the virus.”

Trump said on 3 May that he believed a “mistake” in China was the cause of COVID-19, hours after Secretary of State Mike Pompeo said there was “a significant amount of evidence” suggesting that the virus emerged from a Chinese labora

tory in Wuhan, CNBC reported.

The president is eager to scapegoat China for a virus that has infected more than 1.1M Americans, killed more than 68,000 and left more than 30M jobless, ahead of presidential elections in November, according to the Washington Post.

Two US officials, speaking anonymously to Reuters, said a range of options against China were under discussion while the Washington Post said some officials had discussed the idea of cancelling some of the massive US debt held by China.

Trump warns of new China tariffs due to COVID-1 9

Global partnership makes blockchain deal

China’s soyabean imports from Brazil totalled nearly 2.1M tonnes, down nearly 25% year-on-year as crushers slowed buying due to the COVID-19 pandemic.

However, Brazil was still the largest soyabean supplier to China during March, accounting for more than half of the total volume of 4.28M tonnes imported during the month.

China’s soyabean imports from Argentina during March had been slightly higher at 336,088 tonnes, up 4% from the same month last year.

A blockchain platform provided by Singapore-based dltledgers was used to complete a US$12M shipment agreement of wheat from North America to Southeast Asia, World Grain reported on 15 April.

The companies involved included global agribusiness Cargill, Rabobank North America and Singapore, ship owner Amarante, shipping agent Transmarine and agri-commodity trader Agrocorp International. They said the trade took a total of just five days to settle compared to traditional trading processes, which could take up to a month. The transaction – settled on 1 April – was a way of helping the global agricultural supply chain deliver food, particularly during the COVID-19 pandemic, the companies said.

Blockchain provides a repeatable framework for end-to-end digital trading, digitalising documents and trade execution processes.

FGV warns of significant shortfall in palm oil production Malaysian palm oil producer FGV Holdings is projecting "a significant shortall in production" this year due to the effect of the movement control order (MCO) put in place since 18 March to combat COVID-19, The Star reported on 28 April.

CEO Datuk Haris Fadzilah Hassan said in FGV’s latest annual report that the MCO had affected the group’s performance this year by limiting the strength of its workforce, shuttering businesses and limiting the movement of consumers.

“For our downstream business, we expect a reduction in processing volume especially for the export and bulk product segments.”

The shortfall is in contrast to 2019, when fresh fruit bunch (FFB) production rose 5.6% to 4.45M tonnes and crude palm oil output increased to 3.07M tonnes from 2.82M tonnes the year before.

FGV said it had a total plantation landbank of 439,230ha in Malaysia and Indonesia, including 351,000ha under a land lease agreement with Felda. The total palm oil hectarage in Malaysia was 338,437ha.

FGV expected CPO prices to trade at between RM2,400 (US$558.46) and RM2,200 (US$511.93)/tonne this year, with tight supply and higher biodiesel mandates in Malaysia and Indonesia supporting prices.

In its outlook, FGV said China’s recovery from the pandemic provided relief as demand for CPO was expected to increase as the country replenished its stockpile. However, competition from lower cost producer Indonesia, as well as COVID-19 challenges in other key importing countries, would cap further price increases.

“While CPO prices remain stable in first quarter 2020 in spite of COVID-19 challenges, the duration for recovery is crucial for the CPO outlook,” it said.

MORE THAN ENERGY

Efficient high temperature energy solutions with steam and thermal oil.

Services by GekaKonus:

Engineering | Design | Consulting Commissioning | After Sales Service

GekaKonus GmbH · Siemensstraße 10 · D-76344 Eggenstein-Leopoldshafen Tel.: +49 (0) 721 / 9 43 74 -0 · Fax: +49 (0) 7 21/ 9 43 74 - 44 · info@gekakonus.net · www.gekakonus.net

Pure-Flo B80

BANK ON B80 USE LESS. SAVE MORE.

Pure-Flo ® B80 is the most active natural product for bleaching palm oil. Its high level of activity means dosage can be reduced without compromising performance. Our Pure-Flo ® B80 customers report as much as a 30% reduction in bleaching earth usage and a beneficial reduction in 3-MCPD ester formation.