8 minute read

Stock Adobe Photo

from OFI May 2021

e Black Sea countries of Ukraine and Russia have signi cantly increased their sun ower oil production and exports in the last 10 years. In order to ensure the export quality of this oil, safety parameters on pesticides, PAH, residual solvents and mineral oil contamination must be met Arina Korchmaryova

Sunfl ower oil is one of the world’s most popular edible oils and is widely used for direct food use and cooking purposes.

The annual volume of global sunfl ower oil trade has grown steadily in the last two decades, with the Asia region accounti ng for the greatest increase in sunfl ower oil consumpti on.

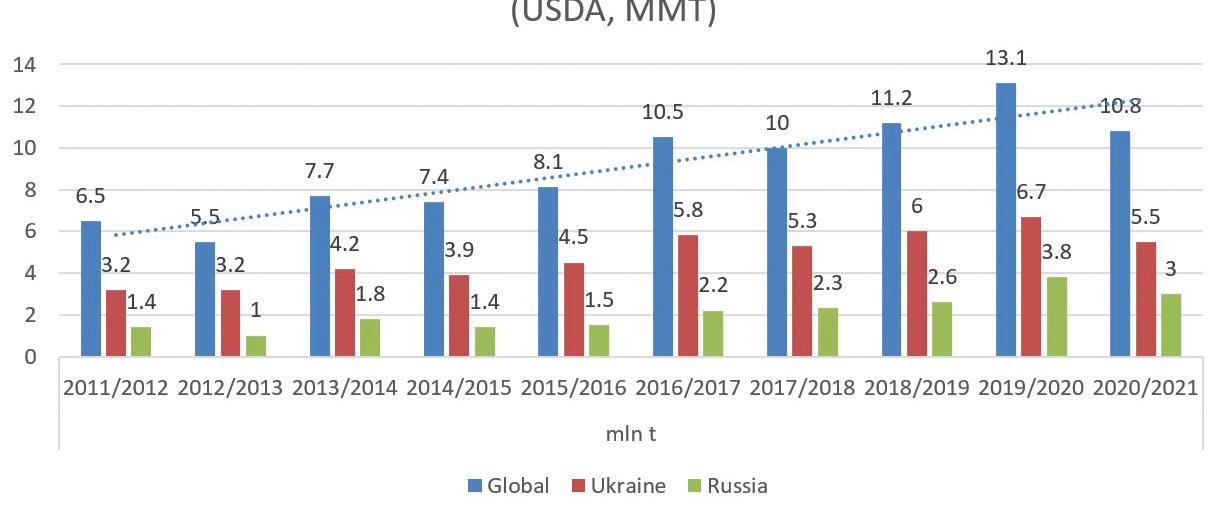

According to the US Department of Agriculture (USDA), the volume of global sunfl ower oil exports has doubled in the last 10 years, with the Black Sea countries of Ukraine and Russia increasing their exports dramati cally (see Figure 1, p20).

In 2019/2020, global sunfl ower oil exports hit a high of 13.1M tonnes

Photo: Adobe Stock

Quality risks in sun ower oil

against 6.5M tonnes in 2011/2012. Of the 13.1M tonnes of global sunfl ower oil exports in 2019/2020, Ukraine accounted for 6.7M tonnes and Russia, 3.8M tonnes. World sunfl ower oil exports fell to 10.8M tonnes in 2020/21, with Ukraine accounti ng for 5.5M tonnes and Russia 3M tonnes.

The main driver of the sunfl ower oil market has been the growth of consumpti on in China and India.

India, which was not among the top 10 importers 12 years ago, is currently the world’s largest sunfl ower oil importer, accounti ng for 24% of global imports, according to the USDA (see Figure 2, p20). It is followed by the EU (18%), China (15.5%), Iran (8%) and Iraq (5%).

Top producers

The world’s four largest sunfl ower seed producers are Russia, Ukraine, the EU and Argenti na, which account for some 70% of the oilseed’s global volume.

Ukraine is the leading global producer and exporter of sunfl ower oil, accounti ng for about a third of the world’s sunfl ower oil producti on and half of global exports.

In 2019/20, Ukraine exported a record 6.7M tonnes of sunfl ower oil, up 10% compared to the previous season. This volume included almost 6M tonnes of crude oil and 0.7M tonnes of refi ned oil. Russia has been increasing sunfl ower oil producti on for the past few years with a growth in planted area, development of its processing industry, and bett er uti lisati on of crushing capaciti es.

In the last few growing seasons, competi ti on between Ukraine and Russia has intensifi ed as the countries’ exports grow at a record pace.

Russian sunfl ower oil is cheaper than Ukrainian oil, helping the country strengthen its positi on in the Indian and Chinese markets.

Sunfl ower seed quality

The quality of sunfl ower seeds defi nes the quality of sunfl ower oil, and the standard of oilseed is heavily infl uenced by weather factors.

Last year’s low harvest, for example, was the result of unfavourable weather

conditions, primarily in southern Russia. A dry spring there was followed by a dry summer, which caused significant damage to sunflowers.

In the southern regions of Ukraine, sunflower plants suffered from heat and a lack of moisture, with yields decreasing dramatically and crops left unharvested in some fields. In central regions, sharp changes in day and night time temperatures led to excess moisture and a wide range of phytopathogenic fungi.

However, although sunflower seed yields varied from region to region, as well as from farm to farm, quality indicators remained stable.

This can be attributed to producers purchasing high-quality seeding material. In addition, the Russian government also provides subsidies to regional research institutes to develop new high-productive hybrids that will assist farmers with improving yields and producing stable quality crops.

Black Sea sunflower oil

In terms of sunflower oil quality, Ukrainian and Russian sunflower oil show relatively stable quality indicators from season to season.

Changes in sunflower oil quality usually relate not only to the quality of the sunflower seed crop, but also to the processing plant and the equipment and technology used.

Historically, Russian crude sunflower oil has a darker colour and a higher content of sediments and phosphorous compared with Ukrainian oil. In Ukraine, the safety parameters for crude sunflower oil are under more careful control.

Export requirements

Sunflower oil exporters must meet specific quality and safety requirements in their contracts, as well as adhere to the legislation of importing countries.

European countries, along with China, Sudan and Iran, have the widest list of requirements for sunflower oil quality and safety. Parameters requiring special attention are sediments, phosphorous, residual solvents and benzo(a)pyrene.

In terms of safety parameters, the key risk areas are:

1: Pesticides used in the field and/or in warehouses

Residual quantities of pesticides should be carefully watched. The EU recently tightened limits for chlorpirifos and chlorpirifos-methyl for all types of agricultural products.

This may attract specific attention to this safety parameter even though the current limit for chlorpirifos in sunflower oil (maximum 0.01ppm) is the same as the new universal limit applied to all types of cargoes effective from 13 November 2020.

Therefore, when it comes to exporting sunflower oil to the European market, shipments should be closely monitored. Inspection firm Cotecna, for example, regularly encounters situations where the content of some pesticides in sunflower oil samples exceeds maximum allowable limits.

While pesticide residues can be eliminated from crude oil during the refining process, meal contamination poses a more substantial problem.

In crude sunflower oil, the list of the most frequently detected pesticides, which Cotecna would classify as risky, are:

• Chlorpyrifos (detected in 42% of cases, of which 24% are in excess of

EU regulations) • Metalaxyl (detected in 20% of cases, of which 16% are in excess of EU regulations) • Thiamethoxam (detected in 5% of cases, of which 3.8% are in excess of

EU regulations)

Figure 1: Global, Ukrainian and Russian sunflower oil exports (million tonnes)

Source: USDA

Figure 2: Main global importers of sunflower oil, 2020/21 (forecast)

Source: USDA

In general, the pesticides which Cotecna detects remain the same from year to year, with minor percentage variations in how much they exceed EU regulations.

Unfortunately, the content of residual amounts of pesticides in crude sunflower oil has not changed or decreased in Ukraine.

The widespread use of readily-available chemicals that are very effective in pest control, violations in application patterns and relatively high limits in Ukrainian regulations mean that the ability to control the level of pesticide residues in exported products is limited.

The presence of residual amounts of pesticides in sunflowers of Russian origin has remained at a low and stable level in recent years.

2: Benzo(a)pyrene

Benzo(a)pyrene is a polyaromatic hydrocarbon (PAHs) which has been classified as a Group 1 carcinogen by the International Agency for Research on Cancer.

It is formed as a result of incomplete combustion of organic matter at temperatures between 300-600°C and does not decompose, but accumulates in the human body. PAH contamination of sunflower seed can occur through air pollution, oil contamination or storage of seeds in warehouses with floors made of asphalt.

The most dangerous pollution source is the drying of sunflower seed with solid fuel (smoke gases), in which incomplete combustion products settle on the husk surface. Even if the technological process involves hulling, PAHs can pass on into the oil.

It is worth noting that traditionally, Ukrainian consumers like “fried scented” oil, which does not involve the hulling of seeds. Roasting also takes place at high temperatures.

Unlike Ukrainian sunflower seeds, those of Russian origin are dried using natural gas, which minimises the presence of benzo(a)pyrene both in the kernel itself and in the oil.

3: Residual solvents (hexanes)

The content of residual solvents in sunflower oil may exceed recommended limits if there is incomplete removal following the solvent extraction process. COTECNA also recommends its control during batch preparation.

4: Mineral oils

According to the EU vegetable oil and protein meal industry association (FEDIOL) mineral oil hydrocarbons (MOH) are divided into two main types: • Saturated aliphatic hydrocarbons (mineral oil saturated hydrocarbons or

MOSH). These correspond to linear and branched alkanes and alkylsubstituted cycloalkanes. • Aromatic hydrocarbons (mineral oil aromatic hydrocarbons or MOAH).

These basically correspond to alkylsubstituted polyaromatic hydrocarbons.

In 2012, the European Food Safety Authority (EFSA) published an opinion on mineral oil hydrocarbons in food and found that these were present at varying levels in almost all foods.

The EFSA has said there is a potential problem with the background presence of MOSH in foods when using white oils as lubricants in production processes.

The authority also believes that foodborne exposure to MOAH may pose a potential threat due to its specific health risks.

The main potential sources of MOH contamination in the production of vegetable oils and fats are during: • The agricultural stage through leaking of diesel or lubricant from agricultural machinery. • Seed transport through diesel or grease leaks from vehicles. • Production through leakage from the mineral oil absorber system (during pressing) or contamination with lubricants (during pressing or during maintenance procedures). • Oil transport, such as contamination from previous cargoes and leaks from equipment such as pumps. • Targeted oil falsification.

Preventative measures are recommended and particular attention should be paid to lubricants and special fluids used in presses and refineries.

At all critical lubrication points, lubricants that are suitable for incidental food contact should only be used.

Mineral oil, which is used as a scavenger in the hexane recovery system, must not contain MOAH.

In addition, white mineral oils are now included in the list of previous EU cargoes. As of today, there is no EU legislation regulating the MOSH/MOAH limits in vegetable oils and fats but contractual limits may vary from 2-10 ppm. ● Arina Korchmaryova is vice president of the Baltic, Black and Caspian Seas group at Cotecna Inspection