CAN FEDEX DELIVER TODAY, EXECUTE FOR TOMORROW?

PAGE 12

BUY WITH PRIME: IS AMAZON RIVALING FEDEX AND UPS?

PAGE 18

NOW IS THE TIME TO OPTIMIZE YOUR DC’S INVENTORY

PAGE 10

MARCH-APRIL 2023 PARCELindustry.com

FIND INSIDE: SHIPPING SOFTWARE/SYSTEMS & WAREHOUSE OPTIMIZATION SOLUTIONS YOU NEED (PAGES 24 & 25) CLICKHERETOSUBSCRIBE

INTERACTIVE SURVEY 18 16 22 26 30 /// CONTENTS Volume 30 | Issue 2 06 EDITOR’S NOTE A Pivotal Summer Ahead By Amanda Armendariz 08 PARCEL COUNSEL Parcel Shippers Beware: Are You a Hazmat Offeror? By Andrew M. Danas and Brent Wm. Primus 10 OPERATIONAL EFFICIENCIES Inventory or End of Story By Susan Rider 12 SUPPLY CHAIN SUCCESS Can FedEx Deliver Today, Execute for Tomorrow? By Andy Johnson 14 INDUSTRY INSIGHT UPS Earnings Call Recap By Adam Holcomb 16 E-COMMERCE SHIPPING OUTLOOK: EFFICIENCY, EFFECTIVENESS, CONSISTENCY By Gaston Curk 18 BUY WITH PRIME: IS AMAZON RIVALING FEDEX AND UPS? By Caleb Nelson 20 FIVE CHALLENGES BRANDS FACE WHEN PURSUING SUSTAINABILITY By Rebecca Wyatt 22 CREATIVE ORDER FULFILLMENT: ADOPTING NEW PRACTICES TO COME OUT AHEAD By Matt Kulp 26 INTERACTIVE SHIPPER SURVEY – LIVE PARCEL FORUM RESULTS UNVEILED: PART ONE By Rob Martinez 30 SECOND ANNUAL MEGAN J. BRENNAN AWARD PRESENTED TO USPS IG SPONSORED CONTENT 07 THE TRUTH ABOUT RESELLING PARCEL SHIPPING RATES 09 3 SIGNS YOUR PACKAGING OPERATION IS READY FOR AUTOMATION 11 TOO LARGE, EXTRA CHARGE: ANOMALY DETECTION UNCOVERS HIDDEN 250% SPIKE IN COSTS 24 8 SHIPPING SOFTWARE & SYSTEMS THAT CAN LEVEL UP YOUR OPERATION 24 5 IDEAS TO OPTIMIZE YOUR WAREHOUSE GET OUR NEWSLETTER? SUBSCRIBE FOR FREE 4 PARCELindustry.com MARCH-APRIL 2023

PRESIDENT CHAD GRIEPENTROG

PUBLISHER

KEN WADDELL EDITOR

AMANDA ARMENDARIZ [ amanda.c@rbpub.com ]

AUDIENCE DEVELOPMENT MANAGER

RACHEL CHAPMAN [ rachel@rbpub.com ]

CREATIVE DIRECTOR

KELLI COOKE

ADVERTISING

KEN WADDELL (m) 608.235.2212 [ ken.w@rbpub.com ]

JOSH VOGT [ josh@rbpub.com ]

P.O. Box 259098

Madison WI 53725-9098

p: 608.241.8777

f: 608.241.8666

PARCELindustry.com

PARCEL (ISSN 1081-4035) is published 7 times a year by MadMen3. All material in this magazine is copyrighted 2023 © by MadMen3. All rights reserved. Nothing may be reproduced in whole or in part without written permission from the publisher. Any correspondence sent to PARCEL, MadMen3 or its staff becomes the property of MadMen3. The articles in this magazine represent the views of the authors and not those of MadMen3 or PARCEL. MadMen3 and/or PARCEL expressly disclaim any liability for the products or services sold or otherwise endorsed by advertisers or authors included in this magazine.

SUBSCRIPTIONS: Free to qualified recipients: $12 per year to all others in the United States. Subscription rate for Canada or Mexico is $35 for one year and for elsewhere outside of the United States is $55. Back-issue rate is $5.

Send subscriptions or change of address to:

PARCEL, P.O. Box 259098 Madison WI 53725-9098

Allow six weeks for new subscriptions or address changes.

REPRINTS: For high-quality reprints, please contact our exclusive reprint provider, ReprintPros, 949.702.5390, www.ReprintPros.com.

MARCH-APRIL 2023 PARCELindustry.com 5

SUBSCRIBE FOR FREE!

A PIVOTAL SUMMER AHEAD

By Amanda Armendariz

By Amanda Armendariz

Everyone in our industry has heard talk of the potential Teamsters strike if negotiations with UPS this spring and summer don’t go as planned, and it’s likely making shippers (especially those who were around for the last strike in 1997) a little nervous. In a statement last year, Teamsters General President Sean O’Brien said, “Our union is resolved to win the best contract for UPS members and to reset the standards for wages and benefits in this industry by August 1, 2023. We won’t extend negotiations by a single day.” If the 350,000 workers go on strike, it would significantly impact

a large amount of package shippers. UPS isn’t sharing much in terms of its negotiation strategy, saying instead that the company prefers to keep tactics close to the vest.

Early preparation is key. Shippers who think they can simply switch their volume to FedEx if a strike does occur will be in for a rude awakening: The company said that it could not guarantee prioritization of volumes of UPS shippers unless business was received by March 31. Given that that deadline has now passed, shippers’ business will be accepted on a first come first served basis.

This uncertainty may mean that it’s the perfect time to consider other forms of carrier diversification, such as the United States Postal Service or regional carriers. Even if negotiations go seamlessly and there is no strike, there is still value in seeing if other carrier options could service some of your company’s needs. After all, our industry is an uncertain one (even without the possibility of a major carrier striking), and the more reliable partners you have in your network, the better.

As always, thanks for staying connected with PARCEL.

6 PARCELindustry.com MARCH-APRIL 2023

EDITOR’S NOTE

The Truth About Reselling Parcel Shipping Rates

If you’ve researched Multi-Carrier Shipping Software (MCSS) before, you may have heard of reseller shipping rate programs. These programs offer discounted rates on carrier services without signing an additional carrier contract, provided by the MCSS vendor. For the smaller shipper who doesn’t quite have the leverage (or appetite) to negotiate themselves, this could be just what they need. But the enterprise and mid-sized retailer, manufacturer, and 3PL provider should question the integrity of a vendor with this program. Is it too good to be true?

Red Flags

When a vendor offers you discounted parcel shipping rates, they’re making a margin off every shipment processed. It could be a flat fee across the board, or a percentage of each transaction. For enterprise shippers who ship thousands of shipments, if not millions (peak season), this can add up quickly.

The biggest concern for shippers using these vendors is that you’re giving away your right to negotiate directly with the carrier. Don’t blow off the need to have an advocate within your carrier partners — the rep should know your business and be able to tailor a rate card and operating plan that fits your needs. For example, if you’re shipping items that are large but light, a general discount on ground services may not offer as much value as a custom dimensional weight divisor. If you need a later pick-up because of an upcoming online sales promotion, you need to know you can call someone in a pinch to get it.

And if you have substantial volume, the carrier wants to work directly with you rather than with a reseller in the middle. Some extremely valuable carrier services, like last-mile postal delivery or consolidated international shipping, are only offered through a direct contractual relationship with the carrier.

It’s sensible to decouple your rate agreements from your technology stack so the two can evolve independently as

needs change. If you have outgrown a reseller’s rate card or technology, you should be confident that you can move on in one area without a disruptive impact to the other.

The principle of a shipping solution being “carrier agnostic” — not favoring one carrier over another — will allow for easy expansion and reduction of your carrier portfolio mix as conditions change. Your carrier-agnostic vendor will be able to deliver objective evaluations based on your business’s unique rules and serve up the fruits of your good negotiating efforts with your carrier partners, rather than focus on carriers who will line their pockets.

A MCSS that is focused on your core shipping profile will serve you now and as your needs change. ProShip’s industry-leading multi-carrier shipping solution offers the tools to achieve millisecond transaction times and offers a broad carrier library, where you can find the carriers and services to best meet your requirements. With a flexible, powerful architecture, ProShip can integrate into your existing software stack to automate and simplify complex parcel shipping challenges. To learn more about how ProShip can upgrade your shipping program, contact our team today.

APPLICATION ARTICLE

sales@proshipinc.com 800.353.7774 www.proshipinc.com

PARCEL COUNSEL PARCEL SHIPPERS BEWARE: ARE YOU A HAZMAT OFFEROR?

By Andrew M. Danas and Brent Wm. Primus

Parcel shippers who ship hazardous (hazmat) materials in domestic or international commerce are subject to a wide variety of rules and regulations governing their shipments. By the very nature of the materials being shipped, the parcel shipper is exposed to higher regulatory and liability risks.

Although true for any shipment, it is critical for parcel shippers shipping hazardous materials that you know and comply with the rules governing your role in the shipment. The first step is to determine whether your package contains hazardous materials. If so, the next step is to determine whether you are an “offeror” when shipping hazmat goods.

The Hazardous Materials Regulations (“HMR”) are issued by the Pipeline and Hazardous Materials Safety Administrator (“PHMSA”) of the U.S. Department of Transportation. They are set forth in the Code of Federal Regulations: 49 C.F.R. Parts 171 et seq. The regulations are divided into four general areas: (1) hazardous materials identification and classification; (2) communications regarding hazardous materials; (3) packaging requirements; and (4) operational rules.

The regulations govern the preparation of shipping documents and the markings, labels, and placards that are used to communicate hazards of materials to both their routine handlers and to emergency responders. They also contain specific training requirements for employers to ensure that each employee dealing with hazardous materials is trained in the HMR.

Confusion over whether a shipper is an “offeror” under the hazmat regulations on a shipment involving multiple parties in the supply chain can arise because the hazmat regulations specifically state that each person who offers

hazardous materials for transportation must comply with the applicable regulations. The regulations also state that “there may be more than one offeror of a shipment of hazardous materials.” In other words, although the regulations state that under some circumstances an offeror can rely upon information provided by another offeror, multiple parties to a shipment may each have a responsibility for ensuring compliance with the hazardous materials rules.

Additional confusion can arise because the HMR general definition provisions use the term “shipper” but do not define it. PHMSA advises that the word “shipper” is not used in the HMR regulations in a commercial or contractual sense, but instead refers to a person who prepares a shipment for transportation, which can also be a carrier in some circumstances.

So who is considered an “offeror” under the HMR? It is any person who (1) performs, or is responsible for performing, any pre-transportation function required under the regulations for transportation of the hazardous material; or (2) tenders or makes the hazardous material available to a carrier for transportation.

Tendering or making a hazardous material available to a carrier is fairly clear. However, the definition of a “pre-transportation function” under the HMR is broad and non-exhaustive. It includes criteria such as determining the hazard class of a hazardous material;

selecting, filling, securing hazardous material packages; and marking and labeling packages to indicate that they contain hazardous materials.

However, parcel shippers should also be aware that “pre-transportation functions” also include engaging in such activities as preparing a shipping document; reviewing a shipping document to verify compliance with the HMR; or loading, blocking, and bracing a hazardous materials package in a freight container or transport vehicle, as well as other activities.

The determination that a shipment is a hazmat shipment and that as a shipper you are an “offeror” triggers your responsibilities to comply with the HMR regulations. These responsibilities are too many to discuss in detail in this column, but at a minimum they include specific pre-transportation functions that you perform as an “offeror” and, where there are multiple “offerors” on a shipment, exercising reasonable care under the circumstances in relying upon the information provided by other offerors.

Andrew M. Danas is a partner in the Washington, D.C. law firm of Grove, Jaskiewicz and Cobert, LLP.

Brent Wm. Primus, J.D., is the CEO of Primus Law Office, P.A. and the Senior Editor of transportlawtexts, inc. Your questions are welcome at brent@primuslawoffice.com or adanas@gjcobert.com.

8 PARCELindustry.com MARCH-APRIL 2023

3 Signs Your Packaging Operation Is Ready for Automation

As an e-commerce business, the order fulfillment and packing process is one of the most crucial steps in delivering your products to customers. However, manual packing can become challenging when trying to keep up with the demands of the market while also maintaining speed, accuracy, and efficiency. In today’s e-commerce environment, your organization must be flexible enough to respond to evolving consumer demands. By turning to automation, you can enhance your daily operations and scale for future growth. Here are three signs your business should consider automating its packaging process.

1. Your Organization Is Experiencing Labor Problems: Hiring and retaining reliable talent can be a challenge in any industry, and e-commerce is no exception. A packing operation that relies heavily on manual labor is especially vulnerable to fluctuations in the labor market. Companies adopting automation may be a real draw when recruiting younger generations. Automated packaging machines are high-tech and easy to use, allowing employees to focus on less tedious and higher value work. With only two operators required, companies can save an average of 88% in labor costs. While human error is natural, an automated process ensures every action is performed identically, for high quality and reliable results.

2. Your Organization Is Producing High Levels of Waste: While your organization cannot control if or how much your customers recycle, you can control how much plastic and cardboard you send them. Automated packaging solutions like the CVP Impack and CVP Everest from Sparck Technologies perform a 3D scan of each single- or multi-item order on demand and create a right-sized box requiring little to no void fill. In addition to saving your company money, this reduction in material use will

make your business more environmentally friendly and appeal to eco-conscious customers. Smaller parcels will also allow you to fit more orders on trucks, reducing your carbon footprint even further and increasing efficiency.

3. Your Organization’s Operating Costs Need to Be Cut: Through more efficient packaging, your organization stands to save on labor, material, and shipping costs by switching to fit-to-size automated packaging. Companies who switch to automated packaging have the potential to realize up to a 38% reduction in material costs, such as corrugate spend and void fill, a 32% decrease in transportation costs and a full return on investment within six to 18 months. Savings like these will free up resources that can be allocated elsewhere in your business and improve your bottom line.

It’s not always easy to know when to make changes to your operations. From reducing labor costs to increasing speed and efficiency, automating your packaging process can have a significant impact on your business’s success. If you’re experiencing any of these issues, this is your sign to consider automating your packaging process.

APPLICATION ARTICLE

sales.packaging@sparcktechnologies.com 800.983.8157 https://sparcktechnologies.com

OPERATIONALEFFICIENCIES

INVENTORY OR END OF STORY

By Susan Rider

For many, spring brings a slower time. You have finished your year-end physical inventory plans and now you are organizing, getting new product in for your next peak season. Some of you stay fairly steady all year through with miniscule changes in volumes month to month. Whether this period of time before summer (and vacations) hits is a slow time or relative steady, inventory still needs to be addressed.

Do you have some inventory that is older than some of your associates? Are you still picking from the forward pick area, which means that the oldest inventory is not getting rotated? Almost every facility I visit has a problem with aged inventory. It’s just something that doesn’t get addressed because day to day orders need to go out, and addressing inventory takes time, analysis, and, quite frankly, some work.

When you look at aged inventory a different way, you may decide that it needs to take priority. Try looking at it by the amount of square footage it consumes. For instance, if your current geographic region is going for $8 per square foot (in some areas, this number ranges from $6 to $13) multiply that by your number of old (never to be sold or end of life) product. Take the number of pallets by the square foot. So, for example, we will multiply 13 square feet by 125 pallets by $8 per square foot = $13,000.

The above example gives you a look at how much each footprint is worth in your warehouse. In this case, it is legitimately costing you $13,000 to store those 125 pallets. Think about it in terms of building a new facility avoidance; how much would that save you? You may not be interested, but you can bet your CFO is very interested. Eventually, this product will need to be written off the books anyway.

The other important point on aged inventory is that it usually is scattered all over the facility, which means your order pickers, replenishers, and putaway drivers are

increasing their travel time by walking or driving by the spaces with aged inventory. Once you determine the amount of aged product you have stored in your warehouse, multiply it by the footprint and calculate the additional travel time. This will give you a rough number of the lost productivity. The sad thing is, typically this inventory is stored in premium spots, which, in effect, could double your loss.

To get started, do a report of all inventory in your warehouse. Sort by age; this can be eye opening. Once you determine the amount, sit down with your CFO and develop an action plan on destroying, donating, or offering the product to jobbers. Your CFO will advise what’s best for your company. Sometimes a contribution to underprivileged groups is the best, while in other scenarios the jobber is preferable. Create a plan of action and then make an on-going succession plan, meaning every year in the slowest month, you do another report and eliminate more aged inventory. One company I worked with had a 200,000 square foot location full of old outdated shoes. Since they were summer shoes, the company donated them to orphanages and schools in South America. Now that you have that report, sort it by area, then location. Look at how well your facility is slotted. Most

facilities can pick up a 10 to 15% increase in productivity if they just pay attention to slotting. A movers should be located in a forward pick area in premium (easiest to get to) areas. B movers get the next best slots, Cs are the least available slot, and you may want to create a “dog pound,” dead zone, or slow zone for D movers, which are the slowest moving products.

It’s a big task to reslot the whole warehouse, so start with the area that has the most activity. Then work your way to the next busiest over a period of time. Also, if you are running into several situations where you wonder how those SKUs got in those particular spots, you may want to look at your putaway and replenishment rules.

Of course, you will need resources to accomplish all the above tasks, but it will certainly be worth it in the long run. Just a tip: one company used high school interns to do this task.

Remember, whether you are getting ready to install automation, get a new software system, or adding a new product line, it’s much better to clean up the old before starting anew.

10 PARCELindustry.com MARCH-APRIL 2023

Susan Rider, President of Rider & Associates, Supply Chain Consultant, and Executive Life Coach can be reached at susanrider@msn.com.

SUPPLY CHAIN SUCCESS

CAN FEDEX DELIVER TODAY, EXECUTE FOR TOMORROW?

By Andy Johnson

To say the domestic parcel shipping landscape has changed in the last three to four years may be a gross understatement. Many long for the days before perpetual peak surcharges, 90+ page contracts, and overly complex pricing. But, as the industry forges ahead in the post-pandemic environment, a new litany of challenges lays on the horizon — specifically for FedEx, whose internal and external struggles have been on full display in recent months. A sizable gap in on-time performance with UPS, poor financial performance, and labor issues have created a PR nightmare for the Purple Palace. Can FedEx take back market share and differentiate themselves in 2023?

A Problem of Perception

Though the two are often looked at interchangeably, FedEx has always played second fiddle to its chief rival in size, and lately, perception has also included quality of service. Rarely has this been more evident than the on-time performance gap of the past 18-24 months. Perhaps the starkest contrast was peak 2021 performance, where FedEx struggled to achieve 88.2% on-time deliveries against UPS’s 96.9%. As one disgruntled customer wryly exclaimed, “At this point, I don’t think FedEx could deliver the morning sunrise.”

Then, the FedEx Ground contractor model’s blemishes were seen in August of 2022 when Spencer Patton, one of its delivery contractors, engaged FedEx Ground in a very public dispute over the financial conditions of the contractor network. As volumes declined from their pandemic level highs, costs began to soar and FedEx contractors who are paid on a per-stop or per-mile basis were faced with the reality of making less, often while doing more work. Patton,

who was sued by FedEx and subsequently had his operating authority revoked, used his Trade Association for Logistics Professionals to publish a survey that cited 54% of current contractors operating at a loss and 67% being “very dissatisfied” with their financial relationship with FedEx Ground. Regardless of who was in the right, it was a PR debacle at a very bad time. And as if all of this wasn’t enough, in September, FedEx stunned investors by withdrawing its financial guidance for the remainder of 2023. Citing economic weakness in Asia and service challenges in Europe, FedEx Express took the bulk of the financial damage with YOY operating income dropping $474 million to $186 million for the first fiscal quarter. A bad look for a company that, only months before, had touted “driving yields and expanding margins… through profitable growth and capital efficiency” during its investors meeting.

Focus on Fundamentals

As with any underdog story, before you can mount your comeback, you must stay in the game. And while FedEx’s survival is not in question, the company has its work cut out for it to position itself as UPS’s equal.

Often, a year can make a lot of difference. 2022, for example, saw FedEx make some much needed gains in its struggling on-time performance metrics. According to FreightWaves, during the 2022 retail peak, FedEx improved from its dismal 88.2% in 2021 to a 95.2% on-time performance. Still not eclipsing UPS’s

97.5% for that same period, FedEx closed the gap substantially. FedEx’s performance also fares slightly better when considering that a portion of those service failures were due to missing a time commitment (e.g. Early AM) though still delivering on the correct day. Some of these gains in on-time performance are due to internal improvements, no doubt. However, the influence of softening volumes and extra capacity — evidenced by year-over-year earnings reporting — has also helped FedEx take steps in the right direction.

Working with Uncertainty

Sometimes in business, you don’t have to be great, you just have to be better than your competition. Even though FedEx’s own labor issues have not gone away, they are not currently in the news, which is more than can be said for UPS. As UPS gears up for particularly challenging labor negotiations with the Teamsters, FedEx is capitalizing on the public drama by insisting the only way UPS customers can avoid the uncertainty is to jump ship now. And though most industry insiders maintain a strike is unlikely, FedEx may have a compelling argument to many who still experience PTSD from the pandemic volume shortages.

FedEx CEO Raj Subramaniam maintains he’s confident FedEx will achieve its 2025 projections, and while there is still a lot of time on the clock, the company is taking action to reduce costs and regain investor confidence. In addition to traditional cost cutting

12 PARCELindustry.com MARCH-APRIL 2023

measures like reducing staff, closing office locations, and grounding flights, FedEx has also reduced the scope of its Sunday deliveries several times. Sunday has traditionally been viewed as a “catch-up” day in the FedEx network, and now with higher operating costs and lower demand, it looks like there will be more time to catch up. Reduced Sunday deliveries should make Ground contractors happy, who cited Sunday deliveries as being one of the main factors in reduced profit margins. FedEx also announced in February it will retire its SameDay City Service in large metro areas to “prioritize several other opportunities for growth.”

Stability Among the Surcharges

While these steps are likely necessary for stability, they don’t necessarily improve FedEx’s value proposition. However, as UPS rolls out perpetual peak surcharges (now renamed “demand surcharges”), FedEx has allowed its peak surcharges to expire in January. It’s not likely to save anyone’s 2023 budget, but for a large UPS SurePost shipper, it could make the difference in deciding to switch. Recently, FedEx has become more aggressive in negotiations both with incumbent and prospective clients. Annual

rate cap offerings at or below four percent rate caps, hefty discounts on transportation rates, and a willingness to negotiate terms and conditions have allowed FedEx to make inroads — all while UPS seemingly continues to do business like it’s still 2020.

Concluding Thoughts

Though UPS may continue its reign as the industry leader for the foreseeable future, it certainly comes with a price (and an opportunity). If FedEx continues to improve service KPIs, focuses on cost reduction, and positions its business as the economical choice for shippers, it’s not difficult seeing a greater

market share capture. The trick will be overcoming a generally negative perception of the company’s model. With storm clouds on the economic horizon, FedEx may have the winning cost-effective formula to help right the ship.

With 17 years of experience, Andy Johnson, Project Manager, Parcel Consulting, Körber Supply Chain Solutions, has worked extensively in supply chain and managed transportation. His background includes sitting on both sides of the table, allowing him to anticipate what most shippers need to drive results and what many carriers are looking for in a good partner.

SUBSCRIBE FOR FREE!

INDUSTRY INSIGHT

UPS EARNINGS CALL RECAP

By Adam Holcomb

On January 31, UPS held its Q4 2022 earnings call. Despite relatively positive packaging, results were mixed. After walking away from Q4 with continued strong margins and a 13.2% dividend increase over the past two years, UPS now faces a looming Teamsters contract negotiation, with the current contract set to expire in July 2023.

So, with all that going on, many were eager to hear what UPS would share, but the tone was surprisingly light-hearted; almost upbeat.

Here is the TLDR (too long didn’t read) version of the UPS 4Q22 earnings call:

Executives realize that the company did not perform as well as it could have in late 2022.

High margins (though lower than last year) couldn’t offset falling package volumes, resulting in lower operating profit.

They understand the significance of the Teamster negotiations.

Everything is fine…

Ken Cook started off the call with some announcements, then introduced CEO, Carol Tomé.

Tomé set the initial tone by thanking “UPSers” for their hard work, by now a staple of virtually all of Tomé’s public statements, then touched on Q4 financials:

“Looking at our fourth quarter results, we expected volume levels to decline from last year and they did, but more than we planned due to macro conditions that Brian (Newman) will discuss. We responded by managing our

network with agility and a focus on service. Consolidated revenue was $27 billion, down 2.7% from last year, and operating profit was $3.8 billion, a decrease of 3.3%. While our consolidated operating margin declined by 10 basis points from last year, to 14.1%, our US operating margin expanded to 12.8% and reached the levels not seen in 10 years.”

Next, she mentioned the Teamsters negotiations.

“Regarding our upcoming labor contract negotiations, we are well prepared for negotiations, and are focused on achieving an agreement that is a win for our employees, a win for the Teamsters, and a win for UPS and our customers. We have great jobs with industry leading pay and benefits… Now, I suspect many of you listening today, would like to talk about our negotiating strategy. Well, we believe the best way to achieve a win, win, win, outcome is for us to leave the details of the negotiations at the bargaining table.”

UPS seems to be playing its negotiation strategy close to the vest. Probably a smart play, but disappointing for the rest of us.

Later in the call, Newman (UPS CFO) spiced things up by talking more about key macro conditions impacting operational expenses, highlighting rising fuel costs and increased union wages (Tomé also mentioned these earlier).

Newman’s statement about fuel costs increasing operational expenses left were likely confusing to many. While fuel costs did increase in 2022, UPS’s fuel expenses are more than offset by customer-paid fuel surcharges. Fuel cost reimbursement happens through the fluctuating fuel surcharges put into place during the 1973 oil crisis. This was initially imposed to protect carriers against huge price variations in the gasoline and diesel fuel market (pricing tables published weekly by the EIA). So, while fuel costs do initially impact UPS, the sting only lasts for a short while. UPS then not only gets reimbursed but it also ends up making money. Like many other fees and surcharges, fuel surcharge has evolved from a way to align cost-to-serve with price into a revenue and margin generator. This is not the first time UPS has listed rising fuel costs as one of the reasons for a deficit. Just from a quick search, I can see it was mentioned in 2006 and again in the 2008 Q2 earnings calls. One might think that “rising fuel costs” may have become a convenient scapegoat.

Increased union wage rates were mentioned as the second reason for the Q4 shortfall. This will likely be a key negotiating point for UPS as it approaches negotiations with the Teamsters Union.

14 PARCELindustry.com MARCH-APRIL 2023

However, any argument UPS makes that labor costs have negative impact is going to fall on deaf ears. The 2018 Teamsters contract largely shielded UPS from the impacts felt by other carriers in the last two years. For example, according to then-CFO Michael Lentz, labor shortages cost FedEx $470M in 2021, due to higher rates paid to employees and the increased use of outside trucking companies. Even if UPS could make a case, Sean O’Brien is not likely to be a receptive audience, particularly when UPS has seemed very proud of increased profits over the last few years.

Aside from the Teamsters negotiation, the biggest thing on UPS’s mind coming out of 2022 is likely what to do about falling market volumes, as yield increases cannot keep up. This means UPS has to first protect existing customers, and second, seek new market share, if it is going to maintain profitability until market volumes turn around. This likely points to increased competitiveness in the parcel markets, with UPS looking hungrily at FedEx shippers. It also means that a Teamsters work stoppage would be disastrous. FedEx has already started talking to many SMBs, urging them to convert and commit volume now, or receive no access to capacity if the Teamsters walk. FedEx is providing competitive rates, but also requiring multi-year commitments for large shares of volume. UPS has to find an answer to this, and soon.

But don’t feel too sorry for UPS. 2022 was far from a disaster for Big Brown. Tomé deftly steered UPS through a tumultuous couple of COVID years, and she shows no signs of slipping anytime soon. While there are storm clouds on the horizon, UPS continues to maintain high margins, and the largest single share of the US domestic, export, and import small parcel markets. The company has a high-performing and highly efficient network and people who obviously know their business. It just may have to settle for some givebacks on yields and margins to ensure it’s getting / keeping its market share in a tough market, and share a little of the fat of the last couple of years with Sean O’Brien and the Teamsters.

MARCH-APRIL 2023 PARCELindustry.com 15

SUBSCRIBE FOR FREE!

Adam Holcomb is a Senior Business Analyst for Intelligent Audit. He helps shippers achieve optimal results in execution and cost containment.

E-COMMERCE SHIPPING OUTLOOK: EFFICIENCY, EFFECTIVENESS, CONSISTENCY

By Gaston Curk

The twists and turns on the consumer’s road from purchase to parcel can influence e-commerce retailers’ bottom lines in a direct relationship to customer experience (CX), and last-mile delivery is a huge component. In one survey of shoppers, 76% of respondents said that an unacceptable delivery experience would strongly or somewhat affect their decision to order from that brand again, which makes shipper and carrier satisfaction a sizable component of overall CX.

With the risks and rewards top of mind, e-commerce brands are challenged to evaluate the myriad of obstacles in front of them and narrow in on a few key areas to shore up a parcel shipping strategy that’s prepared to tackle anything that comes their way in 2023 and beyond. As e-commerce brand decision makers look to allocate and maximize shipping budgets and resources, parcel professionals should advise their clients to focus on three elements essential to shaping a successful delivery experience: Efficiency, effectiveness, and consistency.

Create Efficiencies

Efficiency in shipping and delivery can be interpreted in multiple ways, including things like access, packaging optimization, and reducing “touches” from pickup to drop-off. In almost every case, working with the proper carrier partner will ensure these and others can be realized by shippers.

In terms of experience and network size, the US Postal Service is the industry leader for last-mile delivery, and car-

riers who partner with the USPS make for optimal efficiency advocates on behalf of shippers. Considering access, USPS reaches every home and business in the US — approximately 160 million physical mail and PO boxes — as frequently as seven days a week, whether “dense urban” or “sparse rural.”

Let’s look at that last part, where an extra stop on a delivery route can add miles, not blocks. One major carrier announced an additional $13.25 surcharge per package for shipments to several designated rural ZIP codes, affecting some three million destinations. In total, 24,000 of the country’s 42,000 ZIP Codes represent rural areas, so it’s critical to deliver to these customers efficiently.

Further, if an e-commerce brand ships hundreds of packages every day, it’s essential that its last-mile partner has the bandwidth to keep up with this kind of volume. Not every carrier does, but this is an area where USPS excels. No matter how quickly a brand’s business scales, there’d be no need to worry: Carriers working with USPS can help ship faster, more efficiently, and at a lower total cost.

Prioritize Cost-Effectiveness

The cost of shipping for e-commerce brands — especially small businesses — can have a significant impact on conversion rates and overall profitability. It’s often the top reason for cart abandonment and can impact customer loyalty and repeat business. As such, minimizing such costs needs to be a large area of focus for e-commerce brands.

16 PARCELindustry.com MARCH-APRIL 2023

One of the things any size shipper should do is evaluate their packaging when considering ways to cut costs. Recent changes in the retail shipping model now include dimensional weight as part of the pricing equation. With both the weight and size of the packaging included, it’s important for parcel professionals to work with their clients to review packaging and determine the best options for products being shipped.

For brands with a solid understanding of their business — facets including variance in package size, available delivery options and speeds, etc. — considering carrier diversification is a cost-conscious decision that can stave off various surcharges. Rate increases aren’t equal across the board, and further, carriers have different dimensional (DIM) weight divisors, which can increase charges on large or heavy packages. Having multiple carriers to offer various shipping options improves the overall customer experience, improves conversions, and manages overall expectations consumers have.

One more cost reducing method is a multiple distribution center strategy. Regionalizing product volume can have a significant impact on shipping by reducing zone costs and delivery times. Though this option is dependent on business size and product volume, there are more opportunities with warehouses and distribution centers popping up across the country. Carrier partners with multiple strategic locations in their network will be able to move parcels more efficiently, more quickly, and at a lower cost.

Consistently Carrying CX

In the brand battle for consumer hearts and minds, great CX can come down to the smallest considerations. Considering the wealth of data being collected and stored — and often not used to its full potential — throughout the customer journey, every e-commerce brand should be looking at data collection, storage, sortation, and analysis as an area to provide consistent, dependable CX. By analyzing the shipping data available, e-commerce enterprises can get a true big-picture view of their operations. Leveraging real-time data analytics can provide the information and insights needed to plan ahead for demand, as well as to optimize routes, reduce costs, respond to changes in real time, and increase efficiencies.

Tying It All Together

Apparel, books and printed matter, pharma and nutraceuticals… customers are always eager to receive their packages, and their expectations for seamless receipt are high. Morgan Stanley predicts US e-commerce could reach 31% of all sales by 2026, so the growth trajectory is mapped. Now more than ever, it’s imperative for brands to maintain any and all competitive edge in the face of immense industry disruption. “Getting it right” relative to shipping is a massive — and crucial — step in the process.

MARCH-APRIL 2023 PARCELindustry.com 17

SUBSCRIBE FOR FREE!

Gaston Curk is CEO of OSM Worldwide.

BUY WITH PRIME: IS AMAZON RIVALING FEDEX AND UPS?

By Caleb Nelson

In early January, Amazon announced the expansion of its “Buy with Prime” (BWP) service to all eligible US retailers. The program, which first launched as an invite-only beta in April 2022, allows retailers to offer shoppers browsing their websites an option to purchase products through their Amazon Prime account. The purchase is completed with the payment information on file with Amazon, and Amazon fulfills the order.

There are clear incentives to use the program for all parties. Shoppers save time in the payment process and trust Prime’s services to deliver their orders fast and free. Because of this, the retailer converts more sales. With these factors at play, Amazon stands to increase Prime subscriptions — and most consider that to be its main motive. But is it?

Challenging the Duopoly

While subscriptions are undoubtedly a factor, and maybe the main factor, this is a further step into the logistics space for Amazon. Merchants have used Amazon to ship their orders through the Fulfillment by Amazon (FBA) program for years, but that was only available to third-party merchants selling on Amazon’s marketplace. By integrating BWP into their own websites, merchants can now shift nearly any amount of volume from non-Amazon sales to Amazon. They don’t have to be FBA sellers to be eligible for BWP, meaning virtually anyone can sell and ship with Amazon.

So, what’s driving Amazon to do this? It’s no mystery that Amazon has been building toward a logistics network that matches the capabilities of FedEx and UPS. In 2013 and 2014, Amazon experienced, or narrowly avoided, peak season debacles with UPS, its primary fulfillment partner at the time. Amazon executives, following founder Jeff Bezos’ principle of obsessing over customer experience, realized that fulfillment being out of their control was a major threat to customer satisfaction and, ultimately, a threat to their business.

This, coupled with fulfillment being Amazon’s largest expense, led the e-commerce giant to invest in its own logistics network. The company began investing in warehousing improvements, vehicle fleets, started Amazon air, acquired regional last-mile carriers, and established “Amazon Logistics,” a program to partner with independent delivery service providers for local fulfillment.

When experts predicted Amazon was building towards a logistics network that could potentially compete with FedEx and UPS, Amazon took the stance that it was simply looking to help lighten the capacity burden the company put on its partner carriers. Today, Amazon still remains UPS’s biggest customer.

The efforts have paid off. Per SJ Consulting Group, Amazon controlled the transportation of 72% of its packages in 2021, up from just 45% in 2019. But that wasn’t, and still isn’t, 100% — and that’s not due to lack of capacity.

In 2022, Amazon overexpanded its logistics network to the point where it had to delay openings of distribution centers. Amazon CFO Brian Olsavsky has said the company has “excess capacity” it needs to “grow into.”

Buy With Prime, and profiting off of that capacity, is how Amazon is growing.

“If you build it…”

Merchants will come (to Buy with Prime). The benefits are clear: 59% of American households have at least one Prime membership, and seeing the Prime logo they associate with reliable, fast, and free delivery can be pivotal in purchase decisions. This, combined with the ease of a one-click checkout, led to a 25% conversion rate increase in BWP’s beta testing.

The sales benefits don’t end there. Historically, many FBA merchants have sold their products exclusively on Amazon. Many view creating a website, building brand awareness, and assembling a logistics network as daunting tasks, and FBA offers an opportunity to focus on nothing more than selling products. However, they miss out on opportunities from not

18 PARCELindustry.com MARCH-APRIL 2023

selling direct-to-consumer on their own site.

Brand visibility is limited on Amazon (can you remember the brands of the last three things you bought through Amazon?). With their own site, merchants can present their products with a unique branded experience and build affinity that leads to repeat purchases.

Additionally, Amazon merchants aren’t given identifiable info on who they’re selling to. On their own site, they can incentivize customers to enter their email information, creating remarketing opportunities.

A merchant’s site is a more logical option for advertising. Driving to a product page on Amazon shows potential customers recommended products from competitors. And with intelligent data analytics, merchants can also look at their geographic sales performance, revolutionizing how and where they advertise their products.

BWP creates an opportunity for FBA sellers to quickly set up a site with a service like Shopify and gain these strategic advantages without sacrificing their access to Amazon’s logistics capabilities.

So what about those already selling on their own sites?

Pandemic-related capacity issues opened the eyes of parcel shippers nationwide. Shipping with only one carrier is no longer an option, and we’ve seen regional carriers expanding their capabilities to become even more viable alternatives to FedEx and UPS. Amazon has now entered that mix.

Shippers looking to diversify their carrier mix can use BWP and pre-determine a set amount of volume they want to ship through Amazon (as they’ll have to pre-ship units to an Amazon facility). Should inventory at their own warehouse run out, they can easily divert sales and shipments to BWP.

Large shippers might worry about losing volume-based discounts with their carriers, but logistics intelligence and proper data analysis can find the right amount of volume to shift to Amazon (or elsewhere). This creates “swimlanes” for more resilient shipping, grants them a boost in customer experience with free two-day shipping, and, as the data suggests, increases sales conversions.

A New Era

The benefits of participating in BWP are wide-ranging, and it should be an attractive program for both current Amazon sellers and merchants selling on their own sites. It’s clear they’ve been quietly expanding their logistics capabilities to have a network of this magnitude. With the expansion of the BWP program, Amazon is announcing with a bang that it is here to challenge FedEx and UPS.

SUBSCRIBE FOR FREE!

Caleb Nelson is Chief Growth Officer at Sifted.

By Rebecca Wyatt

As the world becomes increasingly aware of the impact of climate change and the importance of sustainability, companies are under pressure to become more environmentally conscious. One of the most significant areas in which companies are being called upon to make changes is their supply chain and logistics operations. In this article, we will discuss the top five challenges brands are facing as they try to become more environmentally conscious, and what sustainability initiatives could mean for logistics professionals.

Lack of Visibility and Transparency

One of the most significant challenges facing companies striving for supply chain sustainability is the lack of visibility and transparency in their operations. The difficulty in identifying areas for improvement and assessing environmental impact hinders the ability to make informed decisions. To tackle this challenge, companies are increas-

ingly investing in tools and technologies that offer greater data transparency and monitoring capabilities. One prime example is optimizing distribution center utilization, resulting in reduced mileage and carbon emissions. This is achieved by choosing the DC closest to the customer and selecting the most environmentally friendly transportation mode, such as rail instead of air freight. By incorporating sustainability considerations into their transportation planning, shippers can achieve their sustainability goals while also improving their bottom line. Innovative solutions such as this are just one example of the ways that companies are addressing the challenge of supply chain sustainability and driving meaningful change towards a more sustainable future.

Complexity of Global Supply Chains

The complexity of global supply chains presents another challenge for companies looking to become more sustainable. With multiple suppliers, transportation modes, and distribution channels involved, it can be challenging

to identify and mitigate the environmental impact of each step in the supply chain. Companies are addressing this challenge by working closely with suppliers to identify sustainable practices and implementing technologies that enable them to monitor their environmental impact across the entire supply chain. Interestingly, returns are an example of a great opportunity here. It’s no secret returns pose an environmental cost, but carriers like FedEx and UPS have been partnering with retailers to reduce the logistical strain with no-box, no-label returns that really have the opportunity to reduce environmental impact by streamlining the process and optimizing returns traffic (instead of a truck for a single return, one truck may carry hundreds).

High Cost of Sustainable Practices

The cost of implementing sustainable practices is another significant challenge facing companies. While many sustainability initiatives have a positive impact on the environment, they often require significant investment, which can be difficult to justify from a financial perspective. However, companies are increasingly recognizing the value of sustainability in the long term, not just in terms of environmental impact but also in terms of brand reputation and customer loyalty. This is a key brand strategy, too: Apple is well known for its recycle-friendly no-plastic packaging. Not only can sustainable packaging be less costly (say goodbye to oversized packaging), 36% of Americans said in 2020 that a sustainably packaged order would directly lead to a repeat purchase with the brand.

Lack of Regulation and Standards

There is currently a lack of regulation and standards in the area of sustainability, making it difficult for companies to know what actions they should be taking to improve their environmental impact. While some countries and regions have introduced legislation aimed at reducing carbon emissions and improving sustainability, there is no global standard, which can lead to confusion and inconsistency in approaches. To

20 PARCELindustry.com MARCH-APRIL 2023

C H A L L

G

F A C E W H E N P U R S U

G S U S T A I N A B I L I T Y

E N

E S B R A N D S

I N

address this, industry organizations are working to develop standards and guidelines to help companies improve their sustainability performance. For example, the Sustainable Supply Chain Foundation (SSCF) is a non-profit organization that provides education and resources to help companies develop sustainable supply chain strategies. The Global Reporting Initiative (GRI) has developed sustainability reporting standards that provide guidance on how companies can report on their sustainability performance, including their supply chain sustainability. The Carbon Trust, a non-profit organization, provides certification and advisory services to help companies measure and reduce their carbon emissions in their supply chains.

Resistance to Change

Finally, companies face resistance to change, both internally and externally. Some employees and stakeholders may be resistant to sustainability initiatives, either because

they believe they will be too costly or because they are not convinced of the value of such initiatives. To overcome this, companies must engage in stakeholder education and communication to ensure that everyone understands the importance of sustainability and how it benefits not only the environment but also the company and its stakeholders. As the demand for sustainable supply chain management continues to rise, it’s critical for shippers to identify areas where they can reduce their carbon footprint and minimize their environmental impact. By analyzing transportation data, it’s possible to identify opportunities for modal shifts, optimize routes, and consolidate shipments to reduce emissions and increase efficiency. Organizations should also develop sustainability metrics and reporting tools that allow them to track progress towards their sustainability goals and share their results with stakeholders.

The challenges facing companies as they try to become more environ-

mentally conscious are significant, but not insurmountable. By investing in tools and technologies that allow them to monitor their supply chain and logistics operations, working closely with suppliers to identify sustainable practices, and engaging in stakeholder education and communication, companies can overcome these challenges and reap the benefits of sustainability. Logistics professionals who can lead the way in sustainability initiatives will be well positioned to succeed in a rapidly changing business environment.

Rebecca Wyatt is Director, Marketing & PR at Green Mountain Technology (GMT), a 2023 FedEx Certified Freight Bill, Audit, and Pay (FBAP) provider committed to data accuracy and excellence. She leads the team propelling GMT's marketing efforts to new heights, positioning the company as the brand leader in the transportation spend management category while driving exceptional growth and ROI.

MARCH-APRIL 2023 PARCELindustry.com 21

SUBSCRIBE FOR FREE!

BY MATT KULP

CREATIVE ORDER FULFILLMENT: ADOPTING NEW PRACTICES TO COME OUT AHEAD

Let’s start with the very basic principle of what order fulfillment is. A customer places an order, which is then picked, packed, and shipped from a fulfillment center. The carrier then picks up the trailer with hundreds to thousands of other customers’ orders and drives it to its hub, where the order is sorted to the appropriate trailer for its delivery to the customer’s doorstep.

The current problem is that there are many shortages throughout the supply chain, making this relatively simple process very difficult. In order for the customer to place their order, customer service and technical support are required. The fulfillment center that processes the order requires labor, which is not readily available at peak shipping season when needed. The delivery step requires truck drivers and hub capacity at peak shipping times, both of which may not be readily available. And recently, it’s not just during peak holiday shipping season, but shippers are experiencing shortages throughout the year. All of these shortages are challenges and bottlenecks.

Shippers are seeking creative solutions to sustain and hopefully grow their businesses through these challenges. Rather than partaking in the insanity of doing things over and over and expecting different results, let’s review other options that some are considering.

When considering your order process, first think simple. What are the business processes that you have in place to support the order fulfillment practice? Having seen hundreds of operations at this point in my career, I would make the generalized statement that 80% or more of the problems we see are communication issues — whether it’s not enough communication, mis-communication, or even lack of communication entirely. Consider setting up collaborative meetings with marketing and operations. Marketing is certainly working to determine which products will sell. The simple knowledge of knowing what products will be featured on the website will allow operations to re-slot the warehouse in preparation for efficient and timely order fulfillment. I remember studying Design for Manufacturability

and Design for Maintenance. How about Marketing for Operations (MFO)?

The Labor Market

E-commerce is labor intensive at many levels, and the growth of e-commerce is significantly outpacing US population growth. Unless labor supply is made available from other areas of the US economy, supply and demand economics will continue driving up labor costs for order fulfillment jobs.

Labor availability is a constant struggle that you hear in every discussion these days. Increasing wages is the “easy” answer, but not very creative or effective long term. Not to mention the solution isn’t sustainable as competitors and the invisible hand of the supply and demand market erode your advantage. While all businesses should ensure their staff is fairly paid, there is a limit to how high payroll can be increased before the business itself becomes insolvent. Creative solutions for recruiting and retention are necessary for successful order fulfillment. Think of two sporting

22 PARCELindustry.com MARCH-APRIL 2023

teams competing. One team is comprised of players and coaches that have been together for years, learning how to work together. The other team is a collection of high-priced individual contributors thrown together each year. How often have we seen the team with less talent outperform the collection of individuals? In the same way, it makes sense that if you can recruit team players to your order fulfillment team, train them, and give them time to gel into a cohesive unit, you have a much higher probability of operating at a higher level, achieving a lower cost, and, all other things being equal, increasing profitability.

Another creative approach to consider is how your company might make work more meaningful to their employees. Work is work, and family is family, but can you create a familial environment where associates feel committed not just to their job but to the people around them? When achieved, it is a true win/ win situation where the employees have a rewarding and positive work

environment, while the employer benefits from retention and the cohesion and productivity mentioned earlier. People are often less likely to leave when they feel they aren’t just leaving a job, but also the people they value and who value them.

Co-Opetition Could Be the Name of the Game

Many shippers naturally focus on the first two steps of order and pick/pack/ ship because those are more within their sphere of influence. But let’s conclude by taking a moment to address the final order fulfillment steps of shipping and delivery. Collaborative/shared fulfillment or “co-opetition” is an alternative that is popping up. This economic model allows small- to mid-size companies to compete with the Amazons and Walmarts of the world by sharing supply chain resources, assets, and costs. As more companies join, the network expands by adding additional fulfillment centers. The intricacies of the concept are outside the scope of this article, but

are available online for you to research. Shared services collaboration and co-opetition are an example of a creative solutions and, well, drones don’t seem like such a crazy idea anymore!

Unfortunately, there are no quick fixes or silver bullets. If it was easy, it wouldn’t be such a challenge. But these are the opportunities where winners thrive. They approach one day at a time. They realize that a collection of small ideas can lead to big results. Think really big, but start really small and get started. In the words of Nelson Mandela, “Vision without action is just a dream, action without vision just passes the time, but vision with action can change the world.” You may not change the world, but you can change your world with some creative thinking.

MARCH-APRIL 2023 PARCELindustry.com 23

Matt Kulp is EVP, Managing Partner, St. Onge Co. Visit www.stonge.com for more information.

8 SHIPPING SOFTWARE & SYSTEMS THAT CAN LEVEL UP YOUR OPERATION

In today’s fast-paced small-parcel environment, your business needs all the tools it can get, and nowhere is this more evident than when it comes to shipping systems and software. You need to have the most accurate, up-to-date information to get your package to your customers at the lowest cost and quickest transit time. The providers profiled below would be happy to speak with you to show you how they can improve your supply chain and operations.

CT Logistics, a global logistics supply chain provider, delivers impactful cost reduction initiatives. By leveraging CT, you’ll have assets available 24/7 for services including: freight audit & payment, TMS, managed freight, bid management, benchmarking, peer group comparison and expert spend analytics. CT customizes all solutions to reduce your costs & save your company money. CT’s staff include a Professional Services group for consulting & advising. CT’s business intelligent platform provides global supply chain visibility with graphical dashboards. CT is SOC and ISO 9001:2015 certified.

Enveyo is the leading provider of logistics data management, visibility, and shipping optimization software, helping 3PLs and shippers of all sizes move their logistics forward through data-driven technology. From shipment analytics and automated carrier selection to post-purchase delivery experience management and freight auditing, Enveyo is the only suite deploying solutions across the logistics lifecycle. Powered by a robust, enterprise data management platform, Enveyo solutions enable organizations to make business-transforming shipping decisions.

FirstMile is The Optimized Parcel Carrier. Our patented technology, Xparcel, is a proprietary ship method that optimizes price and service on every package shipped — whether you’re shipping 25 orders a day or 25,000. Regain control of your transportation spend and service with the power of an optimized shipping strategy in one simplified hub. Get started with a full suite of domestic and international shipping solutions, free and reliable pickup, simple-to-read invoicing, a dedicated customer service team, and best-in-the-industry claims service.

5 IDEAS TO OPTIMIZE YOUR WAREHOUSE

The warehouse is often seen as a behind-the-scenes player in the small-package industry, but that doesn’t mean its role isn’t crucial. How your warehouse is run and what equipment and supplies you use can make or break your parcel operation, so be sure to check out the solution providers listed here. They offer some great products to make sure that your distribution center is truly running at 100%.

Designed Conveyor Systems (DCS) has 40 years of experience serving major clients in multiple industries by providing material handling solutions, full-scale warehouse operations, and conveyor designs custom crafted for their needs. DCS does not sell readymade conveyor systems but builds relationships that empower collaboration to craft custom warehouse designs together. DCS utilizes consulting, engineering design, project management, installation services, and client support to ensure our customers can keep their promises to deliver on time.

Innovative, industry specific solutions are part of DMW&H’s Post and Parcel team. We understand your needs, from managing cutoff times, throughput, and processing time, to handling the increasing mix of bags and cartons to be delivered. We’ll design, manage, implement, and support a robust material handling system to help you keep your processing center running smoothly.

24 PARCELindustry.com JANUARY-FEBRUARY 2022 | www.designedconveyor.com | info@designedconveyor.com | 615.377.9774

SPONSORED CONTENT www.ctlogistics.com | sales@ctlogistics.com | 216.267.2000, Ext. 2190

| www.dmwandh.com | info@dmwandh.com | 201.933.7840

| www.enveyo.com | info@enveyo.com | 801.948.0727

Sales@FirstMile.com | 888.993.8594

MARCH-APRIL 2023

Founded in 1996, Intelligent Audit is the global leader in multi-modal transportation invoice audit, business intelligence analytics, and secure carrier payment processing. Volatility, complexity, and ambiguity will continue to plague the supply chain for the foreseeable future, creating anxiety in decision-making due to a lack of clarity. Intelligent Audit delivers unmatched freight audit, recovery, business intelligence, and payments so shippers can make smarter decisions in uncertain times.

Address correction fees have once again increased; FedEx now charges $21 per correction. Avoid unnecessary costs associated with incomplete or inaccurate address information such as missing apartment numbers, misspelled street names, and wrong ZIP Codes with affordable, easy-to-use address verification solutions from Melissa. Our USPS® CASS Certified™ address autocompletion and point-of-entry address verification tools ensure information enters your system correctly, shipments are delivered accurately, and customers are satisfied. Visit our website for free trials and a 120-Day ROI guarantee.

Customers are demanding more delivery choices than ever. Shippers are meeting the challenge by expanding carriers and carrier services. Go enterprise with Transtream multi-carrier final mile management system, allowing you to cost-effectively control hundreds of parcel, freight, and local delivery rates from a single platform. Then roll out Transtream apps to thousands of users to automate routing, rating, cartonization, tracking, and warehouse and office shipping. Or use our API to add carrier management to your enterprise or e-commerce solution.

ProShip is the industry-leader in automated multi-carrier parcel shipping software for mid- to enterprise-size shippers. We empower some of the world’s largest companies to ship at lightning speeds, stay carrier compliant 24/7/365, and build stronger than ever customer revenue streams. For over 20 years, customers around the world have trusted ProShip’s time-tested supply chain technology and advanced functionality to simplify complex parcel shipping challenges, deliver on our promise of speed, compliance, support and flexibility, and cultivate positive customer experiences.

ShipNetwork is the 3PL solution built to optimize the shipping experience, expense, and service for D2C and B2B brands. Our nationwide shipping and fulfillment network reduces transit times and transportation costs to benefit the customer experience and your business’s bottom line. In addition to our proprietary shipping technology that optimizes 100% of your shipping volume, we always deliver. With a 100% order accuracy guarantee, 98% same-day shipping, and 100% next-day shipping guarantee, you can bet on exceptional service year-round.

Some warehouses struggle with optimizing handling parcels and packages in bulk; especially if they are received in varying types. To improve your warehouse’s efficiency, a High-Speed Parcel Unloader from Ensign can streamline the process of emptying out packages onto sorting conveyors and tables. This machine can unload any type of box, polybag, envelope, or mix of all of these out of gaylords, carts, hampers, and various other containers.

Based in Hickory, N.C., Shurtape Technologies, LLC, is an industry-leading, global manufacturer and marketer of adhesive tape and consumer home and office products, available under recognizable brand names such as Duck®, FrogTape®, T-REX®, Painter’s Mate®, Shurtape® and Kip®. Shurtape packaging solutions include hot melt, acrylic, and water-activated tapes designed to withstand the rigors of the supply chain. Our ShurSEAL® Automated and Manual Packaging Solutions are purpose-built to keep lines running at peak production. For secure seals, every time.

Sparck Technologies’ CVP Impack and Everest machines measure, construct, seal, weigh, and label each variable dimension single- or multi-item order of either hard or soft goods in a custom fit-to-size box while eliminating or reducing the need for void fill materials. With only one or two operators required, the CVP Impack packs parcels every seven seconds, while the CVP Everest packs parcels every three seconds. They help you operate lean, use less materials and void fill, and ship parcels efficiently.

JANUARY-FEBRUARY 2022 PARCELindustry.com 25 www.intelligentaudit.com | info@intelligentaudit.com | 201.880.1110

www.pierbridge.com | sales@pierbridge.com | 508.630.1220

| www.proshipinc.com | sales@proshipinc.com | 800.353.7774

| Melissa.com | info@melissa.com | 800.MELISSA

| www.shurtape.com/direct | custservice@shurtape.com | 888.442.8273 Ext. 2190

| ensigneq.com | sales@ensigneq.com | 616.738.9000

| https://sparcktechnologies.com/us | sales.packaging@sparcktechnologies.com | 800.983.8157

| GetStarted@ShipNetwork.com | 866.983.7447

MARCH-APRIL

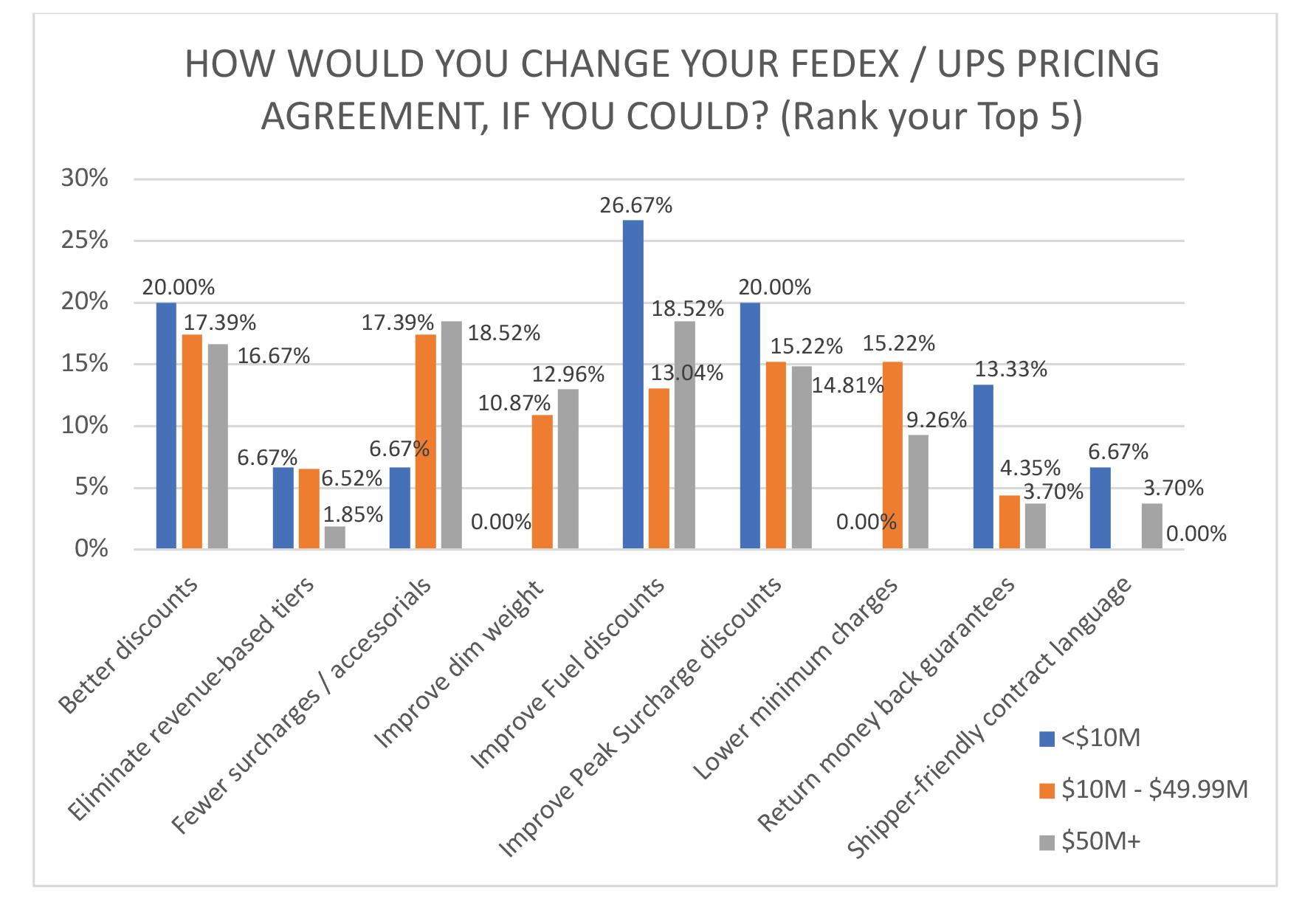

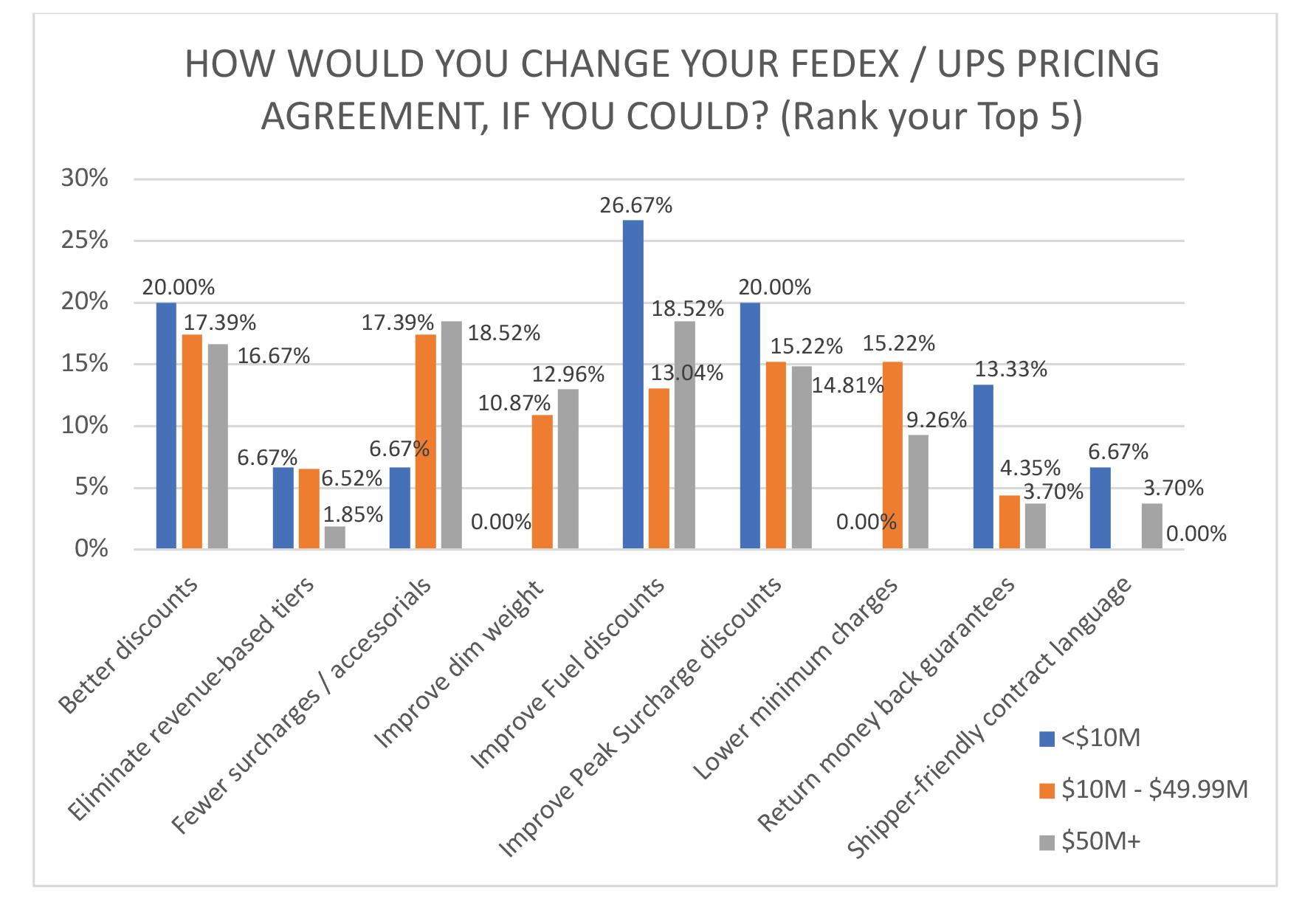

INTERACTIVE SHIPPER SURVEY – LIVE PARCEL FORUM RESULTS UNVEILED: PART ONE

By Rob Martinez

Exclusively for the PARCEL Forum, Shipware conducted a live parcel pricing and benchmarking survey at the 2022 conference. Dozens of shippers responded in real time to survey questions about their parcel usage, carrier preferences, cost reduction strategies, and other valuable benchmarking data. Survey respondents collectively commanded approximately $3.5 billion in annual parcel spend. Due to the length of the survey, we will unveil results in two parts with Part One (this article) covering survey demographics, shipper sentiments around

SURVEY DEMOGRAPHICS Industry

pricing, and procurement practices. Part Two will be published in the May/June issue and will reveal the actual pricing/ discount benchmarks, as well as address several miscellaneous categories.

It’s important to note that parcel pricing agreements were not shared due to confidentiality, but rather, participating shippers responded anonymously to survey questions based on ranges. Technology-enabled and totally blinded to avoid confidentiality concerns, the survey was designed to help shippers better understand how their pricing stacks up with other shippers. Moreover, all survey responses were cross-tabu-

lated by industry, company revenues, primary carrier, and annual parcel volume/spend for more meaningful like-volume correlations.

Why is benchmarking parcel pricing data so critical? Well, the most common challenge we hear from volume parcel shippers is that they don’t know how good — or bad — the incentives, terms, and structure of their carrier pricing agreements are. While no shipper would ever negotiate a contract and knowingly leave money on the table, the reality is that some shippers have clearly done a better job than others when it comes to negotiating the most favorable rates and terms.

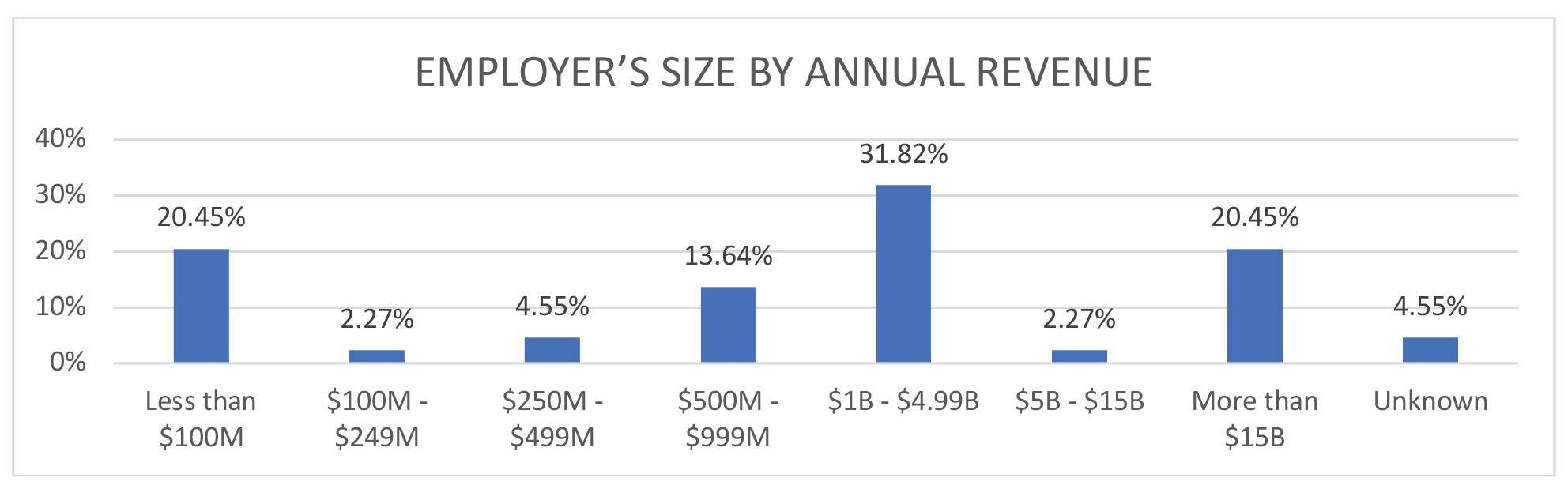

While participants included a mix between several industries, the most common sector was retail/e-commerce (29.55%) followed by 3PL/warehousing/fulfillment (18.18%), healthcare (11.36%), automotive (9.09%), and manufacturing (9.09%).

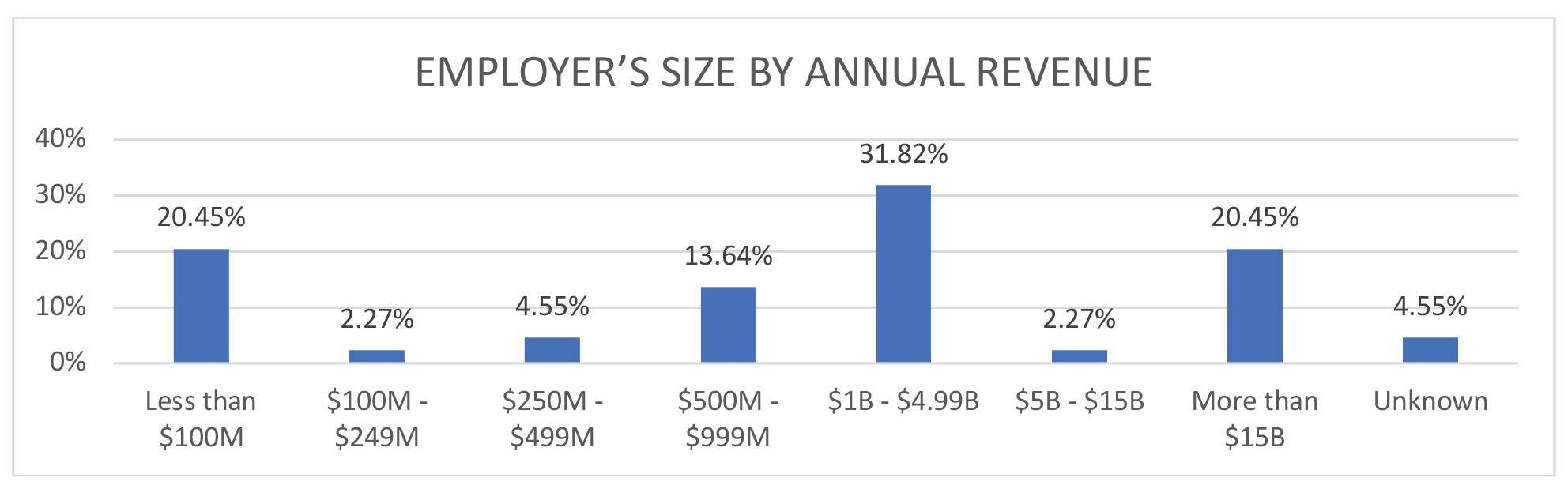

Annual Revenues

Small and large companies alike were represented with annual sales revenues ranging from under $100M to those businesses that generate revenues greater than $15B.

26 PARCELindustry.com MARCH-APRIL 2023

INTERACTIVE

SURVEY

Primary Carrier

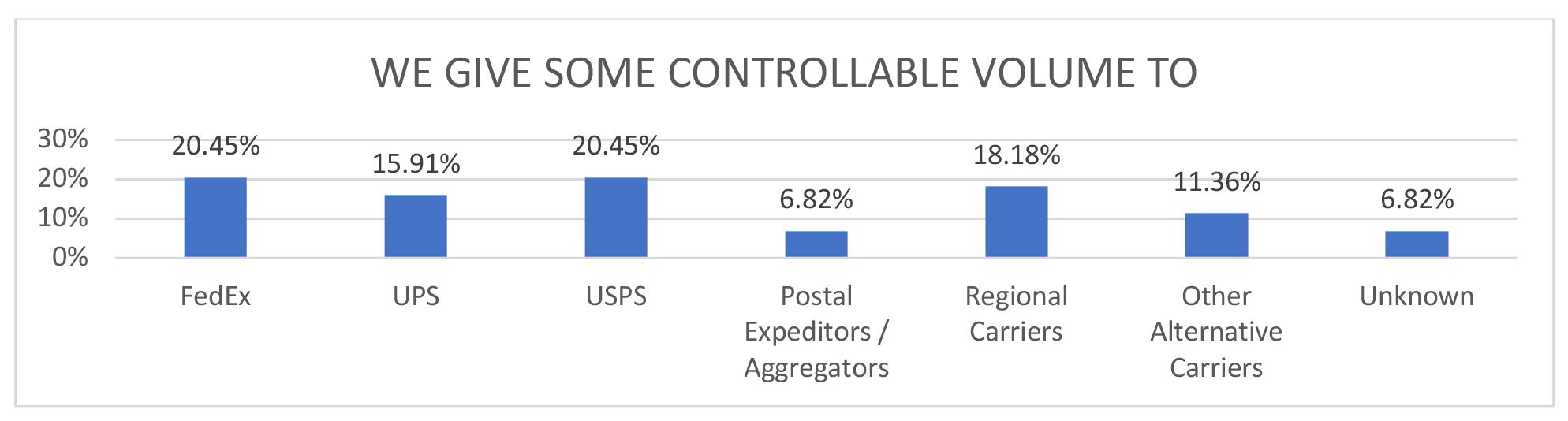

Predictably, 86.4% of all survey participants named UPS (45.45%) or FedEx (40.91%) as the “primary” carriers (as defined as more than half of overall volume). Other carriers included USPS and regional carriers although adoption of carriers outside of FedEx and UPS was not common.

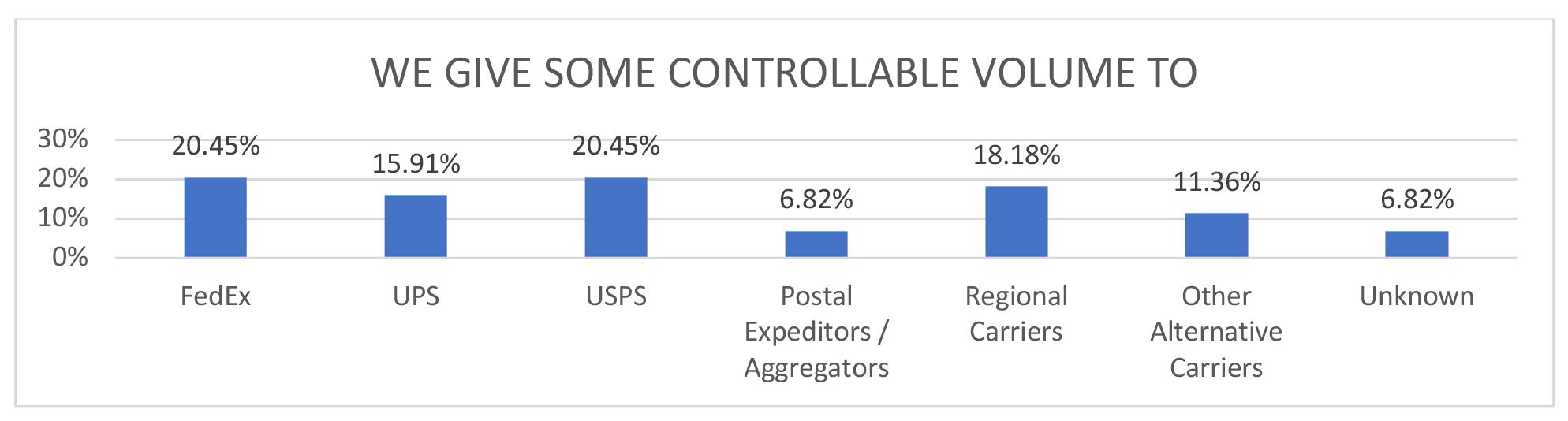

Controllable Volume

While UPS and FedEx enjoy the status as “primary” carrier, shippers continue to diversify carrier mix to include postal aggregators, regionals, postal, and other alternative carriers.

Parcel Volume

Annual parcel volume revealed a balanced mix of small, medium, large, and mega shippers.

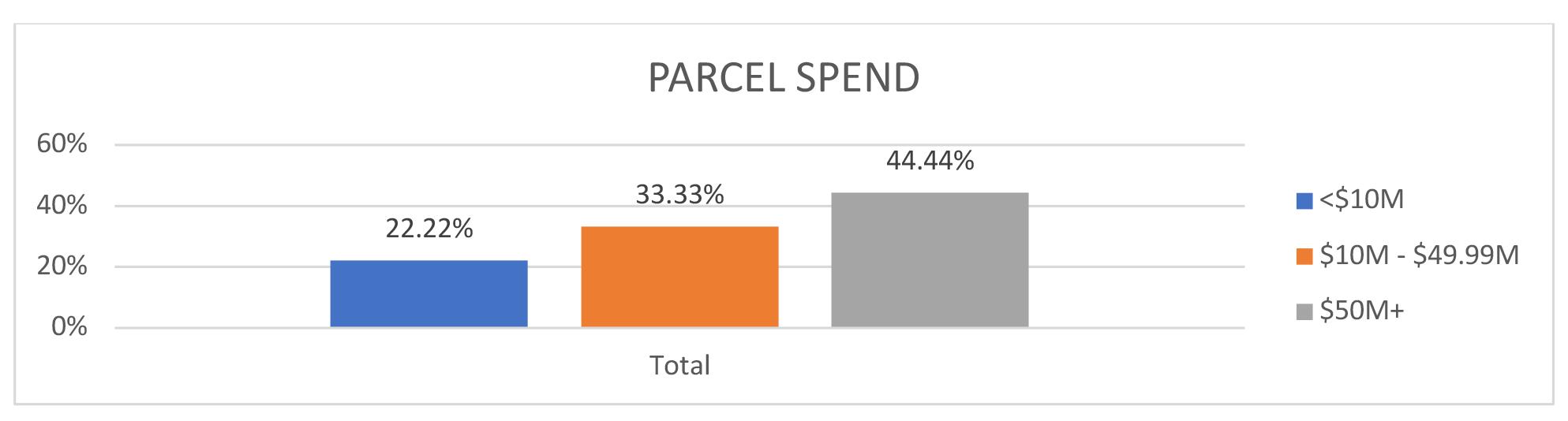

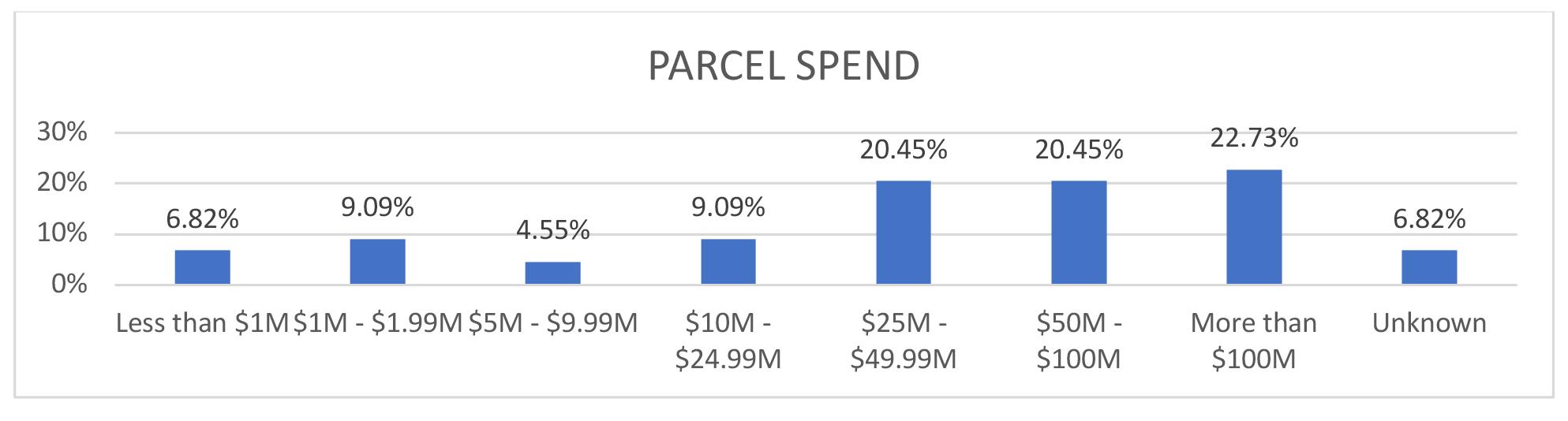

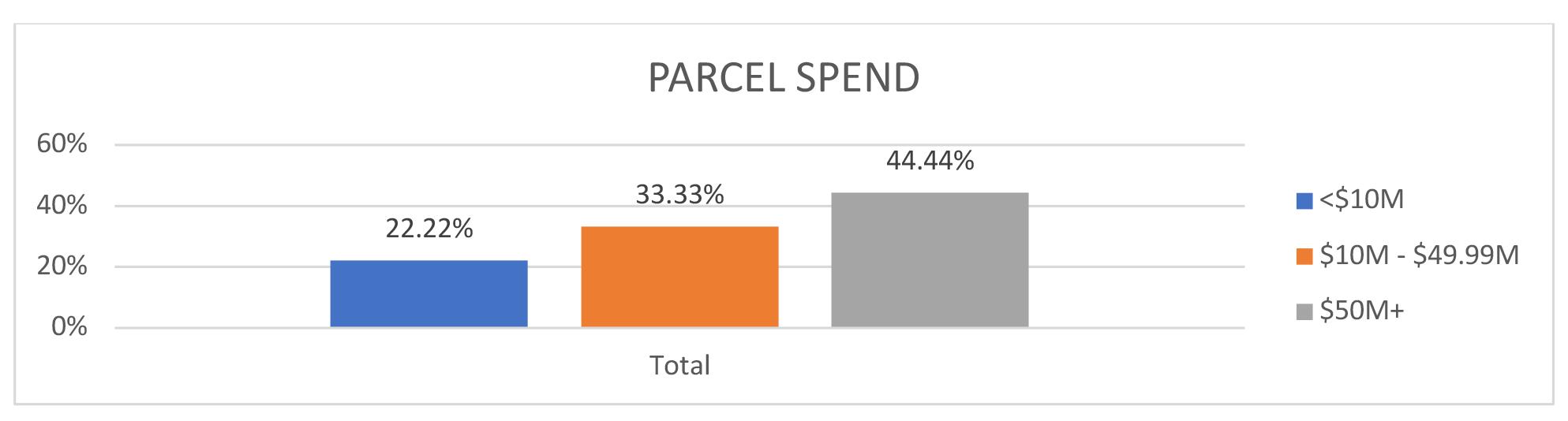

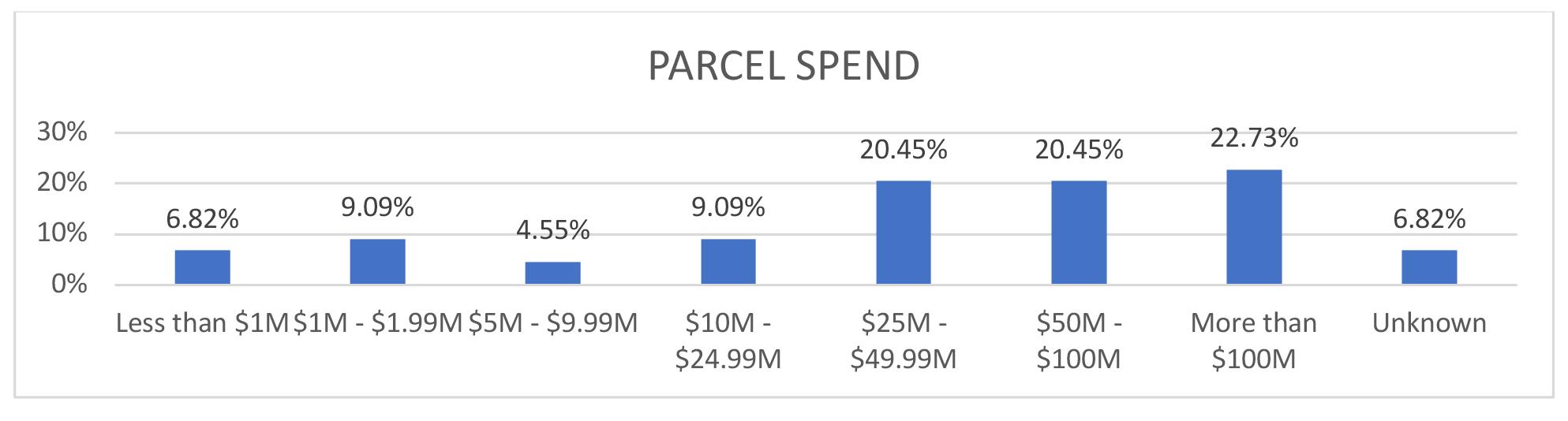

Parcel Spend

Annual parcel expenditures likewise revealed a balanced mix of shippers of all sizes. Collectively, we estimated survey participants command annual parcel spend of $3.5 billion.

As you will see below and throughout this article, for simplicity, we have grouped responses to many survey questions into three revenue categories: Under $10M in annual net charges, $10 to $50 million, and over $50 million.

MARCH-APRIL 2023 PARCELindustry.com 27

GENERAL PARCEL PROCUREMENT

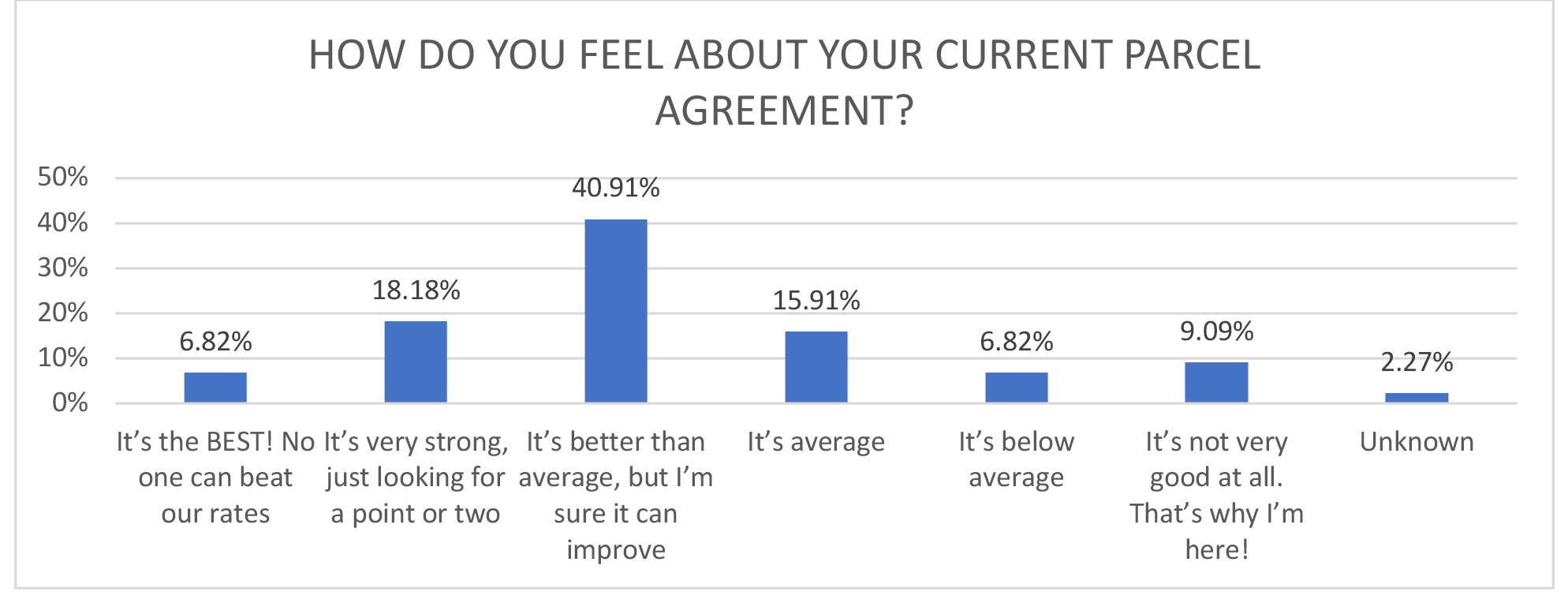

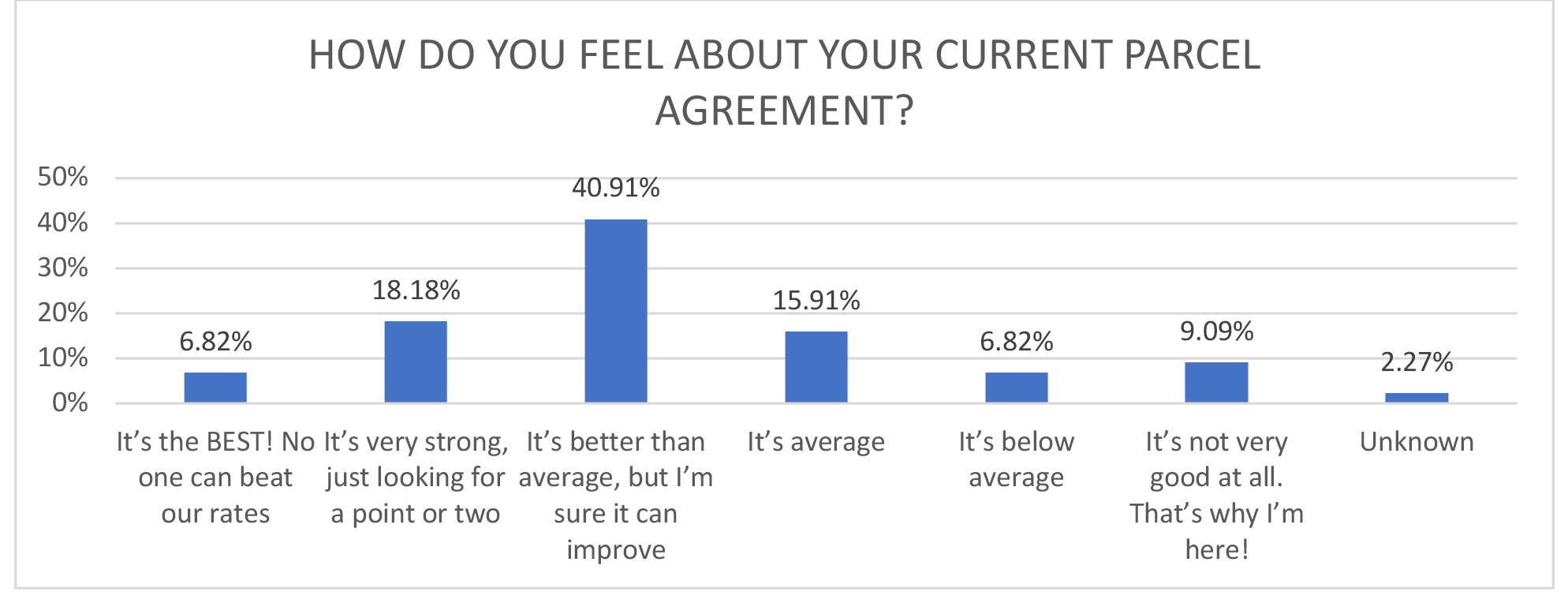

How do you feel about your current parcel agreement?

While nearly 41% of survey respondents feel their discounts are better than average, they conceded that rates and contracts were improvable.

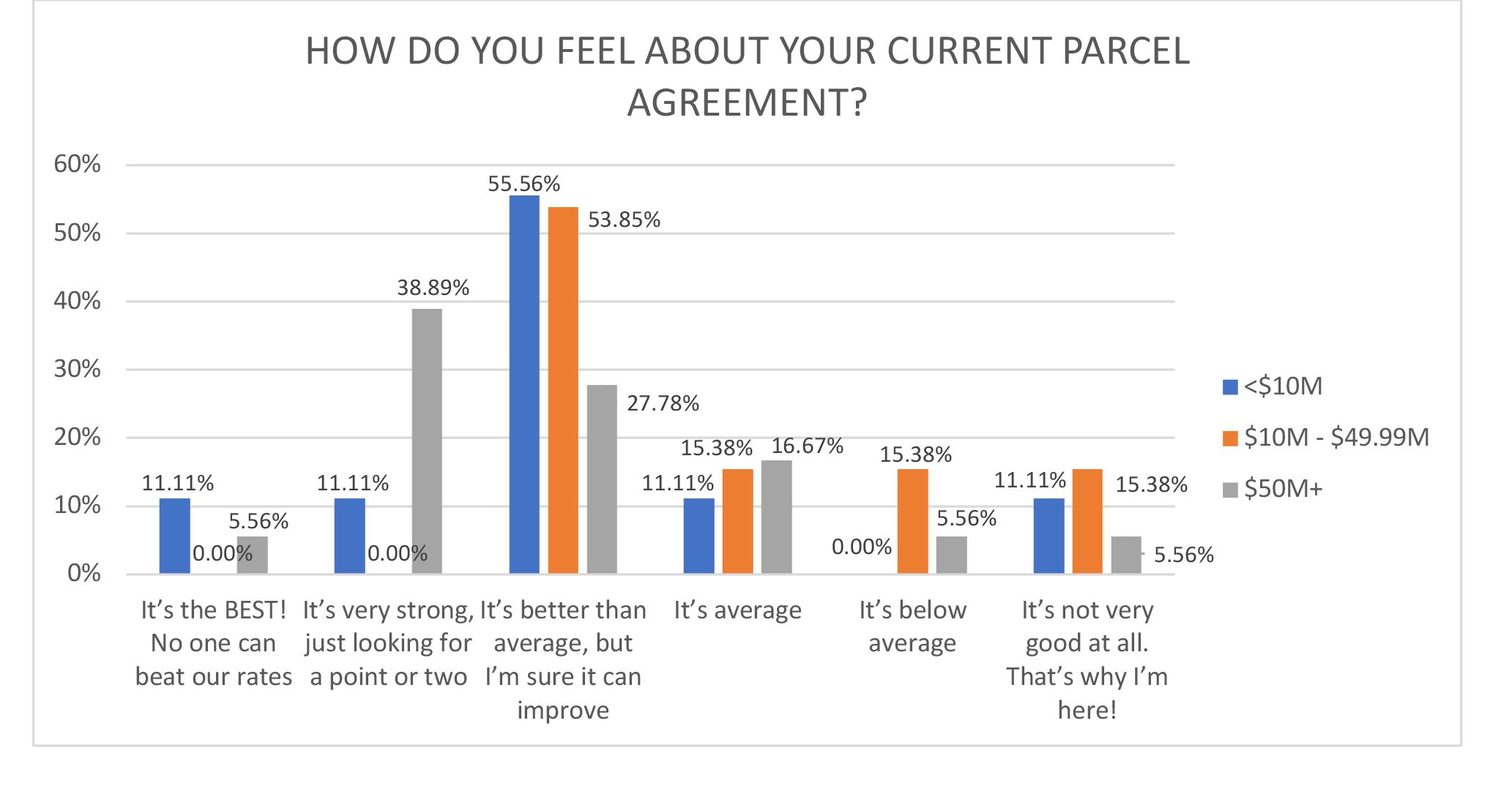

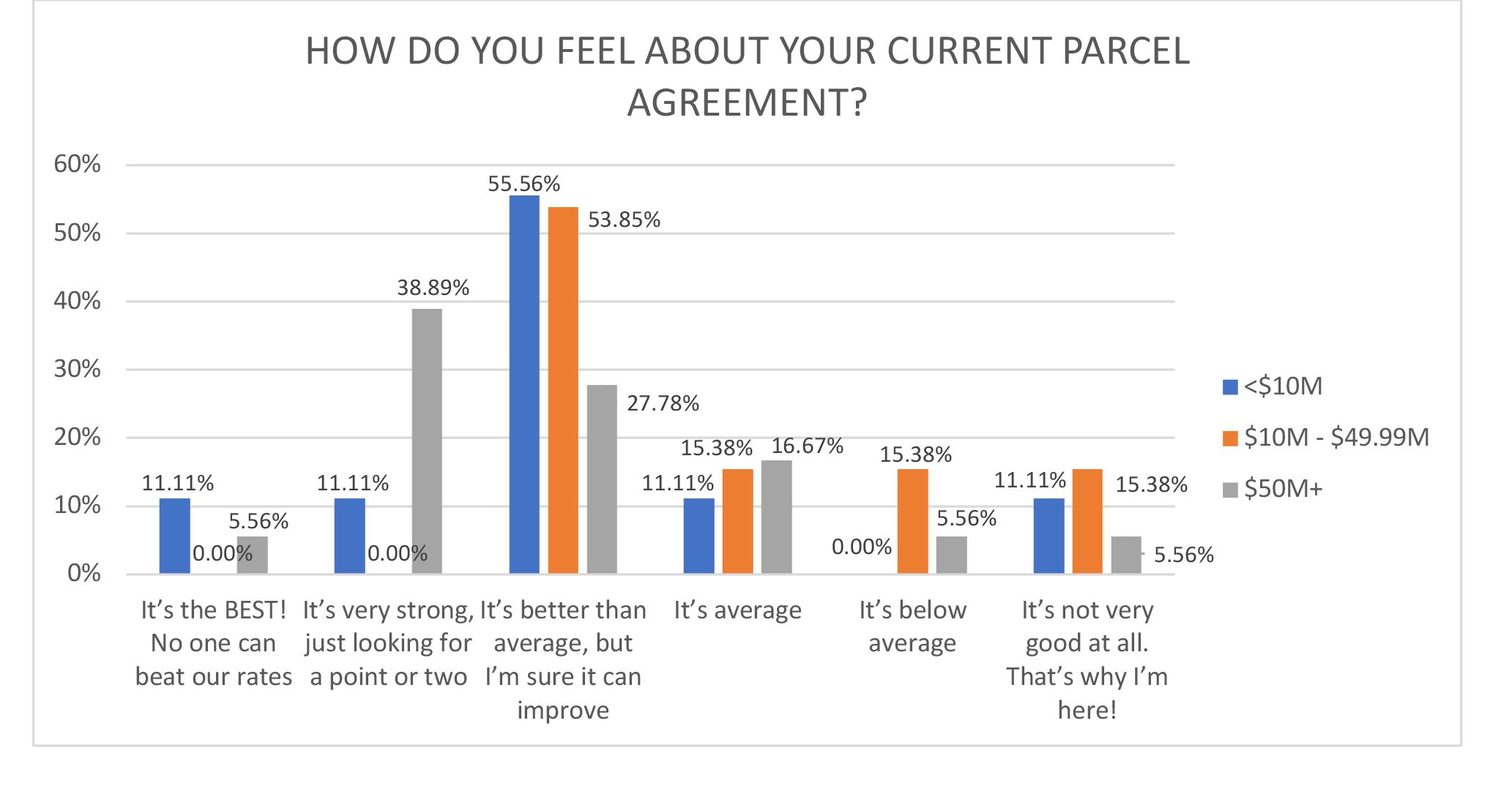

Although all three groups by spend share the sentiment that their parcel discounts are better than average but improvable, there were interesting distinctions amongst the groups, with nearly half of medium spend shippers feeling less confident about their pricing than the other two groups. Surprisingly, nearly a quarter of smaller shippers expressed very strong confidence in their pricing.

Grouping this next question into our three buckets based on shipping spend, we begin to see differentiation on how spend/size impacts concessions sought by shippers, with smaller shippers focusing almost exclusively on discounts, fuel surcharges, peak season concessions, and money-back guarantees, while medium and larger shippers, in addition to those improvement opportunities, are also focused on reducing accessorial charges, improving DIM-weight pricing, and lowering minimum charges.

28 PARCELindustry.com MARCH-APRIL 2023

Rob Martinez, DLP is Founder of Shipware LLC, an innovative parcel audit and consulting firm that helps volume parcel shippers reduce shipping costs 10%-30%. Rob offers more than 33 years’ experience negotiating parcel contracts — on both sides of the negotiating table — for some of the most recognizable brands in the world, and is a sought after speaker and industry thought leader. He welcomes questions and comments, and can be reached at 858-879-2020 Ext 114 or rob@shipware.com.

visit

MARCH-APRIL 2023 PARCELindustry.com 29

see even more results, please

PARCELindustry.com/LiveBenchmarkingPartOne

To

SUBSCRIBE FOR FREE!

SECOND ANNUAL MEGAN J. BRENNAN AWARD PRESENTED TO USPS IG

In early February, Women in Logistics and Delivery Services (WILDS) presented the second annual Megan J. Brennan Award for Excellence to Tammy Whitcomb Hull, Inspector General, United States Postal Service.

“It is such an honor to receive an Award for Excellence, and especially an award named after Megan Brennan, the first female postmaster general,” said IG Whitcomb Hull. “I have so much respect for Megan and the things she accomplished throughout her career. And I also have so much respect for all the women who work at every level in logistics and delivery industries.”

Before she retired from the Postal Service in 2020, Brennan, who was the 74th Postmaster General but the only woman thus far to hold that position, was approached by WILDS with the idea of creating an award that would celebrate women who embody the leadership traits that Brennan was known

for during her time at the USPS. To be considered for this award, the potential recipient must have an appreciation for the employees of her organization, the ability to work collaboratively, and the ability to look at challenges and opportunities in a holistic manner.

Those who know Whitcomb Hull make it clear that she checks all of these boxes and then some.

“During my tenure as Postmaster General, I appreciated the excellent working relationship that Tammy and I maintained,” said Brennan of Ms. Whitcomb Hull’s selection. “Tammy always remained focused on the statutory responsibility of her organization to improve the economy, efficiency, and effectiveness of Postal Service programs, but in fulfilling her important role she also demonstrated a willingness to listen to alternative perspectives and to consider the broader context in our frequent discussions. Her approach invariably led to better

results that strengthened the Postal Service for all stakeholders.”

Former Postal Regulatory Commission Chair and WILDS co-founder Ruth Goldway concurs. “Tammy Whitcomb Hull is an outstanding leader of a multi-faceted organization… Under her leadership, the IG has provided the highest level of technical analyses and challenged the industry by issuing thought-provoking research. Tammy has demonstrated remarkable resolve and assurance during times of great changes in postal technology, USPS management and legislation. Through it all, she has offered mentorship to others — especially young women — helping them to succeed just as she has.”

Whitcomb Hull was appointed as the third Inspector General of the U.S. Postal Service on November 29, 2018. Prior to this, she served as the Deputy Inspector General from November 2011 to February 2016, and as the Acting Inspector General for the U.S. Postal Service Office of Inspector General (OIG) from February 2016 until her appointment as IG.

The first-ever Megan J. Brennan award was presented to Pritha Mehra, the Chief Information Officer and Executive Vice President of the United States Postal Service, at the end of 2021.

WILDS is a nonprofit organization created to promote women’s leadership in the postal, delivery, and logistics industries and to address the challenges women and minorities regularly face in these industries. For more information, visit www.shedelivers.org.

30 PARCELindustry.com MARCH-APRIL 2023

By Amanda Armendariz

By Amanda Armendariz