RailwayAge

November 2016 | www.railwayage.com

Serving the railway industry since 1856

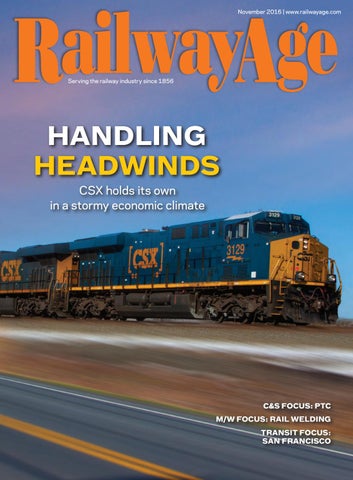

HANDLING HEADWINDS CSX holds its own in a stormy economic climate

C&S FOCUS: PTC M/W FOCUS: RAIL WELDING TRANSIT FOCUS: SAN FRANCISCO

RailwayAge

November 2016 | www.railwayage.com

Serving the railway industry since 1856

HANDLING HEADWINDS CSX holds its own in a stormy economic climate

C&S FOCUS: PTC M/W FOCUS: RAIL WELDING TRANSIT FOCUS: SAN FRANCISCO