JANUARY-FEBRUARY 2023 PARCELindustry.com

THE GROWING OVERLAP BETWEEN WCS, WMS, AND WES — AND HOW THAT IMPACTS YOUR DC.

PAGE 28

ON-TIME DELIVERY PERFORMANCE STATS: FACT OR SPIN?

PAGE 22

CALLING IT QUITS WITH YOUR CARRIER.

PAGE 12

THE CHANGING PARCEL LANDSCAPE: WHAT LIES AHEAD FOR SHIPPERS?

PAGE 26

AVOID COSTLY MISTAKES: 8 AUDIT & SPEND MANAGEMENT PARTNERS TO CONSIDER. PAGE 20

CLICKHERETOSUBSCRIBE

16 MORGAN STANLEY SURVEY RESULTS: AN INTERESTING INFLECTION

18 THE INTERRUPTED SUPPLY CHAIN

How far have we come, and how far do we have yet to go?

By David L. Buss

22 ON-TIME DELIVERY PERFORMANCE: FACT OR SPIN?

UPS claims better on-time performance than FedEx. But is that the case? Here’s how to correctly interpret the data.

By Karl Wheeler

26 A CHANGING PARCEL LANDSCAPE

What does the year ahead hold for shippers?

By Caleb Nelson

28 UNDERSTANDING THE COMPLEX OVERLAP OF WMS, WCS, AND WES WAREHOUSE SOLUTIONS

By Dan Gilmore

By Dan Gilmore

SPONSORED CONTENT

09 GMT IS THE MARKET EXPERT YOU NEED

11 IT’S A GREAT TIME TO RENEGOTIATE YOUR SMALL PARCEL CONTRACTS

20 GET HELP WITH AUDITING & SPEND MANAGEMENT: FIND YOUR PERFECT PARTNER FROM THESE 8 COMPANIES

18 22 26 28 /// CONTENTS Volume 30 | Issue 1 06 EDITOR’S NOTE An Interesting Year Ahead By Amanda Armendariz 07 PARCEL COUNSEL Another Lesson from Hadley v. Baxendale: Invoice Value or Replacement Cost? By Brent Wm. Primus, JD 08 PACKAGING Right-Sized, Fast, and Green By Sean Webb 10 REVERSE LOGISTICS The Benefits of Reverse Logistics Nonprofit Organizations By Tony Sciarrotta 12 SUPPLY CHAIN SUCCESS Breaking Up with Your Shipping Carrier: A Love Story Crushed by Inflation By Chelsea Snedden 14 OPERATIONAL EFFICIENCIES It’s Time to Kick-Start the New Year! By Susan Rider

SUBSCRIBE FOR FREE 4 PARCELindustry.com JANUARY-FEBRUARY 2023

PRESIDENT CHAD GRIEPENTROG

PUBLISHER KEN WADDELL

EDITOR

AMANDA ARMENDARIZ [ amanda.c@rbpub.com ]

AUDIENCE DEVELOPMENT MANAGER

RACHEL CHAPMAN [ rachel@rbpub.com ]

CREATIVE DIRECTOR KELLI COOKE

ADVERTISING KEN WADDELL (m) 608.235.2212 [ ken.w@rbpub.com ]

JOSH VOGT [ josh@rbpub.com ]

P.O. Box 259098 Madison WI 53725-9098

p: 608.241.8777

f: 608.241.8666

PARCELindustry.com

PARCEL (ISSN 1081-4035) is published 7 times a year by MadMen3. All material in this magazine is copyrighted 2023 © by MadMen3. All rights reserved. Nothing may be reproduced in whole or in part without written permission from the publisher. Any correspondence sent to PARCEL, MadMen3 or its staff becomes the property of MadMen3. The articles in this magazine represent the views of the authors and not those of MadMen3 or PARCEL. MadMen3 and/or PARCEL expressly disclaim any liability for the products or services sold or otherwise endorsed by advertisers or authors included in this magazine.

SUBSCRIPTIONS: Free to qualified recipients: $12 per year to all others in the United States. Subscription rate for Canada or Mexico is $35 for one year and for elsewhere outside of the United States is $55. Back-issue rate is $5.

Send subscriptions or change of address to:

PARCEL, P.O. Box 259098 Madison WI 53725-9098

Allow six weeks for new subscriptions or address changes.

REPRINTS: For high-quality reprints, please contact our exclusive reprint provider, ReprintPros, 949.702.5390, www.ReprintPros.com.

JANUARY-FEBRUARY 2023 PARCELindustry.com 5

AN INTERESTING YEAR AHEAD

By Amanda Armendariz

the company is preparing for an “all hands on deck” scenario).

Many shippers today still remember the 1997 Teamsters strike and the impact on the package delivery network. One major difference, though, is that in 1997, UPS controlled the vast majority of the market, whereas today, competition is fiercer. But either way, a strike is something that would impact a large percentage of shippers, so contingency plans should be a priority in the coming months.

EDITOR’S PICK

Here are some of the most-read articles on our site in recent weeks. If you haven’t already checked them out, you might want to — there is some great information in there!

By Josh Dunham

By Josh Dunham

It seems like ever since the world was plunged into the COVID-19 pandemic and experienced the associated supply chain challenges, there hasn’t been such a thing as a “normal” year (understandably so). Whereas I could once be fairly confident about my 12-month forecast in my first editor’s note of the calendar year, post-2020 is a different story. I certainly wish I had a crystal ball that I could look into and be able to share with you what lies ahead, but alas, that is not the case. What we do know is that change is in the air, and shippers need to stay on top of the industry developments in order to stay competitive.

There has been a lot talk, of course, of a strike by the Teamsters union if a new contract isn’t agreed to by August 1, meaning that UPS would be scrambling to figure out a way to get millions of packages delivered. (A December article by FreightWaves noted that numerous anonymous sources reported that managers at UPS were told not to schedule any PTO for July or August, signaling

Shippers are also frustrated by the fact that UPS has, as of the time of this writing, extended its peak season demand surcharges on SurePost, Ground Residential, and Air Residential shipments indefinitely; new rates were effective January 15. Many are scratching their heads at how a company can charge peak prices when it’s not peak season, but that’s apparently the route UPS has decided to take. We will certainly keep our readers posted on if/when anything changes with respect to this.

Of course, a new year also brings with it a sense of optimism and renewal, even with these clouds hanging over the parcel landscape. We’ll continue to share the industry information that you need in order to be successful as a small-package shipper. Thanks for being on this journey with us, year after year.

And as always, thanks for reading PARCEL.

By Micheal McDonagh

USPS

2023 Price Increase & Impact on Shippers

By Gordon Glazer

By Gordon Glazer

6 PARCELindustry.com JANUARY-FEBRUARY 2023

EDITOR’S NOTE

The Data Is in on the 2023 General Rate Increases from FedEx and UPS

The Parcel Landscape in 2023

ANOTHER LESSON FROM HADLEY V. BAXENDALE: INVOICE VALUE OR REPLACEMENT COST?

By Brent Wm. Primus, J.D.

In the November/December 2022 issue of Parcel Counsel, we looked at the landmark case Hadley v. Baxendale (visit PARCELindustry.com/Hadley to view this article). That column focused on consequential damages as opposed to actual damages. This begs the question, “What are actual damages?”

The term “actual damage,” as well as the terms compensatory damage, direct damage, and general damage, all refer to the same type of damage — those which directly relate to the loss. Significantly, the term “actual damage” is used in the federal statute known as the Carmack Amendment, 49 U.S.C. § 14706, which governs liability when cargo is lost or damaged. Pursuant to this statute, regulated motor carriers “are liable to the person entitled to recover under the receipt or bill of lading. The liability imposed under this paragraph is for the actual loss or injury to the property…”

The majority view of today’s courts is that the actual loss to the shipper is measured by the destination market value of the product. In instances where there has been a sale, the destination market value is the amount of the seller’s invoice to a customer. However, the carrier community very strongly believes that if a seller, after a loss, sends a replacement from inventory then the seller will receive a double profit… and, accordingly, the customer

should only be entitled to recover its replacement cost.

Their reasoning goes like this: Assume that the invoice price was $100 and that the replacement or manufactured cost of the substituted product is $60. The argument of the carriers is that if the seller receives $100 from the carrier for the lost product and then $100 from the customer for the replacement product it results in an $80 profit (2 x $40) on just one sale.

This argument has been rejected by most courts. These courts say that the seller did not get a double profit because the seller did not get any profit at all on the item that they took from inventory that they could have otherwise sold to someone else for $100.

The same issue came up in 1840 in the Hadley case. Although the Hadley case is routinely cited by the defendants in cargo claim cases for the proposition that consequential damages are only recoverable if foreseeable, there is another holding in Hadley that also relates to modern day cargo claims for which I have not seen Hadley cited, that is, how to determine actual damages.

The Hadley court stated, “we deem it to be expedient and necessary to state explicitly the rule which the Judge, at the next trial, ought, in our opinion, to direct the jury to be governed by when they estimate the damages.”

Citing an even earlier case, the Hadley court stated, “and here there is a clear rule, that the amount which would have been received if the contract [of carriage] had been kept, is the measure of damages if the contract is broken.”

“In speaking of the rule respecting the breach of a contract to transport goods to a particular place…the difference in value between the price at the point where the goods are and the place where they were to be delivered, is taken as the measure of damages, which, in fact, amounts to an allowance of profits;’…: ‘The damages due to the [seller] consist in general of the loss that he has sustained, and the profit which he has been prevented from acquiring…’” Stated in the modern vernacular, the Hadley court tells us that the measure of damages in a cargo claim should be the destination market value or invoice price, not the manufacturer’s cost or replacement value.

All for now!

Brent Wm. Primus, J.D., is the CEO of Primus Law Office, P.A. and the Senior Editor of transportlawtexts, inc. Previous columns, including those of William J. Augello, may be found in the “Content Library” on PARCELindustry.com. Your questions are welcome at brent@ primuslawoffice.com.

JANUARY-FEBRUARY 2023 PARCELindustry.com 7

PARCEL COUNSEL

SUBSCRIBE FOR FREE!

PACKAGING RIGHT-SIZED, FAST, AND GREEN

By Sean Webb

First impressions matter when it comes to the customer experience, and a company’s secondary packaging plays an important role. Before a customer uses a product they’ve ordered online, there is the unboxing moment that will make an immediate and lasting impression. Even if the customer is satisfied with the product, right-sized shipping packaging has the potential to enhance the customer experience by making the moment memorable. What customers expect from the companies they purchase from is continually evolving. The average customer today wants right-sized, environmentally friendly packaging that arrives quickly and can be used for returns easily. Shippers that fail to give in to these demands may fall behind their competitors who are already integrating this into their shipping packaging.

Right-Size Packaging

Oversized boxes filled with excess void-fill have caused shoppers to want guilt- and frustration-free packaging from the companies they purchase from. There’s significant proof of this in unboxing videos — a growing trend in the United States and abroad. These videos can heavily influence someone’s decision to buy a product. Seeing an influencer complain about poorly sized, unrecyclable shipping packaging can turn potential customers off.

Fast and Reliable Shipping

Due to options such as same-day and two-day shipping, the average consumer expects their orders to arrive faster and cheaper than ever before. As such, fast delivery has become a necessary part of the shopping experience. Fast delivery, however, is not easy. Given the unpredictability of labor, you may not always have enough hands to get your product out fast enough. Even if you could get the product out on time, the cost to do so may make it not worth it once DIM weight charges are factored in.

Branded Corrugate

Because first impressions matter, adding appealing branded packaging could go a long way. Online shopping has created fewer opportunities to connect and engage with customers in person and, as a result, shipping packaging is now so much more than just the container that transports your product — it’s the touchpoint customers associate with your brand.

Environmentally Friendly

To consumers, secondary packaging is the most outward testament of a brand and what it stands for. In fact, 77% of consumers say the packaging a company uses for e-commerce is reflective of their environmental values. When a company delivers a package that contains an exorbitant amount of plastic, they send a signal to the customer that the environment is not a primary concern for them. It’s important for brands to consider the amount of waste their shipping packaging produces as protecting the environment continues to be a top priority for consumers today.

Returnable Packaging

One way to tarnish the customer experience is by failing to make the return process as easy as possible. One-third of all online orders are returned. Of those returns, customers who experienced a difficult return process were much less likely to do business with that company again. When shipping items, companies need to make sure that their boxes open easily enough to prevent being destroyed while also being reliable enough to reuse.

Many parcels shipped today will need to make a round trip without being damaged. The formula for success is striking the perfect balance between reusability and recyclability.

The Case for Auto-Boxing

While secondary packaging has the potential to create a customer experience that leaves a lasting positive impression, it isn’t easy to get right. These benefits are much more difficult to achieve with manual packing but become exponentially easier when the process is automated. Automated right-sized packaging will allow you to create parcels that fit your variable order sizes perfectly, reducing or eliminating the need for void fill; a win for sustainability and efficiency.

Furthermore, large but lightweight parcels incur unnecessarily high shipping costs. Right-sized automated packaging can reduce the overall size of the package and has the potential to reduce freight costs by an average of 32%. These savings can be passed down to the customer, enhancing their experience.

Today’s customers expect shopping online to be an easy and pleasant experience from beginning to end, and the shipping packaging process can seal the deal. Make sure you leave your customers satisfied and looking forward to coming back, without sacrificing cost or productivity.

Sean Webb is the director of automated packaging solutions, North America at Sparck Technologies. For more information, visit https:// sparcktechnologies.com/us/.

8 PARCELindustry.com JANUARY-FEBRUARY 2023

GMT Is the Market Expert You Need

With nearly 25 years of helping the world’s largest and most complex shippers manage their parcel and LTL networks, we have developed a proven process, amassed unmatched market intelligence, and cultivated deep carrier relationships. We help our customers optimize their networks based upon their unique strategic goals to drive maximum impact.

WHY SHOULD YOU CHOOSE US?

Unrivaled market intelligence. Because we partner with the world’s largest and most complex shippers, our view of the supply chain market is second to none. A truly optimized network strategy requires relevant and powerful market insights to guide you. Leverage our expertise to focus your transportation strategy and gain competitive edge for your business.

Gain actionable insights. Shippers are inundated with data of all types (billing, order, carrier performance, and more), making it difficult to know where to begin and what to trust. We help you sift through what matters — and what doesn’t — so you can spend less time wondering what you should do and more time getting it done.

Enable speed to action. We become an extension of your team, taking the time to learn your business at a granular level so that our recommendations are prioritized to have maximum impact. Your team is limited, don’t limit success.

BUT DON’T JUST TAKE OUR WORD FOR IT:

“You can feel 100% confident taking results to senior leadership. GMT’s down-to-the-penny modeling ensured we weren’t making assumptions on critical components. The

accuracy was phenomenal; I felt 100% confident taking their market analysis to the C-Suite.” - Supply Chain Procurement Leader, Fortune 500

GMT is a FedEx Certified Auditor. We’re one of only nine companies in the world to be named a FedEx Certified Freight, Bill, Audit and Pay (FBAP) provider. This rare designation recognizes our intense commitment to providing a best-in-class audit service that is both highly accurate and consistent.

Ranked among CIOReview’s “Most Promising Procurement Solutions Providers”. We’re honored to be the only transportation spend management provider recognized in CIOReview’s breakdown of 2022’s most promising providers at the forefront of the procurement industry.

Green Mountain Technology is the market expert you need. Gain competitive edge and drive success like never before with GMT.

APPLICATION ARTICLE

greenmountaintechnology.com

REVERSE LOGISTICS

THE BENEFITS OF REVERSE LOGISTICS NONPROFIT ORGANIZATIONS

By Tony Sciarrotta

Have you ever wondered what happens to clothing, furniture, and other goods not sold in traditional outlets such as stores, online platforms, or outlets? Some are sold to third parties that sell returned goods by the pound; some are exported to other countries; some, unfortunately, end up in landfills, while others may be donated to charitable organizations.

Goodwill is perhaps the best-known organization in which businesses and consumers donate used clothing, furniture, and other unwanted goods. In 2021, Goodwill handled an estimated 107 million donations of used goods, totaling around 5.7 billion pounds, according to its sustainability manager, Brittany Dickinson.

There are a number of nonprofit organizations that also distribute donated items to local organizations.

“We believe in getting the right product to the right people at the right time” is the motto for Good360, a 501(c)3 nonprofit organization. Good360 partners with large corporations to source essential goods and distribute them to its network of nonprofit organizations.

Corporate donors include Advance Auto Parts, American Eagle Outfitters, CVS Health, Gap, Inc., Levi Strauss & Company, Mattel, Tempur Sealy International, and UPS.

Amazon, an RLA board member, is also a corporate donor. Employees inspect Amazon returns to determine if they can be resold or donated to such charitable groups. In 2019, Amazon introduced FBA Donations. The program allows sellers to choose whether they’d like their eligible excess and returned products to be given to charitable organizations.

RLA member, GiveNKind, is a similar organization. Based in Buffalo, NY, GiveNKind assists companies that are looking to offload canceled orders, surplus, and other unused items and goods in a socially and environmentally responsible way. In addition to new, gently used items are also accepted. It then distributes the goods to such organizations as the YWCA, homeless shelters, and foster parenting organizations.

Besides serving the Buffalo area, GiveNKind also serves the Chicago metropolitan area, with a second chapter in Carlisle-Bethlehem, Pennsylvania. Through these two chapters, charities in California, Texas, Pennsylvania, and Illinois are served.

Electronics Returns

Accurate data on electronics return rates is scarce. Accenture’s estimate of 11% to 20% of consumer electronics are returned dates to at least 2011 and is likely a very conservative estimate. Such items often require special handling, security assurances, and proper disposal if applicable. Government regulations and certification may be required. There are a number of nonprofit organizations that specialize in electronics returns and disposal.

One such organization is eWorks Electronics Services Inc., which provides recycling, refurbishment, and resale services of office and industrial technologies

and consumer electronics, including computers, tablets, servers, monitors and LCDs, scanners, copiers and network equipment, power supplies, TVs, stereos, cell phones, and household appliances.

The nonprofit was established in 2009 to create employment opportunities for people with disabilities and has locations in Chicago and New York.

Meanwhile, Digitunity’s mission is to ensure everyone who needs a computer has one. Through its Digital Opportunity Network, which comprises 1,500 organizations across the US, donors and recipients are connected. In addition, the group assists state and local governments in creating digital equity plans to expand connected devices to those in need.

The circular economy benefits from reverse logistics nonprofit organizations by eliminating waste and recirculating goods.

For more information on each of these nonprofit organizations, please visit their websites:

Good360 - https://good360.org

GiveNKind - https://givenkind.org

eWorks Electronics Services Inc - https://eworksesi.org

Digitunity - https://digitunity.org

Tony Sciarrotta is Executive Director of the Reverse Logistics Association. The RLA offers various tools, white-papers, and monthly webinars that provide best practices in managing reverse logistics.

10 PARCELindustry.com JANUARY-FEBRUARY 2023

It’s a Great Time to Renegotiate Your Small Parcel Contracts

The economy is difficult right now, and companies like yours must be hyper-focused on margins and costs in all parts of the business. Ask yourself, as part of that, are you paying enough attention to the opportunity offered by lowering your shipping costs through renegotiating your small parcel contracts? It’s been a carrier’s market for years, so chances are you’re not.

Founded in 2008, TransImpact’s roots are in parcel contract negotiations. And it’s no small coincidence that today the market’s in a similar period of financial distress as back then, with carriers again holding a lot of leverage over shippers with their rates.

These are not unfamiliar times from our perspective — we’ve been there and done that. Fortunately, it’s something our customers are using to their advantage today.

Our years of experience have also taught us the many misconceptions about parcel contract negotiation that result in shippers leaving millions on the table. There are a lot of consultants and companies that claim they can save you money on your carrier agreements, and even more make promises about saving you a few percent by auditing your invoices. Our approach is different.

TransImpact understands how saving on your parcel shipping affects the bottom line.

Want proof? Over the past three years, we’ve averaged an impressive 19.7% cost reduction for companies just like yours. Depending on your parcel spend, the savings can add up quickly.

For the best carrier agreement, it takes industry expertise, market data, and technology to negotiate the optimal, marketappropriate rates. When it’s done right, your costs go down with no adverse effect on service or carrier relationships. This is what TransImpact does every day, and we have successfully

coached thousands of clients and collectively saved them more than $800 million.

Here’s why TransImpact is better. After learning about your company, we will tell you BEFORE you start to renegotiate what your rates should be (to within 1/10 of a percent). Our experts and technology can not only find significantly more savings than anyone else, but remain an active partner once a new agreement is signed.

How do we know what your parcel rates should be?

It starts with our market knowledge and technology. We pinpoint your market-appropriate rates by knowing where the profit line is for the carriers. It’s a well-practiced process that anticipates how the carriers act during negotiations and takes advantage of our knowledge of where hidden charges could be ferreted away.

Our clients receive weekly report cards validating their savings. Over time, as your shipping needs and patterns change, we’ll help you adjust accordingly. And we’ll continue to optimize your rates as we monitor your company’s shipping habits, market fluctuations, peak season surcharges, GRI implications, and any changes in your overall parcel spend.

The bottom line? With TransImpact, you’re always assured of market-appropriate rates and all the savings you deserve.

APPLICATION ARTICLE

jey.yokeley@transimpact.com 252.764.2885 www.transimpact.com

BREAKING UP WITH YOUR SHIPPING CARRIER: A LOVE STORY CRUSHED BY INFLATION

By Chelsea Snedden

Breakups are never easy, even in the interconnected world of shipping goods. Like modern romance, most carrier breakups begin and end with money. This sentiment is especially true right now as many businesses struggle to rein in costs. The coalescence of steep logistics fees, rising material costs, and depressed demand have inflated prices, making the current economic climate a challenge for many shippers. Declining consumer demand is of particular concern for shippers as, according to the EY Future Consumer Index for 2022, at least 50% of US consumers say rising costs are making it harder to afford goods and services.

Now more than ever, businesses are contemplating a switch to an alternative shipping carrier to manage risk, decrease the cost to consumers, and reduce inflationary impacts. If you are looking to go steady with a new carrier, here are a few strategies to end things on good terms.

How to Know When to Break It Off

Cost is typically the top reason for breaking up with a carrier, but my team has witnessed switching carriers for other notable reasons, such as:

Poor KPI Performance

On-time performance mattered greatly to a client of ours that ships healthcare goods. According to a survey done by ShipMatrix, UPS had a stronger on-time performance. In 2021, UPS delivered 96.1% of parcels on time as compared to FedEx delivering only 83.9% on time. The client ended up switching carriers as their goods

were surgical and needed to be timely. In this case, the carrier’s on-time performance was worth more to the client than the cost.

As this year continues, FedEx has been working to improve this area of service. A survey of the same period in 2022 found that UPS had 96.6% on-time deliveries and FedEx had improved to 95.3%.

Poor Carrier Relationships

They say good communication is the foundation of a healthy relationship. Another client of ours switched due to the carrier representative’s communication style. The client felt the carrier’s communication was infrequent, and they could not get access to them if there were auditing issues. On the other hand, the client saw that the alternative carrier was willing to take the time to prioritize their program and hold quarterly meetings. The switch greatly benefited the client.

Bad Fit for Commodity Shipped

In a recent negotiation, a client switched carriers due to the commodity being shipped not fitting into the carrier’s network. USPS, for example, does not ship gasoline or explosive items. This was a problem for a client shipping goods that needed gasoline. Finding a better carrier that could fulfill their hazardous material needs without unnecessary surcharges was crucial.

How to Have the Breakup Talk

No matter how poor a relationship may become, it is important to maintain a professional relationship with your incumbent (soonto-be) ex-carrier. Negotiations happen as often as once every three years — sometimes more, sometimes less. In either case, the key participants rarely change. Consider the suggestions below when communicating a service breakup:

1. Decide on Further Involvement Maintain a formal, positive relationship. Shippers also tend to leave the door open for split-carrier scenarios. Some may keep their incumbent for cross-border packages or heavier packages if they had a cheaper rate for those services. Be mindful of any revenue-based discounts as these are dependent on maintaining volume with the incumbent carrier! Completing a sensitivity analysis can help determine what volume can be carved away from the primary carrier.

2. Be Firm, but Gentle, While Breaking the News

Provide gentle feedback on service expectations and layout improvements that could earn your business in the future.

3. Work with Incumbent Carrier on Data Needed for the Switch Request a full list of account numbers, your last 12 months of raw shipping data, or anything that could be useful for your new program.

12 PARCELindustry.com JANUARY-FEBRUARY 2023

SUPPLY CHAIN SUCCESS

4. Secure a Temporary Agreement During the Switch Negotiating a temporary agreement (or an extension of the existing incumbent agreement) while switching can help avoid being put at list rate by your incumbent carrier. Failure to do this could result in higher shipping costs!

5. Prepare for a Counteroffer Your incumbent carrier could surprise you with additional savings or a new carrier representative. Keep in mind a counteroffer means you have tremendous value to your carrier!

6. Break Things Off Internally Update internal stakeholders in your company to prepare them for the change. Make sure your IT teams, upper management, and relevant departments are aware of the carrier change. Be sure to communicate the potential technology and internal costs incurred to change carriers.

How to Move On

Moving forward, my team recommends keeping copies of your previous agreements in an accessible place, like

a SharePoint site. This can assist you if you want to approach older carriers when your newer contract expires. It may also be useful to set a calendar notification for when your temporary agreements are about to expire, to finalize the carrier switch. Once fi nalized, keep tabs on your current carrier by meeting with the carrier representative and asking personalized questions about your program, especially during times of peak demand or infl ation surges. Overall, carrier and shipper relationships need

to balance useful service offerings with individualized company needs.

Chelsea Snedden is a Transportation Consultant at Körber Supply Chain. She works with clients to model transportation scenarios, often interpreting complex agreements as the primary data analyst. With a background in sustainability and logistics, she brings a future-oriented perspective to managing transportation programs. Some of the customers she has worked with include Canva, GNC, Covetrus, and many others.

JANUARY-FEBRUARY 2023 PARCELindustry.com 13

SUBSCRIBE FOR FREE!

OPERATIONALEFFICIENCIES

IT’S TIME TO KICKSTART THE NEW YEAR

By Susan Rider

Congratulations! You made it through one more year. Hopefully, you are not kickstarting 2023 by kicking the can down the proverbial distribution row. There are distribution and supply chain managers that may avoid doing any new projects for a multitude of reasons, but the only way your facility will run better and your team will get better is by looking at the tools your facility needs and starting the projects now.

I recently visited a facility that desperately needed an overhaul on layout, process, and opportunity assessment. There were huge gains to be made by just doing a few things. After we made our final recommendations, the Vice President of Distribution said, “Look, I’m retiring in two years; I don’t want to start a project.” Do you have this type of complacency in your network? It can be detrimental in today’s environment.

It all boils down to people, process, technology plus automation. Let’s break it down and review some of the things you can do to improve your facility right now in 2023.

People: Do you have a team culture? Some facilities have fragmented teams. They may have a good supervisor in shipping who has built a successful team atmosphere, but over in order picking, the lackluster supervision and high turnover lead to a diminished throughput. Not to mention, many employees may want to transfer to shipping when there’s an opening. People and team building is hard, but it is so valuable and worth it in day-to-day operations. If you are not a people person and feel you are lacking in this area, find a number-two person with this strength. The people employed by your facility want to enjoy their jobs and work in an environment where they feel appreciated and valued. Unfortunately, you can’t go to a vendor and buy a package of teamwork. This is something that you have to develop and nurture in your facility, especially since teamwork environments will reduce turnover and improve accuracy and efficiency. Now is the ideal time to start a program and evaluation process of your supervisors on

“teamwork.” Your stars will shine, and you can have them teach the other leaders their techniques.

Processes: It’s always a good idea to review your processes at the end of the peak season to see where they need to be tweaked. In each functional area, identify the weak points and what your options are to improve these areas. It may take an investment, but oftentimes, it just takes a small design change. At least identify all the process changes that need to be or could be done. Then take this list and prioritize them as to the value that each change will bring to your facility. Once you have prioritized the list, look at the top 10. The ones that don’t need any investment should be put on your to-do list so you can get the ball rolling. The ones that need investment should be put on your budget list. Small investments may be able to be completed this year, while others may have to wait for the next fiscal year, but the point is to identify and have an action plan for making this area better. It is possible, of course, that you may identify an area that will save substantial dollars (in shipping, for example). This may require an emergency cash intake to accomplish but will save the company big dollars in the end. Recognize and reward supervisors and managers for identifying opportunities to save money.

Technology: This area has changed in the last five years. There is truly no reason for your team to be working in the dark ages (green screen) or without proper reports and

information. The popularity of cloud/SAS offerings have made WMS, TMS, and other systems affordable for even the smallest of companies. As a manager, you may think your job is to review all the supervisors and handle corporate communications, but the best supply chain executives understand that the real job is to provide the right tools for your team.

Automation is something many are looking at to avoid the labor shortages experienced in the most recent past. Automation is not going to be a short-term fix, as most companies have a backlog of two years or more. It may be, however, something you need to review, determine the fit and need in your facility, and plan for in the future. If you have automation or are implementing a system, please keep your employees in mind. One facility spent millions on implementing a new system and trained one (yes, one) person to run it. This employee was good and knew everything about the system. Unfortunately, when he got sick, they were stuck and had to call the vendor to send a very expensive tech person to work until the new person could be trained. If your company is doing automation, train an extra two people per shift on the new equipment. A duplicate person in today’s world is not redundant.

14 PARCELindustry.com JANUARY-FEBRUARY 2023

Susan Rider, President of Rider & Associates, Supply Chain Consultant, and Executive Life Coach can be reached at susanrider@msn.com.

MORGAN STANLEY SURVEY RESULTS: AN INTERESTING INFLECTION

Once again, PARCEL thanks Morgan Stanley for conducting such thorough research into the state of the parcel industry and allowing us to publish those findings. The results are far too numerous to contain to two pages, but the entire survey results, including those relating to trucking, freight, and rail, can be found at PARCELindustry. com/MorganStanleyJan23. The charts here provide just a glimpse into what is currently happening in the industry, and it will be interesting to see how the next quarter’s survey results compare.

16 PARCELindustry.com JANUARY-FEBRUARY 2023

JANUARY-FEBRUARY 2023 PARCELindustry.com 17

By David L. Buss

THE INTERRUPTED SUPPLY CHAIN

How Far Have We Come, and How Far Do We Have Yet to Go?

down at home, the pandemic threw global supply chains into disarray. Factories in other countries were forced to shutter their operations, and transport companies struggled to keep up with the reduced demand.

Oall played a role in how we carry on as a society and how we conduct business. But while each event has been different, they all have one thing in common — change.

been met with great resistance. The way we conduct business has always been in a state of flux, and the needs of customers are constantly changing. So, it should be no surprise that the global supply chain is no different. But, in the wake of COVID-19, the need for agility and resiliency has never been more critical.

Supply Chains During the COVID-19 Pandemic

The outbreak of COVID-19 has been one of the most disruptive events in recent memory. The pandemic has resulted in widespread panic and uncertainty, which has created a ripple effect on economies and supply chains worldwide.

In China, where the virus originated, factories were forced to close their doors, leaving retailers scrambling to find alternative suppliers. The situation was further complicated by travel restrictions and quarantines that made it difficult for goods to move in and out of the country.

These disruptions quickly spread beyond China’s borders. As businesses closed their doors and consumers hunkered

However, while brick-and-mortar store demand has decreased, there has been an uptick in online shopping as people look for ways to stay connected and entertained while social distancing. This shift has put even more pressure on supply chains that are already struggling to keep up with the demand.

The pandemic has exposed the weaknesses of many global supply chains. The just-in-time inventory model, which has become increasingly popular in recent years, has left many businesses struggling to find alternative suppliers when faced with disruptions. In a just-in-time system, companies only order the goods they need to meet current demand, reducing waste and cutting costs. However, this system also leaves little room for error, and disruptions can quickly cause a ripple effect throughout the supply chain.

To complicate matters more, labor shortages have also been a problem for many businesses during the pandemic. With so many people out of work, companies struggle to find the workers they need to keep their operations running. This has led to even more delays and disruptions in the supply chain.

The pandemic has forced business leaders to reevaluate their supply chains and look for ways to make them more agile and resilient. In the short term, this has meant finding alternative suppliers and increasing inventory levels to cushion against future disruptions. However, it will require a more

18 PARCELindustry.com JANUARY-FEBRUARY 2023

fundamental

and the dollar weakens, companies will have to find ways

When Will the Supply Chain Issues End?

It is difficult to say when the supply chain issues that were initiated by the pandemic — and further fueled by the war in Ukraine — will end. The challenge in modern times is that the global economy has become increasingly interconnected. This means that disruptions in one part of the world can quickly spread to other regions.

Regardless of how insignificant a disruption may seem, it can quickly balloon into a major crisis if it is not appropriately managed. The quick succession of worldwide crises is unprecedented, and there is still much unknown about how global supply chains will be affected in the long term.

That being said, we are starting to see some positive signs.

While the global economy is still in flux, many businesses have been able to adapt and find new ways to operate. The pandemic has forced us to reevaluate the way we live and do business, and this will likely lead to some positive changes in the long term. We may see more focus on local supply chains and an increase in agility and resilience.

Much like any disruption, businesses can find an element of growth within the challenge. The pandemic has shown us the importance of having a robust and agile supply chain. It has also forced businesses to find new ways to operate and become more efficient. In the long term, these changes could lead to a more sustainable and resilient economy.

Regardless of what the future holds, one thing is sure — supply chains will never be the same. However, rather than fearing the changes to come, we should embrace them and use them to improve how we do business.

Maintaining an agile and resilient supply chain has never been more critical. Don’t wait until a crisis hits to start diversifying your logistics capabilities — now is the time to build a foundation for a sustainable future.

JANUARY-FEBRUARY 2023 PARCELindustry.com 19

David L. Buss is CEO of DB Schenker USA, a 150-year-old leading global freight forwarder and 3PL provider. David Buss is responsible for all P&L aspects in the United States, which is made up of over 7,000 employees located throughout 39 forwarding locations and 55 logistics centers.

rethink of how global supply chains are designed rises

SUBSCRIBE FOR FREE!

Get Help With Auditing & Spend Management: Find Your Perfect Partner From These 8 Companies

In today’s ever-changing parcel shipping and supply chain environment, it’s important to stay on top of your auditing and transportation spend. Mistakes that are not caught early can cost thousands of dollars, and making the wrong choices with respect to your shipments (such as sending via Next-Day Air when Ground would suit your customers just fine) can add up to even more wasted spending. But it can be daunting to know where to start with respect to getting a handle on this aspect of your operation. Luckily, these 8 companies are a perfect place to start. With a plethora of experience and unsurpassed industry knowledge, each of these solution providers would be an asset to your company. Check out their websites and then give them a call. And when you reach out to them, be sure to mention you saw them in PARCEL.

Here at Advanced Carrier Technologies, we want to make your job easier and more productive and make your company more profitable. We take tedious and annoying audit processes and move them into the “done” column for our clients, recovering dollars from carriers each and every week. Then we do what we are frequently told isn’t possible: we find ways for our clients to reduce their freight spend, usually using the same carriers they are currently using. No BS, we only get paid if we save you real dollars.

Successfully achieving these results for over 18 years.

Alexandretta is the global leader in parcel spend management for shippers spending between $1mm-$500mm+ on parcel annually. With capabilities in the U.S., Canada, Europe, and Asia, we are positioned to manage your parcel spend, wherever you are. Alexandretta provides a comprehensive suite of spend management solutions including: audit/business intelligence, contact optimization, regional carrier optimization, network optimization, and service mix. Savings are table-stakes. Let Alexandretta bring the Transportation Advantage.

| www.alexandrettaconsulting.com | info@alexandrettaconsulting.com

CT Logistics is celebrating our 100th anniversary in the freight audit & payment industry. We are a global logistics supply chain provider, delivering impactful cost reduction solutions. When leveraging CT, you’ll have experienced assets available 24/7 for services including: freight audit & payment, TMS, managed freight, bid management, benchmarking, peer group comparison, and expert spend analytics. CT customizes all solutions to minimize your costs & save your company money. CT’s staff includes knowledgeable Professional Services teams for consulting & advice. CT’s business intelligent platform provides global supply chain visibility with graphical dashboards. CT is ISO 9001:2015 & SOC certified.

20 PARCELindustry.com JANUARY-FEBRUARY 2022

www.Go-ACT.com | 248.630.1326

| 714.606.9298

www.ctlogistics.com | sales@ctlogistics.com | 216.267.2000, Ext. 2190

SPONSORED CONTENT

Green Mountain Technology has been trusted by the world’s largest brands and most complex networks for nearly 25 years. Our award-winning audit combs through every transaction to find and fix the root cause of billing discrepancies. Our commitment to accuracy is one reason why we are one of the few in the industry to be recognized as a FedEx Certified Freight, Bill, Audit, and Pay (FBAP) Provider.

Founded in 1996, Intelligent Audit is the global leader in multi-modal transportation invoice audit, business intelligence analytics, and secure carrier payment processing. Volatility, complexity, and ambiguity will continue to plague the supply chain for the foreseeable future, creating anxiety in decision-making due to a lack of clarity. Intelligent Audit delivers unmatched services so shippers can make smarter decisions in uncertain times. Without normalized cleansed data, it’s impossible to understand your actual costs across carriers, modes, and regions. Intelligent Audit pairs actionable intelligence and highly knowledgeable account managers to discover cost reduction strategies.

If your company ships with FedEx or UPS, you could be entitled to thousands of dollars in refunds. Reveel not only performs the audit, we also do the recovery for you as well. The best part is, Reveel believes you should be able to keep 100% of those refunds, no gain share, no catch, no hidden fees, just money in your pocket. That’s why we offer invoice auditing ABSOLUTELY FREE in our Essential version of our Shipping Intelligence® Platform.

Parcel experts from the start, we combine industry expertise, market data, and proprietary technology to negotiate the optimal, market-appropriate agreements for your business. In 2022, TransImpact saved our clients an average of 19.7%, guaranteeing savings to a tenth of a percent. Once negotiation is done, our Parcel Spend Intelligence technology and weekly report cards continue to optimize your rates as we watch your company’s shipping habits, market fluctuations, peak season surcharges, GRI implications, and any changes in your overall parcel spend — ensuring you’ll continue to have market appropriate rate reductions. | www.transimpact.com | jey.yokeley@transimpact.com

The increasingly complex nature of small parcel shipments makes it difficult to get a timely, accurate picture of true cost and service fulfillment. High volumes, multiple surcharges, contracted delivery guarantees, limited access to information — it all adds up to a complicated invoice process prone to inaccuracies and unnecessary costs. Our small parcel experts work with you to proactively identify areas to reduce expenses with customized solutions that integrate small parcel and freight data for an accurate view of your true transportation spend.

usbank.com/transportation-solutions/small-parcel | cpstransportation@usbank.com

JANUARY-FEBRUARY 2022 PARCELindustry.com 21

www.reveelgroup.com | info@reveelgroup.com | 877.421.4994

www.intelligentaudit.com | info@intelligentaudit.com | 201.880.1110

Video | https://resources.greenmountaintechnology.com/parcel | contact@greenmountaintechnology.com | 877.397.2834

| 252.764.2885

By Karl Wheeler

ON-TIME DELIVERY PERFORMANCE: FACT OR SPIN?

UPS claims better on-time performance than FedEx. But is that the case? Here’s how to correctly interpret the data.

With the onset of COVID, both UPS and FedEx suspended service guarantees that had been in place for years. These guarantees provided shippers a measure of compensation for the many potential issues caused by late deliveries. Freed from long-standing service guarantees, the carriers had no accountability for service failures and coincidentally made record profits during COVID. Now that the pandemic-induced spike in shipping volumes has passed, both carriers have excess network capacity but continue to withhold guarantees on all but the most premium services.

When Carol Tomé, UPS CEO, was pressed in a recent Q&A with Thomas Black (published by Bloomberg) on

why guarantees were still suspended, she said, “When you deliver at 98% effectiveness, service guarantees aren’t necessary.” Tomé’s dismissive attitude toward something so valuable to shippers has trickled down to many front-line salespeople who express no need to compete on price when they claim their service is so much better. For several months now, when reviewing our clients’ contract proposal decks from UPS, they invariably include slides slamming FedEx and claiming vastly superior on-time delivery performance. They even propose a dubious calculation of how much money will be saved by paying more with UPS. But does this even matter?

To be fair, FedEx had some well-publicized on-time delivery performance issues, but to overlook the years when UPS had similar challenges is

disingenuous at best. Over the years, this cycle of better on-time performance has always been in flux. These cycles of performing better or worse will repeat as long as the two companies compete. For their part, shippers want the fastest possible service for the lowest possible price. Unfortunately, the on-time delivery performance metric, which is largely spin and hyperbole, fails to provide shippers with real time-in-transit insight, especially when carriers deliver it without context.

The on-time percentage metric is vague for multiple reasons.

First, the carriers decide what makes a late shipment eligible for inclusion in the calculation. Once deemed ineligible for any reason, the late shipment is not counted at all. This is somewhat akin to getting to the Super Bowl to play Belichick’s Patriots and finding out he is also the referee.

EXAMPLE: ABC Company ships 100 Ground Residential packages, 87 of which arrive on or before the estimated delivery date. That leaves 13 shipments that did not arrive on time. The carrier then decides that really only 89 shipments count, 87 of which were on-time. Then they tell ABC Company they delivered 98% of their packages on time. In reality, 13% of ABC Company’s Ground residential customers did not receive their shipments on time, leading to multiple inquiry calls and angry customers.

Second, on-time delivery performance does not account for the severity of lateness. One day late counts the same as eight days late, and anecdotally, we have observed many shipments linger for days in a carrier’s delivery center after missing the original estimated date.

Third, the definition of “days” is inconsistent. UPS’s transit times, published in “business days,” do not usually include weekends. However, FedEx Ground Home Delivery, with its superior Saturday delivery coverage and actual Sunday delivery to most of the country, commits to a particular day that usually includes weekends.

22 PARCELindustry.com JANUARY-FEBRUARY 2023

FedEx is considering changing these weekend commitments, but for now, this disparity creates many cases in which FedEx could deliver faster than UPS while still being considered late by published standards. To illustrate this point, consider the two maps to the left, the first published by UPS for Ground Residential, and the second by FedEx for Ground Home Delivery. Both are from the same origin ZIP Code. Notice the difference in the published time-in-transit commitments.

The day of the week a package is shipped is very important when determining the delivery commitment and which carrier will ultimately deliver faster. Consider a FedEx shipment sent from San Diego to Arizona on a Thursday. The two-day transit commitment is due on Saturday. The two-day commitment from UPS is vague, and generally not due until Monday.

Currently, you will not find a published UPS Ground transit map with the level of specificity that FedEx provides. This means FedEx could be late by missing the estimated Saturday delivery date, deliver a day later on Sunday, and still reach the recipient a day faster than if the package had been sent with UPS. (Whether or not FedEx would report this as a late delivery is another question.)

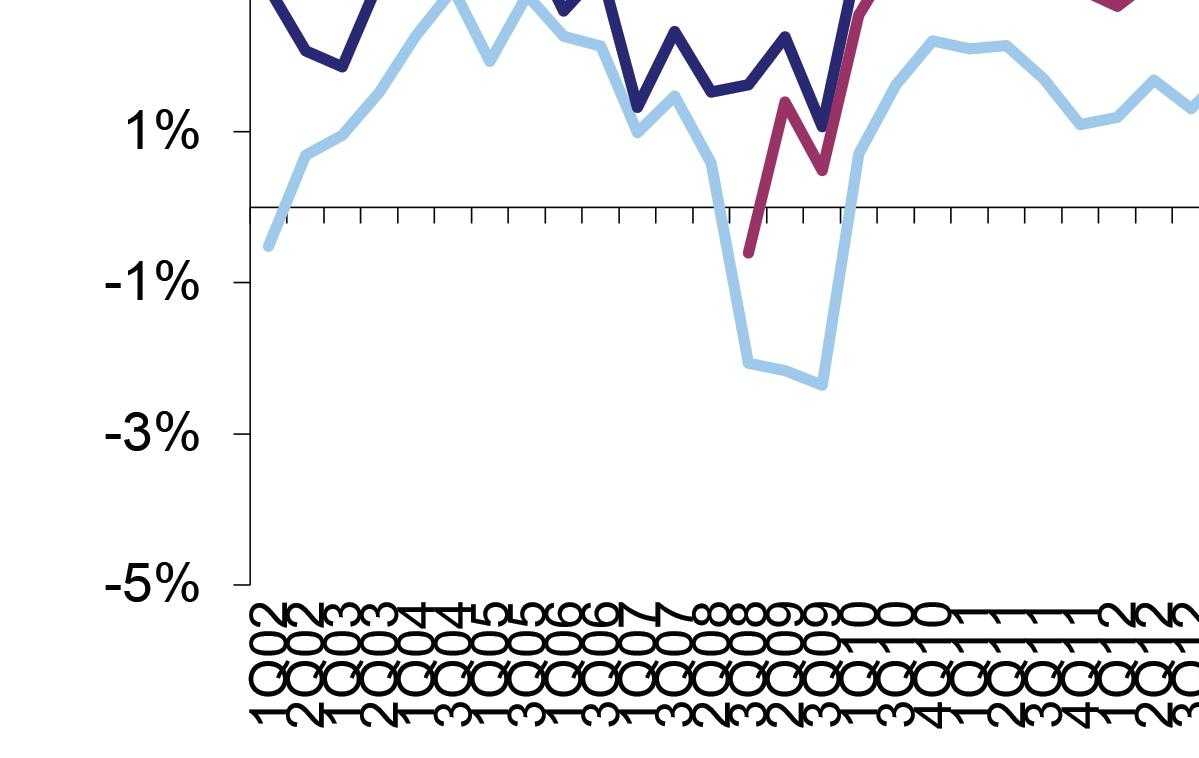

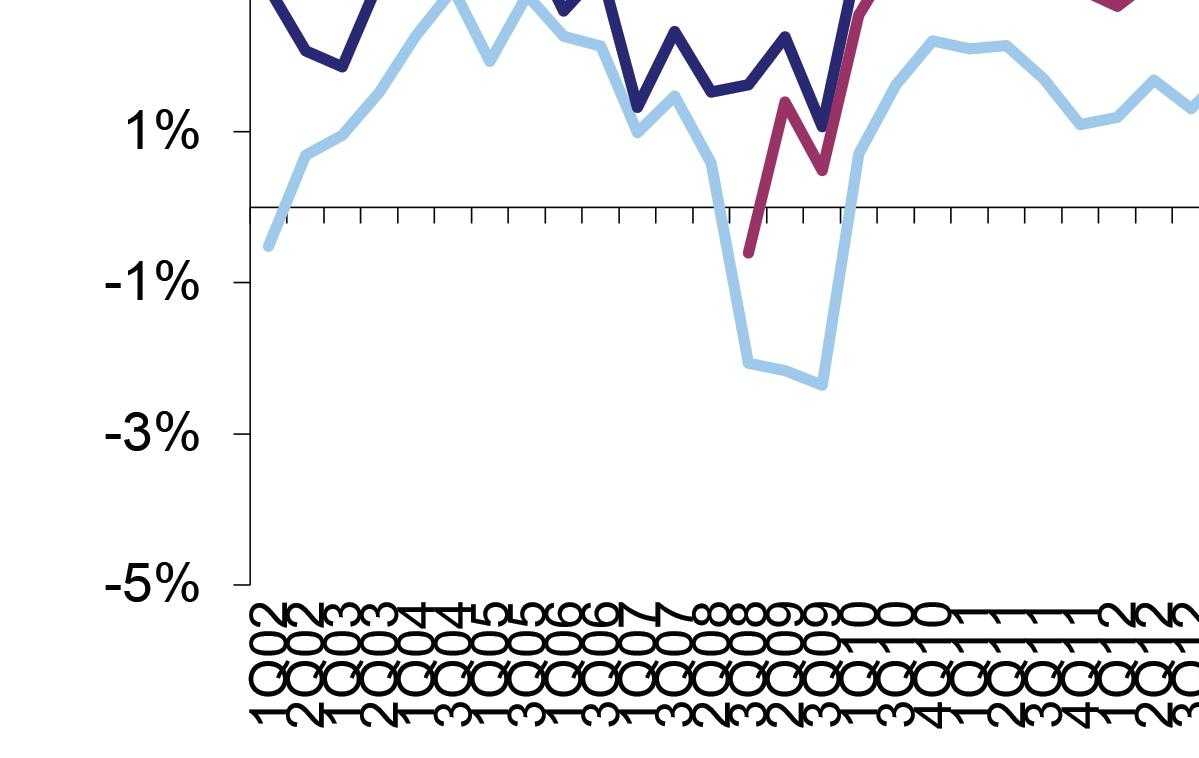

These weekend deliveries result in decreased calendar-days in transit, a difference that clearly shows up in our data. Using a full data set of FedEx Home Delivery shipments versus UPS Ground Residential shipments from our database from October and November 2022, I compared the actual calendar days in transit based on the difference between the carrier-provided ship date and delivery date. Looking at average calendar days in transit is a much clearer metric than a carrier-controlled on-time delivery percentage.

The chart on the following page shows that average calendar days in transit are generally close when shipped on a Monday, Tuesday, or Wednesday. The impact of UPS not committing to weekend deliveries jumps out for packages shipped on Thursday or Friday, with the average difference widening dramatically

JANUARY-FEBRUARY 2023 PARCELindustry.com 23

UPS From San Diego Shipping on a Monday:

SUBSCRIBE FOR FREE!

FedEx From San Diego Shipping on a Monday:

as the week progresses. Again, this data is agnostic to estimated delivery dates and measures only how quickly the average package was delivered. UPS’s broad claims of superiority fall flat when faced with data. Based on over 2.7 million shipments, FedEx clearly delivered its average Ground Home Delivery package faster than UPS delivered its average Ground Residential package.

To be clear, this is a recent, single-service sample of all shipments sent by our clients during the 2022 peak season, at the time of writing. I encourage the carriers to release all the data showing their actual calendar days in transit. Be transparent and show how long it actually took you to deliver! Your current and prospective clients deserve to know what they’re really getting for their money. No cherry picking what counts as late and what doesn’t.

I also encourage FedEx, which had well-publicized “late” issues during COVID, to not take away an actual advantage they currently have with weekend delivery commitments. Based on the quote below from Raj Subramaniam, FedEx President & CEO, during FedEx’s Q2 2023 (12/20/2022) earnings call, FedEx may actually start marketing this current advantage, and it would be foolish to remove it.

“Our team is performing exceptionally well this peak season with ground time-in-transit in the U.S. at just two days. FedEx Ground is delivering holiday shipments faster to more locations than our nearest competitor [UPS].” – Raj Subramaniam, FedEx President & CEO

As much as possible, shippers should use actual performance data to set delivery expectations with their buyers. The final chart in this article uses the same data set as above and shows the average transit time by zone in calendar days. Looking only at Zone 2, which has a nearly universal one-day transit commitment, UPS is averaging 1.20 days. One way to interpret this is that on average, 20% of the time, UPS is not delivering in one day to the closest consignees.

But with UPS publishing no actual data, potential shippers can only guess at UPS’s performance until after they’ve signed a contract. One thing’s for sure: 98% effective it ain’t.

Karl Wheeler is a Senior Professional Services Consultant at Shipware, LLC, a shipping consultancy. His first interaction with Shipware was as a client, and his perspective was a welcome addition. He has over a decade of hands-on experience in e-commerce logistics and shipper operations, combined with impressive data mining and visualization skills. This combination of backgrounds provides a unique perspective among Shipware’s Professional Services team. Karl also has an extensive background in carrier contract negotiations, service level optimization, inventory location optimization, and data-based cost reduction strategies.

24 PARCELindustry.com JANUARY-FEBRUARY 2023

BY CALEB NELSON

BY CALEB NELSON

A CHANGING PARCEL LANDSCAPE WHAT DOES 2023 HOLD FOR SHIPPERS?

2022 was a year of rapid change for parcel shippers. So was 2021 and 2020. Now, shippers are turning their attention from what has happened to what will happen next.

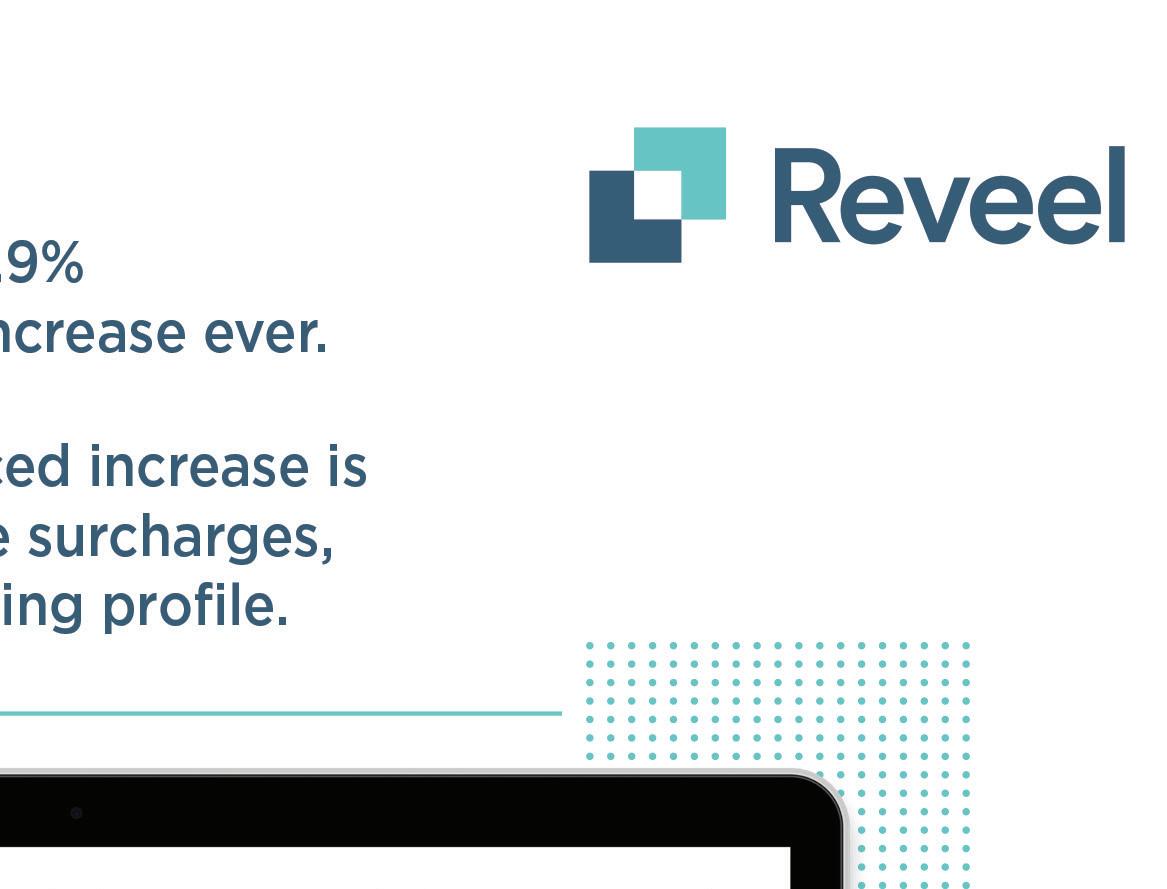

The winds of change aren’t done in 2023. Inflation is still high, and FedEx/ UPS are feeling the heat. 2023 will see the highest shipping rates on record, with an average increase of 6.9% from both carriers. However, the actual impact on shippers will be in the double digits.

Shippers must be prepared for economic and operational challenges, which can impact sales and profits.

To predict 2023’s greatest threats and opportunities for shippers, our data science team dug into approximately $20B in transportation data we’ve collected. Here are the trends, what they mean for 2023, and how shippers can adapt and overcome this year.

Shipping Demand Is Normalizing

Much has been said about declining

shipping volumes. Since April 2022, shipping volume is down nearly seven percent compared to the same span a year before. FedEx has seen a 9.6% decrease, and UPS a 3.4% decrease.

While carriers may be presenting this as a sign of an economic downturn, our data indicates that rather than a shocking slowdown, the reduced volume is more of a normalization back to pre-pandemic levels. While it may be a decrease from 2021, volumes are still well above where they were in 2020.

This view aligns with data from the International Monetary Fund that indicates that while the latest share of online spending is still higher than pre-COVID levels, it’s only 0.6% higher than the projected growth trend for e-commerce before the pandemic.

On-Time Delivery Performance Is Improving

COVID-related challenges and surging e-commerce demand combined to produce historic lows in on-time delivery

and performance in early 2022. FedEx’s performance ratings declined to 56.3% in February 2022. However, they’ve improved considerably, hovering around 85% since October 2022. UPS’s on-time performance has consistently been higher than FedEx’s, but they still struggled to meet their standard performance levels. In May 2022, their on-time performance dropped to 81.5%. As of December, it’s back to 97.6%. FedEx’s performance ratings dropped from 83% in December 2020 to 57% by February 2021. Demand normalization is a key factor in the significant performance improvements.

Accessorials Continue to Be Targets for Rate Increases

The 6.9% GRI only scratches the surface of rising costs. From 2020 to 2023, accessorial and surcharge fees increased 15% to 30%. For many of our clients, this has produced actual year-over-year rate increases in the double digits.

26 PARCELindustry.com JANUARY-FEBRUARY 2023

Disproportionately large accessorial fee increases show us that both carriers are making efficiency a top priority. Packages that are shipped to remote locations or require additional handling are not efficient, which makes them less lucrative. Rather than absorbing those costs, carriers are passing them back to shippers. Carriers are making it clear that if it’s not small or lightweight, it’s not efficient for them to ship.

Examples of this include a 20.25% UPS Large Package fee increase from 2020 to 2023 and a 17.7% increase to FedEx AHS Packaging charges.

UPS and FedEx Are Facing Labor Challenges

The UPS-Teamsters contract, the largest collective bargaining agreement in North America, is set to expire on July 31, 2023. The result of negotiations could have a major impact on UPS and its clients. Inflation and supply chain labor constraints have given Teamsters more bargaining power than they’ve had in the past, and those leading negotiations have threatened to strike if an agreement isn’t reached by August 1, 2023.

Meanwhile, FedEx is facing its own challenges. They’ve missed quarterly targets, and independent contractors (who make up most of their ground network) have complained that fuel costs, fleet maintenance, and other inflationary pressures have made it unprofitable to continue delivering for FedEx under their current agreements.

Potential strikes are on the table for segments of both major carriers’ labor forces.

Economic Uncertainty

Different economic indicators conflict on whether or not a recession is coming, but the short-term outlook signals that the global economy is rapidly weakening. Even if the US avoids a recession, we’ll likely see a significant slowdown of economic growth in 2023.

Consumers may be wary of spending on non-essentials. Rising shipping costs may deter customers from making purchases or push them to buy more in-store.

How Shippers Can Adapt in 2023

Improving on-time performance and normalizing package volumes should make some parts of a shipper’s life easier in 2023. They can feel more confident that carriers will meet their shipping demands and that the shipping timelines they provide to customers will be accurate.

fulfillment centers, encouraging pick-up from brick-and-mortar stores, and evaluating and optimizing their distribution network to ensure packages are shipped from the best locations. Understanding trends in what you’re shipping where, and storing those products in the right locations, can help reduce transit times and costs by limiting the need to pay for faster service types.

Eliminate package inefficiencies

With each carrier’s GRI targeting inefficient shipments, avoiding oversize and dimensional weight charges is critical to reducing shipping costs. Additionally, optimized package sizes can save money in packaging material costs while reducing your carbon footprint.

View your carrier as an ally

At the same time, these positives are countered with concerns over skyrocketing shipping prices, labor shortages, fuel prices, and a limited choice of national carriers. Meanwhile, consumers still expect fast transit times at low costs. Meeting these expectations while absorbing higher shipping costs may leave some shippers with an unprofitable business model.

Here are 4 strategies to prevent that:

Diversify your carrier mix

The days of relying on a single carrier are over. Building a mix of carriers reduces risk and can help lower costs. LaserShip-OnTrac’s new transcontinental expands their footprint to 30 US states. A litany of other regional carrier options exist, and more and more diversification opportunities arise each year.

Optimize your distribution network

Shippers must look for new solutions, such as partnerships with

Your carrier reps are your partners. When you’re successful, they’re successful. They might not be as flexible with discounts as they were in the past, but they may have other ideas. If you arm yourself with data about where you’re getting hit with high fees, plus ways you’re improving operations to be a more efficient partner for them, the more likely it is they’ll work with you to find the best solution for each party.

Data Is Key in 2023

If the pandemic taught us anything, it’s that planning for worst-case scenarios is critical. Should an economic downturn come, shippers must avoid paying the most they ever have for shipping services, especially if they’re fundamental to your business.

Luckily, there are more cost-reduction opportunities than you might think, but you need data to know where to make meaningful improvements and what pain points to address with your carriers. With data analysis, smart shippers can turn uncertainty into opportunity in 2023.

While carriers may be presenting this as a sign of an economic downturn, our data indicates that rather than a shocking slowdown, the reduced volume is more of a normalization back to pre-pandemic levels.

3 4 2 1 JANUARY-FEBRUARY 2023 PARCELindustry.com 27 SUBSCRIBE FOR FREE!

Caleb Nelson is Chief Growth Officer at Sifted.

UNDERSTANDING THE COMPLEX OVERLAP OF WMS, WCS, AND WES WAREHOUSE SOLU TIONS

The interest in software to manage distribution centers remains strong, fueled by omnichannel fulfillment requirements, growing adoption of automation, and other trends.

One challenge logistics managers face is that there are actually three main types of software solutions that can be deployed in a distribution center, individually or in combination. There is a lot of confusion regarding the functionality provided by each type of solution and the boundaries between them — boundaries that vary depending on the specific software vendors involved and the application scenario.

Those three software categories are:

• Warehouse Management Systems (WMS)

• Warehouse Control Systems (WCS)

• Warehouse Execution Systems (WES)

The recent growing prominence of Warehouse Execution Systems has especially muddied the waters, as this is a newer type of solution than the other two categories and therefore is less well understood. What’s more, specific capabilities range widely across WES vendors, and there is

clearly some potential (and growing) overlap between WES and both WMS and WCS solutions (see graphic below). But the change agent in this mix is WES.

There Is Growing Overlap Between WMS, WCS and Newer WES

28 PARCELindustry.com JANUARY-FEBRUARY 2023

By Dan Gilmore

Are your shipping costs too high?

other functions. A true WMS is characterized by use of mobile, real-time data capture and system-directed work tasks, most commonly using wireless (radio frequency) terminals or alternatives such as voice recognition.

Within the WMS universe there are significant variations, from sophisticated systems that can cost one million or more to acquire and implement for large and/or complex facilities to much more limited systems for simpler DC operations that require less advanced capabilities (some systems can even span the spectrum of use cases).

Warehouse Control Systems, by contrast, refer to software that manages the movement of goods across various types of material handling equipment systems deployed in a DC. Most commonly, this involves conveyor movement of cartons/totes from “pick modules” on to sortation systems of one kind or another. These handling systems can take many other forms, such as mini-load Automated Storage and Retrieval Systems (AS/RS), “shuttle” systems, and many other types of technologies.

In a conveyor system context, the WCS directs the movement of the belts and rollers when needed, and manages activities such as carton induction, merges, sortation/diverts, and other carton/tote conveyor transport processes.

There can be some contention about how much “smarts” (decision logic) should go into the WCS. It is my view that all

Our dedicated team of logistics experts with over 30 years of experience, know where to look for incentives and optimization opportunities the carriers don’t want you to see.

Parcel optimization and savings experts

Auditing of all freight modes

Reporting and analytics tools

Payment processing solutions

General ledger coding solutions

Our goal is to reduce your shipping costs, it’s all we do.

White label solutions for consultants www.Go-ACT.com

248-630-1326 | Connect@Go-ACT.com

of the intelligence about where the products should be picked from and where they are ultimately to be delivered should come from the WMS, and that the WCS should simply execute those decisions on the material equipment. But it doesn’t always work that way. In some cases, the WCS takes on some portion of the logical decision-making. This can happen for several reasons:

The automation system provider is largely “in control” of the customer and the project, and lobbies for its WCS software to add more value in an expanded role. Since this involves issues and decisions that are hard to understand, the automation company sometimes gets its way.

The WMS isn’t up to the job. Implementing new automation can be especially difficult in facilities using an older WMS that may not be capable of fully supporting the new operational requirements. Using WMS-like functionality in the WCS, if available, could be an answer.

Side agreements may be in place between the WMS and WCS vendors. The reality is that the end customer often isn’t that involved in the details of the integration of the WMS and WCS, which includes decisions about which system does what. Sometimes in these discussions, the two sides agree for some of the logic to be managed by the WCS, usually as the path of least resistance.

In any of these scenarios, some smarts get put into the WCS. This can lead to issues down the road, because when changes are needed, it often requires modifications in both

JANUARY-FEBRUARY 2023 PARCELindustry.com 29

We’ll get you back on track.

the WMS and the WCS, instead of just the WMS. The WMS should have all the information it needs to make these decisions. The WCS should just take a decision about where a carton goes, deliver it, and then tell the WMS that it has done the job when complete.

Along Comes WES

More recently, the category of Warehouse Execution Systems gained growing market prominence. While this type of software has been around for a number of years, trends such as e-fulfillment and increased automation have raised the level of interest and adoption.

The vendors that first developed WES solutions were driven by a belief that most WMS systems did not do enough to maximize utilization of material handling equipment. The argument was that the efficiency of such automated systems were simply not a concern for most WMS providers in the way they directed work. There is, I believe, some truth in that general observation for many WMS vendors.

However, today’s WES solutions address a wide variety of opportunities and challenges that go well beyond what is typically found even in advanced WMS solutions, including equipment utilization but more.

Though it varies by vendor, WES solutions can be seen as having the following capabilities:

Real-time visibility to throughput, bottlenecks, and events by individual processing area

Direct management and optimization of picking sub-systems, such as mobile robots, pick-to-light, Put Walls and more

Advanced, configurable optimization for order batching, release, picking and replenishment, orchestrating the flow of work across multiple areas

Workload balancing to maximize material handling equipment utilization and flow

Automated order release based on optimization opportunities, service commitments, shipping schedules, and real-time condition monitoring

Sophisticated capabilities to plan, re-plan, and dynamically allocate human and equipment resources

A logical question is this: could some of this functionality be provided by an advanced WMS alone? In some cases, for some of the capabilities, the answer is probably yes. However, this level of optimization and orchestration is really not available today in WMS alone.

There are several other important points related to the exciting new area of WES software. First, it turns out that WES benefits are not only for highly automated DCs, the types of facilities most closely associated with WES deployments to date. But WES can provide the same type of orchestration and optimization benefits to manual DCs and those with mid-level automation.

The basic concept and functionality apply equally to all those DC types. Human workers in, for example, a case

picking area are a resource not conceptually different than a piece of automation in terms of planning and capacity/ constraint management, though the human resources can often have more flexible capacities based with respect to being able add more labor to the mix, versus fixed equipment rates. Another important point is that in many cases, WES can be beneficially added on top of an existing WMS, perhaps breathing new life and productivity into an aging or light functionality WMS without the need for a full replacement.

Typical WES Benefits

The types of results and benefits seen from WES deployment include:

Double digit-plus improvement in labor productivity

Significant reduction in supervisory overhead

Reduced/better managed overtime

Improved throughput, closing the gap between theoretic and actual throughput of a facility or individual sub-systems

Ability to easily and quickly evaluate and deploy new picking sub-systems/technologies

More consistent meeting of customer service commitments with little end-of-day “chaos”

Improved material handling system utilization

WES offers a powerful new tool in the logistics manager’s arsenal, whether deployed as a standalone solution or together with a WMS. These advances in WES are also leading to the near-term arrival of what we might call the “Smart Warehouse of the Future,” featuring much greater use of system-made decisions, powered in part by artificial intelligence and machine learning. This can dramatically reduce the human decision-making still heavily required even in advanced WMS deployments. It is a future that, in reality, is really here today.

30 PARCELindustry.com JANUARY-FEBRUARY 2023

Dan Gilmore is Chief Marketing Officer, Softeon.

WES can be beneficially added on top of an existing WMS, perhaps breathing new life and productivity into an aging or light functionality WMS without the need for a full replacement.

By Dan Gilmore

By Dan Gilmore

By Josh Dunham

By Josh Dunham

By Gordon Glazer

By Gordon Glazer

BY CALEB NELSON

BY CALEB NELSON