7 minute read

Retail and catering oils

Sunflower oil is the main oil used in homes and within the hotel, retail and catering sector in Ukraine. The increasing popularity of eating out and the growth of the fast food sector means demand for fat products, including deep frying fats, will grow Olga Mozgova

There are more than 20 types of vegetable oils present in the Ukrainian oils and fats market with a per capita consumption of about 15kg/year (see Table 1, below).

To a significant extent, the vegetable oil needs of the Ukrainian market are met by domestic production. Sunflower oil was the main oil produced in 2019, totalling 6,704,000 tonnes, followed by soyabean oil at 255,000 tonnes, and corn oil at

Sunflower oil Palm oil Corn oil Soyabean oil Olive oil Other 9.8kg/person 4.4kg/ person 0.3kg/person 0.3kg/person 0.1kg/person 0.1kg/person

11,000 tonnes, according to the State Statistics Service of Ukraine (see Table 2, following page).

Ukraine also imports vegetable oils, mainly comprising palm oil at 212,200 tonnes in 2019, followed by olive oil at 2,700 tonnes (see Table 2, following page).

Sunflower, corn, soyabean and olive oils are consumed directly, while sunflower and palm oils are processed into margarine and spreads, and cooking and deep frying fats.

Use of vegetable oils

Sunflower is a traditional oil, used in homes and in almost all hotel, retail and catering (HoReCa) businesses, both in its refined and non-refined form.

Corn is also a traditional oil, used in households and some HoReCa businesses in refined form.

Soyabean oil is mostly used in Asian food restaurants as well as in fast food as a component of deep frying fats. u

Production 2015 2016 2017 2018 2019 Sunflower oil 4,913 6,410 5,628 6,503 6,704 Soyabean oil 181 165 201 340 255 Corn oil 8 9 10 8 11 Imports Palm oil 1,30.8 194.5 238.8 219.0 212.2

Olive oil 1.2 1.2 1.2 1.5 2.7

Table 2: Ukraine – Vegetable oil production and imports (‘000 tonnes)

Production 2015 2016 2017 2018 2019 Vegetable oils 130.3 121.7 112.4 12.3 124.4 Margarine 13.8 12.8 10.3 10.2 10.1 9.5 9.1 10.8 9.6 9.3 Spreads and fat mixture

Table 3: Ukraine – Vegetable oil consumption by households (‘000 tonnes)

Production 2015 2016 2017 2018 2019 Vegetable oils 78.8 78.1 77.9 81.8 83.1 Margarine 20.0 19.8 19.6 22.6 23.2 Speciality fats 20.6 30.4 30.0 32.9 34.9 4.7 4.6 4.4 5.0 5.1 Spreads and fat mixture

Table 4: Ukraine – Vegetable oil uage in HoReCa sector (‘000 tonnes)

60,000

50,000 50,400 50,200 50,000 52,700 53.200

40,000

30,000

5.6

Figure 1: Ukraine – Number of eating out businesses

Number Growth rates 2015 2016 2017 2018 2019 20,000 10,000 0 1.9 –0.4 –0.5 0.9 10%

8%

6%

4%

2%

0%

–2%

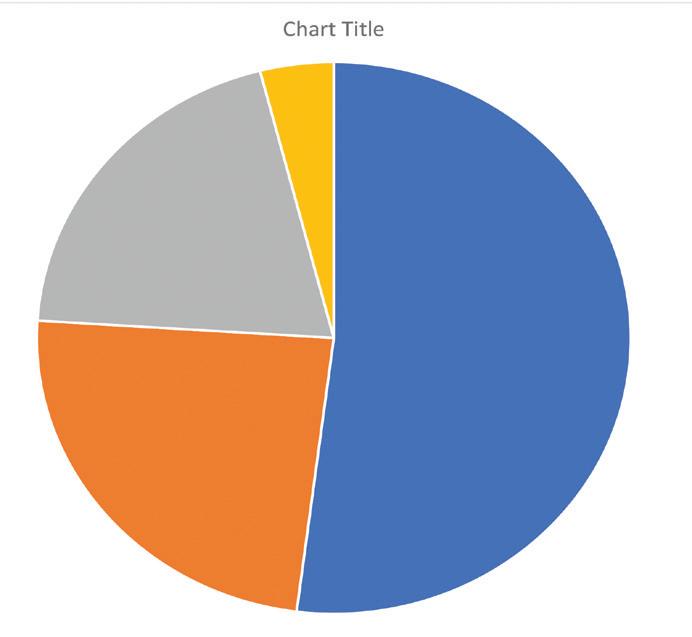

Confectionery fat 8% Spreads 3%

Margarine 16%

Deep frying 16%

Vegetable oil 57%

Source: UkrAgroConsult estimate ne

Hotels 4%

Fuel stations 20%

Catering 24%

Restaurants, cafes, pubs etc 52%

State Statistics Service of Ukraine

UkrAgroConsult

estimate

UkrAgroConsult

estimate

Source: State Statistics Service of Ukraine Ukraine

Source: UkrAgroConsult estimate ne

Olive oil is used primarily in up-market restaurants and as a premium product in households.

Palm oil is used in HoReCa businesses, especially in fast foods as a component of professional deep frying fats and other cooking fats. It is also used in households as a component of margarines and spreads.

Consumption patterns

There are some 14.9M households in Ukraine, with 67% of them concentrated in urban communities.

The size of households differs from region to region, the largest to be found in western Ukraine (2.91-3.49 people). The average number of people in a household is 2.58.

Sunflower oil is still the main vegetable oil used in household cooking due to national cuisine traditions. (See Table 2, left). It is also the dominant oil within the HoReCA sector, where vegetable oil usage comprises 57% of this sector (see Figure 2, below left). This is followed by deep frying use (16%), margarine (16%), confectionery fat (8%) and spreads (3%).

The eating out market in Ukraine is demonstrating stable growth (see Figure 1, left) with restaurants, cafes, bars and pubs accounting for the majority of this sector (see Figure 3, below).

A considerable part of this market is taken up by the catering segment which is dominated by companies delivering catering services to state and private enterprises (such as educational establishments, hospitals and military bases) as well as culinary departments of supermarkets.

Catering in fuel stations is actively developing while catering in hotels comprises the smallest part of the eating out market.

In terms of price and service levels, HoReCa businesses in Ukraine are broken down into elite (premium-class) restaurants; mid-price restaurants; and inexpensive (economy-class) cafes, bars and restaurants.

Trade sources estimate that some 30,000 HoReCa businesses now operate in Ukraine, including over 2,000 in Kiev.

International fast-food chains (particularly McDonald’s and KFC) as well as national brands are quite widely represented in Ukraine.

The McDonald’s company has been operating in Ukraine since the late 1990s. Back then, supported by the US Embassy, the network purchased and rented the best premises. It only runs its own outlets in Ukraine and no franchises are sold. As of 2017, McDonald’s had invested

US$1M in a food court, US$1.2-2.5M in a restaurant in a separate building and spent US$700,000-US$2.5M in reconstruction. The company was operating 90 restaurants in 20 cities and one village in Ukraine as of the end of 2019 and plans to continue reinforcing its position in the Ukrainian market.

KFC opened its first restaurant in Ukraine in late 2012 and now operates 30 restaurants including 18 in Kiev and nearby suburbs; six in Dnipro, four in Kharkiv and one each in Sumy and Zaporizhia. The company’s near-term development plans include opening franchise restaurants in all major cities.

KFC is less dominant than McDonald’s because of its later entry into the market and keen competition for attractive locations. There is also low demand for KFC franchises because of their high costs. According to open sources, the franchisee must pay US$48,400 plus 6% of turnover per month as a royalty fee, 4% to a marketing fund and 1% for local marketing costs. In addition, another US$700,000 on average will have to be spent on opening a restaurant.

Kiev also has 20 fast food brands operating today, while each major region has at least two to three of their own products made in fryers is quite long: pies, doughnuts, meat pastries, potatoes and other vegetables, poultry meat and various national dishes, including confectionery items.

Future trends

Fast-food outlets are the key consumers of specialised oils and deep frying fats.

Currently, almost every catering establishment in Ukraine is equipped with deep-fat fryers. The list of ready-to-eat McDonald’s, including this outlet in Kiev (pictured above), has been operating in Ukraine since the late 1990s. The increasing popularity of the fast food sector is expected to fuel demand for specialised and deep frying fats in the country Regularly visited Not regularly visited Source: Kyiv International Institute of Sociology Ukraine Figure 5: Ukraine – Age groups visiting public catering establishments

100% 80% 60% 40% 20% 0% 18-30 years old 30-39 years old 49-50 years old 46% 54% 60% 40% 77% 33%

Figure 4: Ukraine – Biggest fast food networks (number of outlets) Source: UkrAgro Consult estimate kraine

Ukrainian eating habits remain mainly conservative and most of the population still prefers eating at home.

The number of restaurants per resident in Kiev is eight to nine times smaller than in other European capitals.

However, the number of people who are eating out frequently is slowly rising.

According to poll results from the Kyiv International Institute of Sociology, about 30% of the population are now eating out at least once a month, with the highest proportion aged from 18-30 years of age. (see Figure 5, below left).

The increasing popularity of fast-food outlets is fuelled by demand (especially among young and middle-aged people) for fast service, payment convenience and the possibility to buy and consume food on the go.

This suggests that the sector will continue developing and demand for fat products, including those based on palm oil, will be high.

New companies, both national and international, will enter the market and will develop rapidly, use franchises and create consolidated companies, thereby increasing the number of catering outlets and generating strong demand for fat products. O lga Mozgova is a project manager at UkrAgroConsult, Ukraine outlets (see Figure 4 below).

250 200 150 100 50

0 McDonald’s KFC Fast Food Kryla Puzata Fresh FM Group Mafia Kartofan Pechena Systems Hata Line Belgian Kartoplya Potatoes

International National