CREATING EFFECTIVE CUSTOMER JOURNEYS

CUSTOMERCENTRIC BANKING FOR THE WIN

2022 ASPIRE CCM/CXM LEADERBOARD

CCM INDUSTRY

Practices

Results

DOCUMENTmedia.com | Fall.22

Best

Survey

AN OVERVIEW OF THE

CLICKHERETOSUBSCRIBE

10 Customer-Centric Banking for the Win

Fintechs outcompete banks because they better personalize the customer’s experience

By John Harney

By John Harney

14

Creating Effective and Personalized Customer Journeys

By taking an honest inventory, you may find the customer is doing more work for you than you are for them

By Scott Draeger

16 Tap Into the True Potential

Improve finance and accounting operations with automation technologies

By Naren Goel

By Naren Goel

18 BPM: Workflow and Compliance

Are you overdue for a check-up?

By Gilad David Maayan

20 The Middle Child of Digital Transformation

The productivity powerhouse of PDF editors and eSignatures

By Tom Coppock

22 Digital Experience Is the Way of the Future

Emerging communications buyers are driving and changing enterprise demands

By Patrick Kehoe

24 CCM Industry Best Practices Survey

Results reveal industry in flux, with sharp opinion differences concerning the role of CCM applications in the present technology world

By Allen Shapiro

What the Analysts Say

The 2022 Aspire

Makes Its Debut

About

4 fall.2022 DOCUMENTmedia.com

28

Leaderboard

TABLE OF CONTENTS 10 16 14 20 22 volume 29 issue 3 | Fall.22 | DOCUMENTmedia.com FEATURES DEPARTMENTS 08 What’s New 30 Think

It

Do something today

Do you get stuck in a rut? Do you have countless meetings that just don’t seem to move things forward?

Just over a year ago, I suggested that “As you read the articles in this issue, (you should) think about what you need to do to in your organization… start, iterate, and make it happen.”

DOCUMENT Strategy continues to provide you with pieces of the formula to create and be on top of emerging trends, so you can make improvements for your organization and your customers. I challenge you all to make things better than they were yesterday.

You don’t have to be radical, but you can’t stand still.

You don’t have to execute exactly what the authors suggest; however, you should read and digest their suggestions and thoughts to make them your own. Study the relationships between their stories and yours. Over the decades, many song writers have had their songs re-recorded in a different way, with a slightly different twist on the original. You too, should think this way. You may have a hit, too!

Speaking of music and trends, many artists are collaborating today. Have you collaborated lately? Integration of technologies is one form of collaboration. Are you working across departments in a cross-functional fashion? Are you

making your fiefdom stronger by building higher walls or larger bridges and doors? Diversity of thought strengthens most solutions and outcomes. Including people, expedites buy-in and project execution.

Make two columns on a page or in your digital notebook of choice. In column one, write down 5 “big things” (goals, problems, major objectives, etc.) that you want to achieve, fix or improve. These can be inside or outside of your organization, as in for your customers or partners. In the other column, write down 2-3 actions per “big thing” that you are going to take accomplish those things.

Need some inspiration to be the catalyst for your action? Read the great articles in this issue to stimulate your imagination and to energize you to start. Don’t stop there, iterate, collaborate and make it happen for you, your organization and customers. If you still need a push, also known as, support… reach out to the people that wrote the articles or someone you know to keep things moving. Do something today. O

president

Chad Griepentrog publisher

Ken Waddell

managing editor

Erin Eagan

[ erin@rbpub.com ]

contributing editor

Amanda Armendariz contributors

Tom Coppock, Scott Draeger, Naren Goel, John Harney, Patrick Kehoe, Gilad David Maayan, Allen Shapiro advertising

Ken Waddell

[ ken.w@rbpub.com ] 608.235.2212

audience development manager

Rachel Chapman

[ rachel@rbpub.com ] creative director

Kelli Cooke

PO BOX 259098 Madison WI 53725-9098 p: 608-241-8777 f: 608-241-8666 email: customerservice@rbpub.com

DOCUMENT Strategy Media (ISSN 1081-4078) is published on a daily basis via its online portal and produces special print editions by Madmen3, PO BOX 259098, Madison, WI 53725-9098. All material in this magazine is copyrighted ©2022 by Madmen3 All rights reserved. Nothing may be reproduced in whole or in part without written permission from the publisher. Any correspondence sent to DOCUMENT Strategy Media, Madmen3, or its staff becomes the property of Madmen3.

The articles in this magazine represent the views of the authors and not those of Madmen3 or DOCUMENT Strategy Media. Madmen3 and/or DOCUMENT Strategy Media expressly disclaim any liability for the products or services sold or otherwise endorsed by advertisers or authors included in this magazine.

SUBSCRIPTIONS: DOCUMENT

PAUL ABDOOL is the CRO of WayPath Consulting, a Customer Experience Support Platform implementation organization. He uses his 20+ years of regulatory communications industry experience to help customers develop and optimize their customer communication strategies with process automation, workfl ow solutions and professional services.

Strategy Media is the essential publication for executives, directors, and managers involved in the core areas of Communications, Enterprise Content Management, and Information Management strategies. Free to qualified recipients; subscribe at documentmedia.com/subscribe.

REPRINTS: For high-quality reprints, please contact our exclusive reprint provider, ReprintPros, 949-702-5390, www.ReprintPros.com.

6 fall.2022 DOCUMENTmedia.com

LETTER FROM THE ADVISORY BOARD

What’s New

Catch up on all the news, opinions, and current events happening around the industry.

BFMA Publishes Book Defining Best Practices and Guidelines for Forms Management

Business Forms Management Association (BFMA) announces the availability of its Forms Management Book of Knowledge. The book defines best practices and guidelines in delivering forms management services according to the roles and responsibilities within a forms management program. In addition to being a primary reference for forms management professionals, it also proves useful to other disciplines, such as information technology, records management and document management, in their interaction with a forms management program or the effective use of forms in their own areas of business. www.bfma.org

DSF ’23 Heads to Charlotte on May 22-23, 2023

For the past 15 years, DOCUMENT Strategy Forum (DSF) has reigned supreme in educating and enlightening professionals involved in Content Management, Customer Communications and Customer Experience. It’s the only peer-reviewed and peer-produced educational event for professionals who are responsible for creating and managing content, communications and strategies to enhance customer engagement.

www.documentstrategyforum.com

Madison Advisors Identifies Requirements for Evaluating a CCM Hosted Managed Services Provider

Madison Advisors has published a brief on the customer communications management (CCM) hosted managed services (HMS) market to provide insights on how to evaluate a CCM HMS provider’s overall solutions. “Transforming the Delivery of Customer Communications to Support New Demands” clarifies the definition of CCM HMS and has developed a baseline to evaluate a provider’s overall solution. According to Madison Advisors, there are seven critical components that meet the minimum requirement for a complete CCM HMS solution and that should be considered when evaluating a prospective CCM HMS partner. The brief also provides a view of the current CCM HMS landscape, including both software providers and print service providers, comparing the seven top providers offering CCM HMS. www.madison-advisors.com

Watch “The Challenges of Digital Transformation” Webinar On-Demand

Do your teams manage a large number of document-based processes? Do you have vast libraries of forms and templates that are tailored for products and regions, or multiple legacy platforms that underpin many of your products and transactions? Do budget and time constraints mean only a fraction of your processes get modernized, resulting in disjointed customer and employee experiences? Watch this informative webinar to discover how your organization can overcome these challenges and achieve your goals of transforming the endto-end customer journey. Check out this and other archived webinars at: www.documentmedia.com

8 fall.2022 DOCUMENTmedia.com

BANKING FOR THE WIN CUSTOMER-CENTRIC

Fintechs outcompete banks because they better personalize the customer’s experience

The key question millen nials are asking about their relation with their banks is this: Does my bank know me? In other words, is it addressing all my wants and needs as well as providing service

so personalized that it can predict and even exceed my expectations?

Most millennials now consider such a personalized experience from a financial company to be as valuable as its products and services. A quar ter of the US population comprise

this demographic, so incumbent banks lose big if they fail to “get” these people. Even if they do, mil lennials will bolt if they experience geriatric and sclerotic service. With a few keystrokes, they’ll switch — to a fintech.

10 fall.2022 DOCUMENTmedia.com

You’re doubtless familiar with this term — a “fintech” is a finan cial company with such advanced technology and business practices to automate and improve financial services that it is disrupting less inno vative traditional banks.

According to Business Research Company, the fintech market has exploded to $309.98 billion with a very robust CAGR of 25% through the end of this year. More than 18,000 fintech startups launched during this period (Statista). That’s a phenome nal number.

innovation there, they devote to person alized marketing and customer service. This is where fintechs excel.

With sophisticated omnichannel mar keting campaigns, fintechs can interact with prospects at the most opportune times in the customer’s buying journey. They also proactively provide recom mendations of other services relevant to customers’ present product usage and behavior. They appeal to millennials because this dominant demographic is Net-savvy with very high expectations, and key among them is dealing with a customer-centric bank.

By John Harney

With fintechs, users perform most common banking activities — open ing and managing accounts, making payments, transferring funds, getting loans, getting credit cards and invest ment consultations — anytime/ anywhere by smartphone or wearable.

Fintechs are Net-native — as virtual businesses they don’t have brick-andmortar branches, so their operations are lean, their org structures flat and their infrastructures agile. They lever age tech like AI, ML and cloud to speed and scale service and eliminate human mistakes. What they save through

That said, customers of all stripes are increasingly drawn to fintech products because they’re fast, lowcost, easy-to-use and convenient. Opening an account online takes minutes, getting a loan is almost as fast, doing a trade is instantaneous. Fintechs are also less tightly regu lated than banks, so they are flexible and can easily modify tech or service to react to market exigencies.

Incumbent banks historically have had only one advantage: trust. Customers trusted regulated and proven banks more than they did newer unproven fintechs with their money. At least, they used to.

As fintechs proliferated, they have proven their stability over time and earned the trust of customers. Even for new fin techs, their ability to deliver better service trumps trust — and incumbent banks’ failure to adapt their services promptly to customer needs trumps it further. With fintechs, customers have more leverage than with banks — and for less cost and trouble.

DOCUMENTmedia.com fall.2022 11

With fintechs, customers have more leverage than with banks — and for less cost and trouble.

SUBSCRIBE FOR FREE!

PARTNERING TO SCALE FAST

Now that fintechs are established, other industries are embedding fintech capabilities into their products. Fintech has made corporate travel much easier, for instance. Travel companies have embedded fintech via APIs to automate payment and lending and even insur ance right from the travel app. Banks, therefore, now have new competition from fintech-embedded travel and tour ism but also from all manner of other fintech-embedded companies. For instance, retailers now commonly make loans to merchants, so merchants don’t have to go through banks. You can now get fintech capabilities from many companies, including telcos, insurance companies, and car manufacturers. Just about any company can become fintech-embedded.

To remain competitive, banks them selves have bought or partnered with fintechs instead of trying to build those capabilities. The bigger the bank, the more likely it’s partnered with one or more fintechs. Size matters. Banks’ legacy infrastructure is often dated, so processes are far from friction-free, and data is siloed there. Most banks also have trouble identifying new cus tomers and analyzing their big data for useful insights. They are modernizing their front ends to stave off the fintech competition while they gradually inte grate them with, and modernize, their legacy systems, but these legacy sys tems are holding them back.

When banks and fintechs partner, they necessarily enter into a coopetition sit uation — banks benefit from fintechs’ technology and fintechs in turn get access to banks’ customers, big data and credibility. Both lose some of their com petitive advantage by sacrificing what uniquely distinguishes them, but they win much more — they can scale faster and win new customers by partnering than they could by trying themselves.

THE EXPERIENCE ECONOMY

We have moved from a services economy to an experience economy dominated by millennials who crave

meaningful or at least exciting expe riences more than expensive brands of products and services. Their spending on experiences is probably also due to the fact that materialism is not an option — they generally can’t afford the big house and two cars that pre vious generations could. However, because they spend so much time online, they also inordinately value offline live experiences. Ironically, they seem to get great pleasure from sharing memories of those experi ences back online over social media. Memorable experiences are meaning ful ones, and providing meaning is part of fintechs’ value proposition because it’s part of millennials’ constitution.

that fail to provide pleasurable and personalized experiences just lose mil lennials. Millennials were raised on fingertip finance, can switch to banks with better services online in seconds, and have little brand loyalty.

THE FEELING FACTOR

A surprising fact about millenni als is that about half admit they want an emotional connection with their bank. They want banks to be like fam ilies that honor their values — to be sentient and always engaged. To hyper-reinforce customer trust, fintechs promote activities that stir millenni als’ emotions: with contributions to the community, charities, continuing edu cation for employees and so forth. The appearance of benevolence pays off — it directly impacts customer churn.

SURROUNDING THE CUSTOMER

Banks like Capital One are staging live experiences that make their brand of banking more palatable. Its branches resemble coffee houses more than tradi tional bank branches. They offer coffee, food, a hip setting with free wi-fi and concierges who greet and guide cus tomers throughout the bank to services they might be interested in. Their fin tech capabilities extend this physical experience into a virtual one by then customizing a banking package for each customer instead of forcing her to choose fixed services from a limited menu.

Banks that take a utilitarian approach with standardized services

Banks, companies with embedded fin tech as well as fintechs themselves, of course, each want to own the customer relationship. The winner will be the one that best personalizes its experi ence by meeting millennials’ unique wants and needs throughout their life times. While each of these businesses pursues a complete view of the cus tomer, the customer in turn is best served by having a unified view across all lines of business they deal with like checking and savings accounts, credit cards, mortgages, lending, brokerage account, etc. The customer then gets an easily navigable window display ing all products and services without repeatedly exiting and entering apps.

GETTING PERSONAL

Most millennials rate personalization as fintechs’ most desirable capabil ity. Fintechs enhance the 24x7 remote experience in several ways.

Attend to data. Access to and anal ysis of customer data is essential. For instance, if a fintech knows the age of a customer’s car, it can offer him a car loan. Banks typically accrue lots of data over the course of dealing with a customer. However, often they can’t

12 fall.2022 DOCUMENTmedia.com

[Fintechs] appeal to millennials because this demographic is Net-savvy with high expectations, and key among them is dealing with a customer-centric bank.

locate it because it’s siloed in legacy apps; if they can find it, it might not be reliable — current and accurate; they can’t determine reliability without data analytics; and without analytics they can’t massage the data in a sophisticated way so it yields insights about the customer they can act on to better serve or sell the customer. Fintechs, by contrast, can deliver on all these counts so, whereas banks have data, fintechs can better mine it to develop customized products and services.

Use AI and ML to present sell and serve opportunities. These technologies automatically track and analyze customer behavior. The fintech can trace how customers navigate its website then prompt them with serve and sell offers at various touch points.

Provide omnichannel collaboration. Serve and sell the customers in ways they communicate over multiple

channels like email, instant messaging, chatbots, and so forth.

Offer a unified view of customer’s involvement across lines of business. Often multiple finance personnel are involved in a customer’s interaction. Fintechs make it easy for the customer to simultaneously interact with people in different lines of business seamlessly in real time through a unified view.

Customize portfolios. Fintechs don’t make the customer fit a fixed portfolio model — they customize portfolios according to customers’ requirements, so service is more personalized.

Offer robo-advising so more customers can invest in the market in ways unique to them. Robo-advising lets more customers get investment advice for lower fees and minimum account balances according to a portfolio management algorithm. This

allows automated investing according to customers’ preferences and risk tolerance.

The fintech value proposition is so irresistible that most banks are pursuing partnerships. Meanwhile, fintechs’ advanced technology enhances or automates so many banking services that it frees high-value personnel to concentrate on more complicated high-margin investment and other services. So they win on numbers, as well as quality, of customers. O

JOHN HARNEY is President of SaaSWatch, where he consults on Software-as-a-Service techs and markets. He also reports on IT issues across most industries, particularly where SaaS, cloud, AI and content are solutions, and especially as they drive the greening of the planet. He can be reached at 240.877.5019 and jharney583@gmail.com.

DOCUMENTmedia.com fall.2022 13

SUBSCRIBE FOR FREE!

CREATING EFFECTIVE AND PERSONALIZED CUSTOMER JOURNEYS

doing for them. If so, it is time to fix that mix and align processes to customer goals to improve customer relationships and remove costs from the organization.

Before we get to effective customer journeys, however, let’s survey what you have in place today. Maybe you have some amazing journeys that can serve as a reference point for other teams in your organization. A journey mapping workshop is a great way to get this process started. Collect as many artifacts and as much evidence as possible to represent as many of your customers’ engagements with your brand as possible. As DOCUMENT Strategy readers, we’re going to have a lot of CCM applications, but you also need to collect common call center scripts, tweets with links to landing pages, marketing emails, sales proposals, product reviews, community forum discussions and representation from every one of your systems that create customer experiences.

By Scott Draeger

Before we discuss the act of creating effective and personalized customer journeys, it is important to be reminded that the term “customer journey” tells us it’s the customer’s journey. It’s not mine, not ours and not yours. With near 100% confidence, we can bet your customer didn’t start their day with a desire to fill out forms, enter in dates properly, prove they are not a robot, comply with your password standards, start over because of a typo, press “4” for support or read your 30-page contract. To understand personalized customer journeys, you

must first understand what the customer wanted to accomplish.

Most often, your customer is trying to get something done. It can be myriad things from financing that car, getting braces for their child, moving to a new home, having Wi-Fi in their new apartment or obtaining services from a local agency. That sounds simple, but it’s important to think about how your systems may be making the journey unnecessarily difficult, less successful and more expensive. If you take an honest inventory of your current customer journeys, you may start to see the customer is doing more work for you than you are

Now that you have some artifacts for review, you will clearly see that some experiences and touchpoints will need more improvement than others. Start with the worst you find. You probably know what they are prior to this, but you may be afraid to bring them up in office conversation. Next, find examples of your best experiences from your best journeys. Now, you clearly see some experience deltas, as you have the worst experiences and the best experiences on display.

Do all your customers experience both the best and worst you have to offer? At major enterprises and smaller businesses, sadly, the best clients are often treated the worst. Your best clients often use the widest variety of your products and services, so they experience the full range of experiences you offer. They may receive each possible communication from every system, putting any of your inconsistencies in tone or production value into sharp view. Let’s look for journeys that feature large experience deltas as a starting point.

Choosing that starting project and putting it on the board, let’s focus on

14 fall.2022 DOCUMENTmedia.com

By taking an honest inventory, you may find the customer is doing more work for you than you are for them

some end-to-end journeys that have high experience deltas. The onboarding journey is a common one, because it starts with high production value marketing content, moves through some product

configurations, shifts to a contract reading experience and concludes with a new service to learn. As you evaluate the technologies underneath your experience, you will likely find opportunities to improve service while finally retiring some technology that is creating your worst customer experience problems.

Next, talk to your customers. Don’t make assumptions about them because you think you know them. Talk to them. Do some digital ethnography. Video some interviews. Go to their locations. Understand what they like or dislike about your services. Find out how they like to pay for things. Learn where they get information. Now, you are starting to see how you can personalize journeys in a way that maximizes customer value.

As you move forward, it’s important to measure the impact and effectiveness of these optimized journeys. Chances

are that you may have to deliver an MVP or limited agile project to improve one journey. Make sure you document the returns and the investment in a way that accurately attributes the long-term success to your initial investment. That way, you will be empowered (and budgeted) to improve journeys for more customers from more segments. O

SCOTT DRAEGER, CCXP, M-EDP, is Customer Experience Officer at QUADIENT. He joined the digital document industry in 1997, after graduating from UNLV. He started as a document designer using a collection of hardware and software technologies, before moving to the software side of the industry. His broad experience includes helping clients improve customer communications in over 20 countries. He earned his MBA in 2007 from the Lake Forest Graduate School of Management.

DOCUMENTmedia.com fall.2022 15

At major enterprises and smaller businesses, sadly, the best clients are often treated the worst.

SUBSCRIBE FOR FREE!

TAP INTO THE TRUE POTENTIAL

Improve finance and accounting operations with automation technologies |

By Naren Goel

HOW TO FACILITATE OPTIMAL OPERATIONAL EFFICIENCY

While many solutions can facilitate auto mation in finance, the most effective include a range of hyperautomation tools to automate everything that can be auto mated or made more efficient.

Hyperautomation — By automating everything that can be automated, hyper automation is not a specific technology but a business methodology that lever ages a multitude of technologies and solutions. It is centered around improv ing general operations from DevOps to Accounting to Marketing. When adopt ing a hyperautomation strategy, busi ness leaders will systematically identify any and all viable use cases for automa tion technology across their entire orga nization. Standard hyperautomation tools include AI, machine learning, intelli gent document processing (IDP), RPA, iPaaS, etc.

The basic premise behind hyperau tomation is this: If automating one set of processes has an incremental impact on efficiency, then automating a multi tude of functions will yield substantial operational improvements. This hyper automation strategy is projected to be widespread in the finance sector.

ntities operating within the finance and account ing sector have been some of the most fervent adopt ers of automation technol ogies. McKinsey’s Global Survey found that making automation a strategic pri ority was conducive to success beyond the piloting stage. Automation is trend ing within finance and accounting; how ever, there is still plenty of room to drive further operational efficiency despite all progress.

THE CURRENT STATE OF ACCOUNTS RECEIVABLE AND FINANCE

Most finance, accounts receivable and

accounts payable departments have invested heavily in automation solutions to streamline operations. However, these entities continue to contend with several major efficiency hurdles.

Reports show that almost 50% of all accounting tasks can be done through today’s technologies but is projected to go up to 90% within five years. As high as these values seem, only 1.4% of finance companies are fully auto mated, with only 22.4% primarily auto mated (>75% automated). This data reveals that far too many entities oper ating within accounting and finance are barely tapping into the true potential of automation technologies.

Intelligent Document Processing — Intelligent document processing (IDP) is a technology that can use AI to capture, classify and extract data from various documents, such as invoices or other financial records or forms. Effectively, IDP builds the foundation for data col lection. These technologies eliminate the need for time-consuming manual data entry practices and improve effi ciency by reducing the frequency of input errors.

Automation in finance is virtually impossible without employing a proven IDP solution. This software can be deployed to streamline invoice process ing, ensure compliance with regula tory requirements, extract consumer ID data, automate mailrooms and digitize analog records.

Robotic Process Automation — After post-processing, IDP’s actionable data can then be fed to an RPA solution. RPA is a technology used to automate repet itive business processes using bots,

16 fall.2022 DOCUMENTmedia.com

digital workers or robots. This software can be programmed to perform a wide array of redundant tasks.

According to Gartner’s research, human error in finance costs an aver age of $878,000 per year in avoidable rework. As it applies to automation in finance, RPA can be used to perform redundant tasks far more efficiently than humans. These robots also complete these tasks with near-flawless accuracy, significantly reducing accounting errors.

iPaaS — iPaaS acts as the connec tion between your organization’s differ ent technologies. Integration Platform as a Service or iPaaS is a group of cloudbased services designed to facilitate the integration of various workflows. iPaaS is used to connect multiple applications and processes across an organization.

iPaaS can pave the way for more effi cient automation in finance by allowing separate applications to communicate with one another. For example, using an iPaaS solution is as simple as 1, 2, 3. It can:

1. Connect your IDP solution with an iPaaS tool

2. Automatically feed data into your RPA for invoice processing or other tasks

3. Then, the RPA system can export the invoices into your ERP solu tion, where the data is stored and payment is made

This end-to-end automation enables com panies to use best-of-breed technology without manually entering data multiple times into multiple systems.

5 BENEFITS OF DEPLOYING AUTOMATION TECHNOLOGY IN FINANCE

According to Ardent Partners’ Accounts

Payable Metrics that Matter in 2022 report, the average processing time for an invoice is still 10 days. In addition, pro cessing a single invoice costs businesses $9.25 on average. Although this figure has decreased by 15% since last year, deploy ing additional automation in finance is projected to drive costs even lower.

Investing in automation solutions such as those previously outlined can also provide other benefits. These technol ogies will allow finance and accounting professionals to:

1. Spend Less Time on Manual Tasks

Manual data entry tasks are among the most tedious responsibilities that accounting and finance professionals will engage in. By adopting IDP solutions and automation software, finance orga nizations can significantly reduce the workload of their data entry personnel. This approach will give these profession als time to perform more value-centric tasks, such as interacting with clients.

2. Fuel Efficiency Across All Business Processes

When businesses deploy a single auto mation solution, they can increase the efficiency of a specific workflow or pro cess. However, the Ardent Partners report explains that implementing mul tiple technologies in a short period will allow them to achieve an optimal return on investment on tasks such as:

Invoice processing

Contracts

Audits

Electronic invoicing

Supplier portal management

Procure-to-pay solutions

Contract/payment plan matching

Automated routing and approval workflow

3. Improve Cash Flow Management

Decreasing invoice processing time and lowering the cost of obtaining payment by implementing automation technol ogies will create a stable cash flow. In addition, these tools will increase trans parency by providing businesses with a means of digitizing and structuring their data. For example, Honda Logistics of North America reaped many rewards when they found that document auto mation turned their accounts payable processes into a profit center within their business.

Honda Logistics processes 135,000 invoices per year, which were all previ ously handled manually by a team of peo ple, requiring lots of time and data entry into their JD Edwards system. However, with document automation, integrating all their internal systems was streamlined and offered tremendous efficiency.

Brad Gerritsen, their Accounts Payable Coordinator, was quoted say ing: “The solution freed up our time by

SUBSCRIBE FOR

transforming data entry roles into more managerial roles. We can now quickly answer vendor questions, track invoices and monitor cash flow. We have visibility into all of our documents, so when audi tors come, they have immediate access to all information.”

4. Boost Job Satisfaction

In addition, automation technologies reduce the burden on personnel. Their adoption will lead to higher job satis faction and better employee retention because employees no longer have to key in data themselves or conduct manual data entry. Without these cumbersome, repetitive tasks, they will have time to focus on higher-value activities that can bring more value to your business.

5. Make Data-Driven Decisions

Much of the conversation surrounding automation in finance is centered around how these technologies facilitate opera tional improvements and enhance effi ciency. While these are certainly some of the most prominent benefits these solu tions yield, automation technology also increases data accessibility and is the first step in any hyperautomation initiative.

Businesses can more effectively use, measure and analyze their data, which they can then leverage to guide deci sion-making, gather business intelli gence and provide a higher quality of service to their clients.

WHERE ARE YOUR AUTOMATION PLANS HEADING IN 2022?

Has finance and accounting come a long way in the race to adopt automa tion? Yes, but there is undoubtedly more work to be done. Early adopters will be well-positioned to succeed both in the short and long-term, whereas those that fail to evolve will lag behind. Will your organization make automation in finance a top priority this year? O

NAREN GOEL is responsible for leading the global finance organization for Ephesoft. He is focused on driving the company’s next phase of growth including international expansion in a met rics-driven, structured and fiscally responsible manner as Ephesoft continues to lead world wide adoption of supervised machine learning document capture and analytics.

DOCUMENTmedia.com fall.2022 17

FREE!

BPM:

BY GILAD DAVID MAAYAN

WORKFLOW AND COMPLIANCE

Are you overdue for a check-up?

WHAT IS BUSINESS PROCESS MANAGEMENT?

Business Process Management (BPM) is a strategy that models, analyzes and optimizes end-to-end processes to achieve business objectives, such as improving customer experience and implementing a regulatory compliance framework. BPM methods can apply to repeatable, predictable and continuous processes and tasks.

Business processes are sequences of steps that businesses implement to achieve predefined goals. BPM allows you to evaluate existing business pro cesses and identify ways to increase efficiency, minimize error, reduce costs and drive digital transformation.

Business process management is an ongoing effort that improves business outcomes in the long term. BPM elim inates ad hoc practices and ensures a unified workflow management pro cess. It helps optimize operations and

empowers you to provide better ser vices and products to consumers.

WHAT ARE THE BENEFITS OF IMPLEMENTING BUSINESS PROCESS MANAGEMENT?

BPM provides a management structure to improve business processes, ensur ing operational quality and efficiency. If properly executed, a BPM program elim inates waste, reduces errors, saves time, strengthens compliance, increases agil ity and improves product delivery.

Here are the main reasons to adopt BPM: Increased business agility — You must continuously update and opti mize your business processes to keep pace with changing market condi tions. BPM lets you suspend busi ness processes, apply changes and restart them. By modifying, reusing and customizing workflows, business processes become more agile, giving

your organization greater visibility into the impact of process changes.

Increased revenues and lower costs

— BPM tools eliminate bottlenecks and significantly reduce operational costs over time. BPM helps shorten product sale lead times, allowing customers to receive products and services faster, resulting in increased sales and improved profitability. A BPM solution can allocate and mon itor resources to minimize waste, reducing overall costs.

Increased efficiency — Business pro cess integration lets you improve the overall efficiency of your busi ness strategy. A process owner can leverage the information provided by BPM solutions to monitor pro cesses, identify delays and allocate extra resources when necessary. Another way to increase the effi ciency of business processes is to automate repetitive tasks and elimi nate unnecessary tasks.

Increased visibility — BPM supports automation and ensures real-time performance monitoring. You can track key performance indicators to increase transparency and control over processes and outcomes.

Improved compliance and security — A comprehensive business process management strategy ensures your organization is up-to-date with reg ulations and compliant with indus try standards like the Sarbanes Oxley Act (SOX) or PCI DSS. BPM facili tates security measures with proper documentation of all processes, helping encourage employees to protect corporate assets, including physical resources and confidential data, from misuse or theft.

STEPS OF A BPM LIFECYCLE

A typical business process management lifecycle includes the following steps:

Design — In this step, you review existing business processes and perform end-to-end process map ping. You don’t change any busi ness processes; only identify and document them.

Modeling — This step uses a visual display to represent the business

18 fall.2022 DOCUMENTmedia.com

processes. Here you refine details such as conditions and deadlines to get a clear picture of the data flow and event sequence.

Operation — In this step, you acti vate the model. While implementing the BPM plan, set up success/failure metrics to evaluate and compare the new process to the existing one.

Monitoring — Monitor the new BPM model’s performance after imple menting it. This step verifies that the new processes address inefficiencies and bottlenecks and that people uti lize them. What looks fine on paper or works well for small tests might not be effective when deployed throughout the organization. If the model underperforms, consider roll ing back the deployment. Monitoring the new processes allows you to identify problems proactively and take action when necessary.

Optimization — This step involves continued fine-tuning and improve ments to the business processes. Even a process that works well may have room to improve, such as ineffi cient manual tasks.

5 COMPLIANCE CONSIDERATIONS FOR A BPM PROGRAM

BPM ties closely into compliance ini tiatives at your organization because it determines how sensitive and mis sion-critical business processes take place. Here are several considerations for making your BPM program com patible with, and supportive of, com pliance with regulations and industry standards.

1. Aligning BPM with Compliance Requirements

Make a plan to align your BPM pro gram with your organization’s specific compliance requirements. The plan should include:

Description of compliance stan dards that are relevant to each business process

necessary to meet compliance requirements

Repeating the process when there are changes to the compliance standard or the business process

2. Using a Compliance Management System

The above process can become very labor-intensive, especially in large organizations or heavily regulated industries. A compliance manage ment system collects and organizes policies and procedures related to the company’s compliance efforts. It gen erates compliance reports, facilitates audits and enables visibility for senior management.

If your organization has a compli ance management system, use it to evaluate the service compliance risk in your business processes and ensure they addresses the relevant regula tions, laws, industry standards and organizational policies.

3. Securing Endpoints and Applications

Many compliance standards have spe cific requirements with regard to cyber security. Endpoint protection solutions protect endpoint devices and entry points to the corporate network (i.e., desktops, mobile devices, etc.) from malicious actors or activities. Modern endpoint security goes beyond tradi tional antivirus, providing comprehen sive security measures against advanced malware and zero-day attacks.

Another common requirement of compliance standards is having a clear, well-documented incident response plan. The plan should state how the organization will react to a security breach and take measures to contain and eradicate the threat.

4. Managing Sensitive and Confidential Data

SUBSCRIBE

information without understanding the implications of mishandling this data. This could expose your organization to social engineering attacks, regulatory fines, legal penalties and damaged customer trust.

Identify how each business process protects PII and manages sensitive data assets. This includes how the process and employees are participating in it:

Identify personally identifiable information.

Choose where to store sensitive data.

Evaluate and classify data assets based on sensitivity.

Enforce acceptable usage policies.

Encrypt sensitive data and carry out key management.

Participate in training or education to raise awareness of PII protection.

Make it easy to communicate and report suspicious activities.

5. Documenting Business Processes

An often overlooked aspect of BPM is documenting business processes and ensuring documentation is updated. This can be done manually; however, for larger organizations it is prefera ble to have an automated tool that can generate documentation directly from the BPM system (many BPM platforms have this capability).

For compliance purposes, it is essen tial to have a clear process to generate, update and redistribute BPM docu ments. There should also be a process for managing versioning of process doc umentation. This creates an audit trail which internal and external auditors can investigate to understand changes to business processes over time.

I hope this information will be useful as you consider the compliance impact of your BPM program. O

Mapping compliance standards to specific steps in the business process

Understanding implications of com pliance requirements on each step

Modifying the business process if

It is important to identify which busi ness processes use, collect or process personally identifiable information (PII). This could include information about company employees or custom ers. Some departments in an organiza tion might continuously collect, store and distribute PII and other sensitive

GILAD DAVID MAAYAN is a technology writ er who has worked with over 150 technology companies, producing technical and thought leadership content that elucidates technical solutions for developers and IT leadership. To day he heads Agile SEO, a leading marketing agency in the technology industry.

DOCUMENTmedia.com fall.2022 19

FOR FREE!

THE MIDDLE CHILD OF DIGITAL TRANSFORMATION

BY TOM COPPOCK

BY TOM COPPOCK

When we talk about digital transfor mation, advanced technologies like artificial intelli gence and intelligent automation often steal the limelight. Don’t get me wrong — they both bring a lot of value and certainly accelerate the digital trans formation journey.

But there’s an often-overlooked aspect of transformation. It’s not as flashy as AI, and it doesn’t sound as excit ing as intelligent automation. However, it deserves just as much attention

because it serves as a stable force con stantly propelling companies further toward their transformation goals.

I’m talking about good old-fashioned productivity.

And it’s finally getting its due. While business productivity has always held a spot on the list of goals for companies, the shift to hybrid work, supply chain issues and labor shortages have moved it into the spotlight.

One area getting a lot of attention when it comes to improving productiv ity is document collaboration. Many businesses and departments (from legal

to accounting and even design) deal with complex documents and contracts which require collaboration and sign-off from people in different business units, external partners and clients.

This type of workflow is hard to auto mate because each instance typically has unique requirements. There’s just too much variation in the content or workflow to standardize the process steps or leverage machine learning.

But there are desktop tools and cloud services that can facilitate these inter actions. Specifically, modern PDF edi tors equipped with advanced features

The productivity powerhouse of PDF editors and eSignatures

SUBSCRIBE FOR FREE!

like eSignatures boost productivity and improve the employee experience, while simplifying (and accelerating) workflows.

With the right document manipu lation tools in place, the productivity middle child is finally able to take cen ter stage and show what it can do.

6 REASONS PDF EDITORS DESERVE YOUR ATTENTION

1. Visibility: Document workflows are often cumbersome and slow, with little visibility into progress once the docu ment leaves your organization. With a PDF editor, you have access to the doc ument at all stages.

2. Efficiency: The people involved in reviewing and signing contracts and other important documents are highly skilled (and expensive) resources. A PDF editor lets them review and sign documents when it’s convenient, so you pay for less of their time and avoid scheduling headaches.

3. Simplicity: A PDF editor is easy to set up and use, keeping your workforce productive without placing an added burden on IT resources for implemen tation and maintenance.

4. Speed: Collaboration on documents including reviewing, editing, redlining and even signing — fast and simple.

5. Trust: When you can guarantee the identity of people signing docu ments, your contracts and other PDFs are legally binding and valid.

6. Data protection: The ability to ensure only the correct information is shared and personal information is pro tected reduces the risk of a data breach or GDPR violation.

This combination of benefits makes a PDF editor a productivity powerhouse, and organizations are already seeing boosts in efficiency.

A small law firm had to switch to electronic filing of documents per a state mandate. The firm opted for a fully featured yet cost-effective PDF editor equipped with electronic sig natures and sign-and-fill capabilities. Now, client intake and e-filing with the

state are easier than ever, and compli ance isn’t an issue. They also provide better service to their clients, miss fewer deadlines, and have more accu rate digital paperwork.

Another law firm was frustrated with the slow performance and lack luster features of its current PDF soft ware. They moved to a modern solution that can open large files quickly.

Employees can also save PDFs directly into their document management sys tem and convert PDFs into “live” files for the collection of digital signatures.

Operational efficiency increased with minimal training required.

QUALITIES OF A POWERFUL AND RELIABLE SOLUTION

How can you make sure your PDF editor won’t be ignored or left in the corner? The right solution will be used by your team day in and day out to get more work done, faster and more efficiently.

It should offer a variety of tools when it comes to editing and reviewing, and it should be able to convert PDF files to and from Word, Excel, PowerPoint, JPG and HTML. Integration with doc ument management systems like SharePoint and security features such as encrypted passwords and permis sions are also important.

Those looking for maximum produc tivity gains should also keep an eye out for the following capabilities:

Built-in collaboration tools: When users can easily add comments, redline contracts, and highlight import ant information with an easy-to-use interface, employees can collaborate with each other, partners and clients from anywhere.

going to happen. A powerful PDF editor can take any PDF and create a fillable form so it’s easier to collect information. Added functionality like customization of forms and the capa bility to combine forms with other PDF documents to create packets for employees and clients are additional time-savers.

eSignatures: The shift to hybrid work has made the move from wet sig natures to digital ones even more important. The ability to add legally binding digital IDs and signatures to documents keeps documents moving through the proper chains, regard less of where each party involved is located.

Certificates for eSignatures: It’s not enough to be able to add digital sig natures. You have to be able to iden tify the signing parties, prove they’re the ones who actually signed, ensure the document can’t be changed after it’s signed and that it’s legally valid. Digital certificates use globally agreedupon technology to address these issues, so it’s best to look for a PDF editor that’s easy to configure with a certificate from a Certificate Authority.

Live document collaboration sessions: When users can collaborate on a doc ument in real time from any location, it’s a productivity dream. When evalu ating this feature, however, make sure the solution will automatically delete the PDF from the server as soon as the collaboration session ends for maxi mum security.

Simple automations: The ability to apply a set of stored operations to one or more PDF documents saves time while enhancing security. Look for a solution that enables you to build and reuse simple workflows to add water marks, redact sensitive information or remove comments in batches.

Information collection: While we’d all love forms to just go away, it isn’t

Productivity is no longer a boring, over looked goal. Modern PDF editors with eSignatures and a robust feature set boost productivity and efficiency and move this former middle child of digital transformation to favorite child status. O

TOM COPPOCK is Manager of Sales Engineering at Kofax. As a senior leader of geographically diverse teams, Tom has a track record of achieving targets and driving change programs to achieve business goals.

DOCUMENTmedia.com fall.2022 21

DIGITAL EXPERIENCE IS THE WAY OF THE FUTURE

EMERGING COMMUNICATIONS BUYERS ARE DRIVING AND CHANGING ENTERPRISE DEMANDS

BY PATRICK KEHOE

BY PATRICK KEHOE

The push to digital experiences will continue to grow as digital-savvy consumers demand that communications, invoices and, in general, customer service be available to them via their phones. That brings up concerns for any business with incohesive platforms. How can we meet the demands of today’s digital consumer with the tools we have? How can we drive consistent experiences across channels when different systems offer different personalization options? Organizations with multiple deployment systems requiring the same content to be copied and moved to various platforms, delaying deployment and leaving room for error will not survive in the emerging market.

The old rules of engagement have been thrown out the window. Today’s buyers are living in an age where they can order from Amazon in the morning and receive their item in the afternoon. Our customer communications management (CCM) platforms must be as nimble as Amazon’s delivery.

We have learned from the development of paper communications that creating a document template for each individual communication creates an unmanageable library of templates to maintain. Expanding the channels of communication to include a variety of digital options managed in distinct platforms further compounds this. With that in mind, let’s think about communicating in a way that makes sense: one message, multiple methods of distribution, from one system. We must think on an enterprise

scale with a solution that can meet the needs of the various teams that are involved in customer communications.

Smart companies are looking ahead and managing their content separately from the presentation wrapper. The right kind of content management system will connect to the various channels that are required and will leverage a modular content management paradigm that enables the right content component to be personalized and delivered across the right channel at the right time.

RETHINKING THE APPROACH TO CONTENT

How do we move to this new paradigm? First, we need to think about content differently. Content is not the same as the presentation layer. Content is the message and the presentation

22 fall.2022 DOCUMENTmedia.com

layer is the layout and delivery meth od. The message needs to be as agile as the market is, no matter what the end presentation is. This new way of thinking takes the focus away from sin gle documents and focuses, instead, on renditions of content components.

In regulated industries, such as finan cial services, insurance and healthcare, that have historically relied heavily on composed printed customer communi cations, many digital experiences today consist of downloading static PDFs from emails or web portals. Consumers, particularly the digital-native Genera tions Y and Z, demand more dynamic experiences that are designed for the mobile devices they prefer. Those kinds of experiences require highly personal ized content to be efficiently delivered in near real time. New headless CCM

capabilities are available today to take advantage of a platform’s unique mod ular content management model to dynamically curate and deliver rele vant, personalized content components to modern digital endpoints in response to API calls. Headless CCM leverages your CCM content repository and re sponds to API calls to provide the right content in JSON or HTML to digital endpoints. Since content is abstracted from the presentation layer, any frontend tool can display and format the content and deliver it. Headless CCM complements your website and mobile application frameworks by providing consistent content across all channels while allowing those frameworks to pro vide the presentation and delivery layer. A content-driven approach puts power in the hands of the business to update and deploy content without delay, elimi nating the need for IT to have to make the same content change in several systems and document and communications tem plates. Content can now be delivered in near real-time in response to API calls to digital endpoints based on the require ments for the media being delivered. This enables organizations to move be yond leveraging PDFs on a portal as a key strategy in their digital experiences. How many times have you opened a PDF on your mobile device only to discover it isn’t optimized for mobile or received an email that then sends you to a portal that doesn’t work on your mobile device? This type of poor digital experience is com pletely avoidable by enabling the content presentation to be determined by the dig ital endpoint system.

A CASE IN POINT

One excellent example of how the buy er is changing the market toward a content-driven approach is a leading Canadian bank. The bank recognized customers wanted to be able to use their credit cards via their phone’s mobile app immediately after their account was ap proved versus waiting for a printed card to show up in the mail. To achieve this, the bank needed to present the custom ers with the Cost of Borrowing disclosure (COB) in the mobile app. This meant that, in addition to the printed commu nications that were typically created and

SUBSCRIBE

mailed to the customer, the bank need ed a high-performance, highly scalable way of pushing the right COB disclosure information (for that specific customer based on their card type and terms) to the customer’s mobile app.

The bank was able to share the COB disclosure as a dynamic content object to the mobile app, allowing the customer to receive their COB details immediate ly after approval, allowing them to use their credit card immediately. This is an example of the enterprise meeting market demand with customer commu nications that enabled the bank to: Centralize control over the con tent with dynamic variations of relevant content Provide sub-second response times for the best possible digital experience

THE FUTURE OF THE DOCUMENT IS CHANGING. SO IS CCM.

Obviously, the future of work will still in clude communications and documents in various forms, but the way those doc uments are authored and delivered is changing. Digital experience is the way of the future. Mobile devices continue to have an important role in day-to-day interactions from digital wallets to so cial media posting and everything in between. To remain relevant and stay competitive, enterprises must embrace the digital world in a way that allows them to think modularly about their con tent to empower the ability to deliver timely messages. It’s time for business es to move away from document-centric management models to more flexible modular content management approach es designed to support both old and new customer experiences. O

PATRICK KEHOE is Executive Vice President of Product Management for Messagepoint, Inc. an AI-powered customer communica tions management solution that automates and simplifies the process of migrating, op timizing, authoring, and managing complex customer communications for non-techni cal (business) users. Patrick has more than 25 years of experience delivering business solutions for document processing, customer communications, and content management.

DOCUMENTmedia.com fall.2022 23

FOR FREE!

CCM INDUSTRY

BEST PRACTICES SURVEY

Results reveal industry in flux, with sharp opinion differences concerning the role of CCM applications in the present technology world

By Allen Shapiro

In March of 2022, Macrosoft conducted its second annual CCM industry best practices survey. A total of 253 individuals from more than 88 identified companies participated in the survey of which 99% stated that they have a CCM solution. Based on the diverse group that completed the survey, the robust responses across multiple companies and industries, and the high full survey completion percentage there is strong reliability in survey results. Here is what they found:

SUMMARY OF KEY INSIGHTS FROM THE SURVEY

1. We see more companies are transitioning from having separate CCM platforms to a single cross-channel, integrated CCM platform.

2. Organizations are trying to avoid ‘one size fits all’ batch approach to communicate with their customers. Trends are to communicate on the channel desired by a customer, at the time and in the format desired by the customer.

3. More and more companies are now doing all CCM work internally except for the actual printing services.

4. It’s good practice for organizations to carefully analyze ROI when integrating CCM, not just ROI as a company but across all departments to make sure optimal usage of the CCM platform.

Does your CCM system have the nuance of a “create once and reuse many” methodology?

SURVEY FINDINGS

60% of participants have a single development CCM plat form that enables multiple communication channels. This is defined as creating communication within a single plat form but delivering it and reusing it across multiple business functions, channels and devices. This includes, for exam ple, template development for print with reuse for digital delivery. 40% of participants indicated their company has separate CCM silos. Thus, these companies need to develop separate creativity for each delivery channel.

DATA TREND

Participants having a single CCM platform increase from 50% in 2021 to 60% in 2022, while those who have sep arate platforms drops from 48% in 2021 to 40% this year.

ANALYSIS

The industry is heading in the right direction with over half of the companies having single CCM platforms. We also see

this number increase significantly compared to 2021, which means more companies are transitioning to single platform CCM. We expect to see this trend in the coming years. On the other hand, those companies with multiple CCM plat forms are doing significantly more work as each communi cation type needs to be developed by (separate) designer teams. It also introduces compliance risks of nonmatching results based on the delivery channel. Having separate com munication CCMs means more overall work, less message

SUBSCRIBE

coordination, more inertia in work processes and greater risk of mis-messaging.

There is the best opportunity in the marketplace for use of dynamic communications being delivered to the audience across print PDF, web delivery, text message, fax and other delivery mechanisms. Companies not yet developing in this fashion have a tremendous opportunity for rationalization of development effort and consolidation of creative platforms.

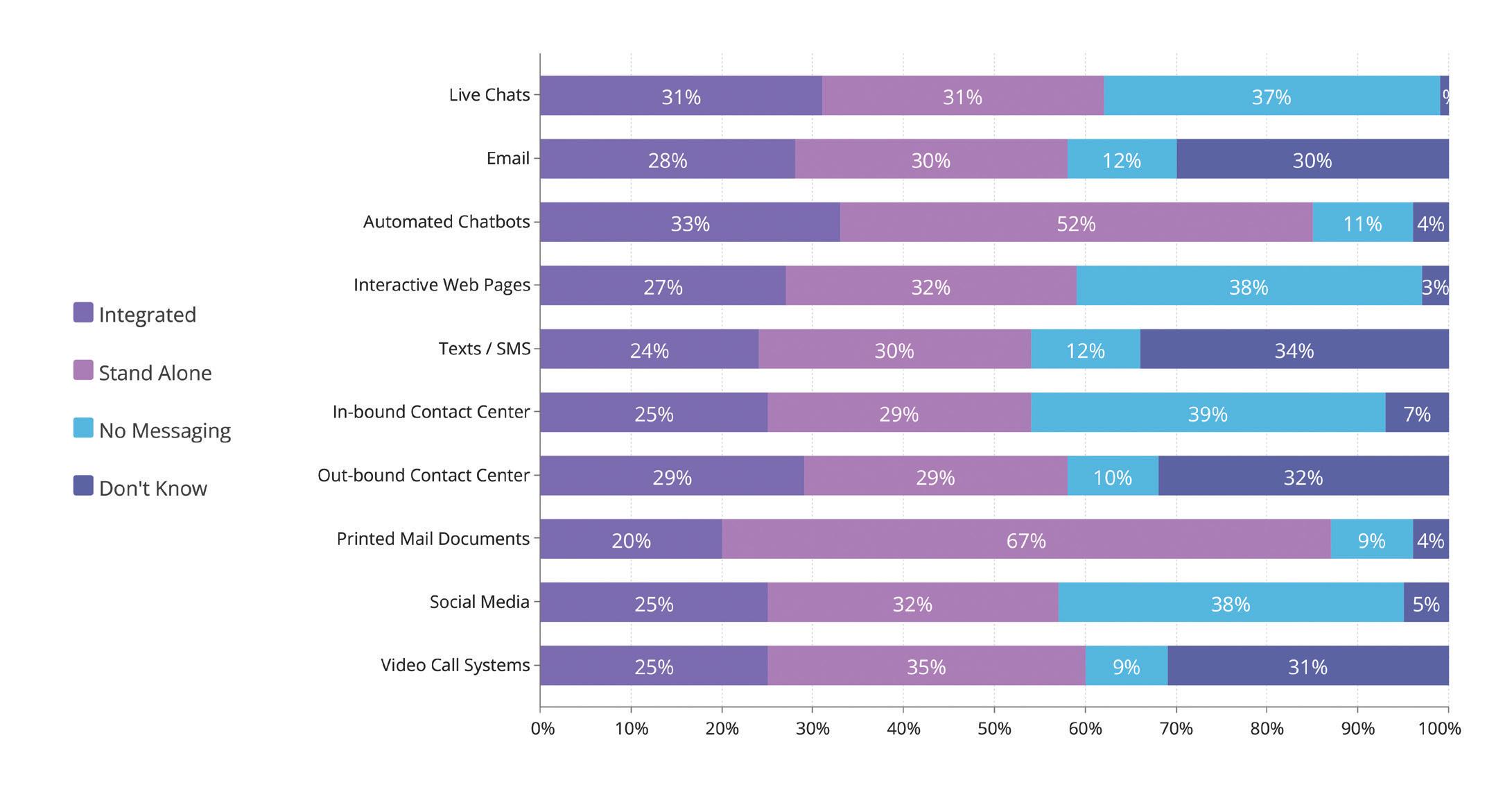

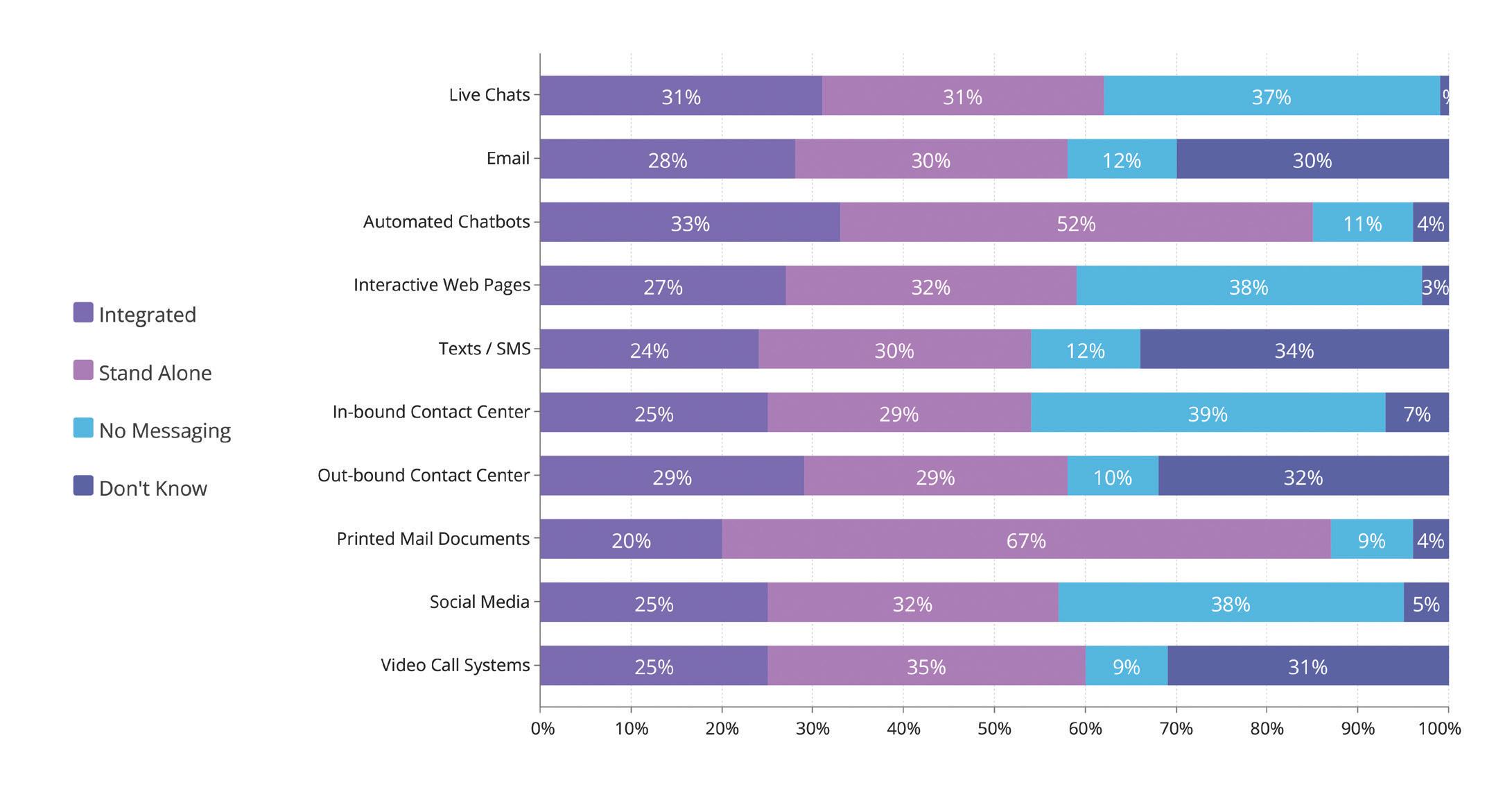

Are the following systems integrated cross platform or standalone?

SURVEY FINDINGS

Participants were asked to identify, for each of the 10 dif ferent communication platforms identified, if their com pany had integrated messaging or standalone messaging. Averaging across all 10 platforms, 27% of respondents indicated they are cross-platform (integrated) whereas 37% are standalone. The lowest integration percentage was iden tified for printed mail documents.

DATA TREND

Average integrated rate increased from 26% last year to 27%, and the average standalone rate decreased from 49% to 37%.

ANALYSIS

We see a slight increase for companies integrating their CCM platform but a huge decrease in the standalone

functions. Taken together with the observation we found in the previous question, the two sets of results both indicate companies are moving towards integrating all communica tion to a single cross-platform channel to track and opti mize customer journey maps.

In today’s world, customer expectations are: they con tact the company, the service rep will know what inter actions have already happened and what is the status of the issue. The customer wants to have seamless inter actions across website chat, call centers, printed infor mation, social media and video call systems. Companies who invest in knowing the customer journey map are going to win more clients and retain and grow the cli ents they already have. So cross-channel, integrated communications is the logical way to proceed for the foreseeable future.

DOCUMENTmedia.com fall.2022 25

FOR FREE!

SURVEY FINDINGS

The top three choices with important benefits are “increased consistency,” “integrated communications” and “improved compliance.” Meanwhile, many participants chose Not Important for “improved branding,” “more happy custom ers” and “less customer confusion,” making them the least three important benefits.

DATA TREND

The top three important benefits remain the same —

“increased consistency,” “integrated communications” and “improved compliance.”

ANALYSIS

Even though the most important benefits stayed the same, last year those who considered these benefits to be important, if not very important, were clearly the vast majority. This year the average rating for this number drops considerably. This indi cates the ever-changing and fast-growing CCM industry values more benefits than those we listed above this year.

26 fall.2022 DOCUMENTmedia.com

What benefits are most important to you with effective customer communication management?

Indicate how the following functions contribute to or benefit from CCM activities at your organization

SURVEY FINDINGS

In terms of paying CCM costs, IT has the most votes at 21%.

Both Operations and Social Media ties at 30% votes saying they are benefiting from CCM. Sales have the most votes with 24% for both pay and benefit from CCM. Meanwhile, IT, Marketing, and Social Media get above 35% votes on neither pay or benefit from CCM.

ANALYSIS

This is a new question for this year’s survey. In many

SUBSCRIBE FOR FREE!

companies the functions that pay for CCM often differ from the functions that benefit from CCM. The results show a variety of opinions on who’s paying and who’s benefiting. This could be caused by companies from different industries with their different use cases for CCM platform.

The result also put out a reminder that it’s necessary for organizations to carefully analyze ROI when integrating CCM, not just ROI as a company but across all departments to make sure of optimal usage of the CCM platform.

ALLEN SHAPIRO is Vice President, CCM & Speech Analytics Practices and Data Protection Officer at Macrosoft. He leads the onshore and offshore CCM development teams. Additionally, Allen oversees pre-sales activities and is responsible for managing the relationship with the company’s CCM software provider, Quadient.

SURVEY FINDINGS

Total of 77% of respondents develop their CCM assets and communication workflows in house, although 56% of those then send the completed communications to an external print vendor for delivery to the recipient. 17% completely outsource the communication development and delivery process to third party vendors. 4% of survey participants self-identify as print service providers.

DATA TREND

Total percent of companies develop CCM assets increased from 73% to 77% and those who then seek an external print vendor also increase from 48% last year to 56%.

ANALYSIS

The result confirms our two expectations last year that the percent of companies doing all CCM work in-house (except printing) will continue to grow over time and in-house printing will continue to decline. Combined with two years of survey data, it is clear most respondents are now doing all CCM work internally except for the actual printing services, and a quarter of the respondents indicate their company is still doing the print service in-house. In our view, these survey results essentially confirm the standard industry business model.

Companies that completely outsource communications development and implementation are in the minority (17%). In our opinion, these companies are missing an opportunity to ensure optimal messaging and to monitor that precise compliance is followed. CCM communications need to be developed and enhanced in-house. Use of an external print delivery provider is common.

View the full survey here

DOCUMENTmedia.com fall.2022 27

Are your communications produced and distributed by an outsource partner like a print company, or do you do that in-house?

WHAT THE ANALYSTS SAY…

The 2022 Aspire Leaderboard Makes Its Debut

In July

will be

with

(CCM)

so that

this

have

a

in two key

2022, Aspire launched the next generation of its CCM/CXM Aspire Leaderboard™, now in its fifth year of development. As the evolution from Customer Communications Management

to Customer Experience Management (CXM) continues to gather steam, numerous acquisitions, consolidations, strategy adjustments and new product introductions

altered the provider landscape. Accurate analysis of the players now requires

more agile approach. Instead of releasing a single market overview annually, Aspire is now constantly updating the Leaderboard

enterprise users

armed

the latest, up-to-date information on

ever-changing industry. The latest iteration included major advancements

areas: new Market Segmentation Grids and interactive Relevance Filters. 28 fall.2022 DOCUMENTmedia.com

MARKET SEGMENTATION CHANGES

As the CCM/CXM market evolves, the space between software technology vendors and Service Providers has become less clearly delineated. The new Leaderboard better reflects the market by introducing five major segmentation grids.

AnyPrem CCM Software

The first grid lists providers offering CCM solutions traditionally deployed as servers in an on-prem environment. These providers are now working to repackage their legacy CCM solutions for containerized, serverless environments that can be deployed on an “AnyPrem” model, meaning either on-prem or in a hosted, public, (virtual) private, or hybrid cloud configuration. This important market trend has influenced every analyzed vendor on this grid, but they have adopted different approaches. While companies like OpenText, Quadient, and Precisely are migrating their core flagship products to cloud-native architectures, others (such as Smart Communications and Messagepoint) offer a hybrid approach coupling on-prem composition with administrative or design aspects delivered as SaaS solutions. Other leading vendors included on this grid are Adobe, MHC, and Sefas.

NEW — Vendor Hosted SaaS CCM

This is a new CCM grid for technology vendors offering self-hosted SaaS solutions. Several key distinctions compared to vendors specializing in AnyPrem software necessitated their separation. For example, SaaS vendors are responsible for data security, making certification, regulatory compliance, and privacy — by design — more essential. SaaS vendors also typically build solutions supporting continuous deployment (known as “Evergreen IT”) and develop software using agile or DevOps methodologies. In addition, cloud-native SaaS software is often less customizable, making integration through out-of-the-box connectors and online marketplaces much more important. Analyzed leaders in this space include Smart Communications, Messagepoint, OpenText, MHC, and Adobe as well as established vendors with new SaaS solutions like Quadient and Precisely

NEW — Communications Experience Platform (CXP)

As the market’s larger evolution continues to take shape, Aspire has seen a growing number of vendors and service providers build cloud platforms pairing traditional CCM solutions with additional capabilities from adjacent fields. Those on the new Communications Experience Platform (CXP) grid combine CCM software with business intelligence dashboards, customer data platforms, marketing automation, e-payments, digital signatures, smart forms, AI-based content intelligence, journey visualization and orchestration, multi-variate testing, or other capabilities depending on customer or industry needs. The solutions are typically offered as managed solutions by tech vendors such as OpenText, Quadient, Precisely, Smart Communications and Adobe, and will soon also feature leading hosted managed service (HMS) providers like O’Neil, DataOceans, and Doxim, among others.

Enterprise Communications Processing (ECP)

This grid includes post-composition downstream processing software providers focused on orchestrating input and print output streams, enhancing communications for accessibility or better processing through barcoding, reformatting, and other means. Even though this is a mature market space, vendors in this grid are also shifting to AnyPrem solutions and cloud deployment while tying software closer to the CX world. Analyzed players in this grid include Sefas, Compart, Transformations, Crawford Technology, Ricoh, Messagepoint and others

CCM/CXM Service Providers

After witnessing the market’s shift toward cloud and services, Aspire has begun to analyze providers selling capabilities including information design, data, IT, or other (often print-related) services in the CCM/CXM space. These service providers may include print-oriented BPOs, solution integrators, HMS providers, value-added resellers, or others. Since these services can often be closely tied to specific countries, languages, or verticals, Aspire continues to analyze a variety of players, including large print BPOs like RRD, Broadridge, and FIS along with HMS

leaders such as O’Neil Digital Solutions, NEPS/Taylor, Tessi, DataOceans, Doxim, and Precisely (Cedar CX).

INTERACTIVE FILTERING

The second major development in this updated Leaderboard is the introduction of interactive filtering that displays the most relevant matches based on an enterprise user’s location, industry and job role.

Aspire’s Leaderboard is dedicated to the belief that most if not all players in the CCM/CXM industry have unique characteristics that deserve to be called out and that could make each one the ideal choice for a specific buyer. Therefore, every company on the Leaderboard is potentially the leading choice for the relevant user. By adding an extensive set of filtering capabilities to this iteration, Aspire has empowered buyers to dynamically configure Leaderboard results that are highly relevant to their own unique requirements, significantly reducing the effort required to create a shortlist of potential matches. Availability of local resources, vertical industry expertise, specific technical capabilities, focus on specific communication types — these are all considerations buyers use when selecting a communications partner. The latest Leaderboard update enables users to dynamically restructure the grid layout highlighting the most relevant vendors instead of the largest ones or the ones with a broader set of potentially less relevant capabilities.

In the end, Aspire’s addition of Market Segmentation grids and Interactive Filtering are both motivated by the same goal: making its Leaderboard the most relevant market analysis tool available to CCM/CXM buyers. Aspire has mapped out substantial new developments for the Leaderboard it plans to release gradually throughout the next year. Their plan is to first apply a more considered segmentation of the Service Provider market before the end of the year, followed by the introduction of a stream of new providers to the Leaderboard before introducing a number of improvements to the user interface that will support additional buyer use-cases.

You can find the latest iteration of the Aspire Leaderboard at www. aspireleaderboard.com.

DOCUMENTmedia.com fall.2022 29

Think About It

IF YOU TAKE AN HONEST INVENTORY OF YOUR CURRENT CUSTOMER JOURNEYS, YOU MAY START TO SEE THE CUSTOMER IS DOING MORE WORK FOR YOU THAN YOU ARE DOING FOR THEM.

For every project to change processes and technology, you need a plan — a living plan that considers every touchpoint in the organization and clearly states what is changing, why and its impact on specific jobs and processes.

Achieving and maintaining regulatory compliance is one of the biggest challenges that businesses face in 2022. Competitive Enterprise Institute analysis revealed that large financial services firms report the average cost to maintain compliance can total up to $10,000 per employee.

The new consumer is focused on posts and hashtags. They are used to signing contracts, paying bills and buying groceries on a mobile device. They look at the world from more of a mind map point of view and less of a file folder structure.

/ PATRICK KEHOE /

/ DR. DORIAN SELZ /

/ SCOTT DRAEGER / / DR. JOHN BATES /

ALL KINDS OF DEVELOPMENTS — IN THE GLOBAL ECONOMY, IN THE REINVENTION OF THE WORKPLACE, AND IN THE WORLD OF TECHNOLOGY — ARE CREATING THE PERFECT STORM FOR AI’S EXTENDED AND MORE DEEPLY INTEGRATED ROLE IN AN ORGANIZATION AND ITS PROCESSES

/ PAT MCGREW /

By John Harney

By John Harney

By Naren Goel

By Naren Goel

BY TOM COPPOCK

BY TOM COPPOCK

BY PATRICK KEHOE

BY PATRICK KEHOE